Metromile Announces First Quarter 2022 Results SAN FRANCISCO, May 10, 2022 -- Metromile, Inc. (NASDAQ: MILE, MILEW), a leading digital insurance platform and pay-per-mile auto insurer, today announced its results for the first quarter ended March 31, 2022. “We were very pleased to cross the 100,000 Policies in Force milestone during the first quarter of 2022 and achieve a Run-Rate Premium of $116 million,” said Dan Preston, Chief Executive Officer of Metromile. “Loss ratios remained elevated during the quarter as industry- wide inflation in costs for bodily injury and physical damage claims persisted, but we continue to believe our rate filings will begin to counter these losses and improve our profitability this year. In addition, we remain on pace to close our transaction with Lemonade, pending regulatory approval, by the end of the second quarter. We are excited to join Lemonade and bring our customized and fairer insurance to millions of more drivers.” Q1 2022 Results, KPIs and Non-GAAP Financial Measures Policies in Force • Policies in Force as of March 31, 2022 were 101,294, a 6% increase compared to 95,958 at the end of the first quarter of 2021. Premium • Direct Earned Premium in the first quarter of 2022 was $28.1 million, an 8.9% increase from the prior-year period. Direct earned premium excludes the impact of premiums ceded to reinsurers. • Average Annual Premium per Policy, defined as Direct Earned Premium divided by the Average Policies in Force for the period, was $1,142 as of March 31, 2022, a 3.9% increase compared to $1,100 on March 31, 2021, due to more miles driven on a year- over-year basis. • Premium Run-Rate, defined as ending Policies in Force multiplied by Average Annual Premium per Policy, was $116 million as of March 31, 2022, a 9.6% increase compared to $106 million on March 31, 2021. Retention • As of March 31, 2022, one-year new customer retention was 56% for policies that completed their second term in the first quarter of 2022. We define one-year new customer retention as the percentage of new customers who remain with us after their first two policy terms, inclusive of all cancellation reasons.

