7. Voting Rights.

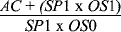

(a) General Preferred Stock Voting Rights. Except as otherwise required by law or as set forth in this Section 7, the holders of shares of Series A Preferred Stock will be entitled to vote, together with the holders of shares of Common Stock and not separately as a class, on all matters upon which holders of shares of Common Stock have the right to vote. The holders of shares of Series A Preferred Stock will be entitled to one vote for each share of Common Stock that such share of Series A Preferred Stock would otherwise be convertible into pursuant to a Deemed Conversion on the record date for the determination of the stockholders entitled to vote.

(b) Class Voting Rights. The Corporation shall not, and shall not permit its subsidiaries to, without the affirmative vote of at least a majority of the outstanding shares of Series A Preferred Stock (whether by written consent or at a meeting of the holders of Series A Preferred Stock duly called for such purpose):

(i) change the shares of Series A Preferred Stock (whether by merger, consolidation, reclassification, operation of law or otherwise) into cash, securities or other property except in accordance with the terms hereof or, in the case of a merger or consolidation of the Corporation in which it is not the surviving or resulting entity, the Series A Preferred Stock may be exchanged for an equivalent number of shares of preferred stock of the surviving or resulting entity, transferee or ultimate parent of such party, with terms substantially the same as the Series A Preferred Stock;

(ii) issue any shares of Series A Preferred Stock other than in accordance with that certain Agreement and Plan of Merger, dated as of March 17, 2022, by and among the Corporation (previously Vickers Vantage Corp. I), Vantage Merger Sub, Inc., a Delaware corporation, and Scilex, Inc. (previously Scilex Holding Corporation), a Delaware corporation, as amended (the “Merger Agreement”);

(iii) create, authorize or issue any Parity Security or other equity security the terms of which provide that it ranks senior to the Series A Preferred Stock with respect to dividend rights or rights upon liquidation, dissolution or winding-up of the Corporation, or increase the authorized amount of any such other class or series; or

(iv) amend, modify or repeal any provision of the Corporation’s Certificate of Incorporation (the “Certificate of Incorporation”), bylaws of the Corporation or this Certificate of Designations, whether by merger, consolidation, reclassification, by operation of law or otherwise, that adversely affects the holders of shares of Series A Preferred Stock.

8. Special Meetings. For so long as the Sorrento Group beneficially owns any shares of Series A Preferred Stock, special meetings of the stockholders of the Corporation for any purpose or purposes shall be called by or at the direction of the Board of Directors or the Chairman of the Board of Directors at the request of Sorrento Therapeutics, Inc. If a special meeting is called at the request of Sorrento Therapeutics, Inc., then the request shall be in writing, specifying the requested date, time and place of such meeting and the general nature of the business proposed to be transacted, and shall be delivered personally or sent by registered or electronic mail to the Chairman of the Board of Directors. Any such special meeting of stockholders shall be held at such date, time, and place, within or without the State of Delaware, as may be specified by order of the Board of Directors or the Chairman of the Board of Directors. The Board of Directors may, in its sole discretion, determine that special meetings of stockholders shall not be held at any place but may instead be held solely by means of remote communication as authorized by Section 211(a)(2) of the DGCL. If such order fails to fix such place, the meeting shall be held at the principal executive offices of the Corporation.

7