NEWS RELEASE OppFi Reports Second Quarter 2022 Financial Results 8/9/2022 Revenue increased 38% year over year to $107.9 million for the second quarter of 2022 Net Originations increased 57% year over year to $226.2 million for the second quarter of 2022 Ending Receivables increased 54% year over year to $401.5 million for the second quarter of 2022 Net income of $9.5 million for the second quarter of 2022 Adjusted Net Income of $6.8 million for the second quarter of 2022 Basic and Diluted EPS of $0.26 and $0.10, respectively, for the second quarter of 2022 Adjusted EPS of $0.08 for the second quarter of 2022 CHICAGO--(BUSINESS WIRE)-- OppFi Inc. (NYSE: OPFI) (“OppFi” or the “Company”), a leading �nancial technology platform that powers banks to help the everyday consumer gain access to credit, today reported �nancial results for the second quarter ended June 30, 2022. “We are pleased with our �nancial and operational performance for the second quarter, relative to our expectations,” said Todd Schwartz, Chief Executive O�cer and Executive Chairman of OppFi. “We are encouraged by continued strong consumer demand that drove 57% growth in originations, e�ciencies that yielded a 16% decrease in marketing cost per new funded loan, and further progress scaling our operating expenses.” 1

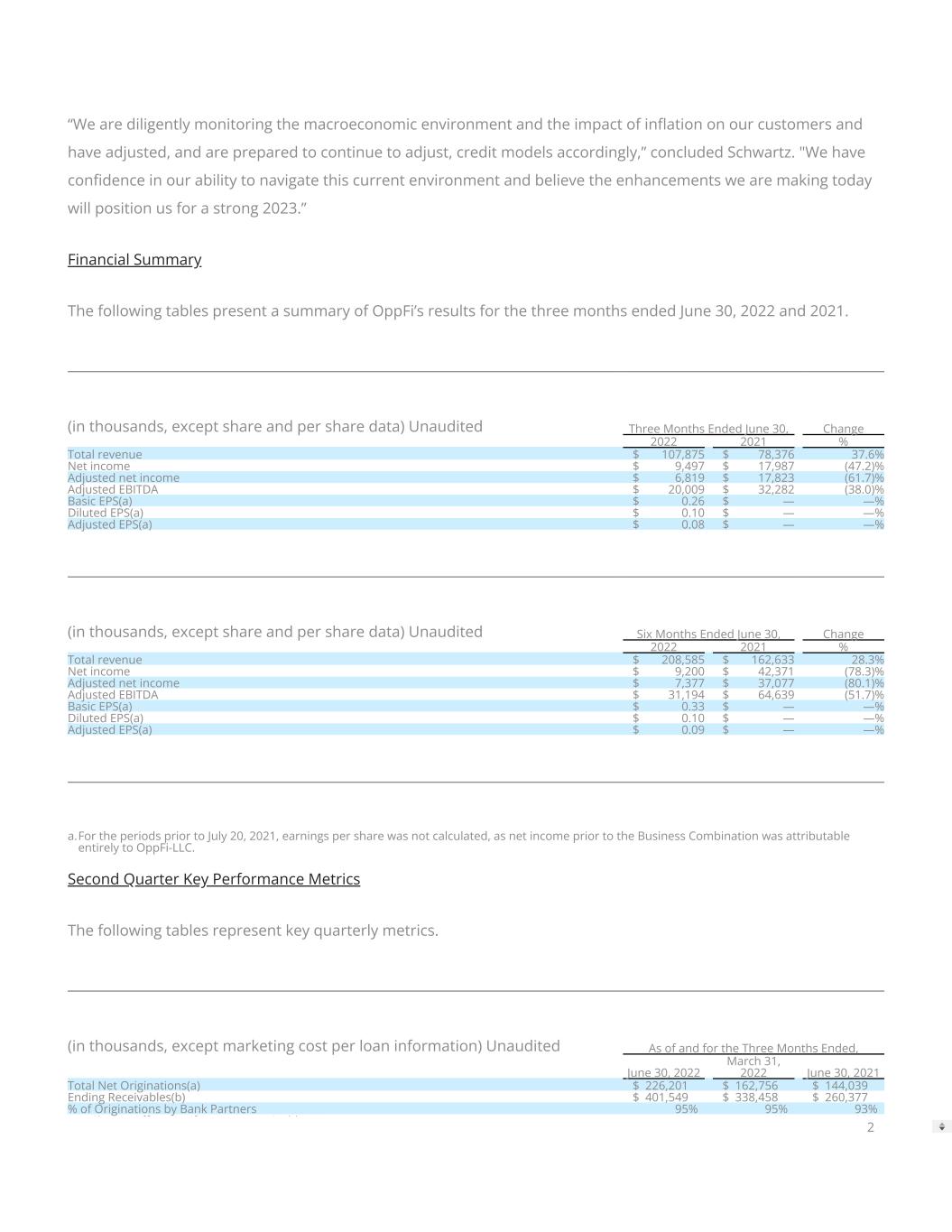

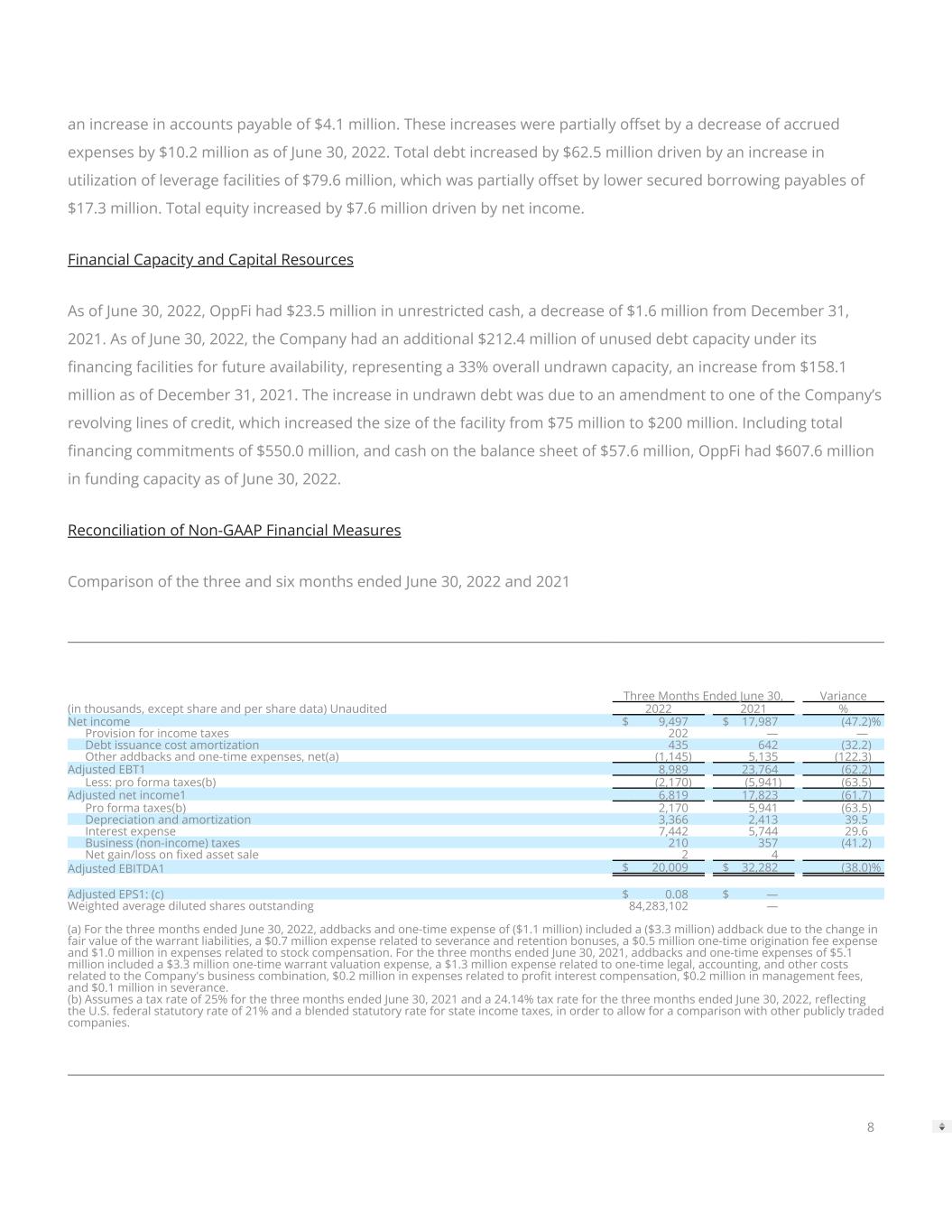

“We are diligently monitoring the macroeconomic environment and the impact of in�ation on our customers and have adjusted, and are prepared to continue to adjust, credit models accordingly,” concluded Schwartz. "We have con�dence in our ability to navigate this current environment and believe the enhancements we are making today will position us for a strong 2023.” Financial Summary The following tables present a summary of OppFi’s results for the three months ended June 30, 2022 and 2021. (in thousands, except share and per share data) Unaudited Three Months Ended June 30, Change 2022 2021 % Total revenue $ 107,875 $ 78,376 37.6% Net income $ 9,497 $ 17,987 (47.2)% Adjusted net income $ 6,819 $ 17,823 (61.7)% Adjusted EBITDA $ 20,009 $ 32,282 (38.0)% Basic EPS(a) $ 0.26 $ — —% Diluted EPS(a) $ 0.10 $ — —% Adjusted EPS(a) $ 0.08 $ — —% (in thousands, except share and per share data) Unaudited Six Months Ended June 30, Change 2022 2021 % Total revenue $ 208,585 $ 162,633 28.3% Net income $ 9,200 $ 42,371 (78.3)% Adjusted net income $ 7,377 $ 37,077 (80.1)% Adjusted EBITDA $ 31,194 $ 64,639 (51.7)% Basic EPS(a) $ 0.33 $ — —% Diluted EPS(a) $ 0.10 $ — —% Adjusted EPS(a) $ 0.09 $ — —% a.For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was attributable entirely to OppFi-LLC. Second Quarter Key Performance Metrics The following tables represent key quarterly metrics. (in thousands, except marketing cost per loan information) Unaudited As of and for the Three Months Ended, June 30, 2022 March 31, 2022 June 30, 2021 Total Net Originations(a) $ 226,201 $ 162,756 $ 144,039 Ending Receivables(b) $ 401,549 $ 338,458 $ 260,377 % of Originations by Bank Partners 95% 95% 93% N Ch O� % f A R i bl ( ) 51% 56% 28% 2

