UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23583 | |

Primark Private Equity Investments Fund

(Exact name of registrant as specified in charter)

| 240 Saint Paul Street, 4th Floor, Denver, Colorado | 80206 |

| (Address of principal executive offices) | (Zip code) |

Gregory C. Davis

Paulita A. Pike

Ropes & Gray LLP, Three Embarcadero Center, San Francisco, CA 94111-4006

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (212) 802-8500 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | September 30, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a)

| TABLE OF CONTENTS |

| Shareholder Letter | 1 |

| | |

| Schedule of Investments | 2 |

| | |

| Statement of Assets and Liabilities | 5 |

| | |

| Statement of Operations | 6 |

| | |

| Statements of Changes in Net Assets | 7 |

| | |

| Statement of Cash Flows | 8 |

| | |

| Financial Highlights | 9 |

| | |

| Notes to Financial Statements | 10 |

| | |

| Approval of Investment Management Agreements and Sub-Advisory Agreement | 27 |

| | |

| Other Information | 32 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

SHAREHOLDER LETTER

September 30, 2022 (Unaudited) |

The overall global markets have continued to be impacted by surging inflation, rising interest rates, tightening monetary stance of many central banks, and the ongoing Russian invasion of Ukraine. This has created an increase in volatility in both the public and private markets, and an overall slowdown in the pace of growth in the global markets.

Whether the Federal Reserve (the “Fed”) can architect a “soft landing” remains a primary economic concern for investors. The Fed has noted that this will be very challenging. Rising inflation has been a key economic issue over the past year as the cost of living has increased at its highest rate in more than 40 years. The persistent high inflation supports the Fed’s stance towards continued rate hikes, which we believe also increases the risk of a recession.

Slowing corporate earnings growth is now also receiving greater attention. Markets had been relatively optimistic about corporate earnings, despite the potential for inflation-induced margin compression. However, markets have become increasingly concerned as companies have begun to issue more gloomy profit warnings and there have been some downward revisions on earnings estimates.

U.S. Private equity dealmakers appear to be feeling the pressure of higher interest rates, as activity in the last 6 months collectively slowed across mergers & acquisitions, growth equity and recap deals. Private equity appetite for deals in China has cooled considerably in 2022 as the region faces a barrage of economic headwinds including slowing global economic growth, higher commodities prices, and continued lockdowns related to COVID-19.

While market volatility will certainly have a continuing impact on private company valuations as we move forward, we believe experienced private equity managers have the opportunity to perform well in this environment given the depth of their diligence processes, flexibility in their investment timing and their value-add business models. We will continue to focus our efforts on investment opportunities that we believe are cash flow positive, showing earnings before interest, taxes, depreciation, and amortization growth in the middle market space.

On behalf of the entire Primark team, I would like to thank you for your continued support and partnership.

Sincerely,

President and Trustee, Primark Private Equity Investments Fund

| Semi-Annual Report Dated September 30, 2022 | 1 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 (Unaudited) |

PUBLICLY LISTED COMPANIES — 19.7%

| CLOSED-END FUNDS — 9.0% | | Shares | | | Value | |

| Apax Global Alpha Ltd. | | | 847,254 | | | $ | 1,626,752 | |

| HarbourVest Global Private Equity Ltd.(a) | | | 113,531 | | | | 2,661,417 | |

| HBM Healthcare Investments AG | | | 4,518 | | | | 1,016,751 | |

| HgCapital Trust plc | | | 486,597 | | | | 1,846,833 | |

| Pantheon International plc(a) | | | 715,630 | | | | 1,925,240 | |

| TOTAL CLOSED-END FUNDS (Cost $11,493,032) | | | | | | $ | 9,076,993 | |

| | | | | | | | | |

| COMMON STOCKS — 10.7% | | | Shares | | | Value | |

| FINANCIALS — 7.3% | | | | | | | | |

| ASSET MANAGEMENT — 7.3% | | | | | | | | |

| 3i Group plc | | | 121,160 | | | $ | 1,478,287 | |

| AURELIUS Equity Opportunities SE & Company KGaA | | | 66,246 | | | | 1,237,606 | |

| Blue Owl Capital Inc. - Class A | | | 180,000 | | | | 1,661,399 | |

| Onex Corporation | | | 36,006 | | | | 1,660,304 | |

| Wendel SE | | | 17,454 | | | | 1,262,751 | |

| | | | | | | | 7,300,347 | |

| INDUSTRIALS — 3.4% | | | | | | | | |

| INDUSTRIAL CONGLOMERATES — 3.4% | | | | | | | | |

| Brookfield Business Partners L.P. | | | 91,500 | | | | 1,780,590 | |

| Compass Diversified Holdings | | | 94,000 | | | | 1,697,640 | |

| | | | | | | | 3,478,230 | |

| TOTAL COMMON STOCKS (Cost $13,979,464) | | | | | | $ | 10,778,577 | |

| | | | | | | | | |

| PRIVATE EQUITY INVESTMENTS — 65.3% | | | Shares | | | Value | |

| PORTFOLIO COMPANIES — 44.8% | | | | | | | | |

| BlueVoyant LLC(a)(b)(c) | | | 2,996,254 | | | $ | 7,200,000 | |

| Circuit Clinical Solutions Preferred Series C Stock(a)(b)(c) | | | 112,300 | | | | 6,000,000 | |

| FS NU Investors L.P.(a)(b)(c)(e) | | | — | | | | 4,750,000 | |

| Hg Vibranium Co-Invest L.P.(a)(c)(d)(e) | | | — | | | | 7,000,000 | |

| Onex ISO Co-Invest L.P.(a)(c)(d)(e) | | | — | | | | 4,426,946 | |

| RCP MB Investments A, L.P.(a)(c)(d)(e) | | | — | | | | 8,000,000 | |

| TriSalus Life Sciences, Inc. Series B-1 Preferred Stock(a)(b)(c) | | | 22,857,142 | | | | 8,000,000 | |

| | | | | | | $ | 45,376,946 | |

See accompanying notes to financial statements.

| 2 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 (Unaudited) (Continued) |

| PRIVATE EQUITY INVESTMENTS — 65.3% (Continued) | | Shares | | | Value | |

| PORTFOLIO FUNDS — 20.5% | | | | | | | | |

| Arsenal Capital Partners Growth L.P.(a)(c)(d)(e) | | | — | | | $ | 364,370 | |

| Arsenal Capital Partners VI L.P.(a)(c)(d)(e) | | | — | | | | 985,586 | |

| Cordillera Investment Fund III, L.P.(a)(c)(d)(e) | | | — | | | | 834,196 | |

| Hg Saturn 3 A, L.P.(a)(c)(d)(e) | | | — | | | | 25,342 | |

| ICG L.P. Secondaries Fund I L.P.(a)(c)(d)(e) | | | — | | | | 2,473,144 | |

| ICG Ludgate Hill IIA Boston L.P. Secondary Fund(a)(c)(d)(e)(f) | | | — | | | | 3,530,714 | |

| Onex Structured Credit Opportunities Partners I, L.P.(c)(d)(e) | | | — | | | | 2,892,975 | |

| Partners Group Direct Equity IV (USD) A, L.P.(a)(c)(d)(e) | | | — | | | | 5,135,704 | |

| Partners Group Secondary 2020 (USD) A, L.P.(a)(c)(d)(e)(f) | | | — | | | | 1,976,099 | |

| Saturn Five Frontier I, LLC - Class A(a)(b)(c)(f) | | | 2,500,000 | | | | 2,500,000 | |

| | | | | | | | 20,718,130 | |

| TOTAL PRIVATE EQUITY INVESTMENTS (Cost $66,037,533) | | | | | | $ | 66,095,076 | |

| | | | | | | | | |

| TOTAL INVESTMENTS AT VALUE — 85.0% (Cost $91,510,029) | | | | | | $ | 85,950,646 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 15.0% | | | | | | | 15,160,280 | |

| | | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 101,110,926 | |

| (a) | Non-income producing security. |

| (b) | Level 3 securities fair valued using significant unobservable inputs (see note 2). |

| (c) | Restricted investments as to resale (see note 2). |

| (d) | Investment is valued using net assets value per share (or its equivalent) as a practical expedient (See note 2 for respective investment strategies, unfunded commitments and redemptive restrictions). |

| (e) | Investment does not issue shares. |

| (f) | Affiliated investment for which ownership is 5% or more of the investment’s capital (see note 5). |

AG – Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

KGaA – Kommanditgesellschaft Auf Aktien is a German Corporate designation standing for partnership limited by shares.

