3Q 2022 Earnings & Investor Presentation November 2022 Exhibit 99.2

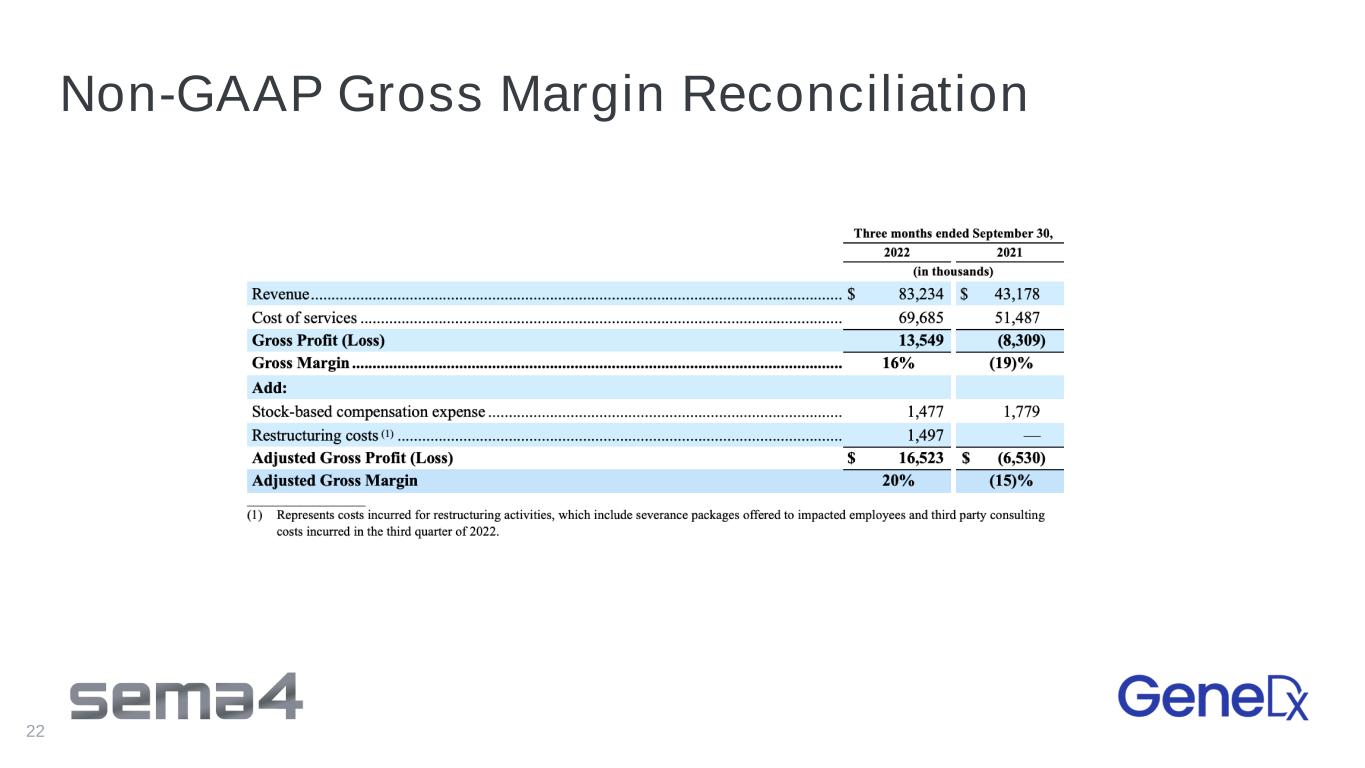

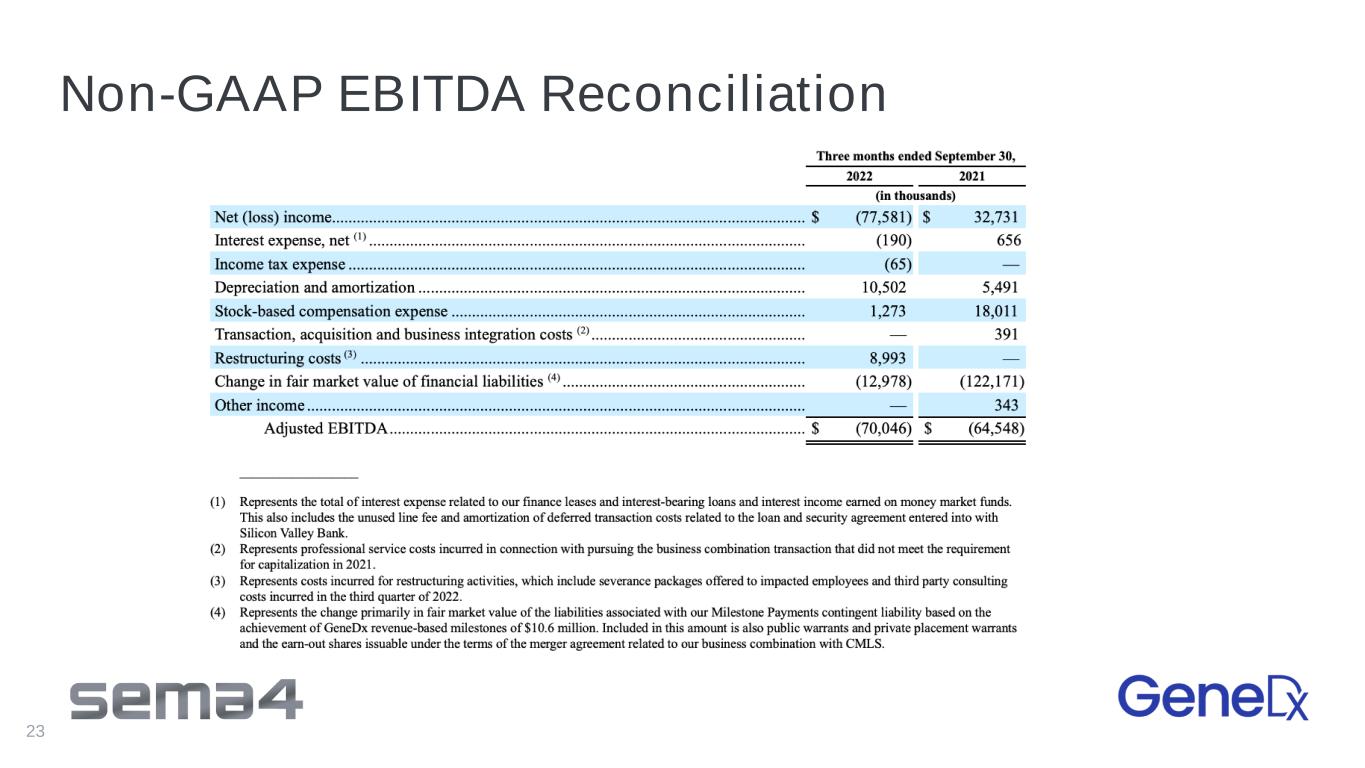

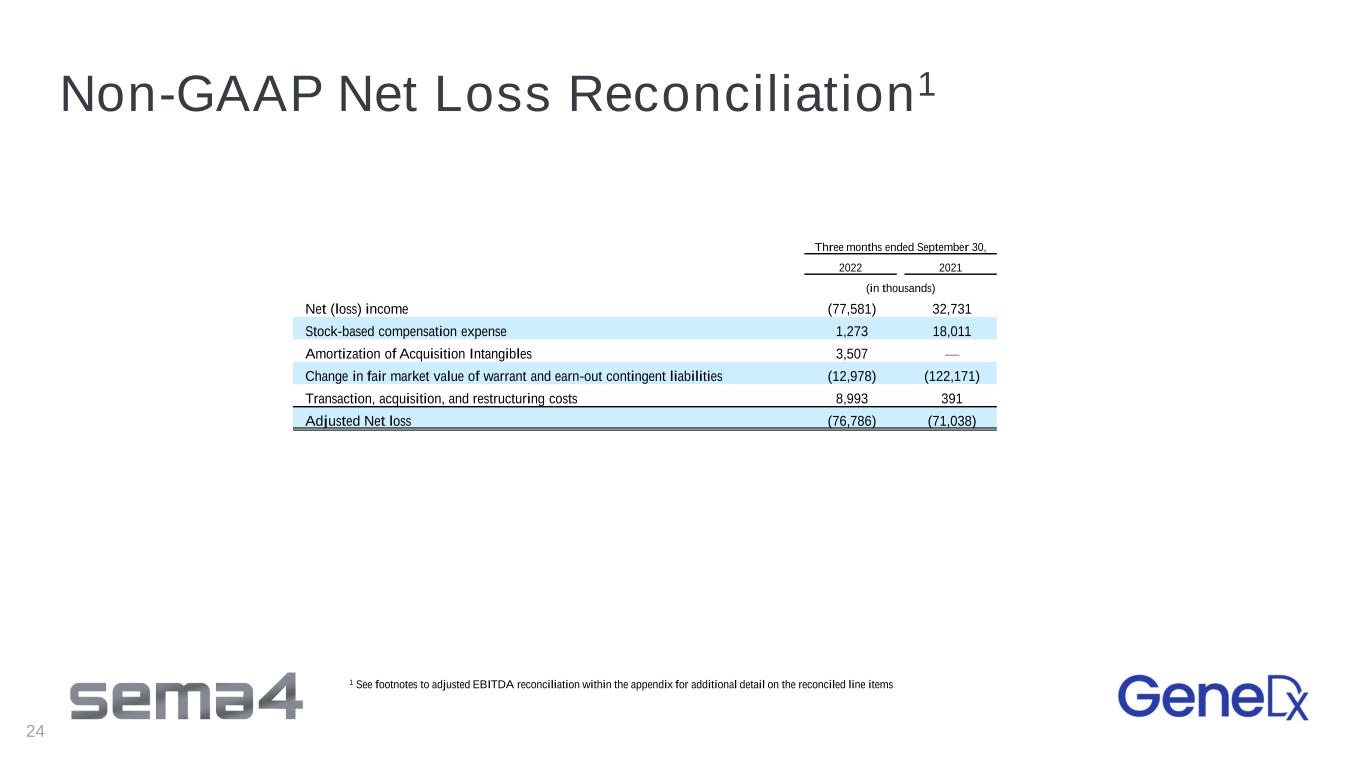

Disclaimer This presentation contains forward-looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not relate to historical facts and events and such statements and opinions pertaining to the future that, for example, contain wording such as “may,” “might,” “will,” “cou ld,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our future performance and our market opportunity, including our expected full year and second half 2022 pro forma and reported revenue and adjusted gross margin guidance, our expectations regarding our annual growth rates over the next several years, our gross margin profile in the near-term, our cash burn expectations for 2023, our path to profitability, our expectations for our growth and future investment in our business, our expectations regarding our plans to pursue new strategic direction, exit our reproductive health testing business and our ability to scale to profitability, our other restructuring plans and the associated cost savings and impact on our gross margins, our expectations of the anticipated benefits and synergies of the recently completed acquisition (the “Acquisition”) of GeneDx, Inc. (“GeneDx”), our addressable market, market growth, future revenue, key performance indicators, expenses, capital requirements and our needs for additional financing, our commercial launch plans, our strategic plans for our business and products, market acceptance of our products, our competitive position and developments and projections relating to our competitors, domestic and foreign regulatory approvals, third-party manufacturers and suppliers, our intellectual property, the potential effects of government regulation and local, regional and national and international economic conditions and events affecting our business. We cannot assure that the forward-looking statements in this presentation will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this presentation are based on our management’s beliefs and assumptions and are based upon information currently available to our management as of the date of this presentation and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) the ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (ii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iii) the size and growth of the market in which we operate, and (iv) ability to pursue our new strategic direction, exit our reproductive health testing business, implement our other restructuring plans and achieve the associated cost savings and impact on our gross margins, (v) the risk that the anticipated benefits of the GeneDx Acquisition may not be fully realized, if at all. The information, opinions and forward- looking statements contained in this announcement speak only as of its date and are subject to change without notice Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin. Adjusted EBITDA is defined (for us and GeneDx) as net loss adjusted for interest expense, net, depreciation and amortization, stock-based compensation expenses, transaction and acquisition costs, restructuring costs, change in fair market value of warrant and earn-out contingent liabilities and other income. Management believes that these non-GAAP measures of financial results are useful in evaluating the Sema4's operating performance compared to that of other companies in its industry, as this metric generally eliminates the effects of certain items that may vary from company to company for reasons unrelated to overall operating performance. Please refer to the Appendix for Non-GAAP to GAAP Reconciliation. This presentation contains estimates, projections and other information concerning our industry, our business, and the markets for our products and services. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we believe our internal company research as to such matters is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports and other fil ings we make with the SEC from time to time. Given these uncertainties, you should not place undue reliance on the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us are available www.sec.gov. Requests for copies of such documents should be directed to our Investor Relations department at Sema4 Holdings Corp. 333 Ludlow Street, North Tower, 8th Floor, Stamford, Connecticut, 06902. Our telephone number is 800-298-6470. 2

Our vision remains the same: to deliver personalized health and wellness plans based on comprehensive data

Our mission is refined: Unlocking insights from data, leading to healthier lives and a healthier society

