EXHIBIT 99.1

UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In Re. Proterra Inc § § § Debtor(s) § Monthly Operating Report Reporting Period Ended: 10/31/2023 Months Pending: 3 Reporting Method: Accrual Basis Debtor's Full-Time Employees (current): Debtor's Full-Time Employees (as of date of order for relief): Case No. 23-11120 Lead Case No. 23-11120 Jointly Administered Petition Date: 08/07/2023 Industry Classification: Cash Basis 0 0 Chapter 11 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) ☒ Statement of cash receipts and disbursements ☒ Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit ☒ Statement of operations (profit or loss statement) ☒ Accounts receivable aging ☒ Postpetition liabilities aging ☐ Statement of capital assets ☐ Schedule of payments to professionals Schedule of payments to insiders ☒ All bank statements and bank reconciliations for the reporting period ☐ Description of the assets sold or transferred and the terms of the sale or transfer /s/ Andrew L. Magaziner Andrew L. Magaziner Signature of Responsible Party Printed Name of Responsible Party 11/21/2023 Young Conaway Stargatt & Taylor LLP Date 1000 North King St, Wilmington, DE 19801 Address STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. 2311120231121000000000028 § 1320.4(a)(2) applies.

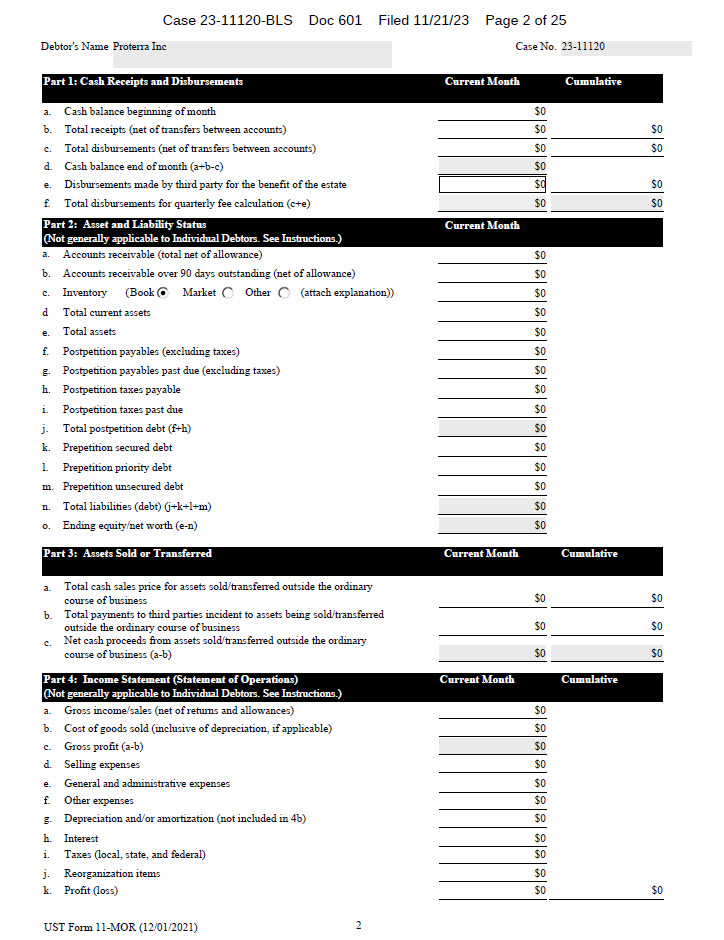

Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $0 b. Total receipts (net of transfers between accounts) $0 $0 c. Total disbursements (net of transfers between accounts) $0 $0 d. Cash balance end of month (a+b-c) $0 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $0 $0 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $0 b. Accounts receivable over 90 days outstanding (net of allowance) $0 c. Inventory (Book Market Other (attach explanation)) $0 d Total current assets $0 e. Total assets $0 f. Postpetition payables (excluding taxes) $0 g. Postpetition payables past due (excluding taxes) $0 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $0 k. Prepetition secured debt $0 l. Prepetition priority debt $0 m. Prepetition unsecured debt $0 n. Total liabilities (debt) (j+k+l+m) $0 o. Ending equity/net worth (e-n) $0

Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. b. c. d. e. f. g. h. i. j. k. Gross income/sales (net of returns and allowances) Cost of goods sold (inclusive of depreciation, if applicable) Gross profit (a-b) Selling expenses General and administrative expenses Other expenses Depreciation and/or amortization (not included in 4b) Interest Taxes (local, state, and federal) Reorganization items Profit (loss) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 UST Form 11-MOR (12/01/2021) 2

