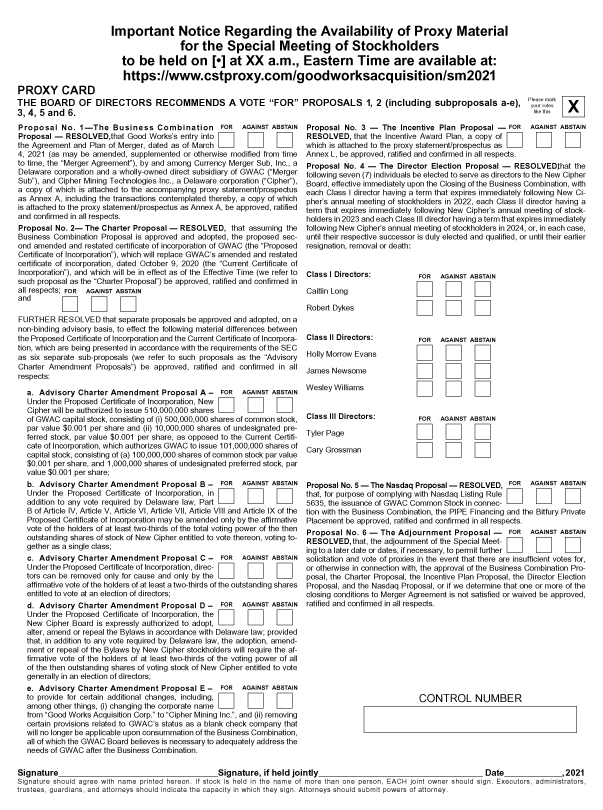

Important Notice Regarding the Availability of Proxy Material for the Special Meeting of Stockholders to be held on [•] at XX a.m., Eastern Time are available at: https://www.cstproxy.com/goodworksacquisition/sm2021 PROXY CARD THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2 (including subproposals a-e), Please mark your votes X3, 4, 5 and 6. like this Proposal No. 1—The Business Combination FOR AGAINST ABSTAINProposal — RESOLVED, that Good Works’s entry into the Agreement and Plan of Merger, dated as of March 4, 2021 (as may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), by and among Currency Merger Sub, Inc., a Delaware corporation and a wholly-owned direct subsidiary of GWAC (“Merger Sub”), and Cipher Mining Technologies Inc., a Delaware corporation (“Cipher”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex A, including the transactions contemplated thereby, a copy of which is attached to the proxy statement/prospectus as Annex A, be approved, ratified and confirmed in all respects.Proposal No. 2— The Charter Proposal — RESOLVED, that assuming the Business Combination Proposal is approved and adopted, the proposed second amended and restated certificate of incorporation of GWAC (the “Proposed Certificate of Incorporation”), which will replace GWAC’s amended and restated certificate of incorporation, dated October 9, 2020 (the “Current Certificate of Incorporation”), and which will be in effect as of the Effective Time (we refer to such proposal as the “Charter Proposal”) be approved, ratified and confirmed in all respects for against abstain; and FURTHER RESOLVED that separate proposals be approved and adopted, on a non-binding advisory basis, to effect the following material differences between the Proposed Certificate of Incorporation and the Current Certificate of Incorporation, which are being presented in accordance with the requirements of the SEC as six separate sub-proposals (we refer to such proposals as the “Advisory Charter Amendment Proposals”) be approved, ratified and confirmed in all respects: a. Advisory Charter Amendment Proposal A – FOR AGAINST ABSTAINUnder the Proposed Certificate of Incorporation, New Cipher will be authorized to issue 510,000,000 shares of GWAC capital stock, consisting of (i) 500,000,000 shares of common stock, par value $0.001 per share and (ii) 10,000,000 shares of undesignated preferred stock, par value $0.001 per share, as opposed to the Current Certificate of Incorporation, which authorizes GWAC to issue 101,000,000 shares of capital stock, consisting of (a) 100,000,000 shares of common stock par value $0.001 per share, and 1,000,000 shares of undesignated preferred stock, par value $0.001 per share; b. Advisory Charter Amendment Proposal B – FOR AGAINST ABSTAINUnder the Proposed Certificate of Incorporation, in addition to any vote required by Delaware law, Part B of Article IV, Article V, Article VI, Article VII, Article VIII and Article IX of the Proposed Certificate of Incorporation may be amended only by the affirmative vote of the holders of at least two-thirds of the total voting power of the then outstanding shares of stock of New Cipher entitled to vote thereon, voting together as a single class; c. Advisory Charter Amendment Proposal C – FOR AGAINST ABSTAINUnder the Proposed Certificate of Incorporation, directors can be removed only for cause and only by