- UP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Wheels Up Experience (UP) 425Business combination disclosure

Filed: 16 Apr 21, 9:00am

Filed by Aspirational Consumer Lifestyle Corp. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Wheels Up Partners Holdings LLC Commission File No. 001-39541 DEMOCRATIZING PRIVATE AVIATION KENNY DICHTER FOUNDER & CEO

DISCLAIMER CONFIDENTIALITY AND DISCLOSURES This presentation has been prepared for use by Aspirational Consumer Lifestyle Corp. (“Aspirational”) and Wheels Up Partners Holdings LLC (“Wheels Up”) in connection with their proposed business combination. This presentation is for information purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in Aspirational and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Aspirational and Wheels Up. Neither Aspirational nor Wheels Up makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. The information in this presentation and any oral statements made in connection with this presentation is subject to change and is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Aspirational and is not intended to form the basis of any investment decision in Aspirational. This presentation does not constitute either advice or a recommendation regarding any securities. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own decisions and perform your own independent investment and analysis of an investment in Aspirational and the transactions contemplated in this presentation. This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Wheels Up and Aspirational. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Aspirational’s securities, (ii) the risk that the transaction may not be completed by Aspirational’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Aspirational, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of that certain Agreement and Plan of Merger, dated as of February 1, 2021 (the “Merger Agreement”), by and among Aspirational, Wheels Up, KittyHawk Merger Sub LLC, a Delaware limited liability corporation and a direct wholly owned subsidiary of Aspirational, Wheels Up Blocker Sub LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Aspirational, the Blocker Merger Subs (as defined in the Merger Agreement) and the Blockers (as defined in the Merger Agreement), by the shareholders of Aspirational, the satisfaction of the minimum trust account amount following redemptions by Aspirational’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the transaction, (v) the inability to complete the PIPE investment in connection with the transaction, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vii) the effect of the announcement or pendency of the transaction on Wheels Up’s business relationships, operating results and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of Wheels Up and potential difficulties in Wheels Up employee retention as a result of the transaction, (ix) the outcome of any legal proceedings that may be instituted against Wheels Up or against Aspirational related to the Merger Agreement or the transaction, (x) the ability to maintain the listing of the Aspirational’s securities a national securities exchange, (xi) the price of Aspirational’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Aspirational plans to operate or Wheels Up operates, variations in operating performance across competitors, changes in laws and regulations affecting Aspirational’s or Wheels Up’s business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive aviation industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Aspirational’s registration statement on Form S-1 (File No. 333-248592), the registration statement on Form S-4 discussed below and other documents filed by Aspirational from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Wheels Up and Aspirational assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Wheels Up nor Aspirational gives any assurance that either Wheels Up or Aspirational or the combined company will achieve its expectations. SPECULATIVE INVESTMENT An investment in Aspirational’s equity interests is a speculative investment involving a high degree of risk. There is no guarantee that you will realize any gain from this investment, and you could lose the total amount of your investment. No federal or state agency has made any finding or determination regarding the fairness of the sale of equity interests to which this presentation relates, or any recommendation or endorsement thereof. The risks related to the business of Wheels Up and associated with a potential investment in Aspirational’s equity interests presented below are only certain of the general risks related to the business of Wheels Up, and such list is not exhaustive. • COVID-19 has adversely affected Wheels Up’s business and may continue to do so. • Wheels Up may fail to successfully execute its business, marketing and other strategies. • Wheels Up’s expansion of existing service offerings or its launch of new service offerings may consume significant financial and other resources and may not achieve the desired results. • Wheels Up’s ability to grow complementary service offerings may be limited, which could negatively impact its growth rate and financial performance. • Wheels Up’s business depends on a strong brand, and if it is unable to enhance and maintain the reputation of its brand and flight experience, Wheels Up’s ability to expand its customer base will be impaired. • Wheels Up may be unable to attract new customers and/or retain existing customers. • Wheels Up has historically relied on the purchase of pre-paid flight funds by its customers as a source of capital to fund its operations. Customer preferences may change, resulting in a significant decrease in such pre-purchased funds or an increase in the rate at which Wheels Up’s customers utilize their pre-paid funds. This could result in liquidity needs that would require Wheels Up to seek alternate sources of capital, including additional financings, which may not be available. • Wheels Up may need additional capital to finance strategic investments and operations, pursue its business objectives and respond to business opportunities, challenges or unforeseen circumstances, and Wheels Up cannot be sure that additional financing will be available. • Wheels Up has a history of incurring operating losses, and it may not achieve or maintain profitability in the future. • Wheels Up operates in a competitive market and it may lose customers to its competitors. • Wheels Up’s inability to comply with the terms of any of its secured credit facilities may adversely affect its business and, in some limited instances, result in recourse to it when the value of the assets securing the facility are insufficient to cover the amounts owed to the lenders. • Wheels Up’s historical growth rates may not be reflective of its future growth. • Wheels Up may fail to effectively and timely integrate acquisitions into its existing business. • A significant failure of systems and technology Wheels Up uses to operate its business and/or that it offers to others may occur. • Wheels Up relies on the continued service of its senior management and other key individuals, particularly its founder and Chief Executive Officer, Kenny Dichter, and Wheels Up may not be able to attract, integrate, manage and retain, other qualified personnel or key employees. • A noteworthy accident or incident involving Wheels Up’s aircraft or brand could occur and adversely impact its brand and its business. • Wheels Up’s business and operating results may be significantly impacted by general economic conditions, the health of the U.S. aviation industry and risks associated with Wheels Up’s aviation assets. • Litigation or investigations involving Wheels Up could result in material settlements, fines or penalties and may adversely affect Wheels Up’s business, financial condition and results of operations. • Existing or new adverse regulations or interpretations thereof applicable to Wheels Up’s industry may restrict its ability to expand or to operate its business as it wishes and may expose Wheels Up to fines and other penalties. • Wheels Up’s business is concentrated in certain geographic markets. Exposure to local economies, regional downturns or severe weather or catastrophic occurrences or other disruptions or events may materially adversely affect Wheels Up’s financial condition and results of operations. • The occurrence of geopolitical events such as war, terrorism, civil unrest, political instability, environmental or climatic factors, natural disaster, pandemic or epidemic outbreak, public health crisis and general economic conditions may have an adverse effect on Wheels Up’s business. • Some of Wheels Up’s potential losses may not be covered by insurance. Wheels Up may be unable to obtain or maintain adequate insurance coverage. • Wheels Up is potentially subject to taxation-related risks in multiple jurisdictions, and changes in U.S. tax laws, in particular, could have a material adverse effect on Wheels Up’s business, cash flow, results of operations or financial condition. WHEELS UP 2

USE OF PROJECTIONS AND ILLUSTRATIVE PRESENTATIONS The financial projections, estimates, targets and illustrative presentations in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Aspirational’s and Wheels Up’s control. While all financial projections, estimates, targets and illustrative presentations are necessarily speculative, Aspirational and Wheels Up believe that the preparation of prospective or illustrative financial information involves increasingly higher levels of uncertainty the further out the projection, estimate, target or illustrative presentation extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates, targets and illustrative presentations in this presentation should not be regarded as an indication that Aspirational and Wheels Up, or their representatives, considered or consider the financial projections, estimates, targets and illustrative presentations to be a reliable prediction of future events. Further, illustrative presentations are not necessarily based on management projections, estimates, expectations or targets but are presented for illustrative purposes only. USE OF DATA The data contained herein is derived from various internal and external sources. All of the market data in the presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Aspirational and Wheels Up assume no obligation to update the information in this presentation. USE OF NON-GAAP FINANCIAL METRICS This presentation includes certain non-GAAP financial measures (including on a forward-looking basis) such as Adjusted EBITDA, Adjusted EBITDA Margin and Contribution Margin. These non-GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Wheels Up believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Wheels Up. Wheels Up’s management uses forward-looking non-GAAP measures to evaluate Wheels Up’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in Wheels Up’s financial measures. In addition, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Wheels Up’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. TRADEMARKS Aspirational and Wheels Up own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to express, and does not imply, a relationship with Aspirational or Wheels Up, or an endorsement or sponsorship by or of Aspirational or Wheels Up. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Aspirational or Wheels Up will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Gama Aviation LLC is not affiliated with Gama Group, Inc., Signature Flight Support LLC, or Gama Aviation plc. ADDITIONAL INFORMATION AND WHERE TO FIND IT This presentation relates to a proposed transaction between Wheels Up and Aspirational. This presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transaction, Aspirational filed a registration statement on Form S-4 with the SEC on March 15, 2021, which includes a document that serves as a prospectus and proxy statement of Aspirational (the “proxy statement/prospectus”). The proxy statement/prospectus will be sent to all Aspirational shareholders. Aspirational also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Aspirational are urged to read the registration statement, the proxy statement/prospectus included therein and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders may obtain free copies of the registration statement, the proxy statement/prospectus included therein and all other relevant documents filed or that will be filed with the SEC by Aspirational through the website maintained by the SEC at www.sec.gov. The documents filed by Aspirational with the SEC also may be obtained free of charge at Aspirational’s website at https://www.aspconsumer.com or upon written request to #18-07/12 Great World City, Singapore 237994. PARTICIPANTS IN SOLICITATION Aspirational and Wheels Up and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Aspirational’s shareholders in connection with the proposed transaction. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction. You may obtain a free copy of these documents as described in the preceding paragraph. AVIATION REGULATORY MATTERS Wheels Up Partners LLC (“Wheels Up”) is subject to the Department of Transportation’s (“DOT”) jurisdiction as a statutorily-defined “ticket agent” (1) and as an “air charter broker” (2) in offering and selling its basic travel program and related programs as agent for the Wheels Up Club Members. Wheels Up is also subject to statutory and regulatory prohibitions against unfair and deceptive practices and unfair methods of competition in 49 U.S.C. Section 41712, as well as DOT regulations contained in Title 14 of the Code of Federal Regulations. These requirements prohibit Wheels Up from “holding out” or otherwise engaging in air transportation, directly or indirectly, as an air carrier without the requisite DOT authority(3). Under federal legislation (e.g. 49 U.S.C. §41101) and Federal Aviation Administration (“FAA”) regulations, a person holding out or otherwise engaging in air transportation requires an air carrier operating certificate. As discussed below, all operators of aircraft in the Wheels Up program are FAA Part 135 certificated and DOT Part 298 registered air carriers. It is important for FAA purposes (as well as for DOT purposes) that Wheels Up maintains its agent-for-member status and not be viewed by FAA as the operator of the aircraft utilized in the Wheels Up Program. With regard to Wheels Up’s basic travel program, Wheels Up acts solely as agent for each club member in arranging flights on their behalf with FAA Part 135 certificated and DOT Part 298 registered air carriers. These air carriers operate the aircraft in the Wheels Up Program and exercise complete, effective, and sustainable operational control over each flight at all times. Wheels Up is affiliated with, or commonly owned along with, certain air carriers that may operate flights under the Wheels Up Program. Other air carriers that operate flights under the Wheels Up Program are external vendors. For Wheels Up’s basic travel program, the King Air 350i and Citation Excel/XLS are operated by Gama Aviation LLC, an affiliate of Wheels Up, which holds the FAA and DOT authorizations noted above. While Wheels Up owns all Beechcraft King Air 350i aircraft and leases all Citation Excel/XLS utilized in the Wheels Up Program, all such aircraft are dry leased to Gama Aviation LLC or the operator. Additional terms and Conditions are included in the Wheels Up Program documents. The Wheels Up shared flight social aviation program is based on the DOT’s concept of self- aggregation whereby Wheels Up provides a forum for those of its members interested in sharing the cost of travel to come together to agree upon a flight itinerary (origin, destination and dates) and then authorize Wheels Up acting as agent for the pre-formed group, to book the flight with an air carrier holding the appropriate DOT and FAA authority noted above. In acting as an agent for self-aggregating passengers, Wheels Up is acting as an air charter broker in accordance with 14 CFR Part 295. All air carriers participating in the Wheels Up Program operate under 14 CFR Part 298, including the disclosure requirements applicable to charters in 14 CFR 298.80. NOTE: 1. A TICKET AGENT MEANS “A PERSON (EXPECT AN AIR CARRIER...) THAT AS A PRINCIPAL OR AGENT SELLS, OFFERS FOR SALE, NEGOTIATES FOR, OR HOLDS ITSELF OUT AS SELLING, PROVIDING OR ARRANGING FOR AIR TRANSPORTATION” (49 U.S.C. SEC. 40102(A)(45)). 2. AN AIR CHARTER BROKER MEANS “A PERSON OR ENTITY THAT, AS AN INDIRECT AIR CARRIER, FOREIGN INDIRECT AIR CARRIER, OR A BONA FIDE AGENT, HOLDS OUT, SELLS, OR ARRANGES SINGLE ENTITY CHARTER AIR TRANSPORTATION USING A DIRECT AIR CARRIER” (14 CFR 295.5(B)). 3. A PERSON ENGAGING IN AIR TRANSPORTATION “DIRECTLY” (A/K/A A DIRECT AIR CARRIER OR DAC) IS THE OPERATOR OF THE AIRPLANE, WHEREAS THE PERSON HOLDING OUT OR OTHERWISE ENGAGING IN AIR TRANSPORTATION “INDIRECTLY” (A/K/A AN INDIRECT AIR CARRIER OR IAC) IS NOT THE OPERATOR OF THE AIRPLANE. THE STATUTORY DEFINITIONS OF “OPERATE AIRCRAFT” AND “OPERATION OF AIRCRAFT” ARE BROAD ENOUGH TO INCLUDE A PERSON “CAUSING OR AUTHORIZING THE OPERATION OF AIRCRAFT WITH OR WITHOUT THE RIGHT OF LEGAL CONTROL OF THE AIRCRAFT” (49 U.S.C. 40102(A)(35)). THUS, IT IS IMPORTANT THAT WHEELS UP HAS NO CONTROL OVER THE ACTUAL OPERATION OF THE AIRCRAFT SO THAT WHEELS UP IS NOT VIEWED AS AN AIRCRAFT OPERATOR OR CO-OPERATOR. WHEELS UP 3

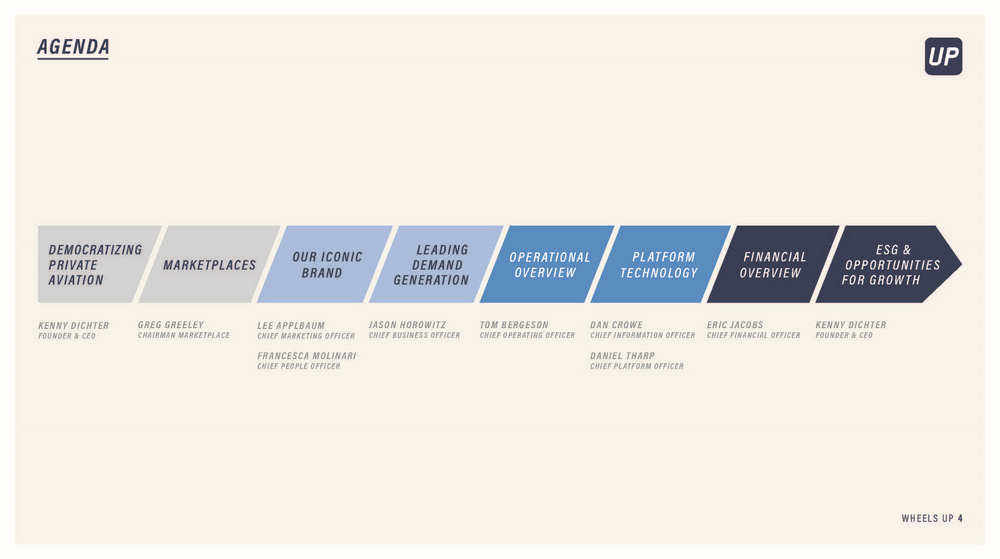

AGENDA LEADING DEMAND GENERATION OUR ICONIC BRAND MARKETPLACES OPERATIONAL OVERVIEW PLATFORM TECHNOLOGY FINANCIAL OVERVIEW ESG & OPPORTUNITIES FOR GROWTH DEMOCRATIZING PRIVATE AVIATION KENNY DICHTER FOUNDER & CEO JASON HOROWITZ CHIEF BUSINESS OFFICER TOM BERGESON CHIEF OPERATING OFFICER DAN CROWE CHIEF INFORMATION OFFICER ERIC JACOBS CHIEF FINANCIAL OFFICER GREG GREELEY CHAIRMAN MARKETPLACE KENNY DICHTER FOUNDER & CEO LEE APPLBAUM CHIEF MARKETING OFFICER FRANCESCA MOLINARI CHIEF PEOPLE OFFICER DANIEL THARP CHIEF PLATFORM OFFICER WHEELS UP 4

VIDEO SLIDE

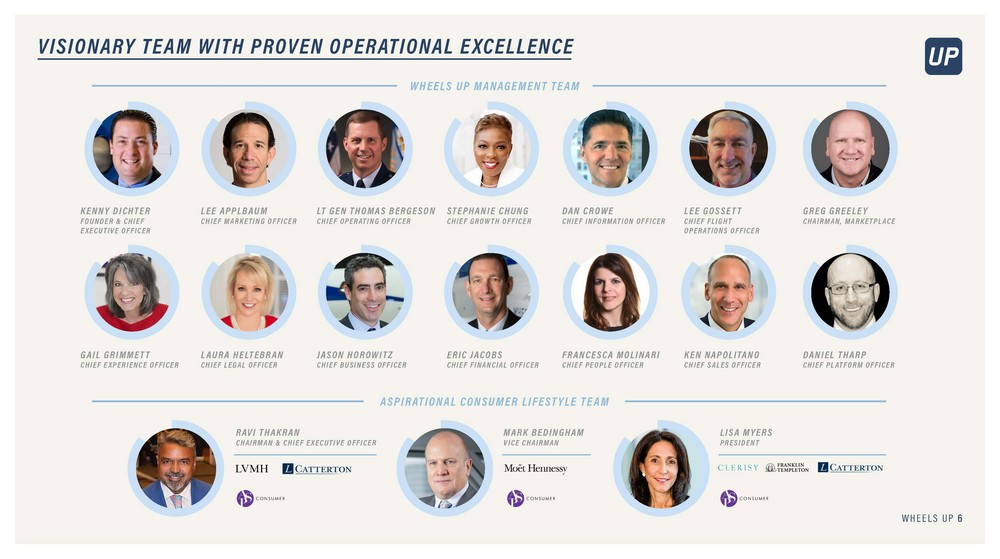

VISIONARY TEAM WITH PROVEN OPERATIONAL EXCELLENCE WHEELS UP MANAGEMENT TEAM KENNY DICHTER FOUNDER & CHIEF EXECUTIVE OFFICER LT GEN THOMAS BERGESON CHIEF OPERATING OFFICER DAN CROWE CHIEF INFORMATION OFFICER GREG GREELEY CHAIRMAN, MARKETPLACE LEE APPLBAUM CHIEF MARKETING OFFICER LEE GOSSETT CHIEF FLIGHT OPERATIONS OFFICER STEPHANIE CHUNG CHIEF GROWTH OFFICER ERIC JACOBS CHIEF FINANCIAL OFFICER KEN NAPOLITANO CHIEF SALES OFFICER FRANCESCA MOLINARI CHIEF PEOPLE OFFICER DANIEL THARP CHIEF PLATFORM OFFICER LAURA HELTEBRAN CHIEF LEGAL OFFICER JASON HOROWITZ CHIEF BUSINESS OFFICER GAIL GRIMMETT CHIEF EXPERIENCE OFFICER ASPIRATIONAL CONSUMER LIFESTYLE TEAM RAVI THAKRAN CHAIRMAN & CHIEF EXECUTIVE OFFICER LISA MYERS PRESIDENT MARK BEDINGHAM VICE CHAIRMAN WHEELS UP 6

SUPPORTED BY A DEEP AND EXPERIENCED BOARD POST-TRANSACTION BOARD DIRECTORS CHIH T. CHUENG MARC FARRELL ADM MICHAEL G. MULLEN DAVID J. ADELMAN KENNY DICHTER TIM J. ARMSTRONG ERIC PHILLIPS RAVI THAKRAN ERIK SNELL BRIAN J. RADECKI SUSAN SCHUMAN STRATEGIC ADVISORS ALAN GOLDFARB ROBERT F. MEHMEL EDITH COOPER JOE POULIN MICHELE SOFISTI WHEELS UP 7

WHEELS UP IS DEMOCRATIZING PRIVATE AVIATION WITH A NEXT-GENERATION, TECHNOLOGY- DRIVEN PLATFORM, MAKING IT ACCESSIBLE FOR MILLIONS OF CONSUMERS.

