Exhibit 99.2

PAGE 1 INVESTOR PRESENTATION J A N U A R Y 2 0 2 2

This presentation (together with oral statements made in connection herewith, this “Presentation”) contains selected confidential information about D - Orbit S . p . A . and its subsidiaries (“D - Orbit”) and Breeze Holdings Acquisition Corp . (“Breeze”) . By participating in this Presentation, you expressly agree to keep confidential all otherwise non - public information disclosed by us, whether orally or in writing, during this Presentation or in these Presentation materials . You also agree not to distribute, disclose or use such information for any purpose, other than for the purpose of your firm’s participation in the potential financing and to return to D - Orbit or Breeze, delete or destroy this Presentation upon request . You are also being advised that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information . This Presentation relates to the potential financing of a portion of a contemplated business combination of D - Orbit and Breeze through a private placement of Breeze’s common stock . This Presentation shall not constitute a “solicitation” as defined in Rule 14 a - 1 of the Securities Exchange Act of 1934 , as amended . No Of f e r o r So l i cita ti o n This Presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product . Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933 , as amended (the “Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501 (a)( 1 ), ( 2 ), ( 3 ) or ( 7 ) under the Act or “qualified institutional buyers” as defined in Rule 144 A under the Act . Accordingly, the Securities must continue to be held unless the Securities are registered under the Act or a subsequent disposition is exempt from the registration requirements of the Act . Investors should consult with their legal counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Act . The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued . Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time . Neither D - Orbit nor Breeze is making an offer of the Securities in any state where the offer is not permitted . NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE . This Presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice . You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein . The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs No representation, express or implied, is or will be given by D - Orbit, Breeze or their respective affiliates and advisors as to the accuracy or completeness of the information contained in this Presentation . In d u s try an d M a rke t In fo r m a ti o n Information contained in this Presentation concerning D - Orbit’s industry and the markets in which it operates, including D - Orbit’s general expectations and market position, market opportunity and market size, is based on information from D - Orbit’s management’s estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties . In some cases, we may not expressly refer to the sources from which this information is derived . Management estimates are derived from industry and general publications and research, surveys and studies conducted by third parties and D - Orbit’s knowledge of its industry and assumptions based on such information and knowledge, which we believe to be reasonable . In addition, assumptions and estimates of D - Orbit’s and its industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors . These and other factors could cause D - Orbit’s future performance and actual market growth, opportunity and size and the like to differ materially from our assumptions and estimates . Trademarks All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and D - Orbit’s or Breeze’s use thereof does not imply an affiliation with, or endorsement by the owners of such trademarks, copyrights, logos and other intellectual property . Solely for convenience, trademarks and trade names referred to in this Presentation may not appear with the ® or Œ symbols, but such references are not intended to indicate, in any way, that D - Orbit or Breeze will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names . PAGE 2 LEGAL DISCLAIMER Disclaimer and Cautionary Note Regarding Forward - Looking Statements

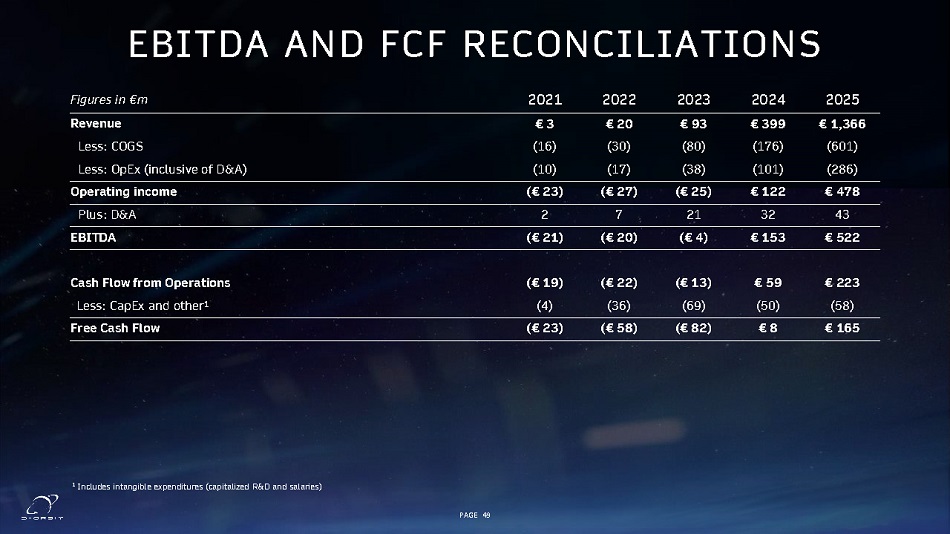

U s e o f Proj e cti o n s This Presentation contains estimated or projected financial information with respect to D - Orbit, including, without limitation, D - Orbit’s projected revenue, operating income, EBITDA, cash flow from operations, and free cash flow for 2021 - 2028 . Such estimated or projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such estimated or projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . See “Forward - Looking Statements” below . Actual results may differ materially from the results contemplated by the estimated or projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such estimates and projections will be achieved . Neither the independent registered public accounting firm of Breeze nor the independent registered public accounting firm of D - Orbit, audited, reviewed, compiled, or performed any procedures with respect to the estimates or projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . The performance projections and estimates herein are also subject to the ongoing COVID - 19 pandemic, and have the potential to be revised to take into account further adverse effects of the COVID - 19 pandemic on the future performance of D - Orbit and Breeze . Projected returns and estimates are based on an assumption that public health, economic, market, and other conditions will improve : however, there can be no assurance that such conditions will improve within the time period or to the extent estimated by D - Orbit and Breeze . The full impact of the COVID - 19 pandemic on future performance is particularly uncertain and difficult to predict . Therefore actual results may vary materially and adversely from the projections included herein . Use of Non - GAAP and Non - IFRS Financial Measures This Presentation includes certain non - IFRS financial measures, including EBITDA, that are not prepared in accordance with International Financial Reporting Standards (“IFRS”) and that may be different from non - IFRS financial measures used by other companies . D - Orbit and Breeze believe that the use of these non - IFRS financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends of D - Orbit . These non - IFRS measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS . Forward - looking non - INFS financial measures are provided ; they are presented on a non - IFRS basis without reconciliations of such forward - looking non - IFRS measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation . F o rw a r d - L oo kin g Sta t e m e n ts This Presentation includes “forward - looking statements” within the meaning of the “safe harbor’’ provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Such forward - looking statements with respect to revenues, earnings, performance, strategies, the market, prospects and other aspects of the businesses of D - Orbit, Breeze or a combined company after completion of the proposed business combination are based on current expectations that are subject to risks and uncertainties . A number of factors, many of which are outside of the control of D - Orbit and Breeze, could cause actual results or outcomes to differ materially from those indicated by such forward - looking statements . These forward - looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions ; (ii) the inability of the D - Orbit and Breeze to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the stockholders of Breeze or equity holders of D - Orbit is not obtained ; (iii) failure to realize the anticipated benefits of the proposed business combination ; (iv) risks relating to the uncertainty of the projected financial information with respect to D - Orbit ; (v) risks related to the rollout of D - Orbit’s technologies ; (vi) the effects of competition on D - Orbit’s business ; (vii) the level of product service or product failures that could lead customers to use competitors’ services ; (viii) developments and changes in laws and regulations ; (ix) the impact of significant investigative, regulatory or legal proceedings ; (x) the amount of redemption requests made by Breeze’s public stockholders ; (xi) the ability of Breeze or the combined company to issue equity or equity - linked securities in connection with the proposed business combination or in the future ; and (xii) those factors discussed in Breeze’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2021 , under the heading “Risk Factors,” and other documents of Breeze filed, or to be filed, with the Securities and Exchange Commission (“SEC”) . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither Breeze nor D - Orbit presently know or that Breeze and D - Orbit currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect Breeze’s and D - Orbit’s expectations, plans or forecasts of future events and views as of the date of this Presentation . Breeze and D - Orbit anticipate that subsequent events and developments will cause Breeze’s and D - Orbit’s assessments to change . You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made . D - Orbit and Breeze undertake no commitment to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law . PAGE 3 LEGAL DISCLAIMER (CONT.)

Add iti o n a l In fo r m a ti o n If the contemplated business combination is pursued, D - Orbit (through an entity to be organized for purchases of effecting the business combination) intends to file a Registration Statement on Form F - 4 with the SEC, which will include a preliminary proxy statement/prospectus . Breeze will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders . INVESTORS AND SECURITY HOLDERS OF BREEZE ARE ADVISED TO READ, WHEN AVAILABLE, THE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH BREEZE’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE CONTEMPLATED BUSINESS COMBINATION AND THE PARTIES THERETO . The definitive proxy statement/prospectus will be mailed to stockholders of Breeze as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain copies of the proxy statement/prospectus, without charge, once available, at the SEC’s website at www . sec . gov . P a rticip a n ts i n th e So l i cita ti o n Breeze, D - Orbit and certain of their respective directors, executive officers, other members of management, and employees, under SEC rules may be deemed to be participants in the solicitation of proxies of Breeze’s stockholders in connection with the proposed business combination . Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Breeze’s directors and officers in Breeze’s filings with the SEC, including Breeze’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2020 , which was filed with the SEC on March 31 , 2021 , and such information and names of D - Orbit’s and Breeze’s directors and executive officers will also be in the Registration Statement on Form F - 4 to be filed with the SEC . PAGE 4 LEGAL DISCLAIMER (CONT.)

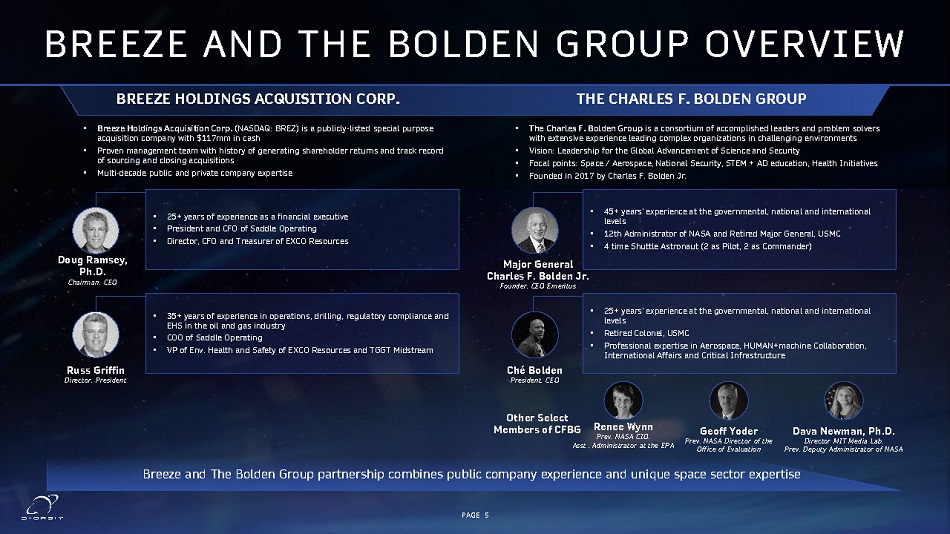

BREEZE AND THE BOLDEN GROUP OVERVIEW • 25+ years of experience as a financial executive • President and CFO of Saddle Operating • Director, CFO and Treasurer of EXCO Resources D ou g Ram sey, Ph.D. Chairman, CEO T HE CHARL E S F. B O L DE N GROUP • The Charles F. Bolden Group is a consortium of accomplished leaders and problem solvers with extensive experience leading complex organizations in challenging environments • Vision: Leadership for the Global Advancement of Science and Security • Focal points: Space / Aerospace, National Security, STEM + AD education, Health Initiatives • Founded in 2017 by Charles F. Bolden Jr. BREEZE HO L DIN GS AC Q UIS I T I O N C O R P . • Breeze Holdings Acquisition Corp. (NASDAQ: BREZ) is a publicly - listed special purpose acquisition company with $117mm in cash • Proven management team with history of generating shareholder returns and track record of sourcing and closing acquisitions • Multi - decade public and private company expertise • 35+ years of experience in operations, drilling, regulatory compliance and EHS in the oil and gas industry • C OO o f S a dd l e Op e ra t i n g • VP of Env. Health and Safety of EXCO Resources and TGGT Midstream R uss G r iff in Director, President • 25+ years’ experience at the governmental, national and international levels • Retired Colonel, USMC • Professional expertise in Aerospace, HUMAN+machine Collaboration, International Affairs and Critical Infrastructure Ché Bo l d en President, CEO • 45+ years’ experience at the governmental, national and international levels • 12th Administrator of NASA and Retired Major General, USMC • 4 time Shuttle Astronaut (2 as Pilot, 2 as Commander) M ajor Ge neral Ch arl e s F. Bo l d e n J r . Founder, CEO Emeritus O th e r S e l ec t M e m b ers o f CF BG R en e e W ynn Prev. NASA CIO, Asst . Administrator at the EPA Geo f f Y o d er Breeze and The Bolden Group partnership combines public company experience and unique space sector expertise D av a N e w man, P h. D . Prev. NASA Director of the Director MIT Media Lab, Office of Evaluation Prev. Deputy Administrator of NASA PAGE 5

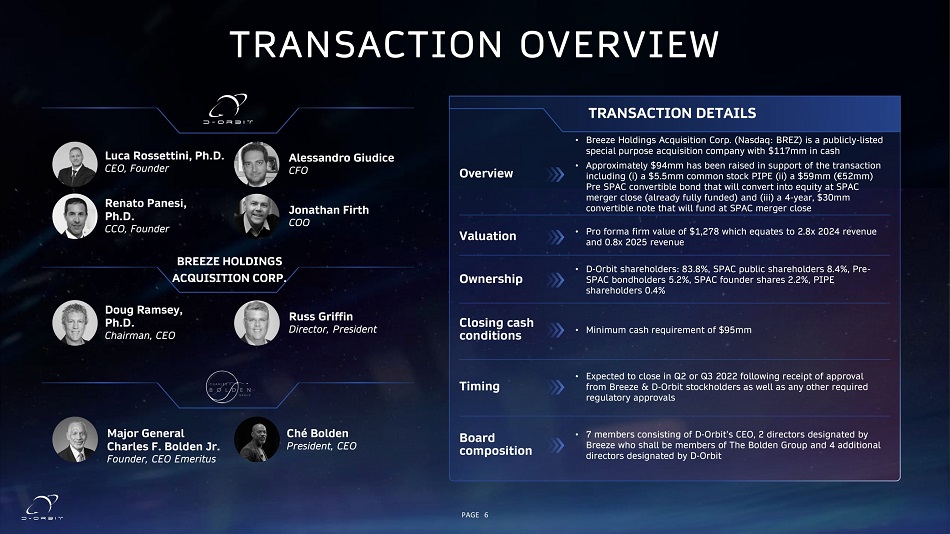

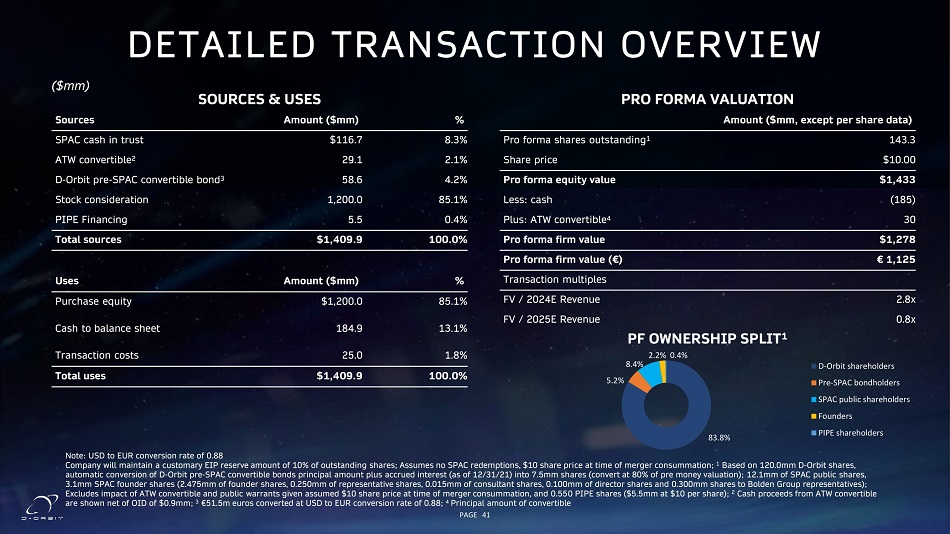

TRANSACTION OVERVIEW L u ca R o sse tt in i , P h .D. CEO, Founder Re n a to Pan e s i , Ph.D. CCO, Founder A l essa n d r o G i ud i ce CFO J o n a t h a n Fi r th COO D o u g Ramse y, Ph.D. Chairman, CEO Ru ss G r i ff in Director, President M a j o r G e n e r a l C h a r l es F. B o l de n J r . Founder, CEO Emeritus C h é B o l de n President, CEO T RANSA C T I O N DE T AI L S • Breeze Holdings Acquisition Corp. (Nasdaq: BREZ) is a publicly - listed special purpose acquisition company with $117mm in cash • Approximately $95mm has been raised in support of the transaction including (i) a $5.5mm common stock PIPE (ii) a $59mm (€52mm) Pre SPAC convertible bond that will convert into equity at SPAC merger close (already fully funded) and (iii) a 4 - year, $31mm convertible note that will fund at SPAC merger close O v er v iew Valuatio n • Pro forma firm value of $1,278 which equates to 2.8x 2024 revenue a n d 0.8x 202 5 r e v e n u e • D - Orbit shareholders: 83.8%, SPAC public shareholders 8.4%, Pre - SPAC bondholders 5.2%, SPAC founder shares 2.2%, PIPE shareholders 0.4% O w n ership • Minimum cash requirement of $95mm PAGE 6 Clo sin g cash conditions • Expected to close in Q2 or Q3 2022 following receipt of approval from Breeze & D - Orbit stockholders as well as any other required regulatory approvals Timin g • 7 members consisting of D - Orbit’s CEO, 2 directors designated by Breeze who shall be members of The Bolden Group and 4 additional directors designated by D - Orbit Board co m p o sit i o n B R E E Z E H O L D I N G S ACQU I S I TIO N C O R P .

