NEWS RELEASE OppFi Exceeds 2023 Earnings Guidance, Provides Outlook for Continued Pro�table Growth in 2024 3/7/2024 Record total revenue and ending receivables for full-year 2023 Ninth consecutive year of net income Net income of $39.5 million for full-year 2023 Adjusted net income of $43.3 million for full-year 2023 Net charge o� rate as a percentage of total revenue improved by 8.1 percentage points to 43.5% for full-year 2023 Total revenue increased 10.7% year over year to $132.9 million for fourth quarter of 2023 Net income of $1.9 million for fourth quarter of 2023 Adjusted net income of $8.9 million for fourth quarter of 2023 Annualized net charge o� rate as a percentage of total revenue improved by 12.9 percentage points year over year to 46.4% for fourth quarter of 2023 CHICAGO--(BUSINESS WIRE)-- OppFi Inc. (NYSE: OPFI; OPFI WS) (“OppFi” or the “Company”), a tech-enabled, mission- driven specialty �nance platform that broadens the reach of community banks to extend credit access to everyday Americans, today reported �nancial results for the fourth quarter and year ended December 31, 2023. “We’re excited to begin 2024 and leverage our strong 2023,” said Todd Schwartz, Chief Executive O�cer and Executive Chairman of OppFi. “This year, we expect to continue focusing on pro�table growth by maintaining 1

prudent risk tolerances and scaling operating expenses e�ciently. We ended 2023 with a strong balance sheet that provides us with optionality to create additional shareholder value.” Financial Summary The following tables present a summary of OppFi’s results for the three and twelve months ended December 31, 2023 and 2022. (in thousands, except per share data) Unaudited Three Months Ended December 31, Change 2023 2022 % Total revenue $ 132,924 $ 120,030 10.7% Net income (loss) $ 1,942 $ (5,199) 137.4% Adjusted net income (loss)(1) $ 8,883 $ (2,790) 418.4% Adjusted EBITDA(1) $ 25,811 $ 9,922 160.1% Basic EPS $ (0.31) $ 0.22 (240.9)% Diluted EPS(2) $ (0.31) $ (0.22) 40.9% Adjusted EPS(1,2) $ 0.10 $ (0.19) 154.1% (in thousands, except per share data) Unaudited Year Ended December 31, Change 2023 2022 % Total revenue $ 508,949 $ 452,859 12.4% Net income $ 39,479 $ 3,340 1082.0% Adjusted net income(1) $ 43,349 $ 4,976 771.2% Adjusted EBITDA(1) $ 114,684 $ 53,866 112.9% Basic EPS $ (0.06) $ 0.51 (111.8)% Diluted EPS(2) $ (0.06) $ 0.05 (220.)% Adjusted EPS(1,2) $ 0.51 $ 0.06 763.0% (1) Non-GAAP Financial Measures: Adjusted Net Income, Adjusted EBITDA and Adjusted EPS are �nancial measures that have not been prepared in accordance with GAAP. See “Reconciliation of Non-GAAP Financial Measures” below for a detailed description and reconciliation of such Non-GAAP �nancial measures to their most directly comparable GAAP �nancial measures. (2) Shares of Class V common stock that are exchangeable into shares of Class A common stock as a result of OppFi's Up-C structure are excluded from the diluted shares calculation in any period in which OppFi reports a loss because the inclusion would be antidilutive. Fourth Quarter Key Performance Metrics The following tables represent key quarterly metrics. (in thousands) Unaudited As of and for the Three Months Ended, December 31, 2023 September 30, 2023 December 31, 2022 2

Total Net Originations(a) $ 191,932 $ 195,671 $ 185,851 Ending Receivables(b) $ 416,463 $ 415,933 $ 402,180 % of Originations by Bank Partners 100% 98% 95% Annualized Net Charge-O�s as % of Total Revenue(c) 46% 42% 59% Annualized Net Charge-O�s as % of Average Receivables(c) 59% 55% 70% Auto-Approval Rate(d) 73% 73% 69% a. Total net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi. b. Receivables are de�ned as the unpaid principal balances of loans at the end of the reporting period. c. Annualized net charge-o�s as a percentage of total revenue and annualized net charge-o�s as a percentage of average receivables (de�ned as the unpaid principal of loans) represents total charge o�s from the period less recoveries as a percent of total revenue and average receivables, respectively. Finance receivables are charged o� at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives noti�cation of a customer bankruptcy or is otherwise deemed uncollectible. d. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto- approval) divided by the total number of loans approved. Full-Year 2024 Guidance Total revenue of $510 million to $530 million Adjusted net income of $46 million to $49 million Adjusted earnings per share (“EPS”) of $0.53 to $0.57 based on approximate weighted average diluted shares outstanding of 86.5 million First Quarter 2024 Guidance Adjusted earnings per share (“EPS”) of $0.05 based on approximate weighted average diluted shares outstanding of 86.0 million Conference Call Management will host a conference call today at 4:30 p.m. ET to discuss OppFi’s �nancial results and business outlook. The webcast of the conference call will be made available on the Investor Relations page of the Company's website. The conference call can also be accessed with the following dial-in information: Domestic: (877) 407-0789 International: (201) 689-8562 An archived version of the webcast will be available on OppFi's website. About OppFi OppFi (NYSE: OPFI; OPFI WS) is a tech-enabled, mission-driven specialty �nance platform that broadens the reach of community banks to extend credit access to everyday Americans. Through transparency, responsible lending, 3

�nancial inclusion, and an excellent customer experience, the Company supports consumers, who are turned away by mainstream options, to build better �nancial health. OppLoans by OppFi maintains a 4.5/5.0 star rating on Trustpilot with more than 4,100 reviews, making the Company one of the top consumer-rated �nancial platforms online. For more information, please visit opp�.com. Forward-Looking Statements This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may di�er from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “possible,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its �rst quarter and full year 2024 guidance, the future performance of OppFi’s platform, and expectations for OppFi’s growth and future �nancial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve signi�cant risks and uncertainties that could cause the actual results to di�er materially from the expected results. Most of these factors are outside OppFi’s control and are di�cult to predict. Factors that may cause such di�erences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, in�ation, interest rate changes, recessions, and tightening of credit markets on OppFi’s business; the impact of challenging macroeconomic and marketplace conditions, including lingering e�ects of COVID-19 on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s �nancing sources will continue to �nance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the impact that events involving �nancial institutions or the �nancial services industry generally, such as actual concerns or events involving liquidity, defaults, or non- performance, may have on OppFi’s business; risks related to the material weakness in OppFi’s internal controls over �nancial reporting; the ability of OppFi to grow and manage growth pro�tably and retain its key employees; risks related to new products; risks related to evaluating and potentially consummating acquisitions; concentration risk; risks related to OppFi’s ability to comply with various covenants in its corporate and warehouse credit facilities; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely a�ected by other economic, business, and/or competitive factors; risks related to management 4

