Exhibit 99.1

F U S I O N - F U E L | I N V E S T O R P R E S E N T A T I O N D e c e mber 2 02 4 INVESTOR P R E S ENTATION N A S D A Q : H T O O

DISCLAIMER This presentation includes statements of future events, conditions, expectations, and projections of Fusion Fuel Green PLC (the “Company”, “HTOO”, or “Fusion Fuel”) . Such statements are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . The Company’s actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward - looking statements as predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predict,” “potential,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, estimates and projections of future performance, which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors which cannot be predicted . Such assumptions involve a number of known and unknown risks, uncertainties, and other factors, many of which are outside of the Company’s control, including, among other things : the failure to obtain required regulatory approvals ; changes in Portuguese, Spanish, Moroccan, or European green energy plans ; the ability to obtain additional capital ; field conditions and the ability to increase production capacity ; supply chain competition ; changes adversely affecting the businesses in which the Company is engaged ; management of growth ; general economic conditions, including changes in the credit, debit, securities, financial or capital markets ; and the impact of COVID - 19 or other adverse public health developments on the Company’s business and operations . Should one or more of these material risks occur or should the underlying assumptions change or prove incorrect, the actual results of operations are likely to vary from the projections and the variations may be material and adverse . The forward - looking statements and projections herein should not be regarded as a representation or prediction that the Company will achieve or is likely to achieve any particular results . The Company cautions readers not to place undue reliance upon any forward - looking statements and projections, which speak only as of the date made . The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based . Financial Upd a t e Presenta t ion The Company’s consolidated financial data is prepared in accordance with International Financial Reporting Standards as adopted by the International Accounting Standards Board (“IFRS”) and is denominated in Euros (“EUR” or “€”) . The numbers shown in this presentation have not been audited and therefore may vary to the final financial results disclosed by the company as part of the annual report . The unaudited consolidated financial data reflects, in the opinion of management, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair statement of the Company's financial data for the periods indicated . The unaudited consolidated financial data should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31 , 2023 included in the Company's Annual Report on Form 20 - F for the year ended December 31 , 2023 . Us e o f Socia l Medi a a s a Source o f M a ter i al N ews The Company uses, and will continue to use, its LinkedIn profile, website, press releases, and various social media channels, as additional means of disclosing information to investors, the media, and others interested in the Company . It is possible that certain information that the Company posts on social media or its website, or disseminates in press releases, could be deemed to be material information, and the Company encourages investors, the media and others interested in the Company to review the business and financial information that the Company posts on its social media channels, website, and disseminates in press releases, as such information could be deemed to be material information . I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

INTRODUCTORY FAST FACTS I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L ▪ We are a full - service energy and utilities solutions provider with two operating subsidiaries servicing the hydrogen and gas sectors ▪ We address today’s critical energy requirements, and we are strategically positioned for future demands ▪ We are restructuring our hydrogen business, and the simultaneous acquisition of QIND positions us for profitable, cashflow - positive growth ▪ Consolidated Shareholders’ Equity above $5M (Nasdaq requirement) ▪ Highlights of our operating gas business, Al Shola Gas: • Services over 36,000 customers in the Middle East • 2024 Forecast: $14M revenue & $2.3M net income (30% growth over 2023) • 2025 Targets: $25.3M revenue & $4M net income ▪ Our hydrogen business, BrightHy (currently being incorporated), aims to be a leading solution provider for the implementation of green hydrogen projects globally

