UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23481

(Investment Company Act File Number)

RiverNorth Flexible Municipal Income Fund II, Inc.

(Exact Name of Registrant as Specified in Charter)

325 North LaSalle Street, Suite 645

Chicago, Illinois 60654

(Address of Principal Executive Offices)

Marcus L. Collins, Esq.

RiverNorth Capital Management, LLC

325 North LaSalle Street, Suite 645

Chicago, Illinois 60654

(Name and Address of Agent for Service)

(312) 832-1440

(Registrant’s Telephone Number)

Date of Fiscal Year End: June 30

Date of Reporting Period: June 30, 2021

Item 1. Reports to Stockholders.

| RiverNorth Flexible Municipal Income Fund II, Inc. |

| Table of Contents |

| Performance Overview | 2 |

| Schedule of Investments | 6 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statement of Changes in Net Assets | 13 |

| Statement of Cash Flows | 14 |

| Financial Highlights | 15 |

| Notes to Financial Statements | 17 |

| Report of Independent Registered Public Accounting Firm | 30 |

| Dividend Reinvestment Plan | 31 |

| Summary of Updated Information Regarding the Fund | 33 |

| Directors and Officers | 55 |

| Additional Information | 61 |

| Consideration and Approval of Advisory and Sub-Advisory Agreements | 62 |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Performance Overview | June 30, 2021 (Unaudited) |

WHAT IS THE FUND’S INVESTMENT STRATEGY?

The RiverNorth Flexible Municipal Income Fund II, Inc. (the "Fund") seeks to provide current income exempt from regular U.S. federal income taxes (but which may be includable in taxable income for purposes of the Federal alternative minimum tax) with a secondary objective of total return.

The Fund’s Managed Assets (as defined in Note 2 below) are allocated among two principal strategies: Tactical Municipal Closed-End Fund (CEF) Strategy (managed by RiverNorth Capital Management, LLC ("RiverNorth")) and Municipal Bond Income Strategy (managed by MacKay Shields LLC ("MacKay Shields")). RiverNorth determines which portion of the Fund’s assets is allocated to each strategy and may, from time to time, adjust the allocations. The Fund may allocate between 25% to 65% of its Managed Assets to the Tactical Municipal CEF Strategy and 35% to 75% of its Managed Assets to the Municipal Bond Income Strategy.

The Tactical Municipal CEF Strategy typically invests in municipal CEFs and exchange-traded funds (ETFs) seeking to derive value from the discount and premium spreads associated with CEFs. The Municipal Bond Income Strategy primarily invests in municipal debt securities.

HOW DID THE RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND II PERFORM RELATIVE TO ITS BENCHMARK DURING THE REPORTING PERIOD?

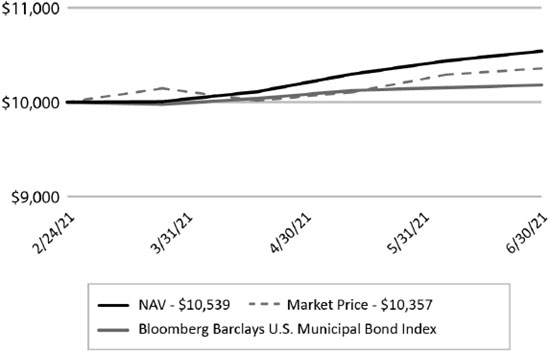

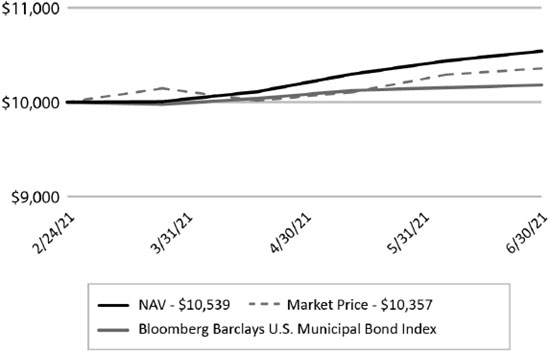

Since the Fund’s inception on February 24, 2021 through June 30, 2021, the Fund returned 5.39% on a net asset value (NAV) basis and 3.57% on a market price basis. The Bloomberg Barclays Municipal Bond Index returned 1.81% during the same period.

PERFORMANCE as of June 30, 2021

| | Cumulative | |

| TOTAL RETURN(1) | 1

Month | 3

Month | Since Inception(2) |

| RiverNorth Flexible Municipal Income Fund II, Inc. – NAV(3) | 0.98% | 4.25% | 5.39% |

| RiverNorth Flexible Municipal Income Fund II, Inc. – Market(4) | 0.64% | 3.41% | 3.57% |

| Bloomberg Barclays U.S. Municipal Bond Index(5) | 0.27% | 1.42% | 1.81% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on February 24, 2021. |

| (3) | Performance returns are net of management fees and other Fund expenses. |

| (4) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its net asset value (“NAV”). |

| (5) | The Bloomberg Barclays U.S. Municipal Bond Index covers the US Dollar-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds. |

The total annual expense ratio as a percentage of net assets attributable to common shares as of June 30, 2021 is 1.81% (excluding interest on short term floating rate obligations). Including interest on short term floating rate obligations, the expense ratio is 2.00%.

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling 844.569.4750. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

| 2 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Performance Overview | June 30, 2021 (Unaudited) |

WHAT CONTRIBUTING FACTORS WERE RESPONSIBLE FOR THE RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND II'S RELATIVE PERFORMANCE DURING THE PERIOD?

RiverNorth Tactical Municipal Closed-End Fund Strategy

Municipal bond CEFs generally had positive NAV returns as well as narrowing discounts over the period since the Fund’s inception, which benefited the RiverNorth sleeve’s performance. The sleeve held some cash as the initial public offering (IPO) proceeds were invested and this detracted from performance relative to the index.

MacKay Shields Municipal Bond Income Strategy

The Fund outperformed its benchmark, the Bloomberg Barclays U.S. Municipal Bond Index during the reporting period. During this period, the Fund was still in ramp up mode and investing new money. AAA benchmark municipal yields moved lower and the yield curve flattened. However, municipal-to-Treasury ratios remained stable and valuations remain relatively rich while market technicals remained supportive.

The high yield segment of the market outperformed investment grade as flows remained strong into high yield mutual funds and investors sought out incremental spread. Given this backdrop, the Fund’s credit selection to the Transportation sector and its overweight exposure to credits in the state of Illinois drove performance. Consequently, the Fund’s underweight exposure to beta, particularly high grade credits represented a modest drag on relative performance. The U.S. Treasury futures hedge was the most significant drag on relative results.

HOW WAS THE RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND II POSITIONED AT THE END OF JUNE 2021?

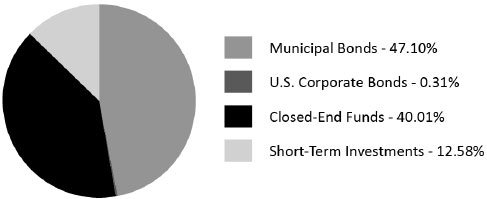

The Fund's allocation was 47% RiverNorth Tactical Municipal Closed-End Fund Strategy and 53% MacKay Shields Municipal Bond Income Strategy.

DEFINITIONS:

Credit ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All fund securities except for those labeled “Not Rated” and “Other” have been rated by Moody’s, S&P or Fitch, which are each a Nationally Recognized Statistical Rating Organization (“NRSRO”).