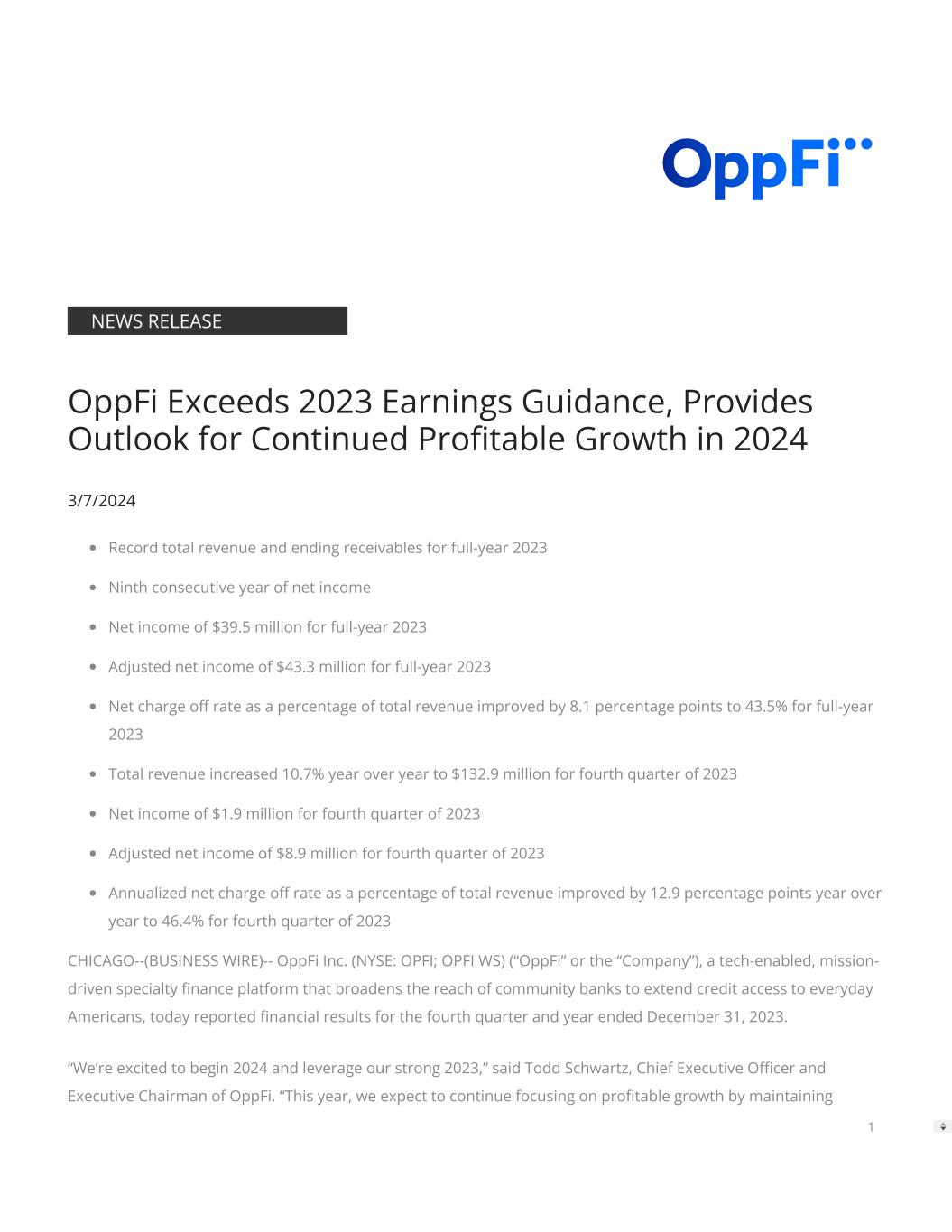

transitions; risks related to the restatement of OppFi’s �nancial statements and any accounting de�ciencies or weaknesses related thereto; and other risks and uncertainties indicated from time to time in OppFi’s �lings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to re�ect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures This press release includes certain non-GAAP �nancial measures that are unaudited and do not conform to GAAP, such as Adjusted EBT, Adjusted Net Income, Adjusted EBITDA and Adjusted EPS. Adjusted EBT is de�ned as Net Income, plus (1) income tax expense (bene�t); (2) debt issuance cost amortization; (3) other addbacks and one-time expenses, net; and (4) sublease income. Adjusted Net Income is de�ned as Adjusted EBT as de�ned above, adjusted for taxes assuming a tax rate of 21.12% for the three months ended December 31, 2023, a tax rate of 24.68% for the three months ended December 31, 2022, a tax rate of 23.56% for the full year ended December 31, 2023, and a tax rate of 24.17% for the full year ended December 31, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EBITDA is de�ned as Adjusted Net Income as de�ned above, excluding (1) pro forma and business (non-income) taxes; (2) depreciation and amortization; and (3) interest expense. Adjusted EPS is de�ned as Adjusted Net Income as de�ned above, divided by weighted average diluted shares outstanding, which represent shares of both classes of common stock outstanding, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units, unvested performance stock units, and the employee stock purchase plan. Adjusted EPS is useful to investors and others because, due to OppFi’s Up-C structure, Basic EPS calculated on a GAAP basis excludes a large percentage of OppFi’s outstanding shares of common stock, which are Class V Voting Stock, and Diluted EPS calculated on a GAAP basis excludes dilutive securities, including Class V Voting Stock, in any period in which OppFi reports a loss as dilutive securities are considered to be antidilutive. These non-GAAP �nancial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be di�erent from non-GAAP �nancial measures used by other companies. OppFi believes that the use of these non-GAAP �nancial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, �nancial measures determined in accordance with GAAP. See “Reconciliation of Non-GAAP Financial Measures” below for reconciliations for OppFi's non-GAAP �nancial measures to the most directly comparable GAAP �nancial measures. A reconciliation of projected full year 2024 Adjusted Net Income and projected �rst quarter and full year 2024 Adjusted EPS to the most directly comparable GAAP �nancial 5

