SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Notice of 2024 Annual Meeting of

Stockholders & Proxy Statement

To Our Stockholders–

2023 was an inflection point for Bakkt, and I believe that the investments as well as the tough decisions we have made this past year have set Bakkt up to capitalize on the market opportunity in crypto. Specifically, we have solidified our path forward as a B2B2C-focused company and built out our partner ecosystem. And we have brought in a new CEO with a track record of growth. With these actions in place, we continue to focus on creating stockholder value by offering trustworthy capabilities that solve business needs.

2023 brought some significant macroeconomic headwinds in the crypto sector, but it also created opportunities, as evidenced by our acquisition of Apex Crypto. With the Apex integration, we are positioned to be the crypto infrastructure provider of choice for a wide range of businesses including fintechs, traditional financial institutions, neobanks, merchants and entertainment.

The regulatory environment for cryptocurrency continues to evolve, which we believe is good news for Bakkt – we were built with an understanding of the risks of crypto and have developed a robust compliance framework, allowing us to differentiate our offerings from those of our competitors. Our team has been engaging in dialogue with varying levels of government and regulatory bodies to educate them on Bakkt and our approach to risk management and security, and to showcase Bakkt as an industry leader in responsible crypto innovation.

As we enter 2024, I am excited by Bakkt’s strategic position, and also by the energy of the leadership team, now led by Andy Main. With our platform and strategy firmly in place, Andy’s proven track record of scaling businesses is the experience we believe Bakkt needs going forward.

Thank you for your investment in Bakkt. I look forward to overseeing Bakkt’s growth as we drive towards profitability, scale, and increased shareholder value.

Sean Collins, Chair of the Board of Directors

Notice of 2024 Annual Meeting of Stockholders & Proxy Statement

Dear Fellow Stockholders –

I am proud to serve you as Bakkt’s new President and CEO. Our company is at a pivotal inflection point requiring us to focus on growth while transforming our cost structure. In my first few weeks I have had the pleasure of meeting many of our clients, all of whom appreciate the value Bakkt brings - as their partner in growth. Simply put, as our clients grow, we also grow. This value proposition is made possible by the strong, secure ecosystem of products our team has built, which are differentiated in the market. Building off this robust foundation, we have much to look forward to, as we work to scale and grow the business.

As a member of the Bakkt Board of Directors since 2021, I have been aware of the challenges Bakkt has faced. The macroeconomic environment has been difficult amidst industry failures and regulatory uncertainty. However, I see the tide turning, where the positive tailwinds in the market are fortuitously meeting the hard work that the Bakkt team has done during the bear market. For example, in the first quarter of 2024, we saw higher transaction volumes from our retail clients. I am also pleased to say that our platform is efficiently scaling to meet this growing demand. Additionally, thanks to the company’s recent capital raise, we fortified our balance sheet so we can continue focusing on building momentum and enhancing shareholder value.

Across Bakkt’s core custody and trading solutions, we have a strong offering that appeals to a wide variety of clients. In the year ahead, your Bakkt team will focus on three key strategic priorities – growing our client network and deepening existing relationships, strategically expanding the Bakkt product ecosystem, and prudently managing expenses. I am very proud of what our team has accomplished thus far, and believe these priorities will put us on a path to profitability.

We are pleased to invite you to attend the annual meeting of stockholders of Bakkt Holdings, Inc. The attached formal meeting notice and proxy statement contain details of the business to be conducted at the annual meeting.

Your vote is important. If you are unable to attend the annual meeting, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our Board of Directors and everyone at Bakkt, we would like to express our appreciation for your continued support of and interest in our company. I am looking forward to Bakkt's bright future and sharing exciting developments in the months and years ahead. It is an honor to lead this team.

Kind regards,

Andrew Main, President & CEO

Notice of 2024 Annual Meeting of Stockholders

| | | | | |

| Time and Date | 12:00 p.m., Eastern Time, on Friday, May 31, 2024. |

| Place | The annual meeting will be conducted virtually via live audio webcast. As a stockholder as of the record date, you will be able to attend the meeting virtually by visiting www.virtualshareholdermeeting.com/BKKT2024, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. |

| Items of Business | •To elect Sean Collins, Richard Lumb and Andrew Main as Class III directors to hold office until the 2027 annual meeting of stockholders or until their respective successors are elected and qualified. •To approve an amendment to the Company’s 2021 Omnibus Incentive Plan, as amended (the “2021 Omnibus Incentive Plan”), to increase the number of shares of Class A Common Stock issuable thereunder to 75,873,051 shares (which number will be correspondingly adjusted to the extent the Proposed Reverse Stock Split (as defined below) is effected prior to the annual meeting); •To vote on the shareholder proposal, if properly presented at the 2024 annual meeting, requesting for the adoption of a simple majority vote standard; and •To transact other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

| Record Date | April 8, 2024 Only stockholders of record as of April 8, 2024 are entitled to attend, notice of and to vote at the annual meeting. |

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement, notice of annual meeting, form of proxy and annual report, is being sent or given on or about April 19, 2024 to all stockholders entitled to vote at the annual meeting. The proxy materials and our annual report can be accessed as of April 19, 2024 by visiting www.proxyvote.com. |

| Voting | Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. |

By order of the Board of Directors,

Marc D’Annunzio, General Counsel and Corporate Secretary

Bakkt Holdings, Inc.

10000 Avalon Boulevard, Suite 1000

Alpharetta, Georgia 30009

April 19, 2024

Table of Contents

This proxy statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding macroeconomic conditions, our ability to achieve the expected benefits of acquisitions, the regulatory environment, our platform’s capabilities, our commitments, our strategies and our expectations regarding future equity grants. These statements involve risks and uncertainties. Actual results could differ materially from any future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties that are discussed in our most recently filed Annual Report on Form 10-K. Other than as required by law, we assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

References to our website or other links to our publications or other information are provided for the convenience of our stockholders. None of the information or data included on our website or accessible at these links is incorporated into, and will not be deemed to be a part of, this proxy statement or any of our other filings with the U.S. Securities and Exchange Commission (the “SEC”).

Unless otherwise noted, share counts, prices per share and related information presented herein does not give effect to the Proposed Reverse Stock Split (as described below).

Leadership & Corporate Governance

Executive Team

We believe that our leadership team has the skills and qualifications needed to drive the future growth of Bakkt. We are proud of the diversity of gender, ethnicity, and thought of our leadership team.

Our executive officers are:

•Andrew Main, Chief Executive Officer and President

•Karen Alexander, Chief Financial Officer

•Marc D’Annunzio, General Counsel and Corporate Secretary

Additional members of our leadership team include:

•Nicholas Baes, Chief Technology Officer

•Liz Gordon, Chief Client Officer

•Nancy Gordon, Chief Business Officer

•Alex Jacobs, Chief Administrative Officer

•Kim Jimenez, Chief Human Resources Officer

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 1

Director Nominees and Continuing Directors

| | | | | | | | | | | | | | |

| | | | |

| Sean Collins | | David Clifton | | De'Ana Dow |

| | | | |

| Michelle J. Goldberg | | Richard Lumb | | Andrew A. Main |

| | | | | | | | |

| | |

| Jill Simeone | | Gordon Watson |

The below provides summary information about each director nominee and continuing director. Please see pages 13 to 28 for more information.

| | | | | | | | | | | | | | | | | |

| Name | Age | Independent | Audit and Risk Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Director Nominees |

| Sean Collins | 44 | Yes | Member | Chair | Member |

| Richard Lumb | 63 | Yes | Member | — | — |

| Andrew Main | 59 | No | — | — | — |

| Continuing Directors |

| David Clifton | 47 | No | — | — | — |

| De’Ana Dow | 68 | Yes | Member | — | — |

| Michelle J. Goldberg | 55 | Yes | Chair | — | Member |

| Jill Simeone | 57 | Yes | — | Member | Chair |

| Gordon Watson | 45 | No | — | — | — |

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 2

Director Dashboard

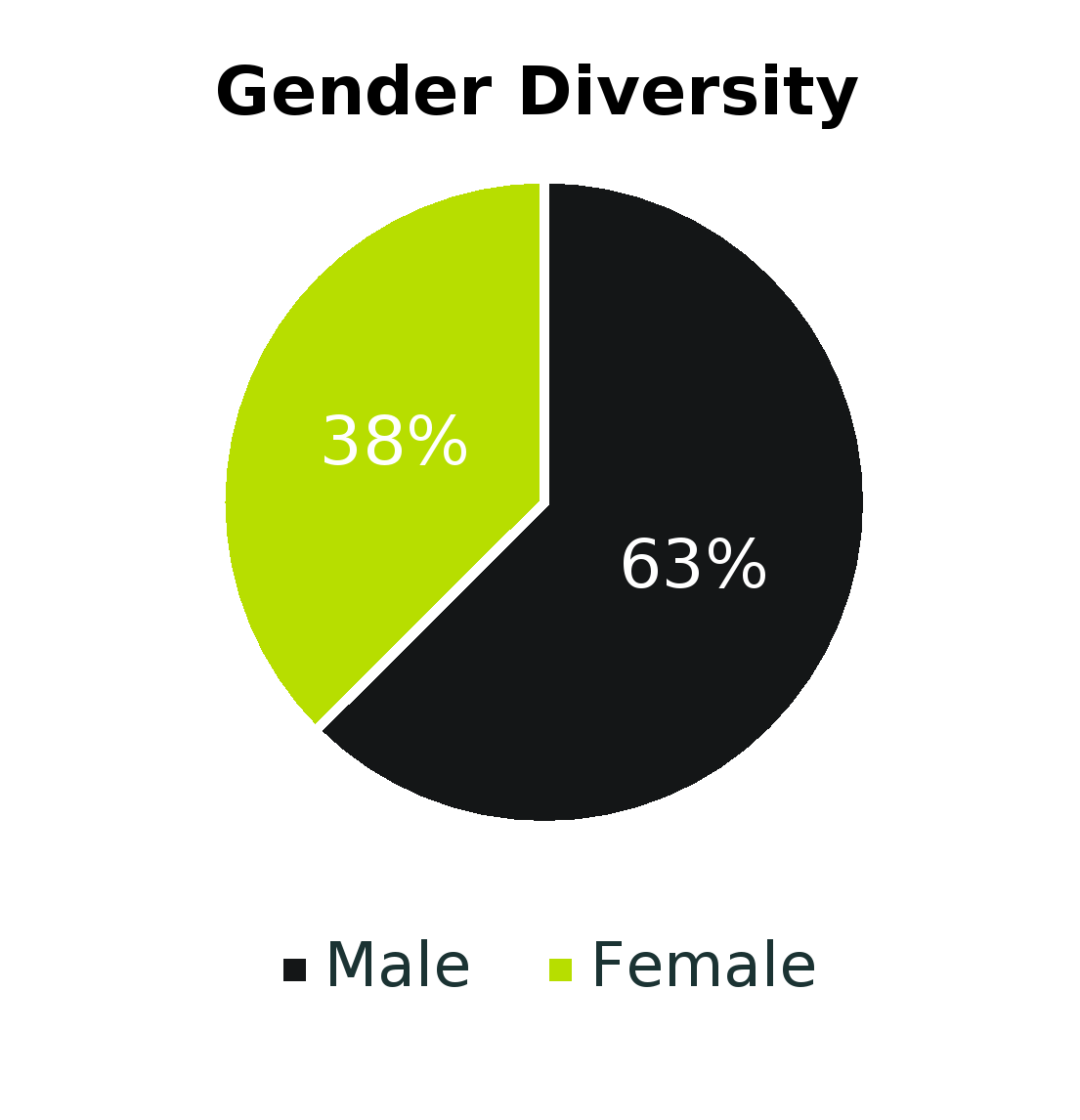

A number of Bakkt’s directors have self-identified as diverse:

•Two directors have self-identified as having two or more races or ethnicities;

•One director has self-identified as African-American or Black; and

•One director has self-identified as having citizenship outside the United States.

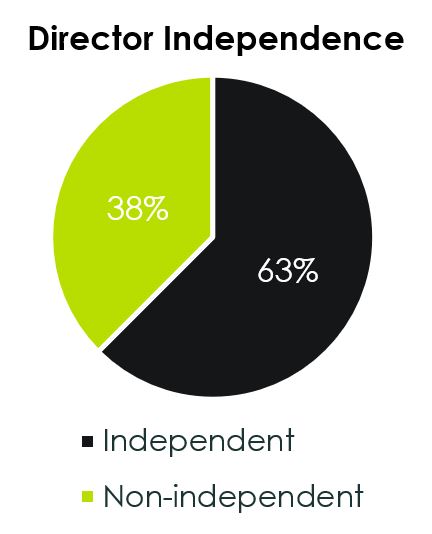

Corporate Governance Strengths

We are focused on effective corporate governance practices that work alongside our business model to promote our growth trajectory, as well as the interests of our stockholders. We have in place a number of governance practices to manage and oversee our business, including:

•An independent Board chair;

•A majority independent Board;

•Committees comprised only of independent directors;

•An engaged Board bringing a diversity of thought and experience to discussions;

•A Voting Agreement with ICE (as defined below), as a result of which we are not a “controlled company” under the NYSE listing standards;

•Active roles by our Board in strategic planning, risk management and oversight;

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 3

•Corporate governance guidelines adopted by the Board setting forth our corporate governance policies and standards; and

•Approval by the audit and risk committee required for related party transactions between the Company and the officers, directors, more than 5% shareholders and their related parties.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 4

Voting and Meeting Information

Bakkt Holdings, Inc. Proxy Statement

2024 Annual Meeting of Stockholders

To be held at 12:00 p.m., Eastern Time, on Friday, May 31, 2024.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully.

Questions and Answers About the Proxy Materials and Our Annual Meeting

Why am I receiving these materials?

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our Board for use at the 2024 annual meeting of stockholders of Bakkt Holdings, Inc., and any postponements, adjournments or continuations thereof. The annual meeting will be held on Friday, May 31, 2024 at 12:00 p.m., Eastern Time. As a stockholder as of the record date, you will be able to attend the meeting virtually by visiting www.virtualshareholdermeeting.com/BKKT2024, where you will be able to listen to the meeting live, submit questions and vote online during the meeting.

The Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and form of proxy, and our annual report, is first being sent or given on or about April 19, 2024 to all stockholders of record as of April 8, 2024. The proxy materials and our annual report can be accessed as of April 19, 2024 by visiting www.proxyvote.com. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the proxy materials or our annual report in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the proxy materials and our annual report are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

•the election of Sean Collins, Richard Lumb and Andrew Main as Class III directors to hold office until our 2027 annual meeting of stockholders and until their respective successors are elected and qualified;

•the approval of an amendment to the 2021 Omnibus Incentive Plan to increase the number of authorized shares of Class A Common Stock issuable thereunder to 75,873,051 shares (which number will be correspondingly adjusted to the extent the Proposed Reverse Stock Split is effected prior to the annual meeting); and

•the shareholder proposal, if properly presented at the annual meeting, requesting for the adoption of a simple majority vote standard.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 5

We have called a Special Meeting of Stockholders to be held on April 23, 2024 (the “Special Meeting”) to consider, among other things, a proposal to effect a reverse stock split of our outstanding Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) and Class V Common Stock, par value $0.0001 per share (the “Class V Common Stock”, and together with the Class A Common Stock, our “common stock”) at a ratio equal to 1-for-25 (the “Proposed Reverse Stock Split”) and, contemporaneously with the Proposed Reverse Stock Split, a reduction in the number of authorized shares of common stock by a ratio corresponding to that effected in the Proposed Reverse Stock Split. The proposal to be considered at the annual meeting related to the approval of an amendment to the 2021 Omnibus Incentive Plan to increase the number of authorized shares of Class A Common Stock issuable thereunder to 75,873,051 shares does not reflect the potential impact of the Proposed Reverse Stock Split. As such, if we effect the Potential Reverse Stock Split prior to the annual meeting, the proposed increase to the authorized shares under the 2021 Omnibus Incentive Plan being considered at the annual meeting will be automatically adjusted such that we will be instead seeking the approval of an amendment to the 2021 Omnibus Incentive Plan to increase the number of authorized shares of Class A Common Stock thereunder by 938,626 shares, which, if approved, would result in the total number of shares of Class A Common Stock issuable under the 2021 Omnibus Plan following such potential increase being 3,034,922 shares. Unless otherwise noted, share counts, price per share and related numbers presented herein do not give effect to the Proposed Reverse Stock Split.

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

How does the Board recommend that I vote on these proposals?

Our Board recommends that you vote your shares:

•“FOR” the election of Sean Collins, Richard Lumb and Andrew Main as Class III directors;

•“FOR” the approval of an amendment to the 2021 Omnibus Incentive Plan, as amended (the “2021 Omnibus Incentive Plan Amendment”) to increase the number of authorized shares of Class A Common Stock issuable thereunder to 75,873,051 shares (which number will be correspondingly adjusted to the extent the Proposed Reverse Stock Split is effected prior to the annual meeting).

•“AGAINST” the shareholder proposal of simple majority vote standard.

Who is entitled to vote at the annual meeting?

Holders of our Class A and Class V Common Stock as of the close of business on April 8, 2024, the record date for the annual meeting, may vote at the annual meeting. As of the record date, there were 145,494,960 shares of Class A Common Stock and 179,883,479 shares of Class V Common Stock outstanding (which numbers do not give effect to the Proposed Reverse Stock Split). Our Class A Common Stock and Class V Common Stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Each share of common stock is entitled to one vote on each matter properly brought before the annual meeting. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 6

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Throughout this proxy statement, we refer to these holders as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the annual meeting?

A list of registered stockholders entitled to vote at the annual meeting will be made available for examination by any stockholder for any purpose germane to the meeting for the ten-day period prior to the annual meeting at 10000 Avalon Boulevard, Suite 1000, Alpharetta, Georgia 30009, between the hours of 9:00 a.m. and 5:00 p.m., local time. The list of registered stockholders entitled to vote at the annual meeting will also be available online during the annual meeting at www.virtualshareholdermeeting.com/BKKT2024, for those stockholders attending the annual meeting.

How many votes are needed for approval of each proposal?

•Proposal No. 1: Each director is elected by a plurality of the votes cast by the stockholders present at the annual meeting or represented by proxy at the annual meeting and entitled to vote on the election of directors. A plurality means that the nominees with the largest number of “FOR” votes are elected as directors. You may (1) vote “FOR” the election of all of the director nominees named herein, (2) “WITHHOLD” authority to vote for all such director nominees, or (3) vote “FOR” the election of all such director nominees other than any nominees with respect to whom the vote is specifically WITHHELD by indicating in the space provided on the proxy. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker nonvote, will have no effect on the outcome of the election.

•Proposal No. 2: Intentionally Omitted.

•Proposal No. 3: The approval of the 2021 Omnibus Incentive Plan Amendment requires the affirmative vote of a majority of the voting power of the outstanding shares of the Company present at the annual meeting or represented by proxy at the annual meeting and entitled to vote on this proposal. You may vote “FOR” or “AGAINST” this proposal, or you may indicate that you wish to “ABSTAIN” from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will be considered as

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 7

being present for the vote on this proposal but will not be counted as a vote cast “FOR” this proposal and will, therefore, have the effect of a vote “AGAINST” this proposal. Broker non-votes will not be considered as entitled to vote on this proposal and will have no effect on this proposal.

•Proposal No. 4: The approval of a shareholder proposal of simple majority vote standard requires the majority of votes cast by the stockholders present at the annual meeting or represented by proxy at the annual meeting and entitled to vote on this proposal. You may vote “FOR” or “AGAINST” this proposal, or you may indicate that you wish to “ABSTAIN” from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will be considered as being present for the vote on this proposal but will not be counted as a vote cast “FOR” this proposal and will, therefore, have the effect of a vote “AGAINST” this proposal. Broker non-votes will not be considered as entitled to vote on this proposal and will have no effect on this proposal.

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our bylaws and Delaware law. The presence, at the annual meeting or by proxy, of a majority of the voting power of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the annual meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, either the chairperson of the meeting or the majority of stockholders entitled to vote at the meeting, present at the annual meeting or represented by proxy, may adjourn the meeting to another time or place.

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

•by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59pm, Eastern Time, on May 30, 2024 (have your Notice of Internet Availability or proxy card in hand when you visit the website);

•by toll-free telephone at 1-800-690-6903, 24 hours a day, 7 days a week, until 11:59pm, Eastern Time, on May 30, 2024 (have your Notice of Internet Availability or proxy card in hand when you call);

•by completing, signing and mailing your proxy card (if you received printed proxy materials), which must be received prior to the annual meeting; or

•by attending the meeting virtually by visiting www.virtualshareholdermeeting.com/BKKT2024, where you may vote during the meeting (have your Notice of Internet Availability or proxy card in hand when you visit the website).

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 8

Street Name Stockholders. If you are a street name stockholder, then you will receive voting instructions from your broker, bank or other nominee. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. We therefore recommend that you follow the voting instructions in the materials you receive. If your voting instruction form or Notice of Internet Availability indicates that you may vote your shares through the proxyvote.com website, then you may vote those shares at the annual meeting with the control number indicated on that voting instruction form or Notice of Internet Availability. Otherwise, you may not vote your shares at the annual meeting unless you obtain a legal proxy from your broker, bank or other nominee.

How can I get help if I have trouble checking in or listening to the annual meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the election of Sean Collins, Richard Lumb and Andrew Main as Class III directors;

•“FOR” the approval of an amendment to the 2021 Omnibus Incentive Plan to increase the number of shares of Class A Common Stock issuable thereunder to 75,873,051 shares (which number will be correspondingly adjusted to the extent the Proposed Reverse Stock Split is effected prior to the annual meeting); and

•“AGAINST” the shareholder proposal of simple majority vote standard.

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. Your broker, bank or other nominee will not have discretion to vote on any proposals at the annual meeting absent direction from you, given none of the proposals being considered at the annual meeting are routine. If you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 9

•entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above);

•completing and returning a later-dated proxy card, which must be received prior to the annual meeting;

•delivering a written notice of revocation to our corporate secretary at Bakkt Holdings, Inc., 10000 Avalon Boulevard, Suite 1000, Alpharetta, Georgia 30009, Attention: Corporate Secretary, which must be received prior to the annual meeting; or

•attending and voting at the annual meeting (although attendance at the annual meeting will not, by itself, revoke a proxy).

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. Andrew Main, our Chief Executive Officer and President, Karen Alexander, our Chief Financial Officer, and Marc D'Annunzio, our General Counsel and Secretary, and each of them, with full power of substitution and re-substitution, have been designated as proxy holders for the annual meeting by our Board. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holders will use their own judgment to determine how to vote your shares. If the annual meeting is postponed or adjourned, then the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

Who will count the votes?

A representative of Broadridge Financial Solutions will tabulate the votes and act as inspector of election.

How can I contact Bakkt’s transfer agent?

You may contact our transfer agent, Equiniti Trust Company, LLC, by telephone at 1-800-937-5449, by email at helpast@equiniti.com or by writing Equiniti Trust Company, LLC, at 55 Challenger Road, Floor 2, Ridgefield Park, NJ 07660. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at https://www.equiniti.com.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our Board is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 10

request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the SEC, within four business days after the meeting. If final voting results are not available to us in time to file a Form 8-K, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials?

In accordance with the rules of the SEC, we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the proxy materials. The Notice of Internet Availability contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials?

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one copy of the Notice of Internet Availability or proxy statement and annual report. How may I obtain an additional copy of the Notice of Internet Availability or proxy statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy,

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 11

or, if you are receiving multiple copies, to request that we only send a single copy of next year’s Notice of Internet Availability or proxy statement and annual report, as applicable, you may contact us as follows:

Bakkt Holdings, Inc.

Attention: Investor Relations

10000 Avalon Boulevard, Suite 1000,

Alpharetta, Georgia 30009

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 12

Information on Board of Directors and Corporate Governance

Composition of the Board

Bakkt’s business and affairs are managed under the direction of our Board. Our Board currently consists of eight directors, five of whom are independent under the listing standards of the New York Stock Exchange, or NYSE. The number of directors is fixed by the Board, subject to the terms of our certificate of incorporation and bylaws. Each of our directors will continue to serve as a director until the election and qualification of his or her successor, or until his or her earlier death, resignation or removal.

Our Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Thus, at each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the names, ages as of April 2, 2024, and certain other information for each of our directors and director nominees:

| | | | | | | | | | | | | | | | | | | | |

| Name | Class | Age | Position(s) | Director Since | Current Term Expires | Expiration of Term for Which Nominated |

| Nominees for Director |

Sean Collins(1)(2)(3) | III | 44 | Director | 2021 | 2024 | 2027 |

Richard Lumb(1) | III | 63 | Director | 2021 | 2024 | 2027 |

| Andrew Main | III | 59 | Chief Executive Officer, President, Director | 2021 | 2024 | 2027 |

| Continuing Directors |

| David Clifton | II | 47 | Director | 2021 | 2026 | — |

De’Ana Dow(1) | II | 68 | Director | 2022 | 2026 | — |

Michelle J. Goldberg(1)(3) | I | 55 | Director | 2021 | 2025 | — |

Jill Simeone(2)(3) | I | 57 | Director | 2022 | 2025 | — |

| Gordon Watson | II | 45 | Director | 2021 | 2026 | — |

(1) Member of audit committee

(2) Member of compensation committee

(3) Member of nominating and corporate governance committee

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 13

Nominees for Director

Sean Collins served on the board of managers of Opco since its inception in December 2018 until the closing of our business combination with VPC Impact Acquisition Holdings on October 15, 2021 (the “Closing”). Mr. Collins has over twenty years of experience investing, advising, operating and building companies focused on digital transformation. As co-founder and Managing Partner of Goldfinch Partners from 2018 to present, he invests across industry verticals, including in enterprise software companies and fintechs. Prior to Goldfinch, Mr. Collins was the co-founder and Chief Investment Officer of Boston Consulting Group (“BCG”) Digital Ventures, the division of BCG that partners with global leaders to help build new digital business units and spin out assets into new companies. In 2017, he was elected the youngest Senior Partner in the history of BCG (“BCG DV”). Prior to BCG DV, Mr. Collins held other roles, including service as a Senior Vice President of Marketing, E-Commerce and Strategy at Sports Authority, Inc., and before that was with McKinsey & Company, where he was a member of the Marketing Practice. Mr. Collins holds a BA in Economics and Music (Classical Piano) from Whitman College.

We believe that Mr. Collins’ extensive experience across the financial services and retail industries, as well as functional depth in marketing and loyalty, provide him with the knowledge and background to serve as a director on the Board.

Richard A. Lumb has been a member of our Board since the Closing and has significant technology, finance and investment expertise. Mr. Lumb has served as an Industry Partner at Motive Partners, a private equity firm specializing in enterprise financial services, software growth and buy-out investments since 2019. Prior to joining Motive Partners, Mr. Lumb enjoyed a 35-year tenure at Accenture, from 1984 until 2019, where he held the position of Group Chief Executive of Financial Services from 2010 to 2019, serving clients in the banking, insurance and capital market sectors. During his time at Accenture, Mr. Lumb played a leading role in multiple technology company acquisitions and minority investments, including the 2011 acquisition of Duck Creek Technologies. Mr. Lumb earned a B.Sc. in Mechanical Engineering and an M.B.A. from the University of Bradford.

We believe that Mr. Lumb’s extensive experience across the financial services and technology industries, Including M&A experience provide him with the financial knowledge and background to serve on the Board.

Andrew A. Main has been a member of our Board since the Closing and our Chief Executive Officer and President since March 26, 2024, and has significant technology and marketing expertise. Mr. Main served as the Chief Executive Officer of Ogilvy, an advertising, marketing and public relations agency from 2020 to 2022. Prior to joining Ogilvy, Mr. Main was the Global Head of Deloitte Digital, the digital consultancy branch of Deloitte from 2014 to 2020 where he oversaw the acquisition of multiple creative agencies to grow the brand. Mr. Main has more than 30 years of consulting and marketing agency experience and has extensive experience working with businesses to modernize and bring new ideas to market quickly. Mr. Main earned a Master of Arts from the University of Edinburgh in Business, Marketing and Geography.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 14

We believe that Mr. Main’s experience helping brands grow and modernize and focus on digital consultancy provide him with the experience needed to serve as a director on the Board.

Continuing Directors

David Clifton served as Interim Chief Executive Officer for the Company’s predecessor, Bakkt Opco Holdings, LLC (f/k/a Bakkt Holdings, LLC (“Opco”)), from April 2020 to January 2021. While serving in this role, Mr. Clifton was involved in the development of strategy and the assessment of its strategic alternatives, which resulted in our business combination with VIH Impact Acquisition Holdings, and our resulting listing as a public company. From 2019 to present, Mr. Clifton has served as Vice President of M&A and Integration at Intercontinental Exchange Holdings, Inc. (“ICE”). In this and prior roles, Mr. Clifton oversaw the successful completion of numerous strategic transactions, including ICE’s 2013 acquisition of NYSE Euronext, along with other global strategic transactions and initiatives. Mr. Clifton joined ICE in 2008, serving previously as ICE’s Associate General Counsel, M&A. Mr. Clifton received his Juris Doctor from Mercer University’s Walter F. George School of Law and is a graduate of a Davidson College.

We believe that Mr. Clifton’s previous experience both with Opco and at ICE provide him with the strategic and management background to serve on the Board.

De’Ana Dow has been a member of our Board since April 22, 2022. Ms. Dow is partner and general counsel with Capitol Counsel LLC, a full-service government relations firm, where she has served since 2012. Her primary focus has been derivatives markets with many years of senior level experience in both technical and policy areas. Prior to Ms. Dow’s position with Capitol Counsel, from 2010 to 2012, Ms. Dow served as the Senior Vice President of Ogilvy Government Relations, Washington, D.C., which specializes in futures and derivatives markets. Before joining Ogilvy, from 2008 through 2010, Ms. Dow was the Managing Director for Government Affairs at CME Group, the world’s largest derivatives exchange. In that role, Ms. Dow managed the organization’s efforts related to the Dodd Frank financial market regulatory reform bill as it progressed through the House and the Senate, as well as the regulatory actions at the CFTC, Securities and Exchange Commission, Treasury Department and the Federal Reserve. From 2005 through 2008, Ms. Dow served as the Senior Vice President and Chief Legislative Counsel for the New York Mercantile Exchange (“NYMEX”), before NYMEX merged with the CME. As the head of office and regulatory counsel for NYMEX, she successfully guided the company through a complex legislative agenda aimed at eliminating critical liquidity providers from the markets, and monitored numerous CFTC regulatory filings for accuracy and sufficient analytical content. Ms. Dow received an undergraduate degree from Bowie State College and a Juris Doctorate from Georgetown University Law Center.

We believe Ms. Dow is qualified to serve on our Board given her expertise in financial markets regulatory issues before federal agencies and departments.

Michelle J. Goldberg has been a member of our Board since the Closing and has significant technology, investment, retail disruption, finance and digital media expertise. Ms. Goldberg was a partner at Ignition, an early stage enterprise software venture capital firm, from 2000 to 2020 and is now an advisor and limited partner to SoGal Ventures. Ms. Goldberg is a seasoned technology

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 15

investor with strategic, financial and governance experience and a focus on consumer-facing, digital media and retail opportunities leveraging data analytics and investing in emerging consumer technologies, including Web 3.0. Ms. Goldberg has served as a member of the board of directors for Taubman Centers, Inc., Legg Mason and Plum Creek where she was a member of the audit and compensation committees and chair of Risk Committee. She has also served on special committees for M&A and technology. Ms. Goldberg has M.A. from Harvard University and a B.A. from Columbia University.

We believe that Ms. Goldberg’s previous public board experience, including her focus on technology, finance and governance, provide her with the leadership experience and background to serve on our board.

Jill Simeone has been a member of our Board since April 22, 2022. Ms. Simeone has served as a strategic business and legal advisor for over 25 years. She is currently a Trustee on the Board of the Brooklyn Friends School, and Chair of their Nominating and Governance Committee. She is a member of the Mt. Sinai Kravis Children’s Hospital Family Advisory Council. From 2017 to 2022, she served as Chief Legal Officer and Corporate Secretary, and previously General Counsel and Corporate Secretary, of Etsy, Inc. (NASDAQ: ETSY). From 2016 to 2017, Ms. Simeone was the Vice President, Senior Counsel, and Assistant Secretary at American Express Global Business Travel (NYSE: AXP). From 2013 to 2016, Ms. Simeone was the General Counsel and Chief Compliance Officer of KCAP Financial, Inc. (NASDAQ: KCAP). From 2001 to 2011, Ms. Simeone was the General Counsel of CMEX S.A. de C.V. (NYSE: CX). Ms. Simeone received a Fulbright Scholarship in Mexico to study international business and law in Mexico, received an AB cum laude in American History and Literature from Harvard University and a Juris Doctorate from University of California Law School, San Francisco.

We believe Ms. Simeone is qualified to serve on our Board because of her experience in international M&A, strategic advising, legal and compliance, governance, fintech and other regulated businesses, executive compensation, and public company reporting.

Gordon Watson serves as a Partner at Victory Park Capital Advisors, LLC, which he joined in 2014. Mr. Watson is a member of Victory Park’s investment committee and helps lead its Fintech investing team. Mr. Watson is the Investment Manager for VIH Specialty Lending Investments PLC (LSE: VSL), a Victory Park-managed, U.K. publicly listed investment trust focused on opportunities in the Fintech market. Gordon is the Co-Chief Executive Officer of VPC Impact Acquisition Holdings II, a special purpose acquisition company, and VPC Impact Acquisition Holdings III, Inc., a special purpose acquisition company. Prior to the business combination, Mr. Watson served on our Board and as our President and Chief Operating Officer. Previously, Mr. Watson was a portfolio manager focused on distressed debt at GLG Partners, a London-based 31 billion multi-strategy hedge fund that concentrates on a diverse range of alternative investments. Mr. Watson joined GLG when it purchased Ore Hill Partners, a credit focused hedge fund where he was a partner. Mr. Watson received a B.A. in political science from Colgate University and an MBA from Columbia University.

We believe that Mr. Watson’s experience in fintech and investments provide him with the financial knowledge and background to serve as a director on the Board.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 16

Board Leadership Structure

Our corporate governance framework provides our board with flexibility to determine the appropriate leadership structure for the company, and whether the roles of chairperson and chief executive officer should be separated or combined. In making this determination, our board considers many factors, including the needs of the business, our board’s assessment of its leadership needs from time to time and the best interests of our stockholders. Mr. Collins currently serves as the chairperson of our Board.

Our board believes that it is currently appropriate to separate the roles of chairperson and chief executive officer. Mr. Main, our chief executive officer, is responsible for day-to-day leadership, while Mr. Collins, our chairperson, along with the rest of our independent directors, ensures that our board’s time and attention is focused on providing independent oversight of management and matters critical to our company. Our Board believes that Mr. Collins’ deep knowledge of the company and industry, as well as strong leadership and governance experience, enable Mr. Collins to lead our board effectively and independently. Accordingly, we believe that our current leadership structure is appropriate and enhances the Board’s ability to effectively carry out its roles and responsibilities on behalf of our stockholders.

Director Independence

Our Class A Common Stock is listed on the NYSE. As a company listed on the NYSE, we are required under NYSE listing rules to maintain a board comprised of a majority of independent directors as determined affirmatively by our board. Under NYSE listing rules, a director will only qualify as an independent director if that listed company’s board of directors affirmatively determines that the director has no material relationship with such listed company (either directly or as a partner, stockholder or officer of an organization that has a relationship with such listed company). In addition, the NYSE listing rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent.

Audit and risk committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and NYSE listing rules applicable to audit and risk committee members. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and NYSE listing rules applicable to compensation committee members.

Our Board has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning his or her background, employment and affiliations, our Board has determined that Mr. Collins, Ms. Dow, Ms. Goldberg, Mr. Lumb and Ms. Simeone, representing five of our eight directors, do not have any material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) and that each of these directors is an “independent director” as defined under the listing standards of the NYSE.

In making these determinations, our Board considered the current and prior relationships that each non-employee director has with Bakkt and all other facts and circumstances that our Board deemed

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 17

relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Related Person Transactions.”

There are no family relationships among any of our directors, director nominees or executive officers.

Role of Board in Risk Oversight Process

Risk is part of every business. Bakkt’s business has several inherent risks, including strategic, financial, business, operational, legal, regulatory, compliance and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our Board, as a whole and assisted by its committees, has responsibility for the oversight of risk management, reviewing, evaluating and discussing strategic and operational risk, cybersecurity risks, among other risks, receives reports from management and on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions.

The committees of the Board also assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The audit and risk committee assists in fulfilling the oversight responsibilities with respect to management of major risk exposures, including in the areas of financial reporting and internal controls, and has general oversight over cybersecurity risks. Risk assessment reports are regularly provided by management to the audit committee. The compensation committee assists in fulfilling oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The nominating and corporate governance assists in fulfilling oversight responsibilities with respect to the management of risks associated with the Board’s organization, membership and structure and corporate governance. All of the committees report back to the Board on the committees’ activities and matters discussed and reviewed at the committees’ meetings.

Attendance at Board and Stockholder Meetings

During our fiscal year ended December 31, 2023, our Board held 21 meetings (including regularly scheduled and special meetings), and each director attended at least 75% of (1) the total number of meetings of the Board held during the period for which he or she has been a director and (2) the total number of meetings held by each committee on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our Board at the annual meetings of stockholders, we strongly encourage, but do not require, directors to attend.

Board Committees

Our Board has established the following standing committees of the Board: an audit and risk committee; a compensation committee; and a nominating and corporate governance committee.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 18

Members will serve on these committees until their resignation or until as otherwise determined by the Board. The composition and responsibilities of each of the committees of our Board is described below. Our Board may also determine to establish one or more additional committees from time to time. For example, our Board established a special committee to negotiate and approve the terms of our recent concurrent registered direct offerings in the first quarter of 2024.

Audit and Risk Committee

The audit and risk committee consists of Richard Lumb, Sean Collins, De’Ana Dow and Michelle J. Goldberg, with Michelle J. Goldberg serving as the chair of the committee. Each of the members of the audit and risk committee satisfies the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and rules of the NYSE. The Board has determined that Mr. Lumb qualifies as an “audit committee financial expert” as defined in Item 407 of Regulation S-K promulgated by the SEC. The audit and risk committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and performance of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, our interim and year-end financial statements;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•reviewing our policies on and overseeing risk assessment and risk management, including enterprise risk management;

•reviewing related party transactions;

•reviewing the adequacy and effectiveness of internal control policies and procedures and our disclosure controls and procedures; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

Our audit and risk committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter of our audit and risk committee is available on our website at https://investors.bakkt.com/governance/governance-documents/. During 2023, our audit and risk committee held seven meetings.

Compensation Committee

The compensation committee consists of Sean Collins and Jill Simeone, with Sean Collins serving as the chair of the committee. Each of the members of the compensation committee meets the

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 19

requirements for independence under the applicable rules and regulations of the SEC and rules of the NYSE. The compensation committee is responsible for, among other things:

•reviewing, approving and determining the compensation of our officers and key employees;

•reviewing, approving and determining compensation and benefits, including equity awards, to directors for service on the Board or any committee thereof;

•administering our equity-based compensation plans;

•reviewing, approving and making recommendations to the Board regarding equity-based compensation plans and non-equity based incentive compensation plans; and

•establishing and reviewing general policies relating to compensation and benefits of our employees.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter of our compensation committee is available on our website at https://investors.bakkt.com/governance/governance-documents/. During 2023, our compensation committee held five meetings.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee consists of Michelle J. Goldberg, Sean Collins and Jill Simeone, with Michelle J. Goldberg serving as the chair of the committee. Each of the members of the nominating and corporate governance committee meets the requirements for independence under the applicable rules and regulations of the SEC and rules of the NYSE. The nominating and corporate governance committee is responsible for, among other things:

•identifying, evaluating and selecting, and making recommendations to the Board regarding, nominees for election to the Board and its committees;

•evaluating the performance of the Board and of individual directors;

•considering, and making recommendations to the Board regarding, the composition of the Board and its committees;

•reviewing developments in corporate governance practices;

•developing, and making recommendations to the Board regarding, corporate governance guidelines and other governance policies; and

•evaluating the adequacy of the company’s corporate governance practices and reporting.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of the NYSE. A copy of the charter of our nominating and corporate governance committee is available on our website at https://investors.bakkt.com/governance/ governance-documents/. During 2023, our nominating and corporate governance committee held four meetings.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 20

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable NYSE rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis, but no less than two times a year. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive session on a periodic basis, but no less than two times a year in executive session.

Compensation Committee Interlocks and Insider Participation

During 2023, the members of our compensation committee were Sean Collins, Jill Simeone, and Andrew Main. Andrew Main was appointed the Chief Executive Officer and President of the Company effective as of March 26, 2024, and at such time he stopped serving on the Compensation Committee. None of the members of our compensation committee is or has been an officer or employee of the company. None of our executive officers currently serves, or in the past fiscal year has served, as a member of our Board or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or compensation committee.

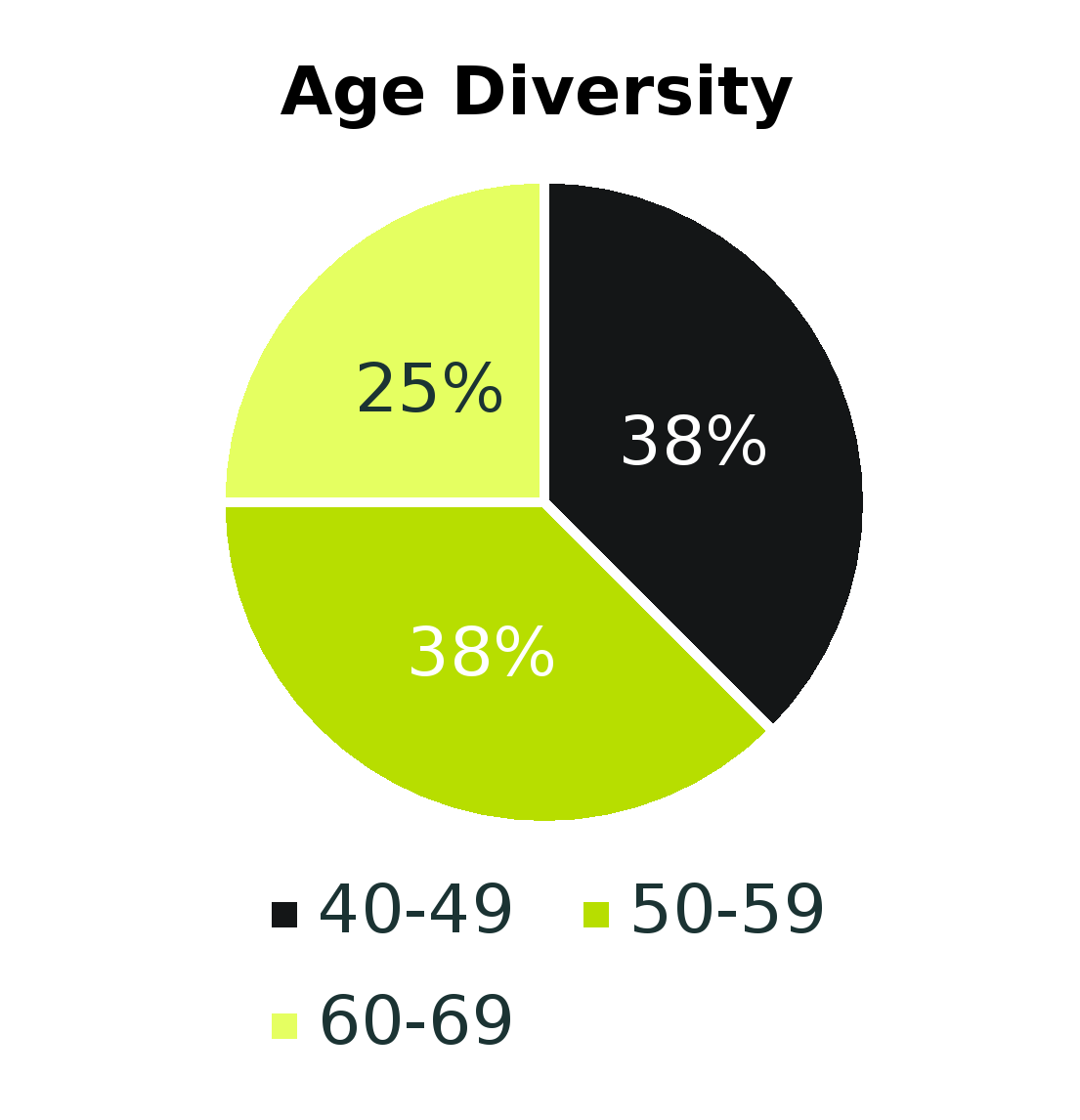

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating potential director nominees. In its evaluation of director candidates, including the current directors eligible for re-election, our nominating and corporate governance committee will consider the current size and composition of our Board and the needs of our Board and the respective committees of our Board and other director qualifications. While our board has not established formal qualifications for board members, some of the factors that our nominating and corporate governance committee considers in assessing director nominee qualifications include issues of character, professional ethics and integrity, judgment, relevant business experience and diversity, and with respect to diversity, such factors as race, ethnicity, gender, differences in professional background, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board. Although our Board does not maintain a specific policy with respect to board diversity, our Board believes that the Board should be a diverse body, and the nominating and corporate governance committee considers a broad range of perspectives, backgrounds and experiences.

In assessing additional directors for the Board, the nominating and corporate governance committee and management have prioritized diversity of background, experience and thought. The nominating and corporate governance committee continuously reviews the current board and new potential directors from perspectives of ethnicity, gender, age, industry, and skills, assessing opportunities to diversify the makeup of the Board and its committees. We aim for the Board to reflect our business commitments to diversity and inclusion. We celebrate the diversity of the people, experiences, and backgrounds that make up Bakkt, and we encourage each other to speak up and share perspectives, respectfully and thoughtfully. Our technology and platform is built to integrate into numerous

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 21

different segments, businesses, institutions and brands and to be used by a wide array of people, so we strive to foster and embrace diversity throughout our business in delivering these solutions. The nominating and corporate governance committee identifies, reviews and makes recommendations of candidates to serve on our Board with this framework for our business in mind.

If our nominating and corporate governance committee determines that an additional or replacement director is required, then it may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, board or management. The nominating and corporate governance committee also thoroughly reviews current diversity characteristics, experience and skills of the Board, as well as the qualification of new potential director candidates, identifying opportunities to expand the collective knowledge base of the Board or diversity in race, ethnicity, gender, age and/or experience.

After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full Board the director nominees for selection. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and our Board has the final authority in determining the selection of director candidates for nomination to our board.

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and corporate governance committee will consider recommendations and nominations for candidates to our Board from stockholders in the same manner as candidates recommended to the nominating and corporate governance committee from other sources, so long as such recommendations and nominations comply with our certificate of incorporation and bylaws, all applicable company policies and all applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our bylaws and corporate governance guidelines and the director nominee criteria described above.

A stockholder that wants to recommend a candidate to our Board should direct the recommendation in writing by letter to our corporate secretary at Bakkt Holdings, Inc., 10000 Avalon Boulevard, Suite 1000, Alpharetta, Georgia 30009, Attention: Corporate Secretary. Such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us, and evidence of the recommending stockholder’s ownership of our capital stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate.

Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 22

Under our bylaws, stockholders may also directly nominate persons for our Board. Any nomination must comply with the requirements set forth in our bylaws and the rules and regulations of the SEC and should be sent in writing to our corporate secretary at the address above. To be timely for our 2025 annual meeting of stockholders, nominations must be received by our corporate secretary observing the deadlines discussed below under “Other Matters—Stockholder Proposals or Director Nominations for 2025 Annual Meeting.”

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors may do so by writing and sending the correspondence to our General Counsel or Legal Department by mail to our principal executive offices at Bakkt Holdings, Inc., 10000 Avalon Boulevard, Suite 1000, Alpharetta, Georgia 30009. Our General Counsel or Legal Department, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board to consider, and (3) matters that are of a type that are improper or irrelevant to the functioning of our board or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our General Counsel or Legal Department will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the Board or the lead independent director (if one is appointed). These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our Board, among others, are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans, and (5) holding our securities in a margin account.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 23

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines. These guidelines address, among other items, the qualifications and responsibilities of our directors and director candidates, the structure and composition of our Board and corporate governance policies and standards applicable to us in general.

Code of Business Conduct and Ethics

In addition, our Board has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. The full text of our corporate governance guidelines and code of business conduct and ethics are available on our website at https://investors.bakkt.com/governance/governance-documents/. We will post amendments to our code of business conduct and ethics or any waiver of our code of business conduct and ethics for directors and executive officers on the same website.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 24

Director Compensation

Non-Employee Director Compensation Program

We have an outside director compensation program (the “Outside Director Compensation Program”) for our non-employee directors based on recommendations and findings regarding comparable market practices, which were provided by Compensation Advisory Partners. The Outside Director Compensation Program provides for the following cash compensation program for our non-employee directors:

•$50,000 per year for service as a non-employee director;

•$100,000 per year for service as non-executive chair of the Board;

•$25,000 per year for service as chair of the audit and risk committee;

•$10,000 per year for service as a member of the audit and risk committee;

•$20,000 per year for service as chair of the compensation committee;

•$7,500 per year for service as a member of the compensation committee;

•$12,000 per year for service as chair of the nominating and corporate governance committee; and

•$5,000 per year for service as a member of the nominating and corporate governance committee.

Each non-employee director who serves as a committee chair will receive the cash retainer fee as the chair of the committee, but not the cash retainer fee as a member of that committee, except that a non-employee director who serves as the non-executive chair of the Board will receive the annual cash fee for services provided in such role as well as the annual cash fee as a non-employee director.

The Board or the Compensation Committee also may approve compensation, if any, for service on any special committee or other ad hoc committee formed from time to time. No compensation was paid to members of the special committee of the Board established in connection with our recent concurrent registered direct offerings.

These fees to our non-employee directors are paid quarterly in arrears on a prorated basis. Under the Outside Director Compensation Program, we also reimburse non-employee directors for reasonable travel expenses to attend meetings of the Board and its committees. The above-listed fees for service as chair or member of a committee are payable in addition to the annual non-employee director retainer fee.

Each non-employee director will automatically receive, on the date of each annual meeting of our stockholders, an annual award (the “Annual Equity Award”) of restricted stock units (“RSUs”) having a value of $200,000. Each non-employee director who joins the Board other than in conjunction with an annual meeting of our stockholders is expected to receive a prorated Annual Equity Award in conjunction with the next full Annual Equity Award granted to the other non-employee directors.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 25

Each Annual Equity Award, including each prorated award, is expected to be scheduled to vest at the earlier of the one-year anniversary of the grant date and the annual meeting, subject to continued services to us through the applicable vesting date. In the event of a change in control under the terms of the 2021 Omnibus Incentive Plan, each non-employee director’s then outstanding equity awards covering the Company’s Class A Common Stock are expected to accelerate vesting in full, provided that he or she remains a non-employee director through the date of the consummation of such change in control. Each Annual Equity Award is expected to be granted under the 2021 Omnibus Incentive Plan and form of award agreement under such plan. We may allow non-employee directors to elect to receive all or a portion of the annual cash retainer fees in the form of restricted stock units. All compensation payable under the Outside Director Compensation Program is expected to be subject to any limits on the maximum amount of non-employee director compensation as set forth in the 2021 Omnibus Incentive Plan.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 26

Director Compensation for Fiscal 2023

The following table sets forth information regarding the total compensation awarded to, earned by or paid to our nonemployee directors for their service on our Board, for the fiscal year ended December 31, 2023. Directors who are also our employees receive no additional compensation for their service as directors. During 2023, Dr. Michael was an employee and executive officer of the company and therefore, did not receive compensation as a director. See “Executive Compensation” for additional information regarding Dr. Michael’s compensation.

| | | | | | | | | | | |

| Name | Fees Paid or Earned in Cash ($) | Stock Awards

($)(1) | Total

($) |

| David Clifton | — | — | — |

| Sean Collins | $0 | $385,000(4) | $385,000 |

De’Ana Dow (2) | $127,500 | $400,002 | $527,500 |

| Michelle J. Goldberg | $72,000 | $200,001 | $272,001 |

| Richard Lumb | $75,000 | $200,001 | $275,001 |

Andrew A. Main(3) | $0 | $257,501(4) | $257,501 |

| Jill Simeone | $62,500 | $200,001 | $262,501 |

| Gordon Watson | $ 0 | $250,001(4) | $250,001 |

(1)The amounts in this column represent the aggregate grant date fair value of restricted stock unit awards granted to each non-employee director, computed in accordance with FASB ASC Topic 718. See Note 11—Share-Based and Unit-Based Compensation to our audited consolidated financial statements included elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of the assumptions made by us in determining the grant-date fair value of our RSU awards to non-employee directors.

(2)Includes $70,000 cash compensation and 142,858 restricted stock units award granted for Ms. Dow’s service on the board of Bakkt Trust.

(3)Stock awards granted to Mr. Main vested in full as a part of his transition to the role as the Company’s Chief Executive Officer.

(4)This amount includes restricted stock units granted in lieu of cash retainer fees earned in 2023 at the election of the director.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 27

The following table lists all outstanding equity awards held by non-employee directors as of December 31, 2023:

| | | | | |

| Name | Number of Shares Underlying Outstanding Stock Awards(1) |

| David Clifton | — |

| Sean Collins | 275,000 |

De’Ana Dow(2) | 285,716 |

| Michelle J. Goldberg | 142,858 |

| Richard Lumb | 142,858 |

| Andrew A. Main | 183,929 |

| Jill Simeone | 142,858 |

| Gordon Watson | 178,572 |

(1)The RSUs shall vest in full on the date of the Company’s 2023 annual meeting of stockholders.

(2)Includes award of 142,858 restricted stock units granted for service on the board of Bakkt Trust.

Alpharetta, GA | New York, NY | Belfast, United Kingdom www.bakkt.com 28

Proposal No. 1: Election of Class III Directors