Q3 2022 Earnings Presentation November 9, 2022 A Leading FinTech Platform for the Everyday Consumer

1 Disclaimer This presentation (the “Presentation”) of OppFi Inc. (“OppFi” or the “Company”) is for information purposes only. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Trademarks and trade names referred to in this Presentation are the property of their respective owners. The information contained herein does not purport to be all-inclusive. This Presentation does not constitute investment, tax, or legal advice. No representation or warranty, express or implied, is or will be given by the Company or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. The Company disclaims any duty to update the information contained in this Presentation, which information is given only as of the date of this Presentation unless otherwise stated herein. Forward-Looking Statements This Presentation includes "forward-looking statements'' within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi's actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," “possible,” "continue," and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations for its full year 2022 guidance, OppFi's expectations with respect to the future performance of OppFi’s platform, OppFi’s expectations for its growth, and including growth of loan automation, profitability and OppFi's new products and their performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside OppFi's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the impact of inflation on OppFi’s business; the impact of COVID-19 on OppFi's business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s financing sources will continue to finance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the risk that the business combination disrupts current plans and operations; the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of OppFi to grow and manage growth profitably and retain its key employees; risks related to new products; concentration risk; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely affected by other economic, business, and/or competitive factors; risks related to management transitions; and other risks and uncertainties indicated from time to time in OppFi’s filings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures Certain financial information and data contained this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any periodic filing, information or proxy statement, or prospectus or registration statement to be filed by OppFi with the SEC. Some of the financial information and data contained in this Presentation, such as Adjusted EBT, Adjusted Net Income (and margin thereof), Adjusted EBITDA (and margin thereof) and Adjusted EPS have not been prepared in accordance with United States generally acceptable accounting principles ("GAAP"). Adjusted EBT is defined as Net Income, plus (1) amortization of debt transaction costs and (2) other addbacks and one-time expenses, including one-time implementation fees, stock compensation expenses, IPO readiness costs, management fees and recruiting fees, severance and relocation. Adjusted Net Income is defined as Net Income, plus (1) amortization of debt transaction costs and (2) other addbacks and one-time expenses, including one-time implementation fees, stock compensation expenses, IPO readiness costs, management fees and recruiting fees, severance and relocation, adjusted for taxes assuming a tax rate of 23.99% for the three months ended September 30, 2021 and a 24.14% tax rate for the three months ended September 30, 2022 and adjusted for taxes assuming a tax rate of 24.68% for the nine months ended September 30, 2021 and a 24.09% tax rate for the nine months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EBITDA is defined as Adjusted Net Income, plus (1) a tax rate of 23.99% for the three months ended September 30, 2021 and a 24.14% tax rate for the three months ended September 30, 2022 and adjusted for taxes assuming a tax rate of 24.68% for the nine months ended September 30, 2021 and a 24.09% tax rate for the nine months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies, (2) depreciation and amortization, (3) interest expense and (4) business (non-income) taxes. Adjusted EPS is defined as adjusted net income divided by weighted average diluted shares outstanding, which represent shares of both classes of common stock outstanding, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units. These financial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be different from non-GAAP financial measures used by other companies. OppFi believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. These non-GAAP measures of financial results are not GAAP measures of our financial results or liquidity and should not be considered as an alternative to net income (loss) as a measure of financial results, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. OppFi believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to OppFi’s financial condition and results of operations. OppFi’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. OppFi believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing OppFi’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non- GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. You should review the OppFi’s audited financial statements, which have been filed with the SEC. A reconciliation for OppFi's non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Appendix. No Offer or Solicitation This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Website This Presentation contains reproductions and references to the Company’s website and mobile content. The contents of the website and mobile content are not incorporated into this Presentation. Any references to URLs for the websites are intended to be inactive textual references only.

2 Key Company Highlights 1. 2016– 2021 2. As of Q3 2022 3. For full-year 2021 at the time of loan approval Solid Revenue Growth 66% 5-year CAGR1 Significant Scale Facilitated more than $4.2 billion in gross loan issuance covering over 2.5 million loans, since inception2 Leading Proprietary Credit & Technology Platform Real-time AI drove automation for 82% of decisions in 2021 CEO and Executive Chairman as Largest Shareholder Owner / operator dynamic aligns incentives to maximize shareholder value Robust Customer Demand More than 2.4 million applications in 2021, ~80% mobile generated Exceptional Customer Satisfaction Net Promoter Score of 853; 3,400+ Trustpilot customer reviews with 4.6 / 5.0 average rating

3 High Percentage of Americans Lack Savings and/or Credit Access 60 million U.S. adults lack access to traditional credit1 64% of U.S. consumers live paycheck to paycheck2 44% of U.S. adults have savings to cover a $1,000 unplanned expense3 1. Hamdani, Kausar, et al. “UNEQUAL ACCESS TO CREDIT The Hidden Impact of Credit Constraints.” NewYorkFed.org, 2019 2. LendingClub Corporation. "New Reality Check: The Paycheck-To-Paycheck Report: The Credit Edition.“ PYMNTS.com, May 2, 2022 3. Bennett, Karen. “Survey: Less than half of Americans have savings to cover a $1,000 surprise expense.” Bankrate.com, January 19, 2022

4 4 A Cheaper, Better Product for Non- Prime Traditionally financing options for the underbanked have been limited, with exorbitant interest rates and poor customer service OppFi Advantage: Market Leading Terms and Excellent Customer Experience OppFi’s Market Leading Terms Underbanked Option APRs Simple interest, amortizing installment loans with no balloon payments No origination, late, or NSF fees No prepayment penalties Market-based offers provide options based on amount, interest rate, and term Report to the 3 major credit bureaus Work compassionately with customers who require payment plan modification TurnUp program helps consumers find most affordable loan even if that option isn’t with us 1. Credit Karma; based on average charge of $34 on average transaction of $24 to be repaid within three days 2. CFPB; from 2017 lawsuit, the annual percentage rates for four tribal lenders’ installment loan products was between 440% and 950% 3. FTC and CFPB; based on title lenders charging average of 25% per month and typical two-week payday loan with a $15 per $100 fee 4. FTC; based on $83/month, 12-month Lease to Own (“LTO”) plan to purchase ~$500 item and $39/week, 48-week LTO plan to purchase ~$600 item 5. Lend Academy; assumes $200 amount financed with $5 finance charge 7 days between the advance and employee’s regularly scheduled paydate ~17,000% ~450% - 950% ~300% - 400% ~100% - 300% ~130% 59% - 160% 0% 200% 400% 600% 800% 1000% 1200% Bank Overdraft Tribal Lenders Payday & Title Loans Lease to Own Earned Wage Access 532 41 Average Loan Amount ~$1,500 Average Term ~11 Months ~17,000 ~450%- 950% ~300%- 400% ~100%- 300% ~59%- 160%~

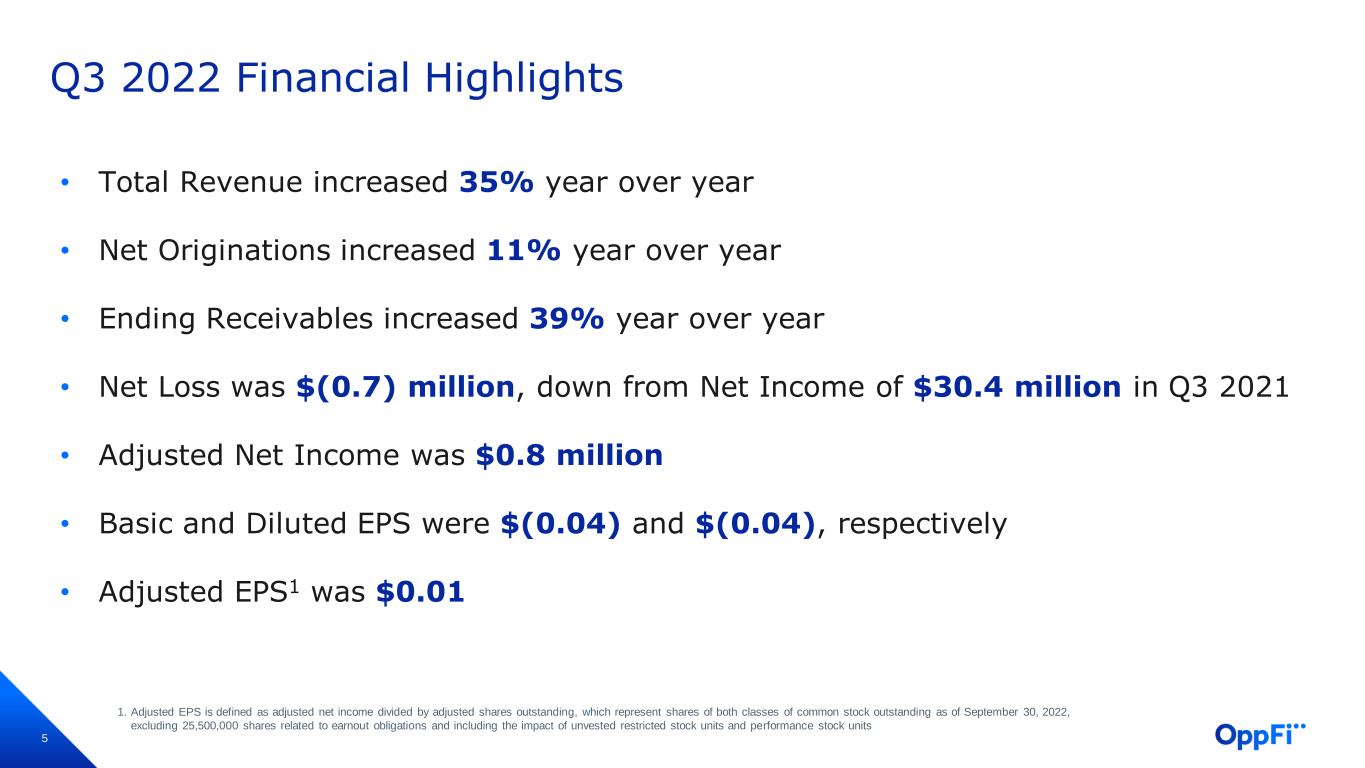

5 Q3 2022 Financial Highlights • Total Revenue increased 35% year over year • Net Originations increased 11% year over year • Ending Receivables increased 39% year over year • Net Loss was $(0.7) million, down from Net Income of $30.4 million in Q3 2021 • Adjusted Net Income was $0.8 million • Basic and Diluted EPS were $(0.04) and $(0.04), respectively • Adjusted EPS1 was $0.01 1. Adjusted EPS is defined as adjusted net income divided by adjusted shares outstanding, which represent shares of both classes of common stock outstanding as of September 30, 2022, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units and performance stock units

6 Q3 2021 Net Originations ($ Millions) Ending Receivables1 ($ Millions) Total Revenue ($ Millions) 1. Receivables are defined as unpaid principal balances of both on- and off-balance sheet loans. YoY Growth +11% Q3 2022 YoY Growth +39% YoY Growth +35% Q3 2022 Performance With continued strong demand, net originations increased 11%, ending receivables expanded 39%, and total revenue grew 35% year over year. $165 $183 $293 $408 $92 $124

