- BKKT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Bakkt (BKKT) POS AMProspectus update (post-effective amendment)

Filed: 5 Apr 22, 5:31pm

Delaware | 7389 | 98-1550750 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

J. Matthew Lyons Austin D. March Wilson Sonsini Goodrich & Rosati, P.C. 900 S. Capital of Texas Highway Las Cimas IV, 5th Floor Austin, TX 78746 (512) 338-5400 | Marc D’Annunzio General Counsel 10000 Avalon Boulevard, Suite 1000 Alpharetta, Georgia 30009 (678) 534-5849 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Page | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 9 | ||||

| 11 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 85 | ||||

| 95 | ||||

| 101 | ||||

| 111 | ||||

| 117 | ||||

| 119 | ||||

| 126 | ||||

| 136 | ||||

| 138 | ||||

| 142 | ||||

| 147 | ||||

| 148 | ||||

| 150 | ||||

| F-1 | ||||

| • | our future financial performance; |

| • | changes in the market for our products and services; and |

| • | expansion plans and opportunities. |

| • | our ability to grow and manage growth profitably; |

| • | changes in the market in which we compete, including with respect to our competitive landscape, technology evolution or changes in applicable laws or regulations; |

| • | changes in the digital asset markets that we target; |

| • | changes to our relationships within the payment ecosystem; |

| • | the inability to launch new services and products or to profitably expand into new markets and services; |

| • | the inability to execute our growth strategies, including identifying and executing acquisitions; |

| • | the inability to develop and maintain effective internal controls and procedures; |

| • | the exposure to any liability, protracted and costly litigation or reputational damage relating to our data security; |

| • | the possibility that we may be adversely affected by other economic, business, and/or competitive factors; |

| • | the impact of the novel coronavirus pandemic; |

| • | our inability to maintain the listing of our Class A Common Stock and Warrants on the NYSE; and |

| • | other risks and uncertainties indicated in this prospectus, including those set forth under “ Risk Factors |

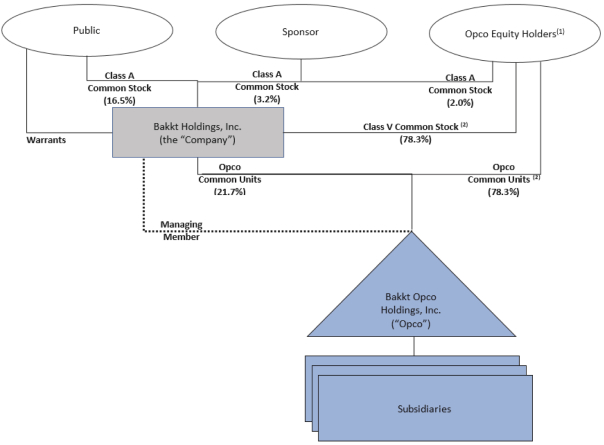

| (1) | The Opco Equityholders are entitled to certain payments under the Tax Receivable Agreement (as defined below). |

| (2) | Each Opco Common Unit, together with one share of Class V Common Stock, are exchangeable in accordance with the Exchange Agreement for one share of Class A Common Stock or, at the Company’s election, cash in lieu of Class A Common Stock. |

| • | our business model is newly developed and may encounter additional risks and challenges as it grows and changes; |

| • | our platform is still in the early stages of its release and is largely untested; |

| • | our ability to add additional functionalities and digital assets to our platform may adversely affect future growth; |

| • | we have limited operating history and a history of operating losses; |

| • | estimates of market opportunity and forecasts of market growth may be inaccurate; |

| • | we may be unable to attract additional enterprise or loyalty partners and retain and grow our relationships with our existing enterprise or loyalty partners; |

| • | we face increasingly intense competition in our markets; |

| • | we may fail to maintain consistently high levels of user satisfaction and trust; |

| • | we may be unable to successfully transition certain services provided to us by ICE in the past; |

| • | we rely on the availability of third-party services and they may experience disruption or performance or regulatory problems; |

| • | if we experience rapid growth, our operational, administrative and financial resources may be strained and unable to sustain such growth; and |

| • | the COVID-19 pandemic may significantly affect our business and operations. |

| • | we rely on cryptoasset custodial solutions and related technology, which may experience theft, employee or vendor sabotage, security and cybersecurity risks, system failures and other operational issues which could damage our reputation and brand; |

| • | our cryptoasset business’s pricing model and incentive arrangements may create conflicts of interest and affect our revenues; |

| • | there may be a general perception among regulators and others that cryptoassets are used to facilitate illegal activity such as fraud, money laundering, tax evasion and ransomware scams; |

| • | cryptoassets, such as bitcoin, do not have extensive historical precedence and distributed ledger technology continues to rapidly evolve; |

| • | cryptoassets are subject to volatile price fluctuations which can impact our business; |

| • | our financial results and the market price of our securities may be adversely affected if price volatility of cryptoassets causes our internal market maker algorithm to malfunction; |

| • | if the underlying smart contracts for cryptoassets do not operate as expected, they could lose value and our business could be adversely affected; and |

| • | we may encounter technical issues in connection with the integration of supported cryptoassets and changes and upgrades to their underlying networks, which could adversely affect our business. |

| • | we are subject to extensive government regulation, oversight, licensure and appraisals and our failure to comply could materially harm our business; |

| • | the U.S. state and federal regulatory regime governing blockchain technologies and cryptocurrencies is uncertain, and new regulations or policies may alter our business practices with respect to cryptocurrencies; |

| • | digital assets are currently subject to many different, and potentially overlapping, regulatory regimes, and may in the future be subject to different regulatory regimes than those that are currently in effect; and |

| • | complying with evolving privacy and other data related laws and requirements may be expensive and force us to make changes to our business. |

| • | actual or perceived cyberattacks, security incidents, or breaches could result in serious harm to our reputation, business and financial condition. |

| • | if we are unable to maintain effective internal controls over financial reporting, we may be unable to produce timely and accurate financial statements, which could have a material effect on our business. |

| • | a significant portion of our total outstanding securities are restricted from immediate resale but may be sold into the market in the near future, which could cause the market price of our securities to drop significantly, even if our business is doing well. |

| • | presentation of only two years of audited financial statements and related financial disclosure; |

| • | exemption from the requirement to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| • | exemption from compliance with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditor’s report on the financial statements; |

| • | reduced disclosure about our executive compensation arrangements; and |

| • | exemption from the requirement to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

Shares of Common Stock and Warrants Offered Hereunder | We are registering the issuance by us, and the resale by the Selling Securityholders, of up to 190,726,638 shares of Class A Common Stock issuable upon the exchange of a corresponding number of outstanding or issuable Paired Interests. We are also registering the resale by the Selling Securityholders of (i) 32,500,000 PIPE Shares, (ii) 5,184,300 Founder Shares and (iii) 3,151,890 Private Warrant Shares. |

Use of Proceeds | All of the securities offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from the sale of the securities hereunder. See “ Use of Proceeds |

Common Stock Outstanding | 57,164,488 shares of Class A Common Stock as of March 25, 2022. |

| 206,003,270 shares of Class V Common Stock (which, together with an equal number of Opco Common Units comprise an equal number of Paired Interests, please see “ Description of Securities—Common Stock |

Risk Factors | See “ Risk Factors |

NYSE Symbol | “BKKT” for our Class A Common Stock and “BKKT WS” for our Warrants. |

Lock-Up Restrictions | Pursuant to the Stockholders Agreement and the Insider Letter Agreement (each as described in “ Certain Relationships and Related Party Transactions Lock-Up Period”) and (ii) the Sponsor and the Insiders may not transfer, or make a public announcement of any intention to transfer any Founder Shares until the earlier of (a) October 15, 2022 and (b) subsequent to the Closing, (i) if the closing price of our Class A Common Stock equals or exceeds $12.00 per share (subject to customary adjustments) for any 20 trading days within any30-trading day period commencing at least 150 days after the Closing or (ii) the date on which we complete a liquidation, merger amalgamation, capital stock exchange, reorganization or other similar transaction that results in the holders of our Class A Common Stock having the right to exchange their |