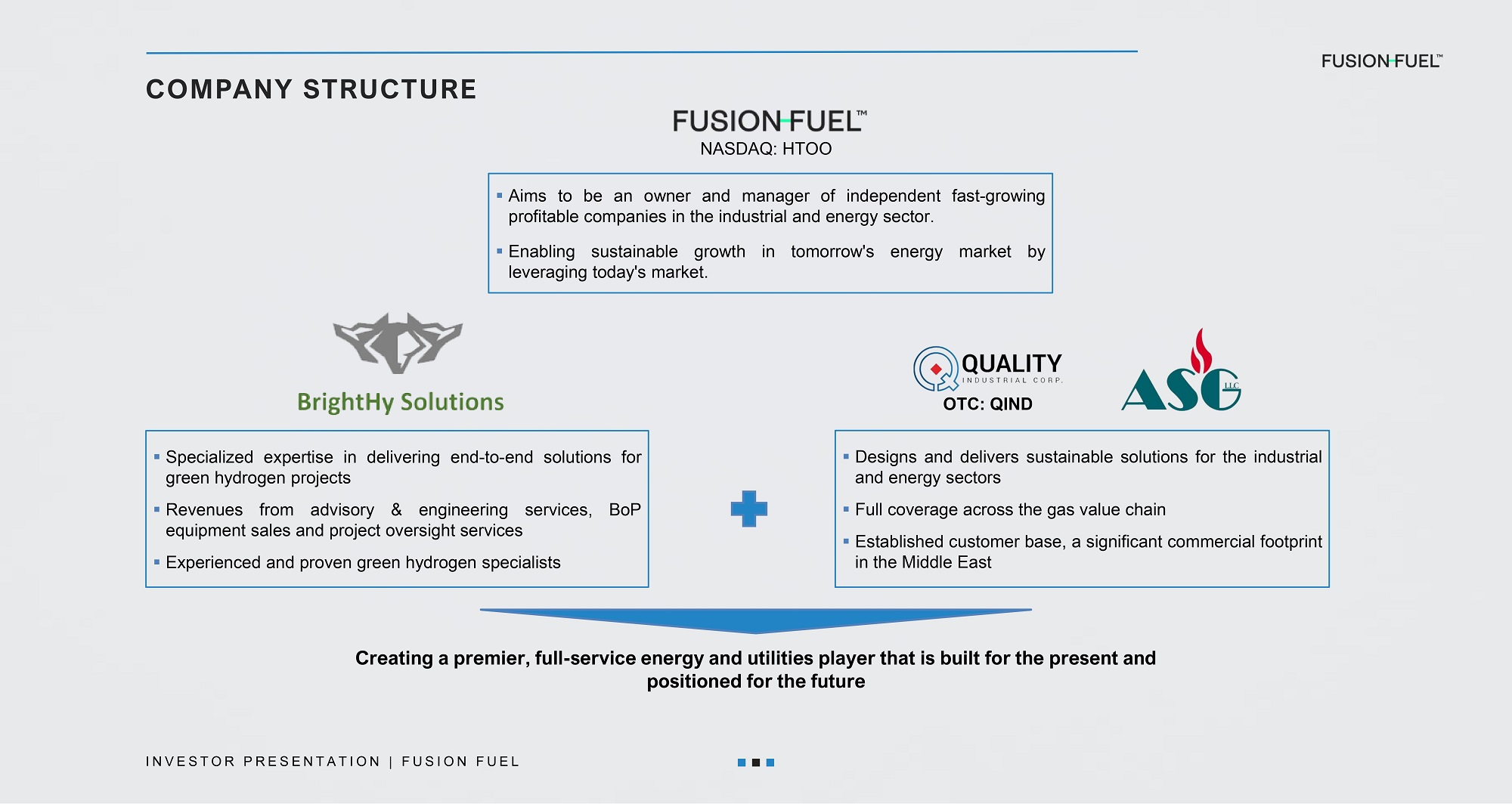

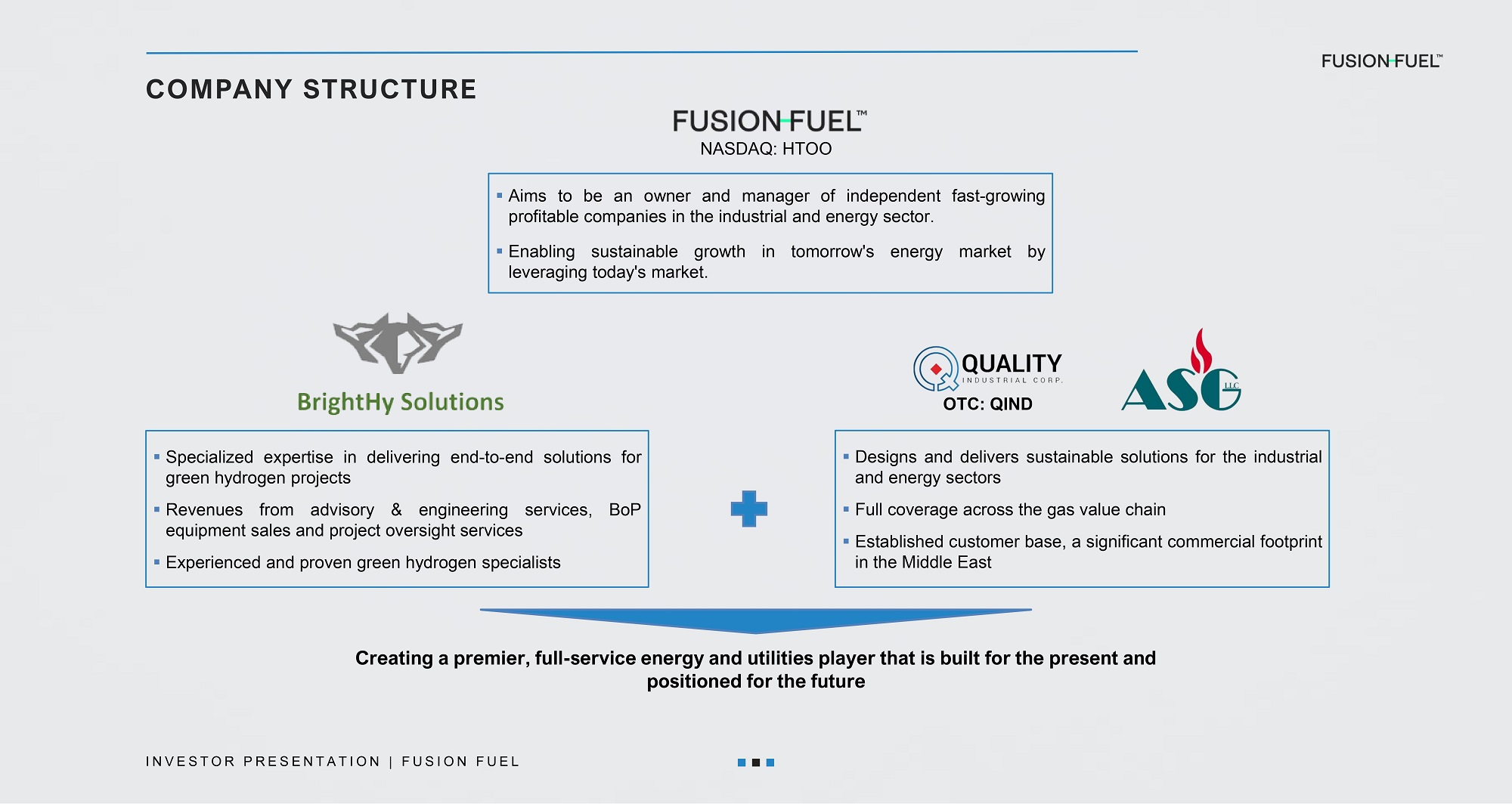

NASDAQ: HTOO ▪ Aims to b e a n o w n e r and ma n a g er o f i n dep e n d e nt fast - gr o w i ng profitable companies in the industrial and energy sector. ▪ Enabling sustainable growth in tomorrow's energy market by leveraging today's market. ▪ S p ec i a l i z e d e xp e rtise i n d e l i ver i ng e n d - t o - en d soluti o ns for green hydrogen projects ▪ R e venu e s from a d vis o r y & e n g i neer i n g serv i ces, B o P equipment sales and project oversight services ▪ Experienced and proven green hydrogen specialists ▪ Designs and delivers sustainable solutions for the industrial and energy sectors ▪ Full coverage across the gas value chain ▪ Established customer base, a significant commercial footprint in the Middle East OTC: QIND Creating a premier, full - service energy and utilities player that is built for the present and positioned for the future COMPANY STRUCTURE I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

