Execution Version Confidential VOTING AND SUPPORT AGREEMENT THIS VOTING AND SUPPORT AGREEMENT (this “Agreement”) is entered into as of January 20, 2025, by and between Redwire Corporation., a Delaware corporation (“Parent”), and the holder of the Shares (as defined below) identified on the signature page hereto (the “Stockholder”). Capitalized terms used but not defined in this Agreement shall have the respective meanings assigned thereto in the Merger Agreement (as defined below). RECITALS WHEREAS, as of the date hereof, Stockholder, directly or indirectly with its Affiliates, is a holder of record and/or the “beneficial owner” (within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of shares of common stock, $0.0001 par value per share (the “Common Stock”) and shares of Series A Convertible Preferred Stock, par value $0.0001 per share (the “Preferred Stock”), which shares of Preferred Stock are convertible into shares of Common Stock, of the Parent, all as set forth on Schedule A hereto (the “Existing Shares”). WHEREAS, Edge Autonomy Ultimate Holdings, LP, a Delaware limited partnership, (ii) Edge Autonomy Intermediate Holdings, LLC, a Delaware limited liability company (the “Company”), (iii) Parent, (iv) Echelon Merger Sub, Inc., a Delaware corporation and (v) Echelon Purchaser, LLC, a Delaware limited liability company, are entering into an Agreement and Plan of Merger on the date hereof (such agreement, as it may be amended, the “Merger Agreement”), which provides (subject to the conditions set forth therein) for, among other things, the acquisition of the Company through merger transactions set forth in the Merger Agreement (collectively, the “Merger”). WHEREAS, Stockholder is entering into this Agreement in order to induce Parent to enter into the Merger Agreement and to cause the Merger to be consummated. AGREEMENT NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and agreements set forth herein, as well as other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, Parent and the Stockholder agree as follows: ARTICLE I AGREEMENT TO VOTE Section 1.1. Agreement to Vote. (a) From and after the date of this Agreement until the date that is the earlier of the following to occur: (a) the consummation of the Merger and (b) the termination of the Merger Agreement in accordance with its terms (such earlier date, the “Expiration Date”), the Stockholder irrevocably and unconditionally agrees, subject to Section 1.4, that at any meeting (whether annual or special and each adjourned, rescheduled or postponed meeting) of the Parent’s stockholders, however called, or in connection with any written consent of the Parent’s stockholders, the Exhibit 99.2 2 Stockholder will (i) appear at such meeting (in person or by proxy) or otherwise cause all of the Stockholder’s Existing Shares and any other shares of Common Stock or Preferred Stock over which it has acquired record or beneficial ownership after the date of this Agreement (including, without limitation, any shares of Common Stock or Preferred Stock acquired by means of purchase, dividend or distribution, or issued upon the exercise of any stock options, warrants, restricted stock units or other rights to acquire Common Stock, Preferred Stock or the conversion of any convertible securities, the vesting of equity awards or otherwise) (collectively, the “New Shares,” and together with the Existing Shares, the “Subject Shares”), which it owns as of the applicable record date, to be counted as present thereat for purposes of determining a quorum, and respond to each request by Parent for written consent, and (ii) unless the Parent shall have publicly announced and not rescinded a Change in Recommendation (as defined in the Merger Agreement, vote or cause to be voted (including by proxy or written consent, if applicable) all such Subject Shares (A) in favor of the issuance of shares of Common Stock by Parent pursuant to the Merger as partial consideration for the acquisition of the Company pursuant to the Merger, including for purposes of Rule 312.03 of the New York Stock Exchange, (B) in favor of the Equity Financing, if any, (C) in favor of any proposal to adjourn or postpone such meeting of the Parent’s stockholders to a later date as may be requested by the Parent, and (D) against any action, proposal, transaction or agreement that would reasonably be expected to prevent, materially impede or materially delay the consummation of the transactions