Presentation for Business Update November 8, 2023

Forward-Looking Statements This communication contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this communication that are not statements of historical fact, including statements about our beliefs and expectations regarding our future results of operations and financial position, business strategy, timing and likelihood of success, potential expansion of bitcoin mining data centers, and management plans and objectives, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These forward-looking statements generally are identified by the words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “forecasts,” “predicts,” “potential” or “continue” and similar expressions (including the negative versions of such words or expressions). These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and our management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: volatility in the price of Cipher's securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, variations in performance across competitors, changes in laws and regulations affecting Cipher's business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, and in Cipher's subsequent filings with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures We use non-GAAP financial measures to assess and analyze our operational results and trends and to make financial and operational decisions. We believe these non-GAAP financial measures are useful to investors because they provide greater transparency regarding our operating performance. The non-GAAP financial measures included in this presentation should not be considered alternatives to measurements required by GAAP, and should not be considered measures of liquidity. These non-GAAP financial measures are unlikely to be comparable with non-GAAP information provided by other companies. Reconciliation of non-GAAP financial measures and GAAP financial measures are included in the tables accompanying this presentation. Reported results are presented in accordance with GAAP, whereas adjusted results are GAAP results adjusted to exclude the impact of (i) depreciation of fixed assets, (ii) change in fair value of warrant liability, (iii) non-cash change in fair value of our derivative asset and (iv) stock compensation expense. The contents and appearance of this presentation is copyrighted and the trademarks and service marks are owned by Cipher Mining Inc. All rights reserved.

Positioned to Win – Growing Through the Cycle Signed agreement to acquire a Texas-based greenfield site with a conditional ERCOT interconnection approval for up to 300 MW, called “Black Pearl” Purchased 1.2 EH/s of Bitmain’s newest generation S21 rigs for $14/TH Continued progress on grid connection at Alborz data center, expected 1H 2024 ~2.7c�Anticipated �Weighted Average �Power Price (c/kWh)(1) 7.2 EH/s�Self-Mining Hash Rate Represents the expected weighted average power price at Cipher’s current sites GROWTH UPDATES BUILT TO SUCCEED ~96%�of Portfolio Energized Through Fixed Price Power 33�Cipher Employees

