Exhibit 99.2

Q1 2022 Presentation 24 May 2022

ALL RIGHTS BELONG TO FUSION - FUEL — Disclaimer This presentation includes statements of future events, conditions, expectations, and projections of Fusion Fuel Green plc (t he “Company”). Such statements are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Ref orm Act of 1995. The Company’s actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward - looking statemen ts as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “ bel ieve,” “predict,” “potential,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, estimate s and projections of future performance, which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors whi ch cannot be predicted. Such assumptions involve a number of known and unknown risks, uncertainties, and other factors, many of which are outside of the Company’s con tro l, including, among other things: the failure to obtain required regulatory approvals; changes in Portuguese, Spanish, Moroccan, or European green energy plans; the abilit y t o obtain additional capital; field conditions and the ability to increase production capacity; supply chain competition; changes adversely affecting the businesses in which th e C ompany is engaged; management of growth; general economic conditions, including changes in the credit, debit, securities, financial or capital markets; and the impact of COVID - 19 or other adverse public health developments on the Company’s business and operations. Should one or more of these material risks occur or should the underly ing assumptions change or prove incorrect, the actual results of operations are likely to vary from the projections and the variations may be material and adverse. The forward - looking statements and projections herein should not be regarded as a representation or prediction that the Company will achieve or is likely to achieve any particular results. The Company cautions readers not to place undue reliance upon any forward - looking statements and projections, which speak only a s of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Financial Update Presentation The Company’s consolidated financial data is prepared in accordance with International Financial Reporting Standards as adopt ed by the International Accounting Standards Board (“IFRS”) and is denominated in Euros (“EUR” or “€”). The numbers shown in this presentation have not been audited and t her efore may vary to the final financial results disclosed by the company as part of the annual report. The unaudited consolidated financial data reflects, in the opinion of man agement, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair statement of the Company's financial data for the periods indicated. T he unaudited consolidated financial data should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2020 in cluded in the Company's Annual Report on Form 20 - F for the year ended December 31, 2020. Use of Social Media as a Source of Material News The Company uses, and will continue to use, its LinkedIn profile, website, press releases, and various social media channels, as additional means of disclosing information to investors, the media, and others interested in the Company. It is possible that certain information that the Company posts on so cial media or its website, or disseminates in press releases, could be deemed to be material information, and the Company encourages investors, the media and others intere ste d in the Company to review the business and financial information that the Company posts on its social media channels, website, and disseminates in press releases, a s s uch information could be deemed to be material information.

ALL RIGHTS BELONG TO FUSION - FUEL AGENDA ▪ Focus on Fusion ▪ Q1 Financials & Highlights ▪ Key Markets, Projects Contracted & Grants ▪ Production & Tech ▪ Team ▪ Chairman’s Remarks ▪ Q&A

ALL RIGHTS BELONG TO FUSION - FUEL 01 – FOCUS ON FUSION

ALL RIGHTS BELONG TO FUSION - FUEL 01 – FOCUS ON FUSION Massive Addressable Market Potential green H 2 production TAM of $250 billion by 2025; $1.2 trillion by 2050 Grid - Independent Solution Integrated solar - to - hydrogen technology unlocks grid - independence Cost Leadership Patented technology enables a market - leading levelized cost of hydrogen First Mover Advantage Fusion Fuel is producing green hydrogen in Portugal today Near - Term Growth Ramp Pipeline of over 170,000 tpa of green hydrogen production Experienced Management Team Extensive track record in the energy and renewables sectors

