Presentation for Business Update March 14, 2023

Disclaimers Forward-Looking Statements This communication contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this communication that are not statements of historical fact, including statements about our beliefs and expectations regarding our future results of operations and financial position, business strategy, timing and likelihood of success, potential expansion of bitcoin mining data centers, and management plans and objectives, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These forward-looking statements generally are identified by the words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “forecasts,” “predicts,” “potential” or “continue” and similar expressions (including the negative versions of such words or expressions). These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and our management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: volatility in the price of Cipher's securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, variations in performance across competitors, changes in laws and regulations affecting Cipher's business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, and in Cipher's subsequent filings with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures We use non-GAAP financial measures to assess and analyze our operational results and trends and to make financial and operational decisions. We believe these non-GAAP financial measures are useful to investors because they provide greater transparency regarding our operating performance. The non-GAAP financial measures included in this presentation should not be considered alternatives to measurements required by GAAP, and should not be considered measures of liquidity. These non-GAAP financial measures are unlikely to be comparable with non-GAAP information provided by other companies. Reconciliation of non-GAAP financial measures and GAAP financial measures are included in the tables accompanying this presentation. Reported results are presented in accordance with GAAP, whereas adjusted results are GAAP results adjusted to exclude the impact of (i) depreciation of fixed assets, (ii) change in fair value of warrant liability, (iii) non-cash change in fair value of our derivative asset and (iv) stock compensation expense. The contents and appearance of this presentation is copyrighted and the trademarks and service marks are owned by Cipher Mining Inc. All rights reserved.

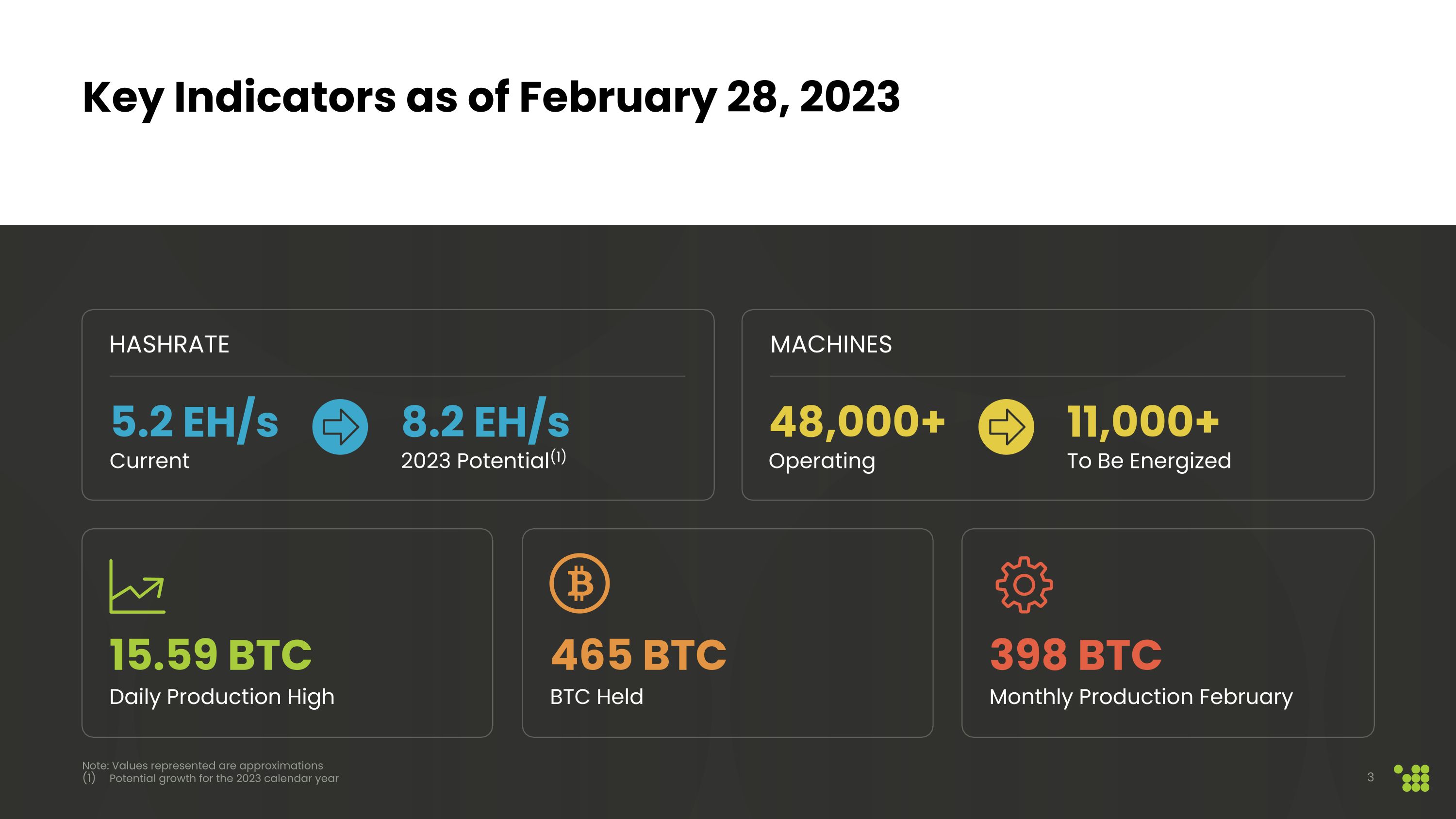

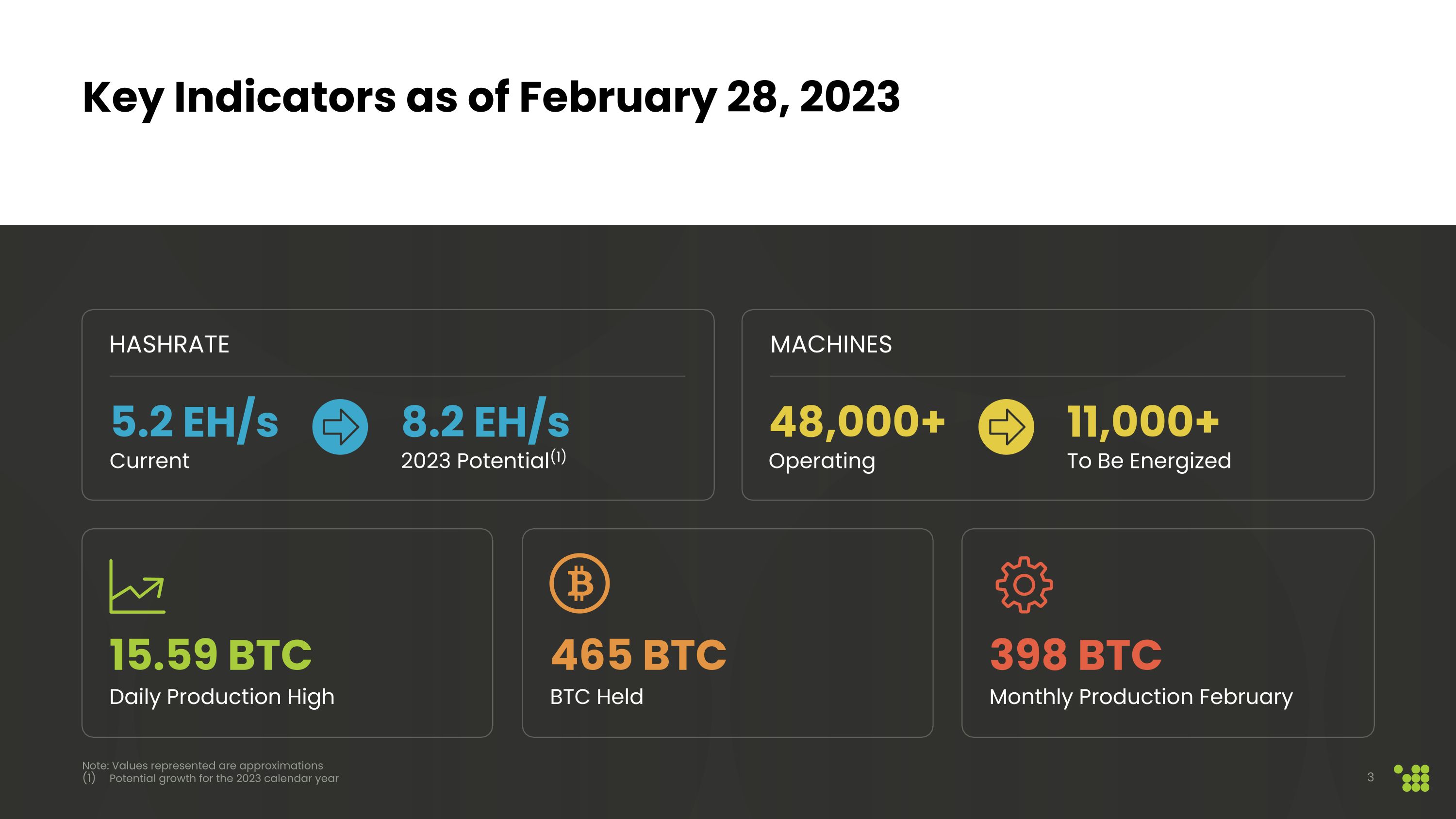

Key Indicators as of February 28, 2023 15.59 BTC Daily Production High 465 BTC BTC Held 48,000+ Operating 398 BTC Monthly Production February 11,000+ To Be Energized Machines 5.2 EH/s Current 8.2 EH/s 2023 Potential(1) Hashrate Note: Values represented are approximations Potential growth for the 2023 calendar year

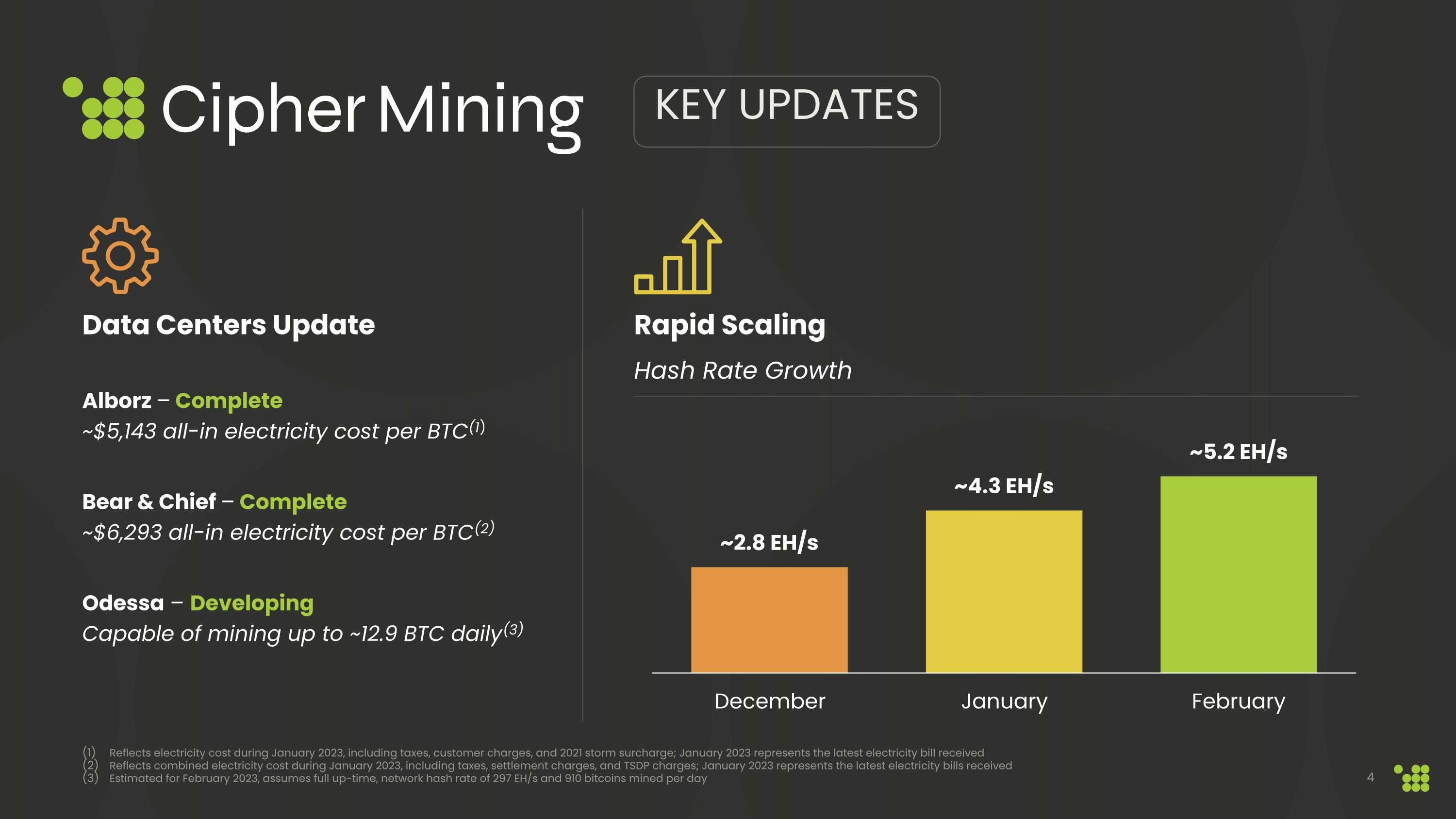

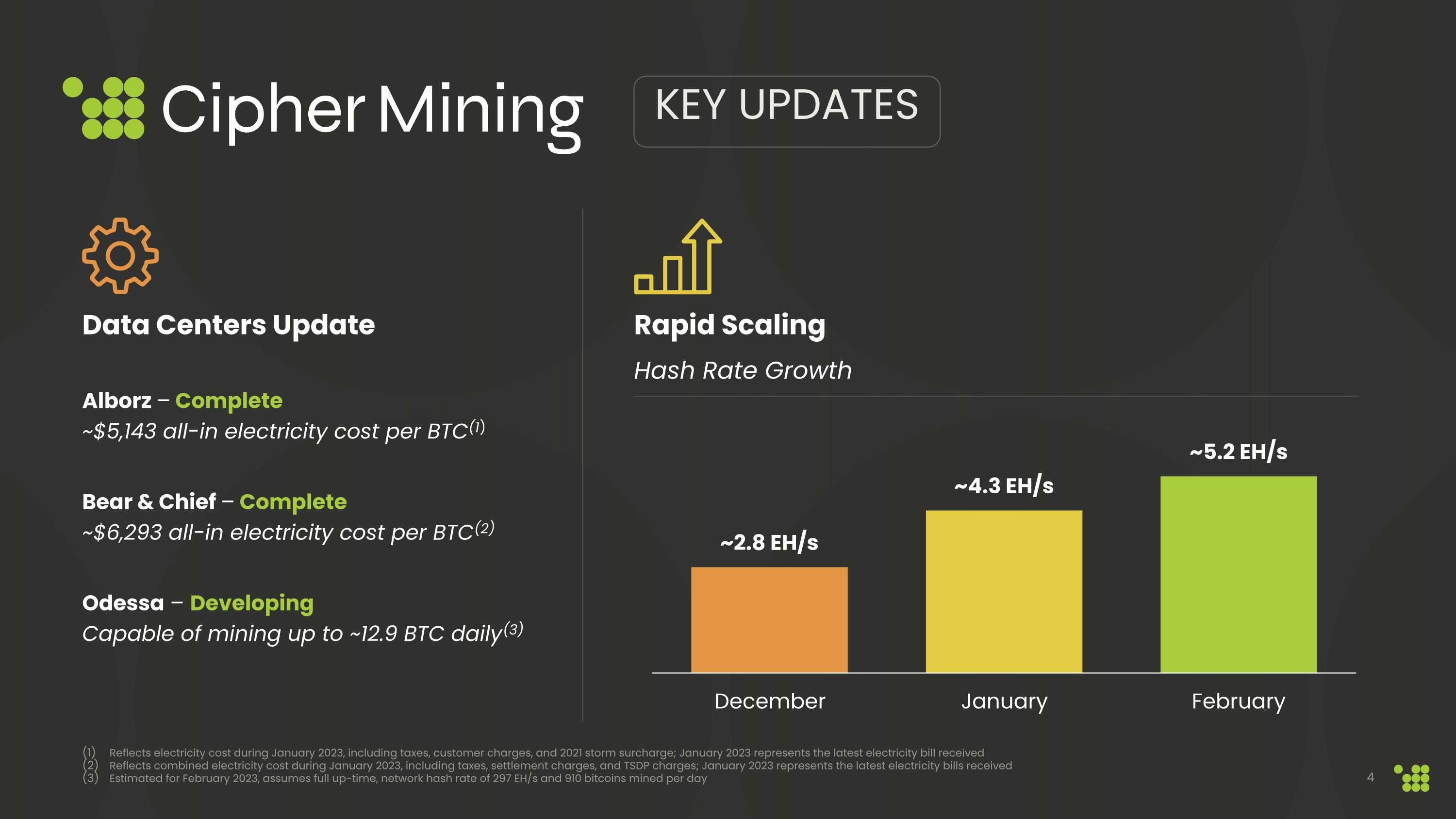

Data Centers Update Alborz – Complete �~$5,143 all-in electricity cost per BTC(1) Bear & Chief – Complete �~$6,293 all-in electricity cost per BTC(2) Odessa – Developing Capable of mining up to ~12.9 BTC daily(3) Rapid Scaling KEY UPDATES Reflects electricity cost during January 2023, including taxes, customer charges, and 2021 storm surcharge; January 2023 represents the latest electricity bill received Reflects combined electricity cost during January 2023, including taxes, settlement charges, and TSDP charges; January 2023 represents the latest electricity bills received Estimated for February 2023, assumes full up-time, network hash rate of 297 EH/s and 910 bitcoins mined per day 4 Hash Rate Growth

