UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2021

Commission File Number 333-250990

SAWAI GROUP HOLDINGS Co., Ltd.

(Translation of registrant’s name into English)

5-2-30, Miyahara

Yodogawa-ku, Osaka 532-0003

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | SAWAI GROUP HOLDINGS Co., Ltd. |

| | | |

| | By: | /s/ Yoshiki Sakurai |

| | Name: | Yoshiki Sakurai |

| | Title: | Executive Officer, Group Chief Financial Officer and General Manager of Group Financial Department |

Date: May 19, 2021

sawai Long-Term Vision for 2030 and Medium-Term Business Plan -FY2021 to FY2023- Sawai Group Joldings Co., LTd. May 2021 1

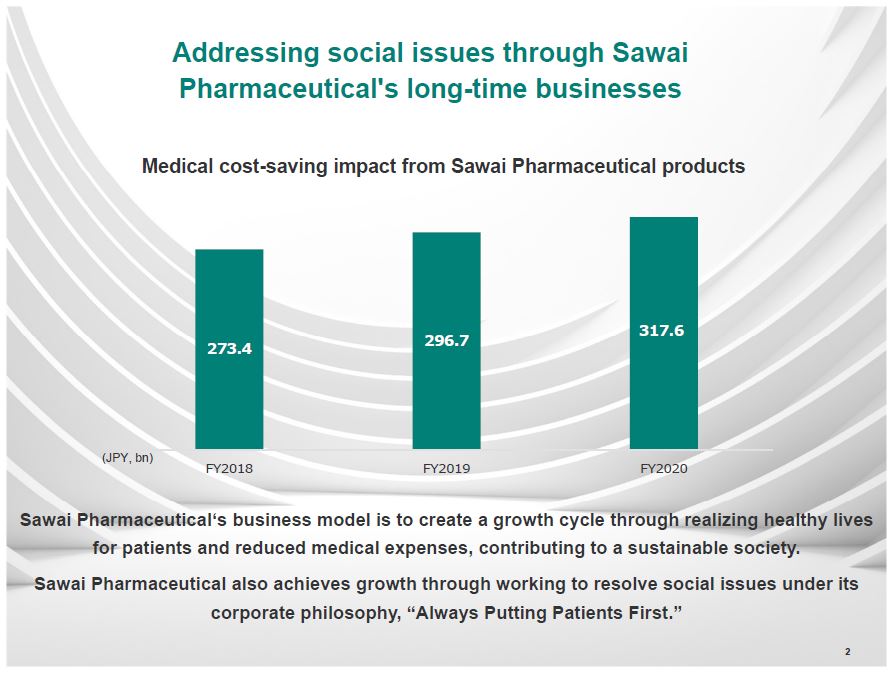

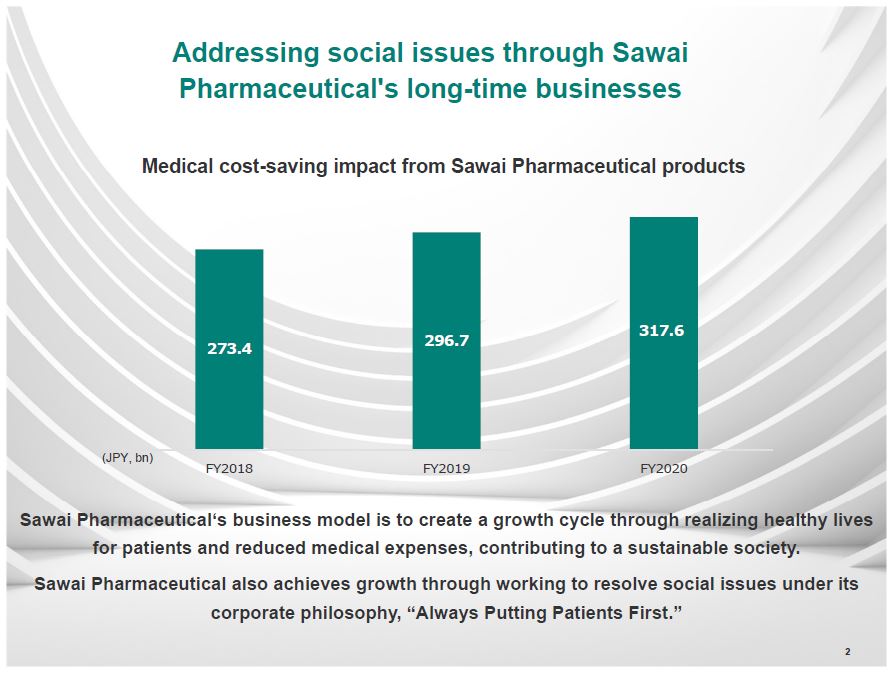

Addressing social issues through Sawai Pharmaceutical's long-time businesses Medical cost-saving impact from Sawai Pharmaceutical products (JPY, bn) 273.4 FY2018 296.7 FY2019 317.6 FY2020 Sawai Pharmaceutical's business model is to creat a growth cycle through realizing healthy lives for patients and reduced medical expenses, contributing to a sustainable society. Sawai Pharmaceuticals also acheives growth through working to resolve social issues under its corporate philosophy, "Always Putting Patients First." 2

Always Putting Healthier Lives First Working to resolve social issues through Sawai Group Holdings' businesses Realizing a sustainable society through the generics business Contributing to the extension of healthy lifespsans through new business We will strive to contribute to the health of as many people as possible as a healthcare corporate group developing sustainably alongside society, with the generic drugs as our core business. 3

CONTENTS sawai I Review of the Medium-Term Business Plan, "M1 TRUST 2021" II Recognizing the Business Environment III Our Vision for 2030 IV Medium-Term Business Plan, "START 2024" V Initiatives Resoliving Social Issues VI Appendix 4

Review of the Medium-Term Business Plan M1 TRUST 2021 sawai 5

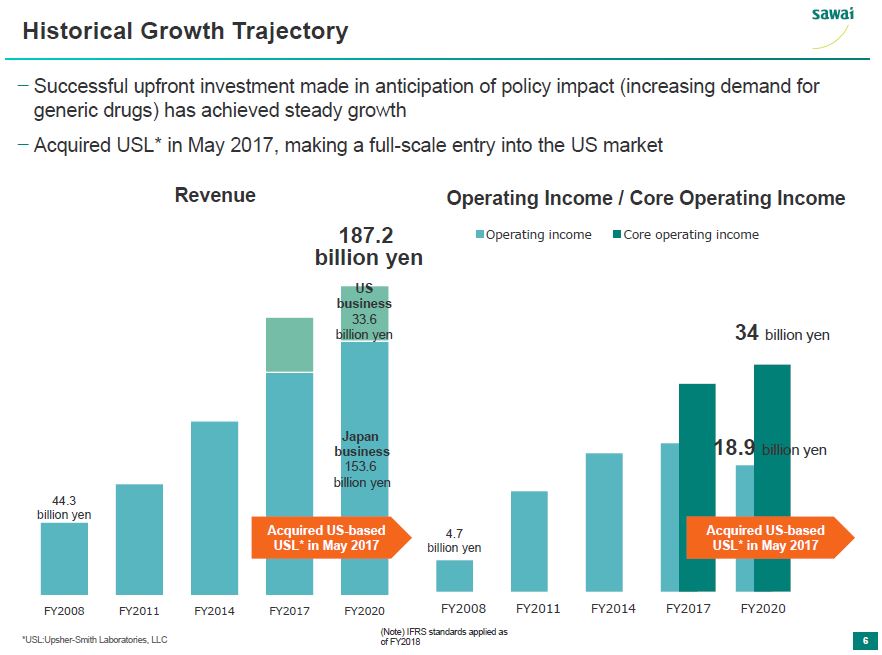

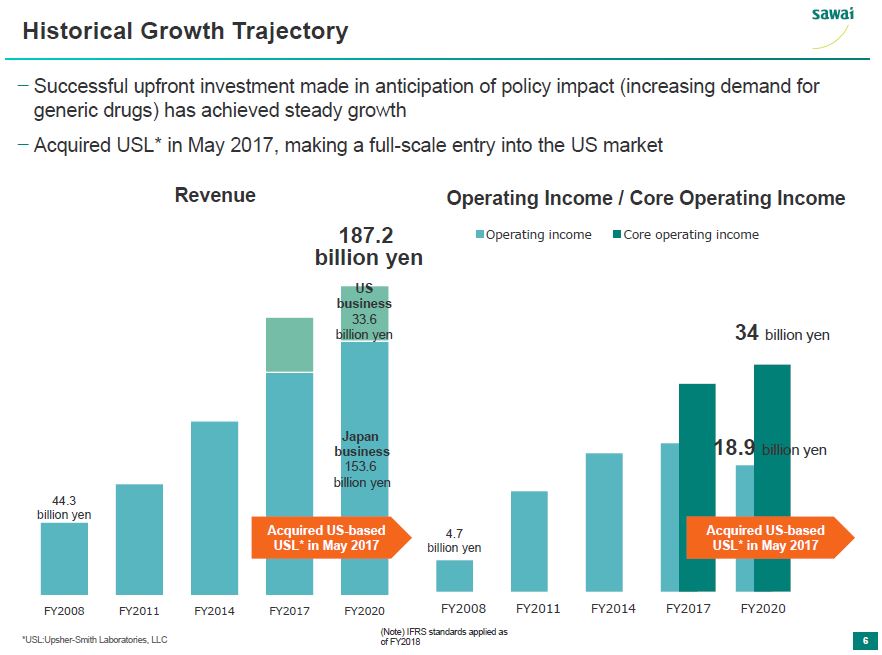

sawai Historical Growth Trajectory - Succesful upfront investment made in anticipation of policy impact (increasing demand for generic drugs) has acheived steady growth - Acquired USL* in May 2017, making a full-scale entry into the US market Revenue 44.3 billion yen FY2008 FY 2011 FY2014 187.2 billion yen FY2017 US businesses 33.6 billion yen Japan businesses 153.6 billion yen FY2020 Acquired US-based USL* in May 2017 Operating Income/Core Operating Income 4.7 billion yen FY2008 FY2011 FY2014 FY2017 34 billion yen 18.9 billion yen FY2020 Acquired US-based USL* May2017 *USL:Upsher-Smith Laboratories, LLC (Note) IFRS standards applied as of FY2018 6