L.P.— Limited Partnerships.

plc – public limited company

SE – Societas Europaea is a European public company.

See accompanying notes to financial statements.

| Semi-Annual Report Dated September 30, 2022 | 3 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 (Unaudited) (Continued) |

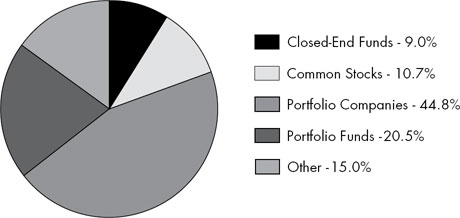

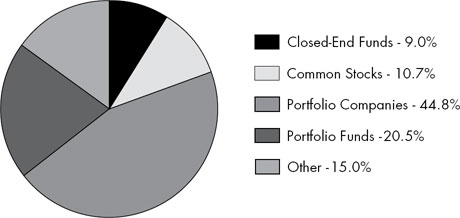

ASSET ALLOCATION (% of Net Assets)

See accompanying notes to financial statements.

| 4 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2022 (Unaudited) |

| ASSETS | | | | |

| Investments in securities: | | | | |

| Affiliated investments at cost (Note 5) | | $ | 6,435,694 | |

| Unaffiliated investments at cost | | | 85,074,335 | |

| Affiliated investments at value (Note 5) | | $ | 8,006,813 | |

| Unaffiliated investments at value | | | 77,943,833 | |

| Cash (Note 2) | | | 18,772,235 | |

| Foreign currency, at value (cost $13,379) | | | 12,405 | |

| Receivable for capital shares sold | | | 558,985 | |

| Tax reclaims receivable | | | 22,511 | |

| Dividends and interest receivable | | | 19,431 | |

| Prepaid expenses | | | 45,162 | |

| TOTAL ASSETS | | | 105,381,375 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for capital shares redeemed | | | 4,197,554 | |

| Payable to Adviser | | | 48,335 | |

| Payable to administrator (Note 4) | | | 10,720 | |

| Accrued shareholder servicing fees (Note 6) | | | 8,502 | |

| Other accrued expenses | | | 5,338 | |

| TOTAL LIABILITIES | | | 4,270,449 | |

| Contingencies and Commitments (Note 8) | | | | |

| | | | | |

| NET ASSETS | | $ | 101,110,926 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 112,544,496 | |

| Accumulated deficit | | | (11,433,570 | ) |

| NET ASSETS | | $ | 101,110,926 | |

| | | | | |

| PRICING OF CLASS I SHARES | | | | |

| Net assets applicable to Class I Shares | | $ | 101,110,926 | |

| Shares of Class I Shares outstanding (no par value, unlimited number of shares authorized) | | | 9,239,185 | |

| Net asset value, offering and redemption price per share (a) (Note 2) | | $ | 10.94 | |

| | | | | |

| (a) | Early repurchase fee may apply to tender of shares held for less than one year (Note 9). |

See accompanying notes to financial statements.

| Semi-Annual Report Dated September 30, 2022 | 5 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

STATEMENT OF OPERATIONS

For the Six Months Ended September 30, 2022

(Unaudited) |

| INVESTMENT INCOME | | | | |

| Dividend income from unaffiliated investments (net of foreign withholding taxes of $24,960) | | $ | 474,181 | |

| Distributions from Portfolio Funds | | | 15,909 | |

| Interest | | | 895 | |

| TOTAL INVESTMENT INCOME | | | 490,985 | |

| | | | | |

| EXPENSES | | | | |

| Investment management fees (Note 4) | | | 730,357 | |

| Legal fees | | | 250,858 | |

| Shareholder servicing fees, Class I (Note 6) | | | 48,690 | |

| Administration fees (Note 4) | | | 44,601 | |

| Certifying financial officer fees (Note 4) | | | 22,500 | |

| Registration and filing fees | | | 27,929 | |

| Insurance expense | | | 26,697 | |

| Audit and tax services fees | | | 24,500 | |

| Transfer agent fees, Class I (Note 4) | | | 18,202 | |

| Compliance fees (Note 4) | | | 20,041 | |

| Trustees’ fees (Note 4) | | | 15,000 | |

| Proxy services fees | | | 12,403 | |

| Custodian fees | | | 12,143 | |

| Postage and supplies | | | 12,124 | |

| Other expenses | | | 34,654 | |

| TOTAL EXPENSES | | | 1,300,699 | |

| Management fees waived and expense reimbursements by the Adviser (Note 4) | | | (326,408 | ) |

| NET EXPENSES | | | 974,291 | |

| | | | | |

| NET INVESTMENT LOSS | | | (483,306 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCY TRANSLATION | | | | |

| Net realized gains (losses) from: | | | | |

| Unaffiliated Investments | | | (978,304 | ) |

| Foreign currency transactions (Note 2) | | | (5,840 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Unaffiliated Investments | | | (10,521,468 | ) |

| Affiliated Investments | | | 1,571,119 | |

| Foreign currency translation (Note 2) | | | (3,879 | ) |

| NET REALIZED AND UNREALIZED GAINS/(LOSSES) ON INVESTMENTS AND FOREIGN CURRENCY TRANSLATION | | | (9,938,372 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (10,421,678 | ) |

| | | | | |

See accompanying notes to financial statements.

| 6 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six-Months Ended | | | | |

| | | September 30, | | | Year Ended | |

| | | 2022 | | | March 31, | |

| | | (Unaudited) | | | 2022 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment loss | | $ | (483,306 | ) | | $ | (78,076 | ) |

| Net realized gains (losses) from investments and foreign currencies | | | (984,144 | ) | | | 284,209 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translation | | | (8,954,228 | ) | | | 1,172,133 | |

| Net increase (decrease) in net assets resulting from operations | | | (10,421,678 | ) | | | 1,378,266 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Class I | | | — | | | | (4,597,032 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 29,731,548 | | | | 83,696,787 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 940,263 | |

| Proceeds from early repurchase fees collected (Notes 2 and 9) | | | 84,031 | | | | 59,615 | |

| Payments for shares repurchased | | | (10,172,575 | ) | | | (9,790,604 | ) |

| Net increase in Class I net assets from capital share transactions | | | 19,643,004 | | | | 74,906,061 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 9,221,326 | | | | 71,687,295 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 91,889,600 | | | | 20,202,305 | |

| End of period | | $ | 101,110,926 | | | $ | 91,889,600 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Class I | | | | | | | | |

| Shares sold | | | 2,584,884 | | | | 6,621,342 | |

| Shares reinvested | | | — | | | | 73,746 | |

| Shares repurchased | | | (908,734 | ) | | | (784,110 | ) |

| Net increase in shares outstanding | | | 1,676,150 | | | | 5,910,978 | |

| Shares outstanding, beginning of period | | | 7,563,035 | | | | 1,652,057 | |

| Shares outstanding, end of period | | | 9,239,185 | | | | 7,563,035 | |

| | | | | | | | | |

See accompanying notes to financial statements.

