- CRXTQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Clarus Therapeutics (CRXTQ) S-1IPO registration

Filed: 17 Dec 21, 5:19pm

Delaware | 2836 | 85-1231852 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code No.) | (I.R.S. Employer Identification No.) |

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☒ |

Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

| Common Stock, $0.0001 par value per share | 6,048,388 (2) | $4.17 (3) | $25,221,778 | $2,338.06 | ||||

Total | $25,221,778 | $2,338.06 | ||||||

| (1) | Pursuant to Rule 416(a), there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (2) | Consists of (i) 2,300,000 shares of Common Stock registered for sale by the Selling Securityholder named in this registration statement (including the shares referred to in the following clause (ii)), (ii) 724,194 shares of Common Stock issuable upon the exercise of 724,194 Pre-Funded Warrants (as defined herein) and (iii) 3,024,194 shares of Common Stock issuable upon the exercise of 3,024,194 Common Warrants (as defined herein) |

| (3) | Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price per share is $4.17, which is the average of the high and low prices of the Common Stock on December 16, 2021 on The Nasdaq Global Market. |

Page | ||||

| ii | ||||

| v | ||||

| 1 | ||||

| 4 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 60 | ||||

| 87 | ||||

| 96 | ||||

| 104 | ||||

| 109 | ||||

| 111 | ||||

| 113 | ||||

| 122 | ||||

| 126 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| F-1 | ||||

| II-1 | ||||

| II-3 | ||||

| II-9 | ||||

| • | “ Blue Water |

| • | “ Blue Water IPO IPO Initial Public Offering |

| • | “ Board |

| • | “ Business Combination |

| • | “ Bylaws |

| • | “ Certificate of Incorporation |

| • | “ Code |

| • | “ Common Stock |

| • | “ Common Warrants |

| • | “ DGCL |

| • | “ Effective Time |

| • | “ Exchange Act |

| • | “ Founder Shares |

| • | “ Legacy Clarus |

| • | “ Merger |

| • | “ Merger Agreement |

| • | “ Merger Closing |

| • | “ Merger Closing Date |

| • | “ PIPE Warrants Pre-Funded Warrants and the Common Warrants. |

| • | “ PIPE Closing |

| • | “ PIPE Closing Date |

| • | “ Placement Warrants |

| • | “ Pre-Funded WarrantsPre-Funded Warrant entitles the holder thereof to purchase one share of Common Stock for $0.00001 per share. |

| • | “ Private Placement Pre-Funded Warrants and Common Warrants described in this prospectus were issued, and the other transactions contemplated by the Securities Purchase Agreement. |

| • | “ Public Warrants |

| • | “ Purchaser Pre-Funded Warrants and Common Warrants pursuant to the Securities Purchase Agreement. |

| • | “ PIPE Registration Rights Agreement |

| • | “ SEC |

| • | “ Securities Act |

| • | “ Securities Purchase Agreement |

| • | “ Shares |

| • | “ Sponsor |

| • | “ Warrant Agreement |

| • | our ability to realize the benefits from the Business Combination; |

| • | the ability to maintain the listing of the Common Stock on the Nasdaq Global Market; |

| • | our future financial performance; |

| • | the potential liquidity and trading of our securities; |

| • | the impact from the outcome of any known and unknown litigation; |

| • | our ability to forecast and maintain an adequate rate of revenue growth and appropriately plan expenses; |

| • | our expectations regarding future expenditures; |

| • | the future mix of revenue and effect on gross margins; |

| • | the attraction and retention of qualified directors, officers, employees and key personnel; |

| • | our ability to compete effectively in a competitive industry; |

| • | our ability to protect and enhance our corporate reputation and brand; |

| • | our expectations concerning our relationships and actions with third parties; |

| • | the impact from future regulatory, judicial, and legislative changes in our industry; |

| • | the ability to locate and acquire complementary products or product candidates and integrate those into our business; |

| • | future arrangements with, or investments in, other entities or associations; |

| • | intense competition and competitive pressures from other companies in the industries in which we operate; and |

| • | other economic, business and/or competitive factors, risks and uncertainties, including those set forth in this prospectus in the section entitled “ Risk Factors |

| • | There is substantial doubt about our ability to continue as a going concern. |

| • | We have incurred significant indebtedness in connection with our business and servicing our debt requires a significant amount of cash. We may not have sufficient cash flow from our operations to satisfy the financial covenants in our debt agreements. We may not receive a waiver of default for outstanding indebtedness for which we may be in default in the future. |

| • | We have identified material weaknesses in our internal control over financial reporting, and we may identify future material weaknesses in our internal control over financial reporting. |

| • | JATENZO is the only product we are commercializing, and we depend almost entirely on its success. |

| • | We have limited experience as a commercial company and the marketing and sale of JATENZO or any future approved drugs may be unsuccessful or less successful than anticipated. |

| • | Our ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited. |

| • | Our reliance on third-party suppliers and distributors could harm our ability to commercialize JATENZO. |

| • | The ongoing COVID-19 pandemic is having, and is expected to have, an adverse impact on our business. |

| • | The FDA and other regulatory agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses. If we are found to have improperly promotedoff-label uses, we may become subject to significant liability. |

| • | Even though we have received marketing approval for JATENZO in the United States, we may never receive marketing approval outside of the United States, or receive pricing and reimbursement outside the United States at acceptable levels. |

| • | Recent federal legislation may increase pressure to reduce prices of certain pharmaceutical products paid for by Medicare. |

| • | Testosterone ( T (non-narcotic) substance under the Controlled Substances Act and any failure to comply with this act or its state equivalents would have a negative impact on our business. |

| • | If coverage and reimbursement for JATENZO are limited, it may be difficult to profitably sell JATENZO. |

| • | Our market is subject to intense competition. |

| • | If we are unable to obtain or protect intellectual property rights related to JATENZO, we may not be able to compete effectively in our market. |

| • | We may be involved in lawsuits and proceedings to protect or enforce our patents, which could be expensive, time consuming and unsuccessful. |

| • | We will need to grow our company, and may encounter difficulties in managing this growth. |

| • | Our future success depends on our ability to retain our chief executive officer, chief financial officer and chief commercial officer and to attract, retain and motivate qualified personnel. |

| • | Our debt agreements contain restrictions that limit our flexibility in operating our business. |

| • | establish and maintain our relationships with healthcare providers who will be treating the patients who may receive JATENZO and any future products; |

| • | obtain adequate pricing and reimbursement for JATENZO and any future products; |

| • | develop and maintain successful strategic alliances; and |

| • | manage our spending as costs and expenses increase due to clinical trials, marketing approvals, and commercialization. |

| • | adversely impacting the third parties we solely rely on to sufficiently manufacture JATENZO in quantities we require including the availability of raw materials and other supply chain requirements; |

| • | decreasing the demand for JATENZO; and |

| • | the ability of our sales representatives to reach healthcare customers. |

| • | physicians’ views as to the scope of the approved indication and limitations on use and warnings and precautions contained in JATENZO’s approved labeling; |

| • | the availability, efficacy and safety of competitive therapies; |

| • | pricing and the perception of physicians and payors as to cost effectiveness; |

| • | the existence of sufficient third-party coverage or reimbursement; and |

| • | the effectiveness of our sales, marketing and distribution strategies. |

| • | issue warning or untitled letters or notice of violation letters; |

| • | seek an injunction or impose civil or criminal penalties or monetary fines; |

| • | suspend or withdraw marketing approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to approve pending applications or supplements to applications submitted by us; |

| • | suspend or impose restrictions on operations, including costly new manufacturing requirements; or |

| • | seize or detain products, refuse to permit the import or export of products, or request that we initiate a product recall. |

| • | the demand for our products and any products for which we may obtain regulatory approval; |

| • | our ability to set a price that we believe is fair for our products; |

| • | our ability to obtain coverage and reimbursement approval for a product; |

| • | our ability to generate revenues and achieve or maintain profitability; and |