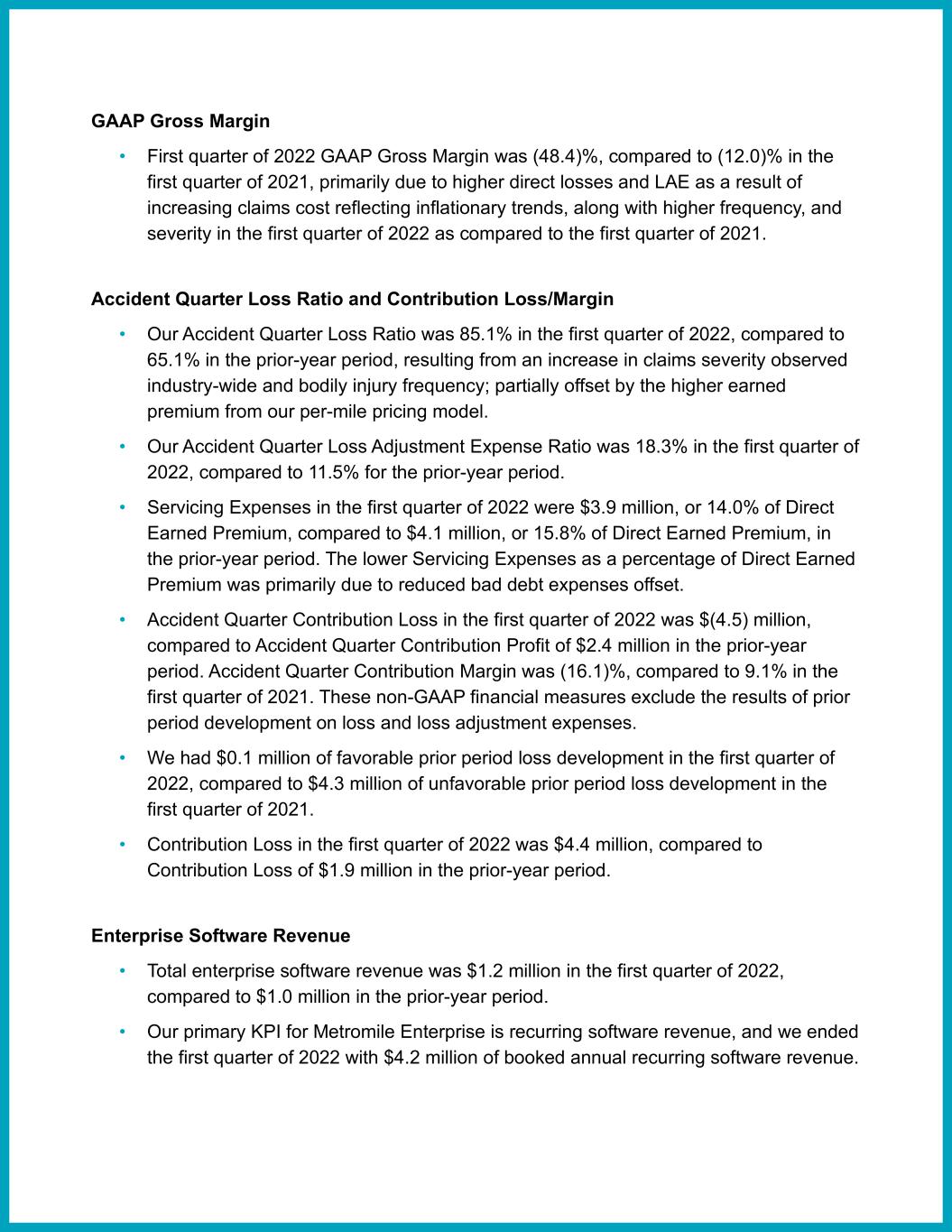

GAAP Gross Margin • First quarter of 2022 GAAP Gross Margin was (48.4)%, compared to (12.0)% in the first quarter of 2021, primarily due to higher direct losses and LAE as a result of increasing claims cost reflecting inflationary trends, along with higher frequency, and severity in the first quarter of 2022 as compared to the first quarter of 2021. Accident Quarter Loss Ratio and Contribution Loss/Margin • Our Accident Quarter Loss Ratio was 85.1% in the first quarter of 2022, compared to 65.1% in the prior-year period, resulting from an increase in claims severity observed industry-wide and bodily injury frequency; partially offset by the higher earned premium from our per-mile pricing model. • Our Accident Quarter Loss Adjustment Expense Ratio was 18.3% in the first quarter of 2022, compared to 11.5% for the prior-year period. • Servicing Expenses in the first quarter of 2022 were $3.9 million, or 14.0% of Direct Earned Premium, compared to $4.1 million, or 15.8% of Direct Earned Premium, in the prior-year period. The lower Servicing Expenses as a percentage of Direct Earned Premium was primarily due to reduced bad debt expenses offset. • Accident Quarter Contribution Loss in the first quarter of 2022 was $(4.5) million, compared to Accident Quarter Contribution Profit of $2.4 million in the prior-year period. Accident Quarter Contribution Margin was (16.1)%, compared to 9.1% in the first quarter of 2021. These non-GAAP financial measures exclude the results of prior period development on loss and loss adjustment expenses. • We had $0.1 million of favorable prior period loss development in the first quarter of 2022, compared to $4.3 million of unfavorable prior period loss development in the first quarter of 2021. • Contribution Loss in the first quarter of 2022 was $4.4 million, compared to Contribution Loss of $1.9 million in the prior-year period. Enterprise Software Revenue • Total enterprise software revenue was $1.2 million in the first quarter of 2022, compared to $1.0 million in the prior-year period. • Our primary KPI for Metromile Enterprise is recurring software revenue, and we ended the first quarter of 2022 with $4.2 million of booked annual recurring software revenue.

Operating Expense (R&D, G&A and Enterprise Costs) • Total operating expense, which excludes loss, loss adjustment expenses, marketing and sales, and variable costs associated with servicing policies, was $23.4 million in the first quarter of 2022, which includes $0.3 million of transaction-related expense, compared to $12.5 million in the prior-year period, driven primarily by increased staffing to support our growth initiatives and higher stock-based compensation expense. Acquisition Expense • Total marketing, sales, underwriting, and device costs were $8.2 million in the first quarter of 2022, compared to $8.5 million in the prior-year period. Reinsurance • Effective January 1, 2022, we entered into a new reinsurance quota share arrangement with Swiss Reinsurance America Corporation and Mapfre RE, Compania de Reaseguros S. A., ceding 30% of gross written premium through June 30, 2023. Available Liquidity • The Company's cash, cash equivalents, and highly liquid money market investments totaled $93.3 million as of March 31, 2022, including $2.4 million within the Metromile Enterprise entity. Conference Call Due to the pending transaction with Lemonade announced on November 8, 2021, the Company will not host a conference call in conjunction with its first quarter 2022 earnings release. Please visit the Investor Relations section of the Company’s website at http://ir.metromile.com for the latest releases and information. About Metromile Metromile (NASDAQ: MILE, MILEW) is a leading digital insurance platform in the United States. With data science as its foundation, Metromile offers real-time, personalized auto insurance policies by the mile instead of the industry’s reliance on approximations that have historically made prices unfair. Metromile’s digitally native offering is built around the modern driver’s needs, featuring automated claims, complimentary smart driving features and annual average savings of 47% over what they were paying their previous auto insurer. In addition, through Metromile Enterprise, it licenses its technology platform to insurance companies around the world. This cloud-based software as a service enables carriers to operate with greater efficiency, automate claims to expedite resolution, reduce losses associated with fraud, and unlock the productivity of employees.