measures is not included in this press release because, without unreasonable e�orts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. Fourth Quarter Results of Operations Consolidated Statements of Operations Comparison of the three months ended December 31, 2023 and 2022 The following table presents consolidated results of operations for the three months ended December 31, 2023 and 2022 (in thousands, except number of shares and per share data). Three Months Ended December 31, Change (unaudited) 2023 2022 $ % Interest and loan related income $ 131,815 $ 119,634 $ 12,181 10.2% Other revenue 1,109 396 713 180.1 Total revenue 132,924 120,030 12,894 10.7 Change in fair value of �nance receivables (66,956) (71,680) 4,724 (6.6) Provision for credit losses on �nance receivables (217) 103 (320) (310.7) Net revenue 65,751 48,453 17,298 35.7 Expenses: Sales and marketing 11,247 11,339 (92) (0.8) Customer operations 10,309 10,381 (72) (0.7) Technology, products, and analytics 9,696 8,590 1,106 12.9 General, administrative, and other 13,718 17,017 (3,299) (19.4) Total expenses before interest expense 44,970 47,327 (2,357) (5.0) Interest expense 12,071 10,740 1,331 12.4 Total expenses 57,041 58,067 (1,026) (1.8) Income (loss) from operations 8,710 (9,614) 18,324 190.6 Change in fair value of warrant liability (5,814) 2,328 (8,142) (349.7) Other income 80 53 27 50.9 Income (loss) before income taxes 2,976 (7,233) 10,209 141.1 Income tax expense (bene�t) 1,034 (2,034) 3,068 150.8 Net income (loss) 1,942 (5,199) 7,141 137.4 Less: net income (loss) attributable to noncontrolling interest 7,509 (8,335) 15,844 190.1 Net (loss) income attributable to OppFi Inc. $ (5,567) $ 3,136 $ (8,703) (277.5)% (Loss) earnings per share attributable to OppFi Inc.: (Loss) earnings per common share: Basic $ (0.31) $ 0.22 Diluted(a) $ (0.31) $ (0.22) Weighted average common shares outstanding: Basic 18,087,627 14,563,168 Diluted(a) 18,087,627 14,563,168 (a) Shares of Class V common stock that are exchangeable into shares of Class A common stock as a result of OppFi's Up-C structure are excluded from the diluted shares calculation in any period in which OppFi reports a loss because the inclusion would be antidilutive. 6

