UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a−101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | |||

| [ ] | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive additional materials | |||

| [ ] | Solicitating material under Rule 14a-12. | |||

PRIMARK PRIVATE EQUITY INVESTMENTS FUND

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) Title of each class of securities to which transaction applies: N/A | |

| 2) Aggregate number of securities to which transaction applies: N/A | |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A | |

| 4) Proposed maximum aggregate value of transaction: N/A | |

| 5) Total fee paid: $0 | |

| [ ] | Fee paid previously with preliminary materials. N/A |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) Amount Previously Paid: N/A | |

| 2) Form, Schedule or Registration Statement No.: N/A | |

| 3) Filing Party: N/A | |

| 4) Date Filed: N/A |

June 23, 2022

PRIMARK CAPITAL

Primark Private Equity Investments Fund

Dear Shareholder:

I am writing to you about important proposals relating to Primark Private Equity Investments Fund (the “Fund”). This proxy statement asks you to consider and vote on the following two proposals: (1) to approve a new investment management agreement between Primark Advisors LLC (“Primark” or the “Adviser”) and the Fund; and (2) to approve a sub-advisory agreement between the Adviser and Meketa Investment Group Inc. (“Meketa”) with respect to the Fund.

A new investment management agreement is being proposed in anticipation of a transaction (the “Transaction”) between the two holders of interests of the Adviser’s parent company, Primark Capital LLC (“Primark Capital”): Primark Distributors LLC (“Primark Distributors”) and Primark Investors LLC (“Primark Investors”). Pursuant to the Transaction, Primark Distributors is proposed to acquire all of the interests of Primark Capital held by Primark Investors. It is possible that the Transaction, when completed, could be deemed to result in a change of control of the Adviser, which, in turn, may be deemed to result in an “assignment” of the Fund’s existing investment management agreement under the Investment Company Act of 1940, as amended. An assignment of the Fund’s investment management agreement would result in the automatic termination of such agreement. Shareholders are also being asked to approve a sub-advisory agreement between the Adviser and Meketa, with respect to the Fund, to permit Meketa to manage the Fund’s investment portfolio. As described in more detail in the enclosed proxy statement, the Transaction and the sub-advisory agreement with Meketa are not expected to have any effect on the Fund’s investment objective or fees and expenses.

A special meeting of shareholders (the “Meeting”) of the Fund has been scheduled for July 28, 2022 to vote on these matters. If you are a shareholder of record of the Fund as of the close of business on May 31, 2022, you are entitled to vote at the Meeting and any adjournment(s) or postponement(s) of all or any portion of the Meeting, even if you no longer own your shares.

Pursuant to these materials, you are being asked to vote on the proposals, as noted above. For the reasons discussed in the enclosed materials, the Fund’s Board of Trustees recommends that you vote “FOR” the proposals.

You can vote in one of four ways:

| o | Over the Internet, through the website listed on the proxy card, |

| o | By telephone, using the toll-free number listed on the proxy card, |

| o | By mail, using the enclosed proxy card -- be sure to sign, date and return the proxy card in the enclosed postage-paid envelope, or |

| o | In person at the shareholder meeting on July 28, 2022. |

We encourage you to vote over the Internet or by telephone using the voting control number that appears on your proxy card.

Please take the time to carefully consider and vote on these important proposals. Please also read the enclosed information carefully before voting. If you have questions, please call Okapi Partners LLC, the Fund’s proxy solicitor, toll-free at 1-844-343-2621.

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

/s/ Michael Bell

Michael Bell

President and Trustee

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

| ii |

QUESTIONS AND ANSWERS

The following “Questions and Answers” section is a summary and is not intended to be as detailed as the discussion found in the proxy materials. For this reason, the information is qualified in its entirety by reference to the enclosed proxy statement to shareholders (the “Proxy Statement”).

| Q. | Why am I receiving this Proxy Statement? |

| A. | You are receiving these proxy materials (the Proxy Statement and your proxy card) because you have the right to vote on important proposals concerning Primark Private Equity Investments Fund (the “Fund”). Each of the proposals is described below. |

| Q. | What are the proposals about? |

| A. | The Proxy Statement presents two proposals. Shareholders of the Fund are being asked to vote on both Proposal 1 and Proposal 2. The Fund’s Board of Trustees (the “Board”) and Primark Advisors LLC (“Primark” or the “Adviser”), the Fund’s investment manager, believe that each proposal is in the best interests of the Fund for the reasons described below. |

Proposal 1, the approval of a new investment management agreement (the “New Investment Management Agreement”) between the Adviser and the Fund, is being proposed in anticipation of a transaction (the “Transaction”) between the two holders of interests of the Adviser’s parent company, Primark Capital LLC (“Primark Capital”): Primark Distributors LLC (“Primark Distributors”) and Primark Investors LLC (“Primark Investors”). Pursuant to the Transaction, Primark Distributors is proposed to acquire all of the interests of Primark Capital held by Primark Investors. Primark Investors could be deemed to control Primark Capital and, in selling its interests in Primark Capital to Primark Distributors, it is therefore possible that the Transaction, when completed, could be deemed to result in a change of control of the Adviser, which, in turn, may be deemed to result in an “assignment” of the Fund’s existing investment management agreement (the “Existing Investment Management Agreement”) under the Investment Company Act of 1940, as amended (the “1940 Act”). An assignment of the Existing Investment Management Agreement would result in the automatic termination of such agreement.

Proposal 2, the approval of a sub-advisory agreement (the “Sub-Advisory Agreement”) between the Adviser and Meketa Investment Group Inc. (“Meketa”), with respect to the Fund, would permit Meketa to serve as sub-adviser to the Fund and manage the Fund’s investment portfolio.

For the reasons discussed in the Proxy Statement, the Board recommends that you vote “FOR” each proposal.

| Q. | What is the impact of the proposals on the Fund’s investment objective, principal investment strategies and risks? |

| A. | Under Meketa’s management as sub-adviser, the Fund is expected to have the same investment objective and substantively similar principal investment strategies and risks as compared to Primark’s management of the Fund under the Existing Investment Management Agreement. |

| Q. | What is the impact of the proposals on the Fund’s fees and expenses? |

| A. | The proposals are not expected to affect the fees and expenses paid by the Fund. Pursuant to the Existing Investment Management Agreement, the Fund pays the Adviser a management fee in the amount of 1.50% of the average daily net assets of the Fund. If shareholders approve the New Investment Management Agreement, the management fee paid by the Fund will not change. If shareholders approve the Sub-Advisory Agreement, the Adviser will pay Meketa a sub-advisory fee as follows: |

| · | Prior to the three year anniversary of the effective date of the Sub-Advisory Agreement: |

| o | 0.00% of the average daily net assets of the Fund up to and including $75 million and |

| o | 0.40% of the average daily net assets of the Fund in excess of $75 million. |

| · | Following the three year anniversary of the effective date of the Sub-Advisory Agreement: |

| o | 0.40% of the average daily net assets of the Fund. |

In addition, Primark Distributors shall grant Meketa an interest in Primark Distributors generally entitling Meketa to 20% of (i) all net income earned by Primark Distributors and (ii) gain realized upon any sale of Primark Distributors (the “Profits Interest”), effective as of the date of the grant (which is expected to be the effective date of the Sub-Advisory Agreement); provided, however, that at any time the net assets of the Fund exceed $250,000,000, then the (a) aggregate sub-advisory fee payments plus (b) any distributions of net income made to Meketa associated with the Profits Interest shall not exceed 35% on an annualized basis of the net income of the Adviser (before accounting for payment of sub-advisory fees) (both (a) and (b) together, the “Sub-Advisory Fee”). The minimum annual fee due to Meketa (including any distributions associated with the Profits Interest) will be $300,000. The compensation payable to Meketa will be borne out of the Adviser’s own assets and not by the Fund.