For more information about Metromile, visit www.metromile.com and enterprise.metromile.com. Stay connected with us on LinkedIn and Twitter Media Inquiries: press@metromile.com Investor Relations: IR@metromile.com Non-GAAP Financial Measures This press release contains information relating to contribution profit/(loss), accident quarter contribution profit/(loss), contribution margin, accident quarter contribution margin, adjusted revenue, and accident period loss ratio excluding catastrophe-related losses. The non-GAAP financial measures below have not been calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) and should be considered in addition to results prepared in accordance with GAAP and should not be considered as a substitute for or superior to GAAP results. In addition, contribution profit/(loss), accident quarter contribution profit/(loss), contribution margin, accident quarter contribution margin, accident quarter loss adjustment expense ratio and accident period loss ratio excluding catastrophe-related losses should not be construed as indicators of our operating performance, liquidity, or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that these non- GAAP measures fail to address. We caution investors that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Therefore, its use can make it difficult to compare our current results with our results from other reporting periods and with the results of other companies. Our management uses these non-GAAP financial measures, in conjunction with GAAP financial measures, as an integral part of managing our business and to, among other things: (1) monitor and evaluate the performance of our business operations and financial performance; (2) facilitate internal comparisons of the historical operating performance of our business operations; (3) facilitate external comparisons of the results of our overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (4) review and assess the operating performance of our management team; (5) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (6) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. For more information regarding the non-GAAP financial measures discussed in this press release, please see “Reconciliation of GAAP to non-GAAP financial measures” below.

Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” or the negative of such terms or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the proposed acquisition involving us and Lemonade, and/or the combined group’s estimated or anticipated future business, performance and financial condition, including forecasts, targets and plans following the acquisition, if completed, for the combined entity, as well as our future financial performance, including with respect to our progress on growth initiatives, and our expectation that our rate filings in progress will address higher losses and improve profitability over the course of 2022. Any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activities, performance or achievements expressed or implied by such forward-looking statements, including, but not limited to, the possibility the proposed acquisition of us by Lemonade will not be completed, failure to obtain necessary regulatory approvals or to satisfy any of the other conditions to the proposed acquisition, adverse effects on the market price of Metromile’s or Lemonade’s shares of common stock and on Metromile’s and Lemonade’s operating results because of a failure to complete the proposed acquisition, failure to realize the expected benefits of the proposed acquisition, failure to promptly and effectively integrate Metromile’s businesses, negative effects relating to the announcement of the proposed acquisition or any further announcements relating to the proposed acquisition or the consummation of the proposed acquisition on the market price of Metromile’s or Lemonade’s shares of common stock, significant transaction costs and/or unknown or inestimable liabilities, potential litigation associated with the proposed acquisition, general economic and business conditions that affect the combined companies following the consummation of the proposed acquisition, changes in global, political, economic, business, competitive, market and regulatory forces, future exchange and interest rates, changes in tax laws, regulations, rates and policies, future business acquisitions or disposals and competitive developments; our financial and business performance may be different from what we expect due to circumstances outside of our control; the implementation, market acceptance and success of our business model; our ability to scale in a cost-effective manner; developments and projections relating to our competitors and industry; the impact of health epidemics, including

the COVID-19 pandemic, on our business and the actions we may take in response thereto; our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others; our future capital requirements and sources and uses of cash; our ability to obtain funding for future operations; our business, expansion plans and opportunities; and the outcome of any known and unknown litigation and regulatory proceedings. These and other important factors are discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2022 and in our other filings with the SEC. While we may elect to update or revise such forward-looking statements at some point in the future, we disclaim any obligation to do so.

