PART II - OFFERING CIRCULAR

PRELIMINARY OFFERING CIRCULAR: An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR DATED: JULY 24, 2020, SUBJECT TO COMPLETION

THE EMANCIPATION FUND INITIATIVE LLC

5330 Griggs Road #D107

Houston, Texas 77021

Best Efforts Offering of up to

$12,000,000 in principal amount

Promissory Notes (“Notes”)

Minimum Note Purchase Amount: $5,000

This Offering Circular relates to the offer and sale on a best efforts basis of up to an aggregate of $12,000,000 in Notes issued by The Emancipation Fund Initiative LLC (the “Company”). The offering will commence as soon as this Offering Circular has been qualified by the Securities and Exchange Commission (the “SEC”) and shall remain open to new and existing investors until the Company has sold Notes with an aggregate purchase price of $12,000,000, unless earlier terminated in the Company’s sole discretion. This offering is available to both accredited and non-accredited investors. Generally, if you are a non-accredited investor, your aggregate investment in any particular offering may not exceed more than 10% of the greater of your annual income or net worth. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The Company is a newly formed Texas limited liability company. The Company will engage in the construction, ownership, sale, rental, and management of residential housing in the Houston, Texas area. The Company may also engage in any other business; however, we have no plans to do so at this time.

The Company is hereby offering to investors, pursuant to this Offering Circular, the opportunity to purchase Notes in the minimum amount of Five Thousand Dollars ($5,000) (the “Minimum Investment Amount”) and up to the maximum aggregate amount of Fifty Million Dollars ($12,000,000) (the “Maximum Offering Amount”).

| | | Price to Public | | | Underwriting Discount and Commissions | | | Proceeds to Issuer | Proceeds to Other Persons | | | |

| Per Investor Minimum | | $ | 5,000 | | | $ | — | | | $ | 5,000 | — | | | |

| Total Maximum | | $ | 12,000,000 | | | $ | — | | | $ | 12,000,000 | — | | | |

Investing in the Notes involves a high degree of risk, including risks associated with our lack of prior operations, lack of collateral for the Notes, and certain risks associated with our operations. Before buying any Notes, you should carefully read the discussion of material risks of investing in the Notes in “RISK FACTORS” herein. This Offering Circular supersedes any prior offering materials with respect to the Notes.

This Offering Circular is prepared in accordance with the Form 1-A disclosure format.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

Table of Contents

| | Page |

| IMPORTANT INFORMATION REGARDING THIS OFFERING CIRCULAR | 1 |

| SUMMARY OF OFFERING | 2 |

| STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS | 3 |

| STATEMENT REGARDING FORWARD-LOOKING INFORMATION | 4 |

| RISK FACTORS | 5 |

| USE OF PROCEEDS | 10 |

| DESCRIPTION OF BUSINESS | 10 |

| DESCRIPTION OF SECURITIES OFFERED | 13 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 13 |

| MANAGEMENT | 14 |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS | 15 |

| PLAN OF DISTRIBUTION | 19 |

| INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | 17 |

| HOW TO PURCHASE NOTES | 19 |

| AUDITED FINANCIAL STATEMENTS | 22 |

| EXHIBITS | 27 |

| SIGNATURES | 27 |

| EXHIBIT 2.1: | | CERTIFICATE OF FORMATION |

| EXHIBIT 2.2: | | COMPANY AGREEMENT |

| EXHIBIT 4.1: | | FORM OF SUBSCRIPTION AGREEMENT |

| EXHIBIT 4.2: | | FORM OF PROMISSORY NOTE |

| EXHIBIT 11.1: | | CONSENT OF WHITLEY LLP ATTORNEYS AT LAW |

| | | (INCLUDED IN EXHIBIT 12) |

| EXHIBIT 11.2: | | CONSENT OF PWR CPA, LLP |

| EXHIBIT 12: | | OPINION OF WHITLEY LLP ATTORNEYS AT LAW |

| EXHIBIT 13.1: | | SOLICITATION OF INTEREST COMMUNICATIONS

|

| EXHIBIT 13.2 | | SOLICITATION OF INTEREST COMMUNICATIONS |

IMPORTANT INFORMATION REGARDING THIS OFFERING CIRCULAR

This Offering Circular has been prepared solely for the benefit of authorized persons interested in the offering. This Offering Circular does not constitute an offer or solicitation to any person except those particular persons who satisfy the suitability standards described herein.

This Offering Circular is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as we make material investments, or have other material developments, we will provide an Offering Circular supplement that may add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The offering statement we filed with the SEC includes exhibits

that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC.

There is no public market for the Notes and none is expected to develop in the future. Sums invested are also subject to substantial restrictions upon withdrawal and transfer, and the Notes offered hereby should be purchased only by investors who have no need for liquidity in their investment.

Non-U.S. investors have certain restrictions on resale and hedging under Regulation S promulgated pursuant to the Securities Act. Distributions under this offering might result in a tax liability for the non-U.S. investors. Each prospective investor is urged to consult his, her or its own tax advisor or pension consultant to determine his, her or its tax liability.

No person has been authorized in connection with this offering to give any information or to make any representations other than those contained in this memorandum, and any such information or representations should not be relied upon. Any prospective purchaser of Notes who receives any such information or representations should contact the Managing Member immediately to determine the accuracy of such information. Neither the delivery of this memorandum nor any sales hereunder shall, under any circumstances, create an implication that there has been no change in the affairs of the company or in the information set forth herein since the date hereof.

Prospective investors should not regard the contents of this memorandum or any other communication from the company as a substitute for careful and independent tax and financial planning. Each prospective investor is encouraged to consult with his, her, or its own independent legal counsel, accountant and other professionals with respect to the legal and tax aspects of this investment and with specific reference to his, her, or its own tax situation, prior to subscribing for Notes.

The purchase of Notes by an individual retirement account (“IRA”), Keogh plan or other qualified retirement plan involves special tax risks and other considerations that should be carefully considered.

The Notes are offered subject to prior sale, acceptance of an offer to purchase, and to withdrawal or cancellation of the offering without notice. The Managing Member reserves the right to reject any investment in whole or in part.

