- GCMG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Grosvenor Capital Management (GCMG) CORRESPCorrespondence with SEC

Filed: 6 Oct 20, 12:00am

| 555 Eleventh Street, N.W., Suite 1000 Washington, D.C. 20004-1304 Tel: +1.202.637.2200 Fax: +1.202.637.2201 www.lw.com | |

| FIRM / AFFILIATE OFFICES |

| Beijing | Moscow |

| Boston | Munich | |

| Brussels | New York | |

| Century City | Orange County | |

| Chicago | Paris | |

| Dubai | Riyadh | |

| Düsseldorf | San Diego | |

| Frankfurt | San Francisco | |

| Hamburg | Seoul | |

| Hong Kong | Shanghai | |

| Houston | Silicon Valley | |

| London | Singapore | |

| Los Angeles | Tokyo | |

| Madrid | Washington, D.C. | |

| Milan |

October 5, 2020

Via EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| Attn: | Sonia Bednarowski |

John Dana Brown

Michael Volley

John Nolan

Division of Corporation Finance

| Re: | GCM Grosvenor Inc. |

Amendment No. 1 to Registration Statement on Form S-4

Filed September 18, 2020

File No. 333-242297

Ladies and Gentlemen:

On behalf of our client, GCM Grosvenor Inc. (the “Company”), we submit this letter setting forth (on Exhibit A) to this letter a corrected version of the diagram on page 16 of the registration statement on Form S-4 cited above (the “Registration Statement”), which was omitted from Amendment No. 2 to the Registration Statement due to technical error. The diagram is being provided in response to comment #6 of the staff of the Securities and Exchange Commission in its comment letter dated September 30, 2020.

* * * *

Please direct any questions or comments regarding the foregoing to me at (202) 637-2139 or my colleague, Drew Capurro, at (714) 755-8008.