| i |

| Q. | When is the Meeting? |

| A. | The enclosed proxy is being solicited for use at the special meeting of shareholders of the Fund to be held on July 28, 2022 (the “Meeting”) at the offices of Primark, 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, at 10:00 a.m. Eastern Time, and, if the Meeting is adjourned or postponed, at any later meetings. The location of the Meeting is also the mailing address for the Fund. |

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration, the Board unanimously recommends that you vote “FOR” each proposal. Please see the sections of the proxy materials discussing each proposal for a discussion of the Board’s considerations in making such recommendation. |

| Q. | What vote is required to approve the proposals? |

| A. | Each proposal must be approved by a “vote of a majority of the outstanding voting securities” of the Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of the Fund entitled to vote on the proposal present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund entitled to vote on the proposal. |

| Q. | What happens if shareholders do not approve the proposals? |

| A. | The Board unanimously recommends that shareholders approve each proposal. However, if shareholders do not approve Proposal 1 (approval of the New Investment Management Agreement) the Board will determine what further action is appropriate for the Fund in light of the pending Transaction, which is expected to close on the earlier of the receipt of shareholder approval or October 7, 2022. Because there is uncertainty regarding whether the Transaction would in fact result in an assignment and automatic termination of the Existing Investment Management Agreement, the Board will consider what other options are appropriate and in the best interests of the Fund, including approving an interim investment management agreement to take effect until such time as sufficient shareholder votes are received for Proposal 1. If shareholders do not approve Proposal 2, the Sub-Advisory Agreement between the Adviser and Meketa, with respect to the Fund, will not take effect, and the Board will determine what further action is appropriate for the Fund. The proposals are not contingent upon one another; therefore, an unfavorable vote on either proposal will not necessarily affect the implementation of the other proposal. |

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the proposals can be acted upon. We encourage all shareholders to participate in the governance of the Fund. Additionally, you will help save the costs of any further solicitations by providing your immediate response on the enclosed proxy card, over the Internet or by telephone. |

| Q. | If I am a small investor, why should I vote? |

| A. | You should vote because every vote is important. If numerous shareholders just like you fail to vote, the Fund may not receive enough votes to go forward with the Meeting. If this happens, the Fund will need to solicit votes again. This may delay the Meeting and the approval of the proposals and generate unnecessary costs. |

| ii |

| Q. | How do I place my vote? |

| A. | You may provide the Fund with your vote by mail using the enclosed proxy card, over the Internet by following the instructions on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person at the Meeting. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to utilize any of these voting methods. If you need more information on how to vote, or if you have any questions, please call Okapi Partners LLC, the Funds’ proxy solicitor (the “Solicitor”), toll-free at 1-844-343-2621. |

| Q. | Whom do I call if I have questions? |

| A. | We will be happy to answer your questions about this proxy solicitation. If you have questions, please call the Solicitor, toll-free at 1-844-343-2621. |

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting.

PROMPT VOTING IS REQUESTED.

| iii |

PRIMARK CAPITAL

Primark Private Equity Investments Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON July 28, 2022

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of Primark Private Equity Investments Fund (the “Fund”) will be held at the offices of Primark Advisors LLC (“Primark” or the “Adviser”), 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206 on July 28, 2022 at 10:00 a.m. Eastern Time for the purposes listed below:

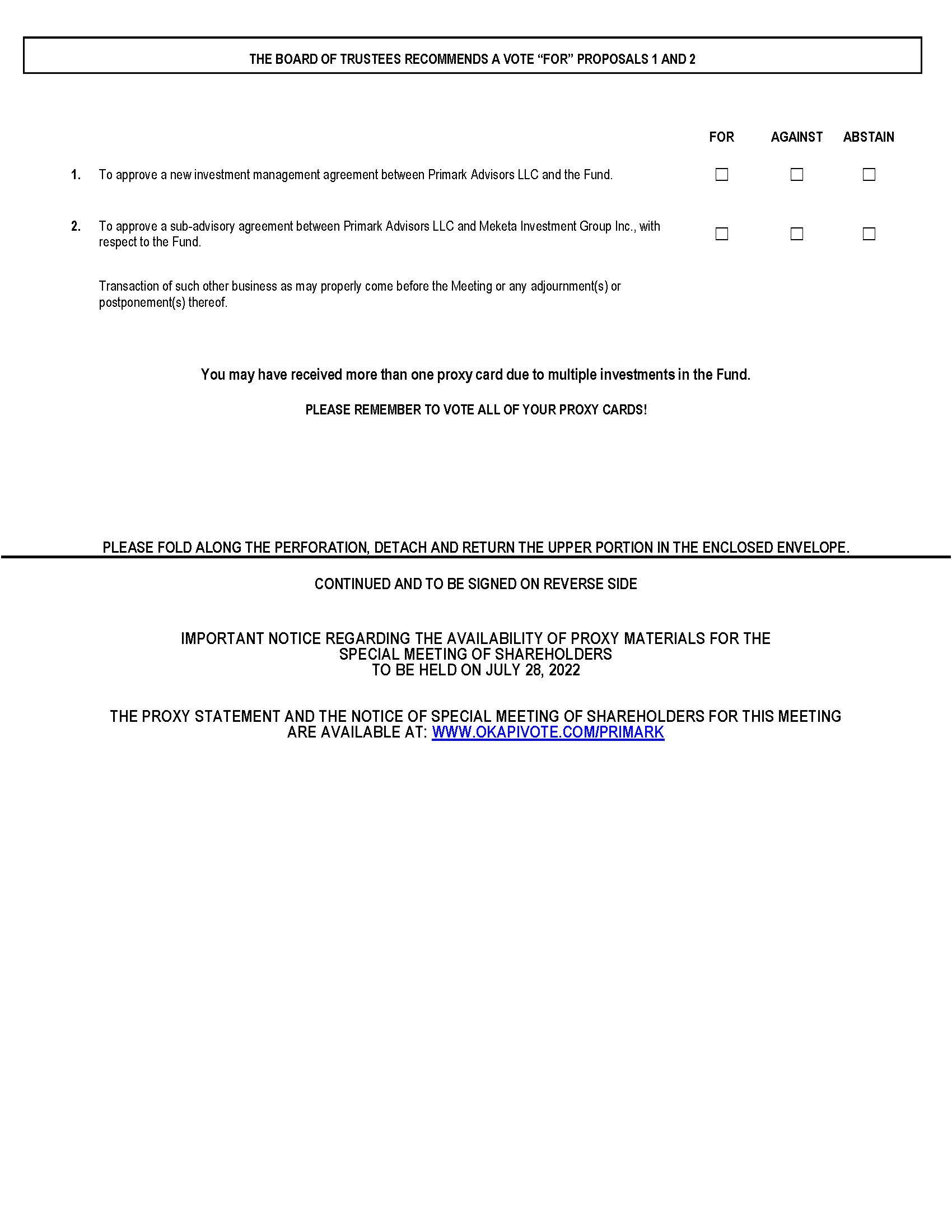

| 1. Approval of a new investment management agreement between the Adviser and the Fund (the “New Investment Management Agreement”). | |

| 2. Approval of a sub-advisory agreement (the “Sub-Advisory Agreement”) between the Adviser and Meketa Investment Group Inc. (“Meketa”), with respect to the Fund. | |

| 3. Transaction of such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. | |

After careful consideration, the Fund’s Board of Trustees (the “Board” or the “Trustees”) unanimously recommends that shareholders vote “FOR” the proposals.

Shareholders of record at the close of business on May 31, 2022 are entitled to notice of, and to vote at, the Meeting, even if any such shareholders no longer own shares.

We call your attention to the accompanying proxy statement. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting by telephone or over the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting. Please call Okapi Partners LLC, the Fund’s proxy solicitor, toll-free at 1-844-343-2621 if you have any questions relating to attending the Meeting in person or your vote instructions.

