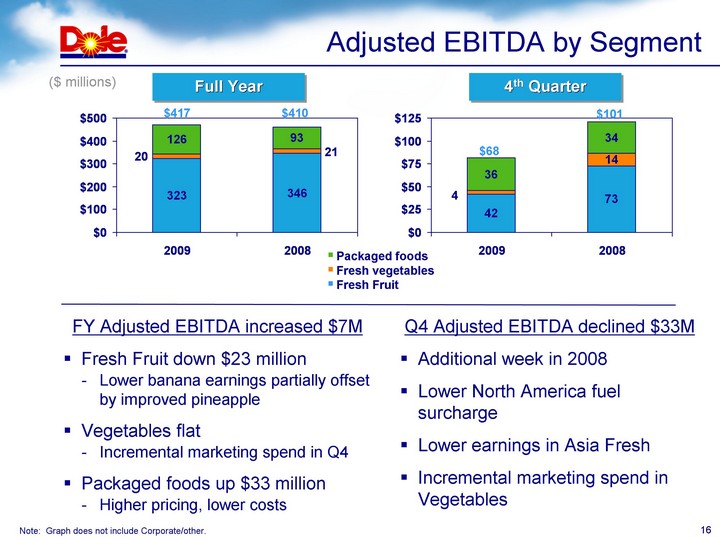

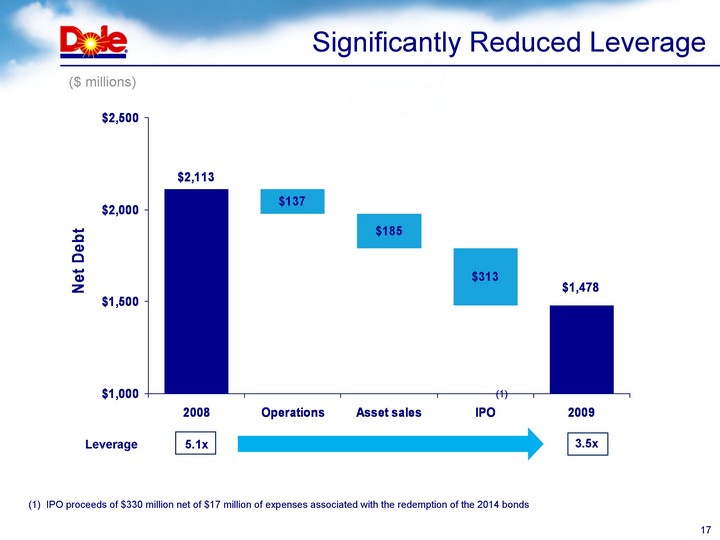

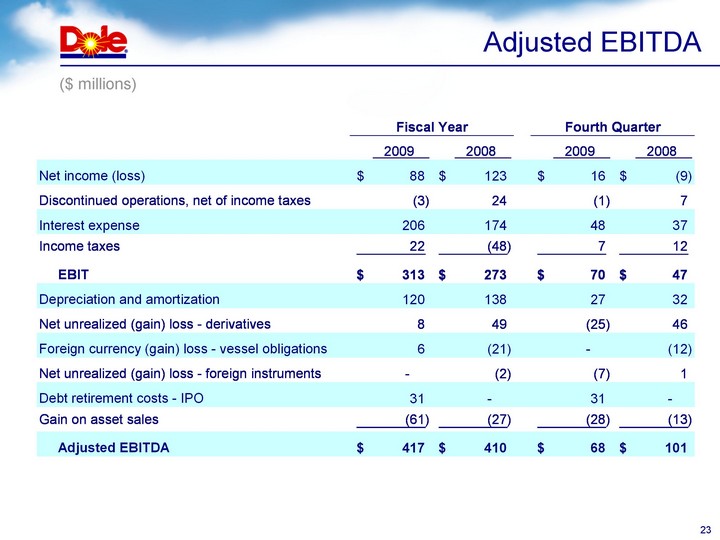

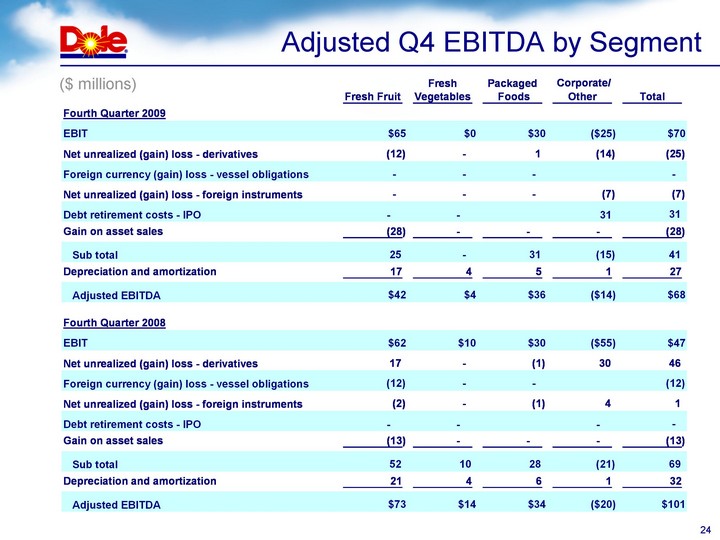

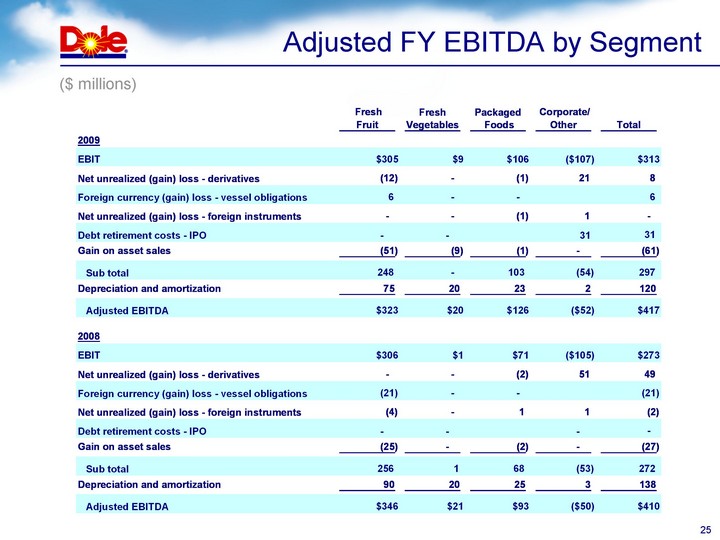

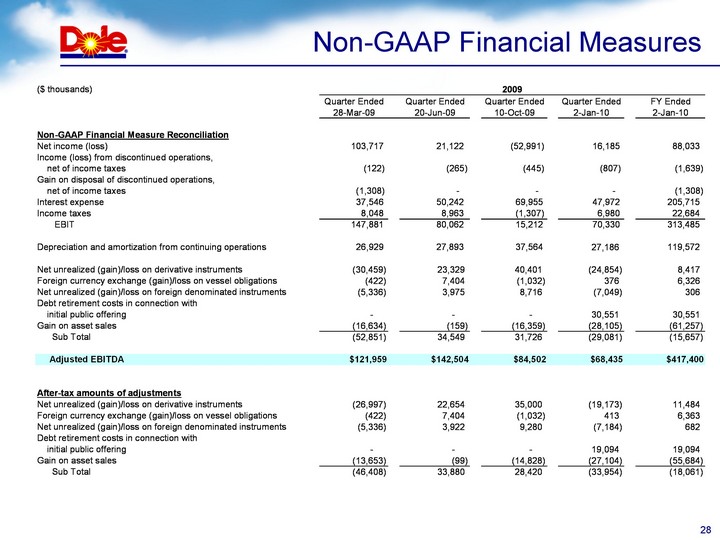

| Non-GAAP Financial Measures EBIT and Adjusted EBITDA are measures commonly used by financial analysts in evaluating the performance of companies. EBIT is calculated by adding the loss from discontinued operations, net of income taxes or subtracting income from discontinued operations, net of incomes taxes, to and from net income (loss), respectively, by subtracting the gain on disposal of discontinued operations, net of income taxes, by adding interest expense and by adding income tax expense or subtracting income tax benefit to and from net income (loss). Adjusted EBITDA is calculated by adding depreciation and amortization from continuing operations to EBIT, by adding the net unrealized loss or subtracting the net unrealized gain on certain derivative instruments (foreign currency and bunker fuel hedges and the cross currency swap), to and from EBIT, respectively, by adding the foreign currency loss or subtracting the foreign currency gain on the vessel obligations to and from EBIT, respectively, by adding the net unrealized loss or subtracting the net unrealized gain on foreign denominated instruments to and from EBIT, respectively, and by subtracting the gain on asset sales from EBIT. These items have been adjusted because management excludes these amounts when evaluating the performance of Dole. For 2009, debt