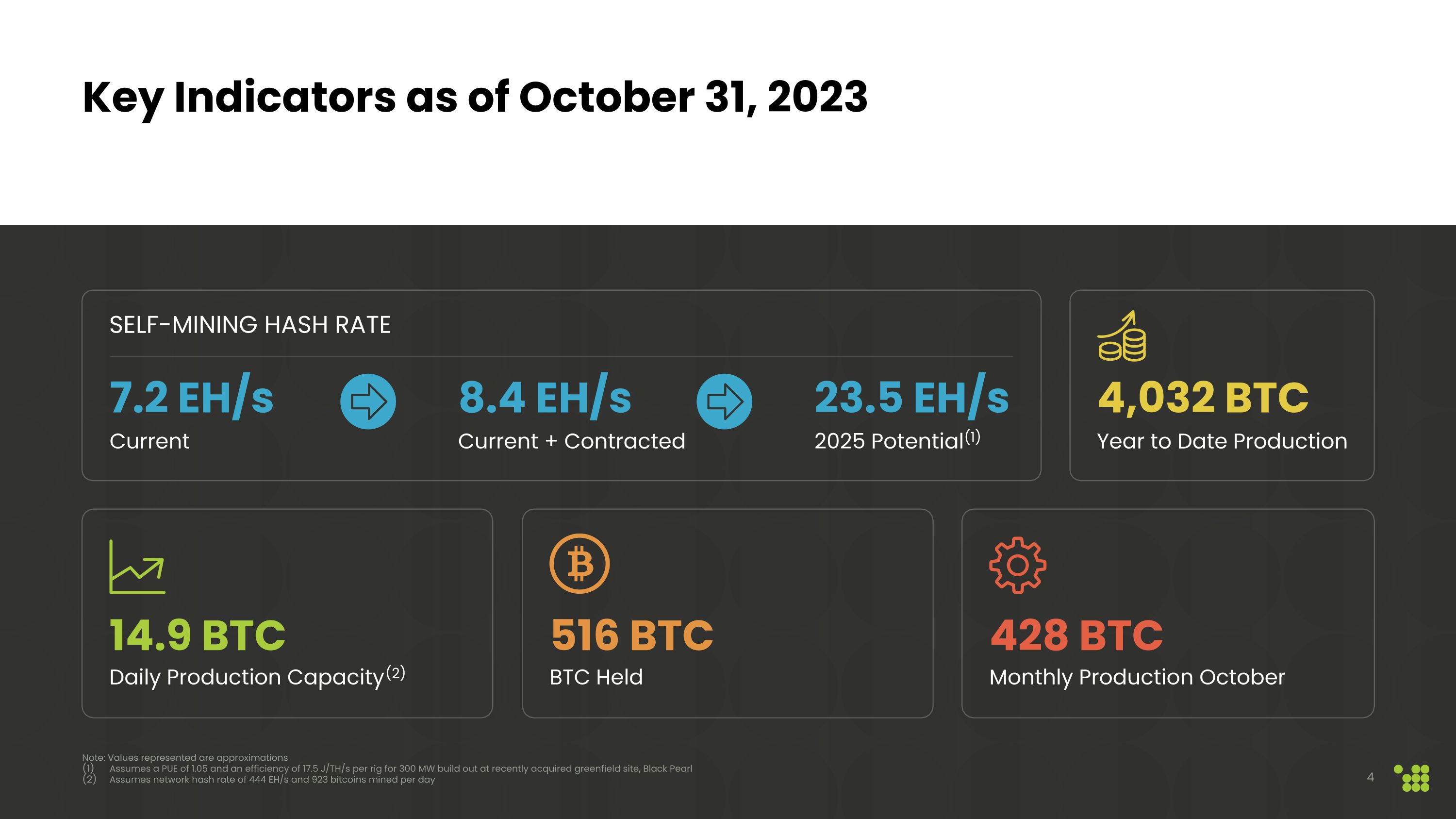

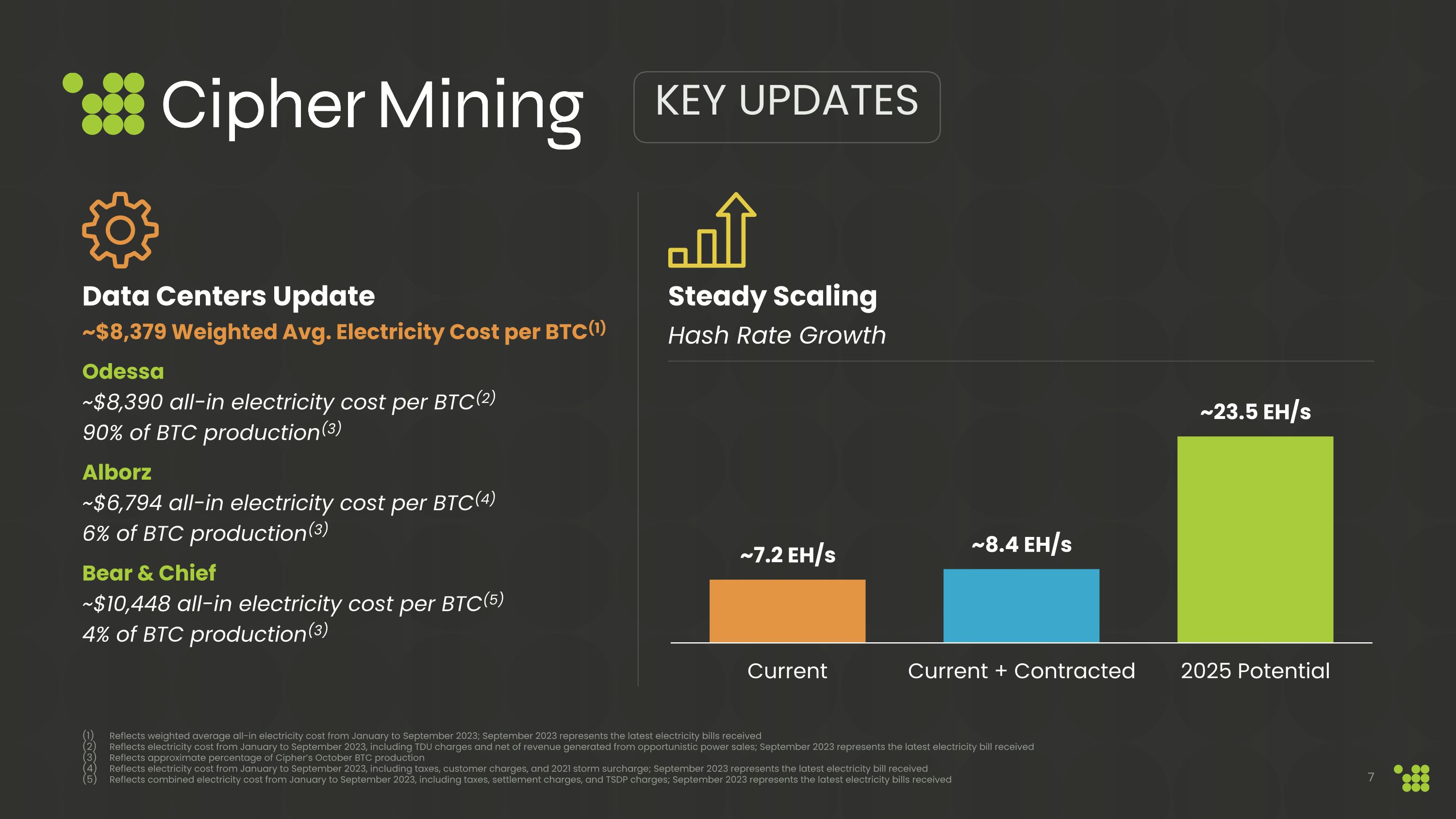

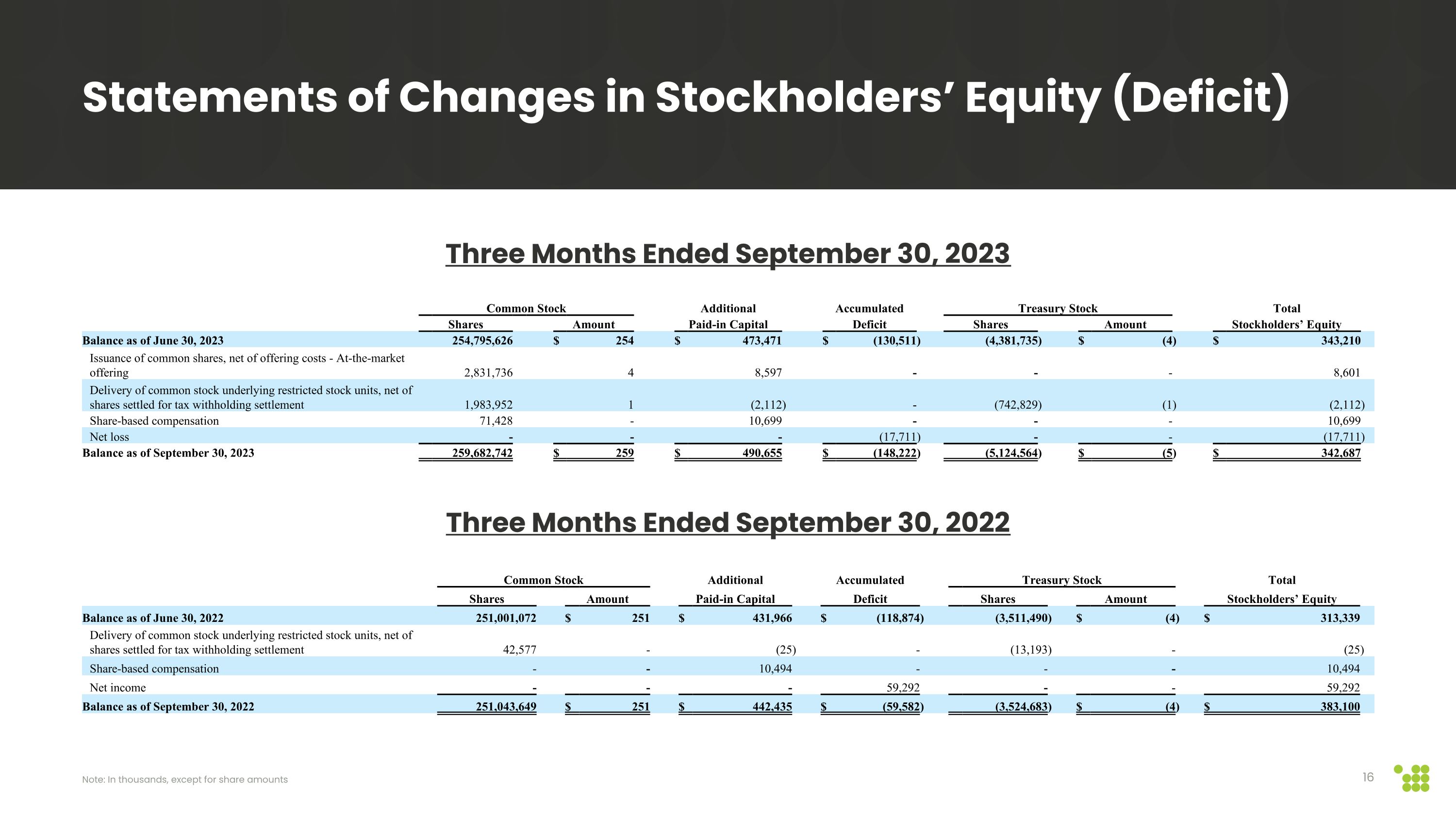

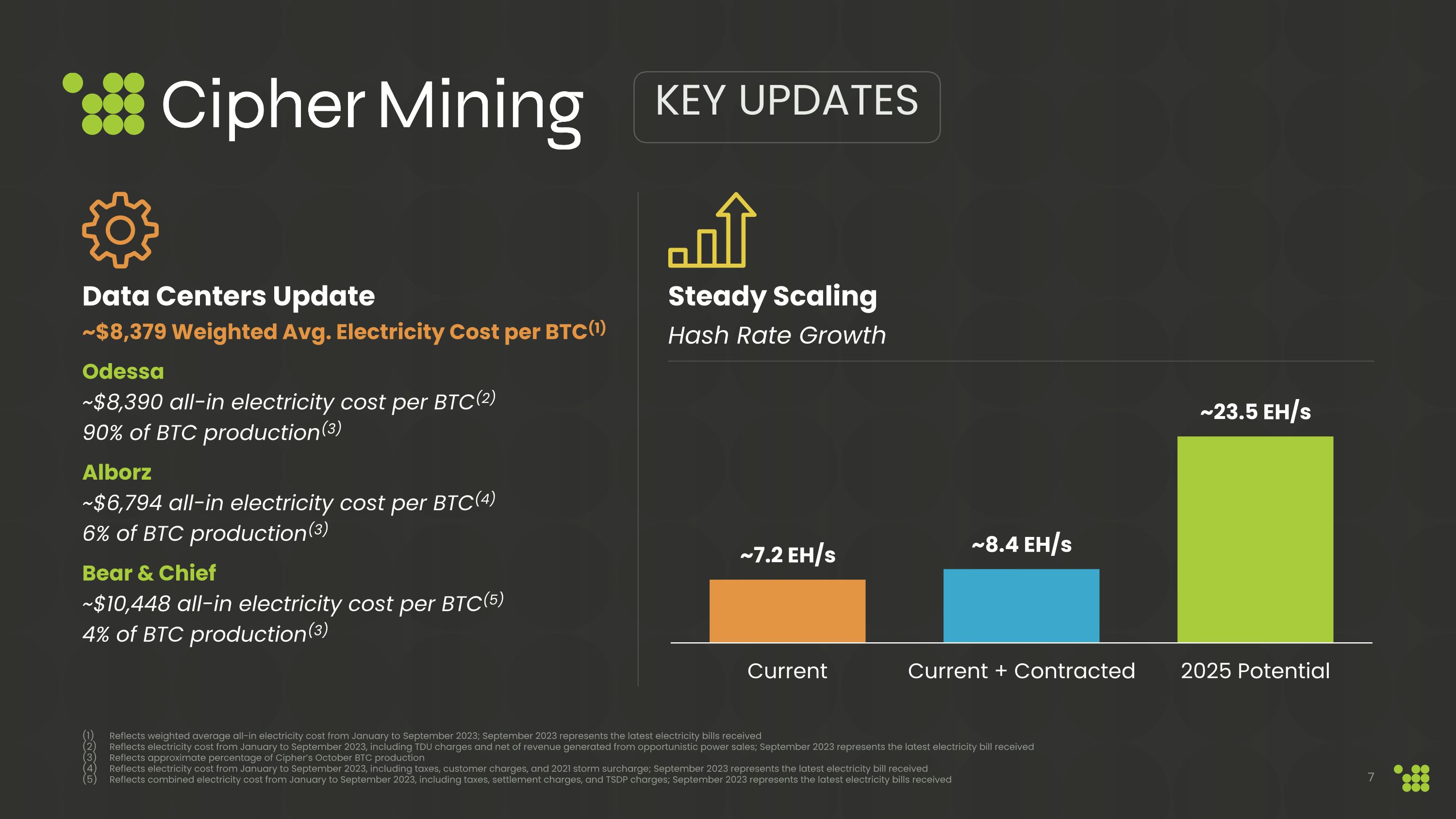

Key Indicators as of October 31, 2023 14.9 BTC Daily Production Capacity(2) 516 BTC BTC Held 4,032 BTC Year to Date Production 428 BTC Monthly Production October 7.2 EH/s Current 23.5 EH/s 2025 Potential(1) Self-Mining Hash rate Note: Values represented are approximations Assumes a PUE of 1.05 and an efficiency of 17.5 J/TH/s per rig for 300 MW build out at recently acquired greenfield site, Black Pearl Assumes network hash rate of 444 EH/s and 923 bitcoins mined per day 8.4 EH/s Current + Contracted