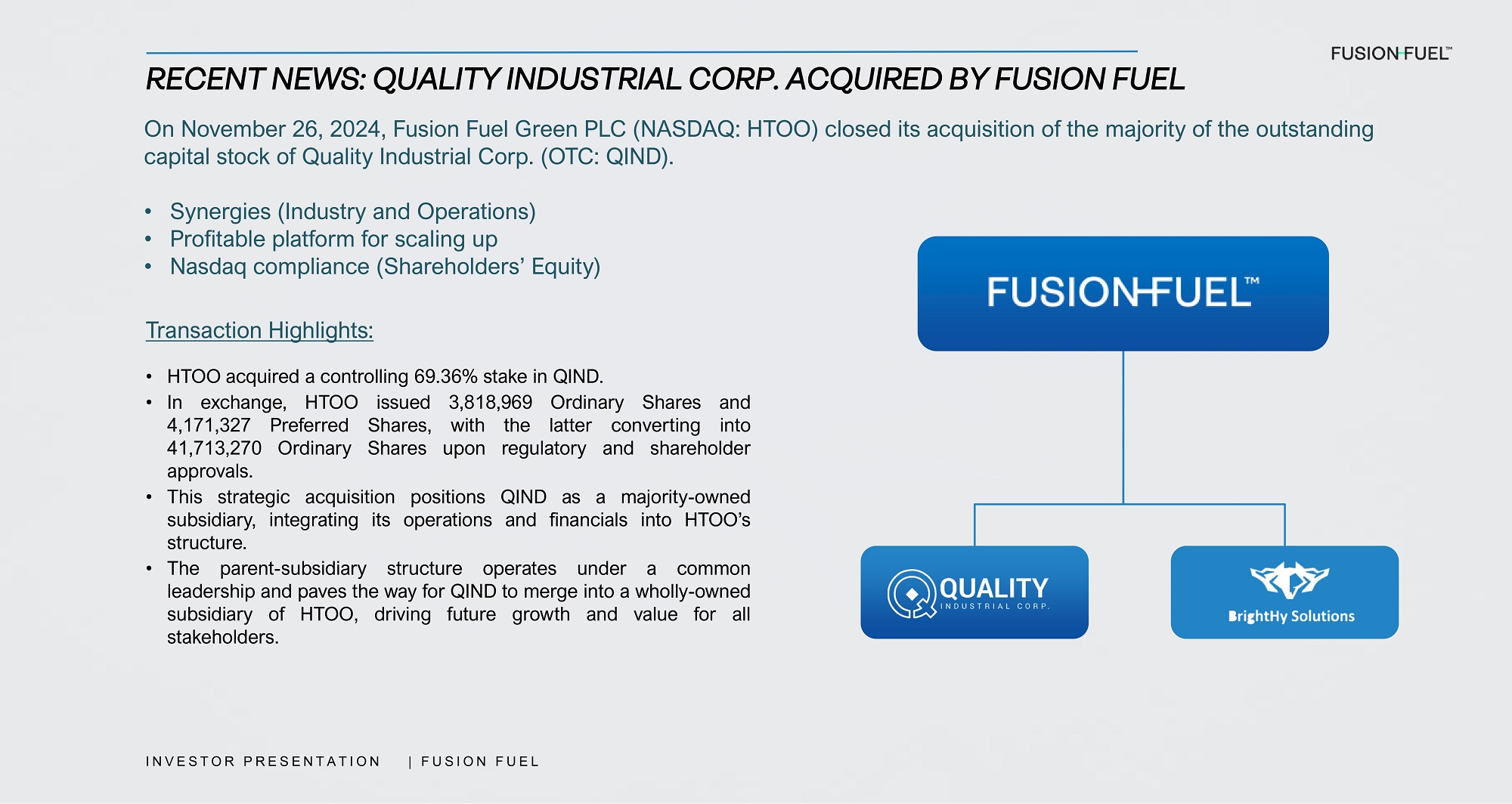

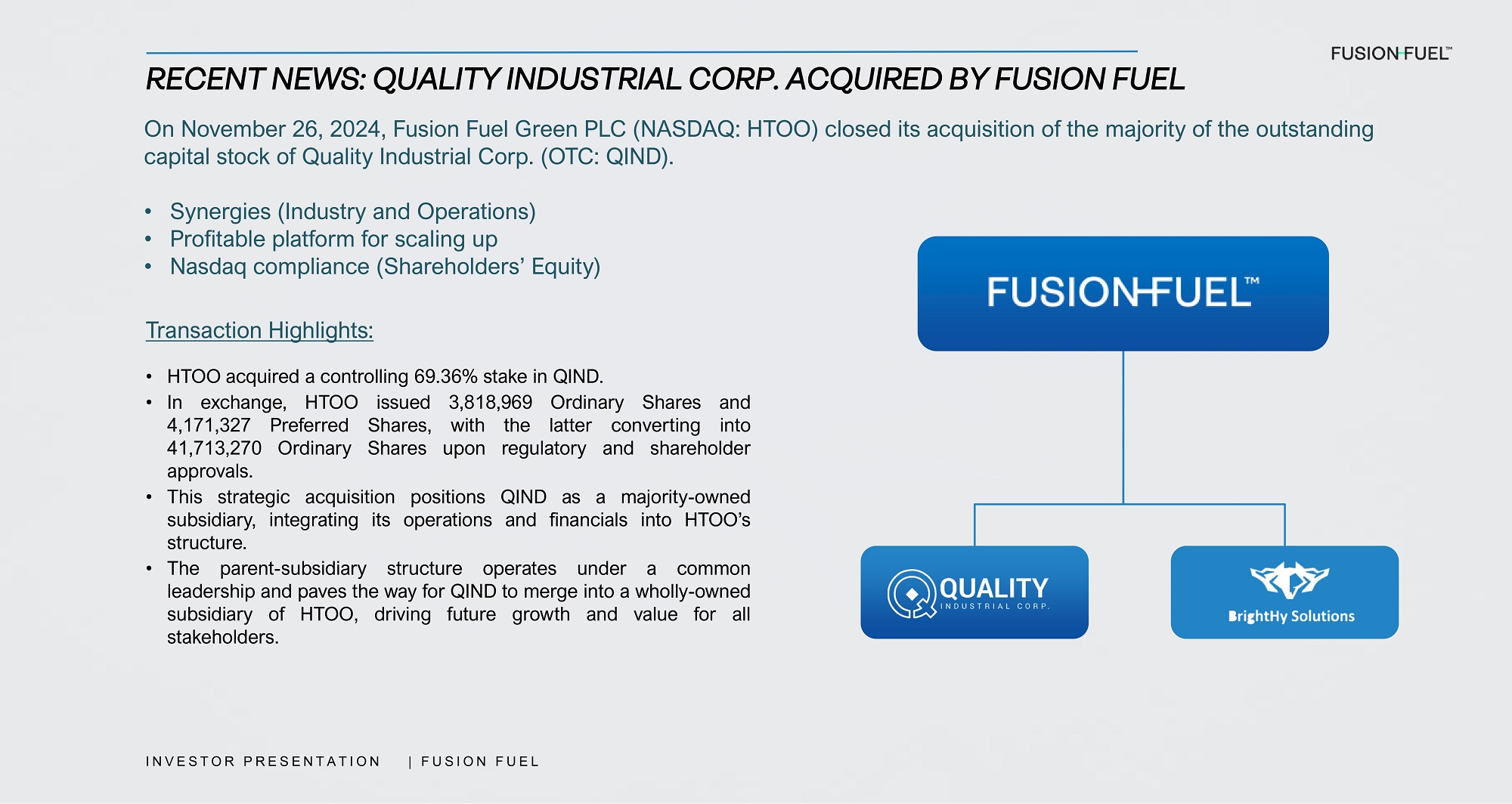

RECENT NEWS: QUALITY INDUSTRIAL CORP. ACQUIRED BY FUSION FUEL I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L On November 26, 2024, Fusion Fuel Green PLC (NASDAQ: HTOO) closed its acquisition of the majority of the outstanding capital stock of Quality Industrial Corp. (OTC: QIND). • Synergies (Industry and Operations) • Profitable platform for scaling up • Nasdaq compliance (Shareholders’ Equity) Transaction Highlights: • HTOO acquired a controlling 69 . 36 % stake in QIND . • In exchange, HTOO issued 3 , 818 , 969 Ordinary Shares and 4 , 171 , 327 Preferred Shares, with the latter converting into 41 , 713 , 270 Ordinary Shares upon regulatory and shareholder approvals . • This strategic acquisition positions QIND as a majority - owned subsidiary, integrating its operations and financials into HTOO’s structure . • The parent - subsidiary structure operates under a common leadership and paves the way for QIND to merge into a wholly - owned subsidiary of HTOO, driving future growth and value for all stakeholders .