Class A Common Stock for cash, securities or other property (the “Founder Shares Lock-Up Period” and, together with the OpcoLock-Up Period, the“Lock-Up Periods”). See “Certain Relationships and Related Party Transactions—Company Related Person Transactions—Insider Letter Agreement Certain Relationships and Related Party Transactions—Transactions Related to the Business Combination—Stockholders Agreement |

| • | the number and variety of digital assets that users may buy, sell, convert, spend, redeem and send through our platform; |

| • | our brand and reputation, as well as users’ experience and satisfaction with, and trust and perception of, our solutions; |

| • | technological innovation; |

| • | regulatory compliance and data security; and |

| • | services and products offered by competitors. |

| • | manage the complexity of our business model to stay current with the industry and new technologies; |

| • | successfully enter new categories, markets and jurisdictions in which we may have limited or no prior experience; |

| • | integrate into multiple distributed ledger technologies as they currently exist and as they evolve; |

| • | successfully develop and integrate products, systems and personnel into our business operations; and |

| • | obtain and maintain required licenses and regulatory approvals for our business. |

| • | our ability to attract and retain new users; |

| • | transaction volume and mix; |

| • | rates of repeat transaction and fluctuations in usage of our platform, including seasonality; |

| • | the amount and timing of our expenses related to acquiring users and the maintenance and expansion of our business, operations and infrastructure; |

| • | changes to our relationships with our enterprise and loyalty partners; |

| • | general economic, industry and market conditions, including the COVID-19 pandemic; |

| • | our emphasis on user experience instead of near-term growth; |

| • | competitive dynamics in the industry in which we operate; |

| • | the amount and timing of stock-based compensation expenses; |

| • | network outages, cyberattacks, or other actual or perceived security incidents or breaches or data privacy violations; |

| • | changes in laws and regulations that impact our business; |

| • | the cost of and potential outcomes of potential claims or litigation; and |

| • | the timing of expenses related to the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill from acquired technologies or businesses. |

| • | ability to attract, retain and engage users on our platform; |

| • | ability to demonstrate to enterprise and loyalty partners that they may achieve incremental sales and attract new customers by using and offering our services to consumers; |

| • | the strength of our integrated solution over other potential coalitions of disparate point solutions; |

| • | consumers’ confidence in the safety, security, privacy and control of their information on our platform; |

| • | ability to develop products and services across multiple commerce channels, including mobile payments, payments at the retail point of sale, cryptoassets and loyalty/rewards points; and |

| • | system reliability, regulatory compliance and data security. |

| • | market credibility, regulatory and industry expertise and infrastructure support; |

| • | critical infrastructure for custody of our cryptoassets; and |

| • | institutional-grade services to support our custody arrangements, which leverage ICE’s robust platform of security protocols. |

| • | increasing the number of consumers on, and the volume of transactions facilitated through, our platform; |

| • | maintaining and developing relationships with existing and new enterprise and loyalty partners and financial institutions; |

| • | securing funding to maintain our operations and future growth; |

| • | maintaining adequate financial, business and risk controls; |

| • | implementing new or updated information and financial risk controls and procedures; |

| • | navigating complex and evolving regulatory and competitive environments; |

| • | attracting, integrating and retaining an appropriate number of qualified employees of an adequate technological skill level; |

| • | particularly in the COVID-19 environment, training, managing and appropriately sizing our workforce and other components of our business on a timely and cost-effective basis; |

| • | expanding within existing markets; |

| • | entering new markets and introducing new solutions; |

| • | continuing to develop, maintain, protect and scale our platform; |

| • | effectively using limited personnel and technology resources; and |

| • | maintaining the security of our platform and the confidentiality of the information, including personally identifiable information, provided and utilized across our platform. |

| • | Total cryptoassets in existence; |

| • | Global cryptoassets supply and demand; |

| • | Investors’ expectations with respect to the rate of inflation of fiat currencies; |

| • | Currency exchange rates; |

| • | Interest rates; |

| • | Cryptoasset market fragmentation and consolidation; |

| • | Fiat currency withdrawal and deposit policies of cryptoasset exchanges and liquidity of such exchanges; |

| • | Interruptions in service from or failure of major cryptoasset exchanges; |

| • | Cyber theft of cryptoassets from online cryptoasset wallet providers, or news of such theft from such providers, or theft from individual cryptoasset wallets; |

| • | Investment and trading activities of hedge funds and other large cryptoasset investors; |

| • | Monetary policies of governments, trade restrictions, currency devaluations and revaluations; |

| • | Regulatory measures, if any, that restrict or facilitate the ability to buy, sell or hold cryptoassets or use cryptoassets as a form of payment; |

| • | Availability and popularity of businesses that provide cryptoasset-related services; |

| • | Maintenance and development of the open-source software protocol of the cryptoasset network; |

| • | Increased competition from other forms of cryptoasset or payments services; |

| • | Global or regional political, economic or financial events and uncertainty (such as the ongoing geopolitical tensions related to Russia’s actions in Ukraine, and resulting sanctions imposed by the U.S. and other countries, and retaliatory actions taken by Russia in response to such sanctions); |

| • | Manipulative trading activity on cryptoasset exchanges, which are largely unregulated; |

| • | The adoption of such cryptoassets as a medium of exchange, store-of-value |

| • | Forks in the applicable cryptoasset network; |

| • | Consumer preferences and perceptions of such cryptoasset specifically and cryptoassets generally; |

| • | An active derivative market for such cryptoasset or for cryptoassets generally; |

| • | Fees associated with processing a transaction of such cryptoasset and the speed at which such transactions are settled; and |

| • | Decreased confidence in cryptoasset exchanges due to the unregulated nature and lack of transparency surrounding the operations of cryptoasset exchanges. |

| • | money transmission; |

| • | virtual currency business activity; |

| • | prepaid access; |

| • | consumer protection; |

| • | anti-money laundering; |

| • | counter-terrorist financing; |

| • | privacy and data protection; |

| • | cybersecurity; |

| • | economic and trade sanctions; |

| • | commodities; |

| • | derivatives; and |

| • | securities. |

| • | In January 2020, the California Consumer Privacy Act (“CCPA”) took effect, providing California residents increased privacy rights and protections, including the ability to opt out of sales of their personal information. The CCPA may increase our compliance costs and exposure to liability. |

| • | In November 2021, the California Privacy Rights (“CPRA”) was approved by California voters. The CPRA significantly modifies the CCPA, including by imposing additional obligations on covered business and expanding consumers’ rights with respect to certain sensitive personal information, potentially resulting in further uncertainty and requiring us to incur additional costs and expenses in an effort to comply. The CPRA also creates a new state agency that will be vested with authority to implement and enforce the CCPA and the CPRA. |

| • | In March 2021, the Governor of Virginia signed into law the Virginia Consumer Data Protection Act (“VCDPA”). The VCDPA creates consumer rights similar to the CCPA, but also imposes security and assessment requirements for businesses. |

| • | In July 2021, Colorado enacted the Colorado Privacy Act, which closely resembles the VCDPA, and, like the VCDPA, will be enforced by the state Attorney General and district attorney. |

| • | Other U.S. states are considering adopting similar laws. The enactment of such laws could have potentially conflicting requirements that would make compliance challenging. |

| • | The United States government is considering regulating artificial intelligence and machine learning. |

| • | The certifications we maintain and the standards we comply with, including the Payment Card Industry Data Security Standard, among others, are becoming more stringent. |

| • | our products and services continue to expand in scope and complexity and to converge with technologies not previously associated with the payments and loyalty points space; |

| • | our products and services may be designed, developed and delivered without thorough due diligence of prior works covered by legitimate patent protections; |

| • | our products and services may be designed, developed or delivered by bad actors knowingly using intellectual property from a previous employer or vendor; |

| • | we may continue to expand into new business areas, including through acquisitions; and |

| • | the number of patent owners who may claim that we, or any of the companies we have acquired, or our enterprise or loyalty partners infringe their patents, and the aggregate number of patents controlled by such patent owners, continues to increase. |

| • | interrupt our operations; |

| • | result in our systems or services being unavailable or degraded; |

| • | result in improper disclosure of information (including consumers’ personal data) and violations of applicable privacy and other laws; |