contemplated by the Merger Agreement or the issuance of shares of Common Stock by Parent as partial consideration for the acquisition of the Company pursuant to the Merger or the Equity Financing, if any, including against any action, agreement or transaction that would reasonably be expected to result in (x) a breach of or failure to perform any representation, warranty, covenant or agreement of the Parent under the Merger Agreement or (y) any of the conditions set forth in Article III of the Merger Agreement not being satisfied. The Stockholder shall retain at all times the right to vote the Stockholder’s Subject Shares in the Stockholder’s sole discretion, and without any other limitation, on any matters other than those set forth in this Section 1.1 that are at any time or from time to time presented for consideration to the Parent’s Stockholders generally. (b) The Stockholder hereby revokes (and agrees to cause to be revoked and to promptly communicate in writing notice of such revocation to the relevant proxy holder) any proxies that the Stockholder has granted before the date hereof with respect to the Subject Shares. For the avoidance of doubt, nothing in this Section 1.1(b) shall revoke, cancel or in any way diminish the proxy and power of attorney set forth in Section 1.1(c). (c) The Stockholder hereby irrevocably grants to, and appoints, Parent, all officers of Parent, and any person or persons designated in writing by Parent, and each of them individually, as the Stockholder’s proxy and attorney-in-fact (with full power of substitution), for and in the name, place and stead of the Stockholder, to vote all its Subject Shares, or grant a consent or approval in respect of such Shares, or execute and deliver a proxy to vote such Shares, on the matters and in the manner specified in Section 1.1(a) (but not on any other matters); provided, that Parent shall only use such proxy in the event that the Stockholder breaches the terms of this Section 1.1. The Stockholder hereby affirms that the irrevocable proxy set forth in this Section 1(c) is given in connection with, and in consideration of, the execution of the Merger Agreement by Parent, and that such irrevocable proxy is given to secure the performance of the duties of the Stockholder under this Agreement and that no such further written instrument or proxy shall be necessary. The Stockholder hereby further affirms that the irrevocable proxy is coupled with an interest sufficient 3 in law to support an irrevocable power and may under no circumstances be revoked. The Stockholder hereby ratifies and confirms all actions that such irrevocable proxy may lawfully do or cause to be done by virtue hereof. Such irrevocable proxy is executed and intended to be irrevocable until such time as this Agreement shall have been terminated in accordance with its terms. ARTICLE II REPRESENTATIONS AND WARRANTIES OF THE STOCKHOLDER The Stockholder represents and warrants to Parent that: Section 2.1. Authorization; Binding Agreement. The Stockholder has the requisite legal capacity to execute and deliver this Agreement and to perform such Stockholder’s obligations hereunder. The execution and delivery of this Agreement has been duly and validly executed and delivered by the Stockholder and, assuming due authorization, execution, and delivery hereof by the Parent, constitutes a legal, valid, and binding obligation of the Stockholder, enforceable against the Stockholder in accordance with its terms, subject to subject to bankruptcy, insolvency, reorganization, moratorium and similar Laws relating to or affecting creditors’ rights or to general principles of equity. Section 2.2. Non-Contravention. Neither the execution and delivery of this Agreement by the Stockholder nor the consummation of the transactions contemplated hereby nor compliance by the Stockholder with any provisions herein will (a) require any Permits of, action by, or filing with or notification to, any Governmental Body on the part of the Stockholder, except for such filings or notifications reasonably required in compliance with applicable securities Laws (including, without limitation, filings required under, and compliance with other applicable requirements of, the Exchange Act), (b) violate, conflict with, or result in a breach of any provisions of, or require any consent, waiver or approval or result in any breach or violation of, constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give rise to