As filed with the Securities and Exchange Commission on October 15, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM F-4

REGISTRATION STATEMENT

Under

the Securities Act of 1933

____________________________

TOTVS S.A.

(Exact name of registrant as specified in its charter)

____________________________

TOTVS S.A.

(Translation of registrant’s name into English)

____________________________

Federative Republic of Brazil

(State or other jurisdiction of

incorporation or organization) | 7372

(Primary Standard Industrial

Classification Code Number) | Not applicable

(I.R.S. Employer

Identification Number) |

Avenida Braz Leme, 1000

São Paulo, São Paulo

Brazil 02511-000

+55 (11) 2099-7089

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_____________________________

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Tel: +1 302 738-7210

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________________

| Copies to |

Tobias Stirnberg, Esq.

Milbank LLP

Av. Brigadeiro Faria Lima, 4100, 5º andar

São Paulo, São Paulo, Brazil 04538-132

+55 (11) 3927-7702 |

____________________________

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

____________________________

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered | Amount to be Registered(2) | Proposed Maximum Offering Price per Common Share | Proposed Maximum

Aggregate Offering

Price (3) | Amount of

Registration Fee(4) |

| Common shares, no par value (1) | 179,428,737 | N/A | US$1,333,025,429.84 | US$145,433.07 |

| (1) | Represents the number of common shares of TOTVS S.A. (“TOTVS” and the “TOTVS Shares”) estimated to be issuable in connection with the transactions contemplated by the Merger Protocol, pursuant to which Linx S.A. (“Linx”) will become a wholly owned subsidiary of TOTVS, and the holders of Linx Shares and American depositary shares (“ADSs”) representing the Linx Shares (“Linx ADSs”) will receive TOTVS Shares and ADSs representing the TOTVS Shares (“TOTVS ADSs” and, together with the TOTVS Shares, the “TOTVS Securities”), respectively, as well as cash consideration, in exchange for their Linx Shares and Linx ADSs, respectively. TOTVS ADSs representing the TOTVS Shares registered hereby are registered pursuant to a separate Registration Statement on Form F-6 (File No. ). Each TOTSV ADS represents one TOTVS Share. |

| (2) | Represents the maximum number of TOTVS Shares underlying the TOTVS ADSs to be issued hereunder. |

| (3) | Pursuant to Rule 457(f) under the Securities Act, and solely for purposes of calculating the registration fee, the proposed maximum aggregate offering price has been calculated based on the number of Linx Shares outstanding and (a) the proposed cash consideration per Linx Share and (b) the market value of the proposed share consideration per Linx Share determined in accordance with Rule 457(c), in each case translated to U.S. dollars using the U.S. dollar closing selling rate of R$5.5393 per US$1.00 as of October 9, 2020, as reported by the Central Bank of Brazil (Banco Central do Brasil). |

| (4) | Computed in accordance with Section 6(b) of the Securities Act of 1933 at an amount equal to the proposed maximum offering price of US$1,333,025,429.84 multiplied by 0.0001091.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine. |

Information contained in this preliminary prospectus is subject to completion and may be changed. A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy these securities be accepted prior to the time the registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of any offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY - SUBJECT TO COMPLETION, DATED OCTOBER 15, 2020

MERGER PROPOSED – YOUR VOTE IS VERY IMPORTANT

To the Holders of Shares and ADSs of Linx S.A.:

Holders of shares (including the shares underlying the ADSs) of Linx S.A. (“Linx”) are invited to attend the extraordinary general shareholders meeting of Linx scheduled for , 2020 at , local time (the “Linx Special Meeting”). At the Linx Special Meeting, you will be asked to consider and vote upon a proposal to approve a business combination of Linx and TOTVS S.A. (“TOTVS”), as contemplated by the terms and conditions set forth in the merger protocol entered into by the independent members of the Board of Directors of Linx (the “Linx Independent Directors”) and the members of the Board of Directors of TOTVS (the “TOTVS Directors”) on (the “Merger Protocol”), pursuant to which Linx will become a wholly owned subsidiary of TOTVS by way of a merger of shares (incorporação de ações) under Brazilian law (the “Merger”).

Upon effectiveness of the Merger, holders of all of the issued and outstanding common shares of Linx (“Linx Shares”) at the record date set in accordance with the Merger Protocol will receive common shares of TOTVS with no par value (“TOTVS Shares”), and holders of Linx Shares represented by ADSs (“Linx ADSs”, and, together with Linx Shares, “Linx Securities”) at the record date set in accordance with the Merger Protocol and the Linx Deposit Agreement (as defined herein) will receive TOTVS Shares represented by ADSs (“TOTVS ADSs”, and, together with TOTVS Shares, “TOTVS Securities”). All TOTVS Securities outstanding at the closing date of the Merger (the “Closing Date”) will remain outstanding following completion of the Merger.

Upon the completion of the Merger and subject to the withdrawal rights described below:

| · | holders of Linx Shares will receive, without any further action by those holders, one TOTVS Share and R$6.20 for each Linx Share they hold. The per share cash component will be updated pro rata die according to the six-month Certificate of Interbank Deposit (“CDI”) rate variation from the date which is six months after August 14, 2020 until the date of the payment of the consideration (the “CDI Variation”); and |

| · | holders of Linx ADSs will receive, subject to the procedures for certificated registered holders described herein, one TOTVS ADS (representing one TOTVS Share) and the equivalent in U.S. dollars of R$6.20, as adjusted by the CDI Variation, for each Linx ADS that they hold (as adjusted prior to the Closing Date as described herein). Each TOTVS ADS represents one TOTVS Share. |

Based on the number of Linx Shares outstanding on the date hereof, TOTVS expects to issue 179,428,737 TOTVS Shares to holders of Linx Shares (“Linx Shareholders”) in the Merger and expects a total of 747,183,640 TOTVS Shares to be outstanding following the completion of the Merger. Immediately following the closing of the Merger, holders of Linx Shares and Linx ADSs prior to the Merger are expected to own approximately 24%, and holders of TOTVS Shares and TOTVS ADSs prior to the Merger are expected to own approximately 76%, respectively, of the outstanding TOTVS Shares immediately following the closing of the Merger, assuming that TOTVS does not issue any additional TOTVS Shares between the date hereof and the closing of the Merger.