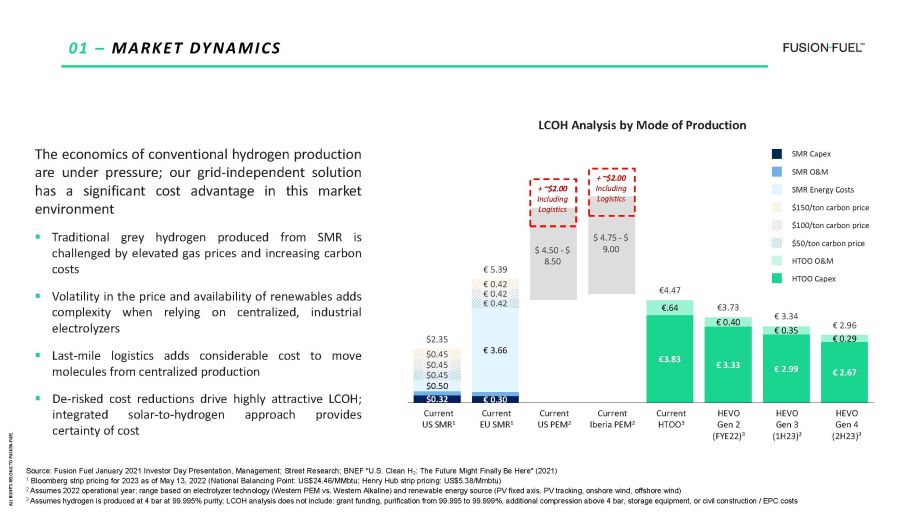

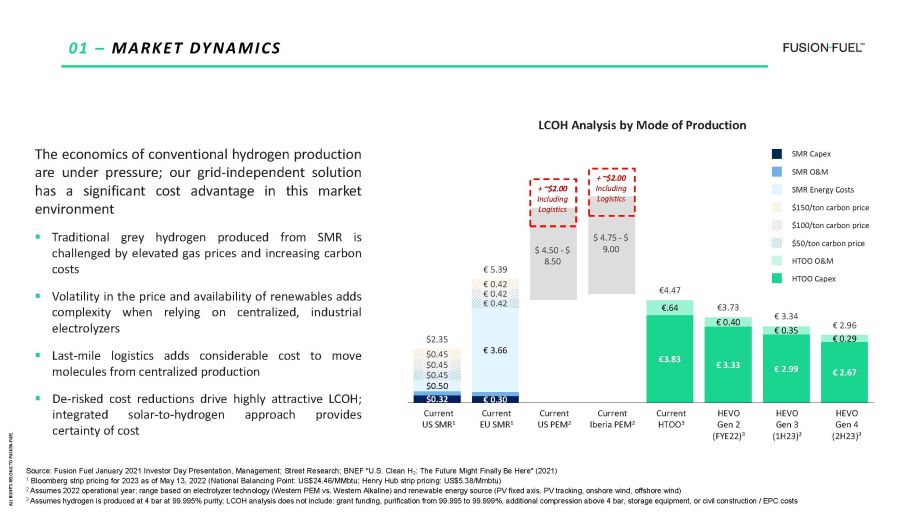

ALL RIGHTS BELONG TO FUSION - FUEL $0.32 € 0.30 € 3.83 € 3.33 € 2.99 € 2.67 €.64 € 0.40 € 0.35 € 0.29 $0.50 € 3.66 $0.45 € 0.42 $0.45 € 0.42 $0.45 € 0.42 $2.35 € 5.39 €4.47 €3.73 € 3.34 € 2.96 Grey US Grey EU Green US Green EU Current FFG Benevente Gen 3 Gen 4 Source: Fusion Fuel January 2021 Investor Day Presentation, Management; Street Research; BNEF "U.S. Clean H 2 : The Future Might Finally Be Here" (2021) 1 Bloomberg strip pricing for 2023 as of May 13, 2022 (National Balancing Point: US$24.46/ MMbtu ; Henry Hub strip pricing: US$5.38/ Mmbtu ) 2 Assumes 2022 operational year; range based on electrolyzer technology (Western PEM vs. Western Alkaline) and renewable energy so urce (PV fixed axis, PV tracking, onshore wind, offshore wind) 3 Assumes hydrogen is produced at 4 bar at 99.995% purity; LCOH analysis does not include: grant funding, purification from 99. 995 to 99.999%, additional compression above 4 bar, storage equipment, or civil construction / EPC costs The economics of conventional hydrogen production are under pressure ; our grid - independent solution has a significant cost advantage in this market environment ▪ Traditional grey hydrogen produced from SMR is challenged by elevated gas prices and increasing carbon costs ▪ Volatility in the price and availability of renewables adds complexity when relying on centralized, industrial electrolyzers ▪ Last - mile logistics adds considerable cost to move molecules from centralized production ▪ De - risked cost reductions drive highly attractive LCOH ; integrated solar - to - hydrogen approach provides certainty of cost LCOH Analysis by Mode of Production SMR Capex SMR O&M $50/ton carbon price $150/ton carbon price $100/ton carbon price HTOO O&M HTOO Capex Current US PEM 2 Current Iberia PEM 2 Current HTOO 3 HEVO Gen 2 (FYE22) 3 Current EU SMR 1 Current US SMR 1 HEVO Gen 3 (1H23) 3 HEVO Gen 4 (2H23) 3 SMR Energy Costs 01 – MARKET DYNAMICS + ~ $ 2.00 Including Logistics $ 4.50 - $ 8.50 $ 4.75 - $ 9.00 + ~ $2.00 Including Logistics

ALL RIGHTS BELONG TO FUSION - FUEL 02 – Q1 HIGHLIGHTS & FINANCIAL REVIEW

ALL RIGHTS BELONG TO FUSION - FUEL 02 – Q1 HIGHLIGHTS Key Developments ▪ Zachary Steele and Frederico Figueira de Chaves appointed as Co - Heads of Fusion Fuel ▪ Zachary Steele and Jason Baran a ppointed as Co - Presidents of Fusion Fuel Americas and members of the Executive Committee ▪ Confirmed tech sales and grant income for 2022 of € 4 . 2 m ▪ Advanced 6 projects into late stage of development totaling over € 20 m in revenue potential (including grants) in 2022 ▪ Entered into commercial partnerships with AESA and HIVE Energy Subsequent Events ▪ Entered new markets in Egypt and North America ▪ Secured an additional € 4 . 2 m in grant income for a total of € 8 . 4 m in 2022 ▪ Launch of HEVO production line at Benavente factory ; full launch on track for 2 H 22 ▪ Executed commercial & technical MOU with Toshiba ESS