any right of termination, cancellation, amendment, or acceleration under any of the terms, conditions or provisions of, any contract, agreement or understanding to which the Stockholder is a party or by which the Stockholder or any of its assets may be bound, (c) result (or, with the giving of notice, the passage of time or otherwise, would result) in the creation or imposition of any Lien on the Subject Shares, or (d) violate any Law or order applicable to the Stockholder or by which any of its assets are bound. Section 2.3. Ownership of Subject Shares; Total Shares. As of the date hereof, the Stockholder is, and at all times during the term of this Agreement will be, the owner of all of the Subject Shares and has good and marketable title to all such Subject Shares free and clear of any Liens, except for any such Liens that may be imposed pursuant to (a) the Investor Rights Agreement, dated as of March 25, 2021, by and among Genesis Park Acquisition Corp., Redwire, LLC, Genesis Park Holdings, Genesis Park II LP and Jefferies LLC (the “Investor Rights Agreement”), and (b) any applicable restrictions on transfer under the Securities Act or any state securities Law. Except to the extent of any Subject Shares acquired after the date hereof (which shall become Subject Shares upon any such acquisition), the Subject Shares (as set forth 4 on SCHEDULE A opposite such Stockholder’s name) are the only equity interests in the Parent beneficially owned by such Stockholder and its Affiliates as of the date hereof. Section 2.4. Voting Power. Subject to this Agreement, the Stockholder has full voting power (or the power to effect the full voting power), full power of disposition, full power to issue instructions with respect to the matters set forth herein and full power to agree to all of the matters set forth in this Agreement, in each case, with respect to all of the Subject Shares. Except for the Investor Rights Agreement, none of the Subject Shares are subject to any stockholders’ agreement, proxy, voting trust, or other agreement or arrangement with respect to the voting of such Subject Shares, except the proxy granted to Parent or its designee(s) under Section 1.1(b). Section 2.5. Reliance and Merger Agreement. The Stockholder understands and acknowledges that Parent is entering into the Merger Agreement in reliance upon the Stockholder’s execution, delivery, and performance of this Agreement and upon the representations and warranties and covenants of the Stockholder contained in this Agreement. The Stockholder has reviewed and understands the terms of this Agreement and the Merger Agreement, and has had the opportunity to consult with his counsel in connection with this Agreement. Section 2.6. Absence of Litigation. With respect to the Stockholder, there are no proceedings of any nature pending against, or, to the knowledge of the Stockholder, threatened in writing against the Stockholder or any of the Stockholder’s properties or assets (including any Subject Shares) before or by any Governmental Body that would reasonably be expected to have, individually or in the aggregate, an adverse effect (whether through prevention, delay, impairment or otherwise) on the Stockholder’s ability to timely perform its obligations under this Agreement. Section 2.7. Stockholder Has Adequate Information. The Stockholder acknowledges that the Stockholder is a sophisticated investor with respect to the Subject Shares and has adequate information concerning the business and financial condition of the Parent, the Company and the transactions contemplated by the Merger Agreement to make fully informed decision regarding the transactions contemplated by this Agreement and has, independently and without reliance upon the Parent or any Affiliate of the Parent, and based on such information as the Stockholder has deemed appropriate, made the Stockholder’s own analysis and decision to enter into this Agreement. The Stockholder has received and reviewed a copy of this Agreement and the Merger Agreement and the Stockholder acknowledges that the Stockholder has had the opportunity to seek independent legal advice prior to executing this Agreement and fully understands and accepts all of the provisions hereof and of the Merger Agreement. Section 2.8. No Inconsistent Agreements. The Stockholder has not entered into any agreement or knowingly taken any action that would make any representation or warranty of the Stockholder contained herein untrue or incorrect with respect to any of the Subject Shares or is otherwise inconsistent with, or would interfere with, or prohibit or prevent the Stockholder from satisfying, its obligations pursuant to this Agreement ARTICLE III REPRESENTATIONS AND WARRANTIES OF PARENT Parent represents and warrants to the Stockholder that:

5 Section 3.1. Organization and Qualification. Parent is duly organized and validly existing and in good standing under the Laws of the jurisdiction in which it is incorporated. Section 3.2. Authority for this Agreement. Parent has all necessary power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution and delivery of this Agreement by Parent has been duly and validly authorized by all necessary corporate action of Parent, and no other corporate proceedings on the part of Parent are necessary to authorize this Agreement. This Agreement has been duly and validly executed and delivered by Parent and, assuming due authorization, execution, and delivery hereof by the Stockholder, constitutes a legal, valid, and binding obligation of Parent, enforceable against Parent in accordance with its terms, subject to bankruptcy, insolvency, reorganization, moratorium and similar Laws relating to or affecting creditors’ rights or to general principles of equity. ARTICLE IV ADDITIONAL COVENANTS OF THE STOCKHOLDER The Stockholder hereby covenants and agrees that until the valid termination of this Agreement in accordance with Section 5.1: Section 4.1. No Transfer; No Inconsistent Arrangements. Except as provided hereunder, from and after the date hereof and until this Agreement is validly terminated in accordance with Section 5.1, the Stockholder shall not, directly or indirectly, (a) create or permit to exist any Liens on any of the Subject Shares, (b) grant or permit the grant of any proxy, power-of-attorney, or other authorization or consent in or with respect to any of the Subject Shares, (c) deposit or permit the deposit of any of the Subject Shares into a voting trust or enter into a voting agreement or arrangement (including any grant of any proxy or power of attorney) with respect to any of the Subject Shares or (d) take any other action that in any way would be reasonably expected to restrict, limit, impede, delay or interfere with the performance of such Stockholder’s obligations hereunder. If any involuntary Transfer of any of the Subject Shares occurs (including, but not limited to, a sale by the Stockholder’s trustee in any bankruptcy, or a sale to a purchaser at any creditor’s or court sale), the transferee (which term, as used herein, includes any and all transferees and subsequent transferees of the initial transferee) will take and hold such Subject Shares subject to all of the restrictions, liabilities, and rights under this Agreement, which will continue in full force and effect until valid termination of this Agreement in accordance with Section 5.1 and the Stockholder will undertake best efforts to cause such transferee to execute a joinder to this Agreement. The Stockholder agrees that it shall not, and shall cause each of its Affiliates not to, become a member of a group (as defined purposes of Section 13(d) under the Exchange Act) for the purpose of taking any actions inconsistent with the transactions contemplated by this Agreement. Notwithstanding the foregoing, Stockholder shall not be prohibited from effecting any sale of Subject Shares. Section 4.2. Documentation and Information. The Stockholder shall not make any public announcement regarding this Agreement, the Merger Agreement or the transactions contemplated hereby or thereby without the prior written consent of the Parent (such consent not to be unreasonably withheld or delayed), except as may be required by applicable Law, including, without limitation, applicable filings with the SEC (provided, that the Stockholder shall provide reasonable prior written notice of any such disclosure to the Parent and such notice shall include a 6 copy of any such disclosure). The Stockholder consents to and hereby authorizes the Parent to publish and disclose in all documents and schedules filed with the SEC, and any press release or other disclosure document that the Parent (as the case may be) reasonably determines to be necessary in connection with the Merger, and any transactions contemplated by the Merger Agreement, the Stockholder’s identity and ownership of the Subject Shares, the existence of this Agreement, and