| Very truly yours, | |

| /s/ Rachel W. Sheridan | |

| Rachel W. Sheridan | |

| of LATHAM & WATKINS LLP |

| cc: | Michael J. Sacks, Chief Executive Officer, GCM Grosvenor Inc. |

Burke Montgomery, General Counsel, Grosvenor Capital Management

Justin G. Hamill, Latham & Watkins LLP

Drew Capurro, Latham & Watkins LLP

Stuart Neuhauser, Ellenoff Grossman & Schole LLP

Douglas S. Ellenoff, Ellenoff Grossman & Schole LLP

Joshua N. Englard, Ellenoff Grossman & Schole LLP

Ken Lefkowitz, Hughes Hubbard & Reed LLP

Gary J. Simon, Hughes Hubbard & Reed LLP

Michael Traube, Hughes Hubbard & Reed LLP

Exhibit A

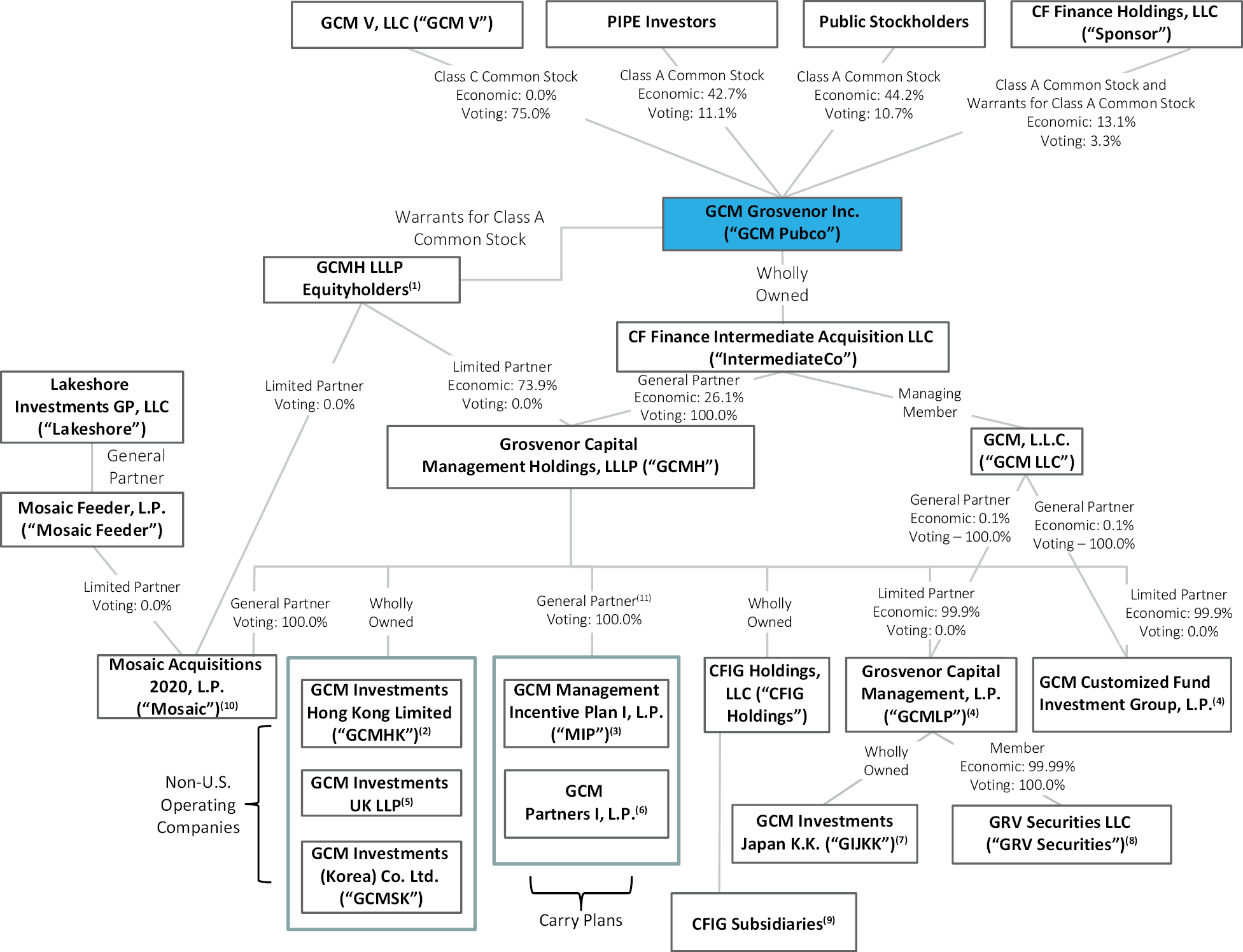

Organizational Structure

The following diagram, which is subject to change based upon any redemptions by current CFAC stockholders of public shares in connection with the business combination, illustrates the expected ownership structure of GCM PubCo immediately following the Closing. The percentages of voting and economic interests in GCM PubCo and GCMH described below assume no redemptions of shares of CFAC Class A common stock in connection with the business combination.

____________

(1) Refers to Holdings, Management LLC and Holdings II.

(2) GCMHK is licensed to deal in securities (Type 1) and advise on securities (Type 4) by the Hong Kong Securities and Futures Commission.

(3) MIP is entitled to carried interest distributions from certain GCM Funds.

(4) GCMLP and GCM Customized Fund Investment Group, L.P. are SEC-registered investment advisers.

(5) GCM Investments UK LLP is authorized and regulated by the UK Financial Conduct Authority to provide investment advisory and arranging services to professional investors.

(6) GCM Partners I, L.P. is entitled to carried interest distributions from certain GCM Funds.

(7) GIJKK is registered as a securities company in Japan with the Kanto Local Finance Bureau.

(8) GRV Securities is an SEC-registered broker-dealer registered with the SEC.

(9) Certain entities that are subsidiaries of CFIG Holdings are also entitled to carried interest distributions from certain GCM Funds.

(10) Mosaic holds limited partnership interests representing a right to 80-90% of GCM Grosvenor’s share of the carried interest generated by funds raised prior to December 31, 2019 and certain funded general partner interests. Distributable proceeds received by Mosaic for certain of its assets are distributed to its limited partners in accordance with their respective capital contributions with respect to such assets until such time as the third-party investor has received a certain specified multiple of its capital contributions, and thereafter to GCMH. Distributable proceeds received by Mosaic for its other assets are distributed to its limited partners in accordance with their respective capital contributions with respect to such assets. In the event that the third-party investor has received amounts attributable to the Mosaic Carry in excess of certain specified

16

thresholds prior to certain specified dates, and certain net asset value thresholds are exceeded, then the percentage of the Mosaic Carry allocated to the third-party investor will be adjusted downward. For more information on Mosaic and these interests, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations of GCM Grosvenor — Mosaic Transaction.”

(11) GCM Grosvenor’s economic interest is variable by carry plan and by award tranche within each carry plan. Economic interest in each carry plan is divided among current and former GCM Grosvenor professionals and GCM Grosvenor, with GCM Grosvenor’s economic interest shared with Mosaic as described in note (10) above.

17