Net Charge-O�s as % of Average Receivables(c) 51% 56% 28% Auto-Approval Rate(d) 62% 61% 51% Marketing Cost per Funded Loan(e) $ 82 $ 76 $ 72 Marketing Cost per New Funded Loan(f) $ 206 $ 221 $ 245 a.Total net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi. b.Receivables are de�ned as unpaid principal balances of both on- and o�-balance sheet loans. c. Annualized net charge-o�s as a percentage of average receivables (de�ned as unpaid principal of both on- and o�-balance sheet loans) represents total charge o�s from the period less recoveries as a percent of average receivables. Finance receivables are charged o� at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives noti�cation of a customer bankruptcy or is otherwise deemed uncollectible. d.Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved. e.Marketing Cost per Funded Loan represents marketing cost per funded loan for new and re�nanced loans. This metric is the amount of direct marketing costs incurred during a period divided by the number of loans originated during that same period. f. Marketing Cost per New Funded Loan represents marketing cost for new loans. This metric is the amount of direct marketing costs incurred during a period divided by the number of new loans originated during that same period. Share Repurchase Program Update During the second quarter, OppFi repurchased 333,318 shares of class A common stock for $1.1 million at an average price of $3.31 per share. During the �rst half of 2022, the Company repurchased 615,652 shares of class A common stock at an average price of $3.48 per share for a total of $2.1 million. Full Year 2022 Guidance Update OppFi rea�rms its previously issued full-year 2022 �nancial guidance of total revenue growth of 20% to 25% year over year and operating expenses as a percentage of total revenue of 43% to 47%, excluding interest expense, add backs, and one-time items. Given limited visibility considering the current macroeconomic environment, the Company now expects to report break-even results on an adjusted basis or a modest adjusted net loss for the full- year, due to persistent high in�ation that caused signi�cant credit deterioration in the latter half of the second quarter and early third quarter. OppFi withdraws its previously issued guidance for metrics other than total revenue growth and operating expenses as a percentage of total revenue. Conference Call Management will host a conference call today at 4:30 p.m. ET to discuss OppFi’s �nancial results and outlook. The webcast of the conference call will be made available on the Investor Relations page of the Company's website. The conference call can also be accessed with the following dial-in information: Domestic: (888) 567-1602 International: (404) 267-0373 An archived version of the webcast will be available on OppFi's website. 3