WHEELS UP CONNECTS FLYERS TO PRIVATE AIRCRAFT – AND ONE ANOTHER DELIVERING EXCEPTIONAL, PERSONALIZED EXPERIENCES POWERING A MARKETPLACE WITH... ...MILLIONS OF CONSUMERS ...TENS OF THOUSANDS OF AIRCRAFT WHEELS UP 9

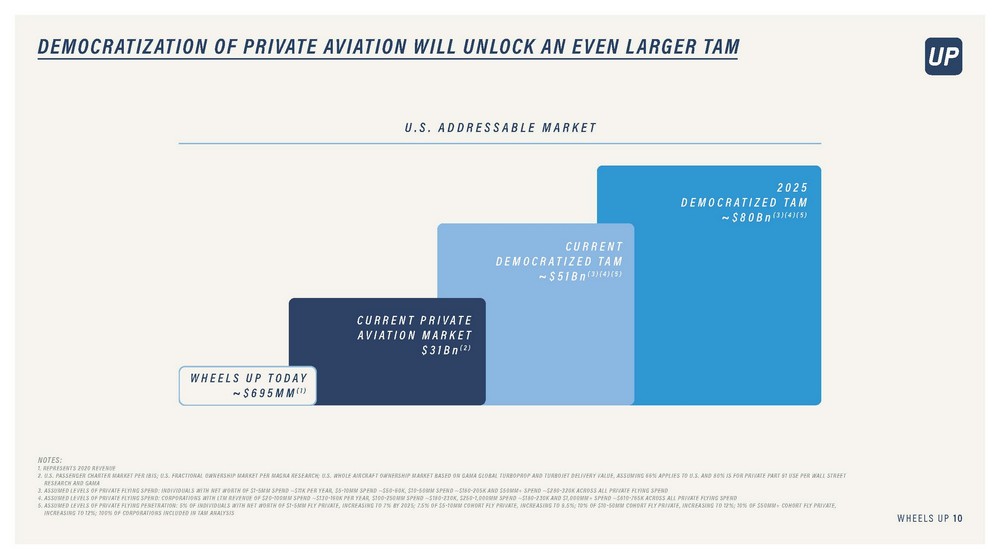

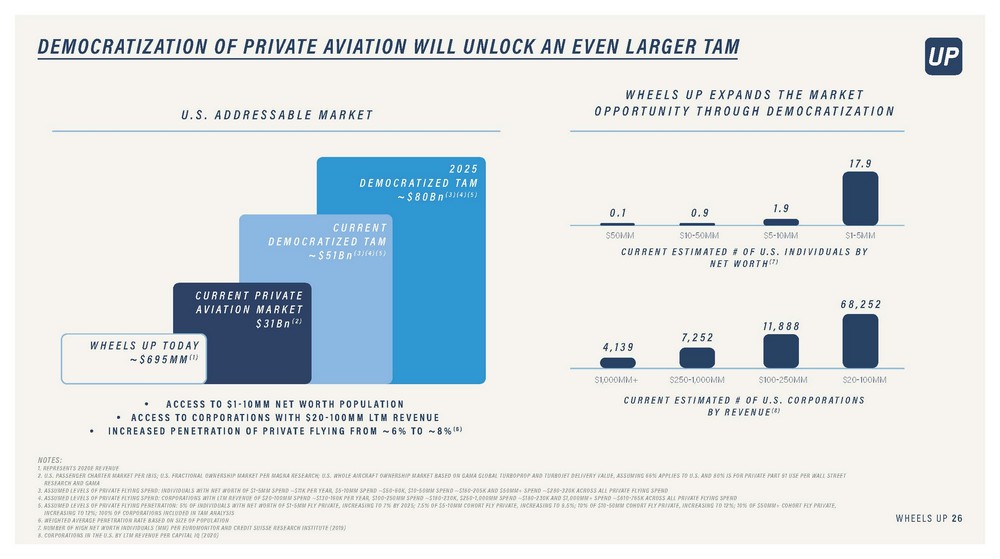

DEMOCRATIZATION OF PRIVATE AVIATION WILL UNLOCK AN EVEN LARGER TAM U.S. ADDRESSABLE MARKET 2025 DEMOCRATIZED TAM ~$80Bn(3)(4)(5) CURRENT DEMOCRATIZED TAM ~$51Bn(3)(4)(5) CURRENT PRIVATE AVIATION MARKET $31Bn(2) WHEELS UP TODAY ~$695MM(1) NOTES: 1. REPRESENTS 2020 REVENUE 2. U.S. PASSENGER CHARTER MARKET PER IBIS; U.S. FRACTIONAL OWNERSHIP MARKET PER MAGNA RESEARCH; U.S. WHOLE AIRCRAFT OWNERSHIP MARKET BASED ON GAMA GLOBAL TURBOPROP AND TURBOJET DELIVERY VALUE, ASSUMING 66% APPLIES TO U.S. AND 80% IS FOR PRIVATE PART 91 USE PER WALL STREET RESEARCH AND GAMA 3. ASSUMED LEVELS OF PRIVATE FLYING SPEND: INDIVIDUALS WITH NET WORTH OF $1-5MM SPEND ~$11K PER YEAR, $5-10MM SPEND ~$50-60K, $10-50MM SPEND ~$180-205K AND $50MM+ SPEND ~$280-320K ACROSS ALL PRIVATE FLYING SPEND 4. ASSUMED LEVELS OF PRIVATE FLYING SPEND: CORPORATIONS WITH LTM REVENUE OF $20-100MM SPEND ~$130-160K PER YEAR, $100-250MM SPEND ~$180-230K, $250-1,000MM SPEND ~$180-230K AND $1,000MM+ SPEND ~$610-765K ACROSS ALL PRIVATE FLYING SPEND 5. ASSUMED LEVELS OF PRIVATE FLYING PENETRATION: 5% OF INDIVIDUALS WITH NET WORTH OF $1-5MM FLY PRIVATE, INCREASING TO 7% BY 2025; 7.5% OF $5-10MM COHORT FLY PRIVATE, INCREASING TO 9.5%; 10% OF $10-50MM COHORT FLY PRIVATE, INCREASING TO 12%; 10% OF $50MM+ COHORT FLY PRIVATE, INCREASING TO 12%; 100% OF CORPORATIONS INCLUDED IN TAM ANALYSIS WHEELS UP 10

PRIVATE AVIATION INDUSTRY STRUCTURE SIZE OF ADDRESSABLE MARKET ANNUAL COST & LENGTH OF COMMITMENT FOR CONSUMER LARGEST CAPITAL OUTLAY FULL OWNERSHIP CAPITAL OUTLAY, HOURLY COSTS, & MONTHLY MANAGEMENT FEES FRACTIONAL OWNERSHIP PRE-PURCHASED FLIGHT TIME JET CARD PROGRAMS MEMBERSHIP BENEFITS + PAY AS YOU FLY MEMBERSHIP PROGRAMS PAY AS YOU FLY INDEPENDENT BROKERS CHARTER WHEELS UP 11

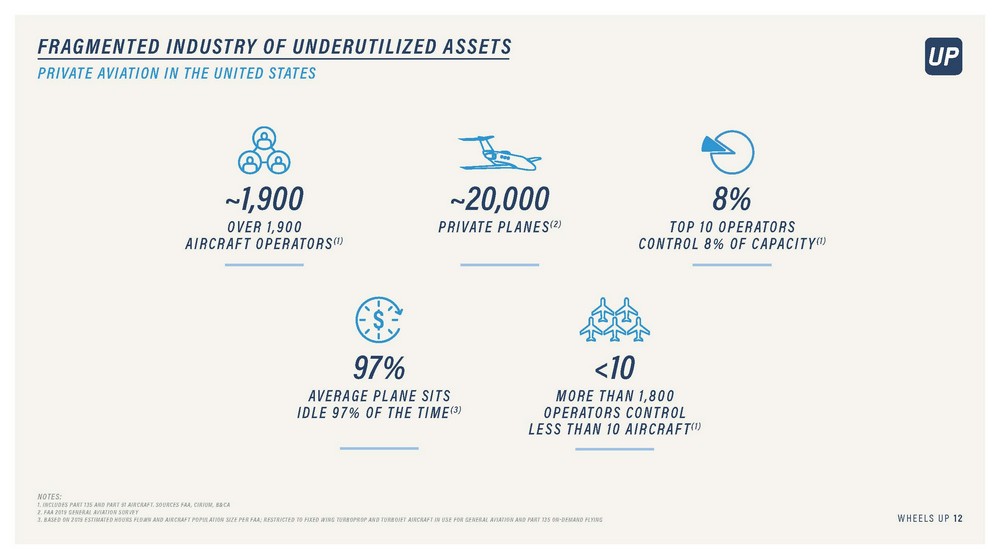

FRAGMENTED INDUSTRY OF UNDERUTILIZED ASSETS PRIVATE AVIATION IN THE UNITED STATES ~1,900 OVER 1,900 AIRCRAFT OPERATORS(1) 8% TOP 10 OPERATORS CONTROL 8% OF CAPACITY(1) ~20,000 PRIVATE PLANES(2) 97% AVERAGE PLANE SITS IDLE 97% OF THE TIME(3) <10 MORE THAN 1,800 OPERATORS CONTROL LESS THAN 10 AIRCRAFT(1) NOTES: 1. INCLUDES PART 135 AND PART 91 AIRCRAFT. SOURCES FAA, CIRIUM, B&CA 2. FAA 2019 GENERAL AVIATION SURVEY 3. BASED ON 2019 ESTIMATED HOURS FLOWN AND AIRCRAFT POPULATION SIZE PER FAA; RESTRICTED TO FIXED WING TURBOPROP AND TURBOJET AIRCRAFT IN USE FOR GENERAL AVIATION AND PART 135 ON-DEMAND FLYING WHEELS UP 12

FOUNDED TO DISRUPT THE PRIVATE AVIATION INDUSTRY Berkshire’s NetJets buys Marquis Jet card company WHEELS UP AND READY FOR TAKEOFF Unicorn Wheels Up Sees A Future Being Valued Like Uber Or Amazon, And It May Have A Point

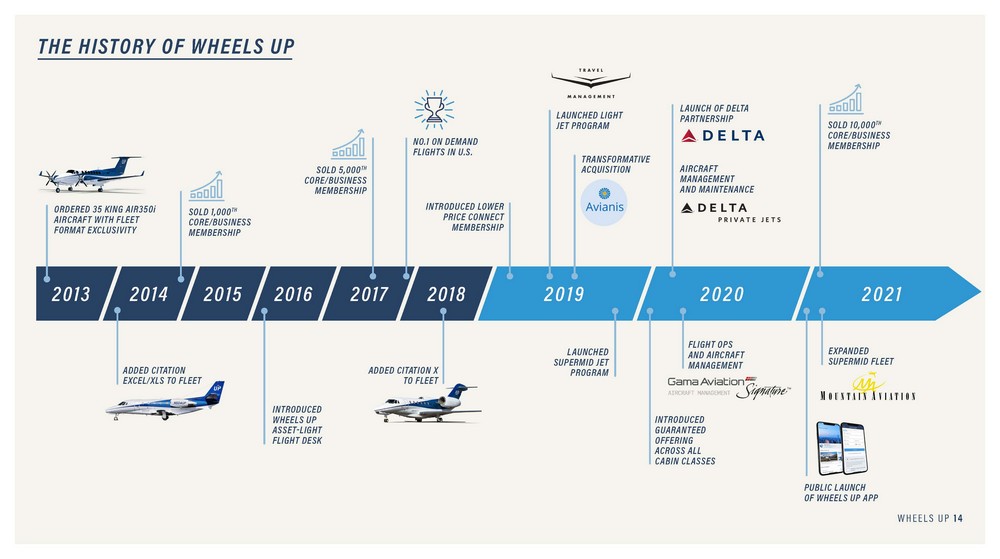

THE HISTORY OF WHEELS UP LAUNCH OF DELTA PARTNERSHIP LAUNCHED LIGHT JET PROGRAM SOLD 10,000TH CORE/BUSINESS MEMBERSHIP NO.1 ON DEMAND FLIGHTS IN U.S. TRANSFORMATIVE ACQUISITION AIRCRAFT MANAGEMENT AND MAINTENANCE SOLD 5,000TH CORE/BUSINESS MEMBERSHIP INTRODUCED LOWER PRICE CONNECT MEMBERSHIP ORDERED 35 KING AIR350i AIRCRAFT WITH FLEET FORMAT EXCLUSIVITY SOLD 1,000TH CORE/BUSINESS MEMBERSHIP 2020 2021 2019 2018 2017 2016 2015 2014 2013 FLIGHT OPS AND AIRCRAFT MANAGEMENT EXPANDED SUPERMID FLEET LAUNCHED SUPERMID JET PROGRAM ADDED CITATION X TO FLEET ADDED CITATION EXCEL/XLS TO FLEET TM INTRODUCED WHEELS UP ASSET-LIGHT FLIGHT DESK INTRODUCED GUARANTEED OFFERING ACROSS ALL CABIN CLASSES PUBLIC LAUNCH OF WHEELS UP APP WHEELS UP 14

IMPORTANT STRATEGIC TRANSACTIONS HAVE TRANSFORMED WHEELS UP KEY ACQUISITIONS AND PARTNERSHIPS HAVE FURTHER ENHANCED OUR VALUE PROPOSITION AND BROADENED OUR OPERATIONS SCALING “ASSET-RIGHT” FLEET AND ENHANCING CAPABILITIES ADDED FLIGHT OPERATIONS AND AIRCRAFT MANAGEMENT CAPABILITIES (112 AIRCRAFT) ADDED AIRCRAFT MANAGEMENT AND IN-HOUSE MAINTENANCE AND REPAIR CAPABILITIES (69 AIRCRAFT) ADDED SUPER MID OPERATIONS AND IN-HOUSE MAINTENANCE AND REPAIR CAPABILITIES (59 AIRCRAFT) ADDED LIGHT JET OPERATIONS CAPABILITIES (26 AIRCRAFT) DRIVING DEMAND LARGE RETAIL AND CORPORATE CUSTOMER BASE, INCLUDING HIGH VOLUME JET CARD FLYERS MARKETING PARTNERSHIP WITH #1 AIRLINE IN THE WORLD(1) ENHANCES VALUE PROPOSITION TO WHEELS UP CUSTOMERS AND PROVIDES ACCESS TO HIGH VALUE DELTA CUSTOMERS THROUGH CO-MARKETING PRODUCTS, FEATURES AND BENEFITS ADVANCED TECH CAPABILITIES FLIGHT MANAGEMENT SYSTEM (FMS) NOTES: 1. MEASURED BY FY2019 REVENUE, CAPITAL IQ WHEELS UP 15

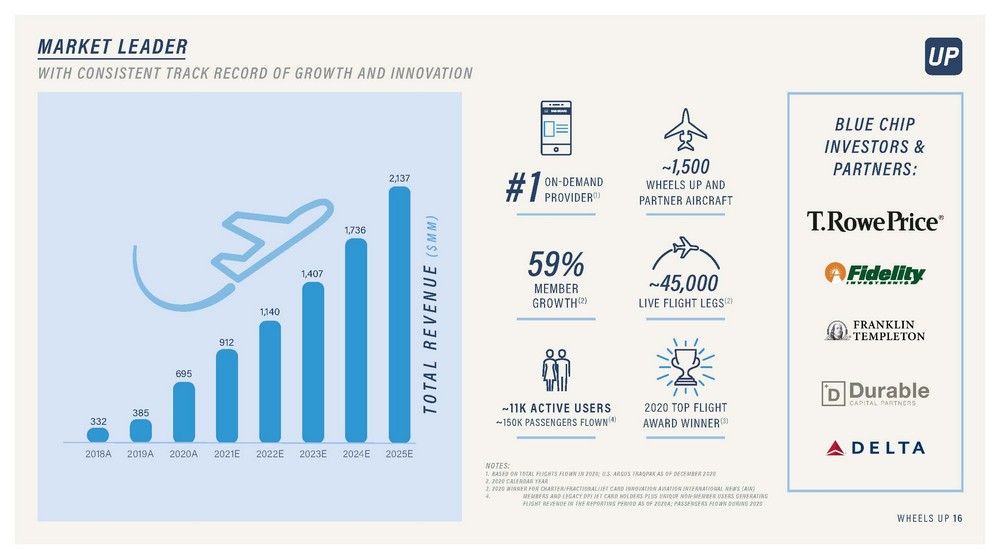

MARKET LEADER WITH CONSISTENT TRACK RECORD OF GROWTH AND INNOVATION BLUE CHIP INVESTORS & PARTNERS: ~1,500 WHEELS UP AND PARTNER AIRCRAFT #1 2,137 ON-DEMAND PROVIDER(1) TOTAL REVENUE ($MM) 1,736 59% 1,407 ~45,000 MEMBER GROWTH(2) LIVE FLIGHT LEGS(2) 1,140 912 695 ~11K ACTIVE USERS ~150K PASSENGERS FLOWN(4) 2020 TOP FLIGHT AWARD WINNER(3) 385 332 2025E 2023E 2022E 2021E 2020A 2019A 2018A 2024E NOTES: 1. BASED ON TOTAL FLIGHTS FLOWN IN 2020; U.S. ARGUS TRAQPAK AS OF DECEMBER 2020 2. 2020 CALENDAR YEAR 3. 2020 WINNER FOR CHARTER/FRACTIONAL/JET CARD INNOVATION AVIATION INTERNATIONAL NEWS (AIN) 4. MEMBERS AND LEGACY DPJ JET CARD HOLDERS PLUS UNIQUE NON-MEMBER USERS GENERATING FLIGHT REVENUE IN THE REPORTING PERIOD AS OF 2020A; PASSENGERS FLOWN DURING 2020 WHEELS UP 16

MARKETPLACES GREG GREELEY CHAIRMAN MARKETPLACE

WHERE DIGITAL MARKETPLACES THRIVE 1 2 4 3 LEGACY TECHNOLOGY UNNECESSARY CONSTRAINTS UNLOCK SUPPLY & DEMAND HIGHLY FRAGMENTED MARKET WHEELS UP 18

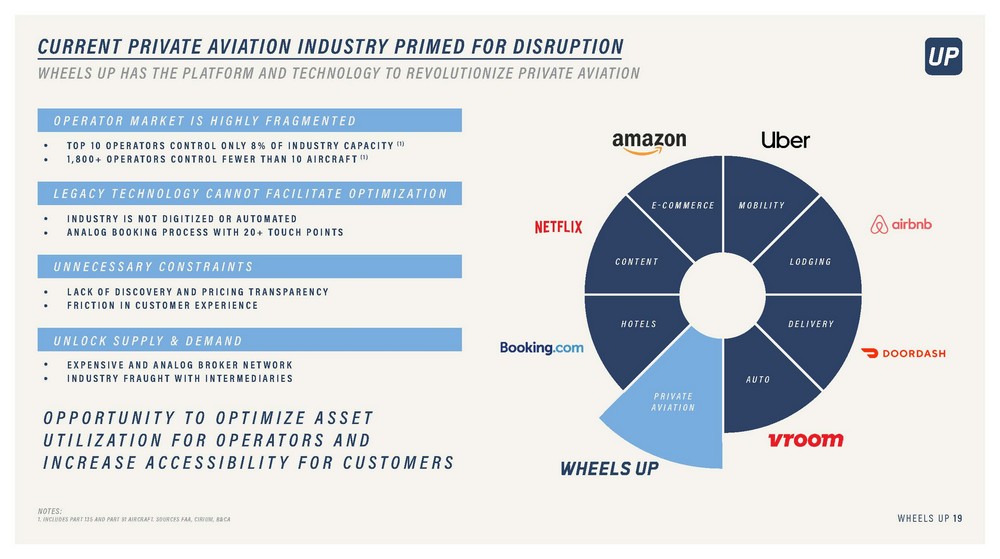

CURRENT PRIVATE AVIATION INDUSTRY PRIMED FOR DISRUPTION WHEELS UP HAS THE PLATFORM AND TECHNOLOGY TO REVOLUTIONIZE PRIVATE AVIATION OPERATOR MARKET IS HIGHLY FRAGMENTED TOP 10 OPERATORS CONTROL ONLY 8% OF INDUSTRY CAPACITY (1) 1,800+ OPERATORS CONTROL FEWER THAN 10 AIRCRAFT (1) LEGACY TECHNOLOGY CANNOT FACILITATE OPTIMIZATION E-COMMERCE MOBILITY INDUSTRY IS NOT DIGITIZED OR AUTOMATED ANALOG BOOKING PROCESS WITH 20+ TOUCH POINTS CONTENT LODGING UNNECESSARY CONSTRAINTS LACK OF DISCOVERY AND PRICING TRANSPARENCY FRICTION IN CUSTOMER EXPERIENCE HOTELS DELIVERY UNLOCK SUPPLY & DEMAND EXPENSIVE AND ANALOG BROKER NETWORK INDUSTRY FRAUGHT WITH INTERMEDIARIES AUTO PRIVATE AVIATION OPPORTUNITY TO OPTIMIZE ASSET UTILIZATION FOR OPERATORS AND INCREASE ACCESSIBILITY FOR CUSTOMERS NOTES: 1. INCLUDES PART 135 AND PART 91 AIRCRAFT. SOURCES FAA, CIRIUM, B&CA WHEELS UP 19

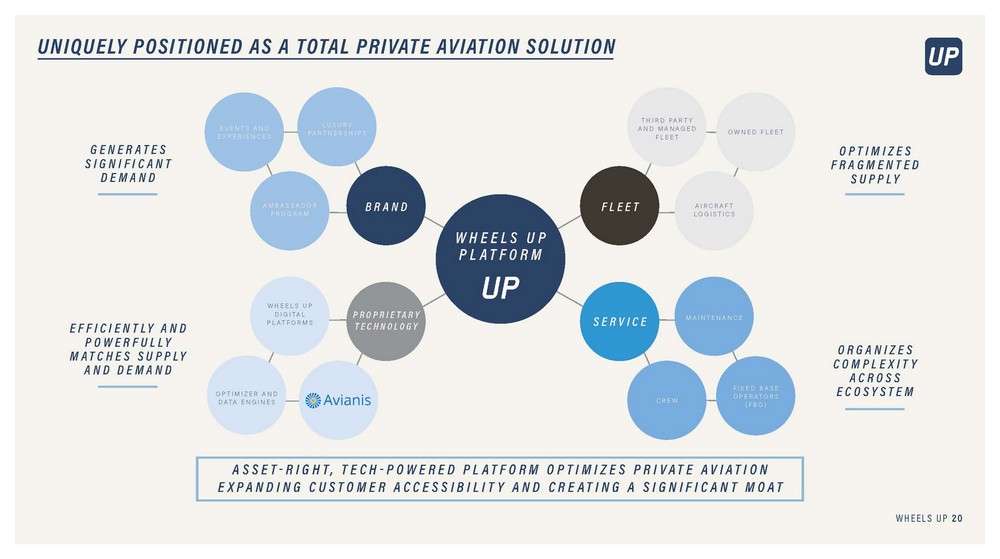

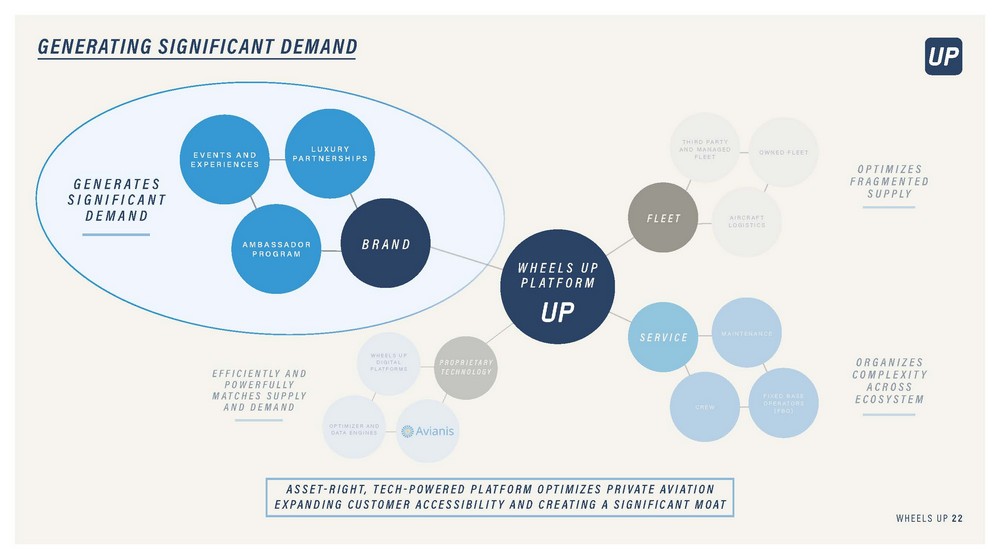

UNIQUELY POSITIONED AS A TOTAL PRIVATE AVIATION SOLUTION THIRD PARTY AND MANAGED FLEET LUXURY PARTNERSHIPS EVENTS AND EXPERIENCES OWNED FLEET GENERATES SIGNIFICANT DEMAND OPTIMIZES FRAGMENTED SUPPLY FLEET BRAND AMBASSADOR PROGRAM AIRCRAFT LOGISTICS WHEELS UP PLATFORM WHEELS UP DIGITAL PLATFORMS PROPRIETARY TECHNOLOGY MAINTENANCE SERVICE EFFICIENTLY AND POWERFULLY MATCHES SUPPLY AND DEMAND ORGANIZES COMPLEXITY ACROSS ECOSYSTEM FIXED BASE OPERATORS (FBO) OPTIMIZER AND DATA ENGINES CREW ASSET-RIGHT, TECH-POWERED PLATFORM OPTIMIZES PRIVATE AVIATION EXPANDING CUSTOMER ACCESSIBILITY AND CREATING A SIGNIFICANT MOAT WHEELS UP 20

OUR ICONIC BRAND LEE APPLBAUM CHIEF MARKETING OFFICER FRANCESCA MOLINARI CHIEF PEOPLE OFFICER

GENERATING SIGNIFICANT DEMAND LUXURY PARTNERSHIPS THIRD PARTY AND MANAGED FLEET EVENTS AND EXPERIENCES OWNED FLEET OPTIMIZES FRAGMENTED SUPPLY GENERATES SIGNIFICANT DEMAND FLEET AIRCRAFT LOGISTICS AMBASSADOR PROGRAM BRAND WHEELS UP PLATFORM MAINTENANCE SERVICE WHEELS UP DIGITAL PLATFORMS ORGANIZES COMPLEXITY ACROSS ECOSYSTEM PROPRIETARY TECHNOLOGY EFFICIENTLY AND POWERFULLY MATCHES SUPPLY AND DEMAND FIXED BASE OPERATORS (FBO) CREW OPTIMIZER AND DATA ENGINES ASSET-RIGHT, TECH-POWERED PLATFORM OPTIMIZES PRIVATE AVIATION EXPANDING CUSTOMER ACCESSIBILITY AND CREATING A SIGNIFICANT MOAT WHEELS UP 22

OUR MISSION AND VISION WE CONNECT FLYERS TO PRIVATE AIRCRAFT— AND ONE ANOTHER—TO DELIVER EXCEPTIONAL, PERSONALIZED EXPERIENCES. AND WE’RE BUILDING AN INNOVATIVE MARKETPLACE TO DO SO AT SCALE. WHEELS UP 23

WHEELS UP IS DEMOCRATIZING PRIVATE AVIATION WITH A NEXT-GENERATION, TECHNOLOGY- DRIVEN PLATFORM, MAKING IT ACCESSIBLE FOR MILLIONS OF CONSUMERS.