the affirmative vote of the holders of at least a two-thirds of the outstanding shares entitled to vote at an election of directors; d. Advisory Charter Amendment Proposal D – FOR AGAINST ABSTAINUnder the Proposed Certificate of Incorporation, the New Cipher Board is expressly authorized to adopt, alter, amend or repeal the Bylaws in accordance with Delaware law; provided that, in addition to any vote required by Delaware law, the adoption, amendment or repeal of the Bylaws by New Cipher stockholders will require the affirmative vote of the holders of at least two-thirds of the voting power of all of the then outstanding shares of voting stock of New Cipher entitled to vote generally in an election of directors; e. Advisory Charter Amendment Proposal E – FOR AGAINST ABSTAIN to provide for certain additional changes, including, among other things, (i) changing the corporate name from “Good Works Acquisition Corp.” to “Cipher Mining Inc.”, and (ii) removing certain provisions related to GWAC’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which the GWAC Board believes is necessary to adequately address the needs of GWAC after the Business Combination.Proposal No. 3 — The Incentive Plan Proposal — FOR AGAINST ABSTAINRESOLVED, that the Incentive Award Plan, a copy of which is attached to the proxy statement/prospectus as Annex L, be approved, ratified and confirmed in all respects.Proposal No. 4 — The Director Election Proposal — RESOLVED, that the following seven (7) individuals be elected to serve as directors to the New Cipher Board, effective immediately upon the Closing of the Business Combination, with each Class I director having a term that expires immediately following New Cipher’s annual meeting of stockholders in 2022, each Class II director having a term that expires immediately following New Cipher’s annual meeting of stockholders in 2023 and each Class III director having a term that expires immediately following New Cipher’s annual meeting of stockholders in 2024, or, in each case, until their respective successor is duly elected and qualified, or until their earlier resignation, removal or death:Class I Directors: FOR AGAINST ABSTAINCaitlin LongRobert Dykes Class II Directors: FOR AGAINST ABSTAINHolly Morrow Evans James Newsome Wesley WilliamsClass III Directors: FOR AGAINST ABSTAINTyler PageCary Grossman Proposal No. 5 — The Nasdaq Proposal — RESOLVED, FOR AGAINST ABSTAIN that, for purpose of complying with Nasdaq Listing Rule 5635, the issuance of GWAC Common Stock in connection with the Business Combination, the PIPE Financing and the Bitfury Private Placement be approved, ratified and confirmed in all respects.Proposal No. 6 — The Adjournment Proposal — FOR AGAINST ABSTAINRESOLVED, that, the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposal, the Charter Proposal, the Incentive Plan Proposal, the Director Election Proposal, and the Nasdaq Proposal, or if we determine that one or more of the closing conditions to Merger Agreement is not satisfied or waived be approved, ratified and confirmed in all respects.CONTROL NUMBERSignature Signature, if held jointly Date , 2021Signature should agree with name printed hereon. If stock is held in the name of more than one person, EACH joint owner should sign. Executors, administrators, trustees, guardians, and attorneys should indicate the capacity in which they sign. Attorneys should submit powers of attorney.