By Order of the Board of Trustees,

/s/ Jesse D. Hallee

Jesse D. Hallee

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE MEETING TO BE HELD ON July 28, 2022

This Proxy Statement and the accompanying Notice of Special Meeting of Shareholders are available at www.OkapiVote.com/Primark. In addition, shareholders can find important information about the Fund in the Fund’s annual report, dated March 31, 2022, including financial reports for the fiscal year ended March 31, 2022. You may obtain copies of these reports without charge, upon request, by writing to Primark Advisors LLC, 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, or by calling 1-877-792-0924, or on the Fund’s website at www.primarkcapital.com.

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR OVER THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY TELEPHONE OR OVER THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU ELECT TO CHANGE YOUR VOTE.

Primark Capital

Primark Private Equity Investments Fund

_______________________________

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON July 28, 2022

_______________________________

This proxy statement (“Proxy Statement”) and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Primark Private Equity Investments Fund (the “Fund”). The proxies are being solicited for use at a special meeting of shareholders of the Fund to be held at the offices of Primark Advisors LLC (“Primark” or the “Adviser”), 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206 on July 28, 2022 at 10:00 a.m. Eastern Time, and at any and all adjournments or postponements of all or any portion thereof (the “Meeting”).

The Board has called the Meeting and is soliciting proxies from shareholders of the Fund for the purposes listed below:

| 1. Approval of a new investment management agreement (the “New Investment Management Agreement”) between the Adviser and the Fund. |

| 2. Approval of a sub-advisory agreement (the “Sub-Advisory Agreement”) between the Adviser and Meketa Investment Group Inc. (“Meketa”), with respect to the Fund. |

| 3. Transaction of such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

This Proxy Statement and the accompanying notice and the proxy card are being first mailed to shareholders on or about June 23, 2022.

Shareholders of record at the close of business on May 31, 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting, even if such shareholders no longer own shares of the Fund.

If you have any questions about the proposals or about voting, please call Okapi Partners LLC, the Fund’s proxy solicitor, toll-free at 1-844-343-2621.

Introduction

The Fund is a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act. The Adviser, located at 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, is a wholly-owned subsidiary of Primark Capital LLC (“Primark Capital”). The Adviser is an investment adviser registered under the Investment Advisers Act of 1940, as amended, and is responsible for the Fund’s overall investment operations. The Fund has retained Ultimus Fund Solutions, LLC (the “Administrator”), located at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45249, to provide certain fund services, including fund administration, fund accounting and transfer agency services. Northern Lights Compliance Services, LLC, located at 4221 North 203rd Street, Suite 100, Elkhorn, NE 68022, an affiliate of the Administrator, provides compliance services to the Fund pursuant to a Compliance Services Consulting Agreement. Foreside Financial Services, LLC, located at Three Canal Plaza, Suite 100, Portland, Maine 04101, serves as the Fund’s distributor.

Proposal 1, approval of the New Investment Management Agreement, is being proposed in anticipation of a transaction (the “Transaction”) between the two holders of interests of the Adviser’s parent company, Primark Capital LLC (“Primark Capital”): Primark Distributors LLC (“Primark Distributors”) and Primark Investors LLC (“Primark Investors”). Pursuant to the Transaction, Primark Distributors is proposed to acquire all of the interests of Primark

| 1 |

Capital held by Primark Investors. Primark Investors could be deemed to control Primark Capital and, in selling its interests in Primark Capital to Primark Distributors, it is therefore possible that the Transaction, when completed, could be deemed to result in a change of control of the Adviser, which, in turn, may be deemed to result in an “assignment” of the Fund’s existing investment management agreement (the “Existing Investment Management Agreement”) under the Investment Company Act of 1940, as amended (the “1940 Act”). An assignment of the Existing Investment Management Agreement would result in the automatic termination of such agreement.

Proposal 2, approval of the Sub-Advisory Agreement, would permit Meketa to serve as sub-adviser to the Fund and manage the Fund’s investment portfolio.

At a meeting held on May 27, 2022, the Board, including a majority of the Trustees who are not “interested persons” (as such term is defined in the 1940 Act) of the Fund (the “Independent Trustees”) unanimously approved the New Investment Management Agreement and the Sub-Advisory Agreement.

The material terms and differences between the Existing Investment Management Agreement and the New Investment Management Agreement are described below under “Terms of the New Investment Management Agreement” in the section describing Proposal 1. The material terms of the Sub-Advisory Agreement are described below under “Terms of the Sub-Advisory Agreement” in the section describing Proposal 2.

If the shareholders of the Fund do not approve the New Investment Management Agreement, the Board will consider what other options are appropriate and in the best interests of the Fund in light of the pending Transaction, including approving an interim investment management agreement to take effect until such time as sufficient shareholder votes are received for Proposal 1. If shareholders of the Fund do not approve the Sub-Advisory Agreement, the Sub-Advisory Agreement will not take effect and the Board will determine what further action is appropriate for the Fund.

Voting Procedures

Shareholders of the Fund who own shares at the close of business on the Record Date will be entitled to notice of, and to vote at, the Meeting and any adjournment(s) or postponement(s) thereof. You are entitled to one vote, or fraction thereof, for each share of the Fund, or fraction thereof, that you own on each matter as to which such shares are to be voted at the Meeting.

A quorum must be present at the Meeting for the transaction of business. For the Fund, the holders of 33-1/3% of the shares outstanding and entitled to vote present in person or represented by proxy at the Meeting shall constitute a quorum for the transaction of business. Abstentions and broker non-votes will be included for purposes of determining whether a quorum is present at the Meeting. Abstentions and broker non-votes will be treated as votes present at the Meeting, but will not be treated as votes cast. Because the affirmative “vote of a majority of the outstanding voting securities,” as defined below, of the Fund is required to approve each proposal, abstentions and broker non-votes will have the same effect as a vote “against” a proposal. “Broker non-votes” are shares held by a broker or nominee as to which instructions have not been received from the beneficial owners or persons entitled to vote, and the broker or nominee does not have discretionary voting power but for which a broker or nominee returns the proxy card or otherwise votes without actually voting on the relevant proposal.

Whether or not a quorum is present at the Meeting, the chair of the Meeting may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any adjourned session or sessions may be held, any time after the date set for the Meeting, without the necessity of further notice, unless a new record date for the adjourned meeting is fixed or unless the adjournment is for more than 180 days from the Record Date, in which case the Board will set a new record date for the adjourned meeting. Upon motion of the chair of the Meeting, the question of adjournment may be (but is not required to be) submitted to a vote of the shareholders, and in that case, any adjournment with respect to one or more matters must be approved by the vote of a majority of the votes cast in person or by proxy at the Meeting with respect to the matter or matters adjourned, whether or not a quorum is present with respect to such matter or matters. Unless a proxy is otherwise limited in this regard, any shares present and entitled to vote at a meeting may, at the discretion of the proxies named therein, be voted “FOR” a proposal in favor of such an adjournment.

| 2 |

Information regarding the number of issued and outstanding shares of the Fund as of the Record Date is provided under “Additional Information” below, representing the same number of votes for the Fund. The persons who are known to have owned beneficially or of record 5% or more of the Fund’s outstanding shares as of May 31, 2022, are also listed in the “Additional Information” section.

The person(s) named as proxies on the enclosed proxy card will vote in accordance with your directions if your proxy card is received properly executed or if you vote appropriately by phone or over the Internet. If we receive your proxy card, and it is executed properly, but you give no voting instructions with respect to the proposals, your shares will be voted in accordance with management’s recommendation. The duly appointed proxies may, in their discretion, vote upon such other matters as may properly come before the Meeting and any adjournment(s) or postponement(s) thereof. Shareholders are not entitled to any appraisal or similar rights of dissenters with respect to the proposals.