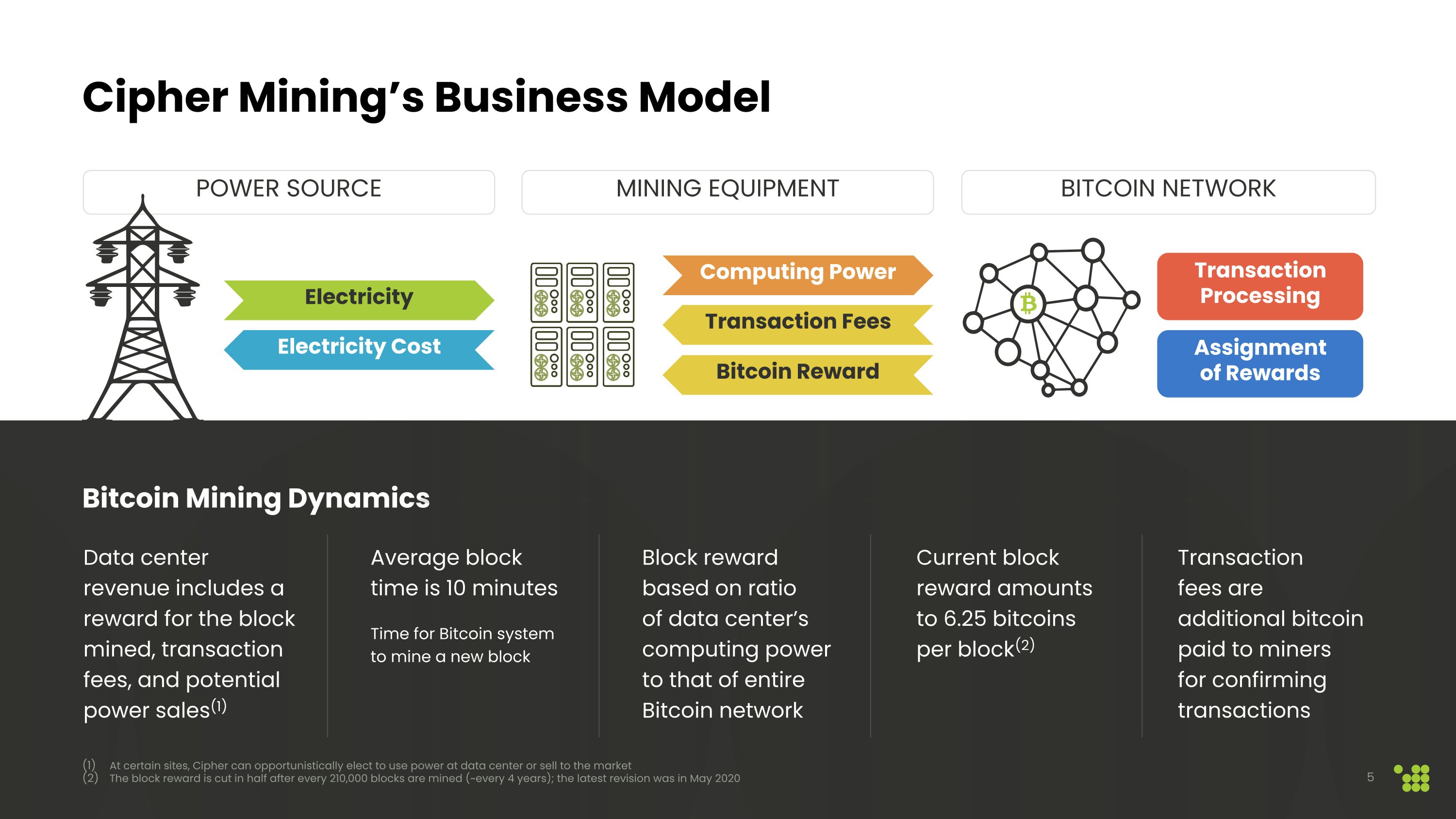

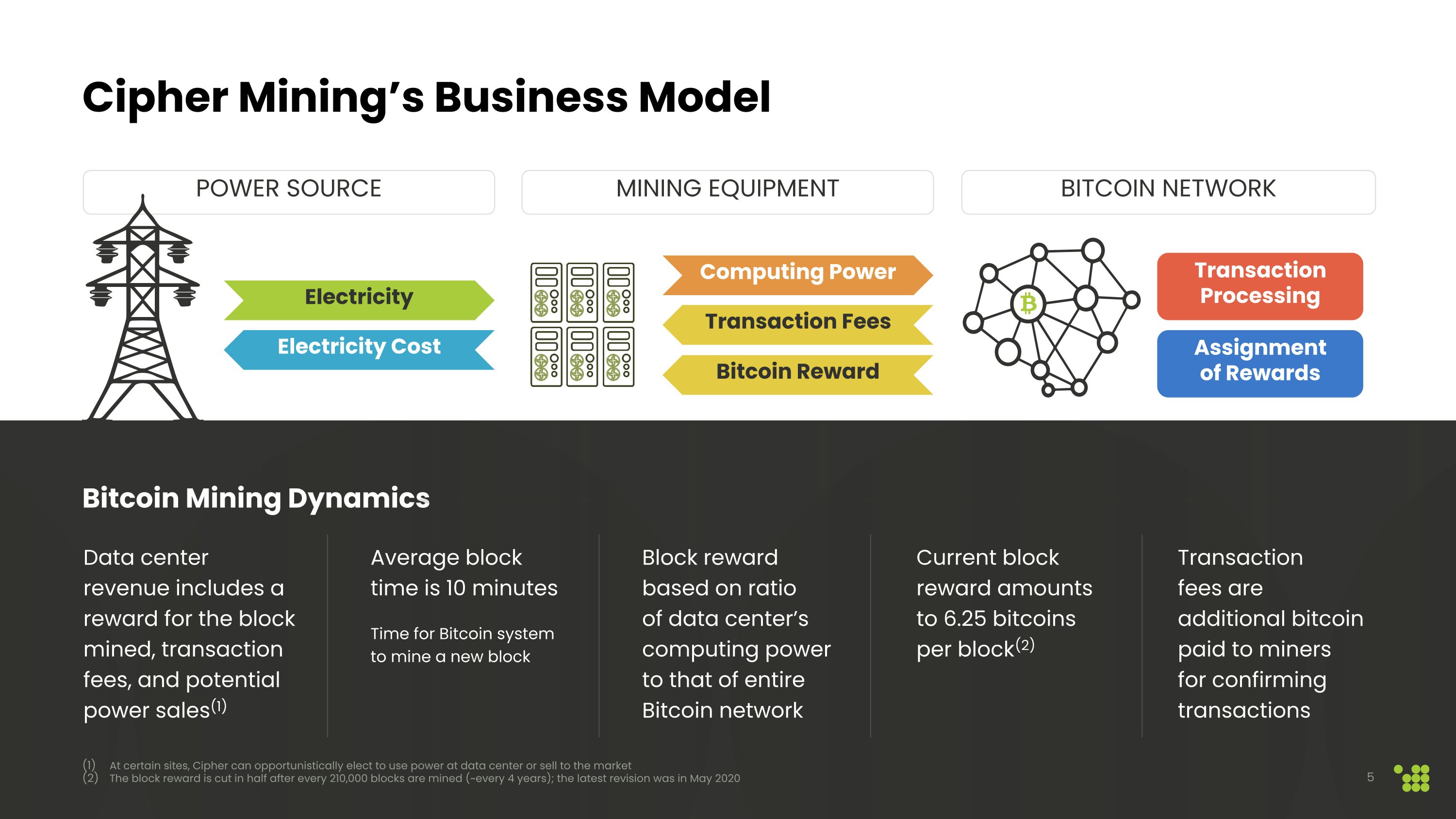

Cipher Mining’s Business Model At certain sites, Cipher can opportunistically elect to use power at data center or sell to the market The block reward is cut in half after every 210,000 blocks are mined (~every 4 years); the latest revision was in May 2020 POWER SOURCE MINING EQUIPMENT BITCOIN NETWORK Data center revenue includes a reward for the block mined, transaction fees, and potential power sales(1) Average block time is 10 minutes Time for Bitcoin system �to mine a new block Block reward based on ratio �of data center’s computing power to that of entire Bitcoin network Current block reward amounts �to 6.25 bitcoins �per block(2) Transaction �fees are �additional bitcoin paid to miners �for confirming transactions Bitcoin Mining Dynamics Electricity Electricity Cost Computing Power Transaction Fees Bitcoin Reward Transaction �Processing Assignment �of Rewards 5

