Exhibit 99.2

ALL RIGTHS BELONG TO FUSION - FUEL – ENDLESS ENERGY. UNLIMITED FUTURE.

ALL RIGTHS BELONG TO FUSION - FUEL — Disclaimer This presentation includes statements of future events, conditions, expectations, and projections of Fusion Fuel Green plc (t he “Company”). Such statements are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Ref orm Act of 1995. The Company’s actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward - looking statemen ts as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “ bel ieve,” “predict,” “potential,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, estimate s and projections of future performance, which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors whi ch cannot be predicted. Such assumptions involve a number of known and unknown risks, uncertainties, and other factors, many of which are outside of the Company’s con tro l, including, among other things: the failure to obtain required regulatory approvals; changes in Portuguese, Spanish, Moroccan, or European green energy plans; the abilit y t o obtain additional capital; field conditions and the ability to increase production capacity; supply chain competition; changes adversely affecting the businesses in which th e C ompany is engaged; management of growth; general economic conditions, including changes in the credit, debit, securities, financial or capital markets; and the impact of COVID - 19 or other adverse public health developments on the Company’s business and operations. Should one or more of these material risks occur or should the underly ing assumptions change or prove incorrect, the actual results of operations are likely to vary from the projections and the variations may be material and adverse. The forward - looking statements and projections herein should not be regarded as a representation or prediction that the Company will achieve or is likely to achieve any particular results. The Company cautions readers not to place undue reliance upon any forward - looking statements and projections, which speak only a s of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Financial Statement Presentation The Company’s consolidated financial statements are prepared in accordance with International Financial Reporting Standards a s a dopted by the International Accounting Standards Board (“IFRS”) and are denominated in Euros (“EUR” or “€”). Use of Social Media as a Source of Material News The Company uses, and will continue to use, its LinkedIn profile, website, press releases, and various social media channels, as additional means of disclosing information to investors, the media, and others interested in the Company. It is possible that certain information that the Company posts on so cial media or its website, or disseminates in press releases, could be deemed to be material information, and the Company encourages investors, the media and others intere ste d in the Company to review the business and financial information that the Company posts on its social media channels, website, and disseminates in press releases, a s s uch information could be deemed to be material information.

ALL RIGTHS BELONG TO FUSION - FUEL AGENDA ▪ Focus on Fusion ▪ Q2/2021 Highlights & Financial Review ▪ Business Update ▪ 2021 Milestones ▪ Q&A

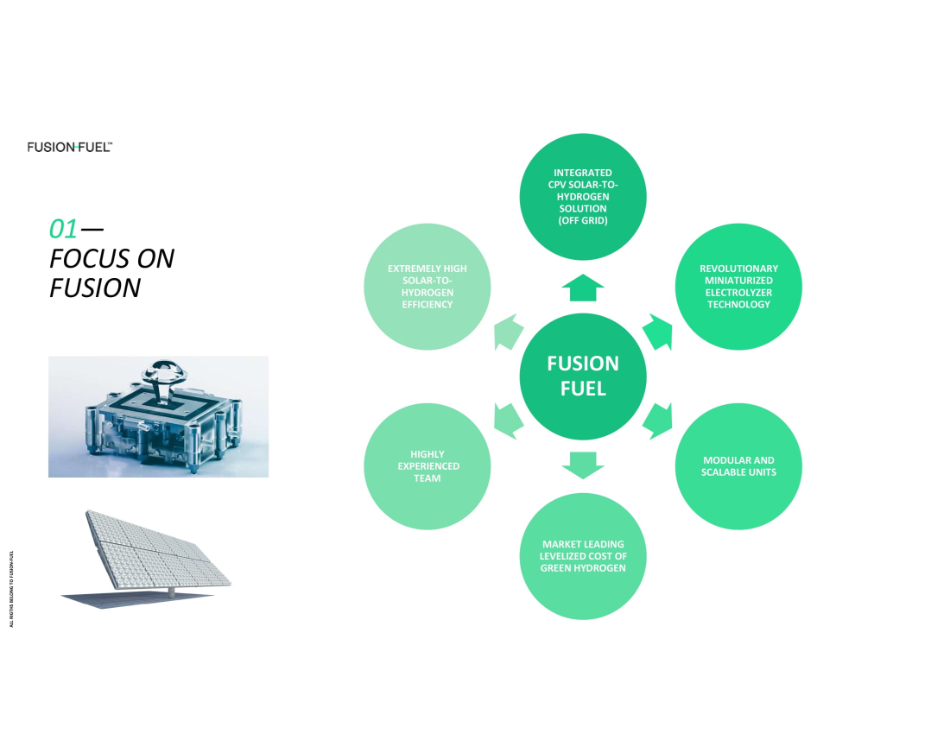

ALL RIGTHS BELONG TO FUSION - FUEL 01 – FOCUS ON FUSION

ALL RIGTHS BELONG TO FUSION - FUEL 0 1 — FOCUS ON FUSION FUSION FUEL INTEGRATED CPV SOLAR - TO - HYDROGEN SOLUTION (OFF GRID) REVOLUTIONARY MINIATURIZED ELECTROLYZER TECHNOLOGY MODULAR AND SCALABLE UNITS MARKET LEADING LEVELIZED COST OF GREEN HYDROGEN HIGHLY EXPERIENCED TEAM EXTREMELY HIGH SOLAR - TO - HYDROGEN EFFICIENCY

