Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-259797 and 333-257440

PROSPECTUS SUPPLEMENT NO. 3

(to Prospectus dated October 7, 2021)

Rocket Lab USA, Inc.

16,266,666 Shares of Common Stock Underlying Warrants

5,600,000 Warrants by the Selling Securityholders

417,404,393 Shares of Common Stock by the Selling Securityholders

This prospectus supplement is being filed to update and supplement the information contained in the combined prospectus dated October 7, 2021 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statements on Form S-1 (Registration Nos. 333-259797 and 333-257440). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on November 15, 2021 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock and public warrants are listed on the Nasdaq Capital Market under the symbols “RKLB” and “RKLBW,” respectively. On November 12, 2021, the last reported sales price of our common stock was $14.37 per share and the last reported sales price of our public warrants was $5.03 per warrant.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, have elected to comply with certain reduced disclosure and regulatory requirements.

Investing in our securities involves risks. See the section entitled “Risk Factors” beginning on page 9 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued or sold under the Prospectus or determined if the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 15, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 15, 2021

Rocket Lab USA, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39560 | 98-1550340 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3881 McGowen Street Long Beach, California | 90808 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (714) 465-5737

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | RKLB | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, each whole warrant exercisable for one share of common stock, $0.0001 par value | RKLBW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On November 15, 2021, Rocket Lab USA, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among the Company, Platinum Merger Sub, Inc. (“Merger Sub”), Planetary Systems Corporation (“PSC”), and Michael Whalen as shareholder representative, which provides for, among other things, the merger of Merger Sub with and into PSC, with PSC being the surviving corporation of the merger and a direct, wholly owned subsidiary of the Company. Pursuant to the terms of the Merger Agreement, all of the issued and outstanding shares of PSC will be cancelled in exchange for aggregate consideration of up to approximately $42 million in cash, 1,720,841 shares of the Company’s common stock, and up to 956,023 shares of the Company’s common stock that are subject to a performance based earn-out, subject to customary adjustments at closing for cash, working capital, transaction expenses and indebtedness, and amounts held back by the Company (the “Acquisition”). The Merger Agreement contains representations, warranties and indemnification provisions customary for transactions of this kind. In connection with the Acquisition, the Company has entered into customary offer letters or employment agreements with certain key employees of PSC. The Company has also agreed to file a resale registration statement with respect to the common stock issued or issuable in the Acquisition prior to the six-month anniversary of the date of the Merger Agreement. The transactions contemplated by the Merger Agreement are expected to close in the Company’s fourth quarter of 2021.

The foregoing summary of the terms of the Merger Agreement does not purport to be complete and is subject to and qualified in its entirety by the full text of the Merger Agreement which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