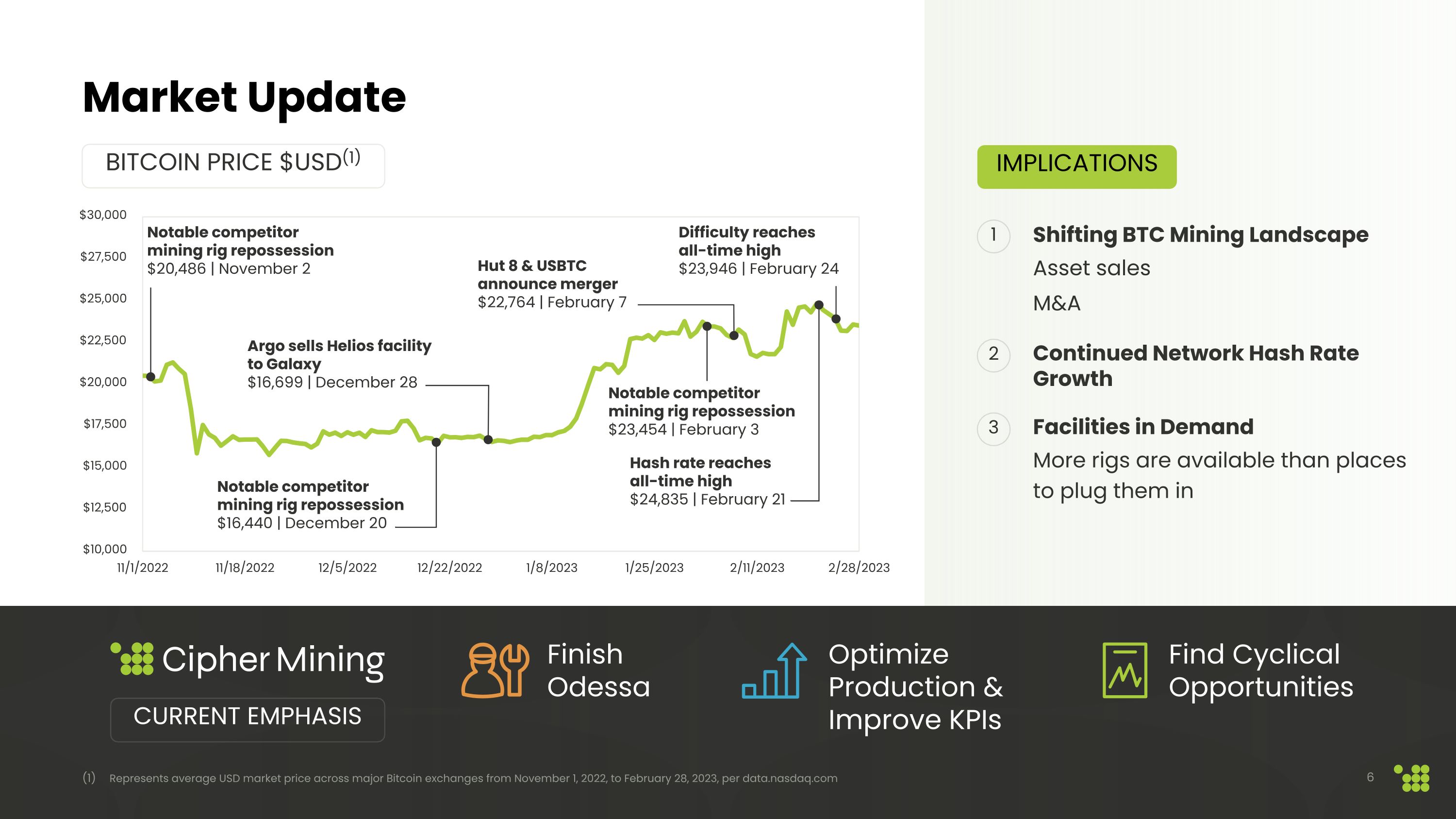

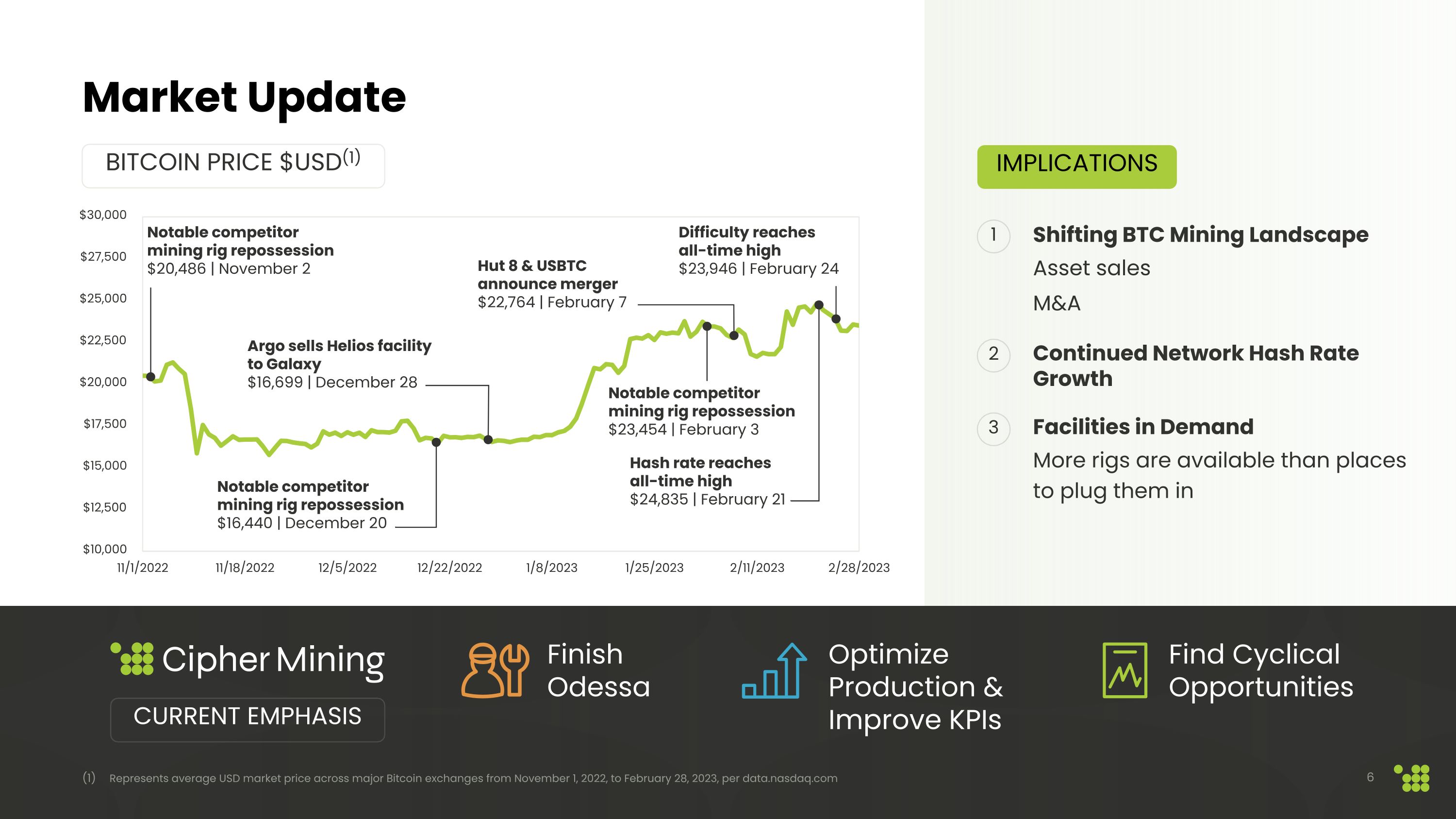

Notable competitor mining rig repossession $16,440 | December 20 Market Update Bitcoin price $USD(1) Implications Shifting BTC Mining Landscape Asset sales M&A Continued Network Hash Rate Growth Facilities in Demand More rigs are available than places to plug them in Current emphasis Argo sells Helios facility to Galaxy $16,699 | December 28 Hut 8 & USBTC announce merger $22,764 | February 7 Difficulty reaches all-time high $23,946 | February 24 Hash rate reaches all-time high $24,835 | February 21 1 2 3 Notable competitor mining rig repossession $23,454 | February 3 Notable competitor mining rig repossession $20,486 | November 2 Find Cyclical Opportunities Optimize Production & Improve KPIs Finish Odessa Represents average USD market price across major Bitcoin exchanges from November 1, 2022, to February 28, 2023, per data.nasdaq.com

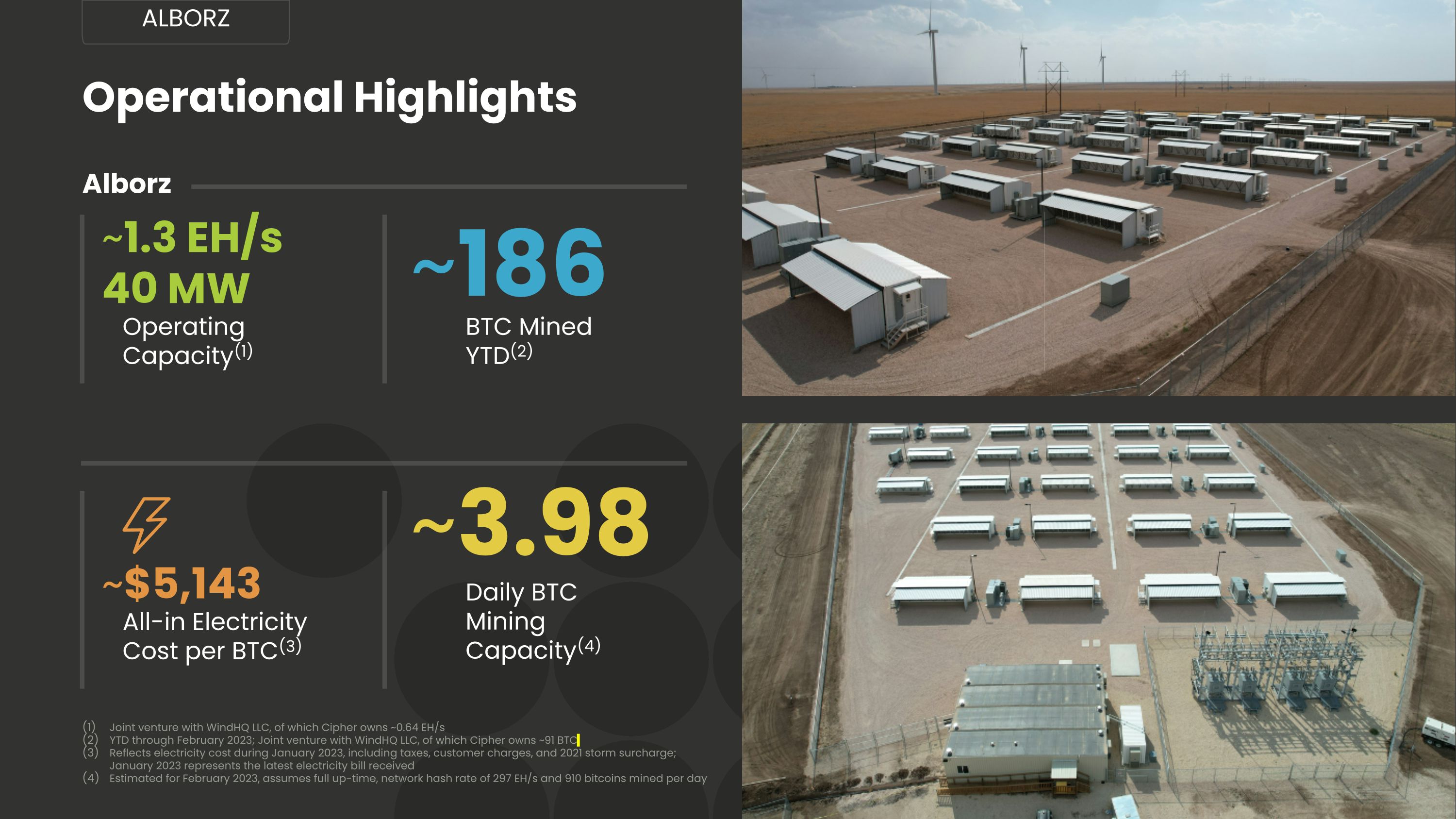

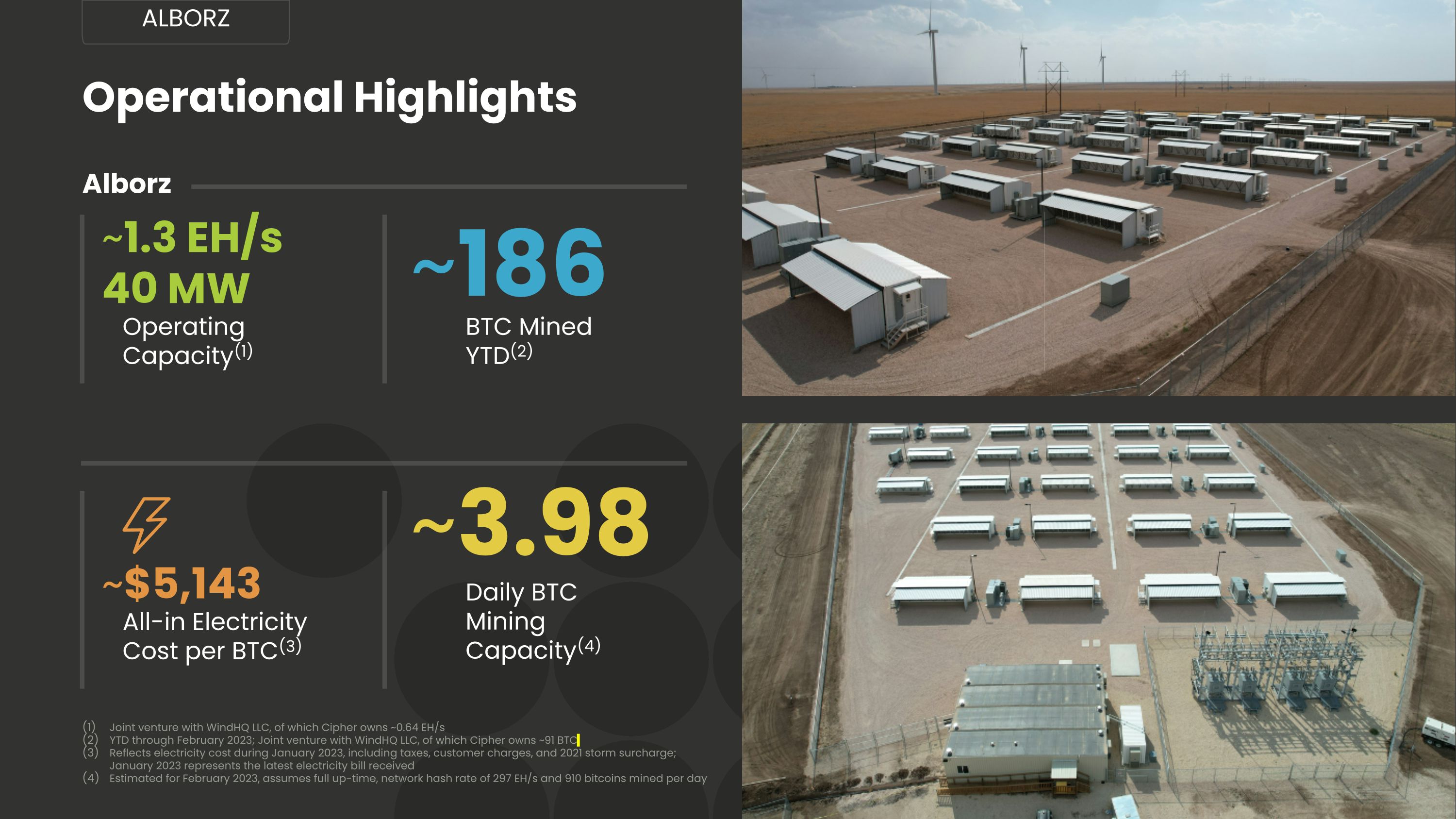

Operational Highlights Joint venture with WindHQ LLC, of which Cipher owns ~0.64 EH/s YTD through February 2023; Joint venture with WindHQ LLC, of which Cipher owns ~91 BTC Reflects electricity cost during January 2023, including taxes, customer charges, and 2021 storm surcharge; January 2023 represents the latest electricity bill received Estimated for February 2023, assumes full up-time, network hash rate of 297 EH/s and 910 bitcoins mined per day Alborz ~$5,143 All-in Electricity �Cost per BTC(3) ~3.98 Daily BTC Mining Capacity(4) ~1.3 EH/s 40 MW Operating �Capacity(1) ~186 BTC Mined �YTD(2) Alborz

Operational Highlights Bear & Chief Joint venture with WindHQ LLC, of which Cipher owns ~0.32 EH/s YTD through February 2023; Joint venture with WindHQ LLC, of which Cipher owns ~54 BTC Represents expansion capacity up to 135 MW at each site; expansion capacity above 75 MW at each site is subject to ERCOT approval Reflects combined electricity cost during January 2023, including taxes, settlement charges, and TSDP charges; January 2023 represents the latest electricity bills received Estimated for February 2023, assumes full up-time, network hash rate of 297 EH/s and 910 bitcoins mined per day ~$6,293 All-in Electricity �Cost per BTC(4) ~1.99 Daily BTC Mining Capacity(5) ~0.65 EH/s 20 MW Operating �Capacity(1) ~111 BTC Mined �YTD(2) Bear & Chief Expansion Capacity up to 270 MW(3)

