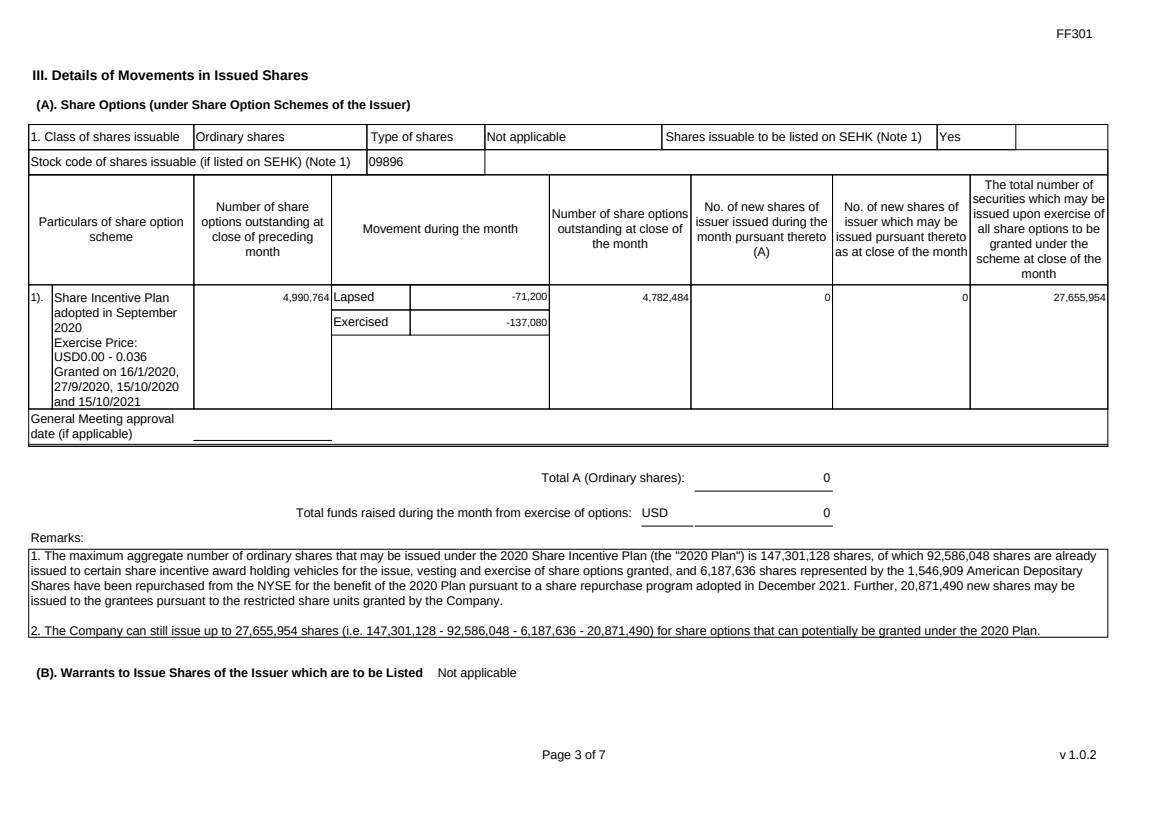

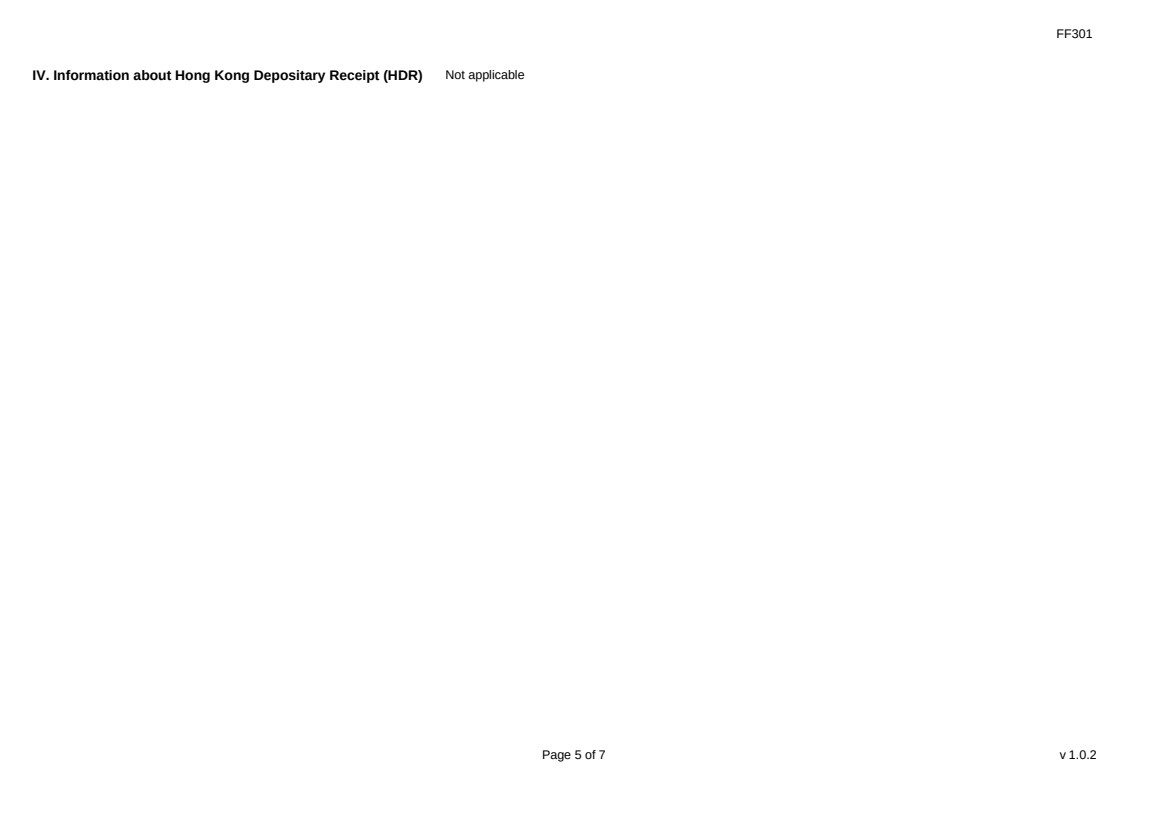

| FF301 Page 3 of 7 v 1.0.2 III. Details of Movements in Issued Shares (A). Share Options (under Share Option Schemes of the Issuer) 1. Class of shares issuable Ordinary shares Type of shares Not applicable Shares issuable to be listed on SEHK (Note 1) Yes Stock code of shares issuable (if listed on SEHK) (Note 1) 09896 Particulars of share option scheme Number of share options outstanding at close of preceding month Movement during the month Number of share options outstanding at close of the month No. of new shares of issuer issued during the month pursuant thereto (A) No. of new shares of issuer which may be issued pursuant thereto as at close of the month The total number of securities which may be issued upon exercise of all share options to be granted under the scheme at close of the month 1). Share Incentive Plan adopted in September 2020 Exercise Price: USD0.00 - 0.036 Granted on 16/1/2020, 27/9/2020, 15/10/2020 and 15/10/2021 4,990,764 Lapsed -71,200 Exercised -137,080 4,782,484 0 0 27,655,954 General Meeting approval date (if applicable) Total A (Ordinary shares): 0 Total funds raised during the month from exercise of options: USD 0 Remarks: 1. The maximum aggregate number of ordinary shares that may be issued under the 2020 Share Incentive Plan (the "2020 Plan") is 147,301,128 shares, of which 92,586,048 shares are already issued to certain share incentive award holding vehicles for the issue, vesting and exercise of share options granted, and 6,187,636 shares represented by the 1,546,909 American Depositary Shares have been repurchased from the NYSE for the benefit of the 2020 Plan pursuant to a share repurchase program adopted in December 2021. Further, 20,871,490 new shares may be issued to the grantees pursuant to the restricted share units granted by the Company. 2. The Company can still issue up to 27,655,954 shares (i.e. 147,301,128 - 92,586,048 - 6,187,636 - 20,871,490) for share options that can potentially be granted under the 2020 Plan. (B). Warrants to Issue Shares of the Issuer which are to be Listed Not applicable |