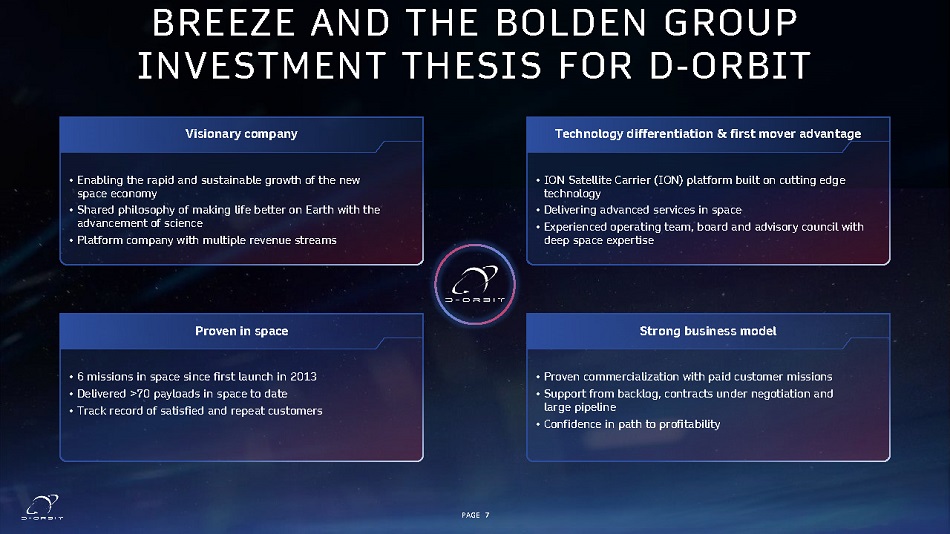

BREEZE AND THE BOLDEN GROUP INVESTMENT THESIS FOR D - ORBIT • Enabling the rapid and sustainable growth of the new space economy • Shared philosophy of making life better on Earth with the advancement of science • Platform company with multiple revenue streams Visio n ary co m pany • ION Satellite Carrier (ION) platform built on cutting edge technology • Delivering advanced services in space • Experienced operating team, board and advisory council with deep space expertise Technology differentiation & first mover advantage • 6 missions in space since first launch in 2013 • Delivered >70 payloads in space to date • Track record of satisfied and repeat customers Pr o v e n i n spa c e • Proven commercialization with paid customer missions • Support from backlog, contracts under negotiation and large pipeline • Confidence in path to profitability S t ro n g busin es s m o del PAGE 7

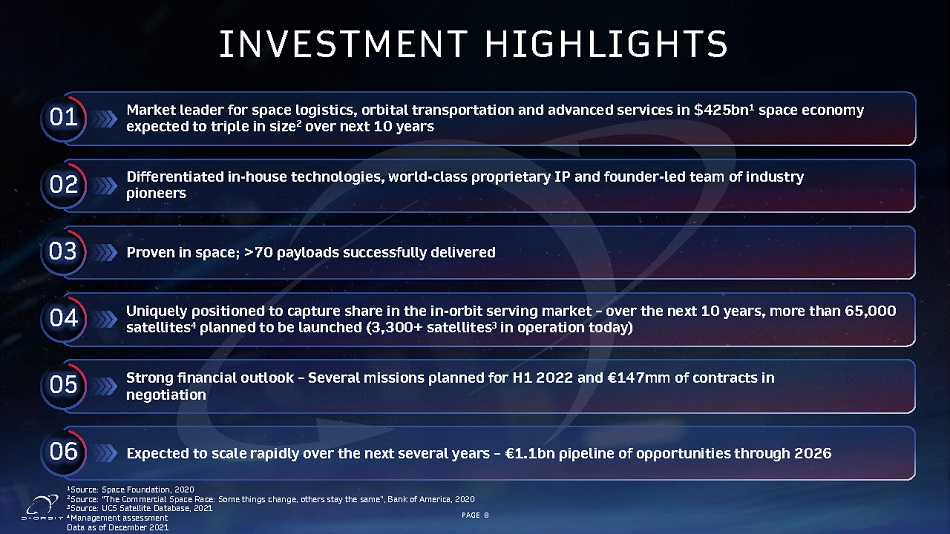

PAGE 8 INVESTMENT HIGHLIGHTS Market leader for space logistics, orbital transportation and advanced services in $425bn 1 space economy expected to triple in size 2 over next 10 years 01 Differentiated in - house technologies, world - class proprietary IP and founder - led team of industry pioneers Proven in space; >70 payloads successfully delivered Uniquely positioned to capture share in the in - orbit serving market – over the next 10 years, more than 65,000 satellites 4 planned to be launched (3,300+ satellites 3 in operation today) Strong financial outlook – Several missions planned for H1 2022 and €147mm of contracts in negotiation Expected to scale rapidly over the next several years – €1.1bn pipeline of opportunities through 2026 02 03 04 05 06 1 Source: Space Foundation, 2020 2 Source: “The Commercial Space Race: Some things change, others stay the same”, Bank of America, 2020 3 Source: UCS Satellite Database, 2021 4 M a n a g e m e n t a ss e ssm e n t Data as of December 2021

PAGE 9 BUSINESS OVERVIEW PHOTOGRAPH OF EARTH TAKEN FROM ION ORIGIN MISSION (SEP - 20)

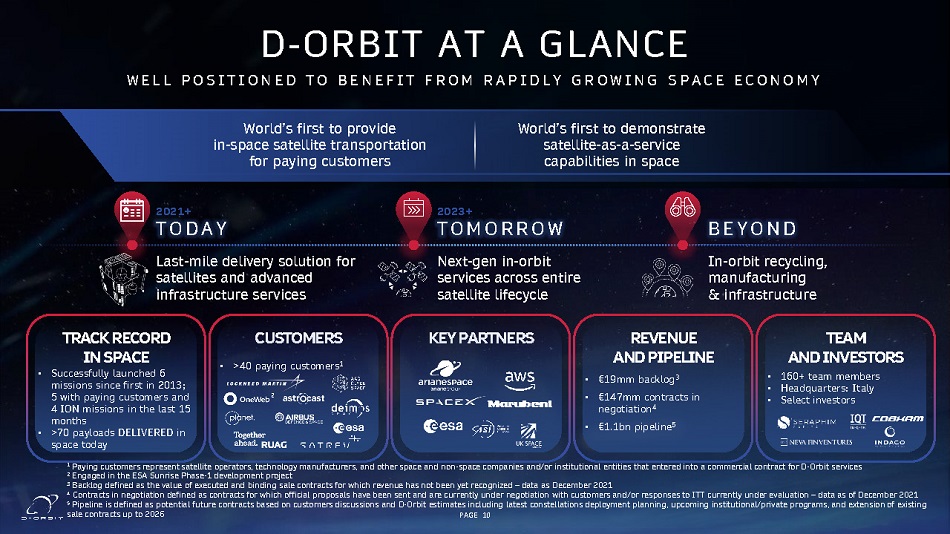

D - ORBIT AT A GLANCE W E L L P O S I T I O N E D T O B E N E F I T F R O M R A P I D L Y G R O W I N G S P A C E E C O N O M Y B E Y O N D In - orbit recycling, manufacturing & infrastructure World’s first to provide in - space satellite transportation for paying customers World’s first to demonstrate satellite - as - a - service capabilities in space T R A C K R E C O R D I N S P A C E • Successfully launched 6 missions since first in 2013; 5 with paying customers and 4 ION missions in the last 15 months • >70 payloads DELIVERED in space today 2023+ T O M O R R O W Next - gen in - orbit services across entire satellite lifecycle 2021+ T O D A Y Last - mile delivery solution for satellites and advanced infrastructure services REVENUE A N D P I P E L I N E • €19mm backlog 3 • €147mm contracts in negotiation 4 • €1.1bn pipeline 5 1 Paying customers represent satellite operators, technology manufacturers, and other space and non - space companies and/or institutional entities that entered into a commercial contract for D - Orbit services 2 Engaged in the ESA Sunrise Phase - 1 development project 3 Backlog defined as the value of executed and binding sale contracts for which revenue has not been yet recognized – data as December 2021 4 Contracts in negotiation defined as contracts for which official proposals have been sent and are currently under negotiation with customers and/or responses to ITT currently under evaluation – data as of December 2021 5 Pipeline is defined as potential future contracts based on customers discussions and D - Orbit estimates including latest constellations deployment planning, upcoming institutional/private programs, and extension of existing sale contracts up to 2026 PAGE 10 K E Y P A R T N E R S TEAM A N D I N V E S T O R S • 160+ team members • Headquarters: Italy • Select investors CUSTOMERS • >40 paying customers 1 2

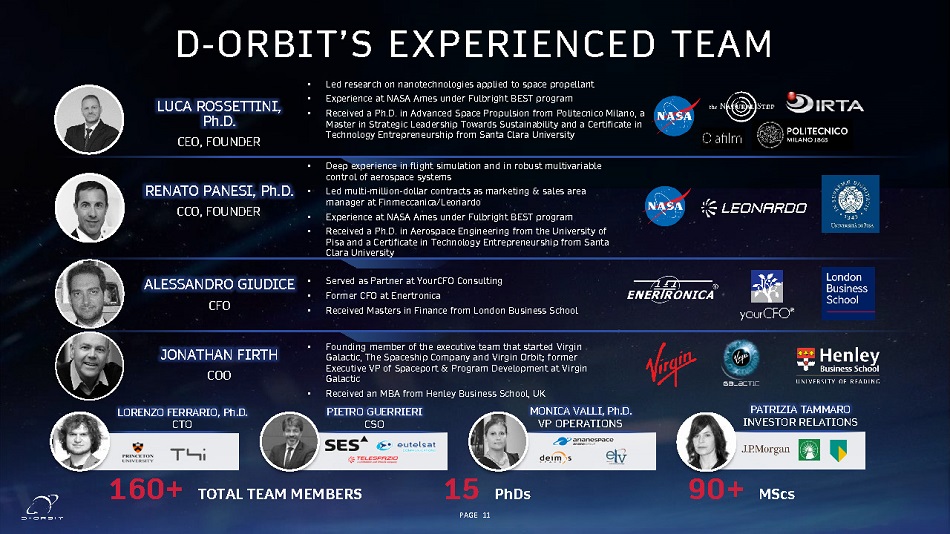

D - ORBIT’S EXPERIENCED TEAM L U C A R O SS E TT I N I , Ph.D. C E O , F O U N D E R • Led research on nanotechnologies applied to space propellant • Experience at NASA Ames under Fulbright BEST program • Received a Ph . D . in Advanced Space Propulsion from Politecnico Milano, a Master in Strategic Leadership Towards Sustainability and a Certificate in Technology Entrepreneurship from Santa Clara University RENATO PANESI, Ph.D. CC O , F O U N D E R • Deep experience in flight simulation and in robust multivariable control of aerospace systems • Led multi - million - dollar contracts as marketing & sales area manager at Finmeccanica/Leonardo • Experience at NASA Ames under Fulbright BEST program • Received a Ph . D . in Aerospace Engineering from the University of Pisa and a Certificate in Technology Entrepreneurship from Santa Clara University ALESSANDRO GIUDICE CFO • Served as Partner at YourCFO Consulting • Former CFO at Enertronica • Received Masters in Finance from London Business School JONATHAN FIRTH COO • Founding member of the executive team that started Virgin Galactic, The Spaceship Company and Virgin Orbit; former Executive VP of Spaceport & Program Development at Virgin Galactic • Received an MBA from Henley Business School, UK L O R E N Z O F E RR A R I O , P h . D . CTO PIETRO GUERRIERI CSO M O N I C A V A LL I , P h . D . VP OPERATIONS PATRIZIA TAMMARO INVESTOR RELATIONS 160+ T O T A L T EA M M EMBERS 90+ MScs 15 PhDs PAGE 11

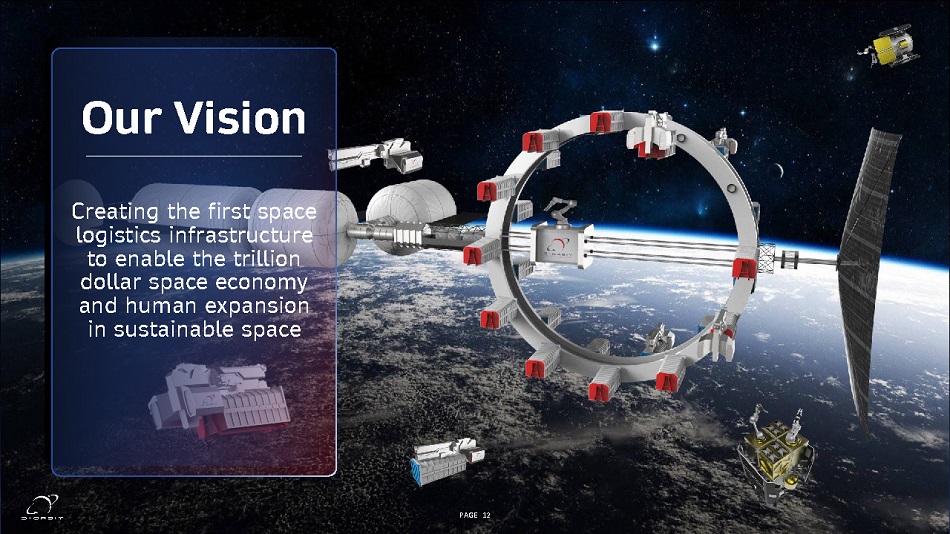

Ou r Vision Creating the first space logistics infrastructure to enable the trillion dollar space economy and human expansion in sustainable space PAGE 12 PAGE 12

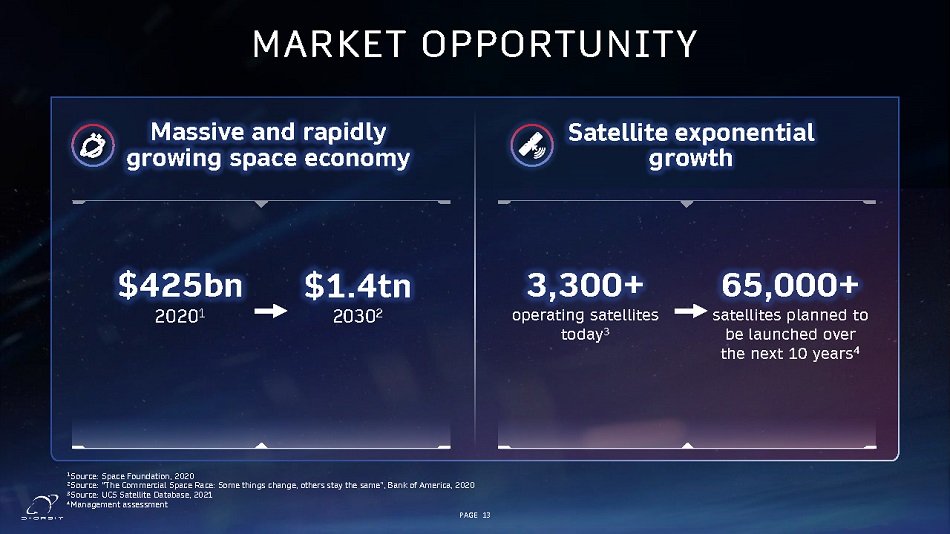

Massiv e and ra p idly gro w in g s p ace eco n omy 1 Source: Space Foundation, 2020 2 Source: “The Commercial Space Race: Some things change, others stay the same”, Bank of America, 2020 3 Source: UCS Satellite Database, 2021 4 Management assessment Satellit e exponential growth $425bn 2020 1 65,000+ satellites planned to be launched over the next 10 years 4 MARKET OPPORTUNITY $1.4tn 2030 2 3,300+ operating satellites today 3 PAGE 13