SIGNIFICANT TAILWINDS UNDERPIN PRIVATE AVIATION MARKET GROWTH IN EXPERIENCE ECONOMY EXPERIENCES ACCOUNT FOR OVER 65% OF DISCRETIONARY SPENDING (1) CONSUMERS ACROSS ALL AGE GROUPS AND INCOME BRACKETS REPORT THEY MISS TRAVELING MORE THAN ANYTHING ELSE (2) SHARED ECONOMY WILL INCREASE ASSET UTILIZATION AVERAGE PRIVATE PLANE TODAY SITS IDLE 97% OF THE TIME (3) UNDERPENETRATED OPPORTUNITY ESTIMATED ~90% OF PEOPLE WHO CAN AFFORD TO FLY PRIVATELY DON’T (4) FOCUS ON WELLNESS OVER COST COVID-19 INCREASINGLY VALIDATING PRIVATE TRAVEL EXPENSE AS “SMART” OR “NECESSARY” BY INDIVIDUALS AND BUSINESSES WITH AN EMPHASIS ON FAMILY AND EXPERIENCES, QUALITY TIME IS AN EVEN MORE VALUABLE COMMODITY NOTES: 1.WALL STREET RESEARCH 2.BOSTON CONSULTING GROUP 3.BASED ON 2019 ESTIMATED HOURS FLOWN AND AIRCRAFT POPULATION SIZE PER FAA; RESTRICTED TO FIXED WING TURBOPROP AND TURBOJET AIRCRAFT IN USE FOR GENERAL AVIATION AND PART 135 ON-DEMAND FLYING 4.McKINSEY AS OF MAY 15, 2020

DEMOCRATIZATION OF PRIVATE AVIATION WILL UNLOCK AN EVEN LARGER TAM WHEELS UP EXPANDS THE MARKET OPPORTUNITY THROUGH DEMOCRATIZATION U.S. ADDRESSABLE MARKET 17.9 2025 DEMOCRATIZED TAM ~$80Bn(3)(4)(5) 1.9 0.1 0.9 CURRENT DEMOCRATIZED TAM ~$51Bn(3)(4)(5) $1-5MM $5-10MM $10-50MM $50MM CURRENT ESTIMATED # OF U.S. INDIVIDUALS BY NET WORTH(7) CURRENT PRIVATE AVIATION MARKET $31Bn(2) 68,252 11,888 7,252 WHEELS UP TODAY ~$695MM(1) 4,139 $1,000MM+ $250-1,000MM $100-250MM $20-100MM CURRENT ESTIMATED # OF U.S. CORPORATIONS BY REVENUE(8) ACCESS TO $1-10MM NET WORTH POPULATION ACCESS TO CORPORATIONS WITH $20-100MM LTM REVENUE INCREASED PENETRATION OF PRIVATE FLYING FROM ~6% TO ~8%(6) NOTES: 1. REPRESENTS 2020E REVENUE 2. U.S. PASSENGER CHARTER MARKET PER IBIS; U.S. FRACTIONAL OWNERSHIP MARKET PER MAGNA RESEARCH; U.S. WHOLE AIRCRAFT OWNERSHIP MARKET BASED ON GAMA GLOBAL TURBOPROP AND TURBOJET DELIVERY VALUE, ASSUMING 66% APPLIES TO U.S. AND 80% IS FOR PRIVATE PART 91 USE PER WALL STREET RESEARCH AND GAMA 3. ASSUMED LEVELS OF PRIVATE FLYING SPEND: INDIVIDUALS WITH NET WORTH OF $1-5MM SPEND ~$11K PER YEAR, $5-10MM SPEND ~$50-60K, $10-50MM SPEND ~$180-205K AND $50MM+ SPEND ~$280-320K ACROSS ALL PRIVATE FLYING SPEND 4. ASSUMED LEVELS OF PRIVATE FLYING SPEND: CORPORATIONS WITH LTM REVENUE OF $20-100MM SPEND ~$130-160K PER YEAR, $100-250MM SPEND ~$180-230K, $250-1,000MM SPEND ~$180-230K AND $1,000MM+ SPEND ~$610-765K ACROSS ALL PRIVATE FLYING SPEND 5. ASSUMED LEVELS OF PRIVATE FLYING PENETRATION: 5% OF INDIVIDUALS WITH NET WORTH OF $1-5MM FLY PRIVATE, INCREASING TO 7% BY 2025; 7.5% OF $5-10MM COHORT FLY PRIVATE, INCREASING TO 9.5%; 10% OF $10-50MM COHORT FLY PRIVATE, INCREASING TO 12%; 10% OF $50MM+ COHORT FLY PRIVATE, INCREASING TO 12%; 100% OF CORPORATIONS INCLUDED IN TAM ANALYSIS 6. WEIGHTED AVERAGE PENETRATION RATE BASED ON SIZE OF POPULATION 7. NUMBER OF HIGH NET WORTH INDIVIDUALS (MM) PER EUROMONITOR AND CREDIT SUISSE RESEARCH INSTITUTE (2019) 8. CORPORATIONS IN THE U.S. BY LTM REVENUE PER CAPITAL IQ (2020) WHEELS UP 26

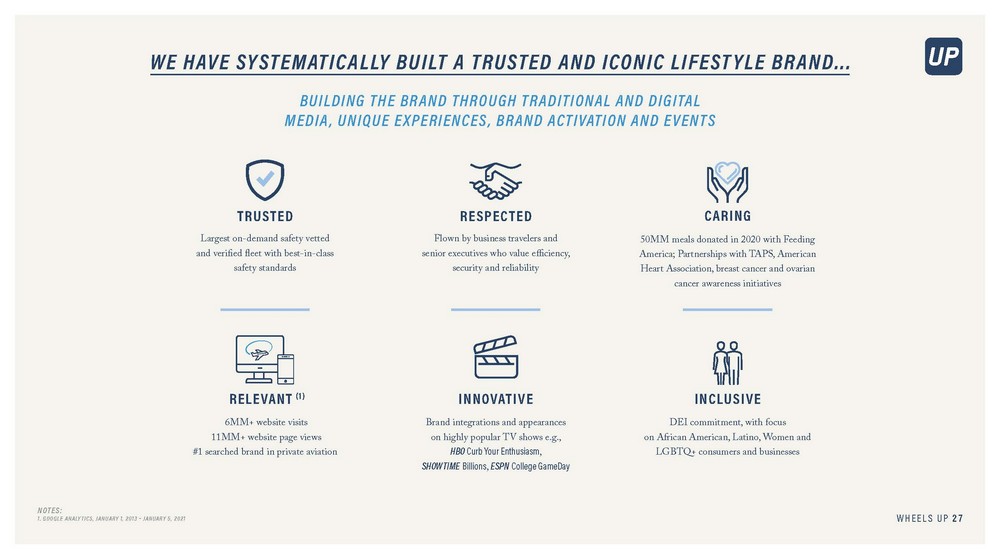

WE HAVE SYSTEMATICALLY BUILT A TRUSTED AND ICONIC LIFESTYLE BRAND... BUILDING THE BRAND THROUGH TRADITIONAL AND DIGITAL MEDIA, UNIQUE EXPERIENCES, BRAND ACTIVATION AND EVENTS CARING RESPECTED TRUSTED Flown by business travelers and senior executives who value efficiency, security and reliability Largest on-demand safety vetted and verified fleet with best-in-class safety standards 50MM meals donated in 2020 with Feeding America; Partnerships with TAPS, American Heart Association, breast cancer and ovarian cancer awareness initiatives RELEVANT (1) INNOVATIVE INCLUSIVE Brand integrations and appearances on highly popular TV shows e.g., HBO Curb Your Enthusiasm, SHOWTIME Billions, ESPN College GameDay 6MM+ website visits 11MM+ website page views #1 searched brand in private aviation DEI commitment, with focus on African American, Latino, Women and LGBTQ+ consumers and businesses NOTES: 1. GOOGLE ANALYTICS, JANUARY 1, 2013 – JANUARY 5, 2021 WHEELS UP 27

POWERFUL 100+ AMBASSADOR PROGRAM INFLUENCERS WITH BROAD SOCIAL REACH SERENA WILLIAMS LINDSEY VONN RICKIE FOWLER TOM BRADY 12.7MM+ 2.1MM+ 1.8MM+ 7.8MM+ 4.6MM+ 1.3MM+ 165K+ 6.4MM+ 1.3MM+ 1.0MM+ 1.6MM+ 10.8MM+ RUSSELL WILSON CIARA WILSON J.J. WATT JOEY LOGANO 4.9MM+ 26.8MM+ 4MM+ 200K+ 2.1MM+ 185K+ 13MM+ 1.9MM+ 5.5MM+ 500K+ 11.5MM+ 5.5MM+ KIRK HERBSTREIT THOMAS KELLER ALEX RODRIGUEZ SCOTT VAN PELT 2MM+ 130K+ 622K+ 3.9MM+ 52K+ 179K+ 1.8MM+ 1.5MM+ 695K+ 1.2MM+ WHEELS UP 28

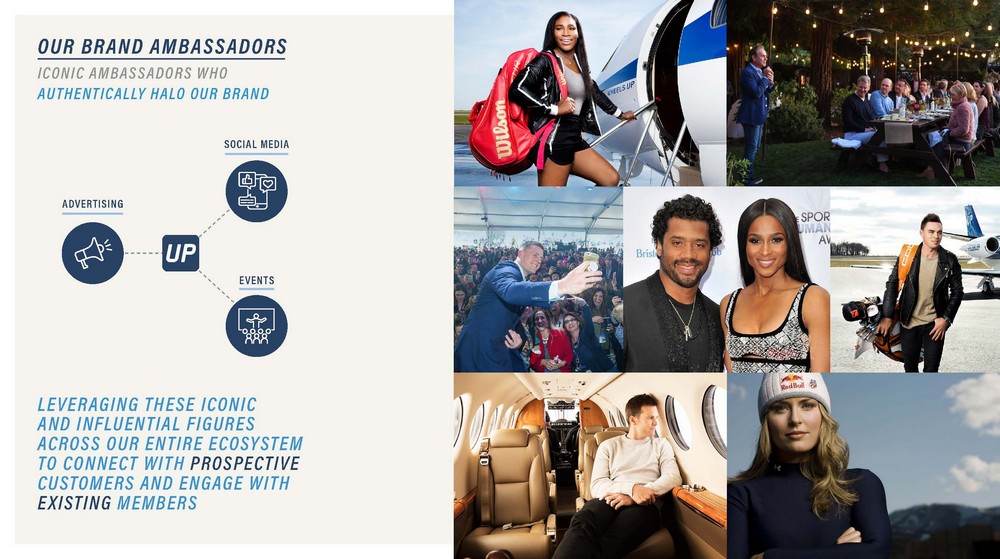

OUR BRAND AMBASSADORS ICONIC AMBASSADORS WHO AUTHENTICALLY HALO OUR BRAND SOCIAL MEDIA ADVERTISING EVENTS LEVERAGING THESE ICONIC AND INFLUENTIAL FIGURES ACROSS OUR ENTIRE ECOSYSTEM TO CONNECT WITH PROSPECTIVE CUSTOMERS AND ENGAGE WITH EXISTING MEMBERS

SIGNATURE EVENTS UNPARALLELED EVENTS & EXPERIENCES THAT ENGENDER LOYALTY WHEELS DOWN IN AUGUSTA OUR SIGNATURE SERIES OF WHEELS UP EXPERIENCES HELP ELEVATE LIFE ON THE GROUND FOR MEMBERS DURING SOME OF THE BIGGEST, MOST HIGH-PROFILE EVENTS OF THE YEAR. Wheels Up Members are invited to Augusta for an unforgettable week-long experience off the green that includes a daytime Hospitality House and evening celebrations. REACH NO. OF ATTENDEES 1,500 NO. OF PRESS IMPRESSIONS 500MM+ SUPER SATURDAY TAILGATE ART BASEL During one of the most remarkable art exhibitions with some of the hottest parties of the year, Wheels Up hosts Members and guests for an exclusive night of art and music. Held at a distinctive venue in the host city, the event is one of the most talked about off the field events during Super Bowl weekend. REACH REACH NO. OF ATTENDEES 300 NO. OF PRESS IMPRESSIONS 50MM+ NO. OF ATTENDEES 1,700 NO. OF PRESS IMPRESSIONS 2.56Bn WHEELS UP 30

VIRTUAL EVENTS DURING THE COVID-19 PANDEMIC, WHEELS UP PIVOTED IN AN INNOVATIVE WAY TO BRING MEMBERS EVENTS AT HOME VIRTUAL EVENTS WILL CONTINUE TO BE A PART OF OUR EVENT OFFERING BRINGING MEMBERS THE OPPORTUNITY TO GET IN FRONT OF INFLUENCERS ACROSS SPORTS, CULINARY ARTS, PHILANTHROPY, CULTURE AND THE ECONOMY. WHEELS UP 31

LEADING BRANDS PARTNER WITH WHEELS UP WHEELS UP HAS BUILT A TRUSTED AND ICONIC LIFESTYLE BRAND CONSISTENTLY DELIVERING AMAZING EXPERIENCES IN THE AIR AND ON THE GROUND. WE HAVE PARTNERED WITH BRANDS ACROSS THE FOLLOWING VERTICALS TO ENHANCE THE WHEELS UP MEMBER OVERALL MEMBERSHIP EXPERIENCE: TRAVEL SERVICES HOSPITALITY HEALTH, WELLNESS & BEAUTY RETAIL OUTDOOR EXPERIENCES KIDS & FAMILY REAL ESTATE WHEELS UP 32

OUR SOCIAL RESPONSIBILITY SOCIAL RESPONSIBILITY THAT ENHANCES BRAND AFFINITY AND CREATES MEANINGFUL VALUE FOR THE CHARITIES WHEELS UP 33 WHEELS UP 33

WHEELS UP FOCUS ON DIVERSITY, EQUITY, AND INCLUSION OUTSIDE WHEELS UP $400Bn SPENT IN 2019 (1) INDUSTRY LEADER In 2019, Women, African Americans, Hispanics, and the LGBTQ+ community spent a combined $400 billion+ on travel in the United States, yet they have largely been ignored by the private aviation industry We believe Wheels Up is the first company in our industry to place Diversity, Equity, and Inclusion front and center leading the effort to democratize private aviation CULTURALLY RELEVANT MESSAGING INCLUSIVE STRATEGY The Wheels Up Team works to expand customer acquisition and maximize corporate growth through the development and execution of an inclusive strategy that amplifies values, while prioritizing cultural sensitivity and fluency across a diverse target audience Executing inclusive marketing efforts to successfully and authentically reach diverse audiences through culturally relevant messaging NOTES: 1. WHEELS UP ESTIMATES BASED ON MMGY’S 2019 SHIFFLET TRAVEL PERFORMANCE/MONITOR, IGLTA FOUNDATION, AND “THE POWER AND OPPORTUNITY OF THE MULTICULTURAL MARKETS” BY: SUZANNE D. COOK, PH.D. AND SUZANNE COOK CONSULTING, LLC IN COOPERATION WITH U.S. TRAVEL ASSOCIATION AND FUNDED BY: AMERICAN HOTEL & LODGING EDUCATIONAL FOUNDATION (2010)

WHEELS UP FOCUS ON DIVERSITY, EQUITY, AND INCLUSION INSIDE WHEELS UP DIVERSITY AT THE TOP SUPPORT FOR ALL TYPES OF FAMILIES Diversity starts with the Executive Leadership team and Board of Directors Our comprehensive benefits offering supports the medical, emotional and financial well-being of our employees and all types of families. We will continue to review our plans to ensure coverage of diverse health and wellness needs CREATING A DIVERSE WORKFORCE UP TOGETHER Cultivating partnerships with external organizations to establish trust and solidify our commitment to support and grow a diverse workforce. Organizations include: Women Aviation International, National Gay Pilot Association, Organization of Black Aerospace Professionals We are launching a multi-year DEI strategy, called Up Together, to support our corporate goal of being the most diverse, equitable, and inclusive company in private aviation and a leader in luxury and lifestyles

LEADING DEMAND GENERATION JASON HOROWITZ CHIEF BUSINESS OFFICER

OUR SOLUTION POWER A MARKETPLACE WITH... ...MILLIONS OF CONSUMERS ...TENS OF THOUSANDS OF AIRCRAFT WHEELS UP 37

MEMBERSHIP VALUE IN THE AIR AND ON THE GROUND TOTAL AVIATION SOLUTION DIGITAL CONVENIENCE ELEVATED LIFESTYLE ACCESS TO ONE OF THE WORLD’S LARGEST COMBINED FLEETS OF OWNED, LEASED, MANAGED AND THIRD-PARTY AIRCRAFT SEAMLESS CONTROL OF MEMBERSHIP EXPERIENCE, INCLUDING CUTTING-EDGE DIGITALLY ENABLED OFFERINGS WHEELS DOWN PROGRAMMING OFFERING EXCLUSIVE EVENTS, MEMBER BENEFITS, AND 24/7 FULL SERVICE CONCIERGE GUARANTEED OFFERING ACROSS ALL CABIN CLASSES ADDRESSING ALL TYPICAL PRIVATE AVIATION MISSIONS FLEET OF KING AIR 350I, BEST SHORT HAUL AIRCRAFT IN MARKET, PROVIDES DIFFERENTIATED OPTION SOCIAL AVIATION CREATES A COMMUNITY OF FLYERS WHO SHARE COMMON INTERESTS AND TRAVEL PATTERNS LEADING TO BETTER ENGAGEMENT AND IMPROVED RETENTION INSTANT BOOKING, TRIP MANAGEMENT, AND COMMUNICATION WITH THE WHEELS UP COMMUNITY THROUGH OUR DIGITAL APPLICATIONS SINGLE SEARCH INTERFACE PROVIDING DYNAMIC PRICING WITH A CONSISTENT QUALITY OF SERVICE VALUE ENHANCING HOT NIGHTS, HOT FLIGHTS AND SHUTTLES FEATURES DRIVE MORE FREQUENT MEMBER ENGAGMENT EXCLUSIVE ACCESS TO POPULAR SPORTS AND CULTURAL EVENTS AND INTIMATE GATHERINGS HOSTED BY OUR WHEELS UP AMBASSADORS 24/7 PREMIER CONCIERGE SERVICE PLUS ACCESS TO INSPIRATO AND HOT NIGHTS LUXURY VACATIONS BENEFITS AND SPECIAL OFFERS FROM PARTNERS ACROSS FASHION, TRAVEL, LIFESTYLE, RETAIL, AND MORE WHEELS UP 38

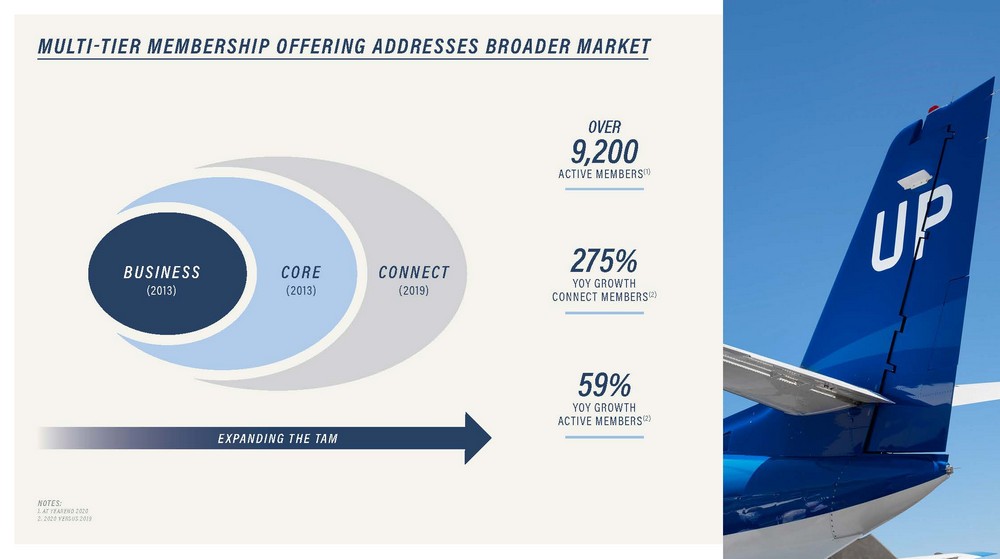

MULTI-TIER MEMBERSHIP OFFERING ADDRESSES BROADER MARKET OVER 9,200 ACTIVE MEMBERS(1) 275% YOY GROWTH CONNECT MEMBERS(2) BUSINESS CORE CONNECT (2019) (2013) (2013) 59% YOY GROWTH ACTIVE MEMBERS(2) EXPANDING THE TAM NOTES: 1. AT YEAREND 2020 2. 2020 VERSUS 2019