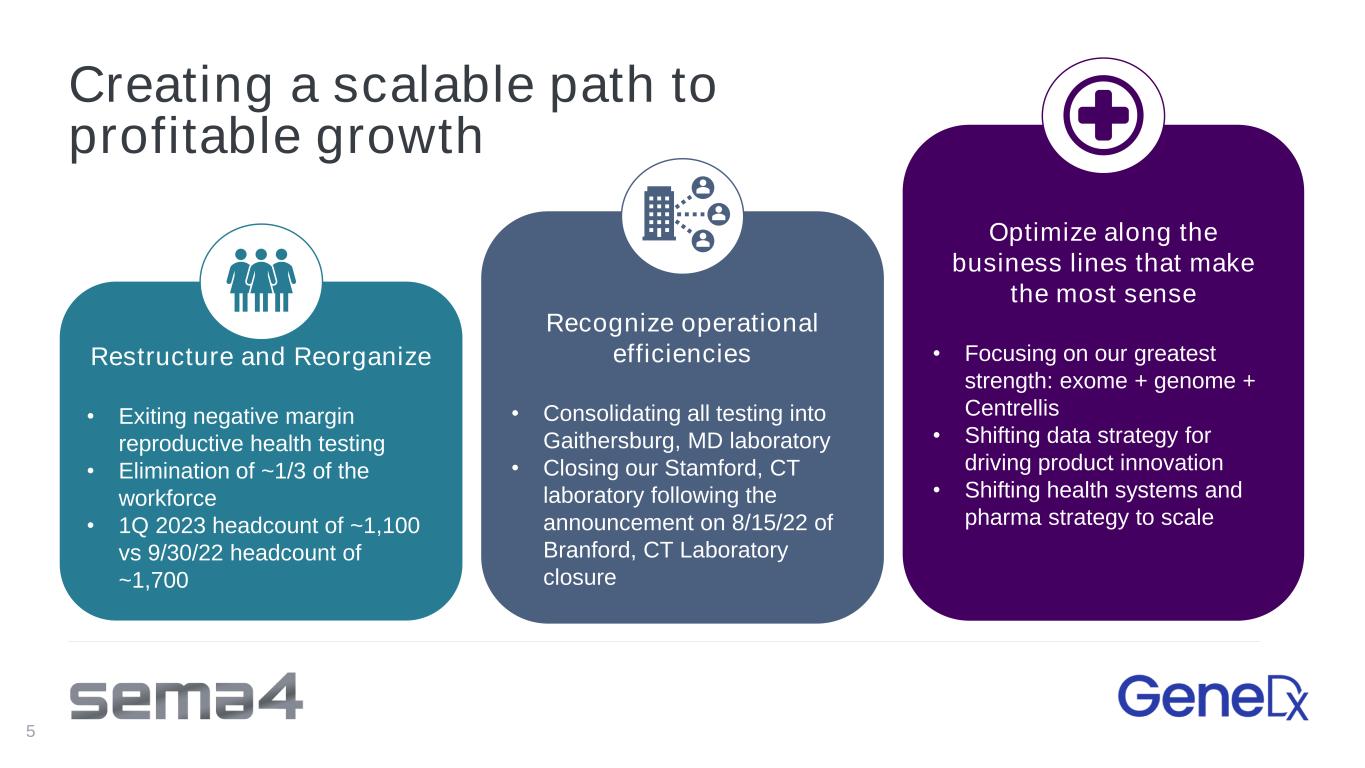

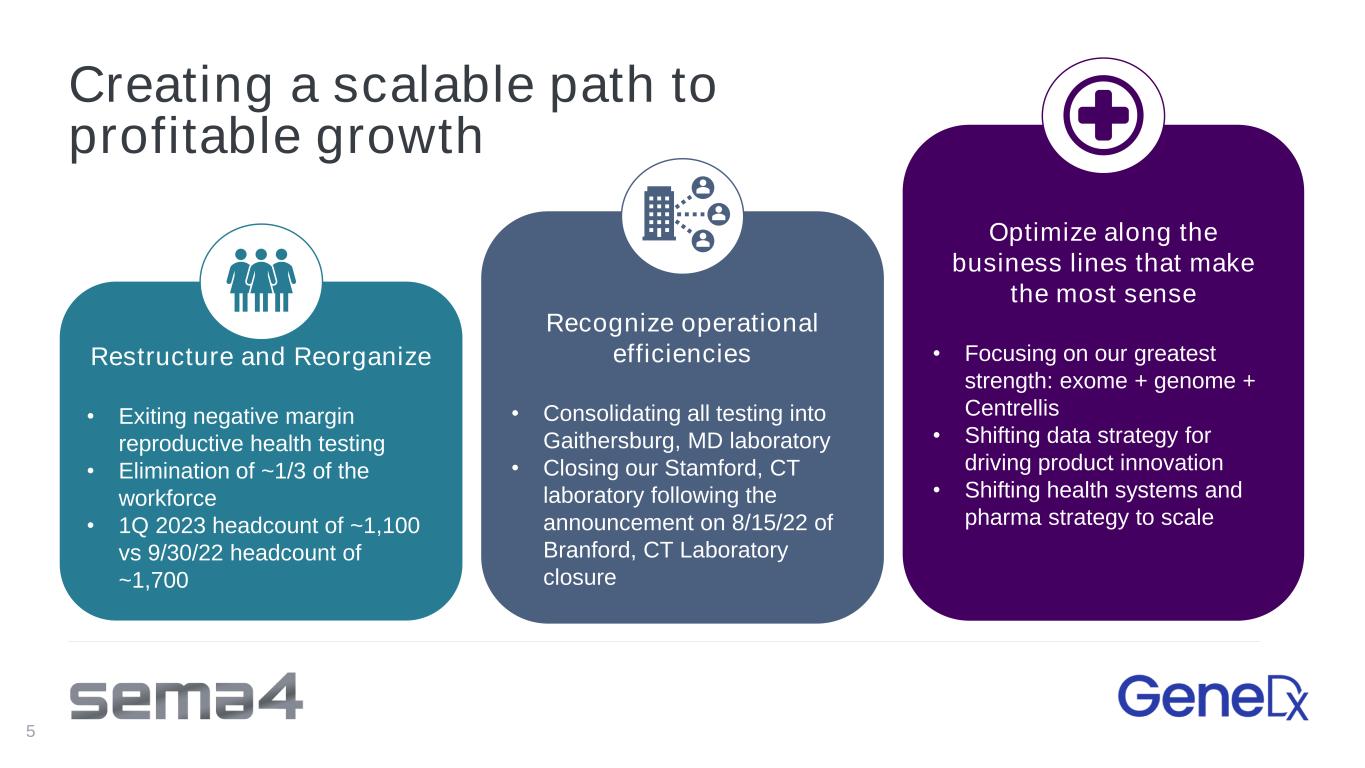

Creating a scalable path to profitable growth Restructure and Reorganize • Exiting negative margin reproductive health testing • Elimination of ~1/3 of the workforce • 1Q 2023 headcount of ~1,100 vs 9/30/22 headcount of ~1,700 Recognize operational efficiencies • Consolidating all testing into Gaithersburg, MD laboratory • Closing our Stamford, CT laboratory following the announcement on 8/15/22 of Branford, CT Laboratory closure Optimize along the business lines that make the most sense • Focusing on our greatest strength: exome + genome + Centrellis • Shifting data strategy for driving product innovation • Shifting health systems and pharma strategy to scale 5

A More Focused Business Mix Managing towards profitable growth through strategic channels Peds / Rare Disease Health Systems Pharma 6

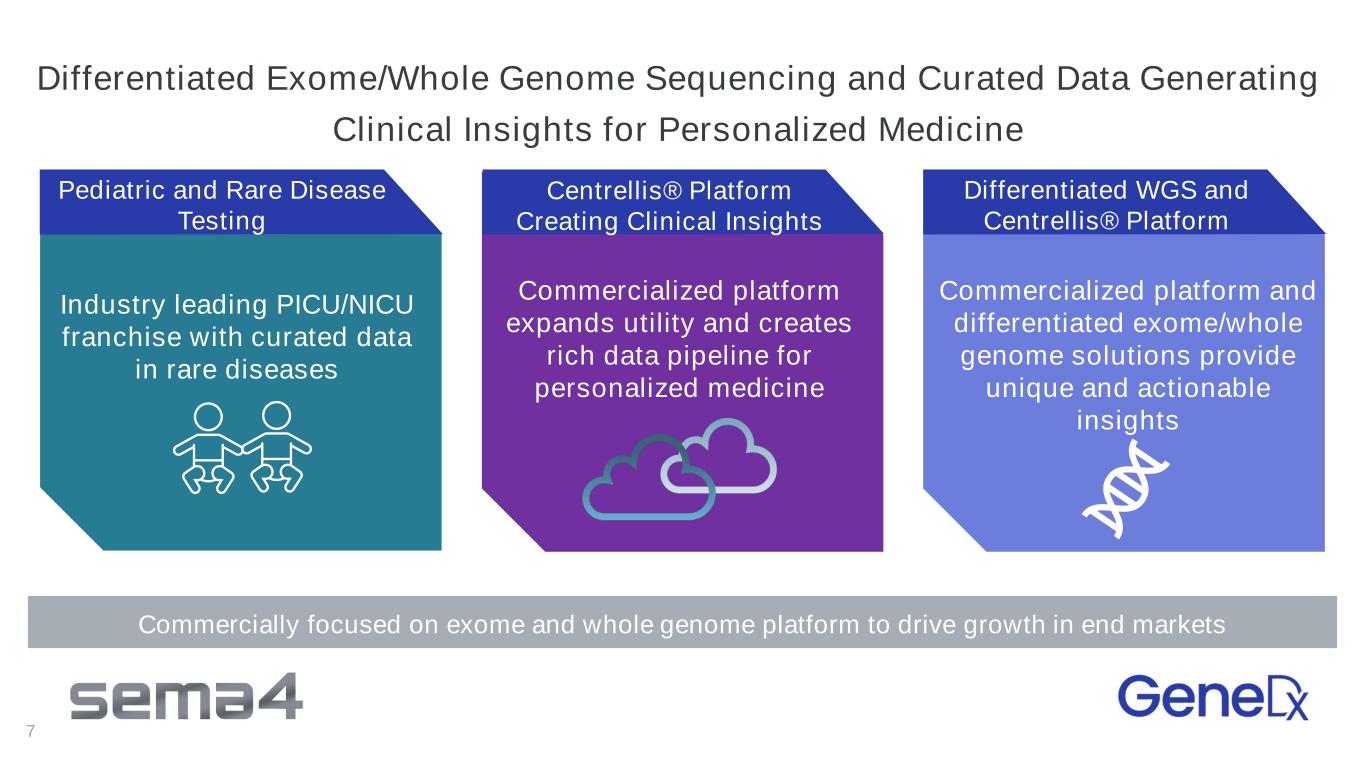

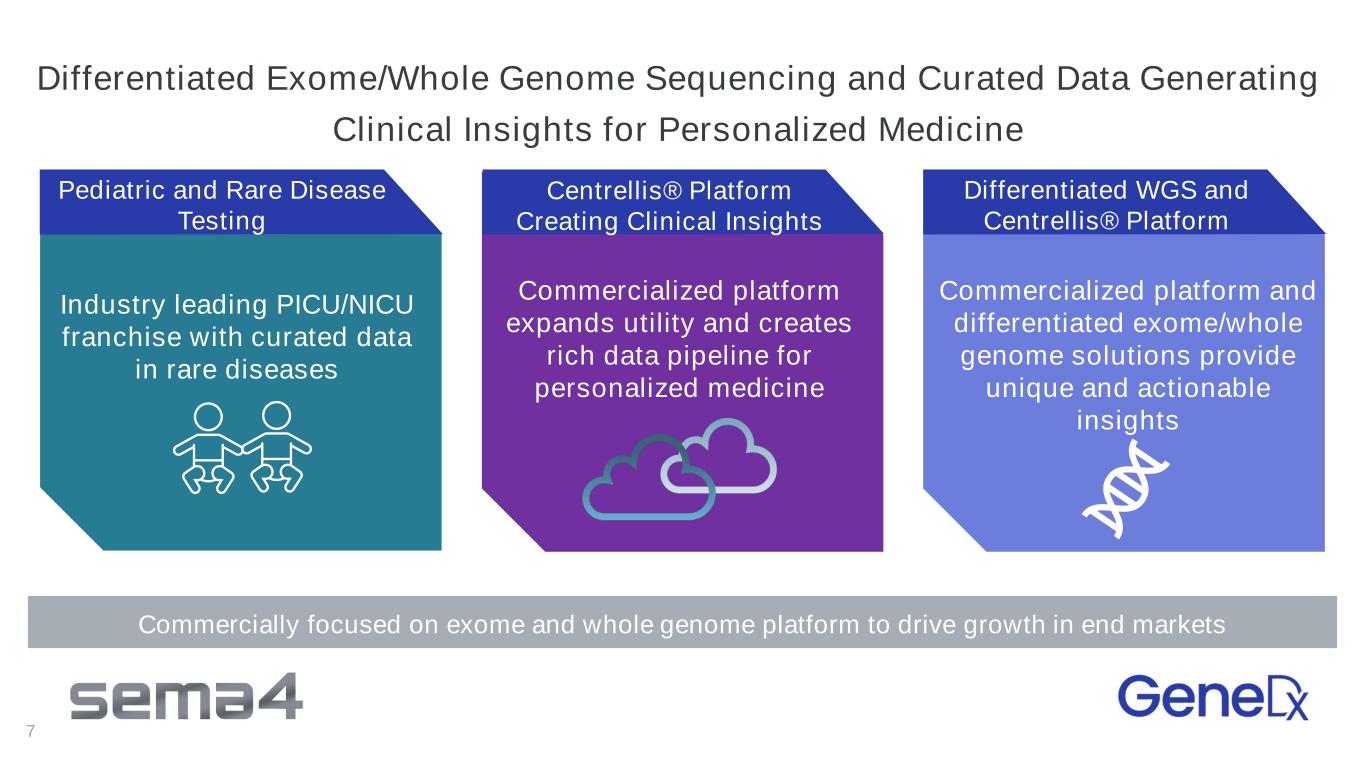

7 Industry leading PICU/NICU franchise with curated data in rare diseases Commercialized platform expands utility and creates rich data pipeline for personalized medicine Pediatric and Rare Disease Testing Centrellis® Platform Creating Clinical Insights Differentiated WGS and Centrellis® Platform Commercialized platform and differentiated exome/whole genome solutions provide unique and actionable insights Commercially focused on exome and whole genome platform to drive growth in end markets Differentiated Exome/Whole Genome Sequencing and Curated Data Generating Clinical Insights for Personalized Medicine

