Disclaimer 2 This presentation (the “Presentation”) of OppFi Inc. (“OppFi” or the “Company”) is for information purposes only. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Trademarks and trade names referred to in this Presentation are the property of their respective owners. The information contained herein does not purport to be all-inclusive. This Presentation does not constitute investment, tax, or legal advice. No representation or warranty, express or implied, is or will be given by the Company or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. The Company disclaims any duty to update the information contained in this Presentation, which information is given only as of the date of this Presentation unless otherwise stated herein. Forward-Looking Statements This Presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “possible,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward- looking. These forward-looking statements include, without limitation, the impact of the Bitty investment on OppFi's business, OppFi's ability to scale and grow the Bitty business, the small business financing market opportunity, the future performance of OppFi’s platform, and expectations for OppFi’s growth, new products, and future financial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside OppFi’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, inflation, interest rate changes, recessions, and tightening of credit markets on OppFi’s business; the impact of challenging macroeconomic and marketplace conditions on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s financing sources will continue to finance the purchase of participation rights in loans originated by OppFi’s bank partners in California; OppFi’s ability to scale and grow the Bitty business; the impact that events involving financial institutions or the financial services industry generally, such as actual concerns or events involving liquidity, defaults, or non-performance, may have on OppFi’s business; risks related to the material weakness in OppFi’s internal controls over financial reporting; the ability of OppFi to grow and manage growth profitably and retain its key employees; risks related to new products; risks related to evaluating and potentially consummating acquisitions; concentration risk; risks related to OppFi's ability to comply with various covenants in its corporate and warehouse credit facilities; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely affected by other economic, business, and/or competitive factors; risks related to management transitions; risks related to the restatement of OppFi’s financial statements and any accounting deficiencies or weaknesses related thereto; and other risks and uncertainties indicated from time to time in OppFi’s filings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. No Offer or Solicitation This Presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Website This Presentation contains reproductions and references to the Company’s website and mobile content. Website and mobile content are not incorporated into this Presentation. Any references to URLs for the websites are intended to be inactive textual references only.

3 • Many small businesses have difficulty accessing traditional bank loans, resulting in a significant supply-demand imbalance.1 • Recent upward trend in new business application filings, with 5.5 million in 2023, a 57% increase compared to 2019.4 1. The State of Small Business Now, U.S. Chamber of Commerce, April 2023. 2. CFPB Finalizes Rule to Create a New Data Set on Small Business Lending in America, Consumer Financial Protection Bureau, March 2023. 3. 2024 Report on Employer Firms: Findings From the 2023 Small Business Credit Survey, The Federal Reserve Banks, March 2024. 4. New Business Applications Surge Across the Country, U.S. Chamber of Commerce. February 2024. Small Business Financing Market Represents Significant Opportunity 33 Million+ Small Businesses in the United States 99.9% of Businesses in the U.S. Are Small Businesses 1 71% of medium to high credit risk small business applicants for a loan, line of credit, or merchant cash advance applied to a non-bank financing company, online lender, or community development financial institution (CDFI).3 Approximately $550 Billion in Annual Non- Bank and Online Lender Financing for Small Businesses2 61% of small business applicants cited “chance of being funded” as a reason for applying to an online lender.3 50% of small businesses that are “discouraged nonapplicants” cited lender requirements were too strict and/or that they were denied financing previously.3

4 Bitty: Financing Solutions for Underserved Small and Midsize Businesses (SMBs) Bitty is a credit access company that offers revenue-based financing and other working capital solutions $2,000-$250,000 Range of typical financing amounts facilitated by Bitty; $165 million of annual origination volume 1 $420+ Million Extended to 29,000+ Customers2 Scaled business with a history of organic growth and broad customer reach Experienced Leadership Led by entrepreneur and industry veteran Craig Hecker along with established team Aligned with OppFi’s Mission to Broaden Credit Access Focused on providing credit to underserved small businesses across America 25%+ Operating Margin1 Profitable business model with potential to expand margins through operating leverage 1. Based on trailing twelve months figures as of March 31, 2024. 2. Since July 2020 and as of March 31, 2024, including repeat customers.

