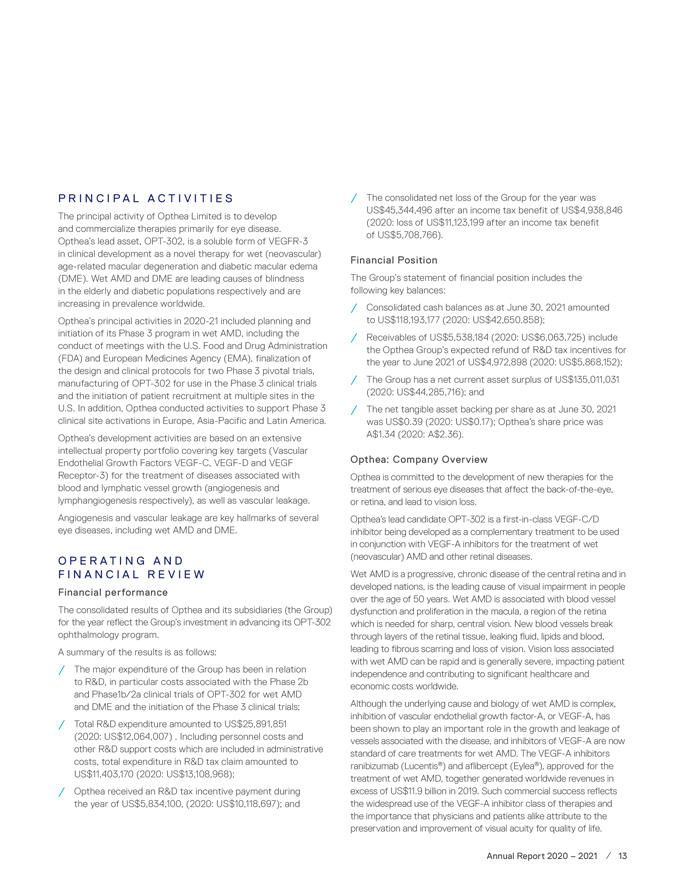

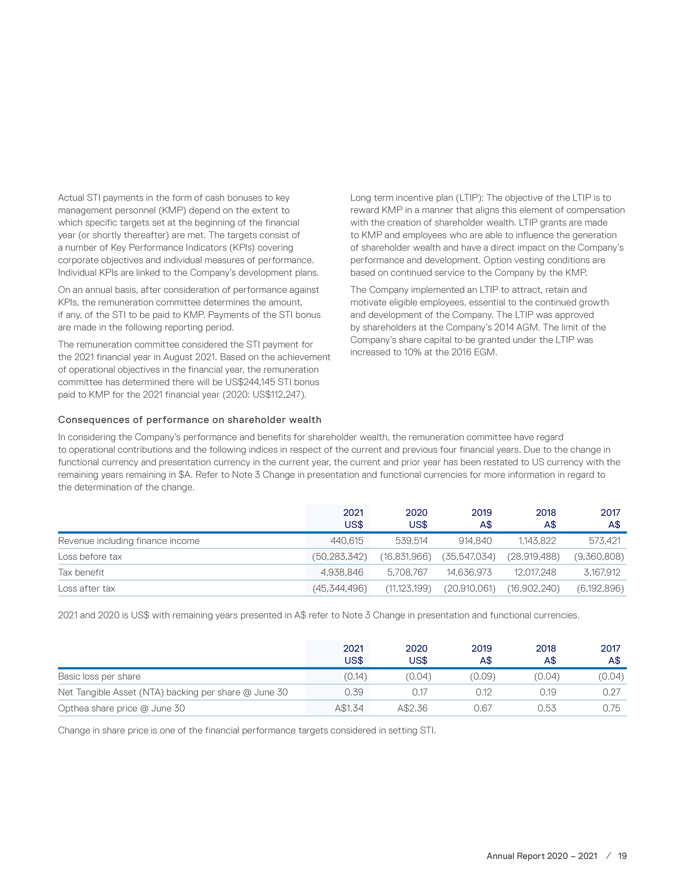

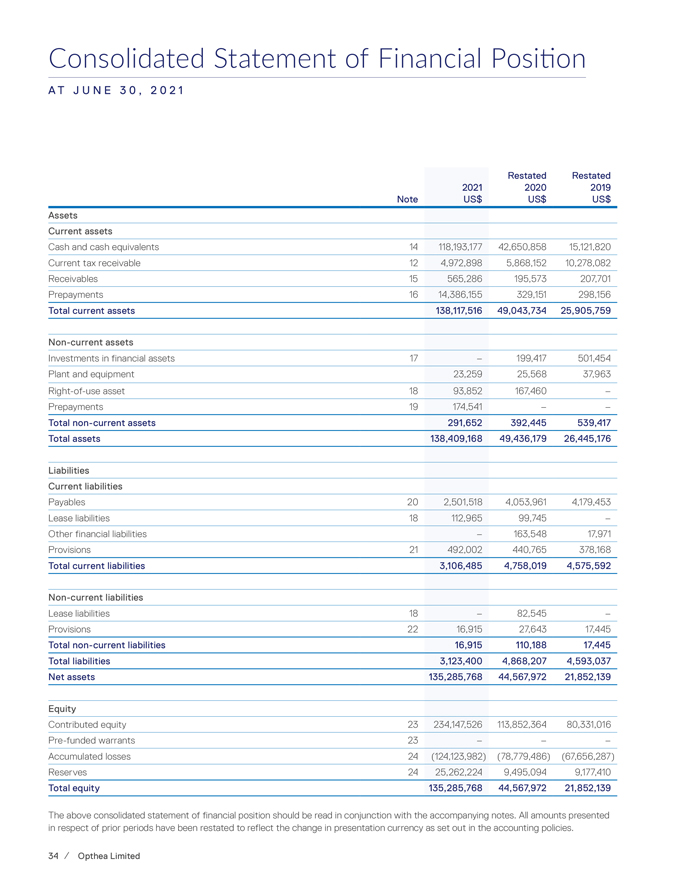

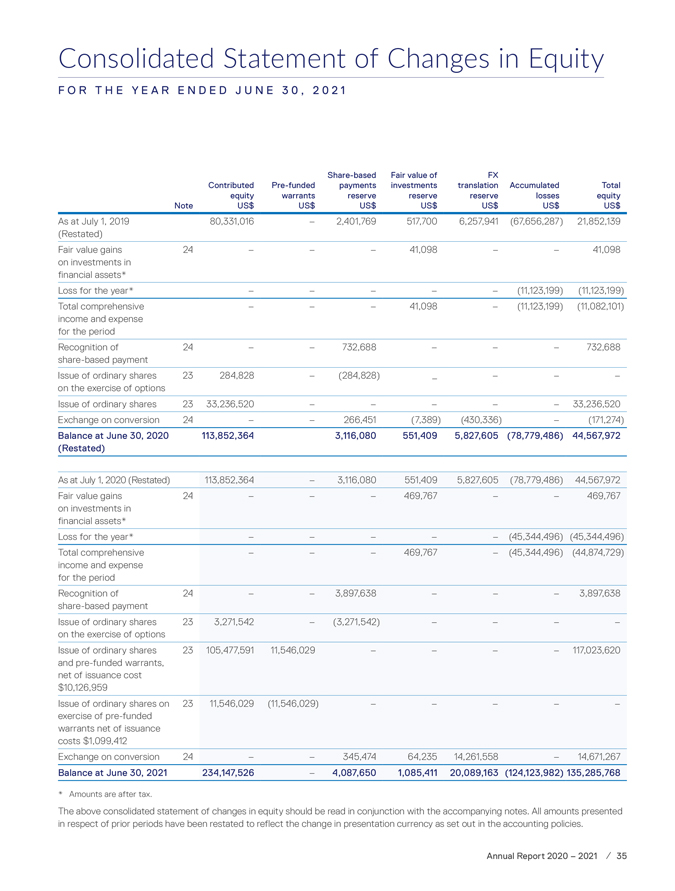