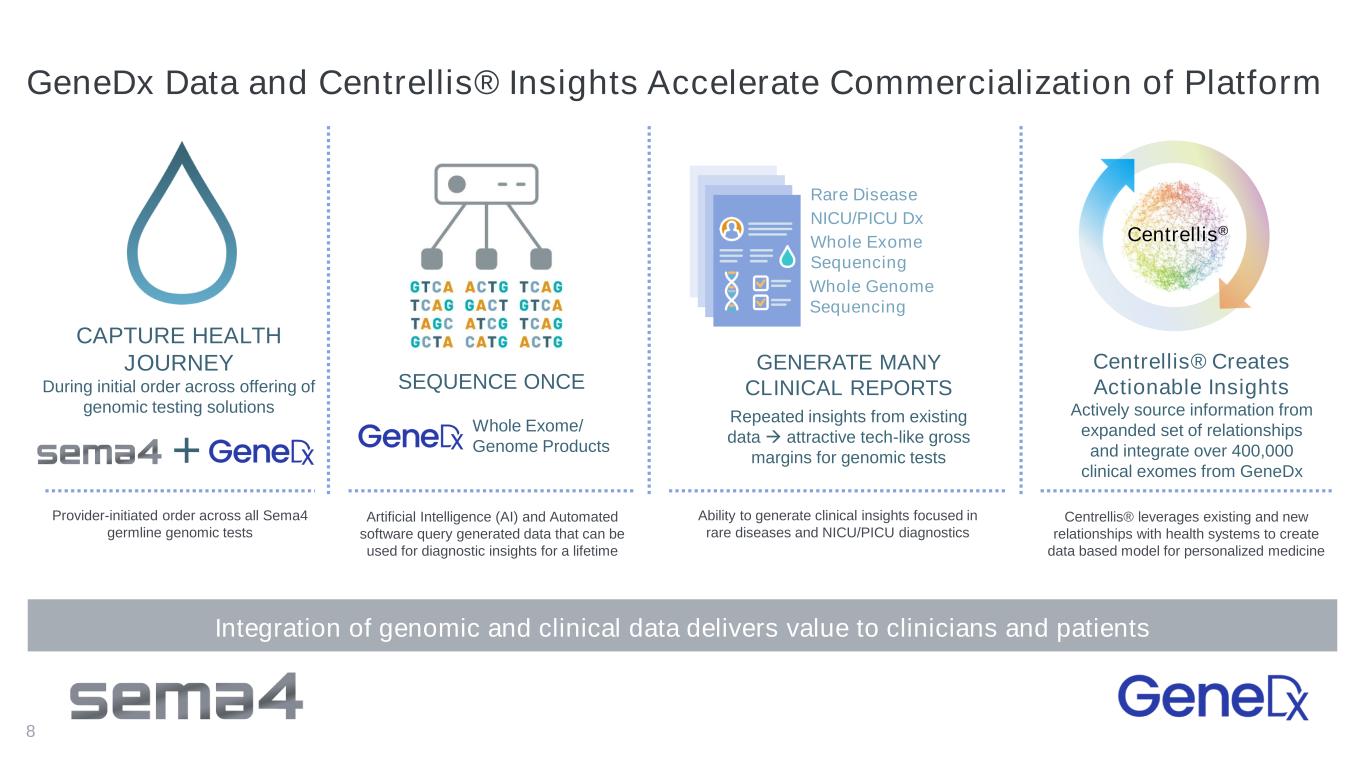

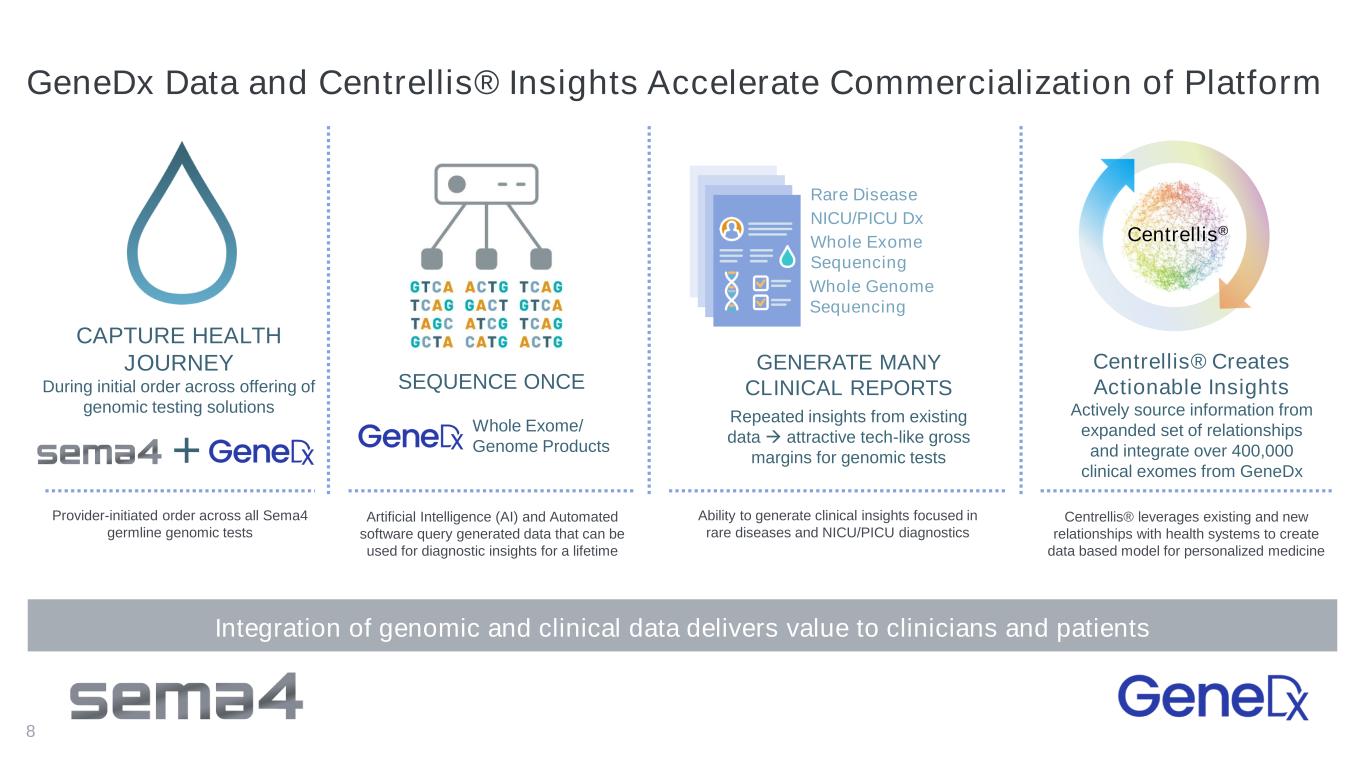

8 GENERATE MANY CLINICAL REPORTS Repeated insights from existing data → attractive tech-like gross margins for genomic tests SEQUENCE ONCE CAPTURE HEALTH JOURNEY During initial order across offering of genomic testing solutions Centrellis® Creates Actionable Insights Actively source information from expanded set of relationships and integrate over 400,000 clinical exomes from GeneDx Whole Genome Sequencing Whole Exome Sequencing Whole Exome/ Genome Products+ NICU/PICU Dx Centrellis® Rare Disease Integration of genomic and clinical data delivers value to clinicians and patients Provider-initiated order across all Sema4 germline genomic tests Artificial Intelligence (AI) and Automated software query generated data that can be used for diagnostic insights for a lifetime Ability to generate clinical insights focused in rare diseases and NICU/PICU diagnostics Centrellis® leverages existing and new relationships with health systems to create data based model for personalized medicine GeneDx Data and Centrellis® Insights Accelerate Commercialization of Platform