The Linx Shares are listed on the São Paulo Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão, or the “B3”), under the symbol “LINX3”, and the Linx ADSs are listed on the New York Stock Exchange (the “NYSE”), under the symbol “LINX”. Following the completion of the Merger, the Linx ADSs will be delisted from the NYSE, Linx will be deregistered under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and from the Brazilian Securities Commission (Comissão de Valores Mobiliários, referred to as the “CVM”) and the Linx Shares will be delisted from the B3.

The TOTVS Shares are listed on the B3 under the symbol “TOTS3” and TOTVS will apply to list the TOTVS ADSs on the NYSE, effective as of the Closing Date.

The Merger requires the approval of Linx’s shareholders representing at least 50% of Linx’s issued and outstanding voting capital at an extraordinary general shareholders meeting duly called under Brazilian law. The Merger also requires approval by TOTVS’s shareholders through the affirmative vote of a majority of the votes cast at a TOTVS extraordinary general shareholders meeting. In addition to the approval by the shareholders of Linx and the shareholders of TOTVS, the

Merger must be approved by the Brazilian antitrust authority (Conselho Administrativo de Defesa Econômica, referred to as “CADE”), as further described herein. The antitrust approval is a discretionary decision based on the elements submitted to CADE. Other than the fixed termination fee, TOTVS is not able to provide additional assurances that the requisite antitrust approval in Brazil will be achieved or that all other conditions precedent to the completion of the Merger will be met.

Holders of Linx Shares who vote to approve the Merger Proposal will not have appraisal or withdrawal rights under Brazilian Law No. 6.404/76, as amended (the “Brazilian Corporation Law”). Holders of Linx Shares who vote against the approval of the Merger Proposal, or who do not vote on the approval of the Merger Proposal, will have withdrawal rights under the Brazilian Corporation Law. Holders of Linx ADSs will not be able to exercise withdrawal rights, even if they give instructions to the Linx Depositary (as defined herein) to vote against the Merger Proposal.

The Merger Protocol was signed by Linx Independent Directors and TOTVS Directors on .

Your vote is important, regardless of the number of shares you own. The accompanying disclosure documents (including the Merger Protocol, which is filed as an exhibit to the registration statement of which this prospectus is a part) contain detailed information about the Merger and the Linx Special Meeting. This document is a prospectus for the TOTVS Shares that will be issued in the Merger. You should read this prospectus carefully. In particular, please read the section entitled “Risk Factors” beginning on page 18 for a discussion of risks that you should consider in evaluating the Merger described in this prospectus.

Neither TOTVS nor Linx is asking any shareholders for a proxy, and each shareholder is requested to not send TOTVS or Linx a proxy. Pursuant and subject to the provisions of the Deposit Agreement dated as of June 25, 2019 (the “Linx Deposit Agreement”), among Linx, The Bank of New York Mellon, as the Linx ADS depositary (the “Linx Depositary”), and the owners and holders from time to time of Linx ADSs issued thereunder, the Linx Depositary will seek instructions from you on how to vote the Linx Shares underlying your Linx ADSs. If the Linx Depositary does not receive instructions from an owner of Linx ADSs on or before the date established by the Linx Depositary for that purpose, the Linx Depositary shall deem that owner to have instructed the Linx Depositary to give a discretionary proxy to a person designated by Linx to vote the underlying Linx Shares.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Merger or the securities to be issued in connection with the Merger or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus incorporates by reference important business and financial information about Linx that is contained in its filings with the SEC but that is not included in, or delivered with, this prospectus. This information is available on the SEC’s website at www.sec.gov and from other sources. TOTVS will also make copies of this information available to you without charge upon your written or oral request at Avenida Braz Leme, 1000, 02511-000, São Paulo, State of São Paulo, Brazil, Attention: Sergio Serio, telephone: +55 (11) 2099-7773. In order for you to receive timely delivery of the documents in advance of the Linx Special Meeting, TOTVS should receive your request no later than five business days prior to the Linx Special Meeting.

This prospectus is dated ,2020 and is expected to be mailed to holders of Linx Shares and Linx ADSs beginning on or about that date.

TABLE OF CONTENTS

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain or may contain “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, as amended (the “Securities Act”) and the Exchange Act. Forward looking terms such as “may,” “will,” “could,” “should,” “would,” “plan,” “potential,” “intend,” “anticipate,” “project,” “target,” “believe,” “estimate” or “expect” and other words, terms and phrases of similar nature are often intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are statements which are not historical fact and involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Such forward-looking statements may include, but are not limited to, statements related to:

| · | the Merger and the expected timing and satisfaction of conditions precedent prior to the Closing Date, including among others, the approval of the Merger by shareholders of each of Linx and TOTVS, regulatory and governmental approvals and other customary closing conditions; |

| · | the impact of the Merger on TOTVS’s earnings, credit rating, market value and growth rate; |

| · | the expectation that TOTVS will become an SEC registrant and that TOTVS ADSs will be listed on the NYSE in connection with the Merger; |

| · | the expected strategic and integration opportunities and other synergies from the Merger and the expected financial and other benefits therefrom; |

| · | the future composition of TOTVS’s management team and directors and those of its subsidiaries, including, after the Closing Date, Linx; |

| · | the occurrence of a natural disaster, widespread health epidemic or pandemics, including the coronavirus (COVID-19) pandemic; |

| · | the future growth opportunities, expected earnings, expected capital expenditures, future financing requirements and estimated future dividends or other distributions; and |

| · | the expectation that TOTVS and its subsidiaries will remain compliant with debt covenants and other contractual obligations. |

Forward-looking statements in this prospectus are based on current expectations and assumptions made by the management of TOTVS. Although the management of TOTVS believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements. We can give no assurance that they will prove to be correct. Additionally, forward-looking statements are subject to various risks and uncertainties which could cause actual results to differ materially from the anticipated results or expectations expressed in this prospectus. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements, or that could contribute to such differences, include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors”. Some of the key risks and uncertainties include statements related to:

| · | difficulties, unexpected costs and delays in integrating Linx’s and TOTVS’s businesses, business model and culture after the Merger and the inability to realize synergies, efficiencies or cost savings from the Merger; |

| · | the failure to obtain regulatory, stock exchange, shareholders and other third-party approvals in a timely manner or on conditions acceptable to the parties or the failure to satisfy other customary closing conditions or the failure of the Merger to be completed for any other reason (or to be completed in a timely manner); |

| · | fluctuation in value of the Merger Consideration (including as a result of currency exchange fluctuations); |

| · | TOTVS’s ability to obtain financing for its projects and acquisition plans; |

| · | TOTVS’s ability to integrate its recently acquired businesses or those it may acquire, as well as to realize the expected benefits of those acquisitions; |