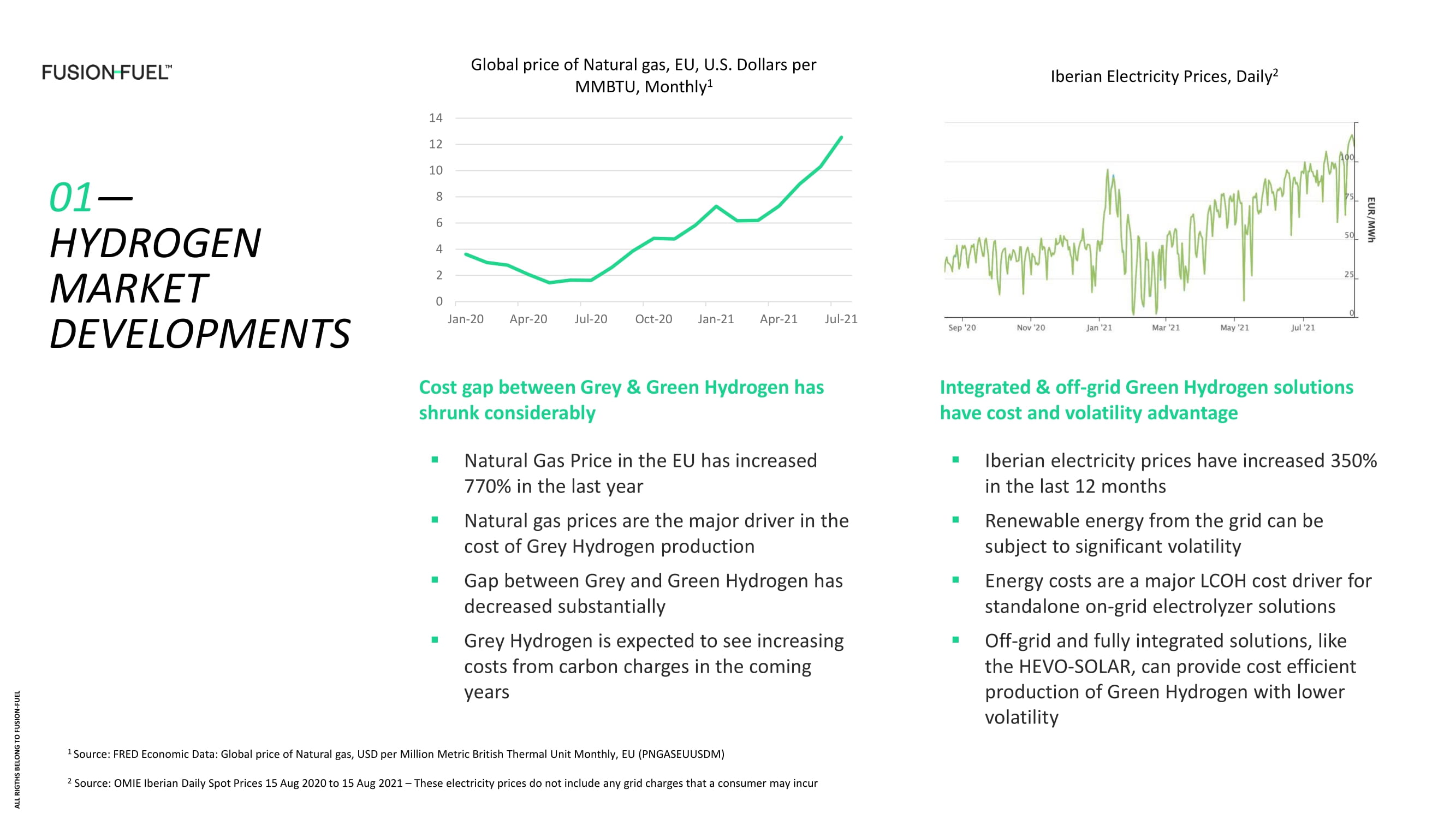

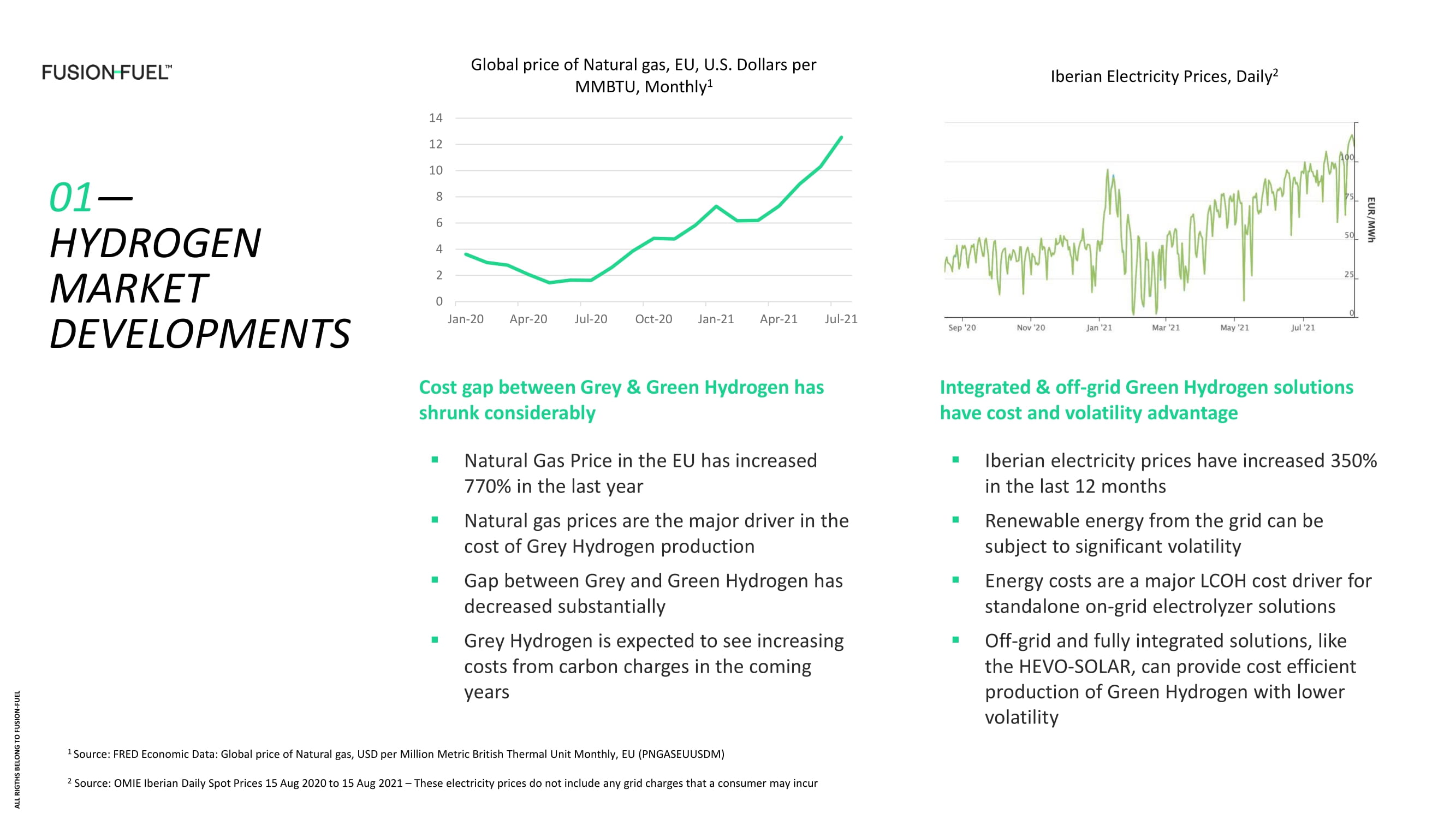

ALL RIGTHS BELONG TO FUSION - FUEL 0 1 — HYDROGEN MARKET DEVELOPMENTS 0 2 4 6 8 10 12 14 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Global price of Natural gas, EU, U.S. Dollars per MMBTU, Monthly 1 1 Source: FRED Economic Data: Global price of Natural gas, USD per Million Metric British Thermal Unit Monthly, EU (PNGASEUUSDM) 2 Source: OMIE Iberian Daily Spot Prices 15 Aug 2020 to 15 Aug 2021 – These electricity prices do not include any grid charges th at a consumer may incur ▪ Natural Gas Price in the EU has increased 770% in the last year ▪ Natural gas prices are the major driver in the cost of Grey Hydrogen production ▪ Gap between Grey and Green Hydrogen has decreased substantially ▪ Grey Hydrogen is expected to see increasing costs from carbon charges in the coming years ▪ Iberian electricity prices have increased 350% in the last 12 months ▪ Renewable energy from the grid can be subject to significant volatility ▪ Energy costs are a major LCOH cost driver for standalone on - grid electrolyzer solutions ▪ Off - grid and fully integrated solutions, like the HEVO - SOLAR, can provide cost efficient production of Green Hydrogen with lower volatility Cost gap between Grey & Green Hydrogen has shrunk considerably Integrated & off - grid Green Hydrogen solutions have cost and volatility advantage Iberian Electricity Prices, Daily 2

ALL RIGTHS BELONG TO FUSION - FUEL 02 – Q2 HIGHLIGHTS & FINANCIAL REVIEW

ALL RIGTHS BELONG TO FUSION - FUEL 0 2 — Q2/2021 HIGHLIGHTS ▪ Entered into an agreement with Elecnor for the development of green hydrogen projects in Spain ▪ Entered into a partnership with CCC to develop green hydrogen pilot plants in the Middle East ▪ Entered into Heads of Agreement with Ampol to install demonstrator plant in Australia establishes framework for JV to pursue other green hydrogen projects in the region ▪ Installed first HEVO - SOLAR units at H 2 Évora plant ▪ Submitted three projects to Portugal's Operational Program for Sustainability and Efficient Use of Resources (POSEUR) ▪ Obtained confirmation of HEVO - SOLAR Sines as one of four projects submitted by Portugal to Important Projects of Common European Interest (IPCEI) program ▪ Purchased Benavente factory facility and commenced of renovation work