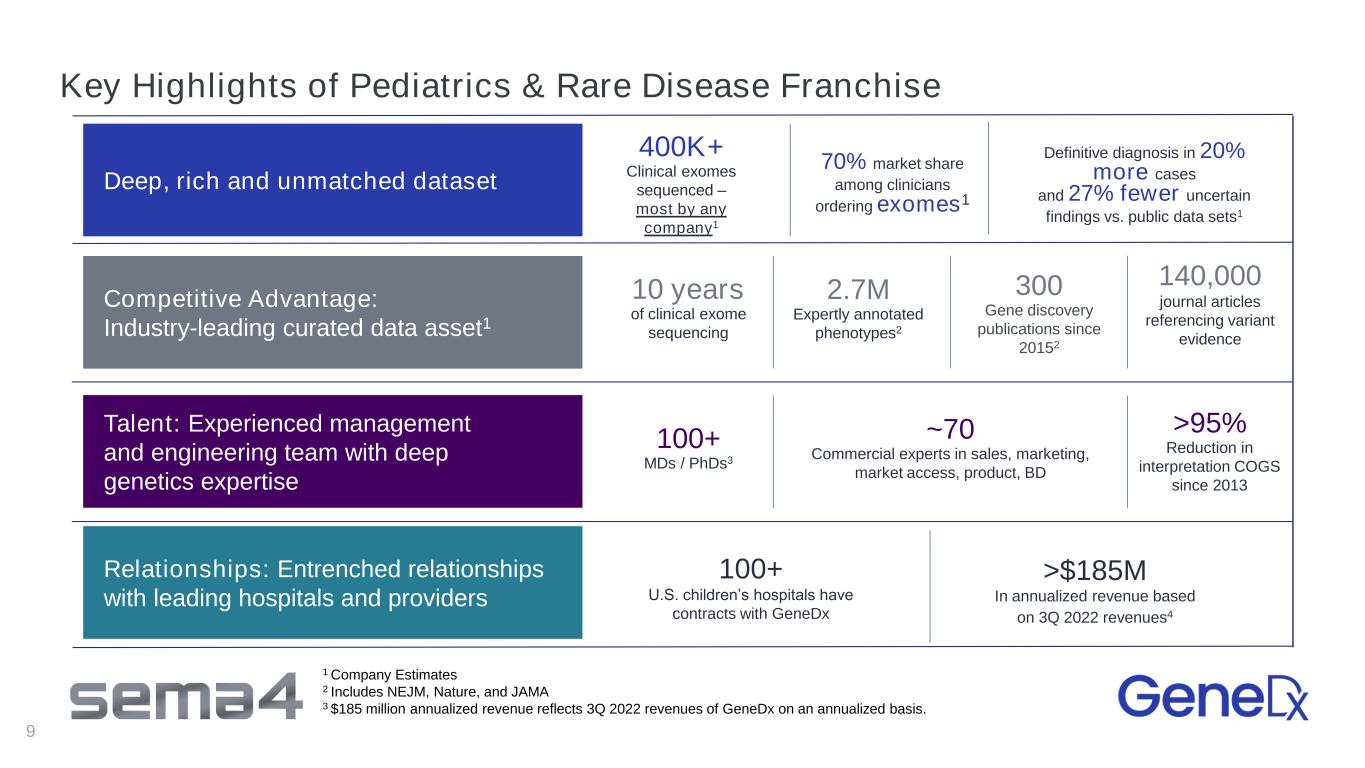

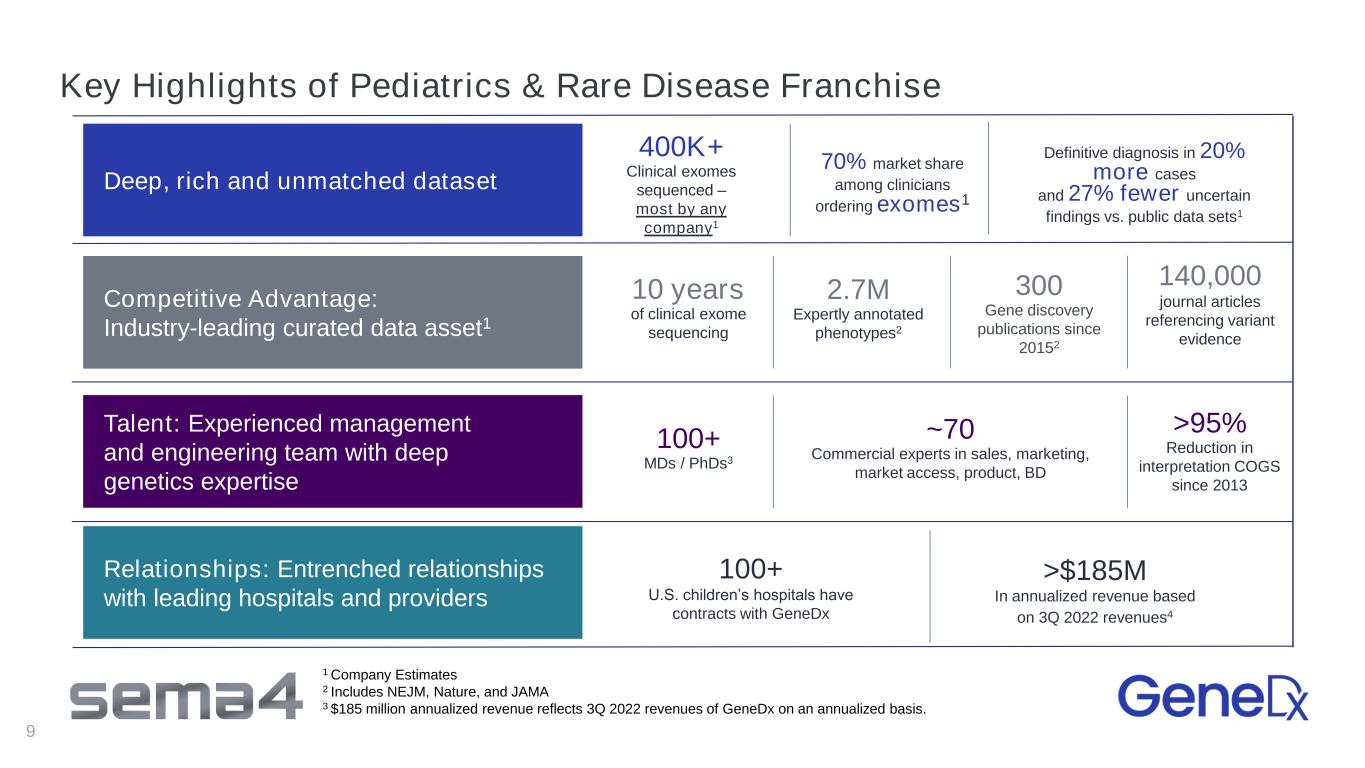

Key Highlights of Pediatrics & Rare Disease Franchise 9 Relationships: Entrenched relationships with leading hospitals and providers Deep, rich and unmatched dataset Competitive Advantage: Industry-leading curated data asset1 Talent: Experienced management and engineering team with deep genetics expertise 100+ U.S. children’s hospitals have contracts with GeneDx 100+ MDs / PhDs3 ~70 Commercial experts in sales, marketing, market access, product, BD 300 Gene discovery publications since 20152 10 years of clinical exome sequencing 140,000 journal articles referencing variant evidence >$185M In annualized revenue based on 3Q 2022 revenues4 2.7M Expertly annotated phenotypes2 Definitive diagnosis in 20% more cases and 27% fewer uncertain findings vs. public data sets1 400K+ Clinical exomes sequenced – most by any company1 70% market share among clinicians ordering exomes1 >95% Reduction in interpretation COGS since 2013 1 Company Estimates 2 Includes NEJM, Nature, and JAMA 3 $185 million annualized revenue reflects 3Q 2022 revenues of GeneDx on an annualized basis.

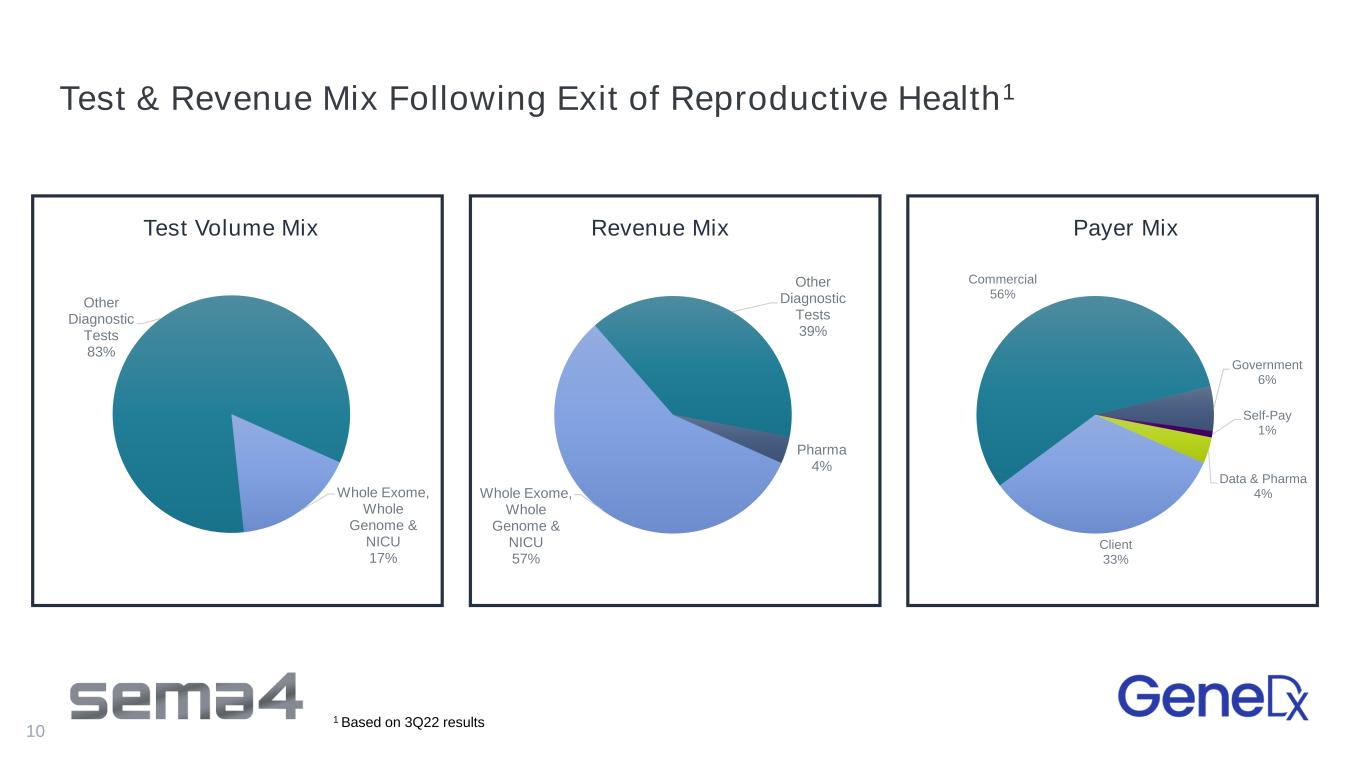

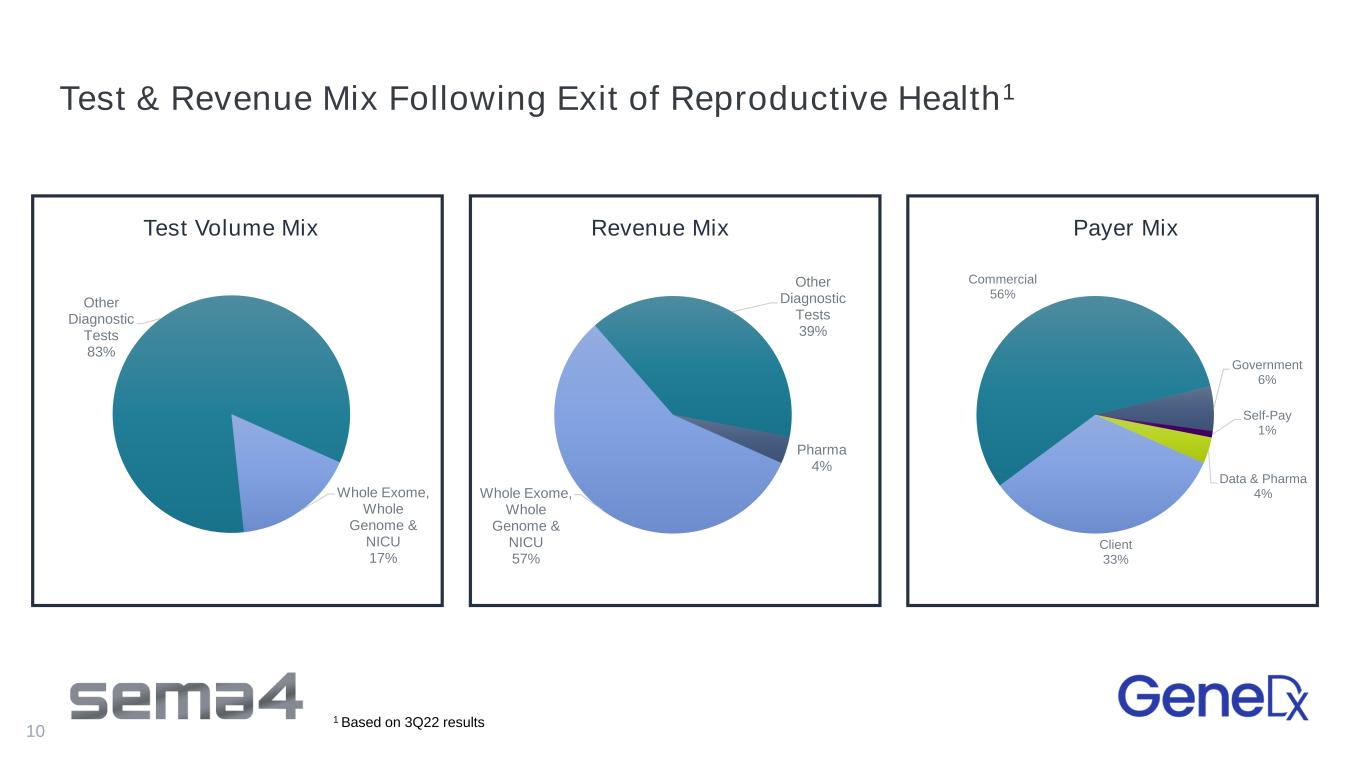

Test & Revenue Mix Following Exit of Reproductive Health1 10 Client 33% Commercial 56% Government 6% Self-Pay 1% Data & Pharma 4%Whole Exome, Whole Genome & NICU 57% Other Diagnostic Tests 39% Pharma 4% Whole Exome, Whole Genome & NICU 17% Other Diagnostic Tests 83% Test Volume Mix 1 Based on 3Q22 results Revenue Mix Payer Mix

Well positioned to deliver actionable insights for patients, clinicians and researchers

Translating into a significant opportunity Our diagnostic testing total addressable market is ~$30 billion1 Accelerating our move to Exome/WGS Newborn Screening: $10B Increasing inclusion of genetics in screening programs Underdeveloped Solution for Sema4 R&D and clinical trials underway to capture Genomic Health Screening: $16B Rapidly expanding into cardio and neuro Accelerating our move to Whole Genome & Exome Current Gap for Sema4 Key growth driver for legacy GeneDx NICU & Outpatient: $3B Potential for substantial cost savings via early screening 12 1 Company Estimates

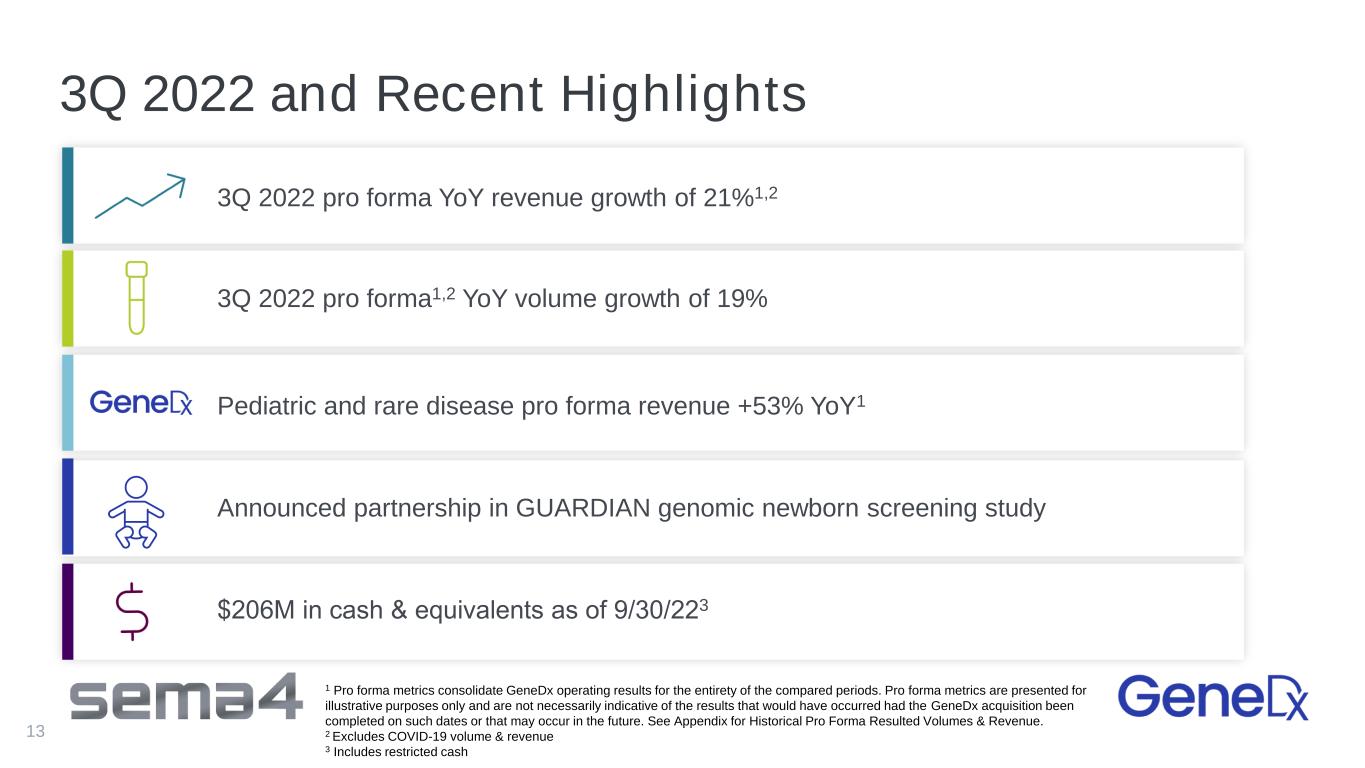

3Q 2022 and Recent Highlights 3Q 2022 pro forma YoY revenue growth of 21%1,2 3Q 2022 pro forma1,2 YoY volume growth of 19% $206M in cash & equivalents as of 9/30/223 Announced partnership in GUARDIAN genomic newborn screening study Pediatric and rare disease pro forma revenue +53% YoY1 1 Pro forma metrics consolidate GeneDx operating results for the entirety of the compared periods. Pro forma metrics are presented for illustrative purposes only and are not necessarily indicative of the results that would have occurred had the GeneDx acquisition been completed on such dates or that may occur in the future. See Appendix for Historical Pro Forma Resulted Volumes & Revenue. 2 Excludes COVID-19 volume & revenue 3 Includes restricted cash 13