| · | TOTVS’s ability to execute its business strategy successfully and to implement its expansion strategy, whether by acquisitions or organically; |

| · | TOTVS’s ability to serve its customers satisfactorily; |

| · | TOTVS’s ability to develop new products and services; |

| · | TOTVS’s ability to keep up with and adapt to technological innovations; |

| · | competition in the Brazilian technology industry; |

| · | increase in customer default rates; |

| · | changes in data privacy legislation in Brazil and abroad; |

| · | socio-economic, political and business conditions in Brazil, including, but not limited to, exchange rates, employment levels, population growth, consumer confidence, inflation, the market value of government securities and fluctuations in interest rates; |

| · | TOTVS’s capitalization and indebtedness levels; |

| · | difficulties in maintaining and improving TOTVS’s brand image, including customer complaints or negative publicity; |

| · | the increased cost of TOTVS’s operating and capital structure; and |

| · | other risk factors included in the Linx’s annual report on Form 20-F for the year ended December 31, 2019, filed with the SEC on May 15, 2020, as amended on June 12, 2020, and any amendment thereto (the “Linx 2019 Form 20-F”), which is incorporated by reference in this prospectus. |

The foregoing list is not intended to be exhaustive, and there may be other key risks that are not listed above that are not presently known to us or that we currently deem immaterial. Should one or more of these or other risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by the forward-looking statements made by us contained in this prospectus. As a result of the foregoing, readers should not place undue reliance on the forward-looking statements contained in this prospectus. The forward-looking statements contained in this prospectus are expressly qualified in their entirety by the foregoing cautionary statements. All such forward-looking statements are based upon information available as of the date of this prospectus or other specified date and speak only as of such date. TOTVS disclaims any intention or obligation to update or revise any forward-looking statements in this prospectus as a result of new information or future events, except as may be required under applicable securities law.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

The consolidated financial information presented in this prospectus has been derived from the following:

TOTVS

| · | TOTVS’s unaudited interim condensed consolidated financial statements as of June 30, 2019 and for the six months ended June 30, 2019 and the related notes thereto, included in this prospectus; and |

| · | TOTVS’s audited consolidated financial statements as of December 31, 2019 and 2018 and for the years ended December 31, 2019 and 2018 and the related notes thereto, included in this prospectus. |

The consolidated financial statements of TOTVS listed above (the “TOTVS Financial Statements”) are prepared in accordance with IFRS as issued by the IASB and are presented in Brazilian reais. The unaudited condensed interim consolidated financial statements of TOTVS are prepared in accordance with IAS 34 – Interim Financial Reporting as issued by the IASB and are presented in Brazilian reais.

Linx

| · | Linx’s interim consolidated financial information as of June 30, 2020 and for the three and six months ended June 30, 2020 and 2019 has been derived from the unaudited interim consolidated financial statements of Linx appearing in Linx’s current report on Form 6-K furnished to the SEC on August 12, 2020 including the unaudited interim financial statements at June 30, 2020 and for the three and six month period ended June 30, 2020, which is incorporated by reference in this prospectus. |

| · | Linx’s annual consolidated financial information for each of the three years in the period ended December 31, 2019 and as of December 31, 2019 and 2018 have been derived from the audited consolidated financial statements of Linx appearing in Linx’s Annual Report on Form 20-F for the fiscal year ended December 31, 2019, which is incorporated by reference in this proxy prospectus. |

The consolidated financial statements of Linx are prepared in accordance with IFRS as issued by the IASB and are presented in Brazilian reais. The unaudited condensed interim consolidated financial statements of Linx are prepared in accordance with IAS 34 – Interim Financial Reporting as issued by the IASB and are presented in Brazilian reais.

Currency Conversions

On October, 8, 2020, the exchange rate for reais into U.S. dollars was R$5.5393 to US$ 1.00, based on the selling rate as reported by the Central Bank of Brazil (Banco Central do Brasil) (the “Central Bank of Brazil”). The selling rate was R$5.4760 to US$1.00 as of June 30, 2020, R$4.0307 to US$1.00 as of December 31, 2019, R$3.8748 to US$1.00 as of December 31, 2018, R$3.3080 to US$1.00 as of December 29, 2017, and R$3.2591 to US$ 1.00 as of December 30, 2016, in each case, as reported by the Brazilian Central Bank. The real/U.S. dollar exchange rate fluctuates widely, and the selling rate as of September 1, 2020 may not be indicative of future exchange rates. The U.S. dollar equivalent information presented in this prospectus is provided solely for the convenience of the reader and should not be construed as implying that the real amounts represented could be or could have been converted into U.S. dollars at that rate or at any rate.

Solely for the convenience of the reader, we have translated certain amounts included in “Selected Financial Data” and elsewhere in this prospectus from reais into U.S. dollars using the selling rate as reported by the Central Bank of Brazil as of June 30, 2020 of R$ 5.4760 to US$ 1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate.

Rounding

We have made rounding adjustments to reach some of the figures included in this proxy prospectus. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Market Data

We obtained market and competitive position data, including market forecasts, used throughout this prospectus from market research, publicly available information and industry publications, as well as internal surveys. We include data from reports prepared by the Brazilian Central Bank, the B3, the IBGE, and the Fundação Getulio Vargas, or FGV. We believe that all market data in this prospectus is reliable, accurate and complete.

CERTAIN DEFINED TERMS AND CONVENTIONS USED IN THIS PROSPECTUS

In this prospectus, “TOTVS”, the “Company”, “we”, “us” and “our” refer to TOTVS and its consolidated subsidiaries, unless the context otherwise requires. References to the “Companies” refer to TOTVS and Linx. All references to the “real”, “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars”, “dollars” or “US$” are to United States dollars, the official currency of the United States.

“B3” means the B3 S.A. – Brasil, Bolsa, Balcão, or São Paulo Stock Exchange.

“Brazilian Corporation Law” means the Brazilian Law No. 6,404/76, as amended.

“CADE” means the Conselho Administrativo de Defesa Econômica, or the Brazilian administrative council for economic defense.

“CMN” means the Conselho Monetário Nacional, or the Brazilian Monetary Council.

“CVM” means the Comissão de Valores Mobiliários, or the Brazilian Securities Commission.

“Exchange Act” means the U.S. Securities Exchange Act of 1934.

