Exhibit 99.2

Investor Presentation YD BIOPHARMA LIMITED September 2024

©2024, YD BIOPHARMA ., LTD. Disclaimer YD BIOPHARMA This investor presentation (this “ Presentation ”) has been prepared for use in connection with a potential business combination (the “ Business Combination ”) between Breeze Holdings Acquisition Corp . (“ SPAC ”) and YD Biopharma Limited (” YD Biopharma ” or “ YD BIO ” or “ Target ” and together with SPAC, the “ Parties ”) . This Presentation is for information purposes only and may not be reproduced or redistributed, in whole or in part, without the prior written consent of the Parties . This Presentation does not and, if hereafter supplemented, will not be all inclusive or contain all of the information that may be required to evaluate the Business Combination . The Parties reserve the right to update or supplement the information provided in this Presentation but disclaim any obligation to do so . You should not definitively rely upon it or use it to form the definitive basis for any decision, contract, commitment, or action whatsoever, with respect to the Business Combination or otherwise . You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of the Parties and the Business Combination . To the fullest extent permitted by law, in no circumstances will either Party or any of their respective affiliates, officers, directors, employees, representatives, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith . The information in this Presentation is highly confidential . This Presentation shall remain the property of the Parties, and the distribution or disclosure of this Presentation by you to any other person is unauthorized except to your affiliates, officers, directors, employees, representatives, advisors or agents who have a need to receive this Presentation in connection with evaluating the Business Combination and who have been advised of, and have agreed to abide by, the confidentiality obligations described herein . Any unauthorized disclosure, forwarding, reproduction or photocopying, or alteration of the contents, of this Presentation or any portion thereof is prohibited . You shall keep this Presentation and its contents confidential, shall not use this Presentation or its contents for any purpose other than as expressly authorized by the Parties and shall be required to return or destroy all copies of this Presentation or portions thereof in your possession promptly following a request by the Parties . By accepting delivery of this Presentation, you are deemed to agree to the foregoing confidentiality requirements . Any unauthorized distribution or reproduction of any part of this Presentation may result in a violation of the United States Securities Act of 1933 , as amended (the “ Act ”) . Neither Party nor any of their respective affiliates, officers, directors, employees, representatives, advisors or agents makes any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this Presentation or any oral information provided in connection herewith, or any data it generates, or that any transaction has been or may be effected on the terms or in the manner stated or implied by this Presentation, or as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any, and the Parties accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information . The Parties and their respective affiliates, officers, directors, employees, representatives, advisors, and agents expressly disclaim any and all liability which may be based on this Presentation and any errors therein or omissions therefrom . This Presentation and the information contained herein do not constitute : (a) (i) a solicitation of a proxy, consent or authorization with respect to any securities in respect of the Business Combination or (ii) an offer to sell or exchange or the solicitation of an offer to buy or exchange any security, commodity or instrument or related derivative, nor shall there be any sale of any securities, commodities or instruments or related derivatives in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction or (b) an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies . You should not construe the contents of this Presentation as legal, regulatory, tax, accounting or investment advice or a recommendation . We recommend that you seek independent third party legal, regulatory, business, financial, accounting and tax advice regarding the contents of this Presentation . This Presentation does not constitute and should not be considered as any form of financial or fairness opinion or recommendation by either Party or any of their respective affiliates, officers, directors, employees, representatives, advisors or agents . This Presentation is not a research report . By accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision . This Presentation is for distribution only to persons reasonably believed to be sufficiently expert to understand the risks involved in the Business Combination . You should determine the economic risks and merits, as well as the legal, regulatory, business, financial, accounting and tax characterizations and consequences of the Business Combination and independently determine that you are able to assume the risks associated with the foregoing . By accepting delivery of this Presentation, you acknowledge that you have been advised that (a) neither Party is providing you any legal, regulatory, business, financial, accounting or tax advice, (b) you understand that there will be legal, regulatory, business, financial, accounting and tax risks associated with the Business Combination, (c) you should receive legal, regulatory, business, financial, accounting and tax advice from advisors with appropriate expertise to assess relevant risks and (d) you should apprise senior management in your organization as to the legal, regulatory, business, financial, accounting and tax advice (and, if applicable, risks) associated with the Business Combination and these disclaimers as to these matters . You confirm that you are not relying upon the information contained herein to make any decision . NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE OR TERRITORIAL SECURITIES COMMISSION OR ANY OTHER REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED OF THIS PRESENTATION OR DETERMINED THAT IT IS TRUTHFUL OR COMPLETE . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . 2

©2024, YD BIOPHARMA ., LTD. Disclaimer YD BIOPHARMA Forward - Looking Statements This Presentation contains certain “forward - looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 , Section 27 A of the Act and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact contained in this Presentation, including, but not limited to, statements as to the transactions contemplated by the Business Combination and related agreements, the benefits or timing of the Business Combination, the effects of regulations, projected future results of operations and financial position, revenue and other metrics, planned products and services, business strategy and plans, objectives of management for future operations, market size and growth opportunities, competitive position and technological and market trends, are forward - looking statements . Some of these forward - looking statements can be identified by the use of forward - looking words, including, but not limited to, “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast,” “strategy,” and “opportunity” or the negatives of these terms or variations of them or similar expressions . All forward - looking statements are subject to risks, uncertainties, and other factors (including those which are beyond the control of either Party) which could cause actual results to differ materially from those expressed or implied by such forward - looking statements . All forward - looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by the Parties, are inherently uncertain, and many factors may cause the actual results to differ materially from current expectations, which include, but are not limited to : (a) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreements executed by the Parties with respect to the Business Combination ; (b) the outcome of any legal proceedings that may be instituted against either Party or the combined company, or any of their respective directors or officers, following the announcement of the Business Combination and the transactions contemplated thereby ; (c) the inability to complete the Business Combination due to the failure to obtain approval of the stockholders of either Party, or to satisfy other conditions to closing of the Business Combination ; (d) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining applicable regulatory approvals for the Business Combination ; (e) the ability to meet or maintain the Nasdaq Stock Market’s listing standards prior to or following the consummation of the Business Combination ; (f) the risk that the announcement or consummation of the Business Combination disrupts current plans and operations of either Party ; (g) the inability to recognize the anticipated benefits of the Business Combination ; (h) the ability of the combined company to successfully increase market penetration into its target markets, to execute on its business strategy or to compete effectively ; (i) the addressable markets that the Parties intend to target do not grow as expected ; (j) the loss of any key executives ; (k) the loss of any relationships with key suppliers or customers (as may be applicable) or the inability to attract and retain customers ; (l) the inability to protect patents and other intellectual property ; (n) costs related to the Business Combination ; (o) changes in applicable laws or regulations ; (p) the possibility that either Party or the combined company may be adversely affected by other economic, business and/or competitive factors ; (q) the Parties’ estimates of growth and projected financial results and meeting or satisfying the underlying assumptions with respect thereto ; (r) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of either Party’s securities ; (s) the risk that the transaction may not be completed by SPAC’s business combination deadline (as may be extended pursuant to SPAC’s governing documents) ; (t) the impact of the novel coronavirus disease pandemic, including any mutations or variants thereof, and its effect on business and financial conditions ; and (u) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in SPAC’s Form S - 1 (File No . 333 - 249677 ), annual report on Form 10 - K/A for the year ended December 31 , 2023 , quarterly report on Form 10 - Q for the period ended June 30 , 2024 and, when available, the registration statement on Form F - 4 to be filed with the SEC in connection with the Business Combination, which will include a document that serves as a preliminary prospectus and proxy statement of SPAC, referred to as a proxy statement/prospectus, and other documents filed or to be filed from time to time with the SEC in connection with the Business Combination . The foregoing list is not exhaustive, and new risks may emerge from time to time . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements . Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved . You should not place undue reliance on forward - looking statements, which speak only as of the date they are made . Neither Party, nor any of their respective affiliates, gives any assurance that the combined company will achieve its currently expected results . Neither Party nor the combined company undertakes any duty to update or revise these forward - looking statements, except as otherwise required by law . Use of Projections This Presentation may contain financial forecasts of the Parties and the combined company which are based on currently available information and estimates . Neither Party nor its independent auditors, nor the independent registered public accounting firm of either Party, has audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, none of the foregoing has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . These projections are forward - looking statements and should not be relied upon as being necessarily indicative of future results . The projected financial information contained in this Presentation constitutes forward - looking information, and neither Party nor the combined company undertakes any duty to update or revise the projected financial information . The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . See the section titled “Forward - Looking Statements” above . Accordingly, there can be no assurance that the prospective results are indicative of future performance or that actual results will not differ materially from the results presented in the prospective financial information contained in this Presentation . Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation . The inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved . 3