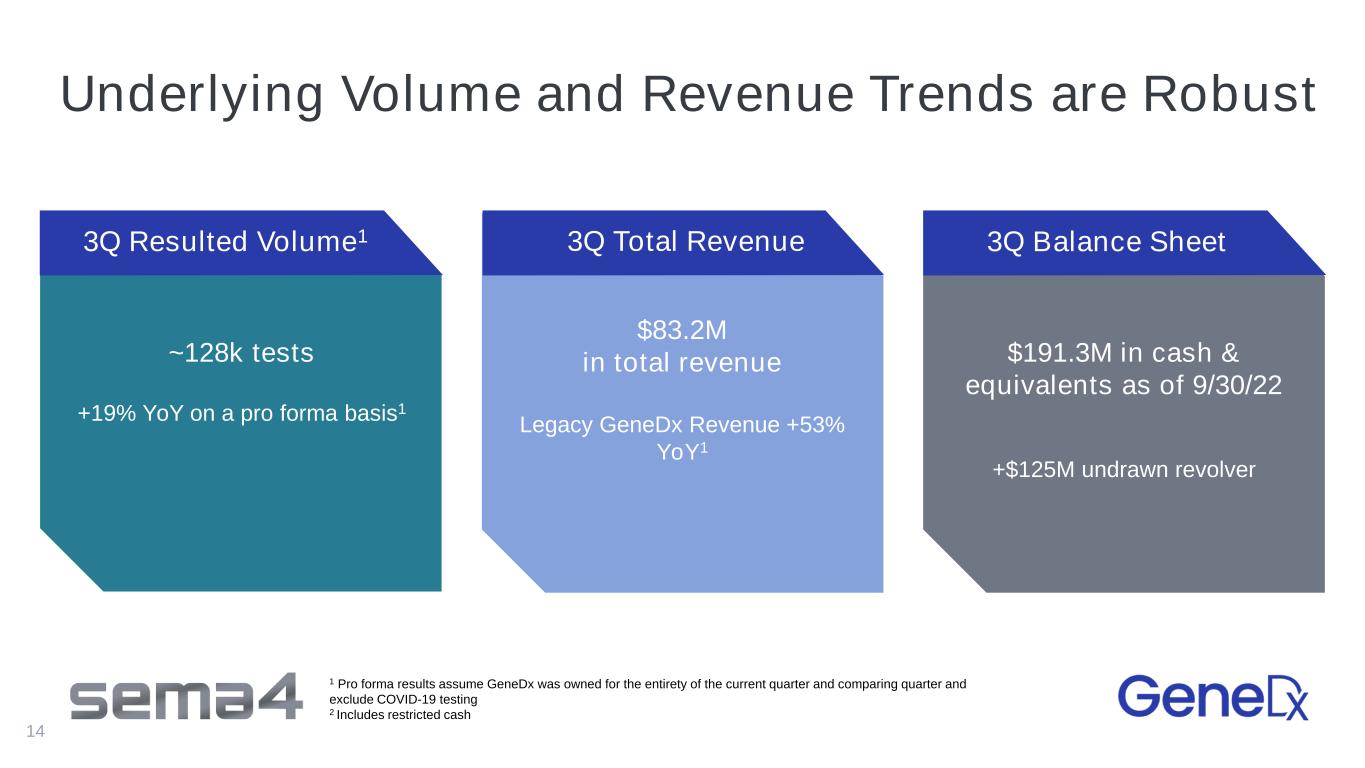

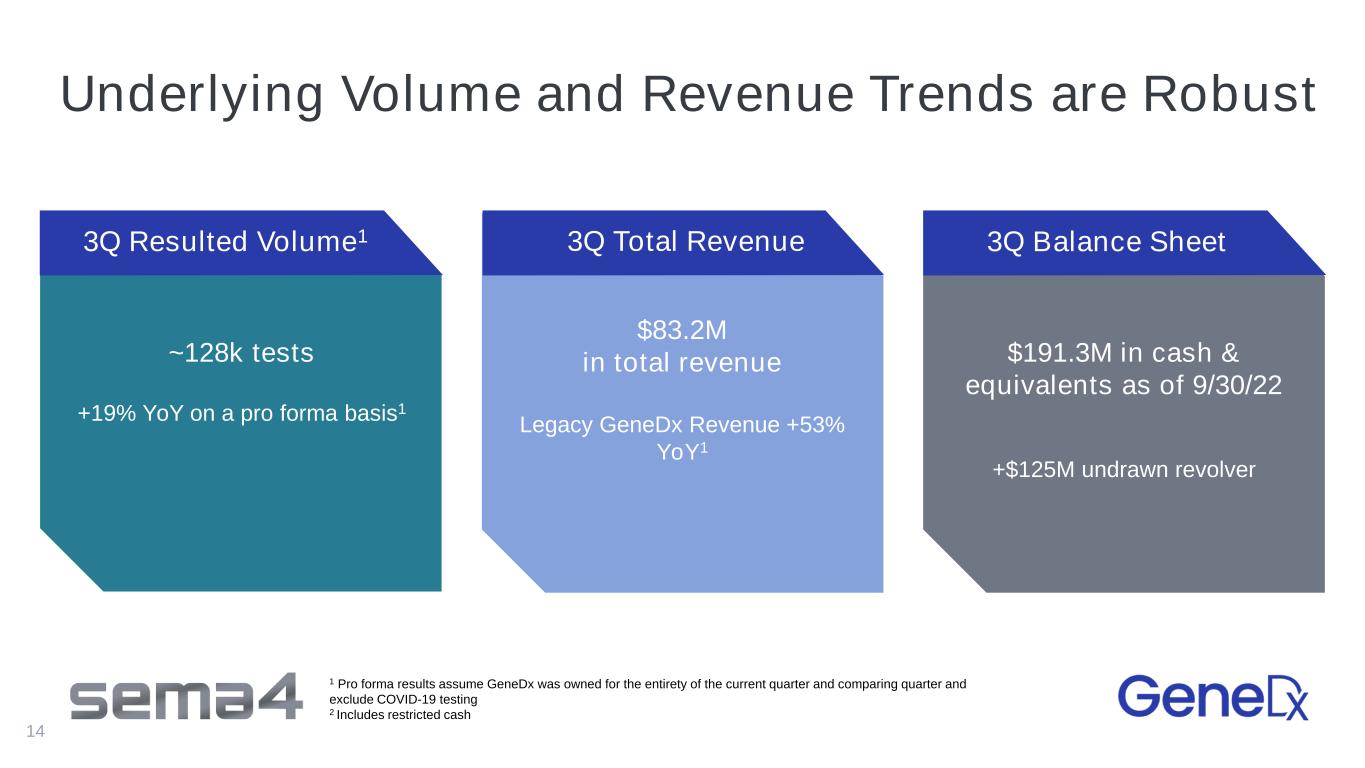

Underlying Volume and Revenue Trends are Robust ~128k tests +19% YoY on a pro forma basis1 $83.2M in total revenue Legacy GeneDx Revenue +53% YoY1 $191.3M in cash & equivalents as of 9/30/22 +$125M undrawn revolver 3Q Resulted Volume1 3Q Total Revenue 3Q Balance Sheet 1 Pro forma results assume GeneDx was owned for the entirety of the current quarter and comparing quarter and exclude COVID-19 testing 2 Includes restricted cash 14