the nature of the Stockholder’s commitments and obligations under this Agreement and such other information pertaining to this Agreement or the Merger that the Parent (as the case may be) reasonably determines is required to be disclosed by Law, and the Stockholder acknowledges that the Parent may, in its sole discretion, file this Agreement or a form hereof with the SEC or any other applicable Governmental Body. The Stockholder agrees to promptly provide the Parent with any information that either of the foregoing may reasonably require for the preparation of any such disclosure documents, and such Stockholder agrees to promptly notify the Parent if it becomes aware of any required corrections with respect to any information regarding this Agreement supplied by such Stockholder specifically for use in any such disclosure document, if and to the extent that any such information shall have become false or misleading in any material respect. Section 4.3. Adjustments, etc. (a) In the event of any stock split, reverse stock split, stock distribution or dividend (including any dividend or other distribution of securities convertible into shares of Common Stock or Preferred Stock), reorganization, recapitalization, reclassification, combination, exchange of shares or other similar change with respect to the Subject Shares, the terms of this Agreement will be equitably adjusted, including to apply to any resulting securities. (b) The Stockholder agrees, while this Agreement is in effect, to notify the Parent promptly in writing of the number of any additional shares of Common Stock or Preferred Stock, any additional options or rights to purchase shares of Common Stock, Preferred Stock or other voting capital stock of the Parent and any other securities convertible into or exercisable or exchangeable therefor acquired by the Stockholder or any of its Affiliates after the date hereof. Section 4.4. Waiver of Certain Rights and Actions. The Stockholder shall not, and shall cause its representatives and affiliates not to, bring, institute, commence, voluntarily aid or participate in, and to take all actions necessary to opt out of any class in any class action with respect to, any claim, derivative or otherwise, appeal or proceeding against the Parent or any of its Affiliates, successors, directors or officers relating to the negotiation, execution or delivery of this Agreement or the Merger Agreement or the consummation of the Merger or the other transactions contemplated by the Merger Agreement. ARTICLE V MISCELLANEOUS Section 5.1. Termination. This Agreement shall automatically terminate without further action upon the earliest to occur of (A) the closing of the Merger, (B) the termination of the Merger Agreement in accordance with its terms and (C) the written agreement of the Stockholder and the Parent to terminate this Agreement; provided that any termination of this Agreement by Parent shall be approved by the Transaction Committee of the Board of Directors of Parent (the 7 “Transaction Committee”). Upon the valid termination of this Agreement in accordance with this Section 5.1, no party will have any further obligations or liabilities under this Agreement; provided, however, that (x) nothing set forth in this Section 5.1 shall relieve any party of any liability or damages to any other party resulting from fraud or intentional breach of this Agreement prior to termination hereof and (y) the provisions of Section 4.2, Section 4.4, and this ARTICLE V will survive any termination of this Agreement. Section 5.2. Notices. All notices and other communications given or made hereunder by one party to the other party shall, unless otherwise specified herein, be in writing and shall be deemed to have been duly given or made on the date of receipt by the recipient thereof if received prior to 5:00 p.m. (New York time) if (a) served by personal delivery or by a nationally recognized overnight courier service upon the party for whom it is intended, (b) delivered by registered or certified mail, return receipt requested or (c) sent by email; provided that any email transmission is promptly confirmed by a responsive electronic communication by the recipient thereof or receipt is otherwise clearly evidenced (excluding out-of-office replies or other automatically generated responses) or is followed up within one Business Day after such email by dispatch pursuant to one of the methods described in the foregoing clauses (a) and (b) of this Section 5.2). Such communications must be sent to the respective parties at the following street addresses or email addresses (or at such street address or email address previously made available or at such other street address or email address for a party as shall be specified for such purpose in a notice given in accordance with this Section 5.2): if to the Parent, to: Redwire Corporation 8226 Philips Highway Suite 102 Jacksonville, FL 32256 Attention: Aaron Futch Email: aaron.futch@redwirespace.com with a copy to (which shall not constitute notice), to: Holland & Knight LLP 701 Brickell Avenue Miami, FL 33131 Attention: David Barkus and Ira Rosner Email: david.barkus@hklaw.com ira.rosner@hklaw.com if to the Stockholder, to: Genesis Park II LP 520 Post Oak Boulevard, Suite 850 Attention: Paul Hobby Email: phobby@genesis-park.com 8 Section 5.3. Expenses. Whether or not the transactions contemplated by this Agreement and the Merger Agreement are consummated, all costs, fees and expenses incurred in connection with this Agreement and the transactions contemplated by this Agreement including all costs, fees and expenses of its representatives, shall be paid by the party incurring such cost, fee or expense, except as otherwise provided herein and therein. Section 5.4. Amendment or Other Modification. Waiver. (a) Subject to the provisions of applicable Law, this Agreement may be amended or otherwise modified only by a written instrument duly executed and delivered by the parties; provided that any amendment, modification or waiver of this Agreement by Parent shall be approved by the Transaction Committee. (b) The conditions to each of the respective parties’ obligations to consummate the transactions contemplated by this Agreement are for the sole benefit of such party and may be waived by such party. Any party may, to the extent permitted by applicable Law, waive any provision of this Agreement in whole or in part (including by extending the time for the performance of any of the obligations or other acts of the other parties); provided, however, that any such waiver shall only be effective if made in a written instrument duly executed and delivered by the party against whom the waiver is to be effective. No failure or delay by any party in exercising any right, power or privilege hereunder or under applicable Law shall operate as a waiver of such rights and, except as otherwise expressly provided herein, no single or partial exercise thereof shall preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by Law. Section 5.5. Governing Law and Venue; Submission to Jurisdiction; Selection of Forum; Waiver of Trial by Jury. (a) This Agreement and all Proceedings against any other party in connection with, arising out of or otherwise relating to this Agreement, shall be interpreted, construed, governed by, and enforced in accordance with, the Laws of the state of Delaware, including, its statutes of limitations, without regard to the conflicts of laws provisions, rules or principles thereof (or any other jurisdiction) to the extent that such provisions, rules or principles would direct a matter to another jurisdiction. (b) Each of the parties agrees that except or actions seeking specific performance or injunctive relief, all disputes, controversies or claims arising out of or relating to this Agreement (whether in contract, tort, equity or otherwise), including the arbitrability of any dispute or controversy that cannot be settled by mutual agreement will be finally settled by binding arbitration in accordance with Section 13.12 of the Merger Agreement, mutatis mutandis. In all cases not subject to such arbitration, each party shall bring any proceeding against any other party in connection with, arising out of or otherwise relating to this Agreement, any instrument or other document delivered pursuant to this Agreement or the transactions contemplated by this Agreement exclusively in the Court of Chancery of the State of Delaware; provided, however, that if such court does not have jurisdiction over any such action or proceeding, such action or proceeding will be heard and determined exclusively in any Delaware state or federal court sitting