About OppFi OppFi (NYSE: OPFI) is a leading �nancial technology platform that powers banks to help the everyday consumer gain access to credit. Through its unwavering commitment to customer service, the Company supports consumers, who are turned away by mainstream options, to build better �nancial health. In 2021, OppFi was recognized by the Deloitte North America Technology Fast 500 for the fourth consecutive year. OppFi maintains a 4.7/5.0 star rating on Trustpilot with more than 3,400 reviews and an A+ rating from the Better Business Bureau (BBB), making the Company one of the top consumer-rated �nancial platforms online. For more information, please visit opp�.com. Forward-Looking Statements This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may di�er from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," “possible,” "continue," and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its full year 2022 guidance, the future performance of OppFi’s platform and expectations for OppFi’s growth. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve signi�cant risks and uncertainties that could cause the actual results to di�er materially from the expected results. Most of these factors are outside OppFi’s control and are di�cult to predict. Factors that may cause such di�erences include, but are not limited to: the impact of in�ation on OppFi’s business; the impact of COVID-19 on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s �nancing sources will continue to �nance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the risk that the business combination disrupts current plans and operations; the ability to recognize the anticipated bene�ts of the business combination, which may be a�ected by, among other things, competition, the ability of OppFi to grow and manage growth pro�tably and retain its key employees; risks related to new products; concentration risk; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely a�ected by other economic, business, and/or competitive factors; risks related to management transitions; and other risks and uncertainties indicated from time to time in OppFi’s �lings 4

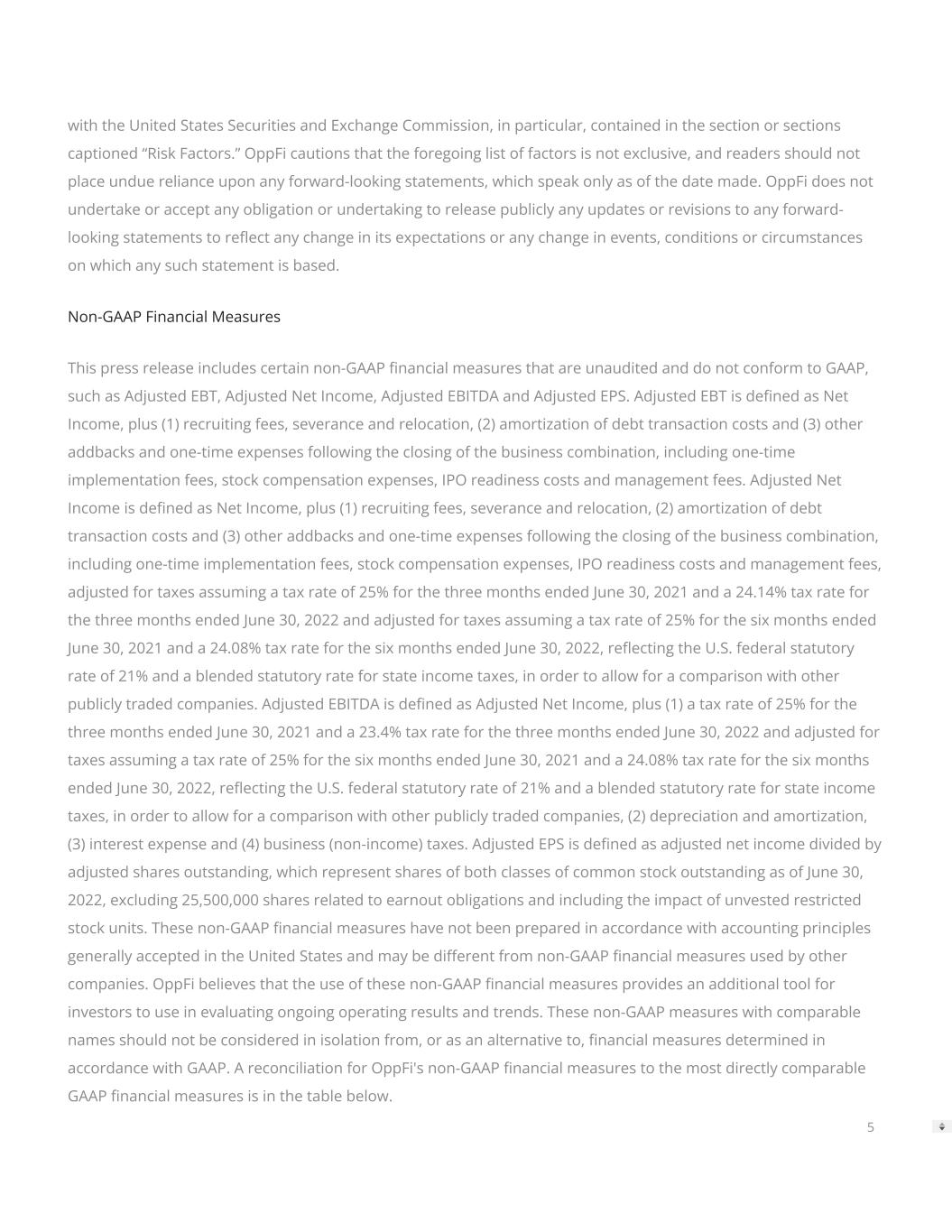

with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward- looking statements to re�ect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures This press release includes certain non-GAAP �nancial measures that are unaudited and do not conform to GAAP, such as Adjusted EBT, Adjusted Net Income, Adjusted EBITDA and Adjusted EPS. Adjusted EBT is de�ned as Net Income, plus (1) recruiting fees, severance and relocation, (2) amortization of debt transaction costs and (3) other addbacks and one-time expenses following the closing of the business combination, including one-time implementation fees, stock compensation expenses, IPO readiness costs and management fees. Adjusted Net Income is de�ned as Net Income, plus (1) recruiting fees, severance and relocation, (2) amortization of debt transaction costs and (3) other addbacks and one-time expenses following the closing of the business combination, including one-time implementation fees, stock compensation expenses, IPO readiness costs and management fees, adjusted for taxes assuming a tax rate of 25% for the three months ended June 30, 2021 and a 24.14% tax rate for the three months ended June 30, 2022 and adjusted for taxes assuming a tax rate of 25% for the six months ended June 30, 2021 and a 24.08% tax rate for the six months ended June 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EBITDA is de�ned as Adjusted Net Income, plus (1) a tax rate of 25% for the three months ended June 30, 2021 and a 23.4% tax rate for the three months ended June 30, 2022 and adjusted for taxes assuming a tax rate of 25% for the six months ended June 30, 2021 and a 24.08% tax rate for the six months ended June 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies, (2) depreciation and amortization, (3) interest expense and (4) business (non-income) taxes. Adjusted EPS is de�ned as adjusted net income divided by adjusted shares outstanding, which represent shares of both classes of common stock outstanding as of June 30, 2022, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units. These non-GAAP �nancial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be di�erent from non-GAAP �nancial measures used by other companies. OppFi believes that the use of these non-GAAP �nancial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, �nancial measures determined in accordance with GAAP. A reconciliation for OppFi's non-GAAP �nancial measures to the most directly comparable GAAP �nancial measures is in the table below. 5