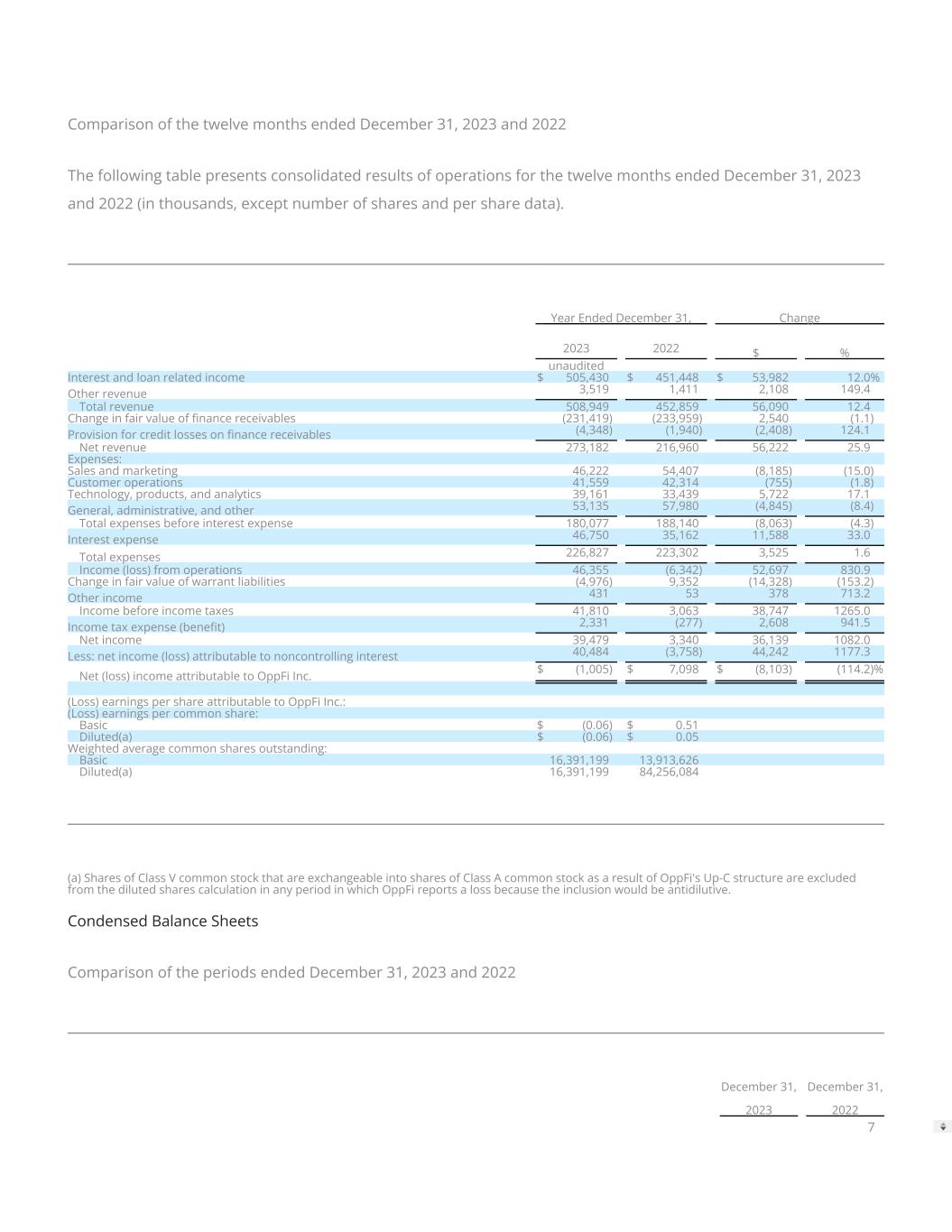

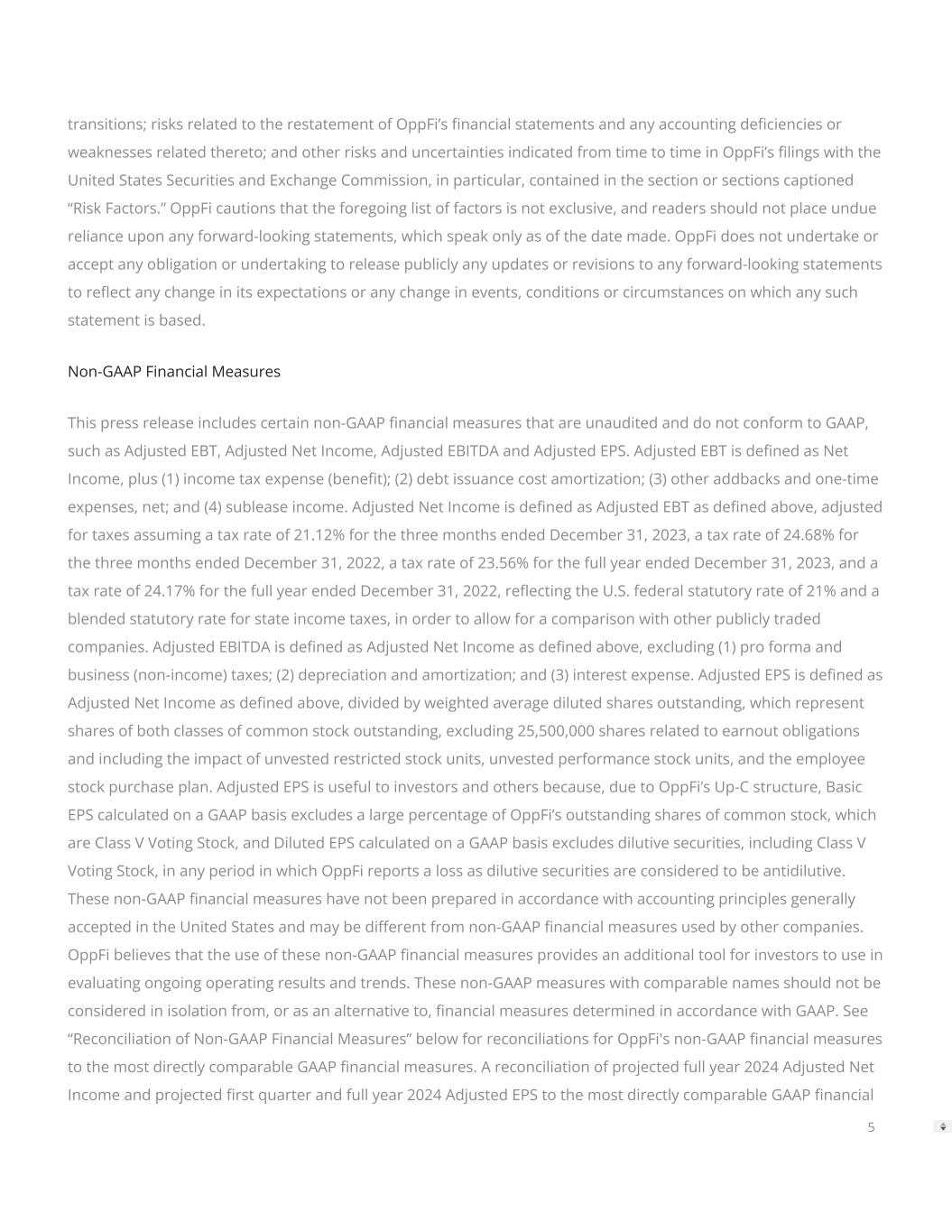

Comparison of the twelve months ended December 31, 2023 and 2022 The following table presents consolidated results of operations for the twelve months ended December 31, 2023 and 2022 (in thousands, except number of shares and per share data). Year Ended December 31, Change 2023 2022 $ % unaudited Interest and loan related income $ 505,430 $ 451,448 $ 53,982 12.0% Other revenue 3,519 1,411 2,108 149.4 Total revenue 508,949 452,859 56,090 12.4 Change in fair value of �nance receivables (231,419) (233,959) 2,540 (1.1) Provision for credit losses on �nance receivables (4,348) (1,940) (2,408) 124.1 Net revenue 273,182 216,960 56,222 25.9 Expenses: Sales and marketing 46,222 54,407 (8,185) (15.0) Customer operations 41,559 42,314 (755) (1.8) Technology, products, and analytics 39,161 33,439 5,722 17.1 General, administrative, and other 53,135 57,980 (4,845) (8.4) Total expenses before interest expense 180,077 188,140 (8,063) (4.3) Interest expense 46,750 35,162 11,588 33.0 Total expenses 226,827 223,302 3,525 1.6 Income (loss) from operations 46,355 (6,342) 52,697 830.9 Change in fair value of warrant liabilities (4,976) 9,352 (14,328) (153.2) Other income 431 53 378 713.2 Income before income taxes 41,810 3,063 38,747 1265.0 Income tax expense (bene�t) 2,331 (277) 2,608 941.5 Net income 39,479 3,340 36,139 1082.0 Less: net income (loss) attributable to noncontrolling interest 40,484 (3,758) 44,242 1177.3 Net (loss) income attributable to OppFi Inc. $ (1,005) $ 7,098 $ (8,103) (114.2)% (Loss) earnings per share attributable to OppFi Inc.: (Loss) earnings per common share: Basic $ (0.06) $ 0.51 Diluted(a) $ (0.06) $ 0.05 Weighted average common shares outstanding: Basic 16,391,199 13,913,626 Diluted(a) 16,391,199 84,256,084 (a) Shares of Class V common stock that are exchangeable into shares of Class A common stock as a result of OppFi's Up-C structure are excluded from the diluted shares calculation in any period in which OppFi reports a loss because the inclusion would be antidilutive. Condensed Balance Sheets Comparison of the periods ended December 31, 2023 and 2022 December 31, 2023 December 31, 2022 7