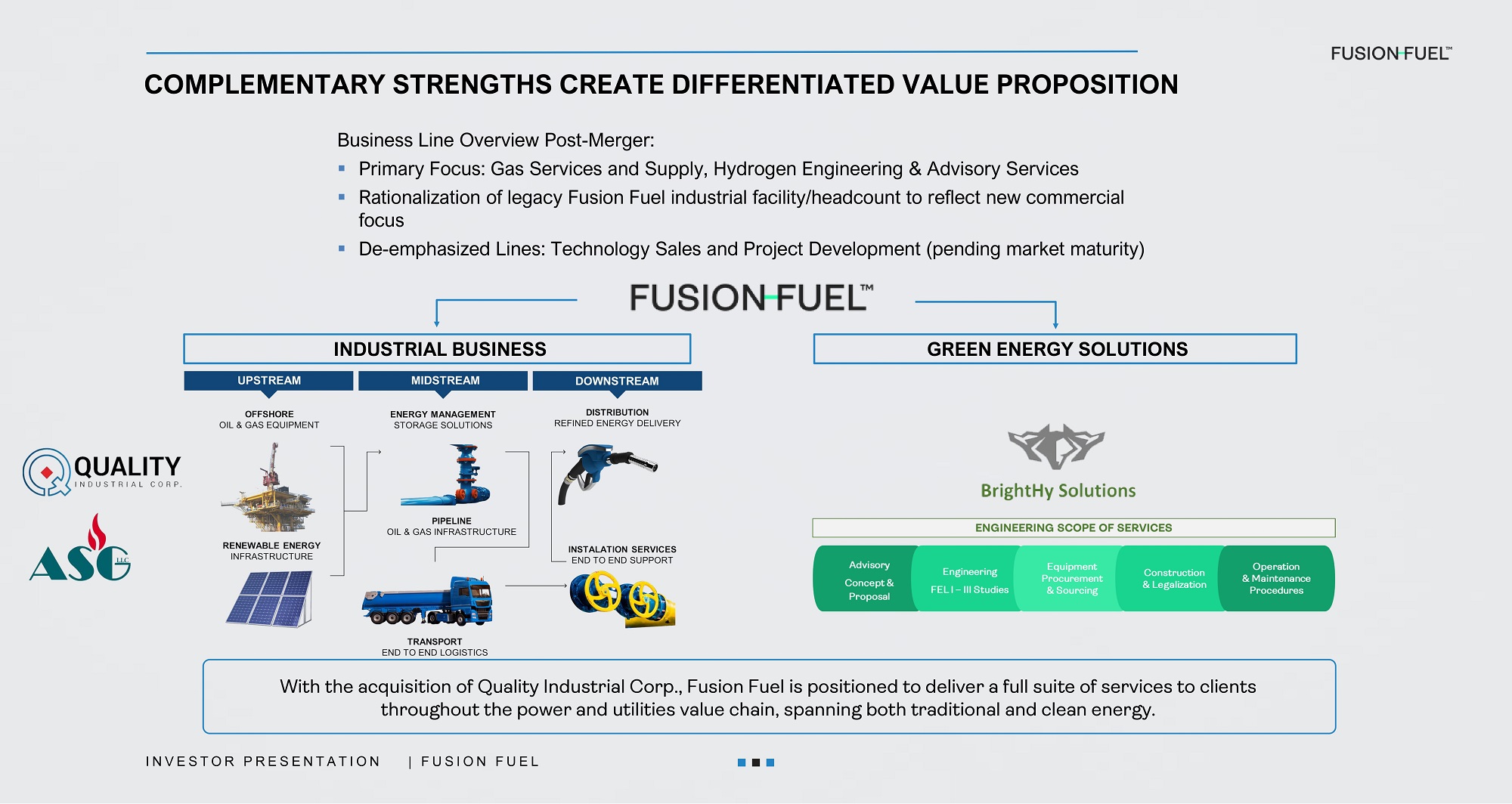

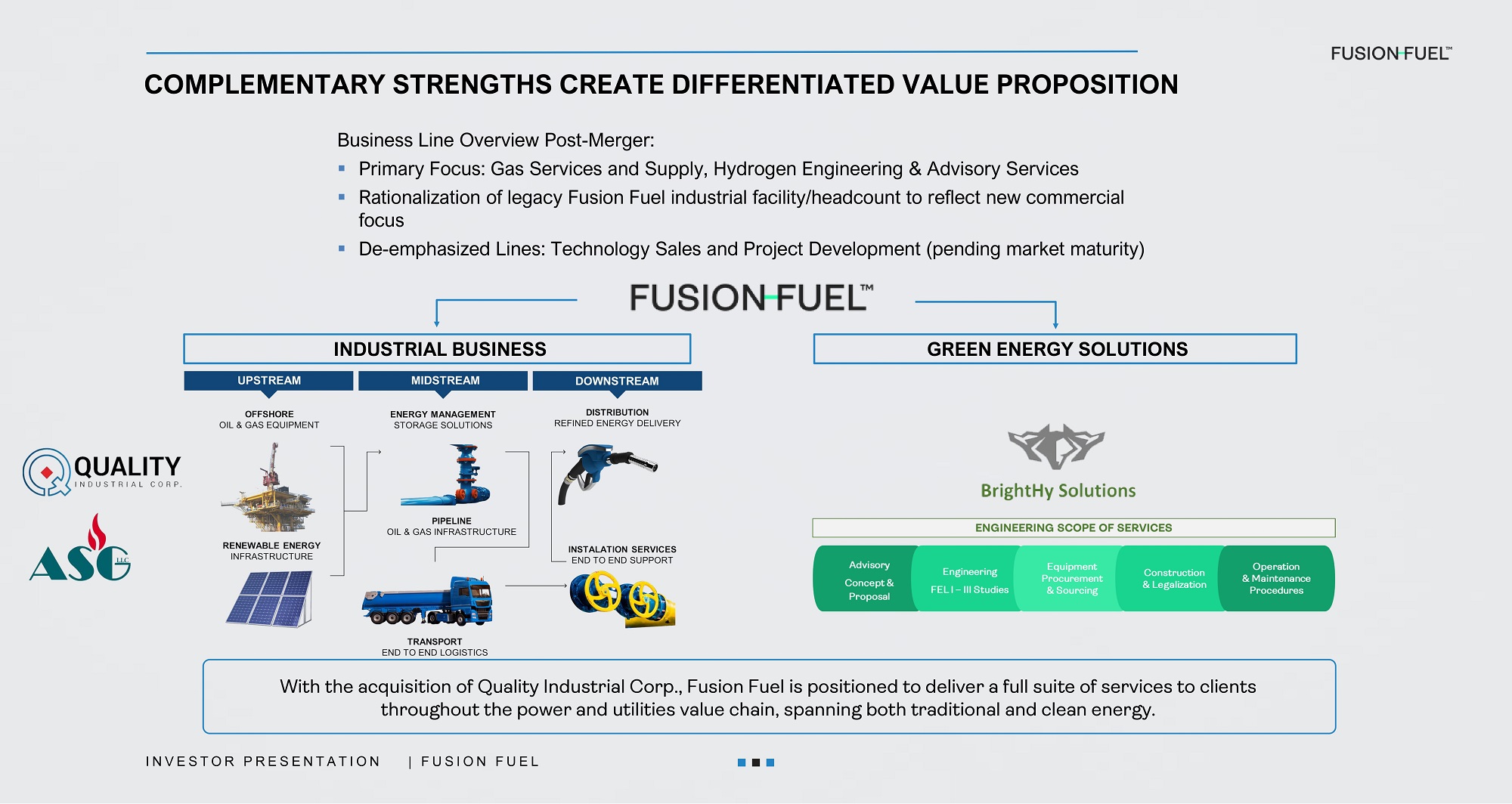

COMPLEMENTARY STRENGTHS CREATE DIFFERENTIATED VALUE PROPOSITION Business Line Overview Post - Merger: ▪ Primary Focus: Gas Services and Supply, Hydrogen Engineering & Advisory Services ▪ Rationalization of legacy Fusion Fuel industrial facility/headcount to reflect new commercial focus ▪ De - emphasized Lines: Technology Sales and Project Development (pending market maturity) INDUSTRIAL BUSINESS G R EEN ENERGY SOL U TIO NS With the acquisition of Quality Industrial Corp., Fusion Fuel is positioned to deliver a full suite of services to clients throughout the power and utilities value chain, spanning both traditional and clean energy. I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

