Exhibit 99.1

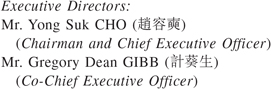

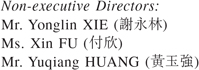

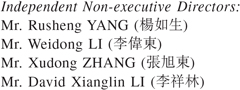

THIS COMPOSITE DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of the Lufax Offers, this Composite Document and/or the accompanying Forms of Acceptance or as to the action to be taken, you should consult a licensed securities dealer or registered institution in securities, a bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Lufax Holding Ltd, you should at once hand this Composite Document and the accompanying Forms of Acceptance to the purchaser(s) or transferee(s) or to the bank, licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Composite Document and the accompanying Forms of Acceptance, make no representation as to their accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Composite Document and the accompanying Forms of Acceptance. This Composite Document should be read in conjunction with the accompanying Forms of Acceptance, the contents of which form part of the terms and conditions of the Lufax Offers contained herein. THIS DOCUMENT HAS NOT BEEN APPROVED, DISAPPROVED OR OTHERWISE RECOMMENDED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY US STATE SECURITIES COMMISSION AND SUCH AUTHORITIES HAVE NOT APPROVED OR DISAPPROVED OF THIS TRANSACTION OR PASSED UPON THE MERITS OF FAIRNESS OF SUCH TRANSACTION OR CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE IN THE US. To the extent the offers referred to in this document are being made into the United States, they are being made solely by the Joint Offerors. References in this document to offers being made by Morgan Stanley on behalf of the Joint Offerors should be construed accordingly. [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] Ping An Insurance (Group) Company of China, Ltd. (A joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 2318 (HKD counter) and 82318 (RMB counter) An Ke Technology Company Limited (Incorporated in Hong Kong with limited liability) China Ping An Insurance Overseas (Holdings) Limited (Incorporated in Hong Kong with limited liability) Lufax Holding Ltd [GRAPHIC APPEARS HERE] (Incorporated in the Cayman Islands with limited liability) (Stock Code: 6623) (NYSE Stock Ticker: LU) COMPOSITE DOCUMENT (1) MANDATORY UNCONDITIONAL CASH OFFERS (TRIGGERED BY ELECTION OF LUFAX SPECIAL DIVIDEND) BY MORGAN STANLEY FOR AND ON BEHALF OF THE JOINT OFFERORS (I) TO ACQUIRE ALL ISSUED LUFAX SHARES AND LUFAX ADSs AND LUFAX SHARES AND LUFAX ADSs TO BE ISSUED UNDER LUFAX 2014 SHARE INCENTIVE PLAN AND LUFAX 2019 PERFORMANCE SHARE UNIT PLAN (OTHER THAN THOSE ALREADY OWNED BY THE OFFEROR GROUP) AND (II) TO CANCEL ALL OUTSTANDING LUFAX OPTIONS; AND (2) LUFAX PSU ARRANGEMENT WITH RESPECT TO ALL UNVESTED LUFAX PSUs Financial adviser to the Joint Offerors [GRAPHIC APPEARS HERE] Morgan Stanley Asia Limited Financial adviser to Lufax [GRAPHIC APPEARS HERE] The Lufax Independent Financial Adviser to the Lufax Independent Board Committee of Lufax [GRAPHIC APPEARS HERE] Capitalized terms used in this cover page shall have the same meanings as those defined in this Composite Document unless the content requires otherwise. A letter from the Lufax Independent Board Committee containing its recommendation in respect of the Lufax Offers to the Independent Lufax Shareholders, the Lufax ADS Holders, the Lufax Optionholders and the Lufax PSU Holders is set out in this Composite Document. A letter from the Lufax Independent Financial Adviser containing its advice in respect of the Lufax Offers to the Lufax Independent Board Committee is set out in this Composite Document. The procedures for acceptance and other related information in respect of the Lufax Offers are set out in Appendix I to this Composite Document and the accompanying Forms of Acceptance. Any persons including, without limitation, custodians, nominees and trustees, who would, or otherwise intend to, forward this Composite Document and/or any Forms of Acceptance to any jurisdiction outside of Hong Kong should read the section headed “Important notices” before taking any action. It is the responsibility of Overseas Lufax Shareholders and/or Overseas Lufax Optionholders and/or Overseas Lufax PSU Holders wishing to accept the Lufax Offers to satisfy themselves as to the full observance