SUMMARY OF OFFERING

The following information is only a brief summary of, and is qualified in its entirety by, the detailed information appearing elsewhere in this Offering Circular. This Offering Circular, together with the exhibits attached including, but not limited to, the Limited Liability Company Agreement of the Company (the “Company Agreement”), the Note, and the Subscription Agreement, should be read in their entirety before any investment decision is made. All capitalized terms used herein but not defined herein shall have the meaning ascribed to them in the Company Agreement. If there is a conflict between the terms contained in this Offering Circular and the Company Agreement or the Note, then the Company Agreement or the Note shall prevail.

| The Company | The Emancipation Fund Initiative LLC (the “Company”) is a Texas limited liability company with a principal office located at 5330 Griggs Road #D107, Houston, Texas 77021. The Company has not yet commenced operations. The Company intends to engage in the construction, ownership, sale, rental, and management of residential housing in the Houston, Texas area. |

| Offering Size | The Company is seeking to raise a maximum aggregate amount of $12 million. However, the Company may reduce the maximum aggregate amount. |

| | |

| Note Terms | Each Note will have a term of one (1) year from the date of purchase. Upon the maturity date of each Note, the principal amount and accrued interest of each Note will automatically renew for an additional term of 1 year with the interest rate and terms that the Company specifies, unless an investor requests payment of the principal amount and accrued interest of the investor’s Note within forty-five (45) days of the date of maturity. Approximately sixty (60) days before the maturity date of each Note, the Company will provide the investor with a notice of maturity and specify the terms (including interest rate) applicable to the Note upon renewal. The investor must then inform the Company within 45 days of the date of maturity that the investor wishes for the Company to redeem the investor’s Note. If an investor timely requests redemption of the investor’s Note, the Company will pay the principal amount and accrued interest of the Note to the investor. Partial redemption is permitted. If the investor does not timely request redemption of his/her Note, the principal amount and accrued interest of the Note will automatically be renewed into a new Note with a new 1 year term with the terms set forth in the notice of maturity provided to the investor. Each Note is an unsecured obligation of the Company. |

| | |

| Interest Rate | The initial interest rate of the Notes will be twenty percent (20%) per year. Upon maturity of a Note, the Company may change the interest rate and other terms of the Note, which will go into effect upon the renewal of the Note. |

| | |

| Collateral | The Notes are not secured by collateral. Each Note is an unsecured obligation of the Company. |

| | |

| Minimum Investment | Investors may purchase Notes from the Company in the minimum investment amount of Five Thousand Dollars ($5,000). Notes may be in any denomination provided that the principal amount is at least $5,000. |

| | |

| Payments of Principal | The principal amount and accrued interest of each Note will be paid upon maturity of the Note provided that the holder of the Note requests that the Company redeem the Note at least 15 days before the maturity date of the Note. If the investor does not request redemption of the Note within such 15-day period, the principal amount and accrued interest of the Note will automatically be rolled over into a new Note with the terms and interest rate provided to the investor in the notice of maturity. |

| | |

| Investor Suitability | This offering is limited to certain individuals, Keogh plans, IRAs and other qualified investors who meet certain minimum standards of income and/or net worth. Each purchaser must execute a Subscription Agreement making certain representations and warranties to the Company, including such purchaser’s qualifications as a “Qualified Purchaser.” See “State Law Exemption and Purchase Restrictions”. |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Notes will be sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law “blue sky”

review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that investments offered hereby are offered and sold only to “qualified purchasers” or at a time when the Notes are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

| 1. | an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person; or |

| 2. | earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details. |

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s residence, and any indebtedness in excess of the value of the investor’s residence should be counted as a liability.

STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Offering Circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward- looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash available for dividends, cash flows, liquidity and prospects include, but are not limited to, the factors referenced in this Offering Circular, including those set forth below.

When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this Offering Circular. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this Offering Circular. The matters summarized below and elsewhere in this Offering Circular could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this Offering Circular, whether as a result of new information,

future events or otherwise.

RISK FACTORS

There are significant risks associated with investing in the Notes. The Notes are highly speculative and should not be purchased by anyone who cannot afford a total loss of his or her entire investment. Before you purchase Notes, please review below a list of risks that the Company specifically wants to bring to your attention. There are other risks that could interfere with the business of the Company and the summary below is not intended to be exhaustive. You should carefully consider the following risk factors together with all of the other information included in this Offering Circular, including the matters addressed under “Forward-Looking Statements,” in evaluating an investment in the Notes. If any of the following risks were to occur, the Company’s business, financial condition, results of operations, cash flows and ability to repay the Notes could be materially adversely affected.

Risks Relating to an Investment in the Company - General

We are conducting this offering on a “best efforts” basis.

This offering is being conducted on a “best efforts” basis. No guarantee can be given that all or any of the Notes will be sold, or that sufficient proceeds will be available to conduct successful operations. Sale of a relatively few Notes may reduce the ability of the Company to effectively undertake its business plan. However, any funds invested are still at risk. Therefore, if the Company does not sell a sufficient number of Notes (as determined by our Managing Member in her sole discretion), the Company may decide to cease operations, which could lead to the Notes not being repaid. Investors are not entitled to return of their funds if the entire offering is not subscribed.

The proceeds of this offering are not being deposited into escrow.

The proceeds of this offering are not being deposited into escrow. Proceeds of this offering are available to the Company immediately for use in the Company’s operations. As a result, if the Company only sells a small part of this offering, it may be unable to raise sufficient funds for its operations; however, the funds previously invested will still be at risk. If the Company is unable to raise sufficient funds in this offering, then you could lose some or all of your investment.

An investment in the Notes is speculative and there is no guarantee of profitability.

The Company anticipates that revenues will be sufficient to create net profits for the Company and permit repayment of the Notes. However, there can be no assurance that revenues will be sufficient for such purpose. If revenues are insufficient to permit repayment of Notes, the Company could default on the Notes. In addition, the Company may repay Notes at times when the Company has not generated net income. As a result, the funds for such repayment could come from the sale of Notes to other investors.

There is no guaranteed return of your investment.

The Notes are speculative and involve a high degree of risk. There can be no guarantee that the Company will be able to repay the Notes upon their maturity. The ability of the Company to repay the Notes will depend upon the Company’s ability to successfully execute its business plan, including achieving positive cash flow from the sale or rental of properties.

The Company may obtain financing from other sources on a secured basis.

Although the Company does not currently anticipate obtaining debt financing from any source other than the investors in the Notes, the Company does have the ability to do so. If the Company obtains financing from another source, that lender may require that the Company provide collateral to secure such financing. Such collateral would be one or more of the properties that the Company owns or will purchase. If the Company defaults on such secured financing, the lender would have the ability to foreclose on the assets pledged as collateral. In such case, the Company would lose the assets pledged as collateral. As a result, in times when our cash flow is constricted, we may decide to prioritize the payment of secured creditors to the detriment of Note investors, in order to prevent the foreclosure of our properties. Furthermore, any secured lender will have priority in any bankruptcy proceeding.