unaudited Assets Cash and restricted cash $ 73,943 $ 49,670 Finance receivables at fair value 463,320 457,296 Finance receivables at amortized cost, net 110 643 Other assets 64,170 72,230 Total assets $ 601,543 $ 579,839 Liabilities and stockholders’ equity Current liabilities $ 26,448 $ 29,558 Other liabilities 40,086 42,183 Total debt 334,116 347,060 Warrant liabilities 6,864 1,888 Total liabilities 407,514 420,689 Total stockholders’ equity 194,029 159,150 Total liabilities and stockholders’ equity $ 601,543 $ 579,839 Total cash and restricted cash increased by $24.3 million as of December 31, 2023 compared to December 31, 2022 driven by an increase in received payments relative to originations. Finance receivables at fair value increased by $6.0 million as of December 31, 2023 compared to December 31, 2022 due to strength in issuance volume and decrease in charge-o�s throughout the second half of the year. Finance receivables at amortized cost, net decreased by $0.5 million as of December 31, 2023 compared to December 31, 2022 due to the continued rundown of OppFi Card and SalaryTap �nance receivables. Other assets decreased by $8.1 million as of December 31, 2023 compared to December 31, 2022 mainly due to a decrease in property, equipment, and software of $3.7 million, a decrease in the operating lease right of use asset of $1.4 million, and a decrease in the deferred tax asset of $1.0 million. Current liabilities decreased by $3.1 million as of December 31, 2023 compared to December 31, 2022 driven by a decrease in accounts payable of $1.9 million and a decrease in accrued expenses of $1.2 million. Other liabilities decreased by $2.1 million as of December 31, 2023 compared to December 31, 2022 driven by a decrease in the operating lease liability of $1.5 million and a decrease in the tax receivable agreement liability of $0.6 million. Total debt decreased by $12.9 million as of December 31, 2023 compared to December 31, 2022 driven by a decrease in utilization of revolving lines of credit of $12.0 million, paydown of the secured borrowing payable of $0.8 million, and a decrease in notes payable of $0.2 million. Warrant liabilities increased by $5.0 million due to the increase in the valuation of the warrants as of December 31, 2023 compared to December 31, 2022. Total stockholders’ equity increased by $34.9 million as of December 31, 2023 compared to December 31, 2022 driven by net income and stock-based compensation. Financial Capacity and Capital Resources As of December 31, 2023, OppFi had $31.8 million in unrestricted cash, an increase of $15.6 million from December 31, 2022. As of December 31, 2023, OppFi had an additional $192.3 million of unused debt capacity under its �nancing facilities for future availability, representing a 37% overall undrawn capacity, an increase from $136.8 million as of December 31, 2022. The increase in undrawn debt was driven primarily by the increase in capacity of the revolving credit agreement with a�liates of Atalaya Capital Management in July 2023. Including total �nancing 8