Consolidated Balance Sheets (In thousands, except share and per share amounts) March 31, 2022 December 31, 2021 (unaudited) Assets Investments Marketable securities - restricted (amortized cost of $67,613 and $62,741) $ 67,149 $ 62,625 Total investments 67,149 62,625 Cash and cash equivalents 84,339 120,940 Restricted cash and cash equivalents 31,978 42,881 Receivable for securities 6,551 — Premiums receivable 18,522 16,839 Reinsurance recoverable on paid loss 2,694 — Reinsurance recoverable on unpaid loss 4,408 — Prepaid reinsurance premium 359 — Prepaid expenses and other assets 27,416 21,677 Deferred policy acquisition costs, net 1,204 1,433 Telematics devices, improvements and equipment, net 12,169 13,654 Website and software development costs, net 21,971 25,866 Intangible assets 7,500 7,500 Assets held for sale 9,253 — Total assets $ 295,513 $ 313,415 Liabilities, Convertible Preferred Stock and Stockholders’ Deficit Liabilities Loss and loss adjustment expense reserves $ 76,916 $ 73,438 Ceded reinsurance premium payable 8,798 — Payable to carriers - premiums and LAE, net 315 340 Unearned premium reserve 16,924 15,726 Deferred revenue — 5,601 Accounts payable and accrued expenses 8,421 10,820 Payable for securities — 422 Warrant liability 1,025 1,156 Other liabilities 19,319 19,524 Liabilities held for sale 6,156 — Total liabilities 137,874 127,027 Commitments and contingencies (Note 8) Stockholders’ equity Common stock, $0.0001 par value; 640,000,000 shares authorized as of March 31, 2022, and December 31, 2021; 130,183,262 and 128,221,885 shares issued and outstanding as of March 31, 2022 and December 31, 2021. 13 13 Accumulated paid-in capital 775,443 769,525 Accumulated other comprehensive loss (464) (116) Accumulated deficit (617,353) (583,034) Total stockholders' equity 157,639 186,388 Total liabilities, convertible preferred stock and stockholders’ equity $ 295,513 $ 313,415

Consolidated Statements of Operations (In thousands, except share and per share amounts) Three Months Ended March 31, 2022 2021 Revenue (unaudited) Premiums earned, net $ 19,165 $ 1,125 Investment income 45 36 Other revenue 1,489 16,115 Total revenue 20,699 17,276 Costs and expenses Losses and loss adjustment expenses 22,060 12,263 Policy servicing expense and other 5,283 4,443 Sales, marketing and other acquisition costs 6,459 47,294 Research and development 4,277 3,650 Amortization of capitalized software 3,368 2,651 Other operating expenses 13,702 8,589 Total costs and expenses 55,149 78,890 Loss from operations (34,450) (61,614) Other expense Interest expense — 15,876 (Decrease) increase in fair value of stock warrant liability (131) 26,137 Total other expense (131) 42,013 Loss before taxes (34,319) (103,627) Income tax benefit — — Net loss $ (34,319) $ (103,627) Net loss per share, basic and diluted $ (0.27) $ (1.37) Weighted-average shares used in computing basic and diluted net loss per share 128,715,031 75,791,557

Consolidated Statements of Cash Flows (In thousands) Three Months Ended March 31, 2022 2021 (unaudited) Cash flows from operating activities: Net loss $ (34,319) $ (103,627) Adjustments to reconcile net loss to cash used in operating activities: Depreciation and amortization 5,255 4,023 Stock-based compensation 5,258 3,208 Change in fair value of warrant liability (131) 26,137 Telematics devices unreturned 244 265 Amortization of debt issuance costs — 11,695 Noncash interest and other expense 638 3,752 Changes in operating assets and liabilities: Premiums receivable (1,683) (2,678) Reinsurance recoverable on paid loss (2,694) 5,707 Reinsurance recoverable on unpaid loss (4,408) 25,247 Prepaid reinsurance premium (359) 7,351 Prepaid expenses and other assets (7,443) (2,972) Deferred transaction costs — 3,581 Deferred policy acquisition costs, net (54) (1,437) Accounts payable and accrued expenses (1,939) 1,400 Ceded reinsurance premium payable 8,798 (15,765) Loss and loss adjustment expense reserves 3,478 4,488 Payable to carriers - premiums and LAE, net (25) 47 Unearned premium reserve 1,198 2,189 Deferred revenue 305 (649) Other liabilities (100) (1,325) Net cash used in operating activities (27,981) (29,363) Cash flows from investing activities: Purchases of telematics devices, improvements, and equipment (12) (126) Payments relating to capitalized website and software development costs (5,188) (1,551) Net change in payable/(receivable) for securities (6,973) 822 Purchase of securities (11,970) (4,211) Sales and maturities of marketable securities 7,013 5,805 Net cash (used in) provided by investing activities (17,130) 739 Cash flow from financing activities: Proceeds from notes payable — 2,015 Payment on notes payable — (69,351) Proceeds from merger with INSU II, net of issuance costs — 336,469 Proceeds from exercise of common stock options and warrants — 4,349 Net cash provided by financing activities — 273,482 Net (decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents including cash classified within assets held for sale (45,111) 244,858 Less: Net increase in cash classified within assets held for sale 2,393 — Net (decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents (47,504) 244,858 Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period 163,821 50,188 Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period $ 116,317 $ 295,046 Supplemental cash flow data: Cash paid for interest $ — $ 3,164 Non-cash investing and financing transactions: Transaction costs in accrued liabilities at period end $ — $ 2,598 Warrants assumed from Business Combination $ — $ 45,516 Net exercise of preferred stock warrants $ — $ 56,160 Net exercise of promissory note $ — $ 415 Capitalized website and software development costs included in accrued liabilities $ 231 $ 137 Capitalized stock-based compensation $ 758 $ 171 Reclassification of liability to equity for vesting of stock options $ 107 $ 284