The Bloomberg Barclays U.S. Municipal Bond Index is an unmanaged index made up of a representative list of general obligation, revenue, insured and pre-refunded bonds. The index is frequently used as a general measure of tax-exempt bond market performance. The index cannot be invested in directly and does not reflect fees and expenses.

Beta reflects the sensitivity of a fund’s return to fluctuations in the market index. A beta of 0.5 reflects half of the market’s volatility as represented by the Fund’s primary benchmark, while a beta of 2.0 reflects twice the volatility.

U.S. Treasury Bond Futures are standardized contracts for the purchase and sale of U.S. government notes or bonds for future delivery. Bond futures are financial derivatives that obligate the contract holder to purchase or sell a bond on a specified date at a predetermined price. The bond futures contract is used for hedging, speculating, or arbitrage purposes. Hedging is a form of investing in products that provide protection to holdings.

| Annual Report | June 30, 2021 | 3 |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Performance Overview | June 30, 2021 (Unaudited) |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the closing market price (NYSE: RFMZ) of $20.00 on February 24, 2021 (commencement of operations) and tracking its progress through June 30, 2021.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

TOP TEN HOLDINGS* as of June 30, 2021

| | % of Net Assets |

| New York City Series F-1, General Obligation Limited Bonds | 7.06% |

| Pennsylvania Turnpike Commission Series A, Revenue Bonds | 3.68% |

| Los Angeles Department of Airports, Revenue Bonds | 3.54% |

| Indianapolis Local Public Improvement Bond Bank, Revenue Bonds | 3.51% |

| Michigan Finance Authority Second Lien Distributable State Aid, Revenue Bonds | 3.45% |

| City & County of Denver Co., Revenue Bonds | 3.43% |

| Nuveen AMT-Free Quality Municipal Income Fund | 5.49% |

| Nuveen New York AMT-Free Quality Municipal Income Fund | 4.53% |

| Nuveen California Quality Municipal Income Fund | 4.36% |

| Nuveen Quality Municipal Income Fund | 3.47% |

| | 42.51% |

| * | Holdings are subject to change and exclude short-term investments. |

| 4 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Performance Overview | June 30, 2021 (Unaudited) |

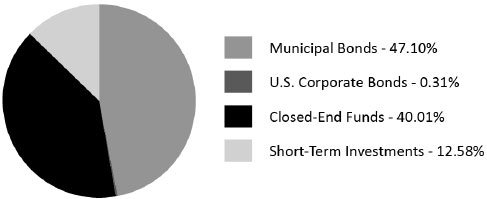

ASSET ALLOCATION as of June 30, 2021^

| ^ | Holdings are subject to change. |

Percentages are based on total investments of the Fund and do not include derivatives.

| Annual Report | June 30, 2021 | 5 |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Schedule of Investments | June 30, 2021 |

| Shares/Description | | Value | |

| CLOSED-END FUNDS (55.47%) | | | | |

| | 25,980 | | | AllianceBernstein National Municipal Income Fund, Inc. | | $ | 395,416 | |

| | 796,650 | | | BlackRock California Municipal Income Trust | | | 11,941,784 | |

| | 302,030 | | | BlackRock Municipal 2030 Target Term Trust | | | 7,922,247 | |

| | 911,444 | | | BlackRock MuniHoldings Fund, Inc. | | | 15,294,030 | |

| | 490,870 | | | BlackRock MuniHoldings Investment Quality Fund | | | 7,250,150 | |

| | 3,171 | | | BlackRock MuniHoldings Quality Fund II, Inc. | | | 44,426 | |

| | 1,420,265 | | | BlackRock MuniVest Fund, Inc. | | | 13,662,949 | |

| | 360,191 | | | BlackRock MuniYield California Fund, Inc. | | | 5,543,339 | |

| | 286,017 | | | BlackRock MuniYield California Quality Fund, Inc. | | | 4,504,768 | |

| | 266,356 | | | BlackRock MuniYield Fund, Inc. | | | 4,021,976 | |

| | 39,090 | | | BlackRock MuniYield Pennsylvania Quality Fund | | | 616,058 | |

| | 231,905 | | | BlackRock MuniYield Quality Fund III, Inc. | | | 3,443,789 | |

| | 97,386 | | | BNY Mellon Municipal Income, Inc. | | | 906,664 | |

| | 198,669 | | | BNY Mellon Strategic Municipal Bond Fund, Inc. | | | 1,635,046 | |

| | 37,294 | | | Delaware Investments Minnesota Municipal Income Fund II, Inc. | | | 527,151 | |

| | 135,037 | | | Delaware Investments National Municipal Income Fund | | | 1,908,572 | |

| | 1,056,540 | | | DWS Municipal Income Trust | | | 12,921,484 | |

| | 76,809 | | | DWS Strategic Municipal Income Trust | | | 967,025 | |

| | 51,598 | | | Eaton Vance California Municipal Bond Fund | | | 617,112 | |

| | 107,929 | | | Eaton Vance California Municipal Income Trust | | | 1,508,847 | |

| | 439,601 | | | Eaton Vance Municipal Bond Fund | | | 6,013,742 | |

| | 135,895 | | | Eaton Vance New York Municipal Bond Fund | | | 1,746,251 | |

| | 118,498 | | | Eaton Vance New York Municipal Income Trust | | | 1,773,915 | |

| | 35,422 | | | Invesco Advantage Municipal Income Trust II | | | 432,503 | |

| | 22,410 | | | Invesco Municipal Trust | | | 307,465 | |

| | 50,107 | | | Invesco Pennsylvania Value Municipal Income Trust | | | 670,432 | |

| | 540,886 | | | Invesco Quality Municipal Income Trust | | | 7,301,961 | |

| | 65,286 | | | Invesco Trust for Investment Grade New York Municipals | | | 906,823 | |

| | 108,000 | | | Invesco Value Municipal Income Trust | | | 1,780,920 | |

| | 40,210 | | | iShares National Muni Bond ETF | | | 4,712,612 | |

| | 156,635 | | | MFS High Yield Municipal Trust | | | 744,016 | |

| | 251,909 | | | MFS Investment Grade Municipal Trust | | | 2,589,625 | |

| | 1,208,445 | | | MFS Municipal Income Trust | | | 8,628,297 | |

| | 68,864 | | | Neuberger Berman California Municipal Fund, Inc. | | | 998,528 | |

| | 141,895 | | | Neuberger Berman New York Municipal Fund, Inc. | | | 1,890,041 | |

| | 72,252 | | | Nuveen AMT-Free Municipal Value Fund | | | 1,248,515 | |

| | 1,768,043 | | | Nuveen AMT-Free Quality Municipal Income Fund | | | 27,758,275 | |

| | 462,336 | | | Nuveen California AMT-Free Quality Municipal Income Fund | | | 7,536,077 | |

| | 194,069 | | | Nuveen California Municipal Value Fund | | | 2,076,538 | |

| | 1,390,289 | | | Nuveen California Quality Municipal Income Fund | | | 22,036,080 | |

| | 359,252 | | | Nuveen Dividend Advantage Municipal Fund 3 | | | 6,182,727 | |

| | 203,019 | | | Nuveen Dividend Advantage Municipal Income Fund | | | 3,625,919 | |

| | 184,127 | | | Nuveen Dynamic Municipal Opportunities Fund | | | 3,106,222 | |

| | 75,537 | | | Nuveen Georgia Quality Municipal Income Fund | | | 1,056,763 | |