retirement costs in connection with Dole's initial public offering are also added to EBIT in calculating Adjusted EBITDA. Net debt is calculated as total debt less cash and cash equivalents. EBIT and Adjusted EBITDA are not calculated or presented in accordance with U.S. GAAP, and EBIT and Adjusted EBITDA are not a substitute for net income attributable to Dole Food Company, Inc., net income, income from continuing operations, cash flows from operating activities or any other measure prescribed by U.S. GAAP. Further, EBIT and Adjusted EBITDA as used herein are not necessarily comparable to similarly titled measures of other companies. However, Dole has included EBIT and Adjusted EBITDA herein because management believes that EBIT and Adjusted EBITDA are useful performance measures for Dole. In addition, EBIT and Adjusted EBITDA are presented because Dole's management believes that these measures are frequently used by securities analysts, investors and others in the evaluation of our Company. EBIT and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation from, or as an alternative to, operating income, cash flow or other combined income or cash flow data prepared in accordance with U.S. GAAP. Because of its limitations, EBIT and Adjusted EBITDA and the related ratios presented throughout this document should not be considered as measures of discretionary cash available to invest in business growth or reduce indebtedness. Dole compensates for these limitations by relying primarily on its U.S. GAAP results and using EBIT and Adjusted EBITDA only supplementally. |