| Semi-Annual Report Dated September 30, 2022 | 7 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

STATEMENT OF CASH FLOWS

For the Six Months Ended September 30, 2022

(Unaudited) |

| Cash flows from operating activities | | | | |

| Net decrease in net assets from operations | | $ | (10,421,678 | ) |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (35,260,027 | ) |

| Purchases of investments from affiliates | | | (1,498,711 | ) |

| Proceeds from sale of investments | | | 6,700,238 | |

| Cash proceeds from return of capital | | | 840,000 | |

| Net realized loss on unaffiliated investments | | | 978,304 | |

| Net realized loss on foreign currency translations | | | 5,840 | |

| Net change in unrealized depreciation on unaffiliated investments | | | 10,521,468 | |

| Net change in unrealized appreciation on affiliated investments | | | (1,571,119 | ) |

| Net change in unrealized depreciation on foreign currency translation | | | 3,879 | |

| (Increase)/Decrease in Assets: | | | | |

| Decrease dividend and interest receivable | | | 99,611 | |

| Increase in tax reclaims receivable | | | (9,551 | ) |

| Increase prepaid expenses | | | (13,344 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Decrease payable to Adviser | | | (56,309 | ) |

| Decrease in accrued audit and tax services fees | | | (51,000 | ) |

| Decrease in accrued legal fees | | | (12,500 | ) |

| Increase to payable to administrator | | | 500 | |

| Increase to accrued shareholder servicing fees | | | 1,518 | |

| Decrease to trustees’ fees | | | (2,500 | ) |

| Decrease to other accrued expenses | | | (27,630 | ) |

| Net cash used in operating activities | | $ | (29,773,011 | ) |

| | | | | |

| Cash flows from financing activities | | | | |

| Proceeds from issuance of shares, net of change in receivable for capital shares sold | | | 29,431,629 | |

| Proceeds from early repurchased fees collected | | | 84,031 | |

| Payment for shares repurchased, net of change in payable for capital shares redeemed | | | (10,794,601 | ) |

| Net Cash provided by financing activities | | $ | 18,721,059 | |

| | | | | |

| Net change in cash | | | (11,051,952 | |

| Cash beginning of period | | | 29,836,592 | |

| Cash end of period | | $ | 18,784,640 | |

| | | | | |

See accompanying notes to financial statements.

| 8 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND

CLASS I SHARES

FINANCIAL HIGHLIGHTS |

| | |

Per Share Data for a Share Outstanding Throughout Each Period

| | | Six Months Ended | | | | | | | |

| | | September 30, | | | Year Ended | | | Period Ended | |

| | | 2022 | | | March 31, | | | March 31, | |

| | | (Unaudited) | | | 2022* | | | 2021*(a) | |

| Net asset value at beginning of period | | $ | 12.15 | | | $ | 12.23 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

| Net investment loss (b) (c) | | | (0.06 | ) | | | (0.02 | ) | | | (0.01 | ) |

| Net realized and unrealized gains (losses) on investments | | | (1.16 | ) | | | 0.83 | | | | 2.25 | |

| Total from investment operations | | | (1.22 | ) | | | 0.81 | | | | 2.24 | |

| | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment loss | | | — | | | | (0.90 | ) | | | (0.01 | ) |

| Net realized capital gains | | | — | | | | 0.00 | (d) | | | — | |

| Total from distributions | | | — | | | | (0.90 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | |

| Proceeds from early repurchase fees collected (Notes 2 and 9) | | | 0.01 | | | | 0.01 | | | | 0.00 | (d) |

| | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 10.94 | | | $ | 12.15 | | | $ | 12.23 | |

| | | | | | | | | | | | | |

| Total return (e) | | | (9.88 | %) (f) | | | 6.33 | % | | | 22.44 | % (f) |

| | | | | | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 101,111 | | | $ | 91,890 | | | $ | 20,202 | |

| | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | |

| Ratio of total expenses to average net assets (g) | | | 2.67 | % (h) | | | 2.77 | % | | | 5.36 | % (h) |

| Ratio of net expenses to average net assets (g) (i) | | | 2.00 | % (h) | | | 2.00 | % | | | 2.00 | % (h) |

| Ratio of net investment loss to average net assets (b) (i) | | | (0.99 | %) (h) | | | (0.15 | %) | | | (0.10 | %) (h) |

| Portfolio turnover rate | | | 9 | % (f) | | | 12 | % | | | 3 | % (f) |

| | | | | | | | | | | | | |

| * | Includes adjustments in accordance with generally accepted accounting principles in the United States, and consequently, the net asset value for financial reporting purposes and returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (a) | Represents the period from the commencement of operations (August 26, 2020) through March 31, 2021. |

| (b) | Recognition of net investment loss by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. The ratio of net investment loss does not include the net investment income/loss of the investment companies in which the Fund invests. |

| (c) | Net investment loss per share has been calculated using the average daily shares outstanding during the period. |

| (d) | Amount rounds to less than $0.01 per share. |

| (e) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The returns would have been lower if certain expenses had not been waived or reimbursed by the Adviser. |

| (g) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests, including management and performance fees. As of September 30, 2022 the Fund’s underlying investment companies included a range of management and/or administrative fees from 0.0% to 2.00% (unaudited) and performance fees from 0.0% to 20% (unaudited). |

| (i) | Ratio was determined after management fees waived and expense reimbursements (Note 4). |

See accompanying notes to financial statements.

| Semi-Annual Report Dated September 30, 2022 | 9 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) |

1. Organization

Primark Private Equity Investments Fund (the “Fund”) is organized as a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act. The Fund’s investment objective is to generate long-term capital appreciation, consistent with prudent investment management. Under normal market conditions, the Fund will invest at least 80% of its net assets, plus any borrowing for investment purposes, in private equity investments, including: (i) investments in the equity of private operating companies (“Portfolio Companies”); (ii) primary and secondary investments in private equity funds (“Portfolio Funds”) managed by third-party managers; and (iii) investments in publicly listed companies that pursue the business of private equity investing, including listed private equity companies, listed funds of funds, business development companies, special purpose acquisition companies, alternative asset managers, holding companies, investment trusts, closed-end funds, financial institutions and other vehicles whose primary purpose is to invest in, lend capital to or provide services to privately held companies. The Fund will also invest in short-term investments, including money market funds, short-term treasuries and other liquid investment vehicles. The Fund commenced operations on August 26, 2020.

The Fund currently offers one class of shares: Class I Shares which are sold without any sales loads, but subject to shareholder servicing fees of up to 0.10% of the average daily net assets of Class I and subject to a $1,000,000 initial investment minimum. As of September 30, 2022, Class II shares (to be sold without any sales loads, but subject to distribution and/ or shareholder servicing fees of up to 0.25% of the average daily net assets of Class II and subject to a $50,000 initial investment minimum) are not currently offered. When all classes are offered, each class of shares will have identical rights and privileges except with respect to distribution (12b-1) and service fees, voting rights on matters affecting a single class of shares, and exchange privileges of each class of shares.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies.