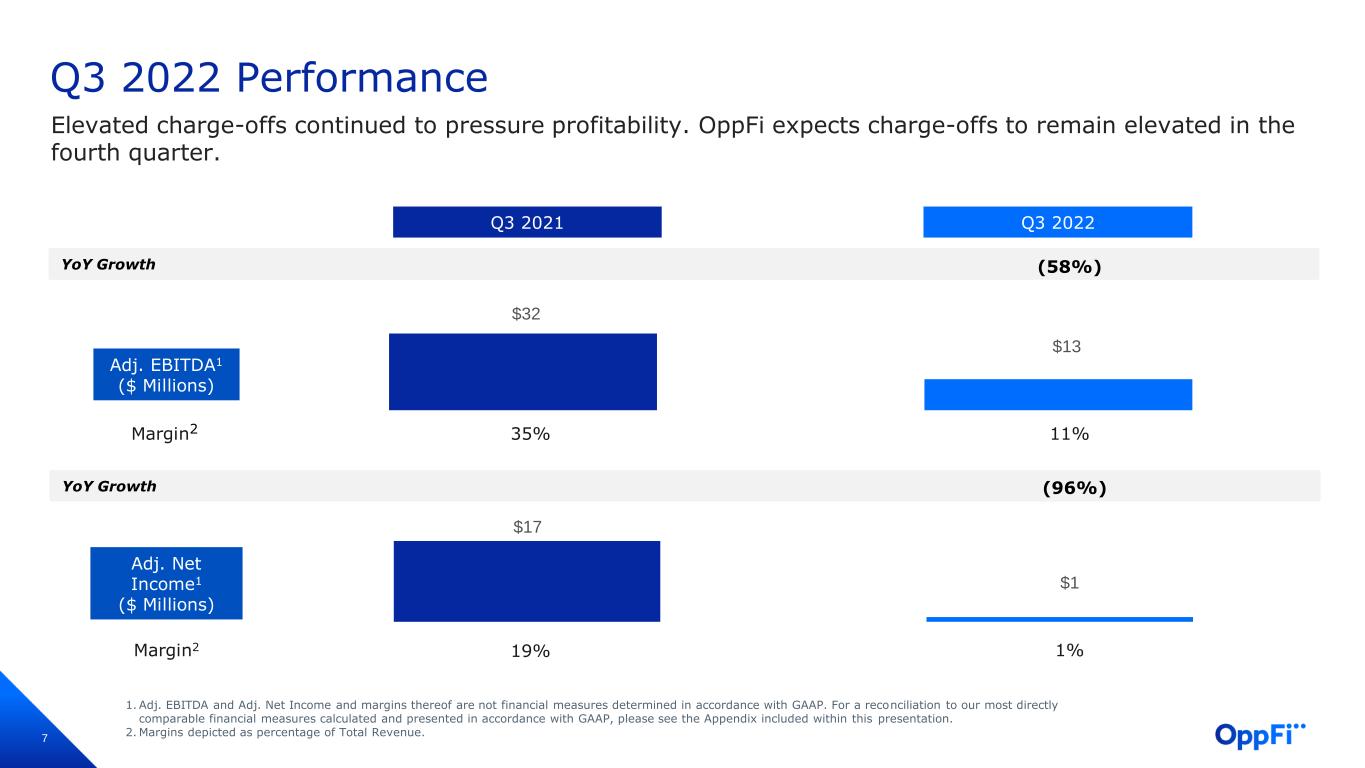

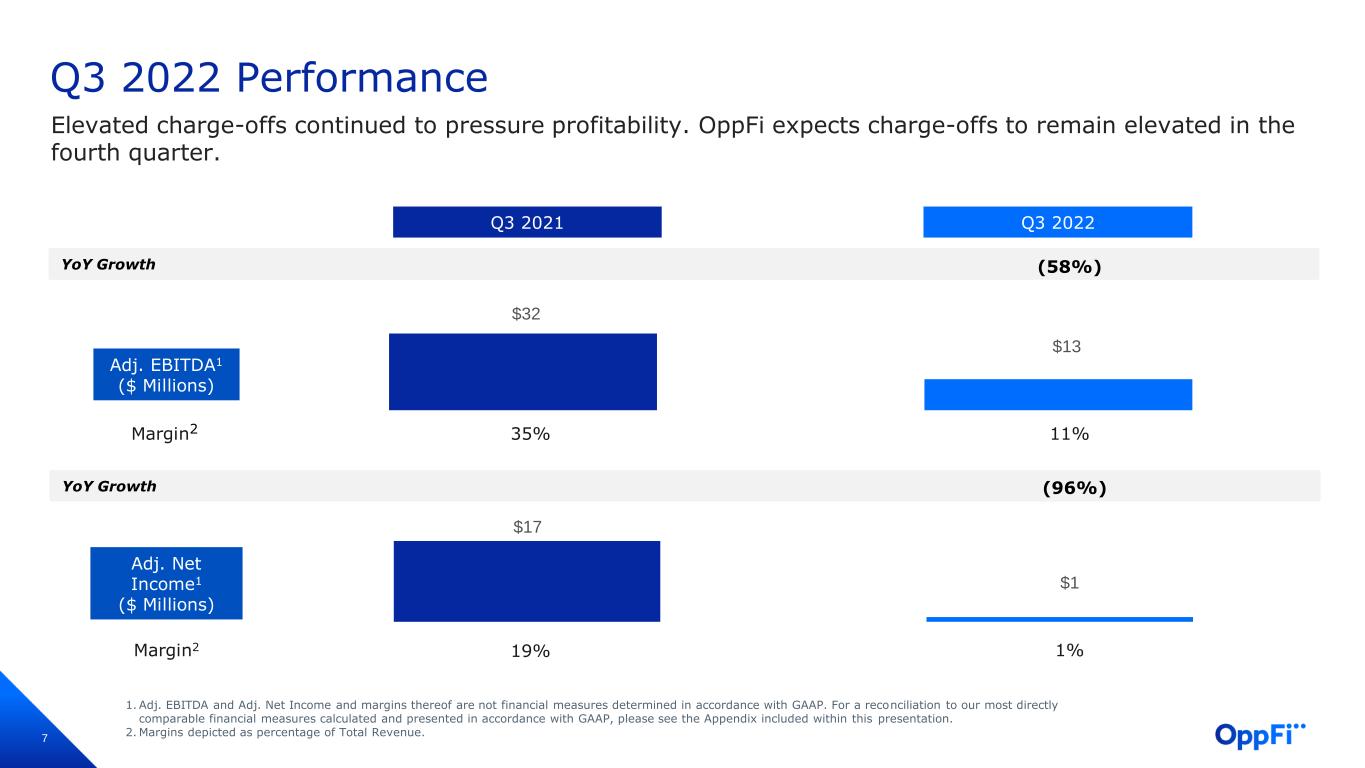

7 Adj. EBITDA1 ($ Millions) Adj. Net Income1 ($ Millions) 11%35%Margin2 Margin2 1. Adj. EBITDA and Adj. Net Income and margins thereof are not financial measures determined in accordance with GAAP. For a reconciliation to our most directly comparable financial measures calculated and presented in accordance with GAAP, please see the Appendix included within this presentation. 2. Margins depicted as percentage of Total Revenue. 1%19% YoY Growth (58%) YoY Growth (96%) Q3 2022 Performance Elevated charge-offs continued to pressure profitability. OppFi expects charge-offs to remain elevated in the fourth quarter. Q3 2021 Q3 2022 $32 $13 $17 $1