THE NEW SPACE ECONOMY IS ENABLING MULTIPLE SECTORS ON EARTH FOR E S T MA N AG E M E NT • Sustainable forestry • Preserve wildlife AG R I C ULT U R E E NH ANC E M E NT • Monitor crop development • Reduce use of water and pesticides • Mitigate famines E A R T H OBS E R VAT I O N, CLIMATE CH ANGE • Greenhouse gas emission monitoring • Natural disaster mitigation and response O IL AN D G A S IN D U S TR Y • Detect and monitor leakages • Find new potential resources A U T O N O M O U S DRI V I N G , NAVIGATION • Secure, precision navigation • Autonomous cars, flying taxis, delivery drones, robots T EL E C O MMUN I CAT I O N, INTER N E T , IoT PAGE 14 • Low cost internet for billions of people • Connect remote areas

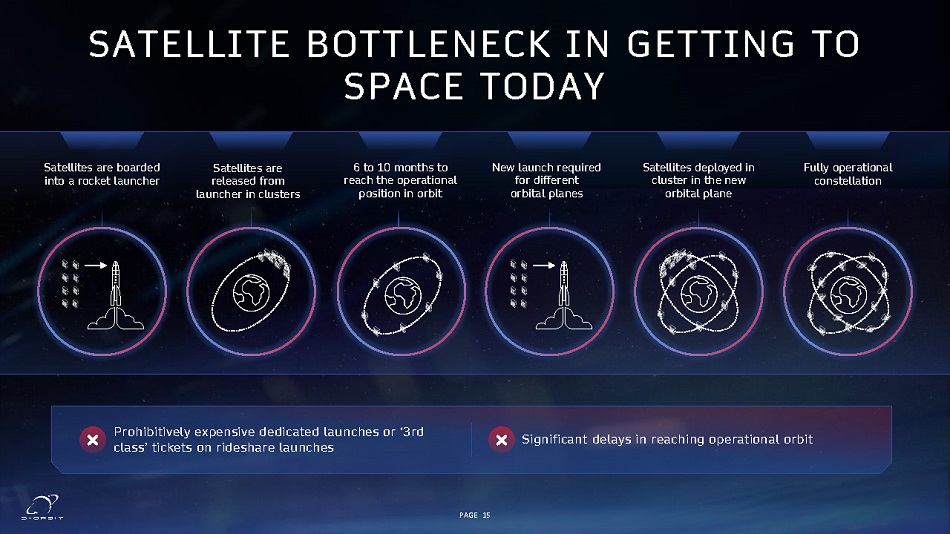

SATELLITE BOTTLENECK IN GETTING TO SPACE TODAY Satellites are boarded into a rocket launcher Satellites are released from launcher in clusters 6 to 10 months to reach the operational position in orbit New launch required for different orbital planes Satellites deployed in cluster in the new orbital plane Fully operational constellation Prohibitively expensive dedicated launches or ‘3rd class’ tickets on rideshare launches PAGE 15 Significant delays in reaching operational orbit

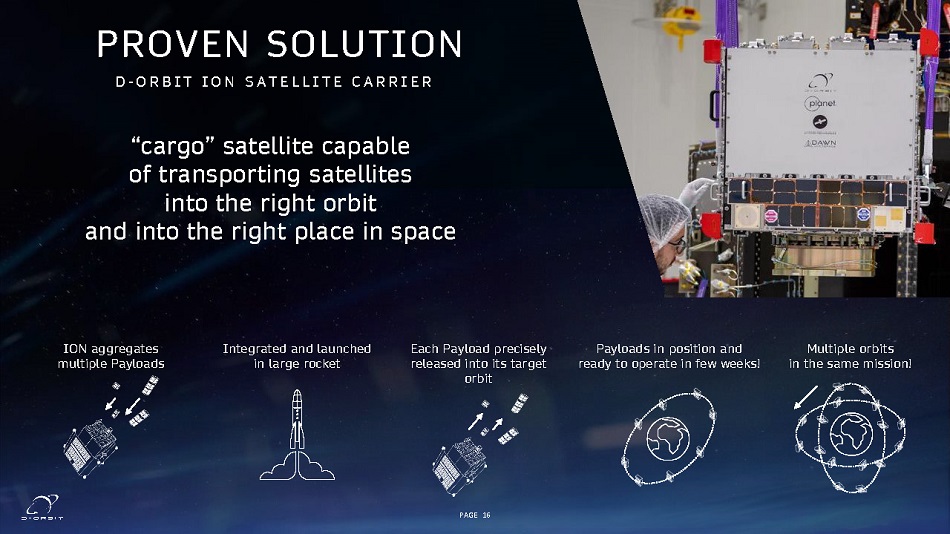

Payloads in position and ready to operate in few weeks! Multiple orbits in the same mission! PROVEN SOLUTION “cargo” satellite capable of transporting satellites into the right orbit and into the right place in space D - O R B I T I O N S A T E L L I T E C A R R I E R Each Payload precisely released into its target orbit Integrated and launched in large rocket ION aggregates multiple Payloads PAGE 16

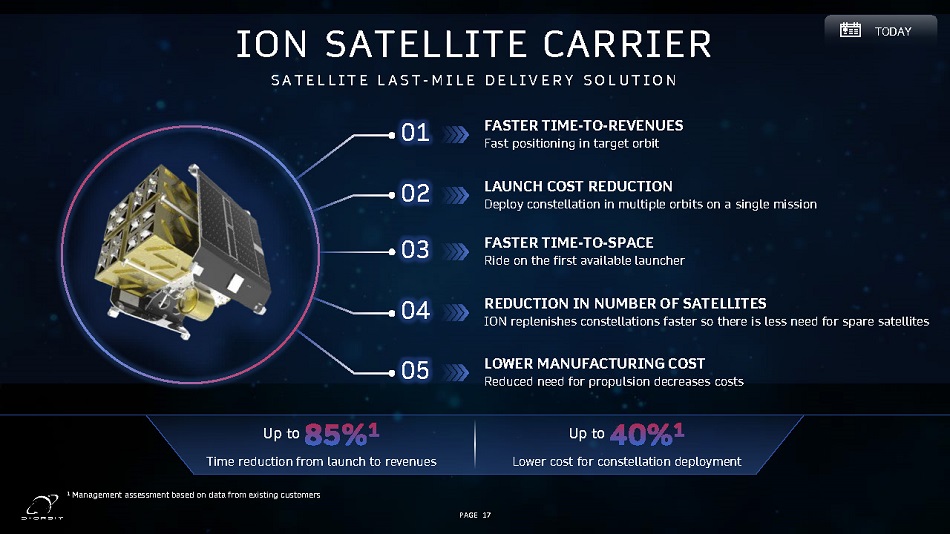

ION SATELLITE CARRIER S A T E L L I T E L A S T - M I L E D E L I V E R Y S O L U T I O N 01 FAST E R T IME - T O - RE V E N UES Fast positioning in target orbit L AU N CH C O S T REDUC T I O N Deploy constellation in multiple orbits on a single mission FA S T E R T IM E - T O - SP A C E Ride on the first available launcher REDUC T I O N IN NUMBER O F SATEL L ITES ION replenishes constellations faster so there is less need for spare satellites 02 03 04 05 L O WER M A N UFACT UR IN G C O ST Reduced need for propulsion decreases costs Up to Time reduction from launch to revenues Up to Lower cost for constellation deployment 1 Management assessment based on data from existing customers PAGE 17

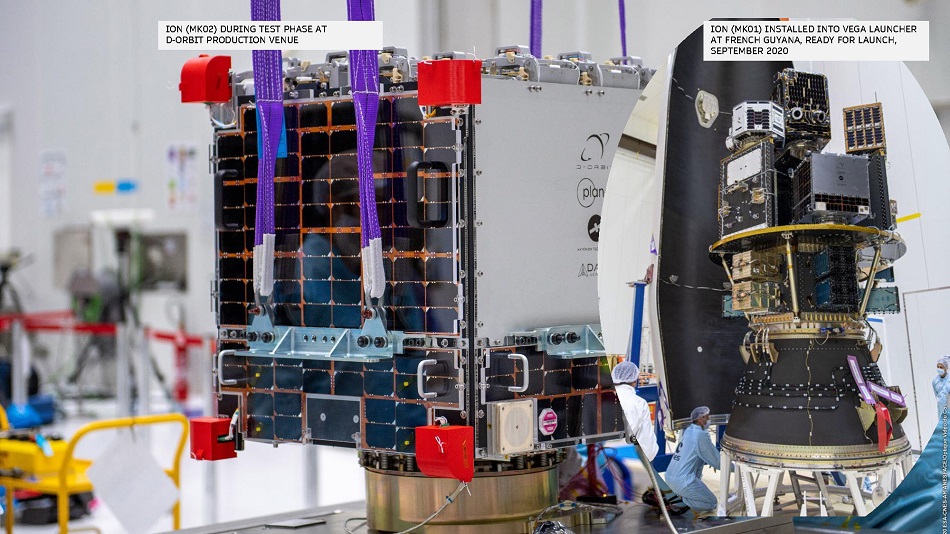

PICTURES TAKEN DURING THE MANUFACTURING AND TESTING OF ION (MK01) LAUNCHED IN 2020

ION (MK01) INSTALLED INTO VEGA LAUNCHER AT FRENCH GUYANA, READY FOR LAUNCH, SEPTEMBER 2020 ION (MK02) DURING TEST PHASE AT D - ORBIT PRODUCTION VENUE

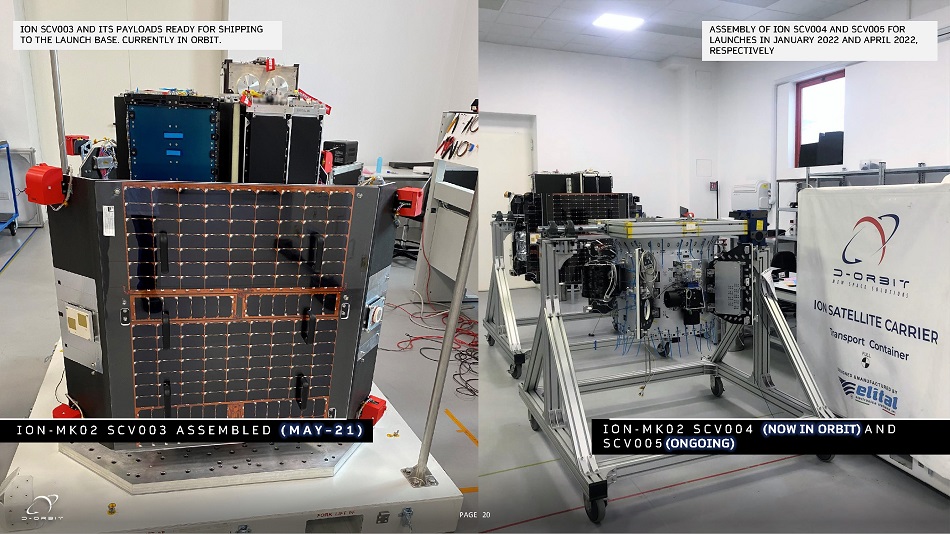

I O N - M K 0 2 S C V 0 0 3 A S S E M B L E D ( M A Y – 2 1 ) I O N - M K 0 2 S C V 0 0 4 (NOW IN O R B I T ) A N D S C V 0 0 5 (ON G O IN G ) ASSEMBLY OF ION SCV004 AND SCV005 FOR LAUNCHES IN JANUARY 2022 AND APRIL 2022, RESPECTIVELY PAGE 20 ION SCV003 AND ITS PAYLOADS READY FOR SHIPPING TO THE LAUNCH BASE. CURRENTLY IN ORBIT.

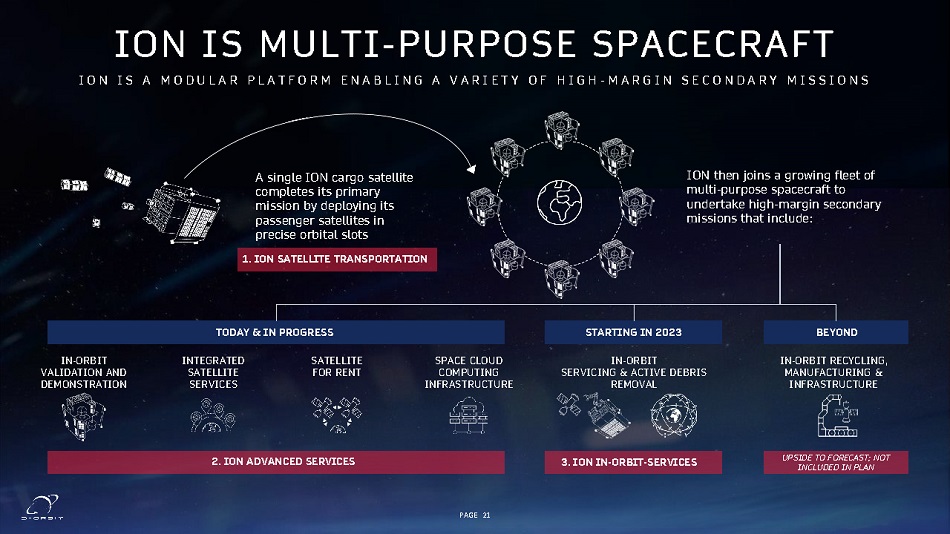

ION IS MULTI - PURPOSE SPACECRAFT I O N I S A M O D U L A R P L A T F O R M E N A B L I N G A V A R I E T Y O F H I G H - M A R G I N S E C O N D A R Y M I S S I O N S A single ION cargo satellite completes its primary mission by deploying its passenger satellites in precise orbital slots ION then joins a growing fleet of multi - purpose spacecraft to undertake high - margin secondary missions that include: IN - ORBIT VALIDATION AND DEM O N S T RATI O N I N T E G RATED SATELLITE SERVICES SATELLITE FOR RENT IN - ORBIT SERVICING & ACTIVE DEBRIS REMOVAL IN - ORBIT RECYCLING, MANUFACTURING & INFRASTRUCTURE SPACE CLOUD COMPUTING I N FRAS TRUC T U RE S T A R T I N G I N 202 3 BEYOND T O D A Y & I N P R O GRE SS 3 . I O N I N - O R B I T - SER V I CE S 2 . I O N A D V A N CE D SER V I CE S UPS I D E T O F O RE CAST ; N O T INCLUDED IN PLAN 1 . I O N S A T EL L I T E T R A N S P O R T A T I O N PAGE 21

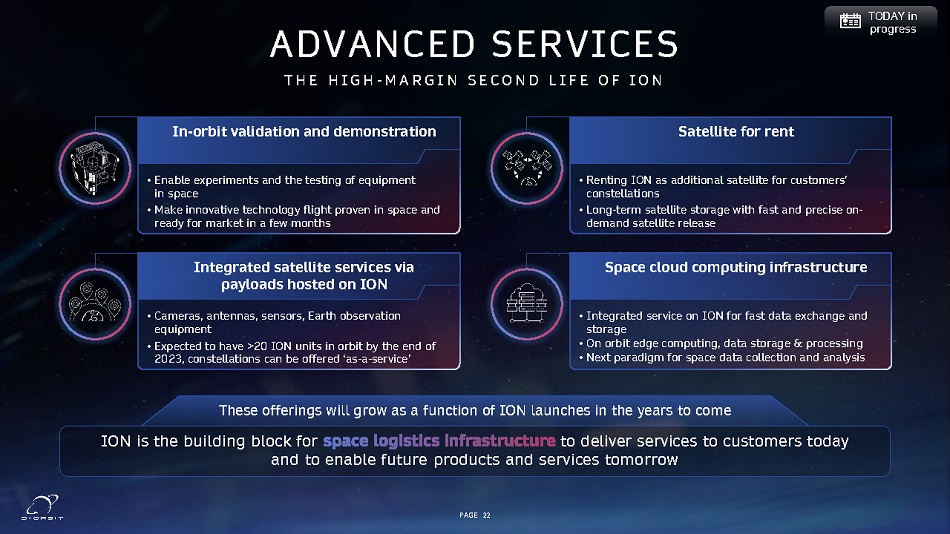

ADVANCED SERVICES T H E H I G H - M A R G I N S E C O N D L I F E O F I O N These offerings will grow as a function of ION launches in the years to come ION is the building block for to deliver services to customers today and to enable future products and services tomorrow • Enable experiments and the testing of equipment in space • Make innovative technology flight proven in space and ready for market in a few months I n - orbi t v alidation a n d demonstra t ion I n tegrated s a telli t e s e rvice s via payload s h oste d o n I O N • Cameras, antennas, sensors, Earth observation equipment • Expected to have >20 ION units in orbit by the end of 2023, constellations can be offered ‘as - a - service’ • Renting ION as additional satellite for customers’ constellations • Long - term satellite storage with fast and precise on - demand satellite release Sate l lit e fo r ren t • Integrated service on ION for fast data exchange and storage • On orbit edge computing, data storage & processing • Next paradigm for space data collection and analysis Sp ace clo u d compu ti n g i n fras tru c ture PAGE 22