| • | the level of taxes that we are required to pay. |

| • | The federal anti-kickback statute, which prohibits, among other things, persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly (including any kickback, bribe or certain rebate), in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal healthcare programs such as Medicare and Medicaid. This statute has been interpreted to apply to arrangements between pharmaceutical manufacturers on the one hand, and prescribers, purchasers and formulary managers, among others, on the other. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. The HHS Office of Inspector General (“ OIG |

| • | The federal False Claims Act, which imposes criminal and civil penalties, including those from civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government, claims for payment that are false or fraudulent or making a false statement to avoid, decrease, or conceal an obligation to pay money to the federal government. For example, pharmaceutical companies have been prosecuted under the False Claims Act in connection with their alleged off-label promotion of drugs, purportedly concealing price concessions in the pricing information submitted to the government for government price reporting purposes, and allegedly providing free product to customers with the expectation that the customers would bill federal health care programs for the product. In addition, the government may assert that a claim including items or services resulting from a violation of the federal anti-kickback statute constitutes a false or fraudulent claim for purposes of the False Claims Act. Manufacturers can be held liable under the False Claims Act, even when they do not submit claims directly to government payors, if they are deemed to have “caused” the submission of the claim. The False Claims Act allows private individuals acting as “whistleblowers” to bring actions on the U.S. Federal Government’s behalf and to share in any recovery. |

| • | The federal and civil false claims laws and civil monetary penalty laws, such as the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which imposes criminal and civil liability for executing a scheme to defraud any healthcare benefit program and also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information. Similar to the federal antikickback statute, a person or entity does not need to have actual knowledge of the healthcare fraud statute implemented under HIPAA or specific intent to violate it in order to have committed a violation. |

| • | HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act (“ HITECH |

tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. |

| • | The federal transparency requirements, sometimes referred to as the “Sunshine Act”, under the ACA, which require manufacturers of drugs, devices, biologics and medical supplies that are reimbursable under Medicare, Medicaid, or the Children’s Health Insurance Program to report to Department of Health and Human Services (“ HHS |

| • | T-gels, such as AndroGel, marketed by AbbVie Inc. (“AbbVie ® , marketed by Endo Pharmaceutical (“Endo ® , marketed by Endo in the United States; |

| • | generic T-injectables; |

| • | oral methyl-T; |

| • | transdermal patches, such as Androderm ® , marketed by Allergan Sales, LLC, a subsidiary of AbbVie; buccal patches, such as Striant® , marketed by Endo; |

| • | implanted subcutaneous pellets, such as Testopel ® , marketed by Endo; |

| • | Aveed, a long-acting T-injectable marketed by Endo; |

| • | Xyosted, a sub-cutaneous weekly auto-injector T-therapy marketed by Antares Pharma, Inc.; and |

| • | Natesto ® , an intranasalT-therapy, marketed by Acerus Pharmaceuticals. |

| • | TLANDO ® , an oral TU formulation developed by Lipocine, and tentatively approved by the FDA pending the expiration on March 27, 2022 of JATENZO’s three-year Hatch-Waxman exclusivity. Antares Pharma, Inc. will market TLANDO under a licensing agreement with Lipocine; |

| • | KYZATREX ® , an oral TU formulation as aT-replacement therapy being developed by Marius Pharmaceuticals with a Prescription Drug User Fee Act (“PDUFA |

| • | a once weekly aromatase inhibitor, for first-line therapy for the treatment of obese men with hypogonadotropic hypogonadism, which has completed its Phase 2b trials, currently being developed by Mereo BioPharma Group Ltd; and |

| • | an oral bio-identical testosterone, which has completed its Phase 2 clinical studies, being developed by TesoRx LLC. |

| • | substantial monetary awards to patients from our clinical trials or other claimants; |

| • | decreased demand for JATENZO; |

| • | damage to our business reputation and exposure to adverse publicity; |

| • | increased FDA warnings on product labels; |

| • | costs of related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | loss of revenue; and |

| • | the inability to successfully commercialize JATENZO. |

| • | sell, transfer, lease or dispose of certain assets; |

| • | encumber or permit liens on certain assets; |

| • | make certain restricted payments, including paying dividends on, or repurchasing or making distributions with respect to, the Common Stock; and |

| • | enter into certain transactions with affiliates. |

| • | a limited availability of market quotations for its securities; |

| • | reduced liquidity for its securities; |

| • | a determination that the Common Stock is a “penny stock,” which will require brokers trading in the Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | results of operations that vary from the expectations of securities analysts and investors; |

| • | results of operations that vary from those our competitors; |

| • | changes in expectations as to our future financial performance, including financial estimates and investment recommendations by securities analysts and investors; |

| • | declines in the market prices of stocks generally; |

| • | strategic actions by us or our competitors; |

| • | announcements by us or our competitors of significant contracts, acquisitions, joint ventures, other strategic relationships or capital commitments; |

| • | any significant change in our management; |

| • | changes in general economic or market conditions or trends in our industry or markets; |

| • | changes in business or regulatory conditions, including new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| • | future sales of Common Stock or other securities; |

| • | investor perceptions of the investment opportunity associated with the Common Stock relative to other investment alternatives; |

| • | the public’s response to press releases or other public announcements by our or third parties, including our filings with the SEC; |

| • | litigation involving our, our industry, or both, or investigations by regulators into our operations or those of our competitors; |

| • | guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance; |

| • | the development and sustainability of an active trading market for the Common Stock; |

| • | actions by institutional or activist stockholders; |

| • | changes in accounting standards, policies, guidelines, interpretations or principles; and |

| • | other events or factors, including those resulting from pandemics, natural disasters, war, acts of terrorism or responses to these events. |

| • | a classified board of directors with three-year staggered terms, which could delay the ability of stockholders to change the membership of a majority of our board of directors; |

| • | opting out of Section 203 of the DGCL to allow us to establish our own rules governing business combinations with interested parties; |

| • | the ability of our board of directors to issue shares of preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

| • | the limitation of the liability of, and the indemnification of, our directors and officers; |

| • | the exclusive right of our board of directors to elect a director to fill a vacancy created by the expansion of our board of directors or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors; |

| • | the requirement that directors may only be removed from our board of directors for cause; |

| • | a prohibition on stockholder action by written consent, which forces stockholder action to be taken at an annual or special meeting of stockholders and could delay the ability of stockholders to force consideration of a stockholder proposal or to take action, including the removal of directors; |

| • | the requirement that a special meeting of stockholders may be called only by our board of directors, the chairperson of our board of directors, our chief executive officer or our president (in the absence of a chief executive officer), which could delay the ability of stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | controlling the procedures for the conduct and scheduling of board of directors and stockholder meetings; |

| • | the requirement for the affirmative vote of holders of at least 2/3 of the voting power of all of the then outstanding shares of the voting stock, voting together as a single class, to amend, alter, change or repeal any provision of the Certificate of Incorporation and Bylaws, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our board of directors and also may inhibit the ability of an acquirer to effect such amendments to facilitate an unsolicited takeover attempt; |

| • | the ability of our board of directors to amend the bylaws, which may allow our board of directors to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend the bylaws to facilitate an unsolicited takeover attempt; and |

| • | advance notice procedures with which stockholders must comply to nominate candidates to our board of directors or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our board of directors and also may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company. |

| • | Easy-to-swallow |

| • | Dose adjustable |

| • | 87% of men achieved T levels in normal range |

| • | Restored T levels to mid-normal range |

| • | Safety profile consistent with TRT class |

| • | No liver toxicity — JATENZO bypasses first-pass hepatic metabolism; liver toxicity not observed in clinical studies of up to 2 years duration. |

| • | continue to commercialize JATENZO in the United States for the treatment of adult males with a deficiency or absence of endogenous T; |

| • | incur sales and marketing costs to support the commercialization of JATENZO; |

| • | incur contractual manufacturing costs for JATENZO; |

| • | implement post-approval requirements related to JATENZO; |

| • | actively pursue additional indications and line extensions for JATENZO for the treatment of adult males with a deficiency or absence of endogenous T; |

| • | seek to attract and retain new and existing skilled personnel; |

| • | invest in measures to protect and expand our intellectual property; |

| • | seek to discover and develop additional product candidates; |

| • | seek to in-license or acquire additional product candidates for other medical conditions; |

| • | adapt our regulatory compliance efforts to incorporate requirements applicable to marketed products; |

| • | maintain, expand and protect our intellectual property portfolio; |

| • | hire additional clinical, manufacturing and scientific personnel; |

| • | add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts; |

| • | create additional infrastructure to support operations as a public company and incur increased legal, accounting, investor relations and other expenses; and |

| • | experience delays or encounter issues with additional outbreaks of the pandemic in addition to any of the above. |

| • | salaries, benefits and other related costs, including stock-based compensation expense, for personnel engaged in research and development functions; |

| • | post-marketing requirements of the FDA for JATENZO and pharmaceutical development expense related to our recently in-licensed products; and |

| • | costs of outside consultants, including their fees and related travel expenses engaged in research and development functions. |