Risks Related to Conflicts of Interest

We will engage in transactions with companies related to our Managing Member.

We intend to contract with Rogers Construction Group, which is owned by the husband of our Managing Member, to be the general contractor for the residential housing units that we will construct. While we believe that the fees and costs charged by Rogers Construction Group are within market values, we do not presently intend to seek other bids for general contractor services. As a result, the Company may pay more for these services than it otherwise would if the Company were to seek competitive bids for general contractors. However, in the future, the Company may use general contractors other than Rogers Construction Group.

In addition, the Company will sell the residential housing units that we select for sale through The Rogers Group Realty, a brokerage firm owned by our Managing Member. The Rogers Group Realty will charge a 6% commission on the sales price of each unit sold. This commission may be split with a buyer’s agent representing a buyer if the buyer has a buyer’s agent.

Risks Related to Our Business Plan

Investing in real estate is subject to several risks.

The Company will be subject to the risks that generally relate to investing in real estate. The Company’s revenues and cash flows may be adversely affected by: changes in national or local economic conditions; changes in local real estate market conditions due to changes in national or local economic conditions or changes in local property market characteristics, including, but not limited to, changes in the supply of and demand for competing properties within a particular local property market; competition from other properties offering the same or similar services; changes in interest rates and the credit markets which may affect the ability to finance, and the value of, investments; the ongoing need for capital improvements, particularly in older building structures; changes in real estate tax rates and other operating expenses; changes in governmental rules and fiscal policies, civil unrest, acts of God, including earthquakes, hurricanes, and other natural disasters, acts of war, or terrorism, which may decrease the availability of or increase the cost of insurance or result in uninsured losses; changes in governmental rules and fiscal policies which may result in adverse tax consequences, unforeseen increases in operating expenses generally or increases in the cost of borrowing; decreases in consumer confidence; government taking investments by eminent domain; various uninsured or uninsurable risks; the bankruptcy or liquidation of major tenants; adverse changes in zoning laws; the impact of present or future environmental legislation and compliance with environmental laws; the impact of lawsuits which could cause the Company to incur significant legal expenses and divert management’s following:

All of the Company’s properties will be located in the Houston, Texas area, which means that we are dependent

upon conditions in the Houston area.

All of the residential housing units that we will construct will be located in the Houston, Texas area. An event affecting only the Houston area, such as a local or regional economic downturn, a major hurricane, terrorist attack or other catastrophic event, could materially adversely affect the Company’s properties while not adversely affecting the performance of other real estate companies located elsewhere in the country. An investment in the Company exposes you to greater risks than would be the case if we were to own a larger number of projects and/or projects located in diverse market areas.

This offering is a blind pool offering and investors will not have the opportunity to evaluate any of our investments or operations before or after purchasing Notes.

Investors will not be able to evaluate the economic merits, transaction terms, or other financial or operational data concerning any of the properties that we develop either prior to or after purchasing Notes. Investors must rely on our Managing Member to evaluate and take advantage of the business opportunities available to us. Because investors cannot evaluate any of our future investments in advance of purchasing Notes, a “blind pool” offering may entail more risk than other types of offerings. This additional risk may hinder investors’ ability to achieve their own personal investment objectives related to portfolio diversification, risk-adjusted investment returns, and other objectives.

The Company may suffer an uninsured or underinsured loss.

While we intend to carry reasonable amounts of comprehensive insurance, including casualty, liability and extended coverage insurance, there are certain risks which may be uninsurable or not insurable on terms which we believe are economical. Such risks may include, for instance, earthquakes and floods or certain types of liability claims. The Company could suffer a severe financial loss in the event of such an uninsured or underinsured casualty or liability loss.

The Company could be responsible for environmental liabilities.

Hazardous substances, wastes, contaminants or pollutants, or sources thereof, defined by present and future state and federal laws and regulations, could be discovered on properties that we acquire, either during our ownership or after sale to a third party. If such substances are discovered or placed on the property during our ownership, the Company may be required to remove the substances and clean up the property and could be subjected to full recourse liability for the entire cost of any such removal and clean-up, even if the cost of such removal and clean-up exceeded the value of the property. In addition, we could incur liability to tenants and other users of the property, or users of neighboring property, including liability for consequential damages. We could also be exposed to the risk of lost revenues during any clean-up. Should we fail to remove the substances or sources and clean up the property, federal, state or local environmental agencies could perform such removal and clean-up, and impose and subsequently foreclose liens on the property for the cost thereof. We could find it difficult or impossible to sell or refinance the property prior to, during or even following any such clean-up. If such substances are discovered after the property is sold, the Company could be liable to the purchaser if we knew or had reason to know that such substances or sources existed. In such case, we could also be subject to the costs described above.

Construction costs could exceed our estimates, and construction delays could delay our ability to deliver completed housing units.

Delays are common in new housing construction. Some of the potential causes of construction delays are labor disputes, adverse weather conditions, governmental orders or delays, unavailability of materials or labor, or the financial insolvency of the general contractor or subcontractors. In particular, construction cost overruns due to

increases in the prices of materials and labor are not uncommon, and certain construction costs which typically constitute a substantial portion of a construction budget may be beyond the Company’s control. For example, city or county development (impact) fees cannot always be estimated accurately. If these or other construction costs were to exceed amounts budgeted, the Company could be required to seek additional debt financing, which might not be obtainable. A failure to secure the needed financing could force the Company to abandon a project and might subject the property to the risk of foreclosure by the mortgage lender.

We may be subject to warranty claims from our customers.

The Company provides customers of its products with a warranty covering defects in material or workmanship for 10 years from the date of purchase. As a result, we may be subject to claims for warranty coverage. We do not maintain any reserves for warranty coverage, because any warranty claims are handled by our general contractor and subcontractors. If we are required to cover the cost of repairs not covered by the warranties of our vendors or should one of our major vendors be unable to cover future warranty claims, we could be required to expend substantial funds, which could harm our financial condition.

Construction defects could adversely affect the financial performance of the Company.