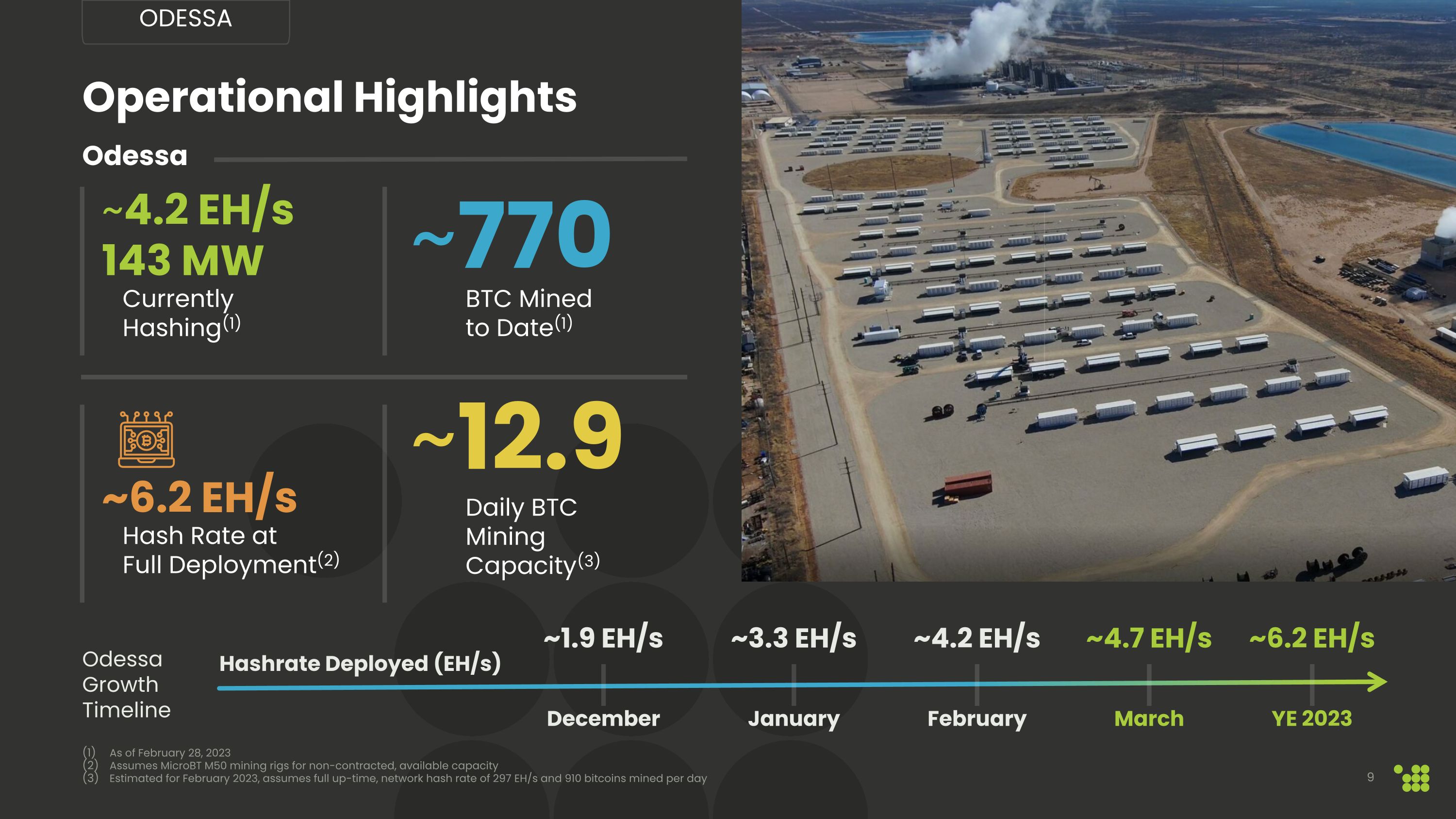

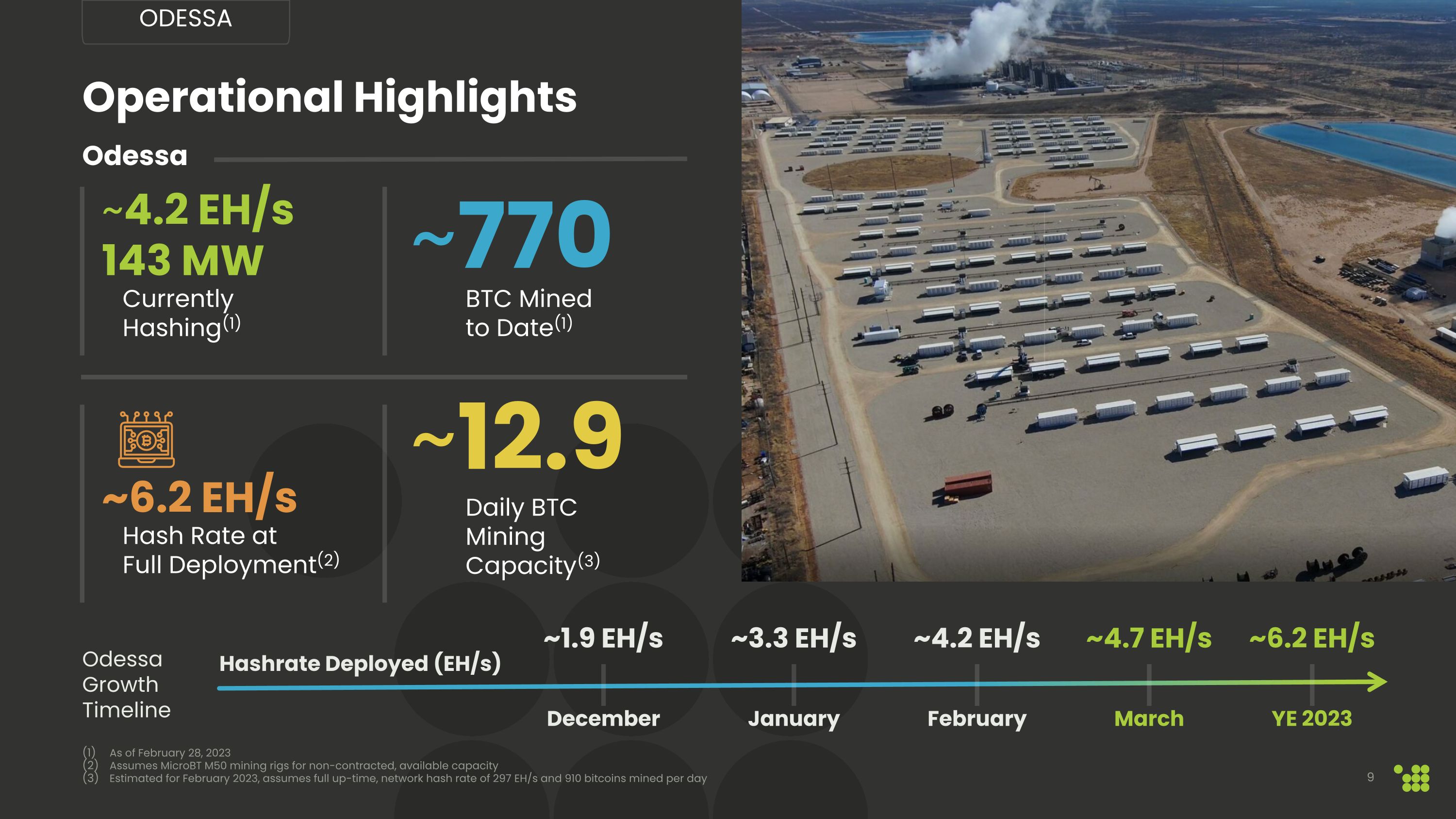

Operational Highlights As of February 28, 2023 Assumes MicroBT M50 mining rigs for non-contracted, available capacity Estimated for February 2023, assumes full up-time, network hash rate of 297 EH/s and 910 bitcoins mined per day odessa Hash Rate at Full Deployment(2) ~12.9 Daily BTC Mining Capacity(3) ~4.2 EH/s 143 MW Currently Hashing(1) ~770 BTC Mined �to Date(1) Odessa ~6.2 EH/s Hashrate Deployed (EH/s) Odessa Growth Timeline ~1.9 EH/s December ~4.7 EH/s March January ~3.3 EH/s February ~4.2 EH/s ~6.2 EH/s YE 2023 9

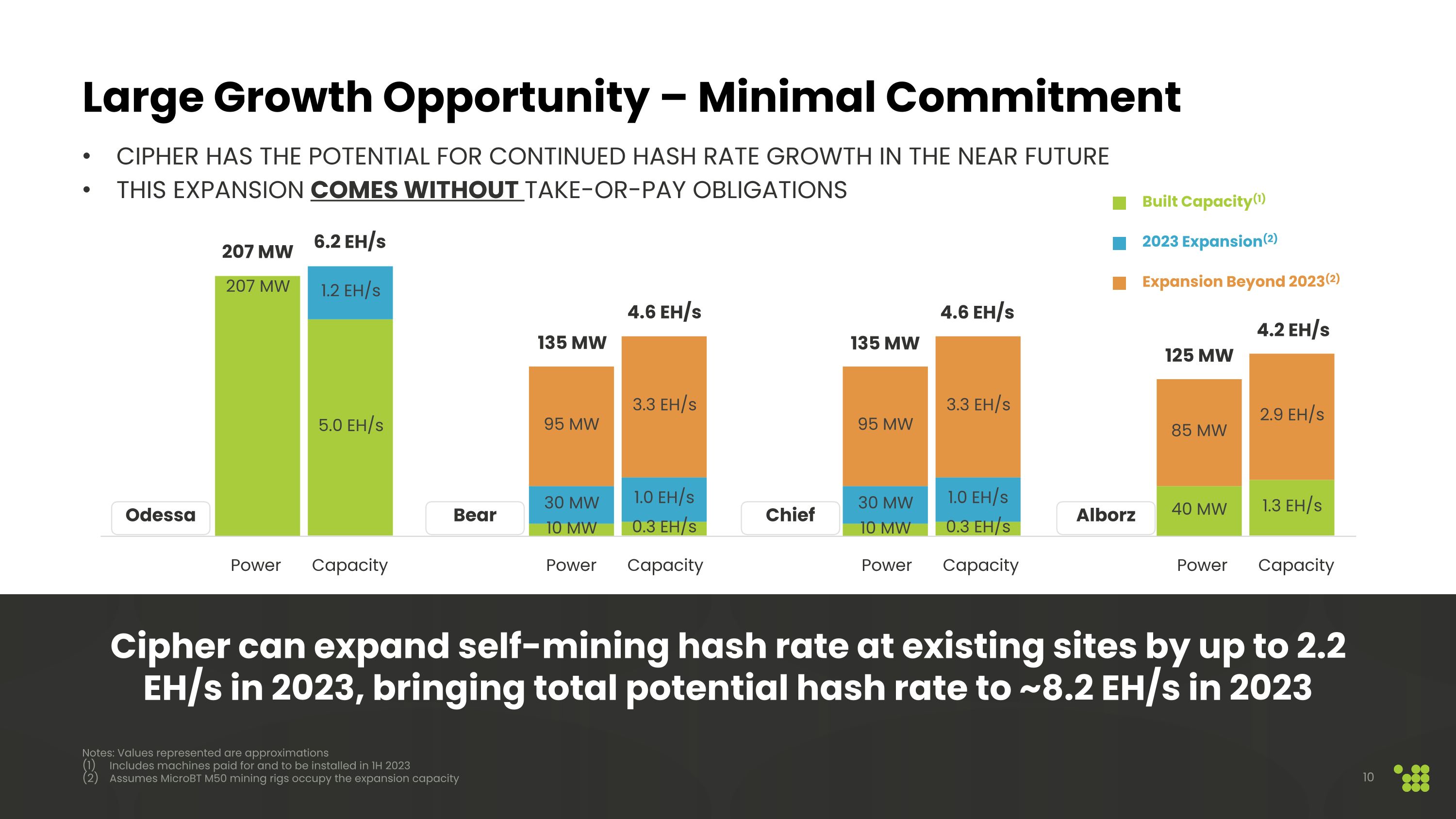

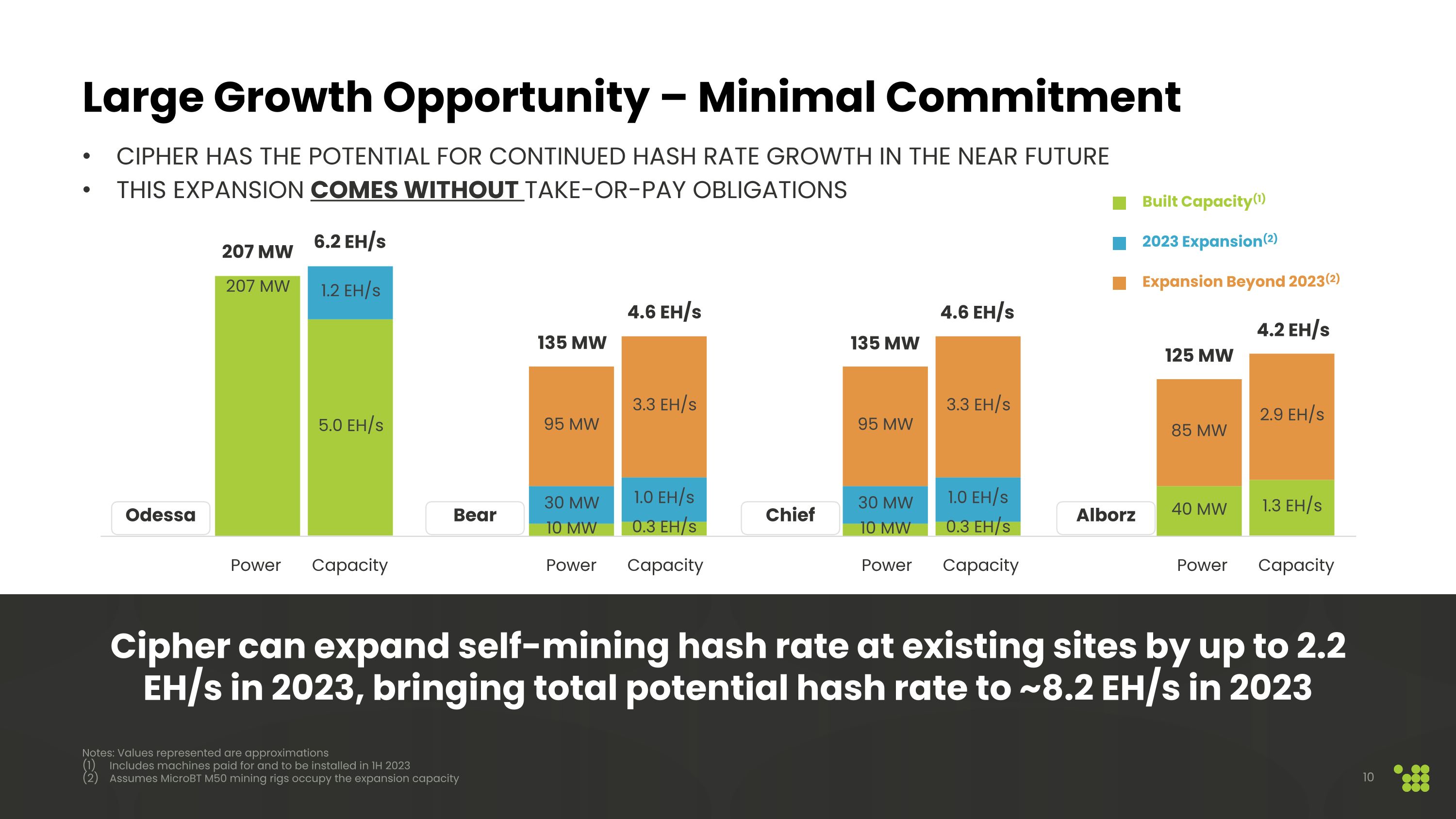

Large Growth Opportunity – Minimal Commitment Cipher has the potential for continued hash rate growth in the near future This expansion comes without take-or-pay obligations Notes: Values represented are approximations Includes machines paid for and to be installed in 1H 2023 Assumes MicroBT M50 mining rigs occupy the expansion capacity Cipher can expand self-mining hash rate at existing sites by up to 2.2 EH/s in 2023, bringing total potential hash rate to ~8.2 EH/s in 2023 Power Capacity Odessa Bear Chief Alborz Power Capacity Power Capacity Power Capacity 207 MW Built Capacity(1) 2023 Expansion(2) Expansion Beyond 2023(2) 6.2 EH/s 135 MW 4.6 EH/s 135 MW 4.6 EH/s 125 MW 4.2 EH/s