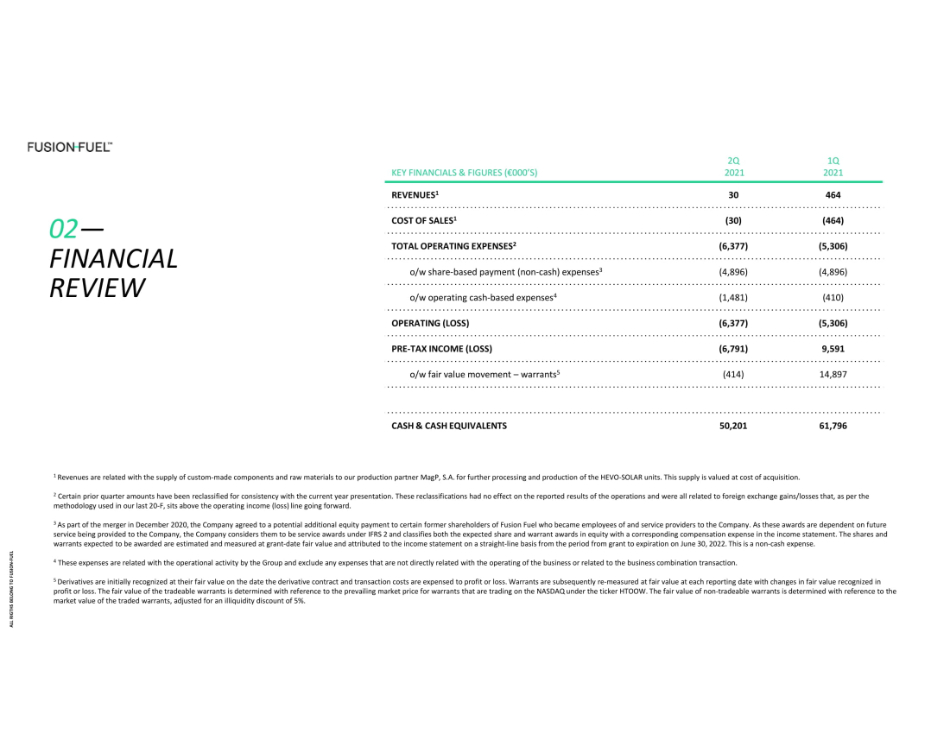

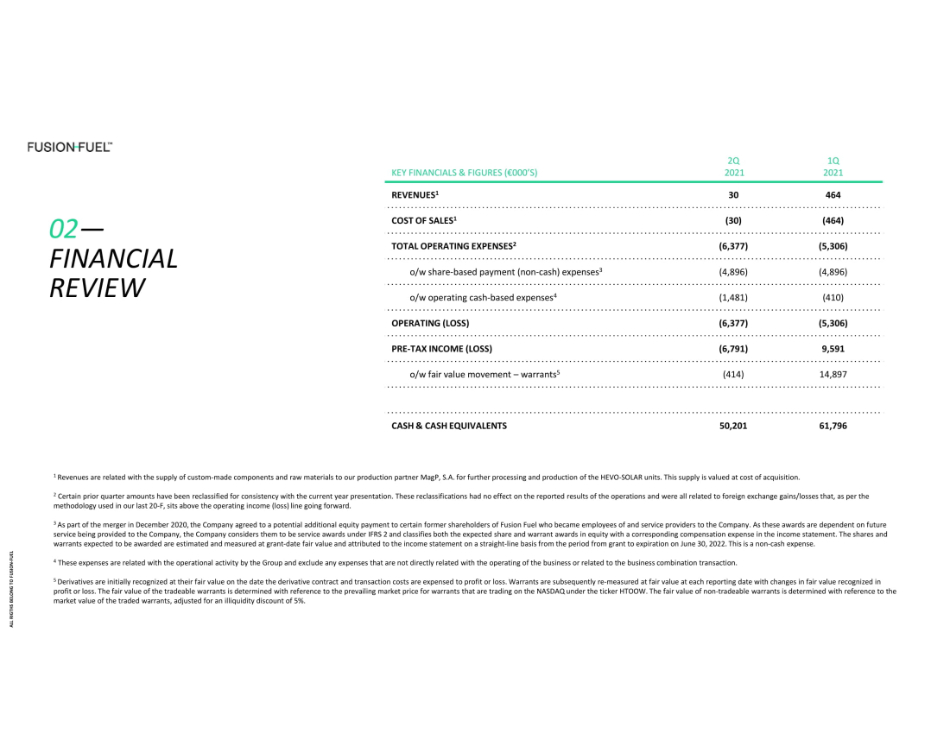

ALL RIGTHS BELONG TO FUSION - FUEL 0 2 — FINANCIAL REVIEW 1 Revenues are related with the supply of custom - made components and raw materials to our production partner MagP , S.A. for further processing and production of the HEVO - SOLAR units. This supply is valued at cost of acquisition. 2 Certain prior quarter amounts have been reclassified for consistency with the current year presentation. These reclassificati on s had no effect on the reported results of the operations and were all related to foreign exchange gains/losses that, as per the methodology used in our last 20 - F, sits above the operating income (loss) line going forward. 3 As part of the merger in December 2020, the Company agreed to a potential additional equity payment to certain former shareho lde rs of Fusion Fuel who became employees of and service providers to the Company. As these awards are dependent on future service being provided to the Company, the Company considers them to be service awards under IFRS 2 and classifies both the e xpe cted share and warrant awards in equity with a corresponding compensation expense in the income statement. The shares and warrants expected to be awarded are estimated and measured at grant - date fair value and attributed to the income statement on a straight - line basis from the period from grant to expiration on June 30, 2022. This is a non - cash expense. 4 These expenses are related with the operational activity by the Group and exclude any expenses that are not directly related wi th the operating of the business or related to the business combination transaction. 5 Derivatives are initially recognized at their fair value on the date the derivative contract and transaction costs are expens ed to profit or loss. Warrants are subsequently re - measured at fair value at each reporting date with changes in fair value recogni zed in profit or loss. The fair value of the tradeable warrants is determined with reference to the prevailing market price for warr ant s that are trading on the NASDAQ under the ticker HTOOW. The fair value of non - tradeable warrants is determined with reference t o the market value of the traded warrants, adjusted for an illiquidity discount of 5%. KEY FINANCIALS & FIGURES (€000’S) 2Q 2021 1Q 2021 REVENUES 1 30 464 COST OF SALES 1 (30) (464) TOTAL OPERATING EXPENSES 2 (6,377) (5,306) o/w share - based payment (non - cash) expenses 3 (4,896) (4,896) o/w operating cash - based expenses 4 (1,481) (410) OPERATING ( LOSS) (6,377) (5,306) PRE - TAX INCOME (LOSS) (6,791) 9,591 o/w fair value movement – warrants 5 (414) 14,897 CASH & CASH EQUIVALENTS 50,201 61,796