©2024, YD BIOPHARMA ., LTD. Disclaimer YD BIOPHARMA Financial Information Certain financial information and data contained in this Presentation is unaudited and may not conform to Regulation S - X . Such information and data may not be included in, may be adjusted in or may be presented differently in the registration statement to be filed with the SEC in connection with the Business Combination and the preliminary proxy statement/prospectus contained therein . Trademarks Each Party owns or has rights to various trademarks, service marks, copyrights, trade names and products that they use in connection with the operation of its business . This Presentation may also contain trademarks, service marks, copyrights, trade names or products of other companies, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, copyrights, trade names or products in this Presentation is not intended to and does not imply a relationship with either Party, or an endorsement or sponsorship by or of either Party . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but such references are not intended to indicate, in any way, that each Party will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable owners, if any, to these trademarks, service marks, copyrights, trade names and products . Industry and Market Data This Presentation contains and relies on certain information obtained from third - party sources and the internal sources . This information involves many assumptions and limitations ; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions, and you are cautioned not to give undue weight to this information . Further, no representation or warranty, express or implied, is made by either Party as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or any other information contained herein, and to the fullest extent permitted by law, the Parties hereby disclaim any responsibility or liability for any direct, indirect or consequential loss or loss of profit arising from the use of such information . Any data on past performance or modelling contained herein are not an indication as to future performance . Neither Party nor any of their respective affiliates, officers, directors, employees, representatives or advisors has independently verified the accuracy or completeness of any such third - party information . Similarly, other third - party survey data and research reports commissioned by the Parties, while believed to be reliable, are based on limited sample sizes and have not been independently verified by either Party . In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the industry in which Target operates, and its future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above . These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by the Parties . Additional Information and Where to Find It The Parties intend to file a definitive proxy statement/prospectus of SPAC with the SEC in connection with the Business Combination (the “ Definitive Proxy Statement/Prospectus ”) . The Definitive Proxy Statement/Prospectus will be sent to all stockholders of SPAC and Target as of a record date to be established . The Parties will also file other documents regarding the Business Combination with the SEC . Before making any voting or other investment decision, investors and security holders of SPAC and Target are urged to read the Definitive Proxy Statement/Prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the Business Combination as they become available because they will contain important information about the Parties and the Business Combination . Investors and security holders will be able to obtain free copies of the Definitive Proxy Statement/Prospectus and all other relevant documents filed or that will be filed with the SEC by the Parties in connection with the Business Combination through the website maintained by the SEC at www . sec . gov . Participants in the Solicitation The Parties and certain other parties to the definitive agreement executed in connection with the Business Combination, and certain of their respective directors, executive officers and other members of management and employees, may, under SEC rules, be deemed to be participants in the solicitation of proxies from SPAC’s stockholders in connection with the Business Combination . A list of the names of such persons and information regarding their interests in the Business Combination will be contained in the Definitive Proxy Statement/Prospectus when available . You may obtain free copies of these documents free of charge by directing a written request to SPAC at doug@breezeacquisition . com . This Presentation does not contain all the information that should be considered in connection with the Business Combination . It is not intended to form any basis of any investment decision or any decision in respect to the Business Combination . 4

©2024, YD BIOPHARMA ., LTD. YD BIO Merger w/ Breeze Holdings Acquisition Corp. YD BIOPHARMA Key Management • SPAC Overview : Breeze Holdings Acquisition Corp . (OTCQX : BRZH) is a publicly - listed special purpose acquisition company with approximately $ 10 M in cash . • Valuation : Company pro forma equity value of approximately $ 700 m . • Structure : Breeze and YD BIO will each merge into wholly - owned subsidiaries of a newly formed Cayman holding company expected to be named “YD Bio Limited . ” Post - merger YD Bio Limited is expected to be listed on Nasdaq . • Ownership : Existing YD BIO shareholders : 90 . 6 % , PIPE shareholders : 2 . 6 % , SPAC public shares : 2 . 1 % , SPAC insider shares : 4 . 7 % . • Timing : The transaction is expected to close 1 Q 25 , subject to customary closing conditions and any required regulatory approvals . • Management and Board Composition : Upon completion of the transaction, YD BIO will continue to be led by Dr . Ethan Shen . The Board will consist of YD BIO’s CEO, five ( 5 ) directors designated by YD BIO and two ( 2 ) directors designated by Breeze Holdings . Breeze and YD Biopharma Partnership Combines Public Company Experience and Sector Expertise Transaction Details Experience Name And Position ~25 Years Doug Ramsey, Ph.D. Chairman & CEO ~35 Years Russ Griffin Director & President ~23 Years Dr. Ethan Shen Chairman & CEO ~17 Years Wu Cheng - feng Chief Medical Officer ~35 Years May Tsai Chief Business Officer ~18 Years Jean Chen Accounting Manager Breeze Holdings YD Biopharma 5

©2024, YD BIOPHARMA ., LTD. Introduction to YD Biopharma YD BIOPHARMA Yong Ding Biopharma Co . , Ltd . (“YD Biopharma” or “YD BIO” of the “Company”) was founded by Dr . Ethan Shen in Taipei, Taiwan in 2013 . YD BIO specializes in the pharmaceutical business and serves as a supplier of drugs and medical materials for clinical trials . In 2015 , YD BIO was appointed as a clinical testing drug supplier by Novartis (Taiwan) and has since expanded its offerings to include development and supply of ancillary products post - launch . In June 2024 , YD BIO obtained patent and technology authorization from 3 D GLOBAL BIOTECH INC . (“ 3 D Biotech”) . In partnership with 3 D Biotech, YD BIO has pioneered the application of corneal mesenchymal stem cells and their exosomes for treating eye diseases . YD BIO has introduced new drugs and treatments for conditions such as dry eye disease, glaucoma, and corneal repair . In Q 2 2024 , YD BIO obtained patents, technology and U . S . market authorization from EG Biomed for core methylation detection of pancreatic cancer . This partnership has led to the establishment of an independent laboratory in the U . S . dedicated to pancreatic cancer detection and marks a significant expansion of YD BIO’s research and development capabilities into critical healthcare areas . YD BIO has recently negotiated related authorizations for breast cancer detection to further expand the Company’s product offerings . The acquisition of the licenses for EG Biomed’s breast cancer detection technology in the U . S . , E . U . , and Asia - Pacific will be consummated simultaneously with the closing of the Business Combination with Breeze Holdings . “ Use our technology to detect physical problems early and help the body regenerate, delay aging, and restore health without ta kin g medicine. ” ~ Dr. Ethan Shen on YD Biopharma’s Mission YD BIOPHARMA LIMITED (Cayman) Yong Ding Biopharm CO., Ltd. (Taiwan) 100% Owned 6