“Material Adverse Change” means any event, effect, occurrence or factual situation or any combination of these, which, individually or jointly, adversely affects or can reasonably be expected to adversely affect Linx or TOTVS’s, as applicable, business, operations, assets, properties, commercial or financial condition, or results of operations in an amount equal to or greater than 20% of the gross revenue generated by Linx or TOTVS in the fiscal year immediately preceding the fiscal year in which the Material Adverse Change occurs; except to the extent that Linx or TOTVS’s signatories of the Merger Protocol had actual knowledge of such change or adverse effect and/or such change or adverse effect results from (A) adverse economic or exchange effects on the industry in which Linx or TOTVS, as applicable, operates in Brazil; (B) regulatory or other changes that affect the industry in which Linx or TOTVS, as applicable operates in general; (C) any changes in applicable law or accounting standards generally accepted in Brazil, including any tax reform; (D) any effect that, if it is subject to reversal before the Closing Date, is reversed before the Closing Date; and (E) effects resulting from the COVID-19 pandemic.

“NYSE” means the New York Stock Exchange.

“Securities Act” means the U.S. Securities Act of 1933.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus incorporates important business and financial information about us and Linx that is not included in or delivered with this prospectus. SEC allows us to “incorporate by reference” information filed with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and certain later information that we or Linx file with the SEC will automatically update and supersede this information. We incorporate by reference the following documents:

| · | TOTVS’s Form F-6 to be filed with the SEC (containing the registration statement for the TOTVS ADSs); |

| · | Linx’s Form F-6 filed with the SEC on June 10, 2019 (containing the registration statement for the Linx ADSs); |

| · | Linx’s current report on Form 6-K furnished to the SEC on August 12, 2020 including the unaudited interim financial statements as of June 30, 2020, and for the three and six month period ended June 30, 2020; |

| · | Linx’s current report on Form 6-K furnished to the SEC on August 14, 2020 relating to the business combination proposal received from TOTVS; |

| · | Linx’s current report on Form 6-K furnished to the SEC on August 17, 2020 relating to its disclosure of the business combination proposal received from TOTVS; |

| · | TOTVS’s report on Form 425 furnished to the SEC on September 14, 2020 relating to updates to its business combination proposal with Linx; |

| · | any documents filed by Linx with the SEC under Sections 31(a), 13(c) or 15(d) of the Exchange Act after the date of this prospectus and before the date of the Linx Special Meeting shall be deemed incorporated by reference into this prospectus and made a part of this prospectus from the respective dates of filing; and |

| · | any of our future submissions on Form 6-K furnished to the SEC after the date of this prospectus that are identified in such submissions as being incorporated by reference in this prospectus. |

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

These documents are available on the SEC’s website at www.sec.gov and from other sources. You may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov).

All information concerning Linx, its business, management and operations presented or incorporated by reference in this prospectus is taken from publicly available information (primarily filings by Linx with the SEC). This information may be examined and copies may be obtained at the places and in the manner set forth in the section titled “Where You Can Find More Information.” TOTVS is not affiliated with Linx, and TOTVS has not had access to Linx’s books and records in connection with the Merger. Therefore, non-public

information concerning Linx has not been used by TOTVS for the purpose of preparing this prospectus. Although TOTVS has no knowledge that would indicate that statements relating to Linx contained or incorporated by reference in this prospectus are inaccurate or incomplete, TOTVS was not involved in the preparation of those statements and cannot verify them.

TOTVS has not authorized anyone to give any information or make any representation about the Merger, Linx or TOTVS that is different from, or in addition to, that contained in this prospectus or in any of the materials that have been incorporated by reference into this prospectus. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase, the securities offered by this prospectus or the solicitation of proxies pursuant to this prospectus is unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you. The information contained in this prospectus is accurate only as of the date of this prospectus unless the information specifically indicates that another date applies.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement (“Registration Statement”)that we have filed with the SEC on Form F-4 under the Securities Act. This prospectus does not contain all of the information set forth in the registration statement. Statements made in this prospectus as to the contents of any contract, agreement or other document are not necessarily complete. We have filed certain of these documents as exhibits to our registration statement, and we refer you to those documents. Each statement in this prospectus relating to a document filed as an exhibit to the registration statement of which this prospectus is a part is qualified in all respects by the filed exhibit.

Linx files annual reports on Form 20-F and makes submissions on Form 6-K with the SEC under the rules and regulations that apply to foreign private issuers. As a foreign private issuer, Linx and its respective shareholders are exempt from some of the reporting requirements of the Exchange Act, including the proxy solicitation rules, the rules regarding the furnishing of annual reports to shareholders and Section 16 short-swing profit reporting for their respective officers, directors and holders of more than 10% of their shares. You may read and copy any materials filed by Linx with, or furnished by Linx to, the SEC at its Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at +1 (800) SEC-0330. The SEC maintains a website at http://www.sec.gov that contains reports and other information regarding issuers that file electronically with the SEC.

Linx and TOTVS are subject to the informational requirements of the CVM and the B3 and file reports and other information relating to their respective businesses, financial condition and other matters with the CVM and the B3. You may read these reports, statements and other information about Linx and TOTVS at the public reference facilities maintained by the CVM at Rua Sete de Setembro, 111, 2nd floor, Rio de Janeiro, RJ, Brazil, and Rua XV de Novembro, 275, Centro, São Paulo, SP, Brazil. Some filings of Linx and TOTVS with the CVM and the B3 are also available at the website maintained by the CVM at http://www.cvm.gov.br and the website maintained by the B3 at http://www.b3.com.br.

The public filings with the SEC and the CVM of TOTVS are also available to the public free of charge through our internet website at http://ir.totvs.com.br. The information included on our website or that might be accessed through our website is not included in this prospectus or the registration statement and is not incorporated into this prospectus or the registration statement by reference. You may also request a copy of TOTVS’s filings at no cost by contacting TOTVS at the following address: Avenida Braz Leme, 1000, 02511-000, São Paulo, SP, Brazil.

EXCHANGE CONTROLS

There are no restrictions on ownership of our common shares by individuals or legal entities domiciled outside Brazil. However, the right to convert dividend payments and proceeds from the sale of common shares into foreign currency and to remit such amounts outside Brazil is subject to exchange control restrictions and foreign investment legislation which generally requires, among other things, obtaining an electronic registration at the Central Bank of Brazil.

According to Resolution No. 4,373 of September 29, 2014 of the National Monetary Council (Conselho Monetário Nacional), or CMN, foreign investors may invest in almost all financial assets and engage in almost all transactions available in the Brazilian financial and capital markets, subject to complying with certain requirements. Resolution No. 4,373 defines a foreign investor as any individual, legal entity, mutual fund or other collective investment entity domiciled or headquartered abroad.