Three Months Ended September 30, | ||||||||||||

2021 | 2020 | Change | ||||||||||

Net product revenue | $ | 4,286 | $ | 2,224 | $ | 2,062 | ||||||

Cost of product sales | 510 | 257 | 253 | |||||||||

Gross profit | 3,776 | 1,967 | 1,809 | |||||||||

Operating expenses: | ||||||||||||

Sales and marketing | 7,550 | 8,733 | (1,183 | ) | ||||||||

General and administrative | 3,384 | 3,040 | 344 | |||||||||

Research and development | 1,275 | 1,437 | (161 | ) | ||||||||

Total operating expenses | 12,209 | 13,210 | (1,000 | ) | ||||||||

Loss from operations | (8,433 | ) | (11,243 | ) | 2,810 | |||||||

Other (expense) income, net: | ||||||||||||

Change in fair value of warrant liability and derivative, net | 7,610 | 20,939 | (13,329 | ) | ||||||||

Interest income | 1 | 1 | — | |||||||||

Interest expense | (4,447 | ) | (4,291 | ) | (156 | ) | ||||||

Litigation settlement | 2,500 | — | 2,500 | |||||||||

Total other (expense) income, net | 5,664 | 16,649 | (10,985 | ) | ||||||||

Net (loss) income | $ | (2,769 | ) | $ | 5,406 | $ | (8,175 | ) | ||||

| • | a $1.7 million decrease in outsourced advertising and promotion costs due to timing of media buys and agency activities; |

| • | a $0.4 million increase in commercial analytic and market research costs, primarily related to prescription and payor data; and |

| • | a $0.1 million decrease in other sales and marketing related costs. |

| • | a $1.0 million increase in personnel costs, including stock-based compensation expense, primarily due to an increase in headcount and external consultants; |

| • | a $0.6 million decrease in consulting and professional fees, primarily due to a decrease in legal fees related to patents; and |

| • | a $0.1 million decrease in other general and administrative costs. |

| • | a $1.0 million decrease in costs related to research and development consulting services; offset by |

| • | a $0.9 million increase in license fees related to the License Agreements with HavaH and McGill. |

Nine Months Ended September 30, | ||||||||||||

2021 | 2020 | Change | ||||||||||

Net product revenue | $ | 9,395 | $ | 3,943 | $ | 5,452 | ||||||

Cost of product sales | 1,431 | 8,328 | (6,897 | ) | ||||||||

Gross profit (loss) | 7,964 | (4,385 | ) | 12,349 | ||||||||

Operating expenses: | ||||||||||||

Sales and marketing | 25,017 | 23,557 | 1,460 | |||||||||

General and administrative | 12,316 | 8,261 | 4,055 | |||||||||

Research and development | 3,093 | 2,818 | 276 | |||||||||

Total operating expenses | 40,426 | 34,636 | 5,790 | |||||||||

Loss from operations | (32,462 | ) | (39,021 | ) | 6,559 | |||||||

Other (expense) income, net: | ||||||||||||

Change in fair value of warrant liability and derivative, net | 7,610 | 53,854 | (46,244 | ) | ||||||||

Interest income | 1 | 24 | (23 | ) | ||||||||

Interest expense | (13,964 | ) | (10,790 | ) | (3,174 | ) | ||||||

Litigation settlement | 2,500 | — | 2,500 | |||||||||

Total other (expense) income, net | (3,853 | ) | 43,088 | (46,941 | ) | |||||||

Net (loss) income | $ | (36,315 | ) | $ | 4,067 | $ | (40,382 | ) | ||||

| • | a $2.6 million increase in marketing costs, primarily related to the timing of agency activities; |

| • | a $0.2 million increase in patient assistance costs and other sales and marketing costs; offset by |

| • | a $1.3 million decrease in commercial analytics and market research costs. |

| • | a $2.6 million increase in personnel costs, including stock-based compensation expense, primarily due to an increase headcount and external consultants; |

| • | a $0.8 million increase in consulting and professional fees, primarily due to an increase in fees paid to outside accounting and finance consultants and audit fees incurred as a result of becoming a public company; |

| • | a $0.5 million increase in insurance fees, related to directors’ and officers’ insurance; and |

| • | a $0.2 million increase in other general and administrative expenses. |

| • | a $0.9 million increase in license fees related to the HavaH Agreement and McGill Agreement; and |

| • | a $1.0 million increase in clinical costs related to Phase 4 studies related to the development of JATENZO, our lead commercial product; offset by |

| • | a $1.6 million decrease in costs related to research and development consulting services. |

Year Ended December 31, | ||||||||||||

2020 | 2019 | Change | ||||||||||

Net product revenue | $ | 6,369 | $ | — | $ | 6,369 | ||||||

Cost of product sales | 8,687 | — | 8,687 | |||||||||

Gross loss | (2,318 | ) | — | (2,318 | ) | |||||||

Operating expenses: | ||||||||||||

Sales and marketing | 29,515 | 7,374 | 22,141 | |||||||||

General and administrative | 11,937 | 7,414 | 4,523 | |||||||||

Research and development | 3,407 | 3,088 | 319 | |||||||||

Loss from operations | (47,177 | ) | (17,876 | ) | (29,301 | ) | ||||||

Other income (expense), net: | ||||||||||||

Change in fair value of warrant liability and derivative, net | 66,891 | 13 | 66,878 | |||||||||

Interest income | 25 | 79 | (54 | ) | ||||||||

Interest expense | (15,394 | ) | (23,866 | ) | 8,472 | |||||||

Total other income (expense), net | 51,522 | (23,774 | ) | 75,296 | ||||||||

Net income (loss) | $ | 4,345 | $ | (41,650 | ) | $ | 45,995 | |||||

| • | A $21.8 million increase in commercialization costs, primarily due to an increase in outsourced commercial costs of $21.1 million and an increase of patient assistance program costs of $0.5 million; and |

| • | a $0.3 million increase in 3PL distribution fees. |

| • | A $2.2 million increase in personnel costs, including stock-based compensation expense, primarily due to an increase headcount and external consultants; and |

| • | a $2.2 million increase in consulting and professional fees, including legal, business development, accounting and audit fees. |

| • | A $0.6 million increase in outside consulting costs; and |

| • | a $0.3 million decrease in costs related to the development of JATENZO, Clarus’s lead commercial product, specifically due to the decreased clinical and manufacturing expenses after JATENZO was commercially available in February 2020. |

Nine Months Ended September 30, | Years Ended December 31, | |||||||||||||||

2021 | 2020 | 2020 | 2019 | |||||||||||||

Net cash used in operating activities | (34,452 | ) | (35,661 | ) | $ | (41,580 | ) | $ | (19,715 | ) | ||||||

Net cash used in investing activities | (20 | ) | (62 | ) | (63 | ) | (21 | ) | ||||||||

Net cash provided by financing activities | 49,192 | 47,220 | 47,220 | 18,360 | ||||||||||||