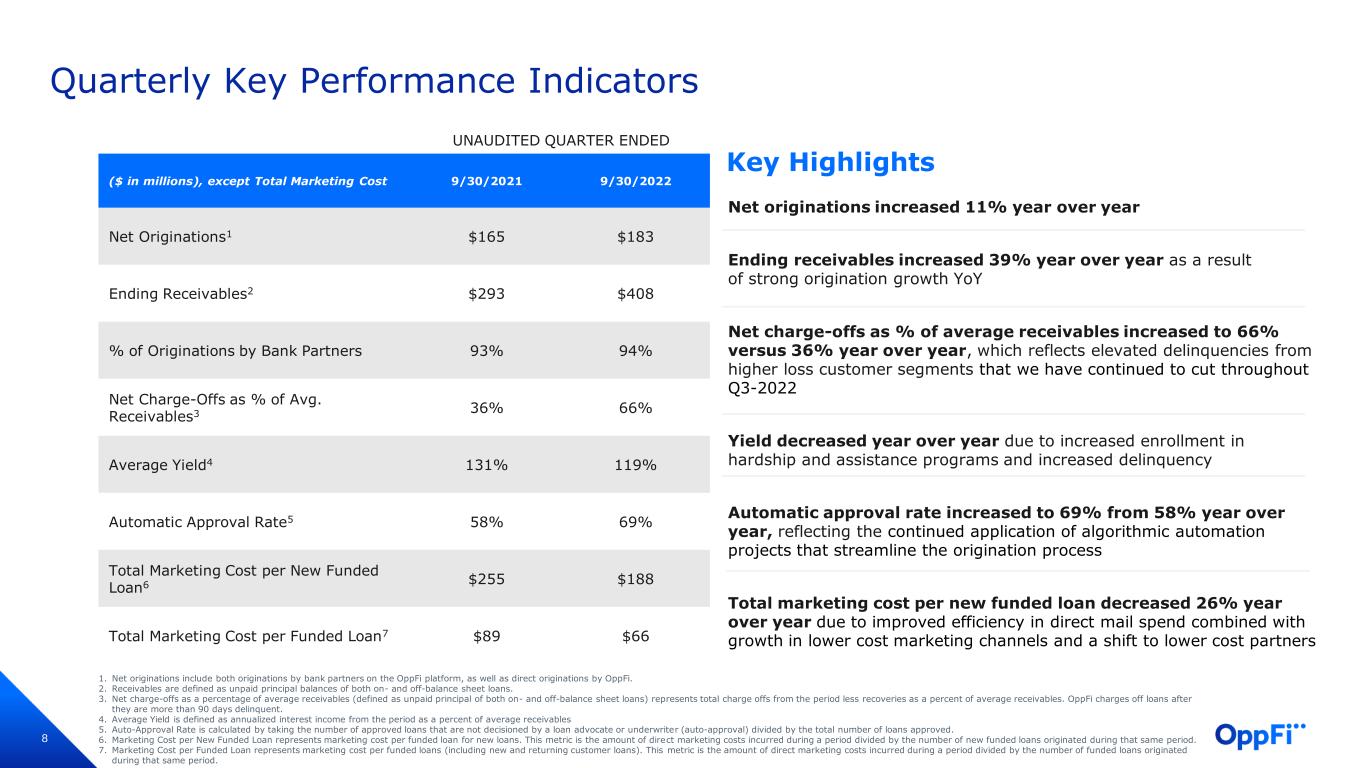

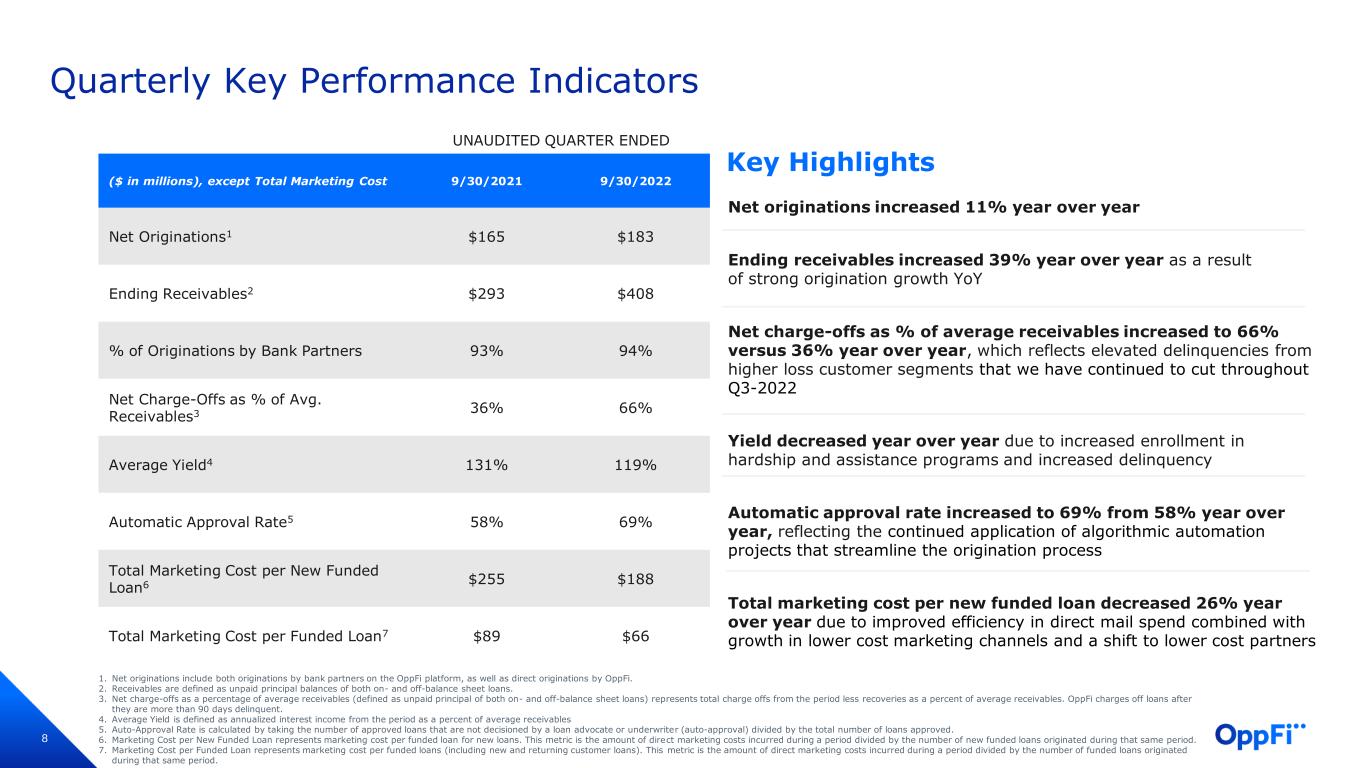

8 Net originations increased 11% year over year Ending receivables increased 39% year over year as a result of strong origination growth YoY Net charge-offs as % of average receivables increased to 66% versus 36% year over year, which reflects elevated delinquencies from higher loss customer segments that we have continued to cut throughout Q3-2022 Yield decreased year over year due to increased enrollment in hardship and assistance programs and increased delinquency Automatic approval rate increased to 69% from 58% year over year, reflecting the continued application of algorithmic automation projects that streamline the origination process Total marketing cost per new funded loan decreased 26% year over year due to improved efficiency in direct mail spend combined with growth in lower cost marketing channels and a shift to lower cost partners Quarterly Key Performance Indicators UNAUDITED QUARTER ENDED ($ in millions), except Total Marketing Cost 9/30/2021 9/30/2022 Net Originations1 $165 $183 Ending Receivables2 $293 $408 % of Originations by Bank Partners 93% 94% Net Charge-Offs as % of Avg. Receivables3 36% 66% Average Yield4 131% 119% Automatic Approval Rate5 58% 69% Total Marketing Cost per New Funded Loan6 $255 $188 Total Marketing Cost per Funded Loan7 $89 $66 1. Net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi. 2. Receivables are defined as unpaid principal balances of both on- and off-balance sheet loans. 3. Net charge-offs as a percentage of average receivables (defined as unpaid principal of both on- and off-balance sheet loans) represents total charge offs from the period less recoveries as a percent of average receivables. OppFi charges off loans after they are more than 90 days delinquent. 4. Average Yield is defined as annualized interest income from the period as a percent of average receivables 5. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved. 6. Marketing Cost per New Funded Loan represents marketing cost per funded loan for new loans. This metric is the amount of direct marketing costs incurred during a period divided by the number of new funded loans originated during that same period. 7. Marketing Cost per Funded Loan represents marketing cost per funded loans (including new and returning customer loans). This metric is the amount of direct marketing costs incurred during a period divided by the number of funded loans originated during that same period. Key Highlights

