Exhibit 99.2 Bakkt to acquire Apex Crypto 11.3.22

Important notice Unless the context otherwise provides, “we,” “us,” “our,” “Bakkt” and like terms refer (i) prior to October 15, 2021 (the closing date of the business combination), to Bakkt Opco Holdings, LLC (f/k/a Bakkt Holdings, LLC, “Opco”) and its subsidiaries and (ii) after October 15, 2021, to Bakkt Holdings, Inc. and its subsidiaries, including Opco. Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, but are not limited to, statements regarding Bakkt’s plans, objectives, expectations and intentions with respect to future operations, products, services, the benefits of the combined company’s operations, anticipated synergies, the expected timing of the transaction, post- closing commercial arrangements, and the timing and amounts of consideration that Bakkt may pay in the Acquisition, among others. Forward-looking statements can be identified by words such as “will,” “likely,” “expect,” “continue,” “anticipate,” “estimate,” “believe,” “intend,” “plan,” “projection,” “outlook,” “grow,” “progress,” “potential” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of Bakkt’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and beyond Bakkt’s control. Actual results and the timing of events may differ materially from the results anticipated in such forward-looking statements. You are cautioned not to place undue reliance on such forward- looking statements. Such forward-looking statements relate only to events as of the date on which such statements are made and are based on information available to us as of the date of this presentation. Unless otherwise required by law, we undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date hereof or to reflect new information or the occurrence of unanticipated events. The following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in such forward-looking statements: (i) the impact of the ongoing COVID-19 pandemic; (ii) changes in the markets in which Bakkt competes, including with respect to its competitive landscape, technology evolution or regulatory changes; (iii) changes in the markets that Bakkt targets; (iv) risk that Bakkt may not be able to execute its growth strategies, including identifying and executing acquisitions; (v) risks relating to data security; and (vi) the companies being able to obtain the necessary regulatory approvals and otherwise satisfy all closing conditions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the heading “Risk Factors” in Bakkt’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. 2

3

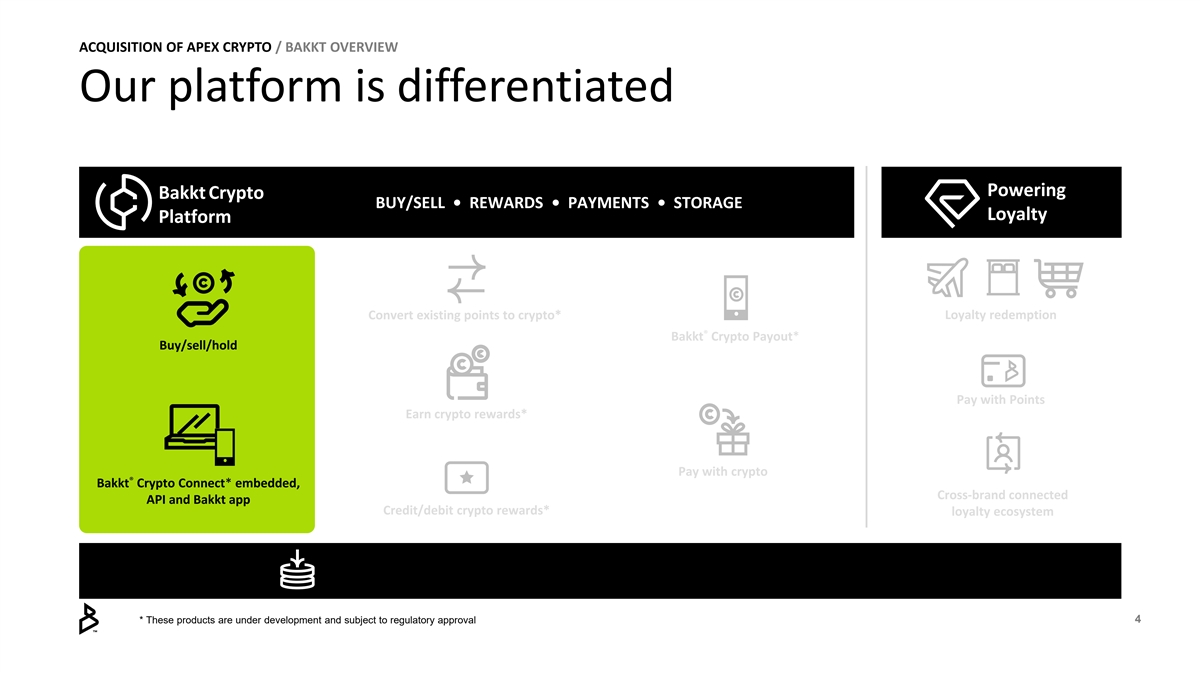

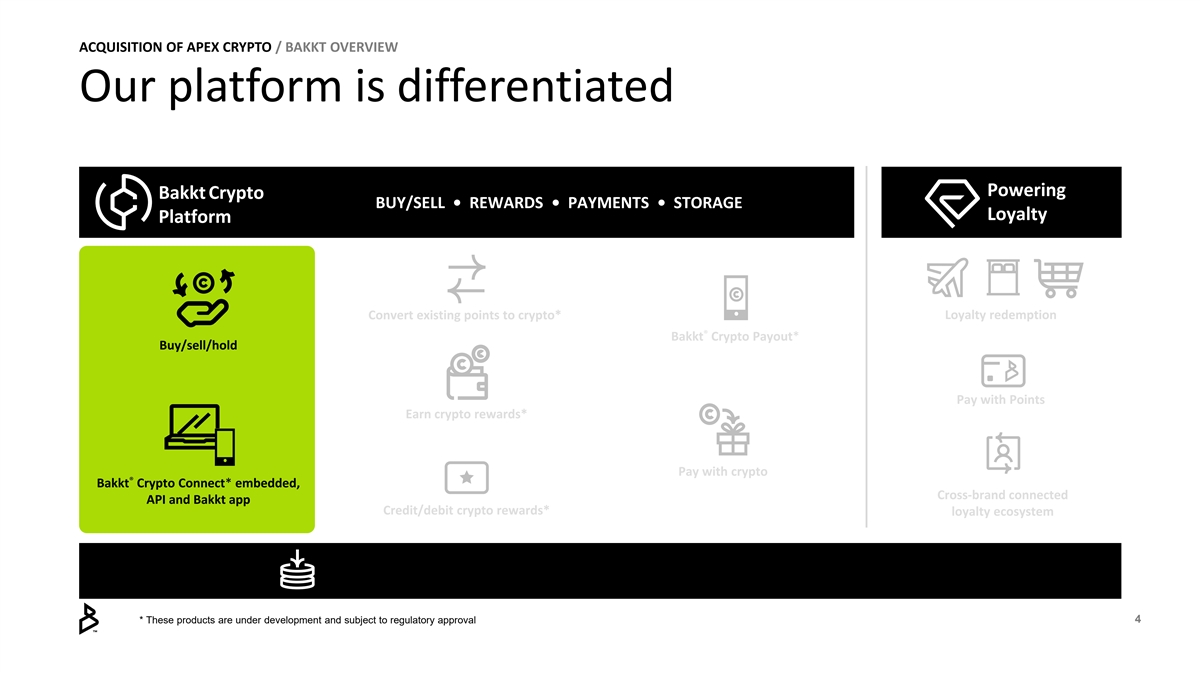

ACQUISITION OF APEX CRYPTO / BAKKT OVERVIEW Our platform is differentiated Powering Bakkt Crypto BUY/SELL • REWARDS • PAYMENTS • STORAGE Loyalty Platform Loyalty redemption Convert existing points to crypto* ® Bakkt Crypto Payout* Buy/sell/hold Pay with Points Earn crypto rewards* Pay with crypto ® Bakkt Crypto Connect* embedded, Cross-brand connected API and Bakkt app Credit/debit crypto rewards* loyalty ecosystem 4 * These products are under development and subject to regulatory approval

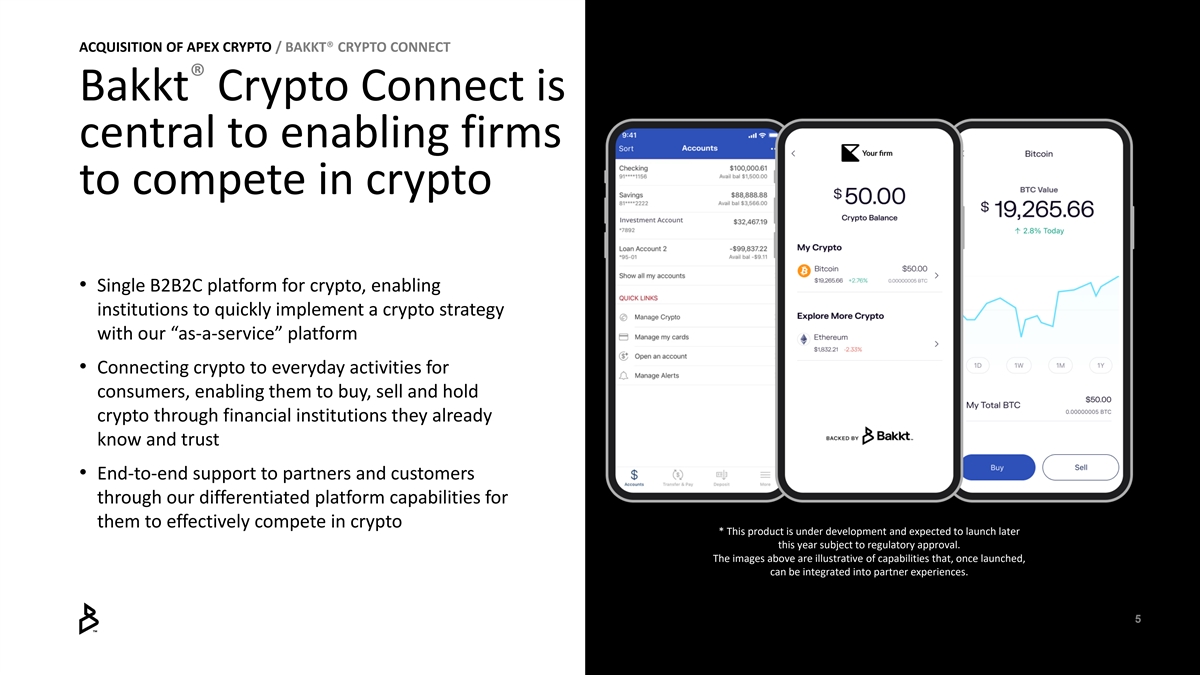

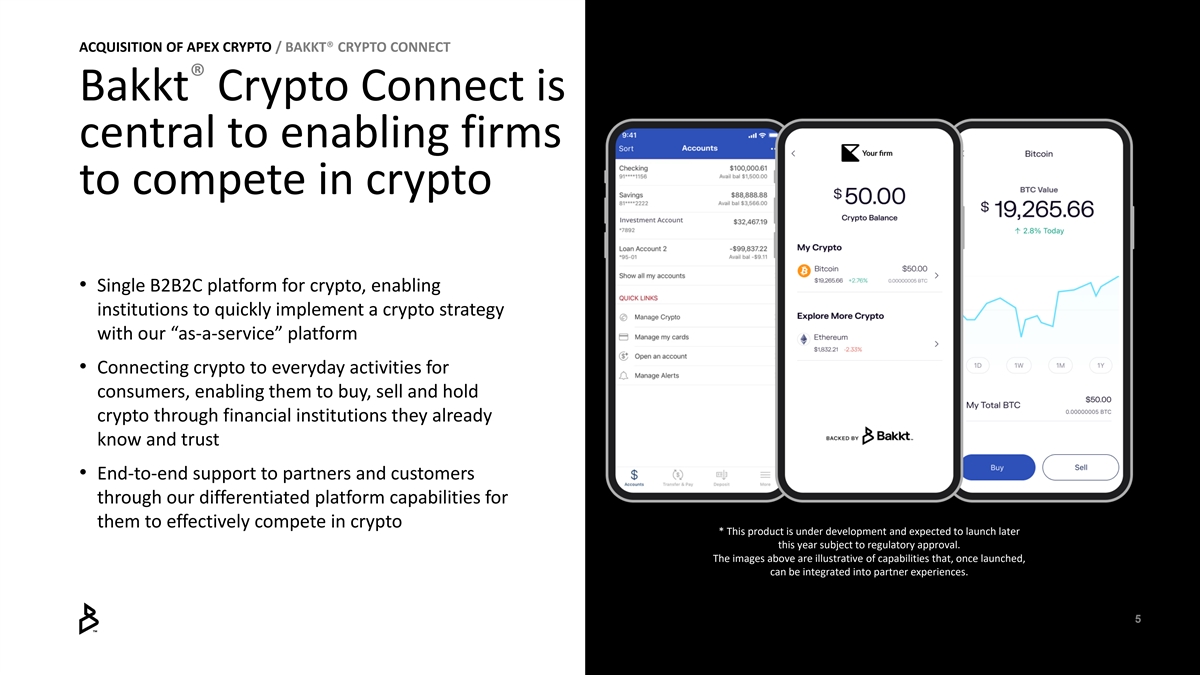

ACQUISITION OF APEX CRYPTO / BAKKT® CRYPTO CONNECT ® Bakkt Crypto Connect is central to enabling firms to compete in crypto • Single B2B2C platform for crypto, enabling institutions to quickly implement a crypto strategy with our “as-a-service” platform • Connecting crypto to everyday activities for consumers, enabling them to buy, sell and hold crypto through financial institutions they already know and trust • End-to-end support to partners and customers through our differentiated platform capabilities for them to effectively compete in crypto * This product is under development and expected to launch later this year subject to regulatory approval. The images above are illustrative of capabilities that, once launched, can be integrated into partner experiences. 5

ACQUISITION OF APEX CRYPTO Acquiring Apex Crypto is expected to accelerate our strategy Will create a robust combination of broad digital asset capabilities on a secure, institutional-grade, compliance-focused technology platform, with expansive scalability 6 Note: Acquisition is subject to regulatory approval

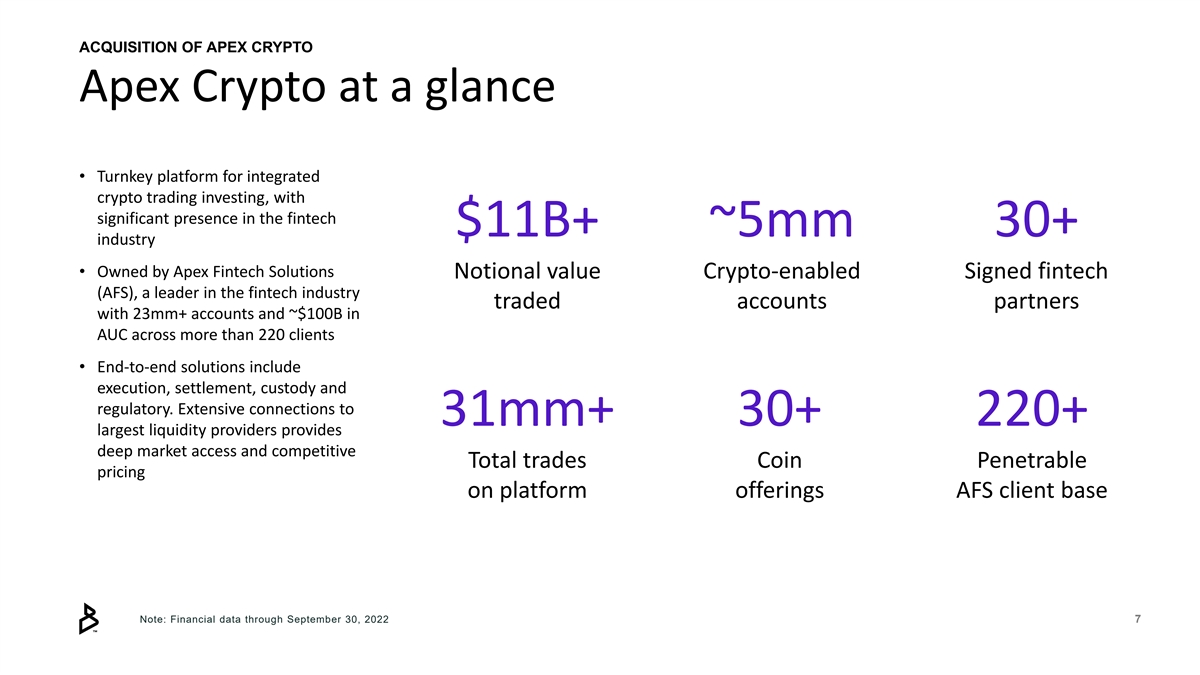

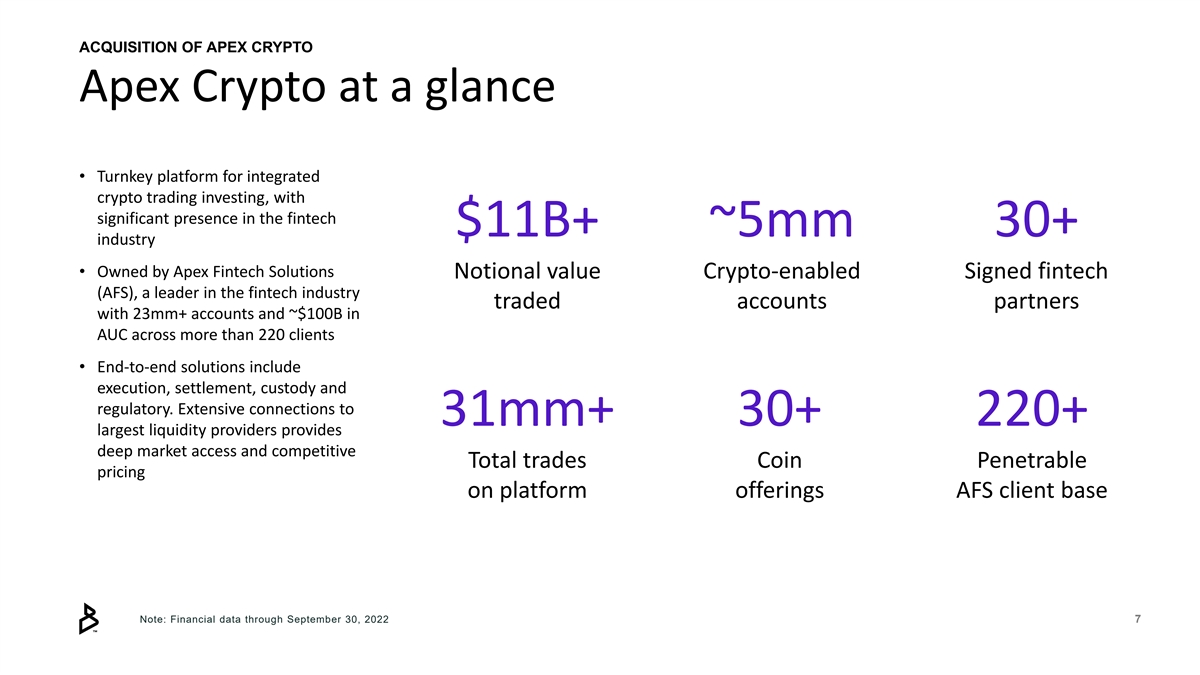

ACQUISITION OF APEX CRYPTO Apex Crypto at a glance • Turnkey platform for integrated crypto trading investing, with significant presence in the fintech $11B+ ~5mm 30+ industry • Owned by Apex Fintech Solutions Notional value Crypto-enabled Signed fintech (AFS), a leader in the fintech industry traded accounts partners with 23mm+ accounts and ~$100B in AUC across more than 220 clients • End-to-end solutions include execution, settlement, custody and regulatory. Extensive connections to 31mm+ 30+ 220+ largest liquidity providers provides deep market access and competitive Total trades Coin Penetrable pricing on platform offerings AFS client base Note: Financial data through September 30, 2022 7

ACQUISITION OF APEX CRYPTO Apex Crypto will drive additional scale in our platform • Acquisition of Apex Crypto is expected to broaden our range of product capabilities and expand our target addressable market, driving significant scale in our platform • Talented Apex Crypto employees with diverse backgrounds in crypto and trading will be a great addition to the Bakkt team • Transaction is expected to provide meaningful synergies and bolsters our path to profitability 8

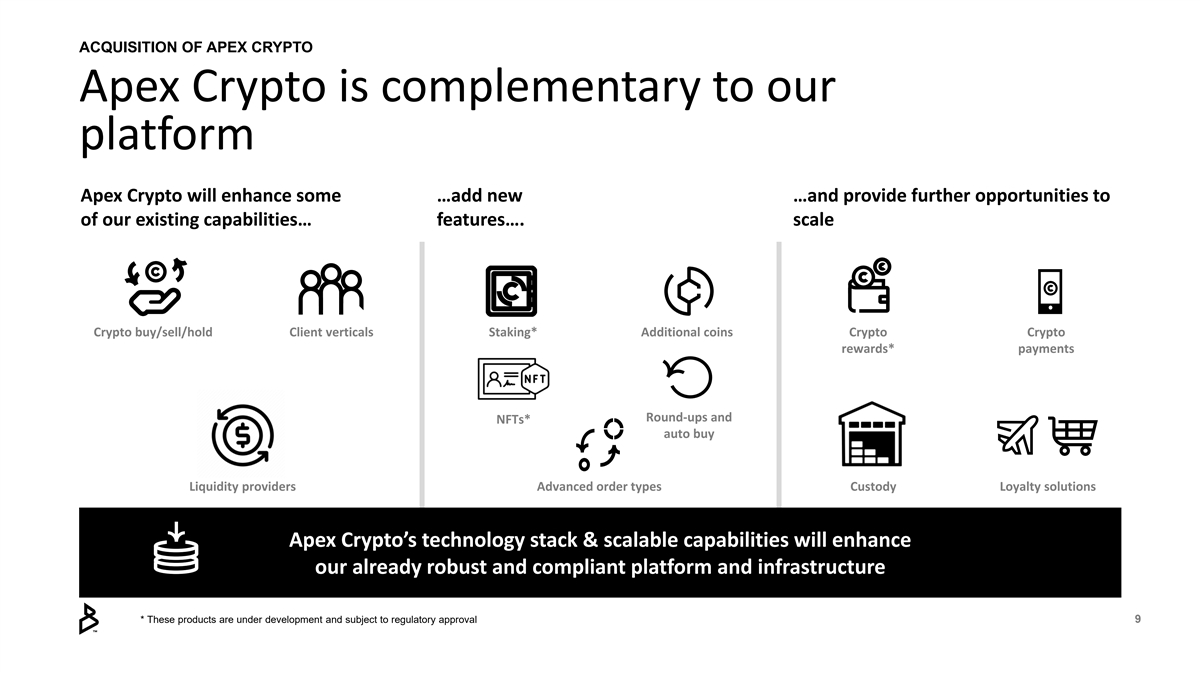

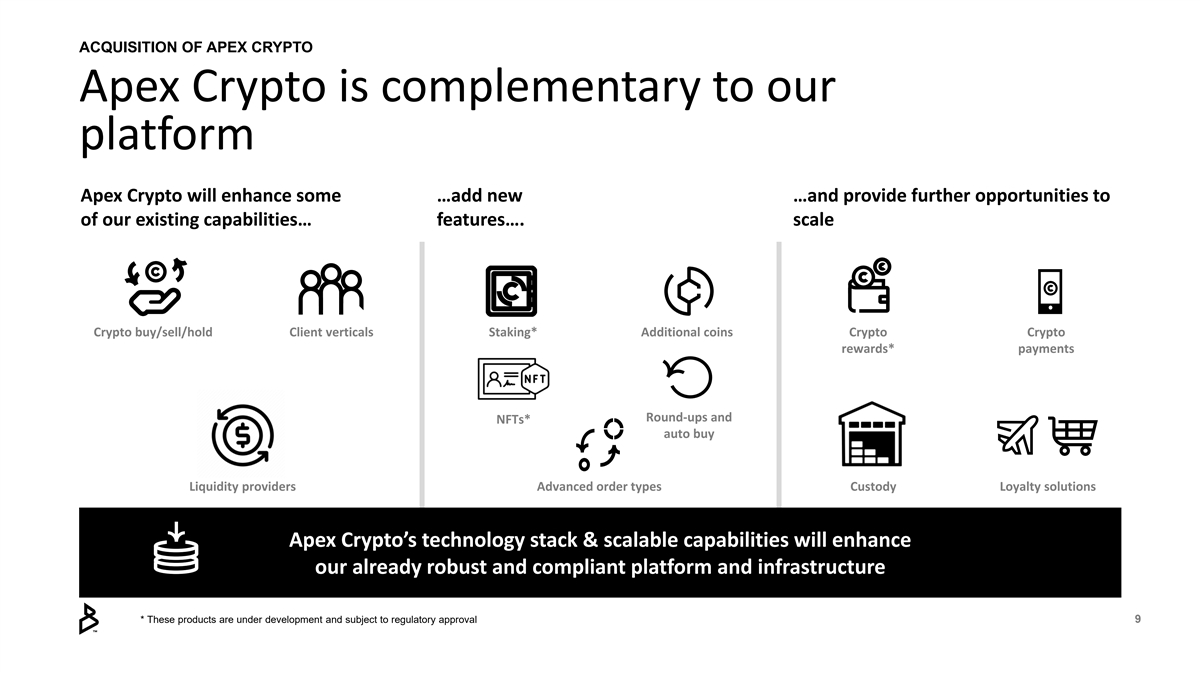

ACQUISITION OF APEX CRYPTO Apex Crypto is complementary to our platform Apex Crypto will enhance some …add new …and provide further opportunities to of our existing capabilities… features…. scale Crypto buy/sell/hold Client verticals Staking* Additional coins Crypto Crypto rewards* payments Round-ups and NFTs* auto buy Liquidity providers Advanced order types Custody Loyalty solutions Apex Crypto’s technology stack & scalable capabilities will enhance our already robust and compliant platform and infrastructure 9 * These products are under development and subject to regulatory approval

ACQUISITION OF APEX CRYPTO Instant access to new client verticals for crypto solutions • Apex Crypto will drive additional scale by broadening our target partners for crypto solutions into a rapidly growing Platform Trading app companies companies fintech industry • Apex has more than 30 signed fintech partners • Robust opportunity to deepen relationships with Apex Crypto’s current customers with solutions such as Bakkt® Banks and Fintechs & Crypto Rewards and Bakkt® Crypto financial Neobanks institutions Payout Bakkt crypto solutions existing Apex Crypto existing client base client base 10

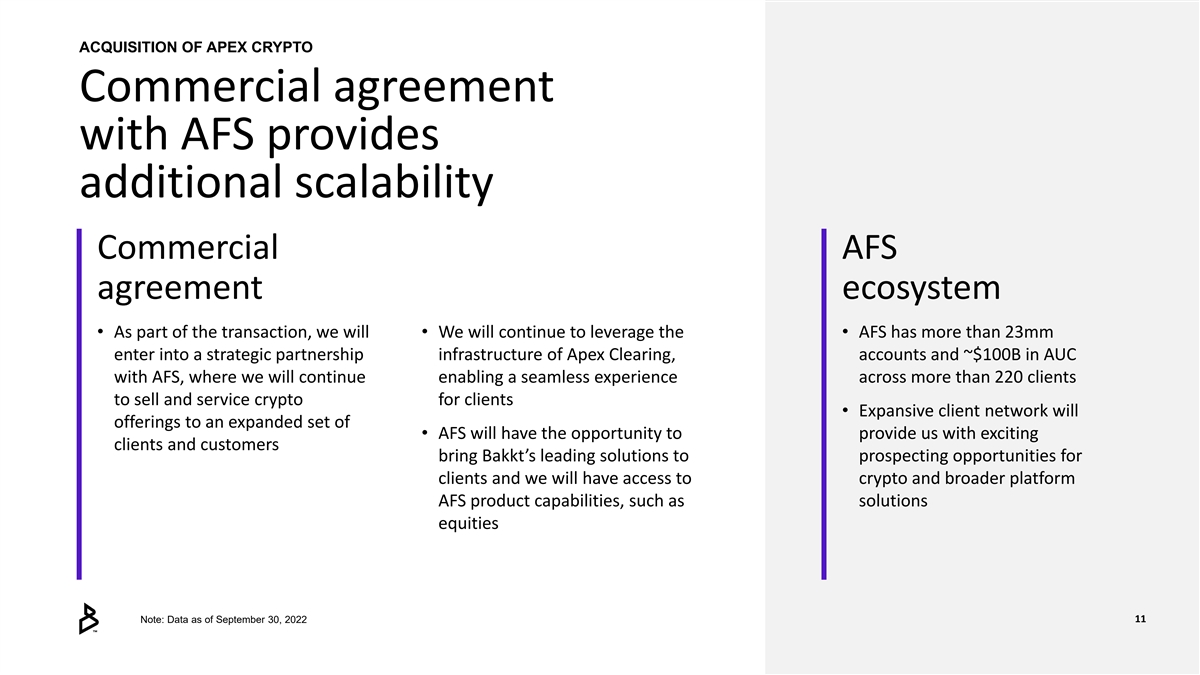

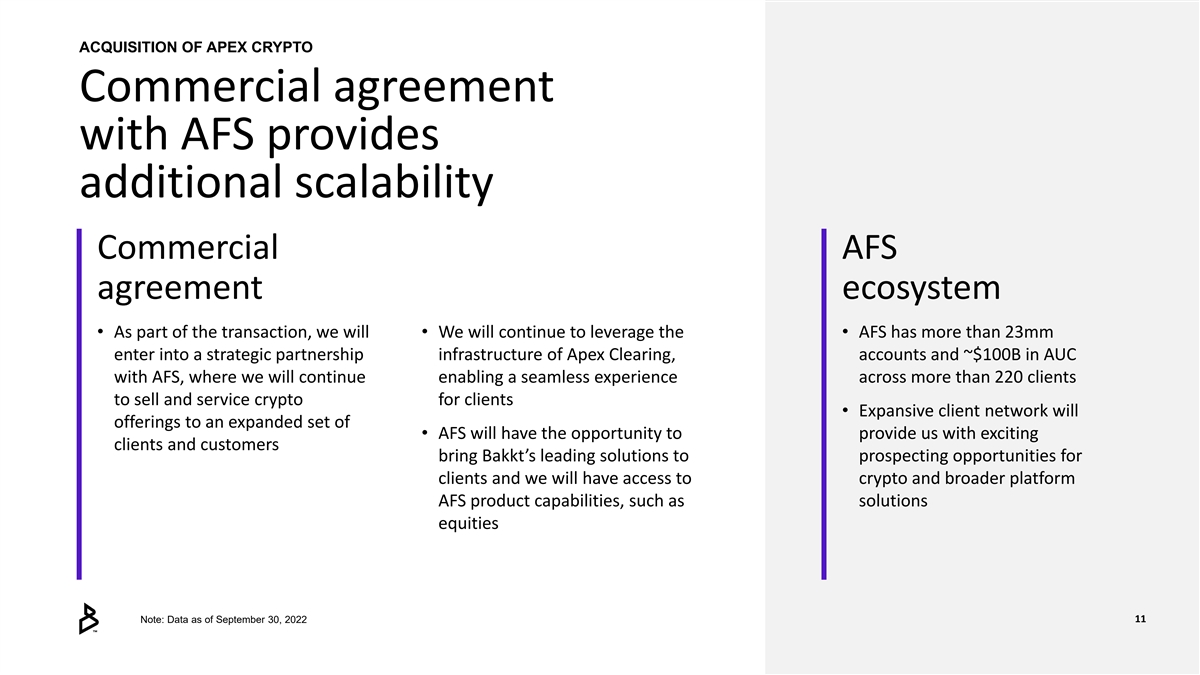

ACQUISITION OF APEX CRYPTO Commercial agreement with AFS provides additional scalability Commercial AFS agreement ecosystem • As part of the transaction, we will • We will continue to leverage the • AFS has more than 23mm enter into a strategic partnership infrastructure of Apex Clearing, accounts and ~$100B in AUC with AFS, where we will continue enabling a seamless experience across more than 220 clients to sell and service crypto for clients • Expansive client network will offerings to an expanded set of • AFS will have the opportunity to provide us with exciting clients and customers bring Bakkt’s leading solutions to prospecting opportunities for clients and we will have access to crypto and broader platform AFS product capabilities, such as solutions equities 11 Note: Data as of September 30, 2022

ACQUISITION OF APEX CRYPTO Transaction overview Financial • Initial payment of $55mm in cash at the closing of the deal and up to consideration $45mm in Bakkt stock depending on the achievement of financial targets by the acquired business in the fourth quarter of 2022 • Up to an additional $100mm in Bakkt stock and seller notes may be paid depending on the achievement of financial targets by the acquired business through 2025 Expected financial impact • Proposed transaction is expected to be accretive to revenue growth rate and provide synergies and cost savings Expected timing • Targeted close by 1H 2023, subject to conditions set forth in the purchase agreement including regulatory approvals 12

ACQUISITION OF APEX CRYPTO Attractive transaction to capture significant growth opportunity Our acquisition of Apex Crypto aligns with our long-term strategy, drives additional scale and enables us to execute on our key priorities Build out and activate Deepen relationships partnerships with existing partners Invest in Execute on expansion products and opportunities capabilities We remain laser focused on execution 13