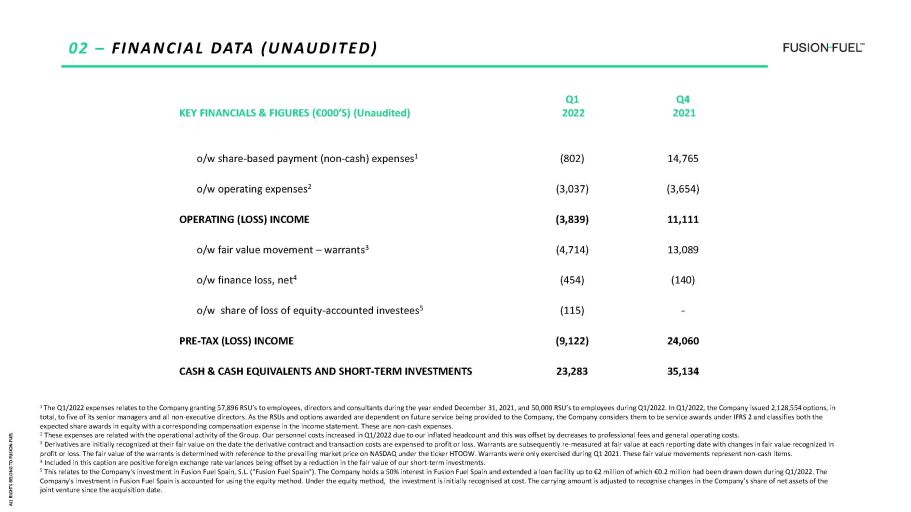

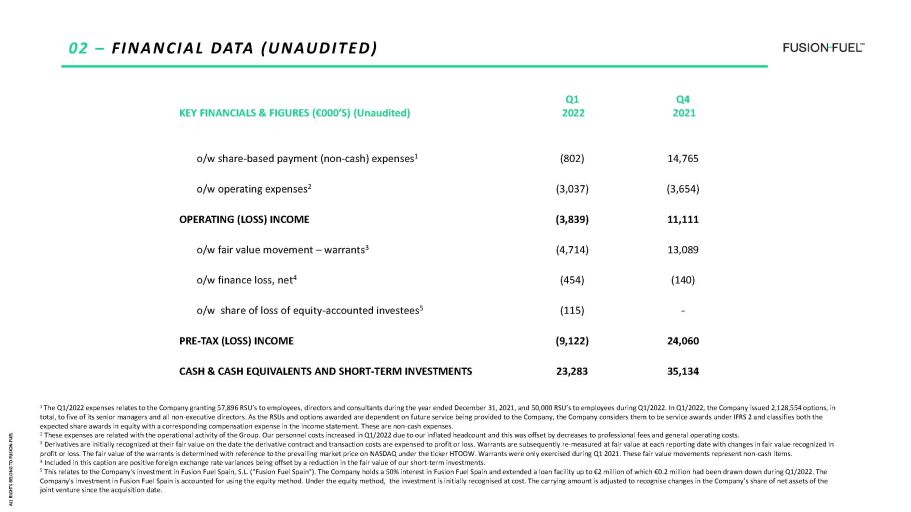

ALL RIGHTS BELONG TO FUSION - FUEL KEY FINANCIALS & FIGURES (€000’S) (Unaudited) Q1 2022 Q4 2021 o/w share - based payment (non - cash) expenses 1 (802) 14,765 o/w operating expenses 2 (3,037) (3,654) OPERATING (LOSS) INCOME (3,839) 11,111 o/w fair value movement – warrants 3 (4,714) 13,089 o/w finance loss, net 4 (454) (140) o/w share of loss of equity - accounted investees 5 (115) - PRE - TAX (LOSS) INCOME (9,122) 24,060 CASH & CASH EQUIVALENTS AND SHORT - TERM INVESTMENTS 23,283 35,134 02 – FINANCIAL DATA (UNAUDITED) 1 The Q1/2022 expenses relates to the Company granting 57,896 RSU’s to employees , directors and consultants during the year ended December 31, 2021, and 50,000 RSU’s to employees during Q1/2022. In Q1/2022, the Company issued 2,128,554 options, in total, to five of its senior managers and all non - executive directors . As the RSUs and options awarded are dependent on future service being provided to the Company, the Company considers them to be service awards under IFRS 2 a nd classifies both the expected share awards in equity with a corresponding compensation expense in the income statement. These are non - cash expenses. 2 These expenses are related with the operational activity of the Group. Our personnel costs increased in Q1/2022 due to our inflated headcount and this was offset by decreases to professional fees and general operating costs. 3 Derivatives are initially recognized at their fair value on the date the derivative contract and transaction costs are expens ed to profit or loss. Warrants are subsequently re - measured at fair value at each reporting date with changes in fair value recogni zed in profit or loss. The fair value of the warrants is determined with reference to the prevailing market price on NASDAQ under th e t icker HTOOW. Warrants were only exercised during Q1 2021. These fair value movements represent non - cash items. 4 Included in this caption are positive foreign exchange rate variances being offset by a reduction in the fair value of our sh or t - term investments. 5 This relates to the Company's investment in Fusion Fuel Spain, S.L. ("Fusion Fuel Spain"). The Company holds a 50% interest i n Fusion Fuel Spain and extended a loan facility up to €2 million of which €0.2 million had been drawn down during Q1/2022. The Company's investment in Fusion Fuel Spain is accounted for using the equity method. Under the equity method, the investment is initially recognised at cost. The carrying amount is adjusted to recognise changes in the Company’s share of net assets of the joint venture since the acquisition date.