In order that your shares may be represented at the Meeting, you are requested to vote your shares by mail, over the Internet or by telephone by following the instructions on your proxy card. IF YOU VOTE BY TELEPHONE OR OVER THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD, UNLESS YOU LATER ELECT TO CHANGE YOUR VOTE. You may revoke your proxy: (a) at any time prior to its exercise by written notice of its revocation to the Secretary of the Fund prior to the Meeting; (b) by the subsequent execution and timely return of another proxy prior to the Meeting (following the methods noted above); or (c) by being present and voting in person at the Meeting and giving oral notice of revocation to the chair of the Meeting. However, attendance in-person at the Meeting, by itself, will not revoke a previously-tendered proxy.

The cost of preparing, printing and mailing the enclosed proxy card and proxy statement and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone or facsimile will be paid 50% by the Adviser and 50% by the Fund. Please see “Additional Information” below for more information regarding solicitation of proxies. If you plan to vote in person by attending the Meeting, please contact the Fund in writing at Primark Private Equity Investments Fund, 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, or by telephone at 1-877-792-0924, for directions.

Information About Primark

The Adviser, located at 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, was formed in 2020 as a wholly-owned subsidiary of Primark Capital. The Adviser is a privately-held asset management company focused on providing investors with exposure to private market transactions, and is focused on investing in the lower middle market in private equity. As of March 31, 2022, the firm had approximately $67.3 million in assets under management.

Information about the directors and principal executive officers of the Adviser is set forth below. The address of each of them is c/o Primark Capital LLC, 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206.

| Name of Directors and Principal Executive Officers | Principal Occupation(s) |

| Michael Bell | Chief Executive Officer; Chief Compliance Officer |

| Adam Goldman | Managing Director |

| Mark Sunderhuse | Managing Director |

The Existing Investment Management Agreement between the Fund and the Adviser, dated July 1, 2020, was approved most recently by the Board on May 3, 2022 and by the Fund’s sole initial shareholder on June 29, 2020. The aggregate amount of management fees paid by the Fund to the Adviser pursuant to the Existing Investment Management Agreement was $385,434 for the Fund’s fiscal year ended March 31, 2022. This amount reflects an aggregate amount of $796,339 earned by the Adviser less $410,905 of management fees waived by the Adviser.

The Adviser does not currently act as an investment adviser or sub-adviser with respect to any other investment company registered under the 1940 Act.

| 3 |

Information About Meketa

Under Meketa’s management, the Fund is expected to have the same investment objective and substantively similar principal investment strategies and risks as compared to Primark’s management of the Fund under the Existing Investment Management Agreement. Meketa, located at 80 University Avenue, Westwood, Massachusetts 02090, was formed in 1974. Meketa currently has seven offices: Boston, San Diego, Miami, Portland, Chicago, New York, and London. Meketa is an independent, employee-owned firm. Meketa’s founder, James E. Meketa, owns approximately 20% of the firm’s outstanding voting securities and Co- Executive Officers Stephen P. McCourt and Peter S. Wooley each own approximately 12% each of the firm’s outstanding voting securities. As of March 31, 2022, the firm had approximately $26.5 billion in assets under management.

Information about the directors and principal executive officers of Meketa is set forth below. The address of each of them is c/o Meketa Investment Group, Inc., 80 University Avenue, Westwood, Massachusetts 02090.

| Name of Directors and Principal Executive Officers | Principal Occupation(s) |

| James E. Meketa | Chairman of the Board of Directors |

| Eric P. Cressman | Chief Compliance Officer; Director of Finance; Managing Principal |

| Timothy G. Zayac | Chief Legal Officer |

| Stephen P. McCourt | Co-Executive Officer, Director |

| Peter S. Woolley | Co-Executive Officer, Director |

| John A. Haggerty | Managing Principal; Director |

| Leandro A. Festino | Managing Principal; Director |

| Mika Malone | Managing Principal; Director |

| Judith F. Chambers | Managing Principal; Director |

| Christiana Fields | Managing Principal; Director |

| Alan D. Spatrick | Managing Principal |

| Allan R. Emkin | Managing Principal |

| Tammy Anchich-Wood | Managing Principal, Chief Marketing Officer |

Meketa does not currently act as an investment adviser or sub-adviser with respect to any other investment company registered under the 1940 Act. Meketa provides private market advisory services for private equity, private credit, infrastructure, natural resources and real estate investment strategies.

| 4 |

PROPOSAL 1

APPROVAL OF THE NEW Investment Management AGREEMENT BETWEEN THE Adviser AND the FUND

Board of Trustees Approvals

At a meeting held on May 27, 2022, based upon the recommendation of the Adviser and other factors, the Board approved the New Investment Management Agreement. In approving the New Investment Management Agreement, the Board, including a majority of the Independent Trustees, determined that the Adviser continuing to serve as investment adviser to the Fund following the Transaction is in the best interests of the Fund and its shareholders. The Board’s determination to approve the New Investment Management Agreement was based on a variety of factors and considerations, including the Board’s knowledge of the Adviser, having served as investment manager to the Fund since its inception, the Adviser’s expected organizational structure following the Transaction, investment process, style and performance record. The Board considered that approval of the New Investment Management Agreement would offer continuity in management for the Fund and its shareholders. The Board also considered that the largest indirect beneficial owner of the Adviser, Michael Bell, would remain the largest indirect beneficial owner of the Adviser following the Transaction. Accordingly, the Board, including a majority of the Independent Trustees, unanimously approved the New Investment Management Agreement, a form of which is attached as Appendix A.

Terms of the New Investment Management Agreement

The following is a summary of the terms of the New Investment Management Agreement, which are identical to the terms of the Existing Investment Management Agreement in all material respects, except as noted below.

Services

The Adviser agrees to furnish the Fund, at the Adviser’s own expense, with Portfolio Management Services (as defined below) and such other services necessary to sponsor and manage the Fund that are not specifically delegated to other service providers of the Fund. For purposes of the New Investment Management Agreement, “Portfolio Management Services” means the investment and reinvestment of the assets belonging to the Fund in accordance with the Fund’s investment objective and policies.

Unlike the Existing Investment Management Agreement, the New Investment Management Agreement authorizes the Adviser to delegate any or all of its responsibilities with respect to Portfolio Management Services to one or more parties that may or may not be affiliated with the Adviser (each such party, a “Sub-Adviser”), in each case pursuant to a written sub-advisory agreement approved by the Trustees and, if required by law, the shareholders of the Fund. The New Investment Management Agreement provides that, in the event that the Adviser delegates all or any part of its responsibilities under the New Investment Management Agreement (as is contemplated in connection with the proposed approval of the Sub-Advisory Agreement with Meketa, described in Proposal 2), the Adviser will furnish the following oversight services: (i) supervising and overseeing each Sub-Adviser’s provision of Portfolio Management Services; (ii) analyzing and reviewing the performance of each Sub-Adviser and reporting to the Board regarding same; (iii) reviewing and considering any changes in the ownership, senior management, or personnel fulfilling the obligations of each Sub-Adviser and reporting to the Board regarding same; (iv) conducting periodic diligence meetings with respect to compliance matters with representatives of each Sub-Adviser; (v) assisting the Board and management of the Fund in developing and reviewing information with respect to the approval and renewal of each agreement with a Sub-Adviser and presenting related recommendations to the Board; (vi) identifying potential successors to or replacements of any Sub-Adviser, or any potential additional Sub-Adviser, and presenting related recommendations to the Board; (vii) compensating each Sub-Adviser from the Adviser’s own resources; and (viii) performing such other review and reporting functions as the Board shall reasonably request.

| 5 |

Fees and Expenses

Under each of the Existing and New Investment Management Agreements, the Fund bears (i) all of the legal and other out-of-pocket expenses incurred in connection with its organization and the offering of its shares; (ii) ordinary administrative and operating expenses; (iii) risk management and other investment expenses in connection with the Fund’s portfolio transactions; (iv) professional fees and costs of service providers, including for legal, accounting, auditing, financial reporting and bookkeeping services; (v) fees and expenses associated with the Fund’s offers to repurchase its shares; (vi) costs associated with printing and mailing materials to shareholders; (vii) compensation of the Independent Trustees; (viii) registration, filing and other fees; (ix) charges and expenses for custodial, paying agent, shareholder servicing plans and other services; (x) brokers’ commissions and transfer taxes in connection with the Fund’s portfolio transactions; (xi) costs of certificates representing shares of the Fund; (xii) legal fees and expenses in connection with the Fund’s affairs; (xiii) expenses of meetings of Trustees and shareholders of the Fund; (xiv) interest on borrowings by the Fund; (xv) all filing costs, fees and other expenses directly related to the Fund’s portfolio investments; and (xvi) any extraordinary expenses, including litigation expenses.