See Notes to Financial Statements.

| 6 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Flexible Municipal Income Fund II, Inc. | |

| Schedule of Investments | June 30, 2021 |

| Shares/Description | | | | | Value | |

| | 14,978 | | | Nuveen Intermediate Duration Municipal Term Fund | | $ | 224,370 | |

| | 301,185 | | | Nuveen New Jersey Quality Municipal Income Fund | | | 4,695,474 | |

| | 1,614,430 | | | Nuveen New York AMT-Free Quality Municipal Income Fund | | | 22,908,762 | |

| | 412,896 | | | Nuveen New York Quality Municipal Income Fund | | | 6,218,214 | |

| | 253,930 | | | Nuveen Ohio Quality Municipal Income Fund | | | 4,156,834 | |

| | 183,374 | | | Nuveen Pennsylvania Quality Municipal Income Fund | | | 2,768,947 | |

| | 1,095,725 | | | Nuveen Quality Municipal Income Fund | | | 17,542,557 | |

| | 11,487 | | | PIMCO California Municipal Income Fund II | | | 110,505 | |

| | 177,801 | | | Western Asset Intermediate Municipal Fund | | | 1,737,116 | |

| | 611,289 | | | Western Asset Managed Municipals Fund, Inc. | | | 8,282,966 | |

| | 68,581 | | | Western Asset Municipal Partners Fund, Inc. | | | 1,128,843 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS | | | | |

| (Cost $266,534,852) | | | 280,531,668 | |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| U.S. CORPORATE BONDS (0.42%) | | | | | | | | | |

| Consumer Discretionary (0.42%) | | | | | | | | | | | | |

| $ | 2,000,000 | | Howard University | | | 4.76 | % | | | 10/01/51 | | | $ | 2,140,628 | |

| TOTAL U.S. CORPORATE BONDS | | | | | | | | | | | | |

| (Cost $2,000,000) | | | | | | | | | | | 2,140,628 | |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| MUNICIPAL BONDS (65.31%) | | | | | | | | | |

| California (8.57%) | | | | | | | | | | |

| $ | 12,330,000 | | | Lake Elsinore Unified School District, General Obligation Unlimited Bonds(a) | | | 4.00 | % | | | 08/01/49 | | | $ | 13,836,924 | |

| | 14,000,000 | | | Los Angeles Department of Airports, Revenue Bonds(a) | | | 5.00 | % | | | 05/15/51 | | | | 17,907,095 | |

| | 10,730,000 | | | Vallejo City Unified School District, General Obligation Unlimited Bonds | | | 3.00 | % | | | 08/01/50 | | | | 11,585,065 | |

| | | | | | | | | | | | | | | | 43,329,084 | |

| Colorado (3.43%) | | | | | | | | | | | | |

| | 14,500,000 | | | City & County of Denver Co., Revenue Bonds(a) | | | 4.00 | % | | | 08/01/51 | | | | 17,358,858 | |

| Florida (2.37%) | | | | | | | | | | | | |

| | 10,000,000 | | | County of Miami-Dade FL Water & Sewer System Revenue, Revenue Bonds(a) | | | 4.00 | % | | | 10/01/46 | | | | 12,000,192 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2021 | 7 |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Schedule of Investments | June 30, 2021 |

| Principal Amount/Description | | | Rate | | | | Maturity | | | Value | |

| Guam (0.59%) | | | | | | | | | | | |

| $ | 2,445,000 | | | Guam Government Waterworks Authority, Revenue Bonds | | | 5.00 | % | | | 01/01/50 | | $ | 3,008,275 | |

| | | | | | | | | | | | | | | | |

| Illinois (6.64%) | | | | | | | | | | | |

| | 2,250,000 | | | Chicago Board of Education, General Obligation Unlimited Bonds | | | 5.00 | % | | | 12/01/34 | | | 2,927,483 | |

| | 6,700,000 | | | Chicago Transit Authority Sales Tax Receipts Fund, Revenue Bonds | | | 4.00 | % | | | 12/01/50 | | | 7,767,847 | |

| | 10,000,000 | | | Metropolitan Pier & Exposition Authority, Revenue Bonds(b) | | | 0.00 | % | | | 06/15/44 | | | 5,787,522 | |

| | 13,600,000 | | | State of Illinois, General Obligation Unlimited Bonds(a) | | | 5.00 | % | | | 03/01/46 | | | 17,102,604 | |

| | | | | | | | | | | | | | | 33,585,456 | |

| Indiana (3.51%) | | | | | | | | | | | |

| | 15,000,000 | | | Indianapolis Local Public Improvement Bond Bank, Revenue Bonds(a) | | | 4.00 | % | | | 06/01/39 | | | 17,748,546 | |

| | | | | | | | | | | | | | | | |

| Michigan (3.45%) | | | | | | | | | | | |

| | 15,000,000 | | | Michigan Finance Authority Second Lien Distributable State Aid, Revenue Bonds(a) | | | 4.00 | % | | | 11/01/55 | | | 17,434,539 | |

| | | | | | | | | | | | | | | | |

| Missouri (2.38%) | | | | | | | | | | | |

| | 10,000,000 | | | Missouri Health and Educational Facilities Authority, Revenue Bonds(a) | | | 4.00 | % | | | 07/01/46 | | | 12,027,043 | |

| | | | | | | | | | | | | | | | |

| Nebraska (0.43%) | | | | | | | | | | | |

| | 2,000,000 | | | University of Nebraska Facilities Corp., Revenue Bonds | | | 3.00 | % | | | 07/15/54 | | | 2,160,745 | |

| | | | | | | | | | | | | | | | |

| New Jersey (4.79%) | | | | | | | | | | | |

| | 5,565,000 | | | New Jersey State Transportation Trust Fund Authority, General Obligation Unlimited Bonds, Revenue Bonds(a) | | | 5.00 | % | | | 06/15/45 | | | 7,020,151 | |

| | 14,500,000 | | | New Jersey Turnpike Authority, Revenue Bonds(a) | | | 4.00 | % | | | 01/01/51 | | | 17,221,524 | |

| | | | | | | | | | | | | | | 24,241,675 | |

| New York (13.48%) | | | | | | | | | | | |

| | 30,000,000 | | | New York City Series F-1, General Obligation Limited Bonds(a) | | | 4.00 | % | | | 03/01/47 | | | 35,687,538 | |

See Notes to Financial Statements.