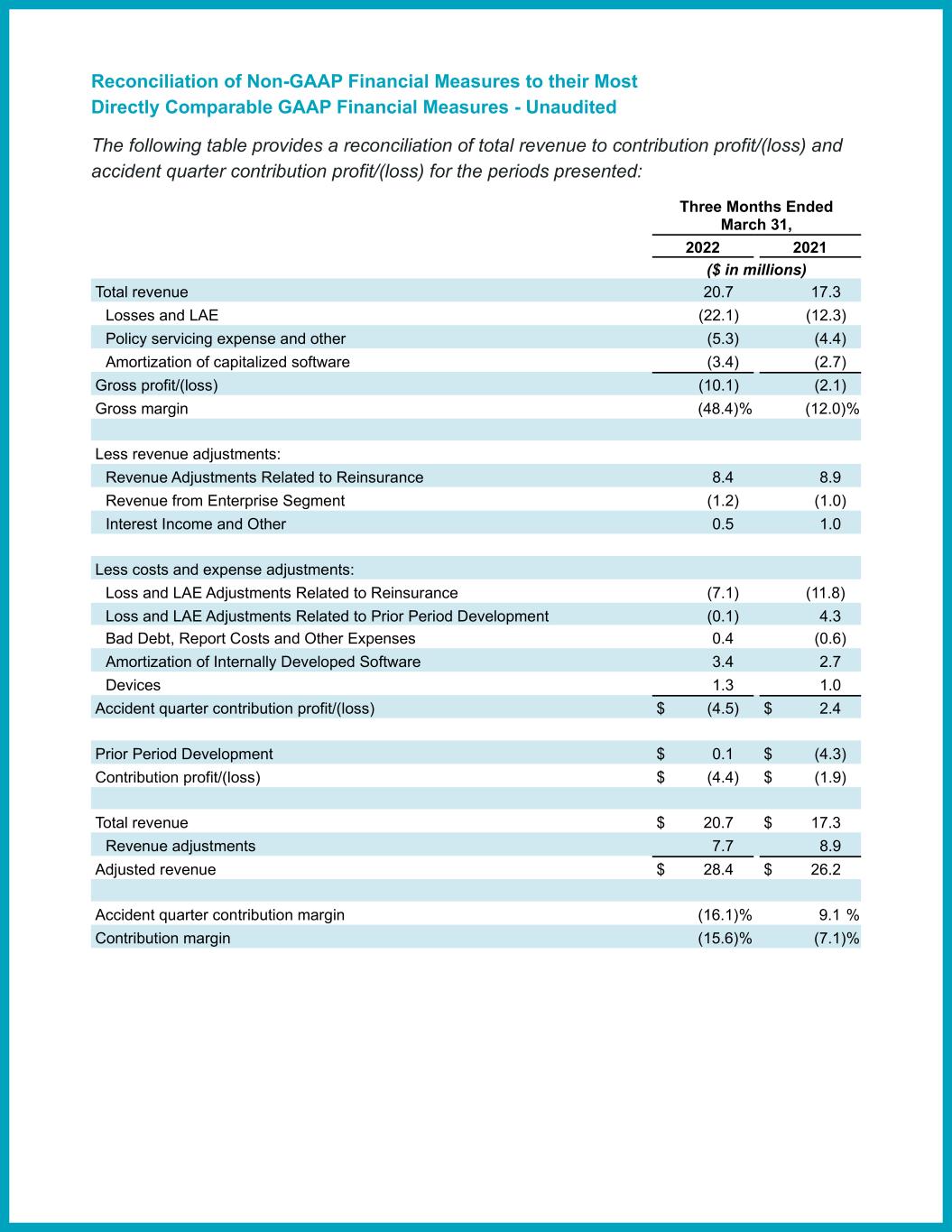

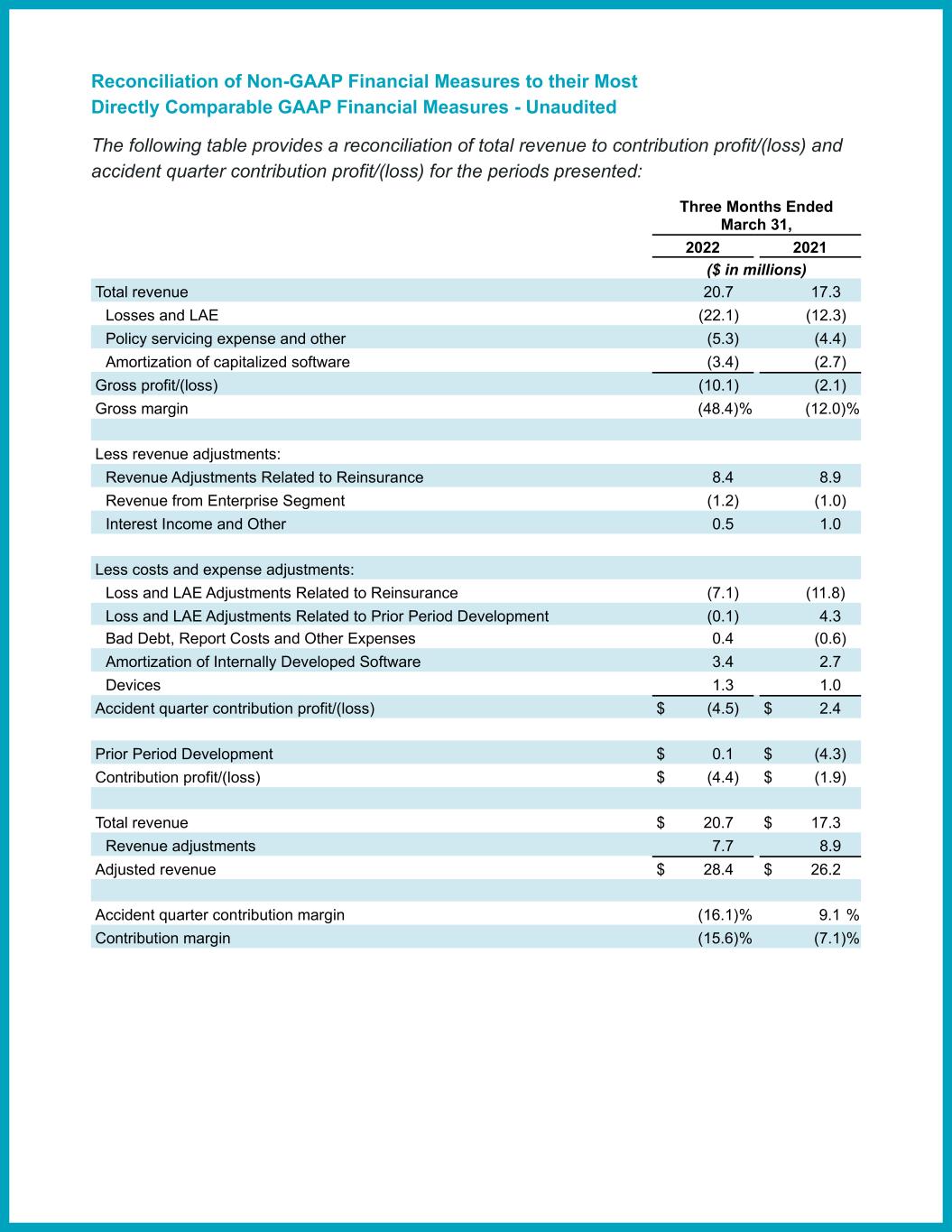

Reconciliation of Non-GAAP Financial Measures to their Most Directly Comparable GAAP Financial Measures - Unaudited The following table provides a reconciliation of total revenue to contribution profit/(loss) and accident quarter contribution profit/(loss) for the periods presented: Three Months Ended March 31, 2022 2021 ($ in millions) Total revenue 20.7 17.3 Losses and LAE (22.1) (12.3) Policy servicing expense and other (5.3) (4.4) Amortization of capitalized software (3.4) (2.7) Gross profit/(loss) (10.1) (2.1) Gross margin (48.4) % (12.0) % Less revenue adjustments: Revenue Adjustments Related to Reinsurance 8.4 8.9 Revenue from Enterprise Segment (1.2) (1.0) Interest Income and Other 0.5 1.0 Less costs and expense adjustments: Loss and LAE Adjustments Related to Reinsurance (7.1) (11.8) Loss and LAE Adjustments Related to Prior Period Development (0.1) 4.3 Bad Debt, Report Costs and Other Expenses 0.4 (0.6) Amortization of Internally Developed Software 3.4 2.7 Devices 1.3 1.0 Accident quarter contribution profit/(loss) $ (4.5) $ 2.4 Prior Period Development $ 0.1 $ (4.3) Contribution profit/(loss) $ (4.4) $ (1.9) Total revenue $ 20.7 $ 17.3 Revenue adjustments 7.7 8.9 Adjusted revenue $ 28.4 $ 26.2 Accident quarter contribution margin (16.1) % 9.1 % Contribution margin (15.6) % (7.1) %

