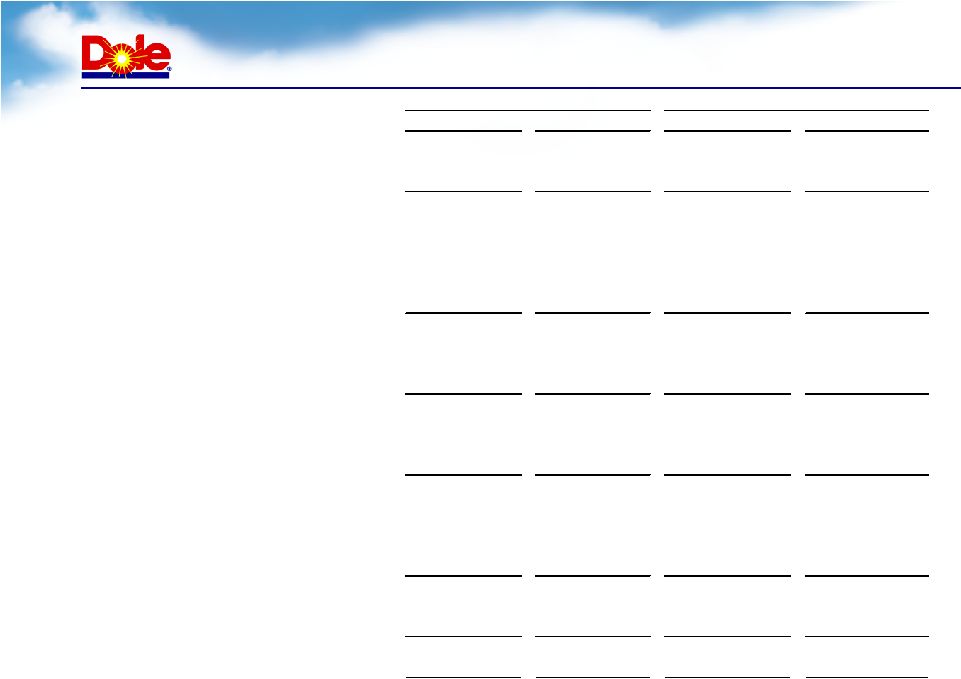

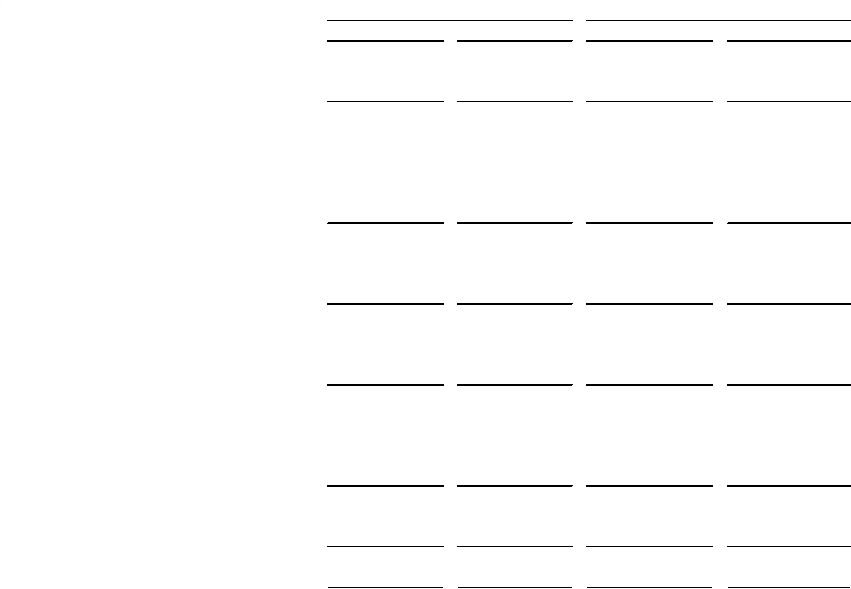

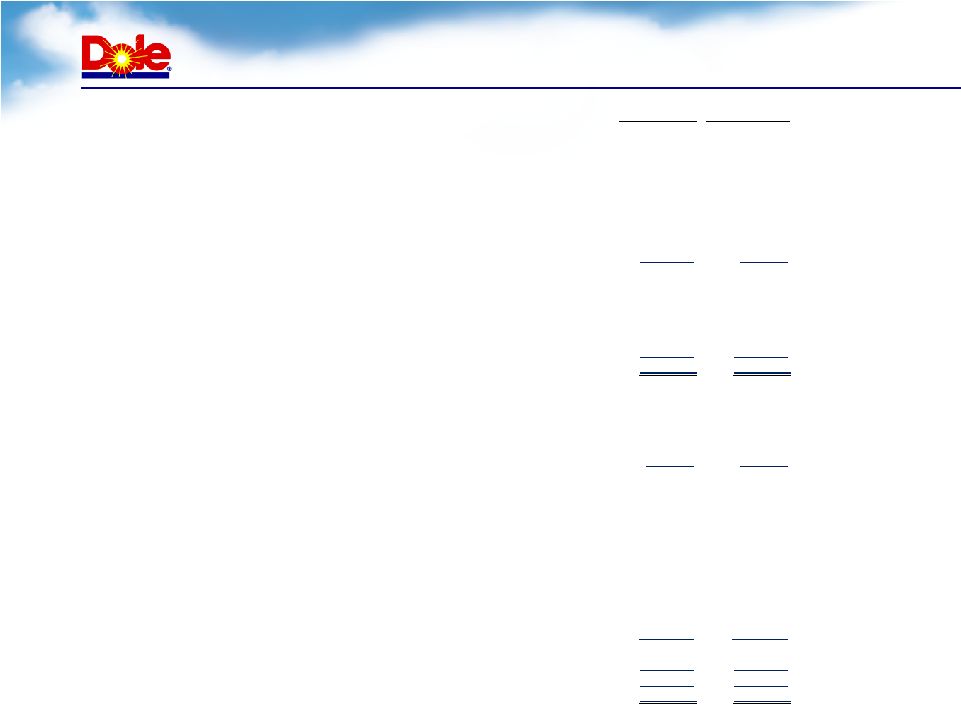

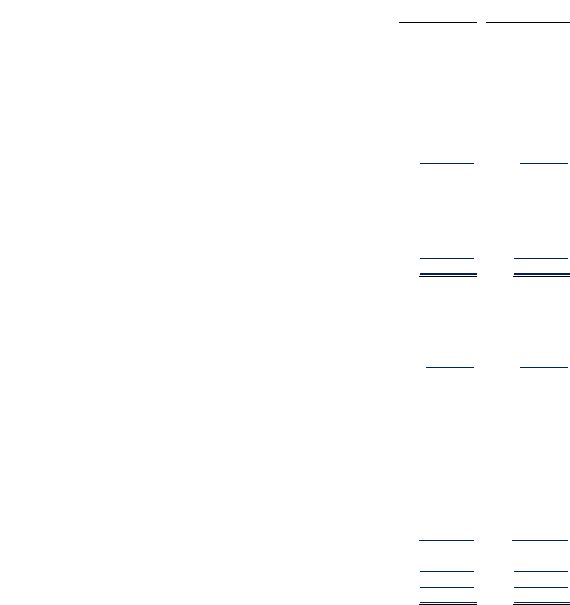

4 Non-GAAP Financial Measures EBIT before discontinued operations, Adjusted EBITDA and Comparable Income (loss) from continuing operations (total and per share) are measures commonly used by financial analysts in evaluating the performance of companies. EBIT before discontinued operations is calculated from net income by adding interest expense and income tax expense, and subtracting income from discontinued operations, net of income taxes, and gain on disposal of discontinued operations, net of income taxes. Adjusted EBITDA is calculated from EBIT before discontinued operations by: (1) adding depreciation and amortization; (2) adding the net unrealized loss or subtracting the net unrealized gain on foreign currency and bunker fuel hedges and the cross currency swap which do not have a more than insignificant financing element present at contract inception; (3) adding the net loss or subtracting the net gain on the long-term Japanese yen hedges; (4) adding the foreign currency loss or subtracting the foreign currency gain on the vessel obligations; (5) adding the net unrealized loss or subtracting the net unrealized gain on foreign denominated instruments; and (6) subtracting the gain on asset sales. Due to the fact that the long-term Japanese yen hedges had more than an insignificant financing element at inception, the liability is treated similar to a debt instrument and the associated cash flows are classified as a financing activity. As a result, both the realized and unrealized gains and losses from these hedges are subtracted from or added back to EBIT before discontinued operations when calculating Adjusted EBITDA. Comparable