| 8 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Schedule of Investments | June 30, 2021 |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| New York (continued) | | | | | | | | | | | | |

| $ | 13,945,000 | | | New York Dormitory State Personal Income Tax Education Series A, Revenue Bonds(a) | | | 4.00 | % | | | 03/15/48 | | | $ | 16,485,976 | |

| | 12,500,000 | | | New York Metropolitan Transport Authority Transportation Series C-1, Revenue Green Bonds, Revenue Bonds(a) | | | 5.25 | % | | | 11/15/55 | | | | 15,977,553 | |

| | | | | | | | | | | | | | | | 68,151,067 | |

| Ohio (0.58%) | | | | | | | | | | | | |

| | 2,490,000 | | | Buckeye Tobacco Settlement Financing Authority, Revenue Bonds | | | 5.00 | % | | | 06/01/55 | | | | 2,910,849 | |

| | | | | | | | | | | | | | | | | |

| Pennsylvania (4.92%) | | | | | | | | | | | | |

| | 5,300,000 | | | City of Philadelphia PA Airport Revenue, Revenue Bonds | | | 4.00 | % | | | 07/01/46 | | | | 6,245,566 | |

| | 14,660,000 | | | Pennsylvania Turnpike Commission Series A, Revenue Bonds(a) | | | 5.00 | % | | | 12/01/49 | | | | 18,616,006 | |

| | | | | | | | | | | | | | | | 24,861,572 | |

| Puerto Rico (1.30%) | | | | | | | | | | | | |

| | 2,750,000 | | | GDB Debt Recovery Authority of Puerto Rico, Revenue Bonds | | | 7.50 | % | | | 08/20/40 | | | | 2,530,000 | |

| | 3,500,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Revenue Bonds | | | 5.00 | % | | | 07/01/58 | | | | 4,042,909 | |

| | | | | | | | | | | | | | | | 6,572,909 | |

| Tennessee (0.32%) | | | | | | | | | | | | |

| | 1,800,000 | | | New Memphis Arena Public Building Authority, Revenue Bonds(b) | | | 0.00 | % | | | 04/01/44 | | | | 1,043,765 | |

| | 1,000,000 | | | New Memphis Arena Public Building Authority, Revenue Bonds(b) | | | 0.00 | % | | | 04/01/45 | | | | 562,142 | |

| | | | | | | | | | | | | | | | 1,605,907 | |

| Virginia (3.29%) | | | | | | | | | | | | |

| | 14,125,000 | | | Hampton Roads Transportation Accountability Commission, Revenue Bonds(a) | | | 4.00 | % | | | 07/01/55 | | | | 16,634,933 | |

| | | | | | | | | | | | | | | | | |

| Washington (2.78%) | | | | | | | | | | | | |

| | 10,000,000 | | | Port of Seattle WA, Revenue Bonds | | | 5.00 | % | | | 08/01/46 | | | | 12,812,691 | |

| | 1,000,000 | | | Washington State Convention Center Public Facilities District, Revenue Bonds | | | 5.00 | % | | | 07/01/34 | | | | 1,226,577 | |

| | | | | | | | | | | | | | | | 14,039,268 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2021 | 9 |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Schedule of Investments | June 30, 2021 |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| Washington D.C. (2.48%) | | | | | | | | | | | | |

| $ | 10,000,000 | | | Metropolitan Washington Airports Authority DC Series, Revenue Bonds(a) | | | 5.00 | % | | | 10/01/44 | | | $ | 12,566,892 | |

| | | | | | | | | | | | | | | | |

| TOTAL MUNICIPAL BONDS | | | | | | | | | | | | |

| (Cost $318,041,406) | | | | | | | | | | | 330,237,810 | |

| Shares/Description | | | | | Value | |

| SHORT-TERM INVESTMENTS (17.45%) | | | | |

| | 88,239,537 | | | BlackRock Liquidity Funds MuniCash (7 Day Yield 0.01%) | | $ | 88,239,537 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (Cost $88,239,537) | | | 88,239,537 | |

| | | | | | | | |

| TOTAL INVESTMENTS (138.65%) | | | | |

| (Cost $674,815,795) | | $ | 701,149,643 | |

| | | | | | | | |

| Floating Rate Note Obligations (-34.30%)(c) | | | (173,465,000 | ) |

| Liabilities in Excess of Other Assets (-4.35%) | | | (21,970,155 | ) |

| NET ASSETS (100.00%) | | $ | 505,714,488 | |

| (a) | All or portion of the principal amount transferred to a Tender Option Bond ("TOB") Issuer in exchange for TOB Residuals and cash. |

| (b) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

| (c) | Face value of Floating Rate Notes issued in TOB transactions. |

Futures Contracts Sold:

| Description | | Contracts

(Short) | | | Expiration

Date | | Notional

Value | | | Value and Unrealized Appreciation/(Depreciation) | |

| US 10 Yr Note Future | | | (1,050 | ) | | September 2021 | | $ | 139,125,000 | | | $ | (787,530 | ) |

| US Long Bond Future | | | (400 | ) | | September 2021 | | | 64,300,000 | | | | (1,762,504 | ) |

| | | | | | | | | $ | 203,425,000 | | | $ | (2,550,034 | ) |

See Notes to Financial Statements.

| 10 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Statement of Assets and Liabilities | June 30, 2021 |

| ASSETS: | | | |

| Investments in securities: | | | | |

| At cost | | $ | 674,815,795 | |

| At value | | $ | 701,149,643 | |

| | | | | |

| Deposit with broker for futures contracts | | | 3,001,250 | |

| Receivable for investments sold | | | 1,671,598 | |

| Interest receivable | | | 2,424,155 | |

| Dividends receivable | | | 755,011 | |

| Total Assets | | | 709,001,657 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for Floating Rate Note Obligations | | | 173,465,000 | |

| Payable for interest expense and fees on Floating Rate Note Obligations | | | 258,893 | |

| Variation margin payable | | | 508,589 | |

| Payable for investments purchased | | | 28,268,951 | |

| Payable to Adviser | | | 781,569 | |

| Other payables | | | 4,167 | |

| Total Liabilities | | | 203,287,169 | |

| Net Assets | | $ | 505,714,488 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 480,867,885 | |

| Total distributable earnings | | | 24,846,603 | |

| Net Assets | | $ | 505,714,488 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 505,714,488 | |

| Shares of common stock outstanding (50,000,000 of shares authorized, at $0.0001 par value per share) | | | 24,351,756 | |

| Net asset value per share | | $ | 20.77 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2021 | 11 |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Statement of Operations | For the Period February 24, 2021

(Commencement of Operations) to June 30, 2021 |

| INVESTMENT INCOME: | | | |

| Interest | | $ | 1,479,479 | |

| Dividends | | | 3,000,502 | |

| Total Investment Income | | | 4,479,981 | |

| | | | | |

| EXPENSES: | | | | |

| Investment Adviser fee | | | 3,011,437 | |

| Interest expense and fees on Floating Rate Note Obligations | | | 315,152 | |

| Legal expenses | | | 15,100 | |

| Total Expenses | | | 3,341,689 | |

| Net Investment Income | | | 1,138,292 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 1,662,616 | |

| Futures | | | (599,827 | ) |

| Net realized gain | | | 1,062,789 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 26,333,848 | |

| Futures | | | (2,550,034 | ) |

| Net change in unrealized appreciation/depreciation | | | 23,783,814 | |

| Net Realized and Unrealized Gain on Investments and Futures Contracts | | | 24,846,603 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 25,984,895 | |

See Notes to Financial Statements.

| 12 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Statement of Changes in Net Assets

| | | For the Period February 24, 2021 (Commencement of Operations) to June 30, 2021 | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS: | | | | |

| Net investment income | | $ | 1,138,292 | |

| Net realized gain | | | 1,062,789 | |

| Net change in unrealized appreciation/depreciation | | | 23,783,814 | |

| Net increase in net assets resulting from operations | | | 25,984,895 | |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| From distributable earnings | | | (1,889,548 | ) |

| From tax return of capital | | | (5,415,979 | ) |

| Net decrease in net assets from distributions to shareholders | | | (7,305,527 | ) |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold | | | 486,935,120 | |

| Net increase in net assets from capital share transactions | | | 486,935,120 | |

| | | | | |

| Net Increase in Net Assets | | | 505,614,488 | |

| | | | | |

| NET ASSETS: | | | | |

| Beginning of period | | | 100,000 | |

| End of period | | $ | 505,714,488 | |

| | | | | |

| OTHER INFORMATION: | | | | |

| Share Transactions: | | | | |

| Shares outstanding- beginning of period | | | 5,000 | |

| Shares sold | | | 24,346,756 | |

| Shares outstanding - end of period | | | 24,351,756 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2021 | 13 |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Statement of Cash Flows | For the Period February 24, 2021