| • | materially harm our reputation and brand; |

| • | result in significant liability claims, litigation, regulatory scrutiny, investigations, fines, penalties and other legal and financial exposure; |

| • | cause us to incur significant remediation costs; |

| • | lead to loss or theft of user digital assets, such as rewards points; |

| • | lead to loss of user confidence in, or decreased use of, our products and services; |

| • | divert the attention of management from the operation of our business; |

| • | result in significant compensation or contractual penalties from us to our users as a result of losses to them or claims by them; and |

| • | adversely affect our business and results of operations. |

| • | not being required to have an independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports and annual report on Form 10-K; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

| • | the last day of the fiscal year in which we had at least $1.07 billion in annual revenue; |

| • | the date we qualify as a “large accelerated filer,” with at least $700.0 million of equity securities held by non-affiliates; |

| • | the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or |

| • | December 31, 2025. |

| • | our existing stockholders’ proportionate ownership interest will decrease; |

| • | the amount of cash available per share, including for payment of dividends in the future, may decrease; |

| • | the relative voting strength of each previously outstanding share of our common stock may be diminished; and |

| • | the market price of our Class A Common Stock and/or Warrants may decline. |

| • | a classified Board with three-year staggered terms, which could delay the ability of stockholders to change the membership of a majority of the Board; |

| • | the ability of the Board to issue shares of Preferred Stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

| • | the limitation of the liability of, and the indemnification of, our directors and officers; |

| • | the right of the Board to elect a director to fill a vacancy created by the expansion of the Board or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on the Board; |

| • | the requirement that directors may only be removed from the Board for cause and upon the affirmative vote of the holders of at least 66 2/3% of the total voting power of then outstanding Class A Common Stock; |

| • | a prohibition on stockholder action by written consent (except for actions by the holders of Class V Common Stock or as required for holders of future series of Preferred Stock), which forces stockholder action to be taken at an annual or special meeting of stockholders and could delay the ability of stockholders to force consideration of a stockholder proposal or to take action, including the removal of directors; |

| • | the requirement that a special meeting of stockholders may be called only by the Board, the Chairman of the Board or our Chief Executive Officer, which could delay the ability of stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | controlling the procedures for the conduct and scheduling of the Board and stockholder meetings; |

| • | the requirement for the affirmative vote of holders of at least 66 2/3% of the total voting power of all of the then outstanding shares of the voting stock, voting together as a single class, to amend, alter, change or repeal certain provisions in the Certificate of Incorporation which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in the Board and also may inhibit the ability of an acquirer to effect such amendments to facilitate an unsolicited takeover attempt; |

| • | the ability of the Board to amend the By-Laws, which may allow the Board to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend theBy-Laws to facilitate an unsolicited takeover attempt; and |

| • | advance notice procedures with which our stockholders must comply to nominate candidates to the Board or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in the Board and also may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control. |

| • | changes in the industries in which we operate; |

| • | developments involving our competitors; |

| • | changes in laws and regulations affecting our business; |

| • | variations in our operating performance and the performance of our competitors in general; |

| • | actual or anticipated fluctuations in our quarterly or annual operating results; |

| • | publication of research reports by securities analysts about us or our competitors or our industry; |

| • | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| • | actions by stockholders, including the sale by the PIPE Investors of any of their holdings; |

| • | additions and departures of key personnel; |

| • | commencement of, or involvement in, litigation involving the combined companies; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of debt; |

| • | the volume of our Class A Common Stock available for public sale; and |

| • | general economic and political conditions, such as the effects of the COVID-19 outbreak, recessions, volatility in the markets, interest rates, local and national elections, fuel prices, international currency fluctuations, corruption, political instability and acts of war or terrorism, such as the ongoing geopolitical tensions related to Russia’s actions in Ukraine, resulting sanctions imposed by the U.S. and other countries, and retaliatory actions taken by Russia in response to such sanctions. |

| • | a limited availability of market quotations for our securities; |

| • | reduced liquidity for our securities; |

| • | determination that our Class A Common Stock is a “penny stock,” which will require brokers trading in the common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

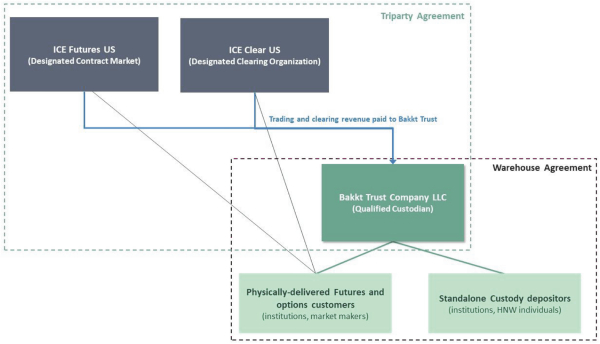

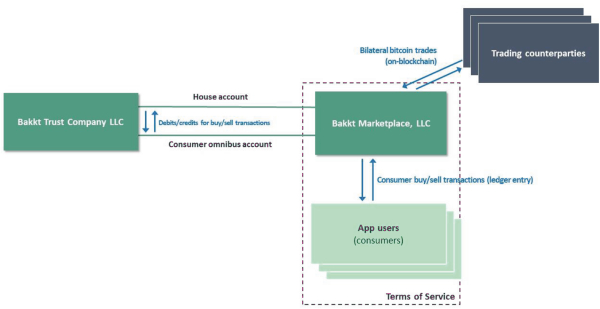

| • | Digital Asset Marketplace. end-to-end net-worth individuals on a standalone basis as approved by the NYDFS. Our custodian also operates as the backbone of many of our consumer- and enterprise-focused offerings. For example, it enables consumers to use our app to transact in bitcoin in real-time. On November 2, 2021, in accordance with our coin listing policy (as approved by the NYDFS), we self-certified the addition of |

ether as a cryptoasset that we support for consumer transactions, as described further below. In addition, in the future, contingent upon achieving the necessary regulatory approvals and/or partnering with an existing licensed broker-dealer, we plan to add the ability to transact in securities such as derivatives, and ETFs. We believe that our institutional-grade infrastructure underpins our ability to expand and scale consumer solutions. We earn revenue in the digital asset marketplace by providing standalone custody services for cryptoassets assets for our institutional customers, which we recognize on a pro rata basis over the term of the custody contract. Our standalone custody revenue is currently immaterial. Separately, as a result of our Triparty Agreement with IFUS and ICUS (the “Triparty Agreement”), we earn the net revenues for providing stand-ready custody services to IFUS and ICUS in connection with the offering of PDF Contracts. For more information, see Note 2 to our audited consolidated financial statements. |

| • | Loyalty Redemption |

| • | Alternative Payment Method |

Successor | Predecessor | |||||||||||

October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | ||||||||||

Revenues: | ||||||||||||

Net revenues (1) | $ | 11,481 | $ | 27,956 | $ | 28,495 | ||||||

Operating expenses: | ||||||||||||

Compensation and benefits | 62,180 | 91,275 | 43,141 | |||||||||

Professional services | 3,034 | 5,175 | 5,751 | |||||||||

Technology and communication | 3,056 | 10,384 | 9,741 | |||||||||

Selling, general and administrative | 8,521 | 20,309 | 8,219 | |||||||||

Acquisition-related expenses | 1,603 | 24,793 | 13,372 | |||||||||

Depreciation and amortization | 5,422 | 9,620 | 8,159 | |||||||||

Related party expenses (affiliate in Predecessor periods) (2) | 617 | 1,484 | 3,082 | |||||||||

Impairment of long-lived assets | 1,196 | 3,598 | 15,292 | |||||||||

Other operating expenses | 398 | 1,379 | 857 | |||||||||

Total operating expenses | 86,027 | 168,017 | 107,614 | |||||||||

Operating loss | (74,546 | ) | (140,061 | ) | (79,119 | ) | ||||||

Interest income (expense), net | 11 | (247 | ) | 123 | ||||||||

Loss from change in fair value of warrant liability | (79,373 | ) | — | — | ||||||||