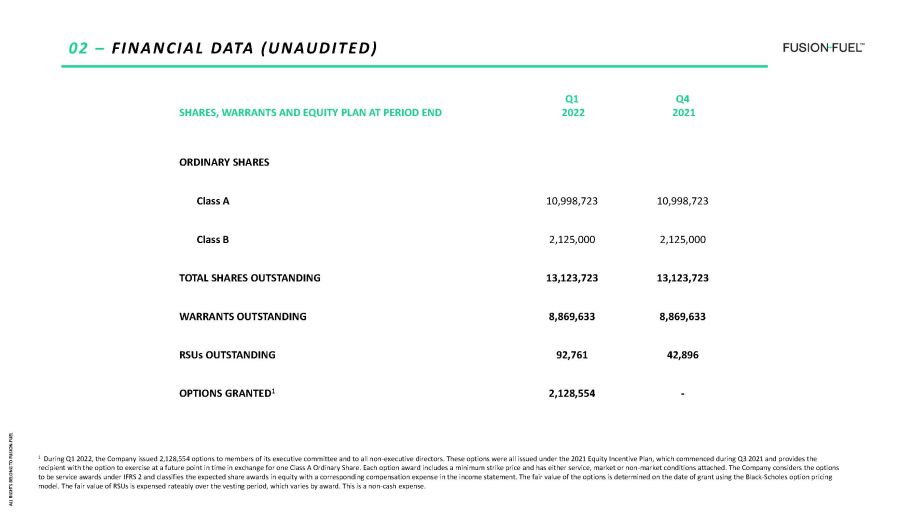

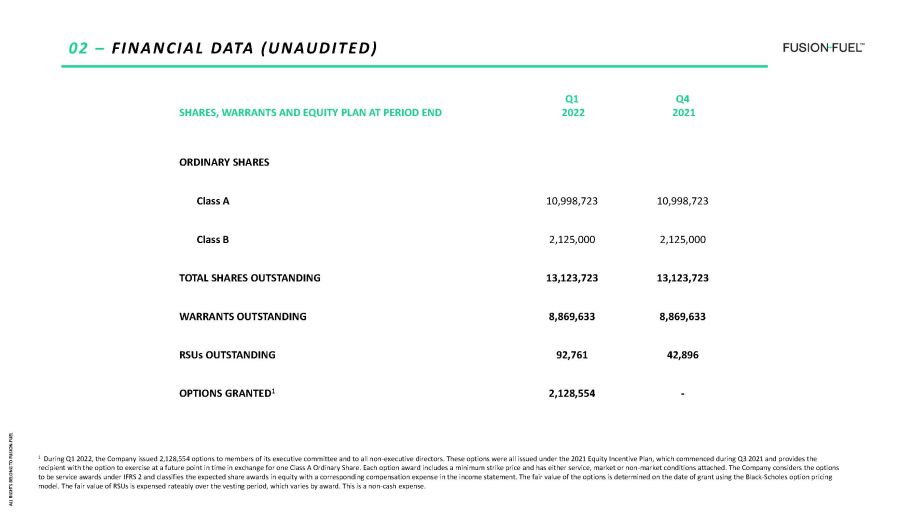

ALL RIGHTS BELONG TO FUSION - FUEL 02 – FINANCIAL DATA (UNAUDITED) 1 During Q1 2022, the Company issued 2,128,554 options to members of its executive committee and to all non - executive directors. These options were all issued under the 2021 Equity Incentive Plan, which commenced during Q3 2021 and provides the recipient with the option to exercise at a future point in time in exchange for one Class A Ordinary Share. Each option award in cludes a minimum strike price and has either service, market or non - market conditions attached. The Company considers the option s to be service awards under IFRS 2 and classifies the expected share awards in equity with a corresponding compensation expens e i n the income statement. The fair value of the options is determined on the date of grant using the Black - Scholes option pricing model. The fair value of RSUs is expensed rateably over the vesting period, which varies by award. This is a non - cash expense. SHARES, WARRANTS AND EQUITY PLAN AT PERIOD END Q1 2022 Q4 2021 ORDINARY SHARES Class A 10,998,723 10,998,723 Class B 2,125,000 2,125,000 TOTAL SHARES OUTSTANDING 13,123,723 13,123,723 WARRANTS OUTSTANDING 8,869,633 8,869,633 RSUs OUTSTANDING 92,761 42,896 OPTIONS GRANTED 1 2,128,554 -

ALL RIGHTS BELONG TO FUSION - FUEL 03 – KEY MARKETS, PROJECTS CONTRACTED & GRANTS

ALL RIGHTS BELONG TO FUSION - FUEL 03 – H 2 VALUE CHAIN AND KEY MARKET SEGMENTS Mobility Natural Gas Blending Green Ammonia, Methanol, eFuels Industrial Applications H 2 Storage & Compression HEVO Micro - electrolyzer HEVO - Solar Green H 2 Plant Fusion Fuel is unique in the market due to its ability to produce green hydrogen on - site, off - grid, economically at both small and large scale. We have already laid the groundwork within each of our core market segments with foundational projects that establish a track record of execution and delivery.