(Commencement of Operations) to June 30, 2021 |

| | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets resulting from operations | | $ | 25,984,895 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchases of investment securities | | | (847,093,048 | ) |

| Proceeds from disposition of investment securities | | | 287,738,077 | |

| Amortization of premium and accretion of discount on investments, net | | | 1,038,682 | |

| Net purchases of short-term investment securities | | | (88,239,537 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | (1,662,616 | ) |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | (26,333,848 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (2,424,155 | ) |

| Dividends receivable | | | (755,011 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Variation margin payable on futures contracts | | | 508,589 | |

| Payable for interest expense and fees on Floating Rate Note Obligations | | | 258,893 | |

| Payable to Adviser | | | 781,569 | |

| Other payables | | | 4,167 | |

| Net cash used in operating activities | | $ | (650,193,343 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Net proceeds from floating rate note obligations | | $ | 173,465,000 | |

| Proceeds from sale of capital shares | | | 486,935,120 | |

| Cash distributions paid to common shareholders | | | (7,305,527 | ) |

| Net cash provided by financing activities | | $ | 653,094,593 | |

| | | | | |

| Net increase in cash and restricted cash | | $ | 2,901,250 | |

| Cash and restricted cash, beginning of period | | $ | 100,000 | |

| Cash and restricted cash, end of period | | $ | 3,001,250 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | |

| Cash paid during the period for interest expense and fees on floating rate note obligations | | $ | 56,259 | |

| | | | | |

| Reconciliation of restricted and unrestricted cash at the end of the period to the statement of assets and liabilities: | | | | |

| Deposit with broker for futures contracts | | $ | 3,001,250 | |

See Notes to Financial Statements.

| 14 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Financial Highlights | For a share outstanding throughout the period presented |

| | | For the Period February 24, 2021 (Commencement of Operations) to June 30, 2021 | |

| Net asset value - beginning of period | | $ | 20.00 | |

| Income/(loss) from investment operations: | | | | |

| Net investment income(a) | | | 0.05 | |

| Net realized and unrealized gain | | | 1.02 | |

| Total income from investment operations | | | 1.07 | |

| Less distributions: | | | | |

| From net investment income | | | (0.08 | ) |

| From tax return of capital | | | (0.22 | ) |

| Total distributions | | | (0.30 | ) |

| Net increase in net asset value | | | 0.77 | |

| Net asset value - end of period | | $ | 20.77 | |

| Market price -end of period | | $ | 20.41 | |

| Total Return(b) | | | 5.39 | %(c) |

| Total Return -Market Price(b) | | | 3.57 | %(c) |

| Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 505,714 | |

| Ratios to Average Net Assets (including interest on short term floating rate obligations)(d) | | | | |

| Ratio of expenses to average net assets | | | 2.00 | %(e)(f) |

| Ratio of net investment income to average net assets | | | 0.68 | %(e)(f) |

| Ratios to Average Net Assets (excluding interest on short term floating rate obligations) | | | | |

| Ratio of expenses to average net assets | | | 1.81 | %(e)(f) |

| Ratio of net investment income to average net assets | | | 0.87 | %(e)(f) |

| Portfolio turnover rate | | | 67 | %(c) |

| Payable for floating rate obligations (in thousands) | | $ | 173,465 | |

| Asset coverage per $1,000 of floating rate obligations payable(g) | | | 3,917 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2021 | 15 |

RiverNorth Flexible Municipal Income Fund II, Inc.

| Financial Highlights | For a share outstanding throughout the period presented |

| (a) | Calculated using average shares throughout the period. |

| (b) | Total investment return is calculated assuming a purchase of common shares at the opening on the first day and a sale at closing on the last day of each period reported. For purposes of this calculation, dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any. Periods less than one year are not annualized. |

| (d) | Interest expense relates to the cost of tender option bond transactions (See Note 2). |

| (f) | The ratios exclude the impact of expenses of the underlying funds in which the Fund invests as represented in the Schedule of Investments. |

| (g) | Calculated by subtracting the Fund's total liabilities (excluding the debt balance and accumulated unpaid interest) from the Fund's total assets and dividing by the outstanding debt balance. |

See Notes to Financial Statements.

| 16 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

1. ORGANIZATION

RiverNorth Flexible Municipal Income Fund II, Inc. (the “Fund”) was organized as a Maryland corporation on June 10, 2020 pursuant to its Articles of Incorporation, which was amended and restated on January 13, 2021 (“Articles of Incorporation”). The Fund commenced operations on February 24, 2021 and had no operations until that date other than those related to organizational matters and the registration of its shares under applicable securities laws.

The Fund is a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Articles of Incorporation permit the Board of Directors (the “Board” or “Directors”) to authorize and issue fifty million shares of common stock with $0.0001 par value per share. The Fund is considered an investment company and therefore follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards codification Topic 946 Financial Services – Investment Companies.

The Fund will terminate on or before February 26, 2036; provided, that if the Board believes that under then-current market conditions it is in the best interests of the Fund to do so, the Fund may extend the Termination Date once for up to one year, and once for an additional six months. The Fund may be converted to an open-end investment company at any time if approved by the Board and the shareholders. Within twelve months prior to the termination date, the Fund may conduct a tender offer to purchase 100% of the then outstanding shares. Following the completion of the tender offer, the Fund must have at least $100 million of net assets. The Board may then eliminate the termination date and convert the Fund to a perpetual structure upon the affirmative vote of a majority of the Board.

The Fund’s investment adviser is RiverNorth Capital Management, LLC (the “Adviser”) and the Fund’s sub-adviser is MacKay Shields, LLC (the "Sub-Adviser"). The Fund’s primary investment objective is to seek current income exempt from regular U.S. federal income taxes (but which may be includable in taxable income for purposes of the Federal alternative minimum tax). The Fund’s secondary investment objective is total return.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The financial statements are prepared in accordance with U.S. GAAP, which requires management to make estimates and assumptions that affect the reported amounts and disclosures, including the disclosure of contingent assets and liabilities, in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on June 30, 2021.

The Fund invests in closed-end funds, each of which has its own investment risks. Those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one closed end fund than in another, the Fund will have greater exposure to the risks of that closed end fund.

| Annual Report | June 30, 2021 | 17 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Security Valuation: The Fund’s investments are generally valued at their fair value using market quotations. If a market value quotation is unavailable a security may be valued at its estimated fair value as described in Note 3.

Security Transactions and Investment Income: The Fund follows industry practice and records securities transactions on the trade date basis. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date, and interest income and expenses are recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method over the life of the respective securities.

Federal Income Taxes: The Fund makes no provision for federal income tax. The Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the "IRC"), by distributing substantially all of its taxable income. If the required amount of net investment income is not distributed, the Fund could incur a tax expense.

As of and during the period from February 24, 2021 (commencement of operations) to June 30, 2021, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses on the Statement of Operations. During the period from February 24, 2021 (commencement of operations) to June 30, 2021, the Fund did not incur any interest or penalties.

Distributions to Shareholders: Distributions to shareholders, which are paid monthly and determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset value ("NAV") per share of the Fund.