Pursuant to Resolution No. 4,373, prior to investing in Brazil, foreign investors must:

| · | appoint at least one representative in Brazil with powers to perform actions relating to the foreign investment; |

| · | register as a foreign investor with the CVM; and |

| · | appoint one or more custodians of its securities and other financial assets in Brazil, that must be registered with the CVM. |

Pursuant to Resolution No. 4,852 of August 27, 2020 of the CMN, individuals are excused from the requirement of appointing a custodian prior to the beginning of its operations in Brazil. Such resolution also granted authority for the CVM to excuse the prior registration of the individuals with the CVM, as mentioned before.

Securities trading is restricted to transactions carried out in the stock exchanges or organized over-the-counter markets licensed by the CVM.

Investors under Resolution No. 4,373 who are not resident in a Favorable Tax Jurisdiction (as defined under “Material Tax Considerations—Material Brazilian Tax Considerations”) are entitled to favorable tax treatment. See “Material Tax Considerations—Material Brazilian Tax Considerations”.

Resolution No. 4,373 of the CMN and CVM Instruction No. 559 of March 27, 2015 provide for the issuance of depositary receipts in foreign markets in respect of shares of Brazilian issuers. An application for registration of the TOTVS ADSs was approved by the Central Bank of Brazil and the CVM.

QUESTIONS AND ANSWERS ABOUT THE MERGER AND LINX SPECIAL MEETING

The following are some questions that you may have regarding the Merger and the other matters being considered at the Linx Special Meeting and brief answers to those questions. We urge you to read the remainder of this prospectus carefully, including, without limitation, the Merger Protocol, which is filed as an exhibit to the registration statement of which this prospectus is a part, because the information in this section does not provide all the information that might be important to you with respect to the Merger. Additional important information is also contained in the documents incorporated by reference in this prospectus and the exhibits to the registration statement of which this prospectus is a part.

| Q: | What is this document and why am I receiving it? |

| A: | This document is a prospectus of TOTVS relating to TOTVS Securities that will be issued as part of the Merger Consideration upon completion of the Merger. In connection with the Merger, TOTVS is required by the Securities Act to deliver this document to all holders of Linx Shares (including the Linx Shares underlying the Linx ADSs) that are U.S. residents. You should carefully review this document, because, as a holder of Linx Shares or Linx ADSs, you will be entitled to vote directly (in case of holders of Linx Shares) or indirectly (through giving voting instructions in case of holders of Linx ADSs) at the Linx Special Meeting that has been called in order for the shareholders of Linx to approve the Merger Proposal. |

| Q: | What is the proposed transaction on which I am being asked to vote? |

| A: | You are being asked to vote on a business combination of Linx and TOTVS. The terms and conditions of the Merger are memorialized in the Merger Protocol, which is filed as an exhibit to the registration statement of which this prospectus is a part. The Merger Protocol was signed by the Linx Independent Directors and TOTVS Directors and the Merger Protocol on .The Merger, and the terms and conditions thereof as set forth in the Merger Protocol, along with the other proposals set forth in the Merger Proposal, are being submitted for approval to you and the other holders of Linx Shares. In addition to approval by the shareholders of Linx and TOTVS, completion of the Merger will be subject to antitrust approval in Brazil and other conditions precedent, as described herein. |

| Q: | What will happen in the Merger transaction? |

| A: | If the Merger is approved by the shareholders of Linx and TOTVS, and subject to other conditions precedent as described herein, the Merger will be implemented through a merger of shares (incorporação de ações) under the Brazilian Corporation Law. A merger of shares under Brazilian Corporation Law is a corporate reorganization whereby a company merges all the shares of another company, which becomes a wholly owned subsidiary of the merging company. As opposed to a customary merger, the merger of shares does not cause the termination or extinction of the company which shares are merged, which continues to hold the same rights, obligations (including contractual and non-contractual obligations) and liabilities held by it prior to the merger of its shares. |

The Merger consists of a series of steps. First, the shares of Linx will be contributed into Katrina Participações S.A. (“Merger Vehicle”), a wholly owned subsidiary of TOTVS, which will issue 717,714,948 common shares and 179,428,737 redeemable preferred shares of capital stock (assuming no further issuance of Linx or TOTVS Shares prior to the completion of the Merger) to the Linx Shareholders. Four common shares and one redeemable preferred share of Merger Vehicle will be exchanged for each share of Linx. As a result, Linx will become a wholly owned subsidiary of Merger Vehicle.

Immediately following the contribution of shares of Linx to Merger Vehicle, (i) all of Merger Vehicle’s preferred shares will be redeemed for cash and (ii) Merger Vehicle’s common shares will be exchanged for TOTVS Shares pursuant to a merger (incorporação) of Merger Vehicle into TOTVS.

All of the foregoing steps will occur substantially simultaneously and will be conditioned on the effectiveness of each of the other steps. Accordingly, on the Closing Date, holders of Linx Shares and Linx ADSs will directly receive TOTVS Shares and TOTVS ADSs, respectively, along with cash consideration, in the amounts set forth herein.

TOTVS intends to merge Linx into TOTVS as soon as practicable after the Merger, subject to receipt of requisite antitrust approval in Brazil or other approvals and consents and completion of required procedures customary for such a transaction. No assurance can be given as to when or whether any of these approvals and consents will be obtained or when such procedures will be concluded, and, as a result, no assurance can be given as to the eventual merger of Linx into TOTVS, after which Linx would cease to exist and all of Linx’s rights and obligations would be succeeded to by TOTVS, pursuant to Brazilian law.

| Q: | What is the status of the Merger transaction? |

| A: | The Merger Protocol was signed by Linx Independent Directors and TOTVS Directors on . Shareholders of both Linx and TOTVS are being asked to vote on the Merger Proposal according to the Merger Protocol at extraordinary general shareholders meetings, and if such approval is received, Linx and TOTVS will continue to seek completion of all conditions precedent to the Merger, including obtaining the necessary antitrust approval in Brazil. If and when such antitrust approval and all other conditions precedent are fulfilled, the Merger will be consummated and all outstanding Linx Securities will be exchanged for TOTVS Securities. Neither TOTVS nor Linx can predict the actual date on which the Merger will be completed, or whether it will be completed. For a discussion of the conditions to the completion of the Merger, see the section entitled “The Merger—Merger Protocol—Conditions Precedent to the Completion of the Merger”. |

| Q: | What will I receive as a holder of Linx Shares or Linx ADSs if the Merger is consummated? |

| A: | As a holder of Linx Shares, for each Linx Share that you hold, you will receive one TOTVS Share and R$6.20, adjusted by the CDI Variation (collectively, the “Share Merger Consideration”). |

As a holder of Linx ADSs, for each Linx ADS that you hold, you will receive one TOTVS ADS (representing one TOTVS Share) and R$6.20 (which is equivalent to US$1.12 at the exchange rate as of October 9, 2020), adjusted by the CDI Variation (collectively, the “ADS Merger Consideration”, and together with the Share Merger Consideration, the “Merger Consideration”). Each TOTVS ADS represents one TOTVS Share.