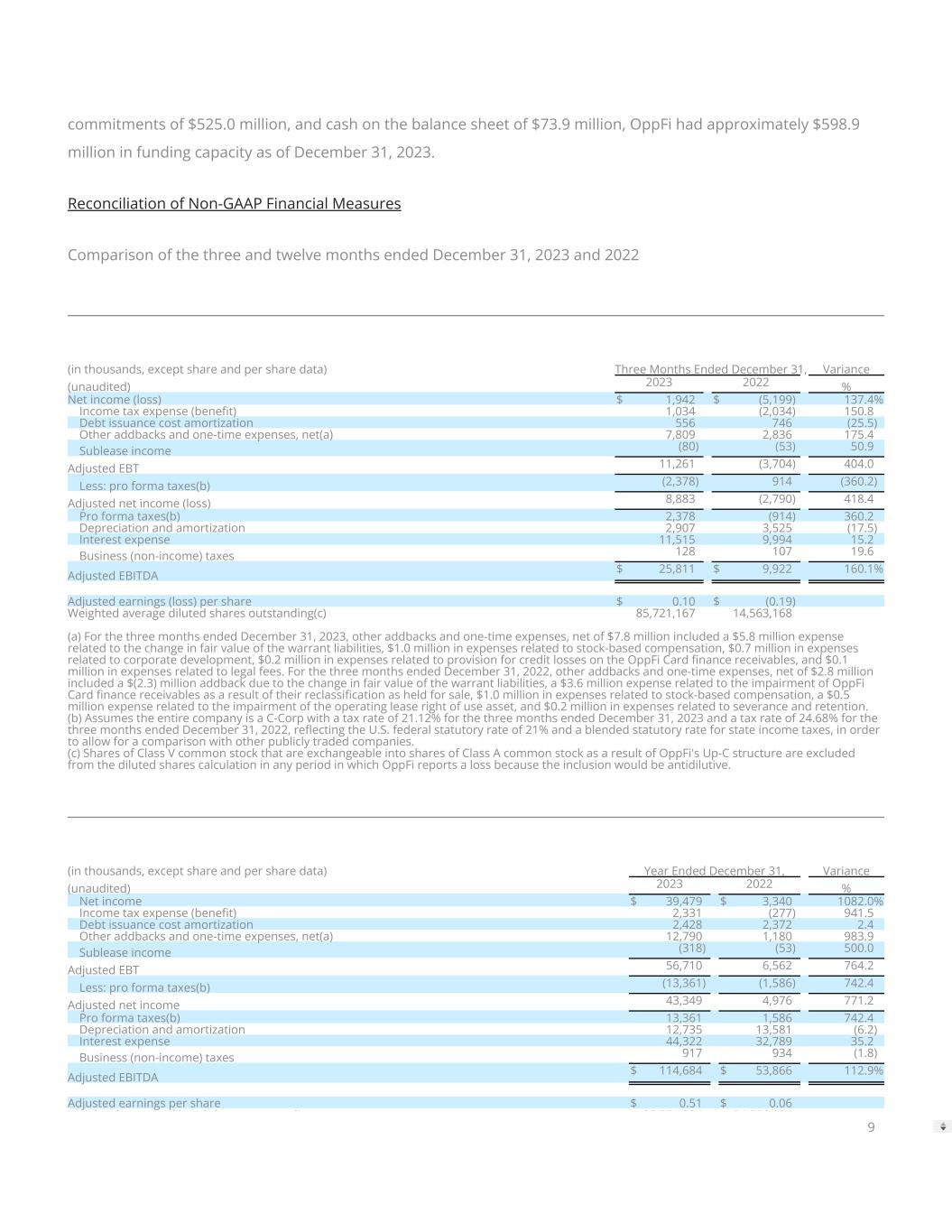

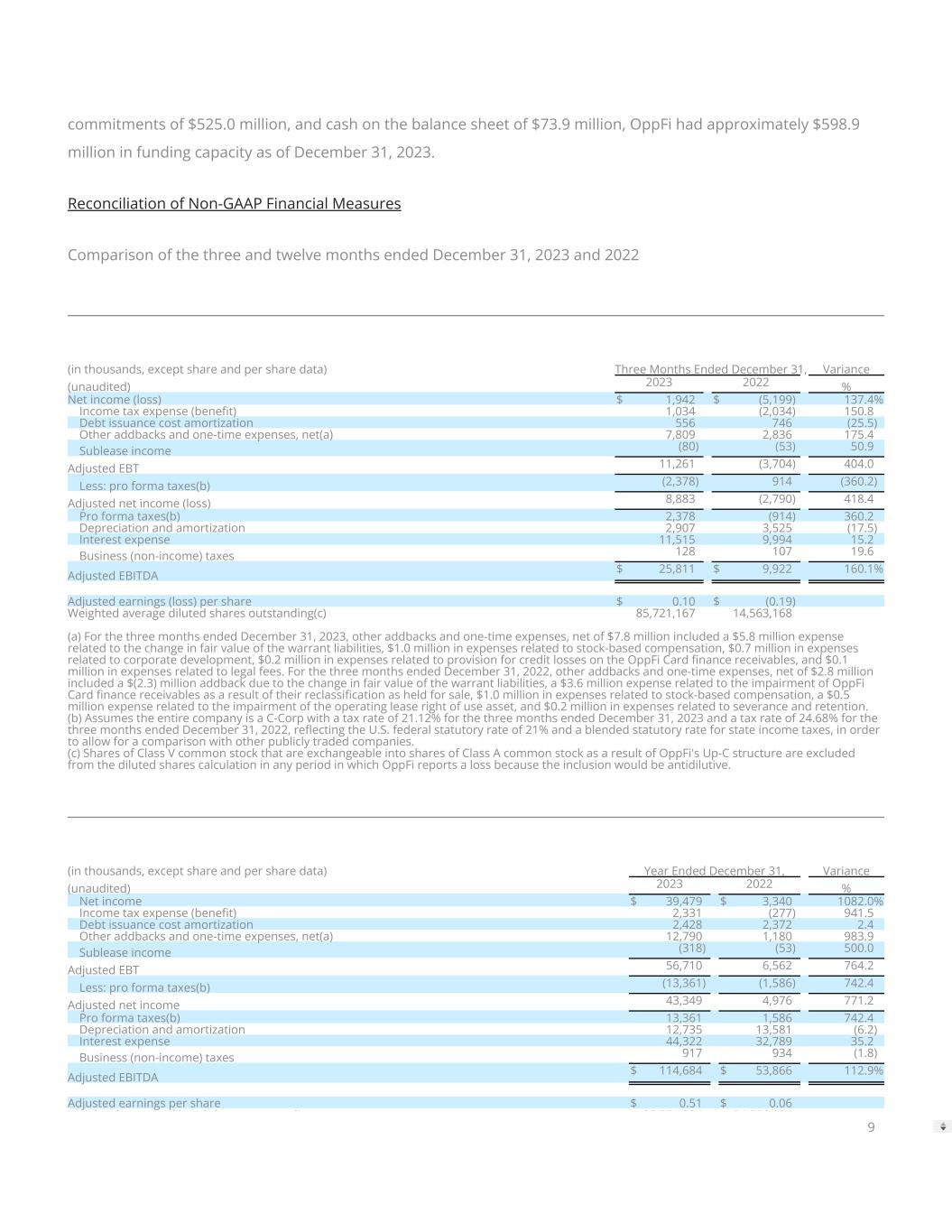

commitments of $525.0 million, and cash on the balance sheet of $73.9 million, OppFi had approximately $598.9 million in funding capacity as of December 31, 2023. Reconciliation of Non-GAAP Financial Measures Comparison of the three and twelve months ended December 31, 2023 and 2022 (in thousands, except share and per share data) Three Months Ended December 31, Variance (unaudited) 2023 2022 % Net income (loss) $ 1,942 $ (5,199) 137.4% Income tax expense (bene�t) 1,034 (2,034) 150.8 Debt issuance cost amortization 556 746 (25.5) Other addbacks and one-time expenses, net(a) 7,809 2,836 175.4 Sublease income (80) (53) 50.9 Adjusted EBT 11,261 (3,704) 404.0 Less: pro forma taxes(b) (2,378) 914 (360.2) Adjusted net income (loss) 8,883 (2,790) 418.4 Pro forma taxes(b) 2,378 (914) 360.2 Depreciation and amortization 2,907 3,525 (17.5) Interest expense 11,515 9,994 15.2 Business (non-income) taxes 128 107 19.6 Adjusted EBITDA $ 25,811 $ 9,922 160.1% Adjusted earnings (loss) per share $ 0.10 $ (0.19) Weighted average diluted shares outstanding(c) 85,721,167 14,563,168 (a) For the three months ended December 31, 2023, other addbacks and one-time expenses, net of $7.8 million included a $5.8 million expense related to the change in fair value of the warrant liabilities, $1.0 million in expenses related to stock-based compensation, $0.7 million in expenses related to corporate development, $0.2 million in expenses related to provision for credit losses on the OppFi Card �nance receivables, and $0.1 million in expenses related to legal fees. For the three months ended December 31, 2022, other addbacks and one-time expenses, net of $2.8 million included a $(2.3) million addback due to the change in fair value of the warrant liabilities, a $3.6 million expense related to the impairment of OppFi Card �nance receivables as a result of their reclassi�cation as held for sale, $1.0 million in expenses related to stock-based compensation, a $0.5 million expense related to the impairment of the operating lease right of use asset, and $0.2 million in expenses related to severance and retention. (b) Assumes the entire company is a C-Corp with a tax rate of 21.12% for the three months ended December 31, 2023 and a tax rate of 24.68% for the three months ended December 31, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. (c) Shares of Class V common stock that are exchangeable into shares of Class A common stock as a result of OppFi's Up-C structure are excluded from the diluted shares calculation in any period in which OppFi reports a loss because the inclusion would be antidilutive. (in thousands, except share and per share data) Year Ended December 31, Variance (unaudited) 2023 2022 % Net income $ 39,479 $ 3,340 1082.0% Income tax expense (bene�t) 2,331 (277) 941.5 Debt issuance cost amortization 2,428 2,372 2.4 Other addbacks and one-time expenses, net(a) 12,790 1,180 983.9 Sublease income (318) (53) 500.0 Adjusted EBT 56,710 6,562 764.2 Less: pro forma taxes(b) (13,361) (1,586) 742.4 Adjusted net income 43,349 4,976 771.2 Pro forma taxes(b) 13,361 1,586 742.4 Depreciation and amortization 12,735 13,581 (6.2) Interest expense 44,322 32,789 35.2 Business (non-income) taxes 917 934 (1.8) Adjusted EBITDA $ 114,684 $ 53,866 112.9% Adjusted earnings per share $ 0.51 $ 0.06 W i h d dil d h di 85 051 304 84 256 084 9