of all laws and regulations of the jurisdiction(s) applicable to them, including the obtaining of any governmental, exchange control or other consents that may be required and the compliance with other necessary formalities or legal requirements and the payment of any transfer or other taxes due in respect of such jurisdiction. The Lufax US Offer is structured to comply with the requirements applicable to tender offers that qualify for “Tier II” exemption under the Rule 14d-1(d) under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), except as to certain exemptive relief provided by the SEC. The Lufax non-US Offer in respect of the Lufax Offer Shares is being conducted pursuant to the Takeovers Code, which offer does not allow tenders of Lufax ADSs, is open to all shareholders whether resident in Hong Kong or outside of Hong Kong (including Lufax US Shareholders), does not permit withdrawal by a tendering holder, requires payment of the consideration no later than seven (7) HK Business Days following the date of receipt of duly completed and valid acceptance, or by the Expected Last Payment Date, whichever is earlier, and differs in other important ways from the Lufax US Offer. You are encouraged to read this entire Offer Document carefully before deciding whether to accept and tender in this Offer. You are encouraged to consult with your personal financial, legal, tax or other advisors before deciding whether or not to tender in this Offer. Morgan Stanley, which is authorised and regulated by SFC, is acting as the financial adviser to the Joint Offerors. Morgan Stanley will for and on behalf of the Joint Offerors, make the Lufax non-US Offer and the Lufax Option Offer pursuant to the Takeovers Code and provide confirmation pursuant to the Takeovers Code that it is satisfied that sufficient financial resources are available to the Joint Offerors to satisfy the maximum cash consideration payable by the Joint Offerors upon full acceptance of the Lufax Offers. Morgan Stanley will not conduct market making activity with respect to making the Lufax Share Offers, the Lufax Option Offer and the Lufax PSU Arrangement. Morgan Stanley will not be responsible to anyone other than the Joint Offerors for providing the protections afforded to clients of Morgan Stanley or for providing advice in relation to the Joint Offers or the contents of this document. To the extent permissible under applicable laws or regulations of Hong Kong, the Cayman Islands and the United States, and in accordance with normal market practice in Hong Kong, Morgan Stanley or its affiliates may from time to time make certain purchases of, or arrangements to purchase, directly or indirectly, Lufax Shares or any securities that are immediately convertible into, exchangeable for, or exercisable for, Lufax Shares, other than pursuant to the Lufax Offers, before, during or after the period in which the Lufax Offers remain open for acceptance. Such purchases, or arrangements to purchase may occur either in the open market at prevailing prices or in private transactions at negotiated prices and will comply with all applicable rules in Hong Kong (including the Takeovers Code), the Cayman Islands and the United States (including applicable exemptions from Rule 14e-5 under the Exchange Act). Any information about such purchases will be disclosed as required by laws or regulations in Hong Kong and the Cayman Islands. This information will be disclosed in the United States through amendments to the Schedule TO filed with the SEC, and available for free at the SEC’s website at www.sec.gov, to the extent that such information is made public in Hong Kong pursuant to the Takeovers Code or the Listing Rules. Notwithstanding the foregoing, none of such purchases, or arrangements to purchase, shall constitute any market making activity with respect to making the Lufax Share Offers, the Lufax Option Offer and the Lufax PSU Arrangement. Independent Lufax Shareholders, the Lufax ADS Holders, the Lufax Optionholders, the Lufax PSU Holders and potential investors of the Lufax’s securities are advised to seek professional advice on deciding whether to accept the Lufax Offers. The English language text of this Composite Document and the Forms of Acceptance shall prevail over the Chinese language text. September 27, 2024