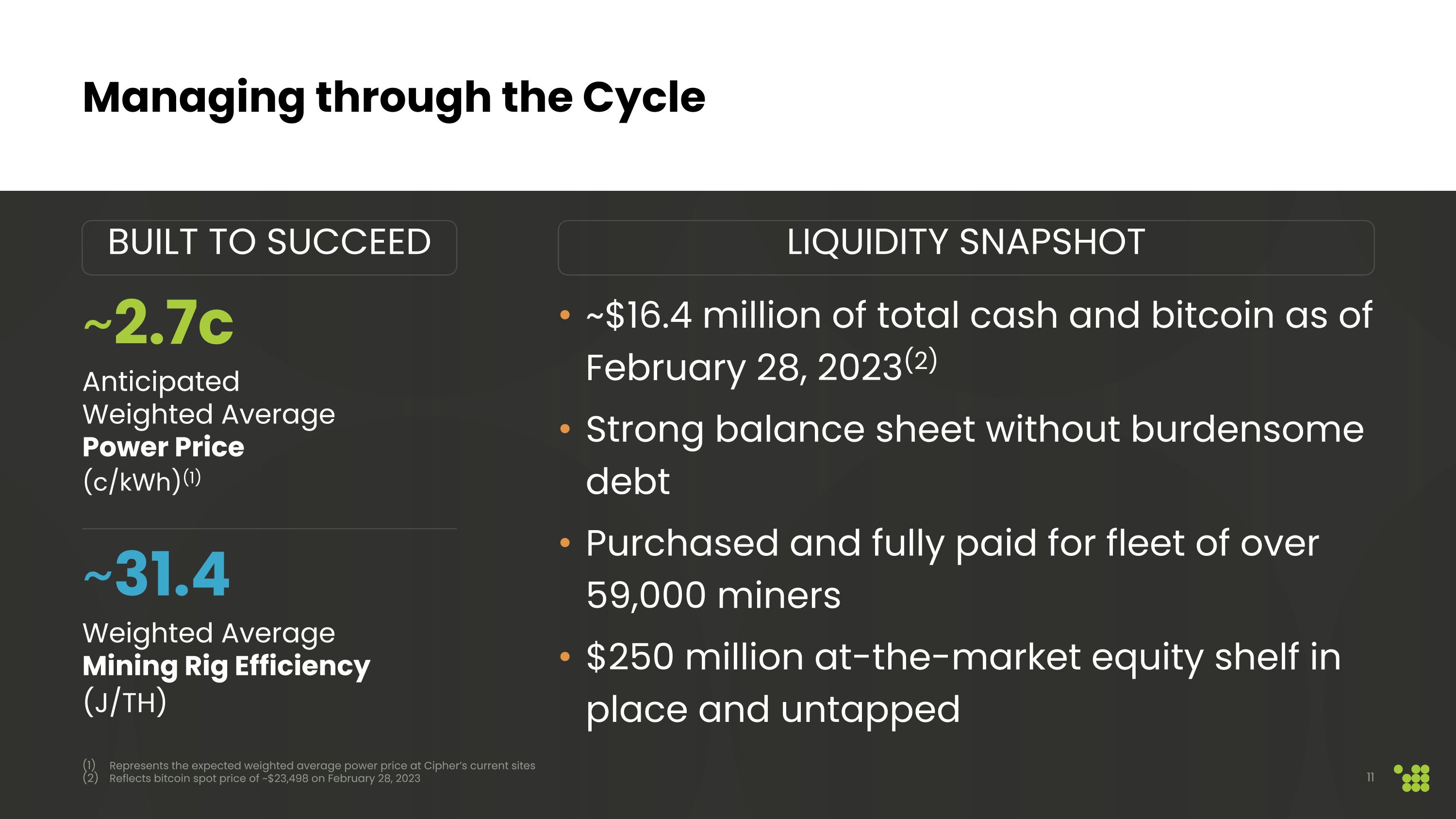

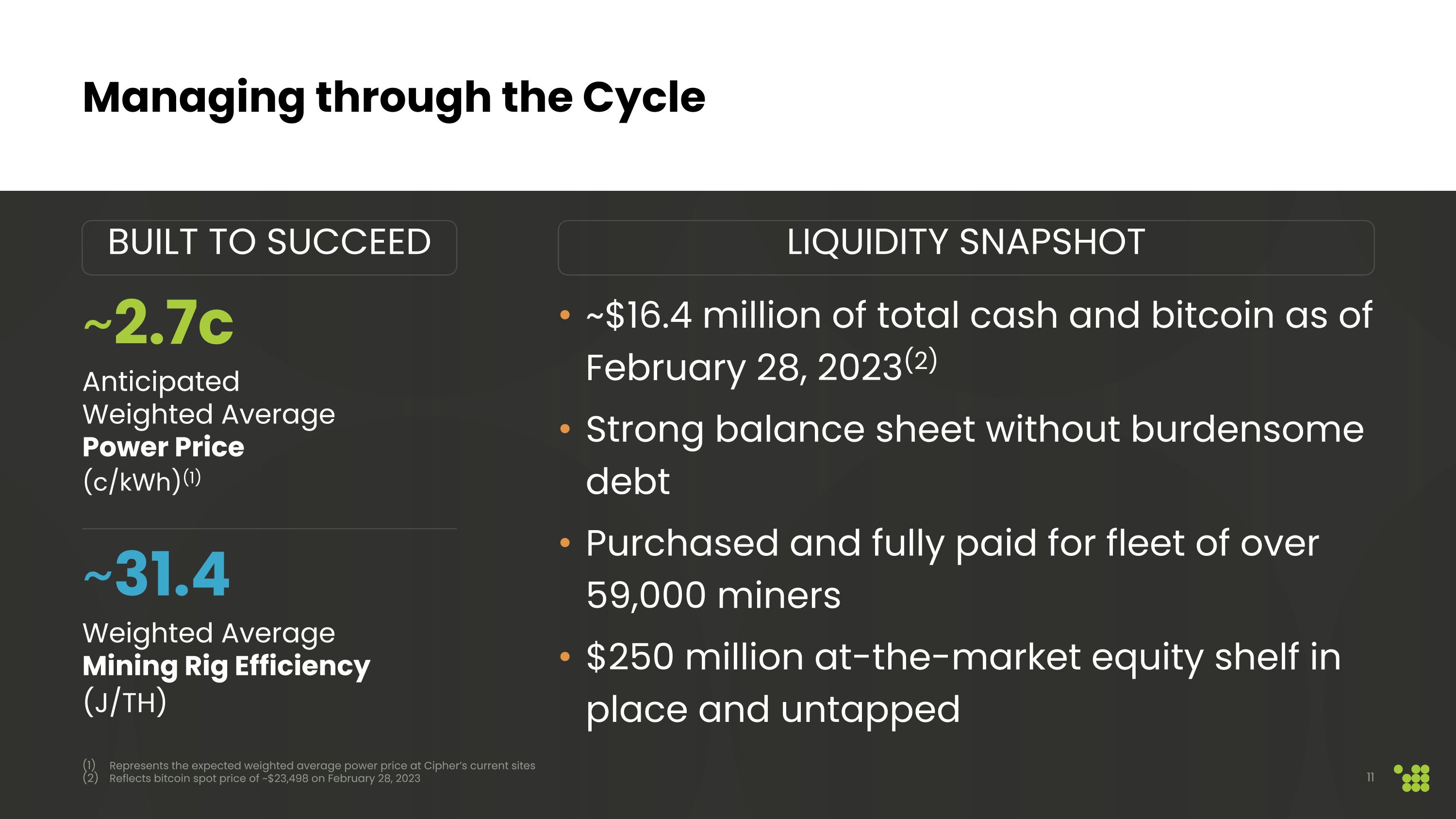

Managing through the Cycle ~$16.4 million of total cash and bitcoin as of February 28, 2023(2) Strong balance sheet without burdensome debt Purchased and fully paid for fleet of over 59,000 miners $250 million at-the-market equity shelf in place and untapped ~2.7c�Anticipated �Weighted Average �Power Price (c/kWh)(1) ~31.4 �Weighted Average �Mining Rig Efficiency (J/TH) Represents the expected weighted average power price at Cipher’s current sites Reflects bitcoin spot price of ~$23,498 on February 28, 2023 LIQUIDITY SNAPSHOT BUILT TO SUCCEED

Financial Update

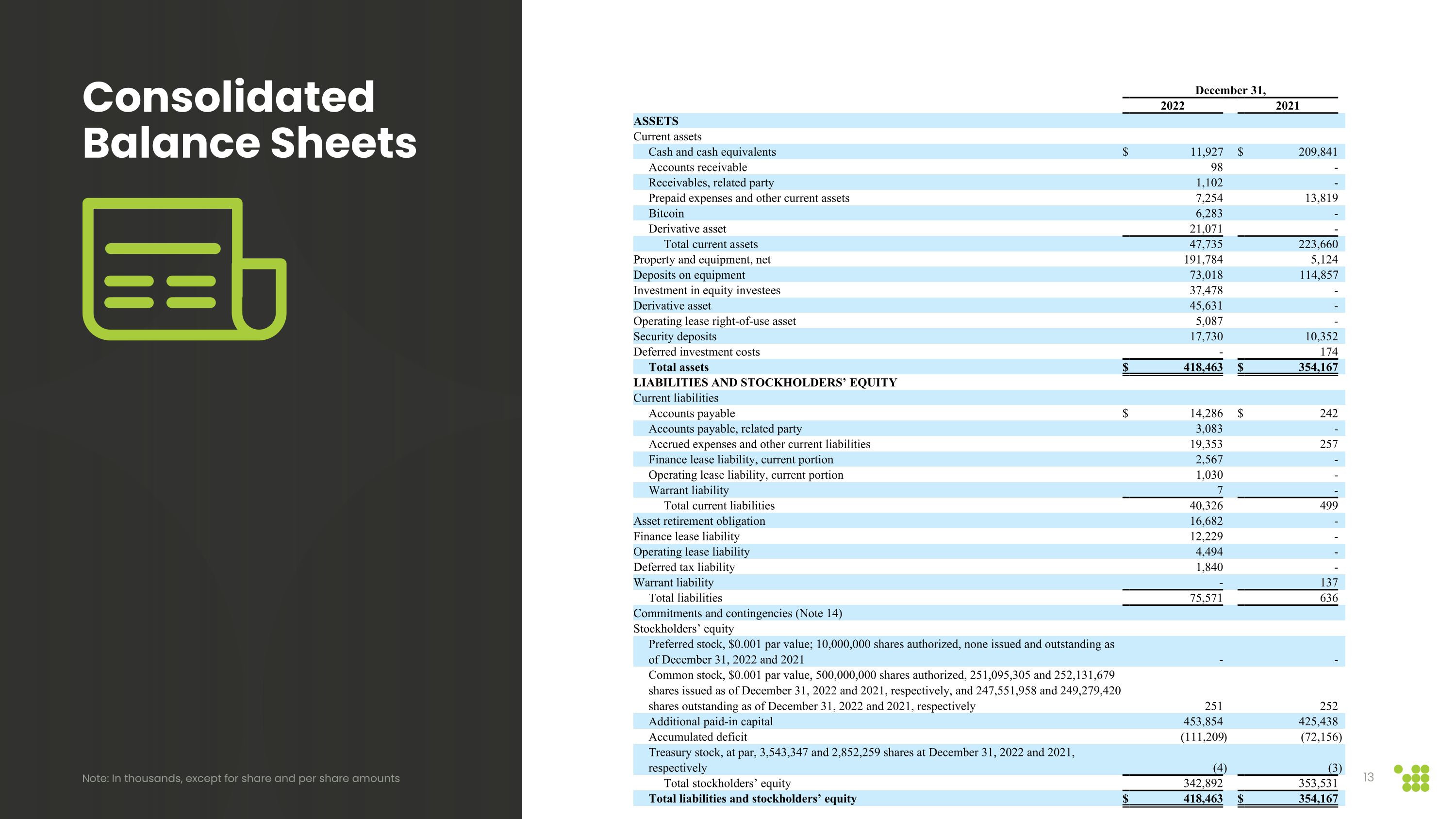

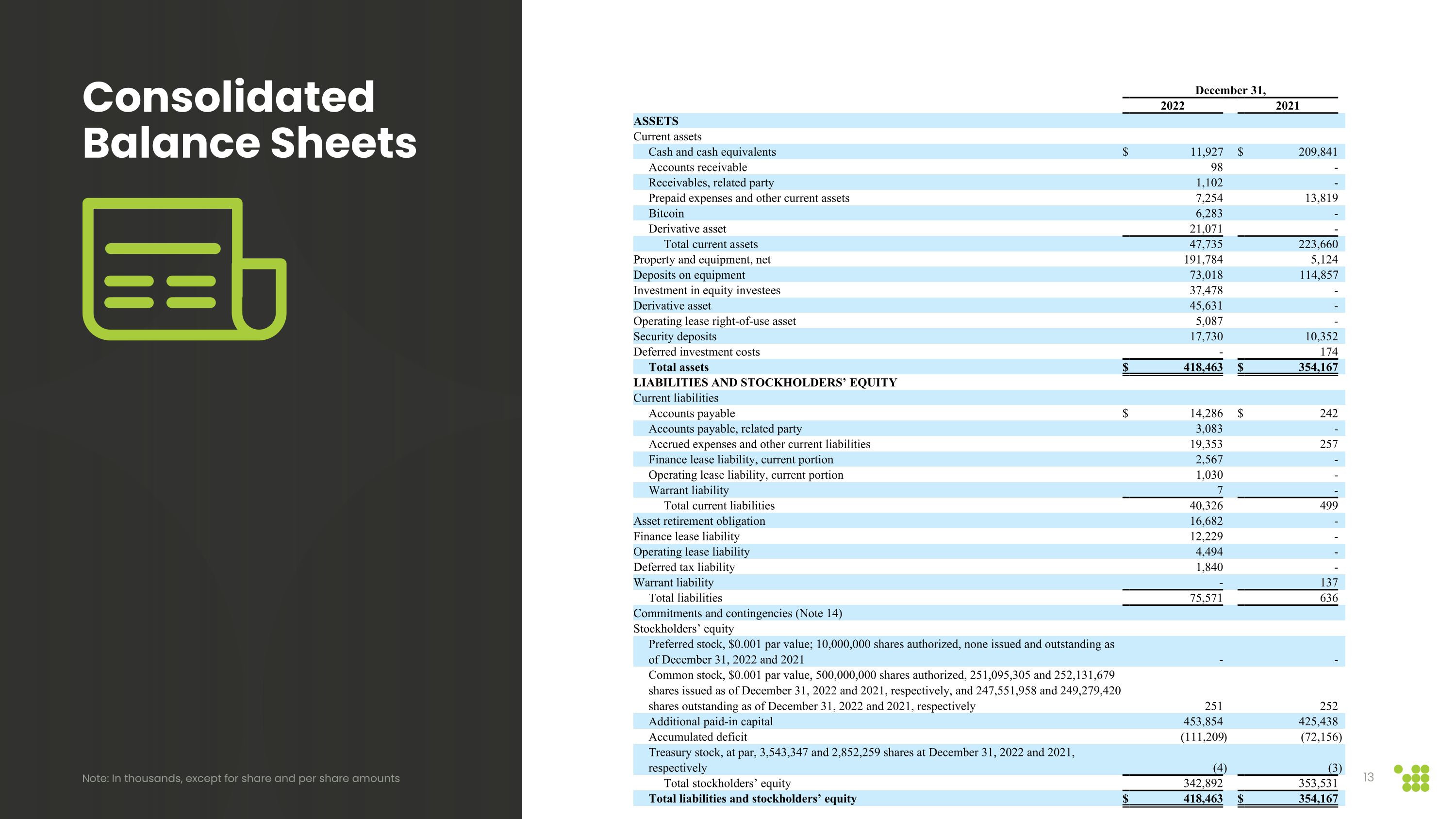

December 31, 2022 2021 ASSETS Current assets Cash and cash equivalents $ 11,927 $ 209,841 Accounts receivable 98 - Receivables, related party 1,102 - Prepaid expenses and other current assets 7,254 13,819 Bitcoin 6,283 - Derivative asset 21,071 - Total current assets 47,735 223,660 Property and equipment, net 191,784 5,124 Deposits on equipment 73,018 114,857 Investment in equity investees 37,478 - Derivative asset 45,631 - Operating lease right-of-use asset 5,087 - Security deposits 17,730 10,352 Deferred investment costs - 174 Total assets $ 418,463 $ 354,167 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 14,286 $ 242 Accounts payable, related party 3,083 - Accrued expenses and other current liabilities 19,353 257 Finance lease liability, current portion 2,567 - Operating lease liability, current portion 1,030 - Warrant liability 7 - Total current liabilities 40,326 499 Asset retirement obligation 16,682 - Finance lease liability 12,229 - Operating lease liability 4,494 - Deferred tax liability 1,840 - Warrant liability - 137 Total liabilities 75,571 636 Commitments and contingencies (Note 14) Stockholders’ equity Preferred stock, $0.001 par value; 10,000,000 shares authorized, none issued and outstanding as of December 31, 2022 and 2021 - - Common stock, $0.001 par value, 500,000,000 shares authorized, 251,095,305 and 252,131,679 shares issued as of December 31, 2022 and 2021, respectively, and 247,551,958 and 249,279,420 shares outstanding as of December 31, 2022 and 2021, respectively 251 252 Additional paid-in capital 453,854 425,438 Accumulated deficit (111,209 ) (72,156 ) Treasury stock, at par, 3,543,347 and 2,852,259 shares at December 31, 2022 and 2021, respectively (4 ) (3 ) Total stockholders’ equity 342,892 353,531 Total liabilities and stockholders’ equity $ 418,463 $ 354,167 Consolidated Balance Sheets Note: In thousands, except for share and per share amounts