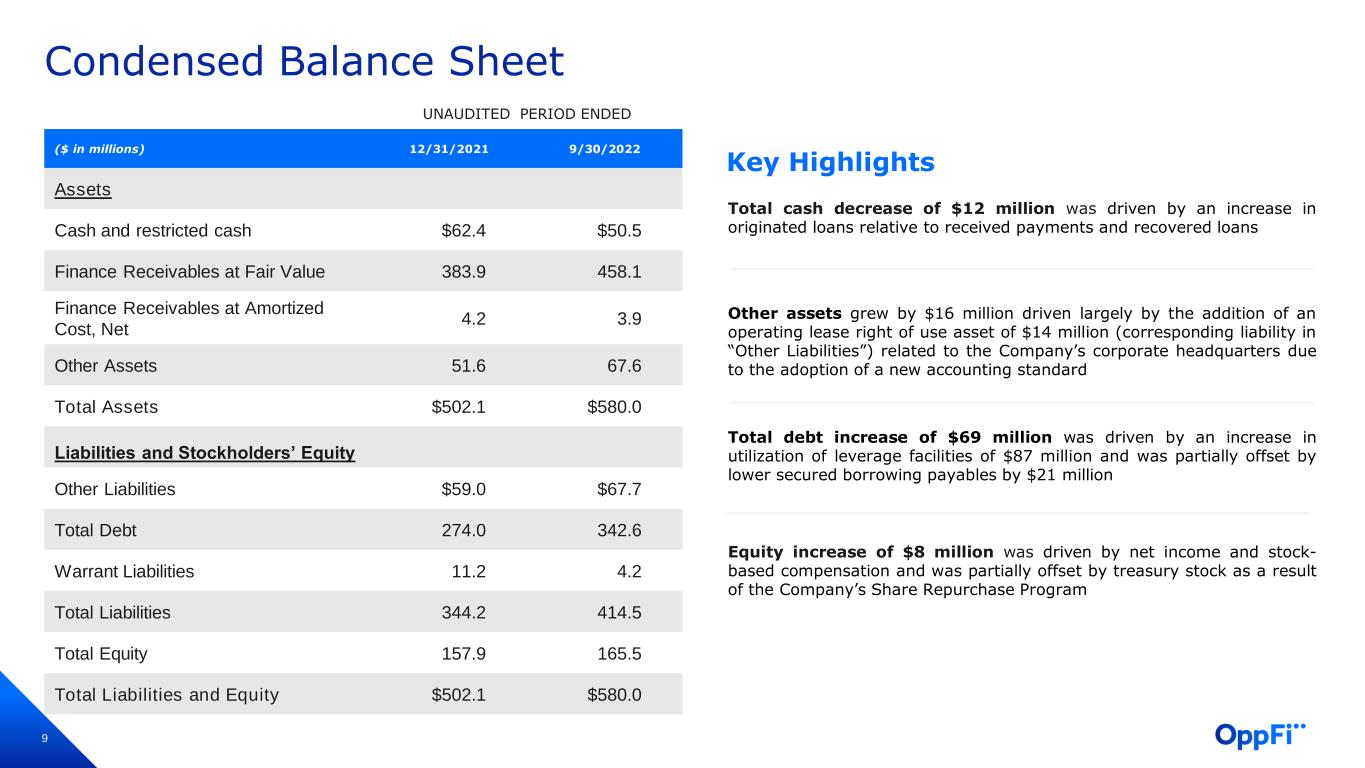

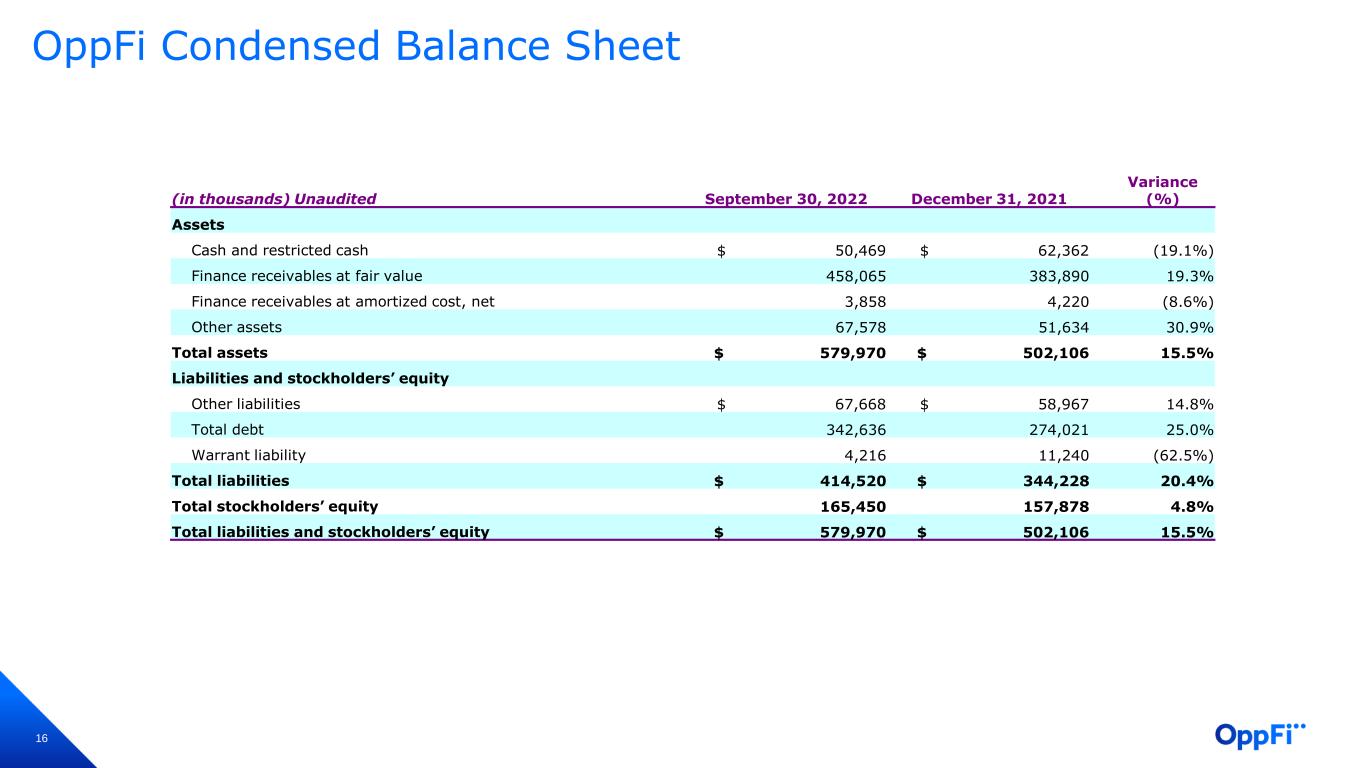

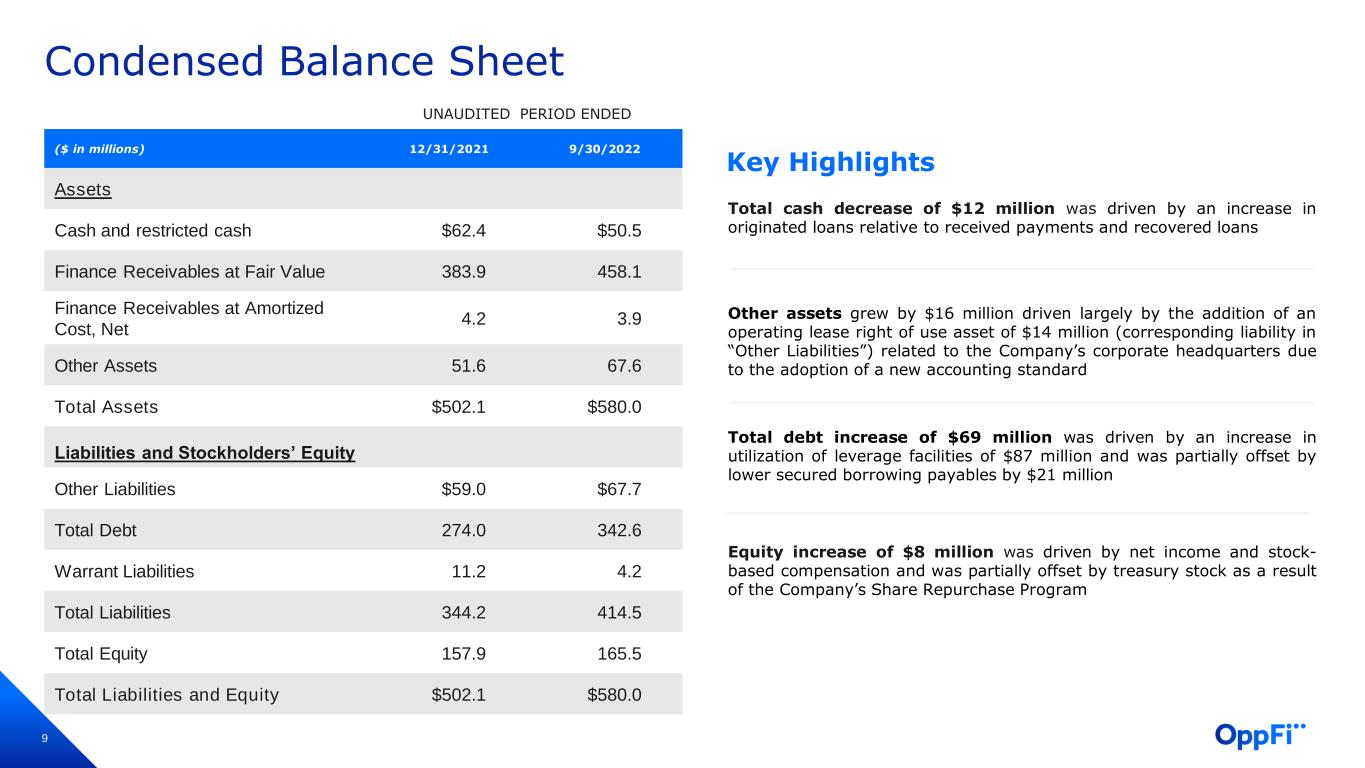

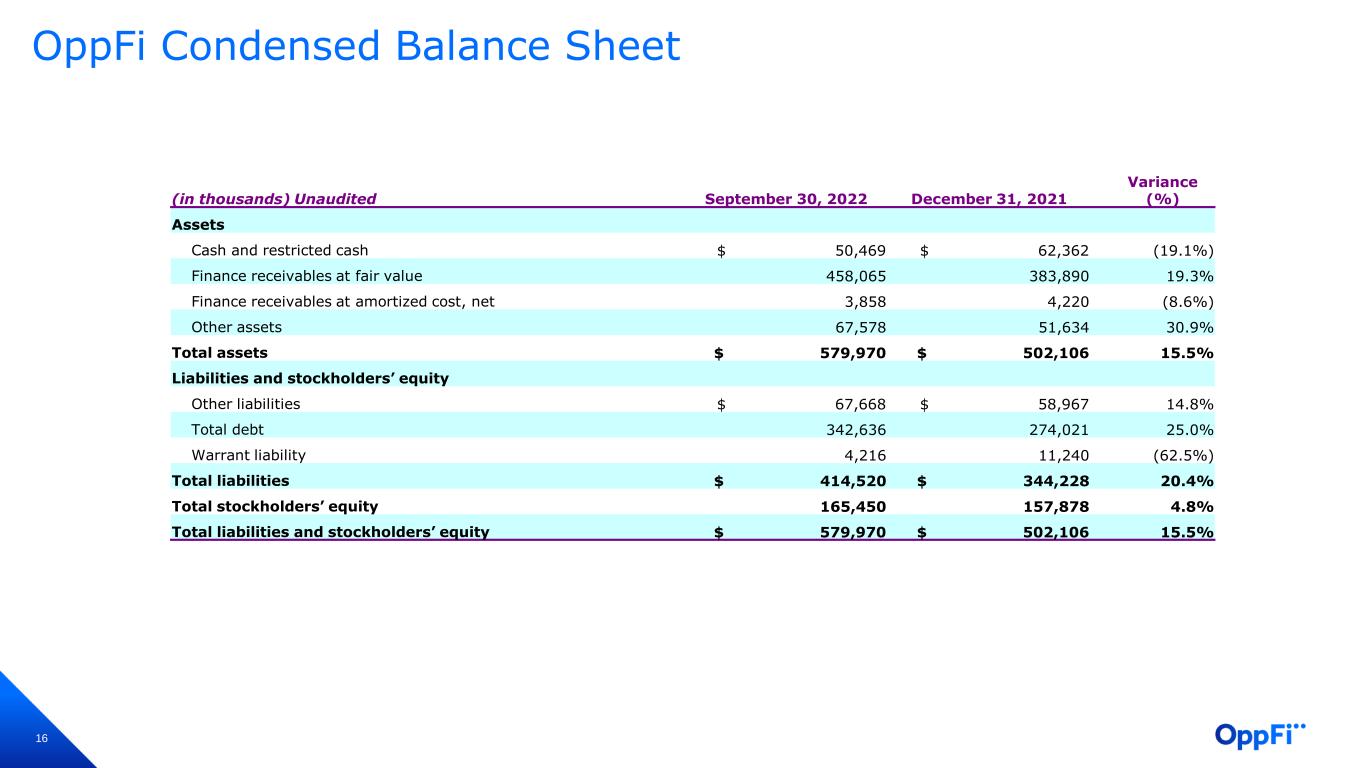

9 Condensed Balance Sheet UNAUDITED PERIOD ENDED ($ in millions) 12/31/2021 9/30/2022 Assets Cash and restricted cash $62.4 $50.5 Finance Receivables at Fair Value 383.9 458.1 Finance Receivables at Amortized Cost, Net 4.2 3.9 Other Assets 51.6 67.6 Total Assets $502.1 $580.0 Liabilities and Stockholders’ Equity Other Liabilities $59.0 $67.7 Total Debt 274.0 342.6 Warrant Liabilities 11.2 4.2 Total Liabilities 344.2 414.5 Total Equity 157.9 165.5 Total Liabilities and Equity $502.1 $580.0 Total cash decrease of $12 million was driven by an increase in originated loans relative to received payments and recovered loans Other assets grew by $16 million driven largely by the addition of an operating lease right of use asset of $14 million (corresponding liability in “Other Liabilities”) related to the Company’s corporate headquarters due to the adoption of a new accounting standard Total debt increase of $69 million was driven by an increase in utilization of leverage facilities of $87 million and was partially offset by lower secured borrowing payables by $21 million Equity increase of $8 million was driven by net income and stock- based compensation and was partially offset by treasury stock as a result of the Company’s Share Repurchase Program Key Highlights

10 Grown liquidity more than 5x since 2017 Decreased cost of borrowing by 500+ bps since 2017 Diversified institutional capital sources Increased financial flexibility with: • corporate credit agreements, • asset-backed facilities, • bank provided asset-based loans, • forward flow arrangements, and • total return swap Ample debt capacity provides a means to fund future growth without equity Liquidity ($ in millions) $55 $126 $207 $142 $274 $282 $338 $339 $40 $52 $140 $338 $158 $132 $212 $168 $11 $23 $36 $46 $62 $60 $58 $51 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Oustanding Debt Remaining Debt Capacity Cash & Restricted Cash $105 $201 $383 $526 $494 $474 $608 Reduced Cost of Financing and Strong Balance Sheet to Power Growth $558