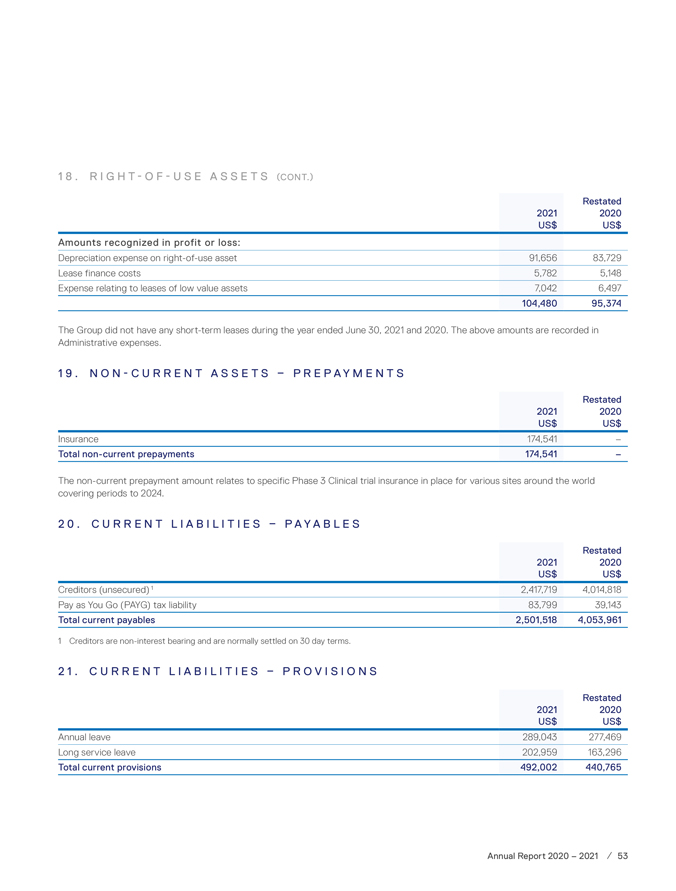

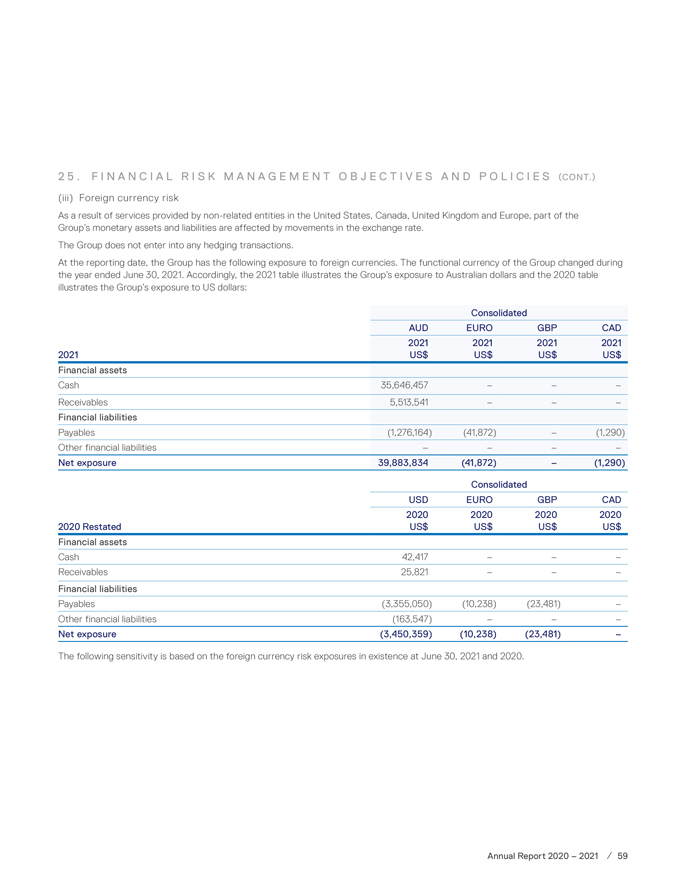

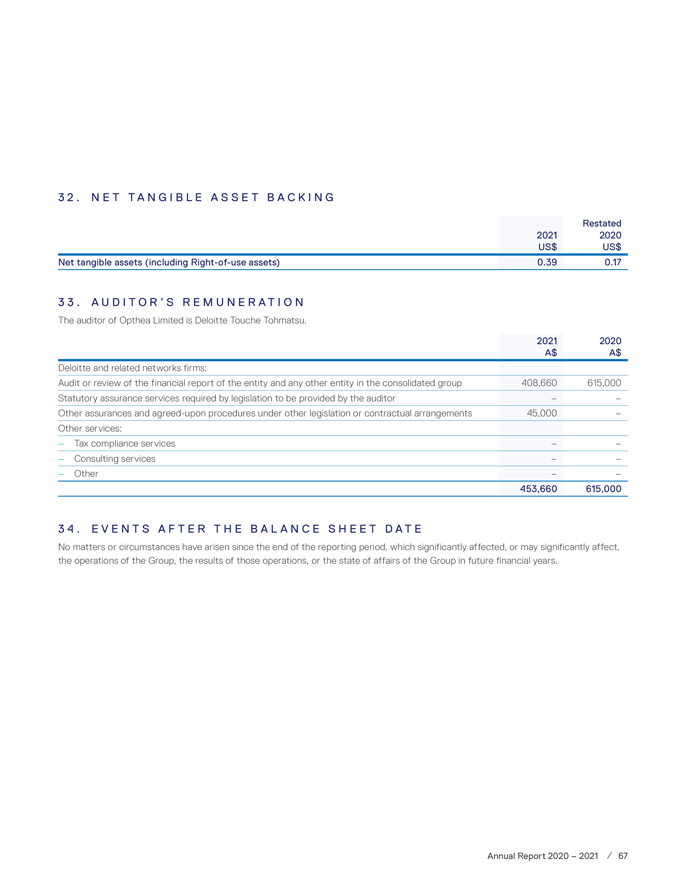

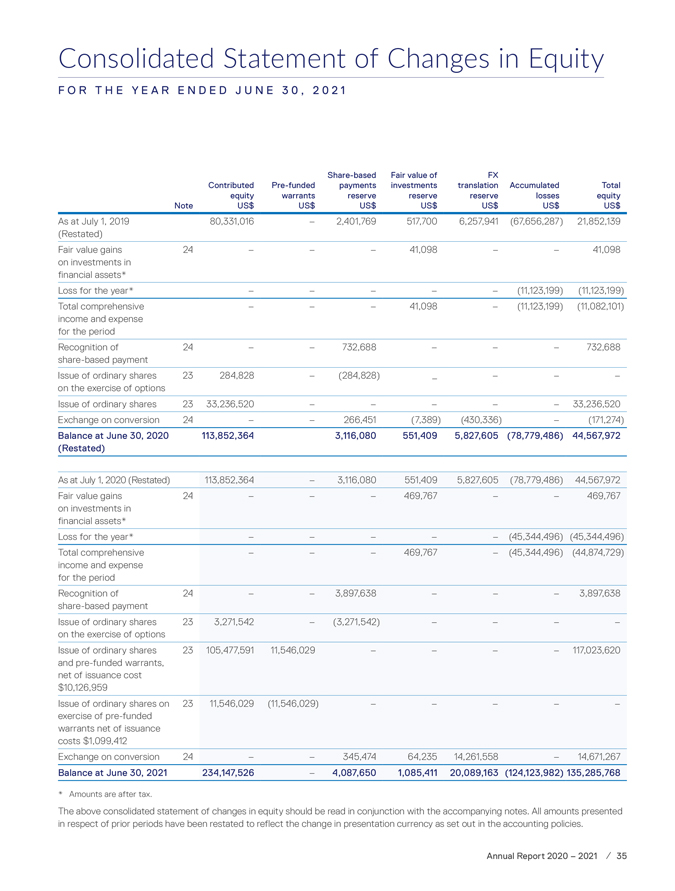

Consolidated Statement of Changes in Equity FOR THE YEAR ENDED JUNE 30, 2 0 2 1 Contributed

equity Pre-funded warrants Share-based payments reserve Fair value of investments reserve FX translation reserve Accumulated losses Total equity Note US$ US$ US$ US$ US$ US$ US$ As at July 1, 2019 (Restated) 80,331,016 – 2,401,769 517,700 6,257,941