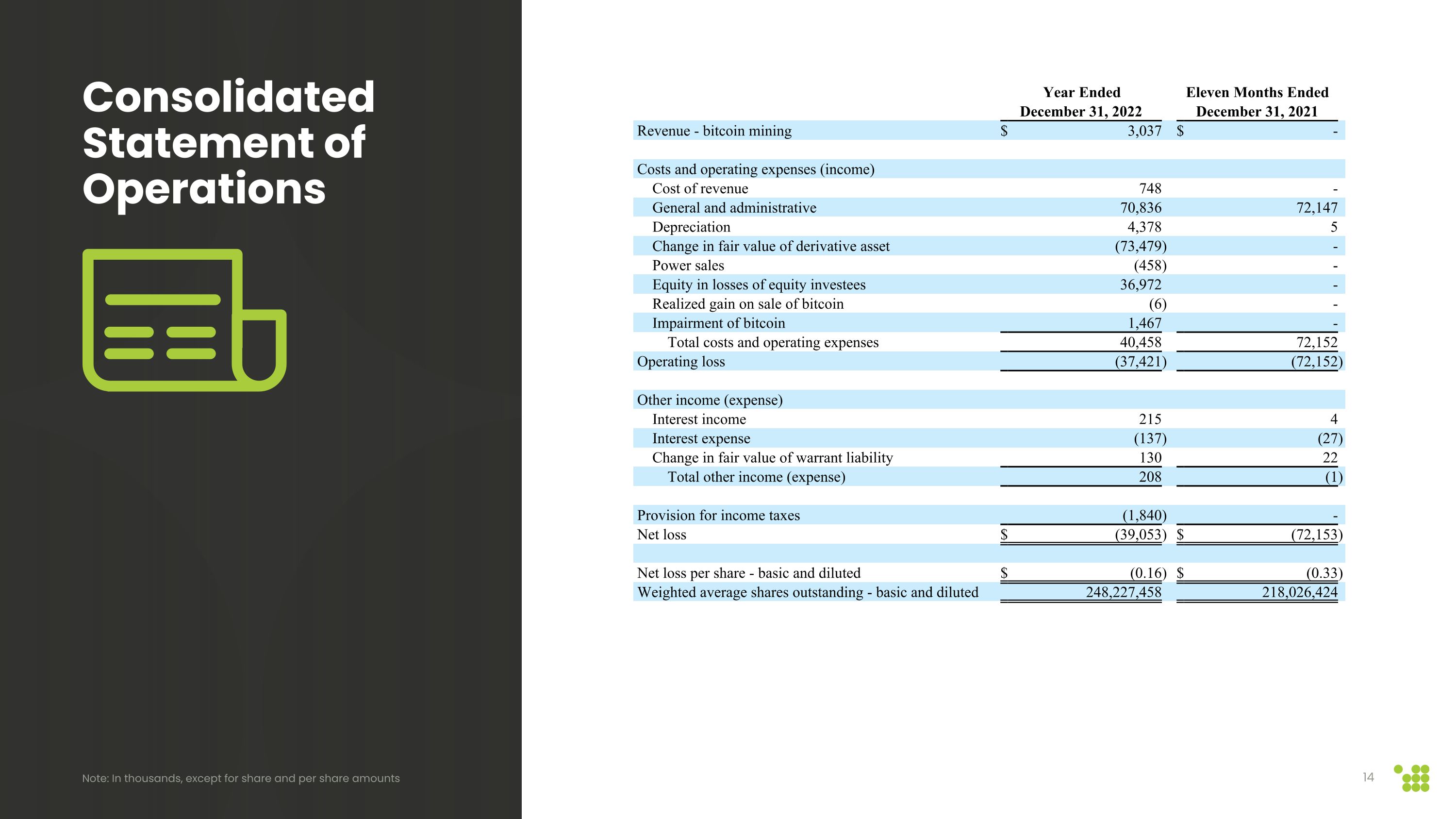

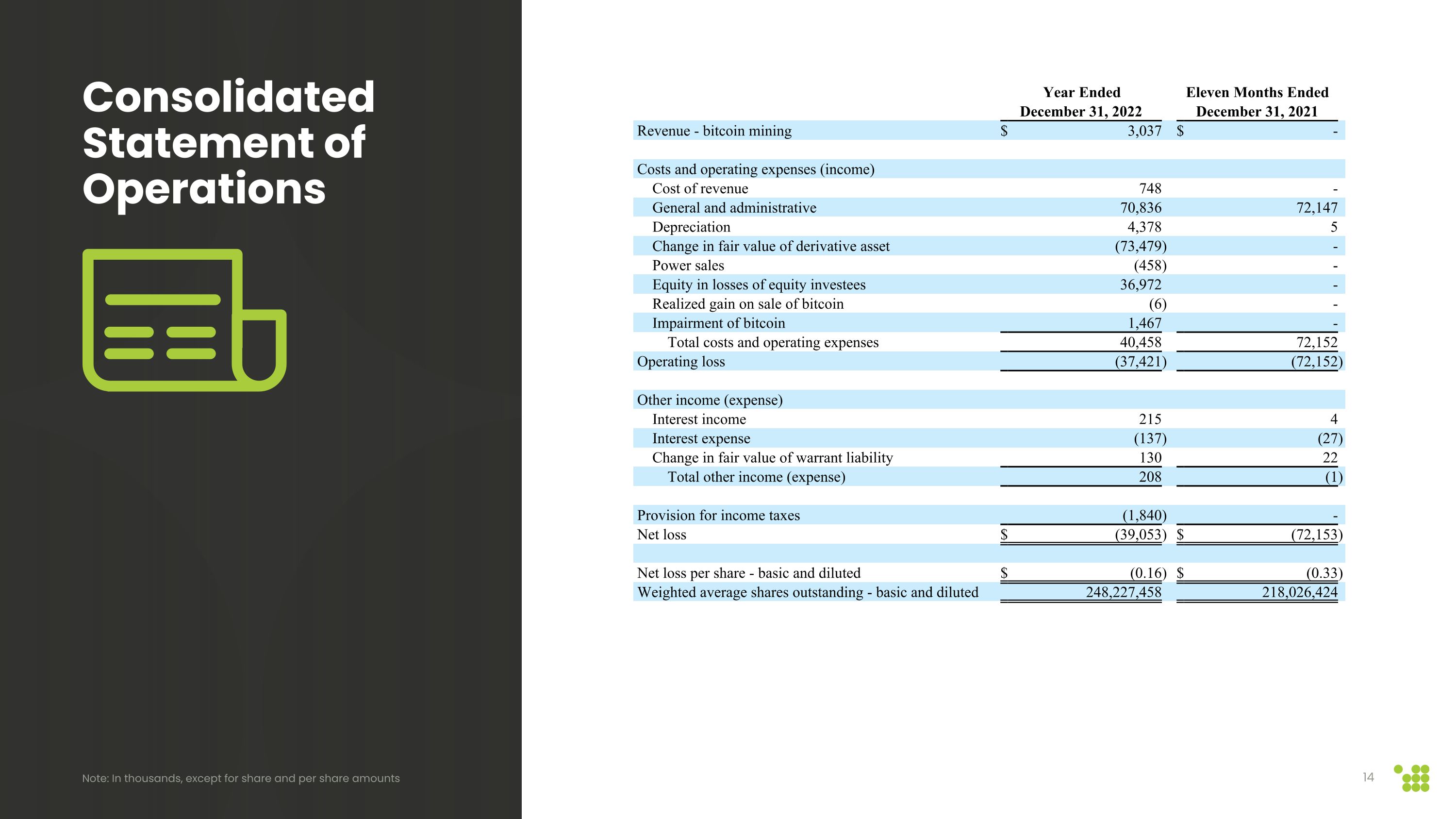

Year Ended Eleven Months Ended December 31, 2022 December 31, 2021 Revenue - bitcoin mining $ 3,037 $ - Costs and operating expenses (income) Cost of revenue 748 - General and administrative 70,836 72,147 Depreciation 4,378 5 Change in fair value of derivative asset (73,479 ) - Power sales (458 ) - Equity in losses of equity investees 36,972 - Realized gain on sale of bitcoin (6 ) - Impairment of bitcoin 1,467 - Total costs and operating expenses 40,458 72,152 Operating loss (37,421 ) (72,152 ) Other income (expense) Interest income 215 4 Interest expense (137 ) (27 ) Change in fair value of warrant liability 130 22 Total other income (expense) 208 (1 ) Provision for income taxes (1,840 ) - Net loss $ (39,053 ) $ (72,153 ) Net loss per share - basic and diluted $ (0.16 ) $ (0.33 ) Weighted average shares outstanding - basic and diluted 248,227,458 218,026,424 Consolidated Statement of Operations Note: In thousands, except for share and per share amounts