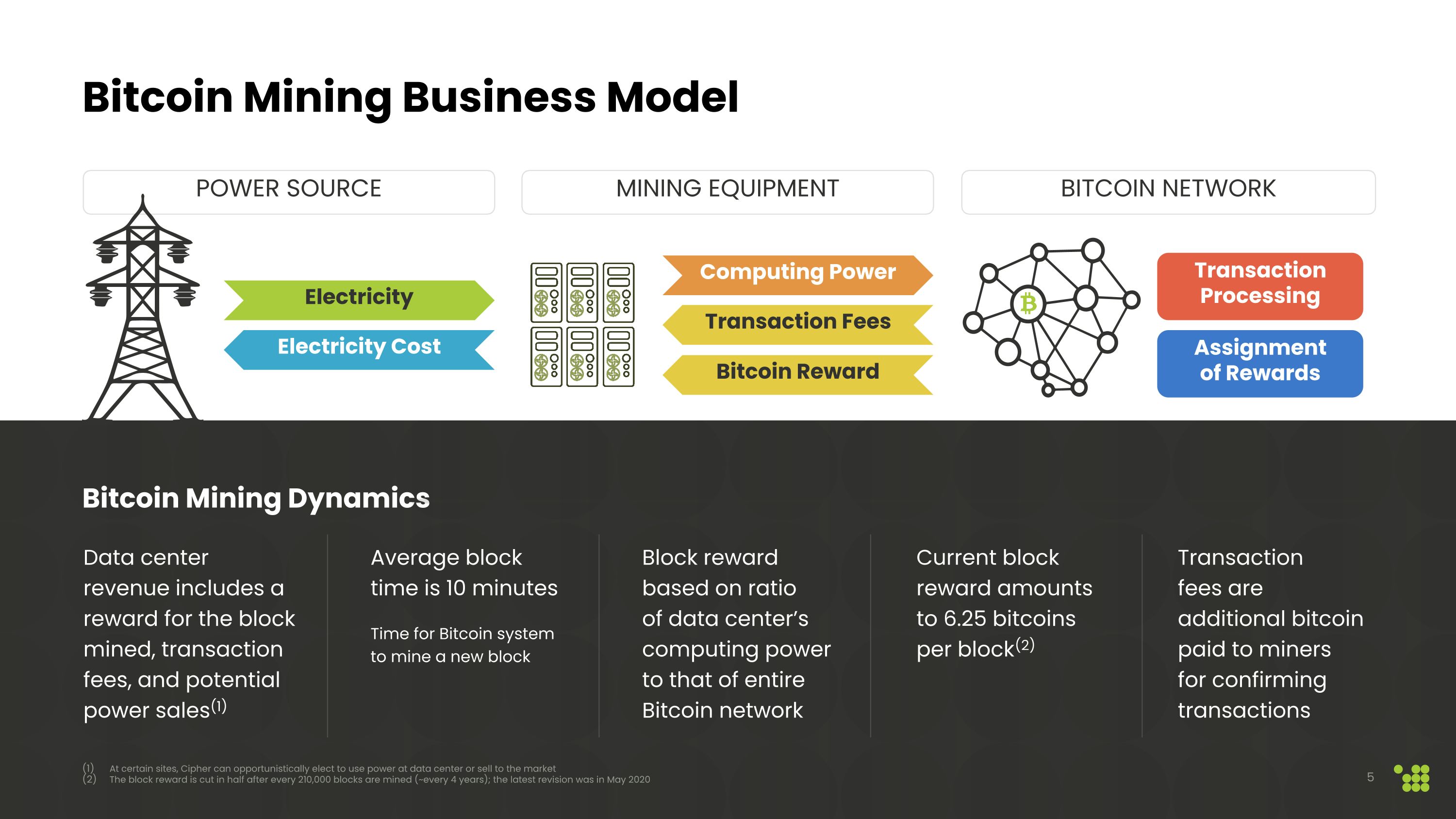

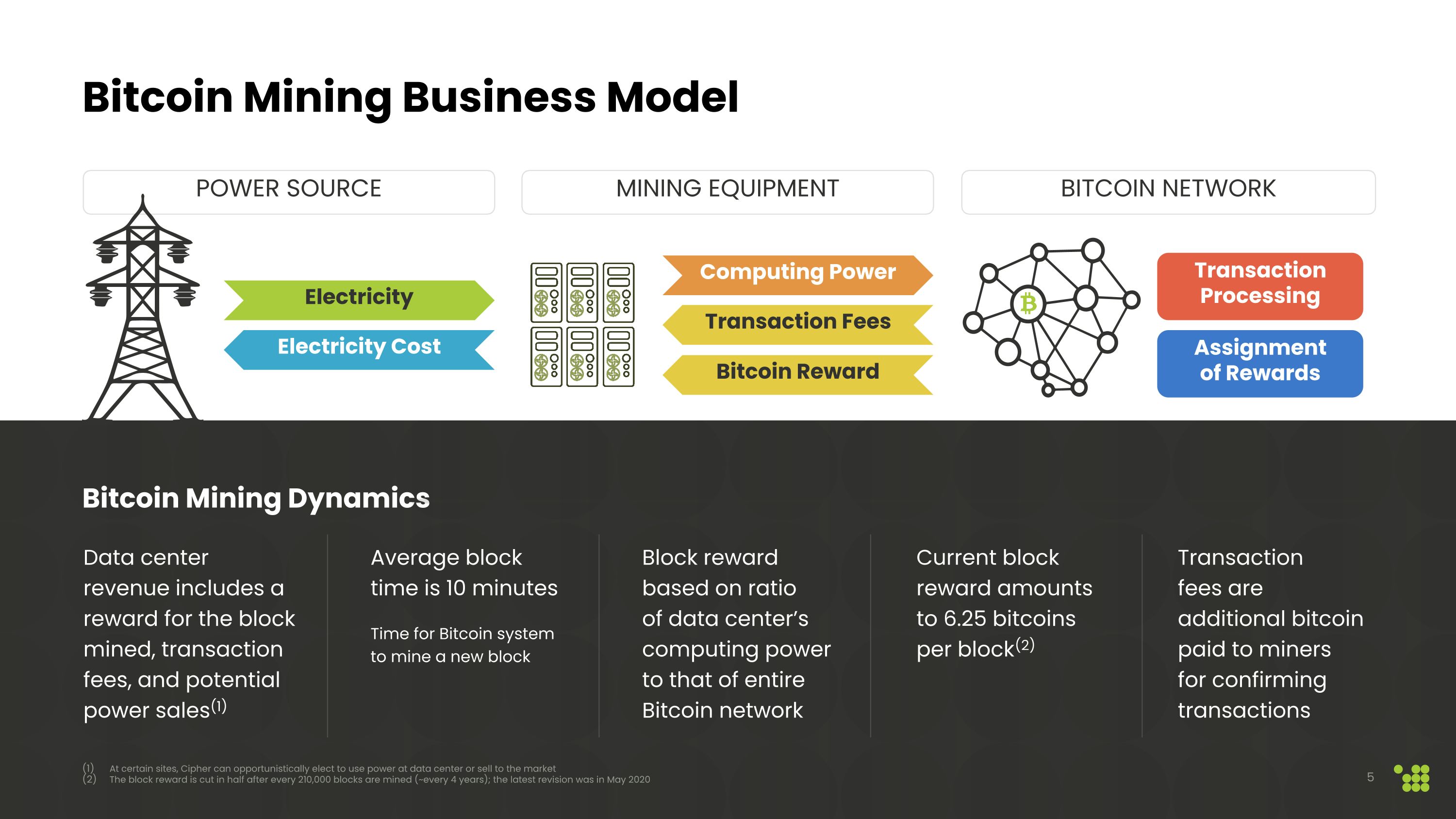

Bitcoin Mining Business Model POWER SOURCE MINING EQUIPMENT BITCOIN NETWORK Data center revenue includes a reward for the block mined, transaction fees, and potential power sales(1) Average block time is 10 minutes Time for Bitcoin system �to mine a new block Block reward based on ratio �of data center’s computing power to that of entire Bitcoin network Current block reward amounts �to 6.25 bitcoins �per block(2) Transaction �fees are �additional bitcoin paid to miners �for confirming transactions Bitcoin Mining Dynamics Electricity Electricity Cost Computing Power Transaction Fees Bitcoin Reward Transaction �Processing Assignment �of Rewards 5 At certain sites, Cipher can opportunistically elect to use power at data center or sell to the market The block reward is cut in half after every 210,000 blocks are mined (~every 4 years); the latest revision was in May 2020