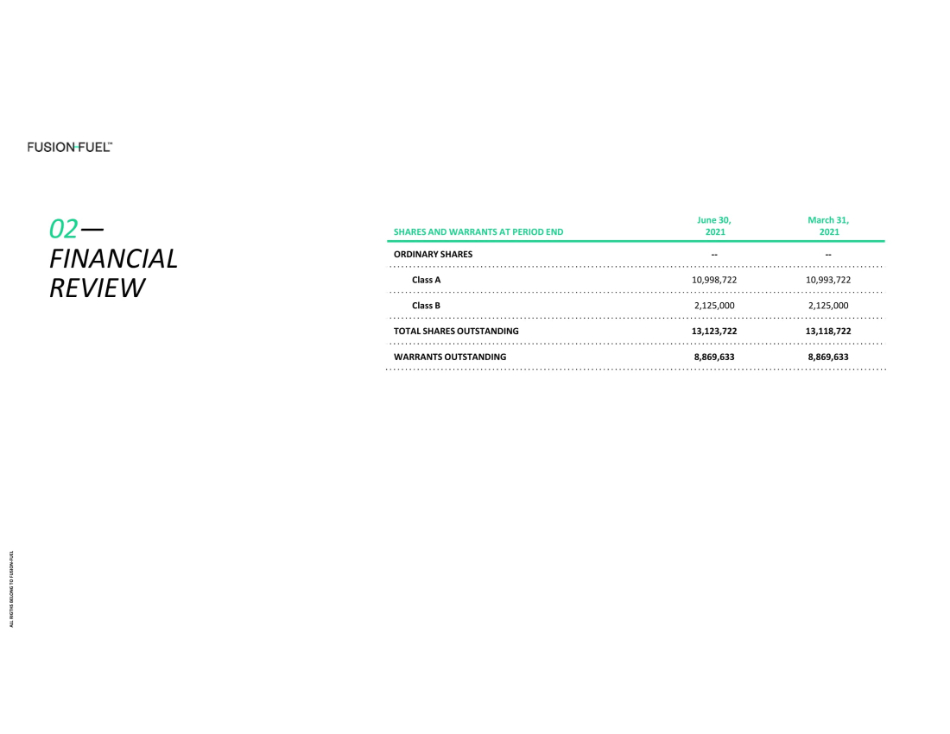

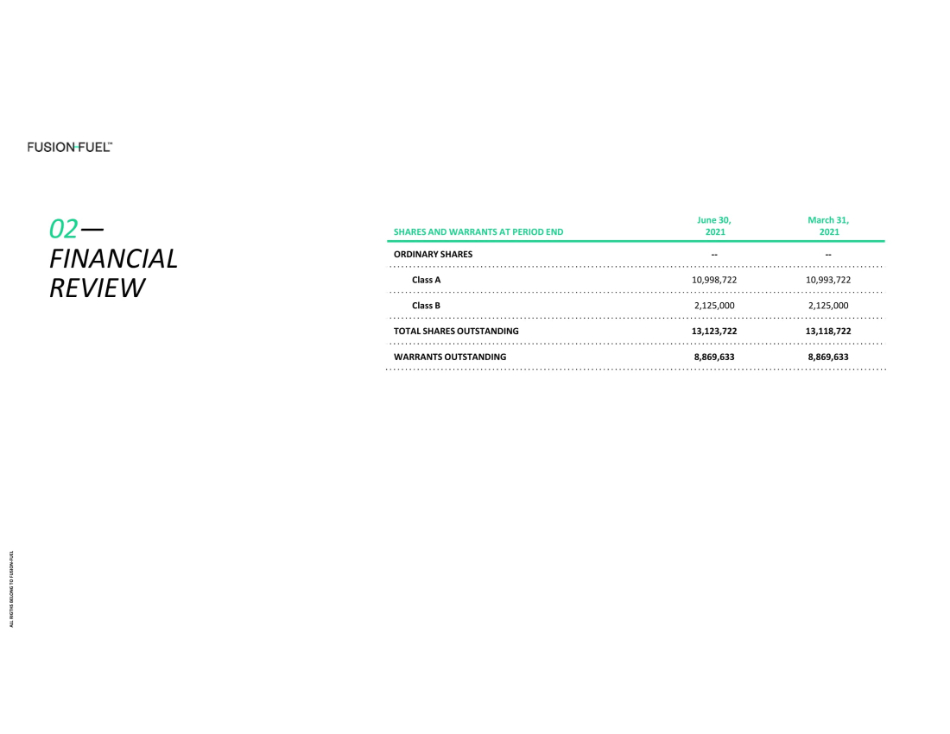

ALL RIGTHS BELONG TO FUSION - FUEL 0 2 — FINANCIAL REVIEW SHARES AND WARRANTS AT PERIOD END June 30, 2021 March 31, 2021 ORDINARY SHARES -- -- Class A 10,998,722 10,993,722 Class B 2,125,000 2,125,000 TOTAL SHARES OUTSTANDING 13,123,722 13,118,722 WARRANTS OUTSTANDING 8,869,633 8,869,633

ALL RIGTHS BELONG TO FUSION - FUEL 03 – BUSINESS UPDATE

ALL RIGTHS BELONG TO FUSION - FUEL 03 — BUSINESS UPDATE

ALL RIGTHS BELONG TO FUSION - FUEL 03 — BUSINESS UPDATE 1 — 2 — 3 — EVORA PLANT GO - LIVE MOU s & HPA s SIGNED PRODUCTION FACILITY The go - live of our first h ydrogen p lant is critical to pro ve the industrial scale effectiveness of our HEVO SOLAR system and to establish a track record for technology bankability Hydrogen plants take time to obtain licenses, permits and to develop. Therefore, multi - year commitments with credible counterparts to purchase hydrogen are important to deliver on revenue targets The buildout of our new production facility during the second half of 2021 and delivery of the first units from that facility by year - end are important to avoid delays to growth plan Our three key milestones for 2021:

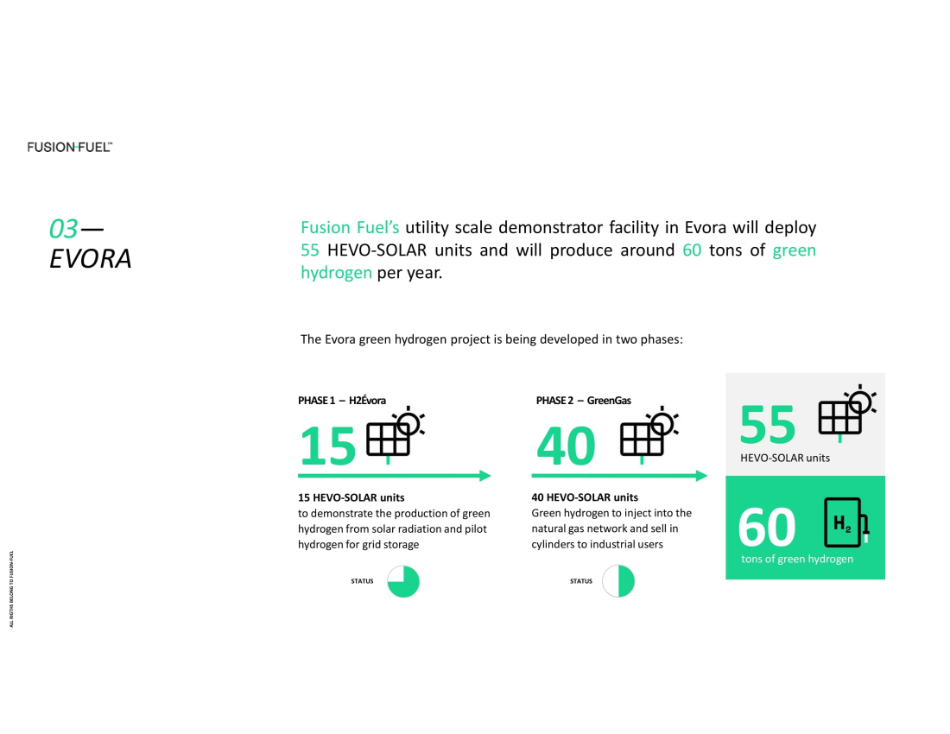

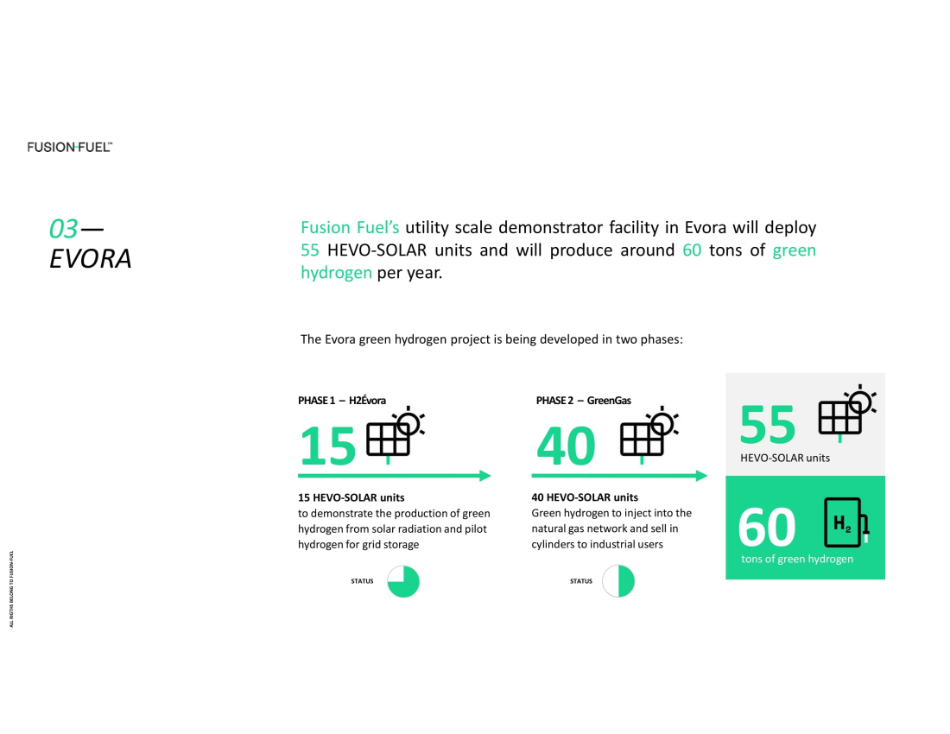

ALL RIGTHS BELONG TO FUSION - FUEL 0 3 — EVORA Fusion Fuel’s utility scale demonstrator facility in Evora will deploy 55 HEVO - SOLAR units and will produce around 60 tons of green hydrogen per year . The Evora g reen h ydrogen project is be ing developed in two phases: 55 60 HEVO - SOLAR units 15 40 PHASE 1 – H2Évora PHASE 2 – GreenGas 15 HEVO - SOLAR units to demonstrat e the production of g reen h ydrogen from solar radiation and pilot hydrogen for grid storage tons of green hydrogen STATUS STATUS 40 HEVO - SOLAR units Green hydrogen to inject into the natural gas network and sell in cylinders to industrial users