The Fund distributes to shareholders regular monthly cash distributions of its net investment income. In addition, the Fund distributes its net realized capital gains, if any, at least annually. At times, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return capital, in addition to current net investment income. Any distribution that is treated as a return of capital generally will reduce a shareholder’s basis in his or her shares, which may increase the capital gain or reduce the capital loss realized upon the sale of such shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain, assuming the shares are held as capital assets.

| 18 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Tender Option Bonds: The Fund may leverage its assets through the use of proceeds received from tender option bond (“TOB”) transactions. In a TOB transaction, a tender option bond trust (a “TOB Issuer”) is typically established, which forms a special purpose trust into which the Fund, or an agent on behalf of the Fund, transfers municipal bonds or other municipal securities (“Underlying Securities”). A TOB Issuer typically issues two classes of beneficial interests: short-term floating rate notes (“TOB Floaters”) with a fixed principal amount representing a senior interest in the Underlying Securities, and which are generally sold to third party investors, and residual interest municipal tender option bonds (“TOB Residuals”) representing a subordinate interest in the Underlying Securities, and which are generally issued to the Fund. The interest rate on the TOB Floaters resets periodically, usually weekly, to a prevailing market rate, and holders of the TOB Floaters are granted the option to tender their TOB Floaters back to the TOB Issuer for repurchase at their principal amount plus accrued interest thereon periodically, usually daily or weekly. The Fund may invest in both TOB Floaters and TOB Residuals, including TOB Floaters and TOB Residuals issued by the same TOB Issuer. The Fund may not invest more than 5% of its “Managed Assets” in any single TOB Issuer. Managed Assets is defined as total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding).

As a result of Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules thereunder (collectively, the “Volcker Rule”), banking entities are generally prohibited from sponsoring the TOB Issuer, and instead the Fund may serve as the sponsor of a TOB issuer (“Fund-sponsored TOB”) and establish, structure and “sponsor” a TOB Issuer in which it holds TOB Residuals. In connection with Fund-sponsored TOBs, the Fund may contract with a third-party to perform some or all of the Fund’s duties as sponsor. The Fund’s role under the Fund-sponsored TOB structure may increase its operational and regulatory risk. If the third-party is unable to perform its obligations as an administrative agent, the Fund itself would be subject to such obligations or would need to secure a replacement agent. The obligations that the Fund may be required to undertake could include reporting and recordkeeping obligations under the IRC and federal securities laws and contractual obligations with other TOB service providers.

Under the Fund-sponsored TOB structure, the TOB Issuer receives Underlying Securities from the Fund through (or as) the sponsor and then issues TOB Floaters to third party investors and TOB Residuals to the Fund. The Fund is paid the cash (less transaction expenses, which are borne by the Fund) received by the TOB Issuer from the sale of TOB Floaters and typically will invest the cash in additional municipal bonds or other investments permitted by its investment policies. TOB Floaters may have first priority on the cash flow from the securities held by the TOB Issuer and are enhanced with a liquidity support arrangement from a bank or an affiliate of the sponsor (the “liquidity provider”), which allows holders to tender their position back to the TOB Issuer at par (plus accrued interest). The Fund, in addition to receiving cash from the sale of TOB Floaters, also receives TOB Residuals. TOB Residuals provide the Fund with the right to (1) cause the holders of TOB Floaters to tender their notes to the TOB Issuer at par (plus accrued interest), and (2) acquire the Underlying Securities from the TOB Issuer. In addition, all voting rights and decisions to be made with respect to any other rights relating to the Underlying Securities deposited in the TOB Issuer are passed through to the Fund, as the holder of TOB Residuals. Such a transaction, in effect, creates exposure for the Fund to the entire return of the Underlying Securities deposited in the TOB Issuer, with a net cash investment by the Fund that is less than the value of the Underlying Securities deposited in the TOB Issuer. This multiplies the positive or negative impact of the Underlying Securities’ return within the Fund (thereby creating leverage). Income received from TOB Residuals will vary inversely with the short term rate paid to holders of TOB Floaters and in most circumstances, TOB Residuals represent substantially all of the Underlying Securities’ downside investment risk and also benefits disproportionately from any potential appreciation of the Underlying Securities’ value. The amount of such increase or decrease is a function, in part, of the amount of TOB Floaters sold by the TOB Issuer of these securities relative to the amount of TOB Residuals that it sells. The greater the amount of TOB Floaters sold relative to TOB Residuals, the more volatile the income paid on TOB Residuals will be. The price of TOB Residuals will be more volatile than that of the Underlying Securities because the interest rate is dependent on not only the fixed coupon rate of the Underlying Securities, but also on the short-term interest rate paid on TOB Floaters.

| Annual Report | June 30, 2021 | 19 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

For TOB Floaters, generally, the interest rate earned will be based upon the market rates for municipal securities with maturities or remarketing provisions that are comparable in duration to the periodic interval of the tender option, which may vary from weekly, to monthly, to extended periods of one year or multiple years. Since the option feature has a shorter term than the final maturity or first call date of the Underlying Securities deposited in the TOB Issuer, the Fund, if it is the holder of the TOB Floaters, relies upon the terms of the agreement with the financial institution furnishing the option as well as the credit strength of that institution. As further assurance of liquidity, the terms of the TOB Issuer provide for a liquidation of the Underlying Security deposited in the TOB Issuer and the application of the proceeds to pay off the TOB Floaters.

The TOB Issuer may be terminated without the consent of the Fund upon the occurrence of certain events, such as the bankruptcy or default of the issuer of the Underlying Securities deposited in the TOB Issuer, a substantial downgrade in the credit quality of the issuer of the securities deposited in the TOB Issuer, the inability of the TOB Issuer to obtain liquidity support for the TOB Floaters, a substantial decline in the market value of the Underlying Securities deposited in the TOB Issuer, or the inability of the sponsor to remarket any TOB Floaters tendered to it by holders of the TOB Floaters. In such an event, the TOB Floaters would be redeemed by the TOB Issuer at par (plus accrued interest) out of the proceeds from a sale of the Underlying Securities deposited in the TOB Issuer. If this happens, the Fund would be entitled to the assets of the TOB Issuer, if any, that remain after the TOB Floaters have been redeemed at par (plus accrued interest). If there are insufficient proceeds from the sale of these Underlying Securities to redeem all of the TOB Floaters at par (plus accrued interest), the liquidity provider or holders of the TOB Floaters would bear the losses on those securities and there would be no recourse to the Fund’s assets (unless the Fund held a recourse TOB Residual).

Pursuant to the Volcker Rule, to the extent that the remarketing agent is a banking entity, it would not be able to repurchase tendered TOB Floaters for its own account upon a failed remarketing. In the event of a failed remarketing, a banking entity serving as liquidity provider may loan the necessary funds to the TOB Issuer to purchase the tendered TOB Floaters. The TOB Issuer, not the Fund, would be the borrower and the loan from the liquidity provider will be secured by the purchased TOB Floaters now held by the TOB Issuer. However, the Fund would bear the risk of loss with respect to any liquidity shortfall to the extent it entered into a reimbursement agreement with the liquidity provider.

| 20 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

For financial reporting purposes, Underlying Securities that are deposited into a TOB Issuer are treated as investments of the Fund, and are presented in the Fund’s Schedule of Investments. Outstanding TOB Floaters issued by a TOB Issuer are presented as a liability at their face value as “Payable for Floating Rate Note Obligations” in the Fund’s Statement of Assets and Liabilities. The face value of the TOB Floaters approximates the fair value of the floating rate notes. Interest income from the Underlying Securities is recorded by the Fund on an accrual basis. Interest expense incurred on the TOB Floaters and other expenses related to remarketing, administration and trustee services to a TOB Issuer are recognized as a component of “Interest expense and fees on floating rate note obligations” in the Statement of Operations. Fees paid upon creation of the TOB Trust are recorded as debt issuance costs and are amortized to "Interest expense and fees on floating rate note obligations" in the Statement of Operations.