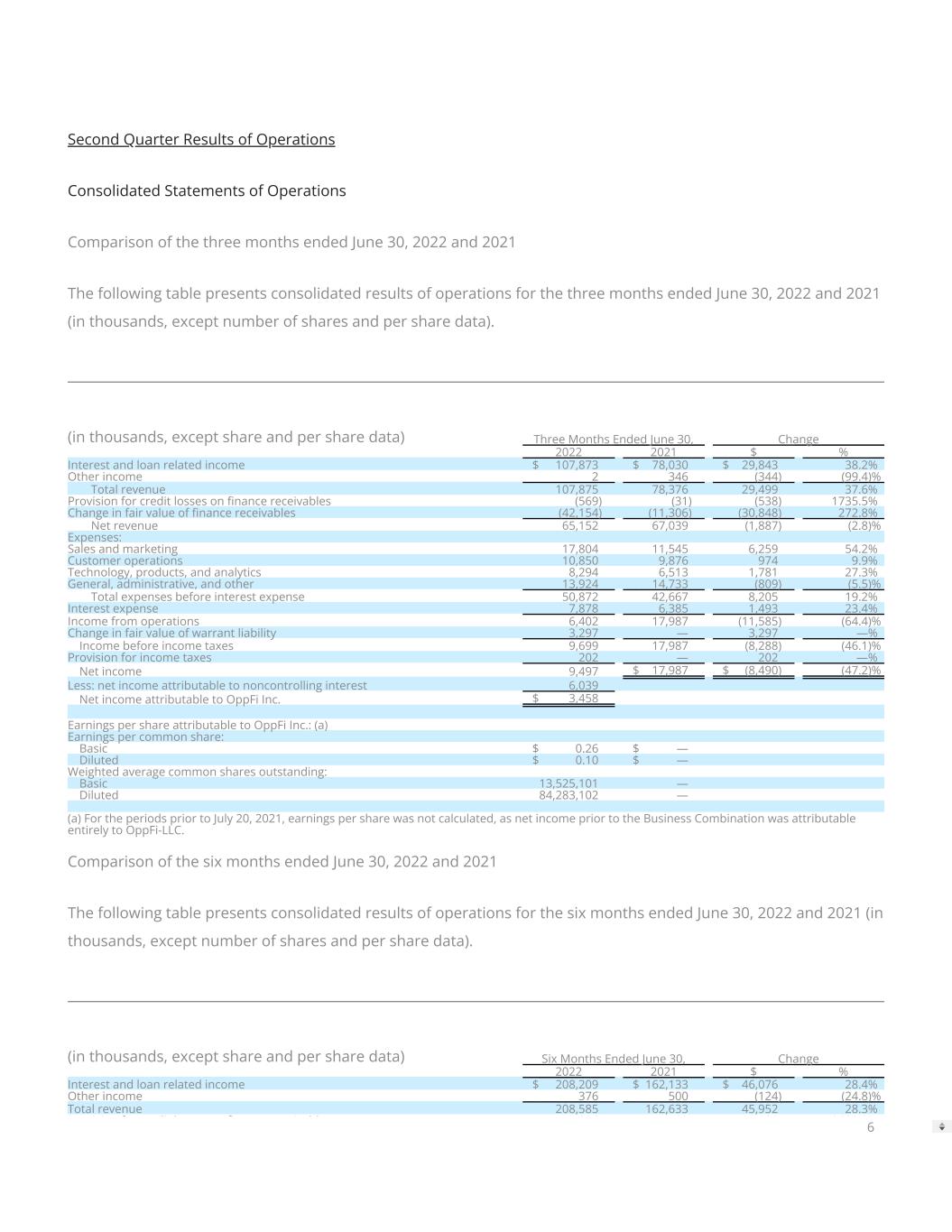

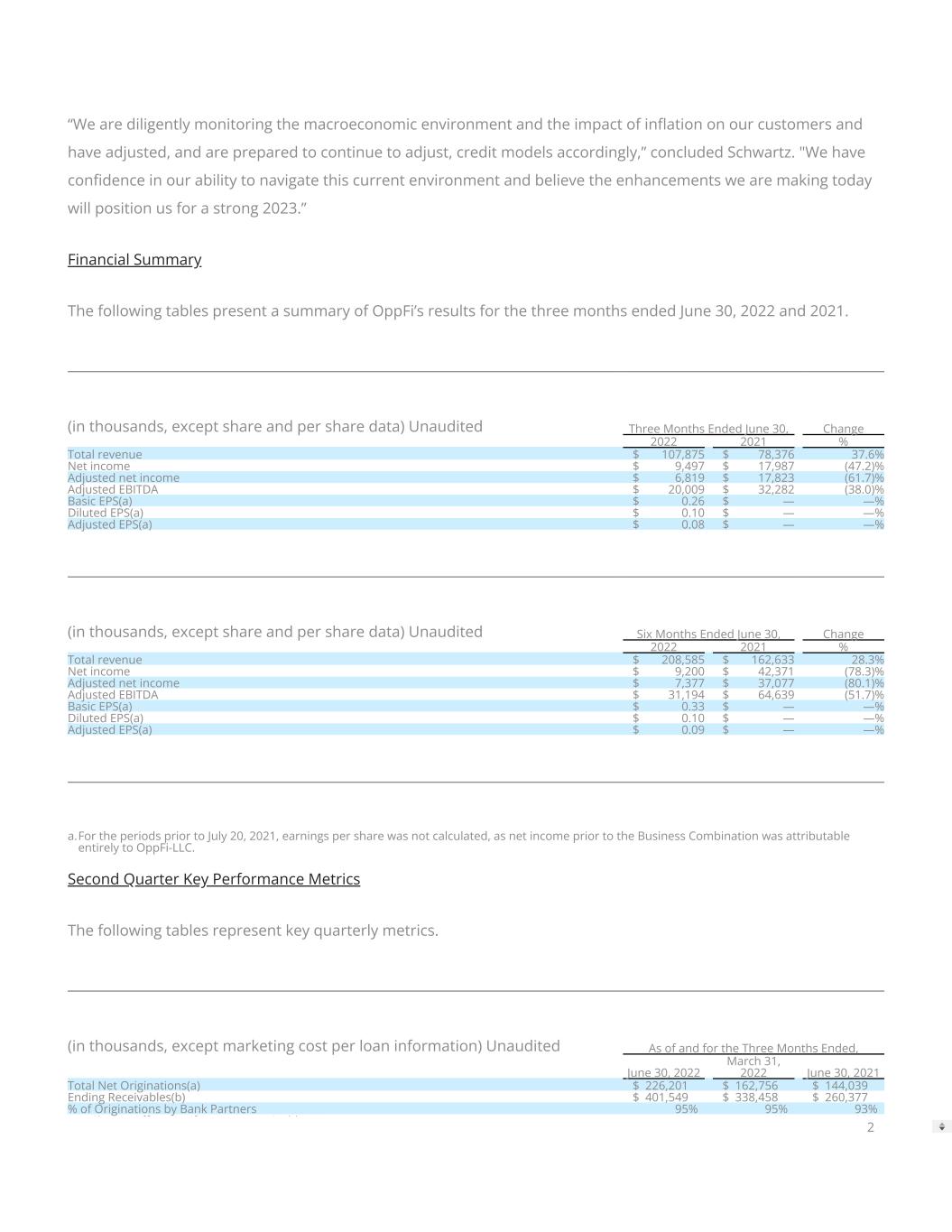

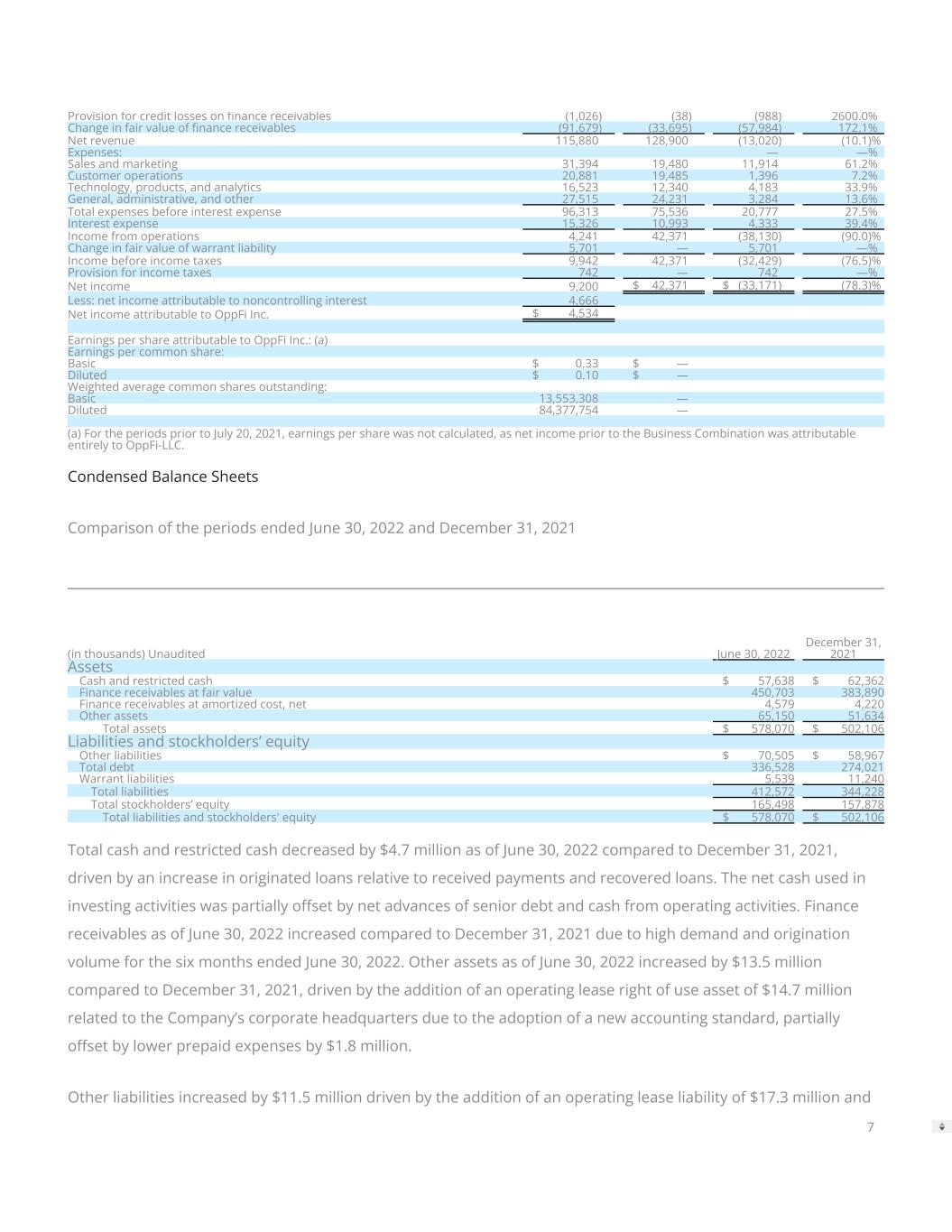

Second Quarter Results of Operations Consolidated Statements of Operations Comparison of the three months ended June 30, 2022 and 2021 The following table presents consolidated results of operations for the three months ended June 30, 2022 and 2021 (in thousands, except number of shares and per share data). (in thousands, except share and per share data) Three Months Ended June 30, Change 2022 2021 $ % Interest and loan related income $ 107,873 $ 78,030 $ 29,843 38.2% Other income 2 346 (344) (99.4)% Total revenue 107,875 78,376 29,499 37.6% Provision for credit losses on �nance receivables (569) (31) (538) 1735.5% Change in fair value of �nance receivables (42,154) (11,306) (30,848) 272.8% Net revenue 65,152 67,039 (1,887) (2.8)% Expenses: Sales and marketing 17,804 11,545 6,259 54.2% Customer operations 10,850 9,876 974 9.9% Technology, products, and analytics 8,294 6,513 1,781 27.3% General, administrative, and other 13,924 14,733 (809) (5.5)% Total expenses before interest expense 50,872 42,667 8,205 19.2% Interest expense 7,878 6,385 1,493 23.4% Income from operations 6,402 17,987 (11,585) (64.4)% Change in fair value of warrant liability 3,297 — 3,297 —% Income before income taxes 9,699 17,987 (8,288) (46.1)% Provision for income taxes 202 — 202 —% Net income 9,497 $ 17,987 $ (8,490) (47.2)% Less: net income attributable to noncontrolling interest 6,039 Net income attributable to OppFi Inc. $ 3,458 Earnings per share attributable to OppFi Inc.: (a) Earnings per common share: Basic $ 0.26 $ — Diluted $ 0.10 $ — Weighted average common shares outstanding: Basic 13,525,101 — Diluted 84,283,102 — (a) For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was attributable entirely to OppFi-LLC. Comparison of the six months ended June 30, 2022 and 2021 The following table presents consolidated results of operations for the six months ended June 30, 2022 and 2021 (in thousands, except number of shares and per share data). (in thousands, except share and per share data) Six Months Ended June 30, Change 2022 2021 $ % Interest and loan related income $ 208,209 $ 162,133 $ 46,076 28.4% Other income 376 500 (124) (24.8)% Total revenue 208,585 162,633 45,952 28.3% P i i f di l � i bl (1 026) (38) (988) 2600 0% 6