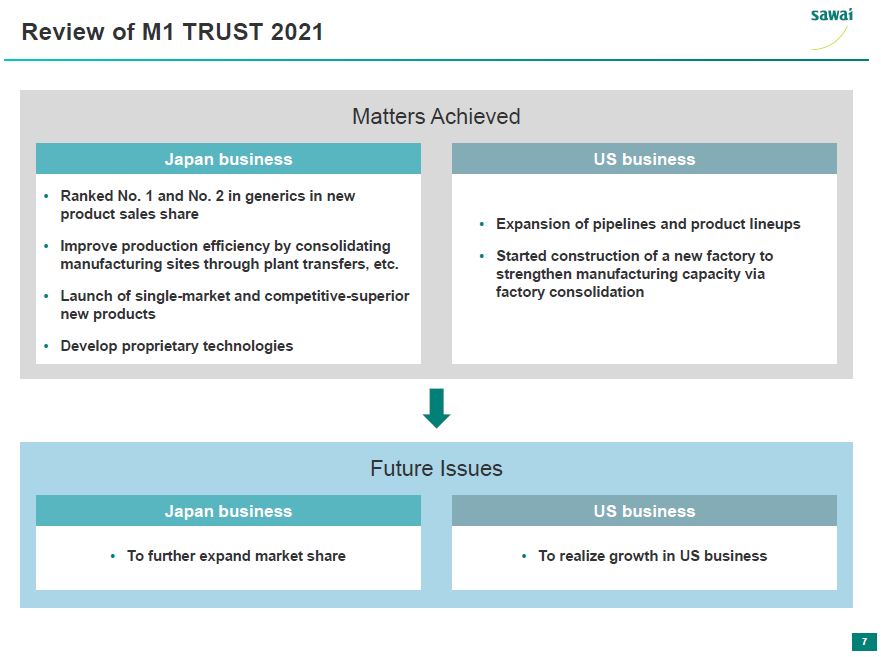

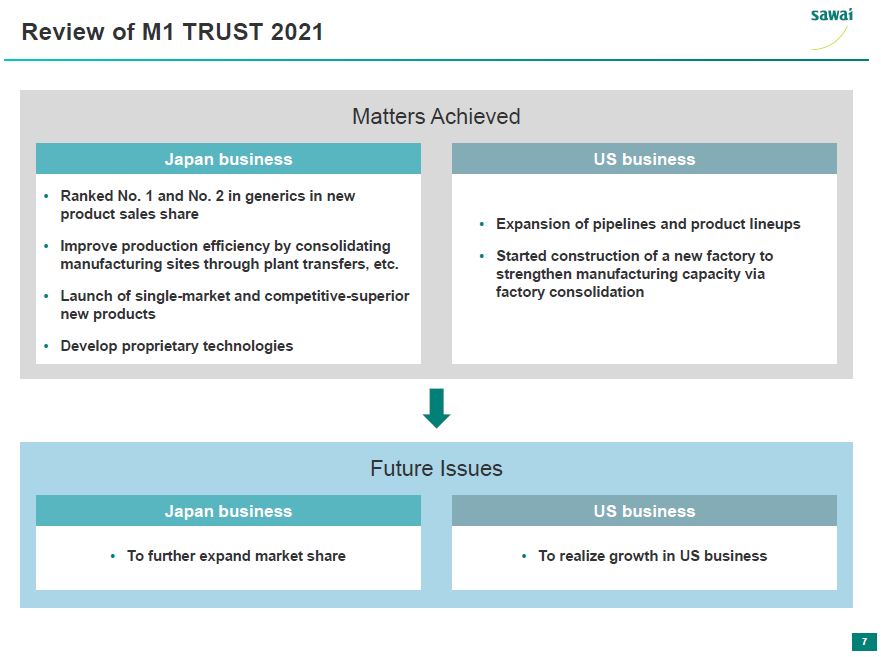

sawai Review of M1 TRUST 2021 Matters Acheived Japan business - Ranked No. 1 and No. 2 in generics in new product sales share - Improve production efficiency by consolidating manufacturing sites through plant transfers, etc. - Launch of single-market and competitive-superior new products - Develop propreitary technologies US business - Expansion of pipelines and product lineups - Started construction of a new factory to strengthen manufacturing capacity via factory consolidation Future Issues Japan business - To further expand market share US business - To realize growth in US business 7

sawai Review of M1 TRUST 2021 - Despite the severe business environment, both revenue and core operating income increased by 10% during the previous medium-term business plan - Generics volume share in Japan rose 0.8 points to 15.7% Revenue Core operating income (billions of yen) FY2017 FY2020 168.1 187.2 14.9% 15.7% 31.1 34 22.2 18.9 8

Recognizing the Business Environment sawai 9

sawai Changes in the External Environment: Trends and Technologies Changes in Trends A more aging society, changes in values for prevention/pre-symptomatic illness Era of 100-year lifespans Emphasis on prevention of disease and pre-symptomatic illness state Increasing medical costs Increasing home care Evolution of Technology Advances in technological innovations such as new modalities, AI, and robots New modalities AI Digital Robotics 10

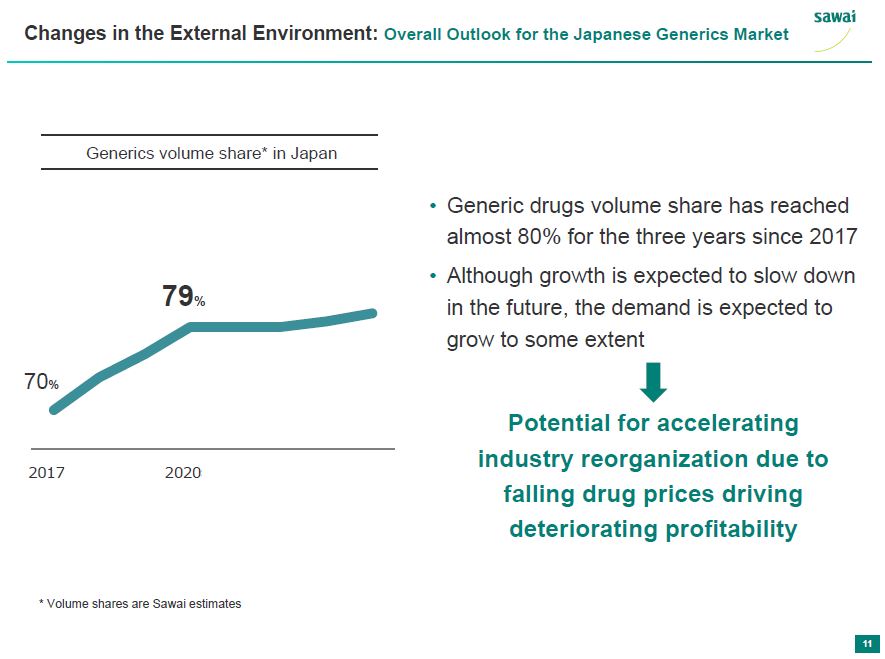

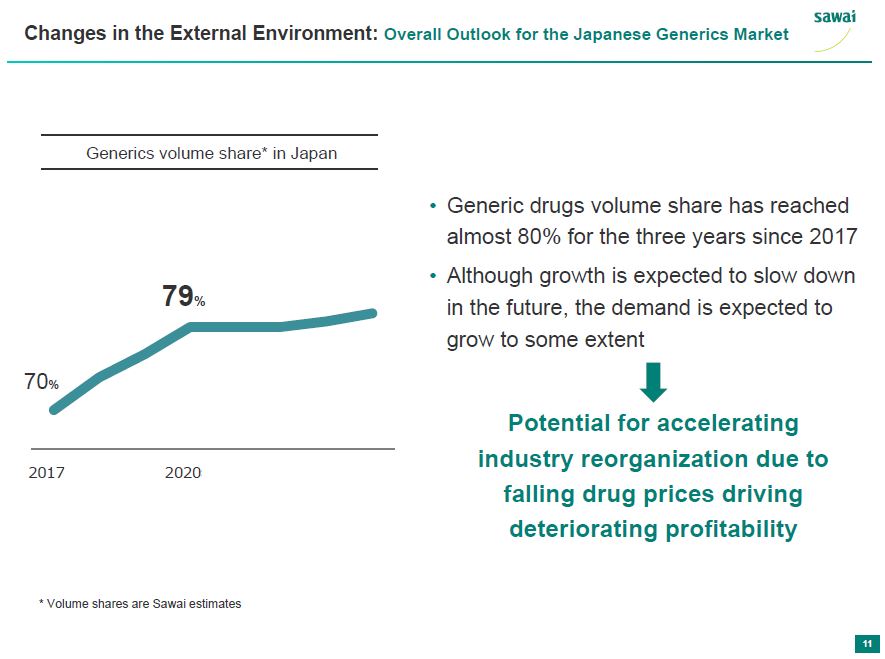

sawai Changes in the External Environment: Overall Outlook for the Japanese Generics Market Generics volume share* in Japan 2017 2020 70% 79% - Generic drugs volume share has reached almost 80% for the three years since 2017 - Although growth is expected to slow down in the future, the demand is expected to grow to some extent Potential for accelerating industry reorganization due to falling drug prices driving deteriorating profitability *Volume shares are Sawai estimates 11

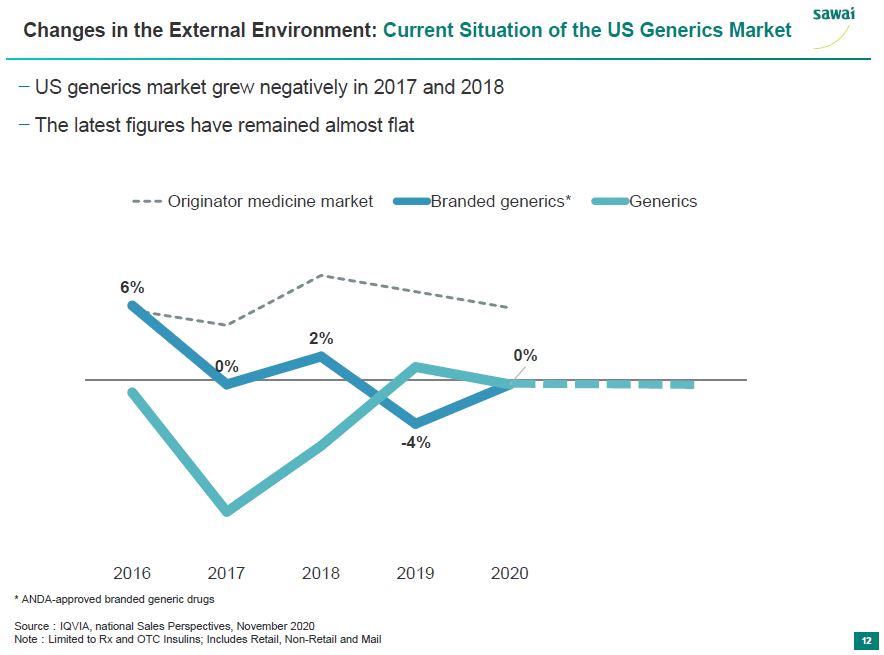

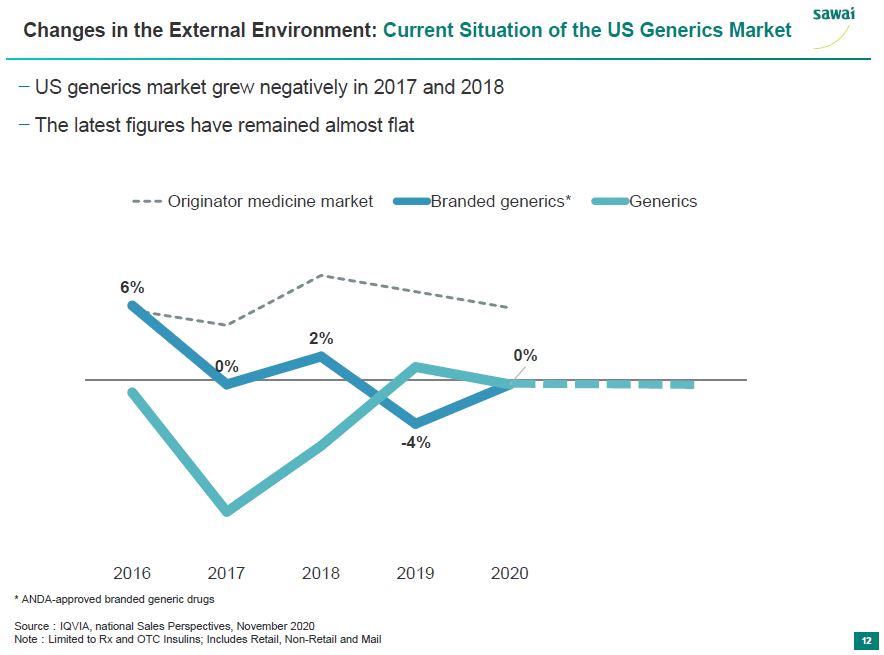

sawai Changes in the External Environment: Current Situation of the US Generics Market - US Generics market grew negatively in 2017 and 2018 - The lastest figures have remained almost flat Originator medicine market Branded generics* Generics 6% 0% 2% -4% 0% 2016 2017 2018 2019 2020 *ADNA-approved branded generic drugs Source: IQVIA, national Sales Perspectivies, Novemer 2020 Note: Limited to Rx and OTC insulins; Includes Retail, Non-Retail and Mail 12