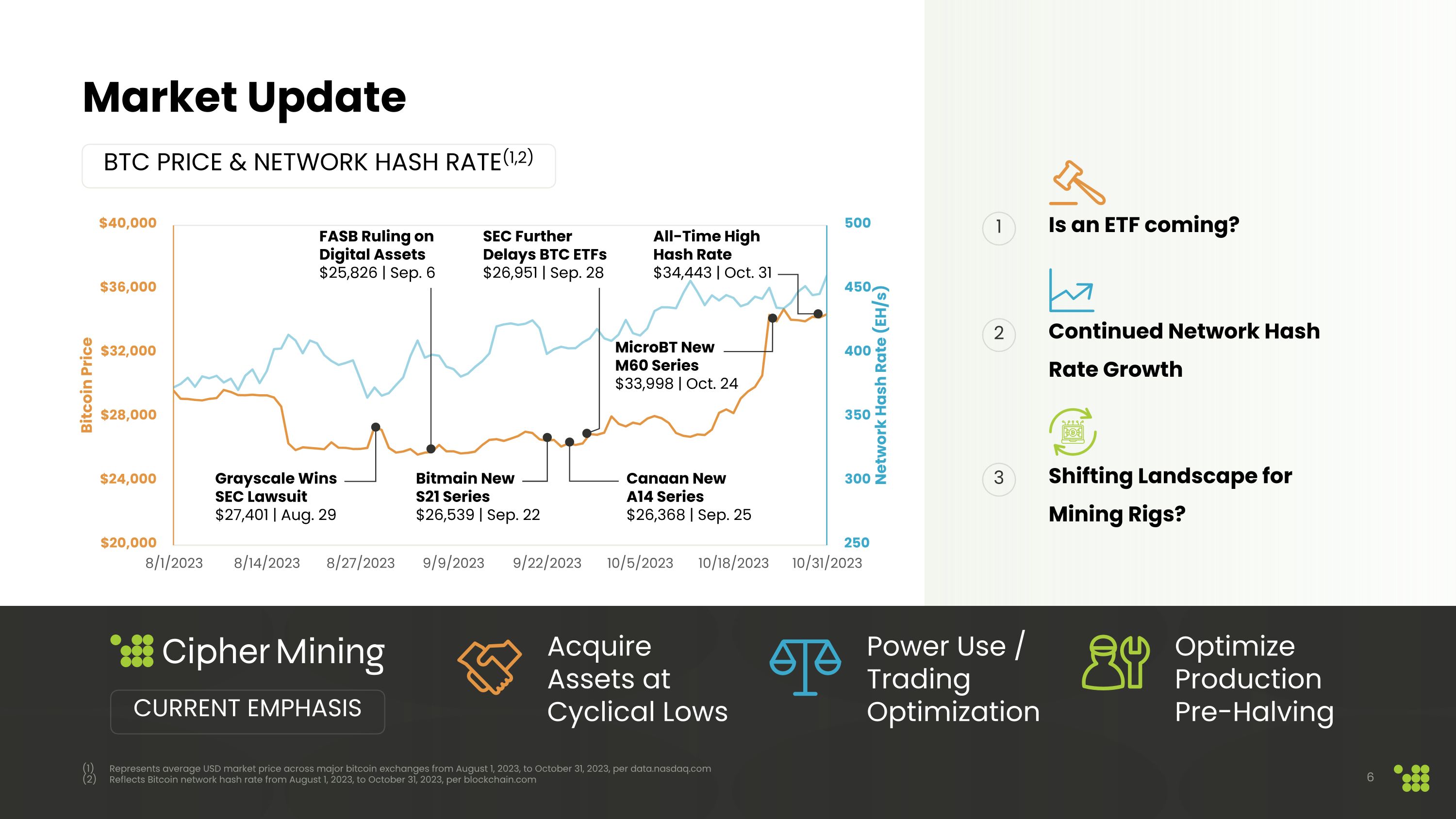

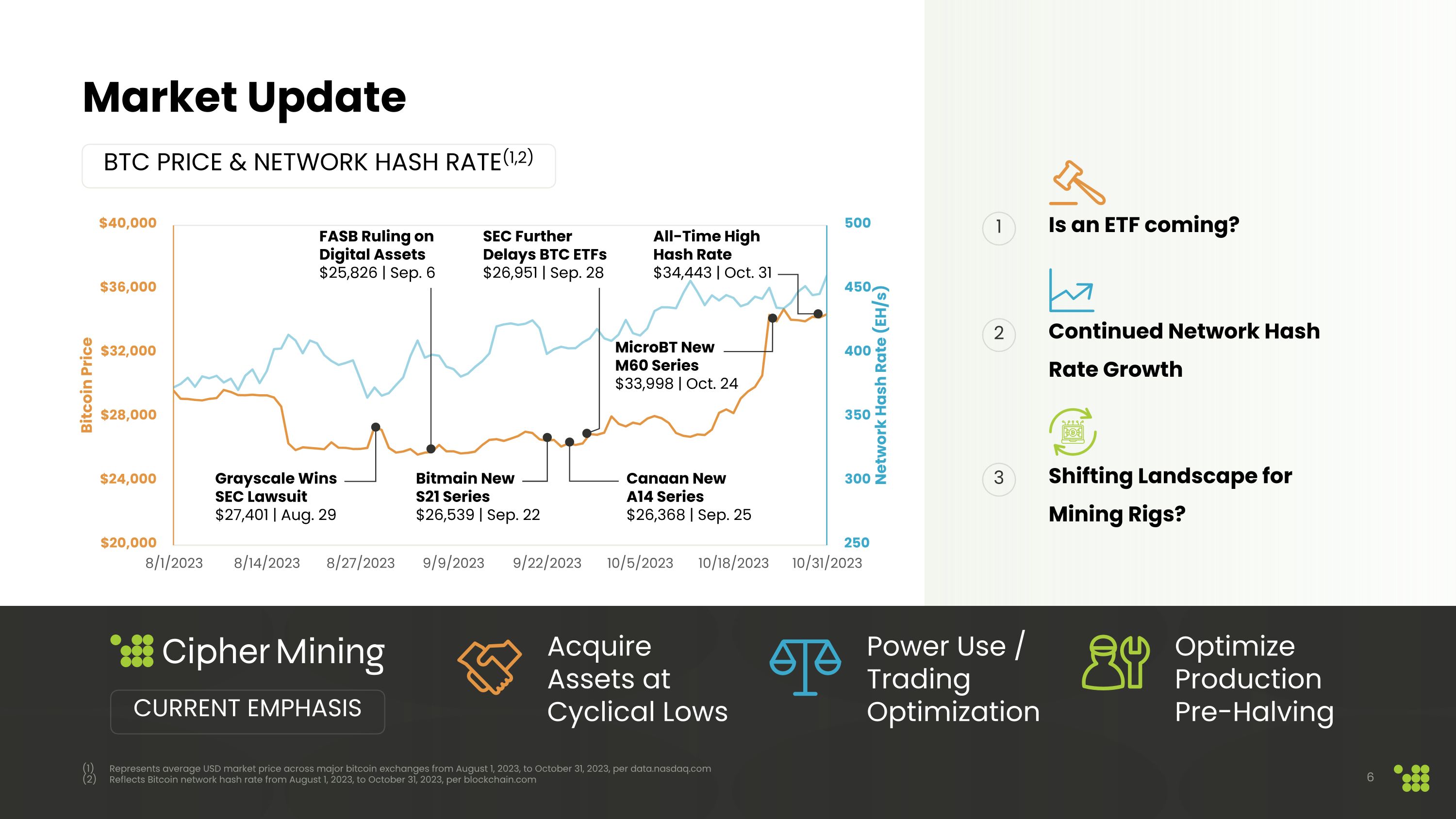

Is an ETF coming? Continued Network Hash Rate Growth Shifting Landscape for Mining Rigs? Represents average USD market price across major bitcoin exchanges from August 1, 2023, to October 31, 2023, per data.nasdaq.com Reflects Bitcoin network hash rate from August 1, 2023, to October 31, 2023, per blockchain.com BTC Price & Network Hash rate(1,2) Current emphasis 1 2 Acquire Assets at Cyclical Lows Power Use / Trading Optimization Optimize Production Pre-Halving Grayscale Wins SEC Lawsuit $27,401 | Aug. 29 FASB Ruling on Digital Assets $25,826 | Sep. 6 Bitmain New S21 Series $26,539 | Sep. 22 Canaan New A14 Series $26,368 | Sep. 25 SEC Further Delays BTC ETFs $26,951 | Sep. 28 All-Time High Hash Rate $34,443 | Oct. 31 MicroBT New M60 Series $33,998 | Oct. 24 Market Update 3

Data Centers Update ~$8,379 Weighted Avg. Electricity Cost per BTC(1) Odessa �~$8,390 all-in electricity cost per BTC(2) 90% of BTC production(3) Alborz �~$6,794 all-in electricity cost per BTC(4) 6% of BTC production(3) Bear & Chief ~$10,448 all-in electricity cost per BTC(5) 4% of BTC production(3) Steady Scaling KEY UPDATES Reflects weighted average all-in electricity cost from January to September 2023; September 2023 represents the latest electricity bills received Reflects electricity cost from January to September 2023, including TDU charges and net of revenue generated from opportunistic power sales; September 2023 represents the latest electricity bill received Reflects approximate percentage of Cipher’s October BTC production Reflects electricity cost from January to September 2023, including taxes, customer charges, and 2021 storm surcharge; September 2023 represents the latest electricity bill received Reflects combined electricity cost from January to September 2023, including taxes, settlement charges, and TSDP charges; September 2023 represents the latest electricity bills received 7 Hash Rate Growth

Operational Highlights Reflects approximate percentage of Cipher’s October BTC production YTD through October 2023 Reflects electricity cost from January to September 2023, including TDU charges and net of revenue generated from opportunistic power sales; September 2023 represents the latest electricity bill received Estimated for October 2023; assumes full up-time, network hash rate of 444 EH/s and 923 bitcoins mined per day Odessa ~$8,390 All-in Electricity �Cost per BTC(3) ~12.9 Daily BTC Mining Capacity(4) ~6.2 EH/s 207 MW Operating �Capacity ~3,531 BTC Mined �YTD(2) Odessa – 90% of BTC Production(1)

Operational Highlights Reflects approximate percentage of Cipher’s October BTC production Joint venture with WindHQ LLC, of which Cipher owns ~0.64 EH/s YTD through October 2023; joint venture with WindHQ LLC, of which Cipher owns ~295 BTC Reflects electricity cost from January to September 2023, including taxes, customer charges, and 2021 storm surcharge; September 2023 represents the latest electricity bill received Estimated for October 2023; assumes full up-time, network hash rate of 444 EH/s and 923 bitcoins mined per day Alborz ~$6,794 All-in Electricity �Cost per BTC(4) ~2.7 Daily BTC Mining Capacity(5) ~1.3 EH/s 40 MW Operating �Capacity(2) ~603 BTC Mined �YTD(3) Alborz – 6% of BTC Production(1)

Operational Highlights Bear & Chief Reflects approximate percentage of Cipher’s October BTC production Joint venture with WindHQ LLC, of which Cipher owns ~0.32 EH/s YTD through October 2023; joint venture with WindHQ LLC, of which Cipher owns ~206 BTC Reflects combined electricity cost from January to September 2023, including taxes, settlement charges, and TSDP charges; September 2023 represents the latest electricity bills received Estimated for October 2023; assumes full up-time, network hash rate of 444 EH/s and 923 bitcoins mined per day ~$10,448 All-in Electricity �Cost per BTC(4) ~1.4 Daily BTC Mining Capacity(5) ~0.65 EH/s 20 MW Operating �Capacity(2) ~421 BTC Mined �YTD(3) Bear & Chief – 4% of BTC Production(1)