The Linx Depositary will convert the Reais cash portion (R$6.20) of the Share Merger Consideration into U.S. dollars at a rate determined by it in accordance with and subject to the terms of the Linx Deposit Agreement. The Linx Depositary may convert currency itself or through any of its affiliates and in those cases the Linx Depositary acts as principal for its own account and not as agent, advisor, broker or fiduciary on behalf of any other person and earns revenue, including, without limitation, transaction spreads, that it will retain for its own account. The revenue is based on, among other things, the difference between the exchange rate assigned to the currency conversion made under the Linx Deposit Agreement and the rate that the Linx Depositary or its affiliate receives when buying or selling foreign currency for its own account. The Linx Depositary makes no representation that the exchange rate used or obtained in any currency conversion under the Linx Deposit Agreement will be the most favorable rate that could be obtained at the time or that the method by which that rate will be determined will be the most favorable to Linx ADS holders, subject to the Linx Depositary’s obligations under the Linx Deposit Agreement. The methodology used to determine exchange rates used in currency conversions is available upon request to the Linx Depositary.

| Q: | Are the Linx Securities and the TOTVS Securities traded on any stock exchange? |

| A: | The Linx Shares and the TOTVS Shares are listed on the B3 under the symbols “LINX3” and “TOTS3”, respectively. The Linx ADSs are listed on the NYSE under the symbol “LINX”. |

| Q: | Will the TOTVS Shares or the TOTVS ADSs to be issued to me at the completion of the Merger be traded on an exchange? |

| A: | Yes. The TOTVS Shares are listed on the B3 under the symbol “TOTS3”. TOTVS will apply to list the TOTVS ADSs on the NYSE, effective as of the Closing Date, but such listing is subject to TOTVS fulfilling all of the listing requirements of the NYSE. There can be no assurance that the TOTVS ADSs will be accepted for trading on the NYSE. For more information regarding the listing and trading of the TOTVS ADSs, see the section entitled “The Merger—Listing of TOTVS’s ADSs”. |

TOTVS Shares received by holders of Linx Shares in connection with the Merger will be freely transferable except for TOTVS Shares issued to any holder of Linx Shares deemed to be an “affiliate” of TOTVS for purposes of U.S. federal securities law. For more information, see the section entitled “The Merger—Restrictions on Resales of TOTVS Shares Received in the Merger”.

| Q: | Why is TOTVS proposing the Merger with Linx, and how was the Merger Consideration determined? |

| A: | After careful examination of the potential advantages and risks related to a prospective merger with Linx, TOTVS’s board of directors decided to submit a proposal stemming from the belief that such combination would be highly valuable, not only for the shareholders of Linx and TOTVS, but also for their clients and other stakeholders. |

TOTVS’s board of directors’ strategic rationale for the transaction assumes that Linx and TOTVS combination of businesses (the “Combined Company”) would enjoy vast regional reach and deep expertise across several business verticals, being able to capture substantial value from cross-selling and cost synergies. From the perspective of TOTVS’s board of directors, a potential merger with Linx has compelling attributes that strengthens and accelerates TOTVS’s ecosystem-driven strategic ambitions, which are based on three business dimensions: Core, TechFin and Business Performance.

| · | In Core software, Linx would be able to market its solutions through a much larger distribution network, composed by franchises, branches and partnerships, enhancing its ability to reach qualified leads. Likewise, TOTVS could leverage Linx’s retail channels to generate incremental sales. |

| · | In TechFin, a combination of Linx’ payments solutions (known as Pay Hub) and TOTVS’s credit-focused B2B platform would create a complete, full-service player. The Combined Company would be able to penetrate across an ample range of verticals through a complementary and more resilient product offering, well-positioned to capture market share from incumbents and compete for a larger portion of the total addressable market. |

| · | In Business Performance, combining with Linx would accelerate TOTVS’s pace of development and time-to-market on the digital solutions roadmap, creating a ‘one-stop-shop’ for clients to engage in e-commerce and omnichannel transformation. Furthermore, as the merger would create a large and sophisticated ‘data lake’, the performance is the most suitable business dimension to benefit from big data monetization initiatives, fueling synergies and enhancing digital products to drive new sales. |

In addition to the revenue synergies from a product and sales perspective, TOTVS’s board of directors also expects to obtain significant cost-saving synergies in the event of a combination with

Linx. More specifically, the Combined Company would have large room for capturing material synergy benefits by exploring cost-efficiency gains in general and administrative expenses, selling and marketing, research and development, and service implementation. TOTVS has a demonstrated track record on integrating newly-acquired software companies, applying an M&A framework with proven ability to drive value creation for shareholders and reduce integration risks.

The Merger Consideration has been determined in an effort to pursue a fair distribution of the value in the Combined Company between the shareholders of both Linx and TOTVS. In determining a fair Merger Consideration for both Linx’s and TOTVS’ shareholders, the board of directors of TOTVS has taken several aspects into consideration. The board has first contemplated current and over time market capitalization and the potential synergies to be possibly achieved in the event of a business combination.