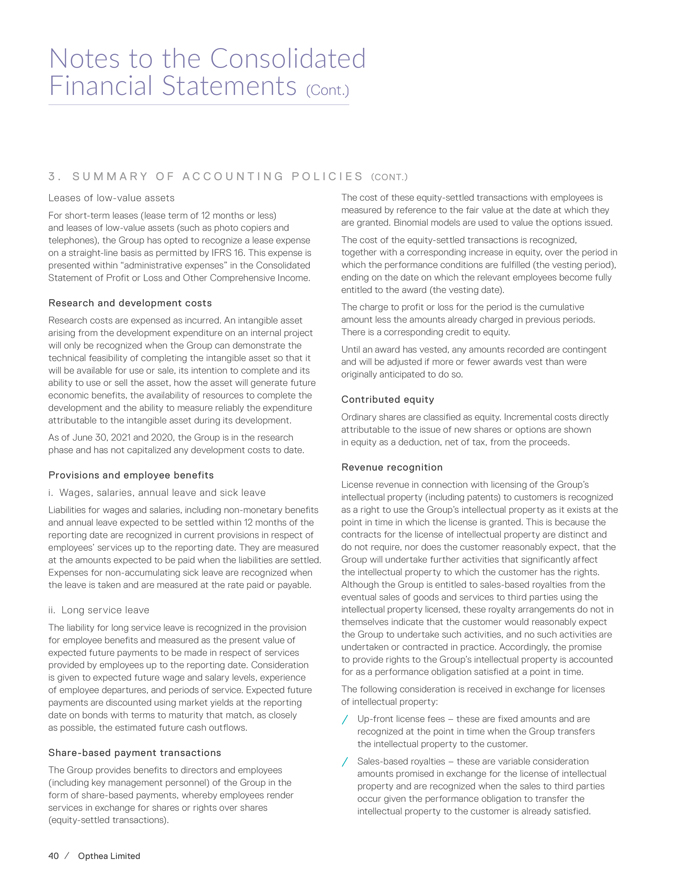

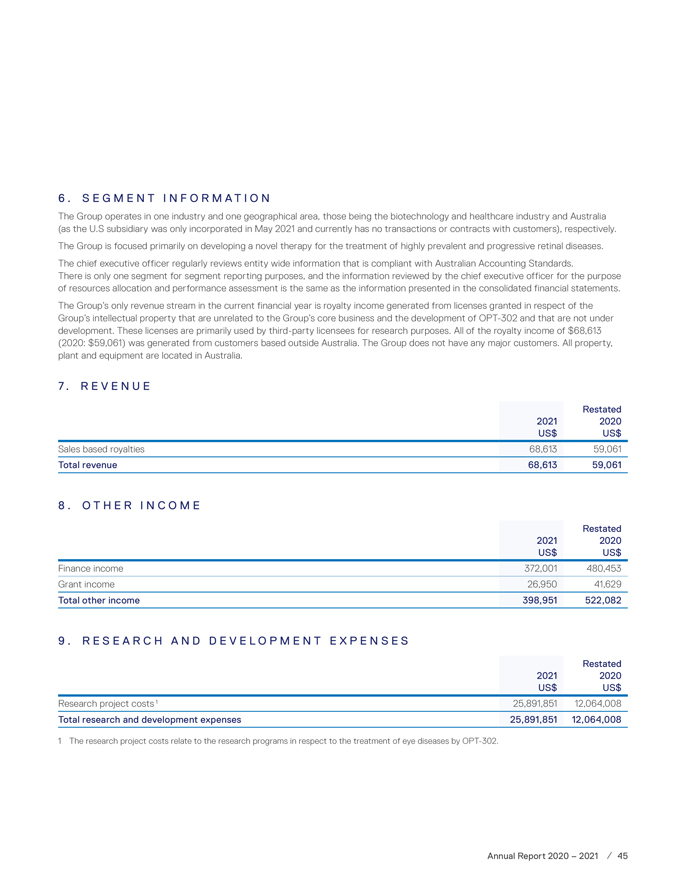

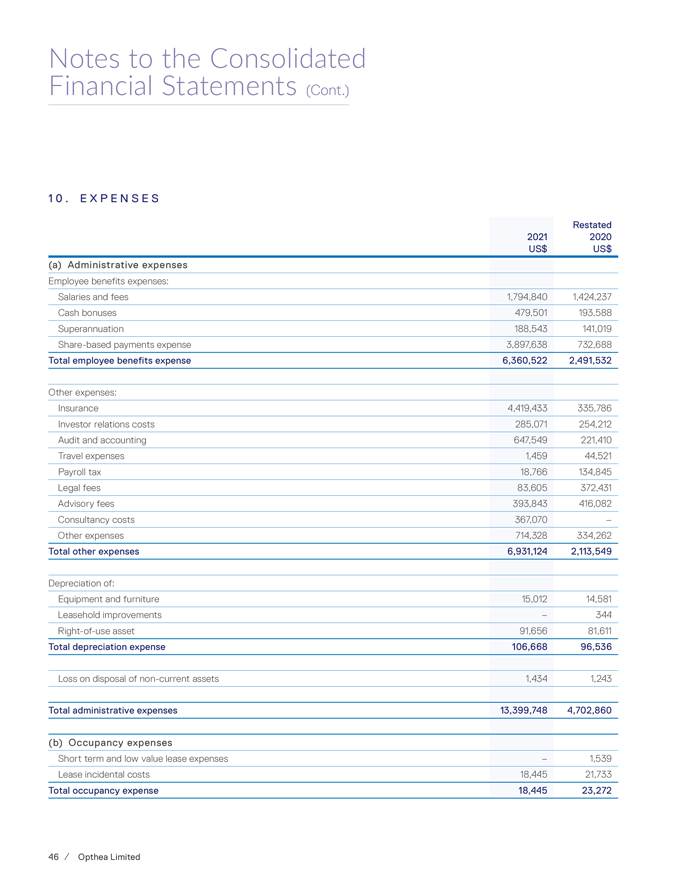

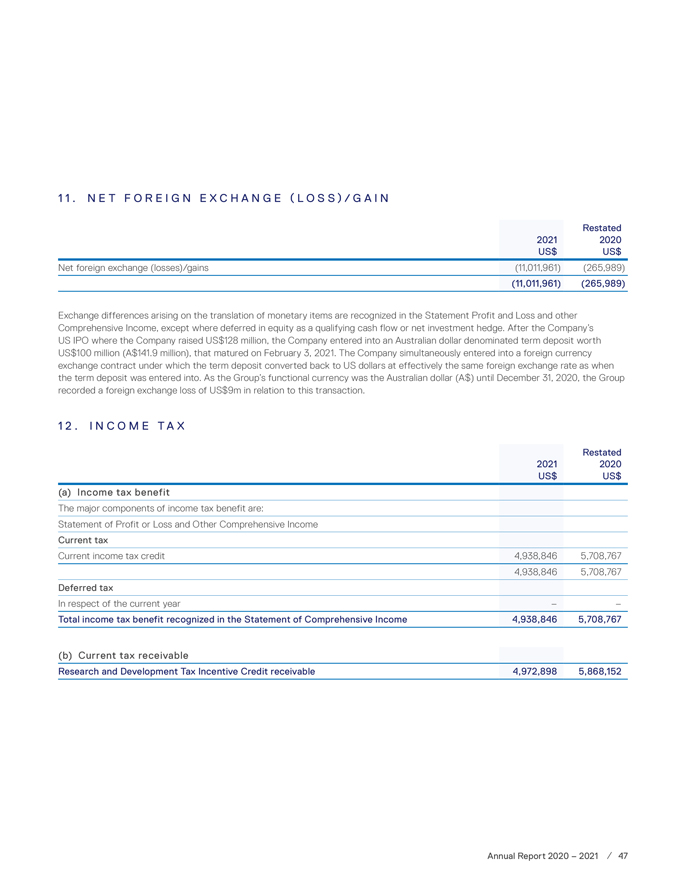

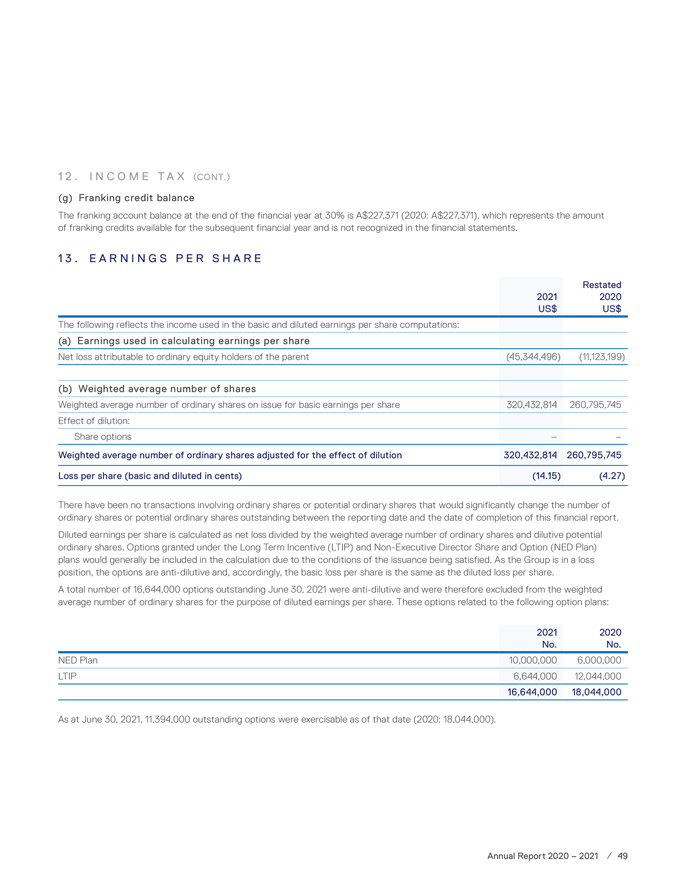

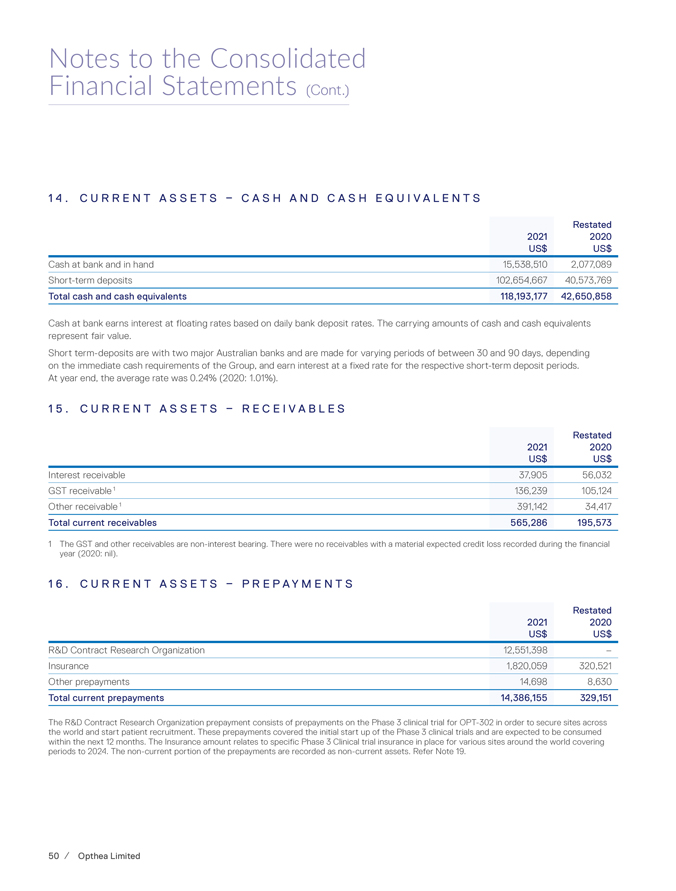

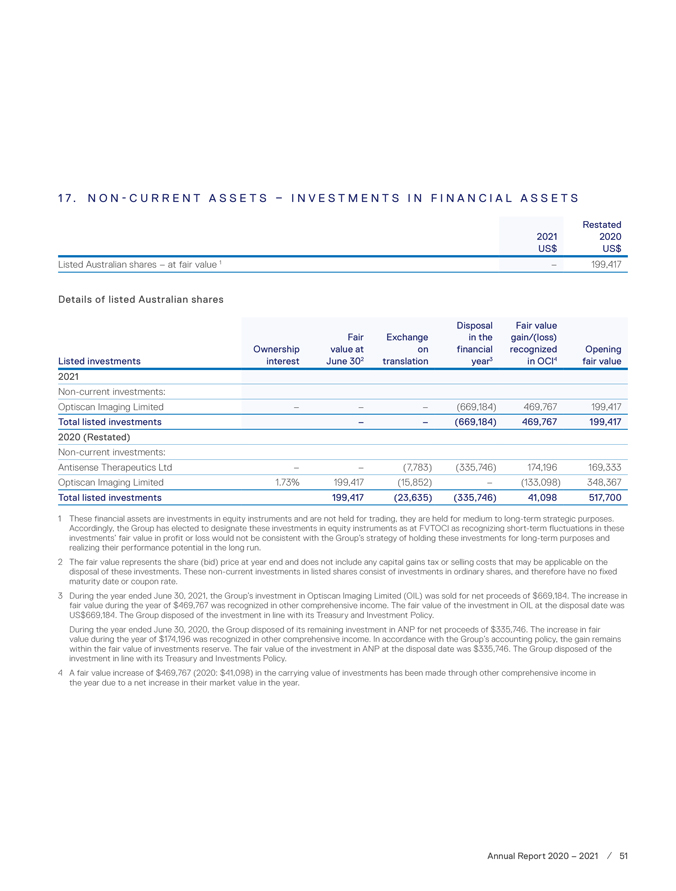

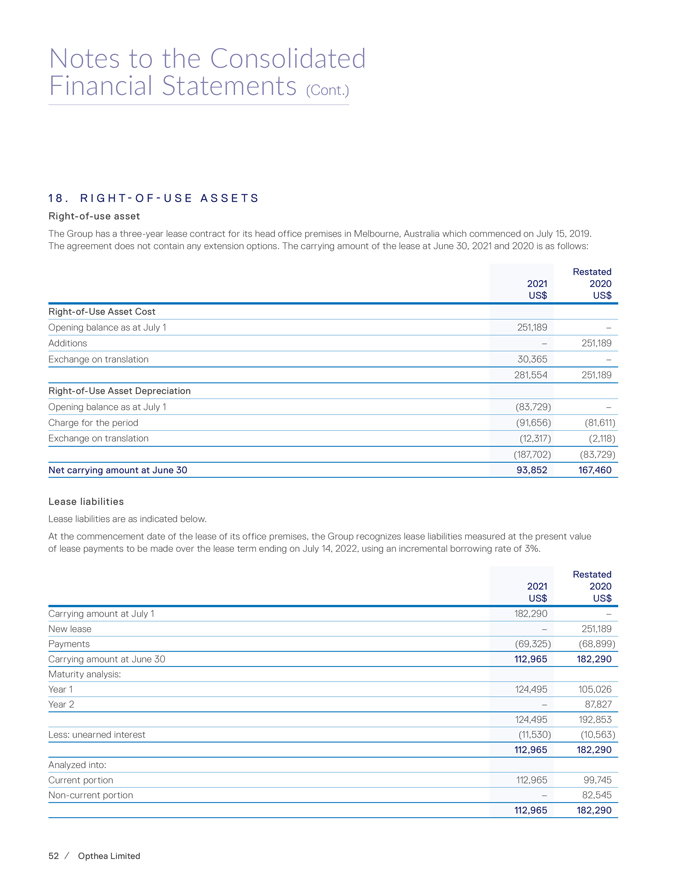

(67,656,287) 21,852,139 Fair value gains24 on investments in financial assets* – – – 41,098 – – 41,098 Loss for the year* – – – – – (11,123,199) (11,123,199) Total comprehensive income and expense