At June 30, 2021, the aggregate value of the Underlying Securities transferred to the TOB Issuer and the related liability for TOB Floaters was as follows:

Underlying Securities Transferred to TOB Issuers | Liability for Floating Rate Note Obligations |

$265,626,374 | $173,465,000 |

During the period from February 24, 2021 (commencement of operations) to June 30, 2021, the Fund’s average TOB Floaters outstanding and the daily weighted average interest rate, including fees, were as follows:

Average Floating Rate Note Obligations Outstanding | Annualized Daily Weighted Average Interest Rate |

$138,321,772 | 0.65% |

Segregation and Collateralization: In cases where the Fund enters into certain investments (e.g., futures contracts) or certain borrowings (e.g., TOB Trust transactions) that would be treated as “senior securities” for 1940 Act purposes, the Fund may segregate or designate on its books and records cash or liquid assets having a market value at least equal to the amount of its future obligations under such investments or borrowings. Doing so allows the investment or borrowings to be excluded from treatment as a “senior security.”

Other: The Fund holds certain investments which pay dividends to their shareholders based upon available funds from operations. It is possible for these dividends to exceed the underlying investments’ taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or long-term capital gains are recorded as a reduction of the cost of investments or as a realized gain, respectively.

3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. U.S. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

| Annual Report | June 30, 2021 | 21 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including using such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including closed-end funds, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser or the Sub-Adviser believes such prices more accurately reflect the fair market value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange-traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Adviser or the Sub-Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, Sub-Adviser, or valuation committee in conformity with guidelines adopted by and subject to review by the Board. These securities will be categorized as Level 3 securities.

| 22 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Investments in mutual funds, including short term investments, are generally priced at the ending NAV provided by the service agent of the funds. These securities will be classified as Level 1 securities.

Fixed income securities, including municipal and corporate bonds, are normally valued at the mean between the closing bid and asked prices provided by independent pricing services. Prices obtained from independent pricing services typically use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. These securities will be classified as Level 2 securities.

Futures contracts are normally valued at the settlement price or official closing price provided by independent pricing services.

In accordance with the Fund’s good faith pricing guidelines, the Adviser, Sub-Adviser, or valuation committee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser, Sub-Adviser, or valuation committee would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) discounted cash flow models; (iii) weighted average cost or weighted average price; (iv) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (v) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s, Sub-Adviser’s, or the valuation committee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser or Sub-Adviser is aware of any other data that calls into question the reliability of market quotations.

Good faith pricing may also be used in instances when the bonds in which the Fund invests default or otherwise cease to have market quotations readily available.

| Annual Report | June 30, 2021 | 23 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

The following is a summary of the inputs used at June 30, 2021 in valuing the Fund’s assets and liabilities:

Investments in Securities at Value* | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

Closed-End Funds | | $ | 280,531,668 | | | $ | – | | | $ | – | | | $ | 280,531,668 | |

U.S. Corporate Bonds | | | – | | | | 2,140,628 | | | | – | | | | 2,140,628 | |

Municipal Bonds | | | – | | | | 330,237,810 | | | | – | | | | 330,237,810 | |

Short-Term Investments | | | 88,239,537 | | | | – | | | | – | | | | 88,239,537 | |

Total | | $ | 368,771,205 | | | $ | 332,378,438 | | | $ | – | | | $ | 701,149,643 | |

Other Financial Instruments** | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Future Contracts | | $ | (2,550,034 | ) | | $ | – | | | $ | – | | | $ | (2,550,034 | ) |

Total | | $ | (2,550,034 | ) | | $ | – | | | $ | – | | | $ | (2,550,034 | ) |

* | Refer to the Fund’s Schedule of Investments for a listing of securities by type. |

** | Other financial instruments are derivative instruments reflected in the Schedule of Investments. Futures contracts are reported at their unrealized appreciation/depreciation. |

4. DERIVATIVE FINANCIAL INSTRUMENTS

The following discloses the Fund’s use of derivative instruments. The Fund’s investment objective not only permits the Fund to purchase investment securities, but also allow the Fund to enter into various types of derivative contracts such as futures. In doing so, the Fund will employ strategies in differing combinations to permit it to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Fund to pursue its objective more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

Market Risk Factors: In pursuit of its investment objectives, the Fund may seek to use derivatives to increase or decrease its exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Interest Rate Risk: Interest rate risk relates to the risk that the municipal securities in the Fund’s portfolio will decline in value because of increases in market interest rates.

| 24 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Risk of Investing in Derivatives

The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Fund. Typically, the associated risks are not the risks that the Fund is attempting to increase or decrease exposure to, per its investment objective, but are the additional risks from investing in derivatives.

Examples of these associated risks are liquidity risk, which is the risk that the Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund.

Futures

The Fund may invest in futures contracts in accordance with its investment objectives. The Fund does so for a variety of reasons including for cash management, hedging or non-hedging purposes in an attempt to achieve the Fund’s investment objective. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time. A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash equal to the difference between the value of the index at the close of the last trading day of the contract and the price at which the index contract was originally written. Futures transactions may result in losses in excess of the amount invested in the futures contract. There can be no guarantee that there will be a correlation between price movements in the hedging vehicle and in the portfolio securities being hedged. An incorrect correlation could result in a loss on both the hedged securities in a fund and the hedging vehicle so that the portfolio return might have been greater had hedging not been attempted. There can be no assurance that a liquid market will exist at a time when a fund seeks to close out a futures contract or a futures option position. Lack of a liquid market for any reason may prevent a fund from liquidating an unfavorable position, and the fund would remain obligated to meet margin requirements until the position is closed. In addition, a fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of their contracts. With exchange-traded futures, there is minimal counterparty credit risk to the Fund since futures are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees the futures against default. The Fund is party to certain enforceable master netting arrangements, which provide for the right of offset under certain circumstances, such as the event of default.

When a purchase or sale of a futures contract is made by a fund, the fund is required to deposit with its custodian (or broker, if legally permitted) a specified amount of liquid assets (“initial margin”). The margin required for a futures contract is set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to the Fund upon termination of the contract, assuming all contractual obligations have been satisfied. These amounts are included in Deposit with broker for futures contracts on the Statement of Assets and Liabilities.

| Annual Report | June 30, 2021 | 25 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Each day the Fund may pay or receive cash, called “variation margin,” equal to the daily change in value of the futures contract. Such payments or receipts are recorded for financial statement purposes as unrealized gains or losses by the Fund. Variation margin does not represent a borrowing or loan by the Fund but instead is a settlement between the Fund and the broker of the amount one would owe the other if the futures contract expired. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

Derivative Instruments: The following tables disclose the amounts related to the Fund’s use of derivative instruments.