The Fund also bears the management fee payable to the Adviser at an annual rate of 1.50% of the Fund’s average daily net assets (or such lesser amount as the Adviser may from time to time agree to receive).

Limitation of Liability

Each of the Existing and New Investment Management Agreements provide that, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of duties, the Adviser shall not be subject to liability to the Fund or to any shareholder of the Fund for any act or omission in connection with rendering services under the agreement.

Third Party Beneficiaries

The New Investment Management Agreement clarifies that such agreement shall not confer upon any person that is not a party to it any right, benefit or remedy under the agreement. The Existing Investment Management Agreement is silent on this point.

Termination

Each of the Existing and New Investment Management Agreements, unless otherwise terminated, continue in effect for two years from the date of execution and from year-to-year thereafter, so long as such continuance is specifically approved at least annually by the Board, including a majority of the Independent Trustees, or by the vote of a majority of the outstanding voting securities of the Fund. The agreement may be terminated (a) upon 60 days’ written notice to the Adviser either by vote of the Board or vote of a majority of the outstanding voting securities of the Fund or (b) upon 90 days’ written notice to the Fund by the Adviser. The agreement terminates automatically in the event of its assignment.

Board of Trustees Recommendation

At a meeting held on May 27, 2022, the Board, and separately a majority of the Independent Trustees, unanimously voted to approve the New Investment Management Agreement between the Adviser and the Fund and the presentation of the New Investment Management Agreement for shareholder approval at a special meeting to be held for such purpose. In advance of the meeting, the Board requested, and the Adviser provided, certain information related to the Adviser and the terms of the New Investment Management Agreement. The Independent Trustees were separately represented by independent legal counsel in their consideration of the New Investment Management Agreement.

In considering the approval of the New Investment Management Agreement and reaching their conclusions with respect to the New Investment Management Agreement, the Trustees took note of relevant judicial precedent and regulations adopted by the Securities and Exchange Commission that set forth factors to be considered by the Trustees when deciding to approve an investment advisory agreement. These factors include, but are not limited to, the following: (1) the nature, extent, and quality of the services to be provided to the Fund; (2) the investment performance

| 6 |

of the Fund and the Adviser; (3) the costs of the services to be provided and profits to be realized by the Adviser and its affiliates from the relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows; and (5) whether fee levels reflect these economies of scale for the benefit of the Fund’s shareholders. The Trustees, including the Independent Trustees, considered a variety of factors, including those described below. The Trustees also considered other factors and did not treat any single factor as determinative, and each Trustee may have attributed different weights to different factors. The Trustees also had an opportunity to meet in executive session to discuss the materials presented.

Nature, extent and quality of services. The Trustees considered materials provided by the Adviser regarding the nature, extent and quality of the services provided to the Fund by the Adviser, including a representation by the Adviser that the nature, extent and quality of its services were not expected to diminish following completion of the Transaction. The Trustees reviewed information regarding the Adviser and the personnel expected to perform services for the Fund following the Transaction. The Trustees considered the qualifications, background and responsibilities of the individuals at the Adviser who would oversee the day-to-day management and operations of the Fund and its service providers.

Performance. The Trustees considered information relating to the Fund’s and the Adviser’s performance. Among other information, the Trustees considered the performance of the Fund, noting that the Adviser intends to continue to oversee the Fund with the same investment objective and substantially similar strategies following the Transaction. The Trustees considered the performance of the Fund for the 2021 calendar year and monthly performance for the Fund and of certain comparable peer funds for the period from the Fund’s inception (August 26, 2020) through March 31, 2022.

Fees and Expenses. The Trustees next considered information regarding the Fund’s expense ratio and its various components, including the management fee for the Fund. The Trustees noted that there is no change in the rate of the fees that the Fund will pay the Adviser under the New Investment Management Agreement.

Profitability. The Trustees considered the Adviser’s profitability in connection with its management of the Fund. The Trustees noted that the advisory fee paid to the Adviser under the New Investment Management Agreement is the same as the rate paid under the Existing Investment Management Agreement. The Trustees also took into account the services the Adviser is expected to provide in performing its functions under the New Investment Management Agreement, including the Adviser’s ability to delegate all or a portion of its responsibilities for Portfolio Management Services. Based on the foregoing, the Trustees concluded that the profitability to the Adviser was reasonable.

Economies of Scale. The Trustees considered whether the Adviser currently realizes economies of scale with respect to its management of the Fund. The Trustees also considered that the Fund may expect to achieve economies of scale as the Fund continues to grow and that the Board will reevaluate whether such economics exist from time to time.

Fall-out Benefits. The Trustees discussed direct or indirect “fall-out benefits,” noting that the Adviser did not anticipate any fallout benefits at this stage.

* * * *

The Trustees, having requested and received such information from the Adviser as they believed reasonably necessary to evaluate the terms of the proposed New Investment Management Agreement, with the Independent Trustees having met in executive session with counsel, determined that the Adviser has demonstrated that it possesses the capability and resources to perform the duties required of it under the New Investment Management Agreement and that the New Investment Management Agreement should be approved and submitted to a vote of shareholders for approval.

Based on all of the above-mentioned factors and their related conclusions, with no single factor or conclusion being determinative and with each Trustee not necessarily attributing the same weight to each factor, the Trustees concluded that approval of the New Investment Management Agreement would be in the best interests of the Fund

| 7 |

and its shareholders. Accordingly, on May 27, 2022, the Trustees, and separately a majority of the Independent Trustees, unanimously voted to approve the Investment Management Agreement.

Required Vote

Proposal 1 must be approved by a “vote of a majority of the outstanding voting securities” of the Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of the Fund entitled to vote on Proposal 1 present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund entitled to vote on Proposal 1. If the vote required to approve Proposal 1 is not obtained from the Fund, the New Investment Management Agreement between the Adviser and the Fund will not be approved. Because the Transaction is expected to close on the earlier of the receipt of shareholder approval of the New Investment Management Agreement or October 7, 2022, the Trustees will consider what other actions to take in the best interests of the Fund, including approving an interim investment management agreement to take effect until such time as sufficient shareholder votes are received for Proposal 1.

THE TRUSTEES UNANIMOUSLY RECOMMEND THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 1.

| 8 |

PROPOSAL 2

APPROVAL OF THE SUB-ADVISORY AGREEMENT BETWEEN THE Adviser AND Meketa WITH RESPECT TO the FUND

Board of Trustees Approvals

At a meeting held on May 27, 2022, based upon the recommendation of the Adviser and other factors, the Board approved the appointment of Meketa as sub-adviser to the Fund and the related Sub-Advisory Agreement between the Adviser and Meketa. In approving the Sub-Advisory Agreement, the Board, including a majority of the Independent Trustees, determined that the hiring of Meketa is in the best interests of the Fund and its shareholders. The Board’s determination to approve the Sub-Advisory Agreement was based on a variety of factors and considerations, including (i) recommendation by the Adviser, which was based on its evaluation of Fund characteristics and exposures and Meketa’s investment strategy; (ii) qualitative and quantitative analysis of Meketa’s organizational structure, investment process, style and long-term track record; and (iii) Meketa’s ability to manage the Fund in accordance with its existing investment objective and policies. The Board also considered that the Adviser, and not the Fund, would bear the sub-advisory fees payable to Meketa under the Sub-Advisory Agreement. Accordingly, the Board, including a majority of the Independent Trustees, unanimously approved the Sub-Advisory Agreement, a form of which is attached as Appendix B.