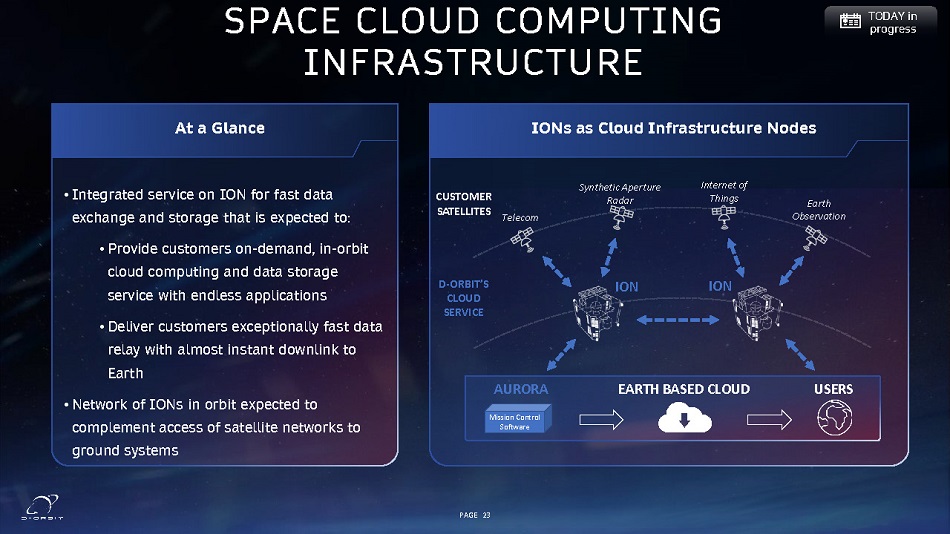

SPACE CLOUD COMPUTING INFRASTRUCTURE Earth O b se r v a tion I n te r n et of Things S yn thetic A p erture Radar Telecom D - O R BI T ’S CLOUD SERVICE • Integrated service on ION for fast data exchange and storage that is expected to: • Provide customers on - demand, in - orbit cloud computing and data storage service with endless applications • Deliver customers exceptionally fast data relay with almost instant downlink to Earth • Network of IONs in orbit expected to complement access of satellite networks to ground systems A t a Gl a n c e ION ION CU S T O M ER SATELLITES USE R S EARTH BASED CLOUD A U R O R A I O N s as Clo u d I n fr a s t ruct u r e Nod e s Mission Control Software PAGE 23

THE NEXT MARKET: In Orbit Servicing D - O rb i t’s lo g i s ti c s s e r vi c e s will e nsu r e f o r c o m m e r c ial an d g o v e rn men t s p ace e nde a vors and debris in space require in - orbit services such as transportation, maintenance, active debris removal and end - of - life disposal Satellite Rocket body Object D e br i s Source: www.stuffin.space Note: Stuff in Space provides a real - time 3D map of objects in Earth’s orbit. The website updates daily with orbit data from Spa ce Track and calculates the actual, current satellite and debris positions T OM O RR O W Debris from Chinese rocket re - enters Earth's atmosphere over Indian Ocean Space junk damages International Space Station's robotic arm Satellite debris forces space station crew to take shelter PAGE 24

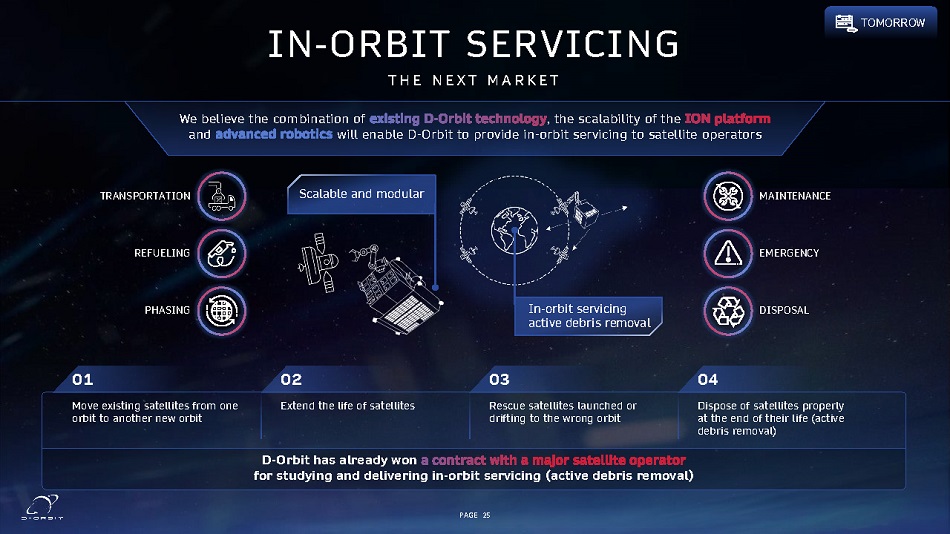

TRANSPORTATION REFUELING PHASING MAINTENANCE EMERGENCY D I S PO S AL IN - ORBIT SERVICING T H E N E X T M A R K E T D - O rb i t h as al r e ady w o n for studying and delivering in - orbit servicing (active debris removal) We believe the combination of , the scalability of the and will enable D - Orbit to provide in - orbit servicing to satellite operators In - orbit servicing active debris removal Scalable and modular Move existing satellites from one orbit to another new orbit Extend the life of satellites Rescue satellites launched or drifting to the wrong orbit Dispose of satellites properly at the end of their life (active debris removal) 01 02 03 04 T OM O RR O W PAGE 25

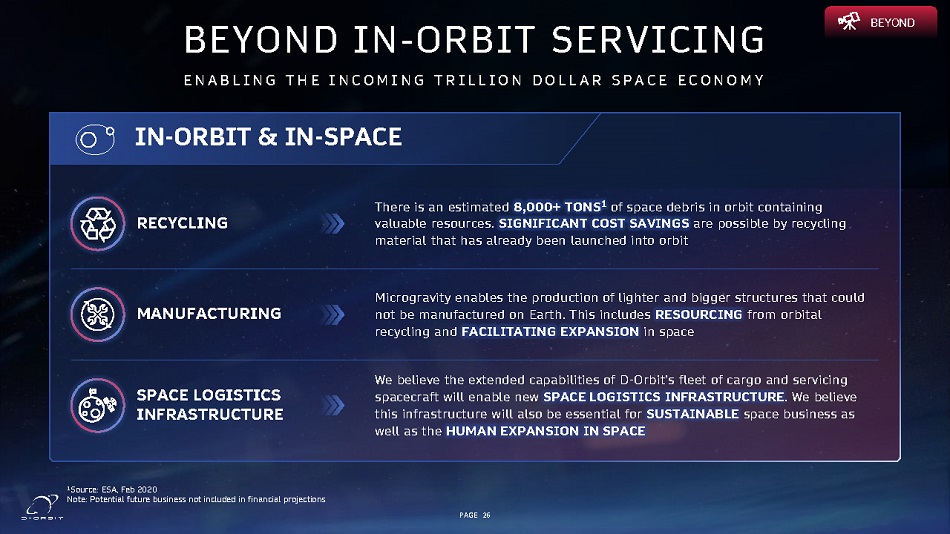

IN - ORBIT & I N - S P ACE 1 Source: ESA, Feb 2020 Note: Potential future business not included in financial projections BEYOND IN - ORBIT SERVICING E N A B L I N G T H E I N C O M I N G T R I L L I O N D O L L A R S P A C E E C O N O M Y There is an estimated 8,000+ TONS 1 of space debris in orbit containing valuable resources. SIGNIFICANT COST SAVINGS are possible by recycling material that has already been launched into orbit RECYCLING BEYOND Microgravity enables the production of lighter and bigger structures that could not be manufactured on Earth. This includes RESOURCING from orbital recycling and FACILITATING EXPANSION in space MANUFACTURING We believe the extended capabilities of D - Orbit’s fleet of cargo and servicing spacecraft will enable new SPACE LOGISTICS INFRASTRUCTURE . We believe this infrastructure will also be essential for SUSTAINABLE space business as w ell as the HU M A N E XPA NS IO N IN S P A CE SPAC E L O G I S T I CS I NFRAS T RUCTURE PAGE 26

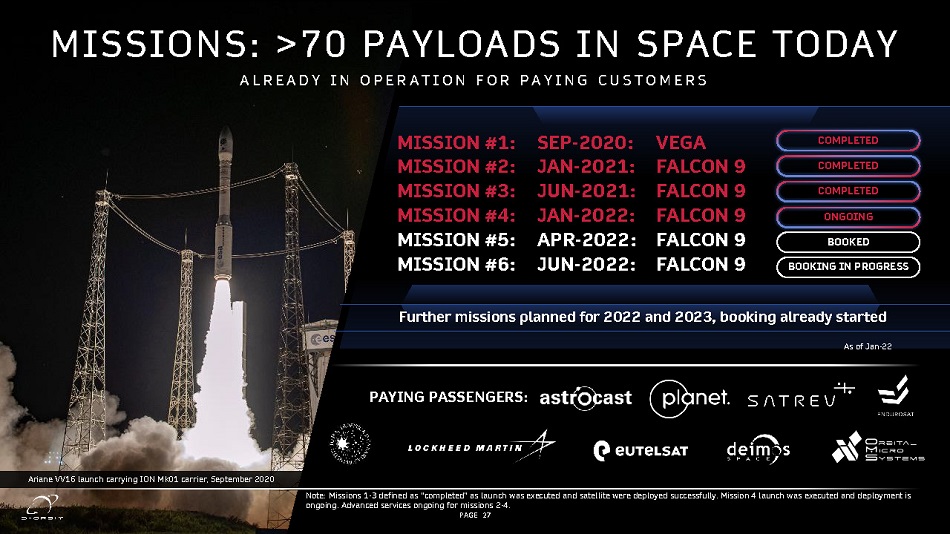

A s o f J an - 22 M I S SI O N #1: SEP - 2020: VEGA M I S SI O N #2: JAN - 2021: FALCON 9 M I S SI O N #3: JUN - 2021: FALCON 9 M I S SI O N #4: JAN - 2022: FALCON 9 M I S SI O N #5: APR - 2022: FALCON 9 M I S SI O N #6: JUN - 2022: FALCON 9 Further missions planned for 2022 and 2023, booking already started MISSIONS: >70 PAYLOADS IN SPACE TODAY A L R E A D Y I N O P E R A T I O N F O R P A Y I N G C U S T O M E R S COMPLETED CO M P L E T ED CO M P L E T ED O N GO I NG BOOKED B O O KI N G I N P R O GRE SS Ariane VV16 launch carrying ION Mk01 carrier, September 2020 Note: Missions 1 - 3 defined as “completed” as launch was executed and satellite were deployed successfully. Mission 4 launch was executed and deployment is ongoing. Advanced services ongoing for missions 2 - 4. PAYI N G PASS E N G ERS: PAGE 27

PAGE 28 x x x I n - or b it d e m onstration o f hosted p ay l oad s D eb r i s tra c k i n g I n - or b it d eb r i s d etection G R O W I N G L E V E L S O F C O M P L E X I T Y A N D E N H A N C E D C A P A B I L I T I E S OUR ION MISSIONS S ep tem b e r 202 0 M I S S I O N M I S S I O N 1 2 M I S S I O N 3 S A T EL L I T E T R A N S P O R T A T I O N A N D D EPL O Y M E N T A D V A N CE D SER V I CE S T EST I N G FOR FUT U R E SER V I CE S CO M M ER CIAL CUSTOMERS CO M M ER CIAL CUSTOMERS T ES T OF N EW TEC H N O L O GIES • Orbital maneuvering • Full cargo validation • Propulsion subsystems tested • Earth Observation payload • Satellite for rent • Propulsion characterization • Laser communication – space to ground • Orbital data - center / in - orbit edge computing • Drag sail • Orbital data - center / in - orbit edge computing x x x Fast dis p ers ion O r b it c ha n ge P l ane c ha n ge x x x Added c apabili t i e s J un e 202 1 M I S S I O N 4 x x x x x x x x x J anu ary 202 1 U ndisc l osed Customer J anu ary 202 2 Several c ustomers including: Several c ustomers including:

PAGE 29 OUR CUSTOMERS D I V E R S E C U S T O M E R B A S E A C R O S S S P A C E S E G M E N T S A N D G E O G R A P H I E S T O TA L B ACK L O G 1 € 1 9mm T O TA L C O N TRACT S I N N E G O TIATION 2 T O 202 4 € 1 4 7 mm T O TA L P I P E L I N E 3 € 1 .1bn Positive customer experience driving repeat business , which makes up a significant proportion of backlog Cu s to m e r s r e po r t hig h ly p o siti ve e x per i e nc e s with ION missions to date, and rigorous launch project management is driving new business Note: Logos represent existing customers with historical revenue / backlog 1 Backlog defined as the value of executed and binding sale contracts for which revenue has not been yet recognized 2 Contracts in negotiation defined as contracts for which official proposals have been sent and are currently under negotiation with customers and/or responses to ITT currently under evaluation 3 Pipeline is defined as potential future contracts based on customers discussions and D - Orbit estimates including latest constellation planning, upcoming institutional/private programs, and extension of existing sale contracts up to 2026 Data as of December 2021 N E W SPAC E TRADIT I O N A L SPAC E INSTITUTIONAL

LAU NCHE R S WORLD - CLASS INDUSTRY PARTNERSHIPS Network of world - class partners that leverage D - Orbit’s products and services to provide end - users with reliable turnkey solutions KE Y I ND U S TRIA L P A R TNE RS D - Orbit has preferred partner relationships with major launch operators, and ION is compatible with most launch providers Agreements with other providers are under discussion PAGE 30

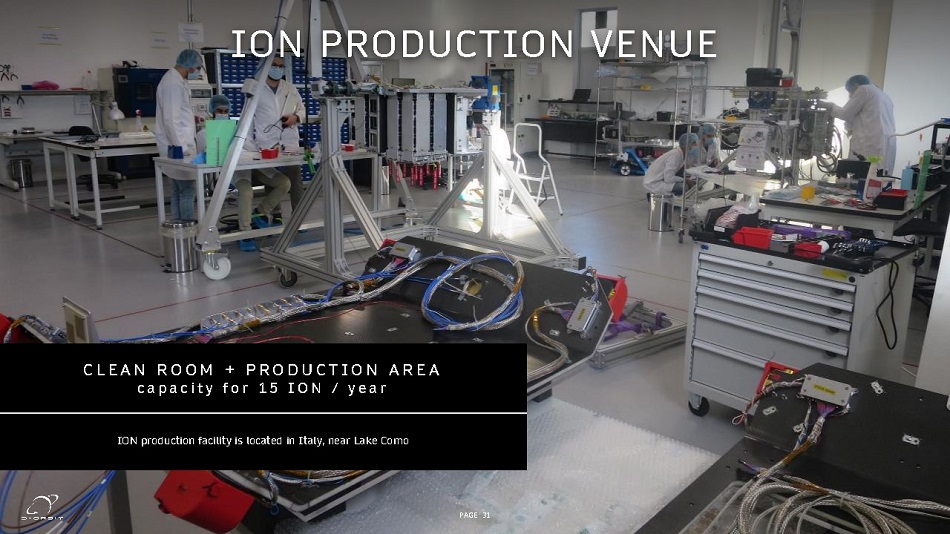

ION PRODUCTION VENUE C L E A N R O O M + P R O D U C T I O N A R E A c a p a c i t y f o r 1 5 I O N / y e a r PAGE 31 ION production facility is located in Italy, near Lake Como