Financial Update

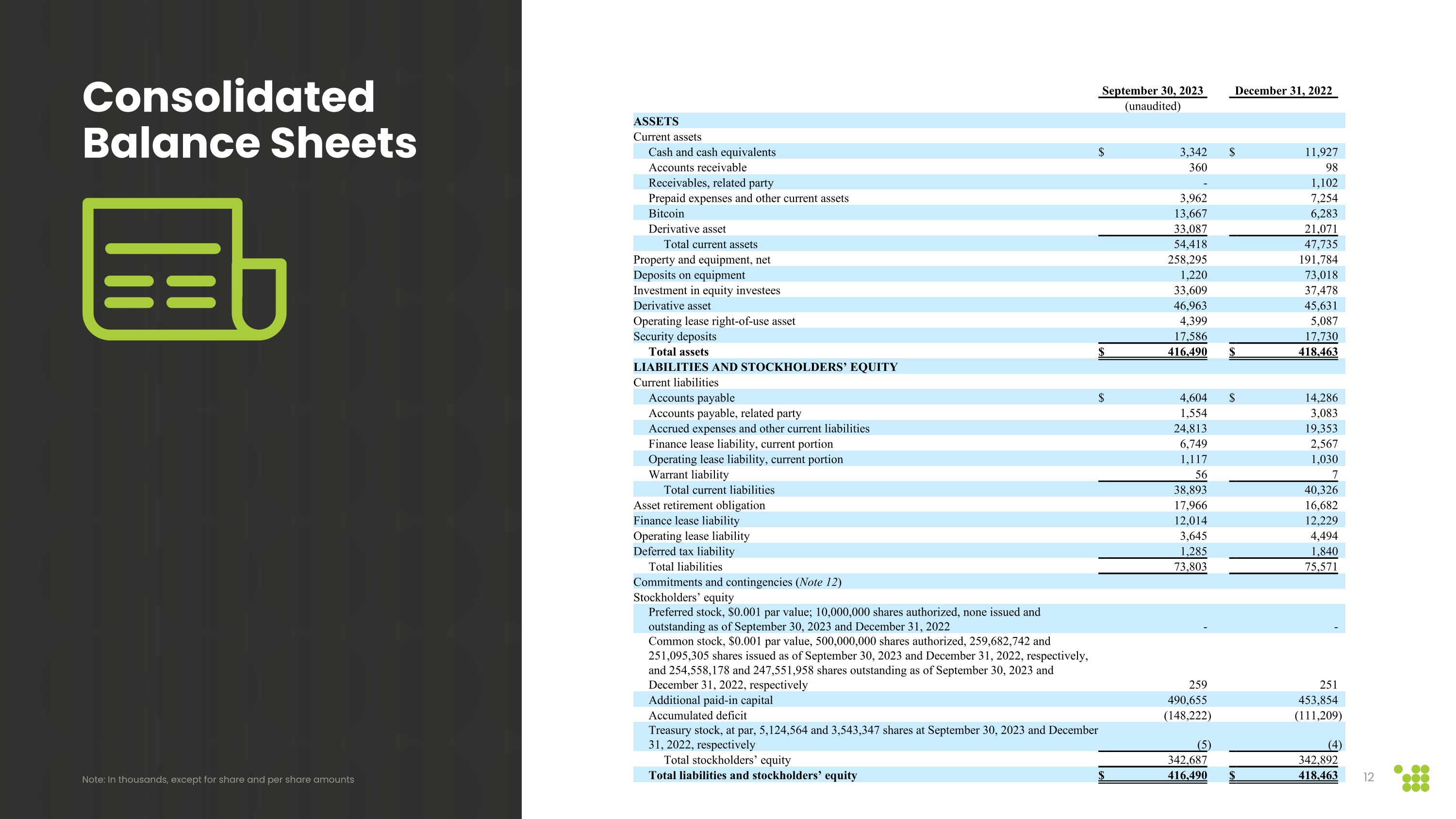

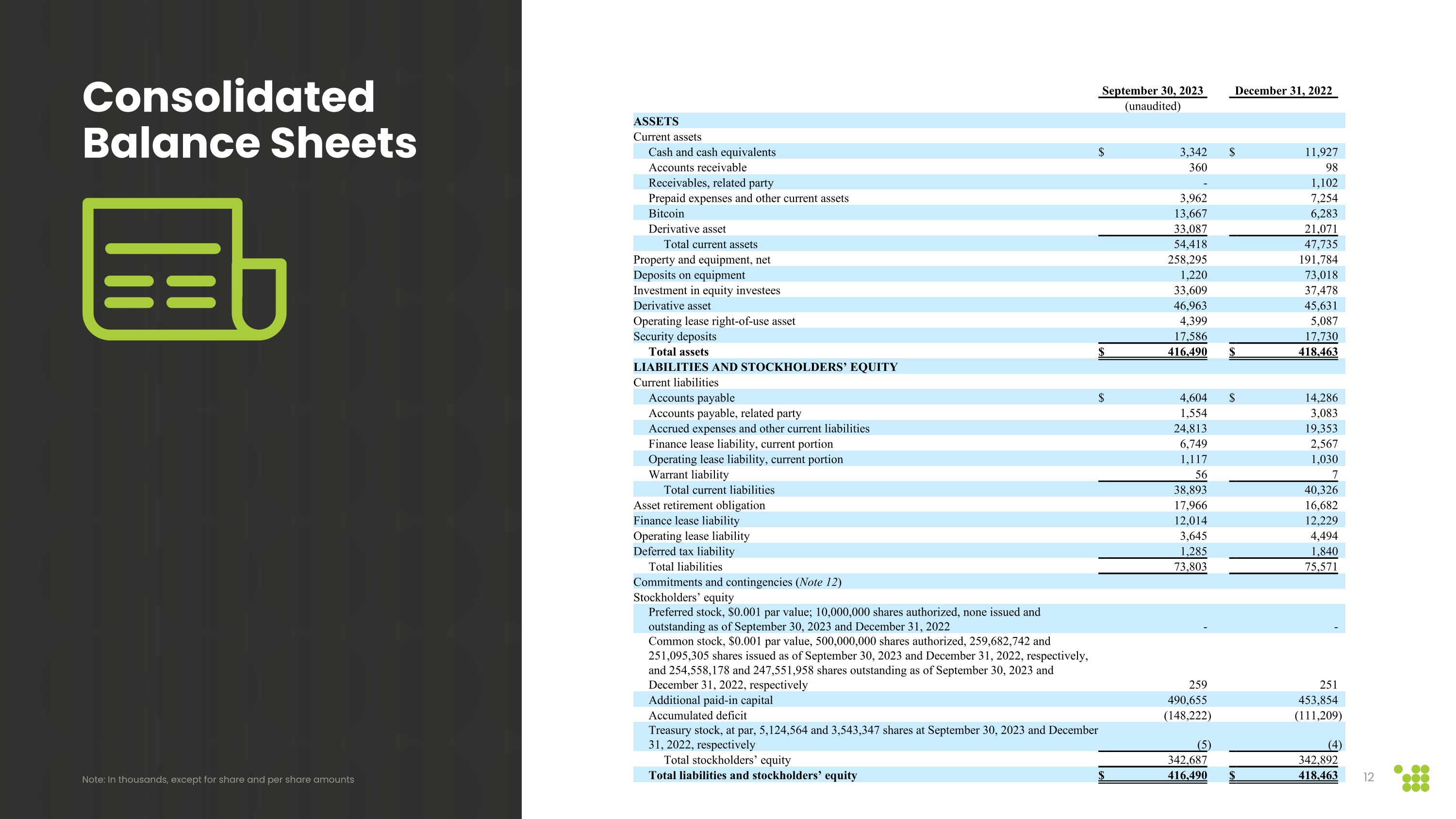

September 30, 2023 December 31, 2022 (unaudited) ASSETS Current assets Cash and cash equivalents $ 3,342 $ 11,927 Accounts receivable 360 98 Receivables, related party - 1,102 Prepaid expenses and other current assets 3,962 7,254 Bitcoin 13,667 6,283 Derivative asset 33,087 21,071 Total current assets 54,418 47,735 Property and equipment, net 258,295 191,784 Deposits on equipment 1,220 73,018 Investment in equity investees 33,609 37,478 Derivative asset 46,963 45,631 Operating lease right-of-use asset 4,399 5,087 Security deposits 17,586 17,730 Total assets $ 416,490 $ 418,463 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 4,604 $ 14,286 Accounts payable, related party 1,554 3,083 Accrued expenses and other current liabilities 24,813 19,353 Finance lease liability, current portion 6,749 2,567 Operating lease liability, current portion 1,117 1,030 Warrant liability 56 7 Total current liabilities 38,893 40,326 Asset retirement obligation 17,966 16,682 Finance lease liability 12,014 12,229 Operating lease liability 3,645 4,494 Deferred tax liability 1,285 1,840 Total liabilities 73,803 75,571 Commitments and contingencies (Note 12) Stockholders’ equity Preferred stock, $0.001 par value; 10,000,000 shares authorized, none issued and outstanding as of September 30, 2023 and December 31, 2022 - - Common stock, $0.001 par value, 500,000,000 shares authorized, 259,682,742 and 251,095,305 shares issued as of September 30, 2023 and December 31, 2022, respectively, and 254,558,178 and 247,551,958 shares outstanding as of September 30, 2023 and December 31, 2022, respectively 259 251 Additional paid-in capital 490,655 453,854 Accumulated deficit (148,222 ) (111,209 ) Treasury stock, at par, 5,124,564 and 3,543,347 shares at September 30, 2023 and December 31, 2022, respectively (5 ) (4 ) Total stockholders’ equity 342,687 342,892 Total liabilities and stockholders’ equity $ 416,490 $ 418,463 Consolidated Balance Sheets Note: In thousands, except for share and per share amounts