Additionally, the board of TOTVS applied supplemental valuation methods on TOTVS and Linx to set the Merger Consideration. These methods include the use of Linx and TOTVS respective enterprise value divided by EBITDA, and a discounted cash flow analysis of TOTVS and Linx. By analyzing the aforementioned factors and applying these valuation methods, the Merger Consideration has been determined so that each Linx Share will be exchanged for one TOTVS Share plus R$6.20 in cash, adjusted by the CDI Variation.

| Q: | How will I receive the Merger Consideration to which I am entitled? |

| A: | If you hold Linx Shares, the TOTVS Shares and cash consideration that you are entitled to receive as a result of the Merger will automatically be credited to your account as promptly as practicable on the Closing Date. |

If you are a holder of Linx ADSs and you hold Linx ADSs through a broker or other securities intermediary in The Depository Trust Company (“DTC”), no further action by you is required in connection with the Merger. If you are a holder of Linx ADSs and you hold as a registered holder of uncertificated Linx ADSs, no further action by you is required in connection with the Merger. If you are a holder of Linx ADSs and you are a registered holder of certificated Linx ADSs, to receive your TOTVS ADSs, you must surrender your Linx ADSs to the Linx Depositary, complete the letter of transmittal (the “Letter of Transmittal”), which will be sent to you by the Linx Depositary, and comply with the procedures described in the Letter of Transmittal. More information may be found under the section entitled “The Merger—Distribution of the Merger Consideration and Receipt of the TOTVS Shares, TOTVS ADSs and Cash Consideration—Receipt of TOTVS ADSs”.

| Q: | How do I calculate the value of the Merger Consideration? |

| A: | The consideration that is payable per Linx Share or Linx ADS is a fixed amount of Brazilian reais and a fixed number of TOTVS Shares or TOTVS ADSs, respectively. As the exchange rate of the real and the market price of TOTVS Shares and Linx Shares fluctuate, the implied value of the Merger Consideration, including in comparison to the value of Linx Shares, will fluctuate too. As a result, the implied value of the Merger Consideration that you will receive upon the completion of the Merger could be greater than, less than or the same as the implied value of the Merger Consideration in U.S. dollars on the date of this prospectus or at the time of the Linx Special Meeting. Based on the closing price per TOTVS Share on October 9, 2020, the latest practicable trading day before the date of this prospectus, and the exchange rate of R$5.5393 per U.S. dollar as of October 9, 2020, as reported by the Central Bank of Brazil, the value of the Merger Consideration for each Linx Share in U.S. dollars was approximately US$5.97. You are encouraged to obtain current stock price quotations for Linx Shares, Linx ADSs, TOTVS Shares and TOTVS ADSs before deciding how to vote with respect to the Merger Proposal. The Linx Shares are listed on the B3 under the symbol “LINX3”, and the Linx ADSs (representing Linx Shares) are listed on the NYSE under the symbol “LINX”. The TOTVS Shares are listed on the B3 under the symbol “TOTS3”. The price of the Linx Shares and the TOTVS Shares on the B3 is reported in Brazilian reais. |

| Q: | If I hold Linx ADSs, will I have to pay ADS cancellation and issuance fees? |

| A: | No, if you hold Linx ADSs, you will not have to pay the applicable Linx ADS cancellation fee nor pay the applicable fees for the issuance of TOTVS ADSs in exchange for your Linx ADSs. |

| Q: | Will I have to pay any brokerage commission? |

| A: | You will not have to pay any brokerage commission if your Linx Shares or Linx ADSs are registered in your name. However, if your securities are held through a bank or broker or a custodian linked to a stock exchange, you should consult with them as to whether or not they charge any transaction fee or service charges in connection with the Merger. |

| Q: | What shareholder approvals are needed for the Merger? |

| A: | To be approved, the Merger, along with the other proposals set forth in the Merger Proposal, requires approvals from TOTVS and Linx Shareholders. TOTVS shareholders approval requires the affirmative vote of a majority of the votes cast at a TOTVS extraordinary general shareholders meeting, and Linx Shareholders approval requires the approval of Linx’s shareholders representing at least 50% of Linx’s issued and outstanding voting capital at an extraordinary general shareholders meeting duly called under Brazilian law. For more information on the Linx Special Meeting, see “The Linx Special Meeting—Required Vote”. |

The Linx Special Meeting will be held on , 2020, and the TOTVS extraordinary general shareholders meeting will be held on , 2020 (the “TOTVS Special Meeting”).

| Q: | Are there risks associated with the Merger? |

| A: | Yes. There are a number of risks related to the Merger that are discussed in this prospectus and in the other documents incorporated by reference. In evaluating the Merger, before making any decision on whether and how to vote, you are urged to read carefully and in its entirety this prospectus, in particular the section entitled “Risk Factors”. |

| Q: | What happens if the transaction is not completed? |

| A: | In the event that CADE (i) imposes restrictions as a condition for the approval of the Merger and, after using best efforts, the Companies fail to satisfy such restrictions or (ii) blocks the Merger, Linx may terminate the Merger Protocol in which case Linx will be entitled to receive from TOTVS a fixed termination fee in the amount of R$100,000,000 in cash within 30 days from Linx’s termination notice to TOTVS to that effect as the sole and exclusive compensation for any losses and damages suffered by Linx. |

If a majority of the shareholders of TOTVS or Linx’s shareholders representing at least 50% of Linx’s issued and outstanding voting capital do not approve the Merger Proposal or if the Merger is not completed for any other reason, (i) TOTVS and Linx will remain independent public companies and no termination fee will be due, (ii) TOTVS Shares will continue to be listed and traded on the B3, (iii) Linx Shares and Linx ADSs will continue to be listed and traded on the B3 and the NYSE, respectively, and (iv) Linx will continue to be registered under the Exchange Act and file periodic reports with the SEC.

In addition, if the Merger is not consummated within 18 months from the execution date of the Merger Protocol, the Merger Protocol will be terminated. If the non-consummation is due to a breach of the obligations provided in the Merger Protocol by Linx or TOTVS, the non-defaulting party may (i) extend the 18 months term to consummate the Merger, or (ii) consider the Merger terminated through a notice of termination to the defaulting party, which in this event, will entitle the non-

defaulting party to an amount of R$150,000,000 as fixed losses and damages to be paid by the defaulting party in a single cash installment within 30 days from the notice of termination.

| Q: | What happens if the Merger is approved by Linx’s shareholders? |

| A: | If the Merger is approved by Linx’s shareholders representing at least 50% of Linx’s issued and outstanding voting capital, Linx is required to publish the minutes of the relevant shareholders meeting with the CVM and on Linx’s website. TOTVS and Linx will then continue to seek the requisite antitrust approval in Brazil for the transaction from CADE. If and when such antitrust approval is obtained, and subject to completion of other customary conditions precedent, the Merger will be consummated, and holders of Linx Securities will receive the Merger Consideration as described herein. The antitrust approval is a discretionary decision based on the elements submitted to CADE. Other than the fixed termination fee, TOTVS is not able to provide additional assurances that the requisite antitrust approval in Brazil will be obtained or that all other conditions precedent to the completion of the Merger will be met. For a discussion of the conditions to the completion of the Merger, see the section entitled “The Merger—Merger Protocol—Conditions Precedent to the Completion of the Merger”. |

| Q: | Do I have appraisal or dissenters’ rights for my Linx Shares in connection with the Merger? |

| A: | You have withdrawal rights with respect to your Linx Shares under the circumstances described herein. Under Brazilian law, withdrawal rights are akin to appraisal or dissenters’ rights in that they permit shareholders to receive a fixed amount of cash in exchange for each Linx Share calculated on the basis of the book value per share of Linx’s shareholders’ equity, subject to the conditions set forth below and described in further detail herein. Other than the withdrawal rights described herein, you do not have appraisal or dissenters’ rights under Brazilian law. |