Net increase in cash and cash equivalents | $ | 14,720 | $ | 11,497 | $ | 5,577 | $ | (1,376 | ) | |||||||

| • | The costs, timing and ability to manufacture JATENZO; |

| • | the costs of future activities, including product sales, marketing, manufacturing and distribution of JATENZO; |

| • | the costs of manufacturing commercial-grade product and necessary inventory to support continued commercial launch; |

| • | the costs of potential milestones related to license agreements; |

| • | the ability to receive additional non-dilutive funding, including grants from organizations and foundations; |

| • | the revenue from commercial sale of its products; |

| • | the costs of preparing, filing and prosecuting patent applications, obtaining, maintaining, expanding and enforcing its intellectual property rights and defending intellectual property-related claims; and |

| • | our ability to establish and maintain collaborations on favorable terms, if at all. |

Contractual obligation | Total | Less than 1 year | More than 1 year and less than 3 | More than 3 years and less than 5 | More than 5 years | |||||||||||||||

Senior secured notes | 43,125 | 6,000 | 29,125 | 8,000 | — | |||||||||||||||

Interest on senior secured notes (1) | 18,226 | 10,207 | 7,439 | 580 | — | |||||||||||||||

Operating lease obligations (2) | 40 | 40 | — | — | — | |||||||||||||||

Catalent Agreement purchase obligation | 12,737 | 3,639 | 7,278 | 1,820 | — | |||||||||||||||

Pfizer Agreement purchase obligation | 4,719 | 1,849 | 2,870 | — | — | |||||||||||||||

Total | $ | 78,846 | $ | 21,734 | $ | 46,712 | $ | 10,400 | $ | 0 | ||||||||||

| (1) | We have $43.1 million outstanding aggregate principal on our senior secured notes that bear interest at 12.5% and mature on March 1, 2025. |

| (2) | We have an operating lease agreement for our office space. |

| • | Establish JATENZO as the preferred choice among appropriate hypogonadal men for T-replacement. |

| • | Accelerate the build of our commercial infrastructure to successfully grow the market for JATENZO and launch any additional products we develop or acquire. |

| • | Explore additional indications for JATENZO and consider business development opportunities to grow our pipeline and product portfolio. |

JATENZO for additional potential indications, including, for example, treatment of hypogonadism associated female-to-male transgender |

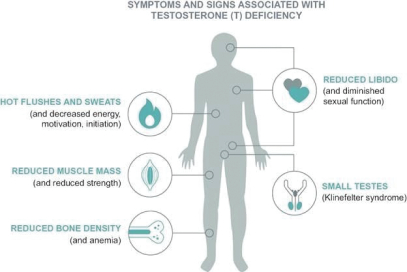

| • | a growing awareness among physicians to diagnose and treat hypogonadism and willingness by patients to discuss signs and symptoms of their medical condition than in the past; |

| • | recognition and association by HCPs of the association of hypogonadism with other increasingly prevalent diseases, such as metabolic syndrome, type 2 diabetes, chronic renal disease and chronic heart disease; |

| • | the ability to easily identify low serum T levels through a simple blood test; and |

| • | continuing guidance from medical societies (including the Endocrine Society, American Association of Clinical Endocrinologists and American Urological Association), that clinicians measure serum T levels of patients if they present with symptoms or signs typically associated with hypogonadism. |

| • | Convenient Oral Dosing. easy-to-swallow softgels |

| • | Normalized T Levels. |

| • | Avoids Administration Challenges. non-oral products. JATENZO avoids the risk of T transfer to partners and children that exists with gel treatment; injection site pain, risk of POME and polycythemia seen with injections, and the gum, nasal and skin irritation and difficulty of administration seen with other TRT products |

| • | Safety Profile. |

| • | qualified two sources of bulk TU, Pfizer and Xianju, both of which are subject to continuing FDA review and periodic inspection, and entered into a commercial supply agreement with each; |

| • | entered into an exclusive manufacturing agreement with Catalent for the manufacture of JATENZO softgel capsules; and |

| • | entered into an agreement with a commercial packager for finished JATENZO capsules. |

| • | nonclinical laboratory and animal tests that must be conducted in accordance with Good Laboratory Practices; |

| • | submission to the FDA of an Investigational New Drug (“ IND |

| • | approval by an independent institutional review board (“ IRB |

| • | adequate and well controlled human clinical trials to establish the safety and efficacy of the proposed product candidate for its intended use, performed in accordance with good clinical practices (“ GCPs |

| • | submission to the FDA of an NDA and payment of user fees; |

| • | satisfactory completion of an FDA advisory committee review, if applicable; |

| • | pre-approval inspection of manufacturing facilities and selected clinical investigators for their compliance with cGMP and GCP; |

| • | satisfactory completion of FDA audits of clinical trial sites to assure compliance with GCPs and the integrity of the clinical data; and |

| • | FDA review and approval of an NDA to permit commercial marketing for particular indications for use. |

| • | Phase 1 — Studies are initially conducted to test the product candidate for safety, dosage tolerance, structure-activity relationships, mechanism of action, absorption, metabolism, distribution and excretion in healthy volunteers or subjects with the target disease or condition. If possible, Phase 1 clinical trials may also be used to gain an initial indication of product effectiveness. |

| • | Phase 2 — Controlled studies are conducted with groups of subjects with a specified disease or condition to provide enough data to evaluate the preliminary efficacy, optimal dosages and dosing schedule and expanded evidence of safety. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expansive Phase 3 clinical trials. |

| • | Phase 3 — These clinical trials are generally undertaken in larger subject populations to provide statistically significant evidence of clinical efficacy and to further test for safety in an expanded subject population at multiple clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. These clinical trials may be done at trial sites outside the United States as long as the global sites are also representative of the U.S. population and the conduct of the study at global sites comports with FDA regulations and guidance, such as compliance with GCPs. In most cases, FDA requires two adequate and well-controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. A single trial may be sufficient in rare instances, including (1) where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible or (2) when in conjunction with other confirmatory evidence. |

| • | created an annual, nondeductible fee on any entity that manufactures or imports specified branded prescription drugs and biologic products, apportioned among these entities according to their market share in certain government healthcare programs; |

| • | expanded eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to certain individuals with income at or below 133% of the federal poverty level, thereby potentially increasing a manufacturer’s Medicaid rebate liability; |

| • | expanded manufacturers’ rebate liability under the Medicaid Drug Rebate Program by increasing the minimum rebate for both branded and generic drugs and revising the definition of “average manufacturer price,” (“ AMP |

| • | addressed a new methodology by which rebates owed by manufacturers under the Medicaid Drug Rebate Program are calculated for drugs that are inhaled, infused, instilled, implanted or injected; |

| • | expanded the types of entities eligible for the 340B drug discount program; |

| • | established the Medicare Part D coverage gap discount program by requiring manufacturers to provide point-of-sale-discounts off |

| • | created a Patient-Centered Outcomes Research Institute to oversee, identify priorities in and conduct comparative clinical effectiveness research, along with funding for such research. |

Name | Age | Position | ||

Robert E. Dudley, Ph.D. | 67 | Chief Executive Officer, President and Chairman of the Board | ||

Richard Peterson | 54 | Chief Financial Officer | ||

Steven A. Bourne | 60 | Chief Administrative Officer, Secretary and Treasurer | ||

Frank Jaeger | 51 | Chief Commercial Officer |

Name | Age | Position | ||

John Amory | 54 | Director | ||

Elizabeth A. Cermak | 64 | Director | ||

Joseph Hernandez | 49 | Director | ||

Kimberly Murphy | 58 | Chairman of the Board | ||

Mark A. Prygocki, Sr | 55 | Director | ||

Alex Zisson | 52 | Director |

| • | the Class I directors are Alex Zisson and John Amory, and their terms will expire at the annual meeting of stockholders to be held in 2022; |

| • | the Class II directors are Mark Prygocki and Elizabeth Cermak, and their terms will expire at the annual meeting of stockholders to be held in 2023; and |

| • | the Class III directors are Robert Dudley, Kimberly Murphy and Joseph Hernandez, and their terms will expire at the annual meeting of stockholders to be held in 2024. |