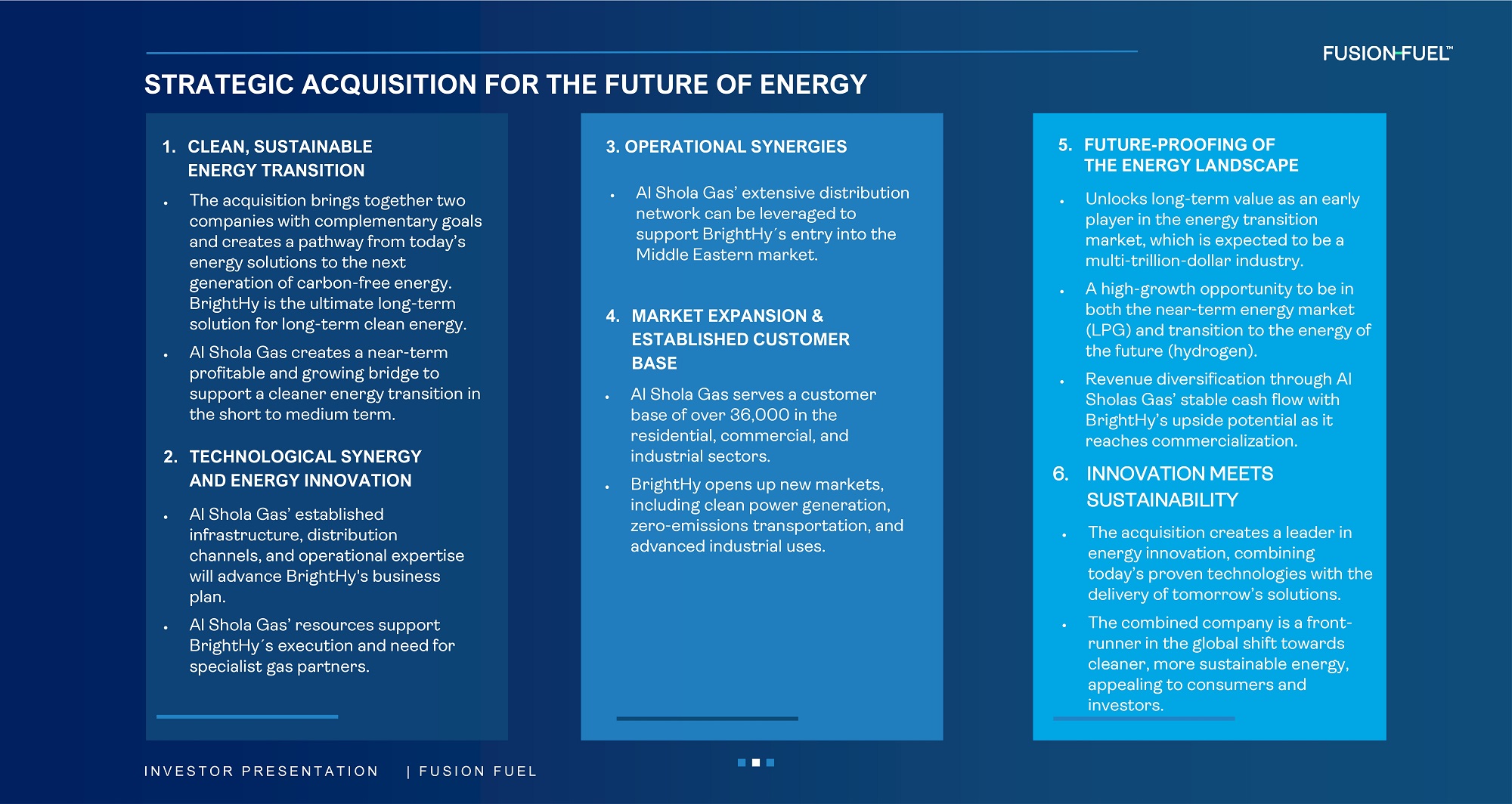

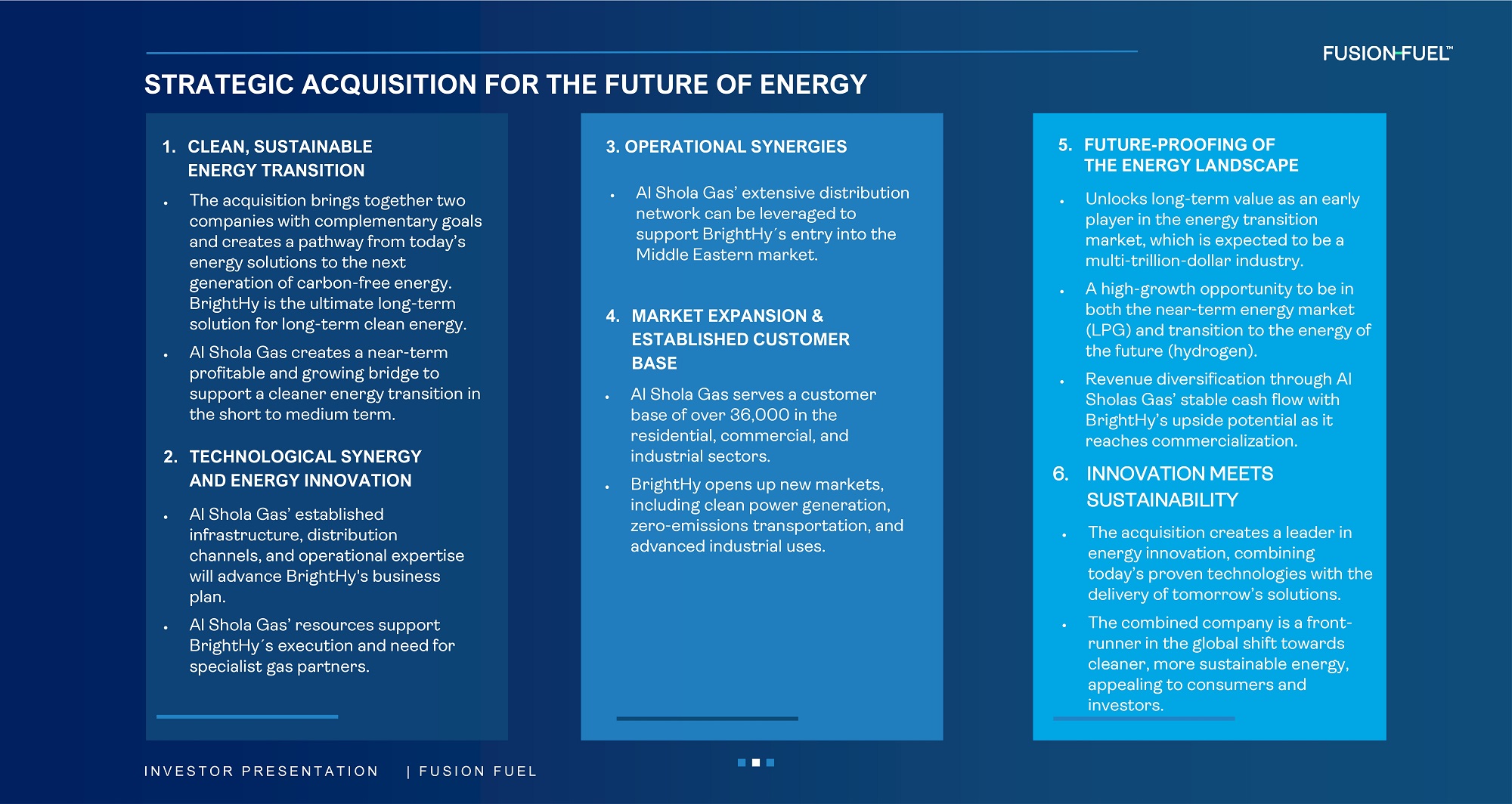

STRATEGIC ACQUISITION FOR THE FUTURE OF ENERGY 1. C L EA N , SUSTAIN ABLE EN ERGY TRANS ITION The acquisition brings together two companies with complementary goals a nd creat e s a p a thw a y from toda y ’s energy solutions to the next generation of carbon - free energy. BrightHy is the ultimate long - term solution for long - term clean energy. Al S ho la Gas cr e a tes a n e a r - ter m profitable and growing bridge to s u pport a cle a ner en e rgy tr a ns i t i on in the short to medium term. 2. TECH N O L OG I CA L SYN ERGY AND ENE RGY IN N OVAT I ON Al Shola Gas’ established infrastructure, distribution channels, and operational expertise will advance BrightHy's business plan. Al S h ola Ga s ’ r e s ources s u ppo rt B r i g htH y s execut i on a nd n e ed for specialist gas partners. I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L 3. OPERATIO N AL SYN ERGIES Al Shola Gas’ extensive distribution network can be leveraged to support BrightHy s entry into the Middle Eastern market. 4. MARKET EXPANSION & ESTA B LISHED CUSTOMER BASE Al Shola G a s s erves a c u s to m er base of over 36,000 in the residential, commercial, and industrial sectors. BrightHy opens up new markets, including clean power generation, zero - emissions transportation, and advanced industrial uses. 5. FUTURE - PROOFING OF THE E N ER G Y LA ND S C APE U nlocks l on g - t e r m v a l u e a s a n early player in the energy transition market, which is expected to be a multi - trillion - dollar industry. A high - growth opportunity to be in both the near - term energy market (LPG) and transition to the energy of the future (hydrogen). Revenue d i v e r s ific a t i on th r ough Al Sholas Gas’ stable cash flow with B r i g htH y ’s up s ide pote n t i a l a s it reaches commercialization. 6. I N NOVATION M EE TS SUSTAINABILITY T h e a cqu i s i t ion cr e a tes a le a der in energy innovation, combining today’s proven technologies with the delivery of tomorrow’s solutions. T h e combined company is a f r on t - runner in the global shift towards cleaner, more sustainable energy, appealing to consumers and investors.

CONSOLIDATED ENTITY – FINANCIAL TARGETS REVENUE COSTS PROFIT/(LOSS) 2025 Targ e t €26 million Combination of continued success in revenue growth of ASG (€24m) and initial revenues earned by BrightHy (€2m) €16.4 million Cost of sales €9.5 million ( e x cl . on e - of f cost s 1 ) Other operating costs €1.2m related to transaction & restructuring costs Profit €0.1 million ( e x cl . on e - of f cost s 1 ) Gains in ASG partially offset start - up costs in BrightHy. Loss of €1.2m incl. transaction costs & restructuring costs 2026 Targ e t €44.9 million Combination of growing revenues in ASG (€33.6m) plus ramp up in operations of BrightHy (€11.2m) €25.7 million Cost of sales €13.1 million Other operating costs Profit €6.0 million Increase in cost of sales more than offset by increased business volume in BrightHy and continued success of ASG *For purposes of this presentation; in/(out)flows for BrightHy and TopCo are assumed to be equal to revenues and expenses incurred. 1 One - off costs include costs related to the HTOO & QIND transaction as well as restructuring costs at Fusion Fuel post the exit of the electrolyzer industrial activity. Projections are based on the financial and business model of Fusion Fuel, constitute “forward - looking statements”, and involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different. See disclosures and disclaimers at the start of this presentation. I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

Consolidated Pro - forma HTOO QIND 30 - Sep - 24 30 - Sep - 24 30 - Sep - 24 30 - Sep - 24 Stockholders’ Equity 4,171 4,151 - 20 P r e f e rr e d s t o c k 6,126 (115,843) 2,307 119,662 C o mm o n s t o c k 264,521,346 (2,508,051) 249,139,437 17,889,959 A dd iti o n a l p a i d - i n c a p it a l (250,454,960) 16,787,119 (250,454,960) (16,787,119) Retained Earnings/ accumulated Deficit (1,999,892) (2,730,548) - 730,656 Noncontrolling interest 12,076,791 11,436,828 - 1,313,215 1,953,178 Total stockholders’ Equity $ 69,120,506 $ 11,436,828 $ 40,622,929 $ 17,060,749 T o t a l li a b ili t i e s a n d s t o c kh o l d er s ’ E qu i t y Background: In May 2024 , Nasdaq notified HTOO of non - compliance with the minimum $ 10 million stockholders’ equity requirement under Nasdaq Listing Rule 5450 (b)( 1 )(A) applicable to companies listed on The Nasdaq Global Market tier of Nasdaq . The company’s reported stockholders’ equity was $ 3 . 02 million as of December 31 , 2023 . Compliance Plan: HTOO management submitted a plan to regain compliance, including a request to transfer its listing to The Nasdaq Capital Market tier of Nasdaq by November 4 , 2024 , the maximum extension period allowed . The applicable minimum stockholders’ equity requirement is $ 2 . 5 million for companies listed on The Nasdaq Capital Market . Delisting Determination: On November 5 , 2024 , Nasdaq issued a delisting determination due to insufficient evidence of compliance . The Company appealed this decision, with a hearing scheduled for January 7 , 2025 . Based on the above unaudited pro - forma financials, HTOO believes that the stockholders’ equity exceeds the $5 million stockholders’ equity threshold for transferring its shares to The Nasdaq Capital Market following the acquisition of 69.36% of QIND. The pro - forma financial data has been prepared using financial information as of September 30, 2024. I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L NASDAQ COMPLIANCE

CAPITALIZATION TABLE Below is a snapshot of the Post Transaction Cap Table and Key Professional Service Providers AUTHORIZED SHARES 100,000,000 OUTSTANDING SHARES 22,923,367* UNRESTRICTED SHARES 19,104,398 RESTRICTED SHARES 3,818,696 AUDITOR KPMG L E GA L C O UNS E L AUTHUR COX LLP & BEVILACQUA PLLC T R ANSF E R A G E NT CONTINENTAL *Excludes 4,171,327 Series A Shares held by Ilustrato Pictures International Inc. and certain QIND “Sellers” converting to 41,713,270 common shares I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L 16.7% 83.3%

QIND OPERATING BUSINESS: AL SHOLA GAS OVERVIEW I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L AL S H O L A GA S – VI S I O N & M IS S I ON VISION To lead with innovation and excellence in the Gas Industry, setting safety, sustainability, and customer satisfaction benchmarks. MISSION To deliver outstanding Energy and Utilities solutions that surpass client expectations, uphold rigorous safety standards, and foster growth for stakeholders and communities. MOTTO Empowering Safety, Fostering Trust: Together, We Drive Progress.

AL S H O L A GA S – OV E RVI E W COMPANY HERITAGE • Founded in 1980 with 44 years of activity in Dubai, UAE. • 7 facilities, a fleet of vehicles, and over 100 employees. • Profitable with $11m revenue and $1.8m net income in 2023. • Over 30% annual growth in revenue during 2024 (forecast). INTERNATIONALLY CERTIFIED & GOVERNMENT APPROVED • Accredited by Dubai s general directorate of civil defense. • ISO 9001: 2015 certification. A commitment to quality & performance. TRUSTED CLIENT BASE • Al Shola Gas services over 36,000 end customers across Dubai. • Customers include EMAAR Properties, Sobha Realty, Dubai Properties, WASL Facilities Managers, and Emirates Airlines.