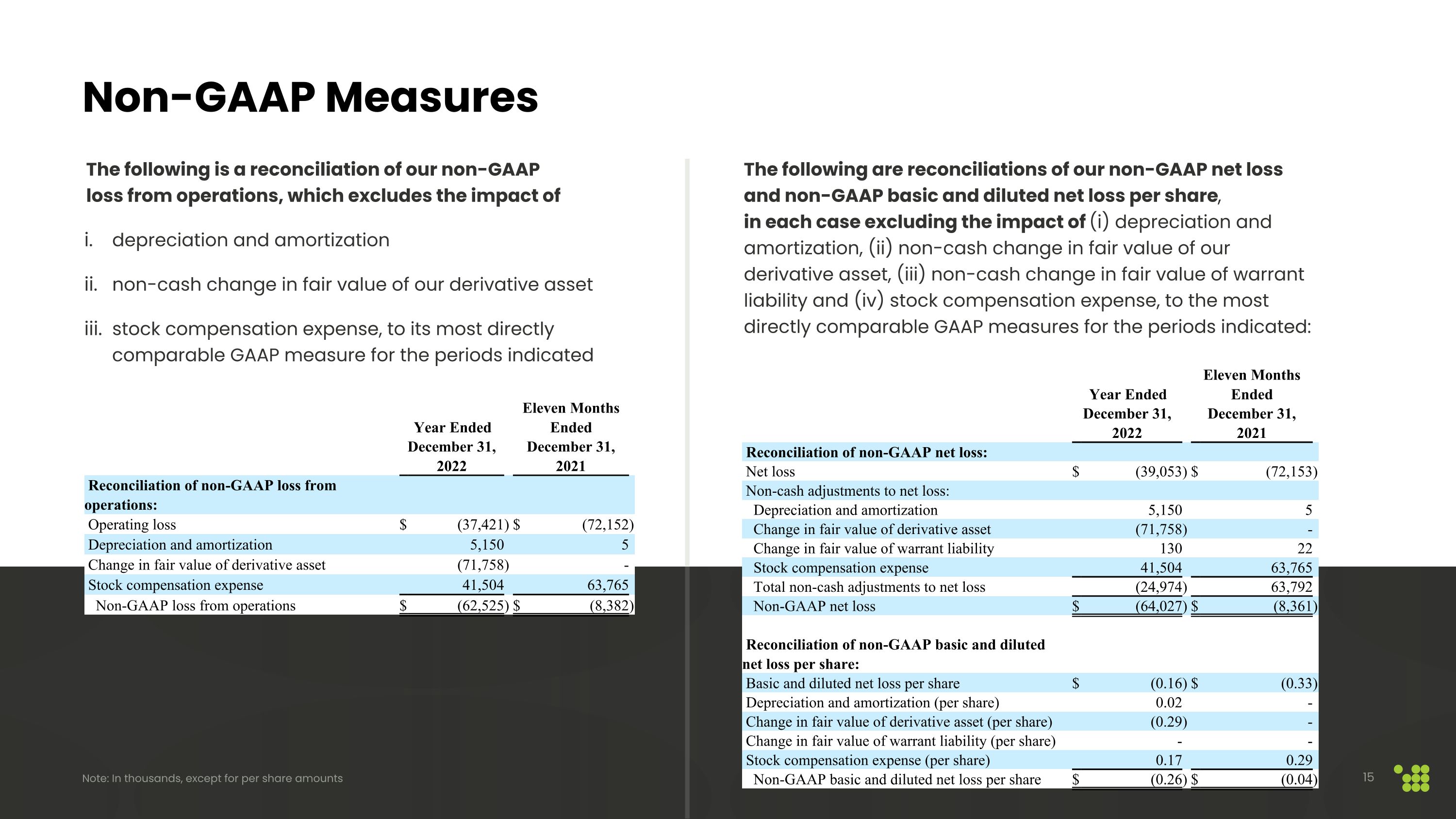

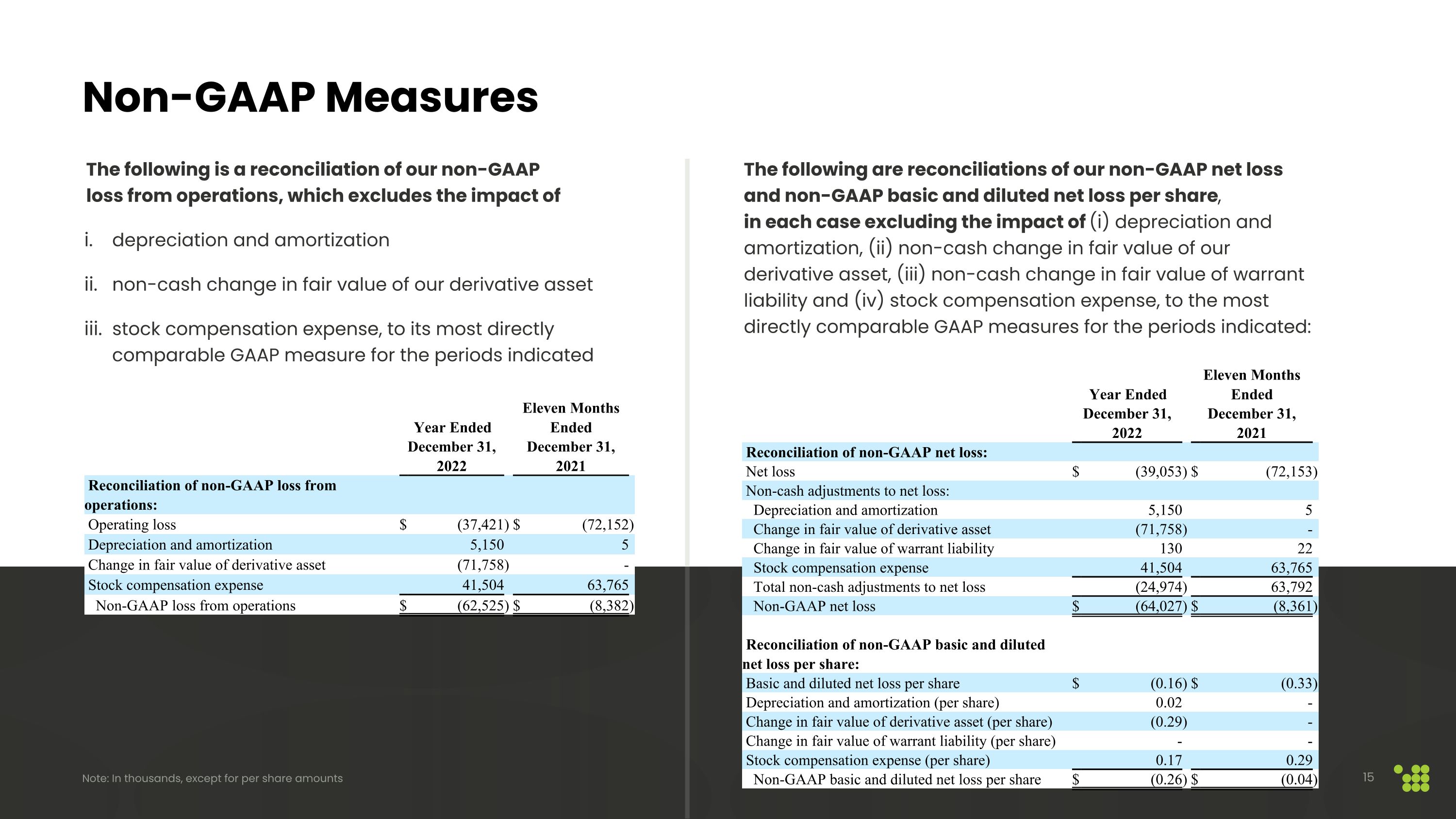

Year Ended Eleven Months Ended December 31, 2022 December 31, 2021 Reconciliation of non-GAAP net loss: Net loss $ (39,053 ) $ (72,153 ) Non-cash adjustments to net loss: Depreciation and amortization 5,150 5 Change in fair value of derivative asset (71,758 ) - Change in fair value of warrant liability 130 22 Stock compensation expense 41,504 63,765 Total non-cash adjustments to net loss (24,974 ) 63,792 Non-GAAP net loss $ (64,027 ) $ (8,361 ) Reconciliation of non-GAAP basic and diluted net loss per share: Basic and diluted net loss per share $ (0.16 ) $ (0.33 ) Depreciation and amortization (per share) 0.02 - Change in fair value of derivative asset (per share) (0.29 ) - Change in fair value of warrant liability (per share) - - Stock compensation expense (per share) 0.17 0.29 Non-GAAP basic and diluted net loss per share $ (0.26 ) $ (0.04 ) Year Ended Eleven Months Ended December 31, 2022 December 31, 2021 Reconciliation of non-GAAP loss from operations: Operating loss $ (37,421 ) $ (72,152 ) Depreciation and amortization 5,150 5 Change in fair value of derivative asset (71,758 ) - Stock compensation expense 41,504 63,765 Non-GAAP loss from operations $ (62,525 ) $ (8,382 ) Non-GAAP Measures The following is a reconciliation of our non-GAAP �loss from operations, which excludes the impact of depreciation and amortization non-cash change in fair value of our derivative asset stock compensation expense, to its most directly comparable GAAP measure for the periods indicated The following are reconciliations of our non-GAAP net loss and non-GAAP basic and diluted net loss per share, �in each case excluding the impact of (i) depreciation and amortization, (ii) non-cash change in fair value of our derivative asset, (iii) non-cash change in fair value of warrant liability and (iv) stock compensation expense, to the most directly comparable GAAP measures for the periods indicated: Note: In thousands, except for per share amounts

Appendix

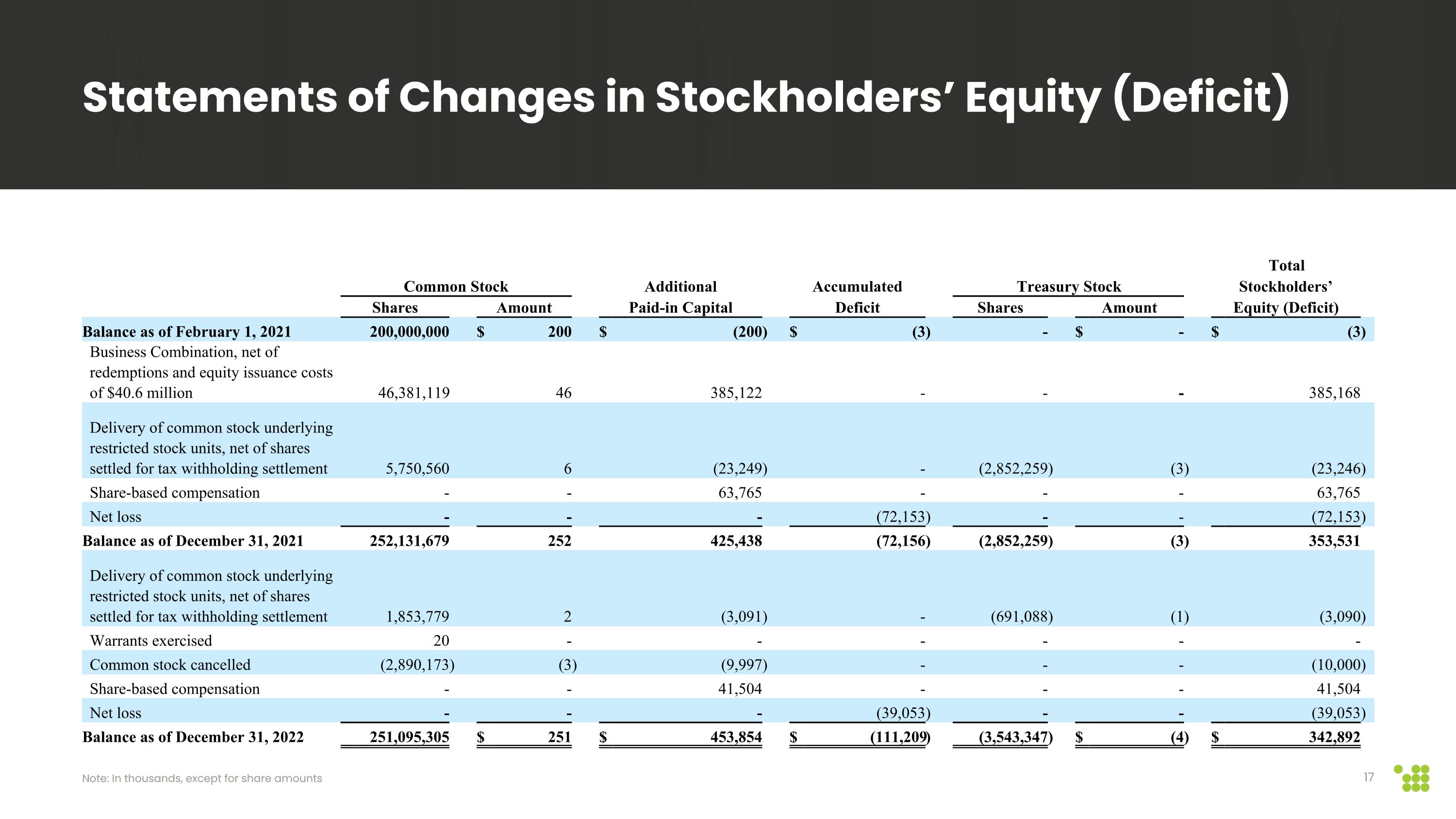

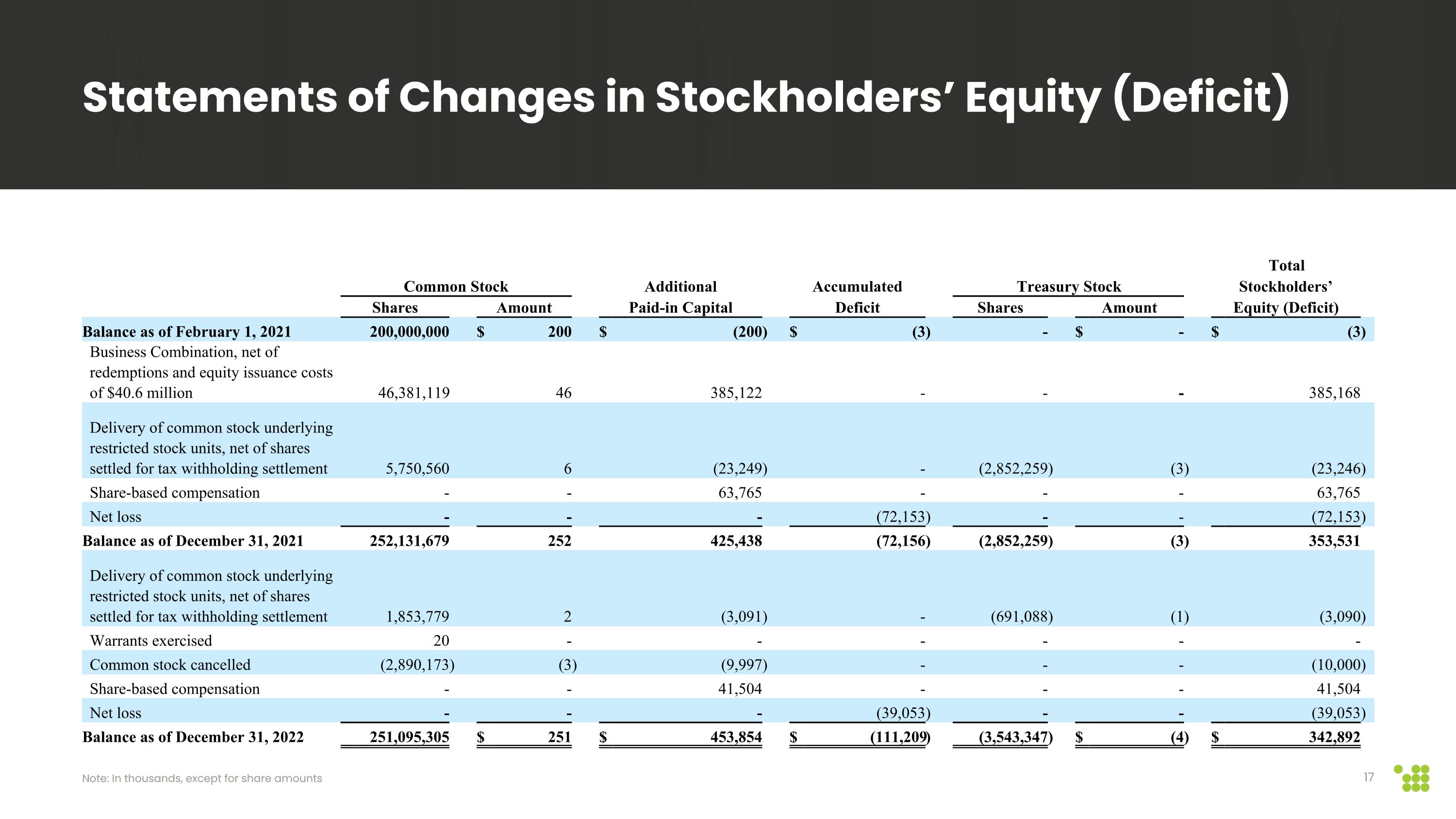

Total Common Stock Additional Accumulated Treasury Stock Stockholders’ Shares Amount Paid-in Capital Deficit Shares Amount Equity (Deficit) Balance as of February 1, 2021 200,000,000 $ 200 $ (200 ) $ (3 ) - $ - $ (3 ) Business Combination, net of redemptions and equity issuance costs of $40.6 million 46,381,119 46 385,122 - - - 385,168 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 5,750,560 6 (23,249 ) - (2,852,259 ) (3 ) (23,246 ) Share-based compensation - - 63,765 - - - 63,765 Net loss - - - (72,153 ) - - (72,153 ) Balance as of December 31, 2021 252,131,679 252 425,438 (72,156 ) (2,852,259 ) (3 ) 353,531 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 1,853,779 2 (3,091 ) - (691,088 ) (1 ) (3,090 ) Warrants exercised 20 - - - - - - Common stock cancelled (2,890,173 ) (3 ) (9,997 ) - - - (10,000 ) Share-based compensation - - 41,504 - - - 41,504 Net loss - - - (39,053 ) - - (39,053 ) Balance as of December 31, 2022 251,095,305 $ 251 $ 453,854 $ (111,209 ) (3,543,347 ) $ (4 ) $ 342,892 Statements of Changes in Stockholders’ Equity (Deficit) Note: In thousands, except for share amounts