Our Vision for 2030 sawai 13

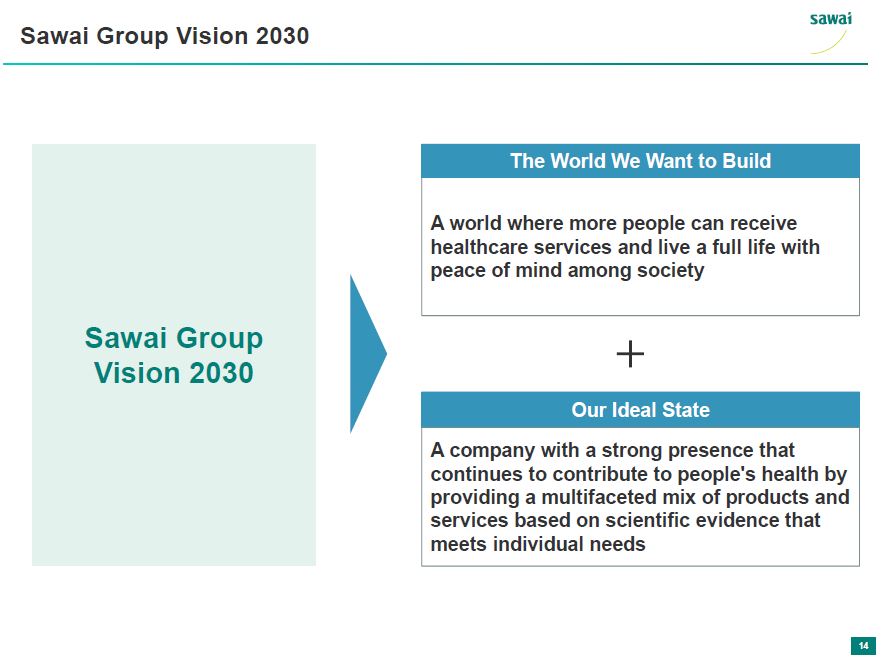

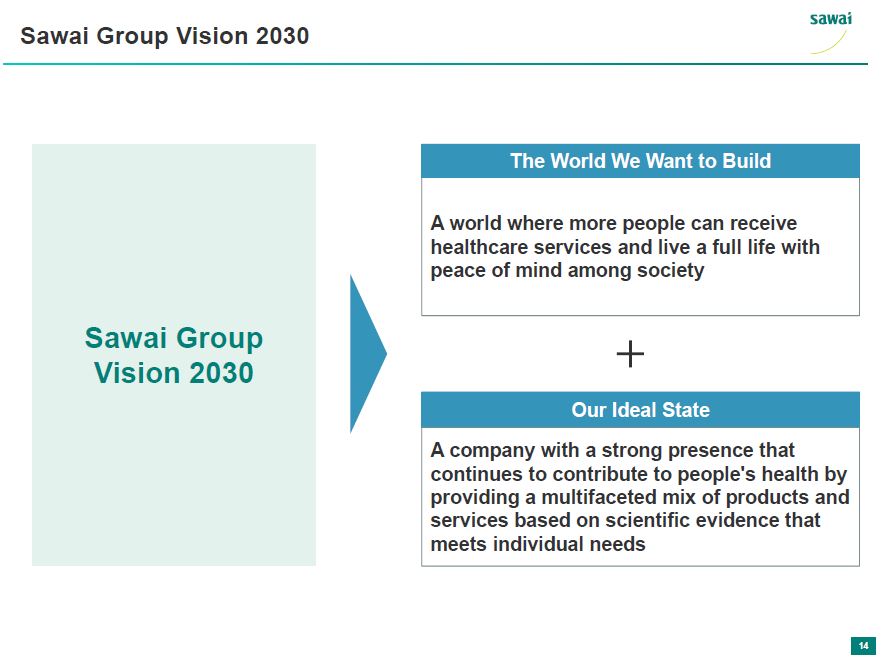

Sawai Group Vision 2030 The World We Want to Build A world where more people can receive healthcare services and live a full life with peace of mind among society + Our Ideal State A company with a strong presence that continues to contribute to people's health by providing a multifaceted mix of products and srvices based on scientific evidence that meets individual needs 14

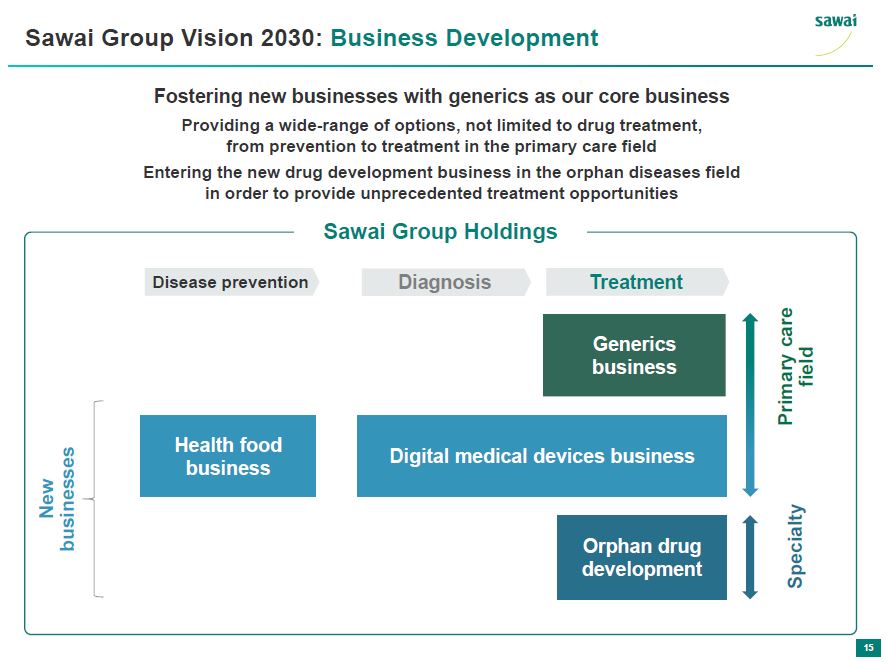

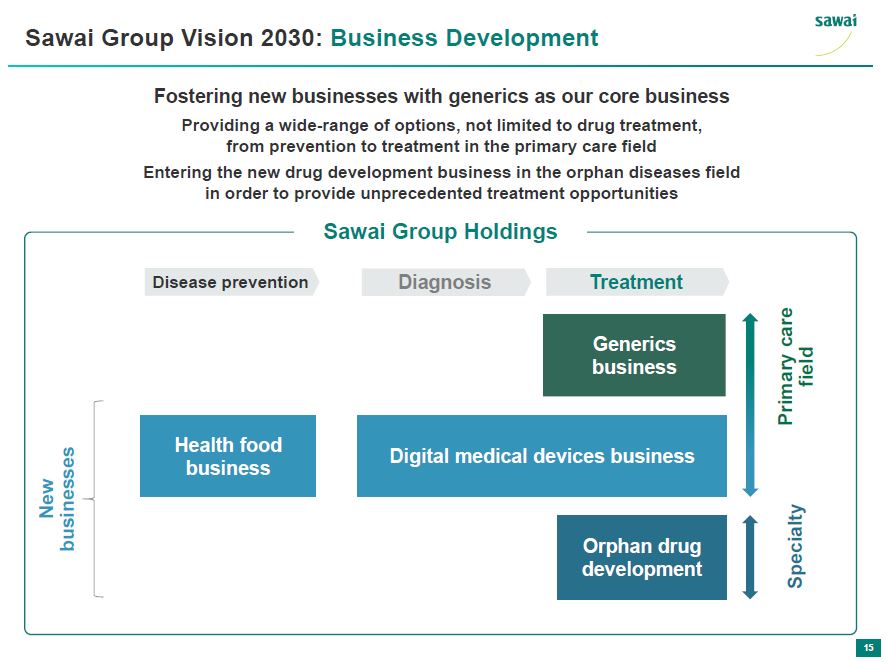

sawai Sawai Group Vision 2030: Business Development Fostering new businesses with generics as our core business Providing a wide-range of options, not limited to drug treatment, from prevention to treatment in the primary care field Entering the new drug development business in the orphan diseases field in order to provide unprecedented treatment opportunities Sawai Group Holdings Disease Prevention Diagnosis Treatment Generic business Primary care field New businesses Health food business Digital medical devices business Orphan drug development Specialty 15

sawai Sawai Group Vision 2030: Quantitative Targets New business U.S. business Japan business Domestic GE share 14.9% 15.7% 20.0% or more 168.1% 187.2 400 billion yen 333 336 New businesses 80 US businesses 60 1,347 1,536 Japan business 260 FY2017 FY2020 FY2023 FY2030 Target (Yen/$=100) Targets and Prerequisite Values As of FY2020 FY2030 under vision 2030 Japan Business Revenue 153.6 billion yen 260 billion yen Sales volume 13.1 billion tablets 260 billion tablets Share of sales 15.7% 20.0% or more Production capacity 15.5 billion tablets 23 billion tablets or more New businesses Revenue - 80 billion yen US businesses Revenue 33.6 billion yen 60 billion yen Total revenue 187.2 billion yen 400 billion yen ROE 5.8% 10% or more 16