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing policies on risk assessment and risk management; |

| • | reviewing related party transactions; |

| • | obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and |

| • | approving (or, as permitted, pre-approving) all audit and all permissiblenon-audit service to be performed by the independent registered public accounting firm. |

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to the Chief Executive Officer’s compensation, evaluating the Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration (if any) of the Chief Executive Officer based on such evaluation; |

| • | reviewing and approving the compensation of the other executive officers; |

| • | reviewing and recommending to the Board the compensation of the directors; |

| • | reviewing our executive compensation policies and plans; |

| • | reviewing and approving, or recommending that the Board approve, incentive compensation and equity plans, severance agreements, change-of-control protections |

| • | administering our incentive compensation equity-based incentive plans; |

| • | selecting independent compensation consultants and assessing whether there are any conflicts of interest with any of the committee’s compensation advisors; |

| • | assisting management in complying with this prospectus statement and annual report disclosure requirements; |

| • | if required, producing a report on executive compensation to be included in the annual proxy statement; |

| • | reviewing and establishing general policies relating to compensation and benefits of our employees; and |

| • | reviewing our overall compensation philosophy. |

| • | identifying, evaluating and selecting, or recommending that the Board approve, nominees for election to the Combined Entity’s board of directors; |

| • | evaluating the performance of the Board and of individual directors; |

| • | reviewing developments in corporate governance practices; |

| • | evaluating the adequacy of our corporate governance practices and reporting; |

| • | reviewing management succession plans; and |

| • | developing and making recommendations to the Board regarding corporate governance guidelines and matters. |

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1) | All Other Compensation ($) | Total ($) | ||||||||||||

Elizabeth Cermak (2) | 30,000 | 32,740 | — | 62,740 | ||||||||||||

Mark A. Prygocki (3) | 16,250 | (4) | 479,109 | 131,162 | (5) | 626,521 | ||||||||||

| (1) | The amounts reported represent the aggregate grant date fair value of the stock option awards granted to Legacy Clarus’ non-employee directors during 2020, calculated in accordance with FASB ASC Topic 718. Such grant date fair values do not take into account any estimated forfeitures. The assumptions used in calculating the grant date fair value of the stock option awards reported in this column are set forth in note 10 of Legacy Clarus’ audited financial statements included elsewhere in this prospectus. The amounts reported in this column reflect the accounting cost for these stock option awards and do not correspond to the actual economic value that may be received by ournon-employee directors upon the exercise of the stock option awards or any sale of the underlying shares of Legacy Clarus common stock. |

| (2) | As of December 31, 2020, Ms. Cermak held stock options to purchase a total of 121,520 shares of Legacy Clarus common stock. These options were cancelled and extinguished at the Merger Closing. |

| (3) | As of December 31, 2020, Mr. Prygocki held stock options to purchase a total of 475,781 shares of Legacy Clarus common stock. These options were cancelled and extinguished at the Merger Closing. |

| (4) | Mr. Prygocki was appointed, temporarily, as an Executive Director of the board of directors of Legacy Clarus on July 15, 2020 and ceased to receive any cash retainer for board services as of such date and until such time that he no longer held the Executive Director position. Mr. Prygocki’s role as Executive Director ceased on May 15, 2021. |

| (5) | Represents amounts paid to Mr. Prygocki for service as a Legacy Clarus non-employee director, consisting of the $128,125 in cash compensation and $3,037 for medical insurance premiums. In connection with Mr. Prygocki’s appointment as an Executive Director, Legacy Clarus’ board approved the following compensation to Mr. Prygocki: (i) a cash payment in an amount equal to 70% of Legacy Clarus’s Chief Executive Officer’s salary, payable on a monthly basis, if Mr. Prygocki is not eligible for and has not elected coverage under Legacy Clarus’ healthcare plans, (ii) a cash payment amount equal to 60% of Legacy Clarus’s Chief Executive Officer’s salary, payable on a monthly basis, if Mr. Prygocki is eligible for and has elected coverage under Legacy Clarus’ healthcare plans, and (iii) eligibility to receive an annual bonus in an amount of up to 60% of Legacy Clarus’s Chief Executive Officer’s bonus, contingent upon achievement of certain performance measures as determined by Legacy Clarus’ board of directors in its sole discretion |

| • | Robert E. Dudley, Ph.D., President and Chief Executive Officer |

| • | Steven A. Bourne, Chief Administrative Officer |

| • | Frank A. Jaeger, Chief Commercial Officer |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) (1) | Nonequity Incentive Plan Compensation ($) (2) | Total ($) | ||||||||||||||||||

Robert E. Dudley President and Chief Executive Office | 2020 | 410,000 | — | — | 147,600 | 557,600 | ||||||||||||||||||

Steven A. Bourne Chief Administrative Officer | 2020 | 325,000 | — | — | 85,830 | 410,830 | ||||||||||||||||||

Frank A. Jaeger Chief Commercial Officer | 2020 | 325,000 | — | 24,500 | 89,234 | 438,734 | ||||||||||||||||||

| (1) | The amounts reported represent the aggregate grant date fair value of the stock option awards granted to the NEO during Fiscal Year 2020, calculated in accordance with FASB ASC Topic 718. Such grant date fair values do not take into account any estimated forfeitures. The assumptions used in calculating the grant date fair value of the stock option awards reported in this column are set forth in Note 10 of Legacy Clarus’ audited financial statements included elsewhere in this prospectus. The amounts reported in this column reflect the accounting cost for these stock option awards and do not correspond to the actual economic value that may be received by our NEOs upon the exercise of the stock option awards or any sale of the underlying shares of Legacy Clarus common stock. |

| (2) | Reflects amounts earned in Fiscal Year 2020. Bonuses were paid in August 2021. |

Name | 2020 Base Salary ($) | 2021 Base Salary* ($) | ||||||

Robert E. Dudley | 410,000 | 609,000 | ||||||

Steven A. Bourne | 325,000 | 348,000 | ||||||

Frank A. Jaeger | 325,000 | 400,000 | ||||||

| * | 2021 Base Salary is effective as of September 9, 2021. |

Option awards | ||||||||||||||||||||||||

Name | Grant date | Vesting commencement date | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Option exercise price ($) | Option expiration date | ||||||||||||||||||

Robert E. Dudley | 9/9/2011 | (1) | 9/9/2011 | 570,000 | — | 0.99 | 9/9/2021 | |||||||||||||||||

| 1/22/2015 | (2) | 1/22/2015 | 58,823 | (3) | — | 2.93 | 1/22/2025 | |||||||||||||||||

| 6/2/2016 | (2) | 6/2/2016 | 128,000 | (3) | — | 1.32 | 6/2/2026 | |||||||||||||||||

| 7/17/2017 | (2) | 7/17/2017 | 125,525 | (4) | 21,431 | (4) | 2.14 | 7/17/2027 | ||||||||||||||||

| 12/15/2017 | (2) | 12/15/2017 | 129,000 | (4) | 43,000 | (4) | 2.13 | 12/15/2027 | ||||||||||||||||

Steven A. Bourne | 9/9/2011 | (1) | 9/9/2011 | 95,000 | (3) | — | 0.99 | 9/9/2021 | ||||||||||||||||

| 1/22/2015 | (2) | 1/22/2015 | 31,512 | (3) | — | 2.93 | 1/22/2025 | |||||||||||||||||

| 6/2/2016 | (2) | 6/2/2016 | 80,000 | (3) | — | 1.32 | 6/2/2026 | |||||||||||||||||

| 7/17/2017 | (2) | 7/17/2017 | 55,521 | (4) | 9,479 | (4) | 2.14 | 7/17/2027 | ||||||||||||||||

| 12/15/2017 | (2) | 12/15/2017 | 73,125 | (4) | 24,375 | (4) | 2.13 | 12/15/2027 | ||||||||||||||||