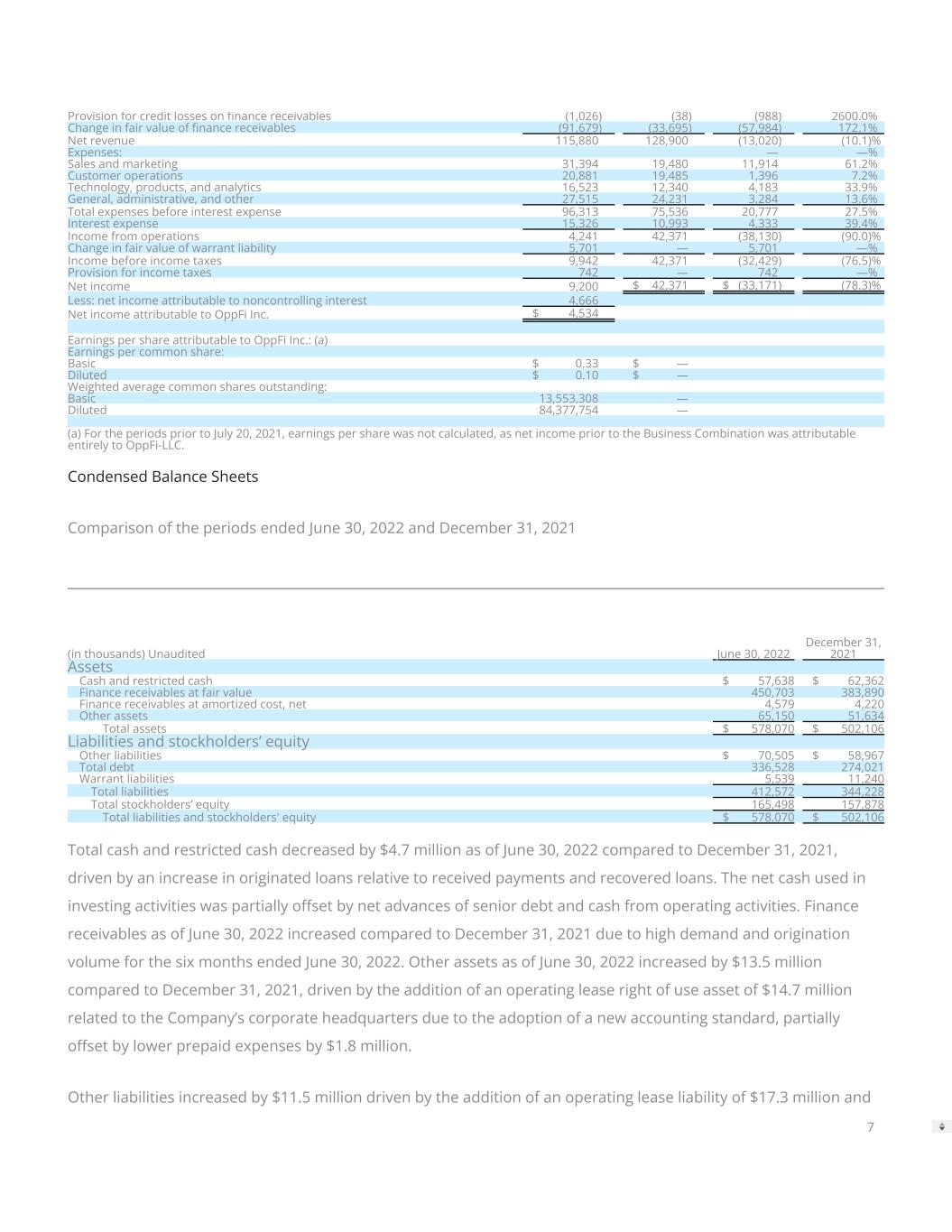

Provision for credit losses on �nance receivables (1,026) (38) (988) 2600.0% Change in fair value of �nance receivables (91,679) (33,695) (57,984) 172.1% Net revenue 115,880 128,900 (13,020) (10.1)% Expenses: — —% Sales and marketing 31,394 19,480 11,914 61.2% Customer operations 20,881 19,485 1,396 7.2% Technology, products, and analytics 16,523 12,340 4,183 33.9% General, administrative, and other 27,515 24,231 3,284 13.6% Total expenses before interest expense 96,313 75,536 20,777 27.5% Interest expense 15,326 10,993 4,333 39.4% Income from operations 4,241 42,371 (38,130) (90.0)% Change in fair value of warrant liability 5,701 — 5,701 —% Income before income taxes 9,942 42,371 (32,429) (76.5)% Provision for income taxes 742 — 742 —% Net income 9,200 $ 42,371 $ (33,171) (78.3)% Less: net income attributable to noncontrolling interest 4,666 Net income attributable to OppFi Inc. $ 4,534 Earnings per share attributable to OppFi Inc.: (a) Earnings per common share: Basic $ 0.33 $ — Diluted $ 0.10 $ — Weighted average common shares outstanding: Basic 13,553,308 — Diluted 84,377,754 — (a) For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was attributable entirely to OppFi-LLC. Condensed Balance Sheets Comparison of the periods ended June 30, 2022 and December 31, 2021 (in thousands) Unaudited June 30, 2022 December 31, 2021 Assets Cash and restricted cash $ 57,638 $ 62,362 Finance receivables at fair value 450,703 383,890 Finance receivables at amortized cost, net 4,579 4,220 Other assets 65,150 51,634 Total assets $ 578,070 $ 502,106 Liabilities and stockholders’ equity Other liabilities $ 70,505 $ 58,967 Total debt 336,528 274,021 Warrant liabilities 5,539 11,240 Total liabilities 412,572 344,228 Total stockholders’ equity 165,498 157,878 Total liabilities and stockholders' equity $ 578,070 $ 502,106 Total cash and restricted cash decreased by $4.7 million as of June 30, 2022 compared to December 31, 2021, driven by an increase in originated loans relative to received payments and recovered loans. The net cash used in investing activities was partially o�set by net advances of senior debt and cash from operating activities. Finance receivables as of June 30, 2022 increased compared to December 31, 2021 due to high demand and origination volume for the six months ended June 30, 2022. Other assets as of June 30, 2022 increased by $13.5 million compared to December 31, 2021, driven by the addition of an operating lease right of use asset of $14.7 million related to the Company’s corporate headquarters due to the adoption of a new accounting standard, partially o�set by lower prepaid expenses by $1.8 million. Other liabilities increased by $11.5 million driven by the addition of an operating lease liability of $17.3 million and 7