11 Appendix

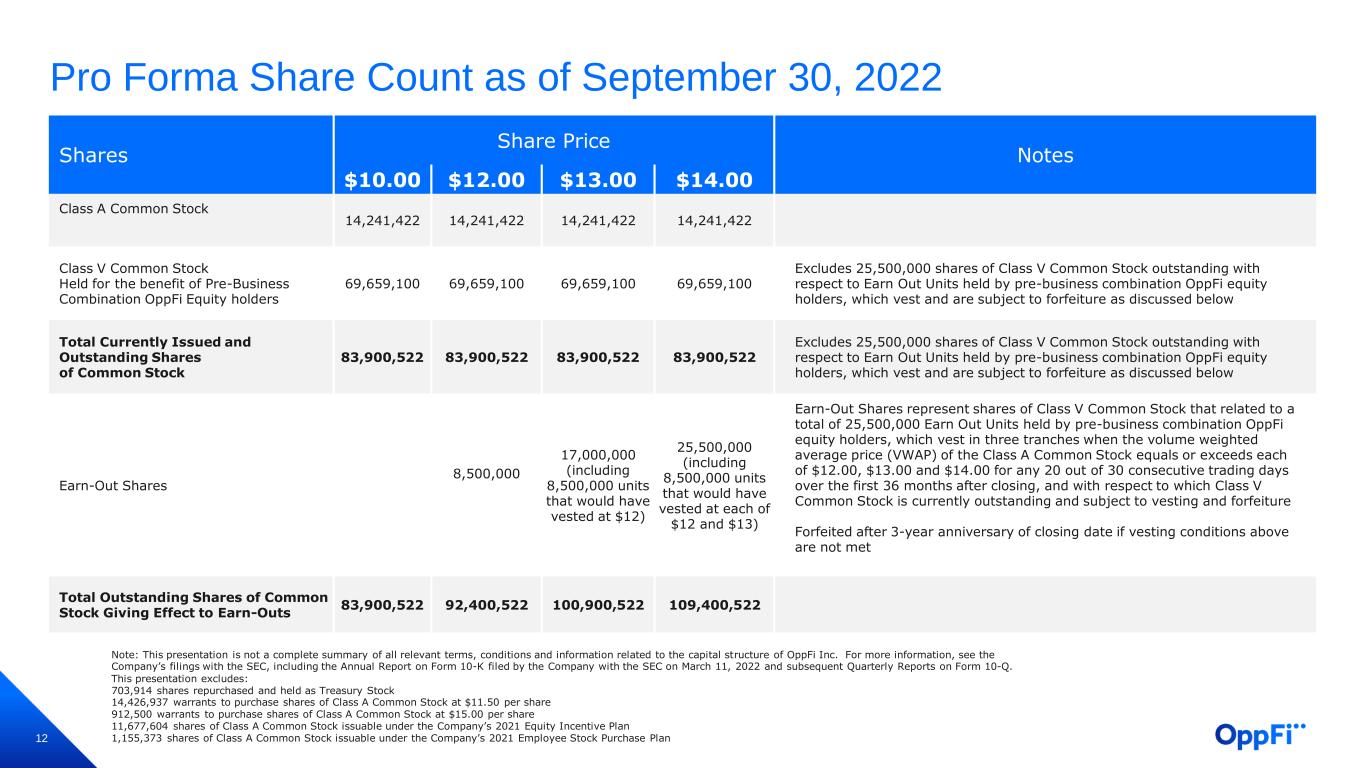

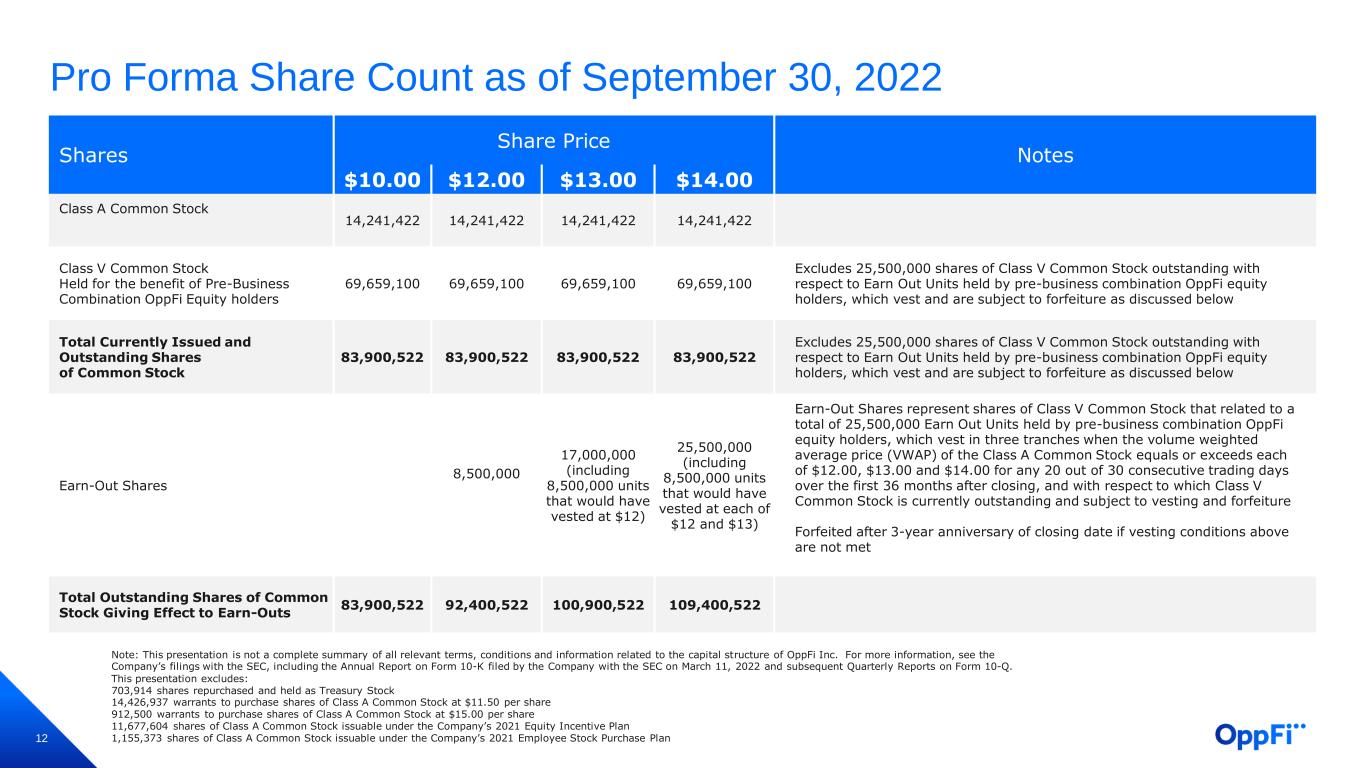

12 Pro Forma Share Count as of September 30, 2022 Shares Share Price Notes $10.00 $12.00 $13.00 $14.00 Class A Common Stock 14,241,422 14,241,422 14,241,422 14,241,422 Class V Common Stock Held for the benefit of Pre-Business Combination OppFi Equity holders 69,659,100 69,659,100 69,659,100 69,659,100 Excludes 25,500,000 shares of Class V Common Stock outstanding with respect to Earn Out Units held by pre-business combination OppFi equity holders, which vest and are subject to forfeiture as discussed below Total Currently Issued and Outstanding Shares of Common Stock 83,900,522 83,900,522 83,900,522 83,900,522 Excludes 25,500,000 shares of Class V Common Stock outstanding with respect to Earn Out Units held by pre-business combination OppFi equity holders, which vest and are subject to forfeiture as discussed below Earn-Out Shares 8,500,000 17,000,000 (including 8,500,000 units that would have vested at $12) 25,500,000 (including 8,500,000 units that would have vested at each of $12 and $13) Earn-Out Shares represent shares of Class V Common Stock that related to a total of 25,500,000 Earn Out Units held by pre-business combination OppFi equity holders, which vest in three tranches when the volume weighted average price (VWAP) of the Class A Common Stock equals or exceeds each of $12.00, $13.00 and $14.00 for any 20 out of 30 consecutive trading days over the first 36 months after closing, and with respect to which Class V Common Stock is currently outstanding and subject to vesting and forfeiture Forfeited after 3-year anniversary of closing date if vesting conditions above are not met Total Outstanding Shares of Common Stock Giving Effect to Earn-Outs 83,900,522 92,400,522 100,900,522 109,400,522 Note: This presentation is not a complete summary of all relevant terms, conditions and information related to the capital structure of OppFi Inc. For more information, see the Company’s filings with the SEC, including the Annual Report on Form 10-K filed by the Company with the SEC on March 11, 2022 and subsequent Quarterly Reports on Form 10-Q. This presentation excludes: 703,914 shares repurchased and held as Treasury Stock 14,426,937 warrants to purchase shares of Class A Common Stock at $11.50 per share 912,500 warrants to purchase shares of Class A Common Stock at $15.00 per share 11,677,604 shares of Class A Common Stock issuable under the Company’s 2021 Equity Incentive Plan 1,155,373 shares of Class A Common Stock issuable under the Company’s 2021 Employee Stock Purchase Plan

13 Fair Value Valuation 1. Stated as a percentage of loan receivable. 2. Represents rate applied to on-balance unpaid principal receivables, inclusive of adjustment for accrued interest. Key Highlights • Interest rate increased by 90bps due to relative increase in base APR loans on the book • Remaining life decreased by 2 weeks due to portfolio aging from recent credit tightening • Discount rate increased 100bps primarily due to increases in the risk-free rate UNAUDITED PERIOD ENDED ($ in thousands) 6/30/2022 9/30/2022 Outstanding Principal $394,709 $402,571 Accrued Interest $12,917 $15,288 Interest Rate 149.9% 150.8% Discount Rate 24.9% 25.9% Servicing Cost1 (5.0)% (5.0)% Remaining Life 0.637 years 0.598 years Default Rate1 19.5% 19.6% Accrued Interest1 3.3% 3.8% Prepayment Rate1 16.4% 21.2% Premium to Principal2 10.9% 9.9%

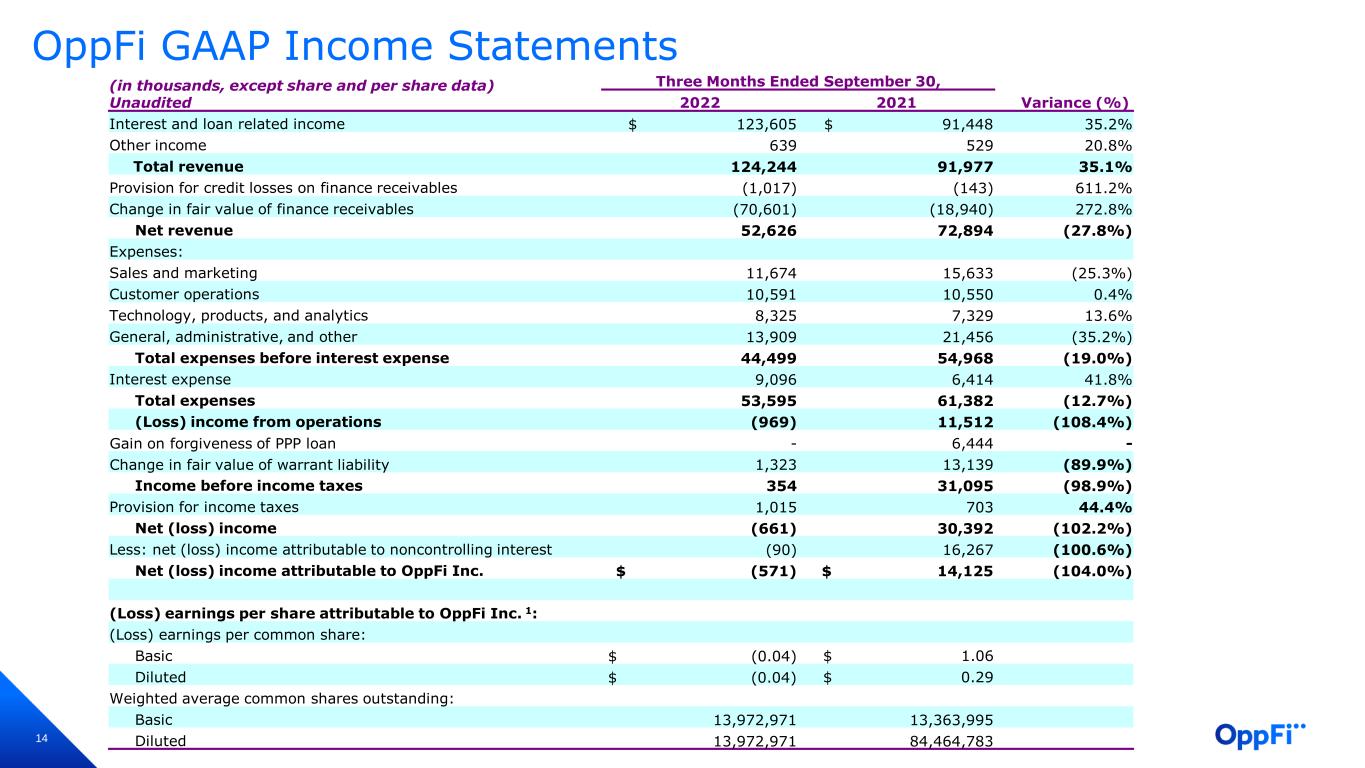

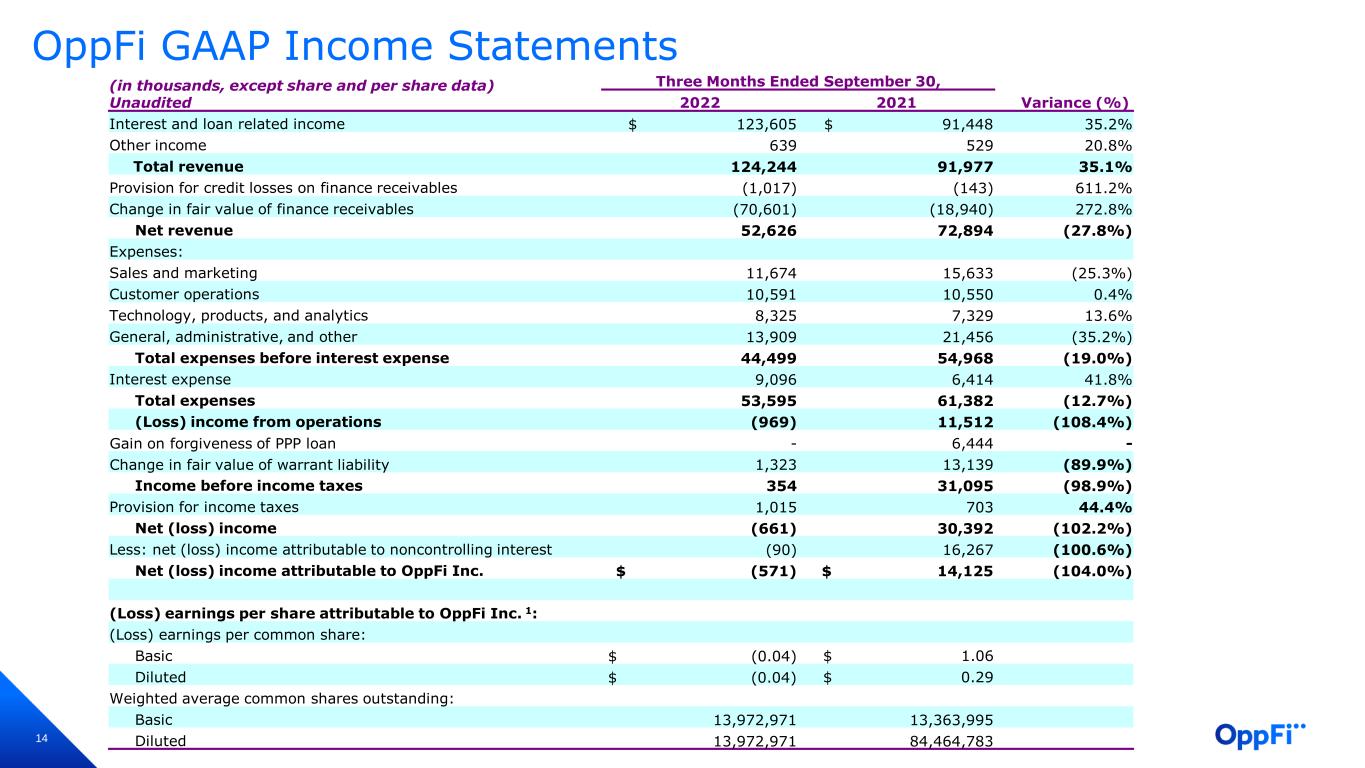

14 OppFi GAAP Income Statements (in thousands, except share and per share data) Unaudited Three Months Ended September 30, 2022 2021 Variance (%) Interest and loan related income $ 123,605 $ 91,448 35.2% Other income 639 529 20.8% Total revenue 124,244 91,977 35.1% Provision for credit losses on finance receivables (1,017) (143) 611.2% Change in fair value of finance receivables (70,601) (18,940) 272.8% Net revenue 52,626 72,894 (27.8%) Expenses: Sales and marketing 11,674 15,633 (25.3%) Customer operations 10,591 10,550 0.4% Technology, products, and analytics 8,325 7,329 13.6% General, administrative, and other 13,909 21,456 (35.2%) Total expenses before interest expense 44,499 54,968 (19.0%) Interest expense 9,096 6,414 41.8% Total expenses 53,595 61,382 (12.7%) (Loss) income from operations (969) 11,512 (108.4%) Gain on forgiveness of PPP loan - 6,444 - Change in fair value of warrant liability 1,323 13,139 (89.9%) Income before income taxes 354 31,095 (98.9%) Provision for income taxes 1,015 703 44.4% Net (loss) income (661) 30,392 (102.2%) Less: net (loss) income attributable to noncontrolling interest (90) 16,267 (100.6%) Net (loss) income attributable to OppFi Inc. $ (571) $ 14,125 (104.0%) (Loss) earnings per share attributable to OppFi Inc. 1: (Loss) earnings per common share: Basic $ (0.04) $ 1.06 Diluted $ (0.04) $ 0.29 Weighted average common shares outstanding: Basic 13,972,971 13,363,995 Diluted 13,972,971 84,464,783