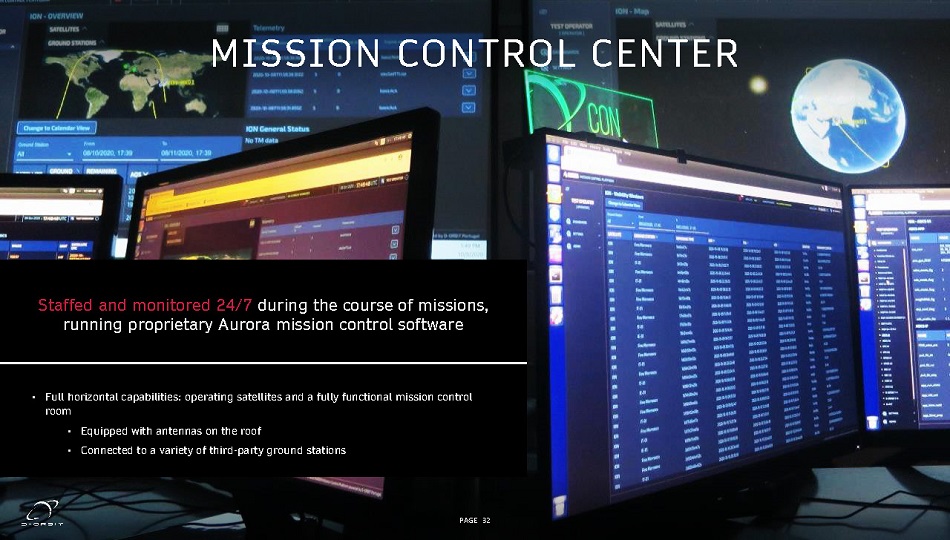

MISSION CONTROL CENTER PAGE 32 Staffed and monitored 24/7 during the course of missions, running proprietary Aurora mission control software • Full horizontal capabilities: operating satellites and a fully functional mission control room • Equipped with antennas on the roof • Connected to a variety of third - party ground stations

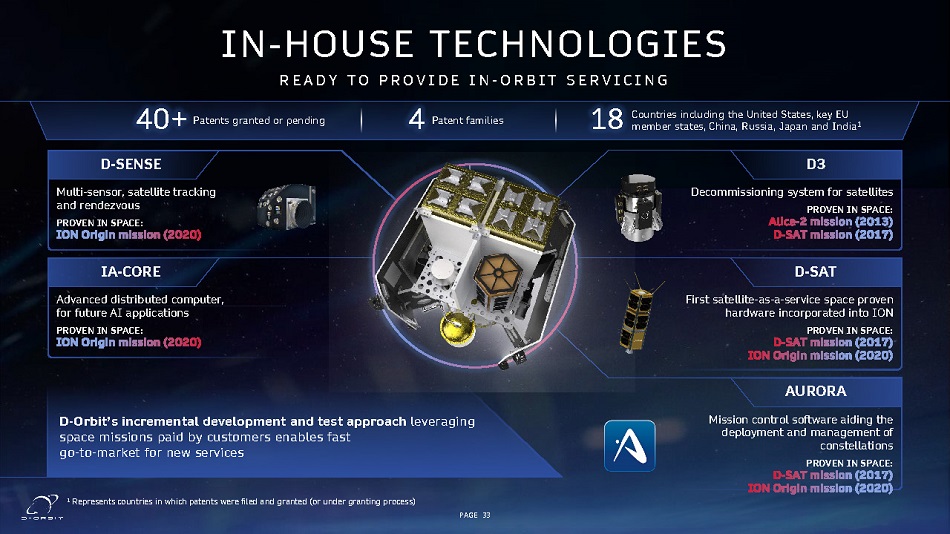

AURORA Mission control software aiding the deployment and management of constellations PR O VEN I N SP A C E: D - SAT First satellite - as - a - service space proven hardware incorporated into ION PR O VEN I N SP A C E: D3 Decommissioning system for satellites PR O VEN I N SP A C E: IN - HOUSE TECHNOLOGIES R E A D Y T O P R O V I D E I N - O R B I T S E R V I C I N G I O N 4 Pa t e n t f a m ilies Countries including the United States, key EU member states, China, Russia, Japan and India 1 18 40+ Pa t e n t s g r a n t e d o r p e n d i n g D - SENSE Multi - sensor, satellite tracking and rendezvous PR O VEN I N SP A C E: PR O VEN I N SP A C E: IA - CORE Advanced distributed computer, for future AI applications D - Orbit’s incremental development and test approach leveraging space missions paid by customers enables fast go - to - market for new services PAGE 33 1 Represents countries in which patents were filed and granted (or under granting process)

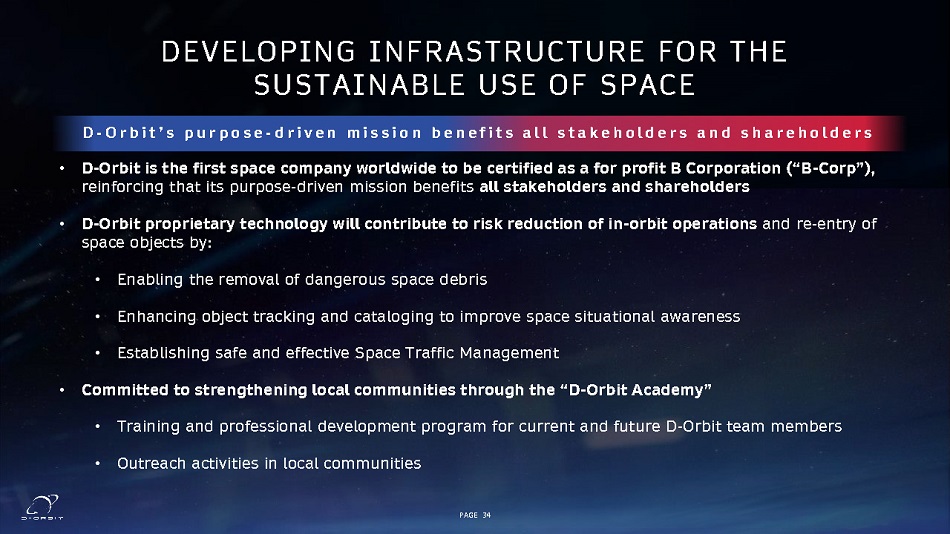

DEVELOPING INFRASTRUCTURE FOR THE SUSTAINABLE USE OF SPACE • D - Orbit is the first space company worldwide to be certified as a for profit B Corporation (“B - Corp”), reinforcing that its purpose - driven mission benefits all stakeholders and shareholders • D - Orbit proprietary technology will contribute to risk reduction of in - orbit operations and re - entry of space objects by: • Enabling the removal of dangerous space debris • Enhancing object tracking and cataloging to improve space situational awareness • Establishing safe and effective Space Traffic Management • Committed to strengthening local communities through the “D - Orbit Academy” • Training and professional development program for current and future D - Orbit team members • Outreach activities in local communities D - O r b i t ’ s p u r p o s e - d r i v e n m i s s i o n b e n e f i t s a l l s t a k e h o l d e r s a n d s h a r e h o l d e r s PAGE 34

FINANCIAL OVERVIEW PAGE 35 PHOTOGRAPH OF ION - MK02 PROPULSION (MAY - 21)

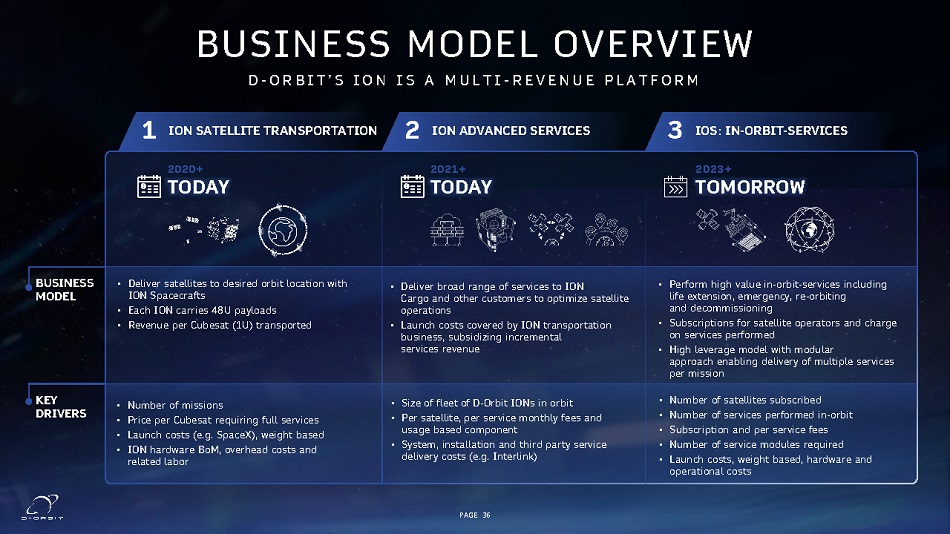

B USI N E SS MODEL KEY DR I VE RS BUSINESS MODEL OVERVIEW D - O R B I T ’ S I O N I S A M U L T I - R E V E N U E P L A T F O R M • Deliver satellites to desired orbit location with ION Spacecrafts • Each ION carries 48U payloads • Revenue per Cubesat (1U) transported T O D A Y TOMORROW I O N S ATELL I T E TRANSP O R TAT I O N 1 I O N AD VA N CED S ER VI CES I O S : I N - O R B I T - S ER VI CES 2 3 T O D A Y • Number of missions • Price per Cubesat requiring full services • Launch costs (e.g. SpaceX), weight based • ION hardware BoM, overhead costs and related labor • Deliver broad range of services to ION Cargo and other customers to optimize satellite operations • Launch costs covered by ION transportation business, subsidizing incremental services revenue • Size of fleet of D - Orbit IONs in orbit • Per satellite, per service monthly fees and usage based component • System, installation and third party service delivery costs (e.g. Interlink) • Perform high value in - orbit - services including life extension, emergency, re - orbiting and decommissioning • Subscriptions for satellite operators and charge on services performed • High leverage model with modular approach enabling delivery of multiple services per mission • Number of satellites subscribed • Number of services performed in - orbit • Subscription and per service fees • Number of service modules required • Launch costs, weight based, hardware and operational costs PAGE 36

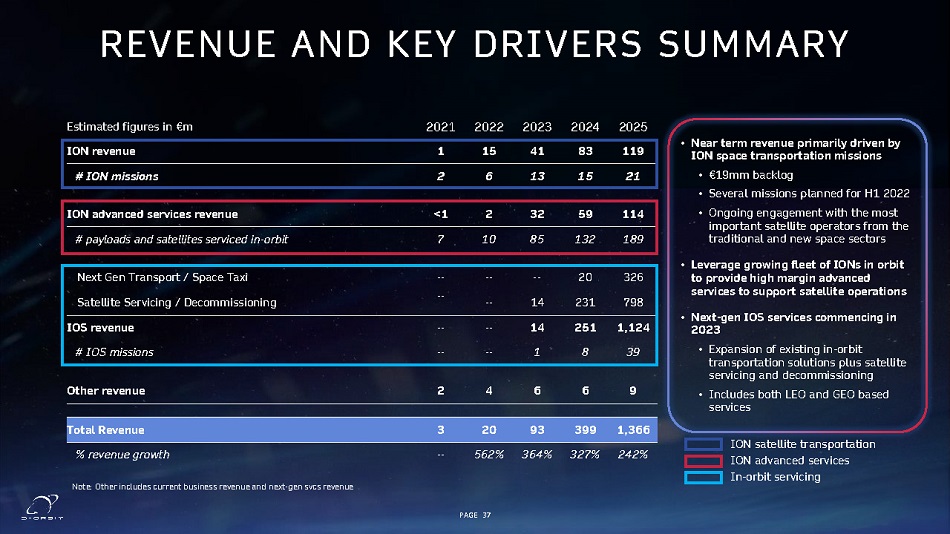

REVENUE AND KEY DRIVERS SUMMARY Estimated f igures in €m 2021 2022 2023 2024 2025 I O N re v e n u e 1 15 41 83 119 # ION missions 2 6 13 15 21 I O N adva nc e d se r vices re v e n u e <1 2 32 59 114 # payloads and satellites serviced in - orbit 7 10 85 132 189 Next Gen Transport / Space Taxi -- -- -- 20 326 Satellite Servicing / Decommissioning -- -- 14 231 798 I O S r e v e n u e -- -- 14 251 1,124 # IOS missions -- -- 1 8 39 O t h e r re v e n u e 2 4 6 6 9 To t a l Reve n u e 3 20 93 399 1,366 % revenue growth -- 562% 364% 327% 242% • N ea r te r m r e v e n u e p r i m a r i l y dr i v e n by I O N space tr a n spo r tati o n mis s i o n s • €19mm backlog • Several missions planned for H1 2022 • Ongoing engagement with the most important satellite operators from the traditional and new space sectors • L e v e r a ge g r o w in g f l ee t o f I O N s in o r bi t to p r o vide h i gh m a r gin a dv a n c e d se r vices to s u pp o r t sate l l i te o pe r a t i o n s • N e x t - gen I O S se r vices co m m e n c i n g i n 2023 • Expansion of existing in - orbit transportation solutions plus satellite servicing and decommissioning • Includes both LEO and GEO based services ION satellite transportation ION advanced services In - orbit servicing PAGE 37 Note: Other includes current business revenue and next - gen svcs revenue

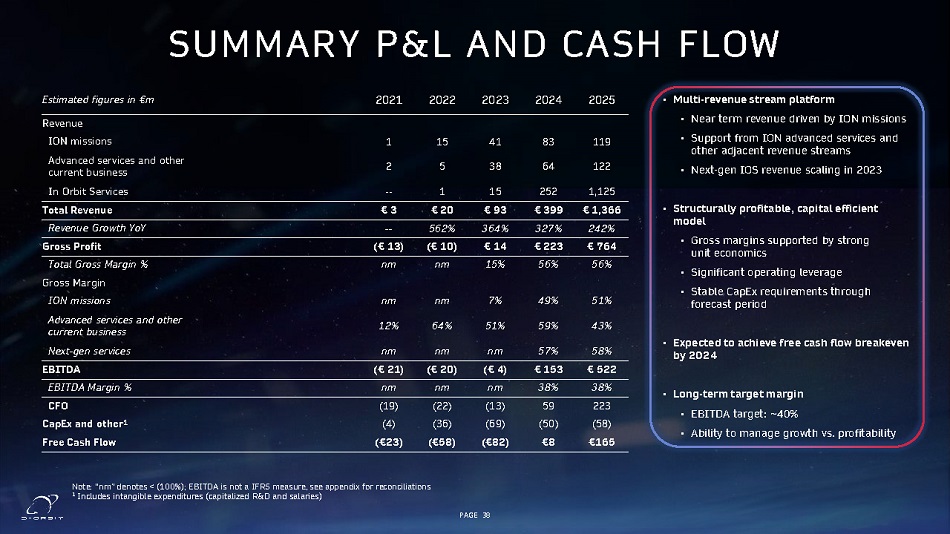

SUMMARY P&L AND CASH FLOW • Multi - r even u e s tr ea m p latf o r m • Near term revenue driven by ION missions • Support from ION advanced services and other adjacent revenue streams • Next - gen IOS revenue scaling in 2023 • S tr uct u r ally p r of ita b le, ca p i tal effi c i ent model • Gross margins supported by strong unit economics • Significant operating leverage • Stable CapEx requirements through forecast period • Ex p ected to achieve f r e e cas h flo w b r eakeven b y 2024 • Lo ng - ter m tar g e t m a r g i n • EBITDA target: ~40% • Ability to manage growth vs. profitability PAGE 38 Note: “nm” denotes < (100%); EBITDA is not a IFRS measure, see appendix for reconciliations 1 Includes intangible expenditures (capitalized R&D and salaries) Estimated f igures in €m 2021 2022 2023 2024 2025 Revenue ION missions 1 15 41 83 119 Advanced services and other current business 2 5 38 64 122 In Orbit Services -- 1 15 252 1,125 T ota l R e v en ue € 3 € 2 0 € 9 3 € 39 9 € 1,36 6 Revenue Growth YoY -- 562% 364% 327% 242% Gross P rofit (€ 13 ) (€ 10 ) € 1 4 € 22 3 € 76 4 Total Gross Margin % nm nm 15% 56% 56% Gross Margin ION missions nm nm 7% 49% 51% Advanced services and other current business 12% 64% 51% 59% 43% Next - gen services nm nm nm 57% 58% EBITDA (€ 21 ) (€ 20 ) (€ 4 ) € 15 3 € 52 2 EBITDA Margin % nm nm nm 38% 38% CFO (19) (22) (13) 59 223 Ca pE x and other 1 (4) (36) (69) (50) (58) Free Cash F l ow (€23) (€58) (€82) €8 €165