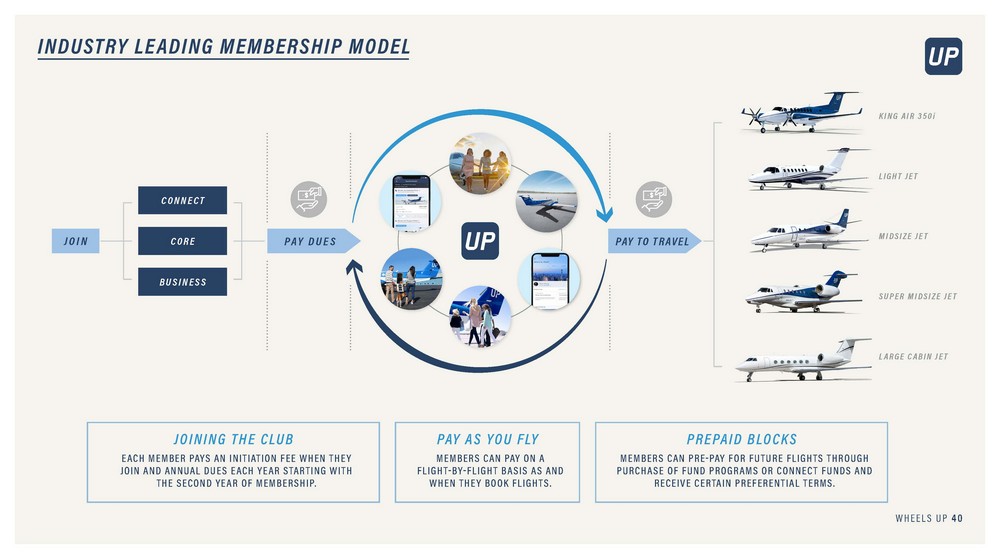

INDUSTRY LEADING MEMBERSHIP MODEL KING AIR 350i LIGHT JET CONNECT MIDSIZE JET CORE JOIN PAY TO TRAVEL PAY DUES BUSINESS SUPER MIDSIZE JET LARGE CABIN JET PREPAID BLOCKS JOINING THE CLUB PAY AS YOU FLY MEMBERS CAN PAY ON A FLIGHT-BY-FLIGHT BASIS AS AND WHEN THEY BOOK FLIGHTS. MEMBERS CAN PRE-PAY FOR FUTURE FLIGHTS THROUGH PURCHASE OF FUND PROGRAMS OR CONNECT FUNDS AND RECEIVE CERTAIN PREFERENTIAL TERMS. EACH MEMBER PAYS AN INITIATION FEE WHEN THEY JOIN AND ANNUAL DUES EACH YEAR STARTING WITH THE SECOND YEAR OF MEMBERSHIP. WHEELS UP 40

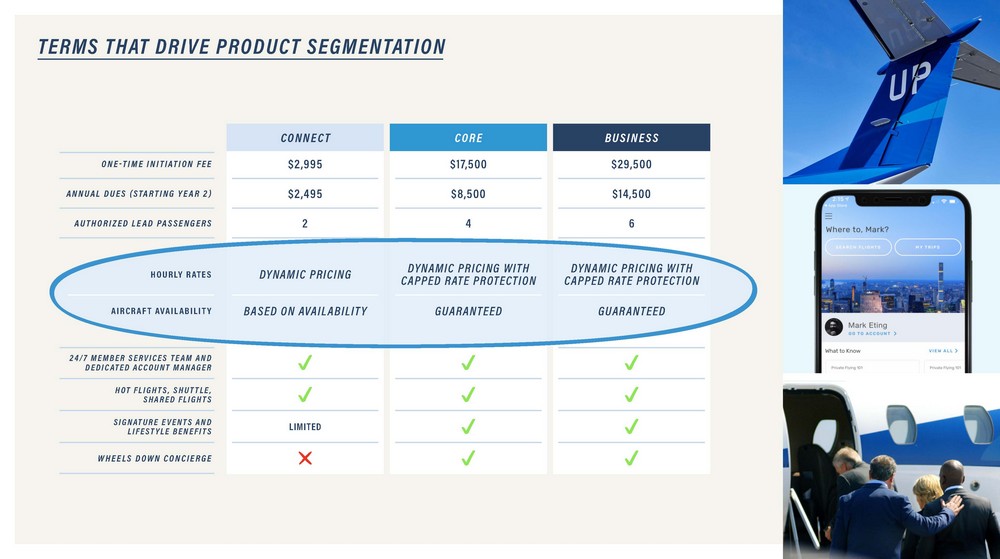

TERMS THAT DRIVE PRODUCT SEGMENTATION CONNECT CORE BUSINESS ONE-TIME INITIATION FEE $2,995 $17,500 $29,500 ANNUAL DUES (STARTING YEAR 2) $2,495 $8,500 $14,500 AUTHORIZED LEAD PASSENGERS 6 4 2 DYNAMIC PRICING DYNAMIC PRICING WITH CAPPED RATE PROTECTION DYNAMIC PRICING WITH CAPPED RATE PROTECTION HOURLY RATES BASED ON AVAILABILITY GUARANTEED GUARANTEED AIRCRAFT AVAILABILITY 24/7 MEMBER SERVICES TEAM AND DEDICATED ACCOUNT MANAGER HOT FLIGHTS, SHUTTLE, SHARED FLIGHTS SIGNATURE EVENTS AND LIFESTYLE BENEFITS LIMITED WHEELS DOWN CONCIERGE

DYNAMIC PRICING COUPLED WITH CAPPED HOURLY PRICE PROTECTION CUSTOMER GETS BEST PRICING IN BOTH SCENARIOS! NO PRICE REDUCTIONS ON LOW DEMAND DAYS CHARTER BROKER JET CARD $ $ $ $ LOW DEMAND DAYS $ $ $ $ $ $ $ $ PEAK TRAVEL DAYS PRICES SURGE ON THE BUSIEST DAYS WHEELS UP 42

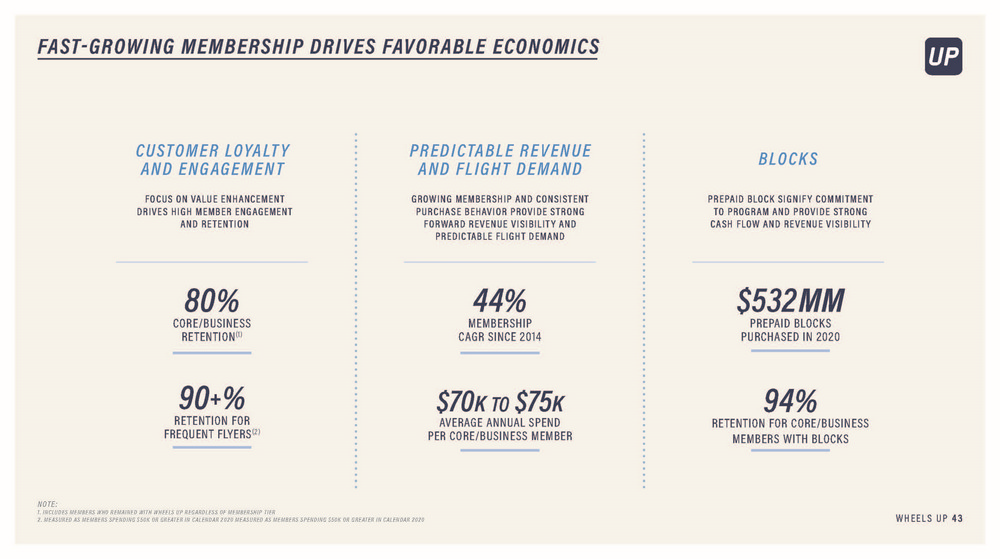

FAST-GROWING MEMBERSHIP DRIVES FAVORABLE ECONOMICS CUSTOMER LOYALTY AND ENGAGEMENT PREDICTABLE REVENUE AND FLIGHT DEMAND BLOCKS FOCUS ON VALUE ENHANCEMENT DRIVES HIGH MEMBER ENGAGEMENT AND RETENTION GROWING MEMBERSHIP AND CONSISTENT PURCHASE BEHAVIOR PROVIDE STRONG FORWARD REVENUE VISIBILITY AND PREDICTABLE FLIGHT DEMAND PREPAID BLOCK SIGNIFY COMMITMENT TO PROGRAM AND PROVIDE STRONG CASH FLOW AND REVENUE VISIBILITY 44% MEMBERSHIP CAGR SINCE 2014 80% CORE/BUSINESS RETENTION(1) $532MM PREPAID BLOCKS PURCHASED IN 2020 90+% RETENTION FOR FREQUENT FLYERS(2) 94% RETENTION FOR CORE/BUSINESS MEMBERS WITH BLOCKS $70K TO $75K AVERAGE ANNUAL SPEND PER CORE/BUSINESS MEMBER NOTE: 1. INCLUDES MEMBERS WHO REMAINED WITH WHEELS UP REGARDLESS OF MEMBERSHIP TIER 2. MEASURED AS MEMBERS SPENDING $50K OR GREATER IN CALENDAR 2020 MEASURED AS MEMBERS SPENDING $50K OR GREATER IN CALENDAR 2020 WHEELS UP 43

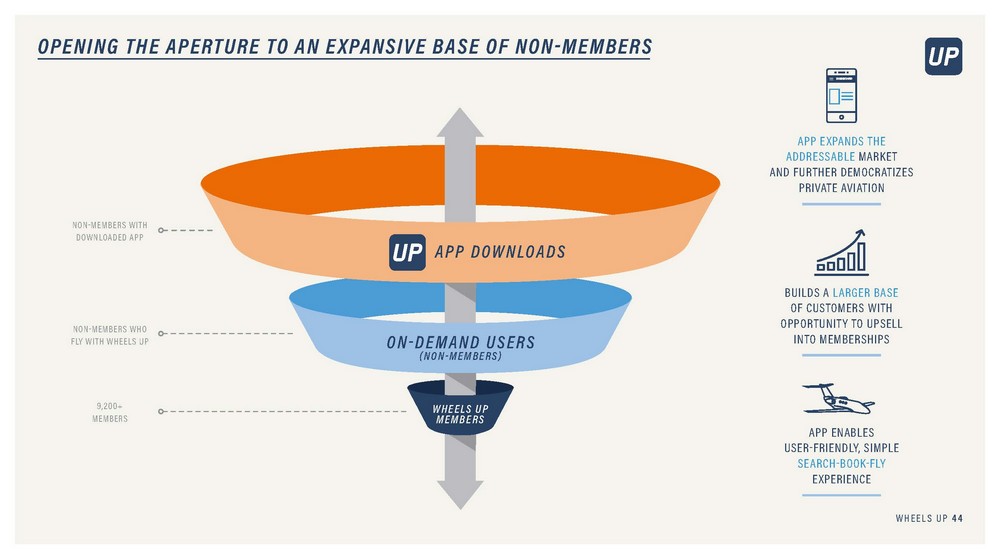

OPENING THE APERTURE TO AN EXPANSIVE BASE OF NON-MEMBERS APP EXPANDS THE ADDRESSABLE MARKET AND FURTHER DEMOCRATIZES PRIVATE AVIATION NON-MEMBERS WITH DOWNLOADED APP APP DOWNLOADS BUILDS A LARGER BASE OF CUSTOMERS WITH OPPORTUNITY TO UPSELL INTO MEMBERSHIPS NON-MEMBERS WHO FLY WITH WHEELS UP ON-DEMAND USERS (NON-MEMBERS) 9,200+ MEMBERS WHEELS UP MEMBERS APP ENABLES USER-FRIENDLY, SIMPLE SEARCH-BOOK-FLY EXPERIENCE WHEELS UP 44

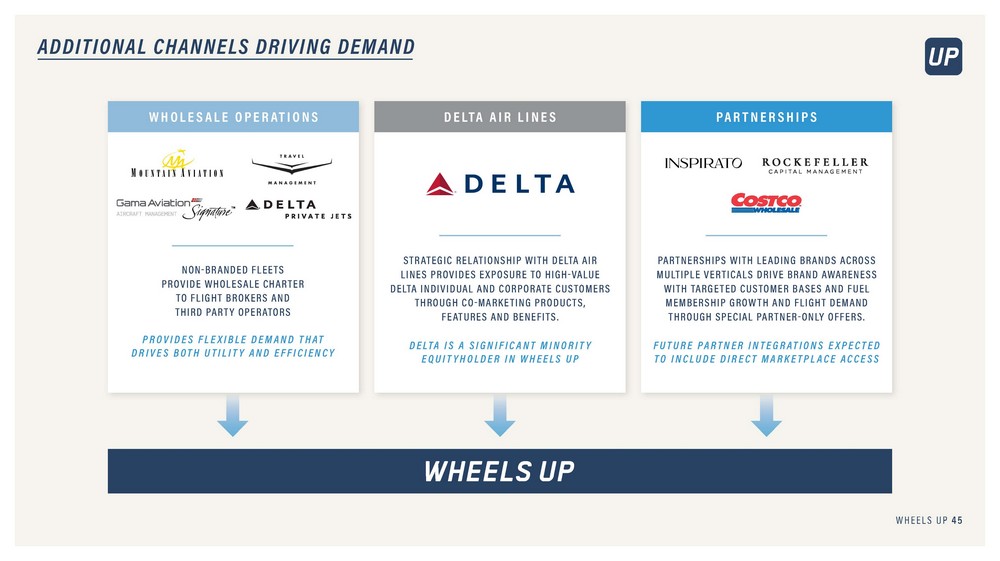

ADDITIONAL CHANNELS DRIVING DEMAND WHOLESALE OPERATIONS DELTA AIR LINES PARTNERSHIPS STRATEGIC RELATIONSHIP WITH DELTA AIR LINES PROVIDES EXPOSURE TO HIGH-VALUE DELTA INDIVIDUAL AND CORPORATE CUSTOMERS THROUGH CO-MARKETING PRODUCTS, FEATURES AND BENEFITS. PARTNERSHIPS WITH LEADING BRANDS ACROSS MULTIPLE VERTICALS DRIVE BRAND AWARENESS WITH TARGETED CUSTOMER BASES AND FUEL MEMBERSHIP GROWTH AND FLIGHT DEMAND THROUGH SPECIAL PARTNER-ONLY OFFERS. NON-BRANDED FLEETS PROVIDE WHOLESALE CHARTER TO FLIGHT BROKERS AND THIRD PARTY OPERATORS PROVIDES FLEXIBLE DEMAND THAT DRIVES BOTH UTILITY AND EFFICIENCY DELTA IS A SIGNIFICANT MINORITY EQUITYHOLDER IN WHEELS UP FUTURE PARTNER INTEGRATIONS EXPECTED TO INCLUDE DIRECT MARKETPLACE ACCESS WHEELS UP 45

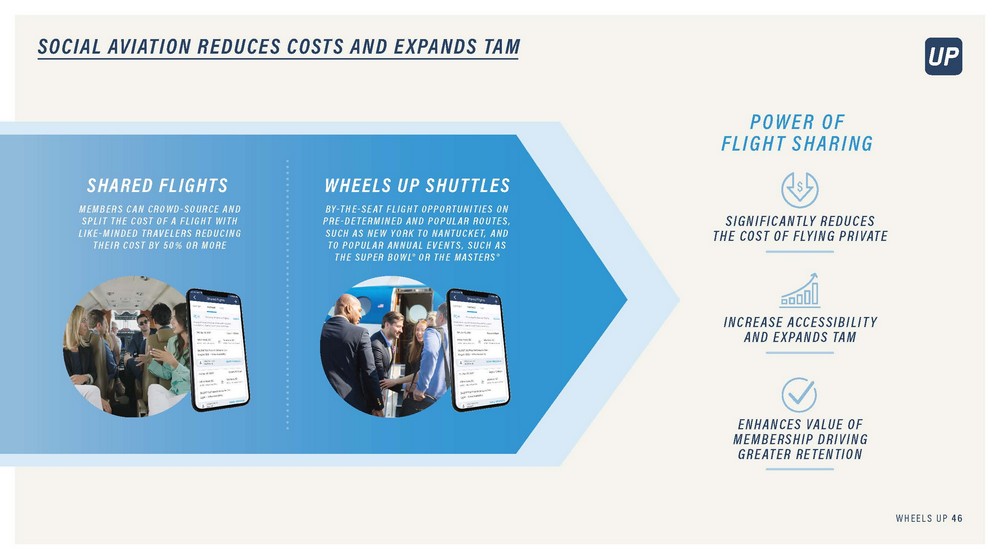

SOCIAL AVIATION REDUCES COSTS AND EXPANDS TAM POWER OF FLIGHT SHARING SHARED FLIGHTS WHEELS UP SHUTTLES $ MEMBERS CAN CROWD-SOURCE AND SPLIT THE COST OF A FLIGHT WITH LIKE-MINDED TRAVELERS REDUCING THEIR COST BY 50% OR MORE BY-THE-SEAT FLIGHT OPPORTUNITIES ON PRE-DETERMINED AND POPULAR ROUTES, SUCH AS NEW YORK TO NANTUCKET, AND TO POPULAR ANNUAL EVENTS, SUCH AS THE SUPER BOWL® OR THE MASTERS® SIGNIFICANTLY REDUCES THE COST OF FLYING PRIVATE INCREASE ACCESSIBILITY AND EXPANDS TAM ENHANCES VALUE OF MEMBERSHIP DRIVING GREATER RETENTION WHEELS UP 46

DRIVING DEMAND BY EXPANDING THE SAM AND THE TAM BUSINESS MEMBERSHIP PARTNERSHIPS WHOLESALE FULL OWNERSHIP CORE MEMBERSHIP FRACTIONAL OWNERSHIP JET CARD PROGRAMS MEMBERSHIP PROGRAMS CHARTER COMMERCIAL AGREEMENT CONNECT MEMBERSHIP WHEELS UP APP WHEELS UP 47

OPERATIONAL OVERVIEW TOM BERGESON CHIEF OPERATING OFFICER

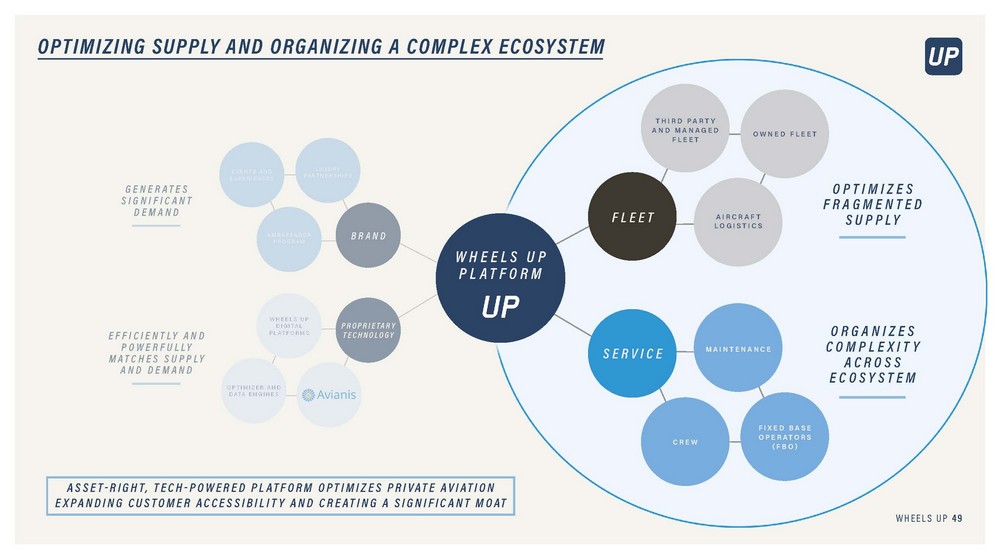

OPTIMIZING SUPPLY AND ORGANIZING A COMPLEX ECOSYSTEM THIRD PARTY AND MANAGED FLEET OWNED FLEET LUXURY PARTNERSHIPS EVENTS AND EXPERIENCES OPTIMIZES FRAGMENTED SUPPLY GENERATES SIGNIFICANT DEMAND FLEET AIRCRAFT LOGISTICS BRAND AMBASSADOR PROGRAM WHEELS UP PLATFORM WHEELS UP DIGITAL PLATFORMS PROPRIETARY TECHNOLOGY ORGANIZES COMPLEXITY ACROSS ECOSYSTEM EFFICIENTLY AND POWERFULLY MATCHES SUPPLY AND DEMAND MAINTENANCE SERVICE OPTIMIZER AND DATA ENGINES FIXED BASE OPERATORS (FBO) CREW ASSET-RIGHT, TECH-POWERED PLATFORM OPTIMIZES PRIVATE AVIATION EXPANDING CUSTOMER ACCESSIBILITY AND CREATING A SIGNIFICANT MOAT WHEELS UP 49

OUR SOLUTION POWER A MARKETPLACE WITH... ...TENS OF THOUSANDS OF AIRCRAFT ...MILLIONS OF CONSUMERS WHEELS UP 50

OUR COMMITMENT... HAVE THE RIGHT PLANE... IN THE RIGHT PLACE... AT THE RIGHT TIME.