Basis of Presentation and Use of Estimates — The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement. Actual results could differ from those estimates.

Cash and Cash Equivalents — Idle cash may be swept into various interest bearing overnight demand deposits and is classified as a cash equivalent on the Statement of Assets and Liabilities. The Fund maintains cash in the bank deposit accounts which, at times, may exceed United States federally insure limit of $250,000. Amounts swept overnight are available on the next business day.

Valuation of Securities –- The Fund calculates the net asset value (“NAV”) of each class of shares of the Fund as of the close of business on each business day (each, a “Determination Date”). In determining the NAV of each class of shares, the Fund values its investments as of the relevant Determination Date. The net assets of each class of the Fund equals the value of the total assets of the class, less all of the liabilities attributable to the class, including accrued fees and expenses, each determined as of the relevant Determination Date.

The valuation of the Fund’s investments is performed in accordance with the Pricing and Fair Valuation Policies adopted by the Trustees of the Fund (the “Board”), and in conjunction with FASB’s Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosures.

| 10 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

Securities traded on one or more of the U.S. national securities exchanges, the Nasdaq Stock Market or any foreign stock exchange are valued based on their respective market price. Debt instruments for which market quotations are readily available are typically valued based on such market quotations. When a marketing quotation for a portfolio security is not readily available or is deemed unreliable and for the purpose of determining the value of the other Fund assets, the asset is priced at its fair value.

The Board has designated Primark Advisors LLC (the “Adviser” or “Valuation Designee”), the investment adviser to the Fund, as the Valuation Designee pursuant to Rule 2a-5 under the 1940 Act to perform the fair value determination relating to any and all Fund investments, subject to the conditions and oversight requirements described in the Fair Valuation of Investments Policy. In furtherance of its duties as Valuation Designee, the Adviser has formed a valuation committee (the “Valuation Committee”), to perform fair value determinations and oversee the day-to-day functions related to the fair valuation of the Fund’s investments. The Valuation Committee may consult with representatives from the Fund’s outside legal counsel or other third-party consultants in their discussions and deliberations.

In validating market quotations, the Valuation Committee considers different factors such as the source and the nature of the quotation in order to determine whether the quotation represents fair value. The Valuation Committee makes use of reputable financial information providers in order to obtain the relevant quotations.

For debt and equity securities which are not publicly traded or for which market prices are not readily available (unquoted investments), the fair value is determined in good faith. In determining the fair values of these investments, the Valuation Committee typically applies widely recognized market and income valuation methodologies including, but not limited to, earnings and multiple analysis, discounted cash flow method and third-party valuations. In order to determine a fair value, these methods are applied to the latest information provided by the underlying portfolio companies or other business counterparties.

Due to the inherent uncertainty in determining the fair value of investments for which market values are not readily available, the fair values of these investments may fluctuate from period to period. In addition, such fair value may differ materially from the values that may have been used had a ready market existed for such investments and may significantly differ from the value ultimately realized by the Fund.

Assets and liabilities initially expressed in foreign currencies will be converted into U.S. Dollars using foreign exchange rates provided by a recognized pricing service.

The Fund’s investments in Portfolio Companies may be made directly with the Portfolio Company or through a special purpose vehicle (“SPV’). Portfolio Companies may be valued at acquisition cost or based on recent transactions. If the Portfolio Company investment is made through an SPV, it will generally be valued based on the latest NAV reported by the SPV. These Portfolio Companies are monitored for any independent audits or impairments reported on the potential value of the investment in accordance with the Fair Valuation of Investments Policy.

Portfolio Funds are generally valued based on the latest NAV reported by the Portfolio Fund Manager. New purchases of Portfolio Funds may be valued at acquisition cost initially until a NAV is provided by the Portfolio Fund Manager. If the NAV of an investment in a Portfolio Fund is not available at the time the Fund is calculating its NAV, the Valuation Committee will consider any cash flows since the reference date of the last NAV reported by the Portfolio Fund Manager by (i) adding the nominal amount of the investment related capital calls and (ii) deducting the nominal amount of investment related distributions from the last NAV reported by the Portfolio Fund Manager.

In addition to tracking the NAV plus related cash flows of such Portfolio Funds, the Valuation Committee may consider relevant broad-based and issuer (or fund) specific valuation information and may conclude in certain circumstances that the information provided by the Portfolio Fund Manager does not represent the fair value of a particular asset held by a Portfolio Fund. If the Valuation Committee concludes in good faith that the latest NAV reported by a Portfolio Fund Manager does not represent fair value (e.g., there is more current information regarding a portfolio asset which significantly changes its fair

| Semi-Annual Report Dated September 30, 2022 | 11 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

value), the Valuation Committee will make a corresponding adjustment to reflect the current fair value of such asset within such Portfolio Fund. In determining the fair value of assets held by Portfolio Funds, the Valuation Committee applies valuation methodologies as outlined above.

U.S. GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurement.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical assets |

| ● | Level 2 – other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Private equity investments that are measured at fair value using the NAV per share (or its equivalent) without further adjustment, as a practical expedient of fair value are excluded from the fair value hierarchy. Generally, the fair value of the Fund’s investment in a privately offered investment represents the amount that the Fund could reasonably expect to receive from the investment fund if the Fund’s investment is withdrawn at the measurement date based on NAV.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments and inputs used to value the investments, by security type, as of September 30, 2022:

| | | Practical | | | | | | | | | | | | | |

| Investments in Securities | | Expedient* | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Closed-End Funds | | $ | — | | | $ | 9,076,993 | | | $ | — | | | $ | — | | | $ | 9,076,993 | |

| Common Stocks | | | — | | | | 10,778,577 | | | | — | | | | — | | | | 10,778,577 | |

| Private Equity Investments** | | | 37,645,076 | | | | — | | | | — | | | | 28,450,000 | | | | 66,095,076 | |

| Total | | $ | 37,645,076 | | | $ | 19,855,570 | | | $ | — | | | $ | 28,450,000 | | | $ | 85,950,646 | |

| * | Certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Schedule of Investments. |

| ** | All sub-categories within the security type represent their respective evaluation status. For a detailed breakout please refer to the Schedule of Investments. |

| 12 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

The following is the fair value measurement of investments that are measured at NAV per share (or its equivalent) as a practical expedient:

| Private Equity Investment(a) | | Investment

Strategy | | Fair Value | | | Unfunded

Commitment | | | Redemption

Frequency | | Redemption

Notice Period |

| Arsenal Capital Partners Growth L.P. | | Healthcare and Industrial Growth | | $ | 364,370 | | | $ | 2,032,400 | | | Subject to General Partner consent | | Not Applicable |

| Arsenal Capital Partners VI L.P. | | Healthcare and Industrial Growth | | | 985,586 | | | | 6,821,903 | | | Subject to General Partner consent | | Not Applicable |

| Cordillera Investment Fund III, L.P. | | Niche non-correlated | | | 834,196 | | | | 656,997 | | | Subject to General Partner consent | | Not Applicable |

| Hg Saturn 3 A, L.P. | | Global private equity investments | | | 25,342 | | | | 4,974,658 | | | Subject to General Partner consent | | Not Applicable |

| Hg Vibranium Co-Invest L.P. | | Enterprise resource planning and Technology | | | 7,000,000 | | | | — | | | Subject to General Partner consent | | Not Applicable |