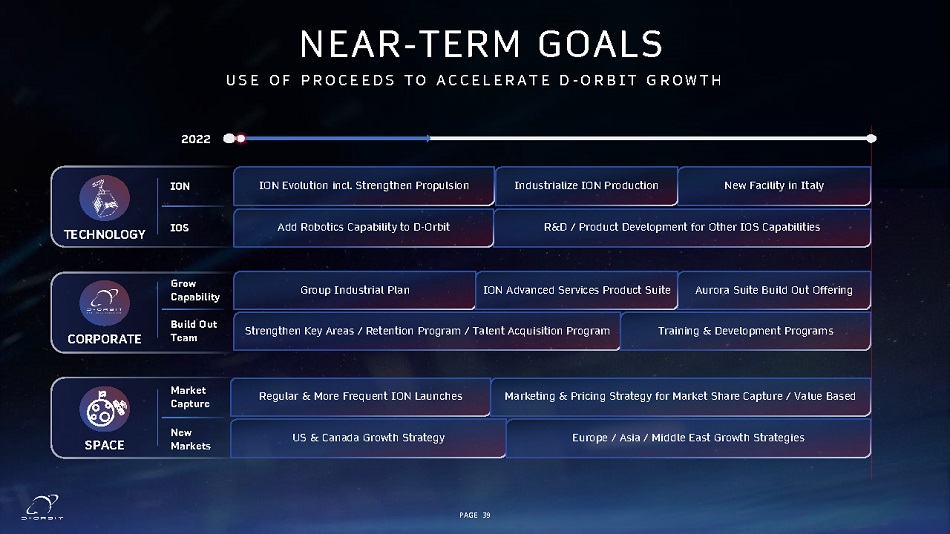

NEAR - TERM GOALS U S E O F P R O C E E D S T O A C C E L E R A T E D - O R B I T G R O W T H TECHNOLOGY S P ACE C O R P O R ATE 202 2 Grow Capability Group Industrial Plan Aurora Suite Build Out Offering ION Advanced Services Product Suite Bu il d O ut Team Strengthen Key Areas / Retention Program / Talent Acquisition Program Training & Development Programs Market Ca p tu r e Regular & More Frequent ION Launches Marketing & Pricing Strategy for Market Share Capture / Value Based New M ar k ets US & Canada Growth Strategy Europe / Asia / Middle East Growth Strategies ION New Facility in Italy Industrialize ION Production ION Evolution incl. Strengthen Propulsion IOS R&D / Product Development for Other IOS Capabilities Add Robotics Capability to D - Orbit PAGE 39

TRANSACTION & VALUATION OVERVIEW PAGE 40

83.8% 5.2% 8.4% 2.2% 0.4% D - Orbit shareholders Pre - SPAC bondholders SPAC public shareholders Founders PIPE shareholders PAGE 41 Note: USD to EUR conversion rate of 0.88 Company will maintain a customary EIP reserve amount of 10% of outstanding shares; Assumes no SPAC redemptions, $10 share price at time of merger consummation; 1 Based on 120.0mm D - Orbit shares, automatic conversion of D - Orbit pre - SPAC convertible bonds principal amount plus accrued interest (as of 12/31/21) into 7.5mm shares (convert at 80% of pre money valuation); 12.1mm of SPAC public shares, 3.1mm SPAC founder shares (2.475mm of founder shares, 0.250mm of representative shares, 0.015mm of consultant shares, 0.100mm of director shares and 0.300mm shares to Bolden Group representatives); Excludes impact of ATW convertible and public warrants given assumed $10 share price at time of merger consummation, and 0.550 PIPE shares ($5.5mm at $10 per share); 2 Cash proceeds from ATW convertible are shown net of OID of $0.9mm; 3 €51.5m euros converted at USD to EUR conversion rate of 0.88; 4 Principal amount of convertible DETAILED TRANSACTION OVERVIEW S O URCE S & U S E S PRO F O R M A VA L U A T IO N Sources Amou n t ($mm) % SPAC cash in trust $116.7 8.3% ATW convertible 2 30.0 2.1% D - Orbit pre - SPAC convertible bond 3 58.6 4.2% Stock consideration 1,200.0 85.1% PIPE Financing 5.5 0.4% T ota l s o ur ces $1,410.8 100.0% Uses Amou n t ($mm) % Purchase equity $1,200.0 85.1% Cash to balance sheet 185.8 13.2% Transaction costs 25.0 1.8% T ota l uses $1,410.8 100.0% PF O WNERSHIP SPL I T 1 Amou n t ($mm, excep t pe r share d ata) Pro forma shares outstanding 1 143.3 Share price $10.00 P r o fo r ma eq uity v a l ue $1,433 Less: cash (186) Plus: ATW convertible 4 31 P r o fo r ma fir m v a l ue $1,278 P r o fo r ma fir m v a l ue (€) € 1,12 5 Transaction multiples FV / 2024E Revenue 2.8x FV / 2025E Revenue 0.8x ($m m )

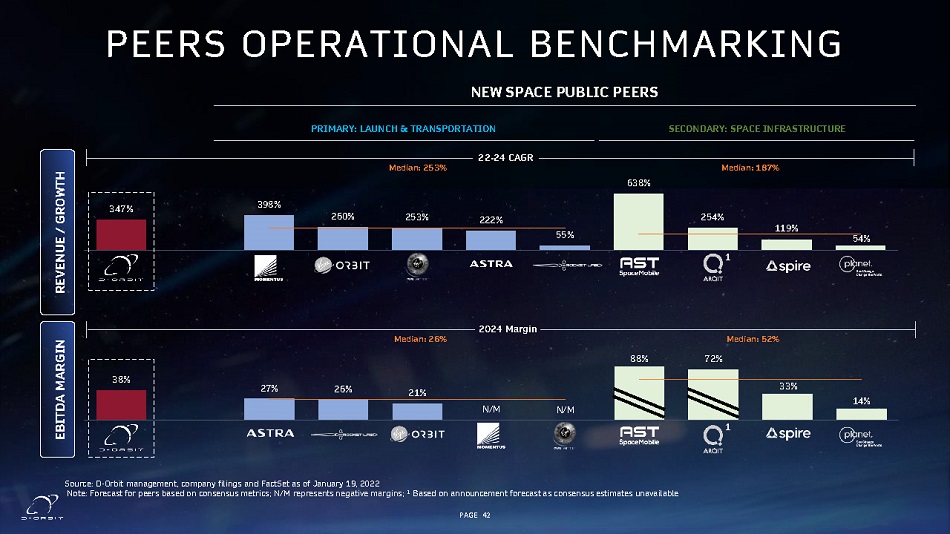

PEERS OPERATIONAL BENCHMARKING REVENUE / G R O WTH EB ITD A MA R G IN Source: D - Orbit management, company filings and FactSet as of January 19, 2022 Note: Forecast for peers based on consensus metrics; N/M represents negative margins; 1 Based on announcement forecast as consensus estimates unavailable 38% 27% 26% 21% N /M N /M 88% 72% 33% 14% M e di a n : 26 % 2024 Ma r gin 1 347% 398% 260% 253% 222% 55% 638% 254% 119% 54% M e di a n : 187 % M e di a n : 253 % 22 - 24 C AG R 1 M e di a n : 52 % PAGE 42 N E W SPAC E PUBL I C PEERS PR I MA R Y: LAUN C H & T R ANS P O R TA T I O N SE C O N D A RY: SP A CE I N F R ASTR U C TURE

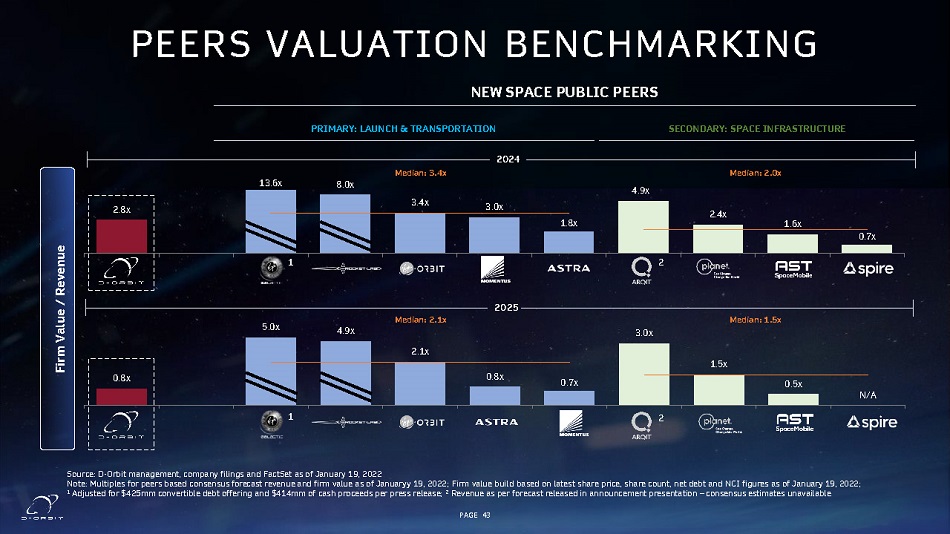

PEERS VALUATION BENCHMARKING Firm Value / R e v e nue Source: D - Orbit management, company filings and FactSet as of January 19, 2022 Note: Multiples for peers based consensus forecast revenue and firm value as of Januaryy 19, 2022; Firm value build based on latest share price, share count, net debt and NCI figures as of January 19, 2022; 1 Adjusted for $425mm convertible debt offering and $414mm of cash proceeds per press release; 2 Revenue as per forecast released in announcement presentation – consensus estimates unavailable 2.8x 13 . 6 x 8.0x 3.4x 3.0x 1.8x 4.9x 2.4x 1.6x 0.7x 0.8x 5.0x 4.9x 2.1x 0.8x 0.7x 3.0x 1.5x 0.5x N /A 1 2024 N E W SPAC E PUBL I C PEERS 2 1 M e di a n : 2 . 0 x 2025 M e di a n : 1 . 5 x M e di a n : 3 . 4 x M e di a n : 2 . 1 x 2 PR I MA R Y: LAUN C H & T R ANS P O R TA T I O N PAGE 43 SE C O N D A RY: SP A CE I N F R ASTR U C TURE

APPENDIX PAGE 44 PHOTOGRAPH OF EARTH TAKEN FROM ION ORIGIN MISSION (SEP - 20)

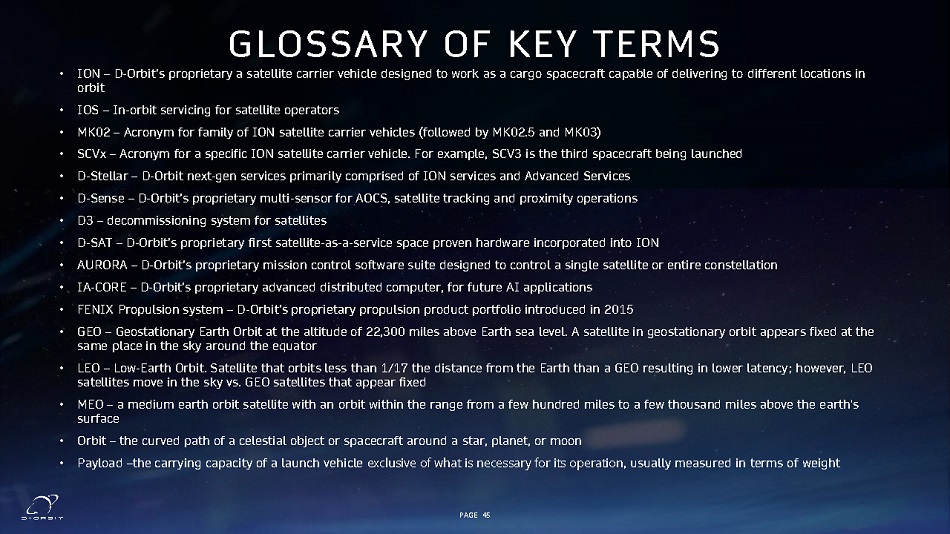

GLOSSARY OF KEY TERMS PAGE 45 • ION – D - Orbit’s proprietary a satellite carrier vehicle designed to work as a cargo spacecraft capable of delivering to different locations in orbit • IOS – In - orbit servicing for satellite operators • MK02 – Acronym for family of ION satellite carrier vehicles (followed by MK02.5 and MK03) • SCVx – Acronym for a specific ION satellite carrier vehicle. For example, SCV3 is the third spacecraft being launched • D - Stellar – D - Orbit next - gen services primarily comprised of ION services and Advanced Services • D - Sense – D - Orbit’s proprietary multi - sensor for AOCS, satellite tracking and proximity operations • D3 – decommissioning system for satellites • D - SAT – D - Orbit’s proprietary first satellite - as - a - service space proven hardware incorporated into ION • AURORA – D - Orbit’s proprietary mission control software suite designed to control a single satellite or entire constellation • IA - CORE – D - Orbit’s proprietary advanced distributed computer, for future AI applications • FENIX Propulsion system – D - Orbit’s proprietary propulsion product portfolio introduced in 2015 • GEO – Geostationary Earth Orbit at the altitude of 22,300 miles above Earth sea level. A satellite in geostationary orbit appears fixed at the same place in the sky around the equator • LEO – Low - Earth Orbit. Satellite that orbits less than 1/17 the distance from the Earth than a GEO resulting in lower latency; however, LEO satellites move in the sky vs. GEO satellites that appear fixed • MEO – a medium earth orbit satellite with an orbit within the range from a few hundred miles to a few thousand miles above the earth's surface • Orbit – the curved path of a celestial object or spacecraft around a star, planet, or moon • Payload – the carrying capacity of a launch vehicle exclusive of what is necessary for its operation , usually measured in terms of weight

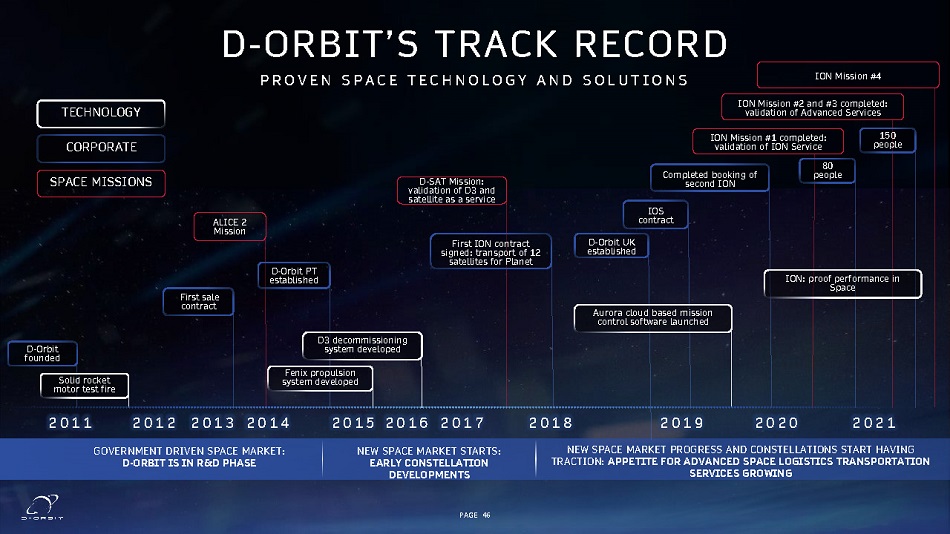

D - ORBIT’S TRACK RECORD P R O V E N S P A C E T E C H N O L O G Y A N D S O L U T I O N S D - Orbit PT e s t abl i she d Fi rst sale contract A L I C E 2 Mission D - Orbit f o u n d e d Fenix propulsion sys t em d e v e l o p e d D 3 d e c o mm i ssi o n i n g system developed D - SAT Mission: validation of D3 and satellite as a service First ION contract signed: transport of 12 satellites for Planet D - Orbit UK e s t abl i she d IOS contract Aurora cloud based mission control software launched se c o n d I ON ION Mission #1 completed: validation of ION Service 80 C o mp l e te d b ook i n g o f p e o p le GOVERNMENT DRIVEN SPACE MARKET: D - O R B I T I S I N R & D P H A S E NEW SPACE MARKET STARTS: EA R L Y CO N S T EL L A T I O N DEVELOPMENTS ION Mission #2 and #3 completed: validation of Advanced Services 150 p e o p le 2018 2019 2020 2021 NEW SPACE MARKET PROGRESS AND CONSTELLATIONS START HAVING TRACTION: APPETITE FOR ADVANCED SPACE LOGISTICS TRANSPORTATION SER V I CE S GR O W I N G 2015 2016 2017 Solid rocket motor test fire 2011 2012 2013 2014 CORPORATE TECHNOLOGY SPACE MISSIONS ION: proof performance in S p ace ION Mission #4 PAGE 46