AL SHO L A – S E RVIC E OFF E RING Offering a wide range of services from centralized gas system solutions, LPG cylinder distribution and bulk gas supply. CENTRALIZ ED GA S SYST E MS Specializing in designing, constructing, and maintaining centralized gas systems for various applications, including commercial, residential, and industrial facilities. LP G CYLIN D ER DI S TRI B UTION Operates one of the leading LPG distribution networks in the IJAE, providing reliable and efficient cylinder distribution services to residential and commercial customers. BUL K GA S SUPPLY Approved supplier for bulk LPG in market, sourcing gas from reputable suppliers and ensuring reliable and consistent supply to customers. DESIGN AND CONSULTATION Creating tailored LPG solutions, from consultation to project delivery, ensuring efficiency, safety, and sustainability. SUPP L Y AND INS T A L L A T I ON End - to - end supply and installation services for LPG systems, including above and below - ground tanks, pipelines, instrumentation, and safety systems. MAINTENANCE AND SUPPORT Comprehensive maintenance and support services to ensure the ongoing reliability and performance of clients' LPG systems.

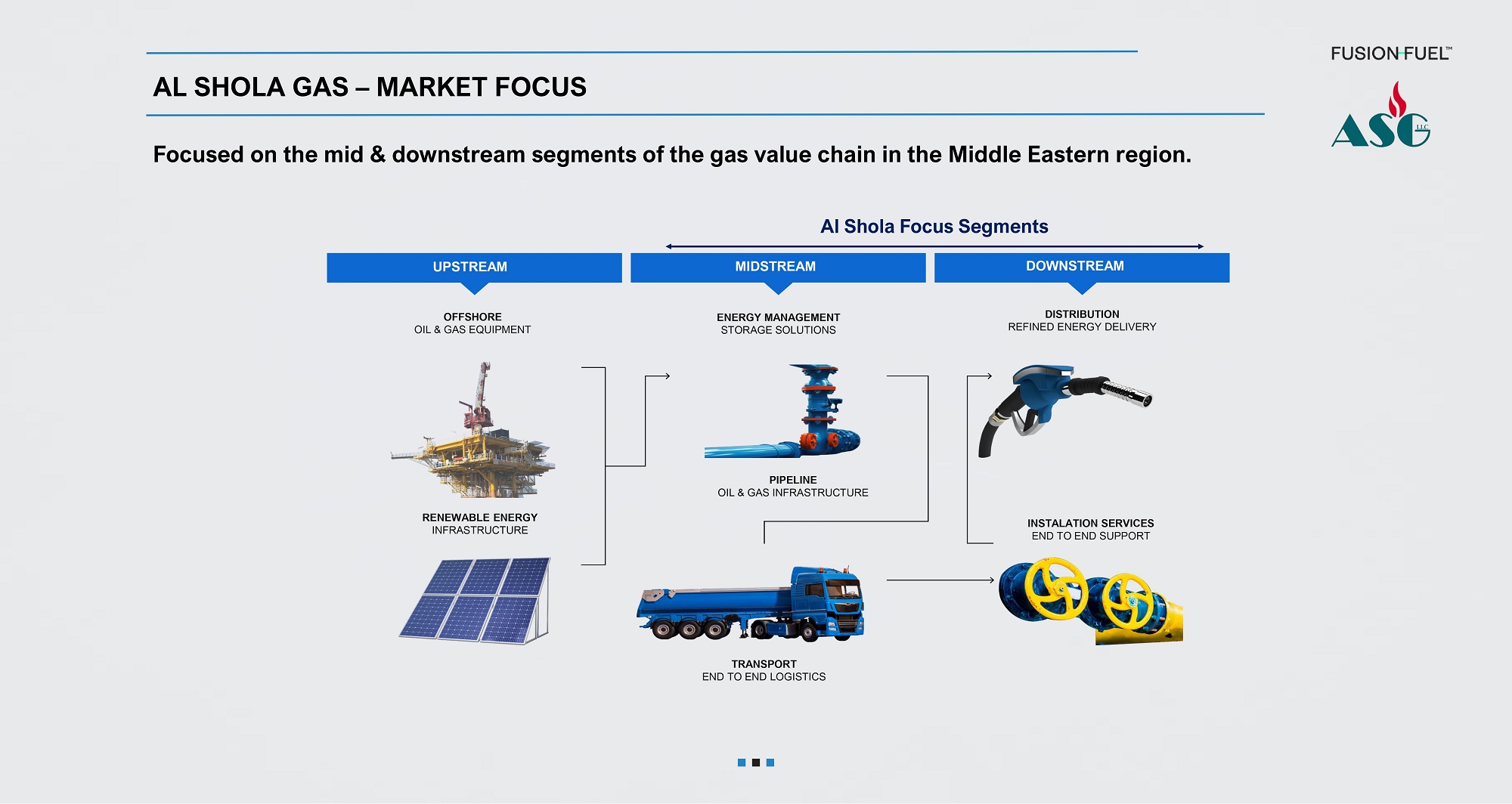

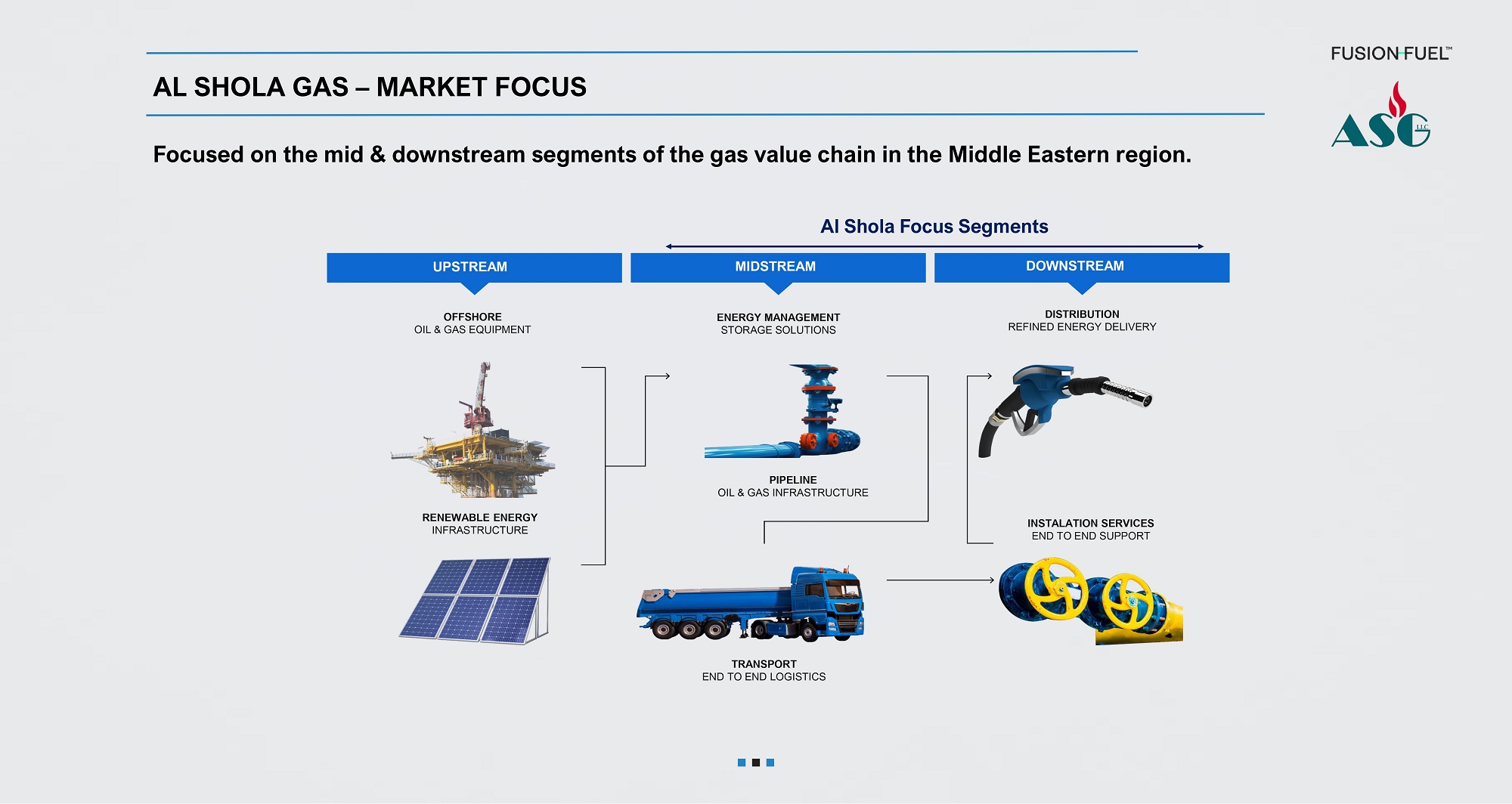

AL SHO L A GA S – MARKE T FOCUS Focused on the mid & downstream segments of the gas value chain in the Middle Eastern region. Al S hol a F ocus Se g me n ts UPSTREAM MIDSTREAM DOWNSTREAM OFFSHORE OIL & GAS EQUIPMENT ENERGY MANAGEMENT STORAGE SOLUTIONS DISTRIBUTION REFINED ENERGY DELIVERY RENEWABLE ENERGY INFRASTRUCTURE PIPELINE OIL & GAS INFRASTRUCTURE INSTALATION SERVICES END TO END SUPPORT TRANSPORT END TO END LOGISTICS