Other income (expense), net | 832 | 487 | (218 | ) | ||||||||

Loss before income taxes | (153,076 | ) | (139,821 | ) | (79,214 | ) | ||||||

Income tax (expense) benefit | (11,751 | ) | 602 | (391 | ) | |||||||

Net loss | $ | (164,827 | ) | $ | (139,219 | ) | $ | (79,605 | ) | |||

Less: Net loss attributable to noncontrolling interest | (120,832 | ) | ||||||||||

Net loss attributable to Bakkt Holdings, Inc. | (43,995 | ) | ||||||||||

Net loss per share attributable to Bakkt Holdings, Inc. | ||||||||||||

Class A common stockholders per share: | ||||||||||||

Basic and diluted | $ | (0.81 | ) | (3 | ) | (3 | ) | |||||

| (1) | The revenue for periods from October 15, 2021 through December 31, 2021 and January 1, 2021 through October 14, 2021, and the year ended December 31, 2020, includes net revenues from related party of $0.1 million, and net revenues from affiliate of $0.1 million and $(2.0) million, respectively. |

| (2) | As a result of the Business Combination, ICE and its affiliates are no longer our affiliates. |

| (3) | Basic and diluted loss per share is not presented for the Predecessor periods due to lack of comparability with the Successor period. |

| • | Revenue increased 38%, primarily driven by higher transaction revenue in our Loyalty platform as COVID-19 impacts subsided and higher subscription and service revenue from expansion of services for an existing Loyalty customer; |

| • | Operating expenses increased 136%, primarily driven by expenses related to the closing of the Business Combination, increases in headcount to support the projected growth in our business and increased compliance and reporting requirements as a public company, and increased marketing expenses associated with the launch of our consumer platform; and |

| • | Net loss was impacted by $79.4 million warrant mark-to-market |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Net revenues | $ | 11,481 | $ | 27,956 | $ | 28,495 | $ | 10,942 | 38.4 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Compensation and Benefits | $ | 62,180 | $ | 91,275 | $ | 43,141 | $ | 110,314 | 255.7 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Professional Services | $ | 3,034 | $ | 5,175 | $ | 5,751 | $ | 2,458 | 42.7 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Technology and Communication | $ | 3,056 | $ | 10,384 | $ | 9,741 | $ | 3,699 | 38.0 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Selling, General and Administrative | $ | 8,521 | $ | 20,309 | $ | 8,219 | $ | 20,611 | 250.8 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Acquisition-related expenses | $ | 1,603 | $ | 24,793 | $ | 13,372 | $ | 13,024 | 97.4 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Depreciation and amortization | $ | 5,422 | $ | 9,620 | $ | 8,159 | $ | 6,883 | 84.4 | % | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Impairment of long-lived assets | $ | 1,196 | $ | 3,598 | $ | 15,292 | $ | (10,498 | ) | (68.7 | %) | |||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Loss from change in fair value of warrant liability | $ | (79,373 | ) | $ | — | $ | — | $ | (79,373 | ) | n/m | |||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Other income (expense), net | $ | 832 | $ | 487 | $ | (218 | ) | $ | 1,537 | n/m | ||||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Successor | Predecessor | |||||||||||||||||||

($ in thousands) | October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | $ Change (1) | % Change (1) | |||||||||||||||

Income tax (expense) benefit | $ | (11,751 | ) | $ | 602 | $ | (391 | ) | $ | (10,758 | ) | n/m | ||||||||

(1) | Change represents the combined 2021 period compared to the year ended December 31, 2020. |

Year Ended December 31, | ||||||||||||||||

2021 | 2020 | $ Change | % Change | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Bakkt gross revenue | $ | 1,029 | $ | 2,198 | $ | (1,169 | ) | (53.2 | %) | |||||||

Bakkt contra-revenue | (2,085 | ) | (4,477 | ) | 2,392 | (53.4 | %) | |||||||||

VIH revenue | — | — | — | — | % | |||||||||||

Bridge2 Solutions revenue | 40,493 | 36,433 | 4,060 | 11.1 | % | |||||||||||

Pro forma revenue | $ | 39,437 | $ | 34,154 | $ | 5,283 | 15.5 | % | ||||||||

Year Ended December 31, | ||||||||||||||||

2021 | 2020 | $ Change | % Change | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Pro forma net loss | $ | (198,467 | ) | $ | (168,751 | ) | $ | (29,716 | ) | 17.6 | % | |||||

Less: pro forma loss attributable to noncontrolling interest | (165,136 | ) | (140,376 | ) | (24,760 | ) | 17.6 | % | ||||||||

Pro forma net loss attributable to Bakkt Holdings, Inc. | $ | (33,331 | ) | $ | (28,375 | ) | $ | (4,956 | ) | 17.5 | % | |||||

Successor | Predecessor | |||||||||||

October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | ||||||||||

Net cash flows used in operating activities | $ | (83,387 | ) | $ | (50,915 | ) | $ | (30,940 | ) | |||

Net cash flows provided by (used in) investing activities | $ | 27,259 | $ | (10,342 | ) | $ | (7,929 | ) | ||||

Net cash flows provided by (used in) financing activities | $ | 256,925 | $ | (97 | ) | $ | 37,487 | |||||

Payments Due by Period | ||||||||||||||||||||

Less than 1 year | 1-3 years | 3-5 years | More than 5 years | Total | ||||||||||||||||

Purchase obligations (1) | $ | 2,250 | $ | 8,750 | $ | 9,000 | $ | — | $ | 20,000 | ||||||||||

Future minimum operating lease payments (2) | (3,114 | ) | 3,715 | 3,696 | 11,817 | 16,114 | ||||||||||||||

Total contractual obligations | (864 | ) | 12,465 | 12,696 | 11,817 | 36,114 | ||||||||||||||

| (1) | Represents minimum commitment payments under a four-year cloud computing arrangement. |

| (2) | Represents rental payments under operating leases with remaining non-cancellable terms in excess of one year. See Note 17 to our audited consolidated financial statements. |

| • | Share-based and unit-based compensation expense, which has been excluded from Adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations, has been, and will continue to be for the foreseeable future, a significant recurring expense in our business and an important part of our compensation strategy; |

| • | the intangible assets being amortized, and property and equipment being depreciated, may have to be replaced in the future, and the non-GAAP financial measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or other capital commitments; and |

| • | non-GAAP measures do not reflect changes in, or cash requirements for, our working capital needs. |

Successor | Predecessor | |||||||||||

October 15, 2021 through December 31, 2021 | January 1, 2021 through October 14, 2021 | Year ended December 31, 2020 | ||||||||||

Net loss | (164,827 | ) | (139,219 | ) | (79,605 | ) | ||||||

Add: Depreciation and amortization | 5,422 | 9,620 | 8,159 | |||||||||

Add/(Less): Interest (income) expense | (11 | ) | 247 | (123 | ) | |||||||

Add/(Less): Income tax (benefit) | 11,751 | (602 | ) | 391 | ||||||||

EBITDA | (147,665 | ) | (129,954 | ) | (71,178 | ) | ||||||

Add: Acquisition-related expenses | 1,603 | 24,793 | 13,372 | |||||||||

Add: Share-based and Unit-based compensation expense | 45,914 | 33,877 | 2,082 | |||||||||

Add: Restructuring charges | — | — | 588 | |||||||||

Add: Impairment of long-lived assets | 1,196 | 3,598 | 15,292 | |||||||||

Add: Loss from change in fair value of warrant liability | 79,373 | — | — | |||||||||

Add: ICE transition services expense | 617 | |||||||||||

Less: Cancellation of common units | (192 | ) | — | — | ||||||||

Less: Gain on extinguishment of software license liability | (1,301 | ) | — | — | ||||||||