a company with limited liability incorporated in the Cayman Islands and listed on the NYSE (NYSE ticker: LU) and the Stock Exchange (stock code: 6623)

a company with limited liability incorporated in the Cayman Islands and listed on the NYSE (NYSE ticker: LU) and the Stock Exchange (stock code: 6623) , a limited liability company established under the laws of the PRC, wholly-owned by Ping An Group, and is one of the Lufax Controlling Shareholders

, a limited liability company established under the laws of the PRC, wholly-owned by Ping An Group, and is one of the Lufax Controlling Shareholders

, a company with limited liability incorporated in Hong Kong, directly wholly-owned by Ping An Group and is one of the Lufax Controlling Shareholders

, a company with limited liability incorporated in Hong Kong, directly wholly-owned by Ping An Group and is one of the Lufax Controlling Shareholders

and Shenzhen Lufax Holding Enterprise Management Co., Ltd.

and Shenzhen Lufax Holding Enterprise Management Co., Ltd. .. Each of Mr. Jingkui SHI and Mr. Xuelian YANG has granted an option to Ping An Financial Technology to purchase up to 100% of his equity interest in Shanghai Lanbang (the “Onshore Call Options”), and together with the Offshore Call Options, the “Call Options”). As far as Tun Kung is aware, save for the Call Options, each of Mr. Jingkui SHI and Mr. Xuelian YANG has no other relationship with the Offeror Group as of the Latest Practicable Date and there is no acting-in-concert arrangement between Tun Kung (including its shareholders) and the Offeror Group, nor does Tun Kung holds the Lufax Shares on behalf of the Offeror Group. The Call Options are exercisable concurrently, in whole or in part, during the period commencing on November 1, 2024 and ending on October 31, 2034. Such ten-year period may be extended by An Ke Technology or Ping An Financial Technology, as applicable, by written notice.

.. Each of Mr. Jingkui SHI and Mr. Xuelian YANG has granted an option to Ping An Financial Technology to purchase up to 100% of his equity interest in Shanghai Lanbang (the “Onshore Call Options”), and together with the Offshore Call Options, the “Call Options”). As far as Tun Kung is aware, save for the Call Options, each of Mr. Jingkui SHI and Mr. Xuelian YANG has no other relationship with the Offeror Group as of the Latest Practicable Date and there is no acting-in-concert arrangement between Tun Kung (including its shareholders) and the Offeror Group, nor does Tun Kung holds the Lufax Shares on behalf of the Offeror Group. The Call Options are exercisable concurrently, in whole or in part, during the period commencing on November 1, 2024 and ending on October 31, 2034. Such ten-year period may be extended by An Ke Technology or Ping An Financial Technology, as applicable, by written notice.

is RMB18.1 trillion for the first half of 2024, which is RMB3.45 trillion or 16.0% lower than that for the same period in 2023. The amount of new RMB loans for the first half of 2024 amounted to RMB13.27 trillion, which is RMB2.46 trillion or 15.6% lower than that for the same period in 2023.

is RMB18.1 trillion for the first half of 2024, which is RMB3.45 trillion or 16.0% lower than that for the same period in 2023. The amount of new RMB loans for the first half of 2024 amounted to RMB13.27 trillion, which is RMB2.46 trillion or 15.6% lower than that for the same period in 2023.

.. He is a professor and doctoral supervisor at the School of Accountancy of Shanghai University of Finance and Economics, a full-time researcher at the Accounting and Finance Research Institute of Shanghai University of Finance and Economics, a Key Research Institute of Humanities and Social Sciences under the Ministry of Education, a member of the first and second Senior Accounting Professional Qualification Evaluation Committee of the National Government Offices Administration, a Director of the Ninth Council of the Accounting Society of China, and a Renowned Accounting Expert designated by the Ministry of Finance. Mr. Chu is also an Independent Non-executive Director of Bank of Hebei Co., Ltd. and an Independent Supervisor of Bank of China Co., Ltd. Mr. Chu was a member of the First Accounting Standards Advisory Committee of the Ministry of Finance, the Executive Secretary-General of the Accounting Education Branch of the Accounting Society of China (formerly known as Chinese Accounting Professors Association), and an Independent Non-executive Director of Universal Scientific Industrial (Shanghai) Co., Ltd. and Tellhow Sci-tech Co., Ltd. He holds a Ph.D., Master’s and Bachelor’s degrees in Accounting from Shanghai University of Finance and Economics.