The Company will be subject to the risk of construction defects, which can arise from inadequate construction plans and specifications, poor workmanship or defective materials. Correction of serious defects can be costly and time consuming. Moreover, certain defects may not become apparent until after the expiration of any contractors’ or suppliers’ warranties.

Other General Risks of an Investment in the Company

Investors will not have the right or ability to terminate the Managing Member.

The Notes do not have any voting rights and investors will not have the ability to remove the Managing Member. As a result, even if investors are dissatisfied with the management of the Company, investors will have no ability to remove the Managing Member and appoint a new Managing Member. Consequently, you are relying upon the Managing Member to effectively manage the Company.

The Company’s activities may subject it to the risks of becoming involved in litigation.

The Company’s business may include activities that will subject it to the risks of becoming involved in litigation by third parties. The expense of defending claims against the Company by third parties and paying any amounts pursuant to settlements or judgments would be borne by the Company and would reduce the monies available to repay the Notes. The Managing Member will be indemnified by the Company in connection with such litigation, subject to certain conditions.

There may not be sufficient quality opportunities to construct residential housing units.

Although we believe that we have identified areas in the Houston market that are in need of residential housing, it is possible that these areas could become saturated or the demand in such areas could deteriorate. In such case, we would need to identify new areas for construction. If we are unable to find new areas promptly or at all, then we may be unable to effectively invest the proceeds of the Notes.

Competition may adversely affect our revenues and profitability.

In general, the property development industry is intensely competitive and highly fragmented. We compete with various companies. Many of our competitors are more established than we are and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors or that the competitive pressures we face will not harm our business.

We may become liable for indemnification obligations to our Managing Member or its affiliates.

The Company will be required to indemnify the Managing Member and certain affiliated persons and entities of the Managing Member for liabilities incurred in connection with the affairs of the Company. Such liabilities may be material and have an adverse effect on the Company’s financial performance. The indemnification obligation of the Company will be payable from the assets of the Company, which would reduce the amount of monies available to repay Notes.

We are dependent upon the continued service of our Managing Member.

Our business strategy is dependent upon the knowledge and business connections of our Managing Member. If our Managing Member were to become unable to participate in the management of the Company, or if her participation were to become materially limited in any way, the Company’s business could be negatively affected.

If our Managing Member left the Company for any reason or if she became ill or unable to work for an extended period of time, our operations could be negatively affected. Even if we are able to find other personnel, it is uncertain whether we could find someone who could develop and execute our business at an acceptable level, or at all. It is likely that if our Managing Member were unable to continue serving in this capacity that the Company would dissolve or otherwise cease operations. If this happens, you could lose some or all of your investment.

Risks Specific to Notes

You must specifically request repayment of your Note within 45 days of the maturity date.

Each investor will have the responsibility for notifying the Managing Member of its desire for repayment of his Note upon maturity. Approximately 60 days prior to the maturity date, the Company will provide each investor with a notice of maturity. The investor must notify the Company within 45 days of the maturity date that the investor desires for the Company to repay the investor’s Note. If the investor fails to timely notify the Company that he wishes for the Company to repay his Note, then the Note will automatically renew (“roll over”) into a new Note. The notice of maturity will state the terms (including interest rate) applicable to the new Note.

The Notes are not liquid.

An investment in the Notes is intended as an illiquid investment. We do not intend to list the Notes on any securities exchange or quotation medium. As a result, there will not be any organized trading market for the Notes.

The Notes are unsecured obligations of the Company.

The Notes are not secured by any collateral. As a result, if the Company defaults in payment of the Notes, you will not be able to foreclose on any collateral in order to recoup your investment. Rather, each investor will be required

to seek repayment from the Company individually. As a result, you may have to file a lawsuit against the Company, obtain a judgment against the Company, and then seek to execute that judgment against the Company’s assets, if any, at that time.

The Company may change the terms of the Notes upon renewal.

Upon maturity of each Note, the Company will send each investor a notice of maturity at least 60 days before the maturity date. The notice of maturity will set forth the terms applicable to the Note upon renewal. If the investor does not notify the Company within 45 days before the maturity date that the investor desires for the Company to repay the note, then the Note will automatically be rolled over into a new Note with the terms set forth in the notice of maturity.

The Notes are not issued pursuant to a trust indenture.

The Notes are not being issued pursuant to a trust indenture. The Trust Indenture Act of 1939 generally requires that debt securities be issued pursuant to a trust indenture, which appoints a trustee to exercise the rights of the debtholders in case of an event of default. However, this offering is exempt from the Trust Indenture Act, and therefore the Notes are not being issued under a trust indenture. As a result, each investor must exercise its rights individually against the Company in the case of an event of default. This could lead to competing claims to the Company’s assets in the case of multiple judgments against the Company following a default.

USE OF PROCEEDS

The net proceeds to the Company from the sale of the Notes will be equal to the aggregate principal amount of the Notes we sell. If we sell the Maximum Offering Amount, which is $12,000,000, the net proceeds will be approximately $12,000,000.

The Company intends to use the net proceeds from this offering to purchase land and construct residential housing in the Houston, Texas area, and for general corporate purposes. We may also purchase pre-existing properties in the Houston area. The Company has not identified the particular properties it will purchase, nor does the Company intend to allocate the proceeds for certain purposes. All proceeds of this offering will be for the Company’s business purposes within the sole discretion of the Managing Member.

Accordingly, an investor must rely upon the ability of the Managing Member in utilizing the offering proceeds in connection with the Company’s business plan. As a result, it is possible that the Company may be unable to find a sufficient number of properties to purchase or that the Company may be unable to build sufficient residential housing units to meet its business objectives.

We intend to use revenues to repay Notes to investors that have requested repayment; however, we reserve the right to use proceeds from the sale of Notes to repay Notes if revenues are insufficient at the time of repayment.

DESCRIPTION OF BUSINESS

Overview

The Company was organized as a Texas limited liability company in April 2020 pursuant to filing of the Company’s Certificate of Formation with the Secretary of State of Texas. Since the Company’s formation, we have not engaged in any business other than undertaking steps in preparation for this offering.

Business Plan

The Company intends to purchase properties in the Houston, Texas area and construct residential housing units. These units may be townhomes, duplexes, or single family homes. Once these units are built, we intend to sell, rent, or refinance the units in order to produce income. We do not have a specified allocation of properties that we intend to sell versus the number of properties that we intend to rent or refinance. We may also purchase pre-existing properties in the Houston area in order to renovate and sell or lease them.