INDUSTRY REGULATIONS PART 91 NON-COMMERCIAL PART 135 COMMERCIAL PART 145 MAINTENANCE CERTIFICATION Ŋ PRIVATE USE ONLY Ŋ NO COMPENSATION Ŋ NO REIMBURSEMENT FOR FLIGHT COSTS Ŋ REDUCED SAFETY REGULATIONS Ŋ LESS RESTRICTIVE CREW DUTY TIME/REST REQUIREMENTS Ŋ ENHANCED SAFETY REQUIREMENTS Ŋ MANDATORY DRUG TESTING Ŋ REQUIRED MEDICAL PHYSICAL Ŋ STRICTER MAINTENANCE STANDARDS Ŋ SPECIFIC FLIGHT CREW/REST REQUIREMENTS Ŋ MAINTENANCE, REPAIR, OVERHAUL Ŋ RETAIL TO SERVICE OTHERS WHEELS UP 52

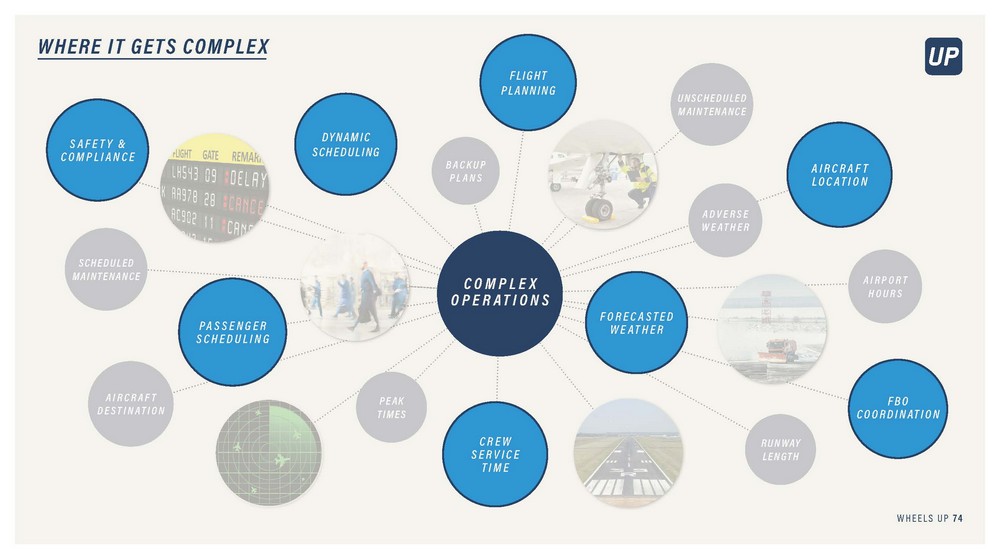

WHERE IT GETS COMPLEX FLIGHT PLANNING UNSCHEDULED MAINTENANCE UNSCHEDULED MAINTENANCE SAFETY & COMPLIANCE DYNAMIC SCHEDULING CREW SERVICE TIME SCHEDULED MAINTENANCE ADVERSE WEATHER AIRCRAFT LOCATION AIRPORT HOURS COMPLEX OPERATIONS FORECASTED WEATHER PASSENGER SCHEDULING AIRCRAFT DESTINATION FBO COORDINATION PEAK TIMES BACKUP PLANS RUNWAY LENGTH WHEELS UP 53

AIRCRAFT ARE EXPENSIVE TO OWN AND OPERATE $ $ $ $ $ $ FIXED COSTS VARIABLE COSTS OPPORTUNITY COSTS Ŋ EMPTY REPOSITIONING Ŋ OUT OF SERVICE TIME (MAINTENANCE) Ŋ AIRCRAFT SITTING IDLE Ŋ FUEL Ŋ FIXED BASE OPERATION (FBO) FEES Ŋ UNSCHEDULED MAINTENANCE Ŋ CLEANING Ŋ AIRPORT CHARGES Ŋ DEBT/LEASE PAYMENTS Ŋ SCHEDULED MAINTENANCE Ŋ PILOTS Ŋ TRAINING Ŋ INSURANCE WHEELS UP 54

OUR OPPORTUNITY COMPLEXITY DRIVES CHALLENGES... FRAGMENTED SUPPLY UNDERUTILIZED ASSETS OUTDATED TECHNOLOGY ...WHICH CREATE OPPORTUNITY INEFFICIENT MATCHING OF SUPPLY WITH DEMAND OPAQUE PRICING AND INACCESSIBILITY WHEELS UP 55

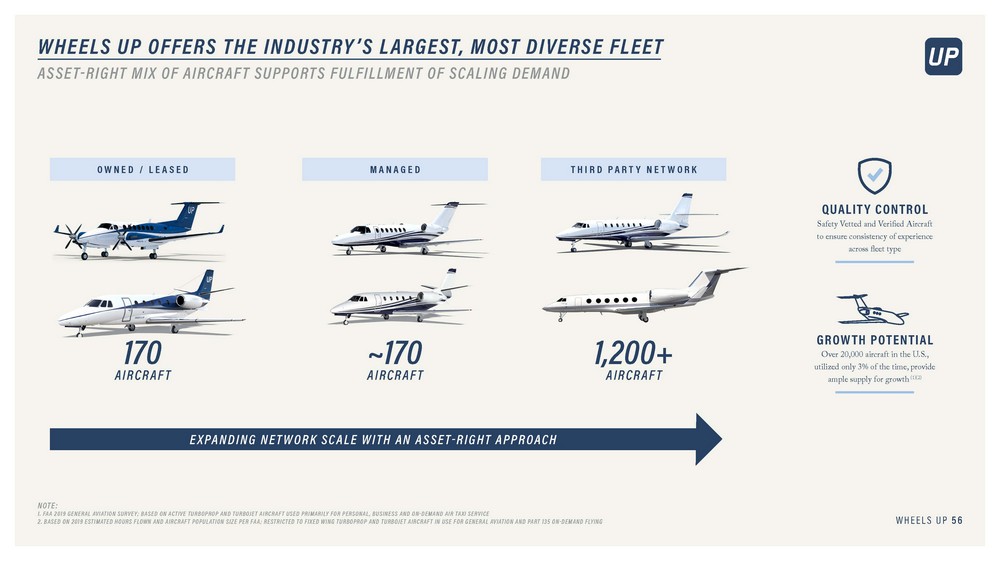

WHEELS UP OFFERS THE INDUSTRY’S LARGEST, MOST DIVERSE FLEET ASSET-RIGHT MIX OF AIRCRAFT SUPPORTS FULFILLMENT OF SCALING DEMAND OWNED / LEASED MANAGED THIRD PARTY NETWORK QUALITY CONTROL Safety Vetted and Verified Aircraft to ensure consistency of experience across fleet type GROWTH POTENTIAL 170 AIRCRAFT ~170 AIRCRAFT 1,200+ AIRCRAFT Over 20,000 aircraft in the U.S., utilized only 3% of the time, provide ample supply for growth (1)(2) EXPANDING NETWORK SCALE WITH AN ASSET-RIGHT APPROACH NOTE: 1. FAA 2019 GENERAL AVIATION SURVEY; BASED ON ACTIVE TURBOPROP AND TURBOJET AIRCRAFT USED PRIMARILY FOR PERSONAL, BUSINESS AND ON-DEMAND AIR TAXI SERVICE 2. BASED ON 2019 ESTIMATED HOURS FLOWN AND AIRCRAFT POPULATION SIZE PER FAA; RESTRICTED TO FIXED WING TURBOPROP AND TURBOJET AIRCRAFT IN USE FOR GENERAL AVIATION AND PART 135 ON-DEMAND FLYING WHEELS UP 56

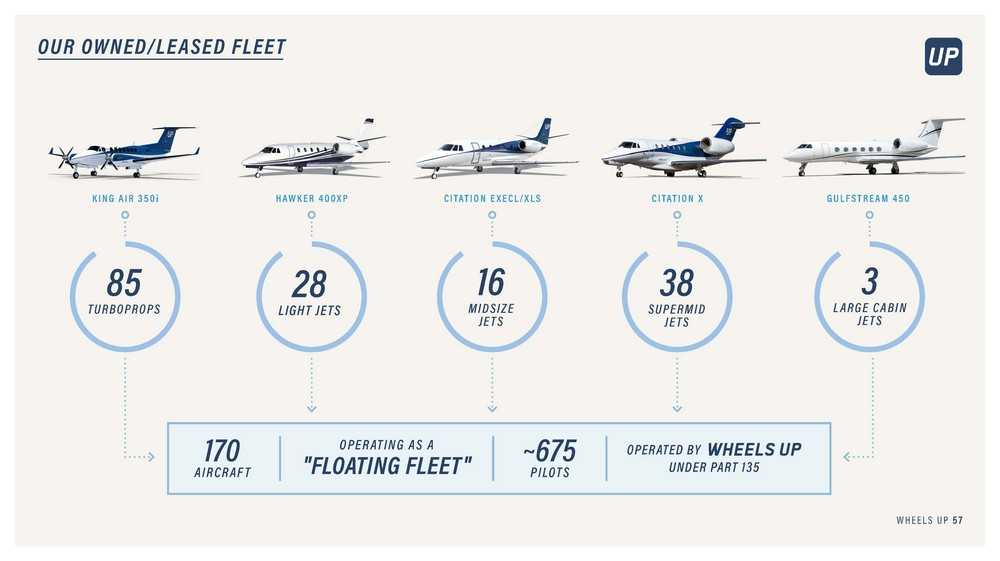

OUR OWNED/LEASED FLEET KING AIR 350i HAWKER 400XP CITATION EXECL/XLS CITATION X GULFSTREAM 450 3 LARGE CABIN JETS 16 MIDSIZE JETS 85 TURBOPROPS 38 SUPERMID JETS 28 LIGHT JETS 170 AIRCRAFT ~675 PILOTS OPERATING AS A "FLOATING FLEET" OPERATED BY UNDER PART 135 WHEELS UP 57

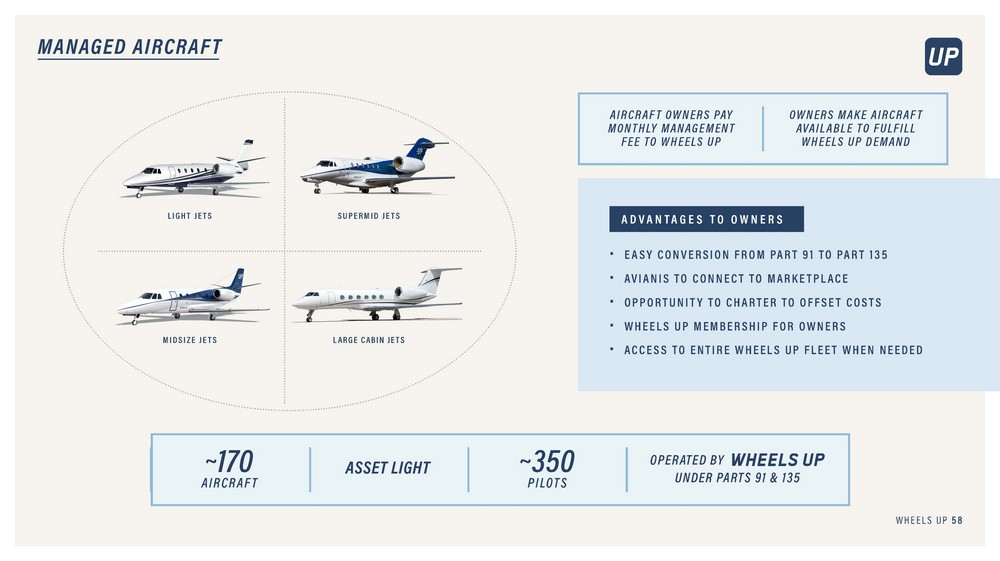

MANAGED AIRCRAFT AIRCRAFT OWNERS PAY MONTHLY MANAGEMENT FEE TO WHEELS UP OWNERS MAKE AIRCRAFT AVAILABLE TO FULFILL WHEELS UP DEMAND ADVANTAGES TO OWNERS LIGHT JETS SUPERMID JETS Ŋ EASY CONVERSION FROM PART 91 TO PART 135 Ŋ AVIANIS TO CONNECT TO MARKETPLACE Ŋ OPPORTUNITY TO CHARTER TO OFFSET COSTS Ŋ WHEELS UP MEMBERSHIP FOR OWNERS Ŋ ACCESS TO ENTIRE WHEELS UP FLEET WHEN NEEDED ~350 PILOTS MIDSIZE JETS LARGE CABIN JETS ~170 AIRCRAFT ~350 PILOTS ASSET LIGHT OPERATED BY UNDER PARTS 91 & 135 WHEELS UP 58

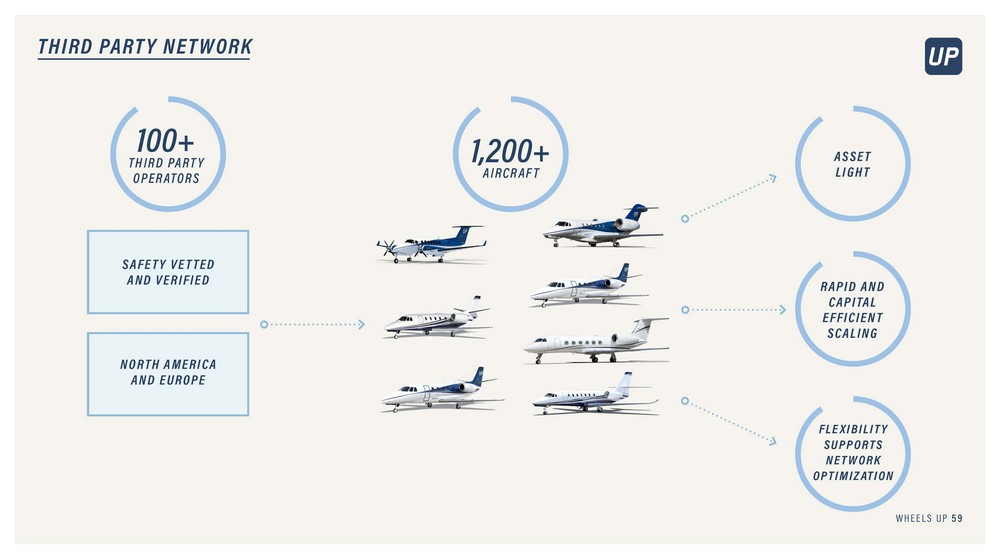

THIRD PARTY NETWORK 100+ THIRD PARTY OPERATORS 1,200+ AIRCRAFT ASSET LIGHT SAFETY VETTED AND VERIFIED RAPID AND CAPITAL EFFICIENT SCALING NORTH AMERICA AND EUROPE FLEXIBILITY SUPPORTS NETWORK OPTIMIZATION WHEELS UP 59

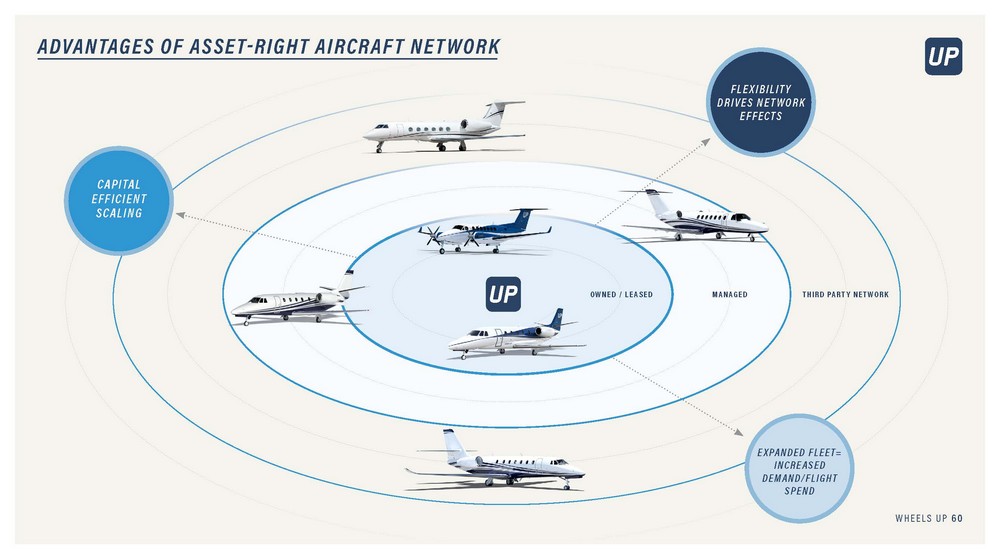

ADVANTAGES OF ASSET-RIGHT AIRCRAFT NETWORK FLEXIBILITY DRIVES NETWORK EFFECTS CAPITAL EFFICIENT SCALING OWNED / LEASED MANAGED THIRD PARTY NETWORK EXPANDED FLEET= INCREASED DEMAND/FLIGHT SPEND WHEELS UP 60

NETWORK EFFECTS UTILITY(1) EFFICIENCY(2) INCREASING UTILIZATION ON FIXED ASSETS REDUCING NON-REVENUE REPOSITIONING FLYING IMPROVE DISPATCH AVAILABILITY REDUCE REPOSITIONING Having aircraft ready with paired crew and available for customer flights Scale means greater opportunity to have aircraft closer to position of where it needs to be CREATE OFF-PEAK DEMAND MONETIZE REPOSITIONING Dynamic pricing algorithms and personalization of Wheels Up App will stimulate flying Wheels Up is leading demand generator NOTE: 1. THE NUMBER OF LIVE HOURS PER AIRCRAFT PER MONTH 2. THE RATIO OF LIVE (PAID) FLIGHT HOURS TO TOTAL FLIGHT HOURS

TRANSITIONING TO IN-HOUSE MAINTENANCE Ŋ LOWER MAINTENANCE COSTS Ŋ IMPROVE RELIABILITY Ŋ IMPROVE AIRCRAFT AVAILABILITY Ŋ HIGHER AVAILABILITY = HIGHER UTILIZATION Ŋ MAINTENANCE FOR RETAIL SCHEDULED MAINTENANCE NON-SCHEDULED MAINTENANCE (MOBILE)

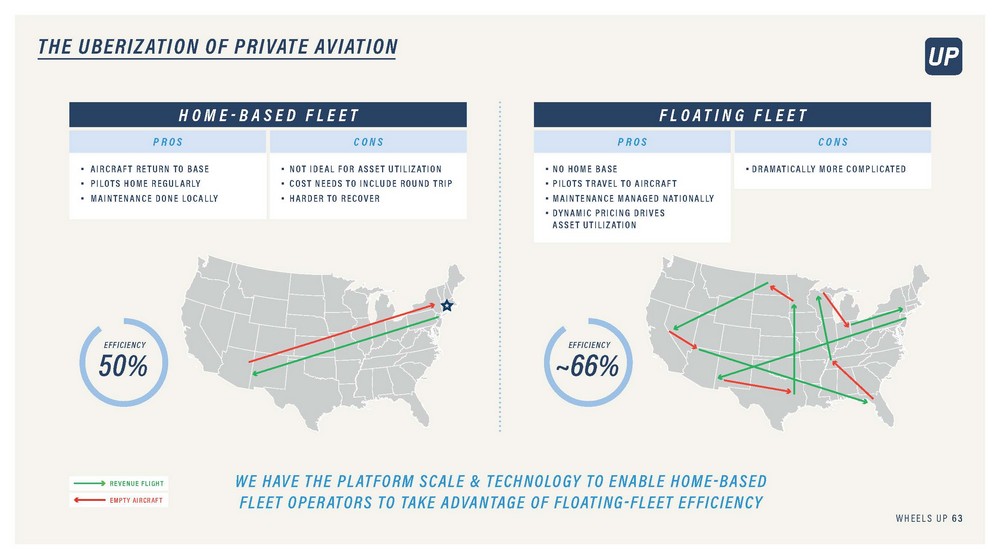

THE UBERIZATION OF PRIVATE AVIATION HOME-BASED FLEET FLOATING FLEET PROS CONS PROS CONS AIRCRAFT RETURN TO BASE PILOTS HOME REGULARLY MAINTENANCE DONE LOCALLY NOT IDEAL FOR ASSET UTILIZATION COST NEEDS TO INCLUDE ROUND TRIP HARDER TO RECOVER DRAMATICALLY MORE COMPLICATED NO HOME BASE PILOTS TRAVEL TO AIRCRAFT MAINTENANCE MANAGED NATIONALLY DYNAMIC PRICING DRIVES ASSET UTILIZATION EFFICIENCY EFFICIENCY 50% ~66% WE HAVE THE PLATFORM SCALE & TECHNOLOGY TO ENABLE HOME-BASED FLEET OPERATORS TO TAKE ADVANTAGE OF FLOATING-FLEET EFFICIENCY REVENUE FLIGHT EMPTY AIRCRAFT WHEELS UP 63

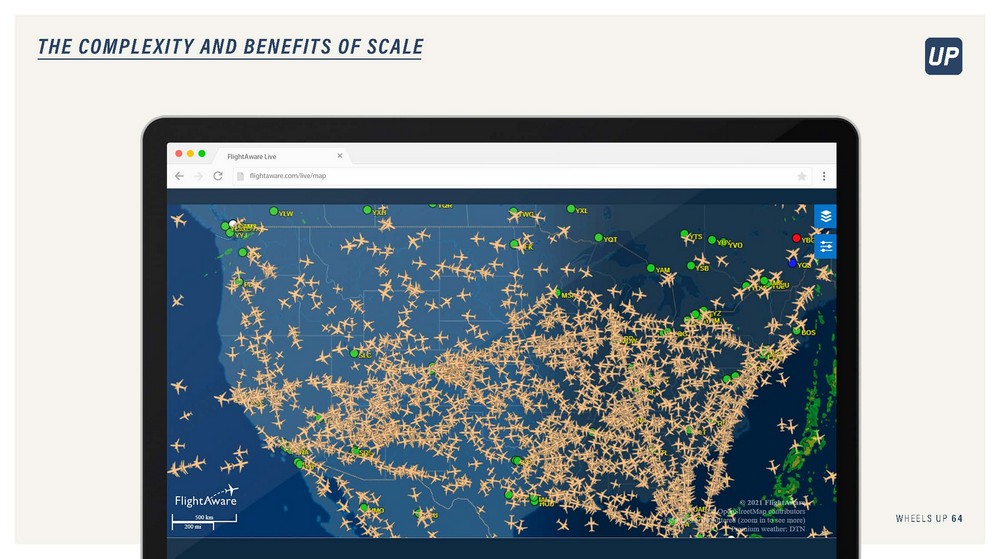

THE COMPLEXITY AND BENEFITS OF SCALE WHEELS UP 64

OUR COMMITMENT... HAVE THE RIGHT PLANE... IN THE RIGHT PLACE... AT THE RIGHT TIME.