9 in the City of Wilmington, Delaware and solely in connection with such proceedings, (A) irrevocably and unconditionally submits to the exclusive jurisdiction of the such courts, (B) irrevocably waives any objection to the laying of venue in any such proceeding in such courts, (C) irrevocably waives any objection that such courts are an inconvenient forum or do not have jurisdiction over any party, (D) agrees that mailing of process or other papers in connection with any such proceeding in the manner provided in Section 5.2 or in such other manner as may be permitted by applicable Law shall be valid and sufficient service thereof and (E) it shall not assert as a defense any matter or claim waived by the foregoing clauses (A) through (D) of this Section 5.5(b) or that any order issued by such courts may not be enforced in or by such courts. (c) EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY PROCEEDING AGAINST ANY OTHER PARTY WHICH MAY BE CONNECTED WITH, ARISE OUT OF OR OTHERWISE RELATE TO THIS AGREEMENT IS EXPECTED TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND THEREFORE EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY SUCH PROCEEDING. EACH PARTY HEREBY ACKNOWLEDGES AND CERTIFIES THAT (I) NO REPRESENTATIVE OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF ANY PROCEEDING, SEEK TO ENFORCE THE FOREGOING WAIVER, (II) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (III) IT MAKES THIS WAIVER VOLUNTARILY AND (IV) IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT, THE INSTRUMENTS OR OTHER DOCUMENTS DELIVERED PURSUANT TO THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS, ACKNOWLEDGMENTS AND CERTIFICATIONS SET FORTH IN THIS Section 5.5(c). Section 5.6. Specific Performance. (a) Each of the parties acknowledges and agrees that the rights of each party to consummate the transactions contemplated by this Agreement are special, unique and of extraordinary character and that if for any reason any of the provisions of this Agreement are not performed in accordance with their specific terms or are otherwise breached, immediate and irreparable harm or damage would be caused for which money damages would not be an adequate remedy. Accordingly, each party agrees that, in addition to any other available remedies a party may have in equity or at law, each party shall be entitled to enforce specifically the terms and provisions of this Agreement and to obtain an injunction restraining any breach or violation or threatened breach or violation of the provisions of this Agreement, consistent with the provisions of Section 5.5(b), without necessity of posting a bond or other form of security. In the event that any Proceeding should be brought in equity to enforce the provisions of this Agreement, no party shall allege, and each party hereby waives the defense, that there is an adequate remedy at law. Section 5.7. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors, legal representatives and permitted assigns. No party may assign this Agreement, any right to damages for breach of this Agreement or any of its rights or interests or delegate any of its obligations under this Agreement, in whole or 10 in part, by operation of Law, by transfer or otherwise, without the prior written consent of the other parties not seeking to assign this Agreement, any right to damages for breach of this Agreement or any of its rights or interests or delegate any of its obligations and any attempted or purported assignment or delegation in violation of this Section 5.7 shall be null and void. Section 5.8. Entire Agreement. (a) This Agreement (together with SCHEDULE A and the other documents, certificates, and instruments referred to herein) constitutes the entire agreement among the parties with respect to the subject matter hereof and thereof and supersedes all other prior and contemporaneous agreements, negotiations, understandings, representations and warranties, whether oral or written, with respect to such matters. (b) In the event of any inconsistency between the statements in the body of this Agreement, on the one hand, and any other documents, certificates, and instruments referred to herein, on the other hand, the statements in the body of this Agreement shall control. (c) Each party acknowledges and agrees that, except for the express representations and warranties set forth in this Agreement (i) no party has made or is making any other representations, warranties, statements, information or inducements, (ii) no party has relied on or is relying on any other representations, warranties, statements, information or inducements and (iii) each party hereby disclaims reliance on any other representations, warranties, statements, information