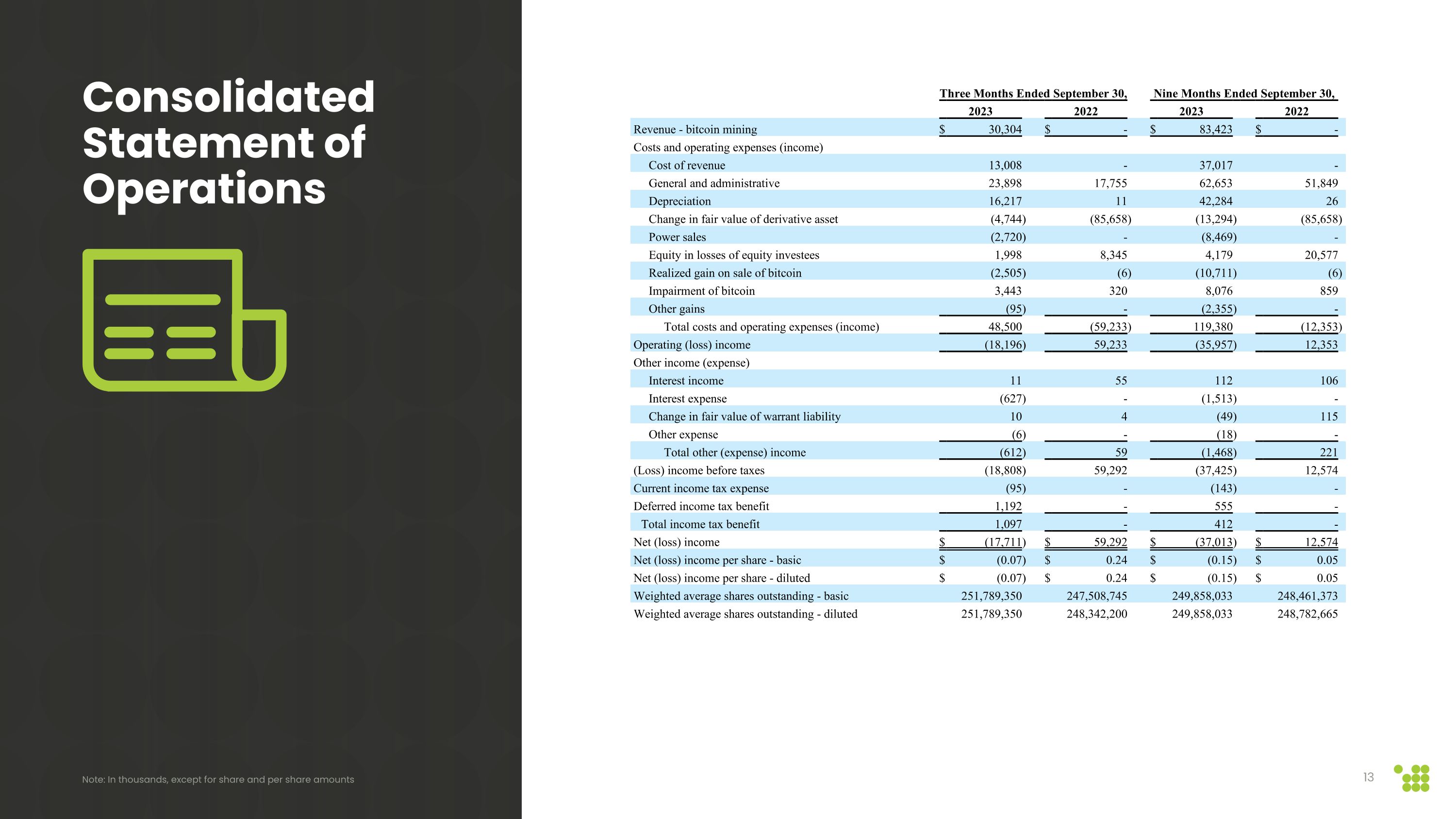

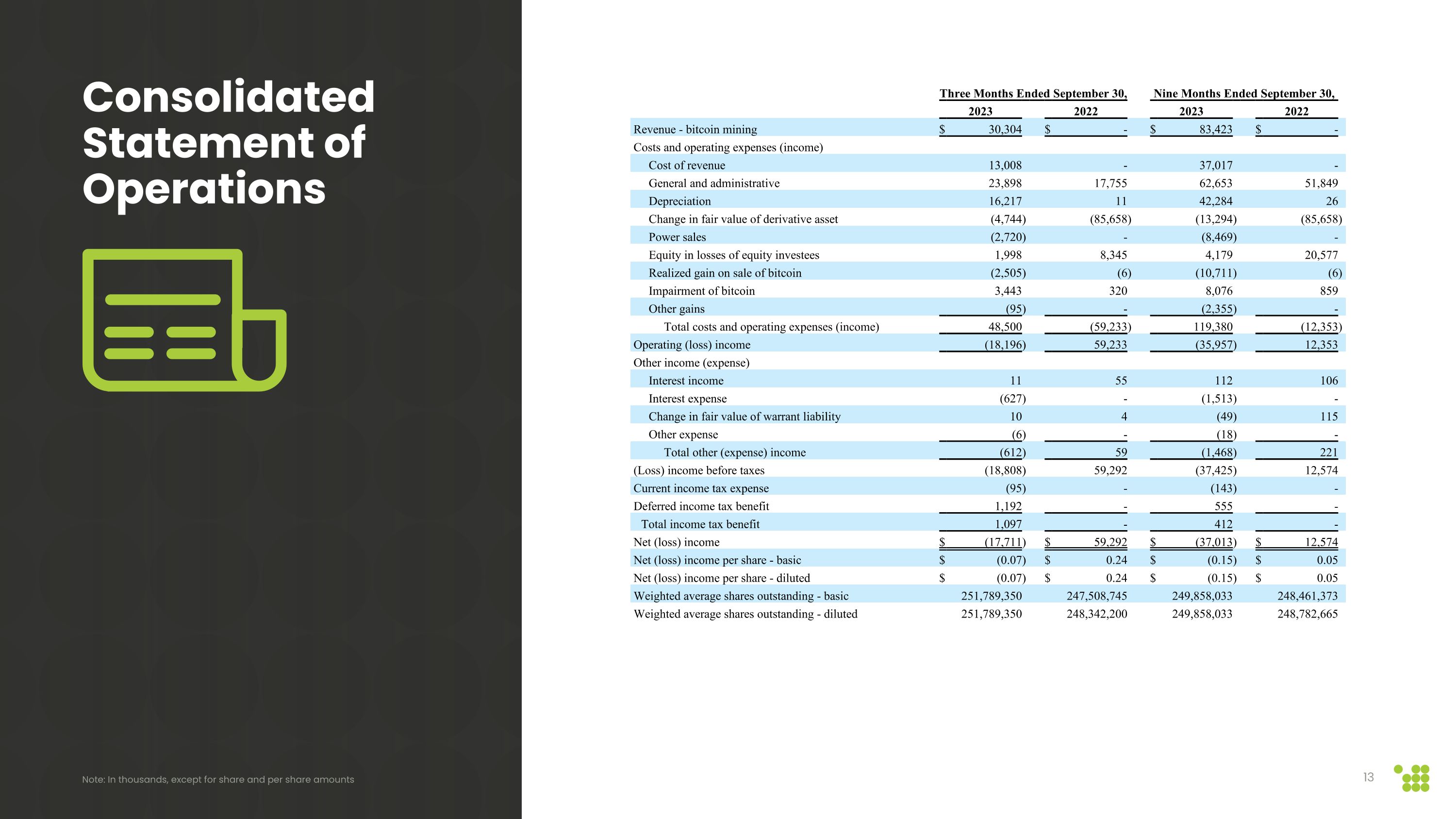

Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Revenue - bitcoin mining $ 30,304 $ - $ 83,423 $ - Costs and operating expenses (income) Cost of revenue 13,008 - 37,017 - General and administrative 23,898 17,755 62,653 51,849 Depreciation 16,217 11 42,284 26 Change in fair value of derivative asset (4,744 ) (85,658 ) (13,294 ) (85,658 ) Power sales (2,720 ) - (8,469 ) - Equity in losses of equity investees 1,998 8,345 4,179 20,577 Realized gain on sale of bitcoin (2,505 ) (6 ) (10,711 ) (6 ) Impairment of bitcoin 3,443 320 8,076 859 Other gains (95 ) - (2,355 ) - Total costs and operating expenses (income) 48,500 (59,233 ) 119,380 (12,353 ) Operating (loss) income (18,196 ) 59,233 (35,957 ) 12,353 Other income (expense) Interest income 11 55 112 106 Interest expense (627 ) - (1,513 ) - Change in fair value of warrant liability 10 4 (49 ) 115 Other expense (6 ) - (18 ) - Total other (expense) income (612 ) 59 (1,468 ) 221 (Loss) income before taxes (18,808 ) 59,292 (37,425 ) 12,574 Current income tax expense (95 ) - (143 ) - Deferred income tax benefit 1,192 - 555 - Total income tax benefit 1,097 - 412 - Net (loss) income $ (17,711 ) $ 59,292 $ (37,013 ) $ 12,574 Net (loss) income per share - basic $ (0.07 ) $ 0.24 $ (0.15 ) $ 0.05 Net (loss) income per share - diluted $ (0.07 ) $ 0.24 $ (0.15 ) $ 0.05 Weighted average shares outstanding - basic 251,789,350 247,508,745 249,858,033 248,461,373 Weighted average shares outstanding - diluted 251,789,350 248,342,200 249,858,033 248,782,665 Consolidated Statement of Operations Note: In thousands, except for share and per share amounts