PLATFORM TECHNOLOGY DAN CROWE CHIEF INFORMATION OFFICER DANIEL THARP CHIEF PLATFORM OFFICER

TECHNOLOGY MATCHING SUPPLY AND DEMAND LUXURY PARTNERSHIPS EVENTS AND EXPERIENCES THIRD PARTY AND MANAGED FLEET OWNED FLEET GENERATES SIGNIFICANT DEMAND OPTIMIZES FRAGMENTED SUPPLY AMBASSADOR PROGRAM BRAND FLEET AIRCRAFT LOGISTICS WHEELS UP PLATFORM WHEELS UP DIGITAL PLATFORMS MAINTENANCE SERVICE PROPRIETARY TECHNOLOGY EFFICIENTLY AND POWERFULLY MATCHES SUPPLY AND DEMAND ORGANIZES COMPLEXITY ACROSS ECOSYSTEM FIXED BASE OPERATORS (FBO) CREW OPTIMIZER AND DATA ENGINES ASSET-RIGHT, TECH-POWERED PLATFORM OPTIMIZES PRIVATE AVIATION EXPANDING CUSTOMER ACCESSIBILITY AND CREATING A SIGNIFICANT MOAT WHEELS UP 67

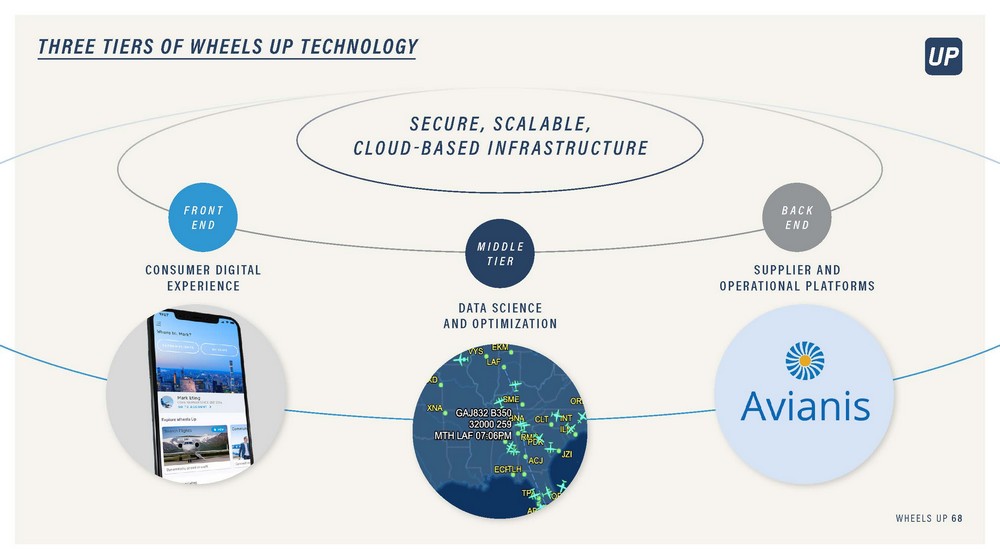

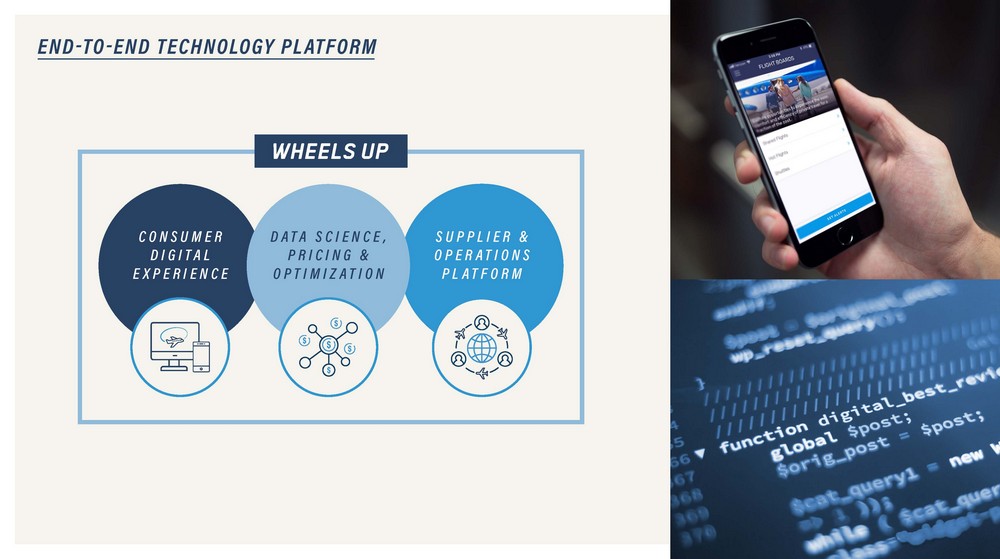

THREE TIERS OF WHEELS UP TECHNOLOGY SECURE, SCALABLE, CLOUD-BASED INFRASTRUCTURE FRONT END BACK END MIDDLE TIER CONSUMER DIGITAL EXPERIENCE SUPPLIER AND OPERATIONAL PLATFORMS DATA SCIENCE AND OPTIMIZATION WHEELS UP 68

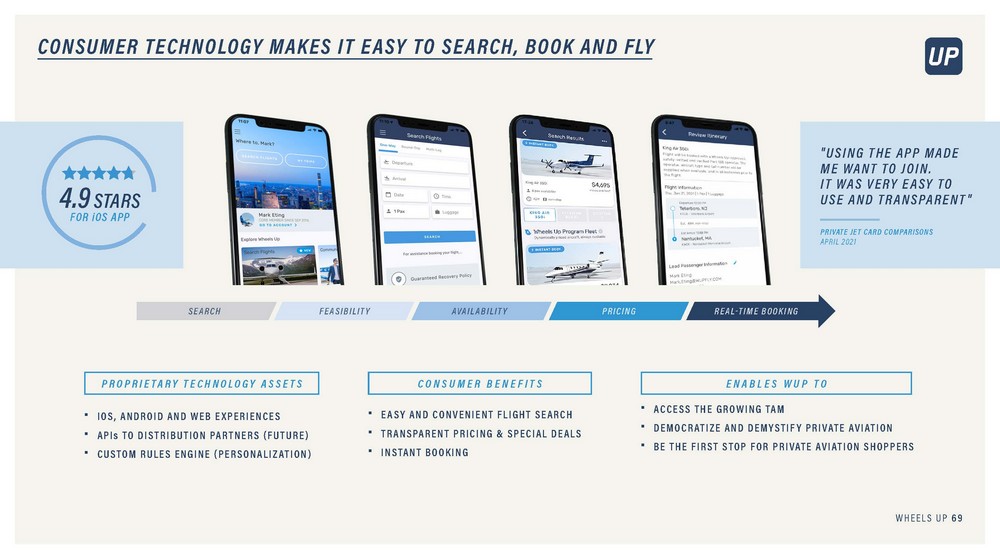

CONSUMER TECHNOLOGY MAKES IT EASY TO SEARCH, BOOK AND FLY "USING THE APP MADE ME WANT TO JOIN. IT WAS VERY EASY TO USE AND TRANSPARENT" 4.9 STARS FOR iOS APP PRIVATE JET CARD COMPARISONS APRIL 2021 SEARCH FEASIBILITY AVAILABILITY PRICING REAL-TIME BOOKING PROPRIETARY TECHNOLOGY ASSETS CONSUMER BENEFITS ENABLES WUP TO Ŋ ACCESS THE GROWING TAM Ŋ DEMOCRATIZE AND DEMYSTIFY PRIVATE AVIATION Ŋ BE THE FIRST STOP FOR PRIVATE AVIATION SHOPPERS Ŋ EASY AND CONVENIENT FLIGHT SEARCH Ŋ TRANSPARENT PRICING & SPECIAL DEALS Ŋ INSTANT BOOKING Ŋ IOS, ANDROID AND WEB EXPERIENCES Ŋ APIs TO DISTRIBUTION PARTNERS (FUTURE) Ŋ CUSTOM RULES ENGINE (PERSONALIZATION) WHEELS UP 69

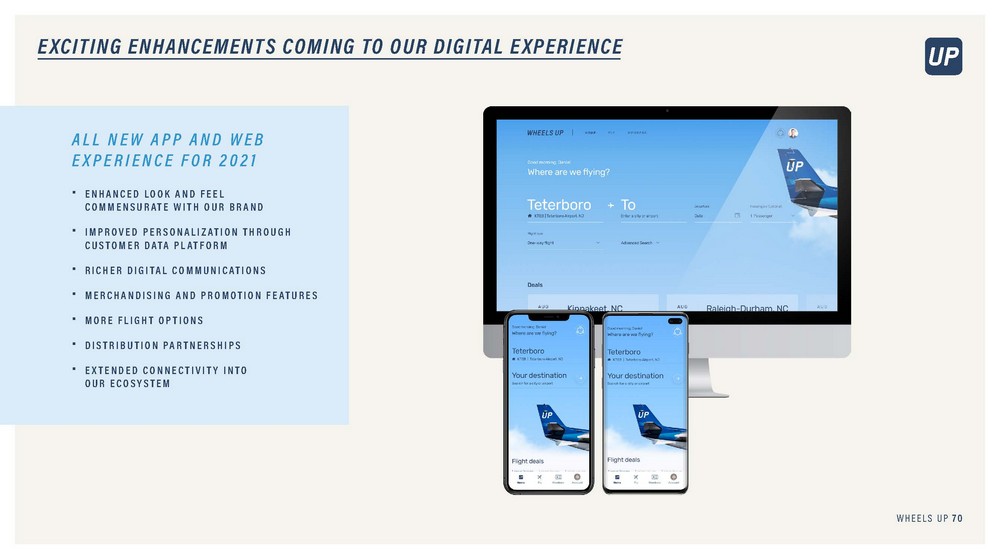

EXCITING ENHANCEMENTS COMING TO OUR DIGITAL EXPERIENCE ALL NEW APP AND WEB EXPERIENCE FOR 2021 Ŋ ENHANCED LOOK AND FEEL COMMENSURATE WITH OUR BRAND Ŋ IMPROVED PERSONALIZATION THROUGH CUSTOMER DATA PLATFORM Ŋ RICHER DIGITAL COMMUNICATIONS Ŋ MERCHANDISING AND PROMOTION FEATURES Ŋ MORE FLIGHT OPTIONS Ŋ DISTRIBUTION PARTNERSHIPS Ŋ EXTENDED CONNECTIVITY INTO OUR ECOSYSTEM WHEELS UP 70

DATA SCIENCE AND OPTIMIZATION TECHNOLOGY POWERS OUR MARKETPLACE PROPRIETARY TECHNOLOGY SOLVES COMPLEX PROBLEMS Ŋ DYNAMIC PRICING & FEASIBILITY IN REAL TIME Ŋ SCHEDULE OPTIMIZATION Ŋ EFFECTIVE REVENUE MANAGEMENT LEVERAGES OUR DATA SCIENCE CAPABILITIES Ŋ AI / MACHINE LEARNING Ŋ PREDICTIVE ANALYTICS Ŋ TALENTED TEAM OF QUANTS DRIVES NETWORK EFFECTS Ŋ OPTIMIZED DEMAND Ŋ HIGHER ASSET UTILITY AND FLEET EFFICIENCY Ŋ GREATER PRICING FLEXIBILITY

WHEELS UP PROPRIETARY ALGORITHMS AND DATA CREATE A DEEP MOAT WE CAPTURE MORE DATA DUE TO OUR SCALE CREATING BENEFITS FOR MARKETPLACE PARTICIPANTS DATA LAYER PROPRIETARY PLATFORM BEHAVIORAL DATA CUSTOMER DATA APP SEARCH DATA SEASONAL TRENDS TRANSACTION DATA FOR OPERATORS • IMPROVE ASSET UTILIZATION • MORE COMPETITIVE DYNAMIC PRICING • BETTER AIRCRAFT AVAILABILITY • RIGHT AIRCRAFT FOR THE MISSION WHEELS UP PROPRIETARY ALGORITHMS AND DATA ANALYTICS ENGINES CREW AVAILABILITY AIRCRAFT SPECIFIC DATA FLIGHT SCHEDULES AIRCRAFT AVAILABILITY & MAINTENANCE PRICING DATA ITINERARY DATA THIRD PARTY INTEGRATIONS FOR FLYERS • BETTER PRICING • MORE CONSISTENT SERVICE • GREATER CHOICES • EASIER TO TRANSACT DEMAND SUPPLY MARKETPLACE WHEELS UP 72

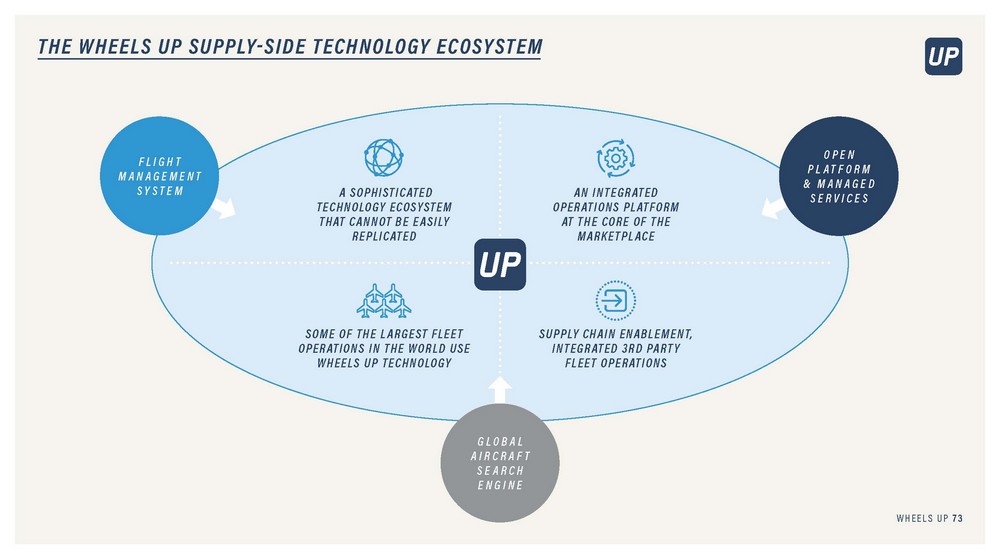

THE WHEELS UP SUPPLY-SIDE TECHNOLOGY ECOSYSTEM OPEN PLATFORM & MANAGED SERVICES FLIGHT MANAGEMENT SYSTEM A SOPHISTICATED TECHNOLOGY ECOSYSTEM THAT CANNOT BE EASILY REPLICATED AN INTEGRATED OPERATIONS PLATFORM AT THE CORE OF THE MARKETPLACE SOME OF THE LARGEST FLEET OPERATIONS IN THE WORLD USE WHEELS UP TECHNOLOGY SUPPLY CHAIN ENABLEMENT, INTEGRATED 3RD PARTY FLEET OPERATIONS GLOBAL AIRCRAFT SEARCH ENGINE WHEELS UP 73

WHERE IT GETS COMPLEX FLIGHT PLANNING UNSCHEDULED MAINTENANCE UNSCHEDULED MAINTENANCE SAFETY & COMPLIANCE DYNAMIC SCHEDULING BACKUP PLANS AIRCRAFT LOCATION ADVERSE WEATHER SCHEDULED MAINTENANCE AIRPORT HOURS COMPLEX OPERATIONS FORECASTED WEATHER PASSENGER SCHEDULING AIRCRAFT DESTINATION FBO COORDINATION PEAK TIMES RUNWAY LENGTH CREW SERVICE TIME WHEELS UP 74

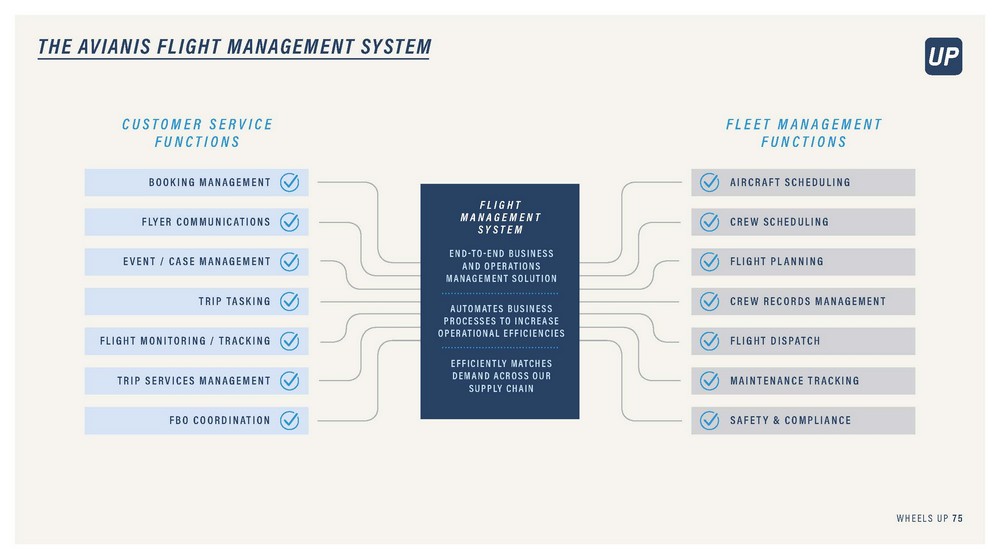

THE AVIANIS FLIGHT MANAGEMENT SYSTEM CUSTOMER SERVICE FUNCTIONS FLEET MANAGEMENT FUNCTIONS BOOKING MANAGEMENT FLYER COMMUNICATIONS EVENT / CASE MANAGEMENT TRIP TASKING FLIGHT MONITORING / TRACKING TRIP SERVICES MANAGEMENT FBO COORDINATION AIRCRAFT SCHEDULING CREW SCHEDULING FLIGHT PLANNING CREW RECORDS MANAGEMENT FLIGHT DISPATCH MAINTENANCE TRACKING SAFETY & COMPLIANCE FLIGHT MANAGEMENT SYSTEM END-TO-END BUSINESS AND OPERATIONS MANAGEMENT SOLUTION AUTOMATES BUSINESS PROCESSES TO INCREASE OPERATIONAL EFFICIENCIES EFFICIENTLY MATCHES DEMAND ACROSS OUR SUPPLY CHAIN WHEELS UP 75

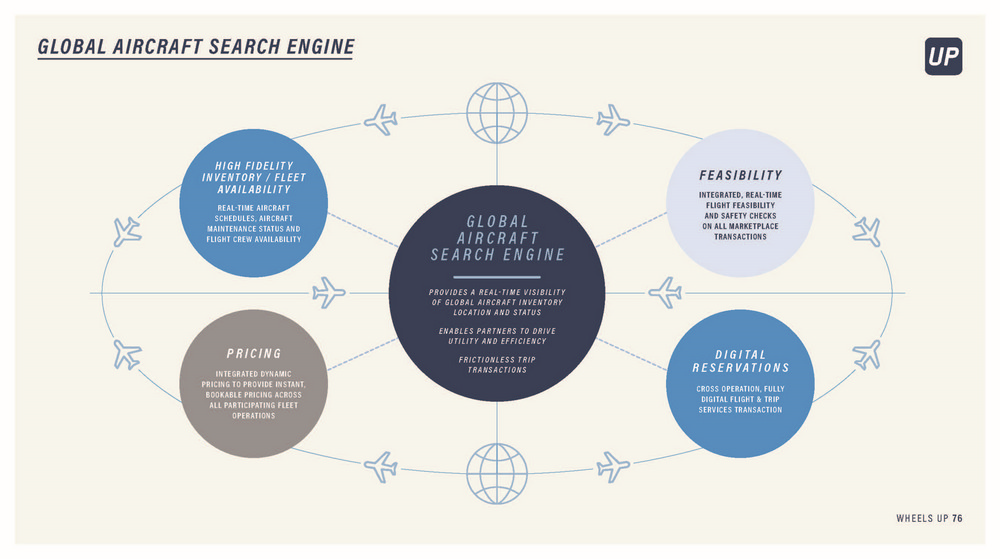

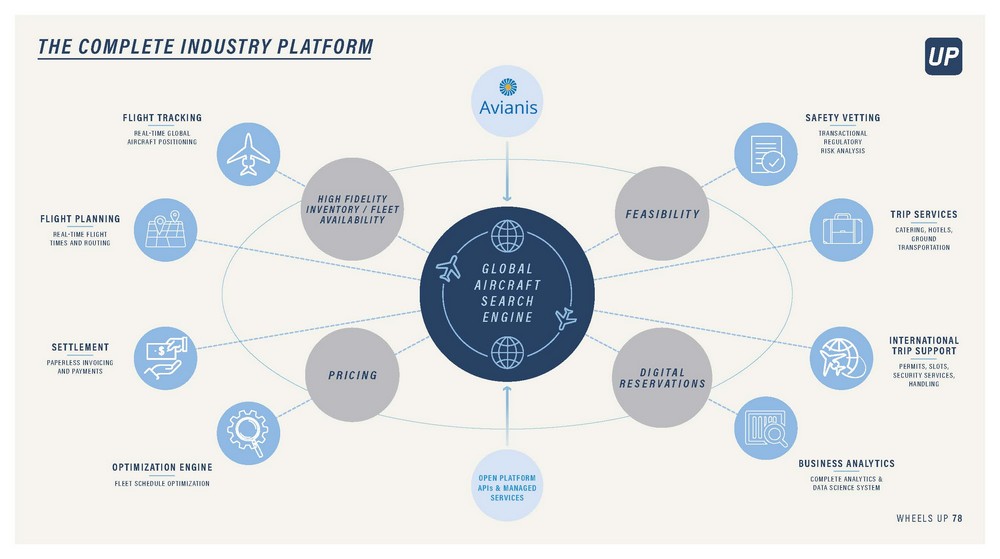

GLOBAL AIRCRAFT SEARCH ENGINE FEASIBILITY HIGH FIDELITY INVENTORY / FLEET AVAILABILITY INTEGRATED, REAL-TIME FLIGHT FEASIBILITY AND SAFETY CHECKS ON ALL MARKETPLACE TRANSACTIONS REAL-TIME AIRCRAFT SCHEDULES, AIRCRAFT MAINTENANCE STATUS AND FLIGHT CREW AVAILABILITY GLOBAL AIRCRAFT SEARCH ENGINE PROVIDES A REAL-TIME VISIBILITY OF GLOBAL AIRCRAFT INVENTORY LOCATION AND STATUS ENABLES PARTNERS TO DRIVE UTILITY AND EFFICIENCY FRICTIONLESS TRIP TRANSACTIONS PRICING DIGITAL RESERVATIONS INTEGRATED DYNAMIC PRICING TO PROVIDE INSTANT, BOOKABLE PRICING ACROSS ALL PARTICIPATING FLEET OPERATIONS CROSS OPERATION, FULLY DIGITAL FLIGHT & TRIP SERVICES TRANSACTION WHEELS UP 76

OPEN PLATFORM, 3RD PARTY SERVICES TRIP SERVICES CHARTER Ŋ AN OPEN PLATFORM TO INTEGRATE 3RD PARTY FLEET MANAGEMENT SYSTEMS Ŋ DIGITAL CONNECTIVITY TO WHEELS UP DEMAND Ŋ BROAD ECOSYSTEM OF INTEGRATED 3RD PARTY SERVICE PROVIDERS AND TECHNOLOGIES - FLIGHT PLANNING - FLIGHT TRACKING - INTERNATIONAL TRIP SUPPORT (PERMITS, SLOTS, HANDLING, ETC) - PASSENGER TRIP SERVICES (CATERING, GROUND, LODGING, FBO) Ŋ COMPREHENSIVE API LIBRARY FOR CUSTOM BUSINESS SYSTEM AND SERVICE INTEGRATIONS GOVERNMENT & REGULATORY FLEET MAINTENANCE WHEELS UP 77