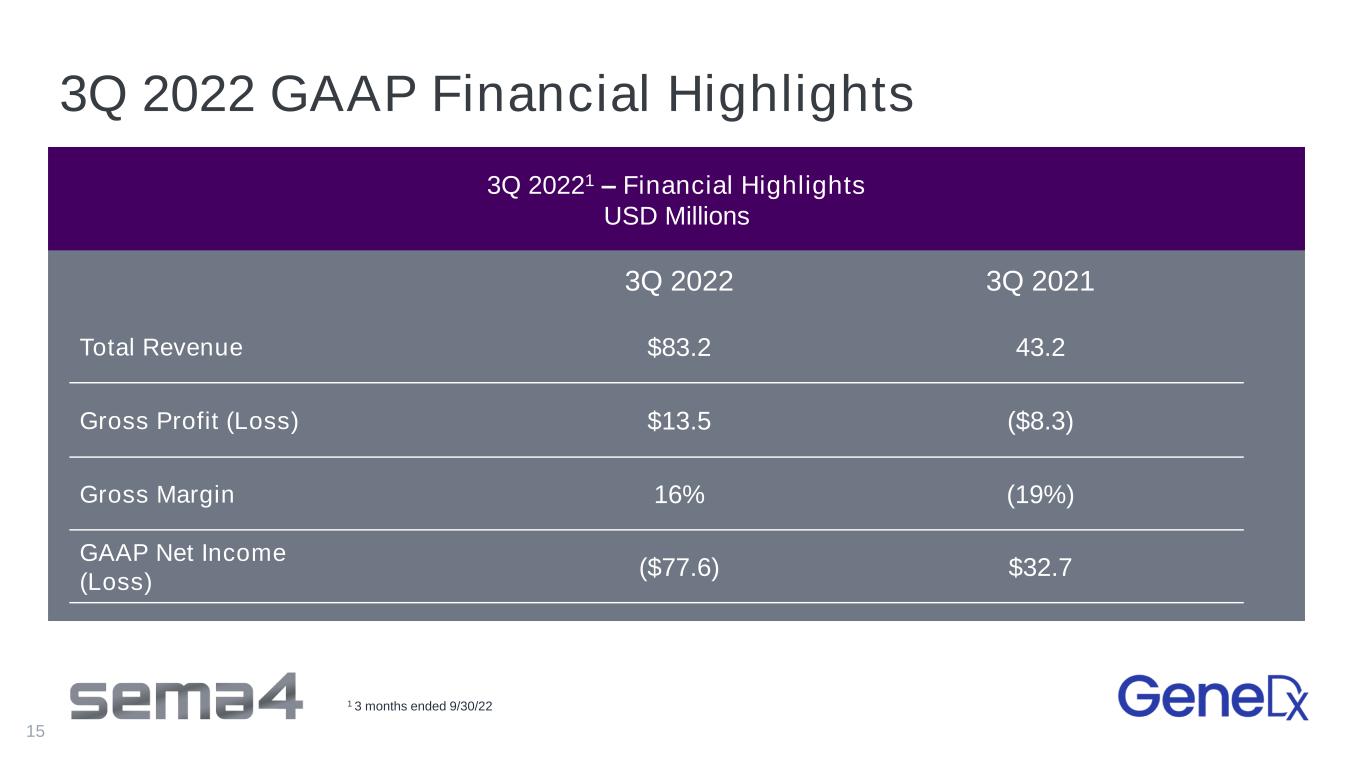

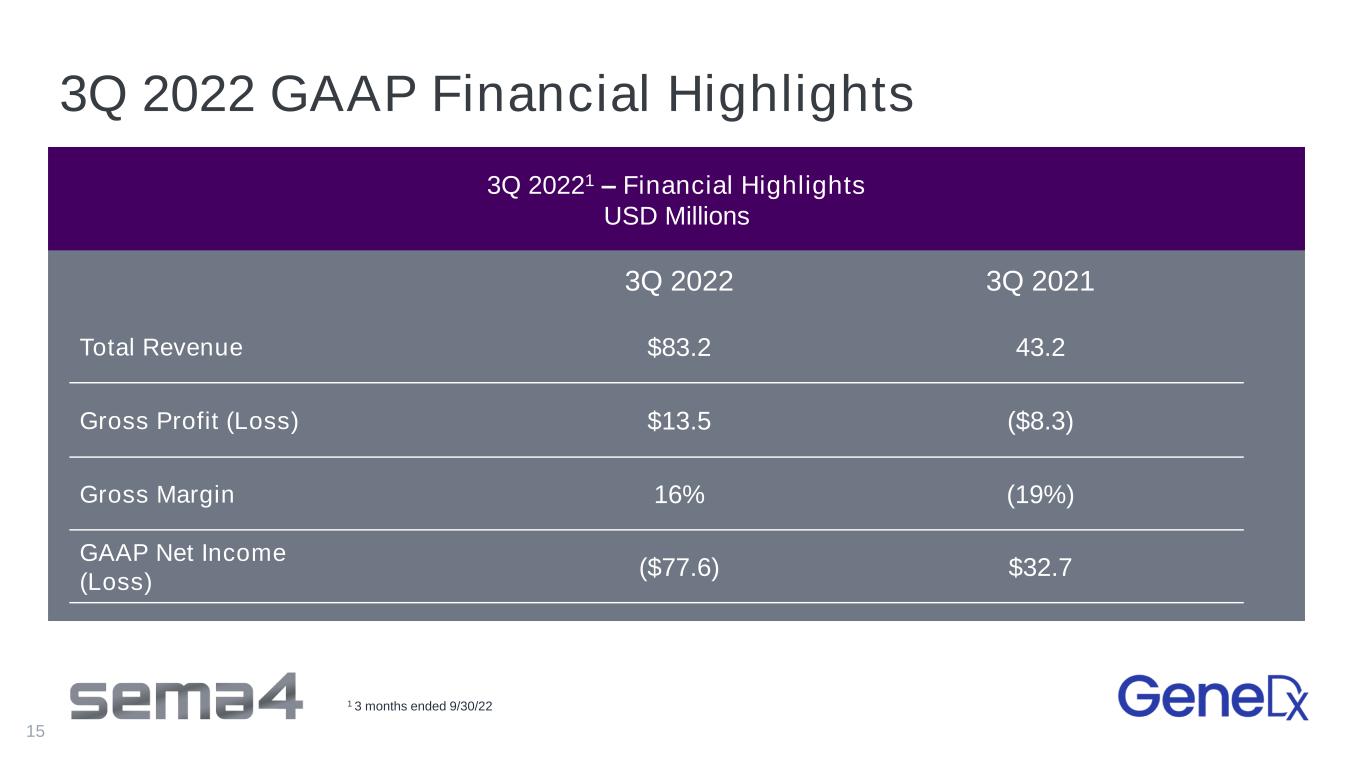

3Q 2022 GAAP Financial Highlights 3Q 20221 – Financial Highlights USD Millions 3Q 2022 3Q 2021 Total Revenue $83.2 43.2 Gross Profit (Loss) $13.5 ($8.3) Gross Margin 16% (19%) GAAP Net Income (Loss) ($77.6) $32.7 1 3 months ended 9/30/22 15

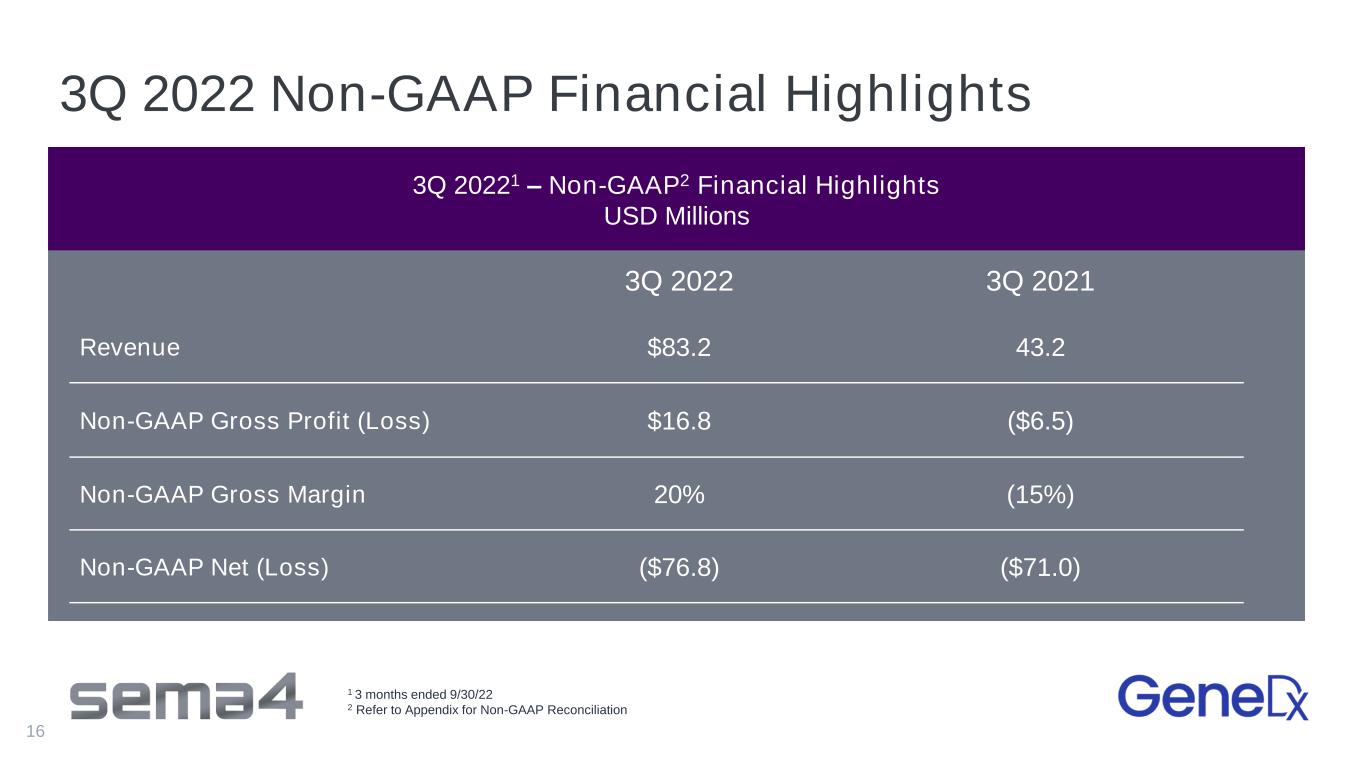

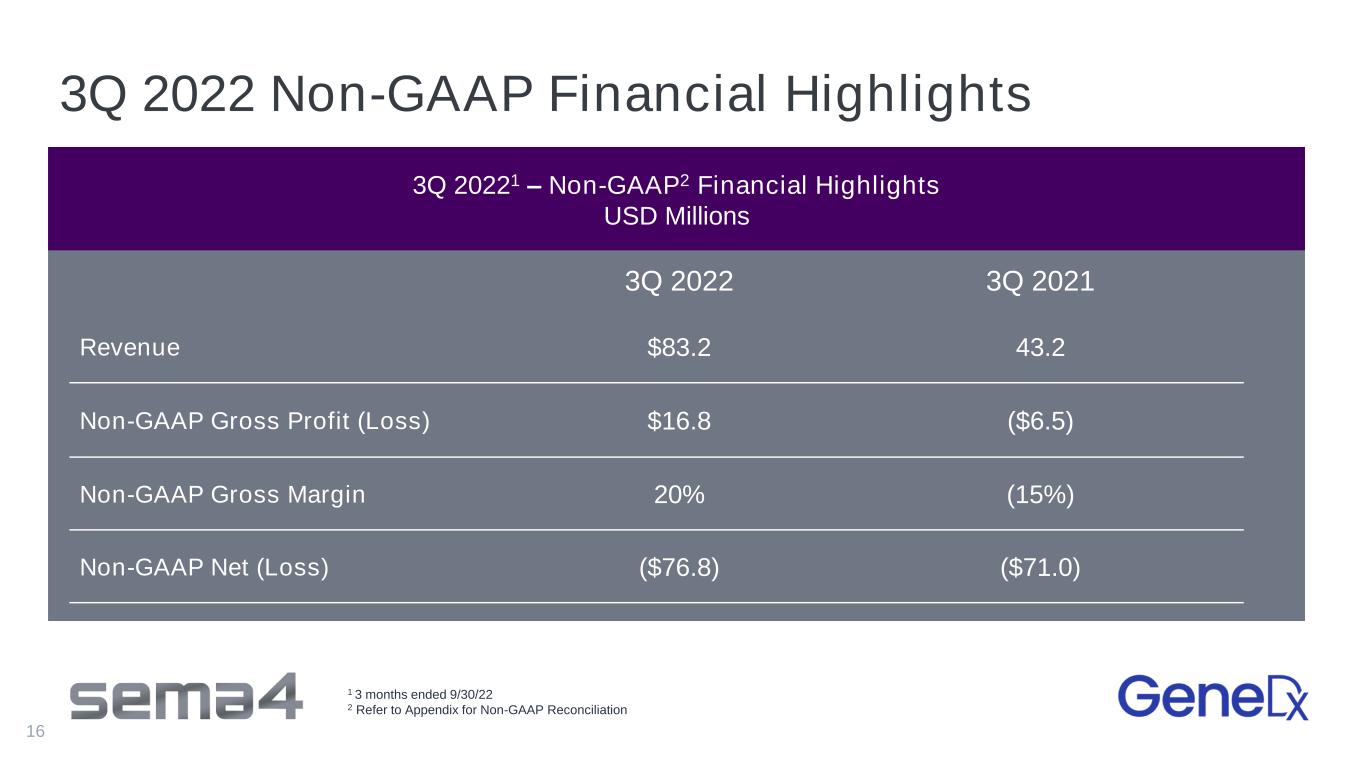

3Q 2022 Non-GAAP Financial Highlights 3Q 20221 – Non-GAAP2 Financial Highlights USD Millions 3Q 2022 3Q 2021 Revenue $83.2 43.2 Non-GAAP Gross Profit (Loss) $16.8 ($6.5) Non-GAAP Gross Margin 20% (15%) Non-GAAP Net (Loss) ($76.8) ($71.0) 1 3 months ended 9/30/22 2 Refer to Appendix for Non-GAAP Reconciliation 16