AL SHO L A – GROWT H PLANS STRATEGIC ACQUISITIONS We are considering strategic acquisitions that can accelerate our delivery of service excellence and infrastructure in the oil, gas, and utility industries. VERTICAL INTEGRATION We plan to expand into adjacent industries and value chain segments to capture additional value and strengthen market position. STRATEGIC COLLABORATIONS We are working to form strategic collaborations with key industry players and government entities to broaden market reach and benefit from mutual growth. ORGANIC GROWTH MARKET EXPANSION We are opening new markets in the MENA region with high demand for critical gas infrastructure and efficient gas supply solutions, such as with current opportunities in Saudi Arabia and Angola. PRODUCT DIVERSIFICATION We are working to expand our offering to include a broader range of critical infrastructure needs, both including renewable and non - renewable energy sources. UPSELLING AND CROSS - SELLING Offer additional products and services to existing customers based on needs and usage patterns. STRATEGIC GROWTH

AL SHO L A – FINANC I AL TARGET S REVENUES COSTS PROFIT / (LOSS) 2025 Targ e t 2026 Targ e t $ 25.3 mi l li on 1 79 % g r o w th f r om 2024 forecast $15.7 million Cost of Sales $5.6 million Operating Expenses & Other Costs Profit of $4.0 million 70 % gro w th f r o m 2 0 24 forecast $35 . 4 m i l l ion 1 40 % gro w th year on year $21.6 million Cost of Sales $8.2 million Operating Expenses & Other Costs Profit of $5.5 million 39 % gro w th year o n year 1 As noted previously, revenue recognition does not always follow sales/inflows so the revenue recognized may not equate to sales made. Projections are based on the financial and business model of Fusion Fuel, constitute “forward - looking statements”, and involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different. See disclosures and disclaimers at the start of this presentation.

COMPANY OVERVIEW I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L

BRIGHTH Y – VI S I O N AND MI S S I ON VISION Through our knowledge and passion, we aspire to be the strategic provider for the implementation of green hydrogen projects across the world. MISSION BrightHy Solutions is committed to advancing green hydrogen solutions through innovative, sustainable, and safety - driven technologies. Our mission is to lead the transition to a carbon - neutral future with reliable and secure energy solutions.

INDUSTRY OPPORTUNITY Engineering knowledge is scarce with expertise in designing green energy production systems, particularly those that use a wide range of electrolyzers. The industry has been focused on large steam methane reformers that produce grey hydrogen, and there is little experience in the market on smaller projects that can manage complex electrolyzer systems. Green hydrogen projects are mainly created by developers or offtakers with no in - house expertise, requiring expertise in the development of the plant and to identify the right solution for their needs and specifications. More than 80% of Fusion Fuel s pipeline has been generated by clients seeking a full - service green hydrogen provider. As the industry enters what we believe to be its exponential growth phase, having the ability to hand hold clients and strategic collaborations through the entire new hydrogen value chain will be critical for market players, in particular as the first projects to come to life will be in the small to mid - size range. S ource: B N E F BRIGHTH Y – OPPORT UNITY & I ND U STRY DEV E LOPMENT

BRIGHTHY MARKET POSITION BrightHy is positioning itself as a leader in the hydrogen solutions market. Its specialized team with concrete experience and track record of developing hydrogen plants can be a full - service provider to clients through the full value chain including plant design, tailored engineering solutions, equipment sourcing, engineering studies and implementation oversight. Clients benefit from a rare and specialized skill set that directly addresses the industry's gap in expertise. Our dedicated focus on designing green hydrogen production plants positions us as a reliable partner, providing innovative, efficient, and customized solutions that meet and exceed industry standards. BRIGHTH Y – MARKE T POS I TION

Enabled by a market - leading engineering offering, our end - to - end service proposition creates significant strategic value and competitive differentiation ENGINEERING SCOPE OF SERVICES Advisory Conc e pt & Proposal Engineering FE L I – II I Stu d ies Equipment Pro c ur e me n t & Sourcing Construction & Legalization Operation & Maintenance Procedures COR E VAL U E PARTNER FOR CLIENTS FROM START TO END OF A PLANT S LIFE Supporting plant owners and developers with end - to - end or partial solutions as they navigate the complexities of bringing a green hydrogen project to life, developing long - lasting and sticky client relationships. SPECIA L IZED EXPERTISE & EXPERIENCE One of the few players with experience developing green hydrogen projects from concept to commissioning. With each additional facility built, we deepen our knowledge, creating additional value for subsequent projects. BES T I N CL A SS SOL U TIO N FOR THE CHALLENGE Designing the plant for the client s specific needs and purpose without predetermined specifications. Sourcing and vetting the best equipment for the need using all technologies available. BRIGHTH Y – COR E OFF E RING & V ALUE

Advisory Services Includes specialized expertise, strategic guidance, and technical insights to stakeholders involved in green hydrogen projects. Assists in planning, development, feasibility, financing, and implementation of hydrogen - related projects. In an advisory capacity, BrightHy may work across various stages of a hydrogen project, from early - stage feasibility assessments to project financing and post - implementation solutions such as management consulting or operations. Full project services (EPC) Providing comprehensive solutions for engineering, procurement, and construction for hydrogen projects. A crucial service to ensure that projects are delivered on schedule, within budget, and meet the required specifications. This includes the integration of key technologies for the electrolyzers, balance of system, balance of plant, energy storage, fuel cells, and hydrogen supply infrastructure. Pipel ine • Tier 1 Cement Company (Europe) • Urea plant consortium (USA) • Hydrogen mobility (LatAm) • Tier 1 Cement Company (Europe) • 2x Hydrogen Plant Redesigns (Europe) • Hydrogen mobility (Europe) Pipel ine • 3 projects with a leading hydrogen developer (Europe) • 1 project with a hydrogen plant developer (Europe) • 1 project with a hydrogen plant developer (Europe) BRIGHTH Y – OFF E RING & C OMMERC I AL PIPEL I NE

Outsourced Services BrightHy will look to outsource administrative functions where possible and for as long as possible. Given the size of contracts and potentially risks involved, a senior legal hire may be required in a second phase. Several project activities require in depth knowledge of local regulations and practices and where possible these will be hired on a project - by - project basis. Specialist Contractor Model In the first phase, BrightHy will hire specialist functions on a project - by - project basis to maintain fixed costs low. These are highly specialized roles that can directly impact the quality of the project delivered to a client and needs careful selection and oversight. Over time, certain roles would be brought in - house. Specialist Contractor Roles Specialized Engineering Services: • Process Engineers • Control & Instrumentation Engineer • Mechanical & Electrical Engineers • Project Managers • Project Legalization (local specialists) Outsourced Roles Administrative Activities: • I T & HR • Legal (during first phase) • Marketing Project Execution Activities: • Health, Safety & Environment (local specialists) • Operation & Maintenance BRIGHTH Y – EXTERNAL CONTRAC T O R MODEL