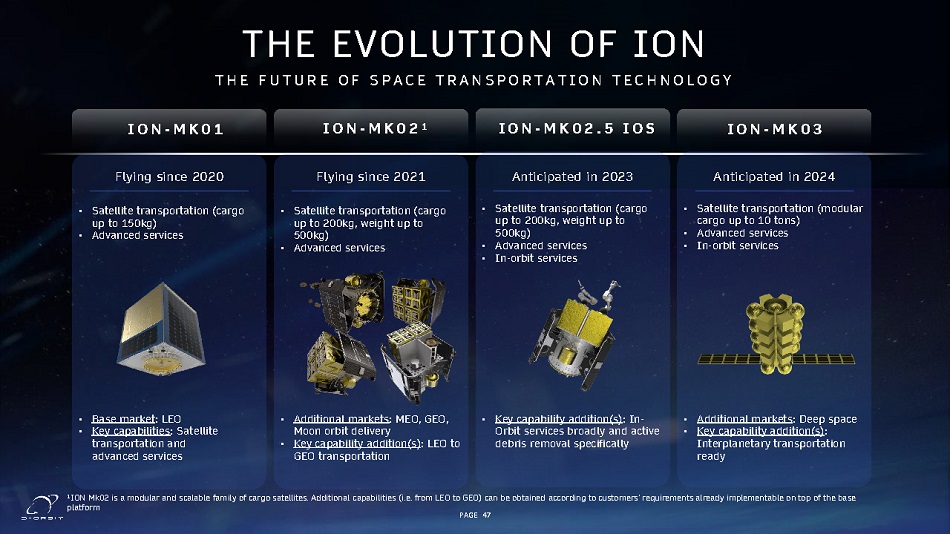

THE EVOLUTION OF ION T H E F U T U R E O F S P A C E T R A N S P O R T A T I O N T E C H N O L O G Y Flying since 2021 • Satellite transportation (cargo up to 200kg, weight up to 500kg) • Advanced services • Additional markets : MEO, GEO, Moon orbit delivery • Key capability addition(s) : LEO to GEO transportation Flying since 2020 • Satellite transportation (cargo up to 150kg) • Advanced services • Base market : LEO • Key capabilities : Satellite transportation and advanced services 1 ION Mk02 is a modular and scalable family of cargo satellites. Additional capabilities (i.e. from LEO to GEO) can be obtained ac cording to customers’ requirements already implementable on top of the base platform Anticipated in 2024 • Satellite transportation (modular cargo up to 10 tons) • Advanced services • In - orbit services • Additional markets : Deep space • Key capability addition(s) : Interplanetary transportation ready Anticipated in 2023 • Satellite transportation (cargo up to 200kg, weight up to 500kg) • Advanced services • In - orbit services • Key capability addition(s) : In - Orbit services broadly and active debris removal specifically PAGE 47

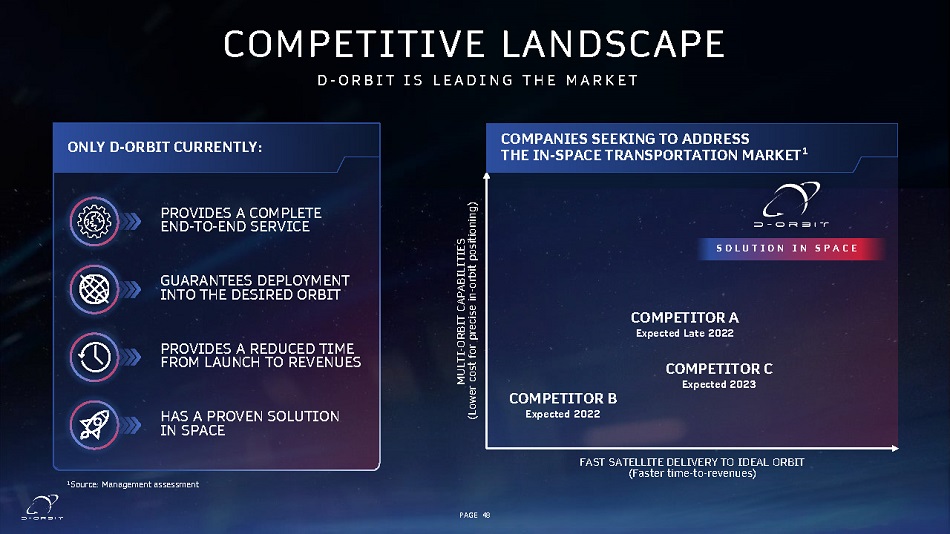

O N L Y D - O RBI T CURR E N T L Y: COMPETITIVE LANDSCAPE D - O R B I T I S L E A D I N G T H E M A R K E T MULTI - ORBIT CAPABILITIES (Lower cost for precise in - orbit positioning) FAST SATELLITE DELIVERY TO IDEAL ORBIT (Faster time - to - revenues) GUARANTEES DEPLOYMENT INTO THE DESIRED ORBIT PROVIDES A REDUCED TIME FROM LAUNCH TO REVENUES HAS A PROVEN SOLUTION IN SPACE PROVIDES A COMPLETE END - TO - END SERVICE 1 Source: Management assessment S O L U T I O N I N S P A C E C O M PAN I E S SE EKI N G T O ADD R ES S T HE I N - SPAC E T RANSPO RTAT I O N M AR K ET¹ PAGE 48 C O M PET ITOR A Exp ec ted L ate 202 2 C O M PET ITOR B Exp ec ted 202 2 C O M PET ITOR C Ex p e c ted 202 3

EBITDA AND FCF RECONCILIATIONS PAGE 49 Figures in €m 2021 2022 2023 2024 2025 Revenue € 3 € 20 € 93 € 399 € 1,366 Less: COGS (16) (30) (80) (176) (601) Less: OpEx (inclusive of D&A) (10) (17) (38) (101) (286) Opera t i ng i nco m e (€ 23) (€ 27) (€ 25) € 122 € 478 Plus: D&A 2 7 21 32 43 EBITDA (€ 21) (€ 20) (€ 4) € 153 € 522 Cash Flow f r om Opera t i ons (€ 19) (€ 22) (€ 13) € 59 € 223 Less: CapEx and other 1 (4) (36) (69) (50) (58) Free Cash Flow (€ 23) (€ 58) (€ 82) € 8 € 165 1 Includes intangible expenditures (capitalized R&D and salaries)

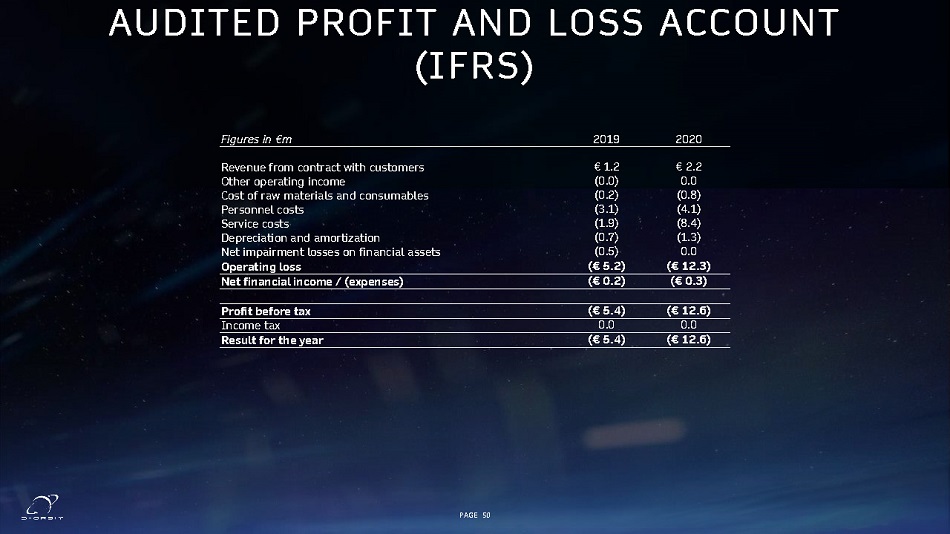

AUDITED PROFIT AND LOSS ACCOUNT (IFRS) PAGE 50 Figures in €m 2019 2020 Revenue from contract with customers € 1.2 € 2.2 Other operating income (0.0) 0.0 Cost of raw materials and consumables (0.2) (0.8) Personnel costs (3.1) (4.1) Service costs (1.9) (8.4) Depreciation and amortization (0.7) (1.3) Net impairment losses on financial assets (0.5) 0.0 Opera t i ng l oss (€ 5.2) (€ 12.3) N e t fin a nc i a l income / ( e xpenses) (€ 0.2) (€ 0.3) Pro f it b e fo r e tax (€ 5.4) (€ 12.6) Income tax 0.0 0.0 Res u l t for t h e y e a r (€ 5.4) (€ 12.6)

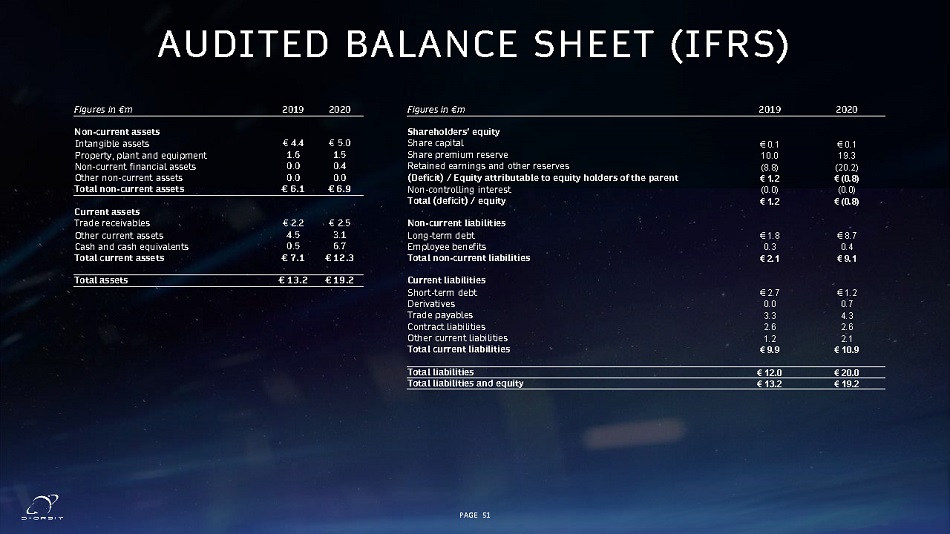

AUDITED BALANCE SHEET (IFRS) PAGE 51 Figures in €m 2019 2020 No n - cu r r e nt a ss e t s Intangible assets € 4.4 € 5.0 Property, plant and equipment 1.6 1.5 Non - current financial assets 0.0 0.4 Other non - current assets 0.0 0.0 To t a l n o n - cu r r e nt a ss e t s € 6 . 1 € 6 . 9 C urr e nt a ss e t s Trade receivables € 2.2 € 2.5 Other current assets 4.5 3.1 Cash and cash equivalents 0.5 6.7 To t a l cu r r e nt asse t s € 7 . 1 € 12.3 To t a l a ss e t s € 13.2 € 19.2 Figures in €m 2019 2020 Sha r e h olde rs' equ i t y Share capital € 0.1 € 0.1 Share premium reserve 10.0 19.3 Retained earnings and other reserves (8.8) (20.2) ( D ef i c i t ) / Eq u i t y a tt ri b u tab le t o eq u i t y h o ld e rs o f t h e pa r ent € 1.2 € (0.8) Non - controlling interest (0.0) (0.0) To t a l ( def ici t ) / eq u i t y € 1.2 € (0.8) No n - cu r r e nt l i a bil i t i e s Long - term debt € 1.8 € 8.7 Employee benefits 0.3 0.4 To t a l n o n - cu r r e nt l i a bil i t i e s € 2.1 € 9.1 C urr e nt l i a bil i t i e s Short - term debt € 2.7 € 1.2 Derivatives 0.0 0.7 Trade payables 3.3 4.3 Contract liabilities 2.6 2.6 Other current liabilities 1.2 2.1 To t a l cu r r e nt l i a bil i t i e s € 9.9 € 10.9 To t a l l i a bil i t i e s € 12.0 € 20.0 To t a l l i a bil i t i e s a nd equ i t y € 13.2 € 19.2

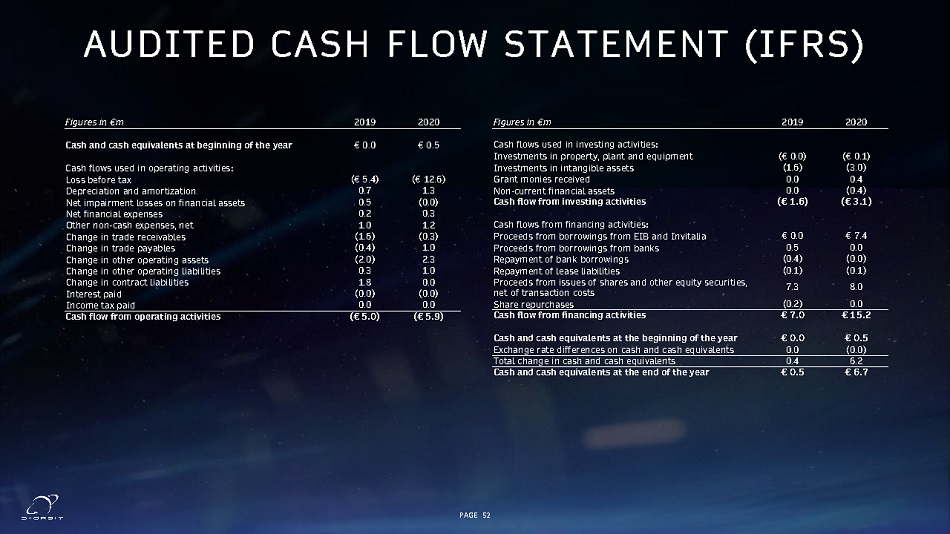

AUDITED CASH FLOW STATEMENT (IFRS) PAGE 52 Figures in €m 2019 2020 Cash and cash equivalents at beginning of the year € 0.0 € 0.5 Cash flows used in operating activities: Loss before tax (€ 5.4) (€ 12.6) Depreciation and amortization 0.7 1.3 Net impairment losses on financial assets 0.5 (0.0) Net financial expenses 0.2 0.3 Other non - cash expenses, net 1.0 1.2 Change in trade receivables (1.6) (0.3) Change in trade payables (0.4) 1.0 Change in other operating assets (2.0) 2.3 Change in other operating liabilities 0.3 1.0 Change in contract liabilities 1.8 0.0 Interest paid (0.0) (0.0) Income tax paid 0.0 0.0 C a sh flo w f r o m ope r a t i ng a c t i vi t i e s (€ 5 . 0) (€ 5 . 9) Figures in €m 2019 2020 Cash flows used in investing activities: Investments in property, plant and equipment (€ 0.0) (€ 0.1) Investments in intangible assets (1.6) (3.0) Grant monies received 0.0 0.4 Non - current financial assets 0.0 (0.4) C a sh flo w f r o m i nv e s t i ng a c t i vi t i e s (€ 1 . 6) (€ 3 . 1) Cash flows from financing activities: Proceeds from borrowings from EIB and Invitalia € 0.0 € 7.4 Proceeds from borrowings from banks 0.5 0.0 Repayment of bank borrowings (0.4) (0.0) Repayment of lease liabilities (0.1) (0.1) Proceeds from issues of shares and other equity securities, net of transaction costs 7.3 8.0 Share repurchases (0.2) 0.0 C a sh flo w f r o m f in a ncing a c t i vi t i e s € 7 . 0 € 15.2 Cash and cash equivalents at the beginning of the year € 0 . 0 € 0 . 5 Exchange rate differences on cash and cash equivalents 0.0 (0.0) Total change in cash and cash equivalents 0.4 6.2 C a sh a nd c a sh eq u i v a len t s a t t he e nd o f t he y ea r € 0 . 5 € 6 . 7