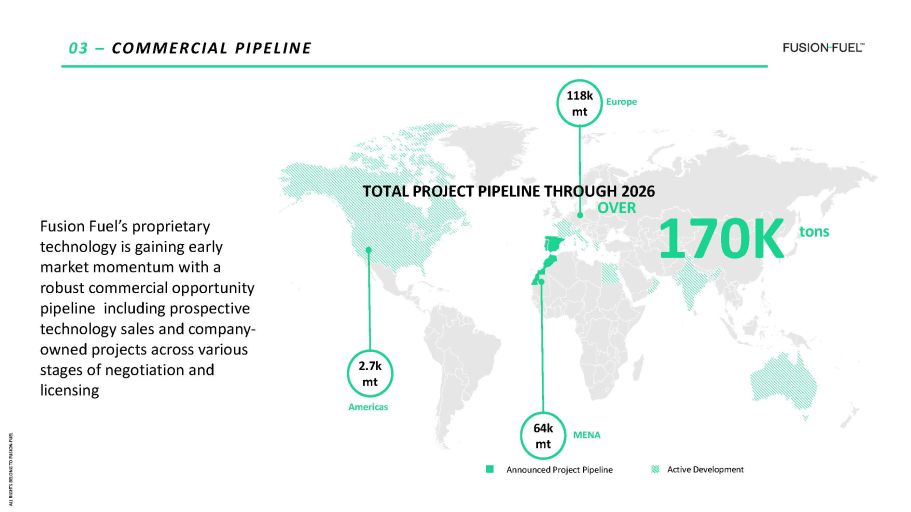

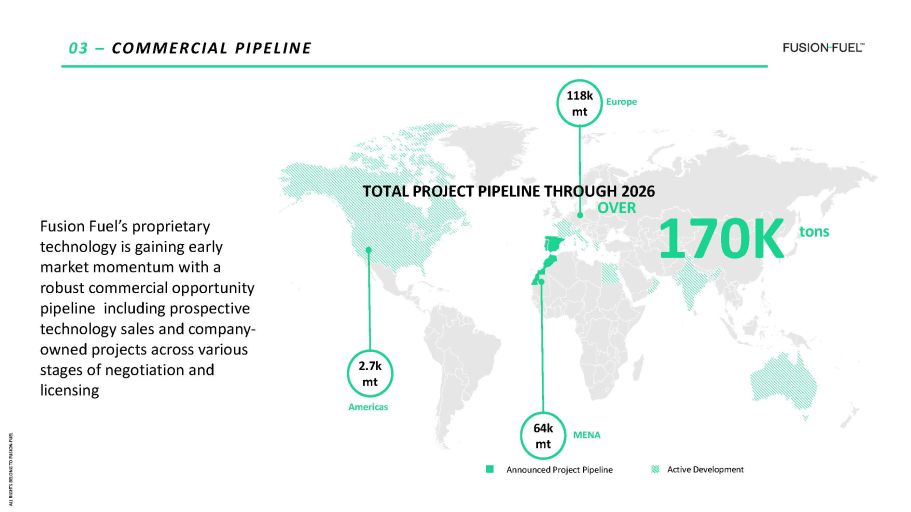

ALL RIGHTS BELONG TO FUSION - FUEL 03 – COMMERCIAL PIPELINE Announced Project Pipeline Active Development Fusion Fuel’s proprietary technology is gaining early market momentum with a robust commercial opportunity pipeline including prospective technology sales and company - owned projects across various stages of negotiation and licensing 2.7k mt MENA Europe Americas 64k mt 118k mt tons 17 0K OVER TOTAL PROJECT PIPELINE THROUGH 2026

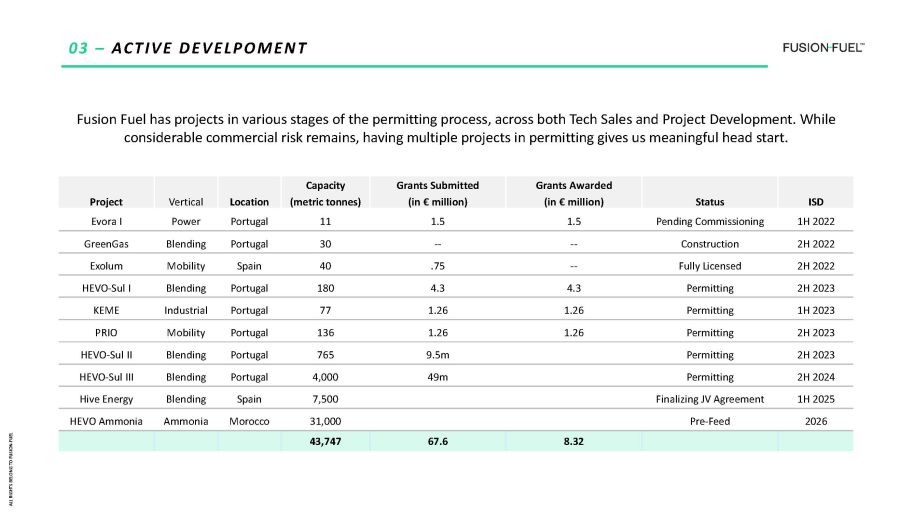

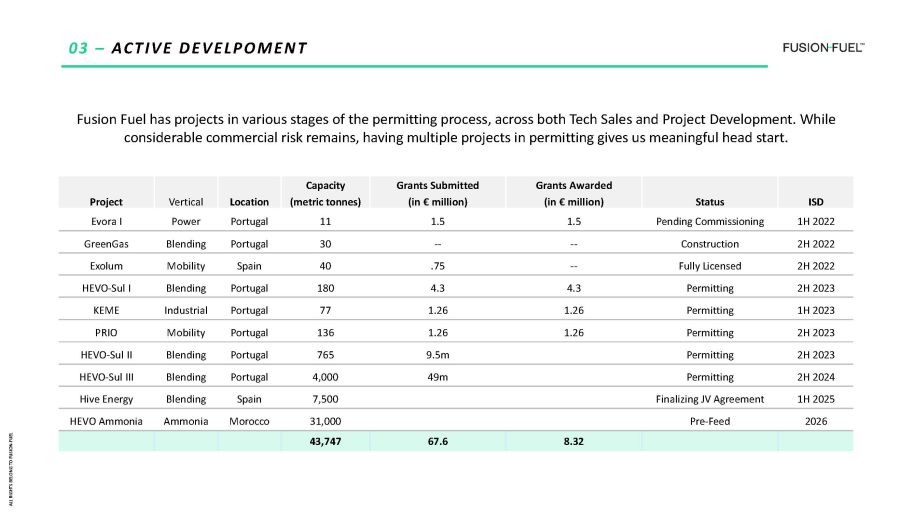

ALL RIGHTS BELONG TO FUSION - FUEL 03 – ACTIVE DEVELPOMENT Project Vertical Location Capacity (metric tonnes) Grants Submitted (in € million) Grants Awarded (in € million) Status ISD Evora I Power Portugal 11 1.5 1.5 Pending Commissioning 1H 2022 Green G as Blending Portugal 30 -- -- Construction 2H 2022 Exo l um Mobility Spain 40 .75 -- Fully Licensed 2H 2022 HEVO - Sul I Blending Portugal 180 4.3 4.3 Permitting 2H 2023 KEME Industrial Portugal 77 1.26 1.26 Permitting 1H 2023 PRIO Mobility Portugal 136 1.26 1.26 Permitting 2H 2023 HEVO - Sul II Blending Portugal 765 9.5m Permitting 2H 2023 HEVO - Sul III Blending Portugal 4,000 49m Permitting 2H 2024 Hive Energy Blending Spain 7,500 Finalizing JV Agreement 1H 2025 HEVO Ammonia Ammonia Morocco 31,000 Pre - Feed 2026 43,747 67.6 8.32 Fusion Fuel has projects in various stages of the permitting process, across both Tech Sales and Project Development. While considerable commercial risk remains, having multiple projects in permitting gives us meaningful head start.