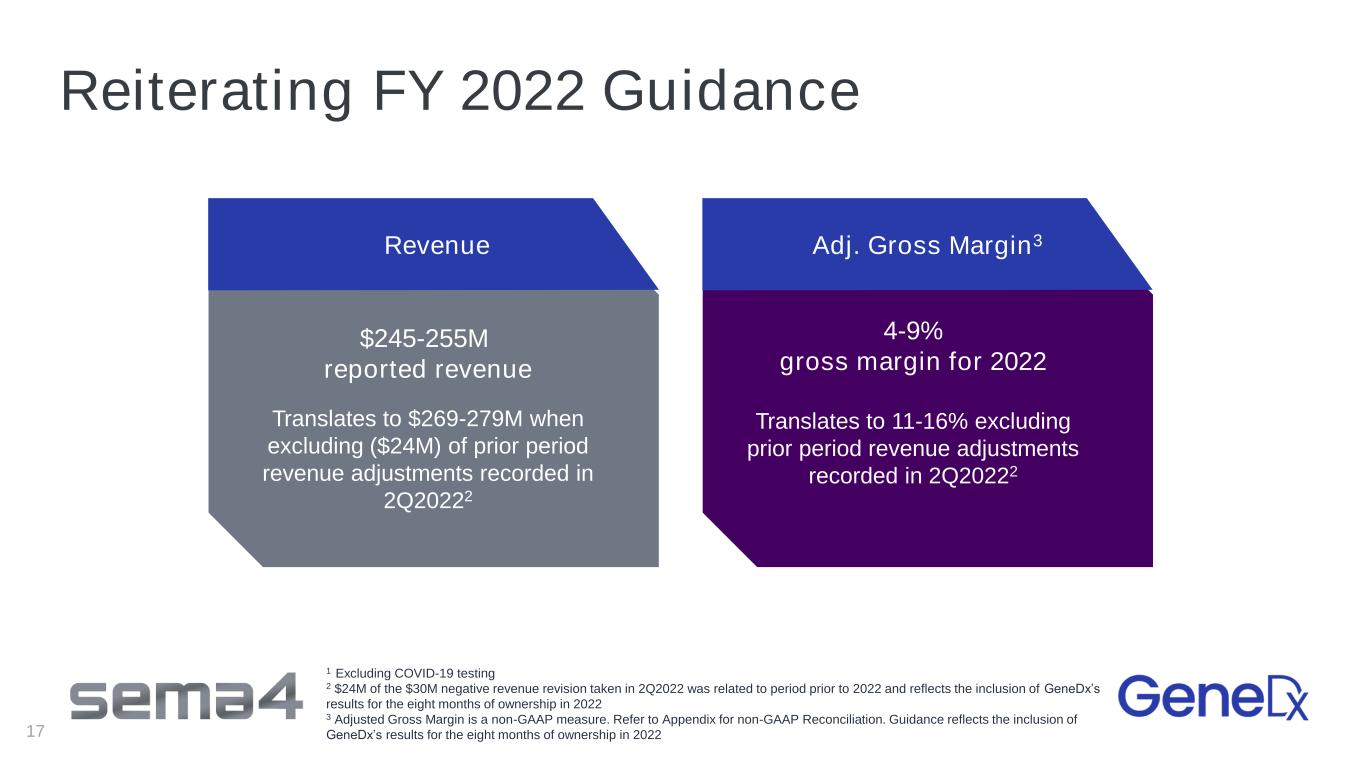

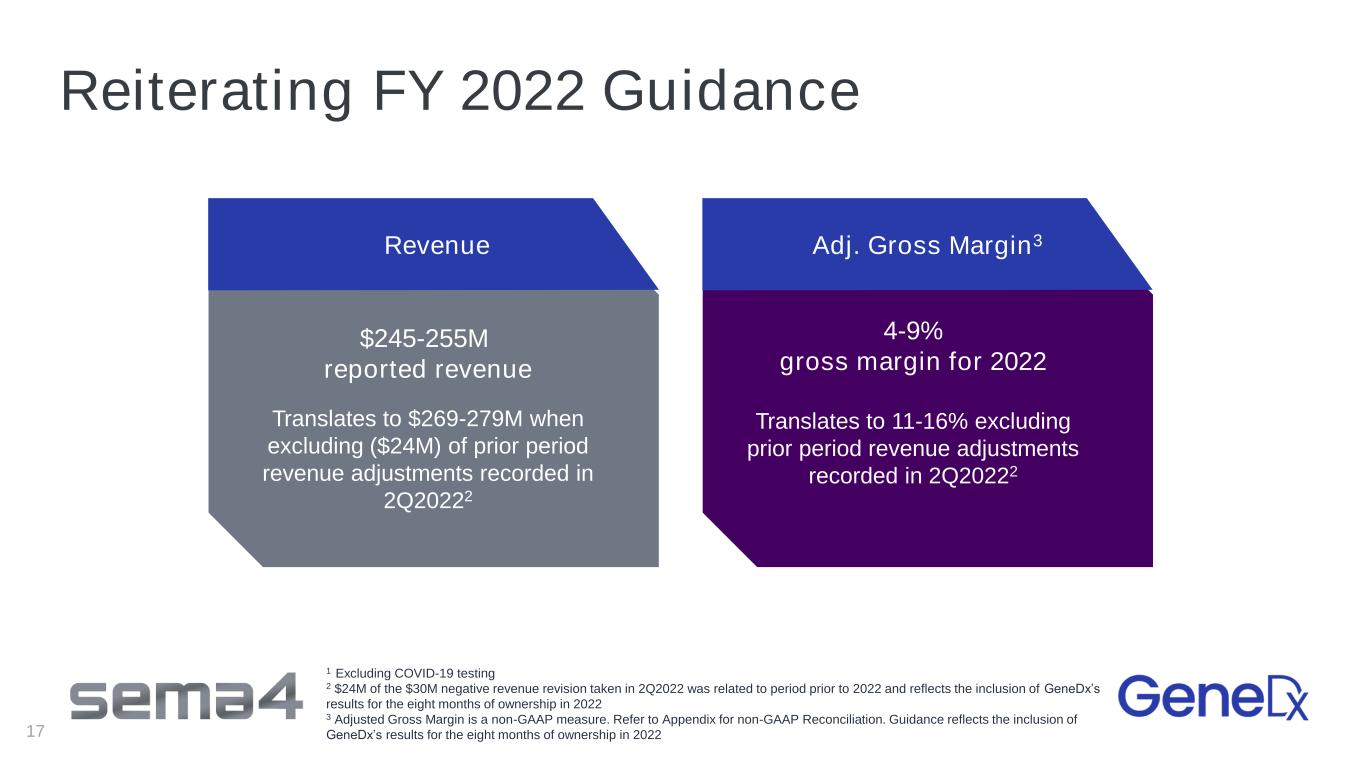

Reiterating FY 2022 Guidance 60%+ growth YoY Implies 460k+ patient tests resulted & 19%+ proforma growth Adjusted gross margin to exceed 10% Revenue $245-255M reported revenue Translates to $269-279M when excluding ($24M) of prior period r venue adjustments recorded in 2Q20222 Adj. Gross Margin3 4-9% gross margin for 2022 Translates to 11-16% excluding prior period revenue adjustments recorded in 2Q20222 1 Excluding COVID-19 testing 2 $24M of the $30M negative revenue revision taken in 2Q2022 was related to period prior to 2022 and reflects the inclusion of GeneDx’s results for the eight months of ownership in 2022 3 Adjusted Gross Margin is a non-GAAP measure. Refer to Appendix for non-GAAP Reconciliation. Guidance reflects the inclusion of GeneDx’s results for the eight months of ownership in 202217

Our Expected Financial Profile Post the Exit of Reproductive Health 18 Annualized revenue run rate of >$185M1 excluding Reproductive Health Testing revenue Adjusted gross margin >40% with a path to >50% by 2025 Reduction in operating cash burn of >50% vs 2022 Target revenue CAGR >20% over the next several years Operating model to drive positive free cash flow in early 2025 1 $185 million annualized revenue run rates reflects 3Q revenues on an annualized basis excluding reproductive health testing revenue 2 Adjusted Gross Margin is a non-GAAP measure. Refer to Appendix for non-GAAP Reconciliation

Appendix

Historical Pro Forma Resulted Volume & Revenue1 1 Pro forma volume and revenue metrics assume GeneDx was owned for the entirety of the applicable quarter and are calculated based on the sum of each of Sema4’s and GeneDx’s historical volumes or revenues, as applicable. Pro forma metrics are presented for illustrative purposes only and are not necessarily indicative of the results that would have occurred had the GeneDx acquisition been completed on such dates or that may occur in the future. 2 Represents aggregated Resulted Volume and Revenue from GeneDx and Sema4. 3 30.1 million of revenue adjustments recorded related to prior periods due to our change in estimate. 20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Volumes2 Complex Reproductive Health 46,052 50,155 49,475 61,741 67,907 73,288 68,109 Whole Exome, Whole Genome & NICU 3,344 6,698 6,162 6,619 7,395 7,572 7,480 Other Diagnostic Testing (Excluding COVID) 49,230 54,412 51,780 53,387 51,057 51,802 52,673 Total 98,626 111,265 107,417 121,747 126,359 132,662 128,262 Sema4 (Excluding COVID) 66,945 72,083 69,895 82,966 84,925 87,094 83,348 GeneDx 31,681 39,182 37,522 38,781 41,434 45,568 44,914 Total1 98,626 111,265 107,417 121,747 126,359 132,662 128,262 Revenue2 Complex Reproductive Health $46.5 $41.3 $37.6 $46.2 $48.3 $8.2 $36.8 Whole Exome, Whole Genome & NICU $8.4 $13.5 $14.2 $15.3 $18.4 $21.1 $26.9 Other Diagnostic Testing (Excluding COVID) $14.8 $15.7 $15.2 $15.7 $17.9 $16.5 $17.7 COVID $15.9 $3.8 $4.2 $10.5 $3.8 $0.3 $0.0 Pharma $1.4 $2.2 $1.8 $2.4 $1.6 $2.3 $1.7 Total2 $87.0 $76.7 $73.0 $90.1 $90.1 $48.3 $83.2 2Q 2022 Prior Period Revenue Adjustment3 - - - - - ($30.1) - Adjusted Total $87.0 $76.7 $73.0 $90.1 $90.1 $78.4 $83.2 Adjusted Total Excluding COVID $71.1 $72.8 $68.8 $79.6 $86.3 $78.1 $83.2 Sema4 $64.2 $47.0 $43.2 $57.8 $53.9 $10.0 $37.7 Sema4 Diagnostic Testing (Excluding COVID) $46.9 $41.0 $37.3 $45.9 $48.7 $8.1 $36.1 Sema4 COVID Testing $15.9 $3.8 $4.2 $10.5 $3.8 $0.3 $0.0 Sema4 Pharma $1.4 $2.2 $1.7 $1.4 $1.4 $1.7 $1.6 GeneDx $22.8 $29.6 $29.8 $32.3 $36.1 $38.3 $45.6 Total2 $87.0 $76.7 $73.0 $90.1 $90.1 $48.3 $83.2 2Q 2022 Prior Period Revenue Adjustment3 - - - - - ($30.1) - Adjusted Total $87.0 $76.7 $73.0 $90.1 $90.1 $78.4 $83.2 Adjusted Total excluding COVID $71.1 $72.8 $68.8 $79.6 $86.3 $78.1 $83.2