Terms of the Sub-Advisory Agreement

Services

Under the Sub-Advisory Agreement, Meketa will manage the investment and reinvestment of the assets of the Fund in conformity with the Fund’s investment objective, policies and restrictions; any additional policies or guidelines established by the Adviser or the Board; and all applicable provisions of law, including without limitation the 1940 Act and the provisions of the Internal Revenue Code applicable to “registered investment companies” (as defined therein). Meketa will be authorized, in its discretion, to buy, sell, lend and otherwise trade in any stocks, bonds and other securities and investment instruments on behalf of the Fund, without regard to the length of time the securities have been held and the resulting rate of portfolio turnover or any tax considerations.

The Adviser may delegate to Meketa, subject to revocation at the discretion of the Board, responsibility for voting proxies relating to the Fund’s portfolio securities pursuant to written proxy voting policies and procedures established by the Adviser. Meketa shall furnish the Adviser, the Administrator and the Board with such information and reports as they may reasonably request.

Fees and Expenses

The Fund will bear the same expenses under the Sub-Advisory Agreement as it currently bears under the Existing Investment Management Agreement and as it is proposed to continue to bear under the New Investment Management Agreement. If shareholders approve the Sub-Advisory Agreement, the Adviser will pay Meketa a sub-advisory fee as follows:

| · | Prior to the three year anniversary of the effective date of the Sub-Advisory Agreement: |

| o | 0.00% of the average daily net assets of the Fund up to and including $75 million and |

| o | 0.40% of the average daily net assets of the Fund in excess of $75 million. |

| · | Following the three year anniversary of the effective date of the Sub-Advisory Agreement: |

| o | 0.40% of the average daily net assets of the Fund. |

In addition, Primark Distributors shall grant Meketa an interest in Primark Distributors generally entitling Meketa to 20% of (i) all net income earned by Primark Distributors and (ii) gain realized upon any sale of Primark Distributors (the “Profits Interest”), effective as of the date of the grant (which is expected to be the effective date of the Sub-Advisory Agreement); provided, however, that at any time the net assets of the Fund exceed $250,000,000, then the (a) aggregate sub-advisory fee payments plus (b) any distributions of net income made to Meketa associated with the Profits Interest shall not exceed 35% on an annualized basis of the net income of the Adviser (before accounting for payment of sub-advisory fees) (both (a) and (b) together, the “Sub-Advisory Fee”). The minimum annual fee due to Meketa (including any distributions associated with the Profits Interest) will be $300,000. The compensation payable to Meketa will be borne out of the Adviser’s own assets and not by the Fund.

| 9 |

Non-Exclusivity

The services provided by Meketa under the Sub-Advisory Agreement are not exclusive and Meketa and its affiliates may act as investment manager and provide other services to other investment companies or other accounts.

Limitation of Liability

The Sub-Advisory Agreement provides that, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of duties, Meketa shall not be subject to liability to the Adviser, the Fund or to any shareholder of the Fund for any act or omission in connection with rendering services under the agreement.

Third Party Beneficiaries

The Sub-Advisory Agreement provides that the Fund is a third party beneficiary of such agreement. Aside from the Fund, nothing in the Sub-Advisory Agreement is intended to confer upon any person that is not a party to it (including, but not limited to, shareholders of the Fund) any right, benefit or remedy under the agreement.

Termination

The Sub-Advisory Agreement, unless otherwise terminated, shall continue in effect for two years from the date of execution and from year-to-year thereafter, so long as such continuance is specifically approved at least annually by the Board, including a majority of the Independent Trustees, or by the vote of a majority of the outstanding voting securities of the Fund. The agreement may be terminated (a) upon 60 days’ written notice to Meketa by the Adviser, by vote of the Board, or by vote of a majority of the outstanding voting securities of the Fund or (b) on or upon 60 days’ written notice to the Adviser by Meketa (i) at any time, provided that the Adviser consents in writing to such termination, or (ii) after the first anniversary of the effective date of the Sub-Advisory Agreement. The agreement terminates automatically in the event of its assignment.

Portfolio Managers

If shareholders approve the Sub-Advisory Agreement, Meketa’s portfolio management team will manage the Fund’s assets. John A. Haggerty, Stephen P. McCourt, Peter S. Woolley, Ethan Samson, Todd K. Silverman, Amy Hsiang and Steven Hartt will serve as the portfolio managers jointly and primarily responsible for the day-to-day management and strategic oversight of the Fund’s investments.

Board of Trustees Recommendation

At a meeting held on May 27, 2022, the Board, and separately a majority of the Independent Trustees, unanimously voted to approve the Sub-Advisory Agreement between the Adviser and Meketa and the presentation of the Sub-Advisory Agreement for shareholder approval at a special meeting to be held for such purpose. The Independent Trustees were separately represented by independent legal counsel in their consideration of the Sub-Advisory Agreement.

In considering the approval of the Sub-Advisory Agreement and reaching their conclusions with respect to the Sub-Advisory Agreement, the Trustees took note of relevant judicial precedent and regulations adopted by the Securities and Exchange Commission that set forth factors to be considered by the Trustees when deciding to approve an investment advisory agreement (including a sub-advisory agreement). These factors include, but are not limited to, the following: (1) the nature, extent, and quality of the services to be provided to the Fund; (2) the investment performance of the Fund and the sub-adviser; (3) the costs of the services to be provided and profits to be realized by the sub-adviser and its affiliates from the relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows; and (5) whether fee levels reflect these economies of scale for the benefit of the Fund’s shareholders. The Trustees, including the Independent Trustees, considered a variety of factors, including those described below. The Trustees also considered other factors and did not treat any single factor as determinative, and each Trustee may have attributed different weights to different factors. The Trustees also had an opportunity to meet in executive session to discuss the materials presented.

| 10 |

Nature, extent and quality of services. The Trustees reviewed materials provided by Meketa regarding the nature, extent and quality of the services to be provided to the Fund by Meketa, including an overview of Meketa and the personnel that would perform services for the Fund. The Trustees reviewed the most recent Form ADV for Meketa and considered the qualifications, background and responsibilities of the members of Meketa’s portfolio management team who would oversee the day-to-day investment management and operations of the Fund. The Trustees considered Meketa’s process for identifying investment opportunities and Meketa’s long history of covering and recommending private equity investments. The Trustees also considered Meketa’s support resources available for investment research, compliance and operations. The Trustees also considered Meketa’s risk management processes and took into account the financial condition of Meketa with respect to its ability to provide the services required under the Sub-Advisory Agreement.

Performance. The Trustees noted that Meketa did not manage other funds and accounts using an investment strategy similar to that proposed to be used for the Fund but considered Meketa’s investment strategy and experience in evaluating and investing in private equity investments. Among other information, the Trustees noted that Meketa intends to manage the Fund with the same investment objective and substantially similar principal investment strategies as those currently used by the Adviser.

Sub-Advisory Fees. The Trustees noted that the Adviser, and not the Fund, is responsible for paying the fees charged by Meketa.

Profitability. In considering the anticipated profitability of Meketa with respect to the provision of sub-advisory services to the Fund, the Trustees considered information regarding Meketa’s organization, management and financial stability. The Board took into account the Adviser’s discussion of the proposed sub-advisory fee structure, and the services Meketa is expected to provide in performing its duties under the Sub-Advisory Agreement. Based on the foregoing, the Trustees concluded that the profitability to Meketa is expected to be reasonable.

Economies of Scale. The Trustees considered whether the Meketa would realize economies of scale with respect to its management of the Fund. The Trustees also considered that the Fund may expect to achieve economies of scale as the Fund continues to grow and that the Board will reevaluate whether such economics exist from time to time.