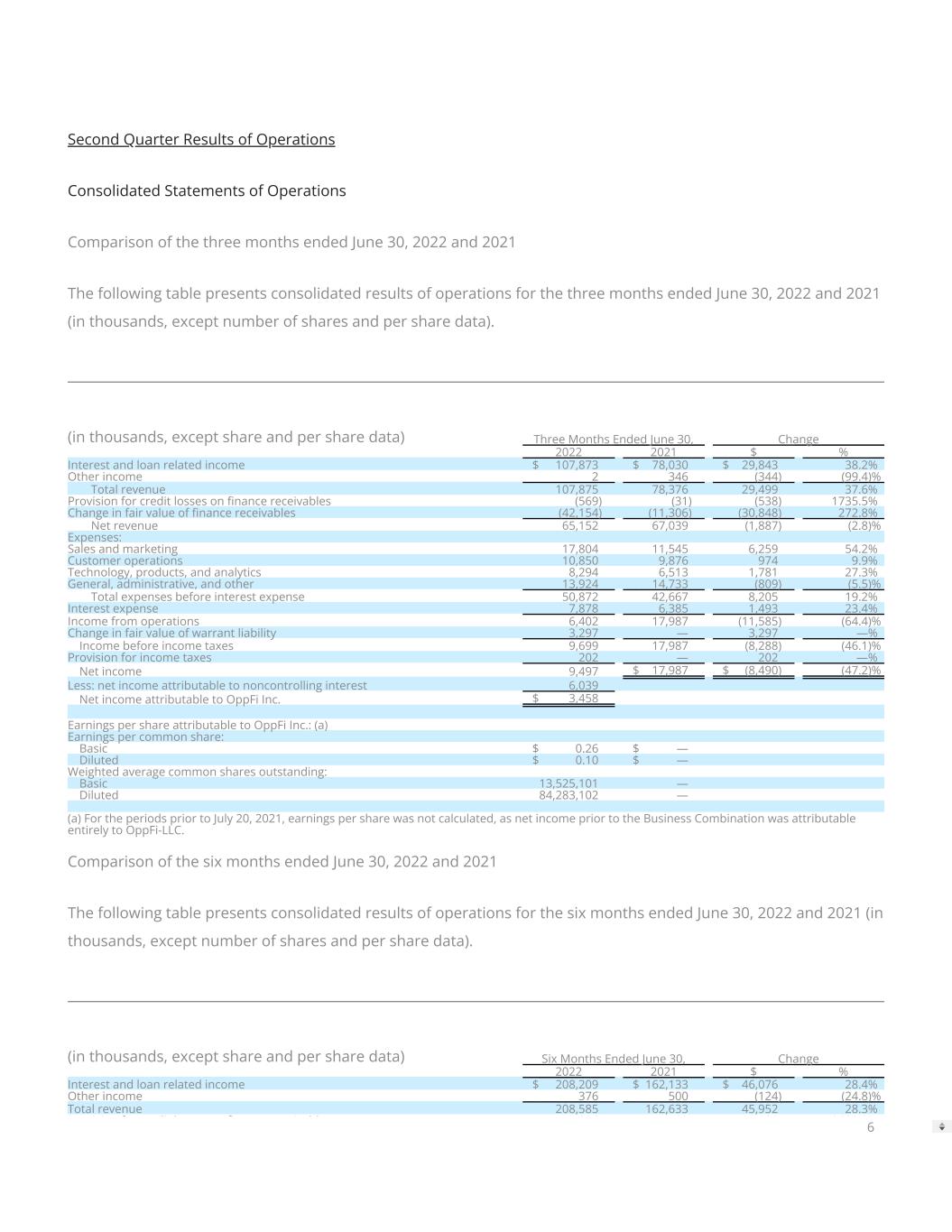

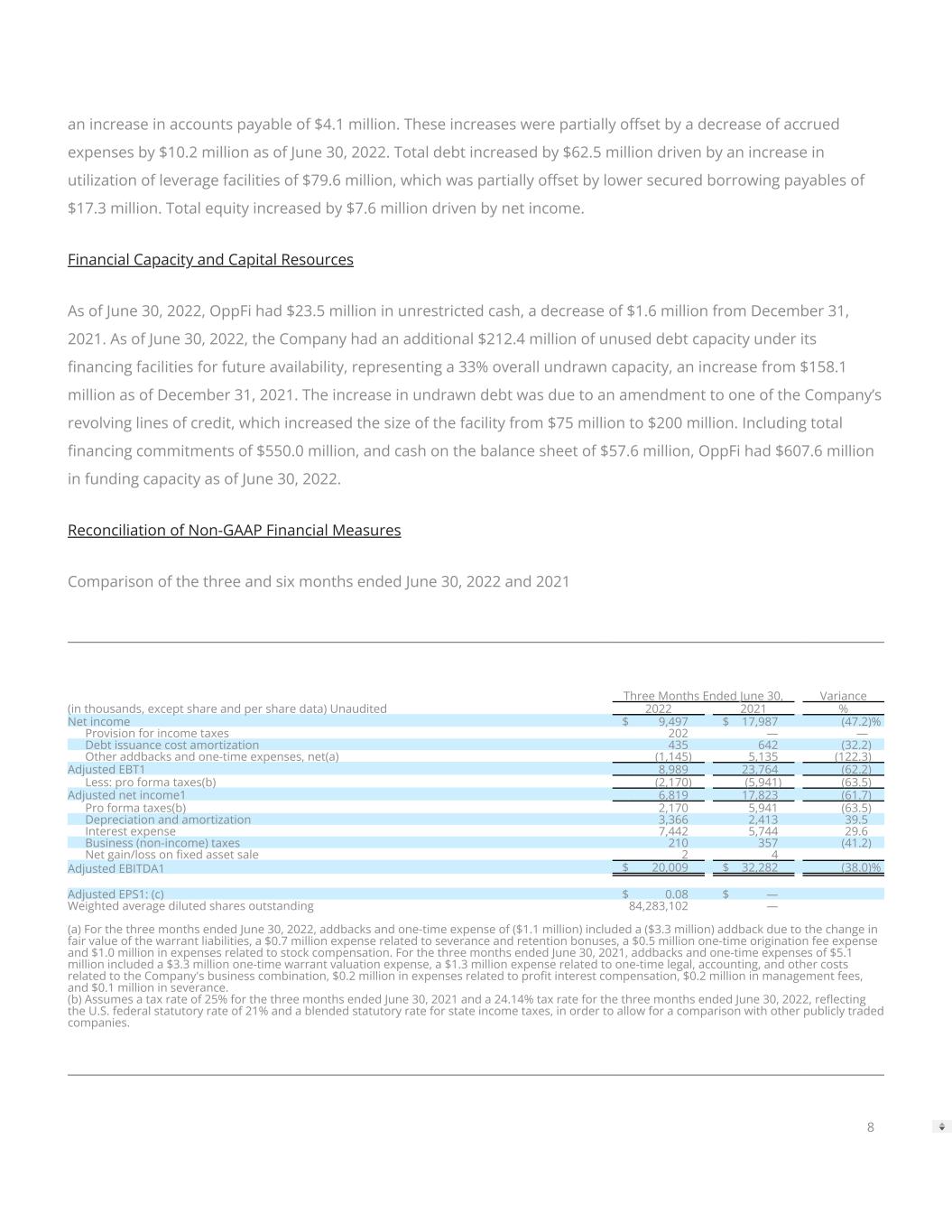

an increase in accounts payable of $4.1 million. These increases were partially o�set by a decrease of accrued expenses by $10.2 million as of June 30, 2022. Total debt increased by $62.5 million driven by an increase in utilization of leverage facilities of $79.6 million, which was partially o�set by lower secured borrowing payables of $17.3 million. Total equity increased by $7.6 million driven by net income. Financial Capacity and Capital Resources As of June 30, 2022, OppFi had $23.5 million in unrestricted cash, a decrease of $1.6 million from December 31, 2021. As of June 30, 2022, the Company had an additional $212.4 million of unused debt capacity under its �nancing facilities for future availability, representing a 33% overall undrawn capacity, an increase from $158.1 million as of December 31, 2021. The increase in undrawn debt was due to an amendment to one of the Company’s revolving lines of credit, which increased the size of the facility from $75 million to $200 million. Including total �nancing commitments of $550.0 million, and cash on the balance sheet of $57.6 million, OppFi had $607.6 million in funding capacity as of June 30, 2022. Reconciliation of Non-GAAP Financial Measures Comparison of the three and six months ended June 30, 2022 and 2021 Three Months Ended June 30, Variance (in thousands, except share and per share data) Unaudited 2022 2021 % Net income $ 9,497 $ 17,987 (47.2)% Provision for income taxes 202 — — Debt issuance cost amortization 435 642 (32.2) Other addbacks and one-time expenses, net(a) (1,145) 5,135 (122.3) Adjusted EBT1 8,989 23,764 (62.2) Less: pro forma taxes(b) (2,170) (5,941) (63.5) Adjusted net income1 6,819 17,823 (61.7) Pro forma taxes(b) 2,170 5,941 (63.5) Depreciation and amortization 3,366 2,413 39.5 Interest expense 7,442 5,744 29.6 Business (non-income) taxes 210 357 (41.2) Net gain/loss on �xed asset sale 2 4 Adjusted EBITDA1 $ 20,009 $ 32,282 (38.0)% Adjusted EPS1: (c) $ 0.08 $ — Weighted average diluted shares outstanding 84,283,102 — (a) For the three months ended June 30, 2022, addbacks and one-time expense of ($1.1 million) included a ($3.3 million) addback due to the change in fair value of the warrant liabilities, a $0.7 million expense related to severance and retention bonuses, a $0.5 million one-time origination fee expense and $1.0 million in expenses related to stock compensation. For the three months ended June 30, 2021, addbacks and one-time expenses of $5.1 million included a $3.3 million one-time warrant valuation expense, a $1.3 million expense related to one-time legal, accounting, and other costs related to the Company's business combination, $0.2 million in expenses related to pro�t interest compensation, $0.2 million in management fees, and $0.1 million in severance. (b) Assumes a tax rate of 25% for the three months ended June 30, 2021 and a 24.14% tax rate for the three months ended June 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. 8