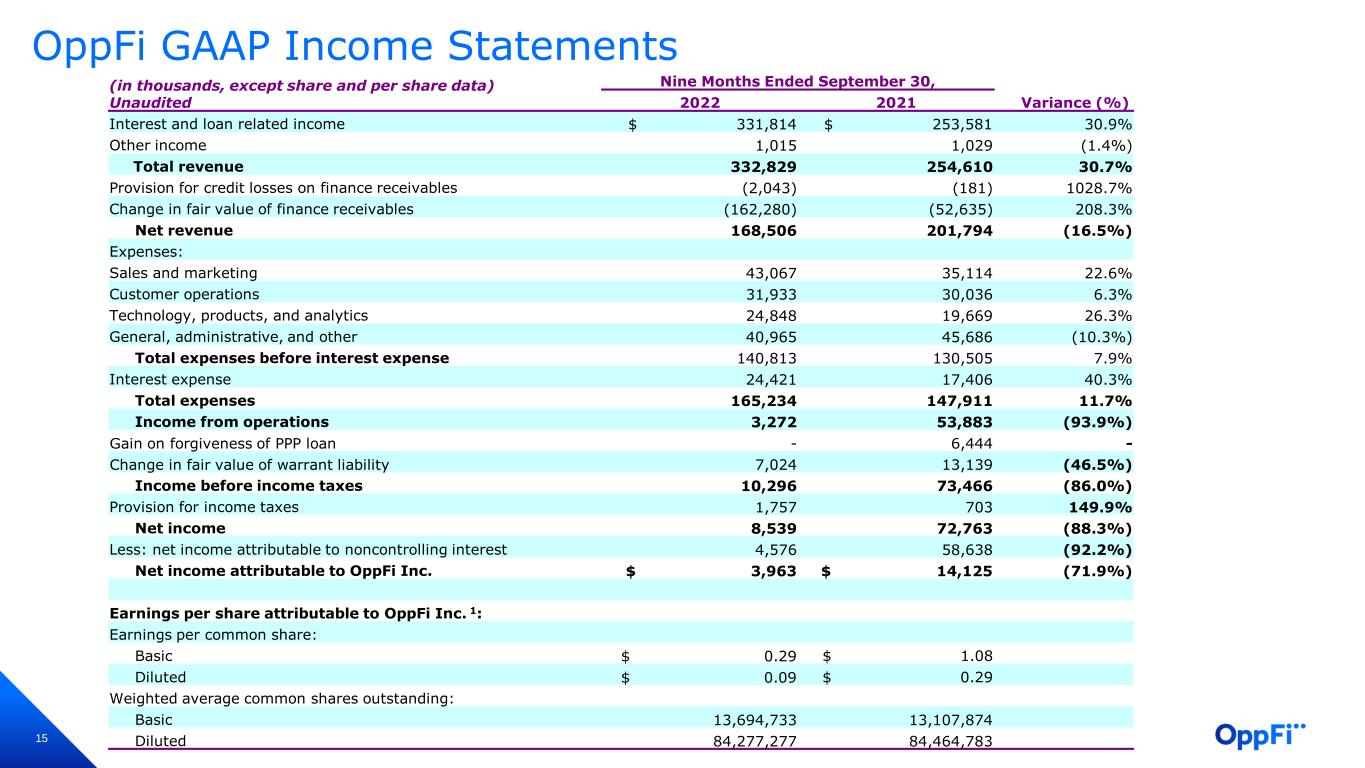

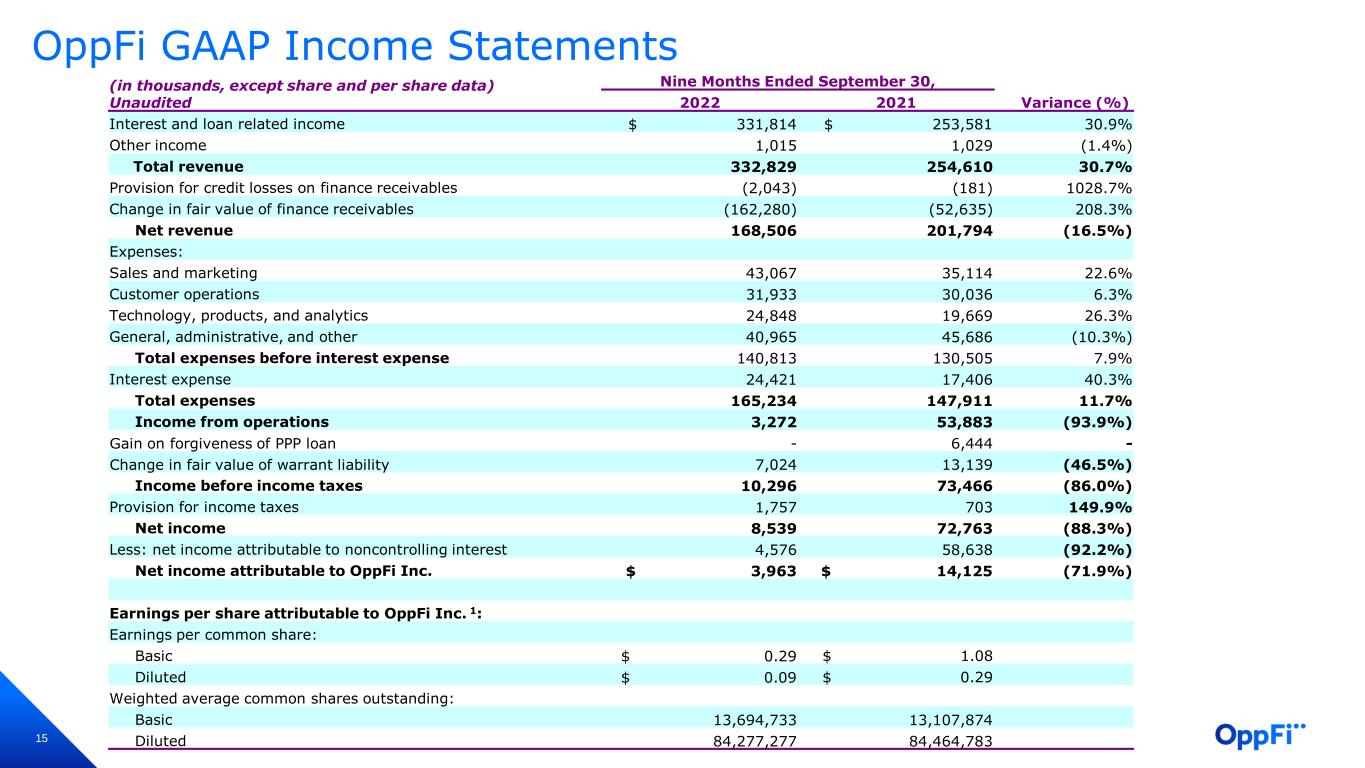

15 OppFi GAAP Income Statements (in thousands, except share and per share data) Unaudited Nine Months Ended September 30, 2022 2021 Variance (%) Interest and loan related income $ 331,814 $ 253,581 30.9% Other income 1,015 1,029 (1.4%) Total revenue 332,829 254,610 30.7% Provision for credit losses on finance receivables (2,043) (181) 1028.7% Change in fair value of finance receivables (162,280) (52,635) 208.3% Net revenue 168,506 201,794 (16.5%) Expenses: Sales and marketing 43,067 35,114 22.6% Customer operations 31,933 30,036 6.3% Technology, products, and analytics 24,848 19,669 26.3% General, administrative, and other 40,965 45,686 (10.3%) Total expenses before interest expense 140,813 130,505 7.9% Interest expense 24,421 17,406 40.3% Total expenses 165,234 147,911 11.7% Income from operations 3,272 53,883 (93.9%) Gain on forgiveness of PPP loan - 6,444 - Change in fair value of warrant liability 7,024 13,139 (46.5%) Income before income taxes 10,296 73,466 (86.0%) Provision for income taxes 1,757 703 149.9% Net income 8,539 72,763 (88.3%) Less: net income attributable to noncontrolling interest 4,576 58,638 (92.2%) Net income attributable to OppFi Inc. $ 3,963 $ 14,125 (71.9%) Earnings per share attributable to OppFi Inc. 1: Earnings per common share: Basic $ 0.29 $ 1.08 Diluted $ 0.09 $ 0.29 Weighted average common shares outstanding: Basic 13,694,733 13,107,874 Diluted 84,277,277 84,464,783

16 OppFi Condensed Balance Sheet (in thousands) Unaudited September 30, 2022 December 31, 2021 Variance (%) Assets Cash and restricted cash $ 50,469 $ 62,362 (19.1%) Finance receivables at fair value 458,065 383,890 19.3% Finance receivables at amortized cost, net 3,858 4,220 (8.6%) Other assets 67,578 51,634 30.9% Total assets $ 579,970 $ 502,106 15.5% Liabilities and stockholders’ equity Other liabilities $ 67,668 $ 58,967 14.8% Total debt 342,636 274,021 25.0% Warrant liability 4,216 11,240 (62.5%) Total liabilities $ 414,520 $ 344,228 20.4% Total stockholders’ equity 165,450 157,878 4.8% Total liabilities and stockholders’ equity $ 579,970 $ 502,106 15.5%