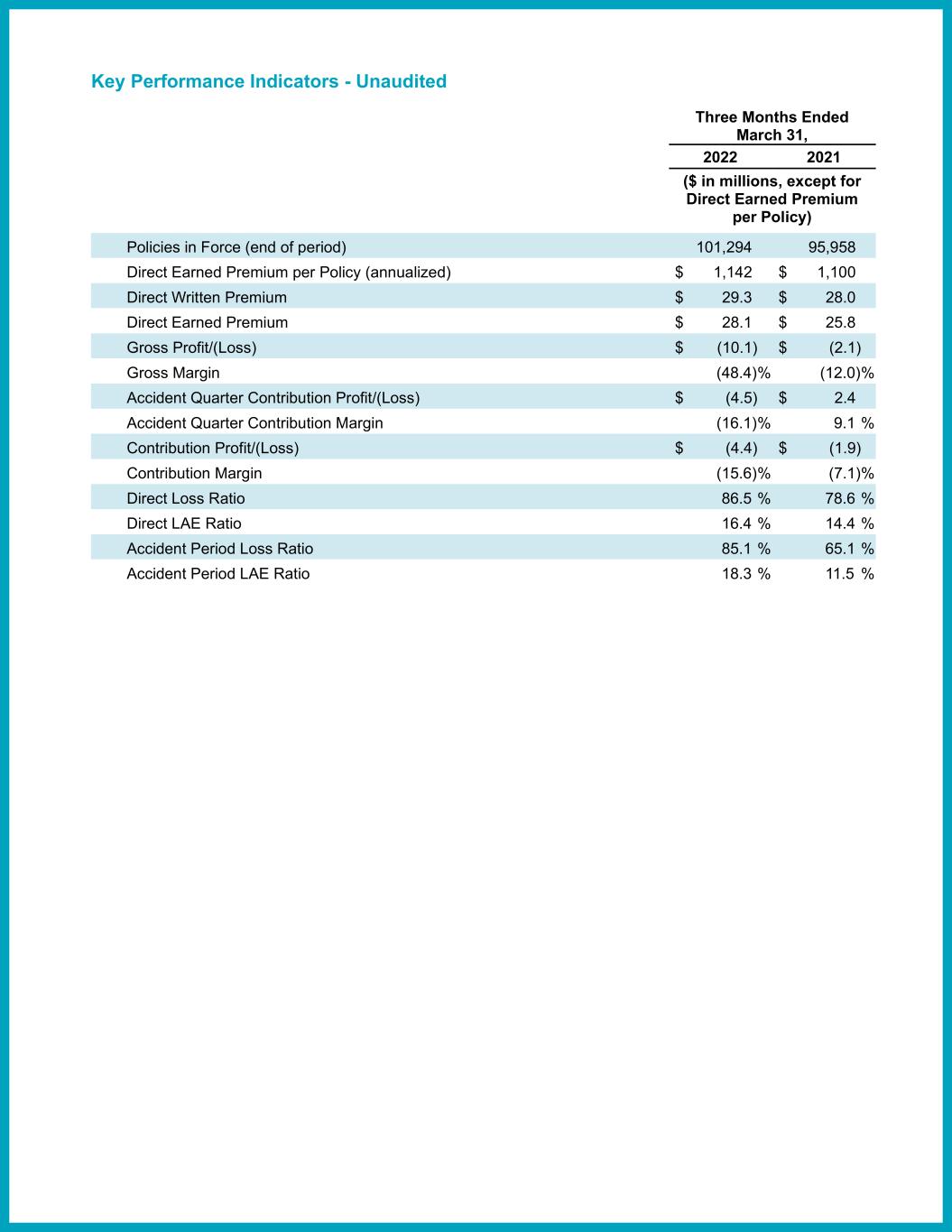

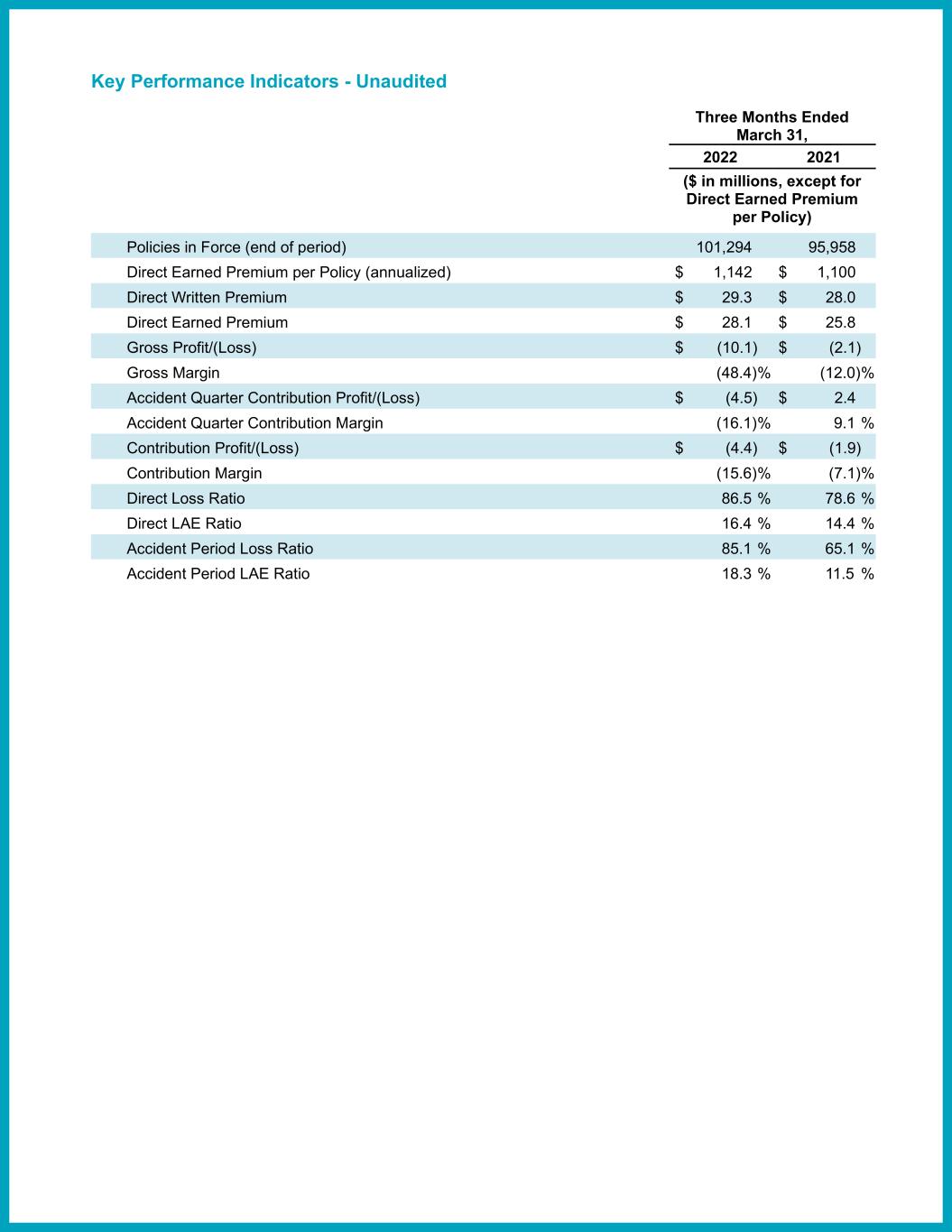

Key Performance Indicators - Unaudited Three Months Ended March 31, 2022 2021 ($ in millions, except for Direct Earned Premium per Policy) Policies in Force (end of period) 101,294 95,958 Direct Earned Premium per Policy (annualized) $ 1,142 $ 1,100 Direct Written Premium $ 29.3 $ 28.0 Direct Earned Premium $ 28.1 $ 25.8 Gross Profit/(Loss) $ (10.1) $ (2.1) Gross Margin (48.4) % (12.0) % Accident Quarter Contribution Profit/(Loss) $ (4.5) $ 2.4 Accident Quarter Contribution Margin (16.1) % 9.1 % Contribution Profit/(Loss) $ (4.4) $ (1.9) Contribution Margin (15.6) % (7.1) % Direct Loss Ratio 86.5 % 78.6 % Direct LAE Ratio 16.4 % 14.4 % Accident Period Loss Ratio 85.1 % 65.1 % Accident Period LAE Ratio 18.3 % 11.5 %