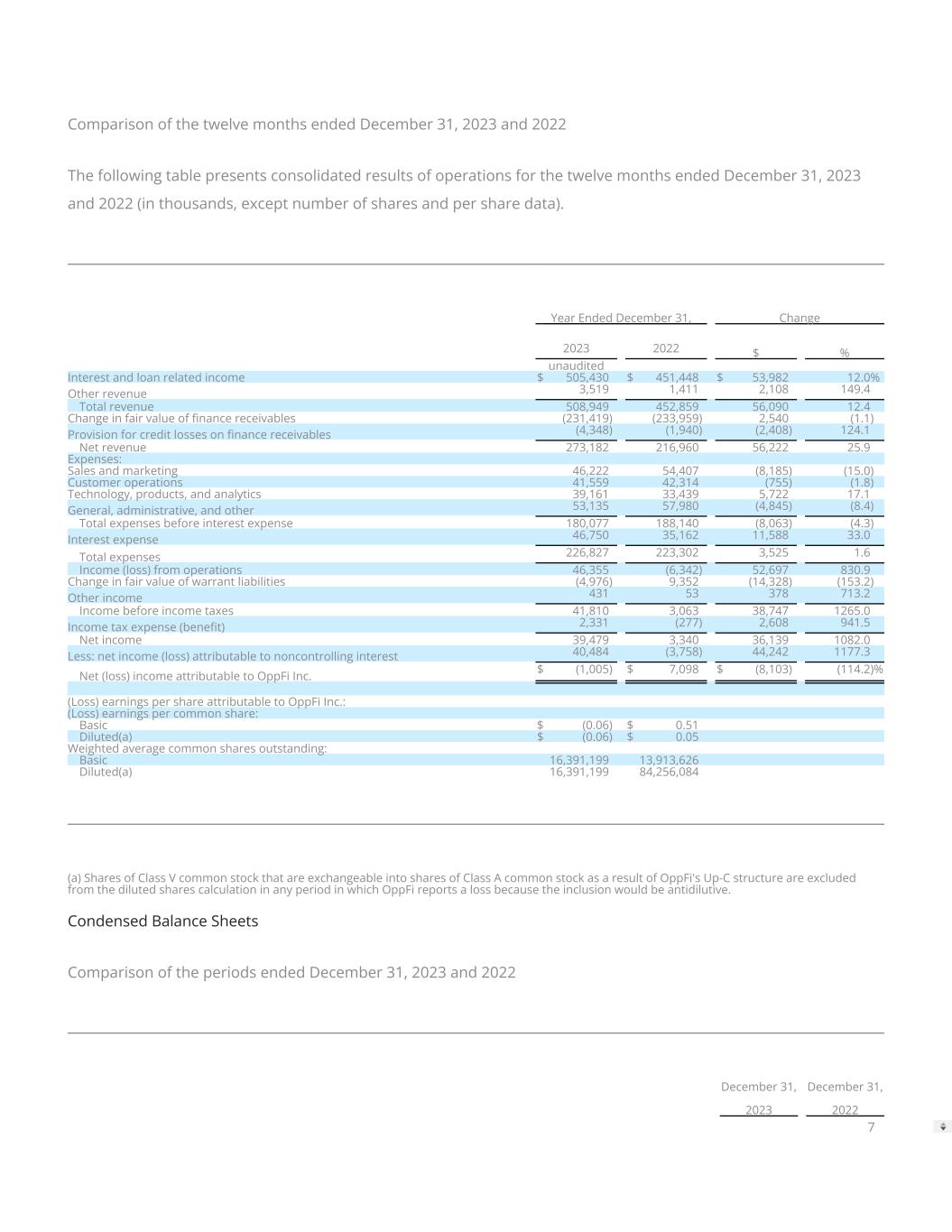

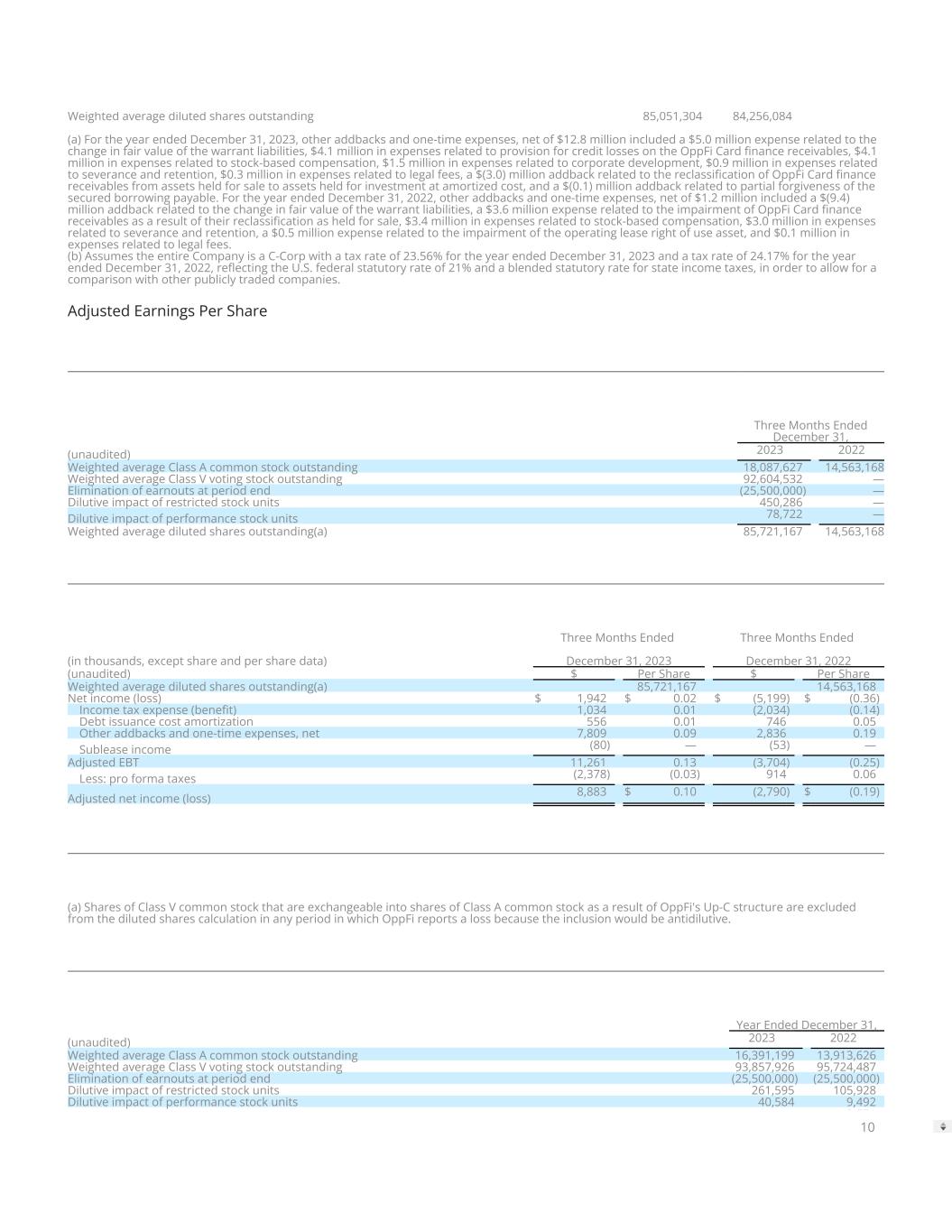

Weighted average diluted shares outstanding 85,051,304 84,256,084 (a) For the year ended December 31, 2023, other addbacks and one-time expenses, net of $12.8 million included a $5.0 million expense related to the change in fair value of the warrant liabilities, $4.1 million in expenses related to provision for credit losses on the OppFi Card �nance receivables, $4.1 million in expenses related to stock-based compensation, $1.5 million in expenses related to corporate development, $0.9 million in expenses related to severance and retention, $0.3 million in expenses related to legal fees, a $(3.0) million addback related to the reclassi�cation of OppFi Card �nance receivables from assets held for sale to assets held for investment at amortized cost, and a $(0.1) million addback related to partial forgiveness of the secured borrowing payable. For the year ended December 31, 2022, other addbacks and one-time expenses, net of $1.2 million included a $(9.4) million addback related to the change in fair value of the warrant liabilities, a $3.6 million expense related to the impairment of OppFi Card �nance receivables as a result of their reclassi�cation as held for sale, $3.4 million in expenses related to stock-based compensation, $3.0 million in expenses related to severance and retention, a $0.5 million expense related to the impairment of the operating lease right of use asset, and $0.1 million in expenses related to legal fees. (b) Assumes the entire Company is a C-Corp with a tax rate of 23.56% for the year ended December 31, 2023 and a tax rate of 24.17% for the year ended December 31, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted Earnings Per Share Three Months Ended December 31, (unaudited) 2023 2022 Weighted average Class A common stock outstanding 18,087,627 14,563,168 Weighted average Class V voting stock outstanding 92,604,532 — Elimination of earnouts at period end (25,500,000) — Dilutive impact of restricted stock units 450,286 — Dilutive