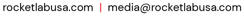

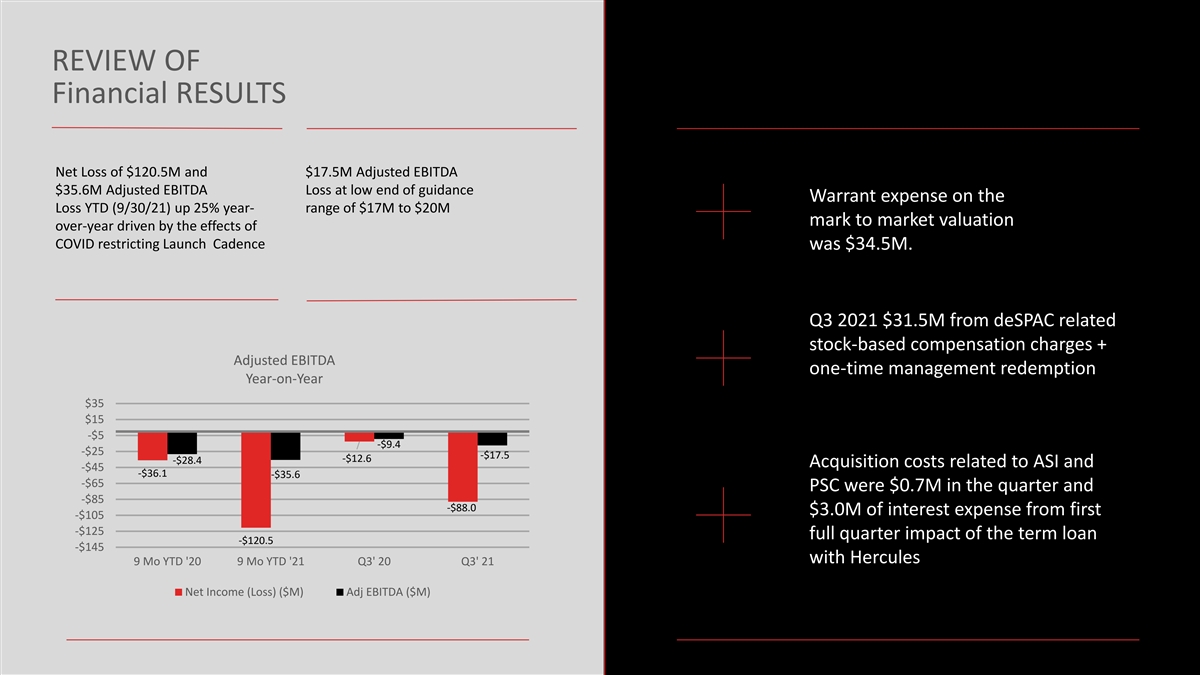

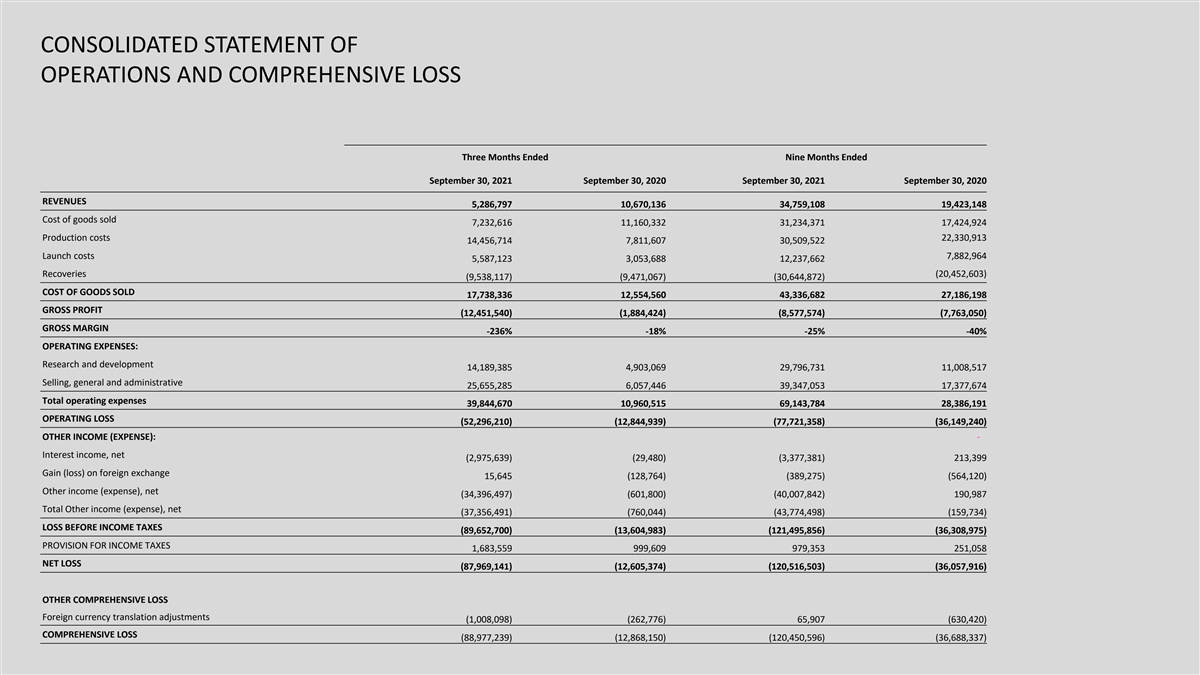

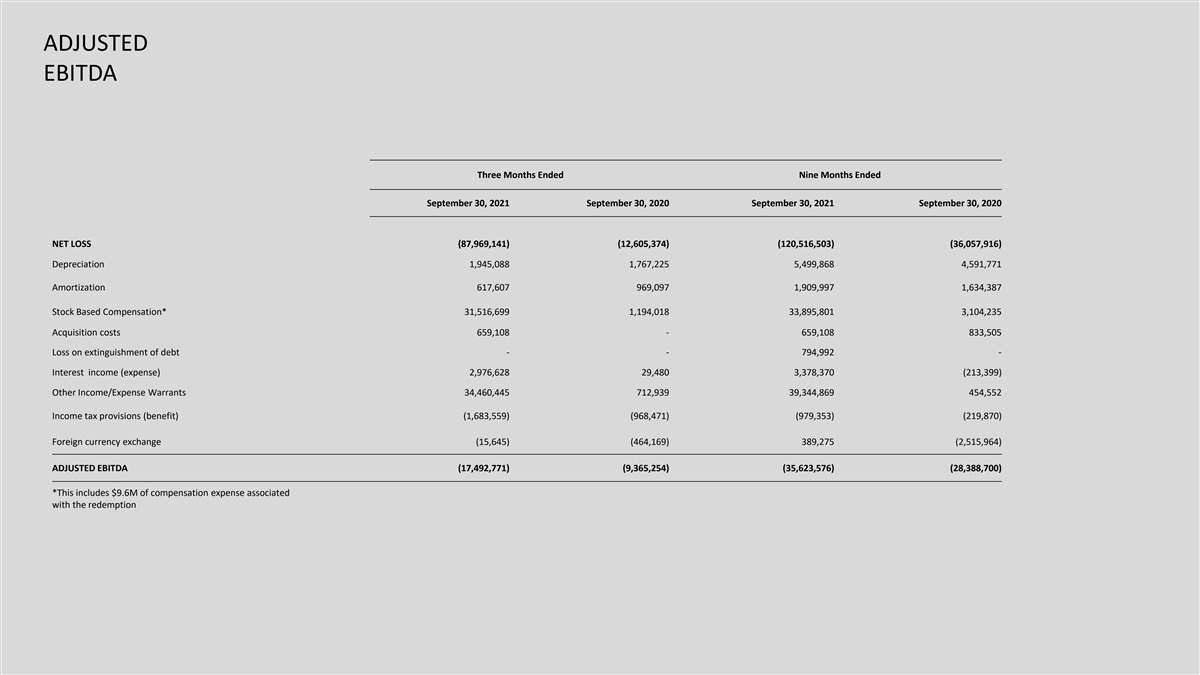

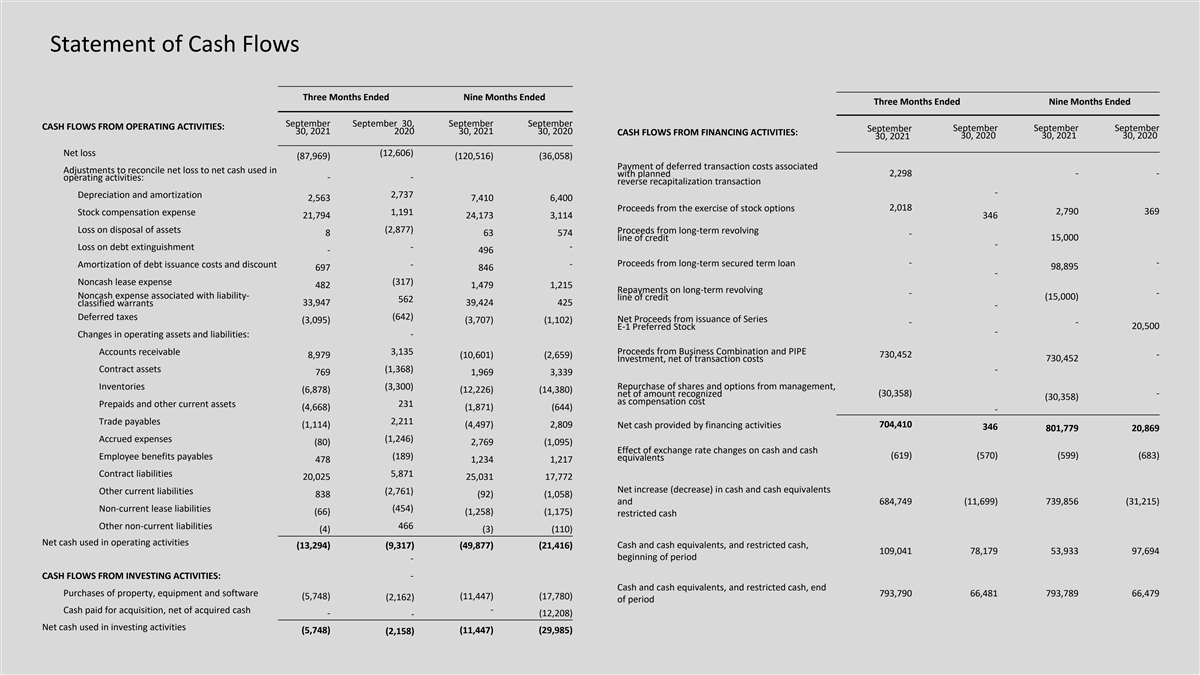

Item 2.01 Results of Operations and Financial Condition

On November 15, 2021, Rocket Lab USA, Inc. issued a press release announcing financial results for the three and nine months ended September 30, 2021. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, and a copy of the related investor presentation to be used on a conference call with investors is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information set forth under this Item 2.02 and in Exhibits 99.1 and 99.2 is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and is not to be incorporated by reference into any filing of the registrant under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The common stock consideration to be issued in connection with the Acquisition (including any shares issued upon the satisfaction of the performance based earn-out) will be issued in reliance upon an exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof and/or Regulation D thereunder, as a transaction by an issuer not involving a public offering.

Item 7.01 Regulation FD Disclosure

On November 15, 2021, the Company issued a press release announcing the entry into the Merger Agreement. A copy of the press release is attached hereto and furnished herewith as Exhibit 99.3.

The information set forth under this Item 7.01 and in Exhibits 99.3 is not being filed for purposes of Section 18 of the Exchange Act and is not to be incorporated by reference into any filing of the registrant under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 10.1* | Agreement and Plan of Merger, by and among Rocket Lab USA, Inc., Platinum Merger Sub, Inc., Planetary Systems Corporation, and Michael Whalen as shareholder representative, dated November 15, 2021. | |

| 99.1 | Press Release of Rocket Lab USA, Inc., dated November 15, 2021, announcing the results for the third quarter ended September 30, 2021. | |

| 99.2 | Investor Presentation, dated November 15, 2021. | |

| 99.3 | Press Release of Rocket Lab USA, Inc., dated November 15, 2021, announcing Planetary Systems Corporation acquisition. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

| * | Certain schedules, exhibits and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the staff of the Securities and Exchange Commission upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 15, 2021 | Rocket Lab USA, Inc. | |||||

| By: | /s/ Adam Spice | |||||

| Adam Spice | ||||||

| Chief Financial Officer | ||||||

Exhibit 10.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

ROCKET LAB USA, INC.,

PLATINUM MERGER SUB, INC.

PLANETARY SYSTEMS CORPORATION

AND

MICHAEL WHALEN, AS SHAREHOLDER REPRESENTATIVE

NOVEMBER 15, 2021

TABLE OF CONTENTS

| Page | ||||||||

1. | Definitions | 2 | ||||||

2. | The Merger | 17 | ||||||

| 2.1 | The Merger | 17 | ||||||

| 2.2 | Closing; Effective Time | 17 | ||||||

| 2.3 | Effect of Merger | 17 | ||||||

| 2.4 | Certificate of Incorporation; Bylaws | 17 | ||||||

| 2.5 | Directors and Officers | 17 | ||||||

| 2.6 | Merger Effect on Capital Stock | 17 | ||||||

| 2.7 | Dissenting Shares | 18 | ||||||

| 2.8 | Estimated Closing Certificate | 18 | ||||||

| 2.9 | Surrender and Payment | 20 | ||||||

| 2.10 | Withholding Rights | 22 | ||||||

| 2.11 | Holdback Amount, Transaction Expenses and Expense Fund | 22 | ||||||

| 2.12 | Earnout | 23 | ||||||

| 2.13 | Taking of Necessary Action; Further Action | 27 | ||||||

| 2.14 | Post-Closing Adjustments | 27 | ||||||

3. | Company Representations and Warranties | 28 | ||||||

| 3.1 | Organization, Standing and Power; Subsidiaries | 28 | ||||||

| 3.2 | Authority | 29 | ||||||

| 3.3 | Governmental Authorization | 29 | ||||||

| 3.4 | Financial Statements | 29 | ||||||

| 3.5 | Capital Structure | 30 | ||||||

| 3.6 | Absence of Certain Changes | 31 | ||||||

| 3.7 | Absence of Undisclosed Liabilities | 32 | ||||||

| 3.8 | Litigation | 32 | ||||||

| 3.9 | Intellectual Property | 32 | ||||||

| 3.10 | Company Products | 38 | ||||||

| 3.11 | Privacy; Security Measures | 39 | ||||||

| 3.12 | Related Person Transactions | 39 | ||||||

| 3.13 | Minute Books | 39 | ||||||

| 3.14 | Material Contracts | 39 | ||||||

| 3.15 | Government Contracts | 41 | ||||||

| 3.16 | Real Estate | 44 | ||||||

| 3.17 | Title to Property; Sufficiency | 45 | ||||||

| 3.18 | Environmental Matters | 45 | ||||||

| 3.19 | Taxes | 46 | ||||||

| 3.20 | Employee Benefit Plans | 48 | ||||||

| 3.21 | Employee Matters | 51 | ||||||

| 3.22 | Insurance | 53 | ||||||

| 3.23 | Compliance with Laws | 53 | ||||||

| 3.24 | International Trade Matters | 53 | ||||||

| 3.25 | Anti-Corruption Compliance | 54 | ||||||

| 3.26 | Accounts Receivable | 55 | ||||||

| 3.27 | Customers | 56 | ||||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||||

| 3.28 | Suppliers | 56 | ||||||

3.29 | Bank Accounts | 56 | ||||||

3.30 | Inventory | 56 | ||||||

3.31 | Brokers’’ and Finders’ Fee | 56 | ||||||

3.32 | No Additional Representations; No Reliance | 56 | ||||||

4. | Representations and Warranties of Parent and Merger Sub | 57 | ||||||

4.1 | Organization, Standing and Power | 57 | ||||||

4.2 | Authority | 57 | ||||||

4.3 | SEC Filings. | 57 | ||||||

4.4 | Absence of Certain Changes or Events | 58 | ||||||

4.5 | Ownership and Operations of Merger Sub | 58 | ||||||

4.6 | Financing | 58 | ||||||

5. | Conduct Prior to the Closing | 58 | ||||||

5.1 | Conduct of Company Business | 58 | ||||||

5.2 | No Solicitation | 61 | ||||||

5.3 | R&W Insurance Policy | 61 | ||||||

6. | Additional Agreements | 61 | ||||||

6.1 | Access to Information | 61 | ||||||

6.2 | Confidentiality | 62 | ||||||

6.3 | Public Disclosure | 62 | ||||||

6.4 | Notification of Certain Matters | 62 | ||||||

6.5 | Employees | 63 | ||||||

6.6 | Expenses | 64 | ||||||

6.7 | Release and Termination of Security Interests | 64 | ||||||

6.8 | Required Contract Consents | 64 | ||||||

6.9 | Shareholder Approval | 64 | ||||||

6.10 | Support Agreements | 65 | ||||||

6.11 | Data Room | 65 | ||||||

6.12 | Tax Matters | 65 | ||||||

6.13 | Release of Claims | 66 | ||||||

6.14 | Indemnification of Directors and Officers | 68 | ||||||

6.15 | Trade Name Filing | 68 | ||||||

6.16 | Securities Laws Matters | 68 | ||||||

7. | Conditions to the Closing | 68 | ||||||

7.1 | Conditions to Obligations of Each Party to Effect the Closing | 68 | ||||||

7.2 | Additional Conditions to the Obligations of Parent | 69 | ||||||

7.3 | Additional Conditions to Obligations of Company | 71 | ||||||

8. | Termination, Amendment and Waiver | 72 | ||||||

8.1 | Termination | 72 | ||||||

8.2 | Effect of Termination | 72 | ||||||

8.3 | Amendment | 72 | ||||||

8.4 | Extension; Waiver | 72 | ||||||

9. | Indemnification | 73 | ||||||

9.1 | Indemnification by the Company Shareholders. | 73 | ||||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||||

9.2 | Indemnification by Parent | 75 | ||||||

9.3 | Indemnification Claims | 75 | ||||||

9.4 | Resolution of Conflicts | 76 | ||||||

9.5 | Shareholder Representative | 76 | ||||||

9.6 | Third-Party Claims | 77 | ||||||

9.7 | Tax Effect of Indemnification Payments | 77 | ||||||

9.8 | Effect of Investigation | 78 | ||||||

9.9 | Exclusive Remedy | 78 | ||||||

9.10 | Additional Limitation | 78 | ||||||

10. | General Provisions | 78 | ||||||

10.1 | Notices | 78 | ||||||

10.2 | Counterparts; Facsimile | 79 | ||||||

10.3 | Entire Agreement; Nonassignability; Parties in Interest | 79 | ||||||

10.4 | Severability | 79 | ||||||

10.5 | Remedies Cumulative | 80 | ||||||

10.6 | Governing Law | 80 | ||||||

10.7 | Rules of Construction | 80 | ||||||

10.8 | Specific Enforcement | 80 | ||||||

10.9 | Amendment; Waiver | 80 | ||||||

10.10 | Interpretation | 81 | ||||||

iii

List of Exhibits

| Exhibit A | Form of Voting and Support Agreement** | |

| Exhibit B | Form of Restrictive Covenant Agreement** | |

| Exhibit C | Plan of Merger** | |

| Exhibit D | Support Agreement** | |

| Exhibit E | Lockup Agreement** | |

| Exhibit F | Letter of Transmittal** | |

| Exhibit G | Stock Holdback Agreement** |

List of Schedules

| Schedule 1 | Calculation of Working Capital** | |

| Schedule 5.1(c)(x) | Capital Expenditures** | |

| Schedule 5.1(c)(xiii) | Employee Benefit Plans; New Hires; Pay Increases** | |

| Schedule 5.1(c)(xiv) | Severance Arrangements and Terminations** | |

| Schedule 6.14(a) | Contractual Right to Indemnification** | |

| Schedule 7.2(g) | Third Party Consents** | |

| Schedule 9.1(a)(x) | Special Indemnifications** |

| ** | These exhibits and schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. |

iv

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger (the “Agreement”) is made and entered into as of November 15, 2021 (the “Agreement Date”), by and among Rocket Lab USA, Inc., a Delaware corporation (“Parent”), Platinum Merger Sub, Inc., a Delaware corporation (“Merger Sub”), Planetary Systems Corporation, a District of Columbia corporation (the “Company”), and Michael Whalen, an individual, solely in his capacity as the representative of the Company Shareholders (“Shareholder Representative”).

RECITALS

A. The Company is engaged in the Company Business.

B. The parties intend for Parent to acquire the Company, on the terms and subject to the conditions set forth in this Agreement

C. In furtherance of such acquisition of the Company by Parent, and on the terms and subject to the conditions set forth in this Agreement and in accordance with the Delaware General Corporation Law (the “DGCL”) and the Business Organizations Code of the District of Columbia (the “DC Code”), Merger Sub shall be merged with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly-owned subsidiary of Parent, and each outstanding share of the Company’s common stock, par value $1.00 per share (the “Company Common Stock”; each share of Company Common Stock a “Share” and, collectively, the “Shares”) (other than the Cancelled Shares and the Dissenting Shares) will be converted into the right to receive the Merger Consideration;

D. The Board of Directors of the Company (the “Company Board”) has unanimously: (i) determined that it is in the best interests of the Company and the holders of shares of the Company Common Stock (the “Company Shareholders”), and declared it advisable, to enter into this Agreement with Parent and Merger Sub; (ii) approved the execution, delivery, and performance of this Agreement and the consummation of the transactions contemplated hereby, including the Merger; and (iii) resolved, subject to the terms and conditions set forth in this Agreement, to recommend adoption of this Agreement by the Company Shareholders;

E. The respective Boards of Directors of Parent (the “Parent Board”) and Merger Sub (the “Merger Sub Board”) have each unanimously: (i) determined that it is in the best interests of Parent or Merger Sub, as applicable, and their respective stockholders, as applicable, and declared it advisable, to enter into this Agreement; and (ii) approved the execution, delivery, and performance of this Agreement and the consummation of the transactions contemplated hereby, including the Merger;

F. The parties desire to make certain representations, warranties, covenants, and agreements in connection with the Merger and the other transactions contemplated by this Agreement and also to prescribe certain terms and conditions to the Merger;

G. Concurrently with the execution of this Agreement, and as a condition and inducement for Parent and Merger Sub to enter into this Agreement, certain Company Shareholders have entered into and delivered voting and support agreements in substantially the form attached hereto as Exhibit A (the “Voting and Support Agreements”);

H. Prior to delivery of this Agreement, and as a condition and inducement for Parent’s willingness to have entered into this Agreement, each Key Employee has executed and delivered to Parent the Restrictive Covenants Agreement in the form attached hereto as Exhibit B (each, a “Restrictive Covenants Agreement”) in each case, to become effective upon the Closing; and

I. Prior to delivery of this Agreement, and as a condition and inducement for Parent’s willingness to have entered into this Agreement, each Key Employee has executed and delivered to Parent an offer letter or employment agreement and an invention disclosure, confidentiality, and proprietary rights agreement with Parent or one of its Affiliates (as determined by Parent in its sole discretion), in each case, to become effective upon the Closing (the “Key Employee Agreements”).

NOW, THEREFORE, in consideration of the covenants and representations set forth herein, and for other good and valuable consideration, the parties agree as follows:

1. Definitions. As used in this Agreement, the following terms shall have the following meanings:

“2022 Achieved Earnout Amount” has the meaning set forth in Section 2.12(b)(viii).

“2022 Earnout Base Revenue” has the meaning set forth in Section 2.12(b)(x).

“2022 Earnout Maximum Consideration” has the meaning set forth in Section 2.12(b)(xi).

“2022 Earnout Period” has the meaning set forth in Section 2.12(b)(i).

“2022 Earnout Revenue Target” has the meaning set forth in Section 2.12(b)(xii).

“2023 Achieved Earnout Amount” has the meaning set forth in Section 2.12(b)(xiii).

“2023 Earnout Base Revenue” has the meaning set forth in Section 2.12(b)(xv).

“2023 Earnout Maximum Consideration” has the meaning set forth in Section 2.12(b)(xvi).

“2023 Earnout Period” has the meaning set forth in Section 2.12(b)(ii).

“2023 Earnout Revenue Target” has the meaning set forth in Section 2.12(b)(xvii).

“401(k) Plan” has the meaning set forth in Section 7.2(l).

“409A Plan” has the meaning set forth in Section 3.19(u).

“ACA” has the meaning set forth in Section 3.20(h).

“Accounting Rules” means, collectively, (i) the rules, principles and methodology consistent with the illustrative calculation of Working Capital set forth on Schedule 1 (collectively, the “Agreed Principles”), (ii) the accounting principles, methods and practices used in preparing the Financial Statements (collectively, the “Historical Principles”) and (iii) GAAP, applied in a manner consistent with its application to the preparation of the Financial Statements (“Historical GAAP”); provided, that notwithstanding any provisions or concepts of GAAP, no developments or events taking place after the Effective Time shall be taken into account; provided, further, that in the event of any conflict among the Agreed Principles, the Historical Principles and Historical GAAP, then the Agreed Principles shall take precedence, followed by the Historical Principles, followed by Historical GAAP.

“Acquisition Proposal” has the meaning set forth in Section 5.2.

2

“Action” means any claim, action, cause of action, suit, litigation, arbitration, proceeding (including any civil, criminal, administrative, investigative or appellate proceeding), hearing, inquiry, audit, examination, subpoena, summons, citation, notice of violation, or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, whether at law or in equity.

“Actual 2022 Revenue” has the meaning set forth in Section 2.12(b)(ix).

“Actual 2023 Revenue” has the meaning set forth in Section 2.12(b)(xiv).

“Adjustment Holdback Amount” means $500,000.

“Affiliate” with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with such Person provided that, for purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities or by contract or otherwise.

“Agreed Principles” has the meaning set forth in the definition of Accounting Rules.

“Agreement” has the meaning set forth in the introductory paragraph.

“Agreement Date” has the meaning set forth in the introductory paragraph.

“Anti-Corruption/ AML Law” means, collectively, (i) the FCPA, the UK Bribery Act 1010, and any other applicable anti-corruption laws or regulations, and (ii) the Currency and Foreign Transactions Reporting Act of 1970, as amended, the applicable anti-money laundering statutes of all jurisdictions where the Company conducts business (or are otherwise applicable to the Company), the rules and regulations thereunder, and any related or similar rules, regulations or guidelines issued, administered or enforced by any Governmental Entity.

“Applicable Law” means, collectively, any applicable federal, state, provincial, foreign or local statute, law, ordinance, regulation, rule, code, order, judicial or arbitral or administrative or regulatory judgment, injunction, decision, or rule of law, including general principles of common law and equity.

“Balance Sheet Date” has the meaning set forth in Section 3.4(a).

“Base Merger Consideration” means the sum of (a) the Cash Merger Consideration and (b) the Stock Merger Consideration (with the value of the Parent Shares calculated by multiplying the aggregate number of Parent Shares issued as Stock Merger Consideration by the Closing Parent Share Price).

“Business Day” means any day except Saturday, Sunday or any other day on which commercial banks located in San Diego, California, the State of Maryland or the District of Columbia are authorized or required by Applicable Law to be closed for business.

“Cancelled Shares” has the meaning set forth in Section 2.6(b).

“Cap” has the meaning set forth in Section 9.1(d)(ii).

“Captive Sales” has the meaning set forth in Section 2.12(b)(iii).

3

“Cash Merger Consideration” means the portion of the Base Merger Consideration payable in cash to Company Shareholders pursuant to the terms of this Agreement, which shall be an amount equal to (a) $42,000,000 plus or minus (as applicable) (b) the Working Capital Adjustment Amount, and plus or minus (as applicable) (c) the Net Cash Adjustment Amount.

“Cash Ratio” means the quotient of (a) the Cash Merger Consideration divided by (b) the Base Merger Consideration.

“CERCLA” means the federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. Section 9601, et seq., as amended.

“Change of Control” means, with respect to a Person, the occurrence of any of the following events: (i) an acquisition of such Person by another Person by means of any transaction or series of related transactions (including, without limitation, any reorganization, merger or consolidation but excluding any merger effected exclusively for the purpose of changing the domicile of such Person), or (ii) a sale of all or substantially all of the assets of such Person, so long as in either case such Person’s stockholders of record immediately prior to such transaction will, immediately after such transaction, hold less than fifty percent (50%) of the voting power of the surviving or acquiring Person.

“Claim Notice” has the meaning set forth in Section 9.3(a).

“Claims” has the meaning set forth in Section 6.13(b).

“Claims Period” has the meaning set forth in Section 9.3(d).

“Closing” has the meaning set forth in Section 2.2.

“Closing Balance Sheet” has the meaning set forth in Section 2.14(a).

“Closing Certificate” has the meaning set forth in Section 2.14(a).

“Closing Date” has the meaning set forth in Section 2.2.

“Closing Cash” means an amount equal to the Company’s consolidated cash and cash equivalents (excluding restricted cash and security deposits) as of the Closing determined in accordance with the Accounting Rules.

“Closing Parent Share Price” means $10.46.

“Closing Purchase Price” means an amount equal to the Base Merger Consideration as set forth in the Estimated Closing Certificate.

“COBRA” has the meaning set forth in Section 3.20(b).

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” has the meaning set forth in the introductory paragraph.

“Company Board” has the meaning set forth in the Recital D.

4

“Company Business” means the operation of the business of the Company as currently conducted and as currently proposed by the Company to be conducted, including the design, manufacture and sale of mechanical systems used in the aerospace industry.

“Company Common Stock” has the meaning set forth in Recital C.

“Company Employee Plans” has the meaning set forth in Section 3.20(a).

“Company Fundamental Representations” has the meaning set forth in Section 9.1(b).

“Company Gross Margin” has the meaning set forth in Section 2.12(b)(iv).

“Company Gross Revenue” has the meaning set forth in Section 2.12(b)(v).

“Company Intellectual Property” means the Company Owned Intellectual Property and the Company Licensed Intellectual Property.

“Company Licensed Intellectual Property” means Intellectual Property owned by any Person other than Company that (i) is used by or licensed or sublicensed to the Company or (ii) for which Company has received from such Person a release, waiver, covenant not to sue or assert or other immunity from suit or similar contractual covenant.

“Company Material Adverse Effect” means any change, event, violation, inaccuracy, circumstance or effect (each, an “Effect”) that, individually or in the aggregate, (x) is or is reasonably likely to be materially adverse to the financial condition, properties, assets, liabilities, business, operations, results of operations of the Company or (y) has or is reasonably likely to have a material adverse effect on the ability of the Company to consummate the Merger and the other transactions contemplated hereby; provided, however, that any Effect arising from the following shall not constitute a Company Material Adverse Effect: (i) general economic, political or business conditions or changes therein (including commencement, continuation or escalation of war, armed hostilities or national or international calamity, changes in interest or exchange rates or any governmental shutdown or slowdown) or any change generally affecting the industry of the Company, provided that such changes shall not have affected the target in a materially disproportionate manner as compared to other companies operating in the target’s line of business, (ii) any act of terrorism, similar calamity, national emergency, pandemic or war (whether or not declared) or any escalation or worsening of any of the foregoing, including the COVID-19 pandemic, (iii) changes in accounting principles or interpretation thereof, including GAAP, (iv) changes in any laws, rules, regulations, orders, enforcement policies or other binding directives issued by any Governmental Entity, (v) the availability or cost of equity, debt or other financing to Parent, (vi) the entry into or announcement of this Agreement or any Transaction Document, the pendency or consummation of the transactions contemplated hereby or thereby or the performance of this Agreement or any Transaction Document, including any adverse change in customer, supplier, governmental, landlord, employee or similar relationships resulting therefrom or with respect thereto, (vii) the compliance with the terms of this Agreement or any Transaction Document or the taking of any action (or the omission of any action) expressly required by this Agreement or any Transaction Document or taken (or omitted to be taken) with the written consent of Parent, or (viii) any act of God or natural disaster, (ix) any changes in geopolitical conditions.

“Company Owned Intellectual Property” means all Intellectual Property owned, purported to be owned (whether owned singularly or jointly with a third party or parties), filed by, held in the name of, or assigned to the Company as of the Agreement Date, including but not limited to Company Registered Intellectual Property.

5

“Common Per Share Cash Consideration” means the amount of cash payable in respect of the Common Per Share Consideration as set forth in the Estimated Closing Certificate, which shall be equal to the product of (a) the Common Per Share Consideration multiplied by (b) the Cash Ratio.

“Common Per Share Consideration” means the amount of Base Merger Consideration payable in respect of each share of Company Common Stock pursuant to the terms of this Agreement as set forth in the Estimated Closing Certificate, which amount shall be equal to the quotient of (a) the Base Merger Consideration divided by (b) the Fully Diluted Shares Outstanding.

“Common Per Share Stock Consideration” means the number of Parent Shares issuable in respect of the Common Per Share Consideration as set forth in the Estimated Closing Certificate, which shall be equal to the product of (a) the Common Per Share Consideration multiplied by (b) the Stock Ratio.

“Company Product(s)” means each and all services and products manufactured or developed (including services and products for which development is ongoing) by or on behalf of the Company, whether at any time in the past, as of the Agreement Date or currently under development.

“Company Registered Intellectual Property” means all Registered Intellectual Property that is included in the Company Owned Intellectual Property.

“Company Shareholders” has the meaning set forth in Recital D.

“Company Technology” means all Company Products and all other Technology owned by or licensed to the Company as of the Agreement Date or at any time in the past, or purported to be owned by or licensed to the Company as of the Agreement Date or at any time in the past, and that is used or was used by or on behalf of the Company in connection with the conduct of the Company Business.

“Company’s Current Facilities” has the meaning set forth in Section 3.18.

“Company’s Facilities” has the meaning set forth in Section 3.18.

“Confidentiality Agreement” has the meaning set forth in Section 6.2(a).

“Contract” means any contract, agreement or arrangement, whether written or oral.

“Copyrights” means all copyrights, copyrightable works and mask works (including all applications and registrations for each of the foregoing), and all other rights corresponding thereto throughout the world, including economic rights in copyrights.

“Cost Accounting Standards” means the Cost Accounting Standards promulgated by the U.S. Cost Accounting Standards Board.

“D&O Tail Policy” has the meaning ascribed to it in Section 6.14(c).

“Damages” has the meaning set forth in Section 9.1(a).

“DC Code” has the meaning set forth in Recital C.

“DGCL” has the meaning set forth in Recital C.

6

“Disability” means, with respect to an employee, such employee’s inability, due to physical or mental incapacity, to perform the essential functions of his or her job, with or without reasonable accommodation, for one hundred eighty (180) days out of any three hundred sixty-five (365) day period. Any question as to the existence of the employee’s Disability as to which the employee and the Parent cannot agree shall be determined in writing by a qualified independent physician mutually acceptable to the employee and the Parent. The determination of Disability made in writing to the Parent and the employee shall be final and conclusive for all purposes of this Agreement.

“Disclosure Schedule” has the meaning set forth in Section 3.

“Disputed Items” has the meaning set forth in Section 2.14(b).

“Dissenting Shares” has the meaning set forth in Section 2.7.

“Draft Earnout Report” has the meaning set forth in Section 2.12(c)(i).

“Earnout Acceleration Event” has the meaning set forth in Section 2.12(b)(xviii).

“Earnout Period” has the meaning set forth in Section 2.12(b)(vi).

“Earnout Revenue” has the meaning set forth in Section 2.12(b)(vii).

“Effect” has the meaning set forth in the definition of Material Adverse Effect.

“Effective Time” has the meaning set forth in Section 2.2.

“Encumbrance” means any lien, pledge, hypothecation, charge, mortgage, security interest, encumbrance, option, right of first refusal, right of first negotiation, equitable interest, preemptive right, community property interest, title retention or title reversion agreement, prior assignment, or any other encumbrance or restriction of any nature, whether accrued, absolute, contingent or otherwise (including any restriction on the transfer or licensing of any asset, any restriction on the receipt of any income derived from any asset, any restriction on the use of any asset and any restriction on the possession, exercise or transfer of any other attribute of ownership of any asset).

“Environmental Laws” means any applicable foreign, federal, state or local governmental laws (including common laws), statutes, ordinances, codes, regulations, rules, policies, permits, licenses, certificates, approvals, judgments, decrees, orders, directives, or requirements that pertain to the protection of the environment, protection of public health and safety, or protection of worker health and safety, or that pertain to the handling, use, manufacturing, processing, storage, treatment, transportation, discharge, release, emission, disposal, re-use, recycling, or other contact or involvement with Hazardous Materials, including CERCLA and the RCRA.

“ERISA” has the meaning set forth in Section 3.20(a).

“ERISA Affiliate” has the meaning set forth in Section 3.20(a).

“Estimated Closing Balance Sheet” has the meaning set forth in Section 2.8(a)(iii).

“Estimated Closing Certificate” has the meaning set forth in Section 2.8(a).

“Estimated Net Cash” means the estimated Net Cash as reflected in the Estimated Closing Certificate and on the Estimated Closing Balance Sheet.

7

“Estimated Working Capital” means the estimated Working Capital as reflected in the Estimated Closing Certificate and on the Estimated Closing Balance Sheet.

“Expense Fund” has the meaning set forth in Section 2.11(c).

“Expiration Date” has the meaning set forth in Section 9.1(b).

“FAR” means the U.S. Federal Acquisition Regulations.

“FCPA” means the U.S. Foreign Corrupt Practices Act, 15 U.S.C. 78dd et seq.

“Final Earnout Report” has the meaning set forth in Section 2.12(c)(iii)

“Final Net Cash” means the Net Cash as of the Closing Date in accordance with Sections 2.14(a) and 2.14(b).

“Final Revenue Report” has the meaning set forth in Section 2.12(c)(iii)

“Final Working Capital” means the Working Capital as of the Closing Date in accordance with Sections 2.14(a) and 2.14(b).

“Financial Statements” has the meaning set forth in Section 3.4(a).

“FMLA” has the meaning set forth in Section 3.20(h).

“Fraud” means common law fraud under the laws of the State of Delaware.

“Fully Diluted Shares Outstanding” means the number of shares of Company Common Stock outstanding immediately prior to the Closing.

“GAAP” means United States generally accepted accounting principles.

“Government Bid” means any outstanding bid, quotation, proposal or grant application by the Company which, if accepted or awarded, would result in a Government Contract.

“Government Contract” means any Contract (including any prime contract, subcontract, teaming agreement or arrangement, joint venture, basic ordering agreement, letter contract, purchase order, delivery or task order, grant, cooperative agreement, awards under the Small Business Innovation Research or Small Business Technology Transfer programs, change order or other arrangement of any kind in writing) entered into by the Company with any Governmental Entity or with any prime contractor or upper-tier subcontractor that by its terms relates to or identifies a Contract where any Governmental Entity is a party thereto by which the Company has agreed to provide goods or services (including one or more licenses) to such Governmental Entity, prime contractor, or upper-tier subcontractor or to any third party (including the public) on behalf of such Governmental Entity, prime contractor or upper-tier subcontractor.

“Governmental Entity” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of law), or any arbitrator, court or tribunal of competent jurisdiction.

8

“Government Involvement” has the meaning set forth in Section 3.9(i).

“Government Officials” has the meaning set forth in Section 3.25(a)(iii).

“Hazardous Materials” means any material, chemical, compound, substance, mixture or by-product that is identified, defined, designated, listed, restricted or otherwise regulated under Environmental Laws as a “hazardous constituent,” “hazardous substance,” “hazardous material,” “acutely hazardous material,” “extremely hazardous material,” “hazardous waste,” “hazardous waste constituent,” “acutely hazardous waste,” “extremely hazardous waste,” “infectious waste,” “medical waste,” “biomedical waste,” “pollutant,” “toxic pollutant,” “contaminant” or any other formulation or terminology intended to classify or identify substances, constituents, materials or wastes by reason of properties that are deleterious to the environment, natural resources, worker health and safety, or public health and safety, including ignitability, corrosivity, reactivity, carcinogenicity, toxicity and reproductive toxicity. The term “Hazardous Materials” shall include any “hazardous substances” as defined, listed, designated or regulated under CERCLA, any “hazardous wastes” or “solid wastes” as defined, listed, designated or regulated under RCRA, any asbestos or asbestos-containing materials, any polychlorinated biphenyls, and any petroleum or hydrocarbonic substance, fraction, distillate or by-product.

“HIPAA” means, collectively, the Health Insurance Portability and Accountability Act of 1996, Public Law 104-191 and the regulations promulgated thereunder.

“Historical GAAP” has the meaning set forth in the definition of Accounting Rules.

“Historical Principles” has the meaning set forth in the definition of Accounting Rules.

“Holdback Amount” means, collectively, the Adjustment Holdback Amount and the Indemnity Holdback Amount.

“Indebtedness” means (i) all indebtedness of the Company for borrowed money (other than current trade payables incurred in the ordinary course of business consistent with past practices), (ii) all long or short term debt obligations of the Company evidenced by notes, bonds, debentures or similar instruments, (iii) all capital lease obligations, (iv) all obligations of the Company under any currency, interest rate or other hedging agreement or arrangement, (v) any obligations secured by a lien on the assets of the Company (other than a Permitted Encumbrance), (vi) all direct and indirect guarantees made by the Company with respect to the foregoing clauses (i) through (v), (vii) all reimbursement obligations under any letters of credit (whether drawn or undrawn), (viii) any unpaid interest, prepayment penalties, premiums, costs and fees that would arise or become due as a result of the prepayment of any of the obligations described in the foregoing clauses (i) through (vii), and (ix) all unpaid income Taxes of the Company for any Pre-Closing Tax Period, which shall not be an amount less than zero, including for the avoidance of doubt, any income Taxes of the Company arising out of or resulting from the transactions contemplated by the Agreement.

“Indemnity Holdback Amount” means $1,500,000.

“Indemnity Holdback Termination Date” means the date which is twelve (12) months following the Closing Date.

“Independent Accounting Firm” means PricewaterhouseCoopers LLP or such other independent accounting firm of national reputation selected by Parent and reasonably acceptable to the Shareholder Representative.

9

“Information Systems” has the meaning set forth in Section 3.11(b).

“Insurance Policies” has the meaning set forth in Section 3.21(a).

“Insurer” means the insurer under the R&W Insurance Policy.

“Intellectual Property” means any and all of the following in any country: (a)(i) Patents, (ii) Trademarks, (iii) rights in domain names and domain name registrations, uniform resource locators associated with the Internet (collectively, “domain names”) (iv) Copyrights, (v) Trade Secrets, and (vi) other intellectual property rights (whether or not appropriate steps have been taken to protect such rights under Applicable Law); and (b) the right (whether at law, in equity, by contract or otherwise) to use, practice or otherwise exploit any of the foregoing.

“International Trade Law” means U.S. statutes, laws and regulations applicable to international transactions, including the Export Administration Act, the Export Administration Regulations, the FCPA, the Arms Export Control Act, the International Traffic in Arms Regulations, the International Emergency Economic Powers Act, the Trading with the Enemy Act, the U.S. Customs laws and regulations, the Foreign Asset Control Regulations, and any regulations or orders issued thereunder.

“Inventory” means inventory finished goods, raw materials, work in progress, packaging, supplies, parts, Company Products and other inventories related to the Company Business.

“Key Employee” means any of Mike Whalen and Walter Holemans.

“Key Employee Agreements” has the meaning set forth in Recital I.

“Knowledge of the Company” or “Company’s Knowledge” or similar terms means the actual knowledge of any of Key Employee, Sam Francis and Joe Reid; provided, however, that each such individual shall be deemed to have actual “knowledge” of a fact or matter if such individual would reasonably be expected to discover or become aware of that fact or matter in the course of carrying out a due inquiry with respect to those individuals having responsibility at the Company for such fact or matter.

“Law” means any federal, state, county, city, municipal, foreign, or other governmental statute, law, rule, regulation, ordinance, order, code, treaty or requirement (including pursuant to any settlement agreement or consent decree) and any Permit granted under any of the foregoing, or any requirement under the common law, or any other pronouncement having the effect of law of any Governmental Entity, in each case as in effect as of the Closing Date.

“Lease” or “Leases” has the meaning set forth in Section 3.16.

“Liability” means any direct or indirect liability, Indebtedness, assessment, expense, claim, loss, damage, deficiency or obligation, known or unknown, disputed or undisputed, joint or several, vested or unvested, executory or not, fixed or unfixed, choate or inchoate, liquidated or unliquidated, secured or unsecured, determinable or undeterminable, accrued or unaccrued, absolute or not, actual or potential, contingent or otherwise.

“Lock-up Agreement” has the meaning set forth in Section 2.9(c)(iii).

“Material Contract” has the meaning set forth in Section 3.14(b).

“Measurement Time” means immediately prior to Closing.

10

“Merger” has the meaning set forth in Recital C.

“Merger Consideration” means an amount equal to the Closing Purchase Price, payable in cash and Parent Shares in accordance with the terms of this Agreement, as may be adjusted pursuant to Section 2.14, and the Achieved Earnout Amount, if any, pursuant to Section 2.12.

“Merger Sub” has the meaning set forth in the introductory paragraph.

“Merger Sub Board” has the meaning set forth in Recital E.

“Net Cash” means (i) Closing Cash, less (ii) the sum of (A) all outstanding Indebtedness of the Company as of the Measurement Time and (B) the amount of all unpaid Transaction Expenses as of the Measurement Time.

“Net Cash Adjustment Amount” has the meaning set forth in Section 2.8(c).

“OCI” has the meaning set forth in Section 3.15(v).

“Off-the-Shelf Software” means Software available for license from a third party vendor without the need for customization, and for a license fee that does not exceed $12,000 per year.

“OFAC” has the meaning set forth in Section 3.24(c).

“Open Source Materials” means (i) any Software that contains, or is derived from, any Software that is distributed as free Software, open source Software (e.g., Linux) or under similar licensing or distribution models, (ii) any Software that requires as a condition of use, modification or distribution that such Software or other Software distributed with such Software owned by Company: (A) be disclosed or distributed in source code form, (B) be licensed for the purpose of making derivative works, or (C) be redistributable at no charge. Open Source Materials includes Software licensed or distributed under any of the following licenses or distribution models, or licenses or distribution models similar to any of the following: (A) GNU’s General Public License (GPL) or Lesser/Library GPL (LGPL); (B) the Artistic License (e.g., PERL); (C) the Mozilla Public License; (D) the Netscape Public License; (E) the Sun Community Source License (SCSL); (F) the Sun Industry Source License (SISL); (G) the Apache Software License; and (H) the Sleepycat license.

“Order” means any judgment, writ, decree, stipulation, determination, decision, award, ruling, injunction, temporary restraining order, or other order of a Governmental Entity of competent jurisdiction.

“Organizational Documents” means, with respect to an entity, the certificate of incorporation, by-laws, articles of organization, operating agreement, certificate of formation or similar governing documents of such entity.

“OSHA” has the meaning set forth in Section 3.21(i).

“Parent” has the meaning set forth in the introductory paragraph.

“Parent Board” has the meaning set forth in Recital E.

“Parent Indemnified Person” has the meaning set forth in Section 9.1(a).

“Parent Shares” means Rocket Lab USA, Inc. common stock, $0.0001 par value.

11

“Patents” means all issued patents (including utility and design patents) and pending patent applications (including invention disclosures, records of invention, certificates of invention and applications for certificates of inventions and priority rights filed with any Registration Office), including all non-provisional and provisional patent applications, substitutions, continuations, continuations-in-part, divisions, renewals, revivals, reissues, re-examinations and extensions thereof.

“Paying Agent” means Wilmington Trust, National Association (or such other Persons as may hereafter be reasonably acceptable to Parent and the Company).

“Payment Schedule” has the meaning set forth in Section 2.8(a)(ix).

“Permit” means any federal, state, county, local or foreign governmental consent, license, permit, grant, franchise, agreement, waiver or other authorization of any Governmental Entity.

“Permitted Encumbrances” means (a) any lien for current Taxes not yet delinquent or being contested in good faith and for which adequate reserves have been established; (b) statutory liens of landlords, liens of carriers, warehousepersons and mechanics, and purchase money liens that in each case are incurred in the ordinary course of business for sums not yet due and payable or being contested in good faith; (c) liens incurred or deposits made in connection with workers’ compensation, unemployment insurance and other similar types of social security programs or to secure the performance of tenders, statutory obligations, surety and appeal bonds, bids, leases, government contracts, performance and return of money bonds and similar obligations, in each case in the ordinary course of business, consistent with past practice; and (d) restrictions on transfer of securities under applicable securities laws.

“Person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated entity or Governmental Entity.

“Personal Data” means any information relating to an identified or identifiable natural person; an identifiable natural person is one who can reasonably be identified, directly or indirectly, in particular by reference to an identifier such as a name, an identification number, location data, an online identifier or to one or more factors specific to the physical, physiological, genetic, mental, economic, cultural or social identity or that natural person.

“Plan of Merger” means the Plan of Merger attached as Exhibit C.

“Pre-Closing Period” has the meaning set forth in Section 5.1(a).

“Pre-Closing Tax Period” means all taxable periods ending on or before the Closing Date and the portion through the end of the Closing Date for any Straddle Period.

“Pre-Closing Taxes” means (a) all Taxes (or the non-payment thereof) of the Company for the Pre-Closing Tax Period, (b) all Taxes of any member of an affiliated, consolidated, combined or unitary group of which the Company (or any predecessor of the Company) is or was a member on or prior to the Closing Date, including pursuant to Treasury Regulation Section 1.1502-6 or any analogous or similar state, local, or non-U.S. law or regulation, and (c) any and all Taxes of any Person imposed on the Company as a transferee or successor, by contract or pursuant to any Applicable Law, which Taxes relate to an event or transaction occurring before the Closing, excluding Taxes to the extent included in the calculation of Working Capital.

“Prohibited Party Lists” has the meaning set forth in Section 3.24(c).

12

“Processing” means any operation or set of operations which is performed on Personal Data or on sets of Personal Data, whether or not by automated means, such as collection, recording, organization, structuring, storage, adaptation or alteration, retrieval, consultation, use, disclosure by transmission, dissemination or otherwise making available, alignment or combination, restriction, erasure, or destruction.

“Pro Rata Portion” means with respect to each Company Shareholder, an amount equal to the quotient, expressed as a percentage, obtained by dividing (i) the amount of consideration payable to such Company Shareholder at the Closing pursuant to Section 2.6, divided by (ii) the aggregate amount payable to all Company Shareholders at the Closing pursuant to Section 2.6, and in either case prior to any deductions for the Holdback Amount, the Expense Fund, or any withholding Taxes. The Pro Rata Portion for each Company Shareholder shall be set forth on the Payment Schedule.

“R&W Insurance Policy” means, collectively, (A) the buyer-side representation and warranty insurance policy to be issued by the Insurer for the benefit of Parent, its successors, permitted assigns and Affiliates (including, after the Closing Date, the Surviving Corporation) and each of the foregoing’s respective Representatives, which shall, among other things, (i) have a coverage limit of $6,000,000, (ii) provide customary coverage for certain Damages incurred by the Parent Indemnified Persons with respect to breaches of representations and warranties contained in Section 3 of this Agreement, and (iii) contain an express waiver of subrogation and contribution rights against the Company Shareholders, their Affiliates, and their respective Representatives, except and only to the extent of Fraud, and then only with the right to subrogate against such Person who committed such Fraud. The foregoing Persons shall be express third-party beneficiaries of such anti-subrogation provision and (B) the buyer-side representation and warranty excess only insurance policy for the benefit of Parent, its successors, permitted assigns and Affiliates (including, after the Closing Date, the Surviving Corporation) and each of the foregoing’s respective Representatives, which shall, among other things, (i) have a coverage limit of $60,000,000, and (ii) provide customary coverage for certain Damages incurred by the Parent Indemnified Persons with respect to breaches of Company Fundamental Representations under this Agreement, and (iii) contain an express waiver of subrogation and contribution rights against the Company Shareholders, their Affiliates.

“R&W Insurance Premium” means the premium, underwriting fees, brokerage fees, taxes, surplus lines tax and fees required by Law and any other costs and expenses associated with obtaining the R&W Insurance Policy and binding coverage thereunder.

“Registered Intellectual Property” means all Intellectual Property for which registrations have been obtained or applications for registration have been filed with a Registration Office.

“Registration Office” means the United States Patent and Trademark Office, United States Copyright Office, or all equivalent foreign patent, trademark, copyright offices or other Governmental Entity.

“Related Person” means (i) any executive officer, director, or direct or indirect holder of 1% or more of the shares of Company Common Stock, (ii) any Affiliate, officer, director or manager of any of the foregoing, or (iii) any immediate family member of any of the foregoing natural Persons.

“Releasing Affiliates” has the meaning set forth in Section 6.13(a).

“Released Parties” has the meaning set forth in Section 6.13(a).

13

“Representative Confirmation Letters” means written confirmations, in a form reasonably satisfactory to Parent, from those Representatives of the Company identified by Parent as to all amounts paid, owed and to be owed by the Company with respect to services performed by them through the Closing Date (or following the Closing Date at the pre-Closing direction of the Company or the Company Shareholders) with respect to the transactions contemplated by the Agreement that constitute Transaction Expenses.

“Representatives” means officers, directors, partners, trustees, executors, employees, agents, attorneys, accountants and advisors.

“Restricted Benefits” has the meaning set forth in Section 3.25(a)(iv).

“Restrictive Covenants Agreement” has the meaning set forth in Recital F.

“Retention Cap” means $600,000.

“Returns” has the meaning set forth in Section 3.19(a).

“SEC” means the Securities and Exchange Commission of the United States.

“Securities Act” means the Securities Act of 1933, as amended.

“Shareholder Representative” has the meaning set forth in the introductory paragraph.

“Shareholder Representative Response” has the meaning set forth in Section 2.12(c)(iii).

“Significant Customers” has the meaning set forth in Section 3.27.

“Significant Suppliers” has the meaning set forth in Section 3.28.

“Software” means any computer program, operating system, applications system, firmware or software code of any nature, whether operational, under development or inactive, including all object code, source code, data files, rules, definitions or methodology derived from the foregoing and any derivations, updates, enhancements and customization of any of the foregoing, processes, know-how, operating procedures, methods and all other Intellectual Property embodied with the foregoing, technical manuals, user manuals and other documentation thereof, whether in machine-readable form, programming language or any other language or symbols and whether stored, encoded, recorded or written on disk, tape, film, memory device, paper or other media of any nature.

“Stock Holdback Agreement” has the meaning set forth in Section 2.11(d).

“Stock Merger Consideration” means the portion of Base Merger Consideration payable to Company Shareholders pursuant to the terms of this Agreement, which shall be equal to such number of Parent Shares as is determined by dividing (i) $18,000,000 by (ii) the Closing Parent Share Price.

“Stock Ratio” means quotient of (a) the Stock Merger Consideration divided by (b) the Base Merger Consideration.

“Straddle Period” has the meaning set forth in Section 6.12(a).

“Support Agreement” means a Support Agreement, substantially in the form attached hereto as Exhibit D.

“Surviving Corporation” has the meaning set forth in Section 2.1.

14

“Tax” and, collectively, “Taxes” mean any and all federal, state and local taxes of any country, assessments and other governmental charges, duties, impositions and liabilities, including taxes based upon or measured by gross receipts, income, profits, sales, use and occupation, and value added, ad valorem, stamp transfer, franchise, withholding, payroll, recapture, employment, excise and property taxes, together with all interest, penalties and additions imposed with respect to such amounts and any obligations under any Contract with any other Person with respect to such amounts and including any liability for taxes of a predecessor entity.

“Tax Authority” means any Governmental Entity with the authority to monitor, oversee, impose, regulate, administer or collect Taxes.

“Tax Contest” has the meaning set forth in Section 6.12(c).

“Tax Representations” has the meaning set forth in Section 9.1(b).

“Tax Returns” means all returns, declarations, reports, claims for refund, information returns or other documents (including any related or supporting schedules, statements or information, or any amendment thereto) filed with or submitted to, or required to be filed with or submitted to, any Governmental Entity in connection with the determination, assessment, or collection of any Taxes of any party or the administration, implementation, or enforcement of or compliance with any Laws relating to any Taxes.

“Technology” means (a) all (i) computer software and other works of authorship (including software, firmware, and middleware in source code and executable code form, architecture, databases, plugins, libraries, APIs, interfaces, algorithms, models, reference designs, and documentation); (ii) inventions (whether or not patentable), designs, discoveries and improvements; (iii) proprietary, confidential and/or technical data and information, Trade Secrets and know how; (iv) databases, data compilations and collections, and customer and technical data, (v) methods and processes, and (vi) devices, prototypes, designs, specifications and schematics and (b) tangible items constituting, disclosing, embodying or from which any Intellectual Property was derived, including all versions thereof.

“Threshold” has the meaning set forth in Section 9.1(c).

“Trade Secrets” means (i) all know-how, proprietary, confidential and/or non-public information, however documented and whether or not documented, and (ii) all trade secrets within the meaning of Applicable Law. The term “Trade Secrets” includes concepts, ideas, knowledge, rights in research and development, financial, marketing and business data, pricing and cost information, plans (including business and marketing plans), algorithms, formulae, inventions, processes, techniques, technical data, designs, drawings (including engineering and auto-cad drawings), specifications, databases, blue prints, and customer and supplier lists and information, in each case that has or derives economic value, actual or potential, as a result of being a secret and not known to the public, whether patentable or not and whether or not reduced to practice.

“Trademarks” means all (i) trademarks, service marks, logos, insignias, designs, trade dress, symbols, trade names and fictitious business names, emblems, signs, insignia, slogans, other similar designations of source or origin and general intangibles of like nature (including all applications and registrations for each of the foregoing and including unregistered trademarks), and (ii) all goodwill associated with or symbolized by any of the foregoing.

15

“Transaction Documents” means this Agreement and each other certificate, schedule, agreement or document delivered pursuant to this Agreement, the Voting and Support Agreements, Support Agreements, the Restrictive Covenants Agreements, the Stock Holdback Agreements and Key Employee Agreements.

“Transaction Expenses” means any fee, cost, expense, payment, expenditure, liability (contingent or otherwise) or obligation of the Company (whether incurred prior to or on the date of the Agreement or between the date of the Agreement and the Closing), including any fees and expenses of legal counsel, accountants and tax advisors, the amount of fees and expenses payable to financial and tax advisors, investment bankers and brokers of the Company, and any such fees and expenses incurred by the Company Shareholders or the Company’s employees, paid for or to be paid for by the Company, that: (a) relates directly or indirectly to (i) the proposed disposition of all or a portion of the business of the Company, or the process of identifying, evaluating and negotiating with prospective purchasers of all or a portion of the business of the Company, (ii) the investigation and review conducted by Parent and its Representatives, and any investigation or review conducted by other prospective purchasers of all of a portion of the business of the Company, with respect to the business of the Company (and the furnishing of information to Parent and its Representatives and such other prospective purchasers and their Representatives in connection with such investigation and review), (iii) the negotiation, preparation, review, execution, delivery or performance by the Company of the Agreement (including the Disclosure Schedule), or any certificate, opinion, agreement or other instrument or document delivered or to be delivered in connection with this Agreement or the transactions contemplated hereby, (iv) the preparation and submission by the Company of any filing or notice required to be made or given in connection with the Merger, and the obtaining of any consent required to be obtained by the Company in connection with any of such transactions, or (v) the consummation of the Merger or any of the transactions contemplated by this Agreement; or (b) arises or is expected to arise, is triggered or becomes due or payable, in whole or in part, as a direct or indirect result of the consummation (whether alone or in combination with any other event or circumstance) of the Merger or any of the other transactions contemplated by this Agreement, including any severance, end-of-service gratuity, stay or retention payments or bonuses, change of control bonuses, transaction or sale bonuses and similar arrangements or obligations arising with respect to any employee or other service provider of the Company in connection with the Merger or any of the transactions contemplated hereby (a “Change of Control Payment”). Without limiting the foregoing, Transaction Expenses shall include the employer’s share of any social security, Medicare, unemployment or payroll Taxes or similar amounts payable in connection with any Change of Control Payment and shall also include fifty percent (50%) of the costs and expenses related to the D&O Tail Policy and fifty percent (50%) of the R&W Insurance Premium.

“Transactions” means the Merger and the other transactions contemplated by this Agreement and the Transaction Documents.

“Voting and Support Agreements” has the meaning set forth in Recital G.

“WARN Act” has the meaning set forth in Section 3.21(h).

“Working Capital” means, without duplication, (i) the total current assets of the Company as of 12:01 a.m. local time on the Closing Date, less (ii) all current liabilities of the Company as of 12:01 a.m. local time on the Closing Date, calculated in each case in accordance with the Agreed Principles. For the avoidance of doubt, Working Capital shall not include Closing Cash, Transaction Expenses and Indebtedness.

“Working Capital Adjustment Amount” has the meaning set forth in Section 2.8(b).

16

“Working Capital Target” means $3,895,000.

2. The Merger.

2.1 The Merger. At the Effective Time (as defined in Section 2.2) and subject to and upon the terms and conditions of this Agreement, the Plan of Merger and the applicable provisions of the DGCL and the DC Code, Merger Sub shall be merged with and into the Company, the separate corporate existence of Merger Sub shall cease and the Company shall continue as the surviving corporation. The Company as the surviving corporation after the Merger is hereinafter sometimes referred to as the “Surviving Corporation.”

2.2 Closing; Effective Time. The closing of the transactions contemplated hereby (the “Closing”) shall take place as soon as practicable, but no later than two (2) business days, after the satisfaction or waiver of each of the conditions set forth in Section 6.14(a) hereof, or at such other time as the parties hereto agree (the “Closing Date”). The Closing shall take place at DLA Piper LLP (US), 4365 Executive Drive, Suite 1100, San Diego California 92121, or at such other location as the parties hereto agree. In connection with the Closing, the parties hereto shall cause the Merger to be consummated by filing the Plan of Merger, together with any required certificates, with the Secretary of State of the State of Delaware and the Department of Consumer and Regulatory Affairs, Corporations Division, of the District of Columbia, in accordance with the relevant provisions of the DGCL and the DC Code (the time of such filing being the “Effective Time”).

2.3 Effect of Merger. At the Effective Time, the effect of the Merger shall be as provided in this Agreement, the Plan of Merger and the applicable provisions of the DGCL and the DC Code. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in the Surviving Corporation, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Corporation.

2.4 Certificate of Incorporation; Bylaws.

(a) The articles of incorporation of the Surviving Corporation as in effect immediately prior to the Effective Time, shall be the articles of incorporation of the Surviving Corporation until thereafter amended.

(b) The Bylaws of Company, as in effect immediately prior to the Effective Time, shall be the Bylaws of the Surviving Corporation until thereafter amended.

2.5 Directors and Officers. At the Effective Time, the directors and officers of Merger Sub immediately prior to the Effective Time shall be the directors and officers of the Surviving Corporation, in each case until their respective successors are duly elected or appointed and qualified.

2.6 Merger Effect on Capital Stock. At the Effective Time, by virtue of the Merger and without any action on the part of Parent, Merger Sub, the Company or the holders of the following securities:

(a) Company Common Stock. Each share of Company Common Stock issued and outstanding immediately prior to the Effective Time (excluding Dissenting Shares, if any, and any shares to be cancelled and retired in accordance with Section 2.6(b)) shall be converted, without any action on the part of the holder thereof, into the right to receive (without interest, and subject to and in accordance with the terms of this Agreement) the Merger Consideration, upon the terms and subject to the conditions set forth in this Agreement, including the holdback provisions set forth in Section 2.11 and the indemnification provisions set forth in Section 9;

17

(b) Certain Company Common Stock. Each share of Company Common Stock that is owned by Parent, Merger Sub or the Company (as treasury stock or otherwise) or any of their Affiliates shall automatically be cancelled and retired and shall cease to exist, and no consideration shall be delivered in exchange therefor (such shares of Company Common Stock being referred to collectively as the “Cancelled Shares”); and

(c) Capital Stock of Merger Sub. Each share of common stock of Merger Sub issued and outstanding immediately prior to the Effective Time shall be automatically converted into one (1) fully paid and nonassessable share of the common stock of the Surviving Corporation, and thereupon each certificate evidencing ownership of shares of common stock of Merger Sub shall thereafter be deemed for all purposes to represent ownership of an equivalent number of shares of common stock of the Surviving Corporation.

2.7 Dissenting Shares. Notwithstanding any provision of this Agreement to the contrary, shares of Company Common Stock issued and outstanding immediately prior to the Effective Time and held by a holder who has not voted in favor of adoption of this Agreement or consented thereto in writing and who has properly exercised appraisal rights of such shares of Company Common Stock in accordance with Section 29-311 of the DC Code (such shares of Company Common Stock being referred to collectively as the “Dissenting Shares” until such time as such holder fails to perfect or otherwise loses such holder’s appraisal rights under the DC Code with respect to such shares of Company Common Stock) shall not be converted into a right to receive a portion of the Merger Consideration, but shall be canceled and shall cease to exist, and shall instead represent the right only to such rights as are granted by the DC Code; provided, however, that if, after the Effective Time, such holder fails to perfect, withdraws or loses such holder’s right to appraisal pursuant to Section 29-311 of the DC Code or if a court of competent jurisdiction shall determine that such holder is not entitled to the relief provided by Section 29-311 of the DC Code, such shares of Company Common Stock shall be treated as if they had been converted as of the Effective Time into the right to receive the applicable portion of the Merger Consideration, if any, to which such holder is entitled pursuant to this Agreement, without interest thereon. The Company shall provide Parent prompt written notice of any demands received by the Company for appraisal of Company Common Stock, any withdrawal of any such demand and any other demand, notice or instrument delivered to the Company prior to the Effective Time pursuant to the DC Code that relates to such demand, and the Company shall have the opportunity and right to direct all negotiations and proceedings with respect to such demands. Except with the prior written consent of Parent, which shall not be unreasonably withheld or delayed, the Company shall not make any payment with respect to, or settle or offer to settle, any such demands.

2.8 Estimated Closing Certificate.

(a) At least five (5) Business Days prior to the Closing Date, the Company shall deliver to Parent a certificate of the President and Chief Financial Officer of the Company (the “Estimated Closing Certificate”) setting forth, in reasonable detail:

(i) the Estimated Working Capital;

(ii) the Estimated Net Cash;

18

(iii) a proposed balance sheet of the Company as of 12:01 am local time on the anticipated Closing Date which shall have been prepared in accordance with the Accounting Rules (the “Estimated Closing Balance Sheet”);

(iv) the Company’s calculation of each of the components of the Estimated Working Capital and the Estimated Net Cash, and the aggregate amounts thereof; the Company’s calculation of the Base Merger Consideration, the Cash Merger Consideration, the Stock Merger Consideration, and each component thereof;

(v) itemization of each element of Indebtedness included in Estimated Net Cash and wire instructions with respect to each element thereof;

(vi) itemization of each element of Transaction Expenses included in Estimated Net Cash and wire instructions with respect to each element thereof;

(vii) the Common Per Share Consideration, the Common Per Share Cash Consideration, the Common Per Share Stock Consideration, and the number of Fully Diluted Shares Outstanding;

(viii) (1) the legal name, email address, and mailing address of each Company Shareholder immediately prior to the Effective Time, (2) the number of shares of Company Common Stock held by each such Company Shareholder immediately prior to the Effective Time, (3) the Cash Merger Consideration and the Stock Merger Consideration each Company Shareholder is eligible to receive at the Closing and (4) whether such Company Shareholder has executed and delivered a Support Agreement or a Voting and Support Agreement;

(ix) a consolidated list reflected in a single tab of the Estimated Closing Certificate presented in Excel format (the “Payment Schedule”) containing (1) the legal name, email address and mailing address of each Company Shareholder (and, if pursuant to applicable Law the issuance of the Stock Merger Consideration must be made to a Person other than the applicable Company Shareholder, the legal name, email address, and mailing address of the Person to whom such shares will be issued), (2) the aggregate amount of the Cash Merger Consideration each Company Shareholder is eligible to receive in respect of the Company Common Stock held by each Company Shareholder, (3) each applicable Company Shareholder’s Pro Rata Portion of each of the Adjustment Holdback Amount and the Indemnity Holdback Amount, and (4) the aggregate number of Parent Shares issuable as Stock Merger Consideration that each Company Shareholder is eligible to receive; and

(x) wire instructions for any payments to be made to the Company or Paying Agent pursuant to this Agreement.