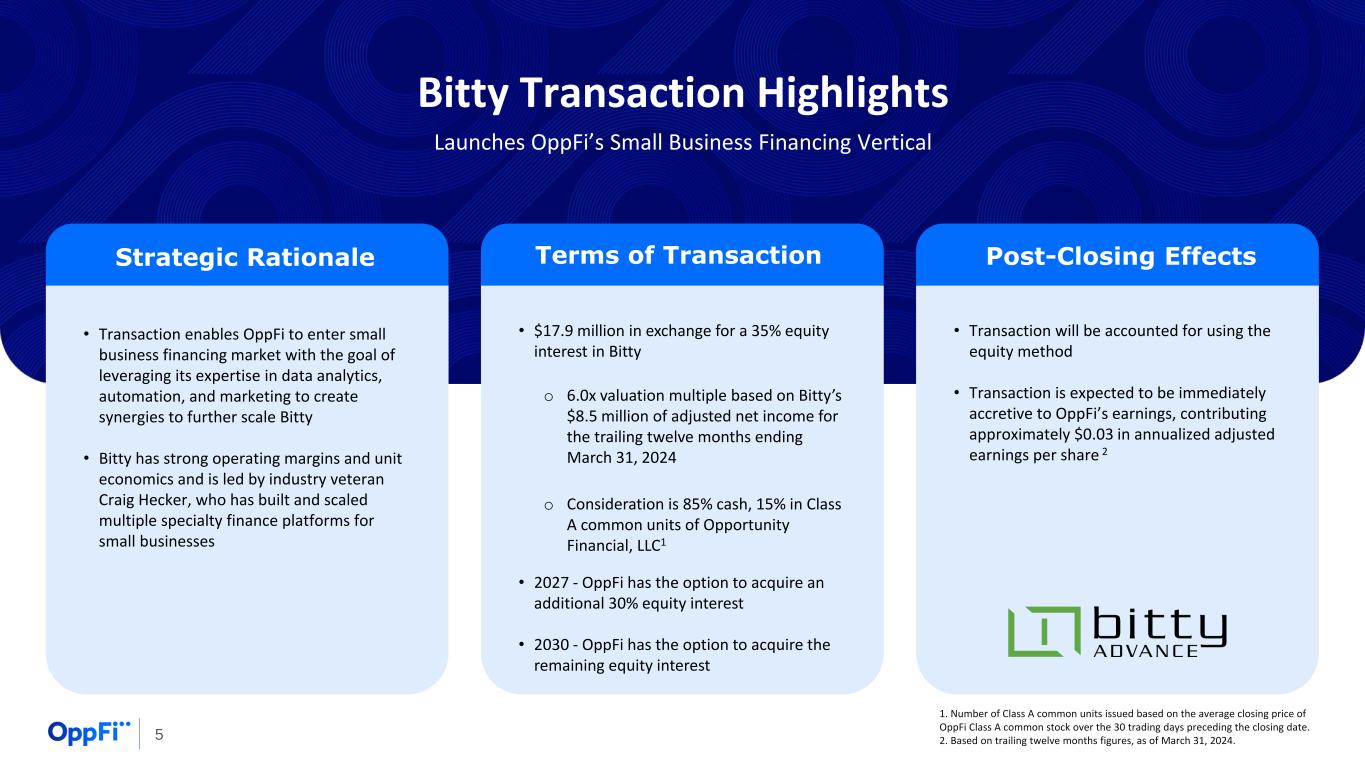

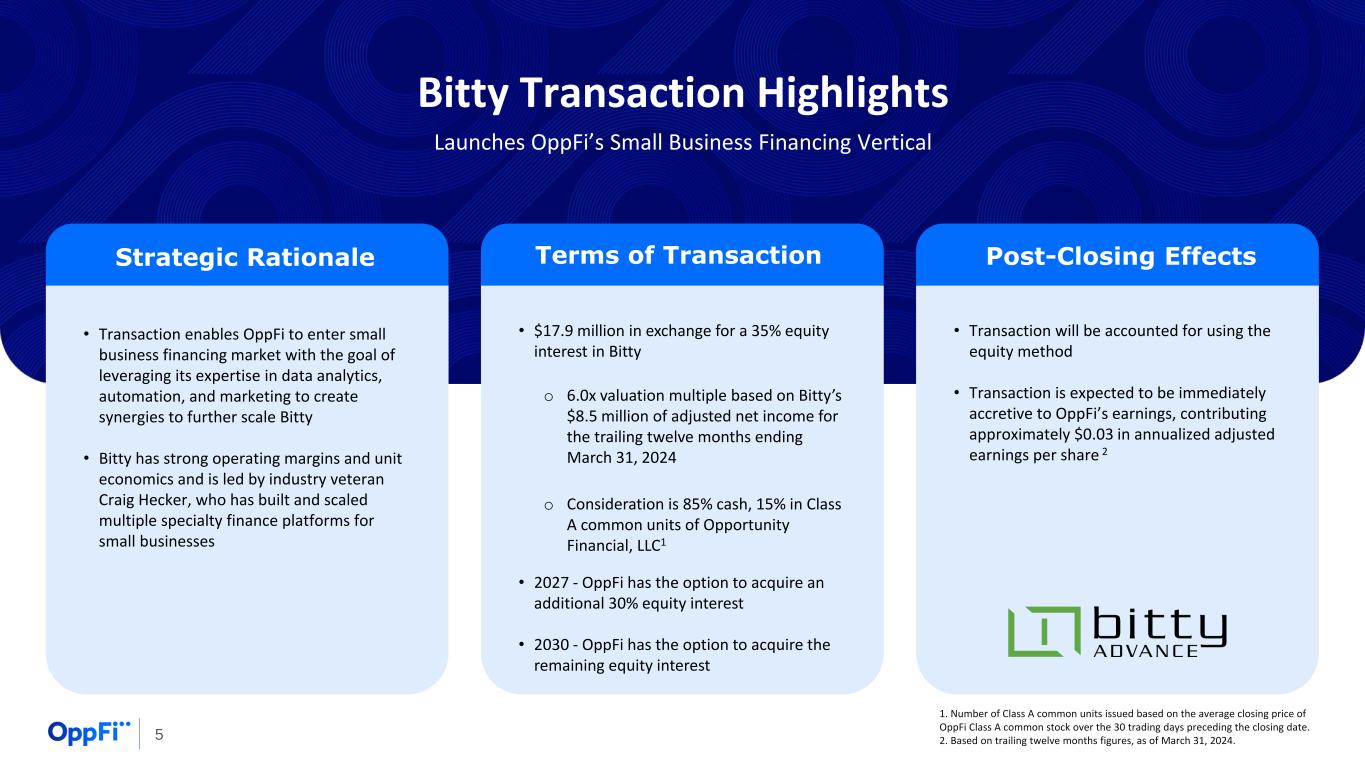

5 Bitty Transaction Highlights Launches OppFi’s Small Business Financing Vertical • $17.9 million in exchange for a 35% equity interest in Bitty o 6.0x valuation multiple based on Bitty’s $8.5 million of adjusted net income for the trailing twelve months ending March 31, 2024 o Consideration is 85% cash, 15% in Class A common units of Opportunity Financial, LLC1 • 2027 - OppFi has the option to acquire an additional 30% equity interest • 2030 - OppFi has the option to acquire the remaining equity interest • Transaction will be accounted for using the equity method • Transaction is expected to be immediately accretive to OppFi’s earnings, contributing approximately $0.03 in annualized adjusted earnings per share 2 • Transaction enables OppFi to enter small business financing market with the goal of leveraging its expertise in data analytics, automation, and marketing to create synergies to further scale Bitty • Bitty has strong operating margins and unit economics and is led by industry veteran Craig Hecker, who has built and scaled multiple specialty finance platforms for small businesses Strategic Rationale Terms of Transaction Post-Closing Effects 1. 1. Number of Class A common units issued based on the average closing price of OppFi Class A common stock over the 30 trading days preceding the closing date. 2. 2. Based on trailing twelve months figures, as of March 31, 2024.