Medium-Term Business Plan, START 2024 sawai 17

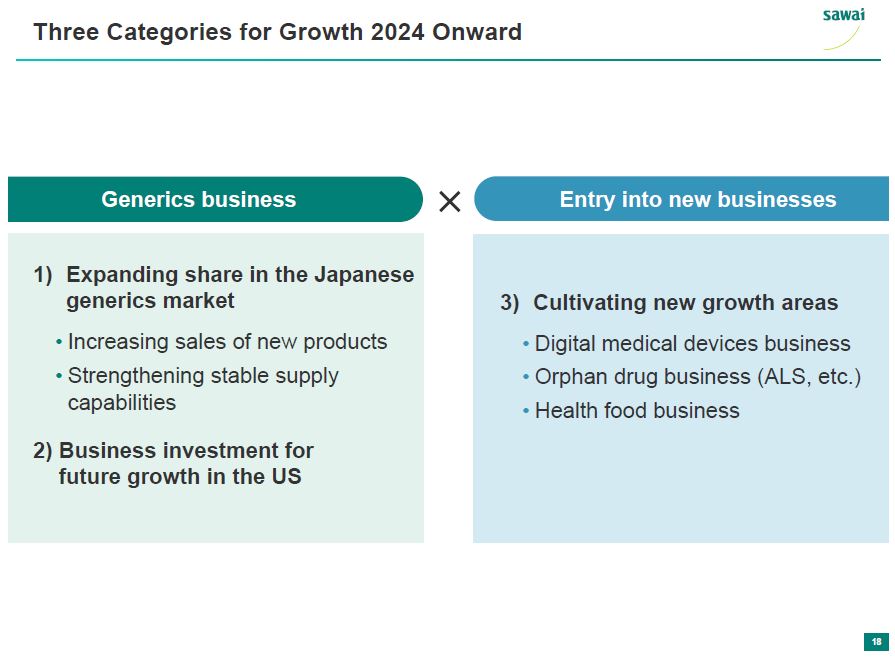

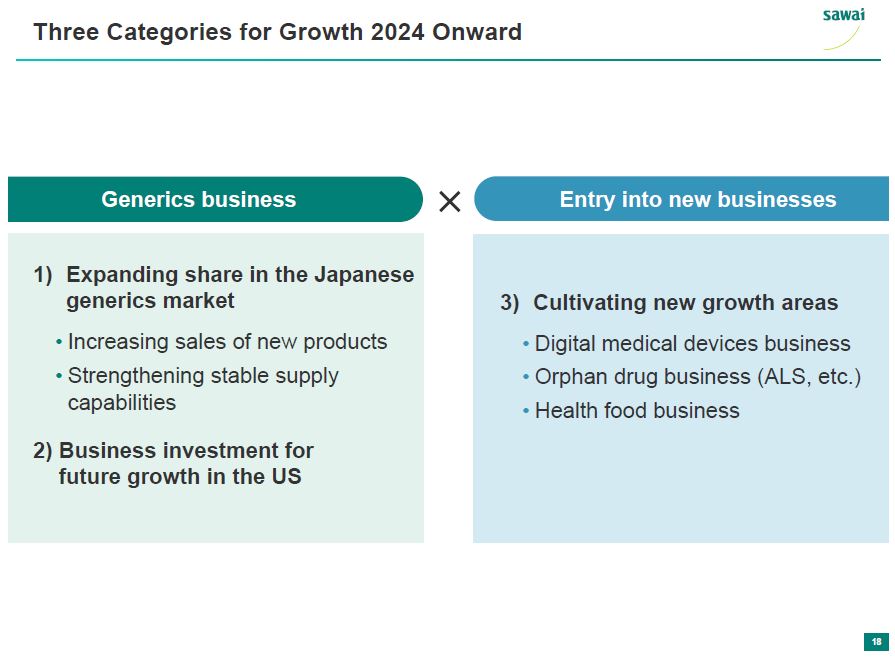

sawai Three Categories for Growth 2024 Onword Generic business 1) Expanding share in the Japanese generics market - Increasing sales of new products - Strengthening stable supply capabilites 2) Business investment for future growth in the US x Entry into new businesses 3) Cultivating new growth areas - Digital medical devices business - Orphan drug business (ALS, etc.) - Health food business 18

sawai (1) Expanding Generics Market Share in Japan: Increasing Sales of New Products Launched 89 prodcuts in three years Strongly competitive products (including single-market products) serve as core drivers for sales Revenue from products launched in the past three years Products launched in FY2018 Products launched in FY2019 Products launched in FY2020 (Unit millions of yen) 13,964 551 1,890 5526 7918 6,514 FY2018 FY2019 FY2020 Numbers of products launched in the past three years and strongly competitive products FY2018 FY2019 FY2020 Number of products 33 14 42 Single-market and strongly 3 7 9 competitive products (included in above) Major products released Capecitabine Micafungin sodium (for IV infusion) Eladecalcitol (generic name) Oseltamivir Tadalafil CI Bazedoxifene Aprepitant Fexofenadine hydrochloride Hydrochloride psuedoephedrine (Pusofeki combination tablets) Repaglinide Varenafil 19

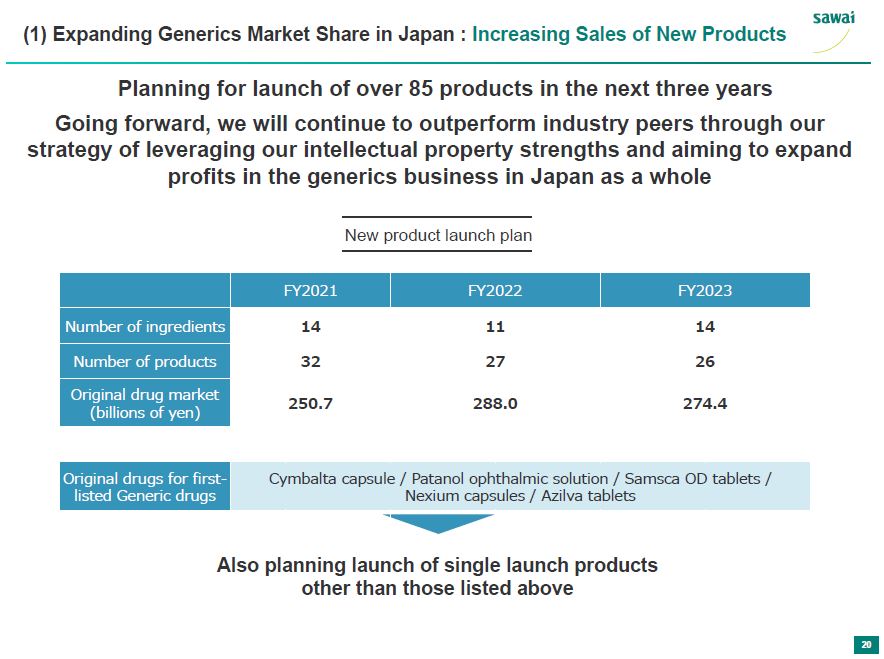

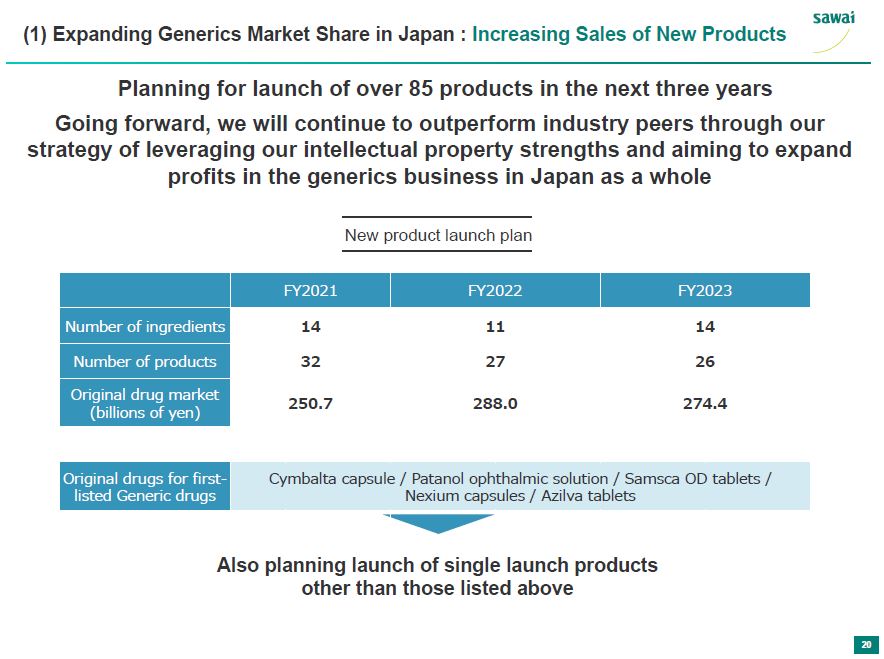

(1) Expanding Generics Market Share in Japand: Increasing sales of New Products Planning for launch of over 85 products in the next three years Going forward, we will continue to outperform inductry peers through our strategy of leveraging our intellectual property strengths and aiming to expand profits in the generics business in Japan as a whole New prodcut launch plan FY2021 FY2022 FY2023 Number of ingredients 14 11 14 Number of products 32 27 26 Original drug market 250.7 288.0 274.4 (billions of yen) Original drugs for first-listed Generic drugs Cymbalta capsule/ Patanol ophthalmic solution/ Samsca OD tablets/ Nexium capsules/ Azilva tablets Also planning launch of single launch products other than those listed above 20

sawai (1) Expanding Generics Market Share in Japan : Strengthening Stable Supply Capabilities Aiming to further improve supply capacity by taking all reasonable measures in anticipation of industry reorganization and consolidation, e.g., building new factories, acquiring factories, and securing high-quality production contractors Industry-leading production capacity, sales volume Aiming to establish an in-house production system for more than 20 billion tablets Production capacity Sales volume (billions of tablets) 10 15.5 8 13.3 FY2014 FY2020 21

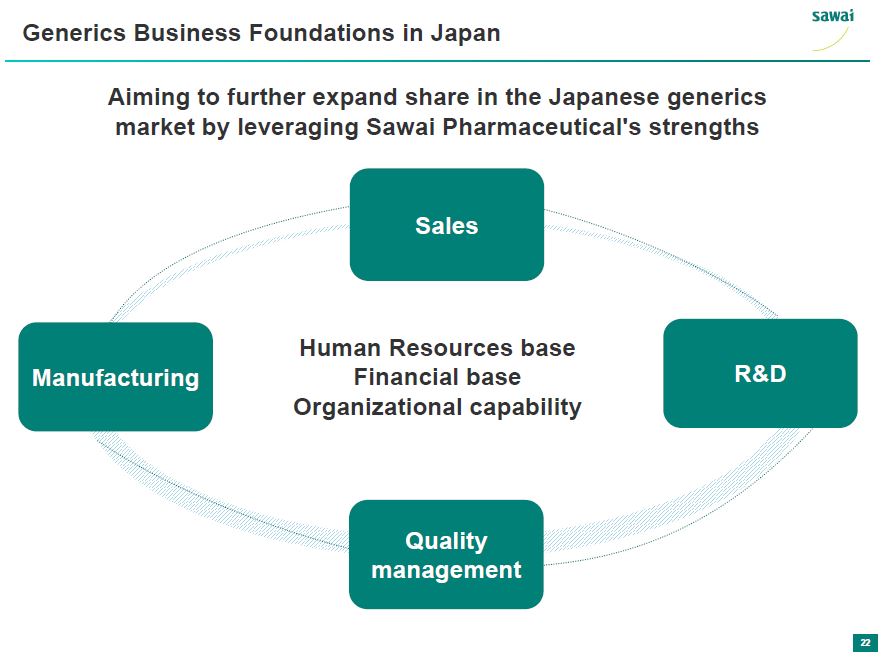

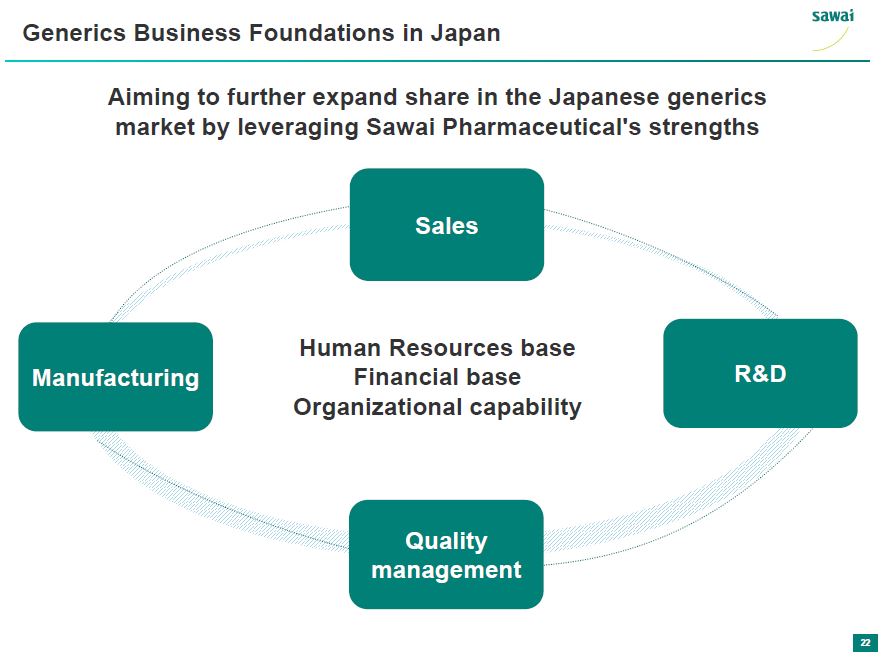

sawai Generics Business Foundations in Japan Aiming to further expand share in the Japanese generics market by leveraging Sawai Pharmaceuticals's strengths Sales Human Resources base Manufacturing Financial base RandD Organizational capability Quality management 22

sawai Generics Business Foundations in Japan: Sales Capability Building the Sawai brand through a steady track record of activities Strong trust relationships with wholesalers and distributors Information gathering capability - Information provision system that promptly and accurately conveys product information for approximately 800 items - Abundant materials and content for patients and medical professionals - Information gathering structure for side effects and safety, designes to further improve products - Responding to demand changes through cross-division cooperation Information provision capability Cross-division cooperation 23

sawai Generics Business Foundations in Japan : RandD Capability Achieving first new peoduct launch through RandD and drug formulation development capabilities Candidate product survey/analysis Early start of RandD - Track record of approvals of around 800 items - Abundant experience in patent invalidation trials, oatent infringement proceedings, etc. - Close collaboration with external experts, including intellectual property lawyers - Personnel structure for acheiving a wide range of first launches - Developing proprietary technologies Expanding pipelines Drug development capability 24

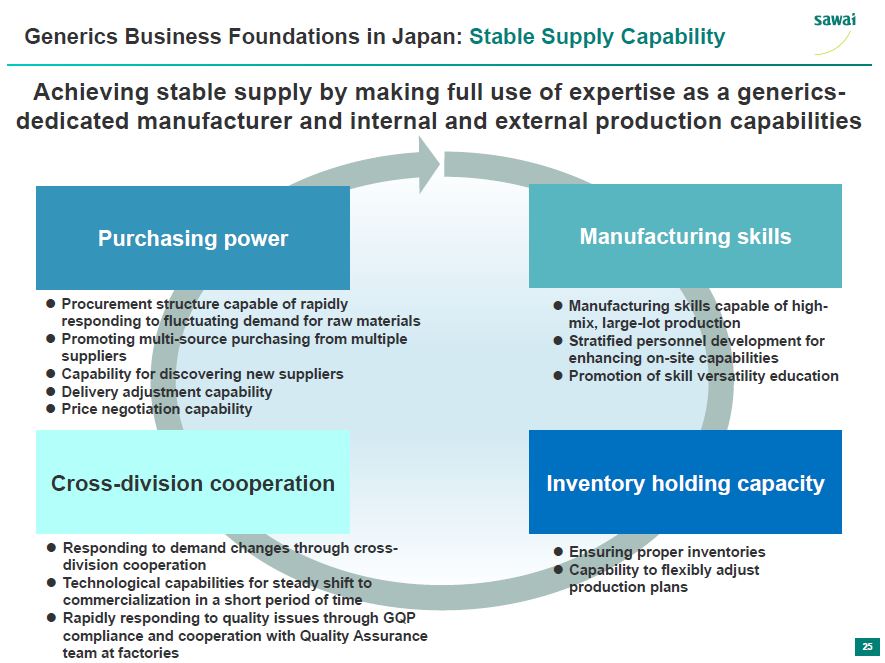

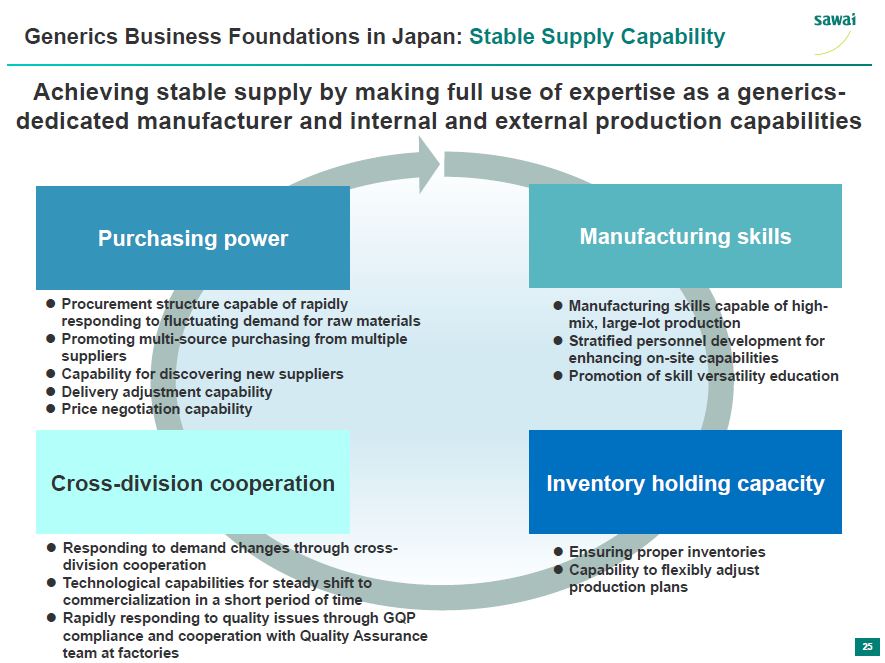

sawai Generics Business Foundations in Japan: Stable Supply Capability Acheiving stable supply by making full use of expertise as a generics-dedicated manufacturer and internal and external production capabilities Purchasing power - Procurement structure capable of rapidly responding to fluctuating demand for raw materials - Promoting multi-source purchasing from multiple suppliers - Capability for discovering new suppliers - Delivery adjustment capability - Price negotiation capability Manufacturing skills - Manufacturing skills capable of high-mix, large-lot production - Stratified personnel development for enhancing on-site capabilities - Promotion of skill versatility education Cross-division cooperation - Responding to demand changes through cross-division cooperation - Technological capabilities for steady shift to commercialization in a short period of time - Rapidly responding to quality issues through GQP compliance and cooperation with Quality Assurance team at factories Inventory holding capacity - Ensuring proper inventories - Capability to felxibly adjust production plans 25

sawai Generics Business Foundations in Japan : Quality Management System Implementing a variety of intiatives to provide a higher standard of quality Management of API manufacturing sites - Approximately 100 of around 450 API manufacturing plants are audited annually, including written and on-site audits - Plan to conduct 240 audits in the next three years to FY2023 - Drawing up a multilingual manual and standardizing audit details Management of drug manufacturing sites - In accordance with GQP*, products manufactured by our factories and factories contracted are audit to conform to the approvl standarts of the Minitry of Health, Labour and Welfare, and provide quality improvement guidance as necessary - Compliance with GMP** standards from the Minstry of Health, Labour and Welfare in factory processes Post-shipment quality management - Single-lot samplings each year for all 800 products based on PIC/S, conducting long-term stability tests Pharmaceutical affairs correspondence - Compliance with ICH Q3D and PIC/S - COmpliance with revisions of the PMD Act * GQP (Good Quality Practice): Criteria for checking whether the company's manufacturing factory or contracted manufacturer is conducting proper manufacturing control/quality control **GMP (Good Manufacturing Practice): Standards for pharmaceutical manufacturing cotrol and quality control by the Ministry of Health, Labour and Welfare 26

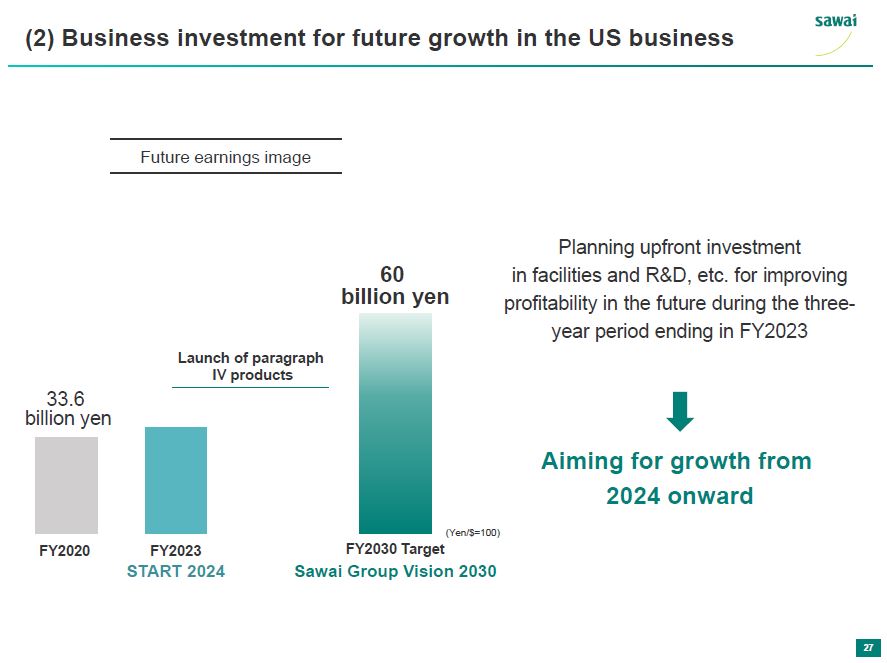

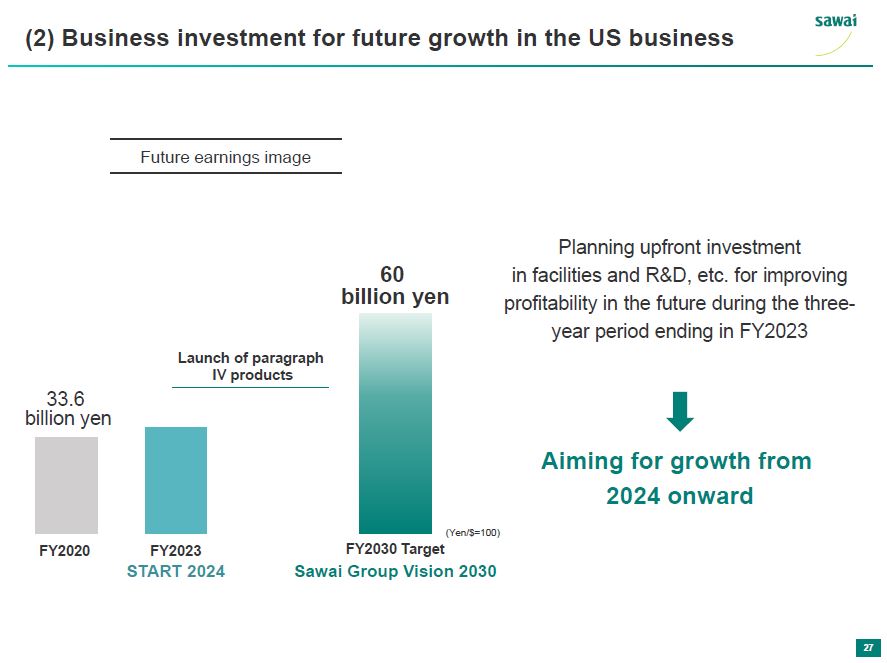

sawai (2) Business investment for future growth in the US business Future earnings image 60 billion yen Launch of paragraph IV products 33.6 yen FY2020 FY2023 (Yen/$=100) START 2024 FY2030 t Sawai Group Vision 2030 Planning upfront investment in facilities and RandD, etc. for improving profitability in the future during the three-year period ending in FY2023 Aiming for growth from 2024 onward 27

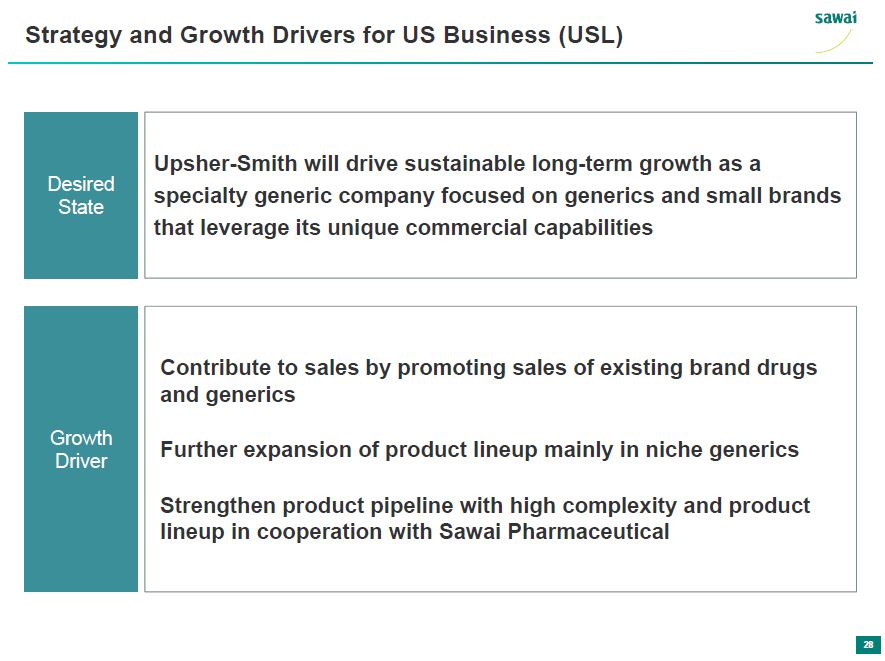

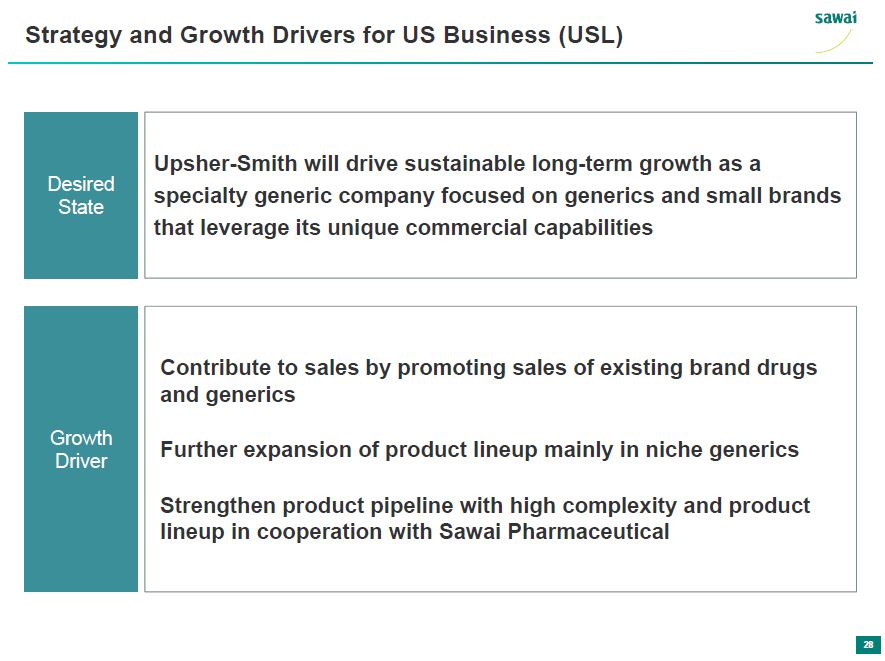

sawai Strategy and Growth Drivers for US Business (USL) Desired State Upsher-Smith will drive sustainable long-term growth as a specialty generic company focused on generics and small brands that leverage its unique commercial capabilities Growth Driver Contribute to sales by promoting sales of existing brand drugs and generics Further expansion of product lineup mainly in niche generics Strengthen product pipeline with high complexity and product lineup in cooperation with Sawai Pharmaceutical 28

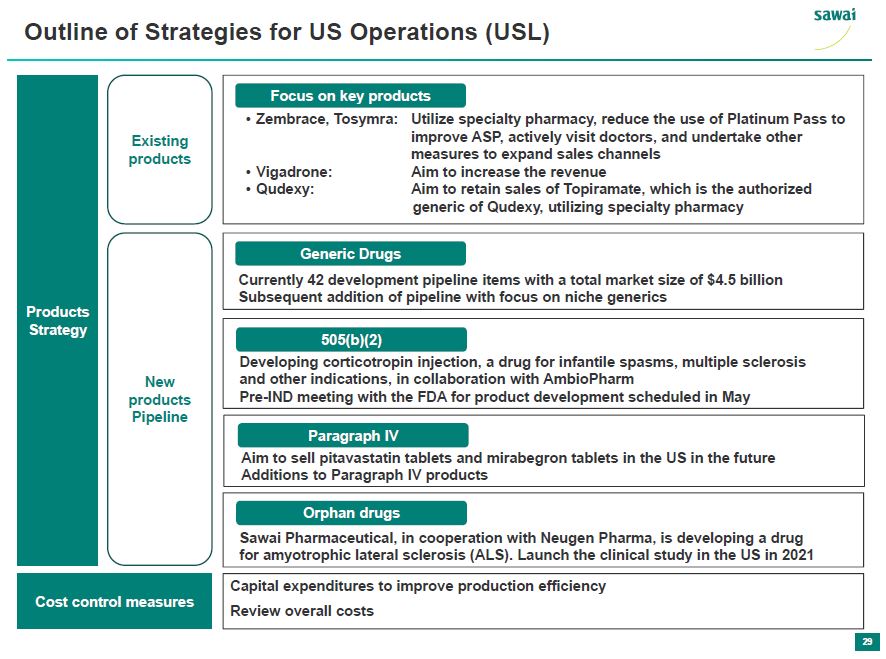

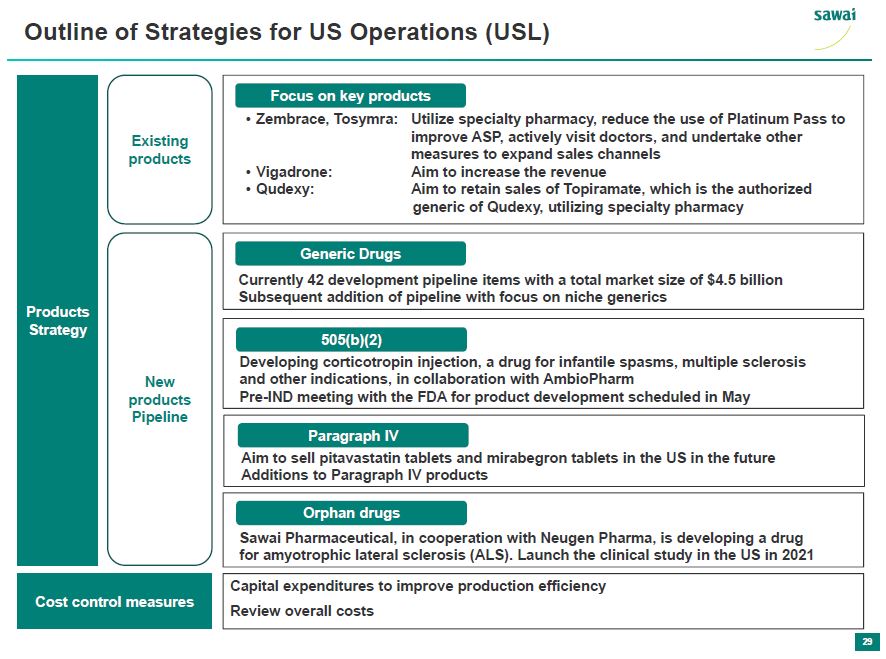

sawai Outline of Strategies for US Operations (USL) Products Strategy Existing Products Focus on key products - Zembrace, Tosymra: Utilize specialty pharmacy, reduce the use of Platinum Pass to improve ASP, actively visit doctors, and undertake other measures to expand sales channels - Vigadrone: Aim to increase the revenue - Qudexy: Aim to retain sales of Topiramate, which is the authorized generic of Qudexy, utilizing specialty pharmacy New products pipeline Generic Drugs Currently 42 development pipeline items with a total market size of $4.5 billion Subsequent addition of pipeline with focus on niche generics 505(b)(2) Developing corticotropin injection, a drug for infantile spasms, multiple sclerosis, and other indications, in collaboration with AmbioPharm Pre-IND meeting with FDA for product development scheduled in May Paragraph IV Aim to sell pitavastatin tablets and mirabegron tablets in the US in the future Additions to Paragraph IV products Orphan drugs Sawai Pharmaceutical, in cooperation with Neugen Pharma, is developing a drug amyotrophic lateral sclerosis (ALS). Launch the clinical study in the US in 2021 Cost control measures Capital Expenditures to improve prodcution efficiency Review overall costs 29