impact of performance stock units 78,722 — Weighted average diluted shares outstanding(a) 85,721,167 14,563,168 (in thousands, except share and per share data) Three Months Ended December 31, 2023 Three Months Ended December 31, 2022 (unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding(a) 85,721,167 14,563,168 Net income (loss) $ 1,942 $ 0.02 $ (5,199) $ (0.36) Income tax expense (bene�t) 1,034 0.01 (2,034) (0.14) Debt issuance cost amortization 556 0.01 746 0.05 Other addbacks and one-time expenses, net 7,809 0.09 2,836 0.19 Sublease income (80) — (53) — Adjusted EBT 11,261 0.13 (3,704) (0.25) Less: pro forma taxes (2,378) (0.03) 914 0.06 Adjusted net income (loss) 8,883 $ 0.10 (2,790) $ (0.19) (a) Shares of Class V common stock that are exchangeable into shares of Class A common stock as a result of OppFi's Up-C structure are excluded from the diluted shares calculation in any period in which OppFi reports a loss because the inclusion would be antidilutive. Year Ended December 31, (unaudited) 2023 2022 Weighted average Class A common stock outstanding 16,391,199 13,913,626 Weighted average Class V voting stock outstanding 93,857,926 95,724,487 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 261,595 105,928 Dilutive impact of performance stock units 40,584 9,492 2 551 10

Dilutive impact of employee stock purchase plan — 2,551 Weighted average diluted shares outstanding 85,051,304 84,256,084 (in thousands, except share and per share data) Year Ended December 31, 2023 Year Ended December 31, 2022 (unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 85,051,304 84,256,084 Net income $ 39,479 $ 0.46 $ 3,340 $ 0.04 Income tax expense (bene�t) 2,331 0.03 (277) — Debt issuance cost amortization 2,428 0.03 2,372 0.03 Other addbacks and one-time expenses, net 12,790 0.15 1,180 0.01 Sublease income (318) — (53) — Adjusted EBT 56,710 0.67 6,562 0.08 Less: pro forma taxes (13,361) (0.16) (1,586) (0.02) Adjusted net income 43,349 $ 0.51 4,976 $ 0.06 Investor Relations: investors@opp�.com Media Relations: media@opp�.com Source: OppFi 11