Frank A. Jaeger | 12/18/2020 | (2) | 9/23/2019 | 109,375 | (4) | 240,375 | (4) | 2.69 | 12/18/2030 | |||||||||||||||

| (1) | This equity award was granted under and is subject to the terms of the Legacy Clarus 2004 Stock Incentive Plan (the “2004 Plan” |

| (2) | This equity award was granted under and is subject to the terms of the Legacy Clarus 2014 Plan, as well as certain acceleration of vesting rights under the NEO’s employment agreement or offer letter, as applicable. This equity award was cancelled and extinguished at the Merger Closing. |

| (3) | This grant was fully vested on December 31, 2020. |

| (4) | 1 ⁄4 of the shares subject to this stock option vest on the one year anniversary of the vesting commencement date, and 1/48 of the shares subject to the stock option vest on a monthly basis thereafter, in each case, subject to the NEO’s continued service relationship through each applicable vesting date. |

| • | any breach of the director’s duty of loyalty to the corporation or its stockholders; |

| • | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| • | unlawful payments of dividends or unlawful stock repurchases or redemptions; or |

| • | any transaction from which the director derived an improper personal benefit. |

| • | the amounts involved exceeded or will exceed $120,000; and |

| • | any of Legacy Clarus’s directors, executive officers or holders of more than 5% of Legacy Clarus’s voting securities, or any member of the immediate family of the foregoing persons, had or will have a direct or indirect material interest. |

Name and Date of Issuance | Aggregate Principal | |||

February Notes | ||||

February 13, 2018 | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 1,654,756.18 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 783,554.49 | ||

CBC SPVI Ltd (3) | $ | 876,618.82 | ||

August Notes | ||||

Initial 2018 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 1,946,771.98 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 1,727,269.09 | ||

CBC SPVI Ltd (3) | $ | 1,031,316.26 | ||

First Subsequent 2019 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 3,893,543.96 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 3,454,538.18 | ||

CBC SPVI Ltd (3) | $ | 2,062,632.52 | ||

Second Subsequent 2019 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 1,946,774.98 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 1,727,269.09 | ||

CBC SPVI Ltd (3) | $ | 1,031,316.52 | ||

Third Subsequent 2019 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 1,946,774.98 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 1,727,269.09 | ||

CBC SPVI Ltd (3) | $ | 1,031,316.26 | ||

First Subsequent 2021 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 2,920,157.98 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 2,590,903.63 | ||

CBC SPVI Ltd (3) | $ | 1,546,974.38 | ||

Second Subsequent 2021 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 2,133,681.77 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 1,413,053.83 | ||

CBC SPVI Ltd (3) | $ | 1,130,333.05 | ||

Third Subsequent 2021 Closing | ||||

Entities affiliated with Thomas, McNerney & Partners (1) | $ | 1,160,295.79 | ||

Entities affiliated with H.I.G. BioVentures (2) | $ | 549,419.29 | ||

CBC SPVI Ltd (3) | $ | 614,674.90 | ||

| (1) | James E. Thomas is a partner at Thomas, McNerney & Partners and was a member of Legacy Clarus’s board of directors. |

| (2) | Bruce C. Robertson, Ph.D. and Alex Zisson are managing directors at H.I.G. BioHealth Partners and were members of Legacy Clarus’s board of directors. Alex Zisson is a member of the Board. |

| (3) | Mengjiao Jiang is a managing partner at C-Bridge Capital Partners and was a member of Legacy Clarus’s board of directors. |

| • | any director or executive officer of the Company; |

| • | any director nominee; |

| • | security holders known to the Company to beneficially own more than 5% of any class of the Company’s voting securities, and |

| • | any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, daughter-in-law, brother-in-law or sister-in-law of |

| • | each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of the Common Stock; |

| • | each current named executive officer and director of the Company; and |

| • | all current executive officers and directors of the Company, as a group. |

Name and Address of Beneficial Owner | Number of Shares | Percentage of Outstanding Shares | ||||||

Directors and Executive Officers | ||||||||

Kimberly Murphy | — | — | ||||||

Joseph Hernandez (4) | 1,302,500 | 5.4 | % | |||||

Robert E. Dudley | 4,566 | * | ||||||

Elizabeth A. Cermak | — | — | ||||||

Mark A. Prygocki, Sr | — | — | ||||||

Alex Zisson (1) | — | — | % | |||||

John Amory | — | — | ||||||

Richard Peterson | — | — | ||||||

Frank Jaeger | — | — | ||||||

Steve Bourne | 1,305 | * | ||||||

All directors and executive officers as a group (10 individuals) | 7,000,752 | 29.12 | % | |||||

Five Percent Holders: | ||||||||

Entities affiliated with H.I.G. BioVentures (1) | 5,692,381 | 23.7 | % | |||||

Entities affiliated with Thomas, McNerney & Partners (2) | 5,498,571 | 22.9 | % | |||||

CBC SPVI Ltd. (3) | 3,602,287 | 15.0 | % | |||||

Blue Water Sponsor LLC (4) | 1,302,500 | 5.4 | % | |||||

Entities affiliated with Bracebridge Capital, LLC (5) | 2,229,855 | 9.3 | % | |||||

Armistice Capital Master Fund Ltd. (6) | 2,411,300 | 9.99 | % | |||||

| * | Less than 1%. |

| (1) | Consists of (i) 2,731,094 shares of Common Stock directly held by H.I.G. Ventures — Clarus, LLC, (ii) 2,470,756 shares of Common Stock directly held by H.I.G. Bio — Clarus II, L.P., and (iii) 490,531 shares of Common Stock directly held by H.I.G. Bio — Clarus I, L.P. Alex Zisson, a member of the Board, is a managing director of H.I.G. Capital LLC, but does not share voting and investment power with respect to the shares directly held by H.I.G. Ventures — Clarus, LLC, H.I.G. Bio — Clarus II, L.P., and H.I.G. |

| Bio — Clarus I, L.P., and disclaims beneficial ownership of such shares except to the extent of any pecuniary interest therein. Those three entities are owned by private funds advised by H.I.G. Capital, LLC, an SEC registered investment advisor, and its affiliates. The address for all entities and individuals affiliated with H.I.G. BioVentures is 1450 Brickell Ave., Suite 3100, Miami, FL 33131. |

| (2) | Consists of (i) 2,436,725 shares of Common Stock directly held by Thomas, McNerney & Partners, L.P., or TMP, (ii) 3,020,674 shares of Common Stock directly held by Thomas, McNerney & Partners II, L.P., or TMP II, (iii) 8,383 shares of Common Stock directly held by TMP Nominee, LLC, or TMP Nominee (iv) 19,970 shares of Common Stock held by TMP Nominee II, LLC or TMP Nominee II, (v) 1,706 shares of Common Stock directly held by TMP Associates, L.P., or TMP Associates and (vi) 11,113 shares of Common Stock directly held by TMP Associates II. L.P. or, TMP Associates II. TMP GP, the general partner of TMP, TMP II, TMP Associates and TMP Associates II, has voting and dispositive power over the shares held by TMP, TMP II, TMP Associates and TMP Associates II. In addition, each of TMP Nominee and TMP Nominee II has entered into an agreement that it shall vote and dispose of securities in the same manner as directed by TMP GP with respect to the shares held by TMP and TMP Associates and as directed by TMP GP II with respect to shares held by TMP II and TMP Associates II. James Thomas is manager of TMP GP and TMP GP II, and of TMP Nominee and TMP Nominee II. He disclaims beneficial ownership of the shares owned by TMP, TMP II, TMP Nominee, TMP Nominee II, TMP Associates and TMP Associates II. The address for all entities and individuals affiliated with Thomas, McNerney is c/o Thomas, McNerney & Partners, L.P., 12527 Central Avenue NE, #297, Minneapolis, MN 55434. |

| (3) | Shares of Common Stock are directly held by CBC SPVI Ltd. The address for CBC SPVI Ltd. is Suites 3306-3307, Two Exchange Square, 8 Connaught Place, Central, Hong Kong. |

| (4) | Joseph Hernandez, a member of the Board, is the managing member of Blue Water Sponsor LLC, and as such may be deemed to have sole voting and investment discretion with respect to the securities held by Blue Water Sponsor LLC. |

| (5) | Represents shares of Common Stock held by FFI Fund Ltd., FYI Ltd. and Olifant Fund, Ltd. (collectively, the “ Bracebridge Funds Bracebridge Investment Manager |

| (6) | Consists of (i) 2,300,000 shares of Common Stock and approximately 111,300 shares underlying Pre-Funded Warrants that are currently exercisable under the beneficial ownership blocker provision in suchPre-Funded Warrants. The shares of Common Stock reported herein are held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund Armistice Capital |