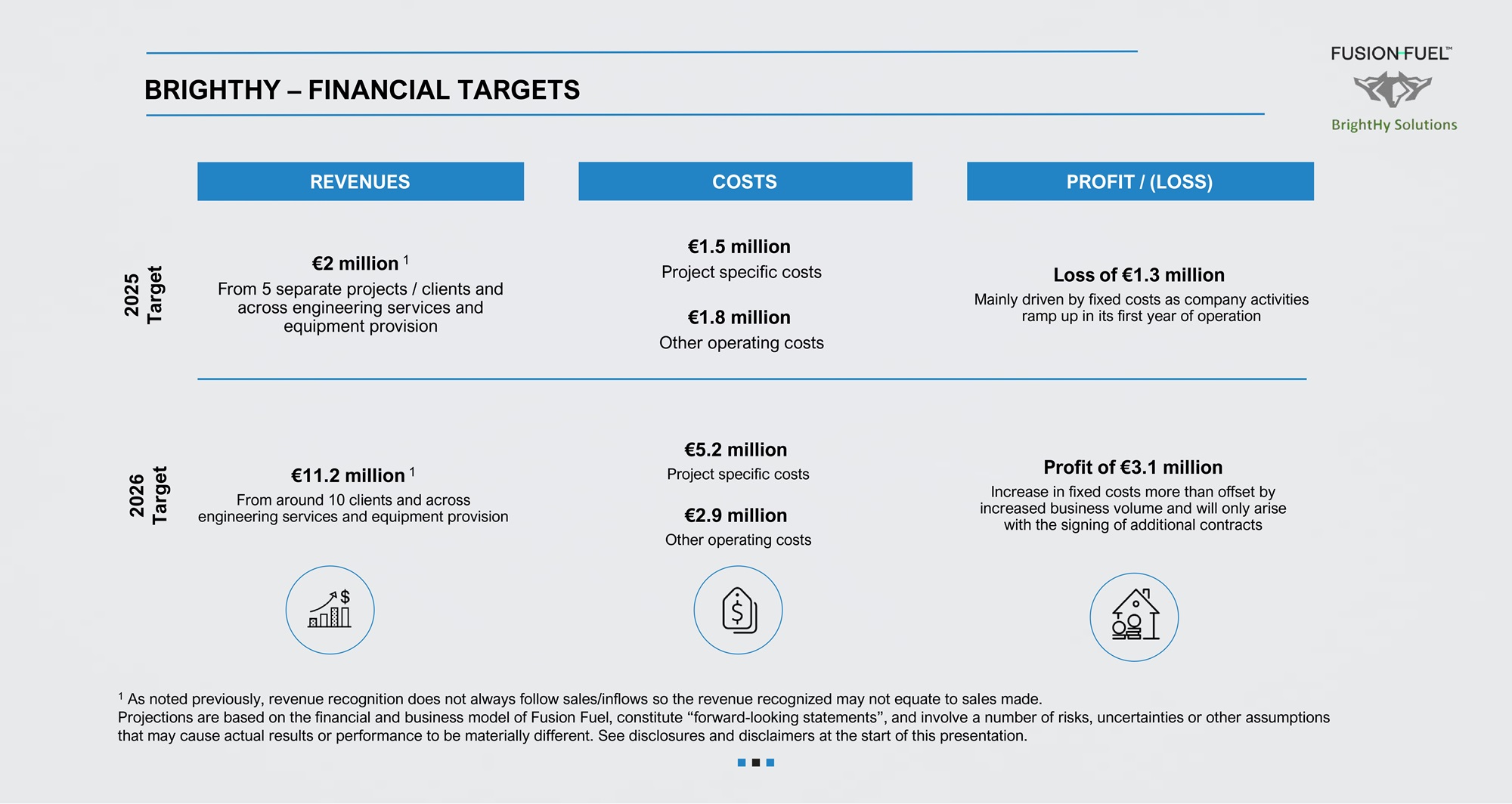

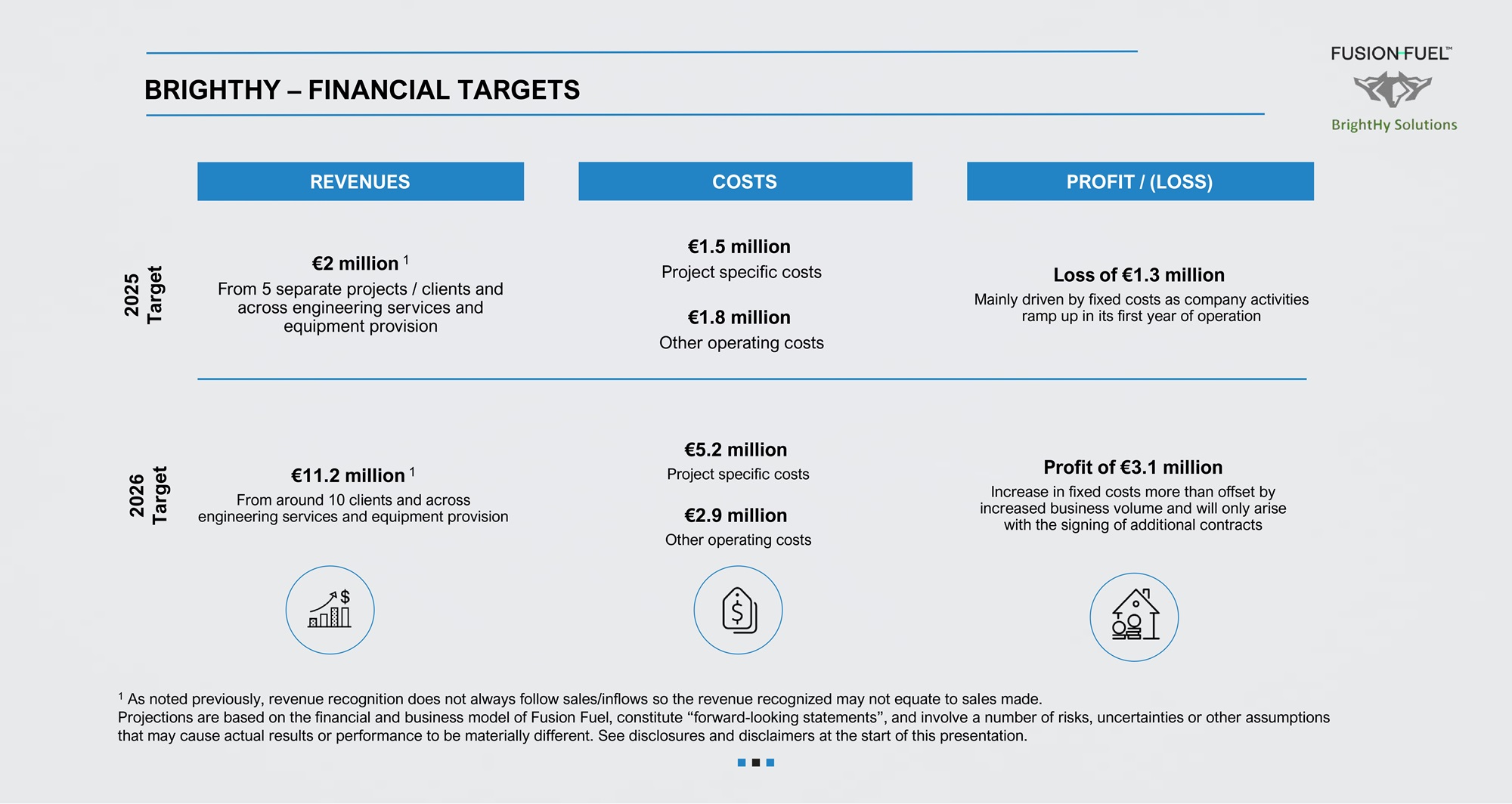

BRIGHTH Y – FINANC I AL TARGET S REVENUES COSTS PROFIT / (LOSS) 2025 Targ e t 2026 Targ e t €2 mil l i on 1 F r o m 5 sep a r a t e p r o je c t s / c l ients a nd across engineering services and equipment provision €11.2 mi l l i on 1 From around 10 clients and across engineering services and equipment provision €1.5 million Project specific costs €1.8 million Other operating costs L o s s of € 1.3 m i l l io n Mainly driven by fixed costs as company activities ramp up in its first year of operation €5.2 million Project specific costs €2.9 million Other operating costs Profit of €3.1 million Increase in fixed costs more than offset by increased business volume and will only arise with the signing of additional contracts 1 As noted previously, revenue recognition does not always follow sales/inflows so the revenue recognized may not equate to sales made. Projections are based on the financial and business model of Fusion Fuel, constitute “forward - looking statements”, and involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different. See disclosures and disclaimers at the start of this presentation.

IN CONCLUSION: INVESTMENT HIGHLIGHTS I N V E S T O R P R E S E N T A T I O N | F U S I O N F U E L ▪ Fusion Fuel controls a profitable entity with strong cash flow, sustainable growth and strategic value chain positioning. ▪ Strong revenue outlook with profits in 2025 and a solid growth trajectory for the future in high - demand sectors with and market share expansion as well as enhanced revenue streams and operational scalability. ▪ Well - established operation in the Gulf Region, where an economic boom continues to drive substantial growth and high demand within the gas sector. ▪ The restructuring of the hydrogen business and the establishment of BrightHy has positioned Fusion Fuel to provide clean energy solutions for the future while addressing current energy needs. ▪ Operating from a robust foundation and steadfastly positioned to spearhead the sustainable energy transition, with an emphasis on natural gas and green hydrogen. ▪ Evaluating acquisition targets to expand into the US market and enhance operations in Europe and the Middle East. ▪ Committed to providing both immediate value drivers and long - term potential for its investors.

THANK YOU www.fusion - fuel.eu