Fall-out Benefits. The Trustees discussed direct or indirect “fall-out benefits” to Meketa. The Trustees considered that, if shareholders approve the Sub-Advisory Agreement, Meketa is expected to hold, indirectly, 20% of the outstanding voting interests of Primark Capital, the Adviser’s parent company. They noted that this arrangement was expected to further align the Meketa’s interests with the performance of the Fund.

The Trustees, having requested and received such information from the Adviser and Meketa as they believed reasonably necessary to evaluate the terms of the Sub-Advisory Agreement, with the Independent Trustees having met in executive session with counsel, determined that approval of the Sub-Advisory Agreement is in the best interests of the Fund and its shareholders.

* * * *

Based on all of the above-mentioned factors and their related conclusions, with no single factor or conclusion being determinative and with each Trustee not necessarily attributing the same weight to each factor, the Trustees concluded that approval of the Sub-Advisory Agreement would be in the best interests of the Fund and its shareholders. Accordingly, on May 27, 2022, the Trustees, and separately a majority of the Independent Trustees, unanimously voted to approve the Sub-Advisory Agreement.

Required Vote

Proposal 2 must be approved by a “vote of a majority of the outstanding voting securities” of the Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of the Fund entitled to vote on Proposal 2 present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more

| 11 |

than 50% of the outstanding voting securities of the Fund entitled to vote on Proposal 2. If the vote required to approve Proposal 2 is not obtained from the Fund, the Sub-Advisory Agreement between the Adviser and Meketa will not be approved, and the Trustees will consider what other actions to take in the best interests of the Fund.

THE TRUSTEES UNANIMOUSLY RECOMMEND THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 2.

OTHER BUSINESS

The Trustees do not know of any additional matters to be presented at the Meeting other than those set forth in this Proxy Statement. If other business should properly come before the Meeting, proxies will be voted in accordance with the judgment of the persons named in the accompanying proxy or any adjournment(s) or postponement(s) thereof.

ADDITIONAL INFORMATION

Other Information

The SEC maintains an Internet web site (at http://www.sec.gov), which contains proxy materials, reports, and other information filed by the Fund.

Voting Information

Proxy Solicitation

Representatives of the Adviser may solicit proxies by telephone, letter or personally and will receive no additional compensation for these services. The Fund may also use one or more proxy solicitation firms to assist with the mailing and tabulation effort and any special personal solicitation of proxies. Banks, brokers, fiduciaries and nominees will, upon request, be reimbursed for their reasonable expenses in sending proxy material to beneficial owners of shares of the Fund.

Okapi Partners LLC (the “Solicitor”) has been engaged to assist in the solicitation of proxies, at an estimated cost of approximately $18,060. The aggregate expense of soliciting proxies is estimated to be approximately $30,000, including the solicitation fee. As the Meeting date approaches, certain shareholders of the Fund may receive a telephone call from a representative of the Solicitor if their votes have not yet been received. Proxies that are obtained telephonically will be recorded in accordance with the procedures described below. The Trustees believe that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the Solicitor’s representative is required to ask for each shareholder’s full name and address, or the zip code or employer identification number, and to confirm that the shareholder has received the proxy materials in the mail. If the shareholder is a corporation or other entity, the Solicitor’s representative is required to ask for the person’s title and confirmation that the person is authorized to direct the voting of the shares. If the information solicited agrees with the information provided to the Solicitor by the Fund, then the Solicitor’s representative has the responsibility to explain the process, read the proposals listed on the proxy card and ask for the shareholder’s instructions on the proposals. Although the Solicitor’s representative is permitted to answer questions about the process, representatives are not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this Proxy Statement. The Solicitor will record the shareholder’s instructions, and within 72 hours, the shareholder will be sent a letter or e-mail to confirm their vote and asking the shareholder to call the Solicitor immediately if their instructions are not correctly reflected in the confirmation.

If a shareholder wishes to participate in the Meeting and does not wish to authorize the execution of a proxy by telephone, mail, facsimile or Internet, the shareholder may vote at the Meeting in person.

| 12 |

If you require additional information regarding the proxy or replacement proxy cards, please call the Solicitor toll free at 1-844-343-2621. Any proxy given by a shareholder, whether in writing, by telephone, by facsimile or the Internet, is revocable until voted at the Meeting.

Shareholders Sharing the Same Address

The Fund will mail only one copy of this proxy statement to a household, even if more than one person in a household is a Fund shareholder of record, unless the Fund has received contrary instructions from one or more of the shareholders. If you need additional copies of this proxy statement and you are a holder of record of your shares, please call the Fund at 1-877-792-0924. If your shares are held in broker street name, please contact your financial service firm to obtain additional copies of this proxy statement. If in the future you do not want the mailing of proxy statements to be combined with those of other members of your household, or if you have received multiple copies of this proxy statement and want future mailings to be combined with those of other members of your household, please contact the Fund in writing at Primark Private Equity Investments Fund, 240 Saint Paul Street, 4th Floor, Denver, Colorado 80206, or by telephone at 1-877-792-0924, or contact your financial service firm. The Fund undertakes to deliver promptly upon written or oral request a separate copy of the proxy statement to a security holder at a shared address to which a single copy of the document was delivered.

Board of Trustees and Officers of the Fund

Independent Trustees

The address of each person below is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246.

| Name, Address and Year of Birth | Position(s) Held with Fund | Term of Office and Length of Time Served(1) | Principal Occupation(s) During the Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past 5 Years |

Brien Biondi (1962) | Trustee | Since 2020 | Chief Executive Officer, Campden Wealth, North America & The Institute for Private Investors (2016-Present); Chief Executive Officer and Founder, The Biondi Group (2011-Present) | 1 | None |

Clifford J. Jack (1963) | Trustee | Since 2020 | Manager, January Labs, LLC (2015-Present); Chief Executive Officer, Capital Tide LLC (2017-2019); Board of Advisors, National Financial Realty (2015-2019) | 1 | None |

Sean Kearns (1970) | Trustee | Since 2020 | Principal, Vicarage Associates LLC (2019-Present); Chief Executive Officer, A World of Tile (2004-2019) | 1 | None |

(1) Under the Fund’s Declaration of Trust, a Trustee serves until his or her retirement, resignation or replacement.

Interested Trustees and Officers

The address of each person below is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

| 13 |

| Name, Address and Year of Birth | Position(s) Held with Fund | Term of Office and Length of Time Served(1) | Principal Occupation(s) During the Past 5 Years |

| Michael Bell (1962) | Trustee, President and Principal Executive Officer | Since 2020 | Managing Director, Primark Advisors LLC (2020-Present); Managing Director, Forum Investment Group (2022-Present); Trustee, Forum Real Estate Income Fund (2021-2022); CEO, Global Financial Private Capital (2015-2019); CEO, Jackson National Life Insurance Retail Asset Management Business (2005-2014); General Counsel and CCO, National Planning Holdings, Inc. (2003-2005); General Counsel and Chief Administrative Officer, Folio Investing (1999-2003); Senior Associate, Latham & Watkins (1993-1999) |

Derek Mullins (1973) | Treasurer, Principal Financial Officer and Principal Accounting Officer | Since 2020 | Managing Partner, PINE Advisor Solutions (2018-Present); Principal Financial Officer, Destra Investment Trust, Destra International & Event Driven Credit Fund and Destra Multi-Alternative Fund (2018-Present); Principal Financial Officer, XAI Octagon Floating Rate & Alternative Income Term Trust (2020-Present); Principal Financial Officer, Emles Trust (2020-Present); Principal Financial Officer, Bow River Capital Evergreen Fund (2021-Present); Principal Financial Officer, Forum CRE Income Fund (2021-Present), Director of Operations, ArrowMark Partners LLC (2009-2018); Chief Financial Officer and Treasurer, MeridianFund, Inc. (2013-2018) |

Jesse D. Hallee (1976) | Secretary | Since 2020 | Vice President and Senior Managing Counsel, Ultimus Fund Solutions, LLC (2019-Present); Vice President and Managing Counsel, State Street Bank and Trust Company (2013-2019) |