Six Months Ended June 30, Variance (in thousands, except share and per share data) Unaudited 2022 2021 % Net income $ 9,200 $ 42,371 (78.3)% Provision for income taxes 742 — — Debt issuance cost amortization 1,044 1,163 (10.2) Other addbacks and one-time expenses, net(a) (1,269) 5,902 (121.5) Adjusted EBT1 9,717 49,436 (80.3) Less: pro forma taxes(b) (2,340) (12,359) (81.1) Adjusted net income1 7,377 37,077 (80.1) Pro forma taxes(b) 2,340 12,359 (81.1) Depreciation and amortization 6,604 4,577 44.3 Interest expense 14,282 9,830 45.3 Business (non-income) taxes 589 792 (25.6) Net gain/loss on �xed asset sale 2 4 Adjusted EBITDA1 $ 31,194 $ 64,639 (51.7)% Adjusted EPS1: (c) 0.09 — Weighted average diluted shares outstanding 84,377,754 — (a) For the six months ended June 30, 2022, addbacks and one-time expense of ($1.3 million) included a ($5.7 million) addback due to the change in fair value of the warrant liabilities, $2.1 million in expenses related to severance and retention bonuses, $1.6 million in expenses related to stock compensation, a $0.5 million one-time origination fee expense, and $0.2 million in one-time legal expenses. For the six months ended June 30, 2021, addbacks and one-time expenses of $5.9 million included a $3.3 million one-time warrant valuation expense, a $1.6 million expense related to one- time legal, accounting, and other costs related to the Company's business combination, $0.4 million in expenses related to severance, $0.3 million in management fees, and $0.2 million in expenses related to pro�t interest compensation. (b) Assumes a tax rate of 25% for the six months ended June 30, 2021 and a 24.08% tax rate for the six months ended June 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. (c) For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was attributable entirely to OppFi-LLC. Adjusted Earnings Per Share Three Months Ended June 30, (unaudited) 2022 2021 Weighted average Class A common stock outstanding 13,525,101 — Weighted average Class V voting stock outstanding 96,114,373 — Elimination of earnouts at period end (25,500,000) — Dilutive impact of restricted stock units 125,383 — Dilutive impact of performance stock units 18,245 Weighted average diluted shares outstanding 84,283,102 — Three Months Ended June 30, (unaudited) 2022 2021 Adjusted net income (in thousands)1 $ 6,819 $ 17,823 Weighted average diluted shares outstanding 84,283,102 — Adjusted EPS:1 $ 0.08 $ — Six Months Ended June 30, (unaudited) 2022 2021 Weighted average Class A common stock outstanding 13,553,308 — Weighted average Class V voting stock outstanding 96,225,804 — Elimination of earnouts at period end (25,500,000) — Dilutive impact of restricted stock units 89,520 — Dilutive impact of performance stock units 9,123 — Weighted average diluted shares outstanding 84,377,754 — 9

Six Months Ended June 30, (unaudited) 2022 2021 Adjusted net income (in thousands)1 $ 7,377 $ 37,077 Weighted average diluted shares outstanding 84,377,754 — Adjusted EPS:1 $ 0.09 $ — (1) Non-GAAP Financial Measures: Adjusted Net Income, Adjusted EBT, Adjusted EPS and Adjusted EBITDA are �nancial measures that have not been prepared in accordance with GAAP. See the “Note Regarding Non-GAAP Financial Measures” for a detailed description and reconciliation of such Non- GAAP �nancial measures to their most directly comparable GAAP �nancial measures. Investor Relations: investors@opp�.com Media Relations: media@opp�.com Source: OppFi 10