For rental properties, the Company will self-manage the properties; however, we may decide to engage a property management company in the future. If a property management company is engaged in the future, this management company may be an affiliate of the Managing Member or an unaffiliated management company.

We intend to engage Rogers Construction Group as the general contractor for our residential properties for the time being. Rogers Construction Group is owned by the husband of our Managing Member. See “Interest of Management and Others in Certain Transactions.” In the future, we may use other general contractors.

When units are built, we will determine whether to sell or rent the finished unit depending on market conditions and indications of interest from potential customers at that time. For units that we decide to sell, we will sell them through The Rogers Group Realty, a real estate brokerage firm owned by our Managing Member. See “Interest of Management and Others in Certain Transactions.”

We anticipate the costs of each constructed unit to be approximately $180,000, including the price of land and construction costs for each unit. We anticipate selling each unit for approximately $250,000, before taking into account selling commissions and other closing costs.

Our Managing Member has a waiting list of over 100 potential buyers interested in multi-family properties for less than $260,000.

Houston, Texas Market Information

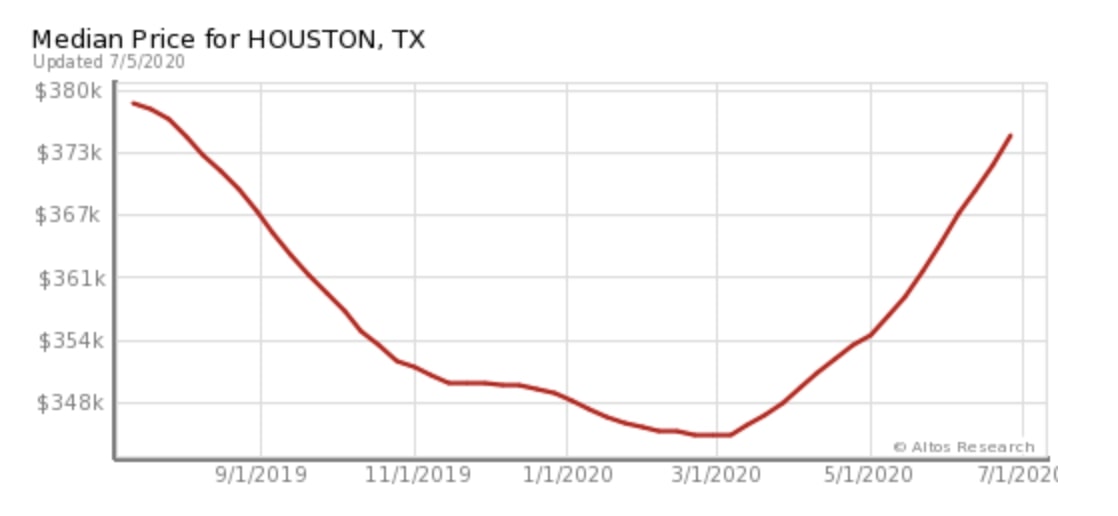

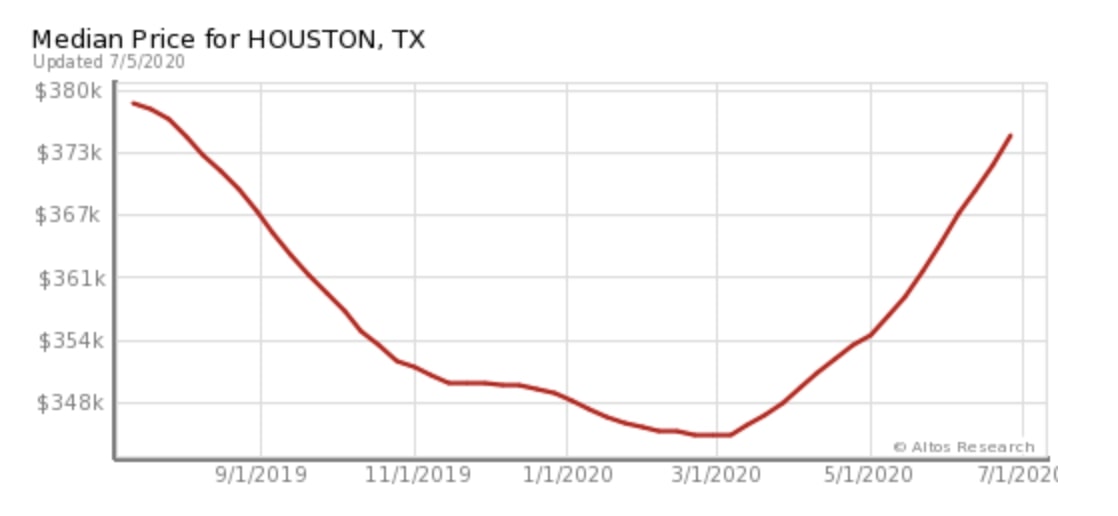

The National Association of Realtors has published that the price of single-family homes priced between $250,000 and $750,000 increased by around 14% in January 2020. The Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, rose from 69 in April to 99.6 in May, the highest month-over-month gain in the index since the National Association of Realtors began tracking contract activity in January 2001.

The median sold price increased by 4.5 percent to $234,000 and the average price climbed 4.6 percent to $291,034. February 2020 was no different as buyers were motivated by low interest rates for home mortgages. Total dollar volume for March jumped 11.0 percent to slightly more than $2.6 billion. The COVID pandemic has affected real estate markets around the country. Prior to April, home sales had been outperforming 2019’s record volume as consumers took advantage of historically low-interest rates.

The current home prices in Houston are relatively low compared to other major cities in the U.S, making it an attractive market for people who are relocating looking for warm weather, affordable living, and a strong economy. It is especially attractive to millenials who make up the fastest growing segment of the population for real estate ownership.

With over 2 million residents, Houston continues to grow steadily because of these factors as well as the region's commitment to attract big business in industries like tech and renewable energy to continue to diversify its economy. Unlike in the 80s and early 2000s, Houston is no longer totally dependent on oil and gas to support its economy. The area's investment in infrastructure has made it a desired area for a variety of industries. Residential units, hotels, office buildings, restaurants; the city has remained committed to development projects that promise to keep the real estate market strong.

There was a decrease in real estate prices as expected during the economic shutdown but quickly recovered after restrictions began to be lifted. Although the area may not reach the predicted highs for 2020 that were expected prior to the pandemic it is still expected to keep pace with 2019 numbers.

