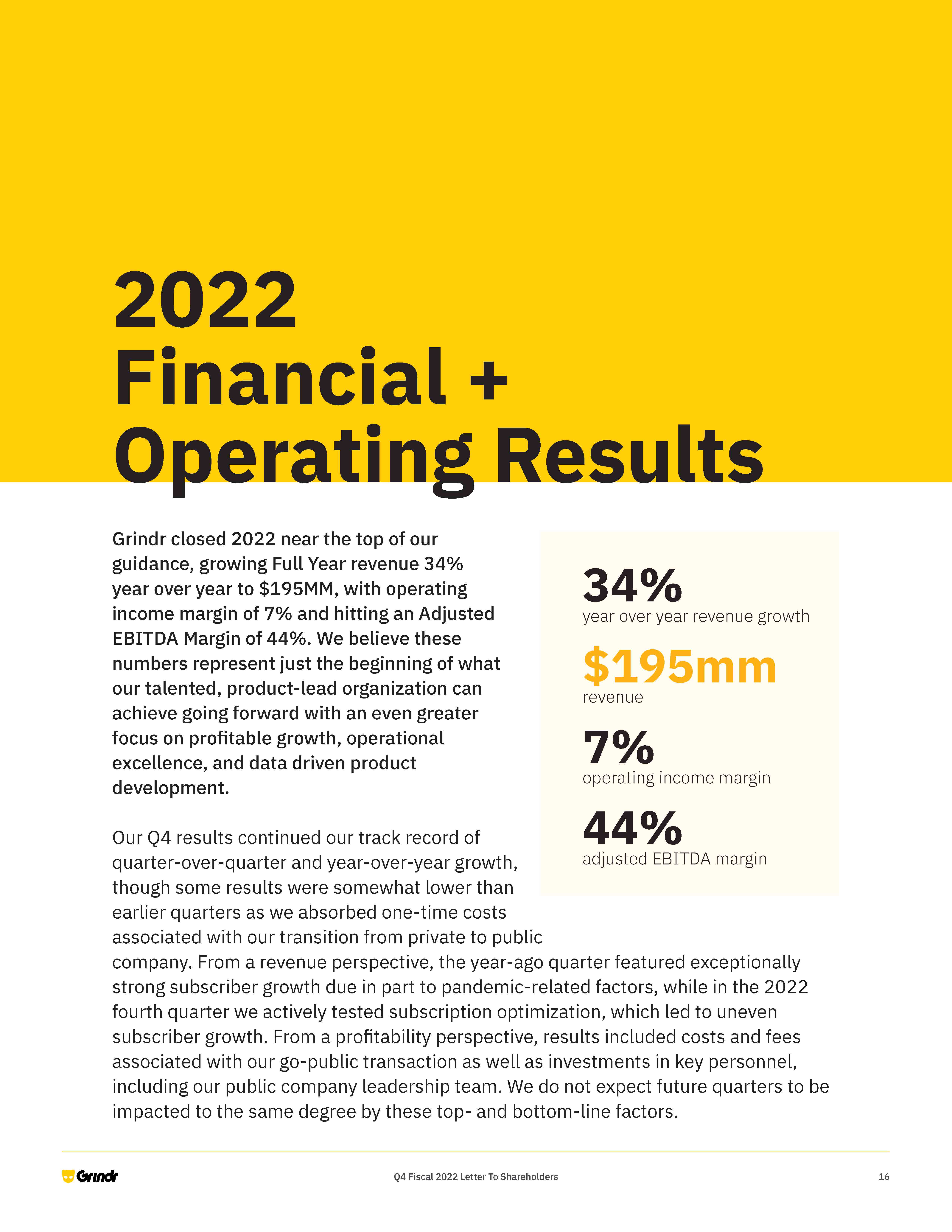

Unaudited Statement of Cash Flow Q4 Fiscal 2022 Letter To Shareholders 16 $ in thousands Q4 2022 Q4 2021 FY 2022 FY 2021 Operating Activities Net income Adjustments to reconcile net income to net cash provided by operating activities: $5,195 5,069 - (21,295) 2,302 11,851 - 522 (610) 10,290 255 (7,623) 1,050 (4,257) (3,296) 7,337 697 - 2,326 5,557 (146) - (1,989) 615 $6,497 796 (1,535) - - - - 283 (756) 10,699 53 (457) - (2,482) (175) 976 (16) - 723 (296) 1,183 - - 85 $852 28,422 - (21,295) 2,302 11,851 - 1,281 (2,842) 37,505 282 (11,218) 1,050 (4,832) (4,440) 2,558 20 - 1,802 10,211 (1,491) - (1,989) 615 $5,064 2,602 (1,535) - - - 1,118 1,180 (2,038) 43,234 53 (4,312) - (6,105) (1,777) (3,292) 37 - 1,845 (7,481) 6,547 10 - (720) Share/Unit-based compensation Gain on Paycheck Protection Program loan forgiveness Fair value change in warrant liability Transaction costs allocated to warrants Loss on extinguishment on deferred purchase price liability Accretion of interest in Credit Agreement Amortization of debt issuance costs Interest income on Promissory note from member Depreciation and amortization Provision for doubtful accounts Provision for deferred taxes Non-cash lease expense Changes in operating assets and liabilities: Accounts receivable Prepaid expenses and deferred charges Other current assets Deposit and other assets Due from parent company Accounts payable Accrued expenses and other current liabilities Deferred revenue Amount due to a related party Operating lease liabilities Other liabilities Net cash provided by operating activities $13,850 $15,578 $50,644 $34,430 Investing activities Purchase of property and equipment Additions to capitalized software Net cash used in by investing activities (91) (1,721) (113) (1,344) (430) (5,155) (269) (3,528) ($1,812) ($1,457) ($5,585) ($3,797) Financing activities Proceeds from issuance of Common Stock in the Business Combination Transaction Costs paid in connection with the Business Combination Payment of related party note payable Exercise of Forward Purchase Agreement Payment of deferred purchase price to Kunlun Exercise of stock options Distributions paid Proceeds from issuance of debt Payment of debt Payment of debt issuance costs Net cash used in financing activities Net decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, beginning of the period Cash, cash equivalents and restricted cash, end of the period Reconciliation of cash, cash equivalents and restricted cash Cash and cash equivalents Restricted cash Cash, cash equivalents and restricted cash 5,182 (28,460) (1,780) 100,000 (155,000) 887 (116,781) 170,800 (1,260) (4,137) - - - - - 762 - - (53,760) - 5,182 (28,460) (1,780) 100,000 (155,000) 2,023 (196,305) 230,800 (3,480) (5,092) - - - - - 1,351 - - (56,640) (960) ($30,549) ($52,998) ($52,112) ($56,249) ($18,511) 28,628 ($38,877) 56,047 ($7,053) 17,170 ($25,616) 42,786 $10,117 8,725 1,392 $17,170 15,778 1,392 $10,117 8,725 1,392 $17,170 15,778 1,392 $10,117 $17,170 $10,117 $17,170