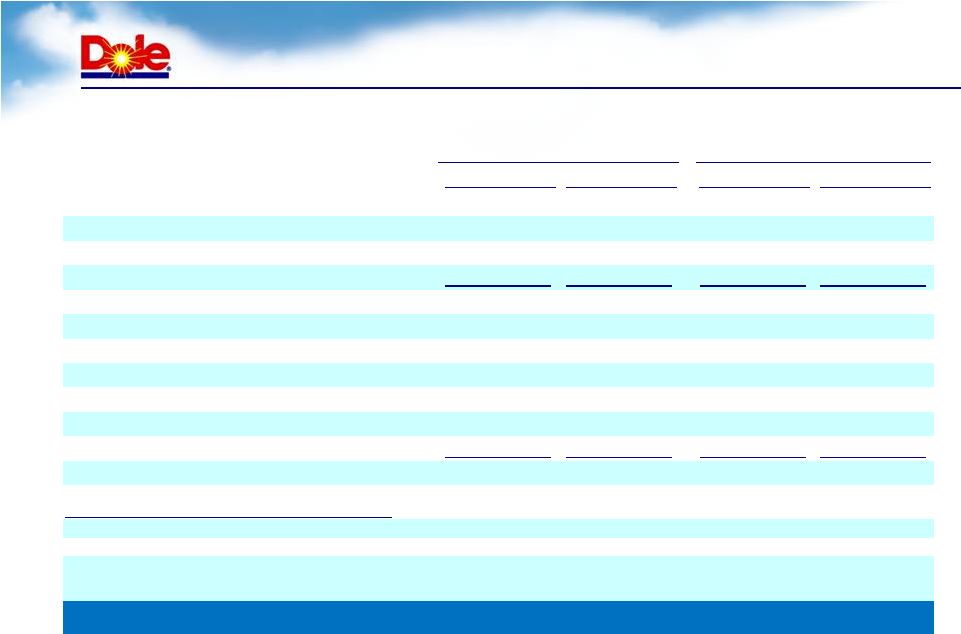

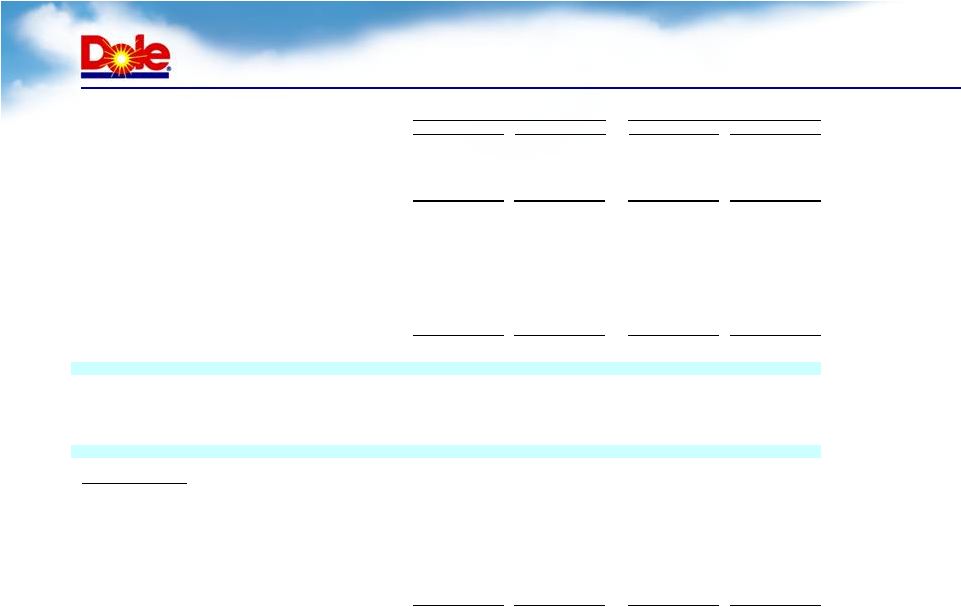

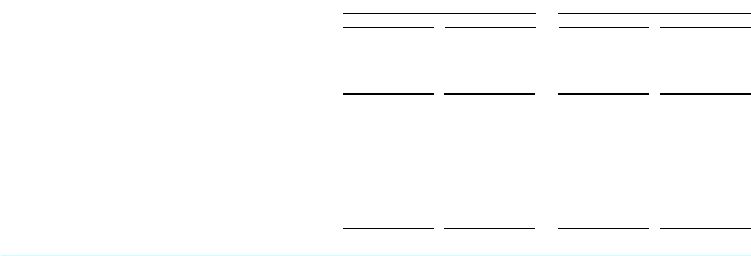

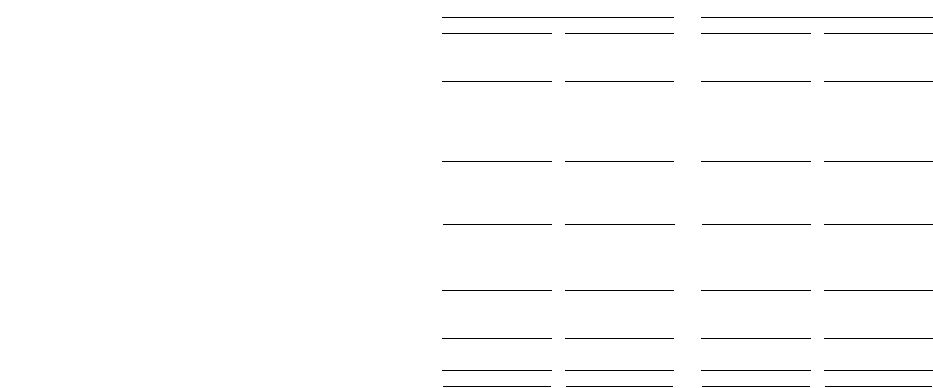

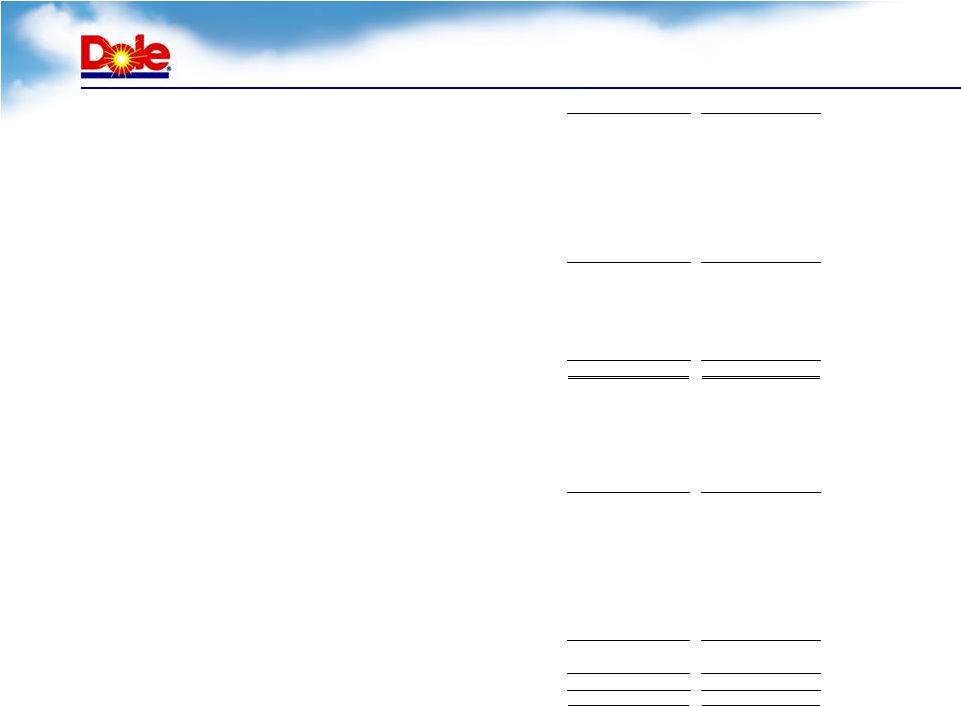

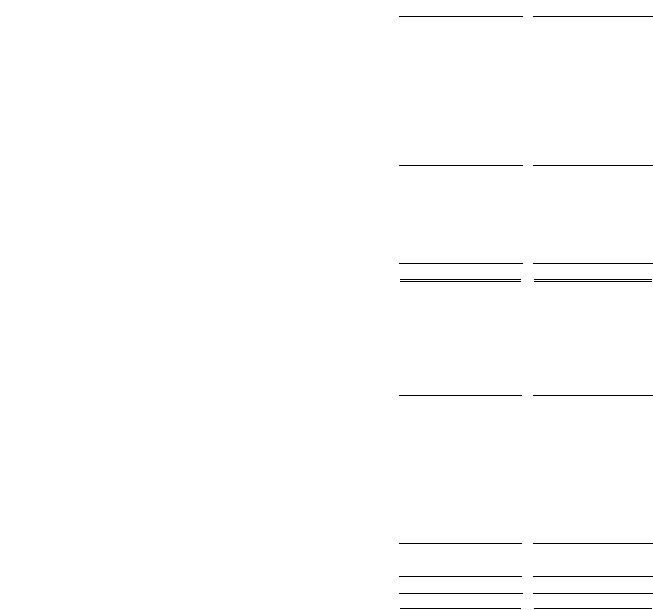

21 Non-GAAP Financial Measures ($ thousands, except per share data) Quarter Ended Three Quarters Ended October 8, 2011 October 9, 2010 October 8, 2011 October 9, 2010 Net Income (loss) (47,004) $ (48,829) $ 38,074 $ 7,405 $ Income (loss) from discontinued operations, net of income taxes 43 (202) (188) (876) Gain on disposal of discontinued operations, net of income taxes - (4,143) (339) (4,143) Interest expense 41,402 49,187 111,709 127,375 Income taxes 123 7,522 18,781 19,764 EBIT 168,037 149,525 Depreciation & amortization 79,064 87,620 Net unrealized (gain)/loss on derivative instruments 2,487 43,527 35,104 59,164 Net (gain) loss on Japanese yen hedges (2,298) (6,582) Foreign