ALL RIGHTS BELONG TO FUSION - FUEL 03 — KEY COMMERCIAL PLATFORMS

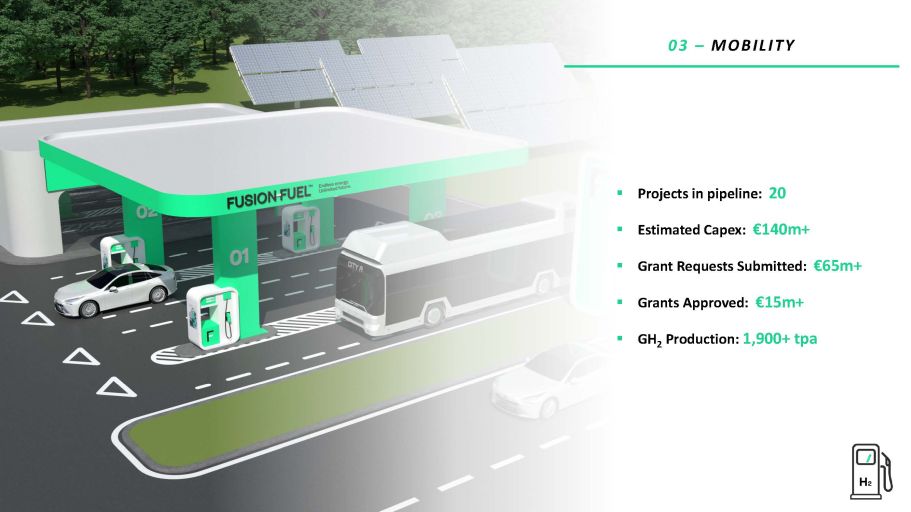

ALL RIGTHS BELONG TO FUSION - FUEL ▪ Projects in pipeline: 20 ▪ Estimated Capex: €140m+ ▪ Grant Requests Submitted: €65m+ ▪ Grants Approved: €15m+ ▪ GH 2 Production: 1,900+ tpa 03 – MOBILITY

ALL RIGTHS BELONG TO FUSION - FUEL ▪ Projects in pipeline: 7 ▪ Estimated Capex: € 43m + ▪ Grant Requests Submitted: € 14m + ▪ Grants Approved: €1.5m+ ▪ GH 2 Production: 740 + tpa 03 – INDUSTRIAL APPLICATIONS & NATURAL GAS BLENDING

ALL RIGTHS BELONG TO FUSION - FUEL 03 – GREEN AMMONIA ▪ Projects in pipeline: 1 ▪ Estimated Capex: N/A ▪ Grants: Under negotiation ▪ GH 2 Production: 32,000+ tpa ▪ GNH 3 Production: 180,000 tpa