The effect of derivatives instruments on the Fund’s Statement of Assets and Liabilities as of June 30, 2021:

Liability

Derivatives

Risk Exposure | | Statements of Assets and Liabilities Location | | | Fair Value | |

Interest Rate Risk (Futures Contracts)* | | | Net unrealized depreciation on futures contracts | | | $ | (2,550,034 | ) |

* | The value presented includes cumulative loss on open futures contracts; however the value reflected on the accompanying Statement of Assets and Liabilities is only the unsettled variation margin payable as of June 30, 2021. |

The effect of derivative instruments on the Statement of Operations for the period from February 24, 2021 (commencement of operations) to June 30, 2021:

Risk Exposure | | Statement of Operations Location | | | Realized Loss on Derivatives | | | Change in Unrealized Appreciation/ Depreciation on Derivatives | |

Interest rate risk (Futures contracts) | | | Net realized loss on futures contracts; Net change in unrealized appreciation/ depreciation on futures contracts | | | $ | (599,827 | ) | | $ | (2,550,034 | ) |

| 26 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

The futures contracts average notional amount during the period from February 25, 2021 (commencement of operations) to June 30, 2021, is noted below.

Fund | | Average Notional Amount of Futures Contracts | |

RiverNorth Flexible Municipal Income Fund II, Inc. | | $ | (103,582,188 | ) |

5. ADVISORY FEES, DIRECTOR FEES AND OTHER AGREEMENTS

RiverNorth serves as the Fund’s investment adviser pursuant to an Investment Advisory Agreement with the Fund (the “Advisory Agreement”). Pursuant to the Advisory Agreement, the Fund will pay RiverNorth an annual management fee of 1.40% of the Fund’s average daily managed assets, calculated as the total assets of the Fund, including assets attributable to leverage, less liabilities other than debt representing leverage and any preferred stock that may be outstanding, for the services and facilities it provides to the Fund (the “Unified Management Fee”). Out of the Unified Management Fee, the Adviser will pay substantially all expenses of the Fund, including the compensation of the Sub-Adviser, the cost of transfer agency, custody, fund administration, legal, audit, independent directors and other services, except for costs, including interest expenses, of borrowing money or engaging in other types of leverage financing including, without limit, through the use by the Fund of tender option bond transactions or preferred shares, distribution fees or expenses, brokerage expenses, taxes and governmental fees, fees and expenses of any underlying funds in which the Fund invests, dividend and interest expense on short positions, fees and expenses of the legal counsel for the Fund’s independent directors, fees and expenses associated with shareholder meetings involving certain non-routine matters, shareholder proposals or contested elections, costs associated with any future share offerings, tender offers and other share repurchases and redemptions, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The Unified Management Fee is designed to pay substantially all of the Fund’s expenses and to compensate the Adviser for providing services for the Fund.

MacKay Shields, LLC is the investment sub-adviser to the Fund. Under the terms of the sub-advisory agreement, the Sub-Adviser, subject to the supervision of the Adviser and the Board of Directors, provides to the Fund such investment advice as is deemed advisable and will furnish a continuous investment program for the portion of assets managed, consistent with the Fund’s investment objective and policies. As compensation for its sub-advisory services, the Adviser, not the Fund, is obligated to pay the Sub-Adviser a fee computed and accrued daily and paid monthly in arrears based on an annual rate of 0.20% of the daily managed assets of the Fund.

ALPS Fund Services, Inc. (“ALPS”), serves as administrator to the Fund. Under an Administration, Bookkeeping and Pricing Services Agreement, ALPS is responsible for calculating the net asset and Daily Managed Assets values, providing additional fund accounting and tax services, and providing fund administration and compliance-related services to the Fund. ALPS is entitled to receive the greater of an annual minimum fee or a monthly fee based on the Fund’s average net assets, plus out-of-pocket expenses. These fees are paid by the Adviser, not the Fund out of the Unified Management Fee.

DST Systems Inc. (“DST”), the parent company of ALPS, serves as the Transfer Agent to the Fund. Under the Transfer Agency Agreement, DST is responsible for maintaining all shareholder records of the Fund. DST is a wholly-owned subsidiary of SS&C Technologies Holdings, Inc. ("SS&C"), a publicly traded company listed on the NASDAQ Global Select Market. The fees of DST Systems, Inc. are paid by the Adviser, not the Fund.

| Annual Report | June 30, 2021 | 27 |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

State Street Bank & Trust, Co. serves as the Fund’s custodian. The fees of State Street Bank & Trust, Co. are paid by the Adviser, not the Fund.

The Fund pays no salaries or compensation to its officers or to any interested Director employed by the Adviser or Sub-Adviser, and the Fund has no employees. For their services, the Directors of the Fund who are not employed by the Adviser or Sub-Adviser, receive an annual retainer in the amount of $16,500, and an additional $1,500 for attending each quarterly meeting of the Board. In addition, the lead Independent Director receives $250 annually, the Chair of the Audit Committee receives $500 annually and the Chair of the Nominating and Corporate Governance Committee receives $250 annually. The Directors not employed by the Adviser or Sub-Adviser are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings of the Board. These fees are paid out of the Unified Management Fee.

6. TAX BASIS INFORMATION

Tax Basis of Distributions to Shareholders: The character of distributions made during the period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gains were recorded by the Fund.

The tax character of the distributions paid by the Fund during the period from February 24, 2021 (commencement of operations) to June 30, 2021 was as follows:

| | June 30, 2021 | |

Ordinary Income | | $ | 13,794 | |

Tax-Exempt Income | | | 1,875,754 | |

Return of Capital | | | 5,415,979 | |

Total | | $ | 7,305,527 | |

Components of Distributable Earnings on a Tax Basis: The tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. Accordingly, for the period ended June 30, 2021, certain differences were reclassified. The amounts reclassified did not affect net assets and were primarily related to the treatment of tender option bonds. The reclassifications were as follows:

Paid-in capital | Total distributable earnings |

$(751,256) | $751,256 |

At June 30, 2021, the components of distributable earnings on a tax basis for the Fund was as follows:

| | | |

Accumulated Capital Loss | | $ | (1,487,246 | ) |

Unrealized Appreciation | | $ | 26,333,849 | |

Total | | $ | 24,846,603 | |

The Fund has elected to defer to the year ending June 30, 2022, capital losses recognized during the period from February 24, 2021 (commencement of operations) to June 30, 2021, in the amount of $1,487,246.

| 28 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Flexible Municipal Income Fund II, Inc.

Notes to Financial Statements | June 30, 2021 |

Unrealized Appreciation and Depreciation on Investments: The amount of net unrealized appreciation/(depreciation) and the cost of investment securities for tax purposes, adjusted for tender option bonds, including short-term securities at June 30, 2021, was as follows:

| | | |

Cost of investments for income tax purposes | | $ | 501,350,795 | |

Gross appreciation on investments (excess of value over tax cost) | | | 28,952,928 | |

Gross depreciation on investments (excess of tax cost over value) | | | (2,619,079 | ) |

Net unrealized appreciation on investments | | $ | 26,333,849 | |

7. INVESTMENT TRANSACTIONS

Investment transactions for the year ended June 30, 2021, excluding short-term investments, were as follows:

| | Purchases | | | Sales | |

| | $ | 875,361,999 | | | $ | 289,408,488 | |

8. CAPITAL SHARE TRANSACTIONS

On February 25, 2021, 22,005,000 shares were issued in connection with the Fund’s initial public offering.

Additional shares of the Fund may be issued under certain circumstances, including pursuant to the Fund’s Automatic Dividend Reinvestment Plan, as defined within the Fund’s organizational documents. Additional information concerning the Automatic Dividend Reinvestment Plan is included within this report.

9. INDEMNIFICATIONS