ALL RIGTHS BELONG TO FUSION - FUEL 0 3 — É VORA PHASE I ▪ The first HEVO - SOLAR units were installed in Q 2 and HEVOs are being rolled out to remaining units currently . Other plants systems now in place in addition ▪ Grupo ISQ, a Portuguese energy engineering and consulting firm, recently conducted a performance test on our HEVO - SOLAR technology at Évora ▪ The test measured the production of hydrogen given the amount of solar radiation ▪ The test successfully validated the operation of the HEVO - SOLAR system and showed > 10 % improvement in performance compared to the previous generation (which was the basis for our 2021 business plan)

ALL RIGTHS BELONG TO FUSION - FUEL 0 3 — PRODUCTION UPDATE Benavente Factory ▪ Purchase of 14,000m 3 facility ▪ Renovation underway and to be completed end of September ▪ Installation of first production lines to begin in September / October ▪ Due to supply chain pressures and longer than expected lead times from suppliers of robotics equipment, expected go - live pushed to 3Q 2022 Supply Chain ▪ Raw materials costs have increased ~25% YoY, and have coincided with extended lead times, short - term procurement contracts and limited volumes ▪ Focus has been on broadening our list of suppliers and securing deliveries and prices to mitigate risk of further supply chain disruption Production Guidance ▪ Due to the supply chain delays and the Benavente delay we are revising the 2021 and 2022 production guidance ▪ 2021 production target of 150 – 200 HEVO - SOLARs (from 600) ▪ 2022 production target of 2,000 – 2,500 HEVO - SOLARs (from 4,700)