Name of Selling Securityholder | Number of Shares of Common Stock Held | Number of Shares of Common Stock Being Offered | Shares of Common Stock Held After the Offering | |||||||||||||

Number | Percent | |||||||||||||||

Armistice Capital Master Fund Ltd. (1) | 6,048,388 | (2) | 6,048,388 | — | — | |||||||||||

| (1) | The shares of Common Stock reported herein are held by Master Fund, and may be deemed to be indirectly beneficially owned by (i) Armistice Capital, as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The address of Master Fund is c/o Armistice Capital, LLC, 510 Madison Ave, 7th Floor, New York, NY 10022. |

| (2) | Consists of (i) 2,300,000 shares of Common Stock directly held by Master Fund, (ii) 724,194 shares of Common Stock issuable upon exercise of Pre-Funded Warrants directly held by Master Fund and (iii) 3,024,194 shares of Common Stock issuable upon exercise of Common Stock Warrants directly held by Master Fund. ThePre-Funded Warrants may not be exercised if Master Fund, together with its affiliates, would beneficially own a number of shares of Common Stock which would exceed 9.99% of the then outstanding Common Stock following such exercise and the Common Stock Warrants may not be exercised if Master Fund, together with its affiliates, would beneficially own a number of shares of Common Stock which would exceed 4.99% of the then outstanding Common Stock following such exercise. |

| • | in whole and not in part; |

| • | at a price of $0.01 per warrant; |

| • | upon not less than 30 days’ prior written notice of redemption to each warrantholder; and |

| • | if, and only if, the reported last sale price of the Common Stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-trading day period ending three business days before we send the notice of redemption to the warrantholders. |

| • | 1% of the total number of shares of common stock then outstanding; or |

| • | the average weekly reported trading volume of the common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

| • | the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| • | the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| • | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| • | at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

| • | permit the Board to issue up to 10,000,000 shares of preferred stock, with any rights, preferences and privileges as they may designate, including the right to approve an acquisition or other change of control; |

| • | provide that the authorized number of directors may be changed only by resolution of our Board; |

| • | provide that, subject to the rights of any series of preferred stock to elect directors, directors may be removed only with cause by the holders of not less than two thirds (2/3) of all of our then-outstanding shares of the capital stock entitled to vote generally at an election of directors; |

| • | provide that, subject to the rights of any series of preferred stock to fill director vacancies, all director vacancies, including newly created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum; |

| • | provide that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors at a meeting of stockholders must provide advance notice in writing, and also specify requirements as to the form and content of a stockholder’s notice; |

| • | provide that Special Meetings of our stockholders may be called our Board pursuant to a resolution adopted by a majority of the total number of authorized directors; |

| • | provide that our Board will be divided into three classes of directors, with the classes to be as nearly equal as possible, and with the directors serving three-year terms, therefore making it more difficult for stockholders to change the composition of our board of directors; and |

| • | not provide for cumulative voting rights, therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose. |

| • | financial institutions or financial services entities; |

| • | broker-dealers; |

| • | governments or agencies or instrumentalities thereof; |

| • | regulated investment companies; |

| • | real estate investment trusts; |

| • | expatriates or former long-term residents of the United States; |

| • | persons that actually or constructively own five percent or more of our voting shares; |

| • | insurance companies; |

| • | dealers or traders subject to a mark-to-market |

| • | persons holding the securities as part of a “straddle,” hedge, integrated transaction or similar transaction; |

| • | U.S. holders (as defined below) whose functional currency is not the U.S. dollar; |

| • | partnerships or other pass-through entities for U.S. federal income tax purposes and any beneficial owners of such entities; and |

| • | tax-exempt entities. |

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation (or other entity taxable as a corporation) organized in or under the laws of the United States, any state thereof or the District of Columbia; or |

| • | an estate the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source; or |

| • | a trust, if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons (as defined in the Code) have authority to control all substantial decisions of the trust or (ii) it has a valid election in effect under Treasury Regulations to be treated as a U.S. person. |

| • | a non-resident alien individual (other than certain former citizens and residents of the U.S. subject to U.S. tax as expatriates); |

| • | a foreign corporation or |

| • | an estate or trust that is not a U.S. holder; |

| • | the gain is effectively connected with the conduct of a trade or business by the Non-U.S. holder within the United States (and, under certain income tax treaties, is attributable to a United States permanent establishment or fixed base maintained by theNon-U.S. holder); or |

| • | we are or have been a “U.S. real property holding corporation” for U.S. federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition or the period that the Non-U.S. holder held our common stock, and, in the case where shares of our common stock are regularly traded on an established securities market, theNon-U.S. holder has owned, directly or constructively, more than 5% of our common stock at any time within the shorter of the five-year period preceding the disposition or suchNon-U.S. holder’s holding period for the shares of our common stock. There can be no assurance that our common stock will be treated as regularly traded on an established securities market for this purpose. |

| • | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| • | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | in privately negotiated transactions; |

| • | settlement of short sales; |

| • | in transactions through broker-dealers that agree with the Selling Securityholder to sell a specified number of such securities at a stipulated price per security; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| • | a combination of any such methods of sale; or |

| • | any other method permitted pursuant to applicable law. |

Page | ||||

| F-2 | ||||

| F-3 | ||||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| F-7 | ||||

Page | ||||

| F-27 | ||||

| F-28 | ||||

| F-29 | ||||

| F-30 | ||||

| F-31 | ||||

| F-32 | ||||

September 30, | December 31, | |||||||

2021 | 2020 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 21,953 | $ | 7,233 | ||||

Accounts receivable, net | 6,932 | 4,400 | ||||||

Inventory, net | 12,480 | 5,857 | ||||||

Prepaid expenses and other current assets | 3,891 | 1,846 | ||||||

Total current assets | 45,256 | 19,336 | ||||||

Property and equipment, net | 66 | 64 | ||||||

Total assets | $ | 45,322 | $ | 19,400 | ||||

Liabilities, redeemable convertible preferred stock, and stockholders’ deficit | ||||||||

Current liabilities: | ||||||||

Senior notes payable | $ | 40,339 | $ | 41,902 | ||||

Accounts payable | 15,843 | 12,107 | ||||||

Accrued expenses | 7,373 | 4,631 | ||||||

Deferred revenue | 827 | 1,172 | ||||||

Total current liabilities | 64,382 | 59,812 | ||||||

Convertible notes payable to related parties | — | 77,911 | ||||||

Royalty obligation | — | 9,262 | ||||||

Derivative warrant liability | 6,465 | — | ||||||

Total liabilities | 70,847 | 146,985 | ||||||

Commitments and contingencies (See Note 12) | 0 | 0 | ||||||

Redeemable convertible preferred stock, $0.001 par value, 0and 53,340,636 shares authorized at September 30, 2021 and December 31, 2020, respectively; 0 and 36,756,498 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | — | 198,195 | ||||||

Stockholders’ deficit: | ||||||||

Preferred stock, $0.0001 par value; 10,000,000 shares authorized; 0shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | — | — | ||||||

Common stock $0.0001 par value; 125,000,000 shares authorized; 21,725,817 and 4,901,564 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 2 | 1 | ||||||