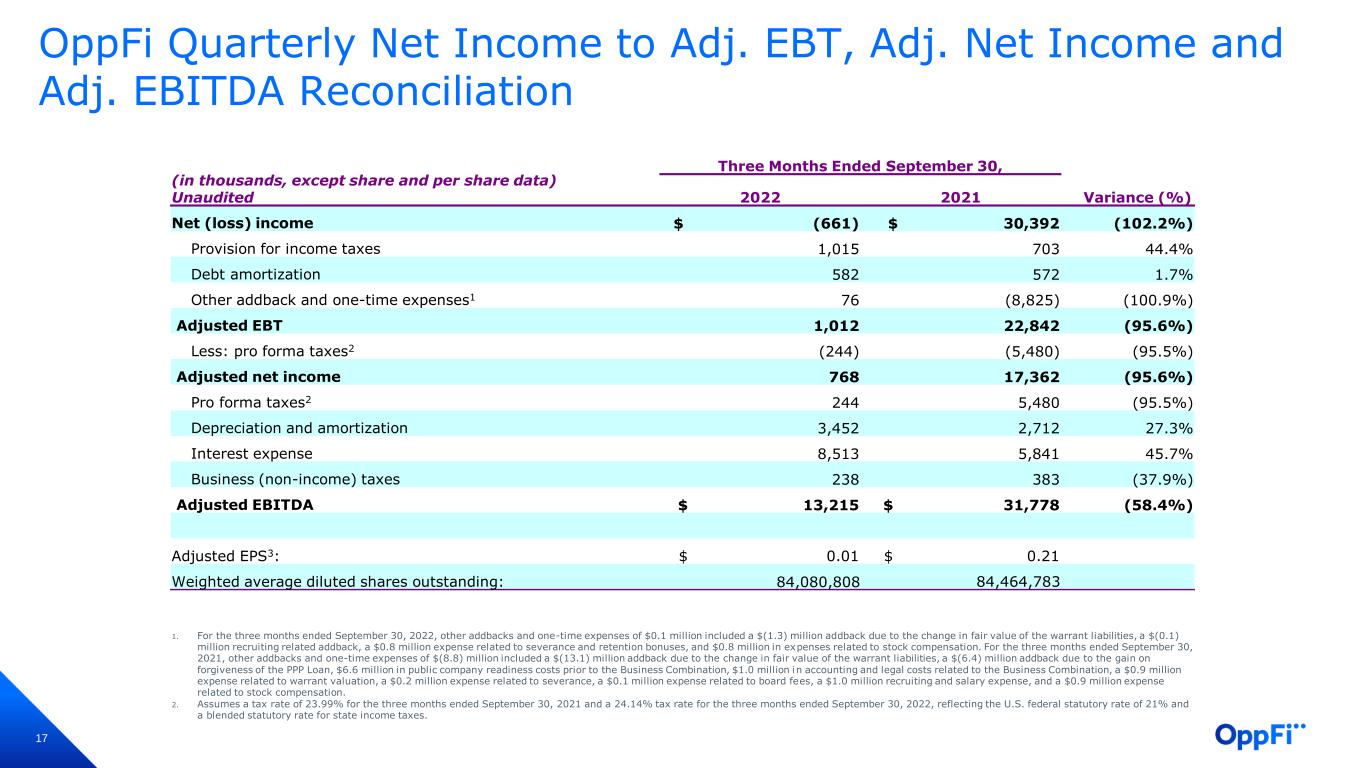

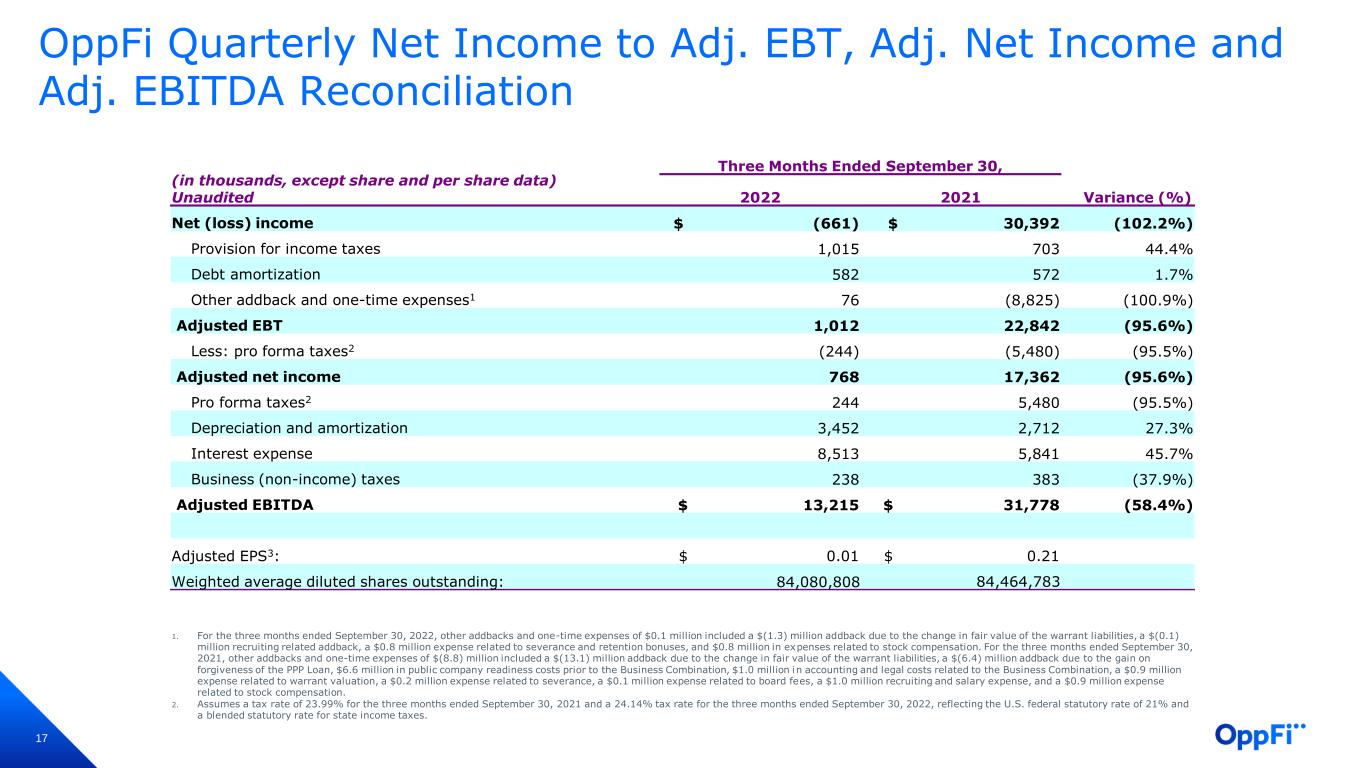

17 OppFi Quarterly Net Income to Adj. EBT, Adj. Net Income and Adj. EBITDA Reconciliation (in thousands, except share and per share data) Unaudited Three Months Ended September 30, 2022 2021 Variance (%) Net (loss) income $ (661) $ 30,392 (102.2%) Provision for income taxes 1,015 703 44.4% Debt amortization 582 572 1.7% Other addback and one-time expenses1 76 (8,825) (100.9%) Adjusted EBT 1,012 22,842 (95.6%) Less: pro forma taxes2 (244) (5,480) (95.5%) Adjusted net income 768 17,362 (95.6%) Pro forma taxes2 244 5,480 (95.5%) Depreciation and amortization 3,452 2,712 27.3% Interest expense 8,513 5,841 45.7% Business (non-income) taxes 238 383 (37.9%) Adjusted EBITDA $ 13,215 $ 31,778 (58.4%) Adjusted EPS3: $ 0.01 $ 0.21 Weighted average diluted shares outstanding: 84,080,808 84,464,783 1. For the three months ended September 30, 2022, other addbacks and one-time expenses of $0.1 million included a $(1.3) million addback due to the change in fair value of the warrant liabilities, a $(0.1) million recruiting related addback, a $0.8 million expense related to severance and retention bonuses, and $0.8 million in expenses related to stock compensation. For the three months ended September 30, 2021, other addbacks and one-time expenses of $(8.8) million included a $(13.1) million addback due to the change in fair value of the warrant liabilities, a $(6.4) million addback due to the gain on forgiveness of the PPP Loan, $6.6 million in public company readiness costs prior to the Business Combination, $1.0 million in accounting and legal costs related to the Business Combination, a $0.9 million expense related to warrant valuation, a $0.2 million expense related to severance, a $0.1 million expense related to board fees, a $1.0 million recruiting and salary expense, and a $0.9 million expense related to stock compensation. 2. Assumes a tax rate of 23.99% for the three months ended September 30, 2021 and a 24.14% tax rate for the three months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes.