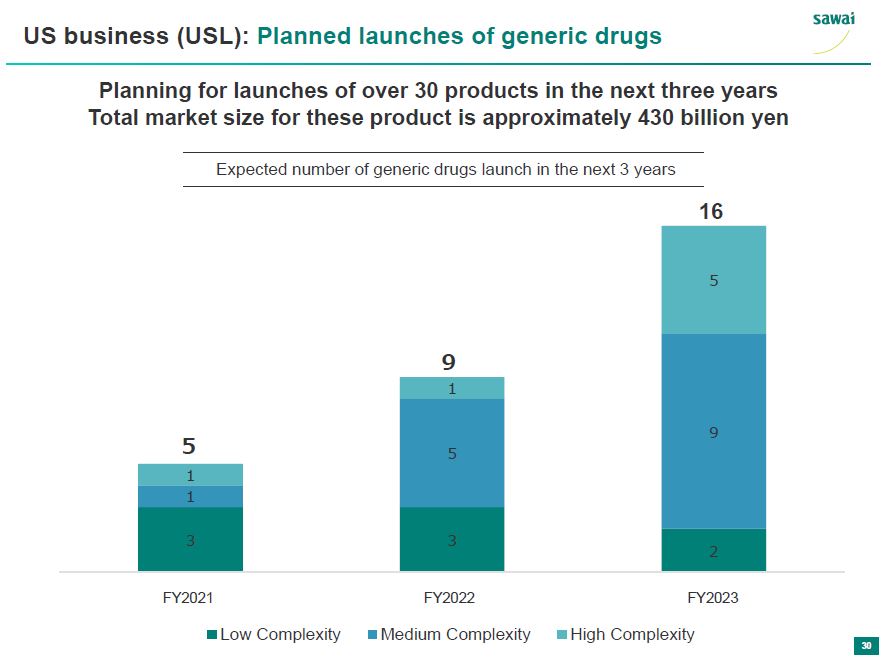

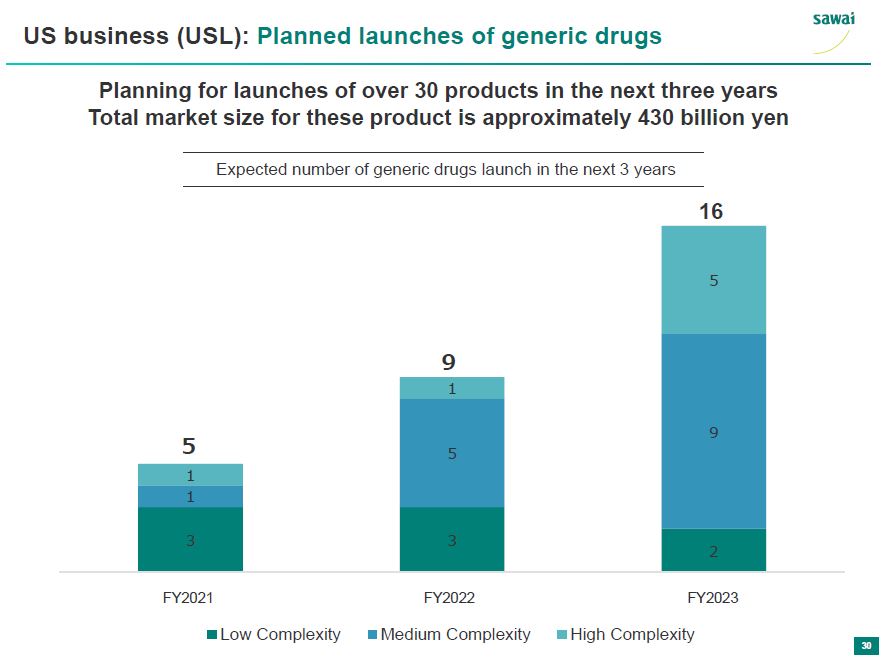

sawai US business (USL): Planned launches of generic drugs Planning for launches of over 30 products in the next three years Total market size for these product is approximately 430 billion yen Expected number of generic drugs launch in the next 3 years 5 9 16 1 1 5 1 5 9 3 3 2 FY2021 FY2022 FY2023 Low Complexity Medium Complexity High Complexity 30

sawai Project to create a new factory in the US business (USL) Overview - Consolidating all marketed products into a single manufacturing plant - Consolidation to a single manufacturing plant to lower operating expenses and improve qualiy and efficiency - Planned total investment amount for the construction and Denver product transfer: $13 billion yen Expected benefit 1. Expected annual manufacturing cost reduction of approx. 1 billion yen from 2023 onward through consolidation of facilities and repatriation of CMO products 2. Improved efficiencies driven by the long-term benefit of consolidating operations into modernized facility 3. Improved quality through electronic batch records, better material and manufacturing flow and improved equipment Key Milestones Jul 2022 Qualification and Validation complete Dec 2022 Denver product transfer complete 31

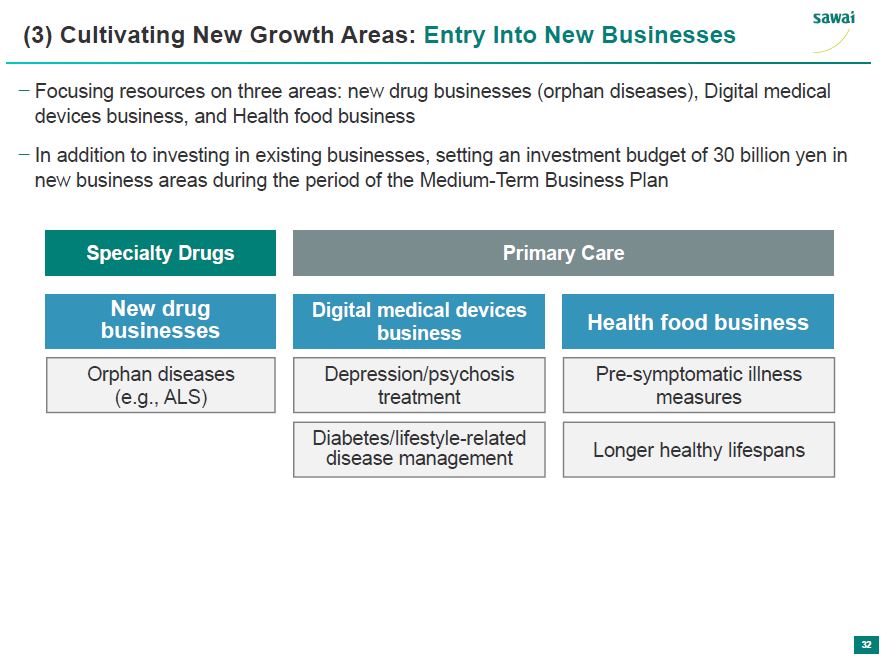

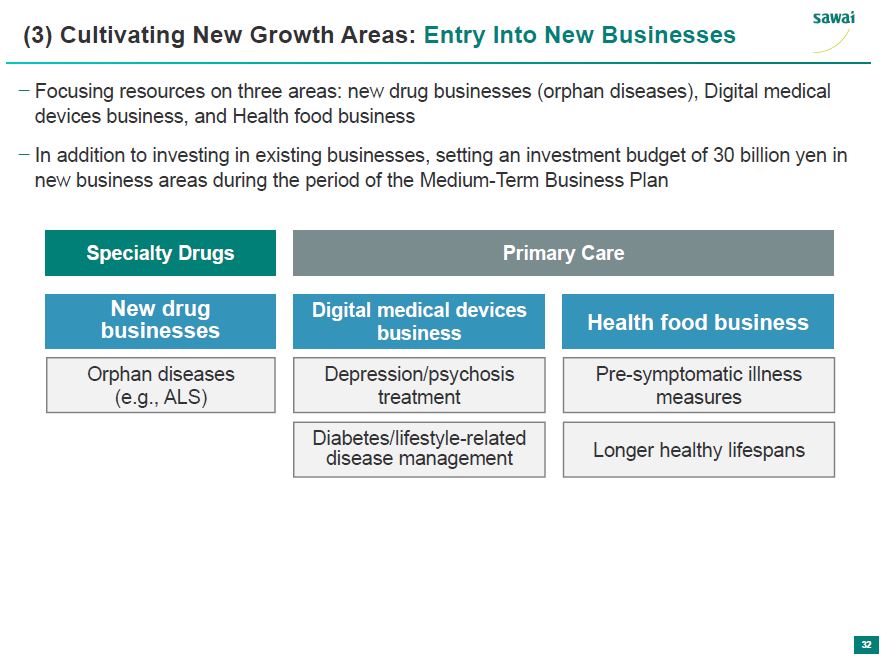

sawai (3) Cultivating New Growth Areas: Entry Into New Businesses - Focusing resources on three areas: new drug businesses (orphan diseases), Digital medical devices business, and Health food business - In addition to investing in existing businesses, setting an investment budget of 30 million yen in new business areas during the period of the Medium-Term Business Plan Specialty Drugs New drug businesses Orphan dieases (e.g., ALS) Primary Care Digital medical devices business Depression/psychosis treatment Diabetes/lifestyle-related disease management Health food business Pre-symptomatic illness measures Longer healthy lifespans 32

sawai (3) Cultivating New Growth Areas: New Businesses: Orphan Diseases ALS treament WN1316/SW007 Jointly develop WN1316, a drug for amyotrophic lateral sclerosis (ALS) treatment, which was discover by Neugen Pharma, targeting global markets including North America, Europe, Asia, and Japan, for all indications applicable as an ethical drug.(announced in June 2020) Advance the devlopment of optimixing each company's expertise - Neugen Pharma's knowledge on ALS and Sawai's clinical RandD capability including drug development Target markets, numbers of ALS patients The United States is the main target market for the time being Between around 20,000 to 30,000 ALS patients in the US Future plans To launch Phase I clinical studies in the US after FY2021 Market launch target: 2025 or thereafter Aiming to expand the pipeline targeting orphan diseases in the future 33

sawai (3) Cultivating New Growth Areas: New Businesses: Digital Medical Devices Business (Central Nervous System area) Aiming to be the only player in the industry who can provide a trifecta solution In the central nervous system area, recent years have seen increasing needs for device therapy and cognitive behavorial therapy in addition to drug therapy. On the other hand, the development and provisoin of solutions are still limites. Generic Drugs Product lineup in central nervous system area: 46 generals with 144 strengths Digital therapuetics Neuromodulation In addition to drug treatment with generic drugs, we are aiming to provide services utilixing cognitive behavorial therapy applications (DTx) and neuromodulation 34

sawai (3) Cultivating New Growth Areas: New Businesses - Digital Medical Devices Business Capital and business alliance with SUSMED Through the investment in SUSMED, a digital therapeutic company with applications for treating insomnia, collaborations that can blend and optimize SUSMED's technology and knowledge in the digital healthcare field and Sawai Pharmaceutial's generic business are under consideration (announced September 2020) Looking ahead We continuously consider improving operational efficiency, such as reduction of RandD costs using SUSMED's blockchain technology, and collaboration in the areas of deperession and psychiatry Medical devices for migraines/depression We have entered into an exclusive development and marketing agreement with Neurolief, targeting the Japanese market. Neurolief's non-invasive nueromodulation device allows patients to use it at home, and can share treatment data with their physician, in addition to uploading the data to the cloud database through a dedicated app. It is also designed to self-learn and analyze the treatments using AI technology in order to optimize the treatments for patients according to their symptoms.(announced January 2021) Proposed as new treatment method to patients who are receiving drug treatment but feel no effect. Number of target patients 392,000 (Patients with migraines who are non-responsive to drug treatment) 174,000 (Patients with acute depression who are non-responsive to drug treatment) Future plans For migraine- Application: 2022, Launch target: 2023 For depression - Application: 2023, Launch target: 2024 35