Additional paid-in capital | 291,825 | — | ||||||

Accumulated deficit | (317,352 | ) | (325,781 | ) | ||||

Total stockholders’ deficit | (25,525 | ) | (325,780 | ) | ||||

Total liabilities, redeemable convertible preferred stock, and stockholders’ deficit | $ | 45,322 | $ | 19,400 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||||||

Net product revenue | $ | 4,286 | $ | 2,224 | $ | 9,395 | $ | 3,943 | ||||||||

Cost of product sales | 510 | 257 | 1,431 | 8,328 | ||||||||||||

Gross profit (loss) | 3,776 | 1,967 | 7,964 | (4,385 | ) | |||||||||||

Operating expenses: | ||||||||||||||||

Sales and marketing | 7,550 | 8,733 | 25,017 | 23,557 | ||||||||||||

General and administrative | 3,384 | 3,040 | 12,316 | 8,261 | ||||||||||||

Research and development | 1,275 | 1,437 | 3,093 | 2,818 | ||||||||||||

Total operating expenses | 12,209 | 13,210 | 40,426 | 34,636 | ||||||||||||

Loss from operations | (8,433 | ) | (11,243 | ) | (32,462 | ) | (39,021 | ) | ||||||||

Other (expense) income, net: | ||||||||||||||||

Change in fair value of warrant liability and derivative, net | 7,610 | 20,939 | 7,610 | 53,854 | ||||||||||||

Interest income | 1 | 1 | 1 | 24 | ||||||||||||

Interest expense | (4,447 | ) | (4,291 | ) | (13,964 | ) | (10,790 | ) | ||||||||

Litigation settlement | 2,500 | — | 2,500 | — | ||||||||||||

Total other (expense) income, net | 5,664 | 16,649 | (3,853 | ) | 43,088 | |||||||||||

Net (loss) income before income taxes | (2,769 | ) | 5,406 | (36,315 | ) | 4,067 | ||||||||||

Provision for income taxes | — | — | — | — | ||||||||||||

Net (loss) income | $ | (2,769 | ) | $ | 5,406 | $ | (36,315 | ) | $ | 4,067 | ||||||

Net (loss) income attributable to common stockholders, basic (Note 13) | $ | (2,357 | ) | $ | 5,396 | $ | (35,903 | ) | $ | (4,059 | ) | |||||

Net loss attributable to common stockholders, diluted (Note 13) | $ | (2,357 | ) | $ | (13,743 | ) | $ | (35,903 | ) | $ | (44,279 | ) | ||||

Net (loss) income per common share attributable to common stockholders, basic (Note 13) | $ | (0.26 | ) | $ | 1.10 | $ | (5.68 | ) | $ | 0.83 | ||||||

Net loss per common share attributable to common stockholders, diluted (Note 13) | $ | (0.26 | ) | $ | (0.63 | ) | $ | (5.68 | ) | $ | (2.03 | ) | ||||

Weighted-average common shares used in net (loss) income per share attributable to common stockholders, basic (Note 13) | 9,153,848 | 4,901,564 | 6,318,992 | 4,901,564 | ||||||||||||

Weighted-average common shares used in net loss per share attributable to common stockholders, diluted (Note 13) | 9,153,848 | 21,828,570 | 6,318,992 | 21,828,570 | ||||||||||||

Redeemable Convertible Preferred Stock | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Deficit | ||||||||||||||||||||||||

Shares | Amount | Shares | Amount | |||||||||||||||||||||||||

Balance at December 31, 2020 (as previously reported) | 36,756,498 | $ | 198,195 | 870,263 | $ | 1 | $ | 0 | $ | (325,781 | ) | $ | (325,780 | ) | ||||||||||||||

Retroactive application of the recapitalization due to the Business Combination (Note 3) | (36,756,498 | ) | (198,195 | ) | 4,031,301 | — | 152,653 | 37,006 | 189,659 | |||||||||||||||||||

Adjusted balance at December 31, 2020 | 0 | 0 | 4,901,564 | 1 | 152,653 | (288,775 | ) | (136,121 | ) | |||||||||||||||||||

Retroactive application of recapitalization related to 2021 activity (1) | — | — | — | — | (7,737 | ) | 7,737 | — | ||||||||||||||||||||

Conversion of Series D redeemable convertible preferred stock into common stock, adjusted for retroactive application of the recapitalization | — | — | — | — | 11,829 | — | 11,829 | |||||||||||||||||||||

Stock-based compensation | — | — | — | — | 176 | — | 176 | |||||||||||||||||||||

Net loss | — | — | — | — | — | (15,429 | ) | (15,429 | ) | |||||||||||||||||||

Balance at March 31, 2021 | 0 | 0 | 4,901,564 | 1 | 156,921 | (296,467 | ) | (139,545 | ) | |||||||||||||||||||

Stock-based compensation | — | — | — | — | 177 | — | 177 | |||||||||||||||||||||

Net loss | — | — | — | — | — | (18,117 | ) | (18,117 | ) | |||||||||||||||||||

Balance at June 30, 2021 | 0 | 0 | 4,901,564 | 1 | 157,098 | (314,584 | ) | (157,485 | ) | |||||||||||||||||||

Stock-based compensation | — | — | — | — | 207 | — | 207 | |||||||||||||||||||||

Recapitalization on September 9, 2021 | — | — | 12,984,784 | 1 | 117,512 | — | 117,513 | |||||||||||||||||||||

Proceeds from Blue Water Acquisition Corp. in Business Combination | — | — | 3,839,469 | — | 17,008 | — | 17,008 | |||||||||||||||||||||

Net loss | — | — | — | — | — | (2,769 | ) | (2,769 | ) | |||||||||||||||||||

Balance at September 30, 2021 | 0 | 0 | 21,725,817 | $ | 2 | $ | 291,825 | $ | (317,352 | ) | $ | (25,525 | ) | |||||||||||||||

| (1) | Relates to reversal of 2021 accretion recorded on the redeemable convertible preferred stock prior to the merger, as the redeemable convertible preferred stock has been retroactively restated to give effect to the reverse recapitalization. |

Redeemable Convertible Preferred Stock | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Deficit | ||||||||||||||||||||||||

Shares | Amount | Shares | Amount | |||||||||||||||||||||||||

Balance at December 31, 2019 (as previously reported) | 36,756,498 | $ | 183,513 | �� | 870,263 | $ | 1 | $ | 0 | $ | (316,269 | ) | $ | (316,268 | ) | |||||||||||||

Retroactive application of the recapitalization due to the Business Combination (Note 3) | (36,756,498 | ) | (183,513 | ) | 4,031,301 | — | 160,363 | 23,150 | 183,513 | |||||||||||||||||||

Adjusted balance at December 31, 2019 | 0 | 0 | 4,901,564 | 1 | 160,363 | (293,119 | ) | (132,755 | ) | |||||||||||||||||||

Stock-based compensation | — | — | — | — | 74 | — | 74 | |||||||||||||||||||||

Net income (loss) | — | — | — | — | — | (11,894 | ) | (11,894 | ) | |||||||||||||||||||

Balance at March 31, 2020 | 0 | 0 | 4,901,564 | 1 | 160,437 | (305,013 | ) | (144,575 | ) | |||||||||||||||||||

Stock-based compensation | — | — | — | — | 70 | — | 70 | |||||||||||||||||||||

Net income | — | — | — | — | — | 10,555 | 10,555 | |||||||||||||||||||||

Balance at June 30, 2020 | 0 | 0 | 4,901,564 | 1 | 160,507 | (294,458 | ) | (133,950 | ) | |||||||||||||||||||

Stock-based compensation | — | — | — | — | 90 | — | 90 | |||||||||||||||||||||

Net income | — | — | — | — | — | 5,406 | 5,406 | |||||||||||||||||||||

Balance at September 30, 2020 | 0 | 0 | 4,901,564 | $ | 1 | $ | 160,597 | $ | (289,052 | ) | $ | (128,454 | ) | |||||||||||||||

Nine Months Ended September 30, | ||||||||