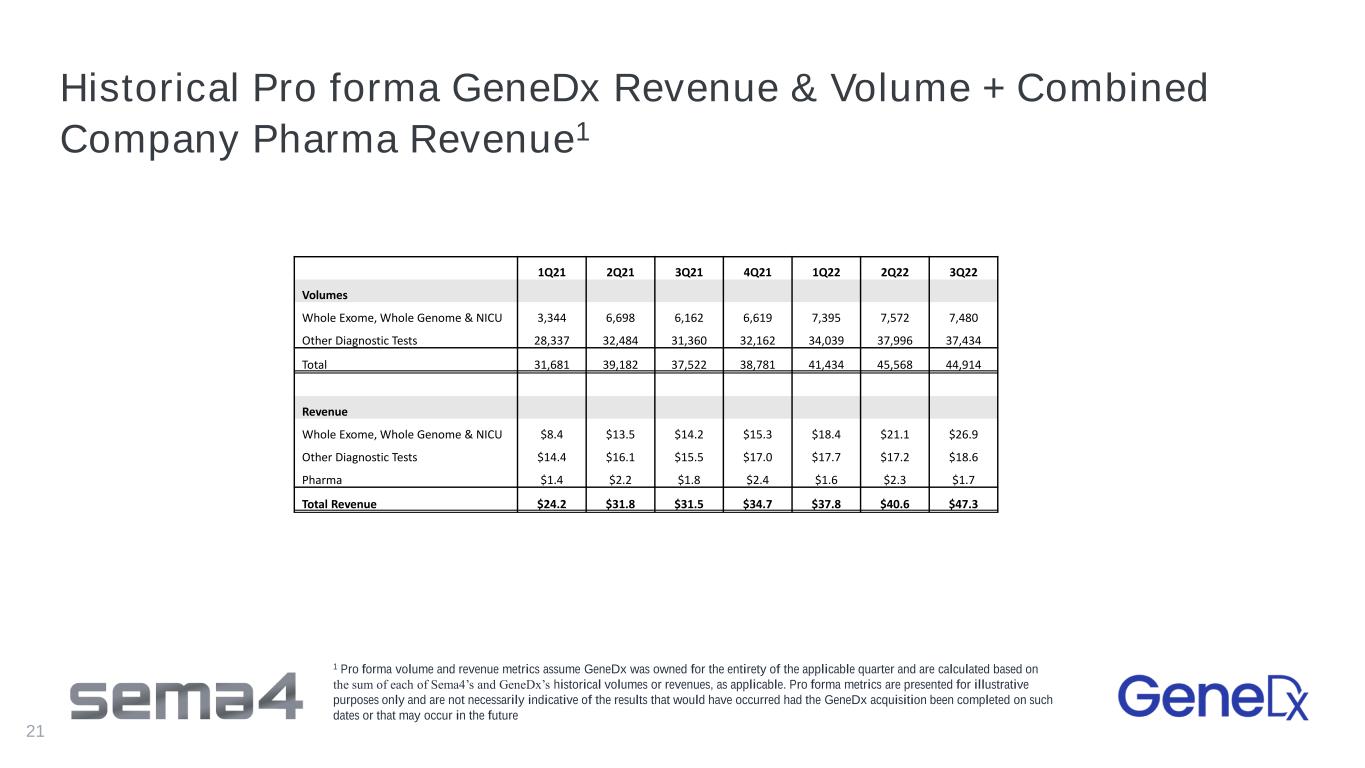

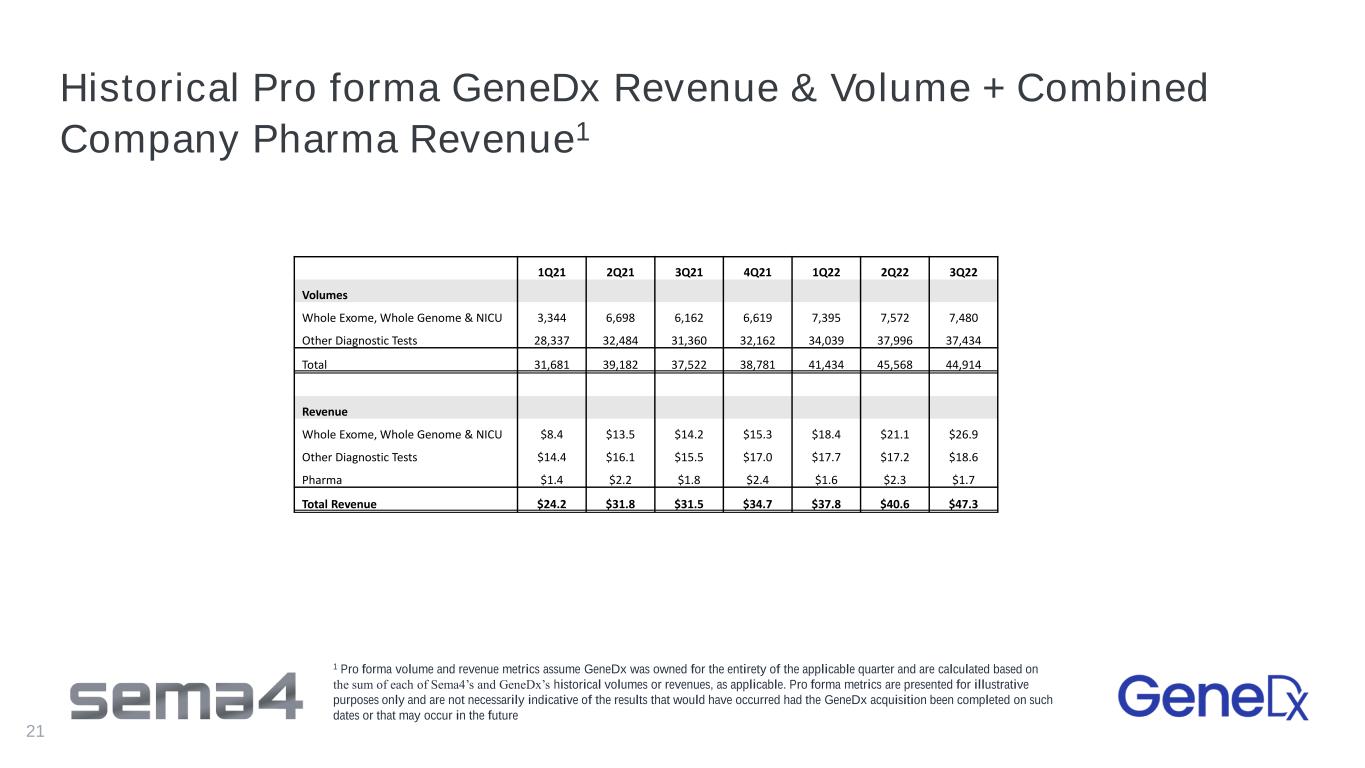

Historical Pro forma GeneDx Revenue & Volume + Combined Company Pharma Revenue1 21 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Volumes Whole Exome, Whole Genome & NICU 3,344 6,698 6,162 6,619 7,395 7,572 7,480 Other Diagnostic Tests 28,337 32,484 31,360 32,162 34,039 37,996 37,434 Total 31,681 39,182 37,522 38,781 41,434 45,568 44,914 Revenue Whole Exome, Whole Genome & NICU $8.4 $13.5 $14.2 $15.3 $18.4 $21.1 $26.9 Other Diagnostic Tests $14.4 $16.1 $15.5 $17.0 $17.7 $17.2 $18.6 Pharma $1.4 $2.2 $1.8 $2.4 $1.6 $2.3 $1.7 Total Revenue $24.2 $31.8 $31.5 $34.7 $37.8 $40.6 $47.3 1 Pro forma volume and revenue metrics assume GeneDx was owned for the entirety of the applicable quarter and are calculated based on the sum of each of Sema4’s and GeneDx’s historical volumes or revenues, as applicable. Pro forma metrics are presented for illustrative purposes only and are not necessarily indicative of the results that would have occurred had the GeneDx acquisition been completed on such dates or that may occur in the future

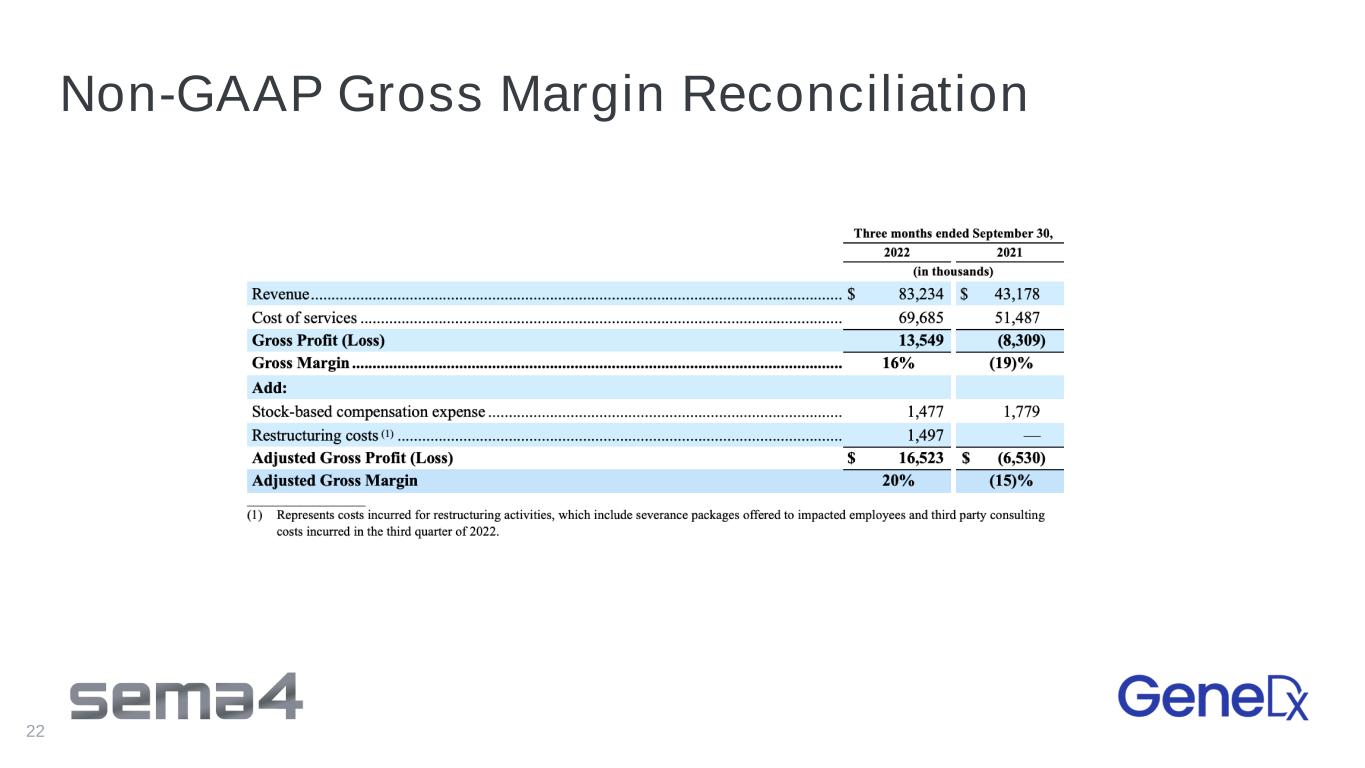

Non-GAAP Gross Margin Reconciliation 22

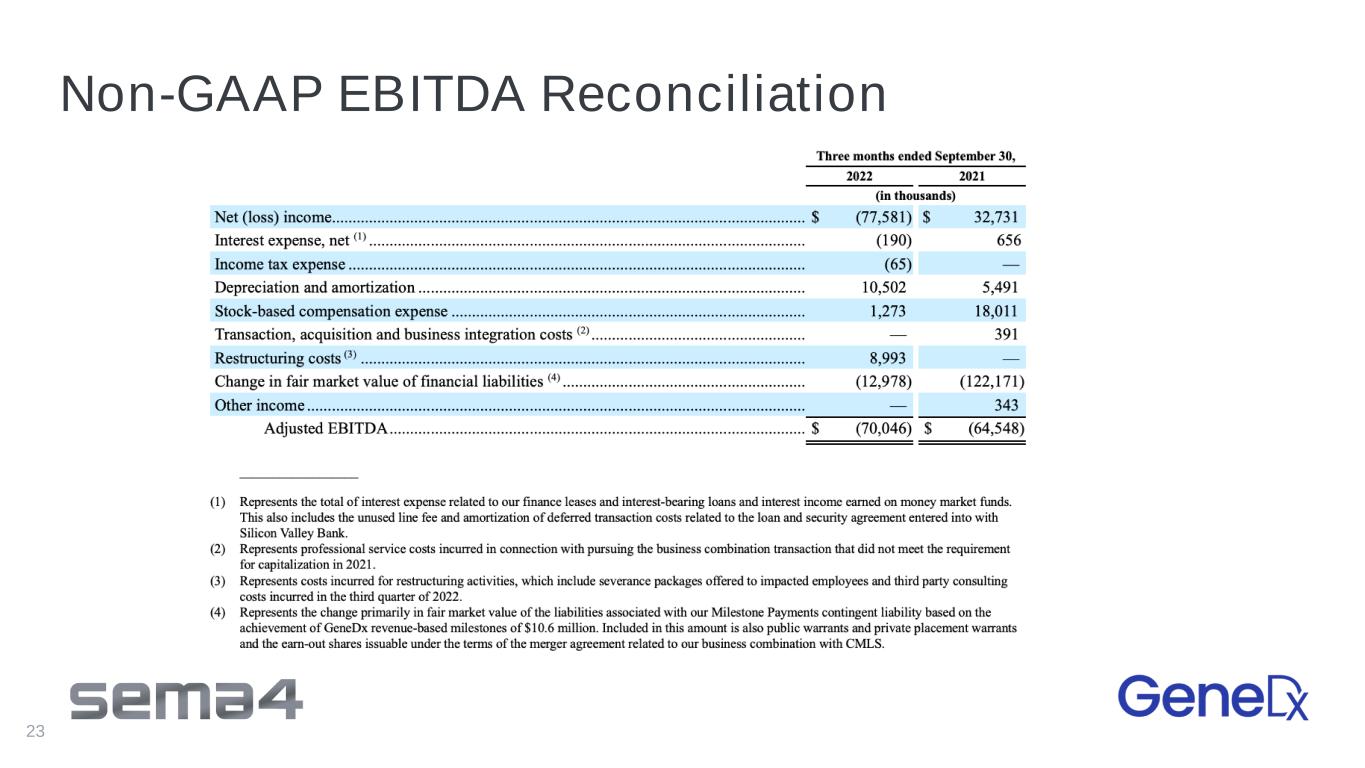

Non-GAAP EBITDA Reconciliation 23

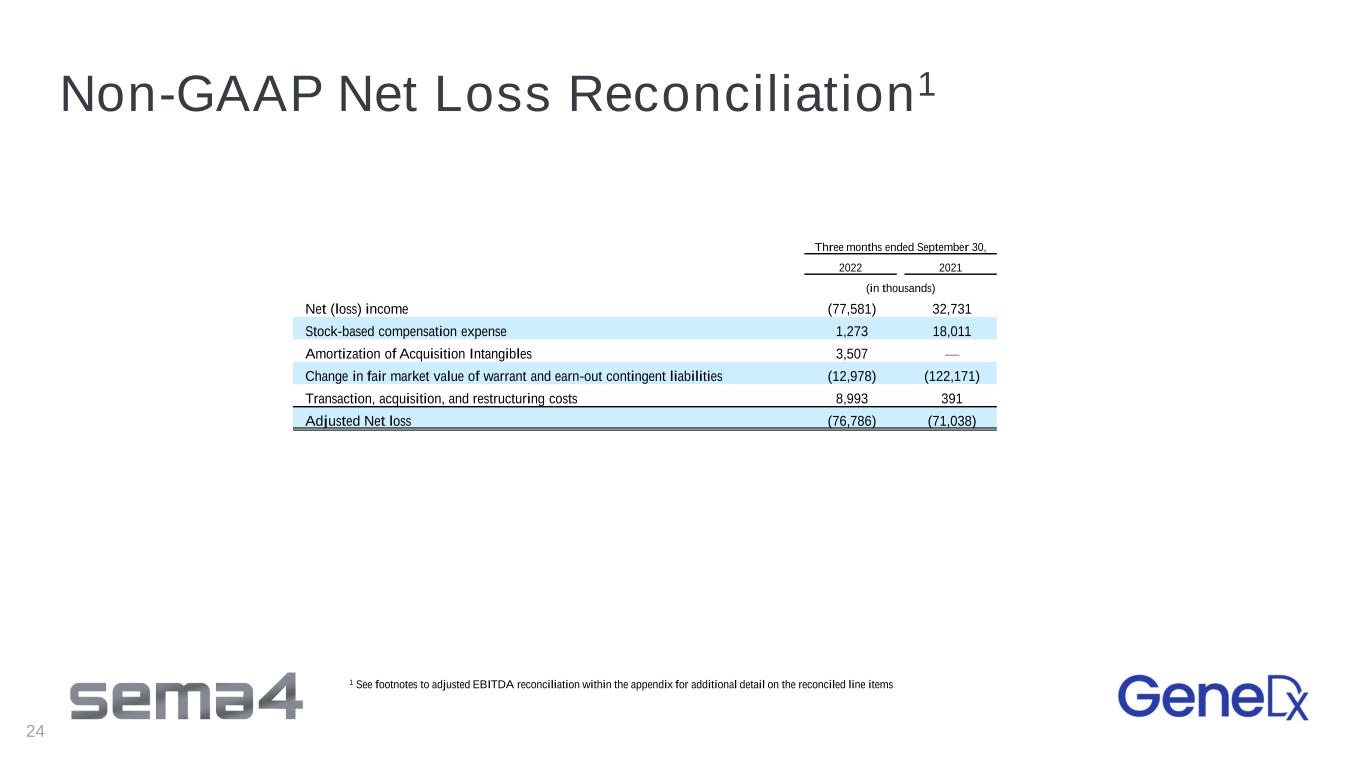

Non-GAAP Net Loss Reconciliation1 24 1 See footnotes to adjusted EBITDA reconciliation within the appendix for additional detail on the reconciled line items Three months ended September 30, 2022 2021 (in thousands) Net (loss) income (77,581) 32,731 Stock-based compensation expense 1,273 18,011 Amortization of Acquisition Intangibles 3,507 — Change in fair market value of warrant and earn-out contingent liabilities (12,978) (122,171) Transaction, acquisition, and restructuring costs 8,993 391 Adjusted Net loss (76,786) (71,038)