Less: Non-recurring bitcoin sale income, net | — | (1,024 | ) | — | ||||||||

Less: Transition services to Bakkt Clearing | — | — | (196 | ) | ||||||||

Adjusted EBITDA | (20,455 | ) | (68,709 | ) | (40,040 | ) | ||||||

| • | Platform subscription fees: |

| • | Transaction fees: |

| • | Revenue share fees: |

| • | Service fees: |

| • | Enabling Crypto Services . |

| • | Fueling Crypto Rewards . |

| • | Paying with Digital Assets . |

| • | Powering Loyalty. We offer a full spectrum of content that retailers and financial institutions can make available to their customers when redeeming loyalty currencies, driving consumer loyalty and engagement. Our redemption solutions span a variety of rewards categories including merchandise (such as Apple products and services), gift cards, digital experiences and charitable giving. Our travel solution offers a retail e-commerce booking platform with a powerful search capability, as well as live-agent booking and servicing. Our platform provides a unified shopping experience that is configurable for companies and their programs. Capabilities include a mobile-first user experience, a multi-tier construct to accommodate loyalty tiers, comprehensive fraud protection capabilities and a split-tender payments platform to accept both points and credit cards as a form of payment. We recognize that businesses want to offer consumers choice, innovation and a frictionless experience, and our platform was constructed with this in mind. |

| • | Transacting accounts. |

| • | Digital asset conversion volume. |

| • | Subscription and service revenue. |

| • | Transaction revenue. |

| • | Adding partners. |

| • | Adding customers. activating our existing partnerships and will launch joint marketing campaigns with our partners to engage with their customers. Our recently announced partnerships provide us with an addressable market of well over 100 million users, who we will focus on bringing onto our platform. |

| • | Expanding our offering. |

| • | Payout and disbursement capabilities. |

| • | Open loop crypto wallets. |

| • | Additional cryptos on platform. |

| • | Points and rewards platform innovation. |

| • | Real-time funding. |

| • | Crypto enhancements. We believe our institutional-grade cryptocurrency custody solution provides an ideal foundation for the expansion of new products and services for retail and institutional investors, for example, crypto lending services and crypto collateralization. By increasing the acceptance of cryptocurrency investing in the institutional space, we believe that these additional products can further interest in cryptocurrency generally among consumers, benefiting our platform. |

| • | Loyalty enhancements. As we add loyalty partners with large active consumer populations to our client portfolio, we can create deeper partnerships across merchants with Bakkt at the center of these loyalty networks. As loyalty programs seek new ways to leverage customer data and behaviors to deliver value, we believe our platform will enable partners to more effectively acquire, re-activate and engage customers. |

| • | Data monetization. Our data is a strategic asset and we plan to deploy personalization capabilities based on this data across our business. Through personalization, we see opportunity to grow our business and improve customer interactions across our platform by creating an individualized set of actions and rewards for each customer based on their behavior. Further we plan to leverage the data to protect the enterprise and mitigate fraud. |

| • | Market expansion. We expect to expand our platform into new markets. While the exact sequence and identity of additional markets are yet to be determined, we presently anticipate expanding next into Australia, Canada, and the United Kingdom. Ultimately, the decision as to when and where to expand will be driven by client and consumer demand and the regulatory environment in those markets. |

| • | Intersection of crypto, loyalty and payments. |

| • | Breadth of digital assets. day-to-day crypto-as-a-service in-house. |

| • | Partner-led strategy. |

| • | Institutional-grade platform. |

| • | Trusted and scalable capabilities. |

| • | Our loyalty redemption service is provided as software as a service (“SaaS”) and powers rewards redemption for leading loyalty programs. The service is built upon highly scalable proprietary technology and supports integration with dozens of suppliers and millions of items, both through a mobile-first responsive web app or integrated into partners’ apps or sites. |

| • | Our digital asset marketplace is an institutional-grade cryptocurrency custody and trading platform, primarily comprised of our custody platform, the Bakkt Warehouse, and our pricing execution engine. The custody platform is purpose-built to safeguard digital assets, with multi-signature wallet policies, hardware security modules and offline storage of private key material, blockchain surveillance and AML/KYC compliance integrated into the core of the platform. Our pricing execution engine is an automated trading system that facilitates the purchase and sale of cryptocurrencies by consumers, and is built to scale on demand leveraging the cloud. |

| • | Our proprietary payments platform is a two-sided, fully integrated, cloud-based scalable payments platform. It is deployed using managed container services and managed databases in the cloud to scale on demand. Our payment APIs conform to industry standards and are used by merchants to accept our alternative payment method eitherin-app, in-store or online. |

Name | Age | Position | ||||

Gavin Michael | 56 | Chief Executive Officer, President, Class I Director | ||||

Andrew LaBenne | 48 | Chief Financial Officer | ||||

Marc D’Annunzio | 50 | General Counsel and Secretary | ||||

David C. Clifton | 44 | Class II Director | ||||

Sean Collins (1)(2)(3) | 42 | Class III Director | ||||

Kristyn Cook (3) | 46 | Class II Director | ||||

Michelle Goldberg (1)(3) | 52 | Class I Director | ||||

Richard Lumb (1) | 60 | Class III Director | ||||

Andrew A. Main (2) | 57 | Class III Director | ||||

Gordon Watson | 43 | Class II Director | ||||

| (1) | Member of the audit committee |

| (2) | Member of the compensation committee |

| (3) | Member of the nominating and corporate governance committee |

| • | the Class I directors are Michelle Goldberg and Gavin Michael, whose terms will expire at the annual meeting of stockholders to be held in 2022; |

| • | the Class II directors are David Clifton, Kristyn Cook and Gordon Watson, whose terms will expire at the annual meeting of stockholders to be held in 2023; and |

| • | the Class III directors are Sean Collins, Richard Lumb and Andrew A. Main, whose terms will expire at the annual meeting of stockholders to be held in 2024. |

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, our interim and year-end financial statements; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing our policies on and oversees risk assessment and risk management, including enterprise risk management; |

| • | reviewing related party transactions; |

| • | reviewing the adequacy and effectiveness of internal control policies and procedures and our disclosure controls and procedures; and |

| • | approving or, as required, pre-approving, all audit and all permissiblenon-audit services, other than de minimisnon-audit services, to be performed by the independent registered public accounting firm. |

| • | reviewing, approving and determining the compensation of our officers and key employees; |

| • | reviewing, approving and determining compensation and benefits, including equity awards, to directors for service on the Board or any committee thereof; |

| • | administering our equity compensation plans; |

| • | reviewing, approving and making recommendations to the Board regarding incentive compensation and equity compensation plans; and |

| • | establishing and reviewing general policies relating to compensation and benefits of our employees. |

| • | identifying, evaluating and selecting, or making recommendations to the Board regarding, nominees for election to the Board and its committees; |

| • | evaluating the performance of the Board and of individual directors; |

| • | considering, and making recommendations to the Board regarding, the composition of the Board and its committees; |

| • | reviewing developments in corporate governance practices; |

| • | evaluating the adequacy of the corporate governance practices and reporting; and |

| • | developing, and making recommendations to the Board regarding, corporate governance guidelines and matters. |

| • | Gavin Michael, Chief Executive Officer and President; |

| • | Andrew LaBenne, Chief Financial Officer; |

| • | Marc D’Annunzio, General Counsel and Secretary; and |

| • | David Clifton, Former Interim Chief Executive Officer. |

Name and Principal Position | Year | Salary ($) (1) | Stock Awards ($) (2) | Non-Equity Incentive Plan Compensation ($) | All other compensation ($) (7) | Total ($) | ||||||||||||||||||

Gavin Michael (3) | 2021 | 471,153 | 6,370,920 | 1,042,000 | (8) | 447 | 7,884,520 | |||||||||||||||||

Chief Executive Officer and President | 2020 | — | — | — | — | — | ||||||||||||||||||

Andrew LaBenne (4) | 2021 | 260,000 | 612,003 | 400,000 | 7,883 | 1,279,886 | ||||||||||||||||||

Chief Financial Officer | 2020 | — | — | — | — | — | ||||||||||||||||||

Marc D’Annunzio (5) | 2021 | 402,590 | — | 400,000 | 11,469 | 814,059 | ||||||||||||||||||

General Counsel and Secretary | 2020 | 425,000 | 973,750 | — | 17,100 | 1,415,850 | ||||||||||||||||||

David Clifton (6) | 2021 | — | — | — | — | — | ||||||||||||||||||

Former Interim Chief Executive Officer | 2020 | — | 1,131,000 | — | — | 1,131,000 | ||||||||||||||||||

| (1) | Amounts reflect annual base salary paid for fiscal year 2020 or 2021. |

| (2) | Amounts represent the grant date fair value of equity-based awards granted in fiscal year 2020 and 2021, calculated in accordance with ASC 718, and do not necessarily correspond to the actual value that may be recognized from the equity-based awards. Assumptions used in the calculation of these amounts are described in Note 11—Share-Based and Unit-Based Compensation |

| (3) | Dr. Michael was not a named executive officer in 2020. Dr. Michael joined Opco as Chief Executive Officer on January 11, 2021. |

| (4) | Mr. LaBenne was not a named executive officer in 2020. Mr. LaBenne joined Opco as Chief Executive Officer on April 27, 2021. |

| (5) | Mr. D’Annunzio was not a named executive officer in 2020. Mr. D’Annunzio joined Opco as General Counsel and Secretary in May 2019. |

| (6) | Mr. Clifton was Chief Executive Officer of Opco from April 2020 until January 11, 2021, when Gavin Michael became our Chief Executive Officer. Mr. Clifton received no other compensation for his services as Opco’s interim Chief Executive Officer other than profits interests in the form of 975,000 preferred incentive units. |

| (7) | The “All other compensation” amounts include: (i) for Dr. Michael, life insurance premiums; (ii) for Mr. LaBenne, life insurance premiums and employer 401(k) plan contributions; and (iii) for Mr. D’Annunzio, (A) in 2021, life insurance premiums and employer 401(k) plan contributions and (B) in 2020, employer 401(k) plan contributions. |

| (8) | Includes a $542,000 sign on bonus. |

Name and Principal Position | Number of profits interests units that have vested (#) | Market value of profits interests units that have vested ($) (1) | Number of profits interests units that have not vested (#) | Market value of profit interests that have not vested ($) (1) | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($) (1) | ||||||||||||||||||

Gavin Michael | — | — | — | — | 694,000 | 5,905,940 | ||||||||||||||||||

Andrew LaBenne | — | — | — | — | 66,667 | 567,336 | ||||||||||||||||||

Marc D’Annunzio (2) | 518,237 | 4,410,197 | 1,036,475 | 8,820,402 | — | — | ||||||||||||||||||

David Clifton (3) | 37,544 | 319,499 | 125,064 | 1,064,295 | — | — | ||||||||||||||||||

| (1) | Represents the market value of the units of stock based on the $8.51 per unit value of the Company’s Class A common stock as of December 31, 2021. |

| (2) | Mr. D’Annunzio was granted profits interests in the form of preferred incentive units on February 28, 2020, one-third of which vested at Closing, and one-third of which will vest on each of the first and second anniversaries of the Closing. At Closing, each profits interest was exchanged for the right to receive a Paired Interest. |

| (3) | Mr. Clifton was granted profits interests in the form of preferred incentive units on December 4, 2020, one-third of which vested at Closing, and one-third of which will vest on each of the first and second anniversaries of the Closing. At Closing, each profits interest was exchanged for the right to receive a Paired Interest. |

Name | Fees Paid or Earned in Cash ($) | Stock Awards ($) (1) (2) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All other compensation ($) | Total ($) | ||||||||||||||||||

David Clifton (3) | — | — | — | — | — | — | ||||||||||||||||||

Sean Collins | 46,250 | 93,000 | — | — | — | 139,250 | ||||||||||||||||||

Kristyn Cook | 13,750 | 93,000 | — | — | — | 106,750 | ||||||||||||||||||

Michelle Goldberg | 18,000 | 93,000 | — | — | — | 111,000 | ||||||||||||||||||

Richard Lumb | 18,750 | 93,000 | — | — | — | 111,750 | ||||||||||||||||||

Andrew A. Main | 15,625 | 93,000 | — | — | — | 108,625 | ||||||||||||||||||

Gordon Watson | 12,500 | 93,000 | — | — | — | 105,500 | ||||||||||||||||||

| (1) | The amounts in this column represent the aggregate grant date fair value of restricted stock unit awards granted to each non-employee director, computed in accordance with FASB ASC Topic 718. See Note 11—Share-Based and Unit-Based Compensation to our audited consolidated financial statements included elsewhere in this prospectus for a discussion of the assumptions made by us in determining the grant-date fair value of our RSU awards to non-employee directors. |

| (2) | All of these RSU awards were granted pursuant to the 2021 Plan. |

| (3) | Represents only compensation received as a director. Mr. Clifton did not receive compensation from the Company for his service on our Board during fiscal year 2021 due to his affiliation with ICE. For information on Mr. Clifton’s compensation as interim Chief Executive Officer, please see “ Summary Compensation Table Narrative Disclosure to Summary Compensation Table—Elements of Compensation |

Name | Number of Shares Underlying Outstanding Stock Awards (1) | Number of Shares Underlying Outstanding Options | ||||||

David Clifton (2) | — | — | ||||||

Sean Collins | 10,000 | — | ||||||

Kristyn Cook | 10,000 | — | ||||||

Michelle Goldberg | 10,000 | — | ||||||

Richard Lumb | 10,000 | — | ||||||

Andrew A. Main | 10,000 | — | ||||||

Gordon Watson | 10,000 | — | ||||||

| (1) | The RSUs shall vest in full on the date of the Company’s 2022 annual meeting of stockholders. |

| (2) | Does not reflect the grant that Mr. Clifton received during his service as Opco’s interim Chief Executive Officer. For more information, see “ Outstanding Equity Awards at Fiscal Year End |

| • | $50,000 per year for service as a non-employee director; |

| • | $100,000 per year for service as non-executive chair of the Board of Directors; |

| • | $25,000 per year for service as chair of the audit committee; |

| • | $10,000 per year for service as a member of the audit committee; |

| • | $20,000 per year for service as chair of the compensation committee; |

| • | $7,500 per year for service as a member of the compensation committee; |

| • | $12,000 per year for service as chair of the corporate governance and nominating committee; and |

| • | $5,000 per year for service as a member of the corporate governance and nominating committee. |

| • | we were or are to be, or the Company or Opco was, a participant; |

| • | the amount involved exceeded or exceeds $120,000; |

| • | any of the Company’s or Opco’s directors, executive officers, or beneficial holders of more than 5% of any class of our capital stock, or any immediate family member of, or person sharing the household with, any of these individuals or entities, had or will have a direct or indirect material interest. |

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of any class of our common stock; |

| • | each of our named executive officers and directors; and |

| • | all of our executive officers and directors as a group. |

Name of Beneficial Owner | Number of Shares of Class A Common Stock (1) | % of Class A Common Stock | Number of Paired Interests (2) | % of Paired Interests | Total Number of Shares of Class A Common Stock and Class V Common Stock | % of Total Voting Power (3) | ||||||||||||||||||

Greater than 5% Stockholders: | ||||||||||||||||||||||||

Intercontinental Exchange Holdings, Inc. (4) | 4,714,336 | 8.2 | % | 170,079,462 | 82.5 | % | 174,793,798 | 66.4 | % | |||||||||||||||

Invesco (5) | 3,488,609 | 6.1 | % | — | * | 3,488,609 | 1.3 | % | ||||||||||||||||

VPC Impact Acquisition Holdings Sponsor, LLC (6) | 8,336,190 | 14.5 | % | — | * | 8,336,190 | 3.2 | % | ||||||||||||||||

Named Executive Officers and Directors: | ||||||||||||||||||||||||

Gavin Michael | 694,000 | * | — | * | 694,000 | * | ||||||||||||||||||

Andrew LaBenne | 66,677 | * | — | * | 66,677 | * | ||||||||||||||||||

Marc D’Annunzio (7) | — | * | 518,237 | * | 518,237 | * | ||||||||||||||||||

Michelle Goldberg | 10,000 | * | — | * | 10,000 | * | ||||||||||||||||||

David Clifton (8) | — | * | 54,202 | * | 54,202 | * | ||||||||||||||||||

Kristyn Cook | 10,000 | * | — | * | 10,000 | * | ||||||||||||||||||

Gordon Watson | 10,000 | * | — | * | 10,000 | * | ||||||||||||||||||

Sean Collins (9) | 592,323 | * | 2,908,110 | * | 3,500,433 | * | ||||||||||||||||||

Richard Lumb | 10,000 | * | — | * | 10,000 | * | ||||||||||||||||||

Andrew Main | 10,000 | * | — | * | 10,000 | * | ||||||||||||||||||

All directors and executive officers as a group (10 persons) (9) | 1,403,000 | 2.4 | % | 3,480,549 | 1.7 | % | 4,883,549 | 1.86 | % | |||||||||||||||

| * | Represents less than 1%. |

| (1) | Each share of Class A Common Stock entitles the holder thereof to one vote per share. |

| (2) | Each Paired Interest consists of one common unit in Opco and one share of Class V Common Stock, the latter of which entitles the holder to one vote per share of Class V Common Stock. Pursuant to the Exchange Agreement, beginning on April 16, 2022, each Paired Interest may be exchanged for a share of Class A Common Stock on a one-for-one |

| (3) | Represents percentage of voting power of holders of Class A Common Stock and Class V Common Stock voting together as a single class. |

| (4) | ICEH has entered into the Voting Agreement with the Company, pursuant to which, to the extent that ICEH’s voting power as jointly calculated by ICEH and the Company, and represented by the shares held by ICEH as of the record date for a stockholder matter, exceeds 30% of the total voting power of all of outstanding Class A Common Stock and Class V Common Stock that are issued and outstanding and entitled to vote as of the record date, ICEH will irrevocably appoint a proxy, designated by the Board, to vote the excess shares in the same percentages for and against such stockholder matter as votes were cast for and against such stockholder matter by all other stockholders of the Company. ICEH is a wholly owned subsidiary of ICE. ICE’s principal business address is 5660 New Northside Drive, Atlanta, GA 30328. |

| (5) | According to a Schedule 13G/A filed on February 4, 2022, Invesco Ltd. in its capacity as a parent holding company to its investment advisers may be deemed to beneficially own 3,488,609 shares of Class A Common Stock, which are held of record by clients of Invesco Ltd. The address of Invesco Ltd. is 1555 Peachtree Street NE, Suite 1800, Atlanta, GA 30309. |

| (6) | Richard Levy, as Chief Executive Officer and Founder of Victory Park Capital Advisors, LLC has voting and investment discretion over these shares. Mr. Levy disclaims beneficial ownership of the securities except to the extent of his pecuniary interest therein. The Sponsor’s principal business address is 150 North Riverside Plaza, Suite 5200, Chicago, IL 60606. |

| (7) | Represents Paired Interests directly held by Bakkt Management, LLC (“Bakkt Management”), corresponding to the vested portion of units in Bakkt Management directly held by each noted person. Subject to certain limitations, units in Bakkt Management are, at the request of the holder, redeemable for an equal number of Paired Interests. One-third of the Bakkt Management units awarded to each officer vested upon the Closing,one-third will vest on October 15, 2022 and the remaining third will vest on October 15, 2023. |

| (8) | Represents Paired Interests directly held by Bakkt Management, corresponding to units in Bakkt Management directly held by Mr. Clifton. One third of the Bakkt Management units were released to Mr. Clifton on the date of Closing and the remaining two thirds will be released in one-third increments on each of October 15, 2022 and October 15, 2023. |

| (9) | Includes shares held directly by Goldfinch Co-Invest I, LP, GoldfinchCo-Invest IC LP and GoldfinchCo-Invest IB, LP. Sean Collins, a member of our Board, is a Managing Partner of GoldfinchCo-Invest I GP LLC, the general partner of each of GoldfinchCo-Invest I, LP, GoldfinchCo-Invest IB, LP and GoldfinchCo-Invest IC LP and has voting and investment discretion over these shares. Mr. Collins disclaims beneficial ownership of the shares except to the extent of his pecuniary interest therein. |

Shares of Class A Common Stock Held of Record Prior to the Offering | Shares of Class A Common Stock Being Offered | Shares of Class A Common Stock Held of Record After the Offering | ||||||||||||||

Name of Selling Securityholder | Number | Percent | ||||||||||||||

Intercontinental Exchange Holdings, Inc. (1) | 174,793,798 | 174,793,798 | — | — | ||||||||||||

VPC Impact Acquisition Holdings Sponsor, LLC (2) | 8,336,190 | 8,336,190 | — | — | ||||||||||||

Securityholders Affiliated with Goldfinch (3) | 3,490,433 | 3,490,433 | — | — | ||||||||||||

Securityholders Affiliated with Corbin Capital Partners (4) | 3,010,876 | 3,000,000 | 10,876 | * | ||||||||||||

Empyrean Capital Overseas Master Fund Ltd. (5) | 3,000,000 | 3,000,000 | — | — | ||||||||||||

Tech Opportunities LLC (6) | 3,000,000 | 3,000,000 | — | — | ||||||||||||

The Boston Consulting Group, Inc. (7) | 2,752,933 | 2,752,933 | — | — | ||||||||||||

Pantera BH LLC (8) | 2,717,437 | 2,717,437 | — | — | ||||||||||||

Microsoft Global Finance (9) | 2,697,399 | 2,697,399 | — | — | ||||||||||||

Adage Capital Partners, L.P. | 2,500,000 | 2,500,000 | — | — | ||||||||||||

Beaumont Glory Limited (10) | 2,263,876 | 2,263,876 | — | — | ||||||||||||

Shares of Class A Common Stock Held of Record Prior to the Offering | Shares of Class A Common Stock Being Offered | Shares of Class A Common Stock Held of Record After the Offering | ||||||||||||||

Name of Selling Securityholder | Number | Percent | ||||||||||||||

Starbucks Corporation (11) | 2,191,307 | 2,191,307 | — | — | ||||||||||||

Securityholders Affiliated with Aristeia (12) | 2,000,000 | 2,000,000 | — | — | ||||||||||||

Soroban Opportunities Master Fund LP (13) | 2,000,000 | 2,000,000 | — | — | ||||||||||||

PayU Fintech Investments B.V. (Naspers) (14) | 1,611,519 | 1,611,519 | — | — | ||||||||||||

Securityholders Affiliated with Apollo (15) | 1,500,000 | 1,500,000 | — | — | ||||||||||||

MMF LT, LLC (16) | 1,500,000 | 1,500,000 | — | — | ||||||||||||

Securityholders Affiliated with Luxor (17) | 1,250,000 | 1,250,000 | — | — | ||||||||||||

Elwood US Investor 1 Inc. (18) | 1,100,777 | 1,100,777 | — | — | ||||||||||||

Galaxy Digital Ventures LLC (19) | 1,100,777 | 1,100,777 | — | — | ||||||||||||

Highbridge Tactical Credit Master Fund, L.P. | 1,000,000 | 1,000,000 | — | — | ||||||||||||

Securityholders Affiliated with TimesSquare Investment Advisor (20) | 800,000 | 800,000 | — | — | ||||||||||||

Securityholders Affiliated with CMT (21) | 714,026 | 714,026 | — | — | ||||||||||||

Securityholders Affiliated with Seven Grand (22) | 600,000 | 600,000 | — | — | ||||||||||||

Alyeska Master Fund, L.P. (23) | 600,000 | 600,000 | 47,042 | — | ||||||||||||

Eagle Seven Digital Investments, LLC (24) | 565,969 | 565,969 | — | — | ||||||||||||

Securityholders Affiliated with Maso Capital (25) | 500,000 | 500,000 | — | — | ||||||||||||

Securityholders Affiliated with Monashee (26) | 500,000 | 500,000 | — | — | ||||||||||||

Securityholders Affiliated with Nantahala Capital Management, LLC (27) | 500,000 | 500,000 | — | — | ||||||||||||

Kepos Alpha Master Fund L.P. (28) | 500,000 | 500,000 | — | — | ||||||||||||

Magnetar Capital Master Fund, Ltd | 500,000 | 500,000 | — | — | ||||||||||||

Sculptor Special Funding, LP (29) | 500,000 | 500,000 | — | — | ||||||||||||

Securityholders Affiliated with Glazer (30) | 300,000 | 300,000 | — | — | ||||||||||||

Securityholders Affiliated with Water Island (31) | 300,000 | 300,000 | — | — | ||||||||||||

Ghisallo Master Fund LP (32) | 250,000 | 250,000 | — | — | ||||||||||||

Securityholders Affiliated with Benjamin Nickoll (33) | 235,000 | 235,000 | — | — | ||||||||||||

Securityholders Affiliated with Richard Marini (34) | 226,387 | 226,387 | — | — | ||||||||||||

WNI LLC (35) | 70,000 | 70,000 | — | — | ||||||||||||

Kurt Summers (36) | 20,000 | 20,000 | — | — | ||||||||||||

Kai Schmitz (37) | 20,000 | 235,000 | — | — | ||||||||||||

Adrienne Harris (38) | 20,000 | 20,000 | — | — | ||||||||||||

BNCA 2011 Directed Irrevocable Trust (39) | 50,000 | 50,000 | — | — | ||||||||||||

Christine Armstrong | 45,000 | 45,000 | — | — | ||||||||||||

| * | Less than 1% |

| (1) | Consists of (i) 4,714,336 shares of Class A Common Stock beneficially owned and (ii) 170,079,462 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests. For information regarding the relationship between the Selling Stockholder and the Company, please see “ Certain Relationships and Related Party Transactions. |

| (2) | Richard N. Levy, as Chief Executive Officer and Founder of Victory Park Capital Advisors, LLC, has voting and investment discretion with respect to the securities held of record by VPC Impact Acquisition Holdings Sponsor, LLC. Mr. Levy disclaims any beneficial ownership of the securities held by VPC Impact Acquisition Holdings Sponsor, LLC other than to the extent of any pecuniary interest he may have therein, directly or indirectly. |

| (3) | Consists of (i) 582,323 shares of Class A Common Stock held directly by Goldfinch Co-Invest IC LP, (ii) 2,751,943 shares of Class A Common Stock that may be acquired by GoldfinchCo-Invest I LP upon the |

| exchange of a corresponding number of Paired Interests and (iii) 156,167 shares of Class A Common Stock that may be acquired by Goldfinch Co-Invest IB LP upon the exchange of a corresponding number of Paired Interests. Sean Collins, a member of our Board and prior to the Closing, a member of the board of managers of Opco, is a Managing Partner of GoldfinchCo-Invest I GP LLC, the general partner of each of GoldfinchCo-Invest IC LP, GoldfinchCo-Invest I, LP and GoldfinchCo-Invest IB, LP, which has voting and investment discretion over these shares. Mr. Collins disclaims beneficial ownership of the shares except to the extent of his pecuniary interest therein. |

| (4) | Consists of (i) 1,551,876 shares of Class A Common Stock held directly by Corbin ERISA Opportunity Fund, Ltd., (ii) 44,608 shares of Class A Common Stock that may be acquired upon the exercise of Warrants held directly by Corbin ERISA Opportunity Fund, Ltd., (iii) 759,000 shares of Class A Common Stock held directly by Corbin Opportunity Fund, L.P., (iv) 23,131 shares of Class A Common Stock that may be acquired upon the exercise of Warrants held directly by Corbin Opportunity Fund, L.P., (v) 600,000 shares of Class A Common Stock held directly by Pinehurst Partners, L.P. and (vi) 100,000 shares of Class A Common Stock held directly by Core Alternative Strategies Fund, L.P. Craig Bergstrom, as the Chief Investment Officer of Corbin Capital Partners, L.P., the investment manager of Corbin ERISA Opportunity Fund, Ltd., Corbin Opportunity Fund, L.P., Pinehurst Partners, L.P. and Core Alternative Strategies Fund, L.P., makes voting and investment decisions for Corbin ERISA Opportunity Fund, Ltd., Corbin Opportunity Fund, L.P., Pinehurst Partners, L.P. and Core Alternative Strategies Fund, L.P., but disclaims beneficial ownership of the shares held by them. |

| (5) | Empyrean Capital Partners, LP (“Empyrean”) serves as investment manager to Empyrean Capital Overseas Master Fund, Ltd. (“ECOMF”), and has voting and investment control of the shares held by ECOMF. Empyrean Capital, LLC serves as the general partner to Empyrean. Amos Meron is the managing member of Empyrean Capital, LLC, and as such may be deemed to have voting and dispositive control of the shares held by ECOMF. |

| (6) | Hudson Bay Capital Management LP, the investment manager of Tech Opportunities LLC, has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Tech Opportunities LLC and Sander Gerber disclaims beneficial ownership over these securities. |

| (7) | Consists of (i) 1,959,581 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests held directly by the Boston Consulting Group (“BCG”) and (ii) 793,352 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests, which Paired Interests may be acquired upon the exercise of outstanding of warrants held directly by BCG. A portion of such warrants are subject to ongoing vesting requirements. The resale of such warrants is not registered hereby. BCG had certain Opco board observer rights prior to the Closing, and it has provided, and may in the future provide, Opco with certain consulting services. Paul Tranter as CFO of BCG has the power to vote or dispose of these securities pursuant to authority delegated to him under BCG’s governance structure. Mr. Tranter disclaims beneficial ownership of these securities except to the extent of his indirect pecuniary interest therein. |

| (8) | Consists of (i) 2,598,230 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests and (ii) 119,207 shares of Class A Common Stock. |

| (9) | Consists of 2,697,399 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired interests. |

| (10) | Consists of (i) 2,201,554 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests and (ii) 62,322 shares of Class A Common Stock. |

| (11) | Represents 2,191,307 shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests. The Selling Securityholder is our partner, with which we have an ongoing relationship. Rachel Ruggeri has the power to vote or dispose of the shares held by the Selling Securityholder. |

| (12) | Consists of (i) 1,704,562 shares of Class A Common Stock held directly by Aristeia Master, L.P., (ii) 129,419 shares of Class A Common Stock held directly by ASIG International Limited, (iii) 117,852 shares of Class A Common Stock held directly by DS Liquid Div RVA ARST, LLC and (iv) 48,167 shares of Class A Common Stock held directly by Windermere Ireland Fund PLC. Aristeia Capital, L.L.C. and |

| Aristeia Advisors, L.L.C. (collectively, “Aristeia”) may be deemed the beneficial owners of the securities described herein in their capacity as the investment manager and/or general partner, as the case may be, of Aristeia Master, L.P., ASIG International Limited, DS Liquid Div RVA ARST, LLC, and Windermere Ireland Fund PLC (each a “Fund” and collectively, the “Funds”), which are the holders of such securities. |

As investment manager and/or general partner of each Fund, Aristeia has voting and investment control with respect to the securities held by each Fund. Anthony M. Frascella and William R. Techar are the co-Chief Investment Officers of Aristeia. Each of Aristeia and such individuals disclaims beneficial ownership of the securities referenced herein except to the extent of its or his direct or indirect economic interest in the Funds. |

| (13) | Such shares (the “Soroban Shares”) are held in the account of Soroban Opportunities Master Fund LP. Soroban Capital GP LLC may be deemed to beneficially own the Soroban Shares by virtue of its role as general partner of Soroban Opportunities Master Fund LP. Soroban Capital Partners LP may be deemed to beneficially own the Soroban Shares by virtue of its role as investment manager of Soroban Opportunities Master Fund LP. Soroban Capital Partners GP LLC may be deemed to beneficially own the Soroban Shares by virtue of its role as general partner of Soroban Capital Partners LP. Eric W. Mandelblatt may be deemed to beneficially own the Soroban Shares by virtue of his role as Managing Partner of Soroban Capital Partners GP LLC. Each of Soroban Capital GP LLC. Soroban Capital Partners LP. Soroban Capital Partners GP LLC and Eric W. Mandelblatt disclaim beneficial ownership of the Soroban Shares except to the extent of his or its pecuniary interest. |

| (14) | Represents shares of Class A Common Stock that may be acquired upon the exchange of a corresponding number of Paired Interests. PayU is ultimately controlled by Prosus N.V. and Naspers Ltd., which are publicly listed entities with widely dispersed ownership. |