for the period – – – 41,098 – (11,123,199) (11,082,101) Recognition of24 share-based payment – – 732,688 – – – 732,688 Issue of ordinary shares23 on the exercise of options 284,828 – (284,828) – – – Issue of ordinary shares23 33,236,520 – – – – – 33,236,520 Exchange on conversion24 – – 266,451 (7,389) (430,336) – (171,274) Balance at June 30, 2020 (Restated) 113,852,364 3,116,080 551,409 5,827,605 (78,779,486) 44,567,972 As at July 1, 2020 (Restated) 113,852,364 – 3,116,080 551,409 5,827,605 (78,779,486) 44,567,972 Fair value gains24 on investments in financial assets* – – – 469,767 – – 469,767 Loss for the year* – – – – – (45,344,496) (45,344,496) Total comprehensive income and expense for the period – – – 469,767 – (45,344,496) (44,874,729) Recognition of share-based payment 24 – – 3,897,638 – – – 3,897,638 Issue of ordinary shares on the exercise of options 23 3,271,542 – (3,271,542) – – – – Issue of ordinary shares23 and pre-funded warrants,net of issuance cost $10,126,959 105,477,591 11,546,029 – – – – 117,023,620 Issue of ordinary shares on23 exercise of pre-funded warrants net of issuance costs $1,099,412 11,546,029 (11,546,029) – – – – – Exchange on conversion 24 – – 345,474 64,235 14,261,558 – 14,671,267 Balance at June 30, 2021 234,147,526 – 4,087,650 1,085,411 20,089,163 (124,123,982) 135,285,768 * Amounts are after tax. The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes. All amounts presented in respect of prior periods have been restated to reflect the change in presentation currency as set out in the accounting policies. Annual Report 2020 – 2021 / 35