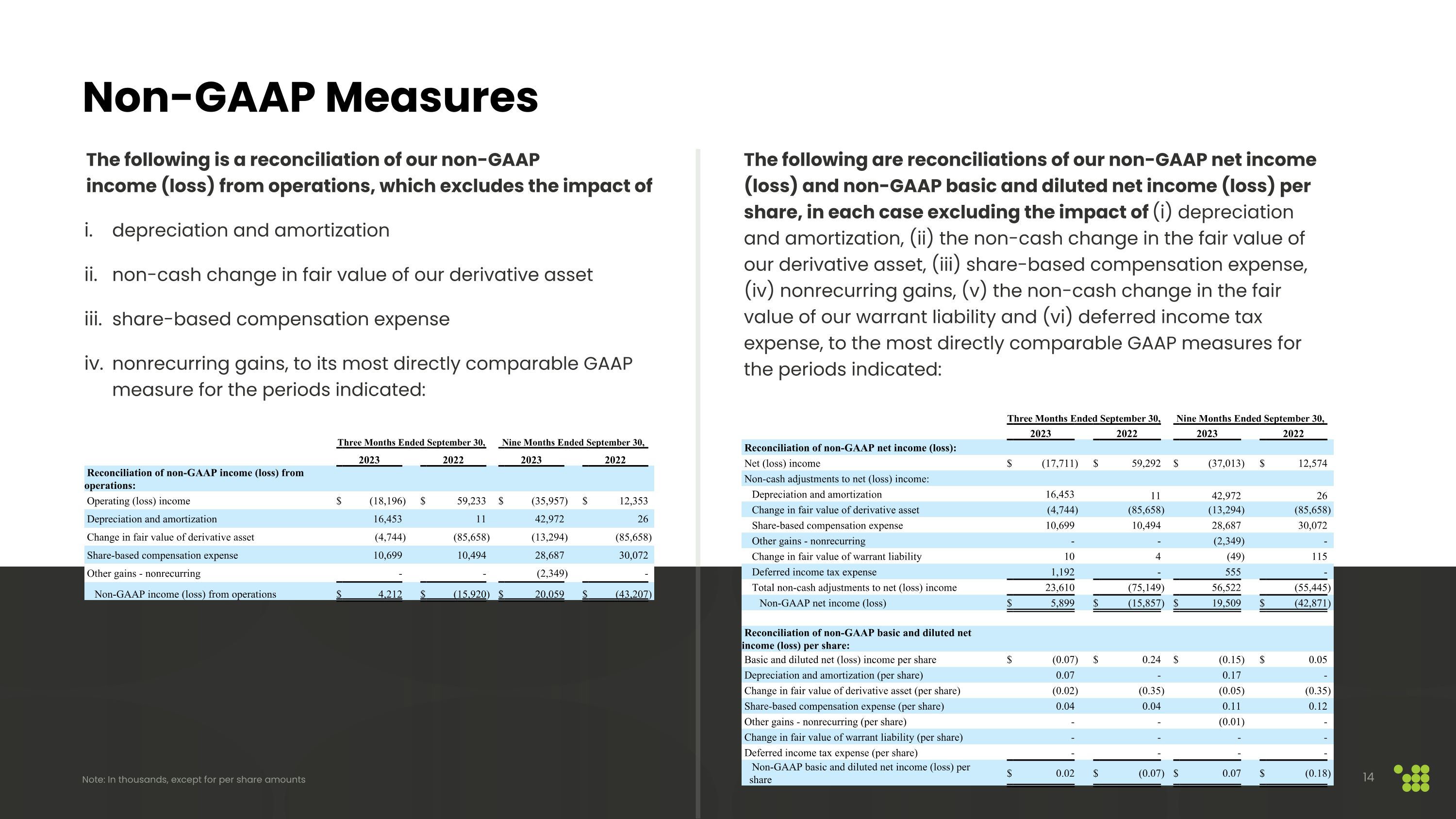

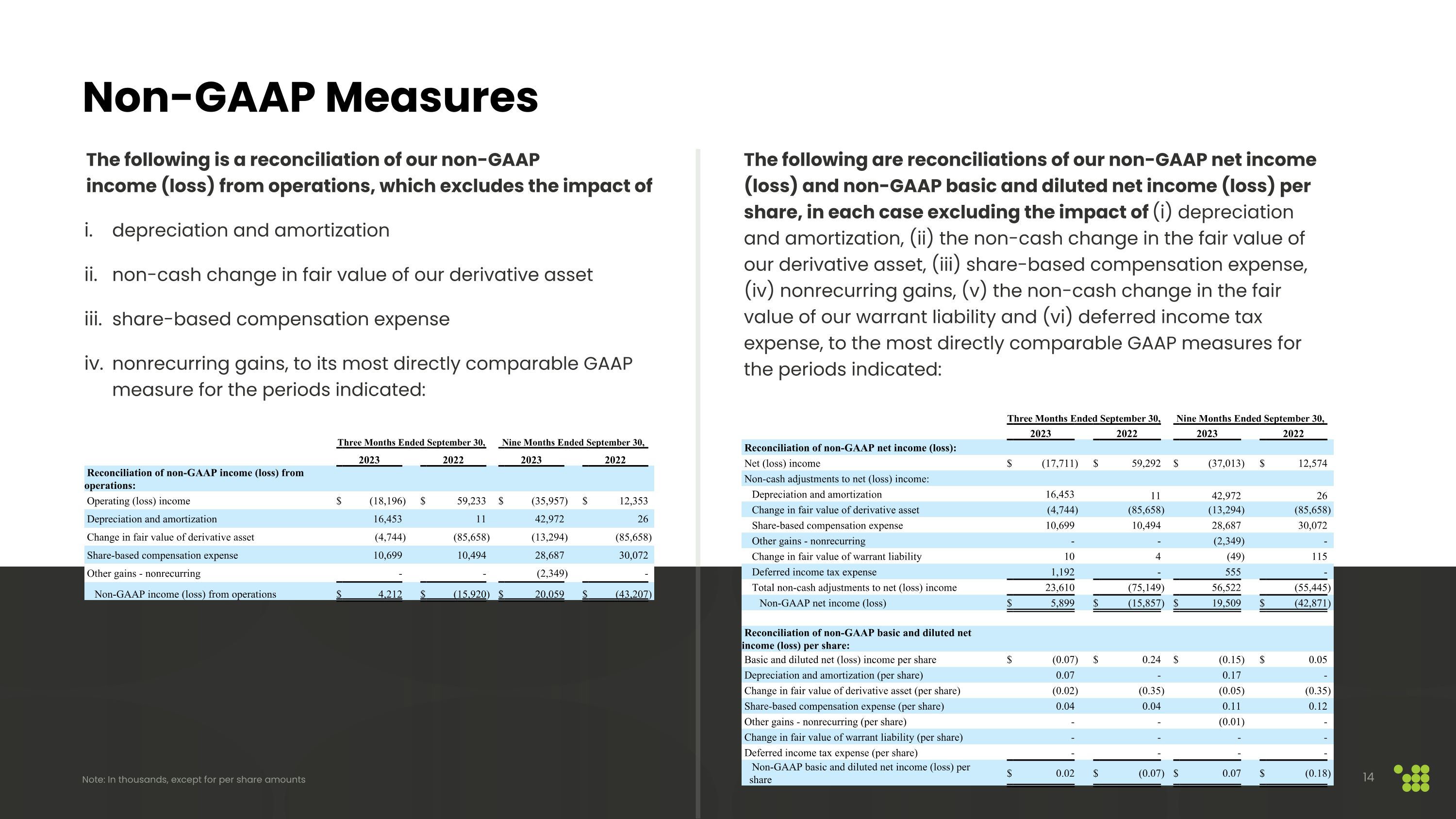

Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Reconciliation of non-GAAP net income (loss): Net (loss) income $ (17,711 ) $ 59,292 $ (37,013 ) $ 12,574 Non-cash adjustments to net (loss) income: Depreciation and amortization 16,453 11 42,972 26 Change in fair value of derivative asset (4,744 ) (85,658 ) (13,294 ) (85,658 ) Share-based compensation expense 10,699 10,494 28,687 30,072 Other gains - nonrecurring - - (2,349 ) - Change in fair value of warrant liability 10 4 (49 ) 115 Deferred income tax expense 1,192 - 555 - Total non-cash adjustments to net (loss) income 23,610 (75,149 ) 56,522 (55,445 ) Non-GAAP net income (loss) $ 5,899 $ (15,857 ) $ 19,509 $ (42,871 ) Reconciliation of non-GAAP basic and diluted net income (loss) per share: Basic and diluted net (loss) income per share $ (0.07 ) $ 0.24 $ (0.15 ) $ 0.05 Depreciation and amortization (per share) 0.07 - 0.17 - Change in fair value of derivative asset (per share) (0.02 ) (0.35 ) (0.05 ) (0.35 ) Share-based compensation expense (per share) 0.04 0.04 0.11 0.12 Other gains - nonrecurring (per share) - - (0.01 ) - Change in fair value of warrant liability (per share) - - - - Deferred income tax expense (per share) - - - - Non-GAAP basic and diluted net income (loss) per share $ 0.02 $ (0.07 ) $ 0.07 $ (0.18 ) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Reconciliation of non-GAAP income (loss) from operations: Operating (loss) income $ (18,196 ) $ 59,233 $ (35,957 ) $ 12,353 Depreciation and amortization 16,453 11 42,972 26 Change in fair value of derivative asset (4,744 ) (85,658 ) (13,294 ) (85,658 ) Share-based compensation expense 10,699 10,494 28,687 30,072 Other gains - nonrecurring - - (2,349 ) - Non-GAAP income (loss) from operations $ 4,212 $ (15,920 ) $ 20,059 $ (43,207 ) Non-GAAP Measures Note: In thousands, except for per share amounts The following is a reconciliation of our non-GAAP �income (loss) from operations, which excludes the impact of depreciation and amortization non-cash change in fair value of our derivative asset share-based compensation expense nonrecurring gains, to its most directly comparable GAAP measure for the periods indicated: The following are reconciliations of our non-GAAP net income (loss) and non-GAAP basic and diluted net income (loss) per share, in each case excluding the impact of (i) depreciation and amortization, (ii) the non-cash change in the fair value of our derivative asset, (iii) share-based compensation expense, (iv) nonrecurring gains, (v) the non-cash change in the fair value of our warrant liability and (vi) deferred income tax expense, to the most directly comparable GAAP measures for the periods indicated:

Appendix

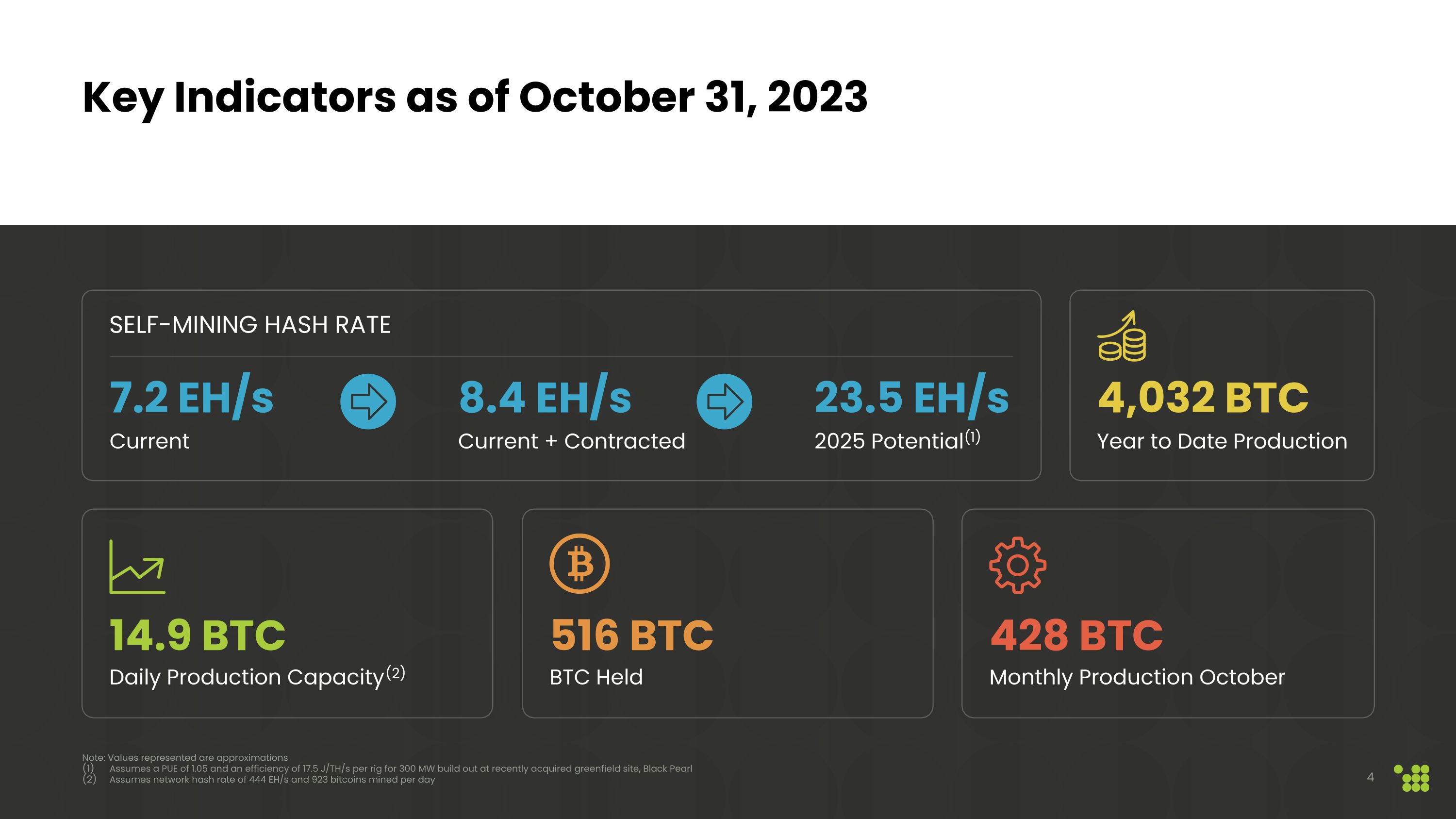

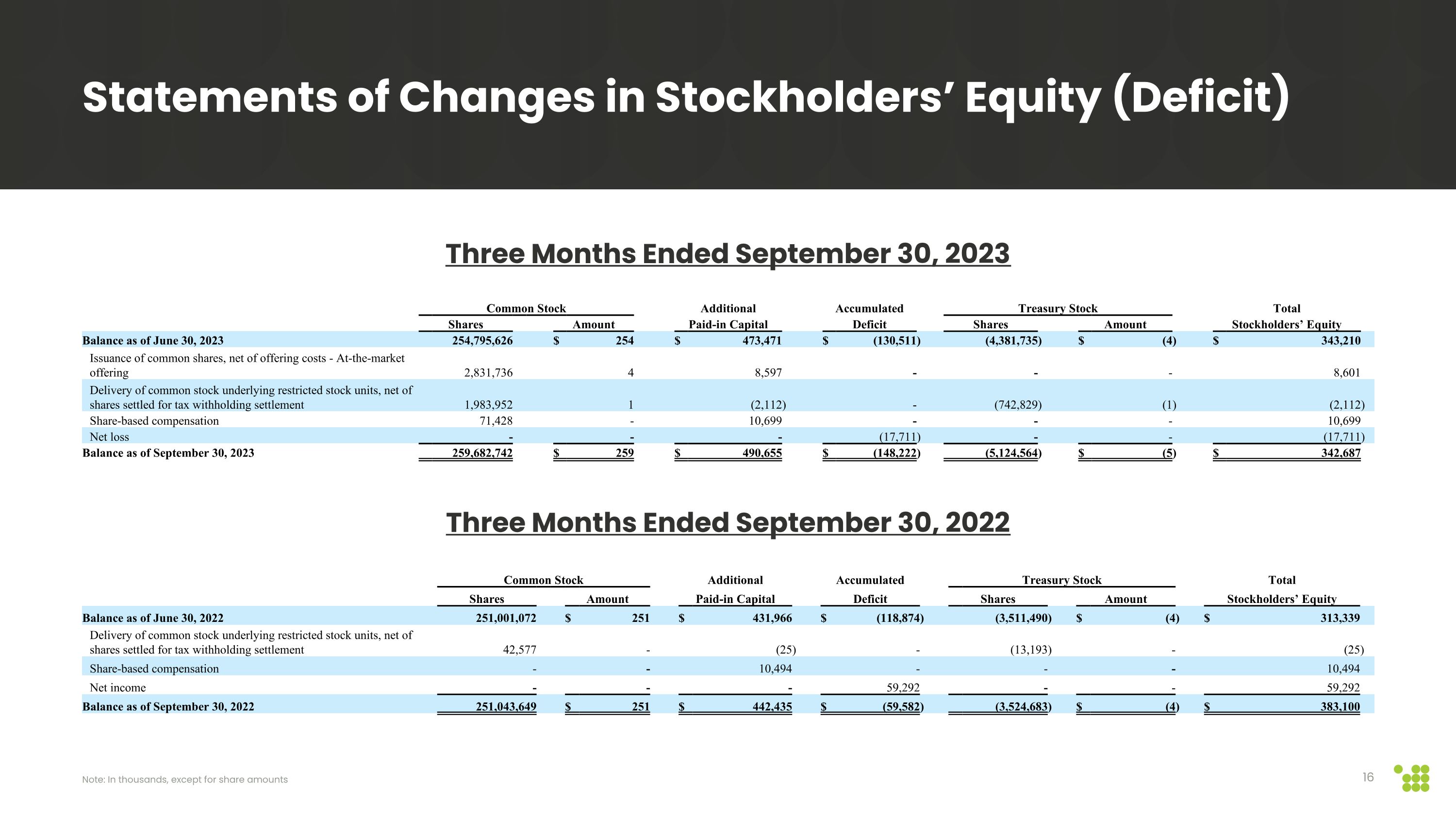

Common Stock Additional Accumulated Treasury Stock Total Shares Amount Paid-in Capital Deficit Shares Amount Stockholders’ Equity Balance as of June 30, 2022 251,001,072 $ 251 $ 431,966 $ (118,874 ) (3,511,490 ) $ (4 ) $ 313,339 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 42,577 - (25 ) - (13,193 ) - (25 ) Share-based compensation - - 10,494 - - - 10,494 Net income - - - 59,292 - - 59,292 Balance as of September 30, 2022 251,043,649 $ 251 $ 442,435 $ (59,582 ) (3,524,683 ) $ (4 ) $ 383,100 Common Stock Additional Accumulated Treasury Stock Total Shares Amount Paid-in Capital Deficit Shares Amount Stockholders’ Equity Balance as of June 30, 2023 254,795,626 $ 254 $ 473,471 $ (130,511 ) (4,381,735 ) $ (4 ) $ 343,210 Issuance of common shares, net of offering costs - At-the-market offering 2,831,736 4 8,597 - - - 8,601 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 1,983,952 1 (2,112 ) - (742,829 ) (1 ) (2,112 ) Share-based compensation 71,428 - 10,699 - - - 10,699 Net loss - - - (17,711 ) - - (17,711 ) Balance as of September 30, 2023 259,682,742 $ 259 $ 490,655 $ (148,222 ) (5,124,564 ) $ (5 ) $ 342,687 Statements of Changes in Stockholders’ Equity (Deficit) Note: In thousands, except for share amounts Three Months Ended September 30, 2023 Three Months Ended September 30, 2022