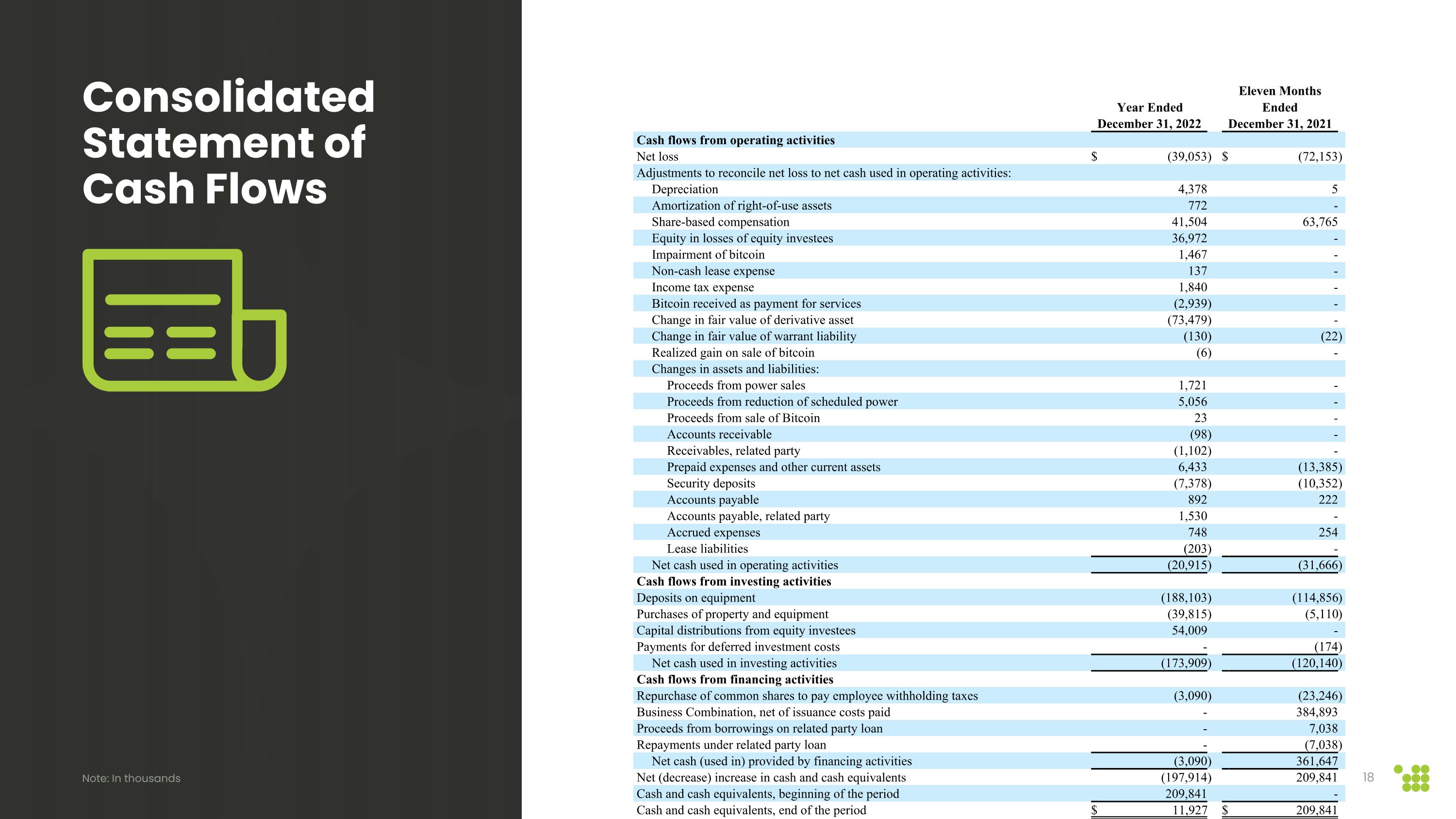

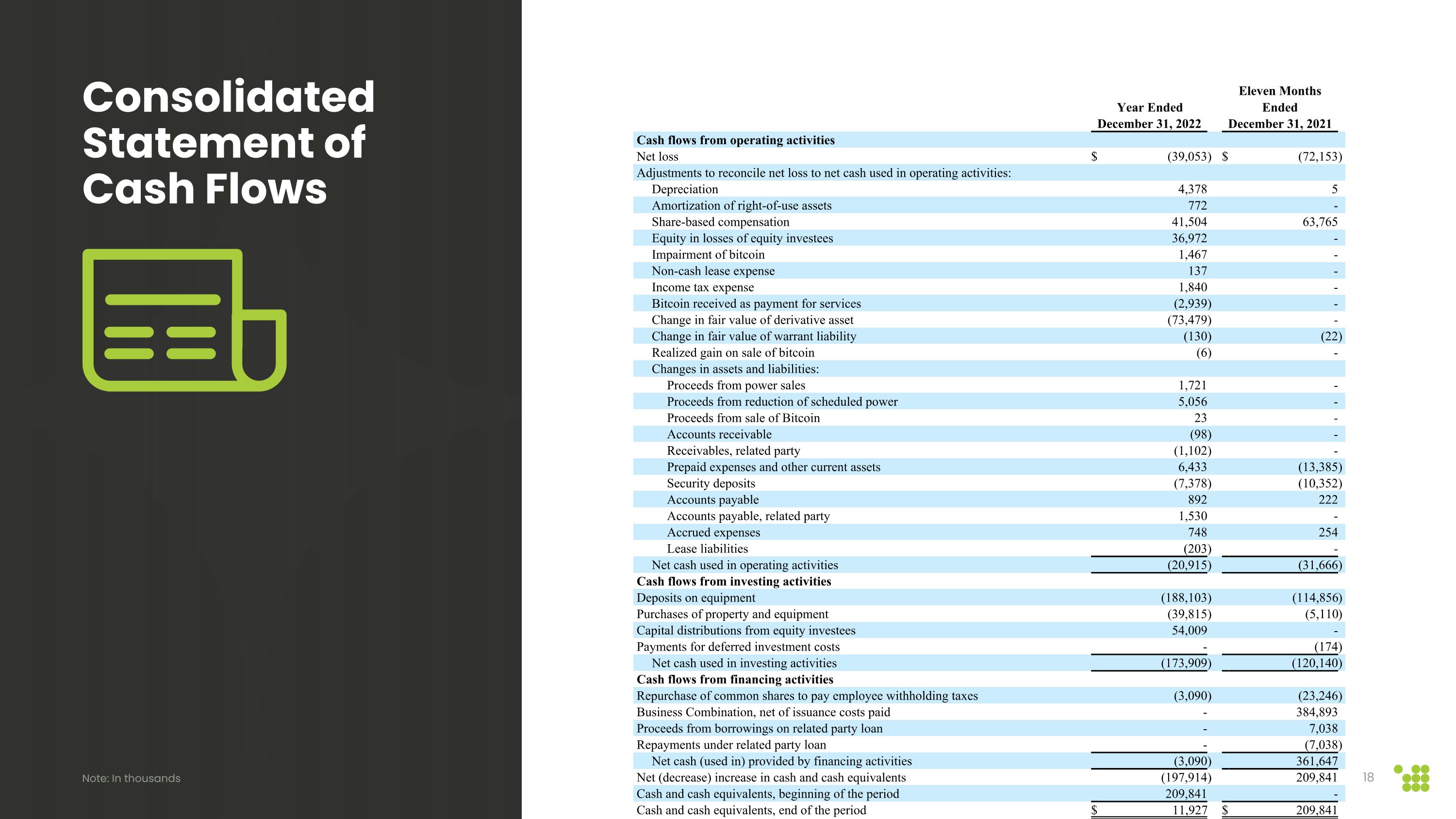

Consolidated Statement of Cash Flows Note: In thousands Year Ended Eleven Months Ended December 31, 2022 December 31, 2021 Cash flows from operating activities Net loss $ (39,053 ) $ (72,153 ) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation 4,378 5 Amortization of right-of-use assets 772 - Share-based compensation 41,504 63,765 Equity in losses of equity investees 36,972 - Impairment of bitcoin 1,467 - Non-cash lease expense 137 - Income tax expense 1,840 - Bitcoin received as payment for services (2,939 ) - Change in fair value of derivative asset (73,479 ) - Change in fair value of warrant liability (130 ) (22 ) Realized gain on sale of bitcoin (6 ) - Changes in assets and liabilities: Proceeds from power sales 1,721 - Proceeds from reduction of scheduled power 5,056 - Proceeds from sale of Bitcoin 23 - Accounts receivable (98 ) - Receivables, related party (1,102 ) - Prepaid expenses and other current assets 6,433 (13,385 ) Security deposits (7,378 ) (10,352 ) Accounts payable 892 222 Accounts payable, related party 1,530 - Accrued expenses 748 254 Lease liabilities (203 ) - Net cash used in operating activities (20,915 ) (31,666 ) Cash flows from investing activities Deposits on equipment (188,103 ) (114,856 ) Purchases of property and equipment (39,815 ) (5,110 ) Capital distributions from equity investees 54,009 - Payments for deferred investment costs - (174 ) Net cash used in investing activities (173,909 ) (120,140 ) Cash flows from financing activities Repurchase of common shares to pay employee withholding taxes (3,090 ) (23,246 ) Business Combination, net of issuance costs paid - 384,893 Proceeds from borrowings on related party loan - 7,038 Repayments under related party loan - (7,038 ) Net cash (used in) provided by financing activities (3,090 ) 361,647 Net (decrease) increase in cash and cash equivalents (197,914 ) 209,841 Cash and cash equivalents, beginning of the period 209,841 - Cash and cash equivalents, end of the period $ 11,927 $ 209,841

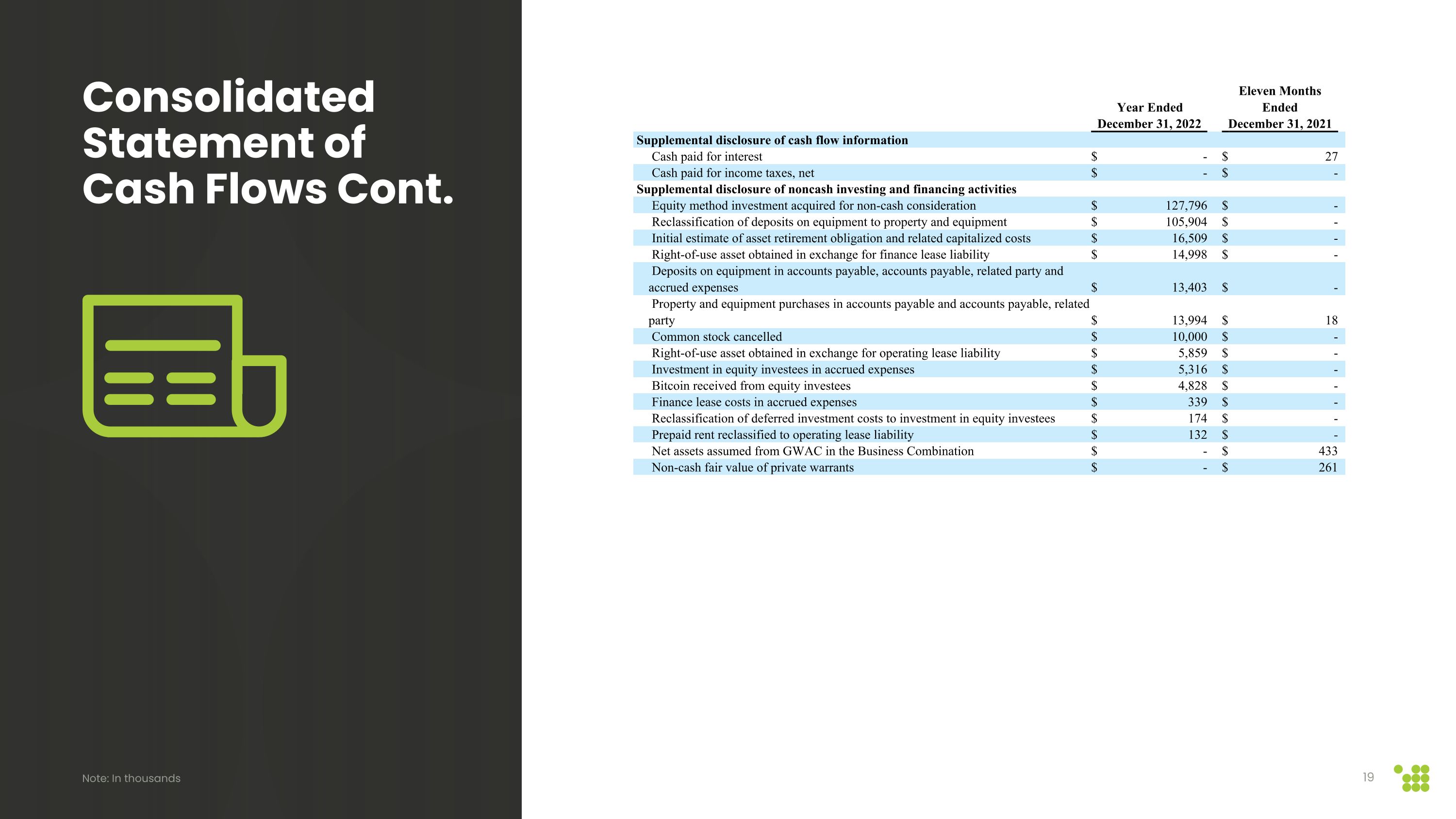

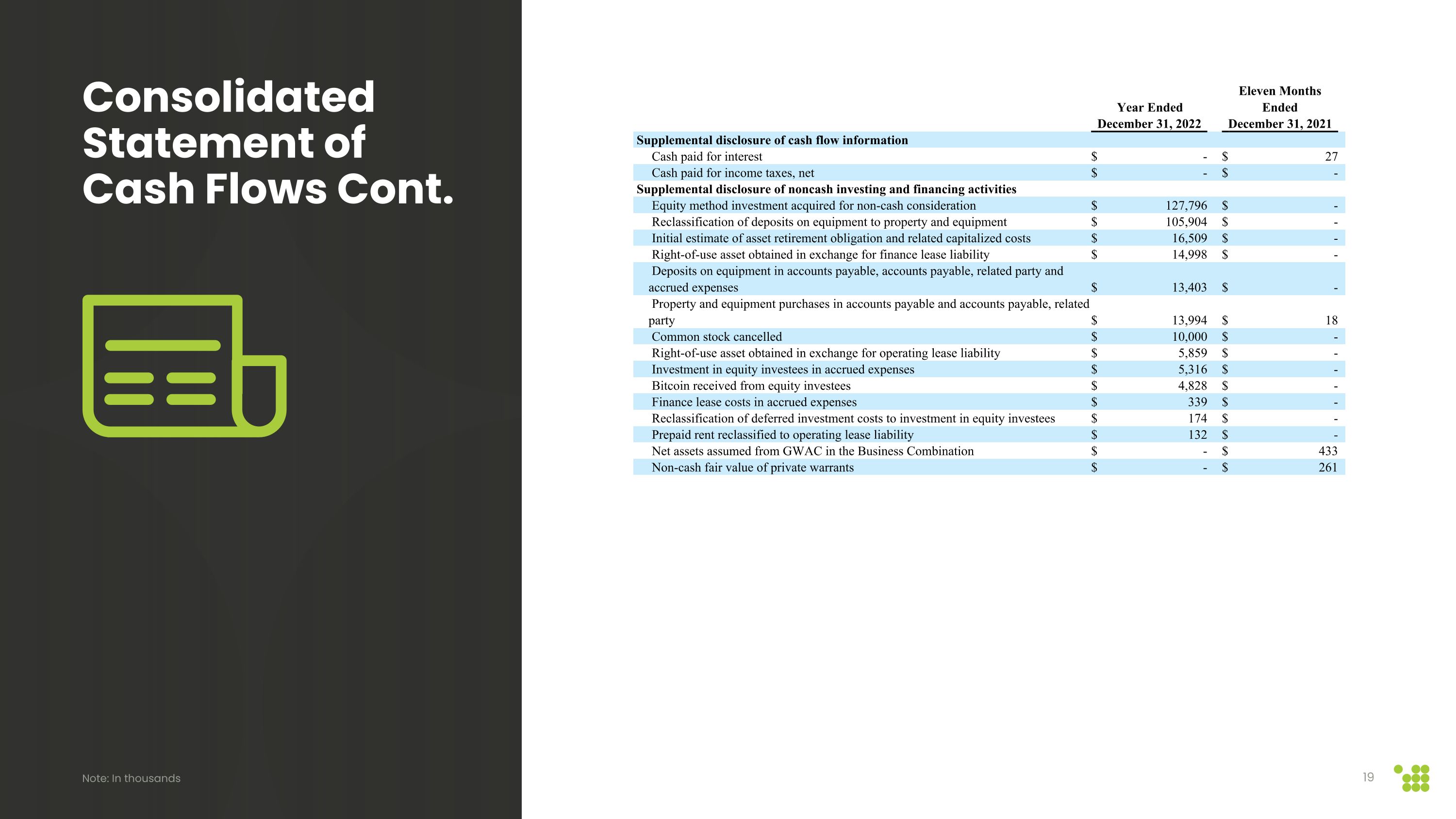

Year Ended Eleven Months Ended December 31, 2022 December 31, 2021 Supplemental disclosure of cash flow information Cash paid for interest $ - $ 27 Cash paid for income taxes, net $ - $ - Supplemental disclosure of noncash investing and financing activities Equity method investment acquired for non-cash consideration $ 127,796 $ - Reclassification of deposits on equipment to property and equipment $ 105,904 $ - Initial estimate of asset retirement obligation and related capitalized costs $ 16,509 $ - Right-of-use asset obtained in exchange for finance lease liability $ 14,998 $ - Deposits on equipment in accounts payable, accounts payable, related party and accrued expenses $ 13,403 $ - Property and equipment purchases in accounts payable and accounts payable, related party $ 13,994 $ 18 Common stock cancelled $ 10,000 $ - Right-of-use asset obtained in exchange for operating lease liability $ 5,859 $ - Investment in equity investees in accrued expenses $ 5,316 $ - Bitcoin received from equity investees $ 4,828 $ - Finance lease costs in accrued expenses $ 339 $ - Reclassification of deferred investment costs to investment in equity investees $ 174 $ - Prepaid rent reclassified to operating lease liability $ 132 $ - Net assets assumed from GWAC in the Business Combination $ - $ 433 Non-cash fair value of private warrants $ - $ 261 Consolidated Statement of Cash Flows Cont. Note: In thousands