Presentation for Business Update FEBRUARY 25, 2025

Forward-Looking Statements This communication contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this communication that are not statements of historical fact, such as, statements about the Company’s beliefs and expectations regarding its future results of operations and financial position, its planned business model and strategy, its bitcoin mining and HPC data center development, timing and likelihood of success, capacity, functionality and timing of operation of data centers, expectations regarding the operations of data centers, potential strategic initiatives, such as joint ventures and partnerships, and management plans and objectives, are forward-looking statements and should be evaluated as such. These forward-looking statements generally are identified by the words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “strategy,” “future,” “forecasts,” “opportunity,” “predicts,” “potential,” “would,” “will likely result,” “continue,” and similar expressions (including the negative versions of such words or expressions). These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and its management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: volatility in the price of Cipher’s securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, Cipher’s evolving business model and strategy and efforts it may make to modify aspects of its business model or engage in various strategic initiatives, variations in performance across competitors, changes in laws and regulations affecting Cipher’s business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Cipher’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 to be filed with the Securities and Exchange Commission (“SEC”), and in Cipher’s subsequent filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Website Disclosure The Company maintains a dedicated investor website at https://investors.ciphermining.com/investors (“Investors’ Website”). Financial and other important information regarding the Company is routinely posted on and accessible through the Investors’ Website. Cipher uses its Investors’ Website as a distribution channel of material information about the Company, including through press releases, investor presentations, reports and notices of upcoming events. Cipher intends to utilize its Investors’ Website as a channel of distribution to reach public investors and as a means of disclosing material non-public information for complying with disclosure obligations under Regulation FD. In addition, you may sign up to automatically receive email alerts and other information about the Company by visiting the “Email Alerts” option under the Investors Resources section of Cipher’s Investors’ Website and submitting your email address. Non-GAAP Financial Measures This communication includes supplemental financial measures for Adjusted Earnings (Loss) and Adjusted Earnings (Loss) per share - diluted, in each case that exclude the impact of (i) the non-cash change in fair value of derivative asset, (ii) share-based compensation expense, (iii) depreciation and amortization, (iv) deferred income tax expense, (v) nonrecurring gains and losses and (vi) the non-cash change in fair value of warrant liability. These supplemental financial measures are not measurements of financial performance under accounting principles generally accepted in the United Stated (“GAAP”) and, as a result, these supplemental financial measures may not be comparable to similarly titled measures of other companies. Management uses these non-GAAP financial measures internally to help understand, manage, and evaluate our business performance and to help make operating decisions. We believe the use of these non- GAAP financial measures can also facilitate comparison of our operating results to those of our competitors by excluding certain items that vary in our industry based on company policy. Non-GAAP financial measures are subject to material limitations as they are not in accordance with, or a substitute for, measurements prepared in accordance with GAAP. For example, we expect that share-based compensation expense, which is excluded from the non-GAAP financial measure, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers and directors. Similarly, we expect that depreciation and amortization will continue to be a recurring expense over the term of the useful life of the related assets. Our non-GAAP financial measures are not meant to be considered in isolation and should be read only in conjunction with our consolidated financial statements included elsewhere in this communication, which have been prepared in accordance with GAAP. We rely primarily on such consolidated financial statements to understand, manage and evaluate our business performance and use the non-GAAP financial measures only supplementally. The contents and appearance of this presentation is copyrighted and the trademarks and service marks are owned by Cipher Mining Inc. All rights reserved. 2

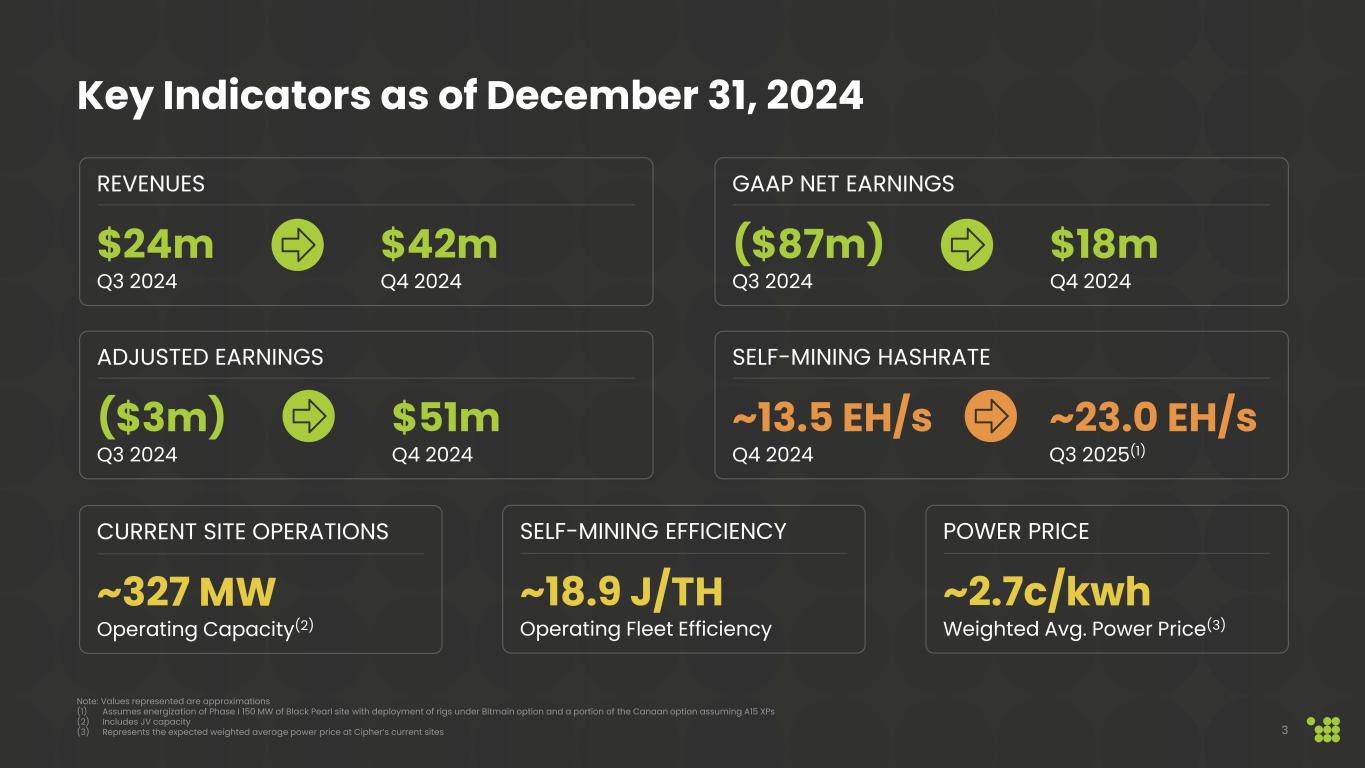

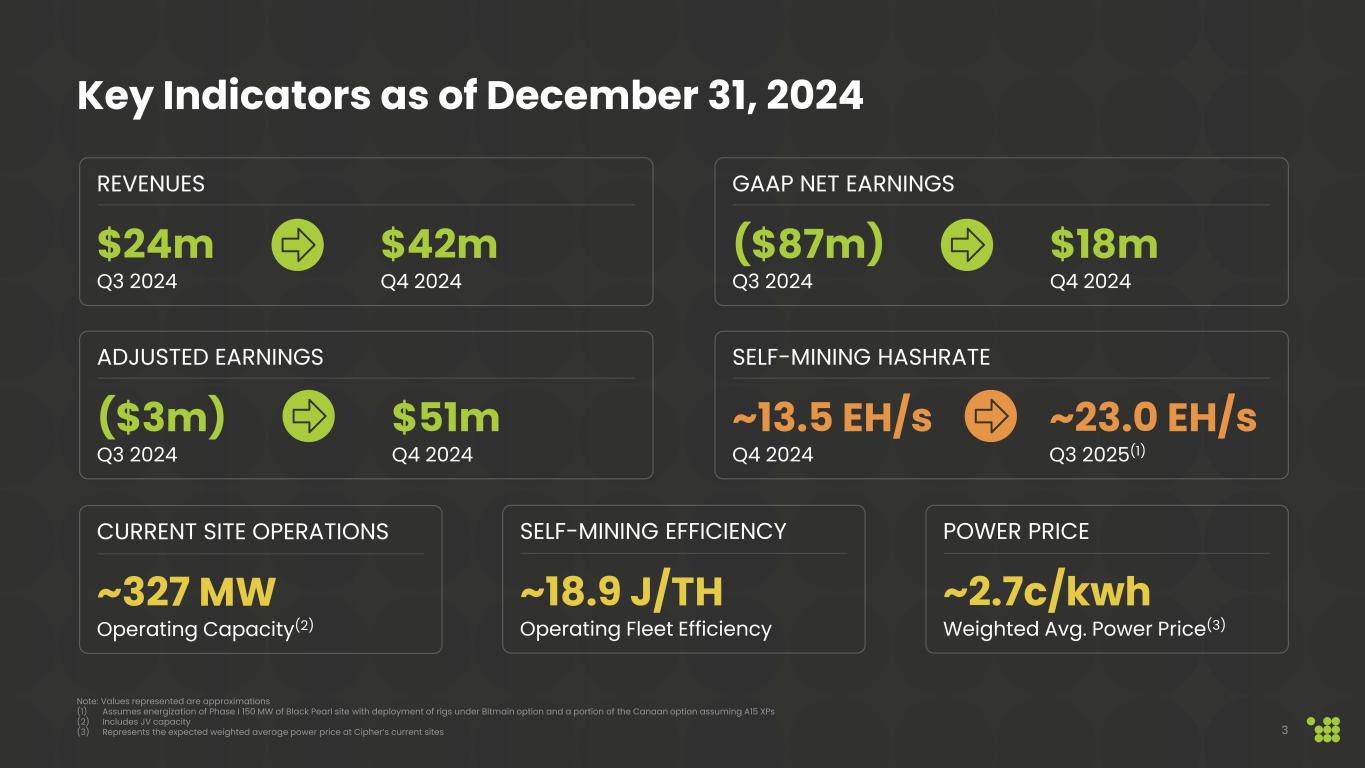

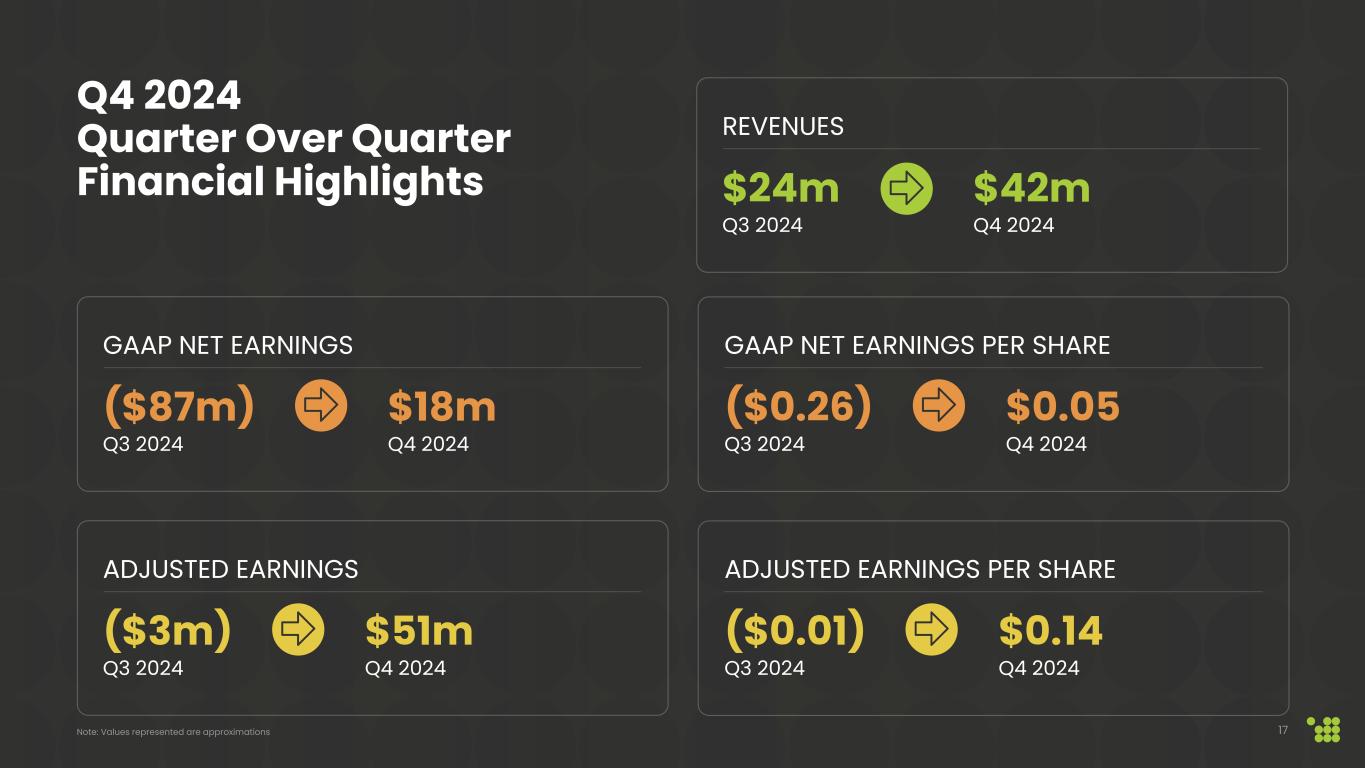

($3m) Q3 2024 $51m Q4 2024 ADJUSTED EARNINGS $24m Q3 2024 $42m Q4 2024 REVENUES ~327 MW Operating Capacity(2) CURRENT SITE OPERATIONS Key Indicators as of December 31, 2024 3 Note: Values represented are approximations (1) Assumes energization of Phase I 150 MW of Black Pearl site with deployment of rigs under Bitmain option and a portion of the Canaan option assuming A15 XPs (2) Includes JV capacity (3) Represents the expected weighted average power price at Cipher’s current sites ($87m) Q3 2024 $18m Q4 2024 GAAP NET EARNINGS ~13.5 EH/s Q4 2024 ~23.0 EH/s Q3 2025(1) SELF-MINING HASHRATE ~18.9 J/TH Operating Fleet Efficiency SELF-MINING EFFICIENCY ~2.7c/kwh Weighted Avg. Power Price(3) POWER PRICE

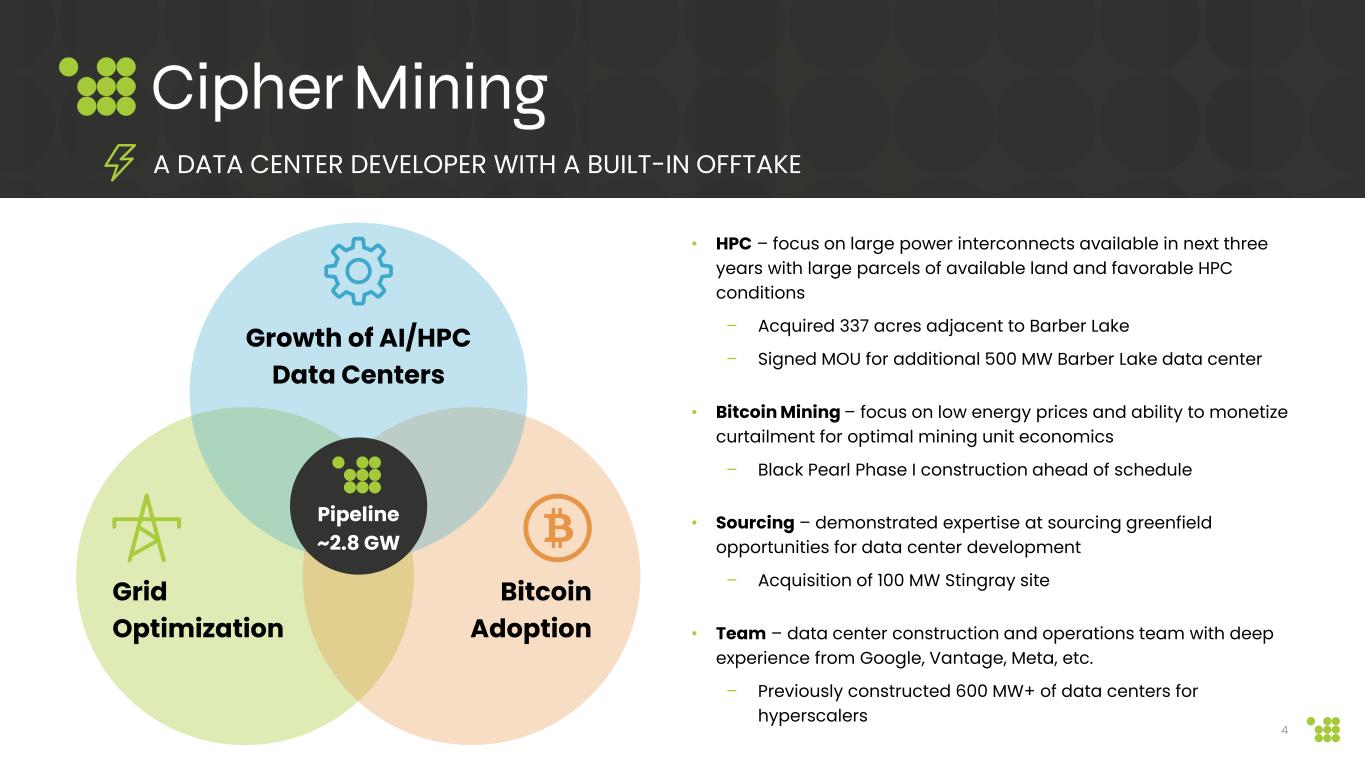

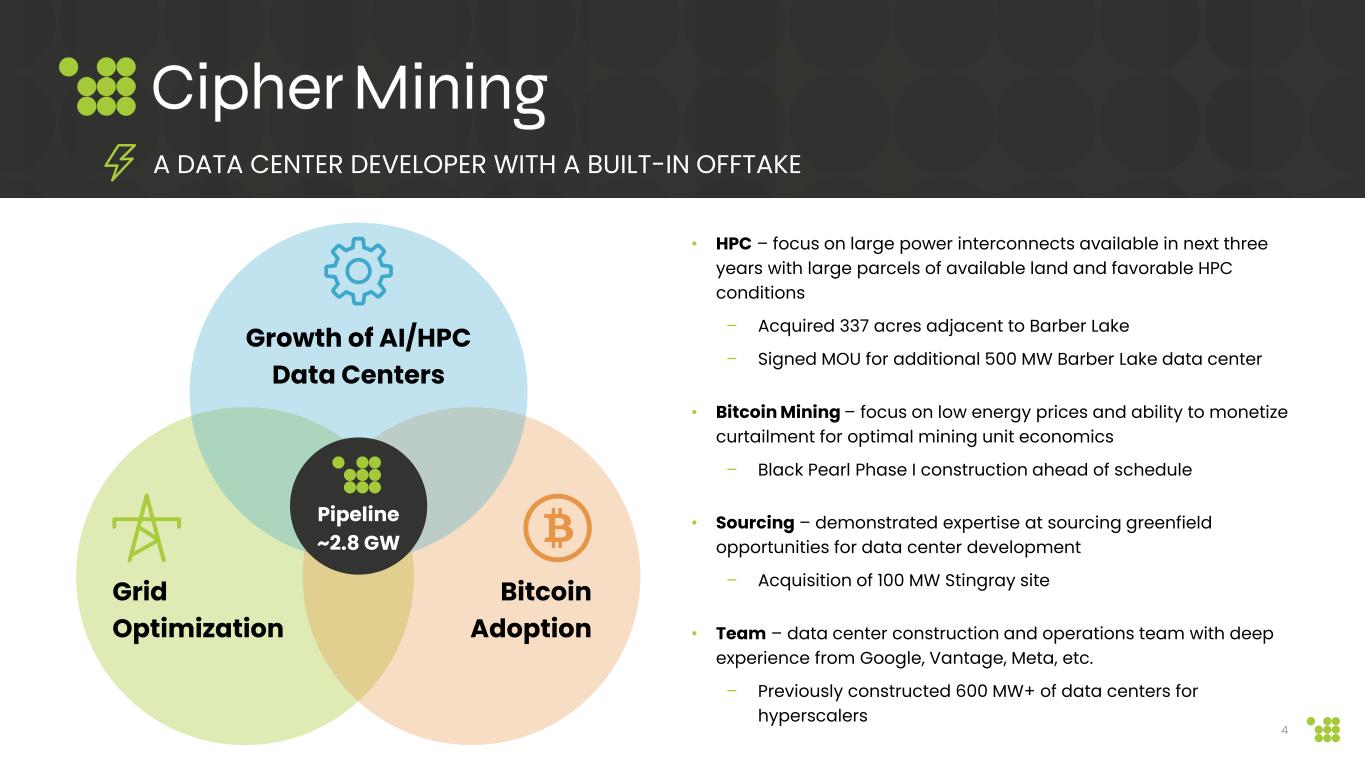

4 Growth of AI/HPC Data Centers Grid Optimization Bitcoin Adoption • HPC – focus on large power interconnects available in next three years with large parcels of available land and favorable HPC conditions – Acquired 337 acres adjacent to Barber Lake – Signed MOU for additional 500 MW Barber Lake data center • Bitcoin Mining – focus on low energy prices and ability to monetize curtailment for optimal mining unit economics – Black Pearl Phase I construction ahead of schedule • Sourcing – demonstrated expertise at sourcing greenfield opportunities for data center development – Acquisition of 100 MW Stingray site • Team – data center construction and operations team with deep experience from Google, Vantage, Meta, etc. – Previously constructed 600 MW+ of data centers for hyperscalers Pipeline ~2.8 GW A DATA CENTER DEVELOPER WITH A BUILT-IN OFFTAKE

Steady Scaling – Pipeline Capacity (1) Joint venture with WindHQ LLC, of which Cipher owns ~59 MW (2) Reflects total potential capacity of 500 MW per site – pending load studies and ERCOT LFL approval 5 207 207 207 207 120 120 120 120 300 300 300 300 300 300 100 100 70 1,500 0 500 1,000 1,500 2,000 2,500 3,000 Current 2025 2026 2027 C ap ac ity , M W Odessa Alborz, Bear, Chief Black Pearl Barber Lake Stingray Reveille Mikeska, Milsing, McLennan ~327 MW ~927 MW ~1.0 GW ~2.6 GW ~183% Increase ~11% Increase ~153% Increase CAGR: ~100% (1) (2)

Current Portfolio

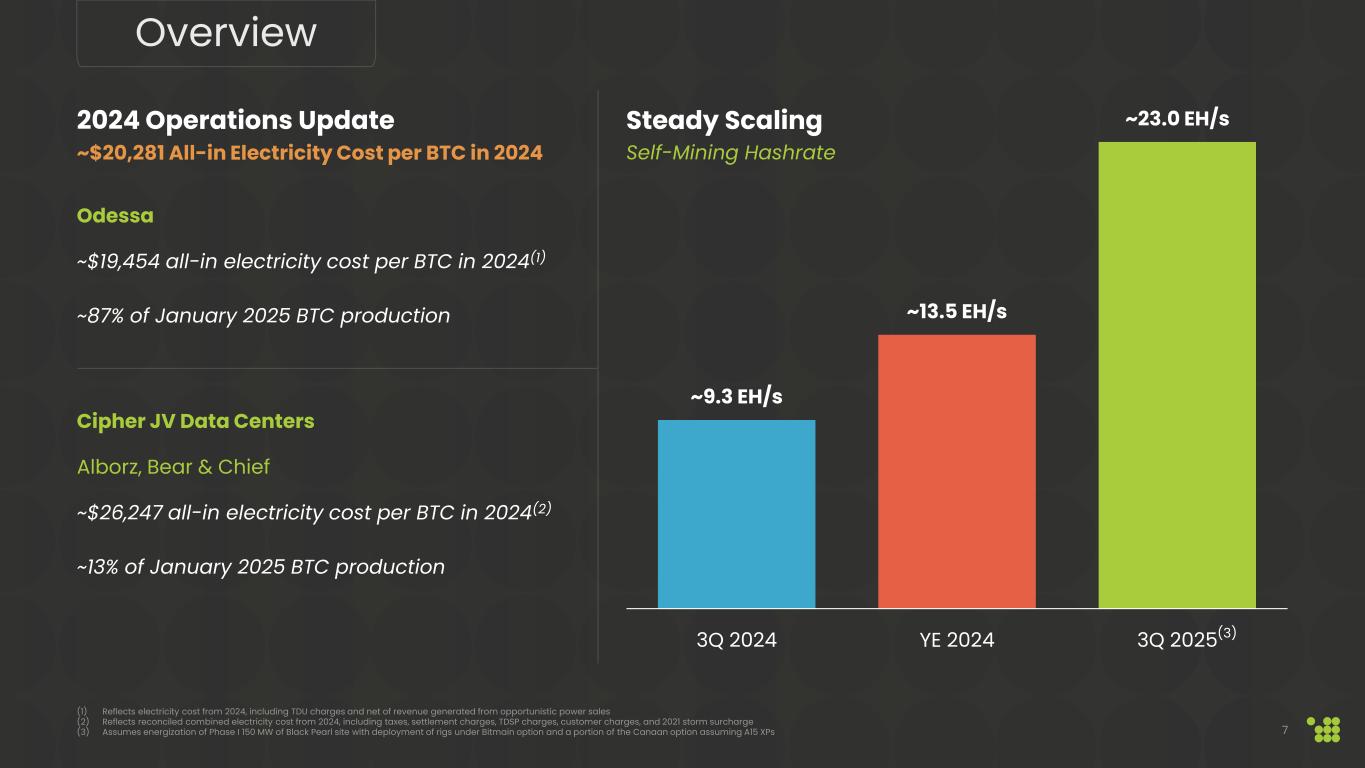

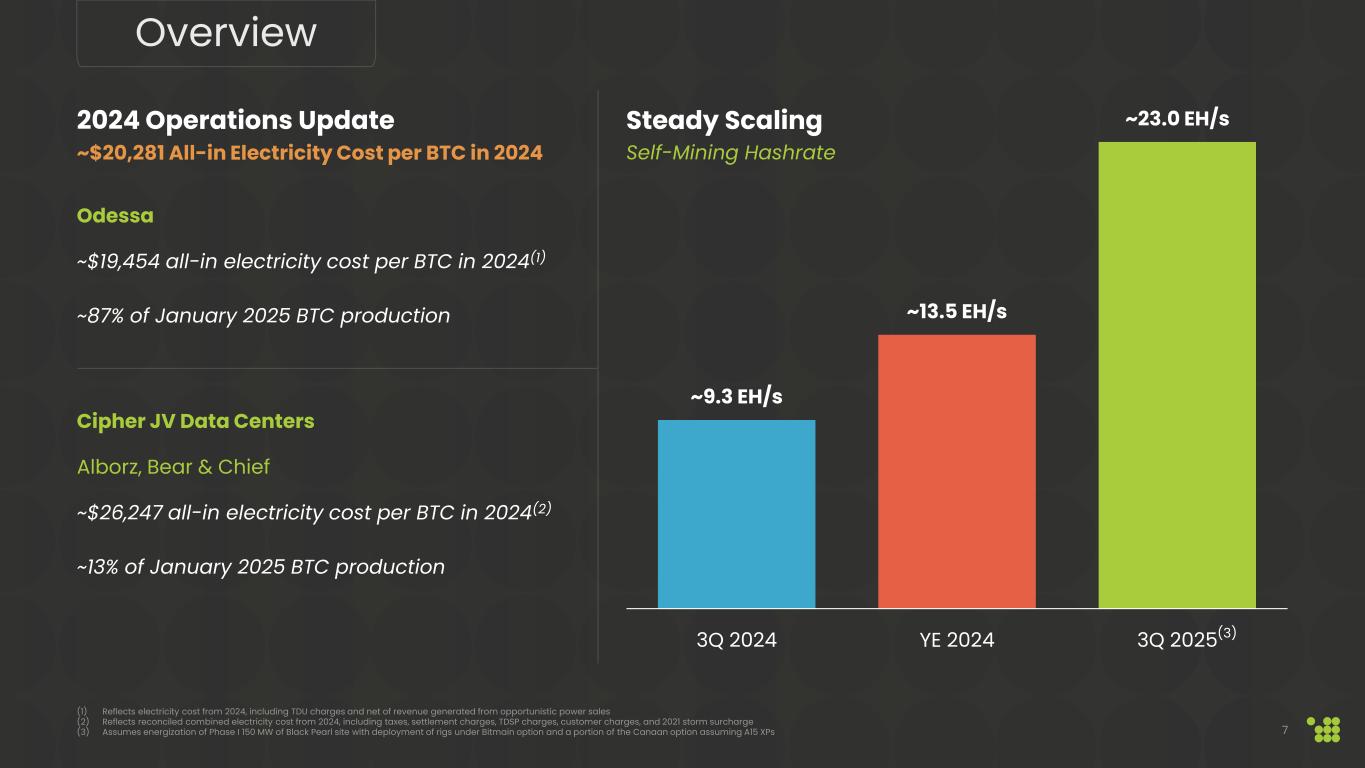

~9.3 EH/s ~13.5 EH/s ~23.0 EH/s 3Q 2024 YE 2024 3Q 2025 2024 Operations Update ~$20,281 All-in Electricity Cost per BTC in 2024 Odessa ~$19,454 all-in electricity cost per BTC in 2024(1) ~87% of January 2025 BTC production Cipher JV Data Centers Alborz, Bear & Chief ~$26,247 all-in electricity cost per BTC in 2024(2) ~13% of January 2025 BTC production Steady Scaling (1) Reflects electricity cost from 2024, including TDU charges and net of revenue generated from opportunistic power sales (2) Reflects reconciled combined electricity cost from 2024, including taxes, settlement charges, TDSP charges, customer charges, and 2021 storm surcharge (3) Assumes energization of Phase I 150 MW of Black Pearl site with deployment of rigs under Bitmain option and a portion of the Canaan option assuming A15 XPs 7 Self-Mining Hashrate Overview (3)

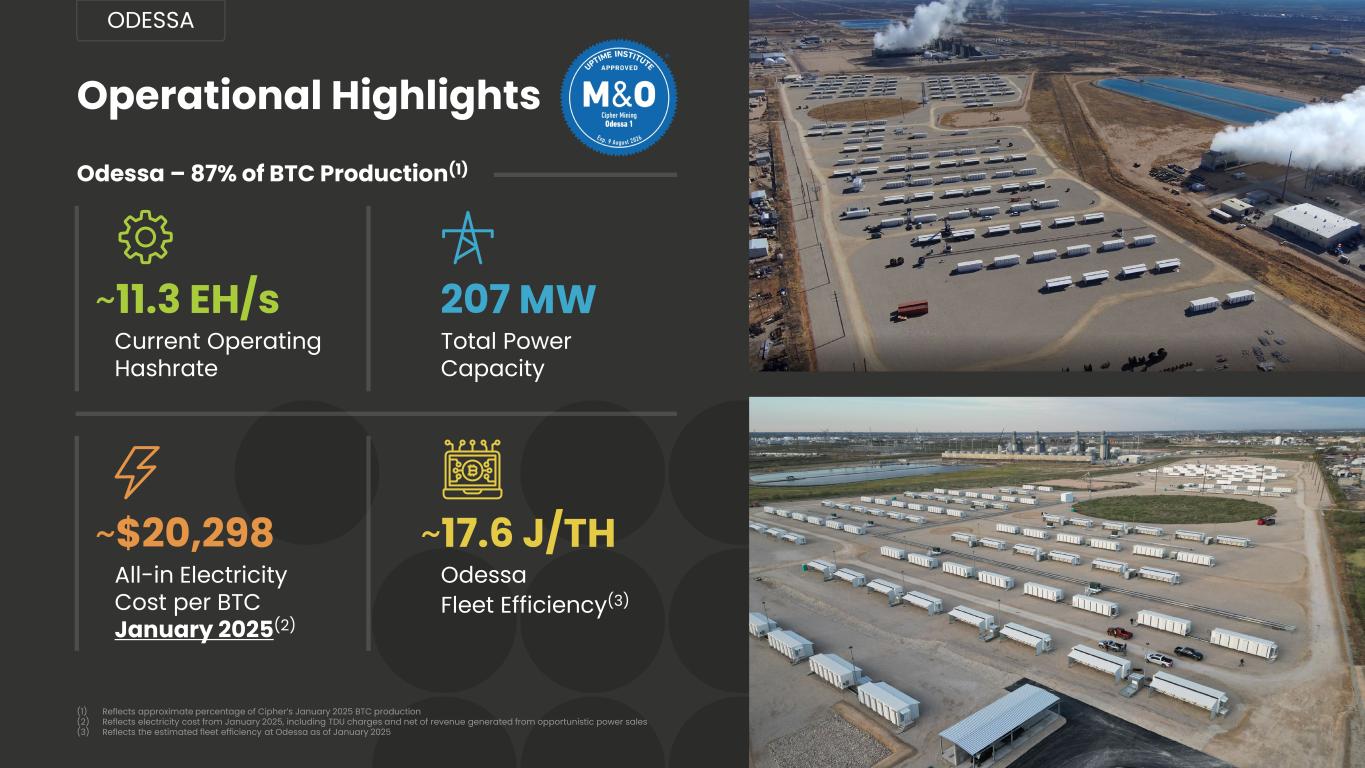

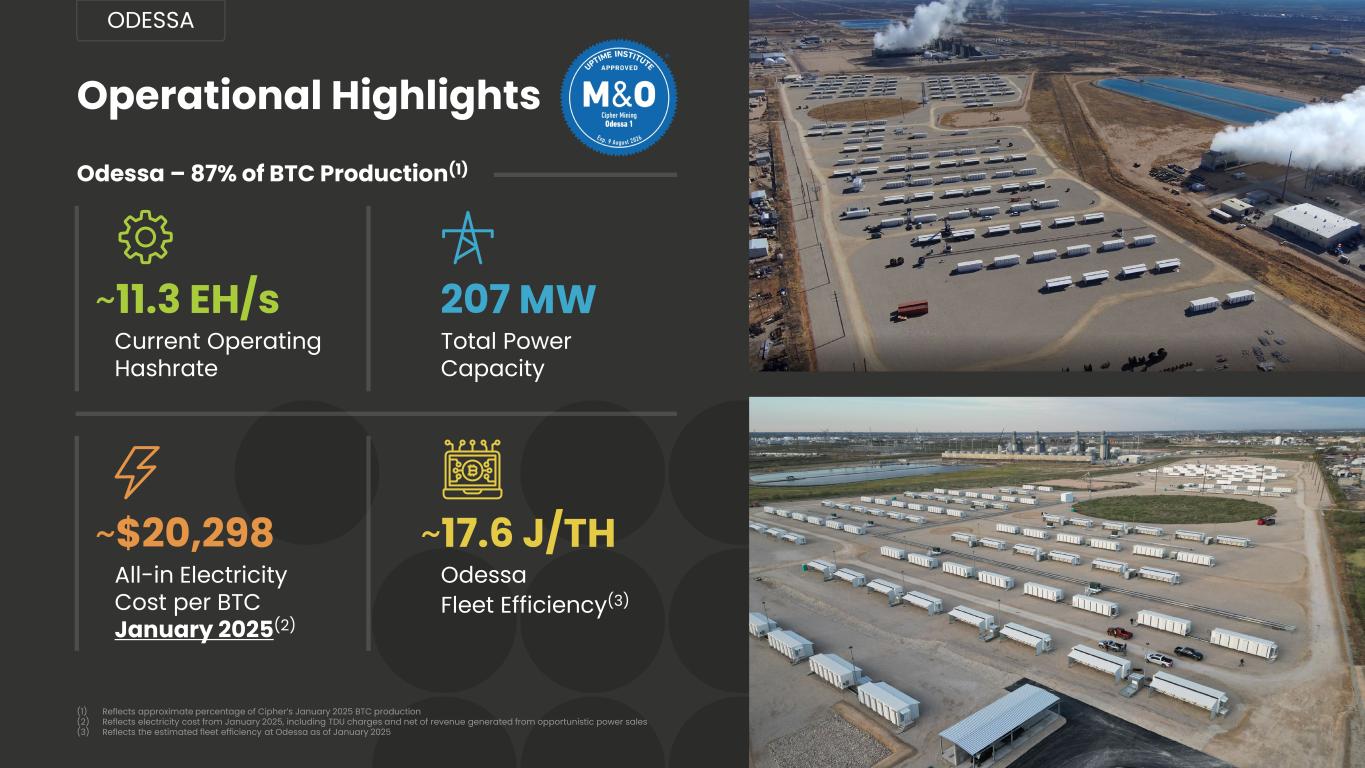

8 Operational Highlights (1) Reflects approximate percentage of Cipher’s January 2025 BTC production (2) Reflects electricity cost from January 2025, including TDU charges and net of revenue generated from opportunistic power sales (3) Reflects the estimated fleet efficiency at Odessa as of January 2025 ODESSA Odessa – 87% of BTC Production(1) ~$20,298 All-in Electricity Cost per BTC January 2025(2) ~11.3 EH/s Current Operating Hashrate Total Power Capacity Odessa Fleet Efficiency(3) ~17.6 J/TH 207 MW

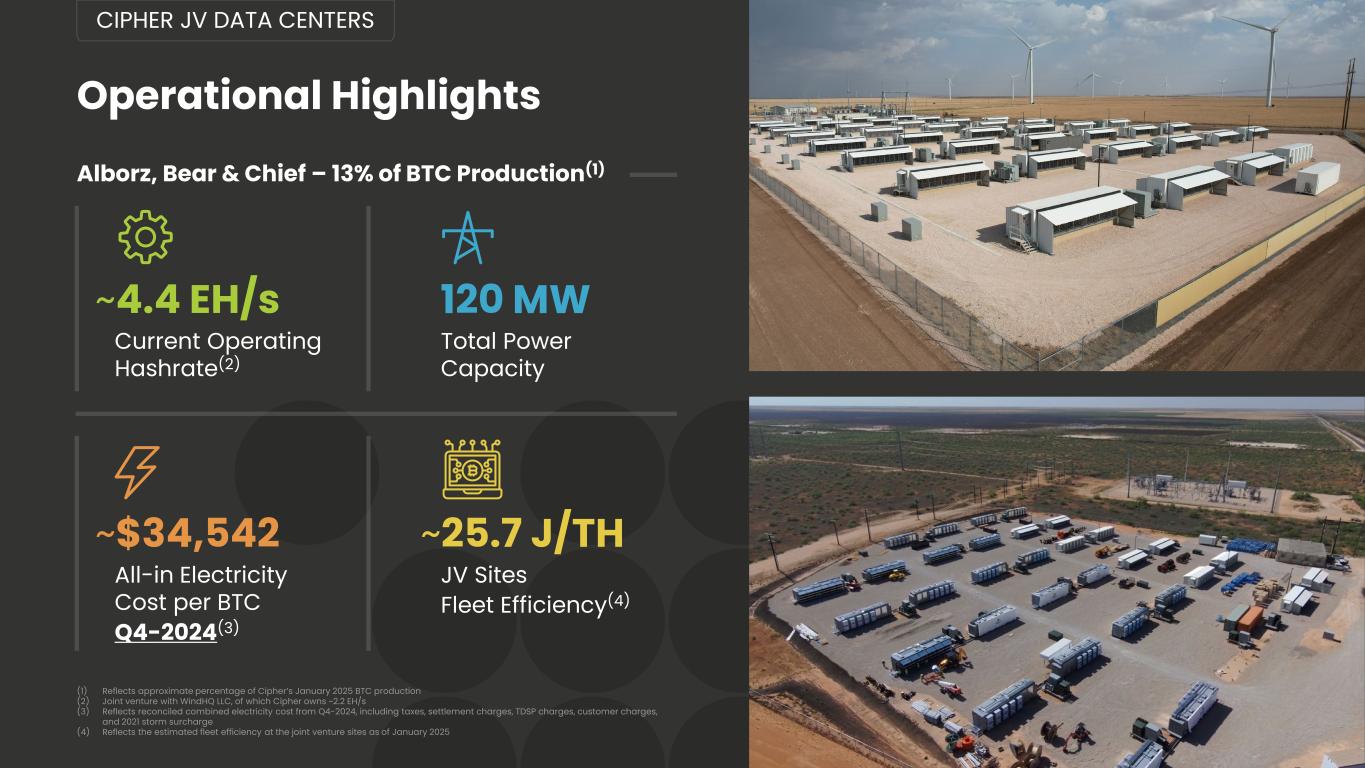

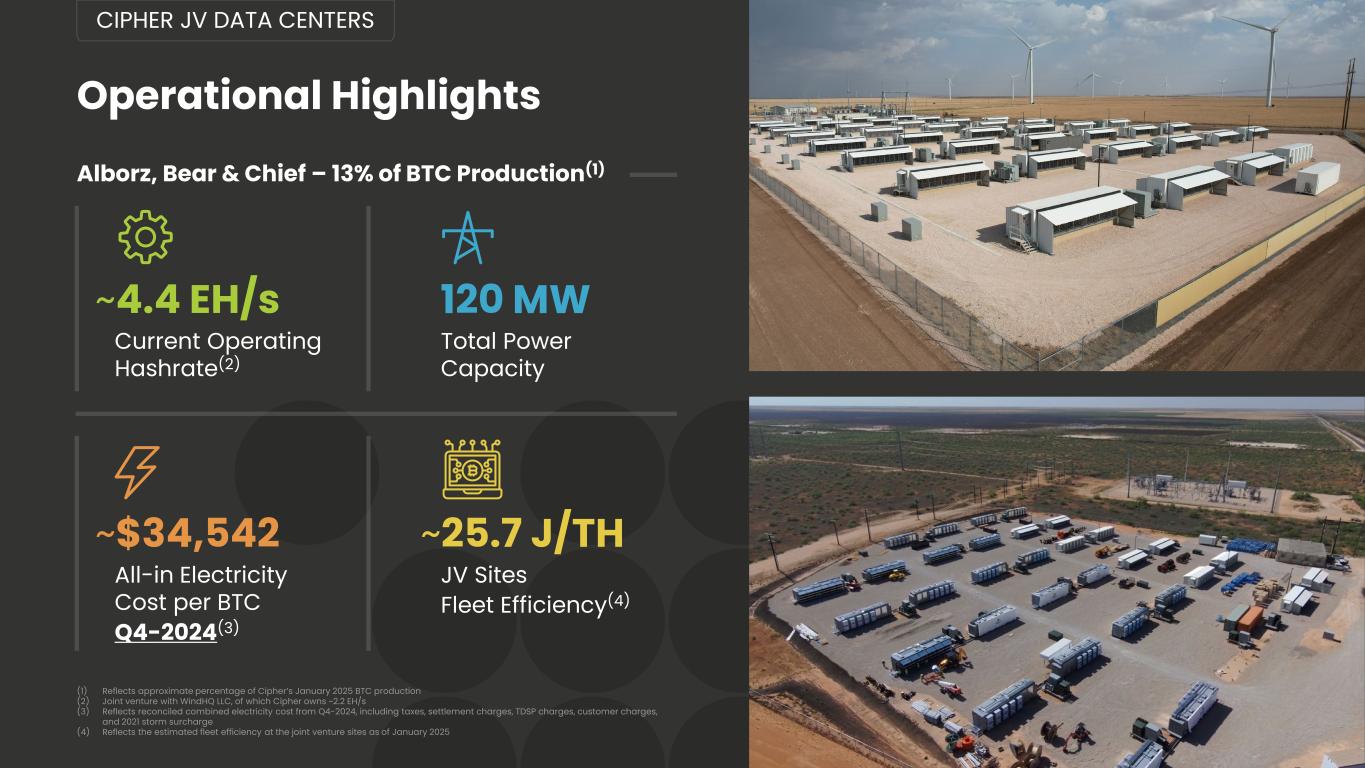

Operational Highlights CIPHER JV DATA CENTERS (1) Reflects approximate percentage of Cipher’s January 2025 BTC production (2) Joint venture with WindHQ LLC, of which Cipher owns ~2.2 EH/s (3) Reflects reconciled combined electricity cost from Q4-2024, including taxes, settlement charges, TDSP charges, customer charges, and 2021 storm surcharge (4) Reflects the estimated fleet efficiency at the joint venture sites as of January 2025 Alborz, Bear & Chief – 13% of BTC Production(1) ~$34,542 All-in Electricity Cost per BTC Q4-2024(3) ~4.4 EH/s Current Operating Hashrate(2) Total Power Capacity JV Sites Fleet Efficiency(4) ~25.7 J/TH 120 MW

Development Pipeline

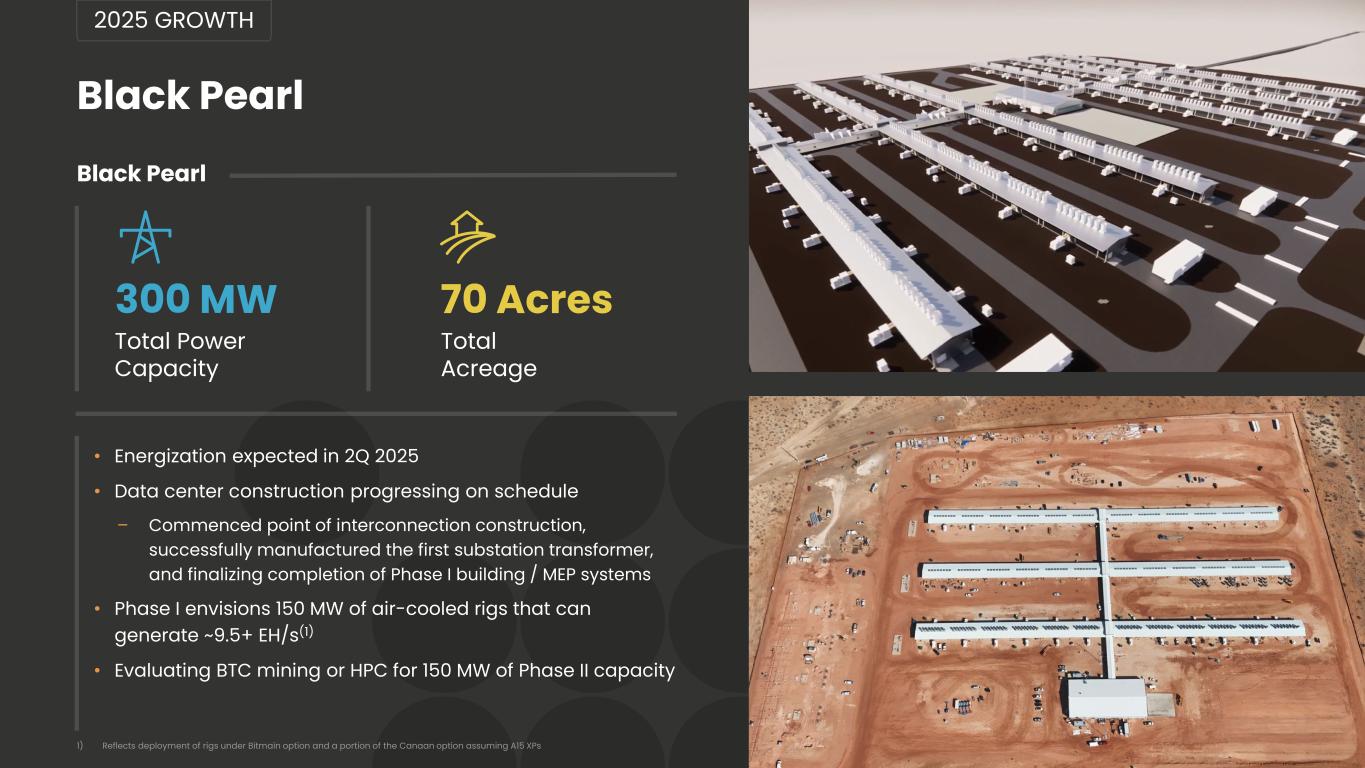

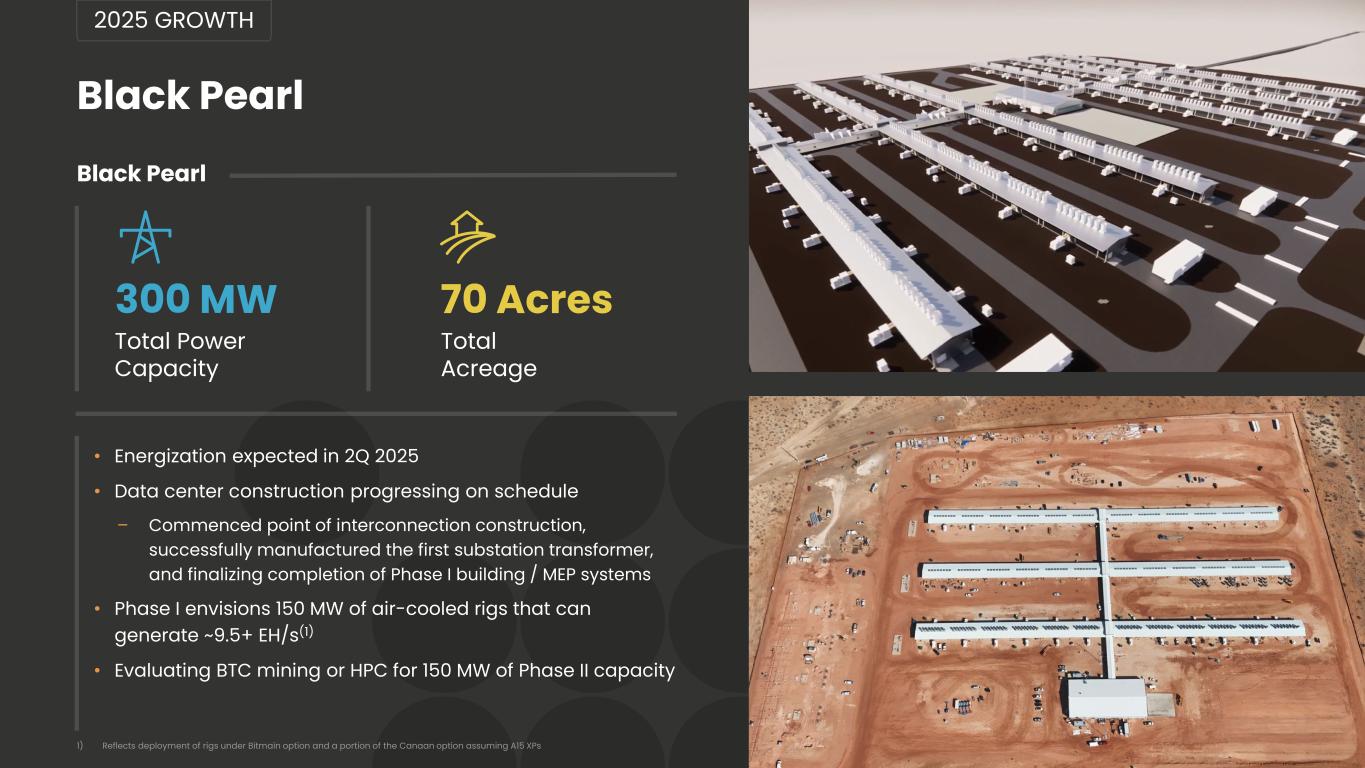

Black Pearl Black Pearl 2025 GROWTH • Energization expected in 2Q 2025 • Data center construction progressing on schedule – Commenced point of interconnection construction, successfully manufactured the first substation transformer, and finalizing completion of Phase I building / MEP systems • Phase I envisions 150 MW of air-cooled rigs that can generate ~9.5+ EH/s(1) • Evaluating BTC mining or HPC for 150 MW of Phase II capacity 1) Reflects deployment of rigs under Bitmain option and a portion of the Canaan option assuming A15 XPs 300 MW Total Power Capacity 70 Acres Total Acreage

13 Barber Lake 2025 GROWTH Barber Lake 300 MW Approved Power Capacity 587 Acres Total Acreage • Site is energized and ready for construction • Site features: – 587 acres of owned land in West Texas – Newly constructed high-to-mid voltage substation – Approvals for 300 MW of interconnection / agreements necessary to participate in the ERCOT market • Signed MOU for additional 500 MW data center and closed acquisition of additional 337 acres in February Barber Lake Site Colorado City

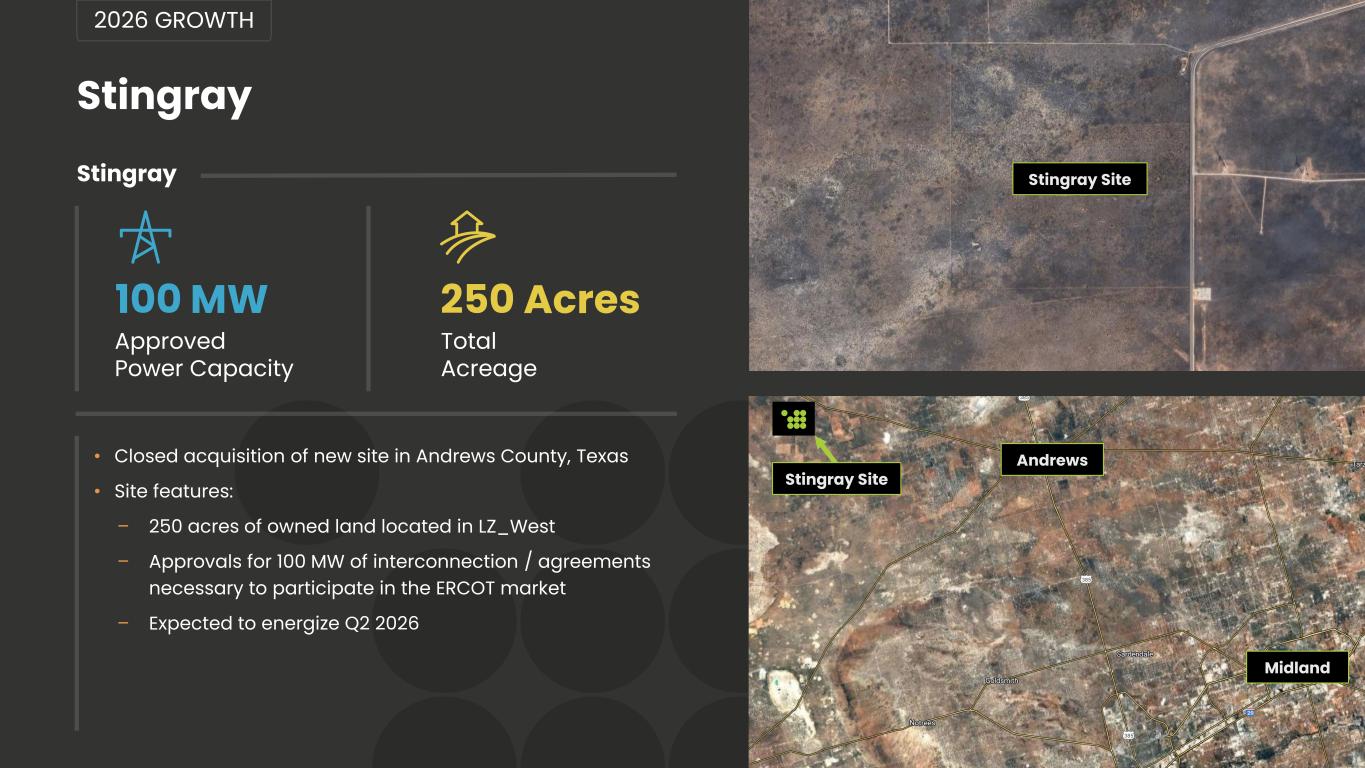

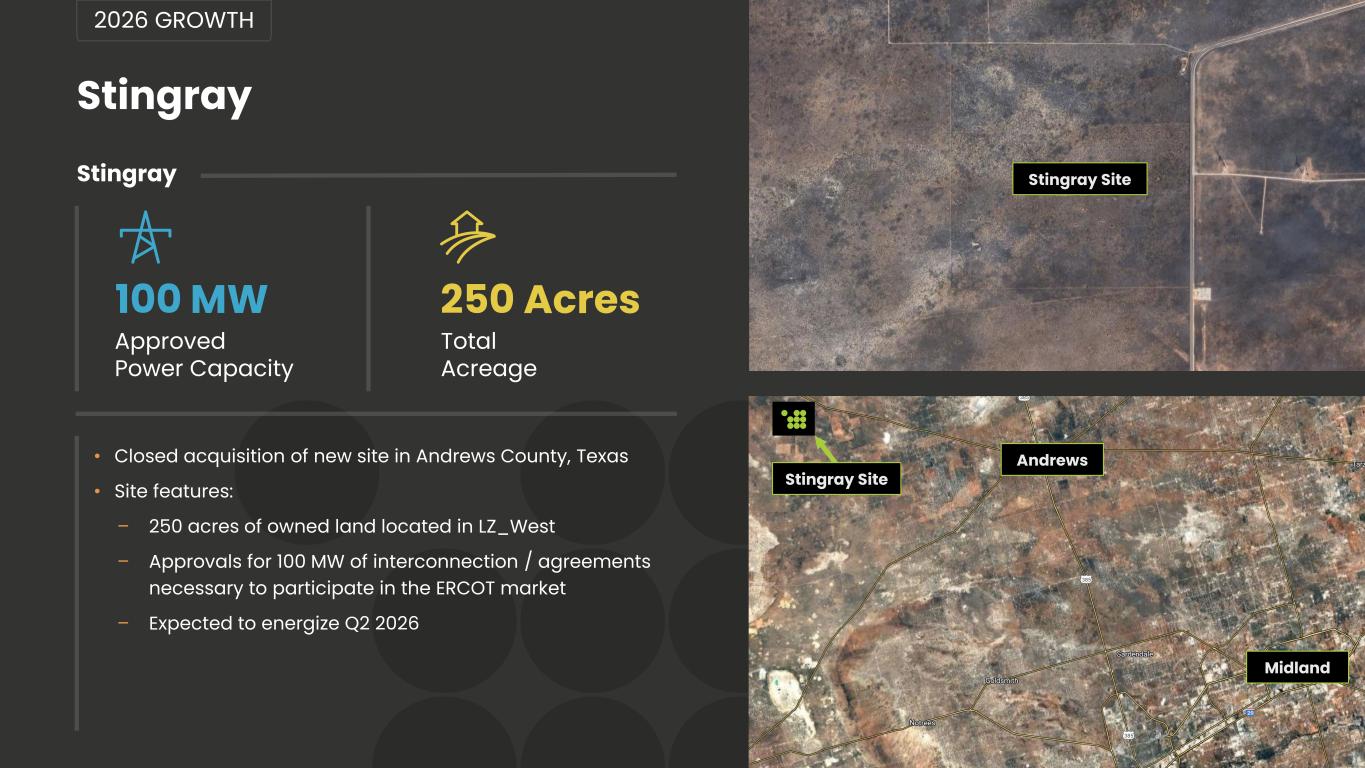

Stingray 2026 GROWTH Stingray 100 MW Approved Power Capacity 250 Acres Total Acreage • Closed acquisition of new site in Andrews County, Texas • Site features: – 250 acres of owned land located in LZ_West – Approvals for 100 MW of interconnection / agreements necessary to participate in the ERCOT market – Expected to energize Q2 2026 14 Stingray Site Andrews Stingray Site Midland

15 Reveille, Mikeska, Milsing, McLennan 2027 GROWTH Reveille Milsing McLennan Mikeska 70 MW Total Power Capacity 55 Acres Total Acreage Reveille 500 MW Total Power Capacity(1) 100 Acres Total Acreage Mikeska 500 MW Total Power Capacity(1) 187 Acres Total Acreage Milsing 500 MW Total Power Capacity(1) 293 Acres Total Acreage McLennan (1) Reflects total potential capacity of 500 MW per site – pending load studies and ERCOT LFL approval

Financial Update

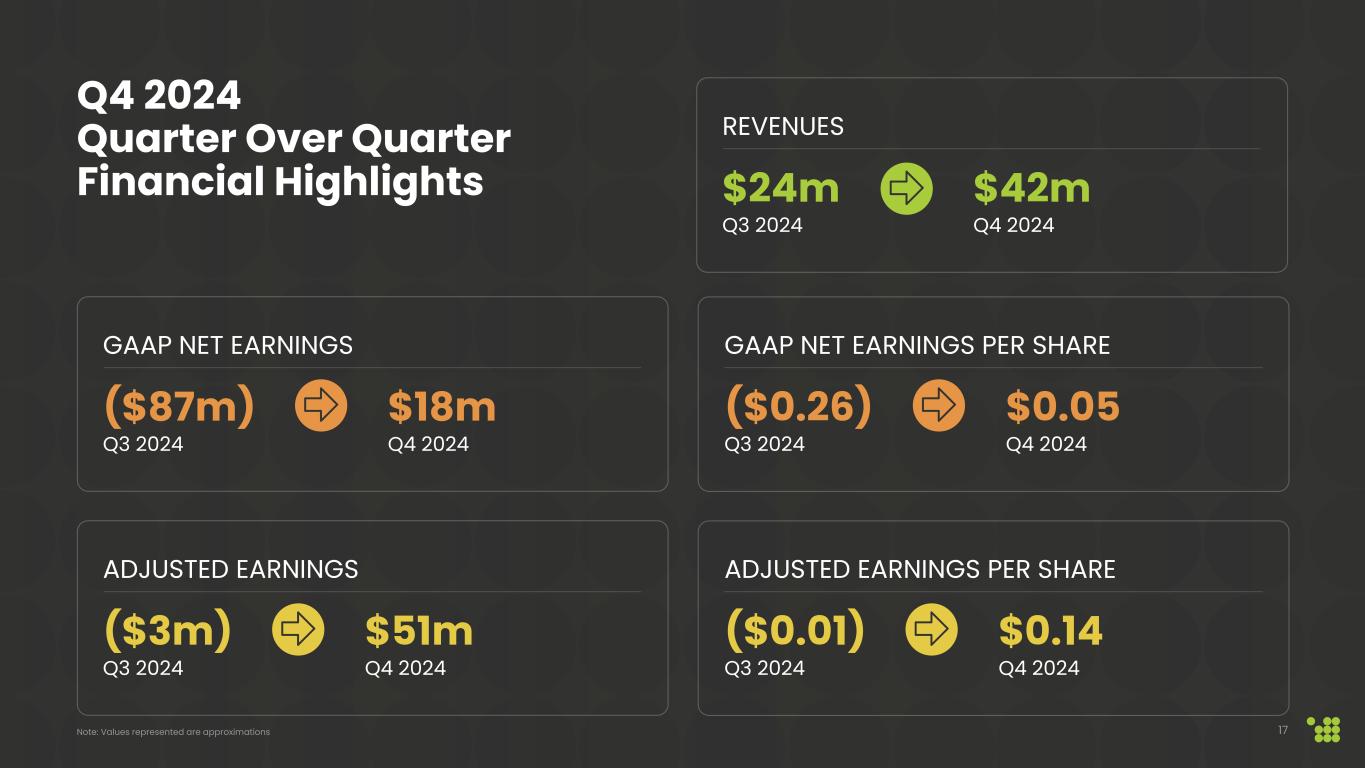

($87m) Q3 2024 $18m Q4 2024 GAAP NET EARNINGS ($0.26) Q3 2024 $0.05 Q4 2024 GAAP NET EARNINGS PER SHARE $24m Q3 2024 $42m Q4 2024 REVENUES Q4 2024 Quarter Over Quarter Financial Highlights 17Note: Values represented are approximations ($3m) Q3 2024 $51m Q4 2024 ADJUSTED EARNINGS ($0.01) Q3 2024 $0.14 Q4 2024 ADJUSTED EARNINGS PER SHARE

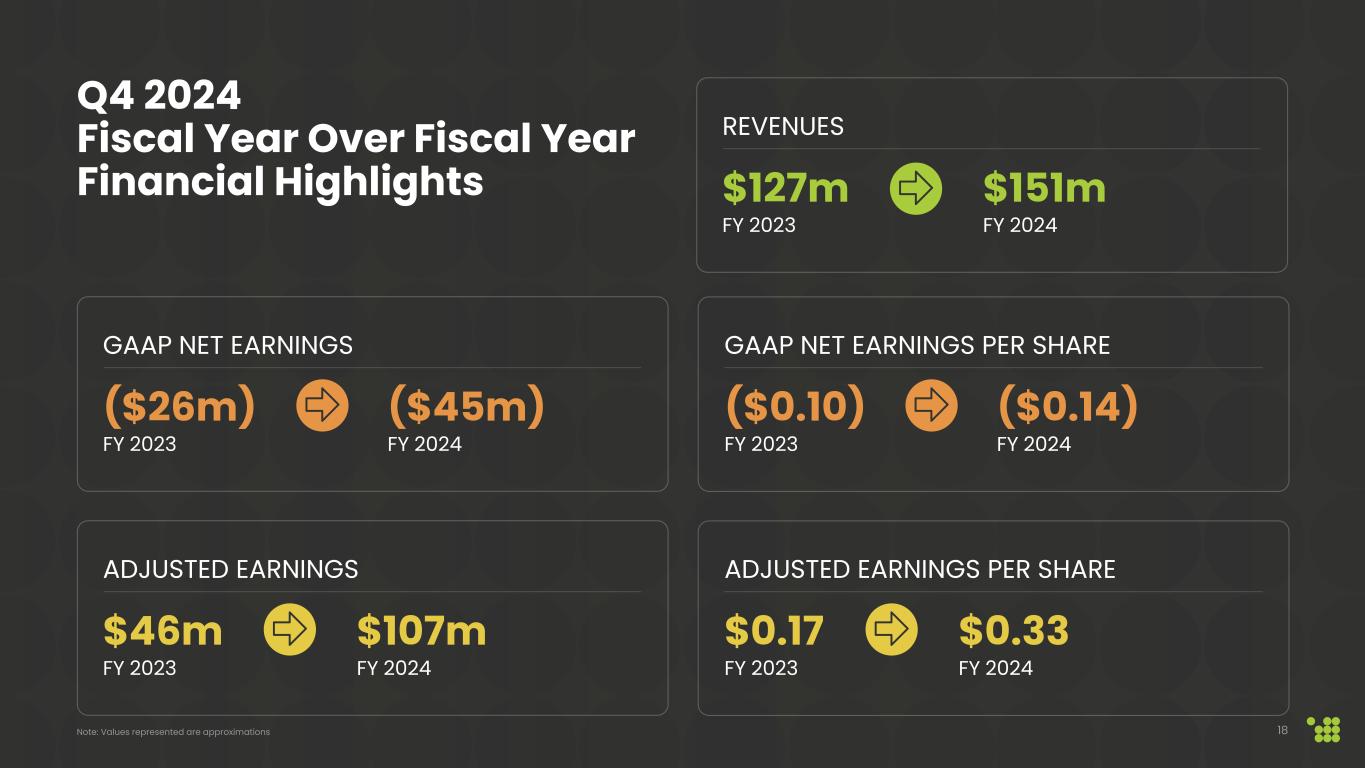

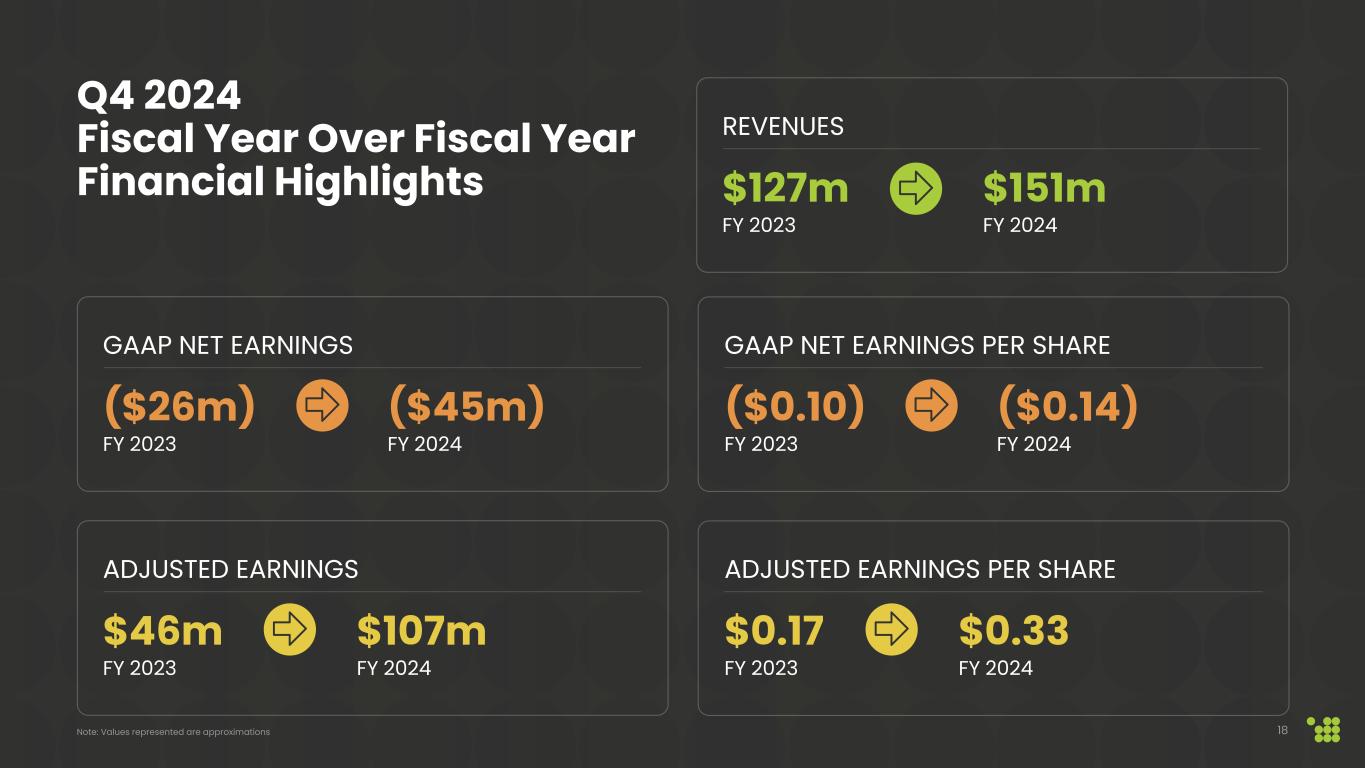

($26m) FY 2023 ($45m) FY 2024 GAAP NET EARNINGS ($0.10) FY 2023 ($0.14) FY 2024 GAAP NET EARNINGS PER SHARE $127m FY 2023 $151m FY 2024 REVENUES Q4 2024 Fiscal Year Over Fiscal Year Financial Highlights 18Note: Values represented are approximations $46m FY 2023 $107m FY 2024 ADJUSTED EARNINGS $0.17 FY 2023 $0.33 FY 2024 ADJUSTED EARNINGS PER SHARE

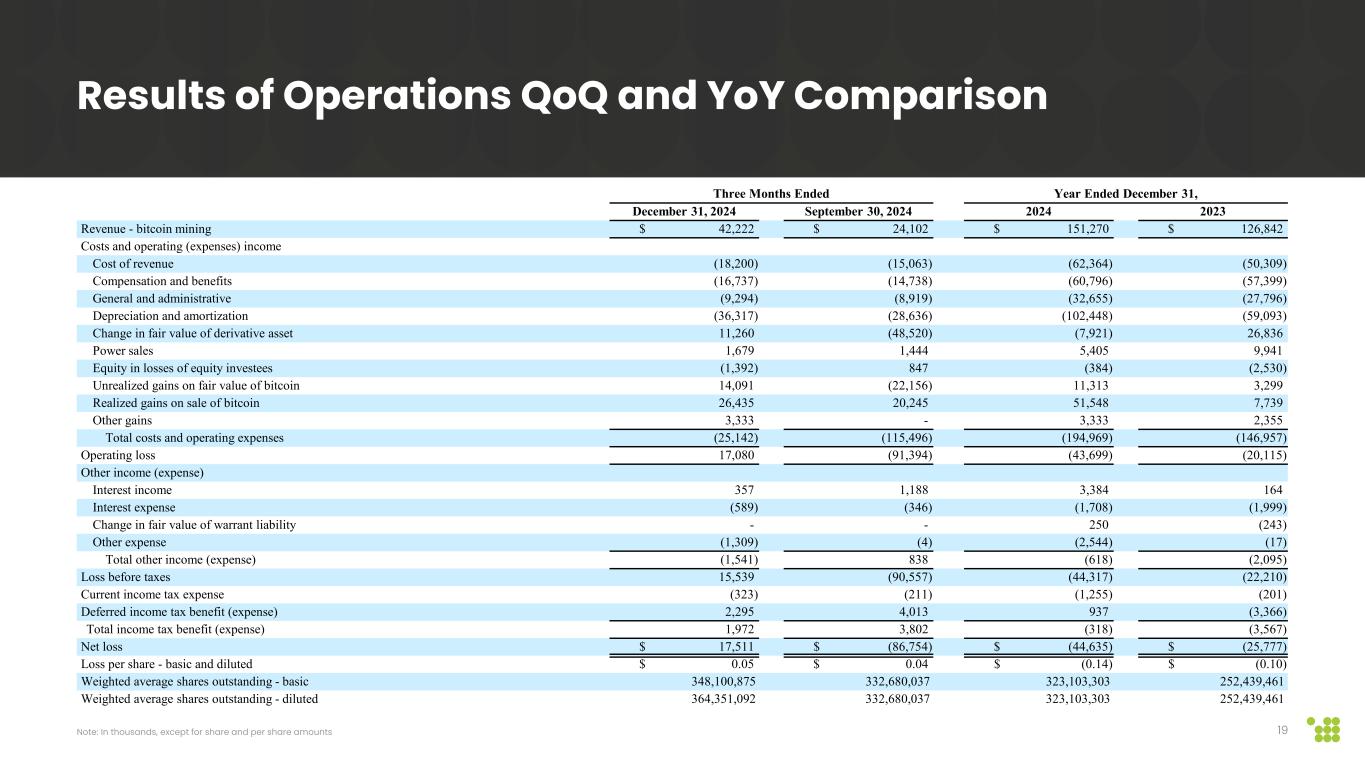

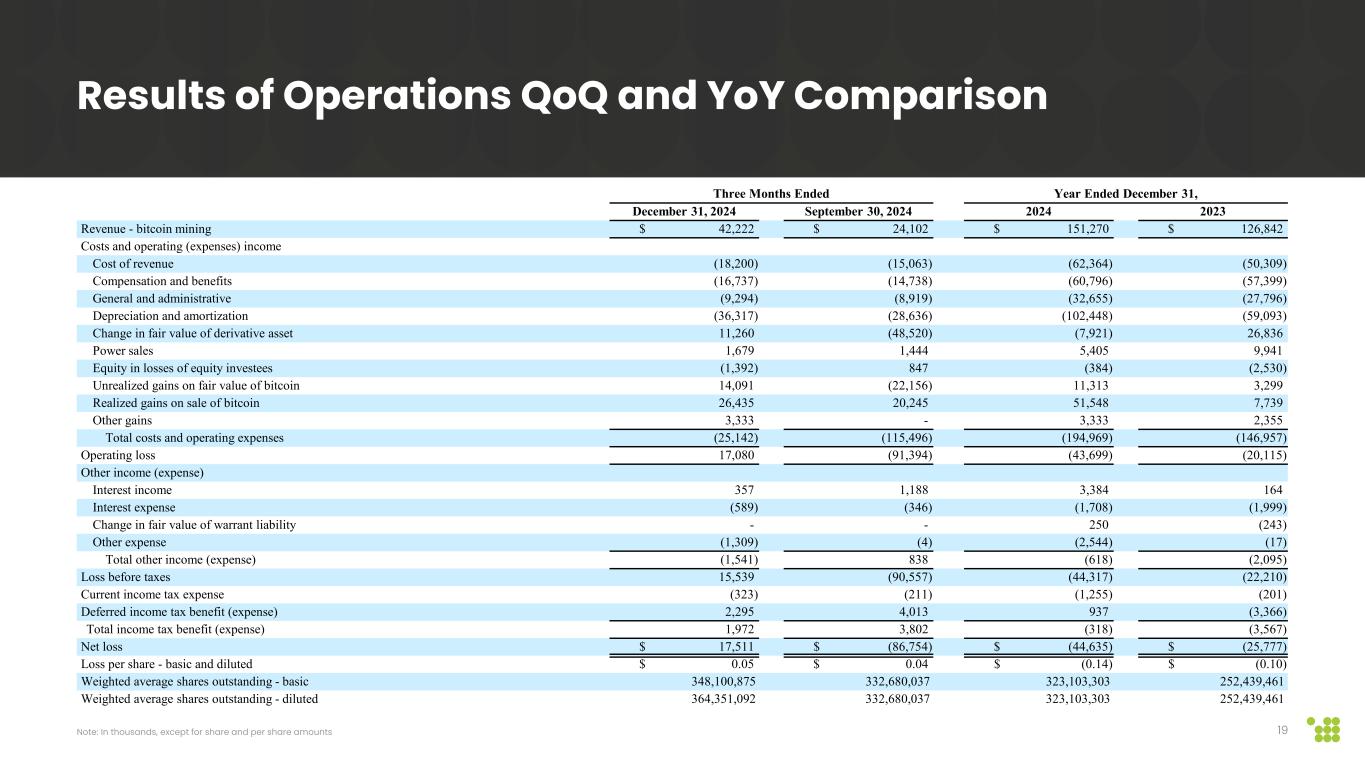

Three Months Ended Year Ended December 31, December 31, 2024 September 30, 2024 2024 2023 Revenue - bitcoin mining $ 42,222 $ 24,102 $ 151,270 $ 126,842 Costs and operating (expenses) income Cost of revenue (18,200) (15,063) (62,364) (50,309) Compensation and benefits (16,737) (14,738) (60,796) (57,399) General and administrative (9,294) (8,919) (32,655) (27,796) Depreciation and amortization (36,317) (28,636) (102,448) (59,093) Change in fair value of derivative asset 11,260 (48,520) (7,921) 26,836 Power sales 1,679 1,444 5,405 9,941 Equity in losses of equity investees (1,392) 847 (384) (2,530) Unrealized gains on fair value of bitcoin 14,091 (22,156) 11,313 3,299 Realized gains on sale of bitcoin 26,435 20,245 51,548 7,739 Other gains 3,333 - 3,333 2,355 Total costs and operating expenses (25,142) (115,496) (194,969) (146,957) Operating loss 17,080 (91,394) (43,699) (20,115) Other income (expense) Interest income 357 1,188 3,384 164 Interest expense (589) (346) (1,708) (1,999) Change in fair value of warrant liability - - 250 (243) Other expense (1,309) (4) (2,544) (17) Total other income (expense) (1,541) 838 (618) (2,095) Loss before taxes 15,539 (90,557) (44,317) (22,210) Current income tax expense (323) (211) (1,255) (201) Deferred income tax benefit (expense) 2,295 4,013 937 (3,366) Total income tax benefit (expense) 1,972 3,802 (318) (3,567) Net loss $ 17,511 $ (86,754) $ (44,635) $ (25,777) Loss per share - basic and diluted $ 0.05 $ 0.04 $ (0.14) $ (0.10) Weighted average shares outstanding - basic 348,100,875 332,680,037 323,103,303 252,439,461 Weighted average shares outstanding - diluted 364,351,092 332,680,037 323,103,303 252,439,461 Results of Operations QoQ and YoY Comparison 19Note: In thousands, except for share and per share amounts

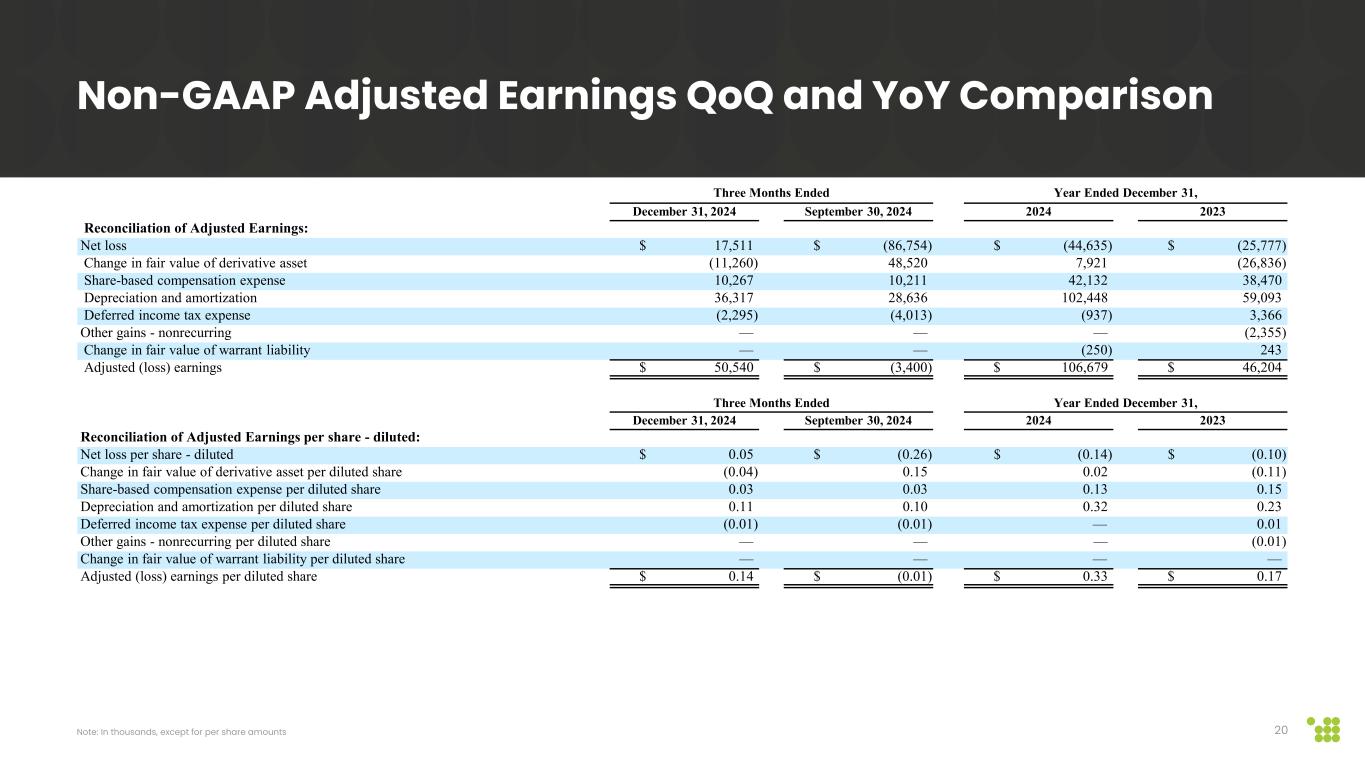

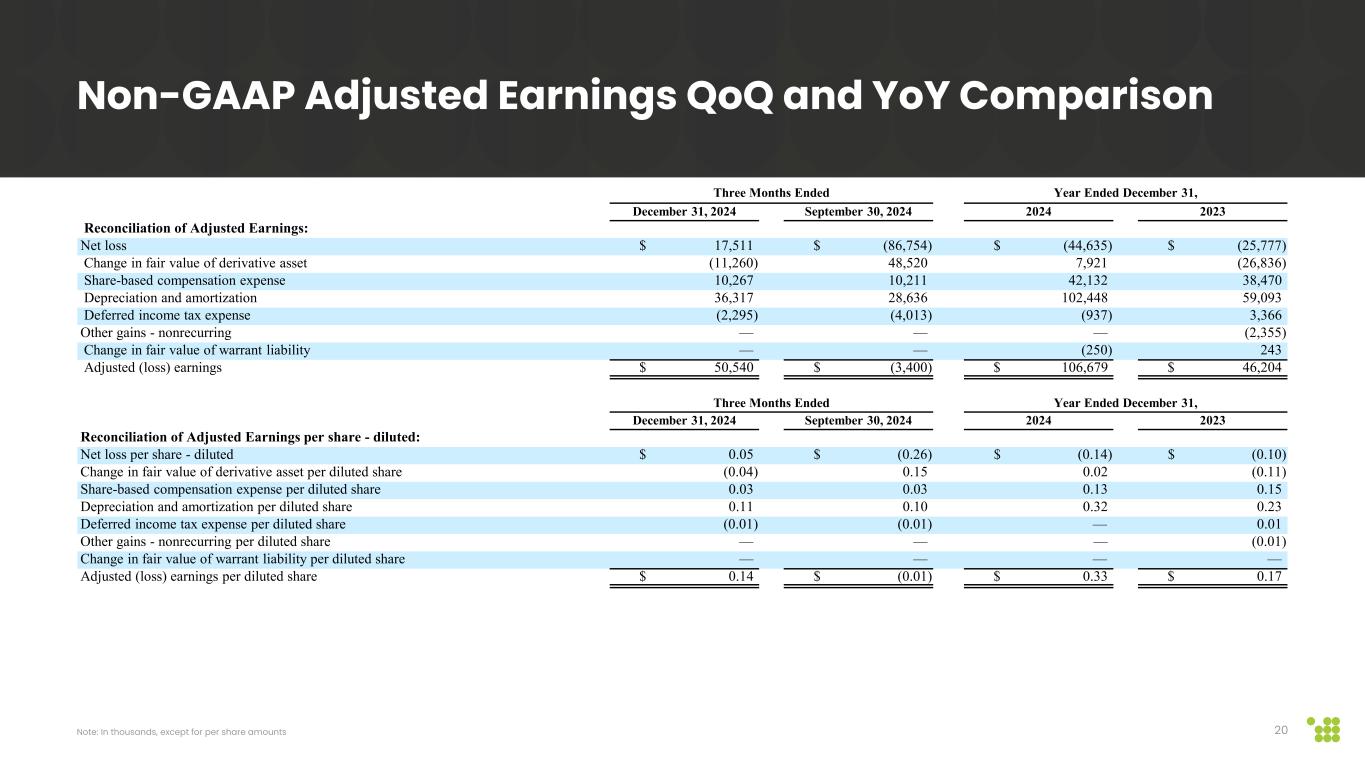

Three Months Ended Year Ended December 31, December 31, 2024 September 30, 2024 2024 2023 Reconciliation of Adjusted Earnings: Net loss $ 17,511 $ (86,754) $ (44,635) $ (25,777) Change in fair value of derivative asset (11,260) 48,520 7,921 (26,836) Share-based compensation expense 10,267 10,211 42,132 38,470 Depreciation and amortization 36,317 28,636 102,448 59,093 Deferred income tax expense (2,295) (4,013) (937) 3,366 Other gains - nonrecurring — — — (2,355) Change in fair value of warrant liability — — (250) 243 Adjusted (loss) earnings $ 50,540 $ (3,400) $ 106,679 $ 46,204 Three Months Ended Year Ended December 31, December 31, 2024 September 30, 2024 2024 2023 Reconciliation of Adjusted Earnings per share - diluted: Net loss per share - diluted $ 0.05 $ (0.26) $ (0.14) $ (0.10) Change in fair value of derivative asset per diluted share (0.04) 0.15 0.02 (0.11) Share-based compensation expense per diluted share 0.03 0.03 0.13 0.15 Depreciation and amortization per diluted share 0.11 0.10 0.32 0.23 Deferred income tax expense per diluted share (0.01) (0.01) — 0.01 Other gains - nonrecurring per diluted share — — — (0.01) Change in fair value of warrant liability per diluted share — — — — Adjusted (loss) earnings per diluted share $ 0.14 $ (0.01) $ 0.33 $ 0.17 Non-GAAP Adjusted Earnings QoQ and YoY Comparison 20Note: In thousands, except for per share amounts

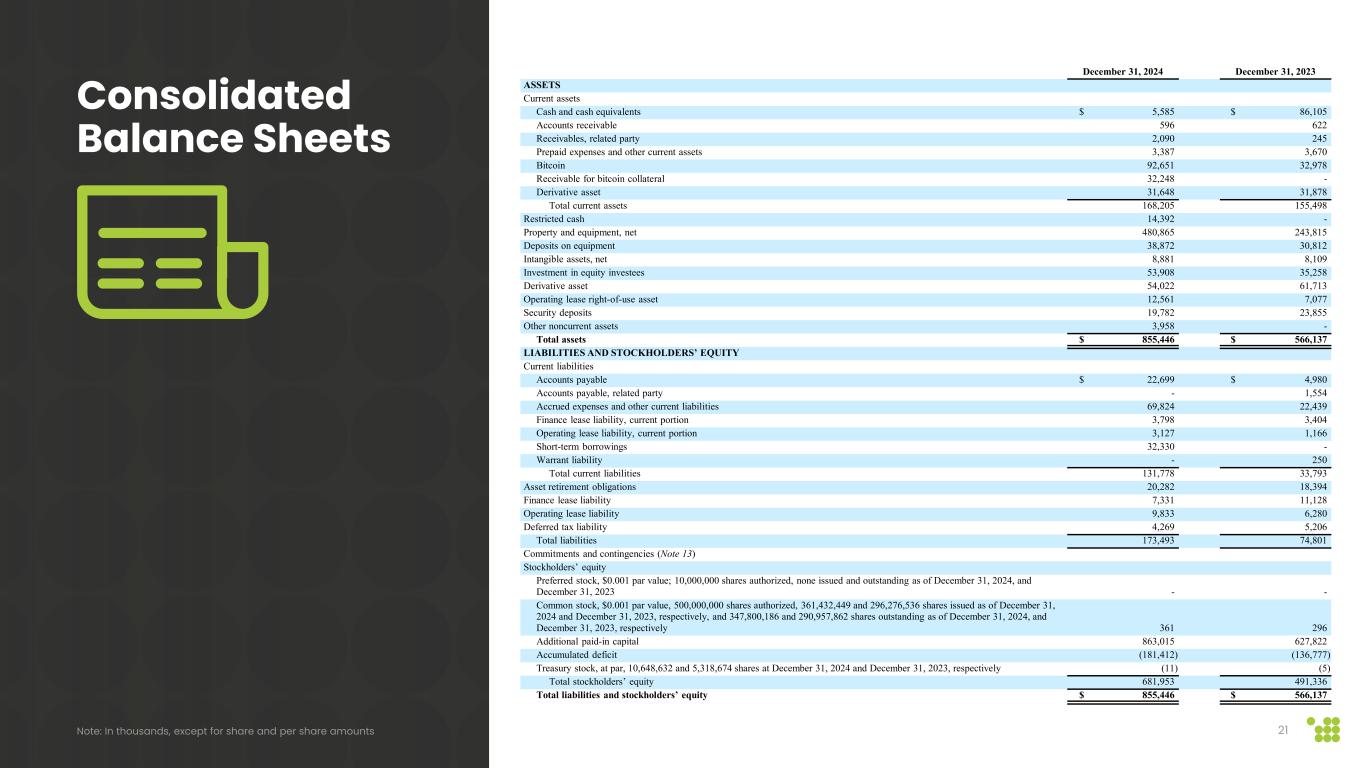

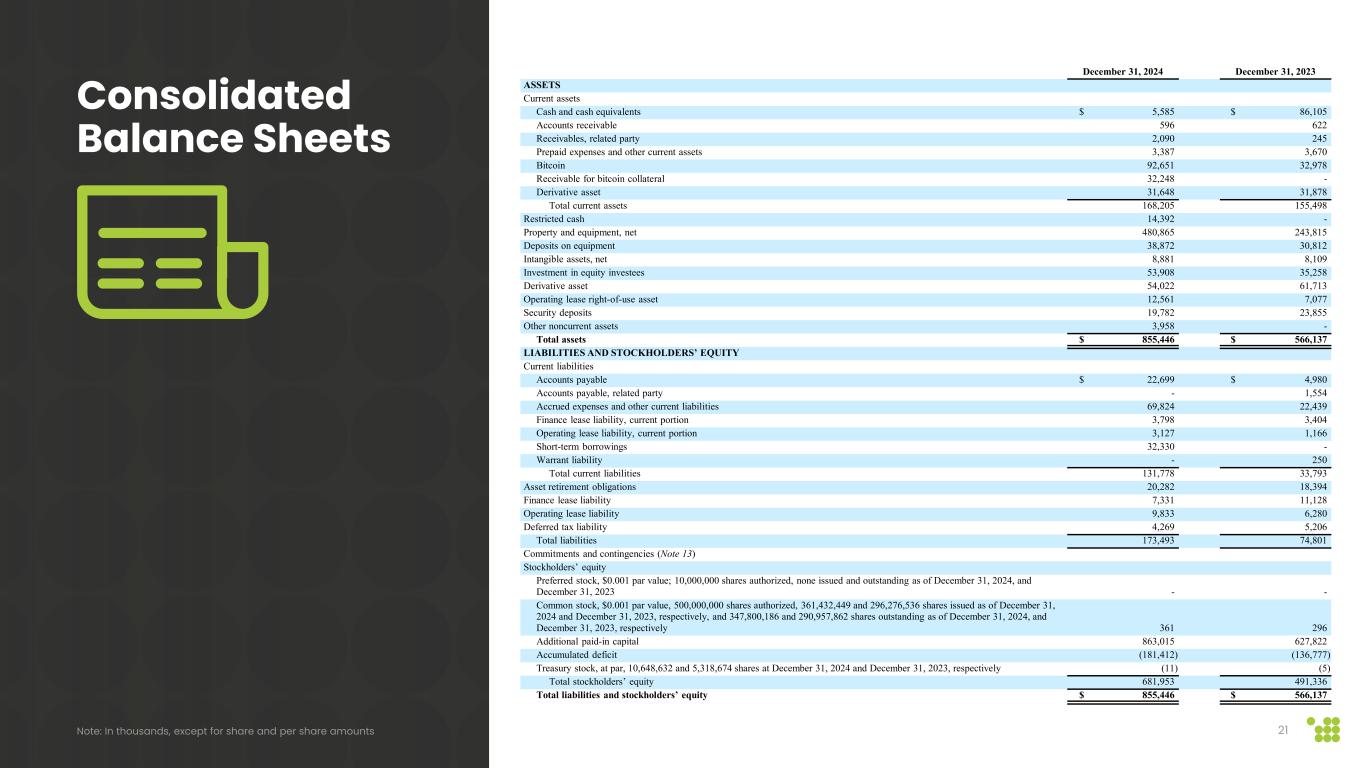

December 31, 2024 December 31, 2023 ASSETS Current assets Cash and cash equivalents $ 5,585 $ 86,105 Accounts receivable 596 622 Receivables, related party 2,090 245 Prepaid expenses and other current assets 3,387 3,670 Bitcoin 92,651 32,978 Receivable for bitcoin collateral 32,248 - Derivative asset 31,648 31,878 Total current assets 168,205 155,498 Restricted cash 14,392 - Property and equipment, net 480,865 243,815 Deposits on equipment 38,872 30,812 Intangible assets, net 8,881 8,109 Investment in equity investees 53,908 35,258 Derivative asset 54,022 61,713 Operating lease right-of-use asset 12,561 7,077 Security deposits 19,782 23,855 Other noncurrent assets 3,958 - Total assets $ 855,446 $ 566,137 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 22,699 $ 4,980 Accounts payable, related party - 1,554 Accrued expenses and other current liabilities 69,824 22,439 Finance lease liability, current portion 3,798 3,404 Operating lease liability, current portion 3,127 1,166 Short-term borrowings 32,330 - Warrant liability - 250 Total current liabilities 131,778 33,793 Asset retirement obligations 20,282 18,394 Finance lease liability 7,331 11,128 Operating lease liability 9,833 6,280 Deferred tax liability 4,269 5,206 Total liabilities 173,493 74,801 Commitments and contingencies (Note 13) Stockholders’ equity Preferred stock, $0.001 par value; 10,000,000 shares authorized, none issued and outstanding as of December 31, 2024, and December 31, 2023 - - Common stock, $0.001 par value, 500,000,000 shares authorized, 361,432,449 and 296,276,536 shares issued as of December 31, 2024 and December 31, 2023, respectively, and 347,800,186 and 290,957,862 shares outstanding as of December 31, 2024, and December 31, 2023, respectively 361 296 Additional paid-in capital 863,015 627,822 Accumulated deficit (181,412) (136,777) Treasury stock, at par, 10,648,632 and 5,318,674 shares at December 31, 2024 and December 31, 2023, respectively (11) (5) Total stockholders’ equity 681,953 491,336 Total liabilities and stockholders’ equity $ 855,446 $ 566,137 Consolidated Balance Sheets 21Note: In thousands, except for share and per share amounts

Appendix

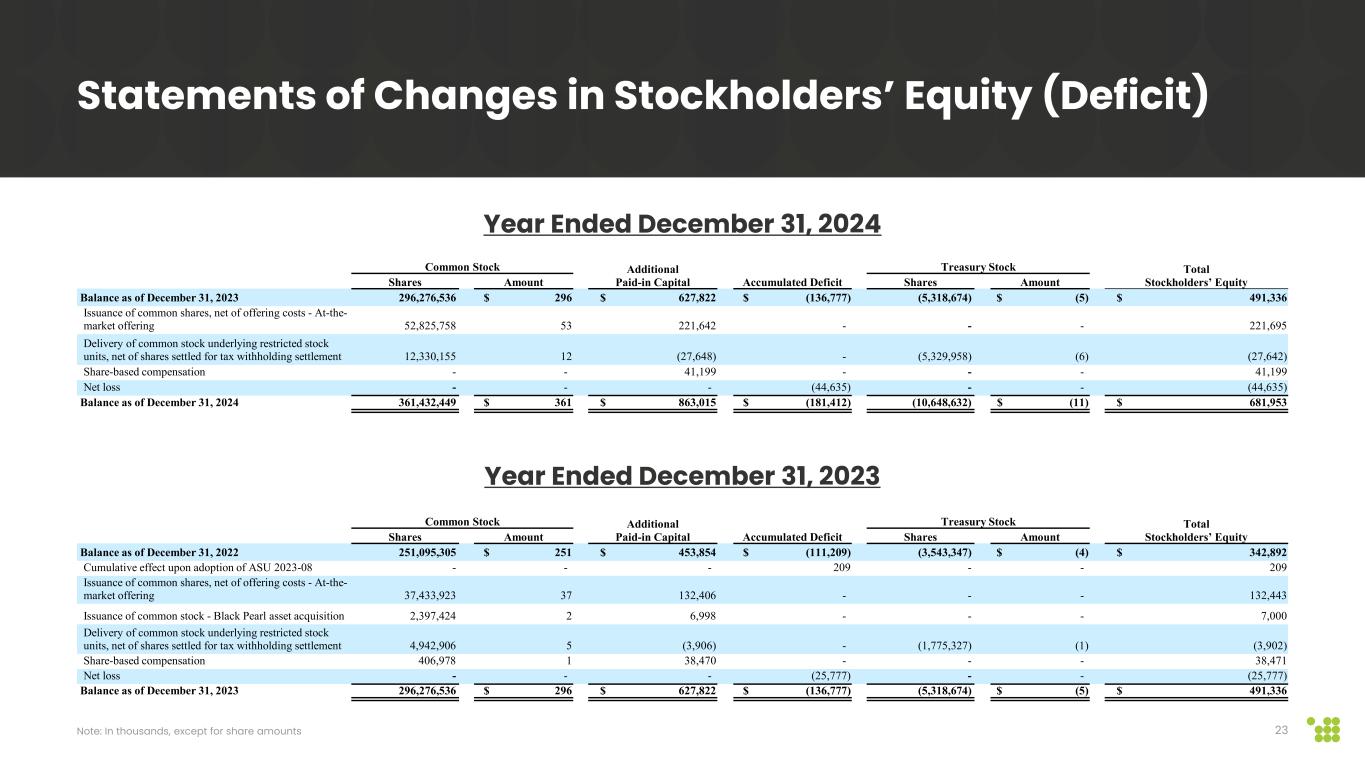

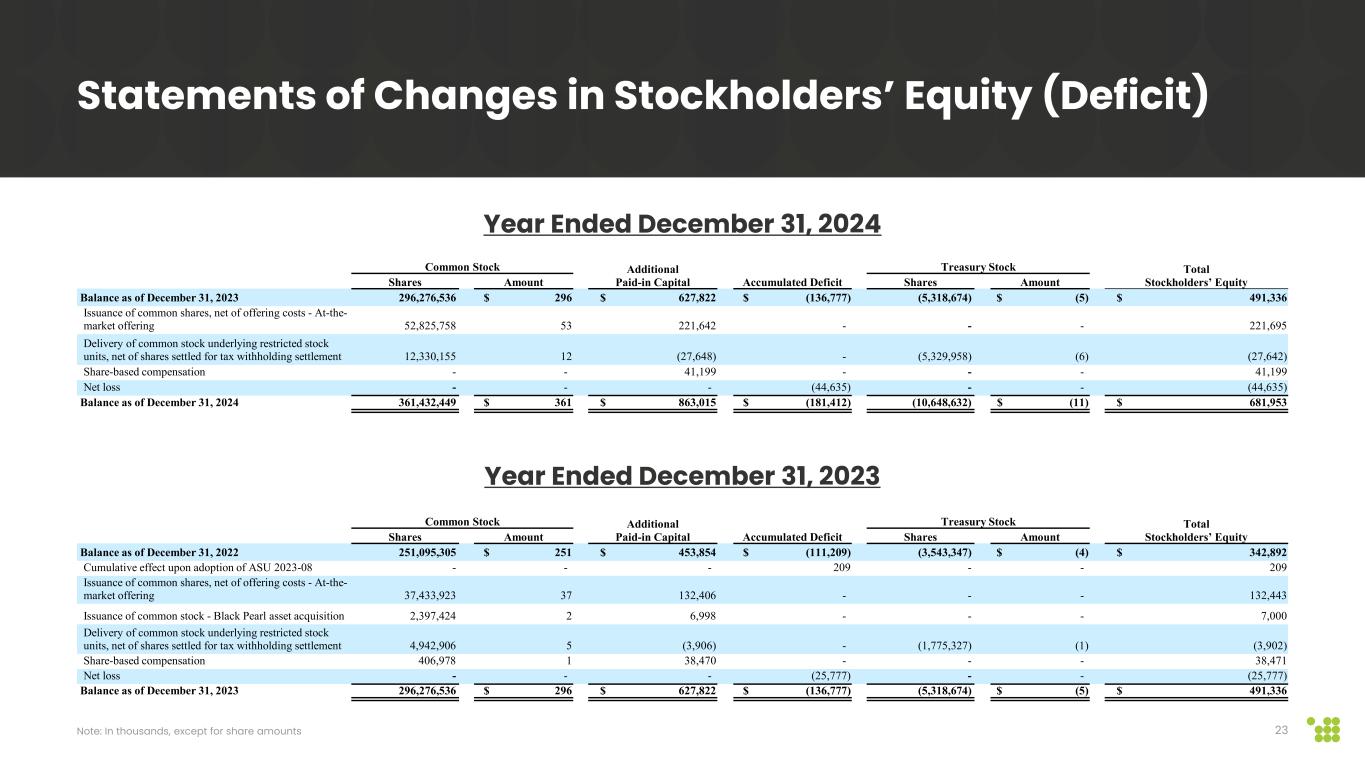

Common Stock Additional Paid-in Capital Accumulated Deficit Treasury Stock Total Stockholders’ Equity Shares Amount Shares Amount Balance as of December 31, 2022 251,095,305 $ 251 $ 453,854 $ (111,209) (3,543,347) $ (4) $ 342,892 Cumulative effect upon adoption of ASU 2023-08 - - - 209 - - 209 Issuance of common shares, net of offering costs - At-the- market offering 37,433,923 37 132,406 - - - 132,443 Issuance of common stock - Black Pearl asset acquisition 2,397,424 2 6,998 - - - 7,000 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 4,942,906 5 (3,906) - (1,775,327) (1) (3,902) Share-based compensation 406,978 1 38,470 - - - 38,471 Net loss - - - (25,777) - - (25,777) Balance as of December 31, 2023 296,276,536 $ 296 $ 627,822 $ (136,777) (5,318,674) $ (5) $ 491,336 Statements of Changes in Stockholders’ Equity (Deficit) 23Note: In thousands, except for share amounts Year Ended December 31, 2024 Year Ended December 31, 2023 Common Stock Additional Paid-in Capital Accumulated Deficit Treasury Stock Total Stockholders’ Equity Shares Amount Shares Amount Balance as of December 31, 2023 296,276,536 $ 296 $ 627,822 $ (136,777) (5,318,674) $ (5) $ 491,336 Issuance of common shares, net of offering costs - At-the- market offering 52,825,758 53 221,642 - - - 221,695 Delivery of common stock underlying restricted stock units, net of shares settled for tax withholding settlement 12,330,155 12 (27,648) - (5,329,958) (6) (27,642) Share-based compensation - - 41,199 - - - 41,199 Net loss - - - (44,635) - - (44,635) Balance as of December 31, 2024 361,432,449 $ 361 $ 863,015 $ (181,412) (10,648,632) $ (11) $ 681,953

Year Ended December 31, 2024 2023 Cash flows from operating activities Net loss $ (44,635) $ (25,777) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation 101,798 58,972 Amortization of intangible assets 650 121 Amortization of operating right-of-use asset 1,249 822 Share-based compensation 42,132 38,470 Equity in losses (gains) of equity investees 384 2,530 Loss on disposal of assets 290 - Non-cash lease expense 919 1,940 Deferred income taxes (937) 3,366 Bitcoin received as payment for services (151,296) (126,319) Change in fair value of derivative asset 7,921 (26,836) Change in fair value of warrant liability (250) 243 Change in fair value of bitcoin collateral (546) - Change in fair value of bitcoin loan (669) - Unrealized gains on fair value of bitcoin (11,313) (3,299) Realized gains on sale of bitcoin (51,548) (7,739) Changes in assets and liabilities: Accounts receivable 26 (524) Receivables, related party (1,845) (1,203) Prepaid expenses and other current assets 283 3,531 Security deposits 12,370 (6,125) Other non-current assets (3,958) - Accounts payable 7,997 (9,306) Accounts payable, related party - (1,529) Accrued expenses and other current liabilities 3,467 5,311 Lease liabilities - (890) Net cash used in operating activities (87,511) (94,241) Consolidated Statement of Cash Flows 24Note: In thousands

Year Ended December 31, 2024 2023 Cash flows from investing activities Proceeds from sale of bitcoin 148,870 111,188 Deposits on equipment (162,958) (33,906) Purchases of property and equipment (139,495) (20,480) Purchases and development of software (1,423) (634) Purchase of strategic contracts - - Capital distributions from equity investees - 3,808 Investment in equity investees (37,123) (3,545) Prepayments on financing lease - (3,676) Net cash (used in) provided by investing activities (192,129) 52,755 Cash flows from financing activities Proceeds from the issuance of common stock 225,181 135,848 Offering costs paid for the issuance of common stock (3,487) (3,404) Repurchase of common shares to pay employee withholding taxes (27,641) (3,902) Proceeds from loans 25,000 - Principal payments on financing lease (5,541) (12,878) Net cash provided by financing activities 213,512 115,664 Net (decrease) increase in cash, cash equivalents, and restricted cash (66,128) 74,178 Cash, cash equivalents, and restricted cash, beginning of the period 86,105 11,927 Cash and cash equivalents, and restricted cash, end of the period $ 19,977 $ 86,105 Consolidated Statement of Cash Flows Cont. 25Note: In thousands

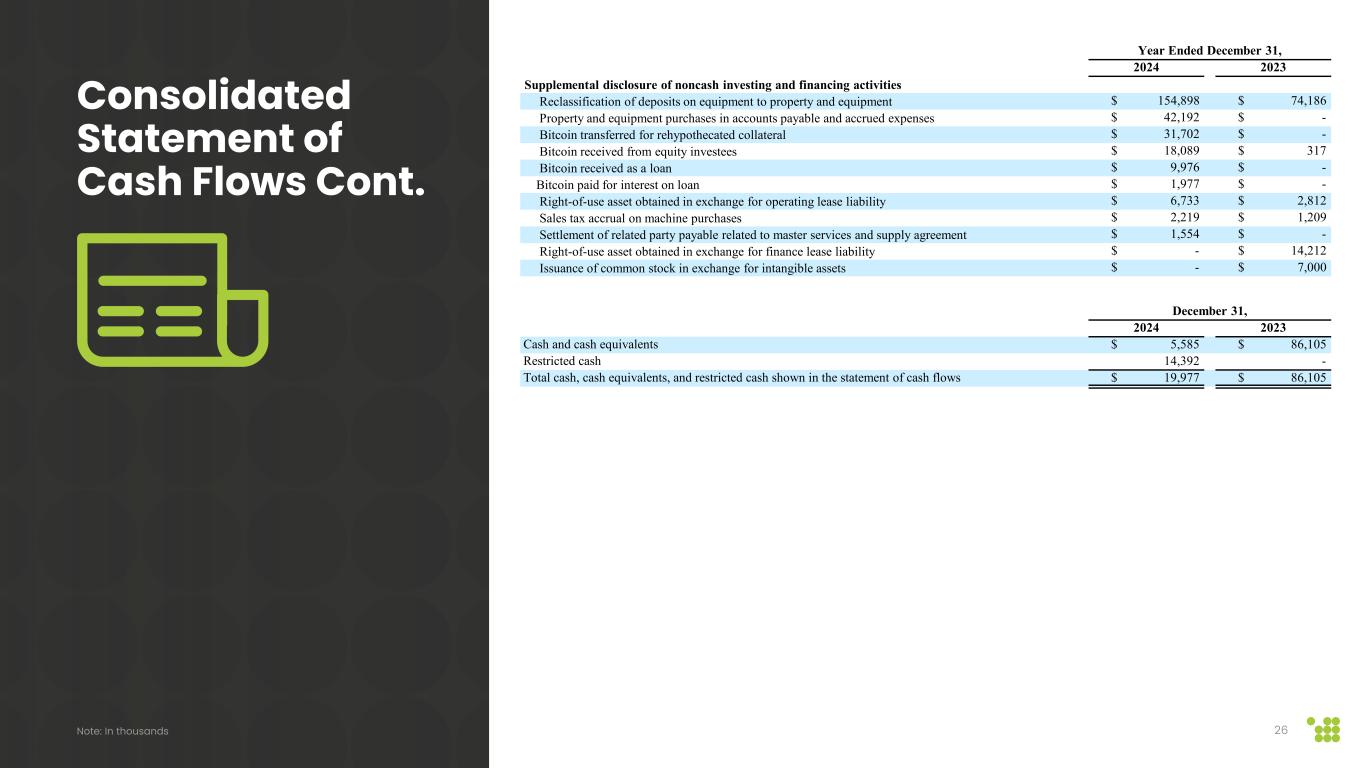

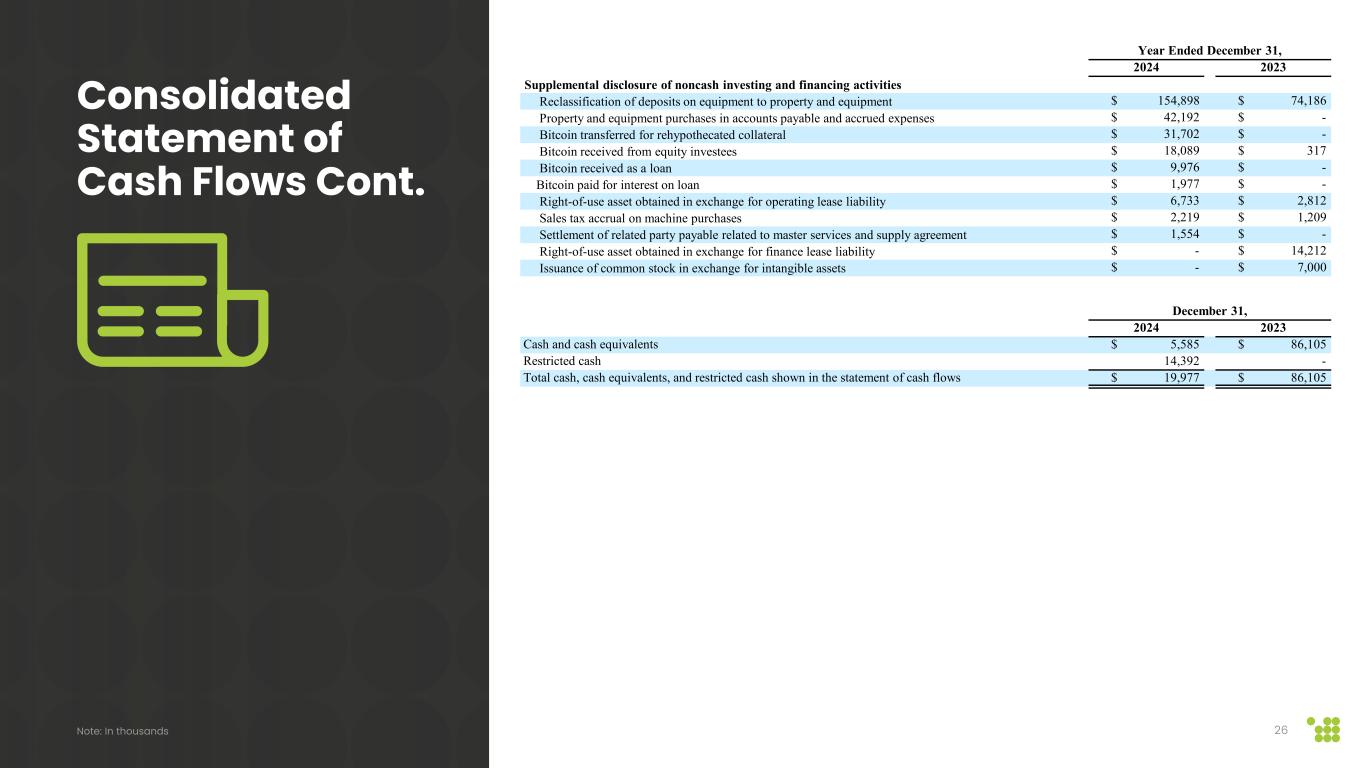

December 31, 2024 2023 Cash and cash equivalents $ 5,585 $ 86,105 Restricted cash 14,392 - Total cash, cash equivalents, and restricted cash shown in the statement of cash flows $ 19,977 $ 86,105 Year Ended December 31, 2024 2023 Supplemental disclosure of noncash investing and financing activities Reclassification of deposits on equipment to property and equipment $ 154,898 $ 74,186 Property and equipment purchases in accounts payable and accrued expenses $ 42,192 $ - Bitcoin transferred for rehypothecated collateral $ 31,702 $ - Bitcoin received from equity investees $ 18,089 $ 317 Bitcoin received as a loan $ 9,976 $ - Bitcoin paid for interest on loan $ 1,977 $ - Right-of-use asset obtained in exchange for operating lease liability $ 6,733 $ 2,812 Sales tax accrual on machine purchases $ 2,219 $ 1,209 Settlement of related party payable related to master services and supply agreement $ 1,554 $ - Right-of-use asset obtained in exchange for finance lease liability $ - $ 14,212 Issuance of common stock in exchange for intangible assets $ - $ 7,000 Consolidated Statement of Cash Flows Cont. 26Note: In thousands