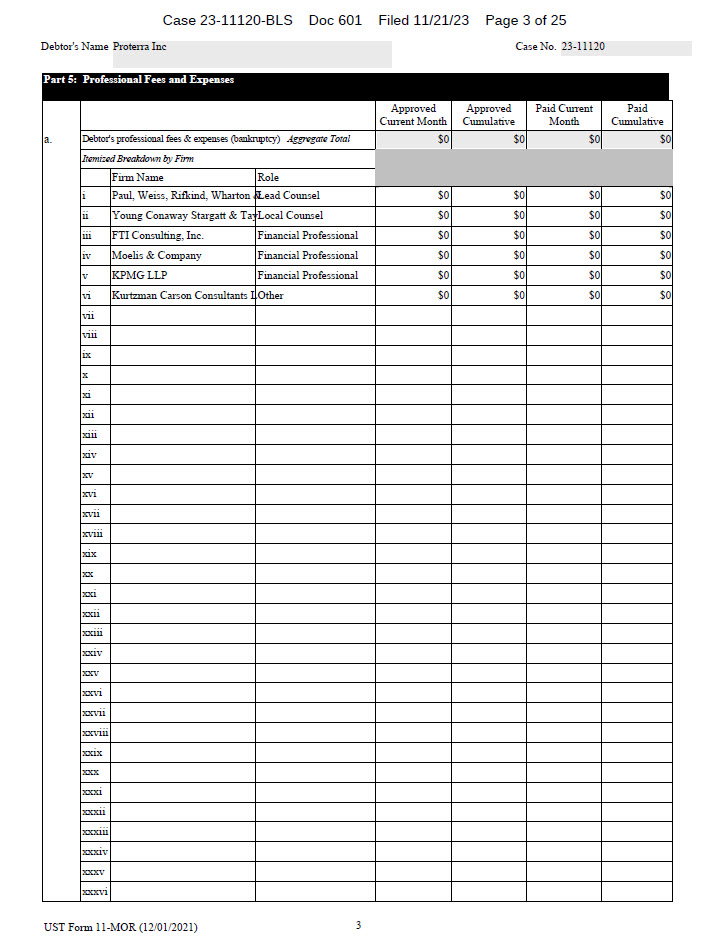

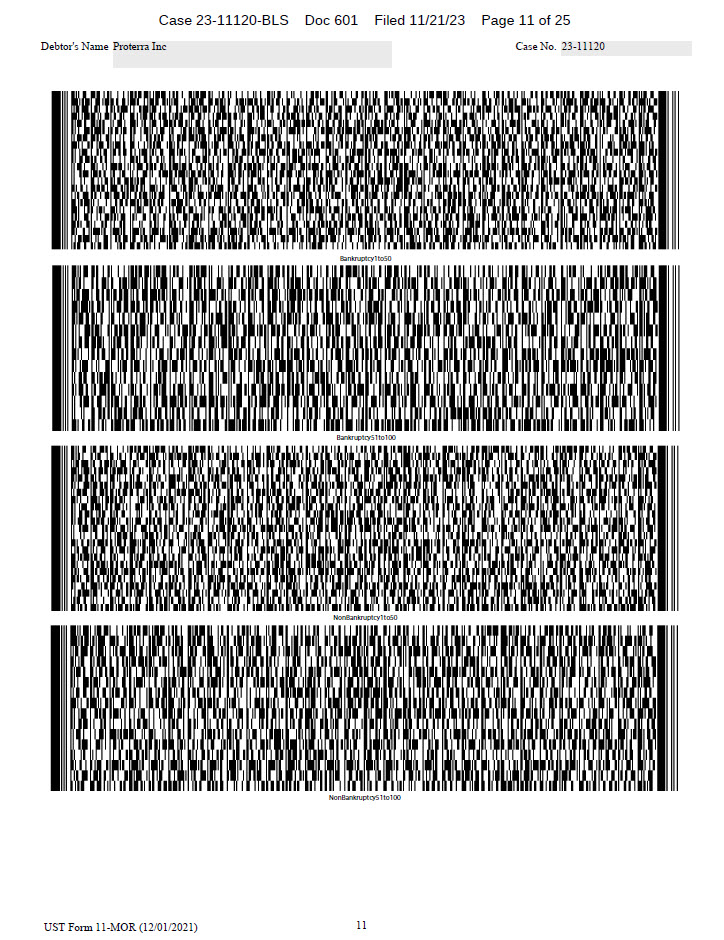

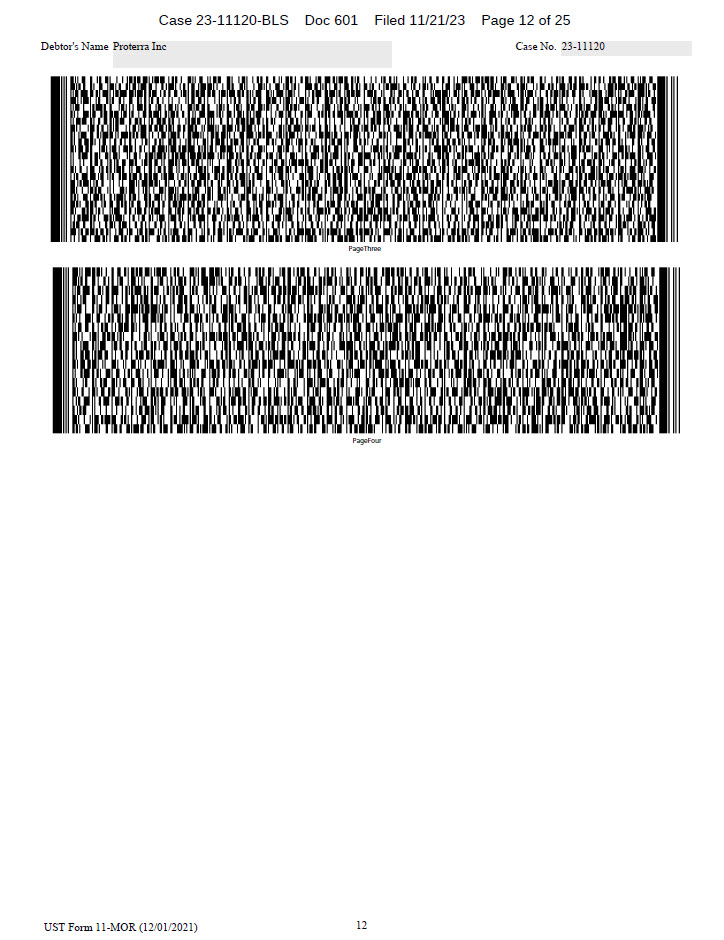

Part 5: Professional Fees and Expenses a. Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Paul, Weiss, Rifkind, Wharton &Lead Counsel $0 $0 $0 $0 ii Young Conaway Stargatt & Taylor Local Counsel $0 $0 $0 $0 iii FTI Consulting, Inc. Financial Professional $0 $0 $0 $0 iv Moelis & Company Financial Professional $0 $0 $0 $0 v KPMG LLP Financial Professional $0 $0 $0 $0 vi Kurtzman Carson Consultants LLC Other $0 $0 $0 $0 vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi

xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii

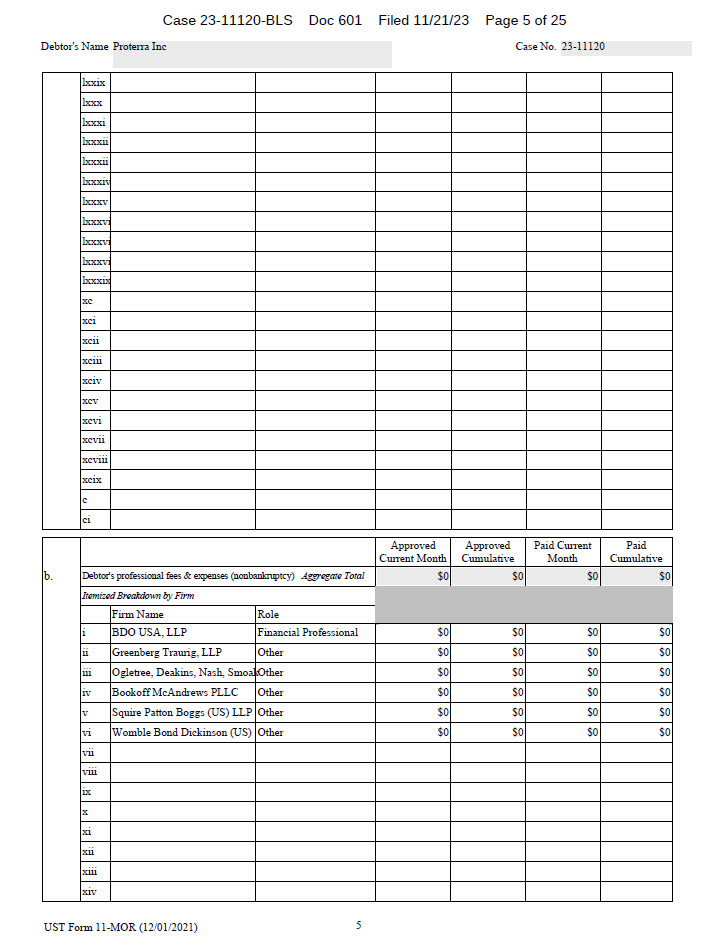

lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci b. Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i BDO USA, LLP Financial Professional $0 $0 $0 $0 ii Greenberg Traurig, LLP Other $0 $0 $0 $0 iii Ogletree, Deakins, Nash, Smoak Other $0 $0 $0 $0 iv Bookoff McAndrews PLLC Other $0 $0 $0 $0 v Squire Patton Boggs (US) LLP Other $0 $0 $0 $0 vi Womble Bond Dickinson (US) Other $0 $0 $0 $0 vii viii ix x xi xii xiii xiv

xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi

lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii

Debtor's Name Proterra Inc Case No. 23-11120 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Were any payments made outside the ordinary course of business Yes No without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? Yes No d. Are you current on postpetition tax return filings? Yes No e. Are you current on postpetition estimated tax payments? Yes No f. Were all trust fund taxes remitted on a current basis? Yes No g. Was there any postpetition borrowing, other than trade credit? Yes No (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by Yes No N/A the court? i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as Yes No set forth under 28 U.S.C. § 1930?