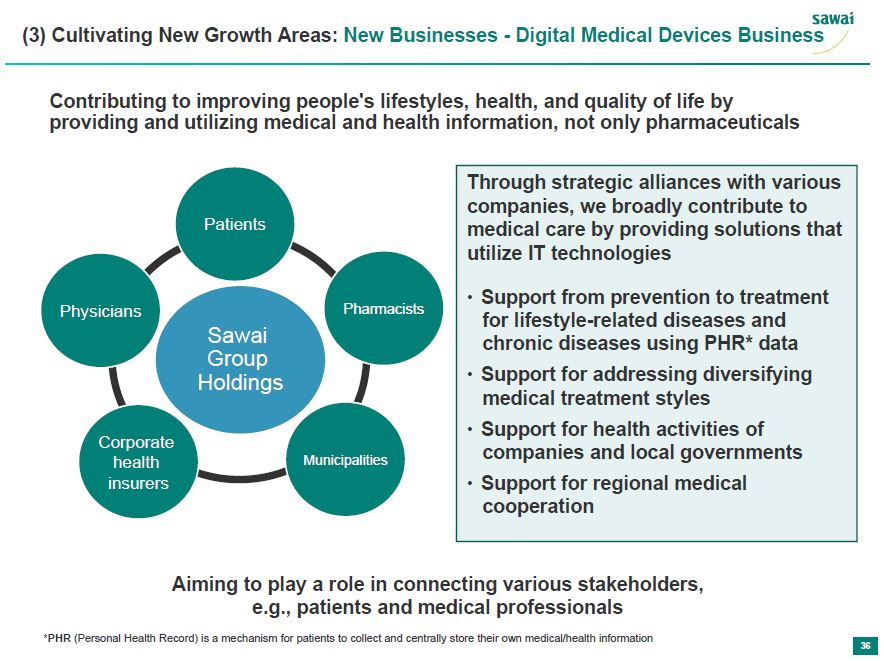

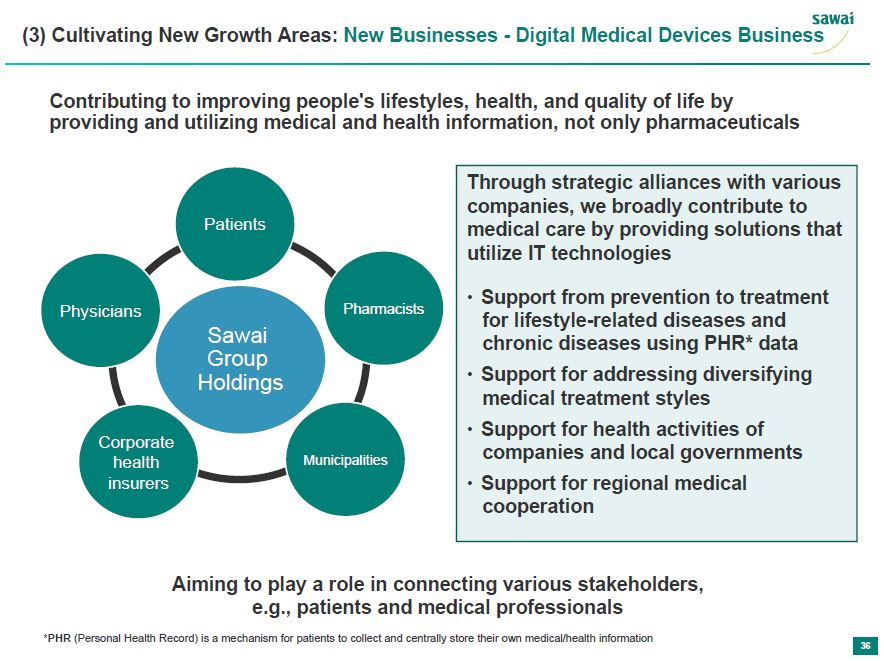

sawai (3) Cultivating New Growth Areas: New Businesses - Digital Medical Device Business Contributing to improving people's lifestyles, health and quality of life by providing and utilizing medical and health information, not only pharmaceuticals Patients Physicians Pharmacist Sawai Group Holdings Corporate health insurers Municipalities Through strategic alliances with various companies, we broadly contribute to medical care by providing solutions that utilize IT technologies - Support from prevention to treatment for lifestyle-related diseases and chronic diseases using PHR* data - Support for addressing diversifying medical treatment styles - Support for health activities of companies and local governments - Support for regional medical cooperation Aiming to play a role in connecting various stakeholders, e.g., patients and medical professionals *PHR (Personal Health Record) is a mechanicsm for patients to collect and centrally store their own medical/health information 36

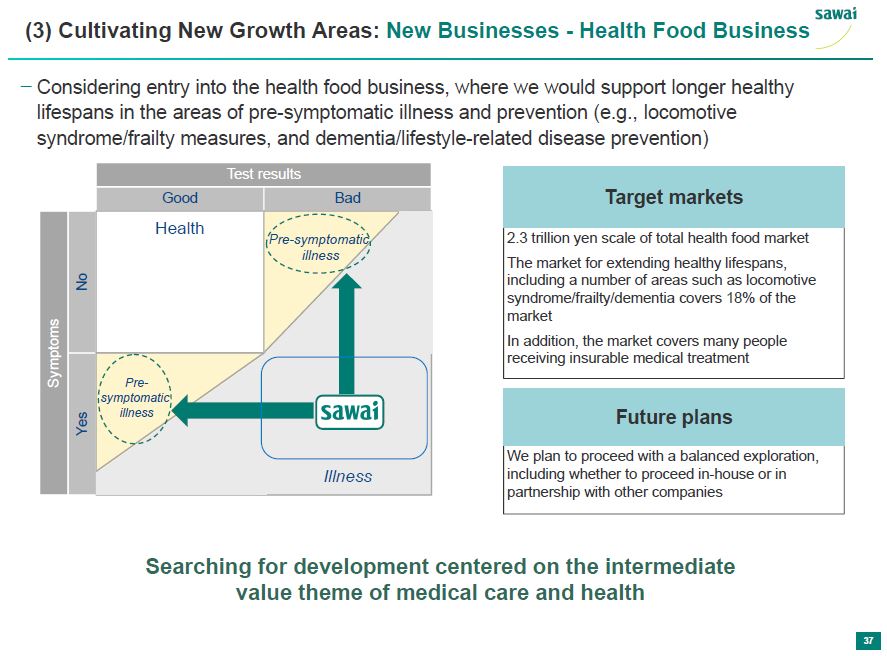

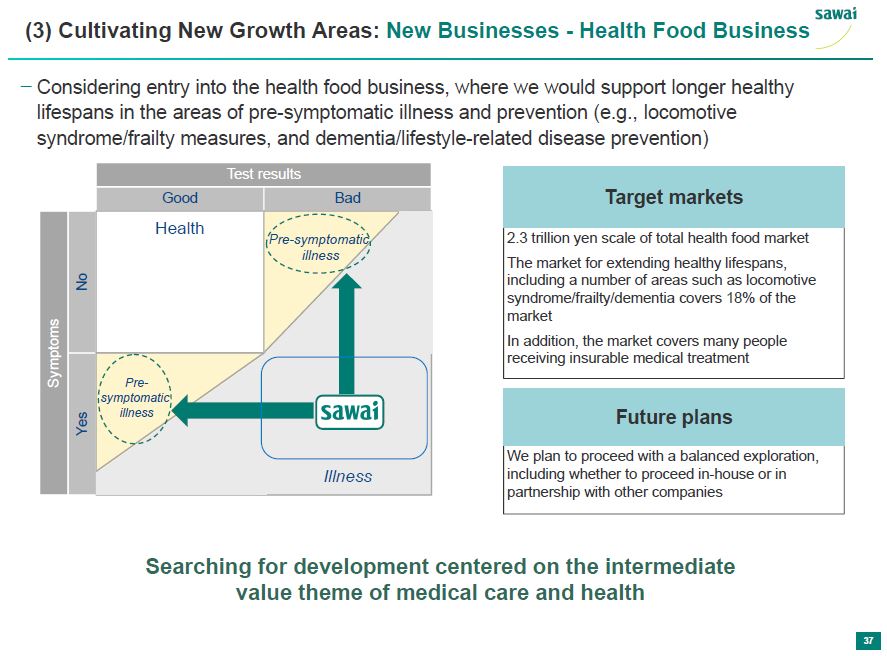

sawai (3) Cultivating New Growth Areas: New Businesses - Health Food Business - Considering entry into the health food business, where we would support longer healthy lifespans in the areas of pre-symptomatic illness and prevention (e.g., locomotive syndrome/fraility measures, and dementia/lifestyle-related disease prevention) Test Results Good Bad Symptoms No Health Pre-symptomatic illness Yes Pre-symptomatic illness Sawai Illness Target Markets 2.3 trillion yen scale of total health food market The market for extending healthy lifespands, including a number of areas such as locomotive syndrome/fraility/dementia covers 18% of the market In addition, the market covers many people receiving insurable medical treatment Future Plans We plan to proceed with a balanced exploration, including whether to proceed in-house or in partnership with other companies Searching for development centered on the intermediate value theme of medical care and health 37

sawai Investment Plan and Shareholder Returns Investment Plan and Expected Shareholder Returns in the Medium-Term Business Plan Period RandD expenses Approx. 45 billion yen (Generic drug business) For expanding product lineup, investing approx. 75 billion yen cash total Expected generics business RandD investment/ operating cash flow over acquisitions three years: Approx. 100 billion yen (e.g., products) Approx. 30 billion yen Capital investment Approx. 70 billion yen (Japan: Approx. 60 billion yen, USA: Approx. 10 billion yen) Cash and deposits approx. 54 billion yen New Businesses 30 billion yen (FY 2021) (planned investment amount) Shareholder returns 17 billion yen or more in total dividends over three years (conducting consistent, ongoing dividends with target of 130 yen/share annually and payout ratio of 30%) + Financing capabilites with RandI rating of A- 38

Intiatives Resolivng Social Issues sawai 39

sawai Intiatives Resolving Social Issues Issues to address Targets (quantitative/etc.) Main businesses 1) Contributing to sustainable social Achieving medical cost savings impact of approx security systems and improved access 2x of Japan and US generics business sales to healthcare (medical cost savings using generics) 2) Contributing to longer healthy lifespans Expanding business to a wider range of healthcare through new businessess domains, including pre-sympyomatic illness and prevention Relationships with stakeholders 3) E: Environmentally friendly production Cuts of 25% in CO2 emissions on production volume insensity basis (FY2030) Waste plastic recycling rate of 65% or more (in 2030) 4) S: Talent development, work styles/ Safe and diverse work environment motivation, respect for human rights Promotion of diversity Initiatives for respect of human rights 5) G: Deepening corporate governance Improvement and deepening of governance through conversion to holding company structure Stronger risk management/compliance 40

sawai Post-COVID-19: Proactively Addressing Efficient, Diverse Work Styles Clean slate review of traditional ways of doing business Acheiving efficiency gains worth over 1 billion yen in the Medium-Term Business Plan period by improving operations Operational improvements post-COVID-19 Issues faced in realizing diverse work styles Permanent remote work system Review of work systems Reviewing of physical space (e.g., offices) Going paperless Proactively leveraging digital technologies 41

Caution Regarding Future Outlooks The information in this document is based on a variety of assumption, and do not constitute a guarantee or promise of the execution of measures or future planning or target figures described. Contact Sawai Group Holdings Co., Ltd. Group Public Relations / IR Office Email: ir@sawai.co.jp 42