ALL RIGHTS BELONG TO FUSION - FUEL 04 — PRODUCTION & TECH

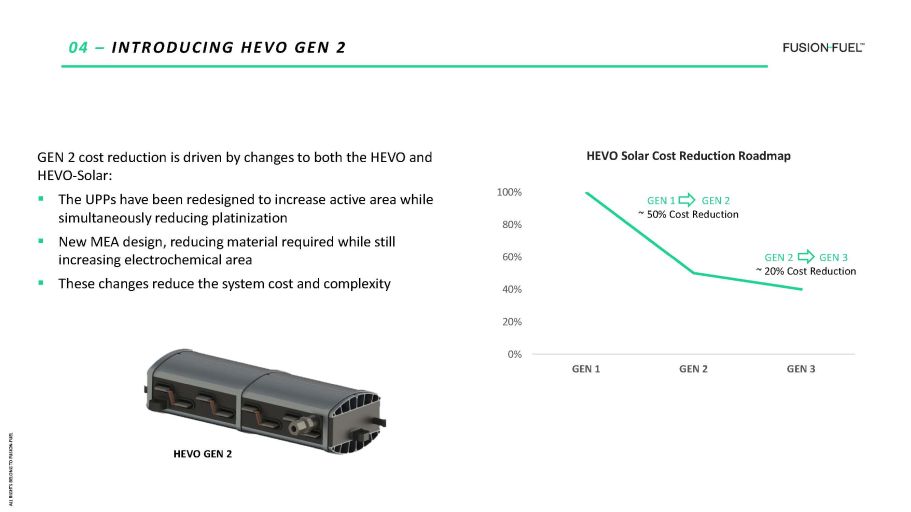

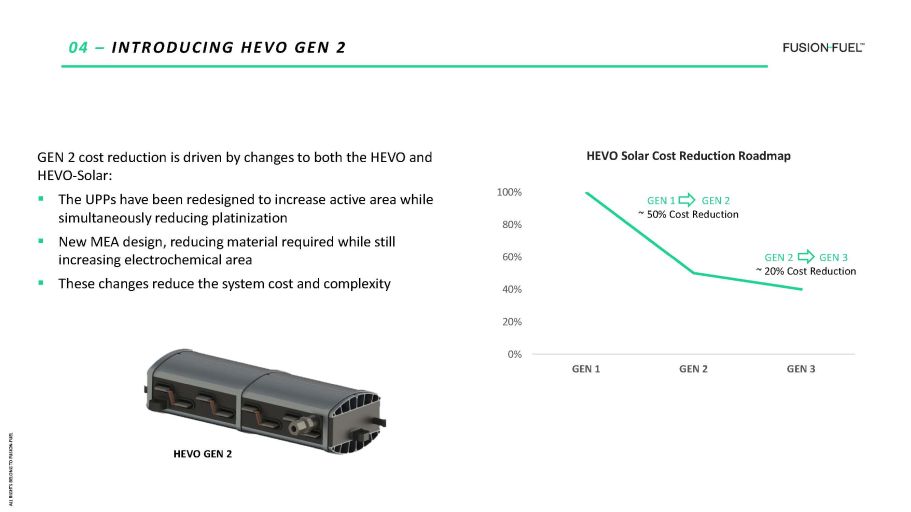

ALL RIGHTS BELONG TO FUSION - FUEL 04 – INTRODUCING HEVO GEN 2 GEN 2 cost reduction is driven by changes to both the HEVO and HEVO - Solar: ▪ The UPPs have been redesigned to increase active area while simultaneously reducing platinization ▪ New MEA design, reducing material required while still increasing electrochemical area ▪ These changes reduce the system cost and complexity HEVO Solar Cost Reduction Roadmap 0% 20% 40% 60% 80% 100% GEN 1 GEN 2 GEN 3 GEN 1 GEN 2 ~ 50% Cost Reduction GEN 2 GEN 3 ~ 20% Cost Reduction HEVO GEN 2

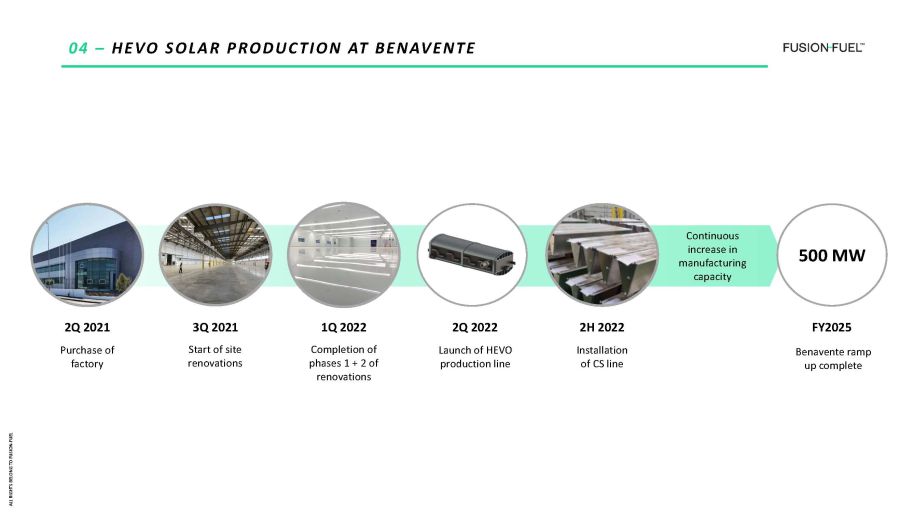

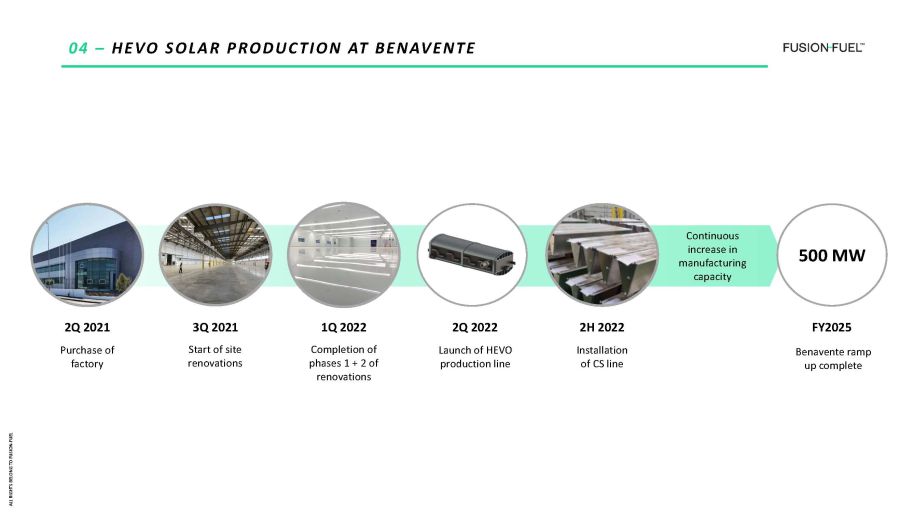

ALL RIGHTS BELONG TO FUSION - FUEL 04 – HEVO SOLAR PRODUCTION AT BENAVENTE Benavente ramp up complete Start of site renovations FY2025 2Q 2022 1Q 2022 3Q 2021 2Q 2021 2H 2022 Launch of HEVO production line Continuous increase in manufacturing capacity Purchase of factory Completion of phases 1 + 2 of renovations Installation of CS line 500 MW

ALL RIGHTS BELONG TO FUSION - FUEL 04 – PARTNERSHIP STRATEGY: TOSHIBA ESS Combined Tech Excellence Evaluate Toshiba’s novel membrane technology for use in Fusion Fuel’s miniaturized PEM electrolyzer ▪ Toshiba Energy Systems and Solutions (“Toshiba ESS”) and Fusion Fuel announced an agreement to study procurement, manufacturing, sales process, and technical collaboration, aimed at expanding sales of electrolyzers in Europe and Australia ▪ This partnership leverages both companies' complementary strengths and create a unique commercial offering – further establishing both Toshiba and Fusion Fuel as leaders at the forefront of clean hydrogen innovation Commercial Collaboration Leverage Toshiba’s extensive local sales channels to accelerate roll - out of Fusion Fuel’s leading technology solutions R&D Commitment Continue pushing the envelope with the next generation of cutting - edge green hydrogen technology