currency exchange (gain)/loss on vessel obligations (2,590) 3,946 (51) (1,147) Gain on asset sales (3,326) - (3,337) (2,921) Debt retirement costs in connection with initial public offering Net unrealized FX (gain)/loss on foreign denominated borrowings (1,645) 12,579 5,802 6,581 Sub Total (7,372) 60,052 30,936 61,677 Adjusted EBITDA 18,858 $ 101,185 $ 278,037 $ 298,822 $ Significant items included in Adjusted EBITDA: Charges for restructuring and long-term receivables 13,171 23,518 21,873 24,888 Gain on arbitration settlement, net - (27,271) - (27,271) Write-off of debt issuance costs, refinancing fees and loss on early retirement of 2014 notes 26,192 - 26,192 - Adjusted EBITDA excluding significant items 58,221 $ 97,432 $ 326,102 $ 296,439 $ After tax adjustments Net unrealized (gain)/loss on derivative instruments 2,609 $ 43,575 $ 34,855 $ 59,183 $ Net (gain) loss on Japanese yen hedges (2,298) - (6,582) - Foreign currency exchange (gain)/loss on vessel obligations (2,590) 3,946 (51) (1,147) Gain on asset sales (3,326) - (3,337) (2,710) Debt retirement costs in connection with initial public offering - - - - Net unrealized FX (gain)/loss on foreign denominated borrowings (1,851) 12,580 5,588 6,590 Charges for restructuring and long-term receivables 13,171 23,518 21,873 24,888 Gain on arbitration settlement, net - (27,271) - (27,271) Refinancing charges and loss on early retirement of 2014 notes 26,192 - 26,192 - Sub Total 31,907 $ 56,348 $ 78,538 $ 59,533 $ Comparable income (loss) from continuing operations ($15,054) $3,125 $116,085 $61,908 Comparable net income attributable to Dole Food Company, Inc. ($16,731) $5,923 $112,706 $63,620 Earnings per share - Diluted: Comparable income from continuing operations ($0.17) $0.04 $1.32 $0.71 Comparable net income attributable to Dole Food Company, Inc. ($0.19) $0.07 $1.28 $0.73 3,535 31,666 37,598 (5,436) |