Income (loss) from continuing operations is calculated from income (loss) from continuing operations by adding charges for restructuring and long-term receivables, net of income taxes, adding the net unrealized loss or subtracting the net unrealized gain on foreign currency and bunker fuel hedges and the cross currency swap, net of income taxes, adding the net loss or subtracting the net gain on the long-term Japanese yen hedges, net of income taxes, adding the foreign currency loss or subtracting the foreign currency gain on the vessel obligations, net of income taxes, adding the net unrealized loss or subtracting the net unrealized gain on foreign denominated instruments, net of income taxes, and subtracting gain on asset sales, net of income taxes. These items have been adjusted because management excludes these amounts when evaluating the performance of Dole. Net debt is calculated as total debt less cash and cash equivalents. EBIT before discontinued operations, Adjusted EBITDA and Comparable Income (loss) from continuing operations (total and per share) are not calculated or presented in accordance with U.S. GAAP and are not a substitute for net income attributable to Dole Food Company, Inc., net income, income from continuing operations, cash flows from operating activities or any other measure prescribed by U.S. GAAP. Further, EBIT before discontinued operations, Adjusted EBITDA and Comparable Income (loss) from continuing operations (total and per share) as used herein are not necessarily comparable to similarly titled measures of other companies. However, Dole has included these three measures herein because management believes that they are useful performance measures for Dole and are frequently used by securities analysts, investors and others in the evaluation of Dole. |