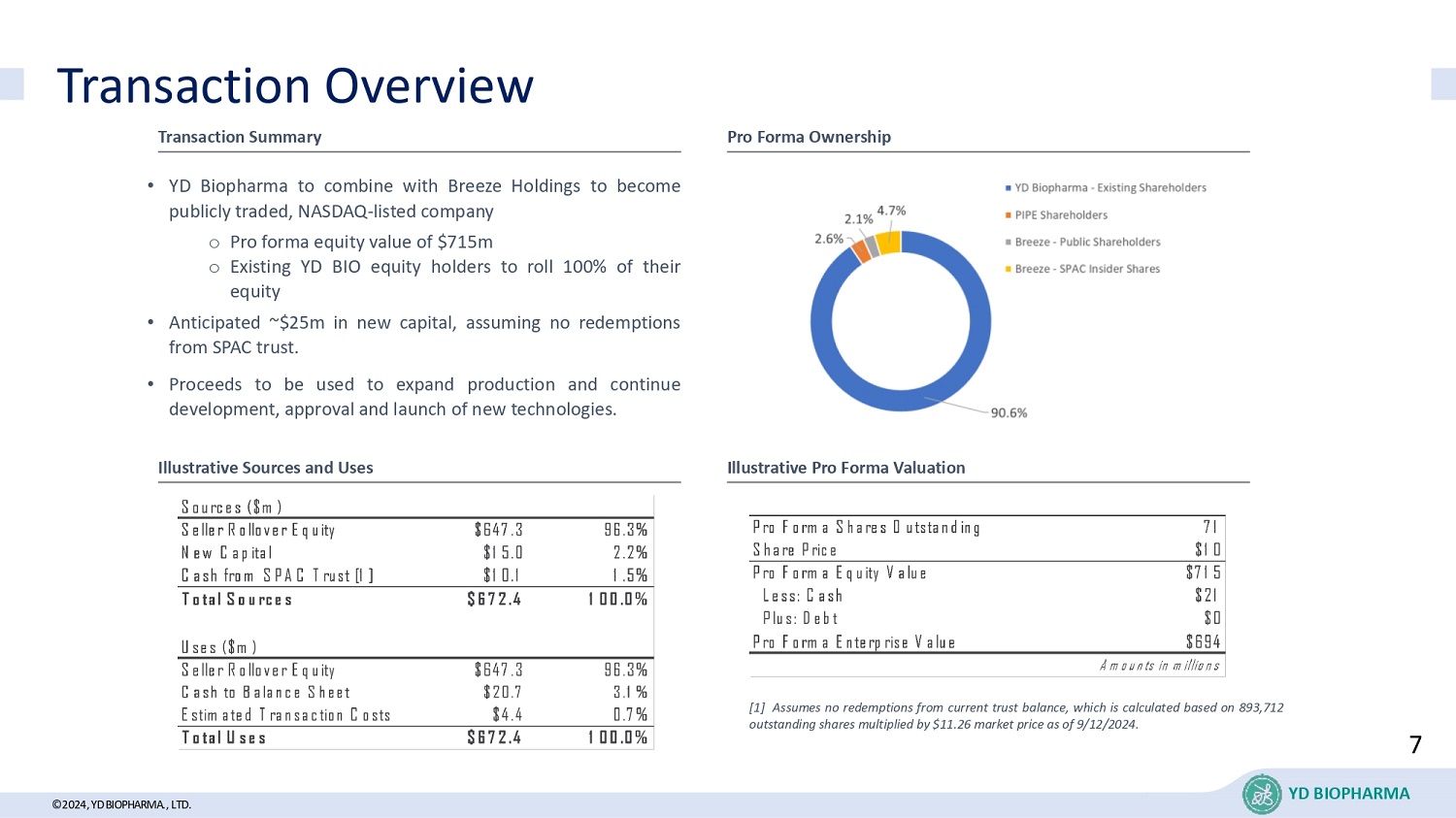

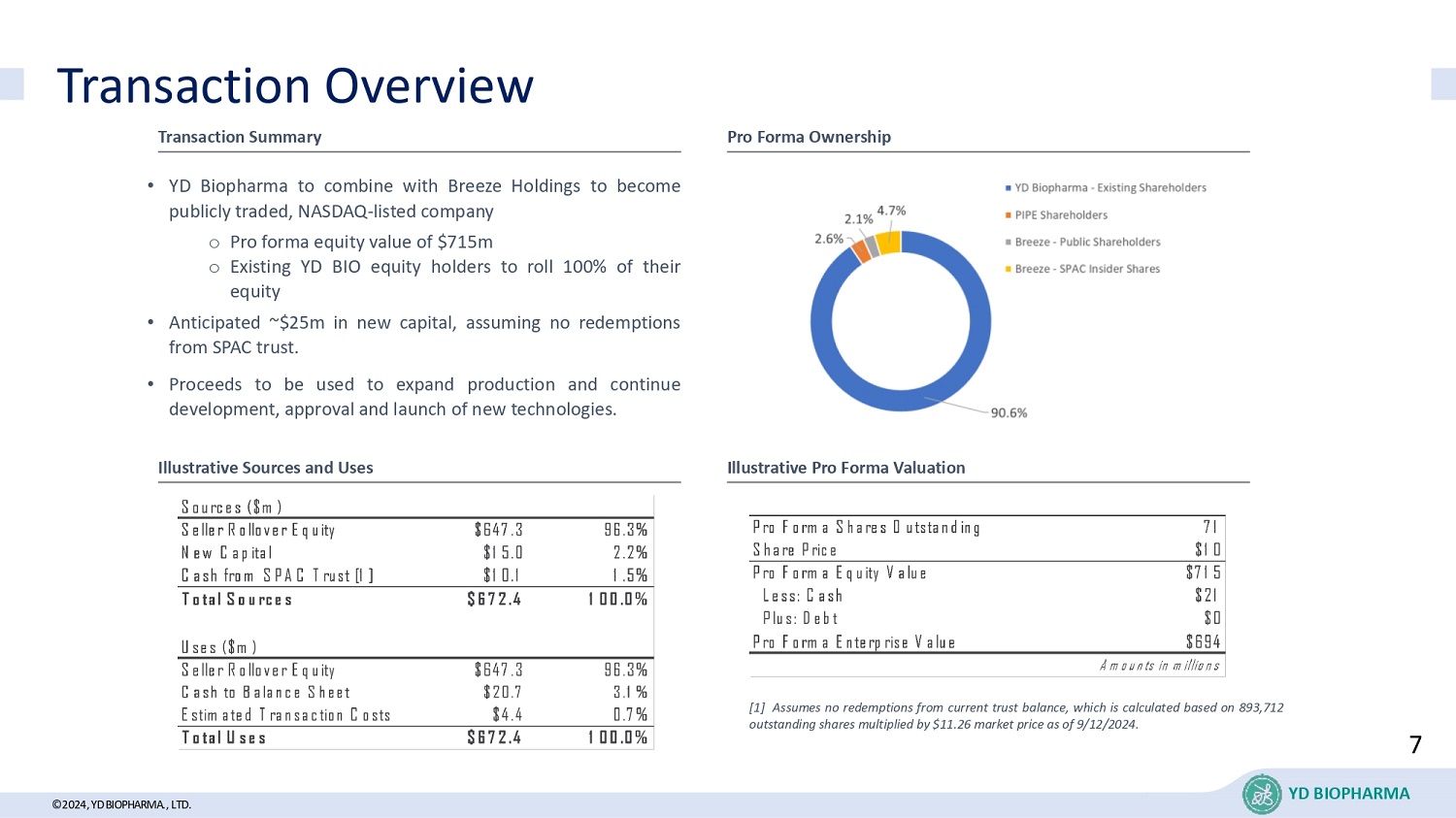

©2024, YD BIOPHARMA ., LTD. Transaction Overview YD BIOPHARMA Transaction Summary Pro Forma Ownership Illustrative Sources and Uses Illustrative Pro Forma Valuation • YD Biopharma to combine with Breeze Holdings to become publicly traded, NASDAQ - listed company o Pro forma equity value of $ 715 m o Existing YD BIO equity holders to roll 100 % of their equity • Anticipated ~ $ 25 m in new capital, assuming no redemptions from SPAC trust . • Proceeds to be used to expand production and continue development, approval and launch of new technologies . 95.4% Pro Forma Shares Outstanding 71 Share Price $10 Pro Forma Equity Value $715 Less: Cash $21 Plus: Debt $0 Pro Forma Enterprise Value $694 Amounts in millions [ 1 ] Assumes no redemptions from current trust balance, which is calculated based on 893 , 712 outstanding shares multiplied by $ 11 . 26 market price as of 9 / 12 / 2024 . Sources ($m) Seller Rollover Equity $647.3 96.3% New Capital $15.0 2.2% Cash from SPAC Trust [1] $10.1 1.5% Total Sources $672.4 100.0% Uses ($m) Seller Rollover Equity $647.3 96.3% Cash to Balance Sheet $20.7 3.1% Estimated Transaction Costs $4.4 0.7% Total Uses $672.4 100.0% 7

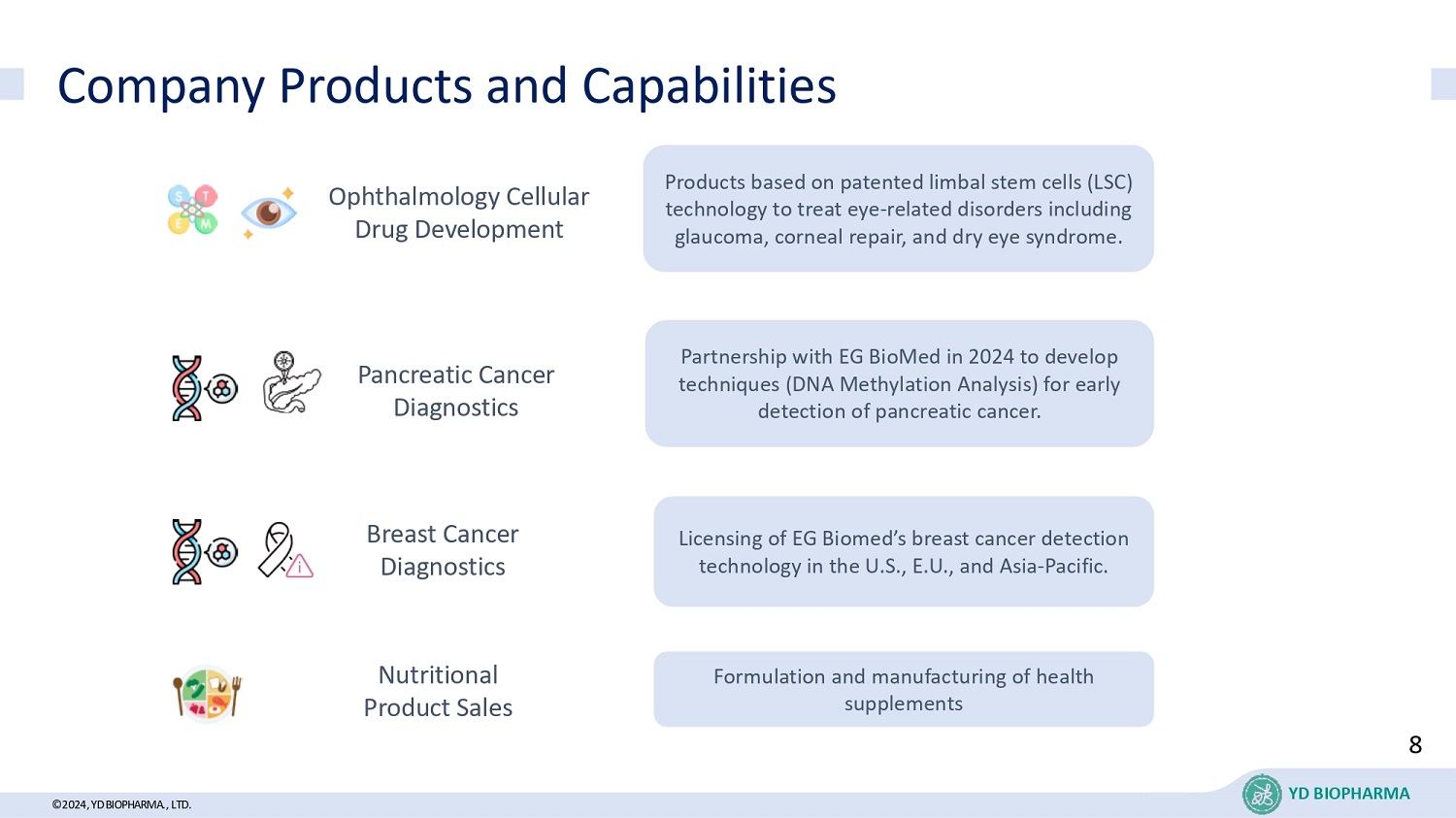

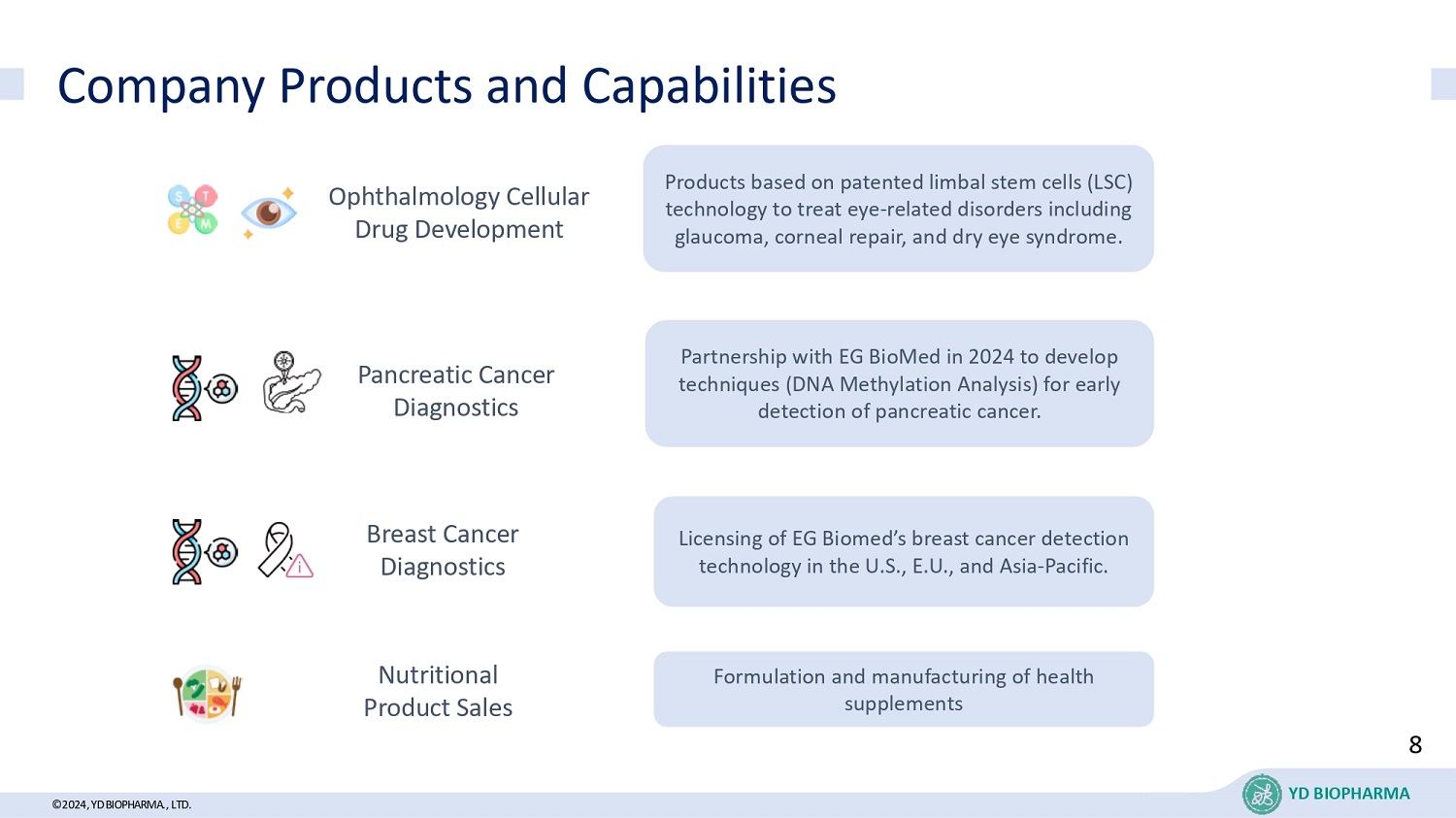

©2024, YD BIOPHARMA ., LTD. Company Products and Capabilities YD BIOPHARMA 8 Formulation and manufacturing of health supplements Products based on patented limbal stem cells (LSC) technology to treat eye - related disorders including glaucoma, corneal repair, and dry eye syndrome. Partnership with EG BioMed in 2024 to develop techniques (DNA Methylation Analysis) for early detection of pancreatic cancer. Licensing of EG Biomed’s breast cancer detection technology in the U.S., E.U., and Asia - Pacific. Pancreatic Cancer Diagnostics Breast Cancer Diagnostics Ophthalmology Cellular Drug Development Nutritional Product Sales

©2024, YD BIOPHARMA ., LTD. Strategic Partnerships YD BIOPHARMA YD Biopharma appointed a clinical testing drug supplier by Novartis (Taiwan) in 2015. Licensing partnership with 3D Global Biotech in 2024 to develop products based on patented limbal stem cells (LSC) technology for the treatment of eye disorders such as glaucoma, corneal repair, and dry eye syndrome. 3D Global Biotech is publicly - traded on the Taipei Stock Exchange. Licensing partnership with EG BioMed, a biomedical and healthcare startup in Taiwan developing new technologies for cancer detection. YD BIO acquired authorization to use EG Biomed’s pancreatic cancer detection technology in Q2 2024 and is finalizing the licensing agreement for EG Biomed’s breast cancer detection technology in the U.S., E.U., and Asia - Pacific. 9

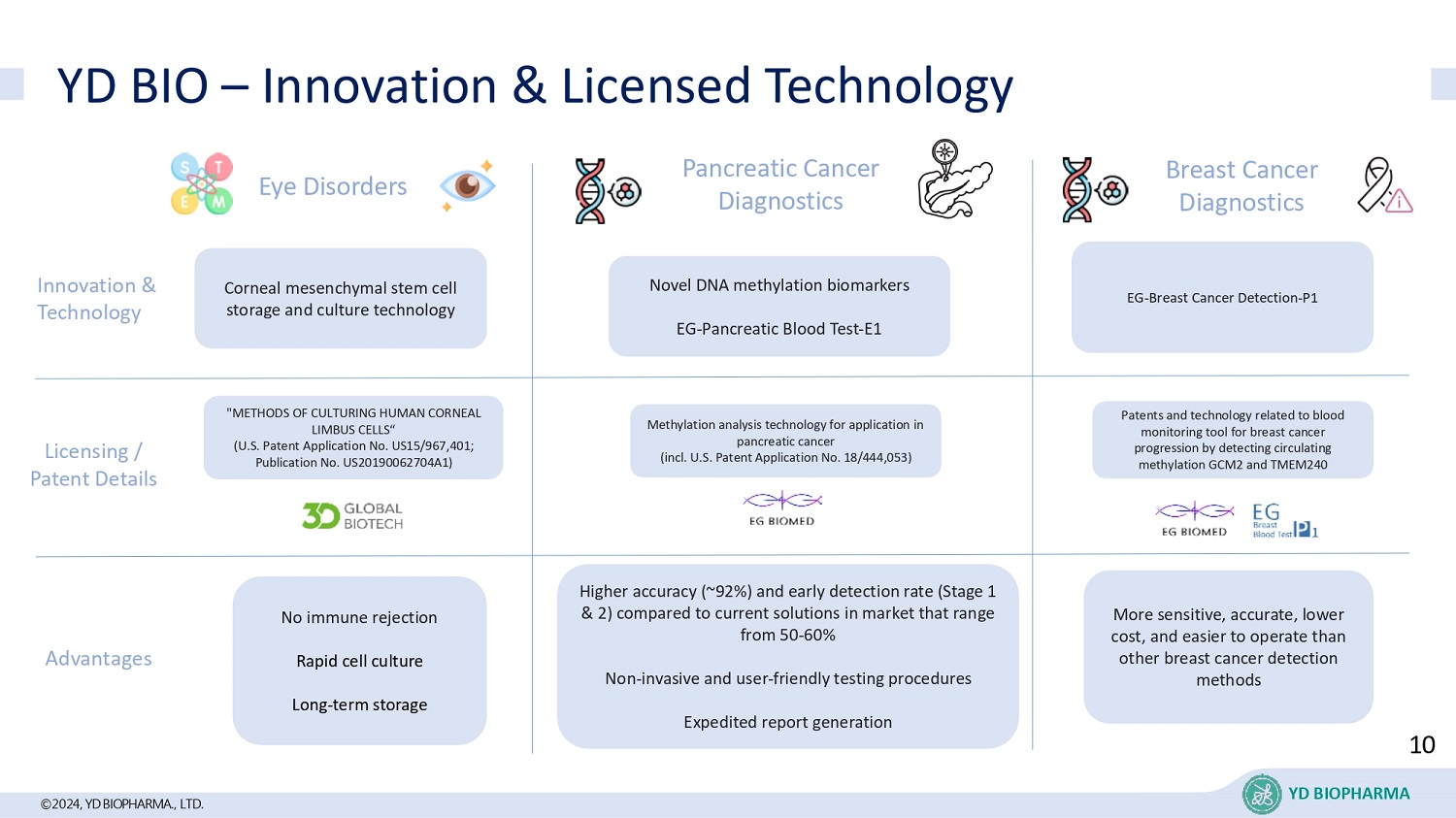

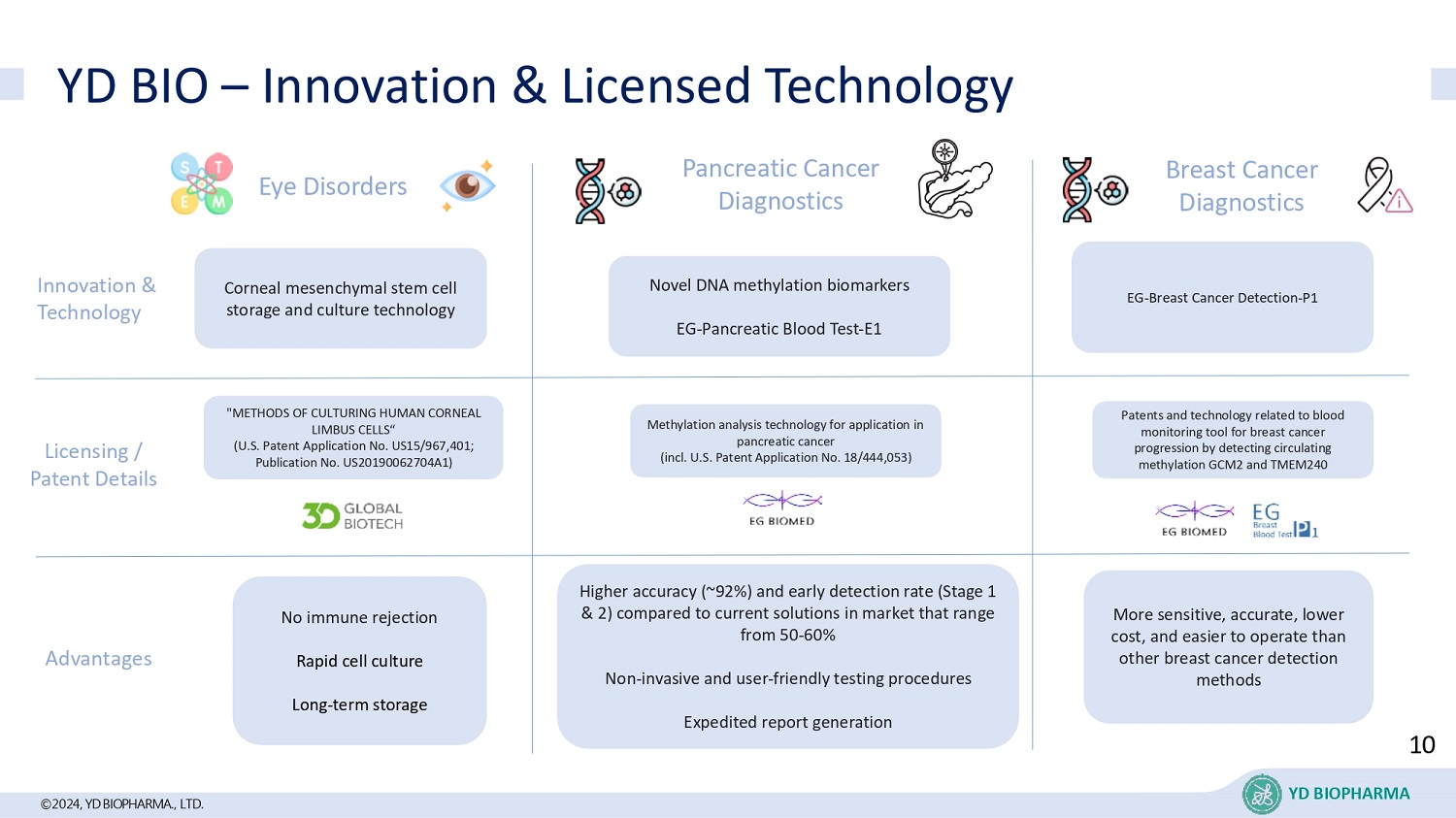

©2024, YD BIOPHARMA ., LTD. YD BIO – Innovation & Licensed Technology Eye Disorders No immune rejection Rapid cell culture Long - term storage Pancreatic Cancer Diagnostics Higher accuracy (~92%) and early detection rate (Stage 1 & 2) compared to current solutions in market that range from 50 - 60% Non - invasive and user - friendly testing procedures Expedited report generation Breast Cancer Diagnostics More sensitive, accurate, lower cost, and easier to operate than other breast cancer detection methods Licensing / Patent Details Advantages Novel DNA methylation biomarkers EG - Pancreatic Blood Test - E1 Corneal mesenchymal stem cell storage and culture technology EG - Breast Cancer Detection - P1 Innovation & Technology "METHODS OF CULTURING HUMAN CORNEAL LIMBUS CELLS“ (U.S. Patent Application No. US15/967,401; Publication No. US20190062704A1) Patents and technology related to blood monitoring tool for breast cancer progression by detecting circulating methylation GCM2 and TMEM240 Methylation analysis technology for application in pancreatic cancer (incl. U.S. Patent Application No. 18/444,053) 10 YD BIOPHARMA

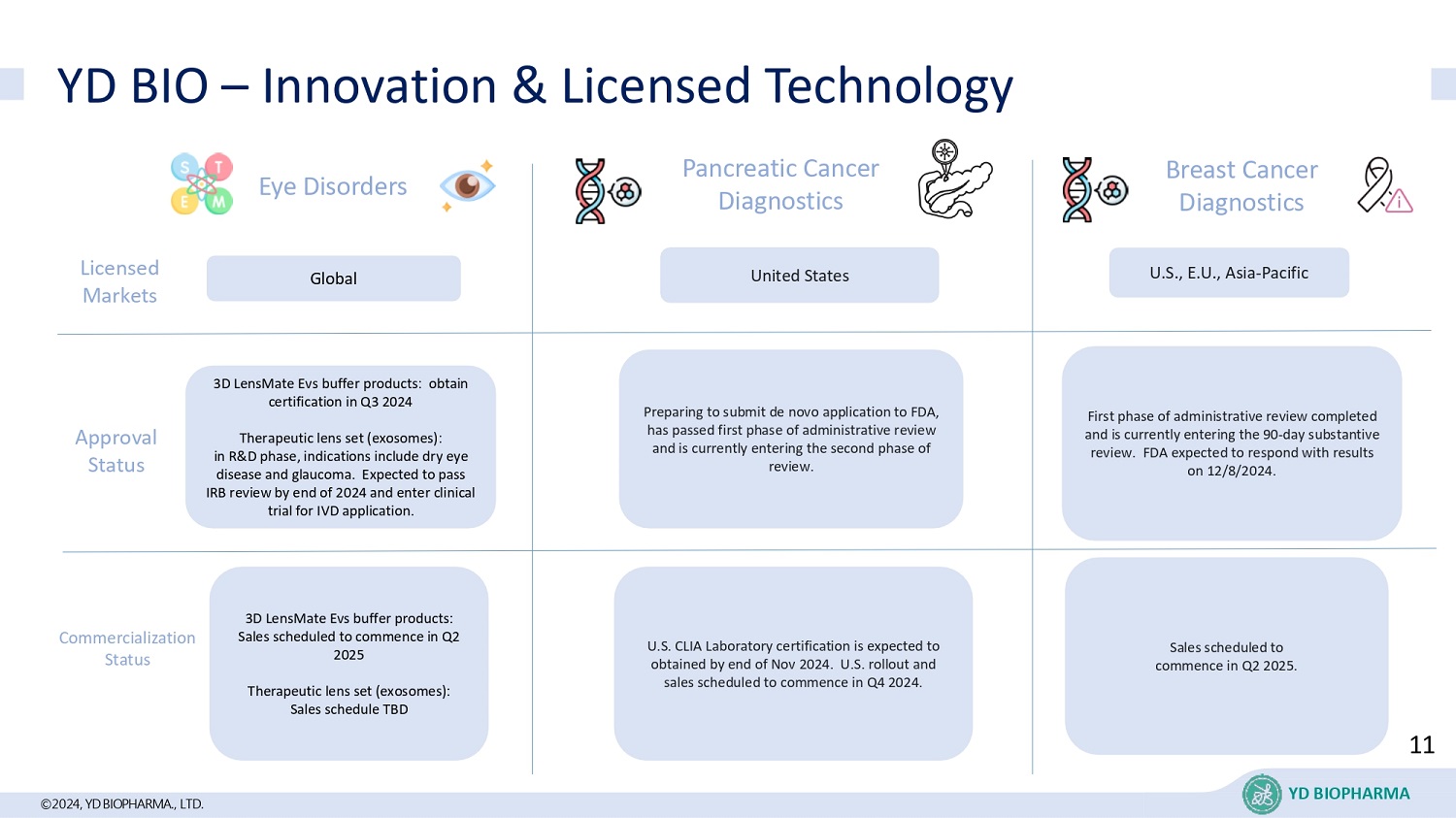

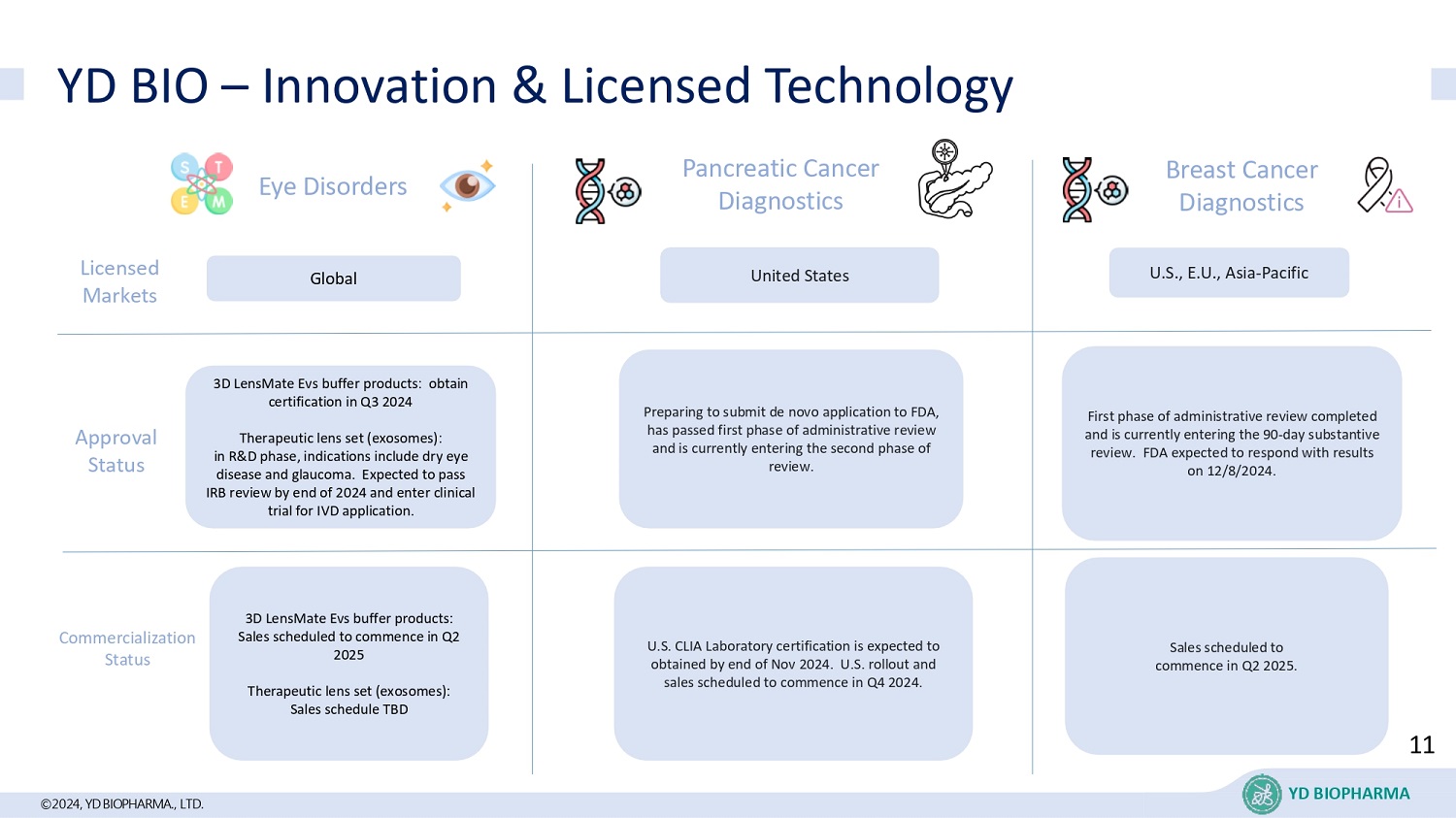

©2024, YD BIOPHARMA ., LTD. YD BIO – Innovation & Licensed Technology Global Pancreatic Cancer Diagnostics United States Breast Cancer Diagnostics U.S., E.U., Asia - Pacific L icensed Markets Approval Status 3D LensMate Evs buffer products: obtain certification in Q3 2024 Therapeutic lens set (exosomes): in R&D phase, indications include dry eye disease and glaucoma. Expected to pass IRB review by end of 2024 and enter clinical trial for IVD application. First phase of administrative review completed and is currently entering the 90 - day substantive review. FDA expected to respond with results on 12/8/2024. Preparing to submit de novo application to FDA, has passed first phase of administrative review and is currently entering the second phase of review. Commercialization Status U.S. CLIA Laboratory certification is expected to obtained by end of Nov 2024. U.S. rollout and sales scheduled to commence in Q4 2024. Sales scheduled to commence in Q2 2025. 3D LensMate Evs buffer products: Sales scheduled to commence in Q2 2025 Therapeutic lens set (exosomes): Sales schedule TBD Eye Disorders 11 YD BIOPHARMA

©2024, YD BIOPHARMA ., LTD. Company History & Milestones YD BIOPHARMA YD Biopharma founded by Dr. Ethan Shen Initial focus on nutritional innovations, product sales, & pharmacy operations Partnership with Novartis (Taiwan) to expand into clinical testing drug market Collaborative Innovation Exosome Development Partnership with 3D Global Biotech to expand into eye disorders treatment Partnership with EG Biomed to expand into pancreatic cancer and breast cancer detection technology / diagnostics 2024 2022 - 2023 2015 2013 / 5 12

©2024, YD BIOPHARMA ., LTD. Market Analysis – Selected Disorders YD BIOPHARMA Pancreatic Cancer Diagnostics Glaucoma Dry Eye Syndrome Disease / Disorder Market Size ~$870M as of 2023 CAGR ~5.6% from 2023 to 2030 ~$5.5B as of 2021 ~3.2% from 2022 to 2028 ~$6.0B as of 2022 Source: https://www.grandviewsearch.com ~7.2% from 2022 to 2030 Source: https://www.gminsights.com/industry - analysis/dry - eye - disease - market Breast Cancer Diagnostics ~$4.5B as of 2023 ~7.2% from 2023 to 2033 Source: biospace.com/breast - cancer - diagnostics - market - size - share - and - growth - report - 2033 Market(s): Global Market(s): North American & Europe Source: https://www.gminsights.com/industry - analysis/dry - eye - disease - market Market(s): Global Market(s): United States 13

©2024, YD BIOPHARMA ., LTD. YD Biopharma Management Team Ph.D. of Translational Medicine Finance/ Baruch College/ New York Expertise: Translational Medicine New drug development Medical - grade health product development Financial Management Chairman / CEO Dr. Ethan Shen C hief Medical Officer Wu Cheng - feng Master of Pharmacology Expertise: Development of new drugs and nutraceuticals/cell medical applications C hief Business Officer May Tsai Masters Degree in Business Administration, UNC Charlotte Expertise: H ealth care products, drug procurement and pharmacy channel development Master of Accountancy, National Taipei University CPA of the Republic of China Expertise: Financial Accounting Financial Management Internal Control Accounting Manager Jean Chen 14 YD BIOPHARMA

Doug Ramsey, Ph.D. Chairman, CEO, CFO and Director ▪ Finance professor at SMU, Baylor and Cal Poly Pomona ▪ BS in Finance from Cal Poly Pomona, MBA from the University of Chicago Booth School of Business and an MA and Ph.D. in Business and Financial Economics from Claremont Graduate University ▪ Public - company CFO experience ▪ National Association of Corporate Directors (NACD) – Directorship Certified ©2024, YD BIOPHARMA ., LTD. Breeze Holdings Acquisition Corp. Management Team – Selected Highlights Russ Griffin President and Director ▪ BS in Petroleum Engineering Technology from Nicholls State University ▪ Led or participated in multiple acquisitions and divestitures, both domestic and international ▪ National Association of Corporate Directors (NACD) – Directorship Certified Charles Ross Chief Operating Officer ▪ BS in Engineering from UT Austin ▪ Led or participated in multiple acquisitions and divestitures, both domestic and international Aaron Ortega Executive VP of Business Development ▪ BA from Duke University, and an MBA from Southern Methodist University’s Cox School of Business ▪ Led or participated in multiple acquisitions and divestitures, both domestic and international SPAC Board Members: Albert McLelland, Robert Thomas, Bill Stark and Gen. James Williams. Various Roles & Credentials ▪ Director of the Chairman’s Asian Cross - Border Transactions Initiative for PwC ▪ Adjunct Professor at SMU Caruth Institute for Entrepreneurship in the Cox School of Business ▪ Extensive international operating, capital markets and corporate governance experience including multiple director roles on b eha lf of the Carlyle Group and other prominent financial services firms 15 YD BIOPHARMA

©2024, YD BIOPHARMA ., LTD. Biotech Sector Strength – Recent Transactions YD BIOPHARMA MBX Biosciences (Nasdaq: MBX) Bicara Therapeutics (Nasdaq: BCAX) Zenas BioPharma (Nasdaq: ZBIO) A developer of therapies for endocrine and metabolic disorders, MBX shares traded immediately post - IPO up 48 % to over $ 23 /share (above its IPO price of $ 16 /share) . MBX’s upsized IPO raised $ 163 M, pricing 10 . 2 M shares at the upper limit of the price range . Order book was reportedly 7 x oversubscribed . A provider of treatments targeting head and neck carcinomas, BCAX shares traded immediately post - IPO up 30 % to over $ 23 /share . BCAX upsized its IPO to sell 17 . 5 M shares at $ 18 (at the top of the price range) to raise $ 315 M . Order book was reportedly 10 x oversubscribed . A number of successful IPOs in the biotech sector have priced in September 2024, representing the busiest period for biotech and pharmaceutical IPOs since July 2021. A developer of therapies for patients with autoimmune diseases, ZBIO shares traded immediately post - IPO up 6 . 8 % to over $ 18 /share . The IPO raised $ 225 M priced at $ 17 /share (the middle of the marketed range) . 16

APPENDIX

We will strive to surpass our competitors within two years Galleri EGPT - E1 Test Grail EG BIOMED Company NGS platform qPCR platform platform High Low Testing Cost Analysis takes a long time and reporting is slow Short analysis time and quick report generation Test of Time High construction costs Unable to quickly deploy globally Low construction cost Rapid global layout Global layout Through low detection cost, fast speed and low construction cost, we hope to surpass our competitors in 2 years . 18 YD BIOPHARMA

©2024, YD BIOPHARMA ., LTD. Publications Related to Licensed Technology 19 YD BIOPHARMA

Pancreatic cancer ranks among top ten cancers in Taiwan Pancreatic Cancer ©2024, YD BIOPHARMA ., LTD. Early diagnosis of pancreatic cancer is difficult Symptoms often appear in advanced stages Five - year survival rate is only 5% High - fat diets contribute to increasing incidence Diabetics face over eight times higher risk YD BIO’s EG Test - E1 is able to detect Stage 1 & 2 pancreatic cancer. 20 YD BIOPHARMA