| ICG L.P. Secondaries Fund I L.P. | | U.S. and Europe Secondaries mid-market | | | 2,473,144 | | | | 2,529,669 | | | Subject to General Partner consent | | Not Applicable |

| ICG Ludgate Hill IIA Boston L.P. Secondary Fund | | North American Buy Out | | | 3,530,714 | | | | 2,503,017 | | | Subject to General Partner consent | | Not Applicable |

| Onex ISO Co-Invest L.P. | | Financial Services | | | 4,426,946 | | | | — | | | Subject to General Partner consent | | Not Applicable |

| Onex Structured Credit Opportunities Partners I, L.P. | | Middle Market Collateralized Loan Obligation | | | 2,892,975 | | | | 998,626 | | | Subject to General Partner consent | | Not Applicable |

| Partners Group Direct Equity IV (USD) A,L.P. | | Global private equity investments | | | 5,135,704 | | | | 2,205,000 | | | Subject to General Partner consent | | Not Applicable |

| Partners Group Secondary 2020 (USD) A,L.P. | | Global Private Equity Secondary Investments | | | 1,976,099 | | | | 3,542,553 | | | Subject to General Partner consent | | Not Applicable |

| RCP MB Investments A, L.P. | | Payment processing software and Technology | | | 8,000,000 | | | | — | | | Subject to General Partner consent | | Not Applicable |

| | | | | $ | 59,145,076 | | | $ | 26,264,863 | | | | | |

| (a) | Refer to the Schedule of Investment for classifications of individual securities. |

| Semi-Annual Report Dated September 30, 2022 | 13 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

The following is a roll-forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | | | | | Transfers | | | Transfers out | | | | | | | |

| | | Beginning | | | into | | | of | | | | | | | |

| | | balance | | | Level 3 | | | Level 3 | | | | | | | |

| | | March 31, | | | during the | | | during the | | | Purchases or | | | Sales or | |

| | | 2022 | | | period | | | period | | | Conversations | | | Conversions | |

| Portfolio Companies | | | | | | | | | | | | | | | | | | | | |

| Portfolio Companies | | $ | 19,000,000 | | | $ | — | | | $ | — | | | $ | 7,750,000 | | | $ | — | |

| Portfolio Funds | | | 5,746,983 | | | | — | | | | (3,530,714 | ) | | | — | | | | — | |

| | | | | | | | | Change in net | | | Ending | |

| | | | | | | | | unrealized | | | Balance | |

| | | Net realized | | | | | | Appreciation | | | September 30, | |

| | | gain(loss) | | | Distributions | | | (Depreciation) | | | 2022 | |

| Portfolio Companies | | | | | | | | | | | | | | | | |

| Portfolio Companies | | $ | — | | | $ | — | | | $ | (800,000 | ) | | $ | 25,950,000 | |

| Portfolio Funds | | | — | | | | (840,000 | ) | | | 1,123,731 | | | | 2,500,000 | |

Transfers out of Level 3 during the period represent investments that are being measured at fair value using the NAV per share (or its equivalent) as a practical expedient.

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of September 30, 2022:

| | | | | | | | | | | | Impact to |

| | | | | | | | | | | | Valuation from |

| | | | | | Valuation | | Unobservable | | | | an increase |

| Level 3 Investment(a) | | Fair Value | | | Technique | | Inputs | | Range of Inputs | | in Input |

| BlueVoyant LLC | | $ | 7,200,000 | | | Market Approach/ Market Comparable | | Revenue Multiples | | 2.75x to 11.70x | | Increase |

| | | | | | | | | EBITDA Multiples | | 3.8x to 27.5x | | Increase |

| Circuit Clinical Solutions Preferred Series C Stock | | | 6,000,000 | | | Market Approach/ Market Comparable | | Revenue Multiples | | 0.92x to 3.89x | | Increase |

| | | | | | | | | EBITDA Multiples | | 11.9x to 19.7x | | Increase |

| FS NU Investors LP | | | 4,750,000 | | | Market Approach | | Cost | | Not Applicable | | Not Applicable |

| TriSalus Life Sciences | | | 8,000,000 | | | Market Approach/ Market Comparable | | Revenue Multiples | | 2.21x to 5.18x | | Increase |

| | | | | | | | | EBITDA Multiples | | 9.9x to 19.1x | | Increase |

| 14 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

| | | | | | | | | | | | Impact to |

| | | | | | | | | | | | Valuation from |

| | | | | | Valuation | | Unobservable | | | | an increase |

| Level 3 Investment(a) | | Fair Value | | | Technique | | Inputs | | Range of Inputs | | in Input |

| Saturn Five Frontier I, LLC Class A | | $ | 2,500,000 | | | Market Approach | | Cost | | Not Applicable | | Not Applicable |

| | | $ | 28,450,000 | | | | | | | | | |

| (a) | Refer to Schedule of Investments for classifications of individual securities. |

Restricted Securities – Restricted securities are securities that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Board. The restricted securities may be valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith using methods approved by the Board. The Portfolio Funds generally are restricted securities that are subject to substantial holding periods and are not traded in public markets, so that the Fund may not be able to resell some of its investments for extended periods, which may be several years.

Additional information on each restricted investment held by the Fund at September 30, 2022 is as follows:

| Security Description | | Acquisition Date | | Cost | | | Value | | | % of Net Assets |

| Portfolio Company | | | | | | | | | | | | |

| BlueVoyant LLC | | 10/29/2021 | | $ | 8,000,000 | | | $ | 7,200,000 | | | 7.12% |

| Circuit Clincial Solutions Preferred Series C Stock | | 1/13/2022 | | | 6,000,000 | | | | 6,000,000 | | | 5.93% |

| FS NU Investors, LP | | 8/11/2022 | | | 4,750,000 | | | | 4,750,000 | | | 4.70% |

| Hg Vibranium Co-Invest L.P. | | 6/29/2022 | | | 7,007,148 | | | | 7,000,000 | | | 6.92% |

| Onex ISO Co-Invest L.P. | | 10/29/2021 | | | 5,000,000 | | | | 4,426,946 | | | 4.38% |

| RCP MB Investments A, L.P. | | 7/11/2022 | | | 8,227,418 | | | | 8,000,000 | | | 7.91% |

| TriSalus Life Sciences | | 12/30/2021 | | | 8,000,000 | | | | 8,000,000 | | | 7.91% |

| | | | | | | | | | | | | |

| Portfolio Funds | | | | | | | | | | | | |

| Arsenal Capital Partners Growth L.P. | | 2/28/2022 | | | 466,963 | | | | 364,370 | | | 0.36% |

| Arsenal Capital Partners Fund VI (1B) | | 5/23/2022 | | | 1,178,097 | | | | 985,586 | | | 0.97% |

| Cordillera Investment Fund III, L.P. | | 5/3/2022 | | | 849,861 | | | | 834,196 | | | 0.83% |

| Hg Saturn 3 A, L.P. | | 7/5/2022 | | | 25,342 | | | | 25,342 | | | 0.03% |

| ICG L.P. Secondaries Fund I L.P. | | 5/13/2022 | | | 2,473,144 | | | | 2,473,144 | | | 2.45% |

| ICG Ludgate Hill IIA Boston L.P. Secondary Fund | | 12/22/2021 | | | 2,406,983 | | | | 3,530,714 | | | 3.49% |

| Onex Structured Credit Opportunities Fund I, L.P. | | 11/1/2021 | | | 2,770,160 | | | | 2,892,975 | | | 2.86% |

| Partners Group Direct Equity IV (USD) A, L.P. | | 8/12/2021 | | | 4,853,706 | | | | 5,135,704 | | | 5.08% |

| Partners Group Secondary 2020 (USD) A, L.P. | | 5/23/2022 | | | 1,528,711 | | | | 1,976,099 | | | 1.95% |

| Semi-Annual Report Dated September 30, 2022 | 15 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

| Security Description | | Acquisition Date | | Cost | | | Value | | | % of Net Assets |

| Saturn Five Frontier I, LLC | | 12/15/2021 | | $ | 2,500,000 | | | $ | 2,500,000 | | | 2.47% |

| | | | | $ | 66,037,533 | | | $ | 66,095,076 | | | 65.37% |

Foreign Currency Translation – Securities and other assets and liabilities denominated in or expected to settle in foreign currencies are translated into U.S. dollars based on exchange rates on the following basis:

| A. | The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

| B. | Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern Time on the respective date of such transactions. |

| C. | The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions and 3) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Share Valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class, except that a 2.00% early repurchase fee may be charged as discussed in Note 9.