The rate of real estate appreciation continues to be slightly above the national rate and even with the economic slowdown of the global pandemic the Houston real estate market forecast for 2020 is still on a positive side. Houston is also one of the hottest real estate markets in the nation. In the past ten years, the annual real estate appreciation rate has reached 4.61%, according to NeighborhoodScout.com. This puts the area in the top 10% nationally for real estate appreciation.

Because Houston's home prices have remained high and appreciation growth has been consistent, the market continues to attract residential real estate investors.

Number of Employees

As of the date of this Offering Circular, we have no employees.

Additional Company Matters

The Company has not filed for bankruptcy protection nor has it ever been involved in receivership or similar proceedings. The Company is not presently involved in any legal proceedings material to the business or financial condition of the Company. The Company does not anticipate any material reclassification, merger, consolidation, or purchase or sale of a significant proportion of assets (not in the ordinary course of business) during the next 12 months.

DESCRIPTION OF PROPERTY

The Company’s corporate office is located at 5330 Griggs Road #D107, Houston, Texas 77021, which space is provided to us on a rent-free basis by our Managing Member. These facilities are suitable for the near term and the Company believes that they will be sufficient for the foreseeable future.

We intend to acquire various properties in order to construct residential housing. We have not yet identified those properties.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

The Company is a newly formed entity and has not yet commenced operations. We have not yet earned any revenue. We intend to purchase undeveloped real estate and construct residential housing, including townhomes, duplexes, and single family homes. We may also purchase pre-existing properties.

The Company was formed on April 21, 2020 as a Texas limited liability company for the general purpose of engaging in any lawful activity for which corporations may be organized under the law of the State of Texas. We intend to purchase real estate in the Houston, Texas area and construct residential housing units, and subsequently sell, rent, or refinance the constructed units.

Results of Operations

The Company did not have any revenues for the period of April 21, 2020 (our date of inception) through April 30, 2020, the date of our audited balance sheet. We incurred legal fees of $35,000 in connection with the foundation of the Company and the commencement of this offering.

Liquidity and Capital Resources

Prior to the formation of the Company and in connection with this offering, our Managing Member paid $35,000 in legal fees, which have been accounted for as a capital contribution.

Upon formation of the Company, our Managing Member contributed an additional $25,000 in capital to the Company.

As of the date of this Offering Circular, the Company has $19,177 in cash.

Plan of Operation

Our plan of operation is to purchase undeveloped real estate and construct residential housing, including townhomes, duplexes, and single family homes. We believe that if we raise at least $6 million in this offering, that these proceeds will satisfy our cash requirements for the next three years.

Trend Information

Our ability to successfully purchase properties, build residential housing units, and sell, rent, or refinance the constructed properties is subject to general economic conditions in the Houston area, residential mortgage rates, and prevailing rental rates for residential housing. If sales prices and rental rates for residential housing in the Houston area decline, then our revenues will be negatively impacted.

We believe that we will be able to start construction activity on a new property at least every other month. If we are unable to construct new units at this pace, this will impact our ability to sell units, which will in turn affect our liquidity and ability to repay the Notes.

We currently have a waiting list of over 100 potential purchasers or renters for the properties that we intend to build. Our Managing Member has accumulated this waiting list through her prior development activities which precede the inception of the Company. The Managing Member intends to refer these potential purchasers and renters to the Company and to fulfill those purchases and rentals through the Company.

DIRECTORS, OFFICERS AND SIGNIFICANT EMPLOYEES

The Managing Member of the Company is Brittney Rogers. The Company does not have any employees at this time.

| Name | Position | Age | Term of Office |

| Brittney Rogers | Managing Member | 37 | N/A |

Brittney Rogers – Managing Member

Brittney Rogers moved to Houston, Texas in 2002 to attend Texas Southern University where she studied Human Performance and Finance. While attending Texas Southern, she began her professional career with a national fitness chain that same year where she was quickly promoted to Service Manager in 2004 and later the role of Club Manager in 2012.

Over her more than 10-year tenure with that organization, she was directly responsible for all of the day-to-day operations of some of the largest fitness facilities in the city. Responsibilities included but were not limited to direct supervision of up to 60 staff members, all outside vendors and contractors, event promotions, club membership sales, member retention, profits and loss. At the time that Brittney left the organization in 2014, the location she managed was one of the top clubs in year-over-year membership sales out of over 300 clubs nationwide.

While growing her corporate career, Brittney also began learning and investing in real estate alongside her husband in 2010. Over the last 10 years, together they have completed and sold multiple new construction projects as personal investments for their business K2K Investments, LLC. Mr. Rogers’ construction company, Rogers Construction Group, LLC, has also completed and sold a number of new construction projects for clients. Along with new construction projects, she and her husband successfully own and manage their own apartment units.

Brittney also started a real estate brokerage in 2017 that facilitates the acquisition and sale of properties in Houston for clients both local and out of state. The Rogers Group Realty, LLC currently sponsors 3 other Houston area real estate agents which Brittney directly supervises. Brittney is also a licensed real estate agent since 2017.

Brittney's most recent business, The Emancipation Fund, LLC was founded in 2018 with the goal of making multi-family income properties accessible to the average buyer.

Brittney is well respected in her local community and across America for her commitment to educate the public about real estate and financial literacy via her social platforms.

Ms. Rogers has not filed a petition in bankruptcy or any state insolvency law nor had a petition filed against her in bankruptcy or under such laws. No receiver, fiscal agent or similar officer has been appointed by a court for the business or property of Ms. Rogers nor any partnership of which she was the general partner, or any corporation or business association of which she was an executive officer.

Ms. Rogers has not been convicted in any criminal proceeding (other than traffic violations and other minor offenses).

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

| Name | Capacities in which compensation was received | Cash compensation | Other compensation | Total compensation |

| Brittney Rogers | — | — | — | — |

Ms. Rogers is our sole Managing Member. Ms. Rogers has not received any compensation from the Company and has not entered into an employment agreement with the Company. She does not intend to enter into an employment agreement with the Company. Rather, Ms. Rogers will be entitled to a distribution of the Company’s profits if, as, and when such distributions are declared. Ms. Rogers is also entitled to reimbursement of expenses incurred on behalf of the Company.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS

The following table presents information regarding the ownership of the Company’s equity interests as of the date of this Offering Circular by:

| · | our Managing Member; and |

· each equity owner known by us to beneficially hold 10% or more of the Company’s equity interests.

Beneficial ownership is generally determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise noted, the address for each beneficial owner is listed below.