THE COMPLETE INDUSTRY PLATFORM FLIGHT TRACKING REAL-TIME GLOBAL AIRCRAFT POSITIONING SAFETY VETTING TRANSACTIONAL REGULATORY RISK ANALYSIS HIGH FIDELITY INVENTORY / FLEET AVAILABILITY FEASIBILITY TRIP SERVICES CATERING, HOTELS, GROUND TRANSPORTATION FLIGHT PLANNING REAL-TIME FLIGHT TIMES AND ROUTING GLOBAL AIRCRAFT SEARCH ENGINE INTERNATIONAL TRIP SUPPORT PERMITS, SLOTS, SECURITY SERVICES, HANDLING SETTLEMENT PAPERLESS INVOICING AND PAYMENTS DIGITAL RESERVATIONS PRICING BUSINESS ANALYTICS COMPLETE ANALYTICS & DATA SCIENCE SYSTEM OPTIMIZATION ENGINE FLEET SCHEDULE OPTIMIZATION OPEN PLATFORM APIs & MANAGED SERVICES WHEELS UP 78

END-TO-END TECHNOLOGY PLATFORM DATA SCIENCE, PRICING & OPTIMIZATION CONSUMER DIGITAL EXPERIENCE SUPPLIER & OPERATIONS PLATFORM

FINANCIAL OVERVIEW ERIC JACOBS CHIEF FINANCIAL OFFICER

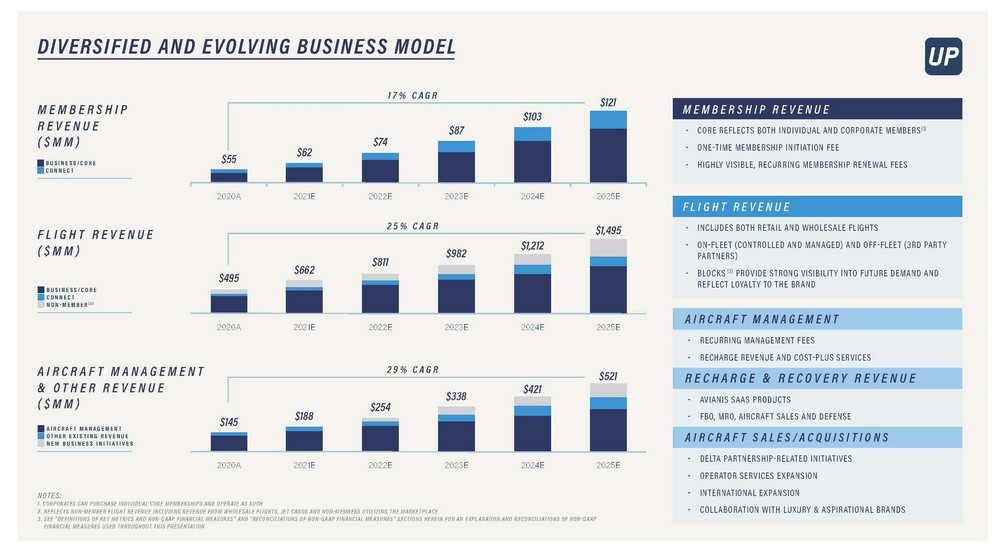

DIVERSIFIED AND EVOLVING BUSINESS MODEL 17% CAGR $121 MEMBERSHIP REVENUE ($MM) MEMBERSHIP REVENUE • CORE REFLECTS BOTH INDIVIDUAL AND CORPORATE MEMBERS(1) • ONE-TIME MEMBERSHIP INITIATION FEE • HIGHLY VISIBLE, RECURRING MEMBERSHIP RENEWAL FEES $103 $87 $74 $62 $55 BUSINESS/CORE CONNECT 2020A 2021E 2022E 2023E 2024E 2025E FLIGHT REVENUE • INCLUDES BOTH RETAIL AND WHOLESALE FLIGHTS • ON-FLEET (CONTROLLED AND MANAGED) AND OFF-FLEET (3RD PARTY PARTNERS) • BLOCKS (3) PROVIDE STRONG VISIBILITY INTO FUTURE DEMAND AND REFLECT LOYALTY TO THE BRAND 25% CAGR $1,495 FLIGHT REVENUE ($MM) $1,212 $982 $811 $662 $495 BUSINESS/CORE CONNECT NON-MEMBER(2) AIRCRAFT MANAGEMENT • RECURRING MANAGEMENT FEES • RECHARGE REVENUE AND COST-PLUS SERVICES RECHARGE & RECOVERY REVENUE • AVIANIS SAAS PRODUCTS • FBO, MRO, AIRCRAFT SALES AND DEFENSE AIRCRAFT SALES/ACQUISITIONS • DELTA PARTNERSHIP-RELATED INITIATIVES • OPERATOR SERVICES EXPANSION • INTERNATIONAL EXPANSION • COLLABORATION WITH LUXURY & ASPIRATIONAL BRANDS 2025E 2024E 2023E 2022E 2021E 2020A 29% CAGR AIRCRAFT MANAGEMENT & OTHER REVENUE ($MM) $521 $421 $338 $254 $188 $145 AIRCRAFT MANAGEMENT OTHER EXISTING REVENUE NEW BUSINESS INITIATIVES 2020A 2021E 2022E 2023E 2024E 2025E NOTES: 1. CORPORATES CAN PURCHASE INDIVIDUAL CORE MEMBERSHIPS AND OPERATE AS SUCH 2. REFLECTS NON-MEMBER FLIGHT REVENUE INCLUDING REVENUE FROM WHOLESALE FLIGHTS, JET CARDS AND NON-MEMBERS UTILIZING THE MARKETPLACE 3. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION

MEMBERSHIP REVENUE INITIATION FEES × ANNUAL DUES(2) BUSINESS: $14,500 CORE: $8,500 CONNECT: $2,495 AVERAGE ACTIVE MEMBERS(1) ANNUAL BLENDED FEE ACTIVE MEMBERS(1) EVOLVING MEMBER BASE 9,212 2018A 2020A 5,787 28% 4,664 4,073 100% 72% 2,812 2020A 2018A 2017A 2016A 2019A BUSINESS/CORE CONNECT BUSINESS/CORE CONNECT NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION 2. STANDARD PRICE WHEELS UP 82

FLIGHT REVENUE × KEY DRIVERS REVENUE PER LEG NUMBER OF LIVE LEGS(1) • DEMAND (RETAIL & WHOLESALE) • CABIN CLASS MIX • DYNAMIC PRICING • STAGE LENGTH • DEMAND (MEMBER & NON-MEMBER) • BLOCKS PROVIDE GREAT VISIBILITY INTO FUTURE DEMAND CABIN CLASS MIX SUPERMID JET CURRENT 2018A LARGE CABIN JET TURBOPROP MIDSIZE JET SUPERMID JET LIGHT JET TURBOPROP MIDSIZE JET NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION

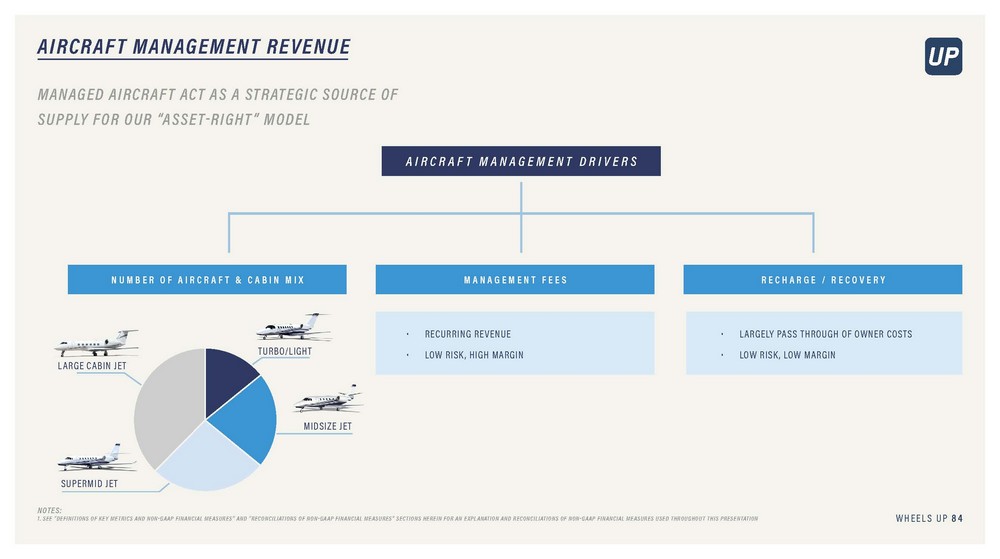

AIRCRAFT MANAGEMENT REVENUE MANAGED AIRCRAFT ACT AS A STRATEGIC SOURCE OF SUPPLY FOR OUR “ASSET-RIGHT” MODEL AIRCRAFT MANAGEMENT DRIVERS NUMBER OF AIRCRAFT & CABIN MIX MANAGEMENT FEES RECHARGE / RECOVERY • RECURRING REVENUE • LOW RISK, HIGH MARGIN • LARGELY PASS THROUGH OF OWNER COSTS • LOW RISK, LOW MARGIN TURBO/LIGHT LARGE CABIN JET MIDSIZE JET SUPERMID JET NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION WHEELS UP 84

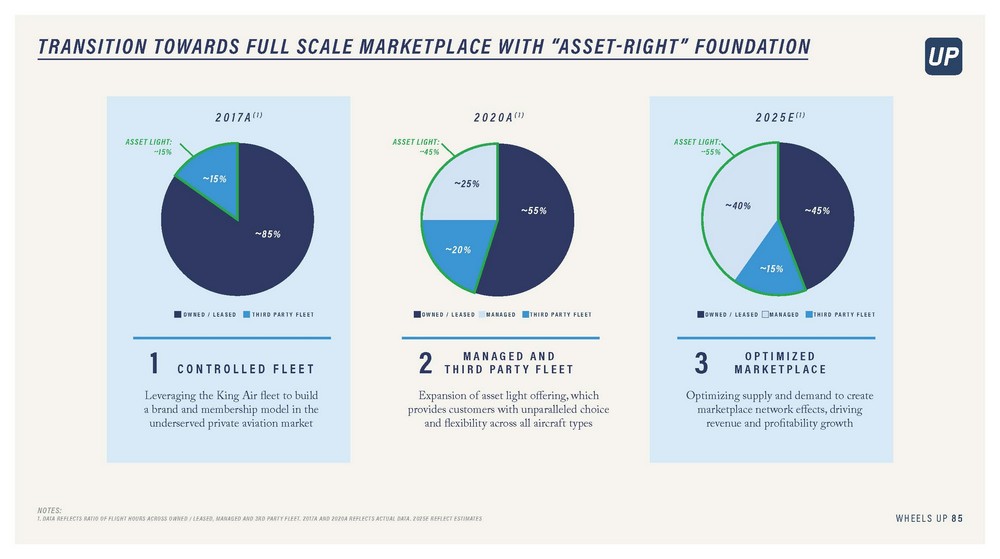

TRANSITION TOWARDS FULL SCALE MARKETPLACE WITH “ASSET-RIGHT” FOUNDATION 2017A(1) 2020A(1) 2025E(1) ASSET LIGHT: ~15% ASSET LIGHT: ~45% ASSET LIGHT: ~55% ~15% ~25% ~40% ~55% ~45% ~85% ~20% ~15% THIRD PARTY FLEET OWNED / LEASED THIRD PARTY FLEET MANAGED THIRD PARTY FLEET MANAGED OWNED / LEASED OWNED / LEASED 1 CONTROLLED FLEET 3 2 MANAGED AND THIRD PARTY FLEET OPTIMIZED MARKETPLACE Optimizing supply and demand to create marketplace network effects, driving revenue and profitability growth Expansion of asset light offering, which provides customers with unparalleled choice and flexibility across all aircraft types Leveraging the King Air fleet to build a brand and membership model in the underserved private aviation market NOTES: 1. DATA REFLECTS RATIO OF FLIGHT HOURS ACROSS OWNED / LEASED, MANAGED AND 3RD PARTY FLEET. 2017A AND 2020A REFLECTS ACTUAL DATA. 2025E REFLECT ESTIMATES WHEELS UP 85

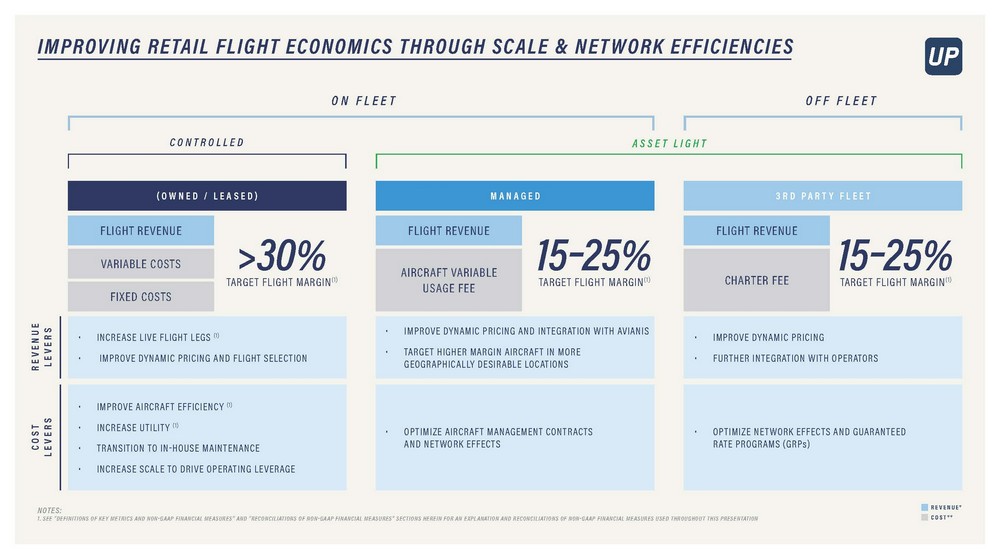

IMPROVING RETAIL FLIGHT ECONOMICS THROUGH SCALE & NETWORK EFFICIENCIES OFF FLEET ON FLEET CONTROLLED ASSET LIGHT (OWNED / LEASED) MANAGED 3RD PARTY FLEET FLIGHT REVENUE FLIGHT REVENUE FLIGHT REVENUE 15–25% TARGET FLIGHT MARGIN(1) 15–25% TARGET FLIGHT MARGIN(1) >30% TARGET FLIGHT MARGIN(1) VARIABLE COSTS AIRCRAFT VARIABLE USAGE FEE CHARTER FEE FIXED COSTS REVENUE LEVERS • INCREASE LIVE FLIGHT LEGS (1) • IMPROVE DYNAMIC PRICING AND FLIGHT SELECTION • IMPROVE DYNAMIC PRICING • FURTHER INTEGRATION WITH OPERATORS • IMPROVE DYNAMIC PRICING AND INTEGRATION WITH AVIANIS • TARGET HIGHER MARGIN AIRCRAFT IN MORE GEOGRAPHICALLY DESIRABLE LOCATIONS COST LEVERS • OPTIMIZE AIRCRAFT MANAGEMENT CONTRACTS AND NETWORK EFFECTS • OPTIMIZE NETWORK EFFECTS AND GUARANTEED RATE PROGRAMS (GRPs) • IMPROVE AIRCRAFT EFFICIENCY (1) • INCREASE UTILITY (1) • TRANSITION TO IN-HOUSE MAINTENANCE • INCREASE SCALE TO DRIVE OPERATING LEVERAGE REVENUE* NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION COST**

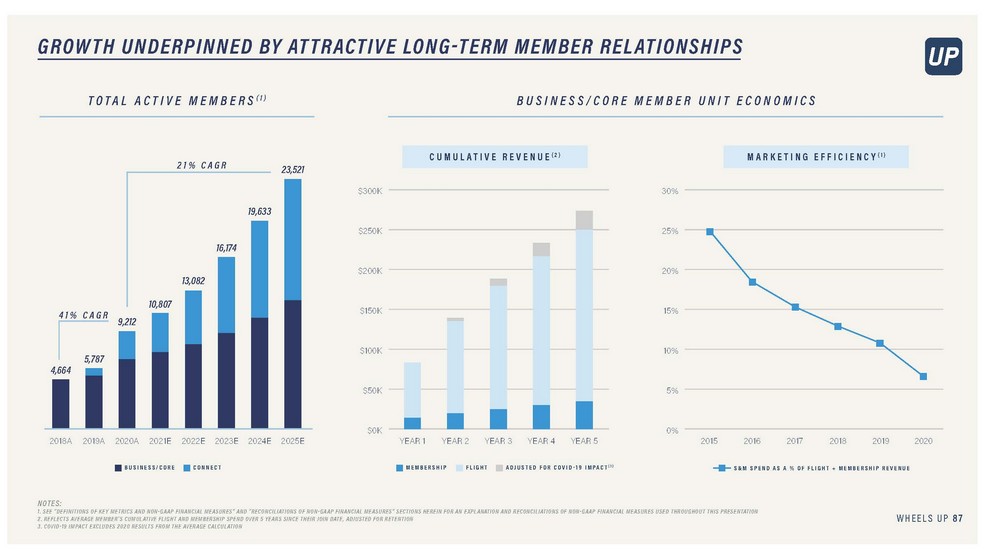

GROWTH UNDERPINNED BY ATTRACTIVE LONG-TERM MEMBER RELATIONSHIPS BUSINESS/CORE MEMBER UNIT ECONOMICS TOTAL ACTIVE MEMBERS(1) MARKETING EFFICIENCY(1) CUMULATIVE REVENUE(2) 21% CAGR 23,521 $300K 30% 19,633 $250K 25% 16,174 $200K 20% 13,082 10,807 15% $150K 41% CAGR 9,212 10% $100K 5,787 4,664 5% $50K $0K 0% 2020A 2021E 2022E 2023E 2024E 2025E 2019A YEAR 2 YEAR 3 YEAR 4 YEAR 5 2015 2016 2017 2018 2019 2020 2018A YEAR 1 FLIGHT ADJUSTED FOR COVID-19 IMPACT(3) MEMBERSHIP CONNECT BUSINESS/CORE S&M SPEND AS A % OF FLIGHT + MEMBERSHIP REVENUE NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION 2. REFLECTS AVERAGE MEMBER’S CUMULATIVE FLIGHT AND MEMBERSHIP SPEND OVER 5 YEARS SINCE THEIR JOIN DATE, ADJUSTED FOR RETENTION 3. COVID-19 IMPACT EXCLUDES 2020 RESULTS FROM THE AVERAGE CALCULATION WHEELS UP 87

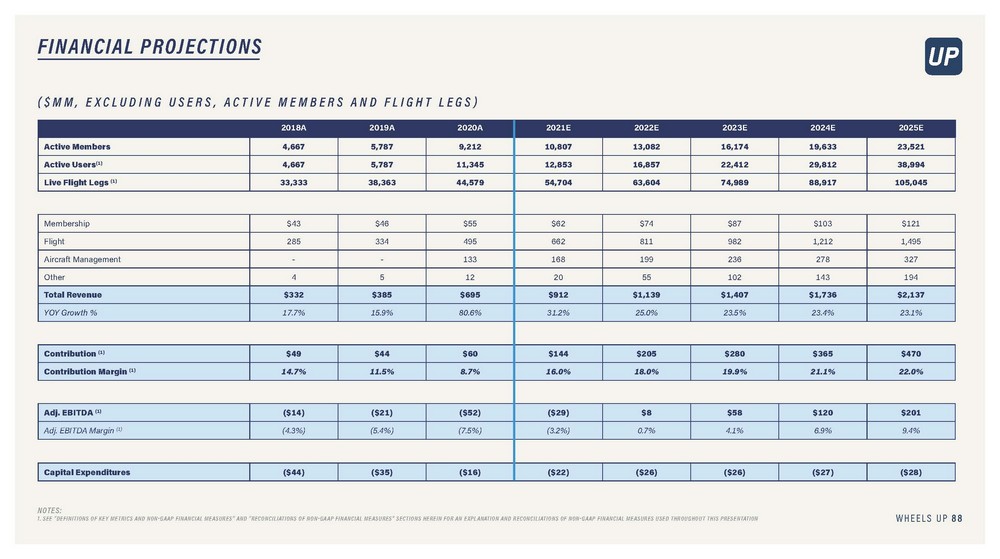

FINANCIAL PROJECTIONS ($MM, EXCLUDING USERS, ACTIVE MEMBERS AND FLIGHT LEGS) 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E Active Members 4,667 5,787 9,212 10,807 13,082 16,174 19,633 23,521 Active Users(1) 4,667 5,787 11,345 12,853 16,857 22,412 29,812 38,994 Live Flight Legs (1) 33,333 38,363 44,579 54,704 63,604 74,989 88,917 105,045 Membership $43 $46 $55 $62 $74 $87 $103 $121 Flight 285 334 495 662 811 982 1,212 1,495 Aircraft Management - - 133 168 199 236 278 327 Other 4 5 12 20 55 102 143 194 Total Revenue $332 $385 $695 $912 $1,139 $1,407 $1,736 $2,137 YOY Growth % 17.7% 15.9% 80.6% 31.2% 25.0% 23.5% 23.4% 23.1% Contribution (1) $49 $44 $60 $144 $205 $280 $365 $470 Contribution Margin (1) 14.7% 11.5% 8.7% 16.0% 18.0% 19.9% 21.1% 22.0% Adj. EBITDA (1) ($14) ($21) ($52) ($29) $8 $58 $120 $201 Adj. EBITDA Margin (1) (4.3%) (5.4%) (7.5%) (3.2%) 0.7% 4.1% 6.9% 9.4% Capital Expenditures ($44) ($35) ($16) ($22) ($26) ($26) ($27) ($28) NOTES: 1. SEE “DEFINITIONS OF KEY METRICS AND NON-GAAP FINANCIAL MEASURES” AND “RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES” SECTIONS HEREIN FOR AN EXPLANATION AND RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES USED THROUGHOUT THIS PRESENTATION WHEELS UP 88

ESG & OPPORTUNITIES FOR GROWTH KENNY DICHTER FOUNDER & CEO

THE IMPORTANCE OF ESG ENVIRONMENT SOCIAL GOVERNANCE WHEELS UP CARES DIVERSITY & INCLUSIVITY OPTIMIZE THE RIGHT PLANE FOR THE MISSION DRIVE EFFICIENCY INTEGRATE NEW FUEL-EFFICIENT AIRCRAFT PROMOTE FLIGHT SHARING DIVERSITY & INCLUSION ACROSS TEAM COMMITMENT TO SHAREHOLDERS WE ARE COMMITTED TO SUPPORT ALL OUR STAKEHOLDERS WHEELS UP 90

OPPORTUNITIES FOR GROWTH EXPAND TAM WITH DIGITALLY ENABLED NON-MEMBER ACCESS FUEL THE MARKETPLACE FLYWHEEL WHEELS UP 91

OPPORTUNITIES FOR GROWTH PLATFORM ADJACENCIES EXPAND GLOBALLY OPPORTUNISTIC ACQUISITIONS $$ FLIGHT SHARING SUPPORT EMERGING AIRCRAFT TECHNOLOGIES WHEELS UP 92

WHEELS UP IS DEMOCRATIZING PRIVATE AVIATION WITH A NEXT-GENERATION, TECHNOLOGY- DRIVEN PLATFORM, MAKING IT ACCESSIBLE FOR MILLIONS OF CONSUMERS.

