Introductory Note

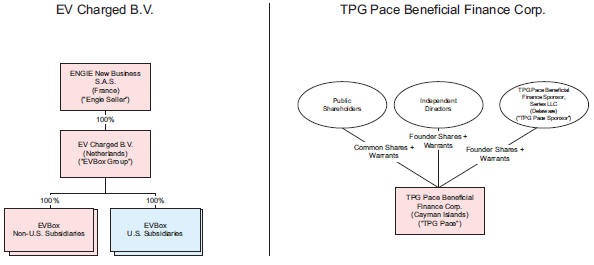

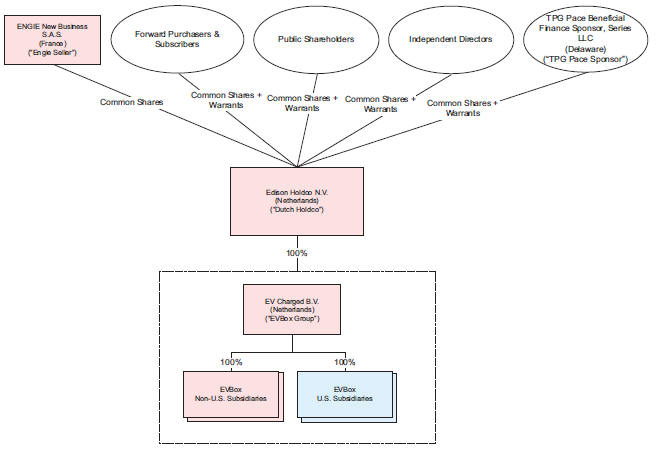

As previously announced, on December 10, 2020, TPG Pace Beneficial Finance Corp., an exempted company incorporated in the Cayman Islands with limited liability under company number 353463 (the “Company”), Edison Holdco B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) and wholly owned subsidiary of the Company (“Dutch Holdco”), New TPG Pace Beneficial Finance Corp., an exempted company incorporated in the Cayman Islands with limited liability under company number 368739 and wholly owned subsidiary of Dutch Holdco (“New SPAC”), ENGIE New Business S.A.S., a société par actions simplifiée organized and existing under the laws of France (“Engie Seller”) and EV Charged B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (“EVBox Group”), entered into a Business Combination Agreement (the transactions contemplated thereby, the “Business Combination”), pursuant to which, among other things, the Company will merge with and into New SPAC, with New SPAC surviving as a wholly owned subsidiary of Dutch Holdco, and immediately thereafter, Engie Seller will, directly or indirectly, sell, transfer, assign, convey or contribute to Dutch Holdco all of the issued and outstanding equity interests in EVBox Group.

Item 7.01 Regulation FD Disclosure

On March 24, 2021, the Company announced in a joint press release that Dutch Holdco confidentially submitted a draft registration statement on Form F-4 (the “Confidential Submission”) relating to the Business Combination with the Securities and Exchange Commission (the “SEC”). A copy of the press release is furnished as Exhibit 99.1 hereto.

On March 24, 2021, the Company provided information regarding the proposed Business Combination in an investor presentation, a copy of which is furnished as Exhibit 99.2 hereto.

In addition, the Company has set forth below certain updated disclosures regarding the proposed Business Combination and the business of EVBox Group.

* * * * *

Parties to the Business Combination

Dutch Holdco

Dutch Holdco is a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) and a direct wholly owned subsidiary of TPG Pace that was incorporated on December 2, 2020. Dutch Holdco is considered a foreign private issuer as defined in Rule 3b-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To date, Dutch Holdco has not conducted any material activities other than those incident to its formation and the Business Combination. Prior to the consummation of the Business Combination, Dutch Holdco will be converted to a Dutch public limited liability company (naamloze vennootschap) and its name will be changed to EVBox Group N.V. Upon the closing of the Business Combination, the Dutch Holdco Shares and Dutch Holdco Public Warrants will be registered under the Exchange Act and listed on the NYSE under the symbols “EVB” and “EVB WS,” respectively.

The mailing address of Dutch Holdco’s principal executive office prior to the closing of the Business Combination is Strawinskylaan 1209, 1077 XX Amsterdam, the Netherlands. The mailing address of Dutch Holdco’s principal executive office after the closing of the Business Combination will be Kabelweg 47, 1014 BA Amsterdam, the Netherlands.

TPG Pace

TPG Pace is a blank check company incorporated as a Cayman Islands exempted company on July 11, 2019 and formed for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more target businesses. TPG Pace consummated the TPG Pace IPO on October 9, 2020, generating gross proceeds of approximately $350,000,000. Substantially concurrently with the consummation of the TPG Pace IPO, TPG Pace completed the private sale of the TPG Pace Founder Warrants at a purchase price of $1.50 per TPG Pace Founder Warrant, to TPG Pace Sponsor, generating gross proceeds to TPG Pace of approximately $9,000,000. A total of $350,000,000, comprised of $343,000,000 of the proceeds from the TPG Pace IPO, including approximately $12,250,000 of the underwriters’ deferred discount, and $7,000,000 of the proceeds of the sale of the TPG Pace Founder Warrants, were placed in a trust account maintained by Continental Stock Transfer & Trust Company, acting as trustee.

TPG Pace’s securities are traded on the NYSE under the ticker symbols “TPGY,” “TPGY.U” and “TPGY WS.” Upon the closing of the Business Combination, the TPG Pace securities will be delisted from the NYSE.

The mailing address of TPG Pace’s principal executive office is 301 Commerce Street, Suite 3300, Fort Worth, Texas 76102.