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Amount and Nature of Beneficial Ownership Acquirable | Percent of Class |

| Membership Interests | Brittney Rogers 5310 Griggs Road #D107 Houston, Texas 77021 | 100% (1) | — | 100% |

| (1) | The Company’s Membership Interests are expressed in terms of percentages, rather than number of units. |

DESCRIPTION OF SECURITIES OFFERED

The following descriptions of our securities, certain provisions of Texas law and certain provisions of our Certificate of Formation and Company Agreement are summaries and are qualified by reference to Texas law, our Certificate of Formation and our Company Agreement, copies of which are filed as exhibits to the offering statement of which this Offering Circular is a part.

General

The Company is a Texas limited liability company organized in April 2020. The Company will sell Notes to investors in this offering.

Purchasers of Notes have no conversion, exchange, sinking fund or appraisal rights, no pre-emptive rights to subscribe for any securities of our Company and no preferential rights to payments.

Term of the Notes

Each Note will have a term of one year. Subscriptions for Notes will be accepted as of the first of each month. If an investor submits his Subscription Agreement and purchase price for the Notes before the first of the month, the Company will accept such purchase price effective as of the first day of the following months. In such case, the investor will not be issued a Note until the first of the month and his investment will not begin accruing interest until the first of the month.

Renewal and Maturity of the Notes

Approximately 60 days before the maturity date of each Note, the Company will notify each investor of the upcoming maturity of his Note. Each Note will automatically renew for a new one year period unless the investor notifies the Company 45 days before the maturity date that he wishes for the Company to repay the Note. If the investor timely requests repayment of the Note, the principal and accrued interest of the Note will be paid to the investor on the maturity date or promptly thereafter. The notice of maturity sent to each investor will set forth the terms applicable to the renewal of the investor’s Note, including the interest rate and any other terms. If the investor does not request repayment of the Note, then the principal amount and accrued interest will be automatically rolled over into a new Note with the terms set forth in the notice of maturity.

Partial redemption is permitted. In such case, the amount indicated by the investor in his request for repayment will be paid to him, and the remaining amount will be rolled over into a new Note with the terms set forth in the notice of maturity. The amount of the new Note issued upon partial redemption must be at least $5,000.

Collateral

The Notes are unsecured obligations of the Company, and the Company is not granting any collateral for the Notes. Each investor will therefore be an unsecured creditor of the Company.

Covenants

The Notes are not subject to any material affirmative or negative covenants.

Payment of Attorneys’ Fees and Court Costs

The Notes provide that the prevailing party (whether the Company or the investor) is entitled to recover its attorneys’ fees and court costs in case of any legal proceeding brought related to or arising under the Notes.

Transfer Agent and Registrar

As of the date of this Offering Circular, we have not engaged a transfer agent, and do not intend to engage a transfer agent until such time as we are required to do so, or deem it to be in the best interest of the Company in order to satisfy the conditional exemption contained in Rule 12g5-1(a)(7) promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

PLAN OF DISTRIBUTION

We are offering up to $12,000,000.00 in Notes pursuant to this Offering Circular. The Notes will be offered by associated persons of ours, primarily through the Company’s Web site and our Managing Member’s social media accounts. In conducting this offering, such associated persons intend to rely on the exemption from registration contained in Exchange Act Rule 3a4-1.

This Offering is not subject to any minimum offering amount and the proceeds of this Offering will not be held in escrow. Rather, all funds raised in this Offering are immediately available to us to use for business purposes.

We reserve the right to appoint one or more brokers as selling agents for the Notes in the future.

Advertising, Sales and other Promotional Materials

In addition to this Offering Circular, subject to limitations imposed by applicable securities laws, we have used and expect to use additional advertising, sales and other promotional materials in connection with this offering. These materials may include information relating to this offering, property brochures, articles and publications concerning real estate, or public advertisements and audio-visual materials, in each case only as authorized by us. In addition, the sales material may contain certain quotes from various publications without obtaining the consent of the author or the publication for use of the quoted material in the sales material. Although these materials will not contain information in conflict with the information provided by this Offering Circular, these materials will not give a complete understanding of this offering, us or the Notes and are not to be considered part of this Offering Circular. This offering is made only by means of this Offering Circular. Prospective investors must read and rely on the information provided in this Offering Circular in connection with their decision to invest.

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

The Company intends to engage Rogers Construction Group, a company owned by Ms. Rogers husband, to serve as the general contractor for the residential housing units that the Company will construct. Rogers Construction Group will charge the Company approximately $150,000 for each unit constructed.

The Company will sell the completed units that are allocated for sale through Ms. Rogers’ brokerage company, The Rogers Group Realty. The Rogers Group Realty will charge a 6% commission to the Company for selling the units. This commission may be shared with unaffiliated buyer’s agents that represent the buyers of the properties.

CONFLICTS OF INTEREST

In addition to the matters set forth above under “Interest of Management and Others in Certain Transactions”, the Company is subject to various other conflicts of interest arising out of its relationship with the Managing Member. In addition, no assurances can be made that other conflicts of interest will not arise in the future.

Fiduciary Duties of the Managing Member

Duties owed the Company by the Managing Member are prescribed by law and our Company Agreement.

The Company Agreement provides that the Managing Member will not be liable to the Company for losses resulting from errors in judgment or other acts or omissions unless the Managing Member acted fraudulently or in bad faith.

The Company Agreement provides that the Managing Member is not required to manage the Company as its sole and exclusive function. The Managing Member may have other business interests and may engage in activities other than those relating to the Company. The pursuit of such ventures by the Managing Member, even if competitive with the business of the Company, shall not be deemed wrongful or improper or a violation of any fiduciary duties by the Managing Member.

Indemnification and Exculpation

Subject to certain limitations, our Company Agreement limits the liability of our Managing Member and our officers, employees, representatives, and agents for monetary damages and provides that we will indemnify and pay or reimburse reasonable expenses in advance of final disposition of a proceeding to our Managing Member, its officers and directors, our sponsor and our sponsor’s shareholder and affiliates.

Our Company Agreement provides that to the fullest extent permitted by applicable law our Managing Member and our officers, employees and agents will not be liable to the Company. In addition, pursuant to our Company Agreement, we have agreed to indemnify our Managing Member and our officers, employees and agents, to the fullest extent permitted by law, against all expenses and liabilities (including judgments, fines, penalties, interest, amounts paid in settlement with the approval of our Company and attorney’s fees and disbursements) arising from the performance of any of their obligations or duties in connection with their service to us or pursuant to the Company Agreement, including in connection with any civil, criminal, administrative, investigative or other action, suit or proceeding to which any such person may hereafter be made party by reason of being or having been the Managing Member or an officer, employee, agent, or representative of the Company.