Part 8: Individual Chapter 11 Debtors (Only) a. b. c. Gross income (receipts) from salary and wages Gross income (receipts) from self-employment Gross income from all other sources $0 $0 $0 d. e. Total income in the reporting period (a+b+c) Payroll deductions $0 $0 f. g. Self-employment related expenses Living expenses $0 $0 h. i. j. k. All other expenses Total expenses in the reporting period (e+f+g+h) Difference between total income and total expenses (d-i) List the total amount of all postpetition debts that are past due $0 $0 $0 $0 l. m. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? If yes, have you made all Domestic Support Obligation payments? Yes Yes No No N/A Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ David S. Black David S. Black Signature of Responsible Party Printed Name of Responsible Party Chief Financial Officer 11/21/2023 Title Date

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Cautionary Statement Regarding the Monthly Operating Report The Debtor cautions investors and potential investors not to place undue reliance upon the information contained in this Monthly Operating Report, which was not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Debtor. The Monthly Operating Report is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the reporting requirements of the U.S. Bankruptcy Court for the District of Delaware. The Monthly Operating Report was not audited or reviewed by independent accountants, was not prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), is in a format prescribed by applicable bankruptcy rules and guidelines, and is subject to future adjustment and reconciliation. Furthermore, the monthly financial information contained in the Monthly Operating Report has not been subjected to the same level of accounting review and testing that the Debtor applies when preparing its quarterly and annual consolidated financial information in accordance with GAAP. Accordingly, upon the application of such procedures, the Debtor believes that the financial information may be subject to change, and these changes could be material. There can be no assurance that, from the perspective of an investor or potential investor in the Debtor’s securities, the Monthly Operating Report is complete. Results and projections set forth in the Monthly Operating Report should not be viewed as indicative of future results.

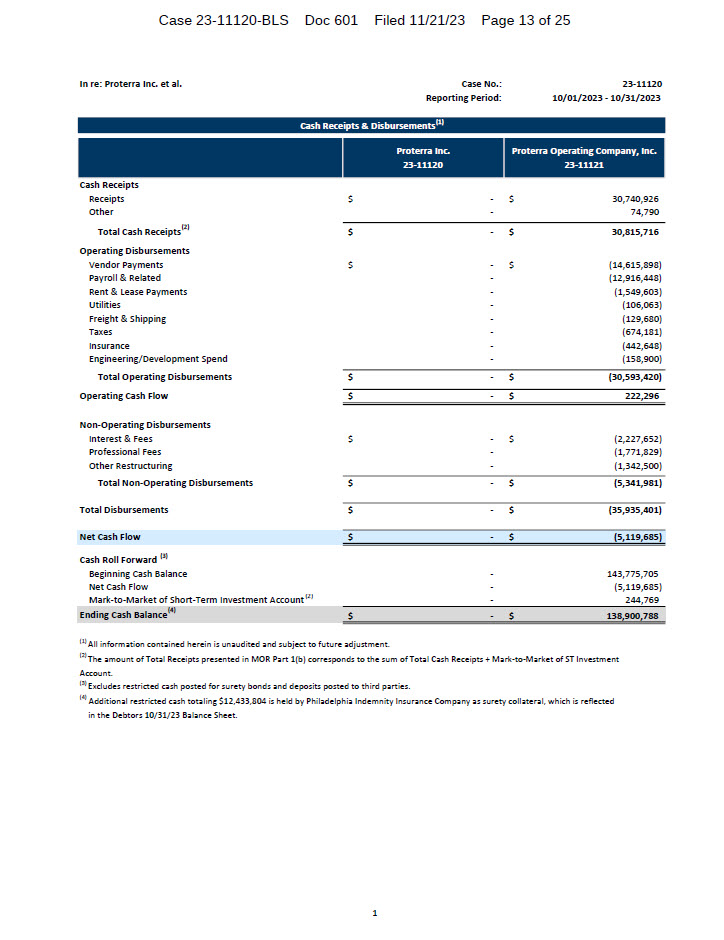

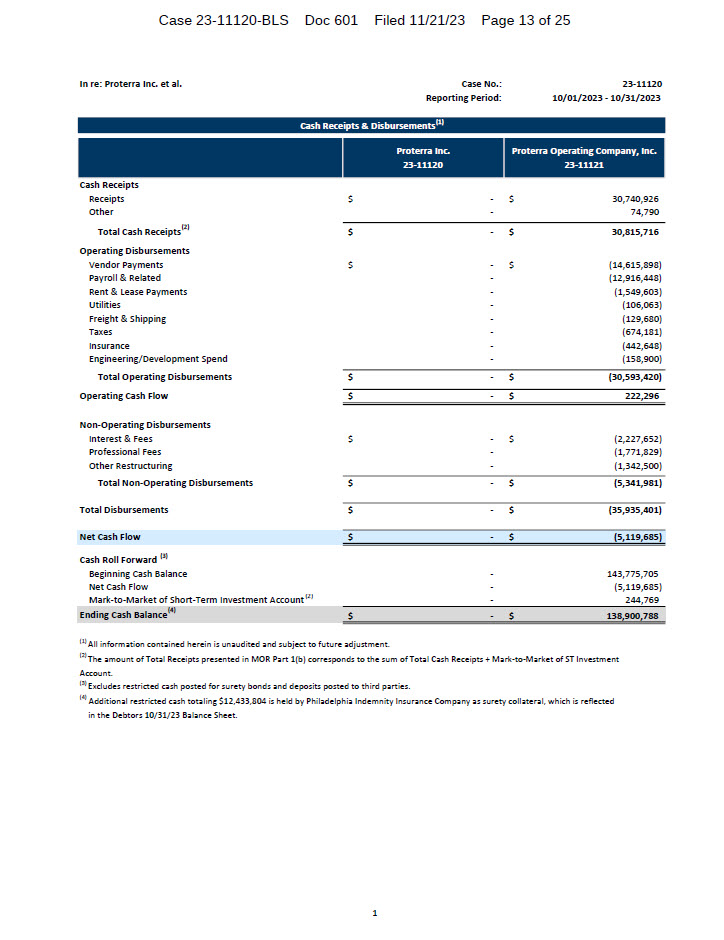

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Cash Receipts & Disbursements Proterra Inc. 23-11120 Proterra Operating Company, Inc. 23-11121 Cash Receipts Receipts $ - $ 30,740,926 Other - 74,790 Total Cash Receipts(2) $ - $ 30,815,716 Operating Disbursements Vendor Payments $ - $ (14,615,898) Payroll & Related - (12,916,448) Rent & Lease Payments - (1,549,603) Utilities - (106,063) Freight & Shipping - (129,680) Taxes - (674,181) Insurance - (442,648) Engineering/Development Spend - (158,900) Total Operating Disbursements $ - $ (30,593,420) Operating Cash Flow $ - $ 222,296 Non-Operating Disbursements Interest & Fees $ - $ (2,227,652) Professional Fees - (1,771,829) Other Restructuring - (1,342,500) Total Non-Operating Disbursements $ - $ (5,341,981) Total Disbursements $ - $ (35,935,401) Net Cash Flow $ - $ (5,119,685) Cash Roll Forward (3) Beginning Cash Balance - 143,775,705 Net Cash Flow - (5,119,685) Mark-to-Market of Short-Term Investment Account(2) - 244,769 Ending Cash Balance(4) $ - $ 138,900,788 (1) All information contained herein is unaudited and subject to future adjustment. (2) The amount of Total Receipts presented in MOR Part 1(b) corresponds to the sum of Total Cash Receipts + Mark-to-Market of ST Investment Account. (3) Excludes restricted cash posted for surety bonds and deposits posted to third parties. (4) Additional restricted cash totaling $12,433,804 is held by Philadelphia Indemnity Insurance Company as surety collateral, which is reflected in the Debtors 10/31/23 Balance Sheet.

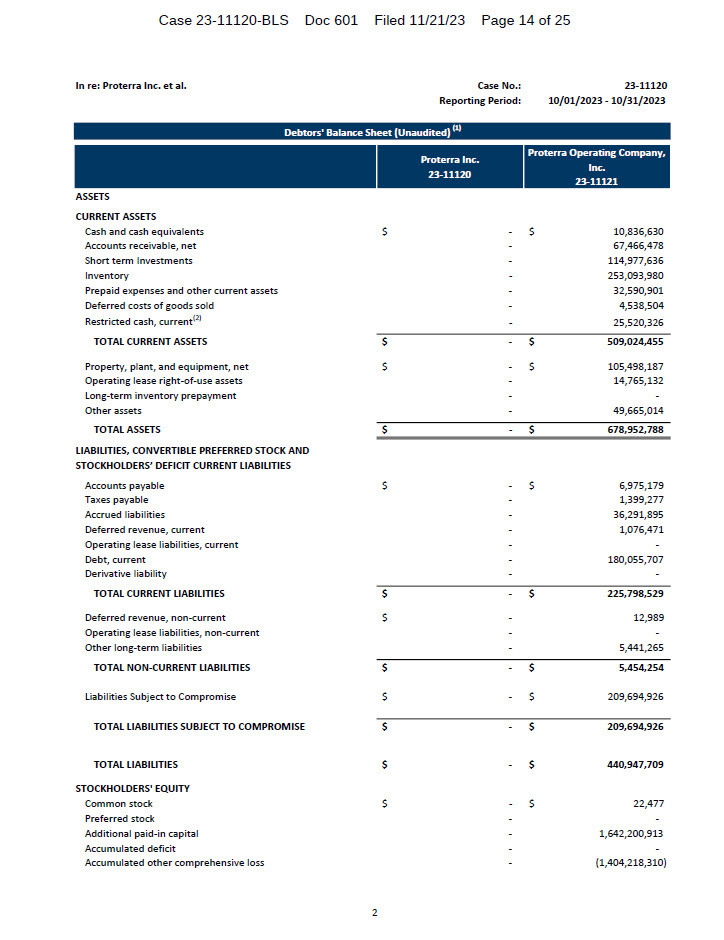

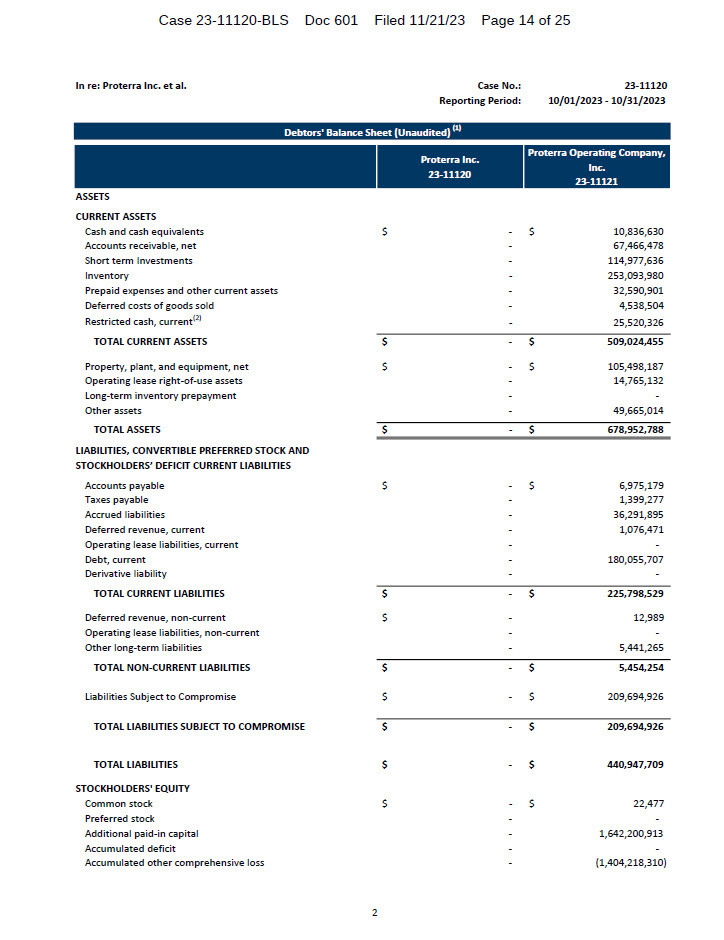

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Debtors' Balance Sheet (Unaudited) Proterra Inc. 23-11120 Proterra Operating Company, Inc. 23-11121 ASSETS CURRENT ASSETS Cash and cash equivalents $ - $10,836,630 Accounts receivable, net - 67,466,478 Short term Investments - 114,977,636 Inventory - 253,093,980 Prepaid expenses and other current assets - 32,590,901 Deferred costs of goods sold - 4,538,504 Restricted cash, current(2) - 25,520,326 TOTAL CURRENT ASSETS $ - $509,024,455 Property, plant, and equipment, net $ - $105,498,187 Operating lease right-of-use assets - 14,765,132 Long-term inventory prepayment - - Other assets - 49,665,014 TOTAL ASSETS $ - $678,952,788 LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT CURRENT LIABILITIES Accounts payable $ - $6,975,179 Taxes payable - 1,399,277 Accrued liabilities - 36,291,895 Deferred revenue, current - 1,076,471 Operating lease liabilities, current - Debt, current 180,055,707 Derivative liability - TOTAL CURRENT LIABILITIES $ - $225,798,529 Deferred revenue, non-current Operating lease liabilities, non-current Other long-term liabilities $ - - - 12,989 - 5,441,265 TOTAL NON-CURRENT LIABILITIES $ - $5,454,254 Liabilities Subject to Compromise $ - $209,694,926 TOTAL LIABILITIES SUBJECT TO COMPROMISE $ - $209,694,926 TOTAL LIABILITIES $ - $440,947,709 STOCKHOLDERS' EQUITY Common stock $ - $22,477 Preferred stock - - Additional paid-in capital 1,642,200,913 Accumulated deficit - Accumulated other comprehensive loss (1,404,218,310)

TOTAL STOCKHOLDERS' EQUITY $ - $238,005,080 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ - $678,952,789 (1) All information contained herein is unaudited and subject to future adjustment. (2) This amount includes $12,433,804 of restricted cash, which is held by Philadelphia Indemnity Insurance Company as surety collateral.

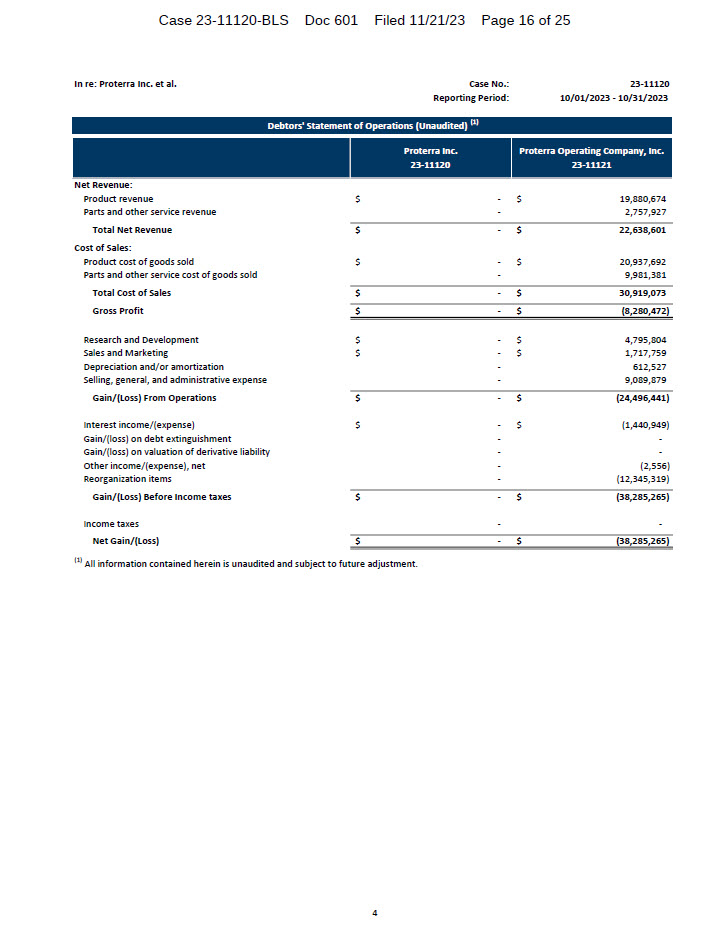

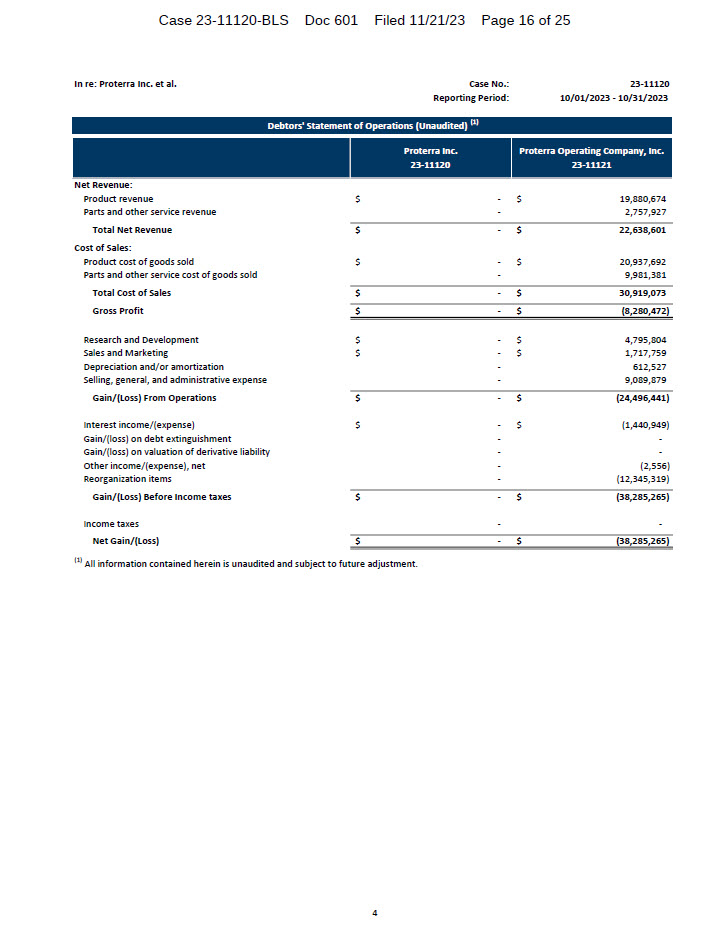

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Debtors' Statement of Operations (Unaudited) Proterra Inc. 23-11120 Proterra Operating Company, Inc. 23-11121 Net Revenue: Product revenue $ - $ $19,880,674 Parts and other service revenue - 2,757,927 Total Net Revenue $ - $ $22,638,601 Cost of Sales: Product cost of goods sold $ - $20,937,692 Parts and other service cost of goods sold - 9,981,381 Total Cost of Sales $ - $30,919,073 Gross Profit $ - $ (8,280,472) Research and Development $ - $4,795,804 Sales and Marketing $ - $1,717,759 Depreciation and/or amortization - 612,527 Selling, general, and administrative expense - 9,089,879 Gain/(Loss) From Operations $ - $ (24,496,441) Interest income/(expense) $ - $(1,440,949) Gain/(loss) on debt extinguishment - - Gain/(loss) on valuation of derivative liability - - Other income/(expense), net - (2,556) Reorganization items - (12,345,319) Gain/(Loss) Before Income taxes $ - $ (38,285,265) Income taxes - - Net Gain/(Loss) $ - $ (38,285,265) (1) All information contained herein is unaudited and subject to future adjustment.

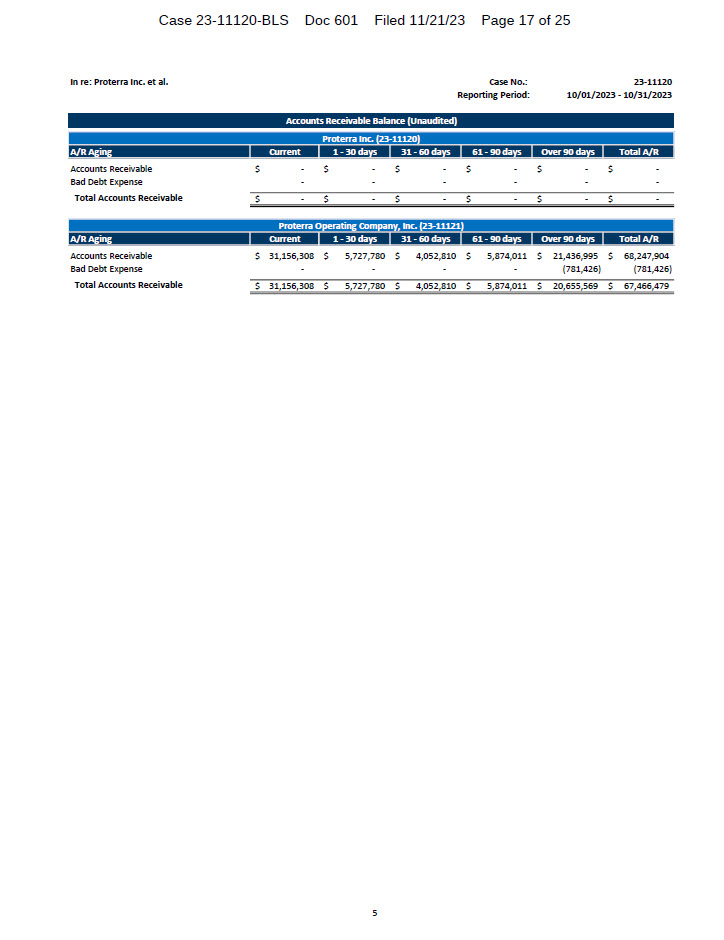

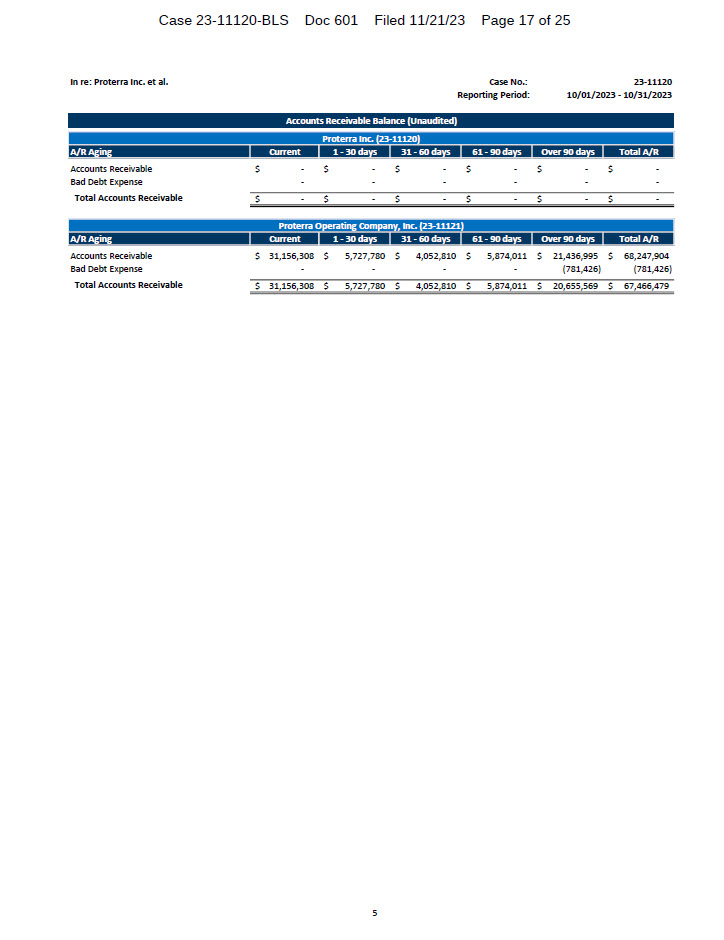

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Accounts Receivable Balance (Unaudited) Proterra Inc. (23 11120) A/R Aging Current 1 30 days 31 60 days 61 90 days Over 90 days Total A/R Accounts Receivable $ - $ - $ - $ - $ - $ - Bad Debt Expense - - - - - - Total Accounts Receivable $ - $ - $ - $ - $ - $ - Proterra Operating Company, Inc. (23 11121) A/R Aging Current 1 30 days 31 60 days 61 90 days Over 90 days Total A/R Accounts Receivable $ 31,156,308 $ 5,727,780 $ 4,052,810 $ 5,874,011 $ 21,436,995 $ 68,247,904 Bad Debt Expense - - - - (781,426) (781,426) Total Accounts Receivable $ 31,156,308 $ 5,727,780 $ 4,052,810 $ 5,874,011 $ 20,655,569 $ 67,466,479

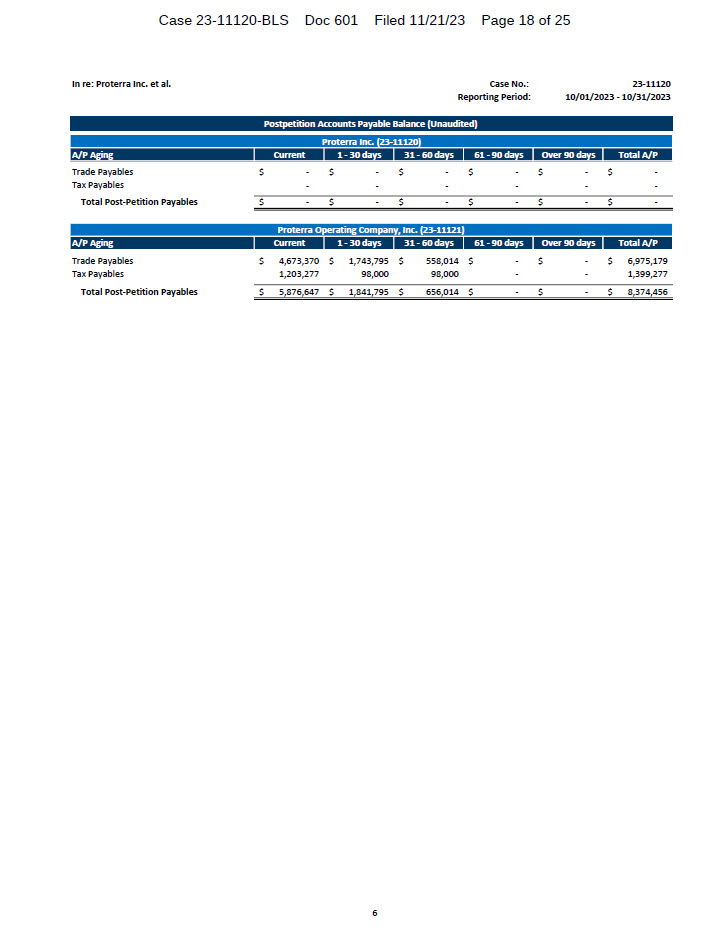

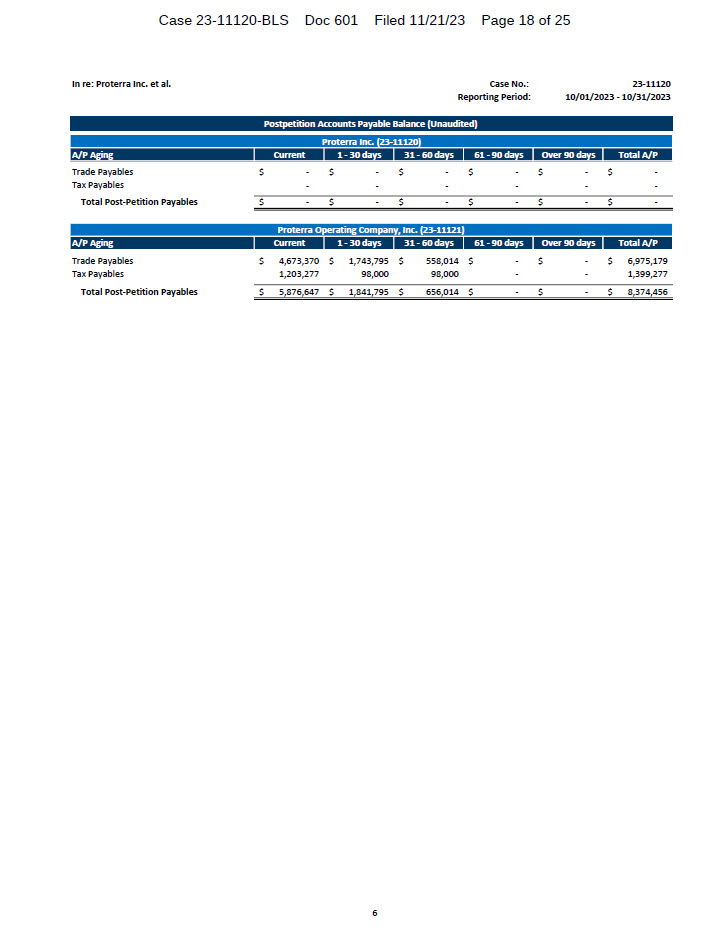

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Postpetition Accounts Payable Balance (Unaudited) Proterra Inc. (23-11120) A/P Aging Current 1 - 30 days 31 - 60 days 61 - 90 days Over 90 days Total A/P Trade Payables Tax Payables $ - - $ - - $ - - $ - - $ - - $ - - Total Post-Petition Payables $ - $ - $ - $ - $ - $ - Proterra Operating Company, Inc. (23-11121) A/P Aging Current 1 - 30 days 31 - 60 days 61 - 90 days Over 90 days Total A/P Trade Payables $ 4,673,370 $ 1,743,795 $ 558,014 $ - $ - $ 6,975,179 Tax Payables 1,203,277 98,000 98,000 - - 1,399,277 Total Post-Petition Payables $ 5,876,647 $ 1,841,795 $ 656,014 $ - $ - $ 8,374,456

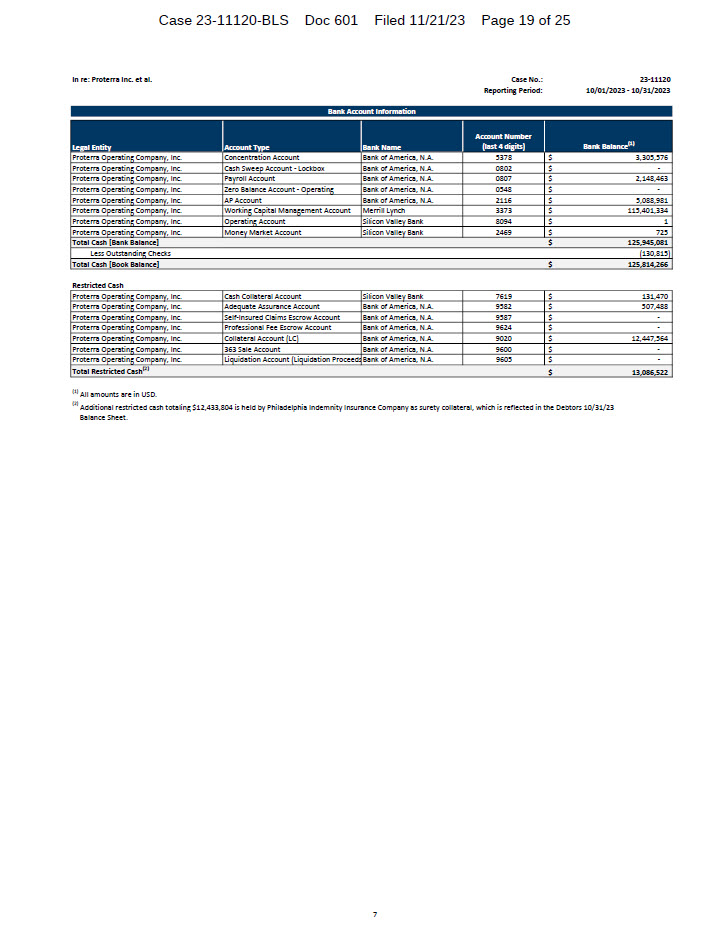

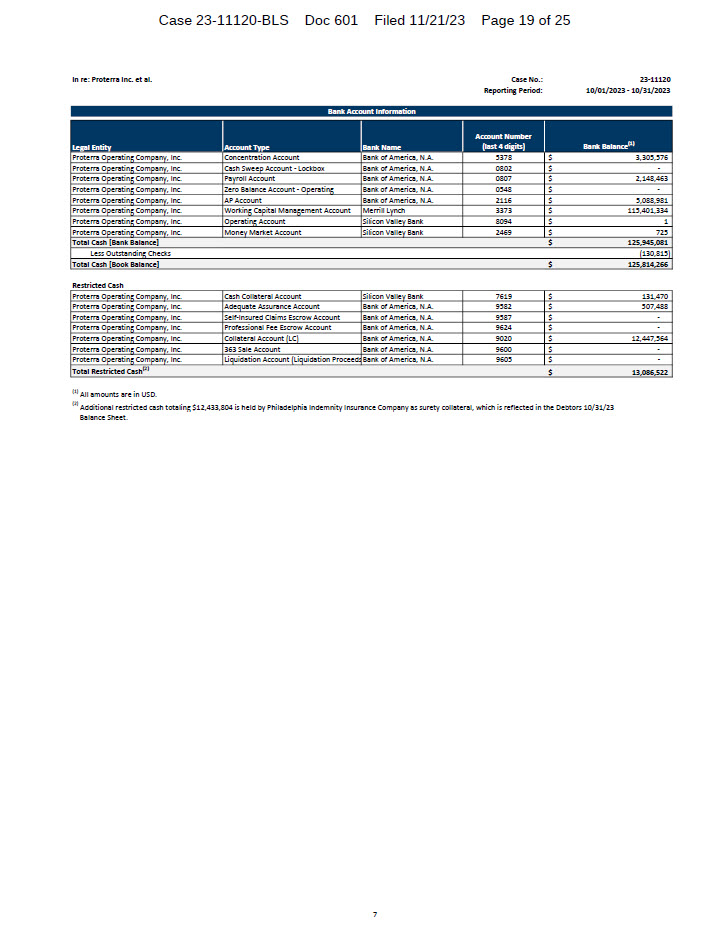

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Bank Account Information Legal Entity Account Type Bank Name Account Number (last 4 digits) Bank Balance(1) Proterra Operating Company, Inc. Concentration Account Bank of America, N.A. 5378 $ 3,305,576 Proterra Operating Company, Inc. Cash Sweep Account - Lockbox Bank of America, N.A. 0802 $ - Proterra Operating Company, Inc. Payroll Account Bank of America, N.A. 0807 $ 2,148,463 Proterra Operating Company, Inc. Zero Balance Account - Operating Bank of America, N.A. 0548 $ - Proterra Operating Company, Inc. AP Account Bank of America, N.A. 2116 $ 5,088,981 Proterra Operating Company, Inc. Working Capital Management Account Merrill Lynch 3373 $ 115,401,334 Proterra Operating Company, Inc. Operating Account Silicon Valley Bank 8094 $ 1 Proterra Operating Company, Inc. Money Market Account Silicon Valley Bank 2469 $ 725 Total Cash [Bank Balance] $ 125,945,081 Less Outstanding Checks (130,815) Total Cash [Book Balance] $ 125,814,266 Restricted Cash Proterra Operating Company, Inc. Cash Collateral Account Silicon Valley Bank 7619 $ 131,470 Proterra Operating Company, Inc. Adequate Assurance Account Bank of America, N.A. 9582 $ 507,488 Proterra Operating Company, Inc. Self-Insured Claims Escrow Account Bank of America, N.A. 9587 $ - Proterra Operating Company, Inc. Professional Fee Escrow Account Bank of America, N.A. 9624 $ - Proterra Operating Company, Inc. Collateral Account (LC) Bank of America, N.A. 9020 $ 12,447,564 Proterra Operating Company, Inc. 363 Sale Account Bank of America, N.A. 9600 $ - Proterra Operating Company, Inc. Liquidation Account (Liquidation Proceeds Bank of America, N.A. 9605 $ - Total Restricted Cash(2) $ 13,086,522 (1) All amounts are in USD. (2) Additional restricted cash totaling $12,433,804 is held by Philadelphia Indemnity Insurance Company as surety collateral, which is reflected in the Debtors 10/31/23 Balance Sheet.

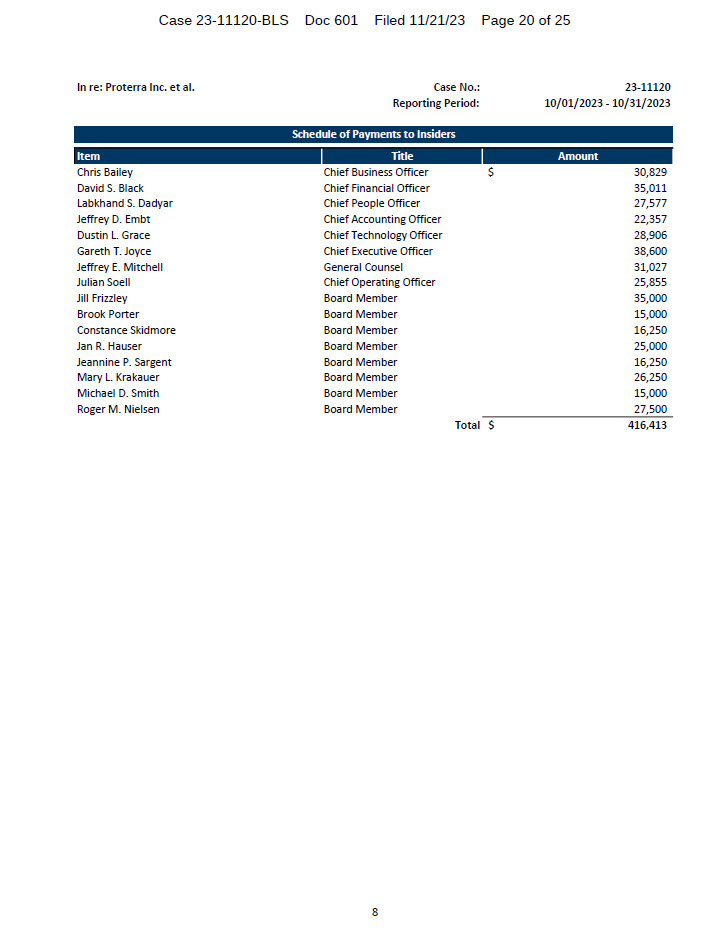

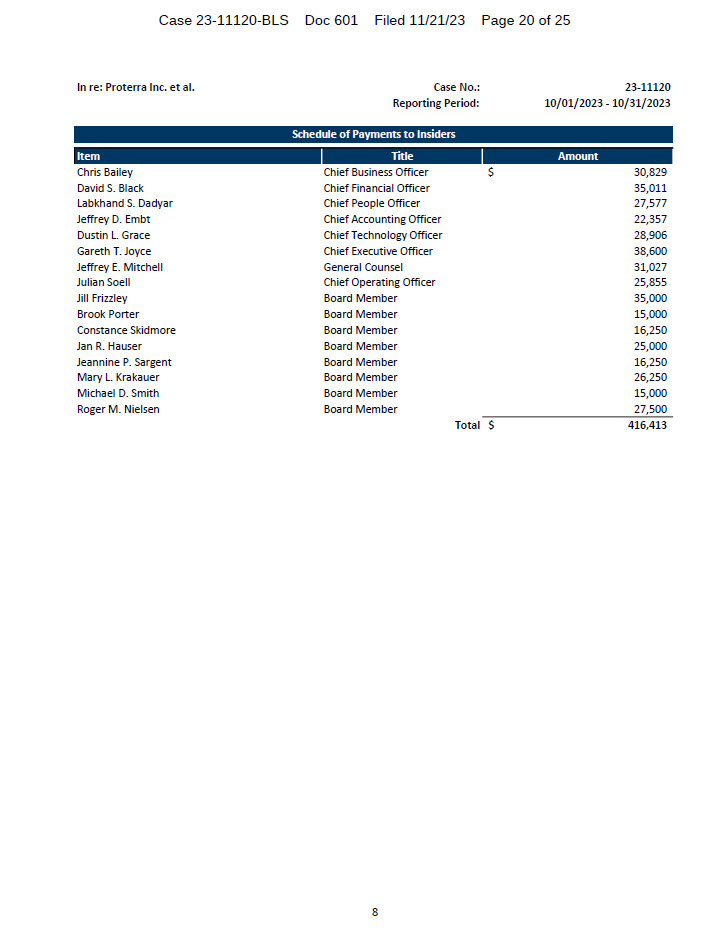

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Schedule of Payments to Insiders Item Title Amount Chris Bailey Chief Business Officer $ 30,829 David S. Black Chief Financial Officer 35,011 Labkhand S. Dadyar Chief People Officer 27,577 Jeffrey D. Embt Chief Accounting Officer 22,357 Dustin L. Grace Chief Technology Officer 28,906 Gareth T. Joyce Chief Executive Officer 38,600 Jeffrey E. Mitchell General Counsel 31,027 Julian Soell Chief Operating Officer 25,855 Jill Frizzley Board Member 35,000 Brook Porter Board Member 15,000 Constance Skidmore Board Member 16,250 Jan R. Hauser Board Member 25,000 Jeannine P. Sargent Board Member 16,250 Mary L. Krakauer Board Member 26,250 Michael D. Smith Board Member 15,000 Roger M. Nielsen Board Member 27,500 Total $ 416,413

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Bank Reconciliations The Debtors hereby submit this attestation regarding bank account reconciliations in lieu of provi- ding copies of bank statements, bank reconciliations and journal entries. The Debtors’ standard practice is to ensure that bank reconciliations are completed before closing the books each reporting period. I attest that each of the Debtors’ bank accounts has been reconci- led in accordance with their standard practices. /s/ David S. Black 11/21/2023 Signature of Authorized Individual Date David S. Black Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Part 3: Question A, B, C Assets Sold or Transfer Certain de minimis sales were made on October 10th [DI 351].

In re: Proterra, Inc. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Part 7: Question A Were any payments made on prepetition debt? To the extent any payments were made on account of prepetition claims following the commencement of these Chapter 11 Cases pursuant to the authority granted to the Debtors by the Bankruptcy Court under the First Day Orders, such payments have been included in the MOR.

In re: Proterra Inc. et al. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Part 7: Questions D & E Are you current on postpetition estimated tax payments? USD 155,600 in PST taxes are owed to British Columbia Ministry of Finance and USD 40,400 in GST/HST taxes are owed to the Canada Revenue Agency. The Debtors intend to file the applicable tax retuns and pay these taxes as soon as possible, upon the completion of accounting work by Deloitte, their Canadian auditor. Pursuant to DI 219 and DI 212, the Debtor intends to engage Deloitte after their OCP application is deemed approved.

In re: Proterra, Inc. Case No.: 23-11120 Reporting Period: 10/01/2023 - 10/31/2023 Monthly Operating Report - Company Information Debtor's Full-Time Employees (current): 0 Note: The full employee headcount pertaining to the Debtors is detailed in the MOR for Proterra Operating Inc. This may encompass certain employment agreements executed with Proterra, Inc.