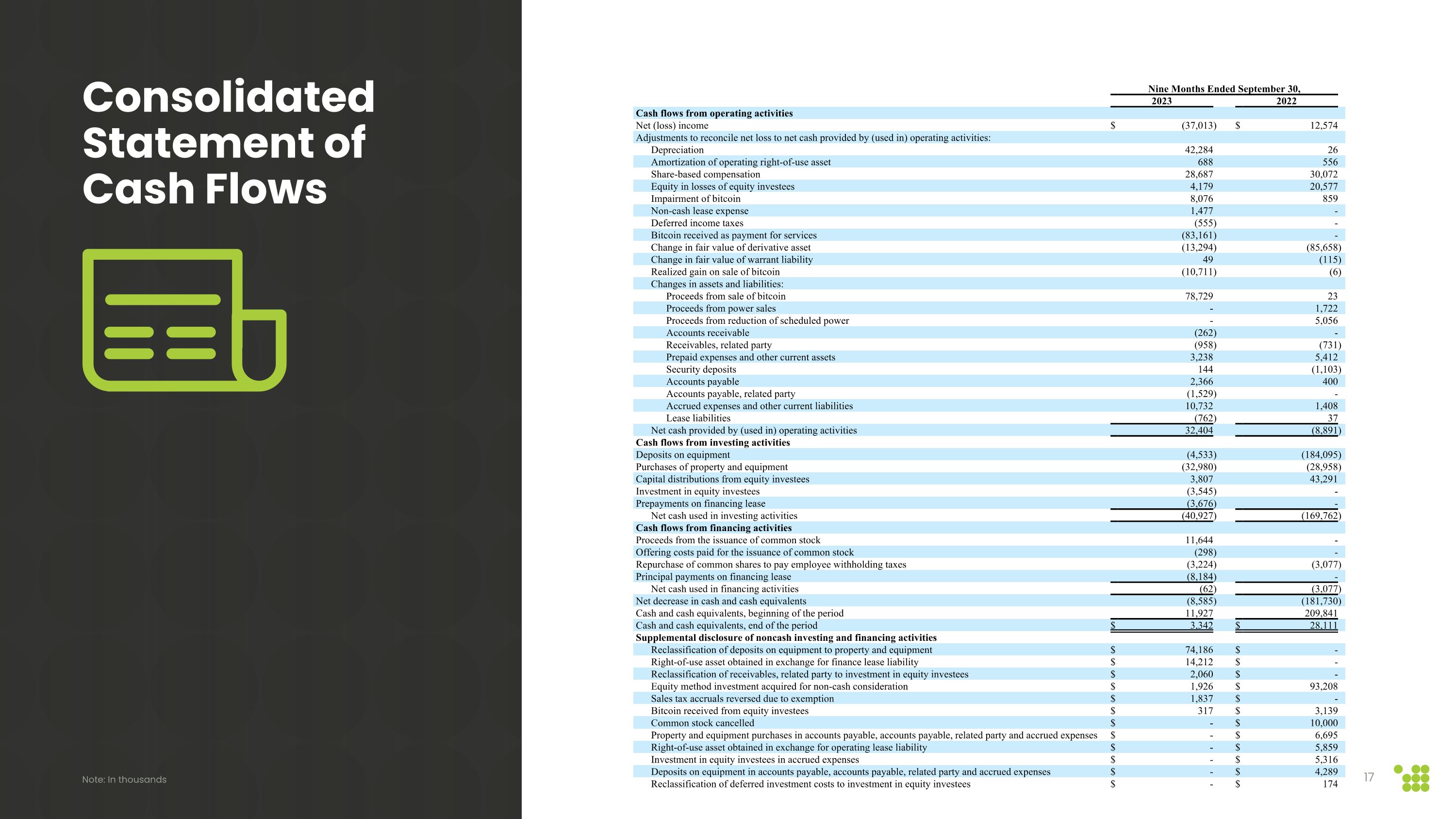

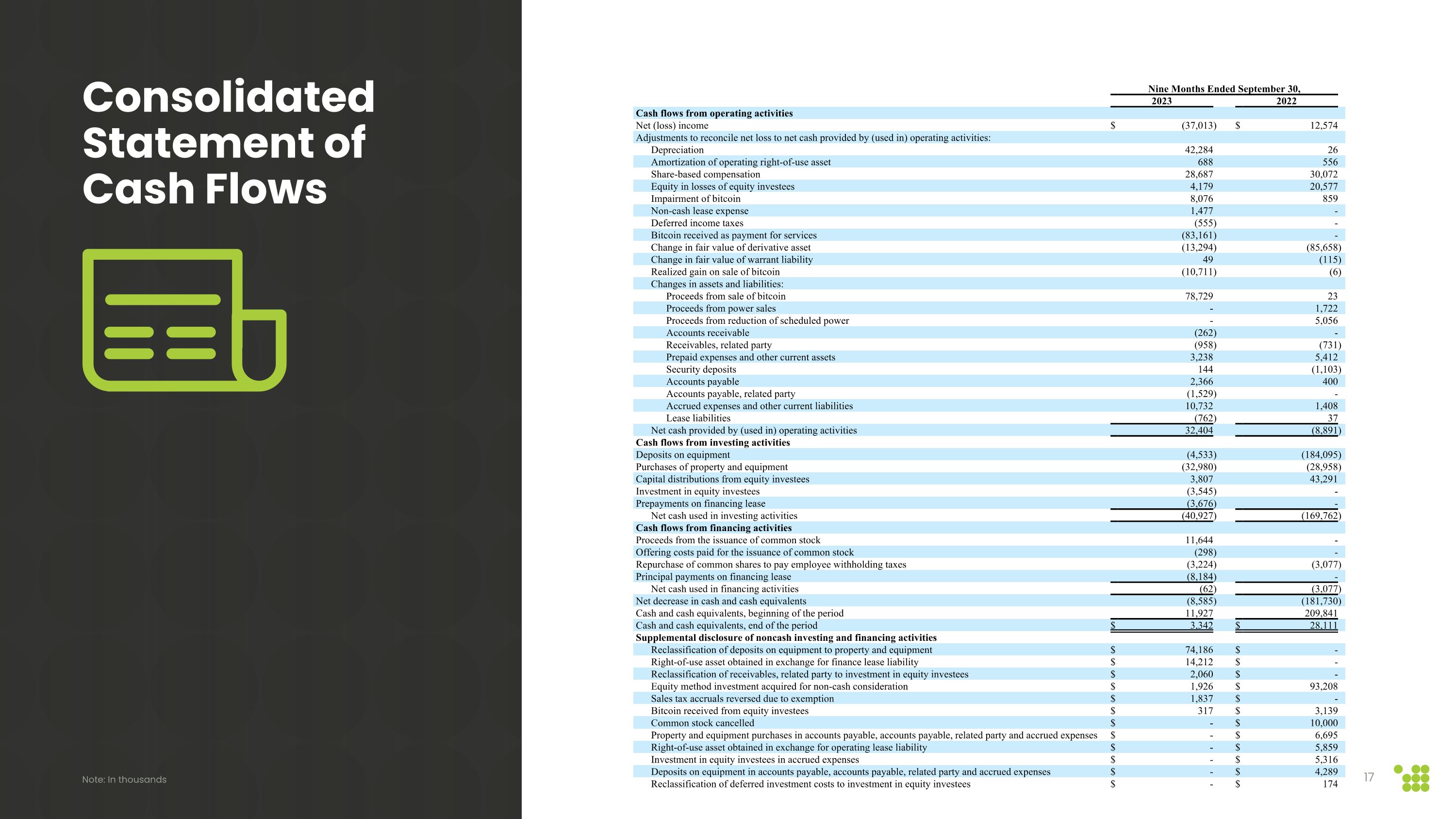

Nine Months Ended September 30, 2023 2022 Cash flows from operating activities Net (loss) income $ (37,013 ) $ 12,574 Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation 42,284 26 Amortization of operating right-of-use asset 688 556 Share-based compensation 28,687 30,072 Equity in losses of equity investees 4,179 20,577 Impairment of bitcoin 8,076 859 Non-cash lease expense 1,477 - Deferred income taxes (555 ) - Bitcoin received as payment for services (83,161 ) - Change in fair value of derivative asset (13,294 ) (85,658 ) Change in fair value of warrant liability 49 (115 ) Realized gain on sale of bitcoin (10,711 ) (6 ) Changes in assets and liabilities: Proceeds from sale of bitcoin 78,729 23 Proceeds from power sales - 1,722 Proceeds from reduction of scheduled power - 5,056 Accounts receivable (262 ) - Receivables, related party (958 ) (731 ) Prepaid expenses and other current assets 3,238 5,412 Security deposits 144 (1,103 ) Accounts payable 2,366 400 Accounts payable, related party (1,529 ) - Accrued expenses and other current liabilities 10,732 1,408 Lease liabilities (762 ) 37 Net cash provided by (used in) operating activities 32,404 (8,891 ) Cash flows from investing activities Deposits on equipment (4,533 ) (184,095 ) Purchases of property and equipment (32,980 ) (28,958 ) Capital distributions from equity investees 3,807 43,291 Investment in equity investees (3,545 ) - Prepayments on financing lease (3,676 ) - Net cash used in investing activities (40,927 ) (169,762 ) Cash flows from financing activities Proceeds from the issuance of common stock 11,644 - Offering costs paid for the issuance of common stock (298 ) - Repurchase of common shares to pay employee withholding taxes (3,224 ) (3,077 ) Principal payments on financing lease (8,184 ) - Net cash used in financing activities (62 ) (3,077 ) Net decrease in cash and cash equivalents (8,585 ) (181,730 ) Cash and cash equivalents, beginning of the period 11,927 209,841 Cash and cash equivalents, end of the period $ 3,342 $ 28,111 Supplemental disclosure of noncash investing and financing activities Reclassification of deposits on equipment to property and equipment $ 74,186 $ - Right-of-use asset obtained in exchange for finance lease liability $ 14,212 $ - Reclassification of receivables, related party to investment in equity investees $ 2,060 $ - Equity method investment acquired for non-cash consideration $ 1,926 $ 93,208 Sales tax accruals reversed due to exemption $ 1,837 $ - Bitcoin received from equity investees $ 317 $ 3,139 Common stock cancelled $ - $ 10,000 Property and equipment purchases in accounts payable, accounts payable, related party and accrued expenses $ - $ 6,695 Right-of-use asset obtained in exchange for operating lease liability $ - $ 5,859 Investment in equity investees in accrued expenses $ - $ 5,316 Deposits on equipment in accounts payable, accounts payable, related party and accrued expenses $ - $ 4,289 Reclassification of deferred investment costs to investment in equity investees $ - $ 174 Consolidated Statement of Cash Flows Note: In thousands