Competition by Other Affiliated Companies with the Company

The Managing Member may engage for her own account or for the accounts of others in other business ventures, including other businesses that compete with the Company.

Managing Member’s Commitment to the Company’s Business

Our Managing Member has substantial business interests that precede the Company. She has no plans to abandon these other business interests

Our Managing Member is not obligated to devote any specific amount of time to the affairs of the Company and is not required to accord exclusivity or priority to the Company in the event of limited investment or business opportunities.

As a result, the attention of our Managing Member could be diverted by her other businesses.

HOW TO PURCHASE NOTES

In order to invest, a prospective investor must electronically complete, sign and deliver to us an executed Subscription Agreement in the form attached to this Offering Circular as Appendix A, and wire funds for its subscription amount in accordance with the instructions provided therein.

Subscriptions for Notes will be accepted on the first day of each month. If you submit your Subscription Agreement and funds for the purchase of a Note on a day other than the first day of the month, the Company will hold your funds until the first day of the month. During this holding period, you will not be a holder of a Note and will not be entitled to interest.

We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Section 18(b)(4)(D)(ii) of the Securities Act. If the offering terminates or if any prospective investor’s subscription is rejected, all funds received from such investors will be returned without interest or deduction.

PART F/S

THE EMANCIPATION FUND INITIATIVE LLC

FINANCIAL STATEMENTS

April 30, 2020

Independent Auditors’ Report

To the Member of

The Emancipation Fund Initiative LLC

Report on the Financial Statements

We have audited the accompanying financial statements of The Emancipation Fund Initiative LLC which comprise the balance sheet as of April 30, 2020, and the related statements of operations and changes in member’s capital, and cash flows for the period from April 21, 2020 (inception) to April 30, 2020 and the related notes to the financial statements.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of The Emancipation Fund Initiative LLC as of April 30, 2020 and the results of its operations and its cash flows for the period from April 21, 2020 (inception) to April 30, 2020 in accordance with accounting principles generally accepted in the United States of America.

PWR CPA, LLP

Houston, TX

July 24, 2020

THE EMANCIPATION FUND INITIATIVE LLC BALANCE SHEET April 30, 2020 |

| ASSETS | | | |

| Current Assets | | | |

| Cash | | | $ 25,000 |

| | | | |

| Total current assets | | | $ 25,000 |

| | | | |

| | | | |

| Member’s capital | | | $ 25,000 |

| | | | |

| | | | | |

THE EMANCIPATION FUND INITIATIVE LLC

STATEMENT OF OPERATIONS and CHANGES IN MEMBER’S CAPITAL

For the period from April 21, 2020 (inception) to April 30, 2020

| | |

| | | | |

| General and administrative expenses | | | $ 35,000 |

| | | | |

| Net Loss | | | (35,000) |

| | | | |

| Capital contribution | | | 60,000 |

| | | | |

| Member’s capital – April 30, 2020 | | | $ 25,000 |

THE EMANCIPATION FUND INITIATIVE LLC STATEMENT OF CASH FLOWS For the period from April 21, 2020 (inception) to April 30, 2020 |

| | |

| | | | |

| Cash Flows from Operating Activities | | | |

| Net loss | | | $ (35,000) |

| Net cash used in operating activities | | | (35,000) |

| | | | |

| | | | |

| Cash Flows from Financing Activity | | | |

| Capital contribution | | | 60,000 |

| Net cash provided by financing activity | | | 60,000 |

| | | | |

| Net Change in Cash | | | 25,000 |

| | | | |

| Cash at Beginning of Period | | | - |

| | | | |

| Cash at End of Period | | | $ 25,000 |

| | | | |

| Supplemental Disclosure of Cash Flow Information: | | | |

| Interest paid | | | $ - |

| Taxes paid | | | $ - |

| | | | |

| | | | |

NOTE 1 - ORGANIZATION

The Emancipation Fund Initiative LLC (“the Company”), a Texas Limited Liability Company, was formed on April 21, 2020. The Emancipation Fund Initiative LLC was formed to purchase residential lots and construct duplex and fourplex housing for resale and rent in Houston, Texas.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported amount of revenues and expenses during the reporting period. Actual results may differ from these estimates.

Cash and Cash Equivalents

The Company considers cash, all short-term investments and all highly liquid debt instruments with an original maturity of less than three months to be cash equivalents. There were no cash equivalents as of April 30, 2020.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

No provision for income taxes has been made in the financial statements as the Company is a “pass through” entity. Each member is individually liable for tax on their share of the Company’s income or loss. The Company prepares a calendar year informational tax return.

NOTE 3 – RELATED PARTY

The Company’s office space is provided by the managing member at no charge to the Company.

NOTE 4 – MEMBERS’ CAPITAL

The rights and obligations of partners, as well as all other significant ownership and governance matters, are set forth in the Company Agreement of The Emancipation Fund Initiative LLC.

NOTE 5 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through July 24, 2020, the date at which the financial statements were available to be issued, in the preparation of these financial statements and footnotes.

PART III - EXHIBITS

Exhibit No. Description

| 2.1 | Certificate of Formation |

| 2.2 | Company Agreement |

| 4.1 | Form of Subscription Agreement |

| 4.2 | Form of Promissory Note |

| 11.1 | Consent of Whitley LLP Attorneys at Law (included in Exhibit 12) |

| 11.2 | Consent of PWR CPA, LLC |

| 12 | Opinion of Whitley LLP Attorneys at Law |

| 13.1 | Solicitation of Interest Communication |

| 13.2 | Solicitation of Interest Communication |

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A and has duly caused this offering statement to be signed on its behalf by the undersigned, duly authorized, in the City of Houston, State of Texas on the 24th day of July, 2020.

| | THE EMANCIPATION FUND INITIATIVE LLC |

| | |

| | By: /s/ Brittney Rogers |

| | Name: Brittney Rogers |

| | Title: Managing Member |

| | |

This offering statement has been signed by the following persons in the capacities and on the dates indicated.

| Name | Title/Capacity | Date |

/s/ Brittney Rogers Brittney Rogers | Managing Member | July 24, 2020 |