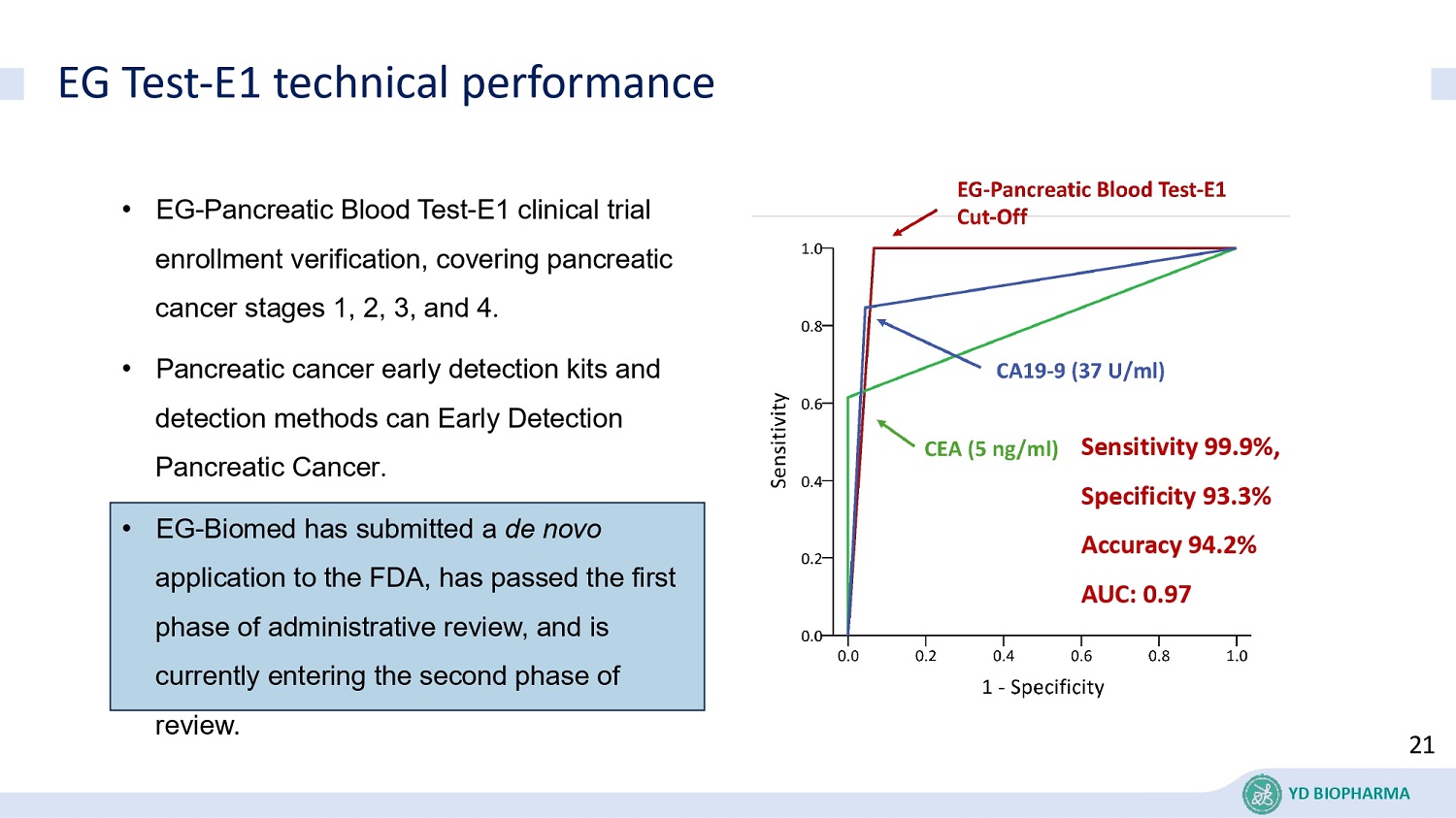

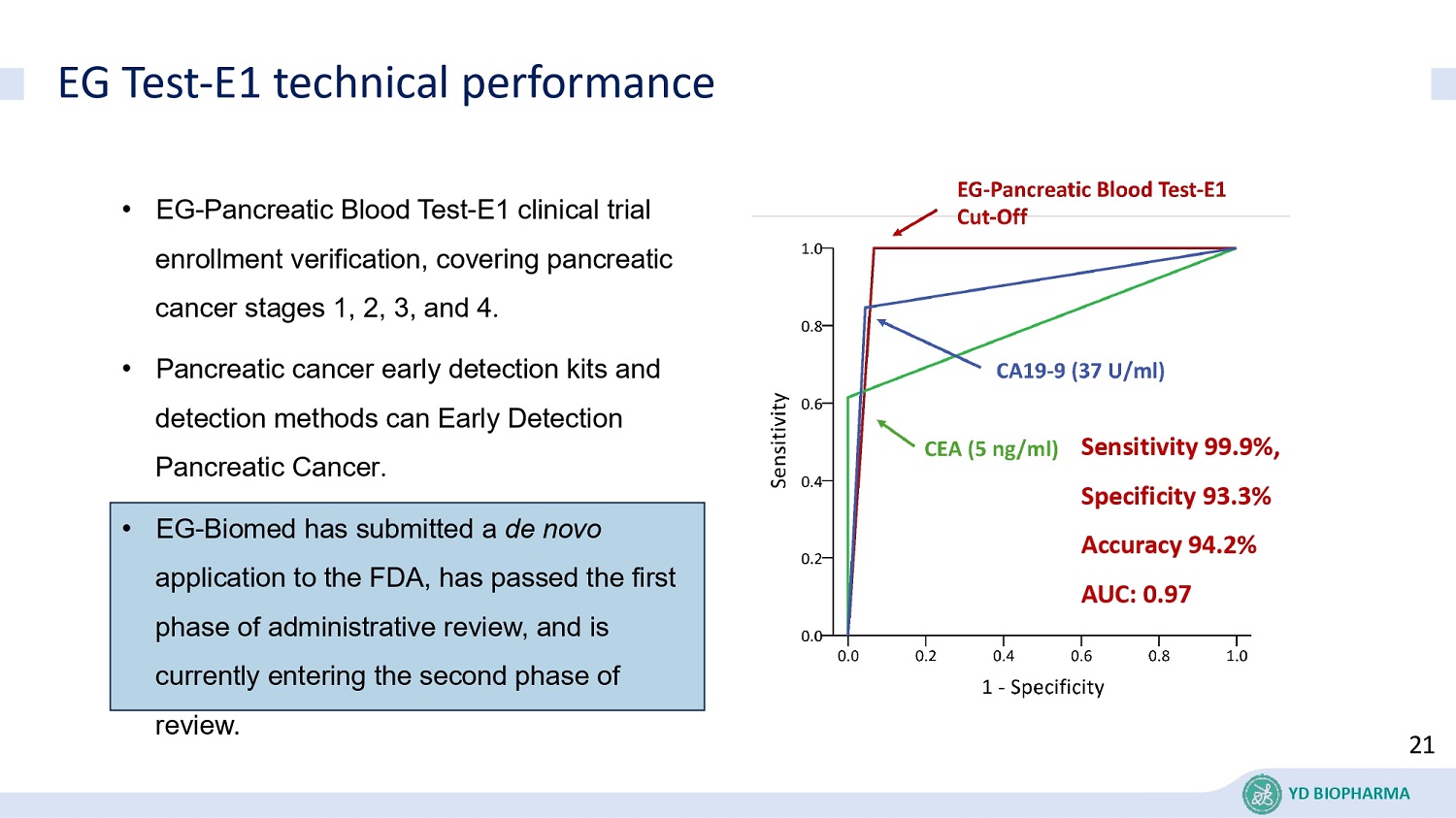

EG Test - E1 technical performance • EG - Pancreatic Blood Test - E1 clinical trial enrollment verification, covering pancreatic cancer stages 1, 2, 3, and 4 . • Pancreatic cancer early detection kits and detection methods can Early Detection Pancreatic Cancer . • EG - Biomed has submitted a de novo application to the FDA, has passed the first phase of administrative review, and is currently entering the second phase of review. Sensitivity 99.9%, Specificity 93.3% Accuracy 94.2% AUC: 0.97 21 YD BIOPHARMA

Breast cancer diagnosis requires invasive and anesthetic breast biopsy procedures, which can be stressful for patients. Current blood tests for breast cancer monitoring lack sufficient sensitivity . The Clinical Need for Precise, Non - Invasive Blood Cancer Detection Breast Cancer 22 ©2024, YD BIOPHARMA ., LTD. YD BIOPHARMA

EG Breast Blood Test - P1 technical performance • Monitoring for Progression of Breast Cancer • FDA de novo Under Review • Sensitivity 95.7% Specificity 90.3% Accuracy 95.4% EGBC - P1 CA15 - 3 CEA 23 ©2024, YD BIOPHARMA ., LTD. YD BIOPHARMA

Summary of Patent Licensing and Technology Transfer Agreement from 3D GLOBAL BIOTECH INC. • Licensed Patent and Know - How: "METHODS OF CULTURING HUMAN CORNEAL LIMBUS CELLS" (U.S. Patent Application No. US15/967,401; Publication No. US20190062704A1), and owns the relevant know - how and technical data. • Scope of License: 3D GLOBAL 's Patent and Know - How, as well as its know - how in the technology of cell culture process, technology of cell bank construction , exosome purification and authentication technology, and exosome production , which are related to and/or derived from "METHODS OF CULTURING HUMAN CORNEAL LIMBUS CELLS" . YD Biopharma obtains a global, exclusive license from 3D GLOBAL to use the licensed subject to develop, manufacture, offer for sale, sell, use, or import for the above purpose the Product. • Method of License: Global, exclusive license. and agrees YD Biopharma can sublicense to a third party. » Authorization tim e: From the effective date of this Agreement until the expiration of twenty (20) years after all the Product have/has been put on the market. » License Fees and Royalties from selling the Product: Total Licensing fee is USD 5,000,000, Signature Deposit is USD 1,000,0000, Other USD4,000,000 authorization fees will be paid upon milestone completion. and a royalty of 10% of the " Gross Sales" of the Product on a quarterly basis. » Sub - licenses Fee: 20% of the sub - license fees 24 YD BIOPHARMA

Summary of Patent Licensing and Technology Transfer Agreement (Pancreatic cancer Detection) from EG BioMed • Licensed Patent and Know - How: methylation analysis technology for application in pancreatic cancer (including U.S. Patent Application No. 18/444,053) and the relevant know - how, and agrees to have the aforesaid patent(s) and relevant know - how • Scope of License: use of the Licensed Patent and Know - How in the Licensed Territory (United States) for manufacturing, offering for sale, selling, using, or importing the Product for the aforementioned purposes. High - fat diets contribute to increasing incidence • Method of License: E xclusive license in U.S. » Authorization tim e : 10 years and will be automatically renewed for another five years or until the expiration of the Licensed Patent » License Fees and Royalties from selling the Product: NT$60,000,000 (tax excluded) and a royalty of 7% of the " Gross Sales" of the Product on a quarterly basis. 25 YD BIOPHARMA

Summary of Patent Licensing and Technology Transfer Agreement (Breast cancer Detection) from EG BioMed * • Licensed Patent and Know - How: methylation analysis technology for application in breast cancer (including U.S. Patent Application No. 17/053,688, Europe 3790984, China Patent No. 201980031343.5,Taiwan Patent No. I721414 and other Patent in Asian countries) and the relevant know - how, and agrees to have the aforesaid patent(s) and relevant know - how • Scope of License: use of the Licensed Patent and Know - How in the Licensed Territory(American, European and Asian) for manufacturing, offering for sale, selling, using, or importing the Product for the aforementioned purposes. High - fat diets contribute to increasing incidence • Method of License: E xclusive license • Authorization tim e : 20 years and will be automatically renewed for another five years or until the expiration of the Licensed Patent » License Fees and Royalties from selling the Product: A royalty of 20% of the " Gross Sales" of the Product on a quarterly basis. *YD Biopharma and EG BioMed have reached an agreement in principle on the above terms and are currently working on definitive documentation. 26 YD BIOPHARMA

YD BIOPHARMA LIMITED THANK YOU