Adjusted EBITDA as a percentage of revenue has been at or above 24% for each three-month period presented above, including throughout the COVID-19 pandemic, reflecting the strength and resilience of our business.

The quarters ending December 31, 2020 and September 30, 2020 resulted in an income tax benefit primarily due to adjustments for research and development tax credits, return to provision adjustments, and other various book to tax items, including stock-based compensation expense.

Liquidity and Capital Resources

Our operations are financed primarily through cash generated from operations. We have also incurred debt in connection with the Providence Acquisition and to finance subsequent acquisitions. As of September 30, 2021, we had cash of $319.8 million and net working capital, consisting of current assets (excluding cash) less current liabilities, of $67.2 million. As of December 31, 2020, we had cash of $33.4 million and net working capital, consisting of current assets less current liabilities, of $107.9 million. As of December 31, 2019, we had cash of $10.9 million and net working capital, consisting of current assets less current liabilities, of $53.2 million.

We received aggregate net proceeds of $253.2 million from the IPO, after deducting underwriting discount fees of $16.2 million. We also received aggregate net proceeds of $28.9 million from the concurrent private placement, after deducting fees of $1.0 million. We believe our existing cash and cash generated from operations, together with the proceeds from our IPO and concurrent private placement and the undrawn balance under the New Revolving Credit Facility, will be sufficient to meet our working capital and capital expenditure requirements for at least the next 12 months.

We anticipate that our capital expenditures, including capitalized software, will be approximately $10 million to $15 million for 2021. We anticipate our operating lease payment obligations, including capitalized leases, will be approximately $8 million for 2021. Our total future capital requirements and the adequacy of available funds will depend on many factors, including those discussed above as well as the risks and uncertainties set forth under “Risk Factors.”

Our liquidity has not been materially impacted by the COVID-19 pandemic. For additional information on the impact of COVID-19 on our business and financial results, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Factors Affecting Our Performance — COVID-19” and “Risk Factors — Risks Relating to Our Business — Economic downturns and unstable market conditions, including as a result of the COVID-19 pandemic, could adversely affect our business, financial condition and results of operations.”

Debt Obligations

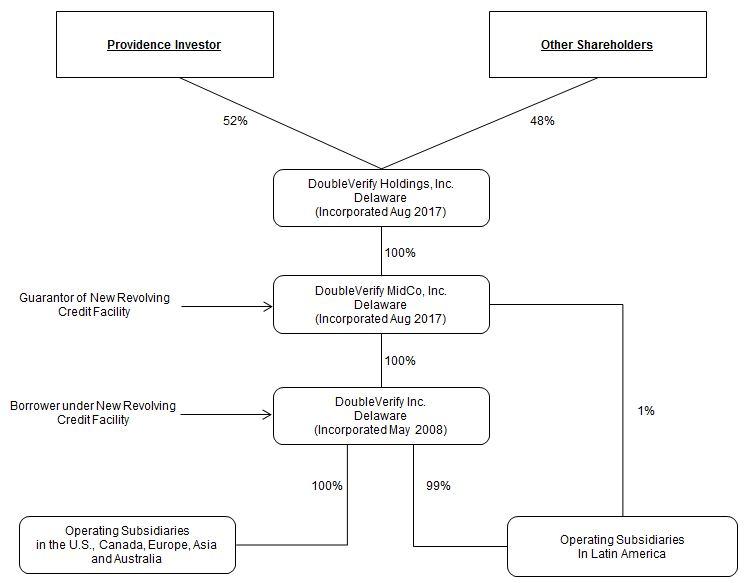

In September 2017, DoubleVerify Inc., as borrower, and DoubleVerify MidCo, Inc., as guarantor, entered into senior secured credit facilities consisting of a $30.0 million term facility and a $7.0 million revolving credit facility (with a letter of credit facility of up to $3.0 million as a sublimit).

In July 2018, such credit facilities were amended and replaced by the Prior Credit Facilities. The Prior Term Loan Facility was payable in quarterly installments of $137,500 with the outstanding balance due in full at maturity in July 2023. In February 2019, DoubleVerify Inc. borrowed $20.0 million under the Prior DDTL Facility, which was payable in quarterly installments of $50,000 with the outstanding balance due in full at maturity in July 2023.

In October 2020, DoubleVerify Inc., as borrower, and DoubleVerify MidCo, Inc., as guarantor, entered into the New Revolving Credit Facility and, in connection therewith, repaid all amounts outstanding under the Prior Credit Facilities.

On December 24, 2020, DoubleVerify Inc. prepaid $68.0 million of the outstanding principal amount under the New Revolving Credit Facility with a portion of the proceeds from the Private Placement (as defined herein). As of December 31, 2020, $22.0 million was outstanding under the New Revolving Credit Facility.

On April 30, 2021, we used a portion of the net proceeds from the IPO and the concurrent private placement to pay the entire outstanding balance of $22.0 million under the New Revolving Credit Facility.

The New Revolving Credit Facility is secured by substantially all of the assets of the Credit Group (subject to customary exceptions) and contain customary affirmative and restrictive covenants, including with respect to our ability to enter into fundamental