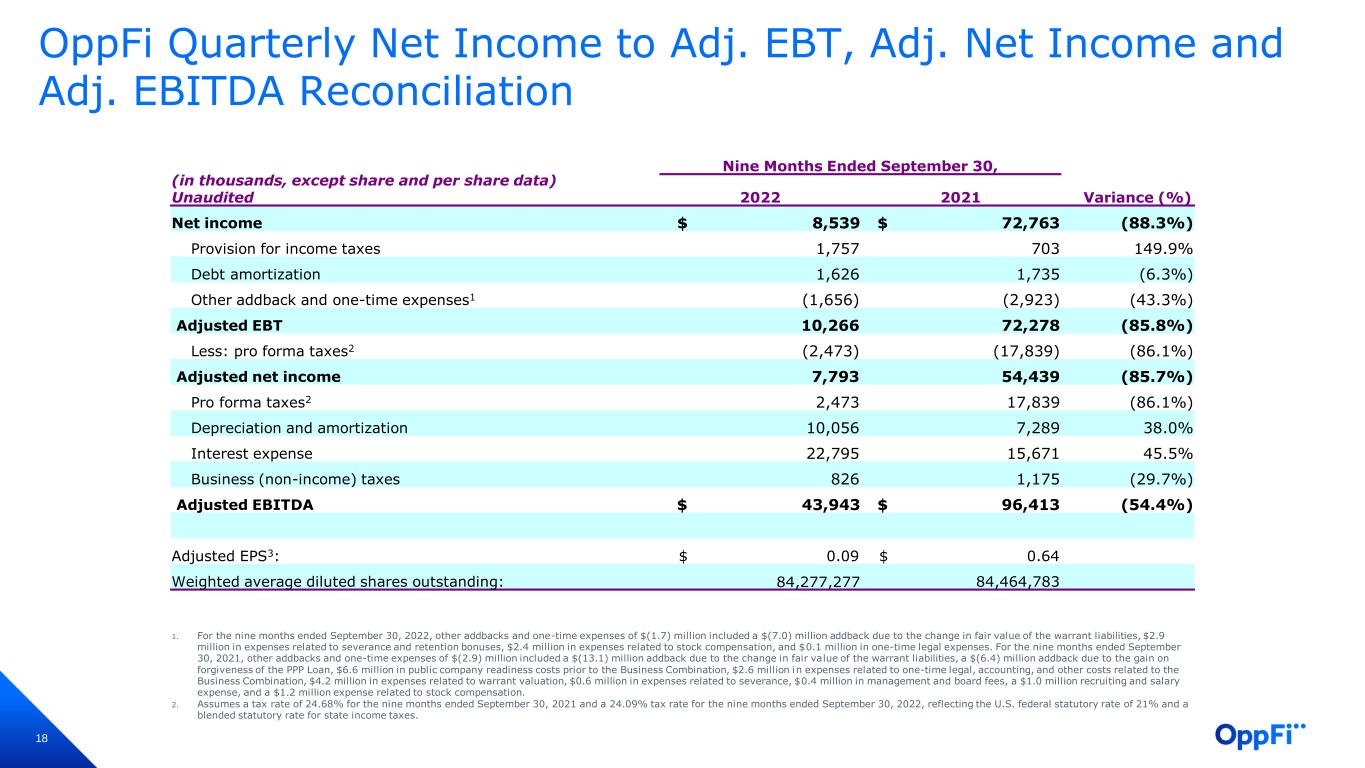

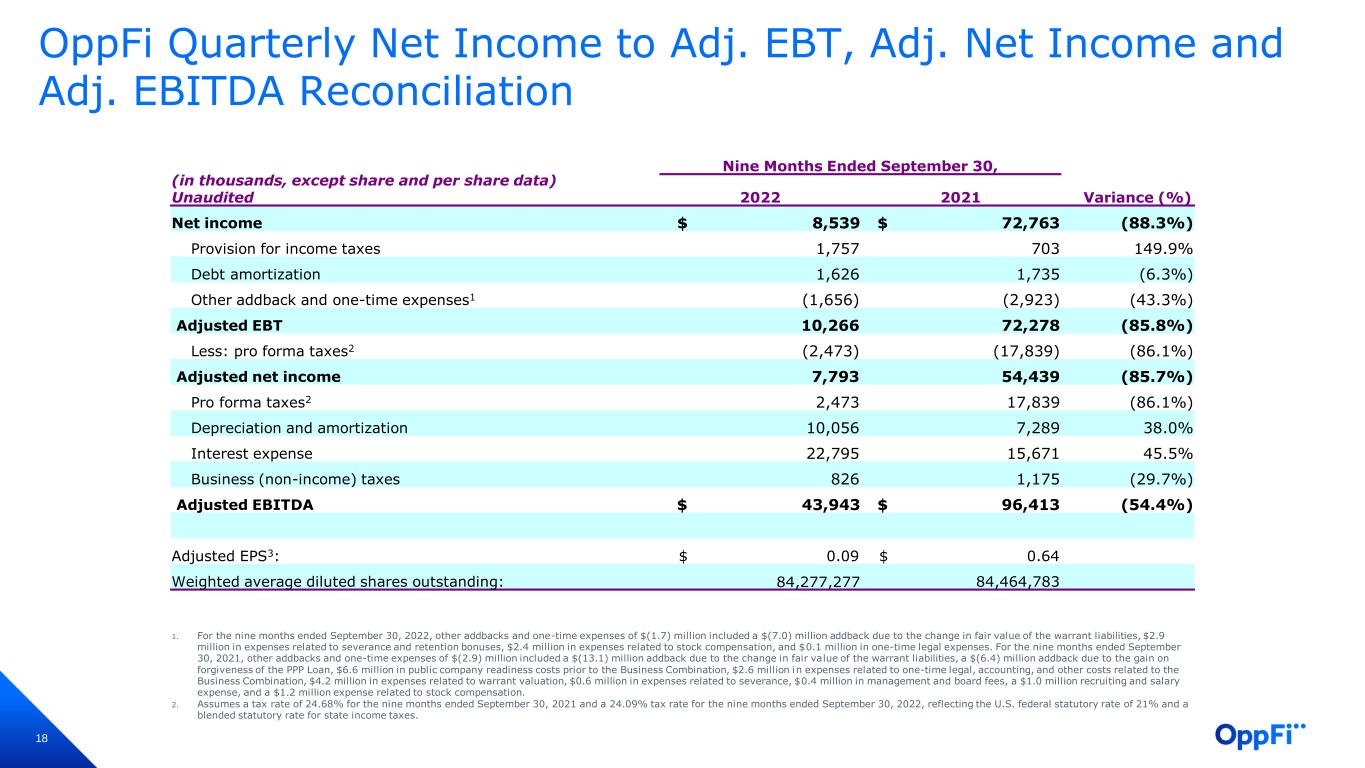

18 OppFi Quarterly Net Income to Adj. EBT, Adj. Net Income and Adj. EBITDA Reconciliation (in thousands, except share and per share data) Unaudited Nine Months Ended September 30, 2022 2021 Variance (%) Net income $ 8,539 $ 72,763 (88.3%) Provision for income taxes 1,757 703 149.9% Debt amortization 1,626 1,735 (6.3%) Other addback and one-time expenses1 (1,656) (2,923) (43.3%) Adjusted EBT 10,266 72,278 (85.8%) Less: pro forma taxes2 (2,473) (17,839) (86.1%) Adjusted net income 7,793 54,439 (85.7%) Pro forma taxes2 2,473 17,839 (86.1%) Depreciation and amortization 10,056 7,289 38.0% Interest expense 22,795 15,671 45.5% Business (non-income) taxes 826 1,175 (29.7%) Adjusted EBITDA $ 43,943 $ 96,413 (54.4%) Adjusted EPS3: $ 0.09 $ 0.64 Weighted average diluted shares outstanding: 84,277,277 84,464,783 1. For the nine months ended September 30, 2022, other addbacks and one-time expenses of $(1.7) million included a $(7.0) million addback due to the change in fair value of the warrant liabilities, $2.9 million in expenses related to severance and retention bonuses, $2.4 million in expenses related to stock compensation, and $0.1 million in one-time legal expenses. For the nine months ended September 30, 2021, other addbacks and one-time expenses of $(2.9) million included a $(13.1) million addback due to the change in fair value of the warrant liabilities, a $(6.4) million addback due to the gain on forgiveness of the PPP Loan, $6.6 million in public company readiness costs prior to the Business Combination, $2.6 million in expenses related to one-time legal, accounting, and other costs related to the Business Combination, $4.2 million in expenses related to warrant valuation, $0.6 million in expenses related to severance, $0.4 million in management and board fees, a $1.0 million recruiting and salary expense, and a $1.2 million expense related to stock compensation. 2. Assumes a tax rate of 24.68% for the nine months ended September 30, 2021 and a 24.09% tax rate for the nine months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes.

19 OppFi Cash Flows Nine Months Ended September 30, (in thousands) Unaudited 2022 2021 Variance (%) Net cash provided by operating activities $ 172,263 $ 120,090 43.4% Net cash (used in) investing activities (243,445) (109,979) (121.4%) Net cash provided by financing activities 59,289 1,034 5,633.9% Net (decrease) increase in cash, cash equivalents and restricted cash $ (11,893) $ 11,145 (206.7%)

20 OppFi Diluted Shares as Reflected in Adjusted Earnings Per Share Three Months Ended September 30, 2022 2021 Weighted average Class A common stock outstanding 13,972,971 13,363,996 Weighted average Class V voting stock outstanding 95,397,996 96,600,787 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 192,127 - Dilutive impact of performance stock units 17,714 - Weighted average diluted shares outstanding 84,080,808 84,464,783

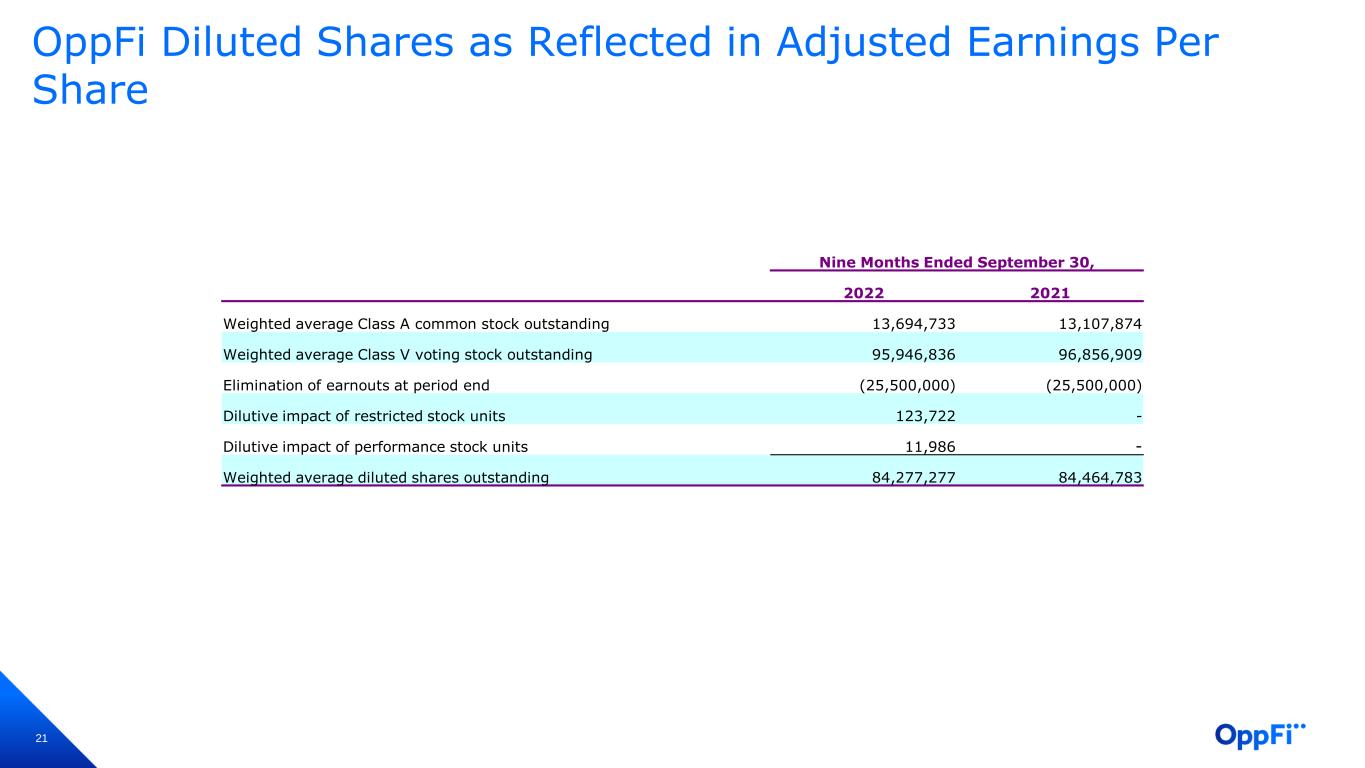

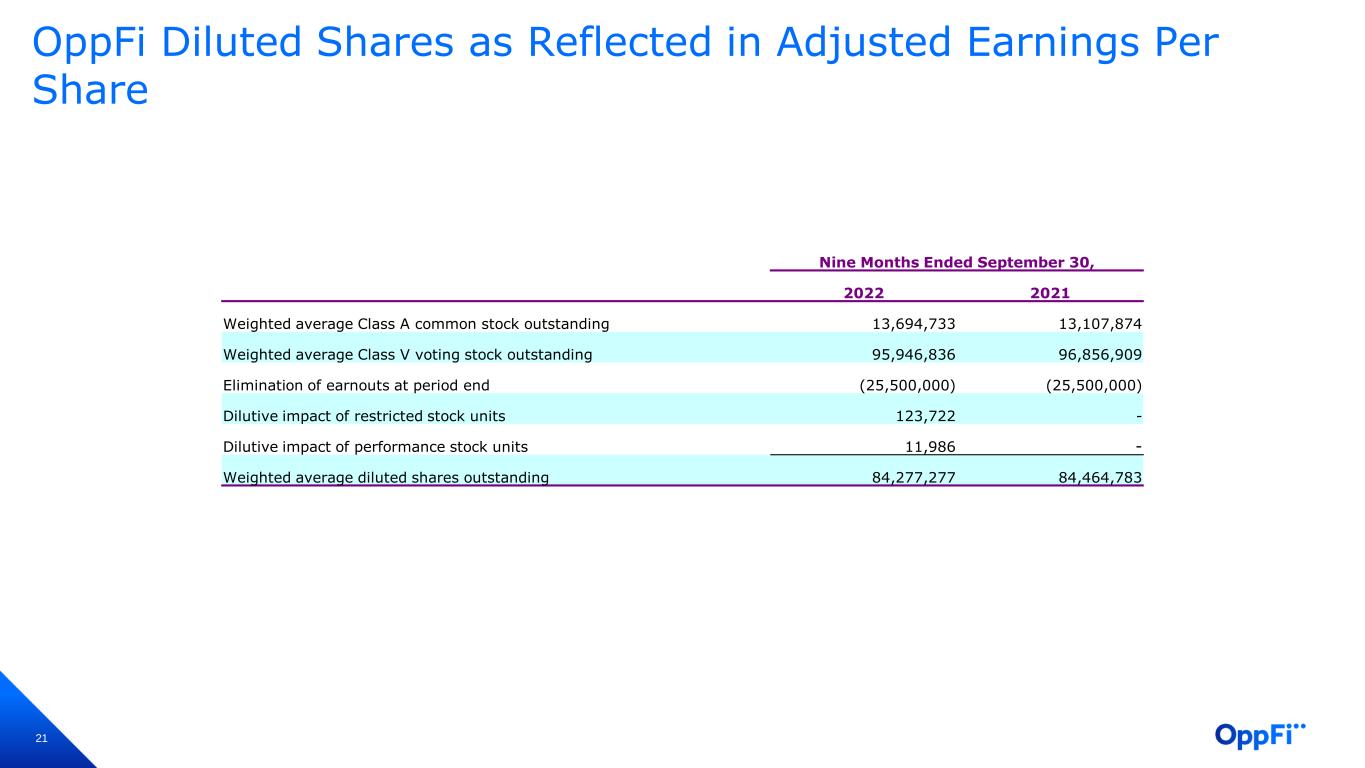

21 OppFi Diluted Shares as Reflected in Adjusted Earnings Per Share Nine Months Ended September 30, 2022 2021 Weighted average Class A common stock outstanding 13,694,733 13,107,874 Weighted average Class V voting stock outstanding 95,946,836 96,856,909 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 123,722 - Dilutive impact of performance stock units 11,986 - Weighted average diluted shares outstanding 84,277,277 84,464,783

22 OppFi Adjusted EPS Three Months Ended September 30, 2022 2021 Adjusted net income (thousands)1 $ 768 $ 17,361 Weighted average diluted shares outstanding 84,080,808 84,464,783 Adjusted basic EPS2: $ 0.01 $ 0.21 Nine Months Ended September 30, 2022 2021 Adjusted net income (thousands)1 $ 7,793 $ 54,439 Weighted average diluted shares outstanding 84,277,277 84,464,783 Adjusted diluted EPS2: $ 0.09 $ 0.64 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EBITDA are financial measures that have not been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”). See the “Note Regarding Non-GAAP Financial Measures” below for a detailed description and reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures.