Filed by Horizon Acquisition Corporation

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Horizon Acquisition Corporation

Commission File No. 001-39465

Date: September 24, 2021

The following is a copy of an email sent by Horizon Acquisition Corporation to its shareholders on September 24, 2021:

HZAC – Vivid Seats Update

Dear [Investor],

Thank you for your interest in Horizon Acquisition Corporation (“Horizon”) (NYSE: HZAC).

We are pleased to share that our pending merger with Vivid Seats (NASDAQ: SEAT), a leading concert, sports and theater ticket marketplace, is progressing, with two key updates today:

| ● | First, the SEC declared the S-4 filing effective on September 23, 2021. |

| | | |

| | ● | Second, the shareholder vote will take place on October 14, 2021, and you can find more information on the voting process in the definitive proxy statement/prospectus here. |

Vivid Seats (“Vivid”) is a leading operator in a market with pent-up demand and strong long-term growth trends.

The Company recently reported second quarter results, highlighting the encouraging return of live events as COVID-19 mitigation measures ease. Many MLB, NHL and NBA teams welcomed fans at significant capacity over the course of the second quarter, and sales of concert tickets also increased as artists announced performances for the second half of 2021 and for 2022.

Vivid highlights since we signed our business combination agreement include:

| ● | Revenues of $139.6 million for the six months ending on June 30, 2021, with the second quarter of 2021 contributing revenues of $115.5 million. |

| | | |

| | ● | Adjusted EBITDA of $40.4 million for the six months ending on June 30, 2021, with the second quarter of 2021 contributing Adjusted EBITDA of $36.2 million. 1 |

| | | |

| | ● | Cash balance of $461 million as of June 30, 2021, which results in: |

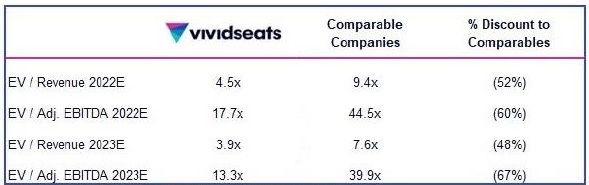

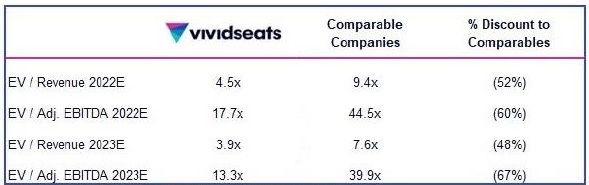

| ○ | Expected pro forma net debt of approximately $0 upon completion of the business combination as compared to $108 million in expected pro forma net debt at the time of signing, and The transaction enterprise value2 for Vivid of approximately $2 billion as a multiple of projected3 Adjusted EBITDA for 2022 and 2023 being reduced to 17.7x and 13.3x respectively as compared to 18.7x and 14.0x respectively at the time of signing. |

| ○ | Below for reference is comparable company benchmarking updated as of September 3, 2021: |

Source: Comparable Company Information from Factset as of September 3, 2021

Comparable Companies represents average across MTCH, ANGI, ETSY, BMBL, ABNB, DASH, FTCH, GDRX, POSH, LYV and EB

Given your interest, we also call your attention to the differentiating attributes of the Horizon-Vivid transaction:

Alignment of interests among sponsor, management and investors:

| ● | As sponsor, we made a $155 million investment in HZAC’s IPO and have further elected to convert substantially all of our founder shares into warrants with strike prices at $10 and $15. We believe this is a significant differentiator relative to other SPACs and aligns our success with the success of Horizon’s public shareholders. |

| | | |

| | ● | Eldridge, an affiliate of sponsor, has made a significant PIPE commitment and agreed to backstop any Horizon shareholder redemptions. |

| | | |

| | ● | Vivid’s management and existing ownership group are rolling over 100% of their equity and are mutually invested in our future value creation opportunity. |

Redemption backstop:

| ● | The backstop from Eldridge ensures that the combined company will receive the full amount of cash proceeds contemplated by the transaction. |

Special Dividend:

| ● | On June 11, 2021, HZAC received a payment of $17.5 million from a third party in connection with a potential business combination that was not consummated. |

| | | |

| | ● | Vivid will use these proceeds to pay a special dividend of approximately $0.23 per share to non-redeeming HZAC shareholders and PIPE investors as soon as practicable following closing. |

We invite you to access the investor materials on our website (link here) and please reach out to Ashley DeSimone at ICR at 646-677-1827 or Ashley.DeSimone@icrinc.com with questions or to schedule a meeting with management.

Fondly,

Todd Boehly

Chairman and CEO

Horizon Acquisition Corporation

Notes:

| 1. | Adjusted EBITDA is not a measure defined under generally accepted accounting principles in the United States (“GAAP”). We believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period comparisons of our business performance. For further information about how we calculate Adjusted EBITDA, see “Use of Non-GAAP Financial Measures” below. |

| | |

| 2. | Defined as market capitalization plus net debt plus minority investments minus unconsolidated investments. |

| | |

| 3. | Based on projections made at the time of signing and included in the proxy statement/prospectus. For further information about the use of financial projections, please see “Certain Prospective Financial Information for Vivid Seats PubCo” below. |

Use of Non-GAAP Financial Measures

This investor letter discusses Adjusted EBITDA. Adjusted EBITDA is a measure not defined under GAAP. It is frequently used by research analysts, investors and other interested parties to evaluate companies. Vivid Seats believes this measure provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period comparisons of our business performance, because it excludes the impact of items that are outside the control of management or not reflective of its ongoing operations and performance. However, it has limitations because it excludes certain types of expenses and it does not reflect changes in working capital needs. Furthermore, other companies may calculate adjusted EBITDA or similarly titled measures differently, limiting their usefulness as comparative measures.

Adjusted EBITDA is presented here as a supplemental measure only. You are encouraged to evaluate each adjustment. The following is a reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, net loss.

Reconciliation of Net (Loss) / Income to Adjusted EBITDA

| | | Three Months Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2020 | | | 2021 | | | 2020 | | | 2021 | |

| | | (in thousands) | | | (in thousands) | |

| Net (loss)/income | | $ | (662,109 | ) | | $ | 2,645 | | | $ | (700,612 | ) | | $ | (17,606 | ) |

| Interest expense | | | 13,473 | | | | 16,839 | | | | 22,766 | | | | 33,158 | |

| Depreciation and amortization | | | 24,080 | | | | 500 | | | | 47,977 | | | | 795 | |

| Sales tax liability(a) | | | (442 | ) | | | 10,726 | | | | 4,471 | | | | 12,987 | |

| Transaction costs(b) | | | — | | | | 3,863 | | | | 359 | | | | 7,409 | |

| Equity-based compensation(c) | | | 1,190 | | | | 1,184 | | | | 2,376 | | | | 2,274 | |

| Loss on extinguishment of debt(d) | | | 685 | | | | — | | | | 685 | | | | — | |

| Litigation, settlements and related costs(e) | | | 311 | | | | 438 | | | | 345 | | | | 1,079 | |

| Impairment charges(f) | | | 573,838 | | | | — | | | | 573,838 | | | | — | |

| Loss on asset disposals(g) | | | 169 | | | | — | | | | 169 | | | | — | |

| Severance related to COVID-19(h) | | | 490 | | | | — | | | | 490 | | | | 286 | |

| Adjusted EBITDA | | $ | (48,315 | ) | | $ | 36,195 | | | $ | (47,136 | ) | | $ | 40,382 | |

| (a) | These expenses relate to sales tax liabilities incurred during the periods presented. Vivid Seats incurs sales tax expenses in jurisdictions where it expects to remit sales tax payments. Vivid Seats does not currently collect sales tax from ticket buyers under its existing IT configuration. |

| (b) | Transaction costs consist primarily of transaction and transition related fees and expenses incurred in relation to completed and attempted acquisitions, in addition to the business combination with Horizon. Vivid Seats does not believe these costs to be representative of normal, recurring, cash operating expenses. |

| (c) | Vivid Seats incurs equity-based compensation expenses, which it does not consider to be indicative of its core operating performance. |

| (d) | Losses incurred in 2020 resulted from the retirement of Vivid Seats’ revolving credit facility in May 2020. |

| (e) | These expenses relate to external legal costs and settlement costs incurred, which were unrelated to Vivid Seats’ core business operations. |

| (f) | During the second quarter of 2020, Vivid Seats incurred impairment charges triggered by the effects of the COVID-19 pandemic. The impairment charges resulted in a reduction in the carrying values of the company’s goodwill, indefinite-lived trademark, definite-lived intangible assets, and other long-lived assets. See Vivid Seats’ audited financial statements for additional information. |

| (g) | Vivid Seats incurred approximately $0.2 million related to asset disposals, which are not considered indicative of its core operating performance. |

| (h) | These charges relate to severance costs resulting from significant reductions in employee headcount due to the effects of the COVID-19 pandemic. |

Certain Prospective Financial Information for Vivid Seats PubCo

Vivid Seats PubCo, the post-business combination Delaware corporation, does not as a matter of course publicly disclose long-term forecasts or internal projections of its future performance, revenue, earnings, financial condition or other results. However, Vivid Seats PubCo’s senior management prepared and provided to Hoya Intermediate’s board of directors, Vivid Seats’ financial advisors and Horizon certain internal, unaudited prospective financial information in connection with the evaluation of the merger. Vivid Seats PubCo’s senior management prepared such financial information based on Vivid Seats PubCo’s senior management’s judgement and assumptions regarding the future financial performance of Vivid Seats PubCo. The inclusion of prospective financial information in the proxy statement/prospectus should not be regarded as an indication that Vivid Seats PubCo or any other recipient of this information considered – or now considers – it to be necessarily predictive of actual future results.

The unaudited prospective financial information of Vivid Seats PubCo is subjective in many respects and is thus susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. As a result, there can be no assurance that the prospective results will be realized or that actual results will not be significantly higher or lower than estimated. Since the unaudited prospective financial information covers multiple years, that information by its nature becomes less predictive with each successive year.

While presented in the proxy statement/prospectus with numeric specificity, the prospective financial information set forth in the proxy statement/prospectus was based on numerous variables and assumptions that are inherently uncertain and may be beyond the control of Vivid Seats PubCo’s senior management, including, among other things, the matters described in the sections entitled “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Vivid Seats” in the proxy statement/prospectus. Vivid Seats PubCo believes the assumptions in the prospective financial information were reasonable at the time the financial information was prepared, given the information Vivid Seats PubCo had at the time. However, important factors that may affect actual results and cause the results reflected in the prospective financial information not to be achieved include, among other things, risks and uncertainties relating to Vivid Seats PubCo’s business, industry performance, the regulatory environment and general business and economic conditions. The prospective financial information also reflects assumptions as to certain business decisions that are subject to change. The unaudited prospective financial information was not prepared with a view toward public disclosure or compliance with the published guidelines of the U.S. Securities and Exchange Commission (“SEC”), or the guidelines established by the American Institute of Certified Public Accountants for the preparation and presentation of financial forecasts but, in the view of Vivid Seats PubCo’s management, such financial information was prepared on a reasonable basis, reflects the best currently available estimates and judgments, and presents, to the best of Vivid Seats PubCo’s senior management’s knowledge and belief, the expected course of action and the expected future financial performance of Vivid Seats PubCo. However, this information is not fact and should not be relied upon as being necessarily indicative of future results, and readers of this proxy statement/prospectus are cautioned not to place undue reliance on the prospective financial information.

No independent auditors have audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to the accompanying prospective financial information and, accordingly, none of Horizon, WithumSmith+Brown, PC, Horizon’s independent registered public accounting firm, and Deloitte & Touche LLP, Vivid Seats PubCo’s independent registered public accounting firm, express an opinion or any other form of assurance with respect thereto or its achievability, and assume no responsibility for, and disclaim any association with, the prospective financial information. The audit reports included in the proxy statement/prospectus relate to historical financial information. They do not extend to the prospective financial information and should not be read to do so.

EXCEPT TO THE EXTENT REQUIRED BY APPLICABLE FEDERAL SECURITIES LAWS, NEITHER VIVID SEATS PUBCO NOR HORIZON INTENDS TO MAKE PUBLICLY AVAILABLE ANY UPDATE OR OTHER REVISION TO THE PROSPECTIVE FINANCIAL INFORMATION. THE PROSPECTIVE FINANCIAL INFORMATION DOES NOT TAKE INTO ACCOUNT ANY CIRCUMSTANCES OR EVENTS OCCURRING AFTER THE DATE THAT INFORMATION WAS PREPARED. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THE UNAUDITED PROSPECTIVE FINANCIAL INFORMATION SET FORTH BELOW AND NOT TO RELY ON SUCH FINANCIAL INFORMATION IN MAKING A DECISION REGARDING THE BUSINESS COMBINATION PROPOSAL, AS SUCH FINANCIAL INFORMATION MAY BE MATERIALLY DIFFERENT THAN ACTUAL RESULTS. NONE OF VIVID SEATS PUBCO, HORIZON NOR ANY OF THEIR RESPECTIVE AFFILIATES, OFFICERS, DIRECTORS, ADVISORS OR OTHER REPRESENTATIVES HAS MADE OR MAKES ANY REPRESENTATION TO ANY VIVID SEATS PUBCO STOCKHOLDER, HORIZON STOCKHOLDER OR ANY OTHER PERSON REGARDING ULTIMATE PERFORMANCE COMPARED TO THE INFORMATION CONTAINED IN THE PROSPECTIVE FINANCIAL INFORMATION OR THAT FINANCIAL AND OPERATING RESULTS WILL BE ACHIEVED. HORIZON DOES NOT INTEND TO REFERENCE THESE FINANCIAL PROJECTIONS IN ITS FUTURE PERIODIC REPORTS FILED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

Certain of the measures included in the prospective financial information may be considered non-GAAP financial measures. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as used by Vivid Seats PubCo may not be comparable to similarly titled amounts used by other companies. Financial measures provided to a financial advisor in connection with a business combination transaction are excluded from the definition of non-GAAP financial measures and therefore are not subject to SEC rules regarding disclosures of non-GAAP financial measures, which would otherwise require a reconciliation of a non-GAAP financial measure to a GAAP financial measure. Accordingly, we have not provided a reconciliation of the financial measures.

About Vivid Seats

Founded in 2001, Vivid Seats is a leading online ticket marketplace committed to becoming the ultimate partner for connecting fans to the live events, artists, and teams they love. Based on the belief that everyone should “Experience It Live”, the Chicago-based company provides exceptional value by providing one of the widest selections of events and tickets in North America and an industry leading Vivid Seats Rewards program where all fans earn on every purchase. Vivid Seats has been chosen as the official ticketing partner by some of the biggest brands in the entertainment industry including ESPN, Rolling Stone, and the Los Angeles Clippers. Through its proprietary software and unique technology, Vivid Seats drives the consumer and business ecosystem for live event ticketing and enables the power of shared experiences to unite people. Vivid Seats is recognized by Newsweek as America’s Best Company for Customer Service in ticketing. Fans who want to have the best live experiences can start by downloading the Vivid Seats mobile app, going to vividseats.com, or calling at 866-848-8499.

About Horizon Acquisition Corporation

Horizon is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. Horizon is sponsored by Horizon Sponsor, LLC, an affiliate of Eldridge Industries, LLC (“Eldridge”). Horizon is led by Todd L. Boehly, the Co-founder, Chairman and Chief Executive Officer of Eldridge. Horizon’s securities are traded on the New York Stock Exchange (the “NYSE”) under the ticker symbols HZAC, HZAC WS and HZAC.U. Learn more at https://www.horizonacquisitioncorp.com/.

Additional Information about the Business Combination and Where to Find It

In connection with the proposed business combination, Horizon will merge with and into Vivid Seats, which will be the surviving entity and the going-forward public company and filed the Registration Statement with the SEC and was declared effective of September 23, 2021, which includes a proxy statement/prospectus, and certain other related documents, to be used at the meeting of stockholders to approve the proposed business combination. INVESTORS AND SECURITY HOLDERS OF HORIZON ACQUISITION CORPORATION ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT ARE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VIVID SEATS, HORIZON AND THE BUSINESS COMBINATION. The definitive proxy statement/prospectus will be mailed to shareholders of Horizon as of a record date of September 7, 2021 established for voting on the proposed business combination. Investors and security holders will also be able to obtain copies of the Registration Statement and other documents containing important information about each of the companies once such documents are filed with the SEC, without charge, at the SEC’s web site at www.sec.gov.

Participants in Solicitation

Horizon and its directors and executive officers may be deemed participants in the solicitation of proxies from Horizon’s members with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in Horizon is contained in Horizon’s filings with the SEC, including Horizon’s annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 31, 2021 and amended on May 10, 2021, and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Horizon Acquisition Corporation, 600 Steamboat Road, Suite 200, Greenwich, CT 06830. Additional information regarding the interests of such participants will be set forth in the Registration Statement for the proposed business combination when available. Vivid Seats and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Horizon in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the Registration Statement for the proposed business combination when available.

Caution Concerning Forward-Looking Statements

Certain statements made in this release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this investor letter, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Vivid Seats’ or Horizon’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include the inability to complete the business combination (including due to the failure to receive required shareholder approvals or the failure of other closing conditions); the inability to recognize the anticipated benefits of the proposed business combination; the inability to obtain the listing of Vivid Seats’ shares on the Nasdaq following the business combination; costs related to the business combination; the risk that the business combination disrupts current plans and operations as a result of the announcement and consummation of the business combination; Horizon and Vivid Seats’ ability to manage growth; Horizon and Vivid Seats’ ability to execute its business plan and meet its projections; potential litigation involving Vivid Seats or Horizon; changes in applicable laws or regulations, and general economic and market conditions impacting demand for Vivid Seats or Horizon products and services, and in particular economic and market conditions in the entertainment/technology/software industry in the markets in which Vivid Seats and Horizon operate; Vivid Seats’ ability to update its IT systems; developments regarding the COVID-19 pandemic; and other risks and uncertainties indicated from time to time in the proxy statement/prospectus relating to the business combination, including those under “Risk Factors” therein, and in Horizon’s other filings with the SEC. None of Vivid Seats or Horizon undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

No Offer or Solicitation

This investor letter does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This investor letter also does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

END OF EMAIL COPY

About Vivid Seats

Founded in 2001, Vivid Seats is a leading online ticket marketplace committed to becoming the ultimate partner for connecting fans to the live events, artists, and teams they love. Based on the belief that everyone should “Experience It Live”, the Chicago-based company provides exceptional value by providing one of the widest selections of events and tickets in North America and an industry leading Vivid Seats Rewards program where all fans earn on every purchase. Vivid Seats has been chosen as the official ticketing partner by some of the biggest brands in the entertainment industry including ESPN, Rolling Stone, and the Los Angeles Clippers. Through its proprietary software and unique technology, Vivid Seats drives the consumer and business ecosystem for live event ticketing and enables the power of shared experiences to unite people. Vivid Seats is recognized by Newsweek as America’s Best Company for Customer Service in ticketing. Fans who want to have the best live experiences can start by downloading the Vivid Seats mobile app, going to vividseats.com, or calling at 866-848-8499.

About Horizon Acquisition Corporation

Horizon is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. Horizon is sponsored by Horizon Sponsor, LLC, an affiliate of Eldridge Industries, LLC (“Eldridge”). Horizon is led by Todd L. Boehly, the Co-founder, Chairman and Chief Executive Officer of Eldridge. Horizon’s securities are traded on the New York Stock Exchange (the “NYSE”) under the ticker symbols HZAC, HZAC WS and HZAC.U. Learn more at https://www.horizonacquisitioncorp.com/.

Additional Information about the Business Combination and Where to Find It

In connection with the proposed business combination, Horizon will merge with and into Vivid Seats, which will be the surviving entity and the going-forward public company and filed the Registration Statement with the SEC and was declared effective of September 23, 2021, which includes a proxy statement/prospectus, and certain other related documents, to be used at the meeting of stockholders to approve the proposed business combination. INVESTORS AND SECURITY HOLDERS OF HORIZON ACQUISITION CORPORATION ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT ARE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VIVID SEATS, HORIZON AND THE BUSINESS COMBINATION. The definitive proxy statement/prospectus will be mailed to shareholders of Horizon as of a record date of September 7, 2021 established for voting on the proposed business combination. Investors and security holders will also be able to obtain copies of the Registration Statement and other documents containing important information about each of the companies once such documents are filed with the SEC, without charge, at the SEC’s web site at www.sec.gov.

Participants in Solicitation

Horizon and its directors and executive officers may be deemed participants in the solicitation of proxies from Horizon’s members with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in Horizon is contained in Horizon’s filings with the SEC, including Horizon’s annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 31, 2021 and amended on May 10, 2021, and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Horizon Acquisition Corporation, 600 Steamboat Road, Suite 200, Greenwich, CT 06830. Additional information regarding the interests of such participants will be set forth in the Registration Statement for the proposed business combination when available. Vivid Seats and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Horizon in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the Registration Statement for the proposed business combination when available.

Caution Concerning Forward-Looking Statements

Certain statements made in this release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this investor letter, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Vivid Seats’ or Horizon’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include the inability to complete the business combination (including due to the failure to receive required shareholder approvals or the failure of other closing conditions); the inability to recognize the anticipated benefits of the proposed business combination; the inability to obtain the listing of Vivid Seats’ shares on the Nasdaq following the business combination; costs related to the business combination; the risk that the business combination disrupts current plans and operations as a result of the announcement and consummation of the business combination; Horizon and Vivid Seats’ ability to manage growth; Horizon and Vivid Seats’ ability to execute its business plan and meet its projections; potential litigation involving Vivid Seats or Horizon; changes in applicable laws or regulations, and general economic and market conditions impacting demand for Vivid Seats or Horizon products and services, and in particular economic and market conditions in the entertainment/technology/software industry in the markets in which Vivid Seats and Horizon operate; Vivid Seats’ ability to update its IT systems; developments regarding the COVID-19 pandemic; and other risks and uncertainties indicated from time to time in the proxy statement/prospectus relating to the business combination, including those under “Risk Factors” therein, and in Horizon’s other filings with the SEC. None of Vivid Seats or Horizon undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

No Offer or Solicitation

This investor letter does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This investor letter also does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.