Brian T. MacKenzie (1980) | Chief Compliance Officer | Since 2022 | Director, Pine Advisor Solutions (2022 to present); Head of Portfolio Surveillance and Reporting, Janus Henderson Investors (2018-2022); Vice President, Brown Brothers Harriman (2006 to 2018). |

Marcie McVeigh (1979) | Assistant Treasurer | Since 2020 | Director of CFO Services, PINE Advisor Solutions (2020-Present); Assistant Treasurer, Destra Investment Trust, Destra International & Event Driven Credit Fund and Destra Multi-Alternative Fund (2020-Present); Assistant Treasurer, Emles Trust (2020-Present); Assistant Treasurer, Bow River Capital Evergreen Fund (2021-Ppresent); Assistant Vice President and Performance Measurement Manager, Brown Brothers Harriman (2019-2020); Senior Financial Reporting Specialist, American Century Investments (2011-2018) |

(1) Under the Fund’s Bylaws, an officer serves until his or her successor is elected or qualified, or until he or she sooner dies, resigns, is removed or becomes disqualified. Officers hold office at the pleasure of the Trustees.

| 14 |

Principal Holders and Management Ownership

The total number of shares of the Fund outstanding, as of the Record Date, and information concerning the shareholders who owned beneficially or of record 5% or more of each class of the Fund’s outstanding securities, as of May 31, 2022, is set forth below.

As of the Record Date, the total number of the Fund’s outstanding shares was 8,120,277.047.

As of May 31, 2022, the following shareholder owned (either of record or beneficially) 5% or more of the Fund’s outstanding securities:

Name and Address Percentage

Charles Schwab & Co (for the benefit of its customers)..................................................................................................................32.42%

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105

As of May 31, 2022, the Trustees and officers of the Fund, as a group, directly and indirectly owned one percent of the Fund’s outstanding securities. As of May 31, 2022, the following Trustees and officers of the Fund were beneficial owners of the Fund’s outstanding securities:

| Name and Address | Number of Shares | Percentage |

| Class I | ||

Michael Bell(1) c/o Primark Advisors LLC, 240 Saint Paul Street, 4th Floor Denver, Colorado 80206

| 77,313.132 | 0.95% |

| Brien Biondi c/o Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

| 4,091.653 | 0.05% |

(1) Includes direct ownership as well as beneficial ownership through the Adviser’s investments in the Fund.

Shareholder Proposals

The Fund does not hold regularly scheduled meetings of shareholders. Any shareholder desiring to present a proposal for inclusion at the meeting of shareholders next following this Meeting should submit such proposal to the Trust at a reasonable time before the solicitation is made.

TO ENSURE THE PRESENCE OF A QUORUM AT THE SPECIAL MEETING, PROMPT VOTING IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE IF YOU WISH TO VOTE BY MAIL, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

By Order of the Board of Trustees,

/s/ Jesse D. Hallee

Jesse D. Hallee

Secretary

| 15 |

APPENDIX A

PRIMARK PRIVATE EQUITY FUND

Investment Management Agreement

AGREEMENT made this [___] day of [___], 2022, by and between PRIMARK PRIVATE EQUITY FUND, a Delaware statutory trust (the “Fund”), and PRIMARK ADVISORS LLC, a Delaware limited liability company (the “Adviser”).

WITNESSETH:

WHEREAS, the Fund and the Adviser wish to enter into an agreement setting forth the terms upon which the Adviser (or certain other parties acting pursuant to delegation from the Adviser) will perform certain services for the Fund;

NOW, THEREFORE, in consideration of the premises and covenants hereinafter contained, the parties agree as follows:

| 1. |

a. The Fund hereby employs the Adviser to (i) furnish the Fund with Portfolio Management Services (as defined in Section 2 hereof), subject to the authority of the Adviser to delegate certain of its responsibilities hereunder to other parties as provided in Section 1(b) hereof and (ii) furnish such other services necessary to sponsor and manage the Fund that are not specifically delegated to other service providers of the Fund, including overseeing the work that is delegated to other service providers, to include the administrator, of the Fund. The Adviser hereby accepts such employment and agrees, at its own expense, to furnish such services (either directly or pursuant to delegation to other parties as and to the extent permitted by Section 1(b) hereof) and to assume the obligations herein set forth, for the compensation herein provided. The Adviser shall, unless otherwise expressly provided or authorized, have no authority to act for or represent the Fund in any way or otherwise be deemed an agent of the Fund.

b. The Adviser may delegate any or all of its responsibilities hereunder with respect to the provision of Portfolio Management Services (and assumption of related expenses) to one or more other parties (each such party, a “Sub-Adviser”), pursuant in each case to a written agreement with such Sub-Adviser that meets the requirements of Section 15 of the Investment Company Act of 1940, as amended (the “1940 Act”), and the rules thereunder applicable to contracts for service as investment adviser of a registered investment company (including without limitation the requirements for approval by the trustees and the shareholders of the Fund), subject, however, to such exemptions and no action relief as may be granted by the Securities and Exchange Commission. Any Sub-Adviser may (but need not) be affiliated with the Adviser.

c. In the event that the Adviser delegates to one or more Sub-Advisers all or part of its responsibilities hereunder with respect to the provision of Portfolio Management Services, the Adviser hereby agrees to furnish to the Fund the following services (“Oversight Services”):

| i. | supervision and oversight of each Sub-Adviser’s provision of Portfolio Management Services with respect to the Fund; |

| ii. | perform periodic detailed analysis and reviews of the performance by each Sub-Adviser of its obligations to the Fund, including without limitation analysis and review of the Portfolio Management Services provided by each Sub-Adviser, analysis and review of portfolio and other compliance matters and review of each Sub-Adviser’s investment performance in respect of the Fund; |

| iii. | prepare and present periodic reports to the Board of Trustees of the Fund regarding the investment performance of each Sub-Adviser and other information regarding each Sub-Adviser, at such times and in such forms as the Board of Trustees of the Fund may |

| A-1 |

reasonably request; review and consider any changes in the personnel of each Sub-Adviser responsible for performing the Sub-Adviser’s obligations and make appropriate reports to the Board of Trustees of the Fund;

| iv. | review and consider any changes in the ownership or senior management of each Sub-Adviser and make appropriate reports to the Board of Trustees of the Fund; |

| v. | perform periodic in-person or telephonic diligence meetings, including with respect to compliance matters, with representatives of each Sub-Adviser; |

| vi. | assist the Board of Trustees of the Fund and management of the Fund in developing and reviewing information with respect to the initial approval of each agreement with a Sub-Adviser (a “Subadvisory Agreement”) and annual consideration of each Subadvisory Agreement thereafter; |

| vii. | prepare recommendations with respect to the continued retention of any Sub-Adviser or the replacement of any Sub-Adviser, including at the request of the Board of Trustees of the Fund; |

| viii. | identify potential successors to or replacements of any Sub-Adviser or potential additional Sub-Advisers, perform appropriate due diligence, and develop and present to the Board of Trustees of the Fund a recommendation as to any such successor, replacement, or additional Sub-Advisers, including at the request of the Board of Trustees of the Fund; |

| ix. | designate and compensate from its own resources such personnel as the Adviser may consider necessary or appropriate to the performance of its services; and |

| x. | perform such other review and reporting functions as the Board of Trustees of the Fund shall reasonably request consistent with this Agreement and applicable law. |

2. As used in this Agreement, “Portfolio Management Services” means management of the investment and reinvestment of the assets belonging to the Fund, consisting specifically of the following:

a. obtaining and evaluating such economic, statistical and financial data and information and undertaking such additional investment research as shall be necessary or advisable for the management of the investment and reinvestment of the assets belonging to the Fund in accordance with the Fund’s investment objectives and policies;

b. taking such steps as are necessary to implement the investment policies of the Fund by purchasing and selling of securities, including the placing of orders for such purchase and sale; and

c. regularly reporting to the Board of Trustees of the Fund with respect to the implementation of the investment policies of the Fund.