Investment Income – Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the security received. Interest income is accrued as earned. Withholding taxes on foreign dividends have been recorded for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Investment Transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investment securities sold are determined on a specific identification basis.

Distributions to Shareholders – Distributions to shareholders arising from net investment and net realized capital gains, if any, are declared and paid annually to shareholders. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. There were no distributions paid to shareholders during the six months ended September 30, 2022. The tax character of distributions paid during the period ended March 31, 2022 are as follows:

| | | Ordinary | | | Long-Term | | | Taxable | | | Total | |

| | | Income | | | Capital Gains | | | Overdistribution | | | Distributions | |

| Periods Ended | | | | | | | | | | | | | | | | |

| March 31, 2022 | | $ | 4,542,518 | | | $ | 754 | | | $ | 54,060 | | | $ | 4,597,032 | |

| 16 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

Federal Income Tax – The Fund has elected and intends to continue to elect to be treated as a registered investment company (“RIC”) for U.S. federal income tax purposes, and it has qualified, and expects each year to continue to qualify as a RIC for U.S. federal income tax purposes. As such, the Fund generally will not be subject to U.S. federal corporate income tax, provided that it distributes all of its net taxable income and gains each year.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The Fund has selected a tax year end of September 30. The following information is computed on a tax basis for each item as of September 30, 2022:

| Cost of portfolio investments* | | $ | 91,476,062 | |

| Gross unrealized appreciation* | | | 2,009,899 | |

| Gross unrealized depreciation | | | (7,535,315 | ) |

| Net unrealized depreciation | | $ | (5,525,416 | ) |

| Net unrealized depreciation on foreign currency translation | | | (4,500 | ) |

| Accumulated Capital and Other Losses | | | (5,903,654 | ) |

| Accumulated deficit | | $ | (11,433,570 | ) |

| * | Included affiliated securities cost $6,435,694 and gross unrealized appreciation $ 1,571,119. |

As of September 30, 2022, the Fund had short-term and long-term capital loss carryforwards available to offset future gains and not subject to expiration in the amount of $85,455 and $930,013, respectively. Net qualified late year ordinary losses represent losses incurred after December 31. These losses are deemed to arise on the first day of the Fund’s next taxable year. For the year ended September 30, 2022, the Fund deferred qualified late year ordinary losses of $4,888,186.

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and U.S. GAAP. These “book/tax” differences are temporary in nature and are primarily due to holdings classified as passive foreign investment companies (“PFICs”) and Master Limited Partnerships (“MLP”).

For the tax year ended September 30, 2022, the Fund reclassified $13,711 of accumulated earnings against paid-in capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, has no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions and concluded that no provision for unrecognized tax benefits or expenses should be recorded related to uncertain tax positions taken in the Fund’s current tax year and all open tax years.

During the tax year ended September 30, 2022, the Fund did not incur any taxes, interest or penalties. Generally, tax authorities can examine tax returns filed during the last three years. The Fund identifies its major tax jurisdiction as U.S. Federal.

| Semi-Annual Report Dated September 30, 2022 | 17 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

3. Investment Transactions

During the six months ended September 30, 2022, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $36,758,738 and $7,527,833, respectively.

4. Transactions with Related Parties and Other Service Providers

Under the terms of the Investment Management Agreement between the Fund and the Adviser, the Adviser manages the Fund’s investments subject to oversight by the Board. The Fund pays the Adviser a fee, which is calculated daily and paid monthly, at an annual rate of 1.50% of the average daily net assets of the Fund. The Adviser may, but is not obligated to, waive up to 0.50% of the Management Fee on cash and cash equivalents held in the Fund from time to time.

The Adviser has entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) with the Fund, whereby the Adviser has agreed to reduce the Management Fee payable to it (but not below zero), and to pay any operating expenses of the Fund, to the extent necessary to limit the operating expenses of the Fund, excluding certain “Excluded Expenses” listed below, to the annual rate of 2.00% and 2.25% of the average daily net assets of Class I and Class II shares of the Fund (the “Expense Cap”), respectively. Excluded Expenses that are not covered by the Expense Cap include: brokerage commissions and other similar transactional expenses, interest (including interest incurred on borrowed funds and interest incurred in connection with bank and custody overdrafts), other borrowing costs and fees including interest and commitment fees, taxes, acquired fund fees and expenses, litigation and indemnification expenses, judgments, and extraordinary expenses. Pursuant to the agreement, expenses totaling $326,408 were waived and/or reimbursed from the Adviser during the six months ended September 30, 2022.

If the Adviser waives its Management Fee or pays any operating expenses of the Fund pursuant to the Expense Cap, the Adviser may, for a period ending three years after the end of the month in which such fees or expenses are waived or incurred, recoup amounts waived or incurred to the extent such recoupment does not cause the Fund’s operating expense ratio (after recoupment and excluding the Excluded Expenses) to exceed the lesser of (a) the expense limit in effect at the time of the waiver, and (b) the expense limit in effect at the time of the recoupment. The Expense Limitation Agreement is expected to continue in effect through July 31, 2023 and will renew automatically for successive periods of one year thereafter, unless written notice of termination is provided by the Adviser to the Fund not less than 10 days prior to the end of the then-current term. The Board may terminate the Expense Limitation Agreement at any time on not less than ten (10) days’ prior notice to the Adviser, and the Expense Limitation Agreement may be amended at any time only with the consent of both the Adviser and the Board. As of September 30, 2022, the Adviser may seek repayment of investment management fees and expense reimbursements no later than the date below:

| March 31, 2024 | | $ | 221,462 | |

| March 31, 2025 | | | 410,905 | |

| September 30, 2025 | | | 326,408 | |

| | | $ | 958,775 | |

On July 28, 2022, shareholders of the Fund approved (i) a new investment management agreement (“Advisory Agreement”) between the Adviser and the Fund, and (ii) a sub-advisory agreement (the “Sub-Advisory Agreement”) between the Adviser and Meketa Investment Group Inc. (“Meketa” or the “Sub-Adviser”), with respect to the Fund. The Advisory Agreement was effective July 29, 2022. Effective September 1, 2022, Meketa is the sub-adviser to the Fund. The Adviser has allocated responsibility for a substantial portion of the assets, and may in the future allocate all of the assets, of the Fund to the Sub-Adviser for the day-to-day investment management of such assets subject to the Adviser’s oversight. Pursuant to the Sub-Advisory Agreement, the Sub-Advisor is compensated by the Adviser.

| 18 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

Employees of PINE Advisors, LLC (“PINE”) serve as the Fund’s Chief Financial Officer and Assistant Treasurer. PINE receives an annual base fee for the services provided to the Fund. PINE is reimbursed for certain out-of-pocket expenses by the Fund. Service fees paid by the Fund for the six months ended September 30, 2022 are disclosed in the Statement of Operations as certifying financial officer fees.