APPENDIX

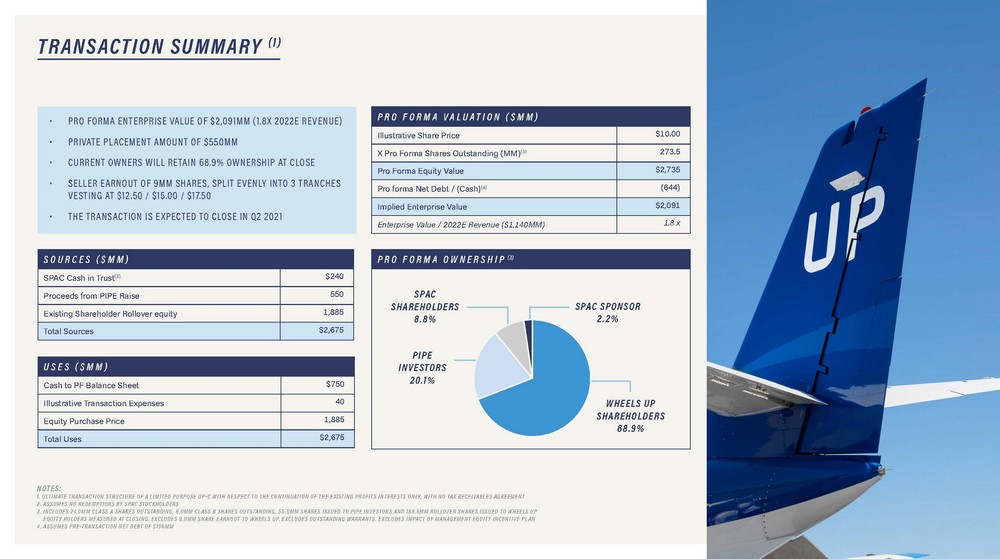

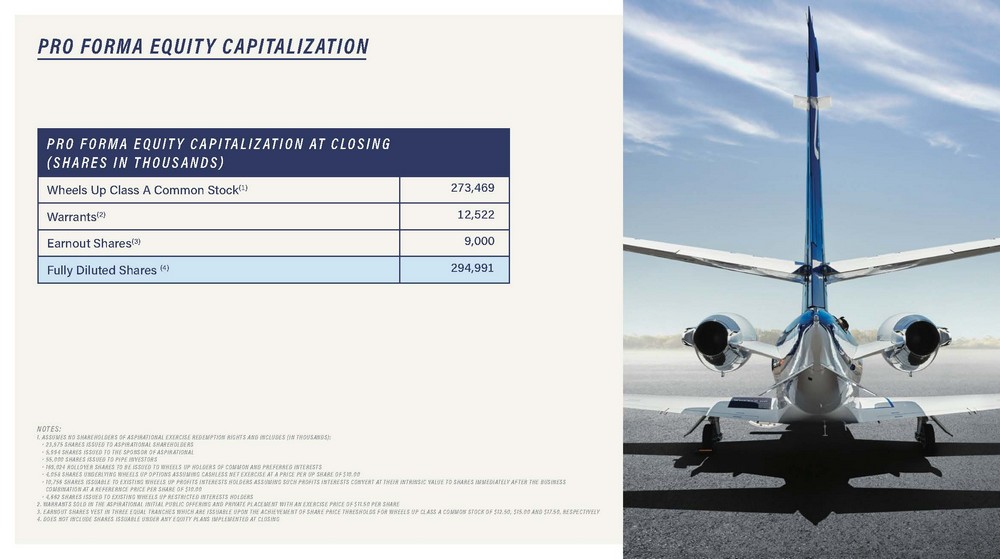

TRANSACTION SUMMARY (1) PRO FORMA VALUATION ($MM) Illustrative Share Price $10.00 X Pro Forma Shares Outstanding (MM)(3) 273.5 Pro Forma Equity Value $2,735 Pro forma Net Debt / (Cash)(4) (644) Implied Enterprise Value $2,091 Enterprise Value / 2022E Revenue ($1,140MM) 1.8 x • PRO FORMA ENTERPRISE VALUE OF $2,091MM (1.8X 2022E REVENUE) • PRIVATE PLACEMENT AMOUNT OF $550MM • CURRENT OWNERS WILL RETAIN 68.9% OWNERSHIP AT CLOSE • SELLER EARNOUT OF 9MM SHARES, SPLIT EVENLY INTO 3 TRANCHES VESTING AT $12.50 / $15.00 / $17.50 • THE TRANSACTION IS EXPECTED TO CLOSE IN Q2 2021 SOURCES ($MM) SPAC Cash in Trust(2) $240 Proceeds from PIPE Raise 550 Existing Shareholder Rollover equity 1,885 Total Sources $2,675 PRO FORMA OWNERSHIP (3) SPAC SHAREHOLDERS 8.8% SPAC SPONSOR 2.2% PIPE INVESTORS 20.1% USES ($MM) Cash to PF Balance Sheet $750 Illustrative Transaction Expenses 40 Equity Purchase Price 1,885 Total Uses $2,675 WHEELS UP SHAREHOLDERS 68.9% NOTES: 1. ULTIMATE TRANSACTION STRUCTURE OF A LIMITED PURPOSE UP-C WITH RESPECT TO THE CONTINUATION OF THE EXISTING PROFITS INTERESTS ONLY, WITH NO TAX RECEIVABLES AGREEMENT 2. ASSUMES NO REDEMPTIONS BY SPAC STOCKHOLDERS 3. INCLUDES 24.0MM CLASS A SHARES OUTSTANDING, 6.0MM CLASS B SHARES OUTSTANDING, 55.0MM SHARES ISSUED TO PIPE INVESTORS AND 188.5MM ROLLOVER SHARES ISSUED TO WHEELS UP EQUITY HOLDERS MEASURED AT CLOSING. EXCLUDES 9.0MM SHARE EARNOUT TO WHEELS UP. EXCLUDES OUTSTANDING WARRANTS. EXCLUDES IMPACT OF MANAGEMENT EQUITY INCENTIVE PLAN 4. ASSUMES PRE-TRANSACTION NET DEBT OF $106MM

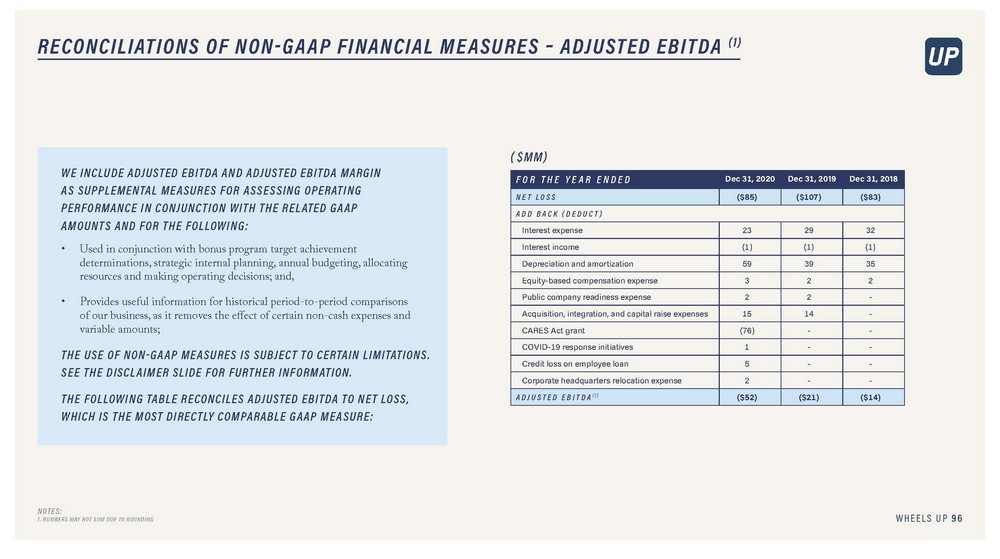

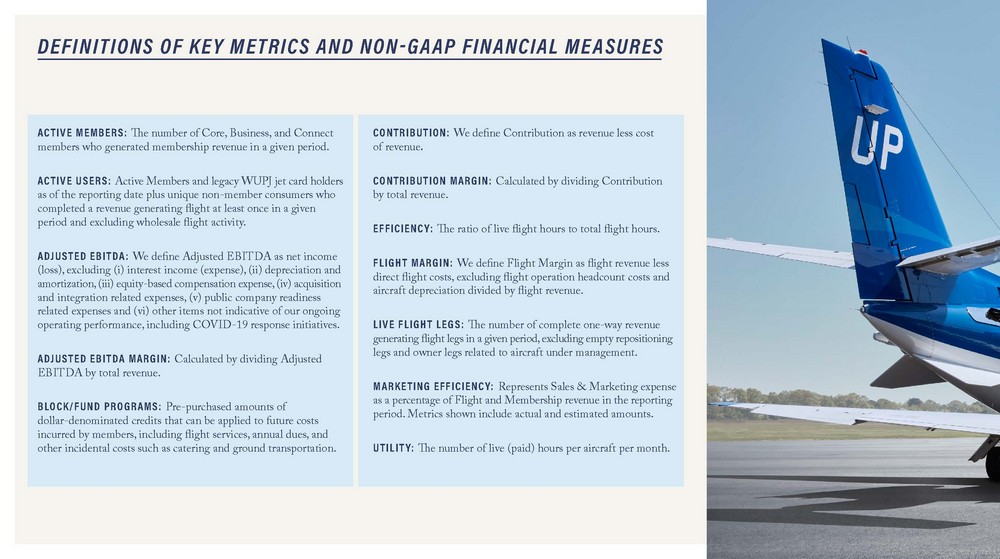

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES – ADJUSTED EBITDA (1) ($MM) WE INCLUDE ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN AS SUPPLEMENTAL MEASURES FOR ASSESSING OPERATING PERFORMANCE IN CONJUNCTION WITH THE RELATED GAAP AMOUNTS AND FOR THE FOLLOWING: • Used in conjunction with bonus program target achievement determinations, strategic internal planning, annual budgeting, allocating resources and making operating decisions; and, • Provides useful information for historical period-to-period comparisons of our business, as it removes the effect of certain non-cash expenses and variable amounts; THE USE OF NON-GAAP MEASURES IS SUBJECT TO CERTAIN LIMITATIONS. SEE THE DISCLAIMER SLIDE FOR FURTHER INFORMATION. THE FOLLOWING TABLE RECONCILES ADJUSTED EBITDA TO NET LOSS, WHICH IS THE MOST DIRECTLY COMPARABLE GAAP MEASURE: FOR THE YEAR ENDED Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 NET LOSS ($85) ($107) ($83) ADD BACK (DEDUCT) Interest expense 23 29 32 Interest income (1) (1) (1) Depreciation and amortization 59 39 35 Equity-based compensation expense 3 2 2 Public company readiness expense 2 2 - Acquisition, integration, and capital raise expenses 15 14 - CARES Act grant (76) - - COVID-19 response initiatives 1 - - Credit loss on employee loan 5 - - Corporate headquarters relocation expense 2 - - ADJUSTED EBITDA(1) ($52) ($21) ($14) NOTES: 1. NUMBERS MAY NOT SUM DUE TO ROUNDING WHEELS UP 96

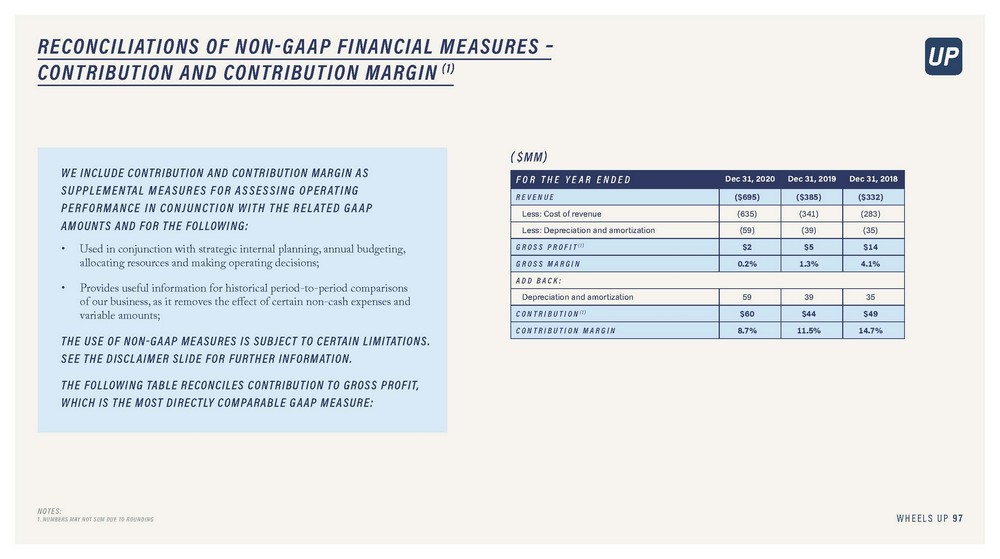

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES – CONTRIBUTION AND CONTRIBUTION MARGIN (1) ($MM) WE INCLUDE CONTRIBUTION AND CONTRIBUTION MARGIN AS SUPPLEMENTAL MEASURES FOR ASSESSING OPERATING PERFORMANCE IN CONJUNCTION WITH THE RELATED GAAP AMOUNTS AND FOR THE FOLLOWING: • Used in conjunction with strategic internal planning, annual budgeting, allocating resources and making operating decisions; • Provides useful information for historical period-to-period comparisons of our business, as it removes the effect of certain non-cash expenses and variable amounts; THE USE OF NON-GAAP MEASURES IS SUBJECT TO CERTAIN LIMITATIONS. SEE THE DISCLAIMER SLIDE FOR FURTHER INFORMATION. THE FOLLOWING TABLE RECONCILES CONTRIBUTION TO GROSS PROFIT, WHICH IS THE MOST DIRECTLY COMPARABLE GAAP MEASURE: FOR THE YEAR ENDED Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 REVENUE ($695) ($385) ($332) Less: Cost of revenue (635) (341) (283) Less: Depreciation and amortization (59) (39) (35) GROSS PROFIT(1) $2 $5 $14 GROSS MARGIN 0.2% 1.3% 4.1% ADD BACK: Depreciation and amortization 59 39 35 CONTRIBUTION(1) $60 $44 $49 CONTRIBUTION MARGIN 8.7% 11.5% 14.7% NOTES: 1. NUMBERS MAY NOT SUM DUE TO ROUNDING WHEELS UP 97

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP ADJUSTED EBITDA (1) YEAR ENDED DECEMBER 31, 2020 ($MM) YEAR ENDED DECEMBER 31, 2020 GAAP AS REPORTED EQUITY-BASED COMPENSATION PUBLIC COMPANY READINESS EXPENSES ACQUISITION, INTEGRATION, AND CAPITAL RAISE EXPENSES COVID-19 RESPONSE INITIATIVES CREDIT LOSS ON EMPLOYEE LOAN CORPORATE HEADQUARTERS RELOCATION OTHER NON-GAAP Revenue: $695 $695 Costs and expenses: - Cost of revenue 635 - - (1) (1) - - - 633 Technology and development 21 - - - - - - - 21 Sales and marketing 55 (1) - - - - - - 54 General and administrative 65 (2) (2) (13) - (5) (2) - 40 Depreciation and amortization 59 - - - - - - - 59 CARES Act grant recognition (76) - - - - - - 76 - Total costs and expenses $758 ($3) ($2) ($15) ($1) ($5) ($2) $76 $806 Loss from operations (63) (111) Other (expense) income: Interest income 1 1 Interest expense (23) (23) Total other expense ($22) ($22) Net Loss ($85) ($133) Depreciation and amortizaiton 59 Total Other Expense 22 Adjusted EBITDA ($52) NOTES: 1. NUMBERS MAY NOT SUM DUE TO ROUNDING WHEELS UP 98

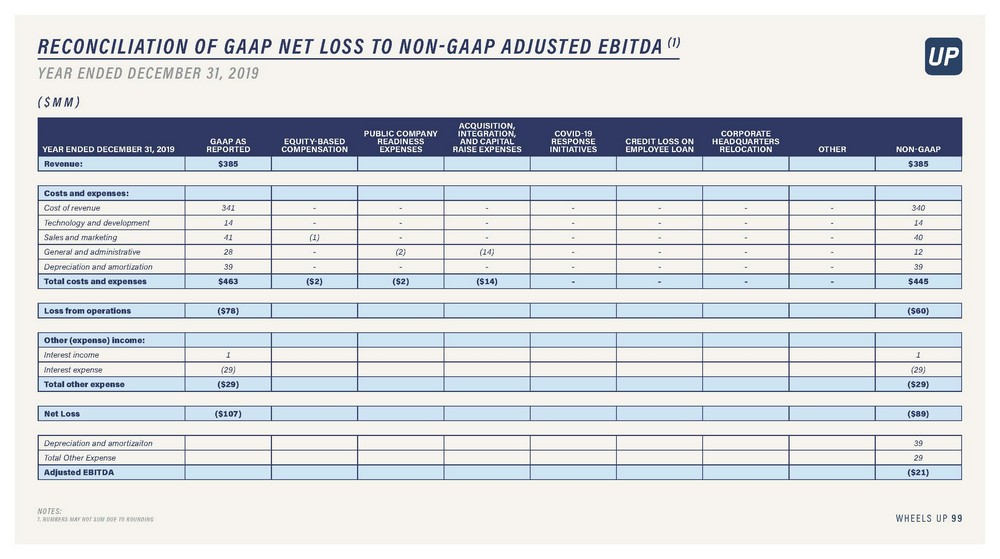

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP ADJUSTED EBITDA (1) YEAR ENDED DECEMBER 31, 2019 ($MM) YEAR ENDED DECEMBER 31, 2019 GAAP AS REPORTED EQUITY-BASED COMPENSATION PUBLIC COMPANY READINESS EXPENSES ACQUISITION, INTEGRATION, AND CAPITAL RAISE EXPENSES COVID-19 RESPONSE INITIATIVES CREDIT LOSS ON EMPLOYEE LOAN CORPORATE HEADQUARTERS RELOCATION OTHER NON-GAAP Revenue: $385 $385 Costs and expenses: Cost of revenue 341 - - - - - - - 340 Technology and development 14 - - - - - - - 14 Sales and marketing 41 (1) - - - - - - 40 General and administrative 28 - (2) (14) - - - - 12 Depreciation and amortization 39 - - - - - - - 39 Total costs and expenses $463 ($2) ($2) ($14) - - - - $445 Loss from operations ($78) ($60) Other (expense) income: Interest income 1 1 Interest expense (29) (29) Total other expense ($29) ($29) Net Loss ($107) ($89) Depreciation and amortizaiton 39 Total Other Expense 29 Adjusted EBITDA ($21) NOTES: 1. NUMBERS MAY NOT SUM DUE TO ROUNDING WHEELS UP 99

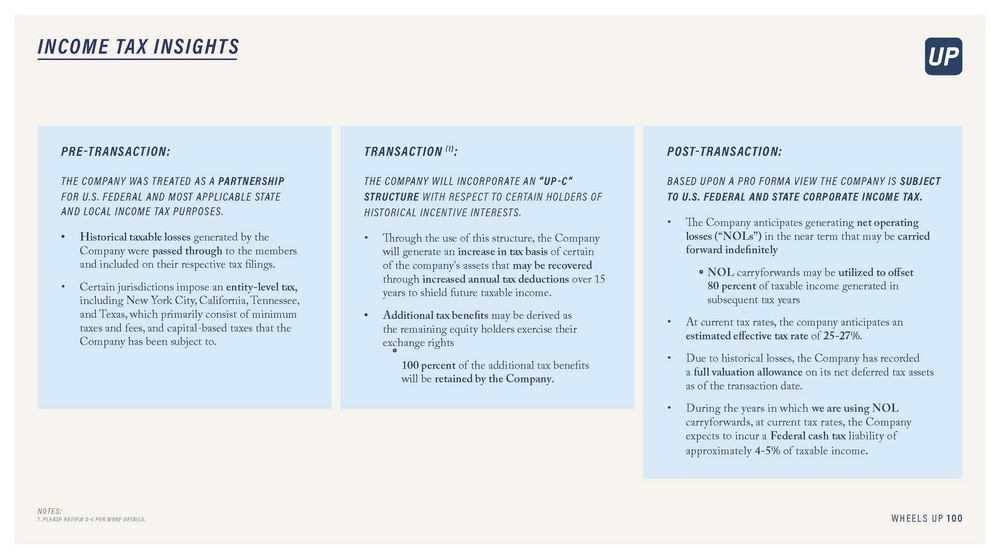

INCOME TAX INSIGHTS PRE-TRANSACTION: THE COMPANY WAS TREATED AS A PARTNERSHIP FOR U.S. FEDERAL AND MOST APPLICABLE STATE AND LOCAL INCOME TAX PURPOSES. • Historical taxable losses generated by the Company were passed through to the members and included on their respective tax filings. • Certain jurisdictions impose an entity-level tax, including New York City, California, Tennessee, and Texas, which primarily consist of minimum taxes and fees, and capital-based taxes that the Company has been subject to. TRANSACTION (1): THE COMPANY WILL INCORPORATE AN “UP-C” STRUCTURE WITH RESPECT TO CERTAIN HOLDERS OF HISTORICAL INCENTIVE INTERESTS. • Through the use of this structure, the Company will generate an increase in tax basis of certain of the company's assets that may be recovered through increased annual tax deductions over 15 years to shield future taxable income. • Additional tax benefits may be derived as the remaining equity holders exercise their exchange rights 100 percent of the additional tax benefits will be retained by the Company. POST-TRANSACTION: BASED UPON A PRO FORMA VIEW THE COMPANY IS SUBJECT TO U.S. FEDERAL AND STATE CORPORATE INCOME TAX. • The Company anticipates generating net operating losses (“NOLs”) in the near term that may be carried forward indefinitely NOL carryforwards may be utilized to offset 80 percent of taxable income generated in subsequent tax years • At current tax rates, the company anticipates an estimated effective tax rate of 25-27%. • Due to historical losses, the Company has recorded a full valuation allowance on its net deferred tax assets as of the transaction date. • During the years in which we are using NOL carryforwards, at current tax rates, the Company expects to incur a Federal cash tax liability of approximately 4-5% of taxable income. NOTES: 1. PLEASE REVIEW S-4 FOR MORE DETAILS. WHEELS UP 100