ALL RIGHTS BELONG TO FUSION - FUEL 05 — TEAM

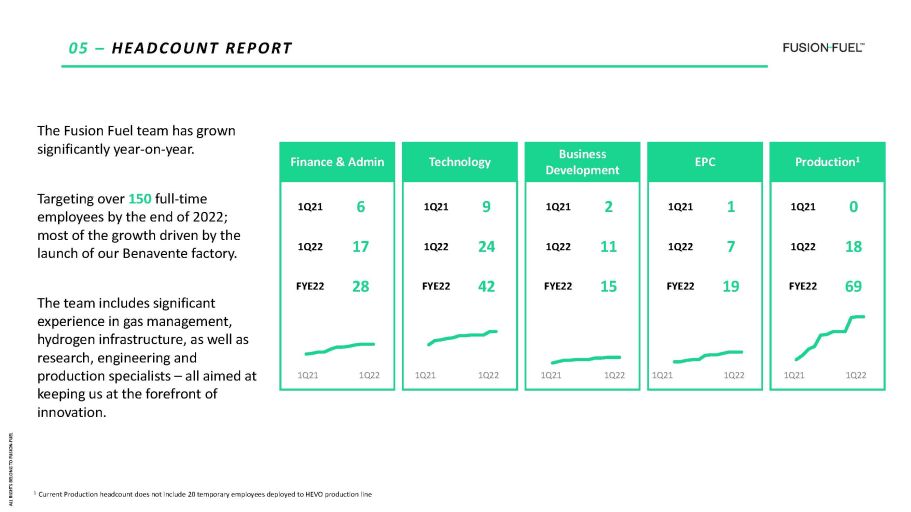

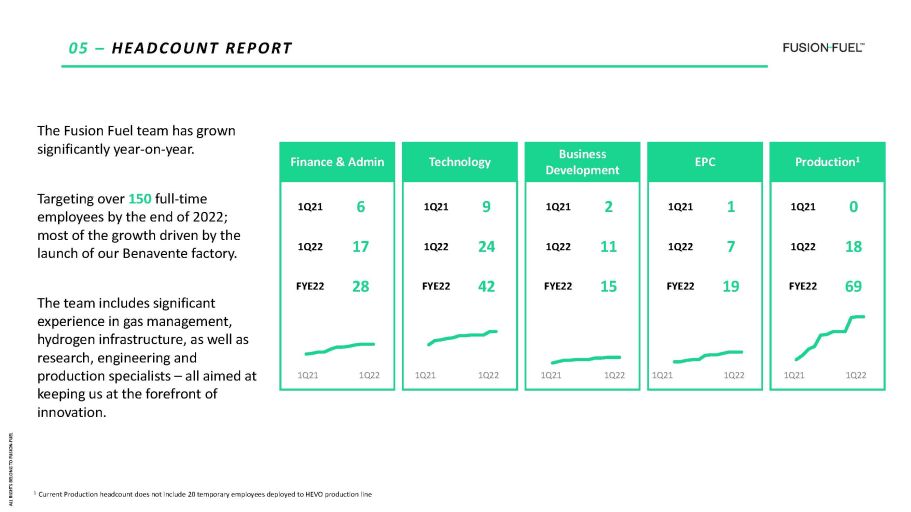

ALL RIGHTS BELONG TO FUSION - FUEL 05 – HEADCOUNT REPORT Finance & Admin Technology Business Development EPC Production 1 1Q21 FYE22 17 28 1Q22 6 1Q21 1Q22 1Q21 1Q22 1Q21 1Q22 1Q21 1Q22 1Q21 1Q22 1Q21 FYE22 24 42 1Q22 9 1Q21 FYE22 11 15 1Q22 2 1Q21 FYE22 7 19 1Q22 1 1Q21 FYE22 18 69 1Q22 0 1 Current Production headcount does not include 20 temporary employees deployed to HEVO production line The Fusion Fuel team has grown significantly year - on - year. Targeting over 150 full - time employees by the end of 2022; most of the growth driven by the launch of our Benavente factory. The team includes significant experience in gas management, hydrogen infrastructure, as well as research, engineering and production specialists – all aimed at keeping us at the forefront of innovation.

ALL RIGHTS BELONG TO FUSION - FUEL 06 – 2022 MILESTONES

ALL RIGHTS BELONG TO FUSION - FUEL 06 – 2022 MILESTONES 2 – 3 – 1 – 4 – HPA, SALES & GRANTS ▪ Fill 2022 and 2023 pipeline with confirmed orders ▪ Secure grants for company - owned plants and for third - party projects TECH DEVELOPMENT ▪ Launch next gens of HEVO and HEVO - Solar ▪ Introduce O 2 Capture System ▪ Continue product innovation and new product development PROJECT DEVELOPMENT ▪ Finalize delivery of approved projects in Portugal and Spain ▪ Kick - off development of projects that will be in construction in 2022 and 2023 ▪ Secure required licenses for existing project portfolio Our five key milestones for 2022: PRODUCTION ▪ Full go - live of Benavente facility ▪ Secure grants and financing for Benavente facility 5 – SAFETY ▪ Promote health & safety as a core pillar of Firm’s culture ▪ Implement robust safety protocols ▪ Zero safety incidents Company - wide

ALL RIGHTS BELONG TO FUSION - FUEL WWW.FUSION - FUEL.EU