Ultimus Fund Solutions, LLC (“Ultimus”) provides certain administrative, accounting and transfer agency services to the Fund pursuant to a Master Services Agreement between the Fund and Ultimus (the “Master Services Agreement”). For its services, the Fund pays Ultimus a fee and separate fixed fees to make certain filings. The Fund also reimburses Ultimus for certain out-of-pocket expenses incurred on the Fund’s behalf. The fees are accrued daily and paid monthly by the Fund and the administrative fees are based on the average net assets for the prior month and subject to monthly minimums.

Until May 23, 2022, Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provided compliance services to the Fund pursuant to a Compliance Services Consulting Agreement. For its services, the Fund paid NLCS a fee for supplying the Fund’s Chief Compliance Officer and related compliance services. The Fund also reimburses NLCS for certain out-of-pocket expenses incurred on the Fund’s behalf. These fees were accrued daily and paid quarterly by the Fund. Effective May 23, 2022, Brian MacKenzie, an employee of PINE, serves as the Chief Compliance Officer of the Fund.

Pursuant to a Distribution Agreement, the Fund continuously offers the Class I shares at their NAV per share through Foreside Fund Services, LLC, the principal underwriter and distributor of the shares (the “Distributor”). Under the Fund’s Distribution Agreement, the Distributor is also responsible for entering into agreements with broker-dealers or other financial intermediaries to assist in the distribution of the shares, reviewing the Fund’s proposed advertising materials and sales literature and making certain filings with regulators. For these services, the Distributor receives an annual fee from the Adviser. The Adviser is also responsible for paying any out-of-pocket expenses incurred by the Distributor in providing services under the Distribution Agreement.

A Trustee and certain officers of the Fund are affiliated with the Adviser, or Ultimus.

In consideration of the services rendered by those Trustees who are not “interested persons” (as defined in Section 2(a)19 of the 1940 Act) of the Trust (“Independent Trustees”), the Fund pays each Independent Trustee an amount of $2,500 per meeting. Trustees that are interested persons will not be compensated by the Fund. The Trustees do not receive any pension or retirement benefits.

Beneficial Ownership of Fund Shares

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of the Fund creates a presumption of control under Section 2(a)(9) of the 1940 Act. As of September 30, 2022, the following shareholders owned of record more than 25% of the outstanding shares of the Fund:

| Name of Record Owner | | % Ownership |

| Charles Schwab & Co (for the benefit of its customers) | | 32% |

| Semi-Annual Report Dated September 30, 2022 | 19 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

5. Affiliated Investments

Issuers that are considered affiliates, as defined in Section 2(a)(3) of the 1940 Act, of the Fund at period-end are noted in the Fund’s Schedule of Investments. The table below reflects transactions during the period with entities that are affiliates as of September 30, 2022.

| | | Beginning | | | | | | | | | Change in | | | | | | Ending | | | | |

| | | Fair Value | | | | | | | | | Unrealized | | | Net | | | Fair Value | | | | |

| Non-Controlled | | March 31, | | | Purchases or | | | Sales or | | | Appreciation | | | Realized | | | September 30, | | | Investment | |

| Affiliates | | 2022 | | | Contributions | | | Distributions | | | (Depreciation) | | | Gain (Loss) | | | 2022 | | | Income | |

| ICG Ludgate Hill IIA Boston L.P. Secondary Fund | | $ | — | | | $ | 3,246,983 | | | $ | (840,000 | ) | | $ | 1,123,731 | | | $ | — | | | $ | 3,530,714 | | | $ | — | |

| Partners Group Secondary 2020 (USD) A,L.P. | | | — | | | | 1,498,711 | | | | — | | | | 477,388 | | | | — | | | | 1,976,099 | | | | — | |

| Saturn Five Frontier I, LLC | | | 2,500,000 | | | | — | | | | — | | | | — | | | | — | | | | 2,500,000 | | | | — | |

6. Shareholder Servicing Plan

The Fund operates a Shareholder Servicing Plan (the “Plan”) with respect to Class I Shares. The Shareholder Servicing Plan will allow the Fund to pay shareholder servicing fees in respect of shareholders holding Class I Shares. Under the Plan, the Fund will be permitted to pay as compensation to qualified recipients up to 0.10% on an annualized basis of the aggregate net assets of the Fund attributable to Class I Shares (the “Shareholder Servicing Fee”). Class II Shares are not subject to the Shareholder Servicing Fee. During the six months ended September 30, 2022, the total expenses incurred pursuant to the Plan were $48,690.

7. Risk Factors

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. The following list is not intended to be a comprehensive listing of all the potential risks associated with the Fund. The Fund’s prospectus provides further details regarding the Fund’s risks and considerations.

Market Disruption and Geopolitical Risk. The Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. War, terrorism, and related geopolitical events (and their aftermath) have led, and in the future may lead, to increased short-term market volatility and may have adverse long-term effects on U.S. and world economies and markets generally. Likewise, natural and environmental disasters, such as, for example, earthquakes, fires, floods, hurricanes, tsunamis and weather-related phenomena generally, as well as the spread of infectious illness or other public health issues, including widespread epidemics or pandemics such as the COVID-19 outbreak, and systemic market dislocations can be highly disruptive to economies and markets. In addition, military action by Russia in Ukraine could adversely affect global energy and financial markets and therefore could affect the value of a Portfolio’s investments, including beyond a Portfolio’s direct exposure to Russian issuers or nearby geographic regions. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict and could be substantial. Those events as well as other changes in non-U.S. and domestic economic and political conditions also could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, credit ratings, inflation, investor sentiment, and other factors affecting the value of Fund Investments.

| 20 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

The impact of the COVID-19 outbreak and any other epidemic or pandemic that may arise in the future could adversely affect the economies of many nations or the entire global economy, the financial performance of individual issuers, borrowers and sectors and the health of capital markets and other markets generally in potentially significant and unforeseen ways. This crisis or other public health crises may also exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty. The foregoing could lead to a significant economic downturn or recession, increased market volatility, a greater number of market closures, higher default rates and adverse effects on the values and liquidity of securities or other assets. Such impacts, which may vary across asset classes, may adversely affect the performance of the Private Equity Investments, the Fund and a Shareholder’s investment in the Fund.

Unlisted Closed-End Structure; Liquidity Limited to Quarterly Repurchases of Shares. The Fund has been organized as a non-diversified, closed-end management investment company and designed primarily for long-term investors. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not intend to list the Shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the Shares. Although the Fund will offer a limited degree of liquidity by conducting quarterly repurchase offers, a Shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. There is no assurance that you will be able to tender your Shares when or in the amount that you desire. In addition, with very limited exceptions, Shares are not transferable, and liquidity will be provided only through repurchase offers made quarterly by the Fund. Shares are considerably less liquid than shares of funds that trade on a stock exchange or shares of open-end registered investment companies, and are therefore suitable only for investors who can bear the risks associated with the limited liquidity of Shares, and should be viewed as a long-term investment.