or inducements, oral or written, express or implied, or as to the accuracy or completeness of any statements or other information, made by, or made available by, itself or any of its representatives, in each case with respect to, or in connection with, the negotiation, execution or delivery of this Agreement, any instrument or other document delivered pursuant to this Agreement or the transactions contemplated by this Agreement and notwithstanding the distribution, disclosure or other delivery to the other or the other’s representatives of any documentation or other information with respect to any one or more of the foregoing, and waives any claims or causes of action relating thereto. Section 5.9. Severability. The provisions of this Agreement shall be deemed severable and the illegality, invalidity or unenforceability of any provision shall not affect the legality, validity or enforceability of the other provisions of this Agreement. If any provision of this Agreement, or the application of such provision to any Person or any circumstance, is illegal, invalid or unenforceable, (a) a suitable and equitable provision to be negotiated by the parties, each acting reasonably and in good faith shall be substituted therefor in order to carry out, so far as may be legal, valid and enforceable, the intent and purpose of such illegal, invalid or unenforceable provision, and (b) the remainder of this Agreement and the application of such provision to other Persons or circumstances shall not be affected by such illegality, invalidity or unenforceability, nor shall such illegality, invalidity or unenforceability affect the legality, validity or enforceability of such provision, or the application of such provision, in any other jurisdiction. Section 5.10. Counterparts; Effectiveness. This Agreement (a) may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all such counterparts shall together constitute the same agreement and (b) shall become effective when each party shall have received one or more counterparts hereof signed by each of the other parties. 11 An executed copy of this Agreement delivered by email or other means of electronic transmission (including DocuSign) shall be deemed to have the same legal effect as delivery of an original executed copy of this Agreement. Section 5.11. Third-Party Beneficiaries. The parties hereby agree that their respective representations, warranties, covenants and agreements set forth in this Agreement are solely for the benefit of the other, subject to the terms and conditions of this Agreement, and this Agreement is not intended to, and does not, confer upon any other Person any rights or remedies, express or implied, hereunder. Section 5.12. Further Assurances. The Stockholder shall execute and deliver, or cause to be executed and delivered, all further documents and instruments and use its reasonable best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper, or advisable under applicable Laws, to perform its obligations under this Agreement. Section 5.13. Capacity as Stockholder. The Stockholder signs this Agreement solely in the Stockholder’s capacity as the owner of Subject Shares. Notwithstanding anything to the contrary in this Agreement, nothing herein will in any way prevent, limit or otherwise restrict a director or officer of the Parent in the taking of any actions (or failure to act) in his or her capacity as a director or officer of the Parent, or in the exercise of his or her fiduciary duties as a director or officer of the Parent, or prevent or be construed to create any obligation on the part of any director or officer of the Parent from taking any action in his or her capacity as such director or officer, and no action taken in any such capacity as an officer or director of the Parent shall be deemed to constitute a breach of this Agreement. Section 5.14. No Agreement Until Executed. This Agreement will not be effective unless and until the Merger Agreement is executed by all parties thereto. [Signature Pages Follow] 12 IN WITNESS WHEREOF, each of Parent and the Stockholder has caused this Agreement to be executed as of the date first written above. Redwire Corporation By: Genesis Park II LP By: Name: Paul Hobby Title: Managing Partner

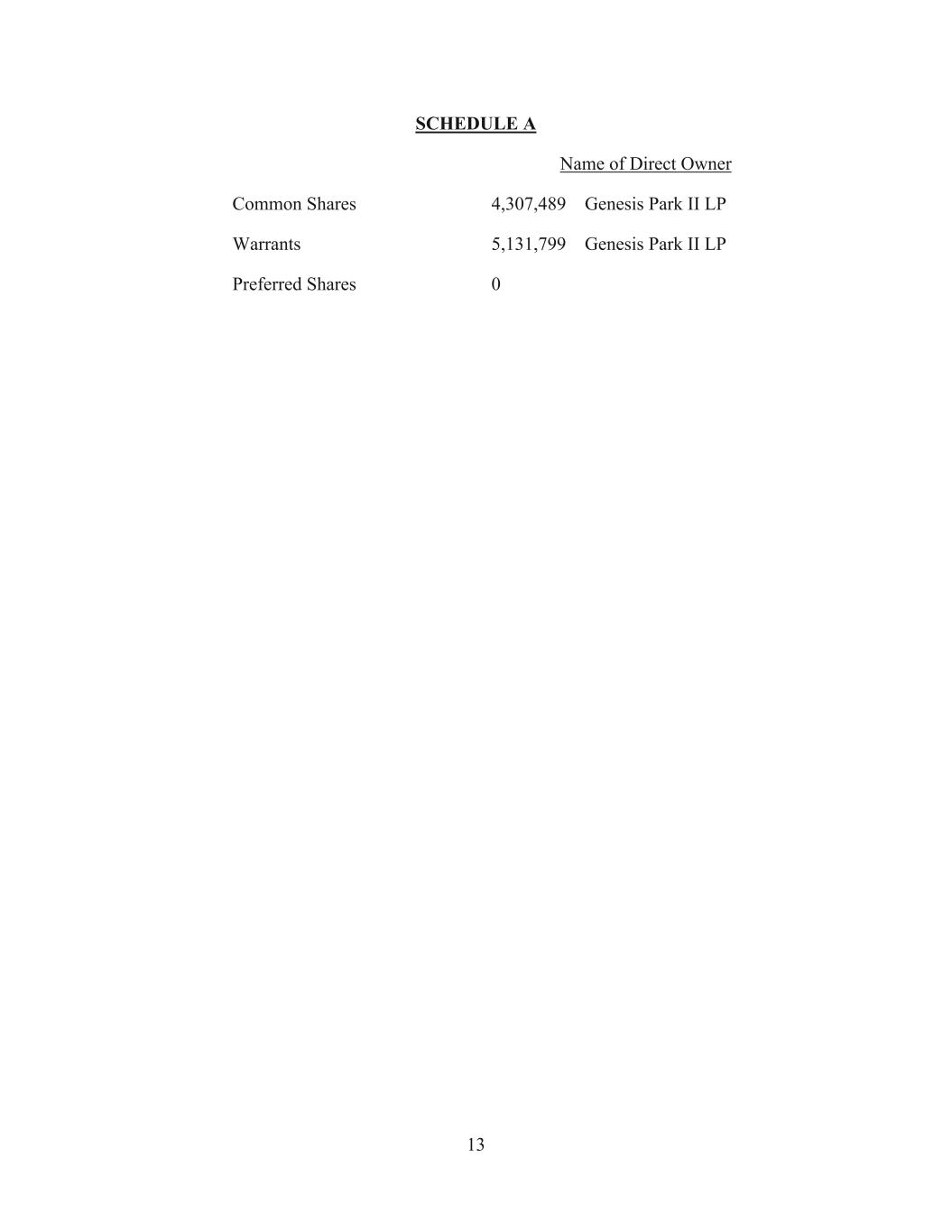

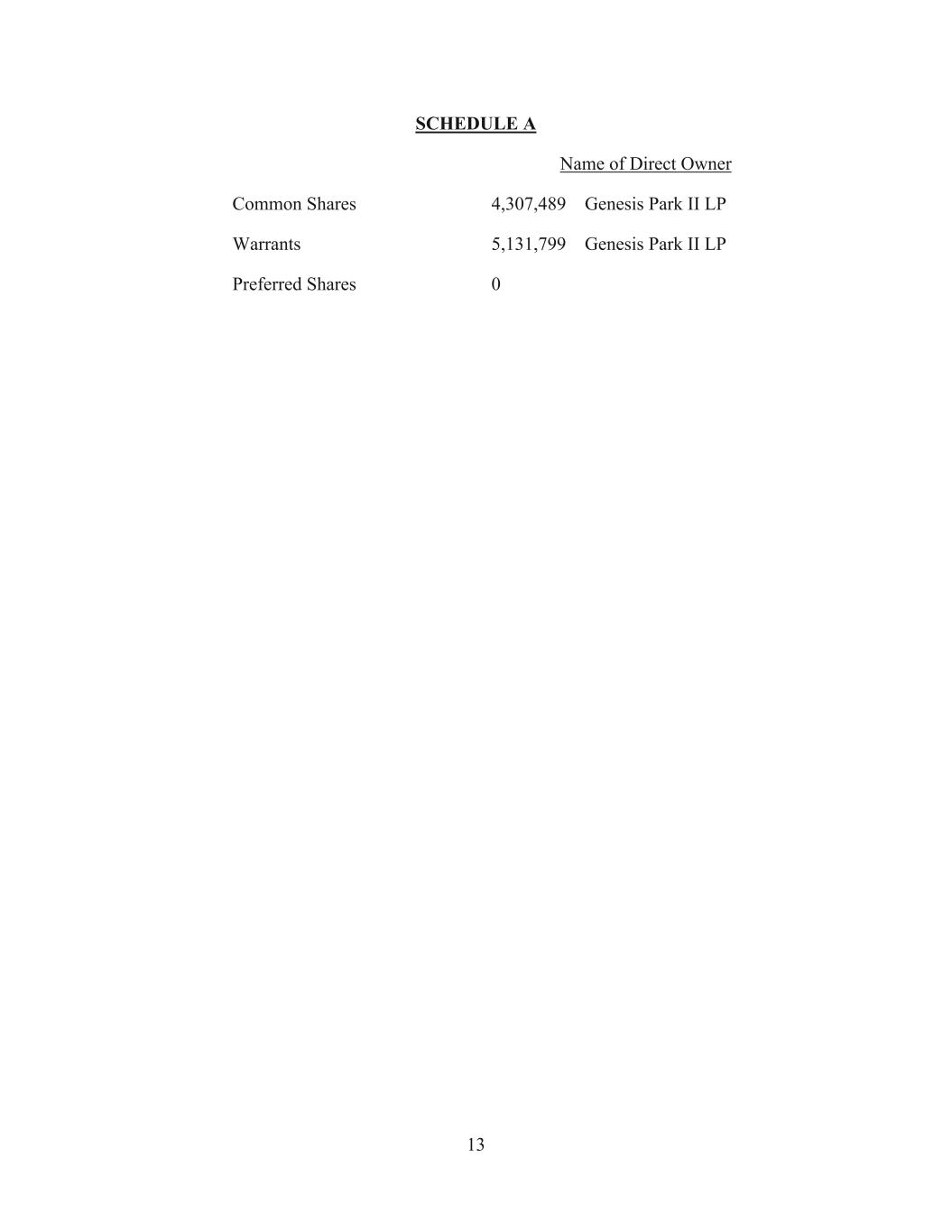

13 SCHEDULE A Name of Direct Owner Common Shares 4,307,489 Genesis Park II LP Warrants 5,131,799 Genesis Park II LP Preferred Shares 0