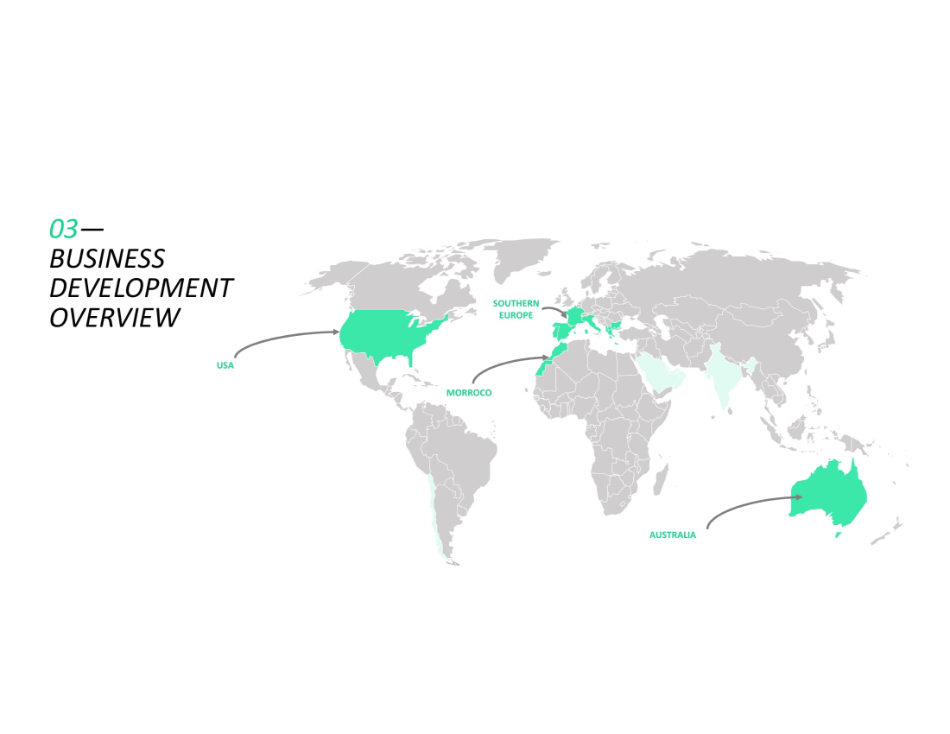

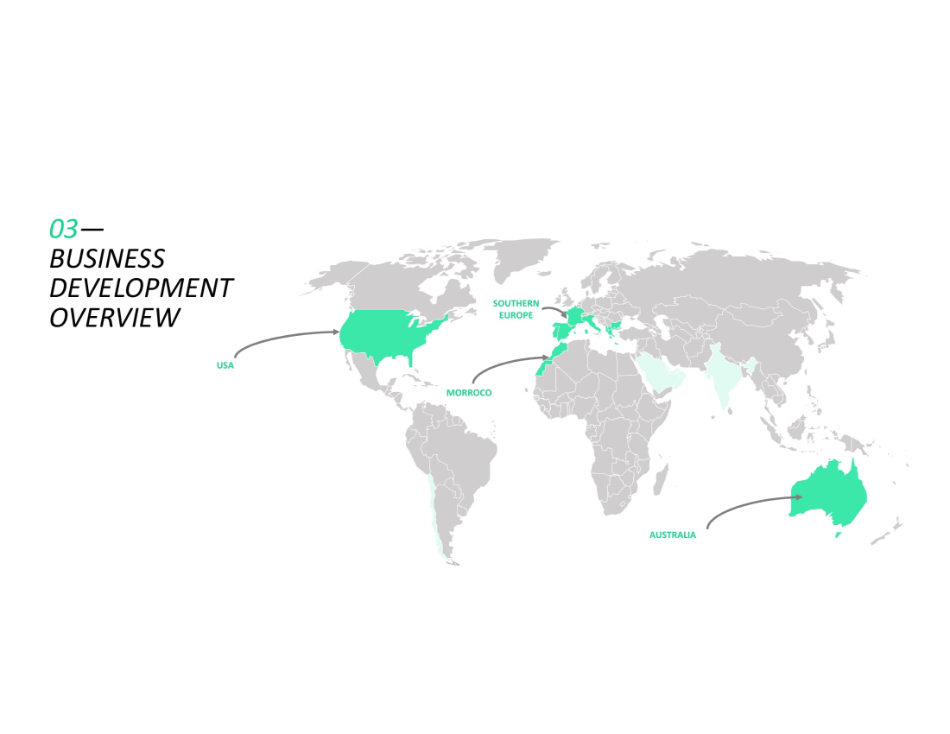

AUSTRALIA USA MORROCO SOUTHERN EUROPE 0 3 — BUSINESS DEVELOPMENT OVERVIEW

ALL RIGTHS BELONG TO FUSION - FUEL 03 — PORTUGAL POSEUR Projects: Green Hydrogen Projects submitted to the POSEUR (Portugal's Operational Program for Sustainability and Efficient Use of Resources): ▪ HEVO - SUL – 178 HEVO - SOLAR, € 8m investment - Green Hydrogen for Green Ammonia, mixing into natural gas grid and bottling ▪ PRIO ENERGY – 62 HEVO - SOLAR, € 2.4m investment - Green Hydrogen for Hydrogen Refueling Stations ▪ KEME ENERGY – 62 HEVO - SOLAR, € 2.5m investment - Green Hydrogen for industrial uses HEVO - SINES Project: Installation of ~25,000 HEVO - SOLAR Units (~600 MW) from 2023 to 2026, to produce Green Hydrogen to be blended in the Natural Gas Network and to be used in the production of Green Ammonia ▪ HEVO - SINES is part of the first 4 projects in the running for the IPCEI recognition in Portugal from an initial 74 applicant projects ▪ Currently, around 800 hectares have been selected for the project Approved Approval Pending Approval Pending

ALL RIGTHS BELONG TO FUSION - FUEL 0 3 — MOROCCO ▪ Hevo Ammonia Morocco project, with an estimated total investment of value of more than 850m USD ▪ Targeted to produce ~31,000 tons of Green Hydrogen to be used in the production of ~180,000 tons of Green Ammonia and abate 280,000 tons of CO 2 annually ▪ The project would be jointly developed by Fusion Fuel and Consolidated Contractors Company, a global construction company that offers a full suite of services across the entire EPC value chain and Vitol, one of the world’s leading energy and commodities companies, would manage the offtake of the Green Ammonia and the certificates of origin

ALL RIGTHS BELONG TO FUSION - FUEL 04 – 2021 MILESTONES

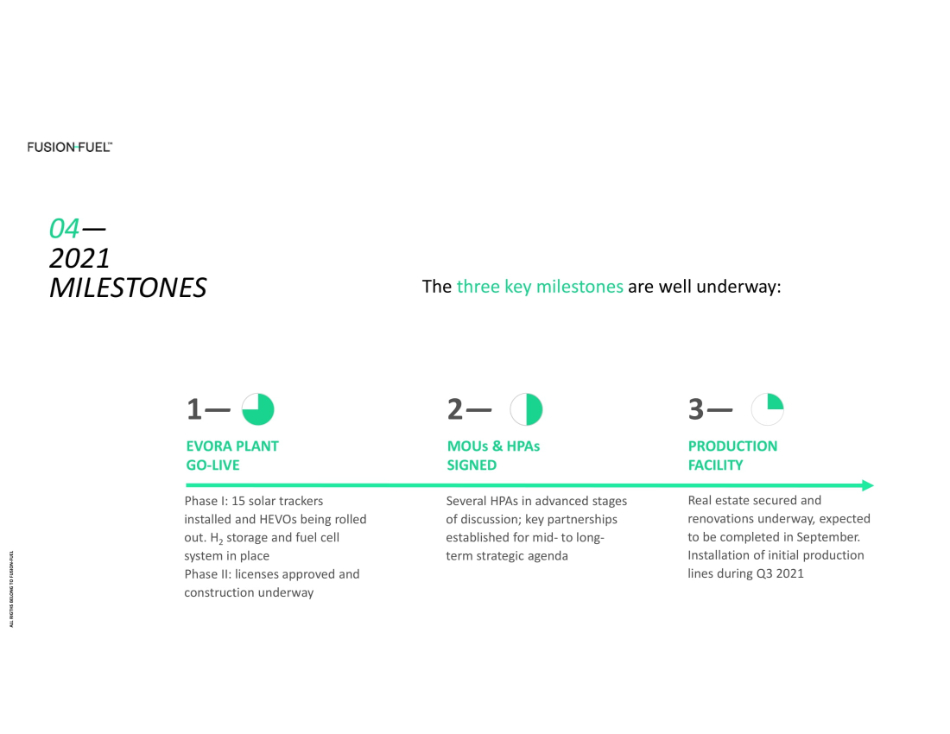

ALL RIGTHS BELONG TO FUSION - FUEL 0 4 — 2021 MILESTONES 1 — EVORA PLANT GO - LIVE Phase I: 15 solar trackers installed and HEVOs being rolled out. H 2 storage and fuel cell system in place Phase II: licenses approved and construction underway 2 — MOU s & HPA s SIGNED Several HPAs in advanced stages of discussion; key partnerships established for mid - to long - term strategic agenda 3 — PRODUCTION FACILITY Real estate secured and renovations underway, expected to be completed in September. Installation of initial production lines during Q3 2021 The three key milestones are well underway:

ALL RIGTHS BELONG TO FUSION - FUEL WWW.FUSION - FUEL.EU