There will be a substantial period of time between the date as of which Shareholders must submit a request to have their Shares repurchased and the date they can expect to receive payment for their Shares from the Fund. Shareholders whose Shares are accepted for repurchase bear the risk that the Fund’s net asset value may fluctuate significantly between the time that they submit their repurchase requests and the date as of which such Shares are valued for purposes of such repurchase. Shareholders will have to decide whether to request that the Fund repurchase their Shares without the benefit of having current information regarding the value of Shares on a date proximate to the date on which Shares are valued by the Fund for purposes of effecting such repurchases.

Repurchases of Shares, if any, may be suspended, postponed or terminated by the Board under certain circumstances. An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of Shares and the underlying investments of the Fund. Also, because Shares are not listed on any securities exchange, the Fund is not required, and does not intend, to hold annual meetings of its Shareholders unless called for under the provisions of the 1940 Act.

Concentration of Investments. Except to the extent required by applicable law and the Fund’s fundamental policies, there are no limitations imposed by the Adviser as to the amount of Fund assets that may be invested in (a) any one geography, (ii) any one Fund Investment, (iii) in a Private Equity Investment managed by a particular general partner or its affiliates, (iv) indirectly in any single industry or (v) in any issuer. In addition, a Portfolio Company’s investment portfolio may consist of a limited number of companies and may be concentrated in a particular industry area or group. Accordingly, the investment portfolio may at times be significantly concentrated, both as to managers, geographies, industries and individual companies. Such concentration could offer a greater potential for capital appreciation as well as increased risk of loss. Such concentration may also be expected to increase the volatility of the Fund’s investment portfolio. The Fund is, however, subject to the asset diversification requirements applicable to RICs.

| Semi-Annual Report Dated September 30, 2022 | 21 |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

Limited operating history of Private Equity Investments. Private Equity Investments may have limited operating histories and the information the Fund will obtain about such investments may be limited. As such, the ability of the Adviser to evaluate past performance or to validate the investment strategies of such Private Equity Investment will be limited. Moreover, even to the extent a Private Equity Investment has a longer operating history, the past investment performance of any of the Private Equity Investments should not be construed as an indication of the future results of such investments or the Fund, particularly as the investment professionals responsible for the performance of such investments may change over time. This risk is related to, and enhanced by, the risks created by the fact that the Adviser relies upon information provided to it by the issuer of the securities it receives or the Portfolio Fund Managers (as applicable) that is not, and cannot be, independently verified.

Nature of Portfolio Companies. The Private Equity Investments will include direct and indirect investments in Portfolio Companies. This may include Portfolio Companies in the early phases of development, which can be highly risky due to the lack of a significant operating history. The Private Equity Investments may also include Portfolio Companies that are in a state of distress or which have a poor record, and which are undergoing restructuring or changes in management, and there can be no assurances that such restructuring or changes will be successful. The management of such Portfolio Companies may depend on one or two key individuals, and the loss of the services of any of such individuals may adversely affect the performance of such Portfolio Companies.

Investments in the Portfolio Funds generally; dependence on the Portfolio Fund Managers. Because the Fund invests in Portfolio Funds, a Shareholder’s investment in the Fund will be affected by the investment policies and decisions of the Portfolio Fund Manager of each Portfolio Fund in direct proportion to the amount of Fund assets that are invested in each Portfolio Fund. The Fund’s net asset value may fluctuate in response to, among other things, various market and economic factors related to the markets in which the Portfolio Funds invest and the financial condition and prospects of issuers in which the Portfolio Funds invest. The success of the Fund depends upon the ability of the Portfolio Fund Managers to develop and implement strategies that achieve their investment objectives. Shareholders will not have an opportunity to evaluate the specific investments made by the Portfolio Funds or the Portfolio Fund Managers, or the terms of any such investments. In addition, the Portfolio Fund Managers could materially alter their investment strategies from time to time without notice to the Fund. There can be no assurance that the Portfolio Fund Managers will be able to select or implement successful strategies or achieve their respective investment objectives.

Valuations of Private Equity Investments; valuations subject to adjustment. The valuations reported by the Portfolio Fund Managers, based upon which the Fund determines its daily net asset value and the net asset value per Share may be subject to later adjustment or revision. For example, fiscal year-end net asset value calculations of the Portfolio Funds may be revised as a result of audits by their independent auditors. Other adjustments may occur from time to time. Because such adjustments or revisions, whether increasing or decreasing the net asset value of the Fund at the time they occur, relate to information available only at the time of the adjustment or revision, the adjustment or revision may not affect the amount of the repurchase proceeds of the Fund received by Shareholders who had their Shares repurchased prior to such adjustments and received their repurchase proceeds. As a result, to the extent that such subsequently adjusted valuations from the Portfolio Fund Managers or revisions to the net asset value of a Portfolio Fund or direct private equity investment adversely affect the Fund’s net asset value, the outstanding Shares may be adversely affected by prior repurchases to the benefit of Shareholders who had their Shares repurchased at a net asset value higher than the adjusted amount.

Conversely, any increases in the net asset value resulting from such subsequently adjusted valuations may be entirely for the benefit of the outstanding Shares and to the detriment of Shareholders who previously had their Shares repurchased at a net asset value lower than the adjusted amount. The same principles apply to the purchase of Shares. New Shareholders may be affected in a similar way.

| 22 | PRIMARK PRIVATE EQUITY INVESTMENTS FUND |

| PRIMARK PRIVATE EQUITY INVESTMENTS FUND NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Unaudited) (Continued) |

The valuations of Shares may be significantly affected by numerous factors, some of which are beyond the Fund’s control and may not be directly related to the Fund’s operating performance. These factors include:

| ● | changes in regulatory policies or tax guidelines; |

| ● | changes in earnings or variations in operating results; |

| ● | changes in the value of the Private Equity Investments; |

| ● | changes in accounting guidelines governing valuation of the Private Equity Investments; |

| ● | any shortfall in revenue or net income or any increase in losses from levels expected by investors; |

| ● | departure of the Adviser or certain of its respective key personnel; |

| ● | general economic trends and other external factors; and |

| ● | loss of a major funding source. |

Valuation of Private Equity Investments uncertain. Under the 1940 Act, the Fund is required to carry Private Equity Investments at market value or, if there is no readily available market value, at fair value as determined by the Adviser, in accordance with the Fund’s valuation procedures, which have been approved by the Board. There is not a public market or active secondary market for many of the securities of the privately held companies in which the Fund intends to invest. Rather, many of the Private Equity Investments may be traded on a privately negotiated over-the-counter secondary market for institutional investors. As a result, the Fund will value these securities at fair value as determined in good faith by the Adviser in accordance with the valuation procedures that have been approved by the Board.

The determination of fair value, and thus the amount of unrealized losses the Fund may incur in any year, is to a degree subjective, and the Adviser has a conflict of interest in making the determination. The Fund values these securities daily at fair value determined in good faith by the Adviser in accordance with the valuation procedures that have been approved by the Board. Because such valuations, and particularly valuations of private securities and private companies, are inherently uncertain, may fluctuate over short periods of time and may be based on estimates, the Fund’s determinations of fair value may differ materially from the values that would have been used if a ready market for these non-traded securities existed. Due to this uncertainty, the Fund’s fair value determinations may cause the Fund’s net asset value on a given date to understate or overstate materially the value that the Fund may ultimately realize upon the sale of one or more Private Equity Investments. Under limited circumstances (such as to resolve a pricing issue regarding a Private Equity Investment), the Fund may retain a valuation assurance service provider to provide the Fund reasonable assurance on the correctness of the processes and procedures leading to the fair value determinations by the Adviser.