.. He is a professor and doctoral supervisor at the School of Accountancy of Shanghai University of Finance and Economics, a full-time researcher at the Accounting and Finance Research Institute of Shanghai University of Finance and Economics, a Key Research Institute of Humanities and Social Sciences under the Ministry of Education, a member of the first and second Senior Accounting Professional Qualification Evaluation Committee of the National Government Offices Administration, a Director of the Ninth Council of the Accounting Society of China, and a Renowned Accounting Expert designated by the Ministry of Finance. Mr. Chu is also an Independent Non-executive Director of Bank of Hebei Co., Ltd. and an Independent Supervisor of Bank of China Co., Ltd. Mr. Chu was a member of the First Accounting Standards Advisory Committee of the Ministry of Finance, the Executive Secretary-General of the Accounting Education Branch of the Accounting Society of China (formerly known as Chinese Accounting Professors Association), and an Independent Non-executive Director of Universal Scientific Industrial (Shanghai) Co., Ltd. and Tellhow Sci-tech Co., Ltd. He holds a Ph.D., Master’s and Bachelor’s degrees in Accounting from Shanghai University of Finance and Economics. .. He is currently serving as an Independent Non- executive Director of Starjoy Wellness and Travel Company Limited (formerly known as Aoyuan Healthy Life Group Company Limited), China East Education Holdings Limited, Huarong International Financial Holdings Limited, Skyworth Group Limited, USPACE Technology Group Limited (formerly known as Hong Kong Aerospace Technology Group Limited),JX Energy Ltd., and Capital Estate Limited and a Non-executive Director of High Fashion International Limited. Mr. Hung served Deloitte China for 31 years where he assumed the Chairman role of Deloitte China and a board member of Deloitte International. Mr. Hung served as an adviser to the Guangzhou Institute of Certified Public Accountants. He also served as a member of the Political Consultative Committee of Luohu District, Shenzhen and was appointed as an expert adviser to the Ministry of Finance of the People’s Republic of China. Mr. Hung was an Independent Non-executive Director and then a Non-executive Director of SMI Holdings Group Limited, an Independent Non-executive Director, then a Non-executive Director and subsequently a re-designated Independent Non- executive Director of Lerthai Group Limited (formerly known as LT Commercial Real Estate Limited). Mr. Hung was also an Independent Non-executive Director of Zhongchang International Holdings Group Limited (formerly known as Henry Group Holdings Limited), Tibet Water Resources Ltd., SY Holdings Group Limited (formerly known as Sheng Ye Capital Limited), and Gome Finance Technology Co., Ltd. (formerly known as Sino Credit Holdings Limited). He holds a Bachelor of Arts in Accountancy from the University of Lincoln, United Kingdom (previously known as The Polytechnic, Huddersfield). He is also a life member of The Institute of Chartered Accountants in England and Wales.

.. He is currently serving as an Independent Non- executive Director of Starjoy Wellness and Travel Company Limited (formerly known as Aoyuan Healthy Life Group Company Limited), China East Education Holdings Limited, Huarong International Financial Holdings Limited, Skyworth Group Limited, USPACE Technology Group Limited (formerly known as Hong Kong Aerospace Technology Group Limited),JX Energy Ltd., and Capital Estate Limited and a Non-executive Director of High Fashion International Limited. Mr. Hung served Deloitte China for 31 years where he assumed the Chairman role of Deloitte China and a board member of Deloitte International. Mr. Hung served as an adviser to the Guangzhou Institute of Certified Public Accountants. He also served as a member of the Political Consultative Committee of Luohu District, Shenzhen and was appointed as an expert adviser to the Ministry of Finance of the People’s Republic of China. Mr. Hung was an Independent Non-executive Director and then a Non-executive Director of SMI Holdings Group Limited, an Independent Non-executive Director, then a Non-executive Director and subsequently a re-designated Independent Non- executive Director of Lerthai Group Limited (formerly known as LT Commercial Real Estate Limited). Mr. Hung was also an Independent Non-executive Director of Zhongchang International Holdings Group Limited (formerly known as Henry Group Holdings Limited), Tibet Water Resources Ltd., SY Holdings Group Limited (formerly known as Sheng Ye Capital Limited), and Gome Finance Technology Co., Ltd. (formerly known as Sino Credit Holdings Limited). He holds a Bachelor of Arts in Accountancy from the University of Lincoln, United Kingdom (previously known as The Polytechnic, Huddersfield). He is also a life member of The Institute of Chartered Accountants in England and Wales.

.. Ping An Overseas Holdings is an investment holding company. Ping An Overseas Holdings is a controlling shareholder of the subject company, Lufax Holding Ltd. The address of Ping An Overseas Holdings’ principal executive office is Suite 2318, 23rd Floor, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. The telephone number of Ping An Overseas Holdings’ principal executive office is +852 3762 9228.

.. Ping An Overseas Holdings is an investment holding company. Ping An Overseas Holdings is a controlling shareholder of the subject company, Lufax Holding Ltd. The address of Ping An Overseas Holdings’ principal executive office is Suite 2318, 23rd Floor, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. The telephone number of Ping An Overseas Holdings’ principal executive office is +852 3762 9228.