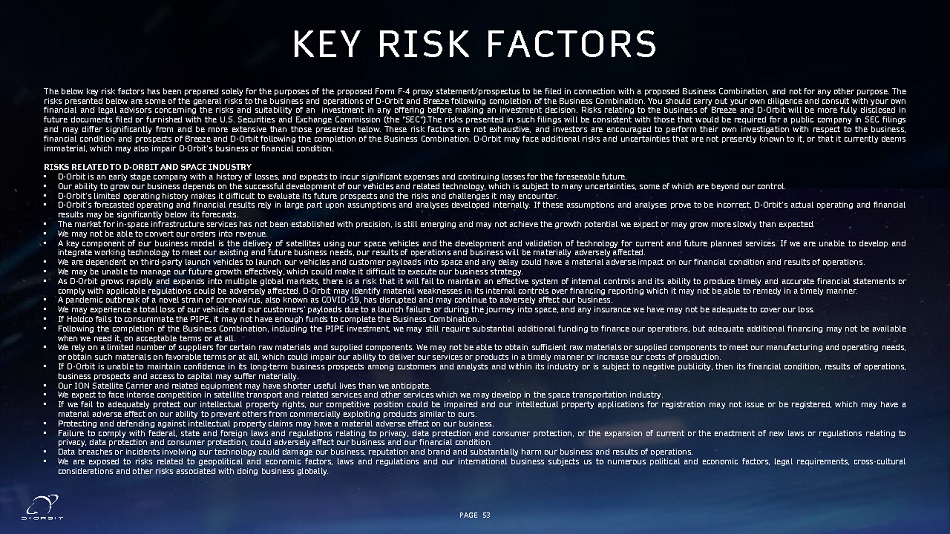

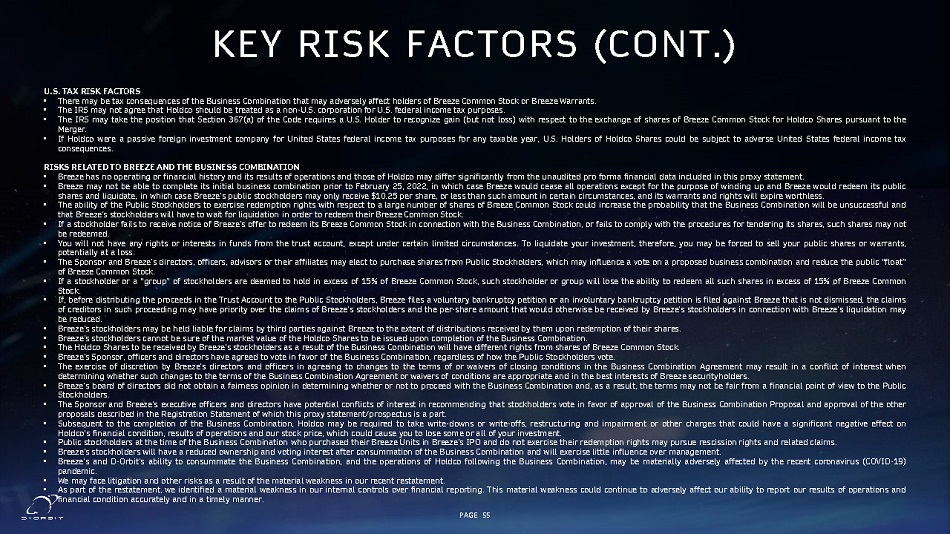

The below key risk factors has been prepared solely for the purposes of the proposed Form F - 4 proxy statement/prospectus to be filed in connection with a proposed Business Combination, and not for any other purpose . The risks presented below are some of the general risks to the business and operations of D - Orbit and Breeze following completion of the Business Combination . You should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in any offering before making an investment decision . Risks relating to the business of Breeze and D - Orbit will be more fully disclosed in future documents filed or furnished with the U . S . Securities and Exchange Commission (the "SEC") . The risks presented in such filings will be consistent with those that would be required for a public company in SEC filings and may differ significantly from and be more extensive than those presented below . These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of Breeze and D - Orbit following the completion of the Business Combination . D - Orbit may face additional risks and uncertainties that are not presently known to it, or that it currently deems immaterial, which may also impair D - Orbit’s business or financial condition . RISKS RELATED TO D - ORBIT AND SPACE INDUSTRY • D - Orbit is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the foreseeable future. • Our ability to grow our business depends on the successful development of our vehicles and related technology, which is subject to many uncertainties, some of which are beyond our control. • D - Orbit’s limited operating history makes it difficult to evaluate its future prospects and the risks and challenges it may encounter. • D - Orbit’s forecasted operating and financial results rely in large part upon assumptions and analyses developed internally. If these assumptions and analyses prove to be incorrect, D - Orbit’s actual operating and financial results may be significantly below its forecasts. • The market for in - space infrastructure services has not been established with precision, is still emerging and may not achieve the growth potential we expect or may grow more slowly than expected. • We may not be able to convert our orders into revenue. • A key component of our business model is the delivery of satellites using our space vehicles and the development and validation of technology for current and future planned services. If we are unable to develop and integrate working technology to meet our existing and future business needs, our results of operations and business will be materially adversely affected. • We are dependent on third - party launch vehicles to launch our vehicles and customer payloads into space and any delay could have a material adverse impact on our financial condition and results of operations. • We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy. • As D - Orbit grows rapidly and expands into multiple global markets, there is a risk that it will fail to maintain an effective system of internal controls and its ability to produce timely and accurate financial statements or comply with applicable regulations could be adversely affected. D - Orbit may identify material weaknesses in its internal controls over financing reporting which it may not be able to remedy in a timely manner. • A pandemic outbreak of a novel strain of coronavirus, also known as COVID - 19, has disrupted and may continue to adversely affect our business. • We may experience a total loss of our vehicle and our customers’ payloads due to a launch failure or during the journey into space, and any insurance we have may not be adequate to cover our loss. • If Holdco fails to consummate the PIPE, it may not have enough funds to complete the Business Combination. • Following the completion of the Business Combination, including the PIPE investment, we may still require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on acceptable terms or at all. • We rely on a limited number of suppliers for certain raw materials and supplied components. We may not be able to obtain sufficient raw materials or supplied components to meet our manufacturing and operating needs, or obtain such materials on favorable terms or at all, which could impair our ability to deliver our services or products in a timely manner or increase our costs of production. • If D - Orbit is unable to maintain confidence in its long - term business prospects among customers and analysts and within its industry or is subject to negative publicity, then its financial condition, results of operations, business prospects and access to capital may suffer materially. • Our ION Satellite Carrier and related equipment may have shorter useful lives than we anticipate. • We expect to face intense competition in satellite transport and related services and other services which we may develop in the space transportation industry. • If we fail to adequately protect our intellectual property rights, our competitive position could be impaired and our intellectual property applications for registration may not issue or be registered, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours. • Protecting and defending against intellectual property claims may have a material adverse effect on our business. • Failure to comply with federal, state and foreign laws and regulations relating to privacy, data protection and consumer protection, or the expansion of current or the enactment of new laws or regulations relating to privacy, data protection and consumer protection, could adversely affect our business and our financial condition. • Data breaches or incidents involving our technology could damage our business, reputation and brand and substantially harm our business and results of operations. • We are exposed to risks related to geopolitical and economic factors, laws and regulations and our international business subjects us to numerous political and economic factors, legal requirements, cross - cultural considerations and other risks associated with doing business globally. PAGE 53 KEY RISK FACTORS

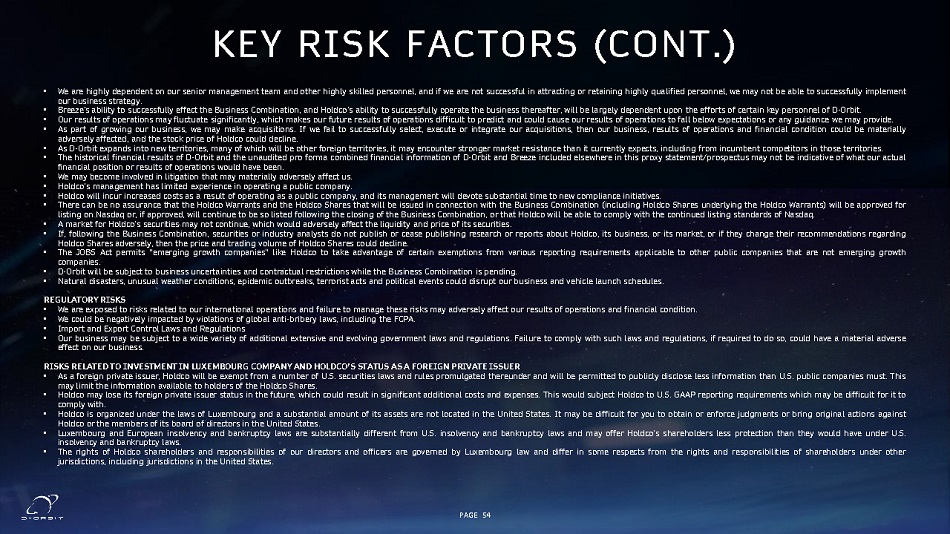

• We are highly dependent on our senior management team and other highly skilled personnel, and if we are not successful in attracting or retaining highly qualified personnel, we may not be able to successfully implement our business strategy. • Breeze’s ability to successfully effect the Business Combination, and Holdco’s ability to successfully operate the business thereafter, will be largely dependent upon the efforts of certain key personnel of D - Orbit. • Our results of operations may fluctuate significantly, which makes our future results of operations difficult to predict and could cause our results of operations to fall below expectations or any guidance we may provide. • As part of growing our business, we may make acquisitions. If we fail to successfully select, execute or integrate our acquisitions, then our business, results of operations and financial condition could be materially adversely affected, and the stock price of Holdco could decline. • As D - Orbit expands into new territories, many of which will be other foreign territories, it may encounter stronger market resistance than it currently expects, including from incumbent competitors in those territories. • The historical financial results of D - Orbit and the unaudited pro forma combined financial information of D - Orbit and Breeze included elsewhere in this proxy statement/prospectus may not be indicative of what our actual financial position or results of operations would have been. • We may become involved in litigation that may materially adversely affect us. • Holdco’s management has limited experience in operating a public company. • Holdco will incur increased costs as a result of operating as a public company, and its management will devote substantial time to new compliance initiatives. • There can be no assurance that the Holdco Warrants and the Holdco Shares that will be issued in connection with the Business Combination (including Holdco Shares underlying the Holdco Warrants) will be approved for listing on Nasdaq or, if approved, will continue to be so listed following the closing of the Business Combination, or that Holdco will be able to comply with the continued listing standards of Nasdaq. • A market for Holdco’s securities may not continue, which would adversely affect the liquidity and price of its securities. • If, following the Business Combination, securities or industry analysts do not publish or cease publishing research or reports about Holdco, its business, or its market, or if they change their recommendations regarding Holdco Shares adversely, then the price and trading volume of Holdco Shares could decline. • The JOBS Act permits “emerging growth companies” like Holdco to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies. • D - Orbit will be subject to business uncertainties and contractual restrictions while the Business Combination is pending. • Natural disasters, unusual weather conditions, epidemic outbreaks, terrorist acts and political events could disrupt our business and vehicle launch schedules. REGU L ATO R Y RIS K S • We are exposed to risks related to our international operations and failure to manage these risks may adversely affect our results of operations and financial condition. • We could be negatively impacted by violations of global anti - bribery laws, including the FCPA. • Import and Export Control Laws and Regulations • Our business may be subject to a wide variety of additional extensive and evolving government laws and regulations. Failure to comply with such laws and regulations, if required to do so, could have a material adverse effect on our business. RISKS RELATED TO INVESTMENT IN LUXEMBOURG COMPANY AND HOLDCO’S STATUS AS A FOREIGN PRIVATE ISSUER • As a foreign private issuer, Holdco will be exempt from a number of U.S. securities laws and rules promulgated thereunder and will be permitted to publicly disclose less information than U.S. public companies must. This may limit the information available to holders of the Holdco Shares. • Holdco may lose its foreign private issuer status in the future, which could result in significant additional costs and expenses. This would subject Holdco to U.S. GAAP reporting requirements which may be difficult for it to comply with. • Holdco is organized under the laws of Luxembourg and a substantial amount of its assets are not located in the United States. It may be difficult for you to obtain or enforce judgments or bring original actions against Holdco or the members of its board of directors in the United States. • Luxembourg and European insolvency and bankruptcy laws are substantially different from U.S. insolvency and bankruptcy laws and may offer Holdco’s shareholders less protection than they would have under U.S. insolvency and bankruptcy laws. • The rights of Holdco shareholders and responsibilities of our directors and officers are governed by Luxembourg law and differ in some respects from the rights and responsibilities of shareholders under other jurisdictions, including jurisdictions in the United States. PAGE 54 KEY RISK FACTORS (CONT.)

U . S . TAX RIS K F AC TORS • There may be tax consequences of the Business Combination that may adversely affect holders of Breeze Common Stock or Breeze Warrants. • The IRS may not agree that Holdco should be treated as a non - U.S. corporation for U.S. federal income tax purposes. • The IRS may take the position that Section 367(a) of the Code requires a U.S. Holder to recognize gain (but not loss) with respect to the exchange of shares of Breeze Common Stock for Holdco Shares pursuant to the Merger. • If Holdco were a passive foreign investment company for United States federal income tax purposes for any taxable year, U.S. Holders of Holdco Shares could be subject to adverse United States federal income tax consequences. RISKS RELATED TO BREEZE AND THE BUSINESS COMBINATION • Breeze has no operating or financial history and its results of operations and those of Holdco may differ significantly from the unaudited pro forma financial data included in this proxy statement. • Breeze may not be able to complete its initial business combination prior to February 25, 2022, in which case Breeze would cease all operations except for the purpose of winding up and Breeze would redeem its public shares and liquidate, in which case Breeze’s public stockholders may only receive $10.25 per share, or less than such amount in certain circumstances, and its warrants and rights will expire worthless. • The ability of the Public Stockholders to exercise redemption rights with respect to a large number of shares of Breeze Common Stock could increase the probability that the Business Combination will be unsuccessful and that Breeze’s stockholders will have to wait for liquidation in order to redeem their Breeze Common Stock. • If a stockholder fails to receive notice of Breeze’s offer to redeem its Breeze Common Stock in connection with the Business Combination, or fails to comply with the procedures for tendering its shares, such shares may not be redeemed. • You will not have any rights or interests in funds from the trust account, except under certain limited circumstances. To liquidate your investment, therefore, you may be forced to sell your public shares or warrants, potentially at a loss. • The Sponsor and Breeze’s directors, officers, advisors or their affiliates may elect to purchase shares from Public Stockholders, which may influence a vote on a proposed business combination and reduce the public “float” of Breeze Common Stock. • If a stockholder or a “group” of stockholders are deemed to hold in excess of 15 % of Breeze Common Stock, such stockholder or group will lose the ability to redeem all such shares in excess of 15 % of Breeze Common Stock . • If, before distributing the proceeds in the Trust Account to the Public Stockholders, Breeze files a voluntary bankruptcy petition or an involuntary bankruptcy petition is filed against Breeze that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of Breeze’s stockholders and the per - share amount that would otherwise be received by Breeze’s stockholders in connection with Breeze’s liquidation may be reduced . • Breeze’s stockholders may be held liable for claims by third parties against Breeze to the extent of distributions received by them upon redemption of their shares . • Breeze’s stockholders cannot be sure of the market value of the Holdco Shares to be issued upon completion of the Business Combination . • The Holdco Shares to be received by Breeze’s stockholders as a result of the Business Combination will have different rights from shares of Breeze Common Stock . • Breeze’s Sponsor, officers and directors have agreed to vote in favor of the Business Combination, regardless of how the Public Stockholders vote . • The exercise of discretion by Breeze’s directors and officers in agreeing to changes to the terms of or waivers of closing conditions in the Business Combination Agreement may result in a conflict of interest when determining whether such changes to the terms of the Business Combination Agreement or waivers of conditions are appropriate and in the best interests of Breeze securityholders. • Breeze’s board of directors did not obtain a fairness opinion in determining whether or not to proceed with the Business Combination and, as a result, the terms may not be fair from a financial point of view to the Public Stockholders. • The Sponsor and Breeze’s executive officers and directors have potential conflicts of interest in recommending that stockholders vote in favor of approval of the Business Combination Proposal and approval of the other proposals described in the Registration Statement of which this proxy statement/prospectus is a part. • Subsequent to the completion of the Business Combination, Holdco may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on Holdco’s financial condition, results of operations and our stock price, which could cause you to lose some or all of your investment. • Public stockholders at the time of the Business Combination who purchased their Breeze Units in Breeze’s IPO and do not exercise their redemption rights may pursue rescission rights and related claims. • Breeze’s stockholders will have a reduced ownership and voting interest after consummation of the Business Combination and will exercise little influence over management. • Breeze’s and D - Orbit’s ability to consummate the Business Combination, and the operations of Holdco following the Business Combination, may be materially adversely affected by the recent coronavirus (COVID - 19) pandemic. • We may face litigation and other risks as a result of the material weakness in our recent restatement. • As part of the restatement, we identified a material weakness in our internal controls over financial reporting. This material weakness could continue to adversely affect our ability to report our results of operations and financial condition accurately and in a timely manner. PAGE 55 KEY RISK FACTORS (CONT.)

PHOTOGRAPH OF PROPULSION SYSTEM ION – MK02 SCV 2 (MAY - 21) PAGE 56

PAGE 57