Under Brazilian law, persons who were holders of record of Linx Shares as of the date of the Linx Special Meeting, and who vote against the Merger Proposal, or do not vote at all to approve the Merger Proposal, at the Linx Special Meeting will be entitled to exercise withdrawal rights under Brazilian law in connection with the Merger. Withdrawal rights must be exercised within 30 days of the publication by Linx of the minutes of Linx’s extraordinary general shareholders meeting at which the Merger Proposal is approved. If any holders of Linx Shares exercise this right, they will receive from Linx a cash amount for their Linx Shares equal to R$9.97 per share, calculated in accordance with the Brazilian Corporation Law, based on the book value per share of Linx’s shareholders’ equity as set forth in Linx’s balance sheet as of December 31, 2019, without prejudice to the right of such holders to request the preparation of a special balance sheet. Holders of Linx Shares that exercise their withdrawal rights will receive the cash amount on the Closing Date.

Holders of Linx ADSs will not be able to exercise withdrawal rights, even if they give instructions to the Linx Depositary (as defined herein) to vote against the Merger Proposal, nor will the Linx Depositary exercise such rights on their behalf, even if given instructions to do so. Holders of Linx ADSs who wish to assert withdrawal rights will need to become shareholders of Linx in Brazil, in accordance with the procedures for cancelling Linx ADSs and withdrawing Linx Shares under the Linx Deposit Agreement, prior to the Linx Special Meeting, and take all requisite actions to assert withdrawal rights as Linx Shareholders in Brazil within the time period set forth above. Other than the withdrawal rights under Brazilian law as described herein, holders of Linx Shares and Linx ADSs will have no appraisal or dissenters’ rights with respect to their Linx Securities. For more information, see the sections entitled “Summary—Withdrawal Rights” and “The Merger—Principal Transaction Documents—Withdrawal Rights in the Merger”.

| Q: | Are any other approvals from any third parties or governmental authorities required for the completion of the Merger? |

| A: | Yes. Prior to the Closing Date, approval must be received from CADE in Brazil. |

| Q: | Are there any conditions to the Merger? |

| A: | Yes. The completion and effectiveness of the Merger is subject to the satisfaction of several conditions, including the following: |

| · | approval of the Merger by Linx’s shareholders meeting and TOTVS’s shareholders meeting; |

| · | approval of the Merger by CADE, the antitrust authority in Brazil; |

| · | the registration statement of which this prospectus forms a part shall have been declared effective by the SEC; |

| · | absence of a Material Adverse Change, which can be waived at any time by TOTVS by means of a written notice; |

| · | compliance by Linx with the interim covenants set forth in the Merger Protocol, which can be waived at any time by TOTVS by means of a written notice; |

| · | the confirmation by each party that the representations and warranties made in the Merger Protocol are true and correct in all their material aspects; |

| · | Linx shall (i) have obtained the respective third-party consents of its agreements currently in force and there will not be obligations, involving R$50,000,000 or more, individually or in the aggregate that may have declared their early termination (or other incident penalties) due to the Merger (“Obligations Subject to Early Termination”); or (ii) have liquidated all its Obligations Subject to Early Termination in their entirety with no outstanding obligations to Linx deriving from such liquidation; or (iii) have cash representing 100% of the necessary amount to liquidate all the Obligations Subject to Early Termination (including any incident penalties); |

| · | the absence of any law enacted, or any judicial or regulatory order issued, by a competent governmental authority or judicial authority or arbitral tribunal that impedes the completion of the Merger; and |

| · | compliance by each of Linx and TOTVS with their respective obligations set forth in the Merger Protocol. |

No assurance can be given as to when or whether any of the approvals and consents listed above will be obtained, the terms and conditions that may be imposed in connection with such approvals and consents, or the consequences of failing to obtain such approvals and consents. For a discussion of the conditions to the completion of the Merger, see the section entitled “The Merger—Merger Protocol—Conditions Precedent to the Completion of the Merger”.

| Q: | What will happen to Linx following the Closing Date? |

| A: | Following the completion of the Merger, Linx will be a wholly owned direct subsidiary of TOTVS. After the Merger, Linx will be deregistered under the Exchange Act, Linx will no longer file Annual Reports on Form 20-F or make submissions on Form 6-K and Linx will be deregistered from the CVM. In addition, the Linx ADSs will be delisted from the NYSE and the Linx Shares will be delisted from the B3. TOTVS also intends to merge Linx into TOTVS as soon as practicable after completion of the Merger, subject to receipt of the requisite regulatory and other approvals and consents and completion of required procedures customary for such a transaction. |

The deregistration and delisting of Linx and the Linx Shares and Linx ADSs, respectively, will not affect holders of Linx Shares and Linx ADSs. At the time of deregistration and delisting following the completion of the Merger, former holders of Linx Shares and Linx ADSs will have received TOTVS Shares and TOTVS ADSs, respectively, and TOTVS will be the sole holder of Linx Shares. TOTVS will be registered under the Exchange Act; it will file Annual Reports on Form 20-F and make submissions on Form 6-K. In addition, TOTVS ADSs will be listed on the NYSE, TOTVS Shares will be listed on the B3 and TOTVS will be registered with the CVM. Therefore, holders of Linx Shares will hold shares in a company that is registered following the Merger and will not be affected by the deregistration of Linx, in which they will no longer hold shares.

| Q: | What are the U.S. federal income tax consequences of the Merger? |

| A: | The Merger may be a taxable transaction to U.S. holders (as defined in the section entitled “Material Tax Considerations—Material U.S. Federal Income Tax Considerations”) for U.S. federal income tax purposes. In that case, a U.S. holder generally should be subject to tax on gain realized on the receipt of cash and TOTVS Securities in the Merger, including any amount received in respect of fractions of Linx Securities. However, it is also possible the Merger may be treated as a reorganization under section 368(a) of the United States Internal Revenue Code, in which case not all of a U.S. holder’s gain may be recognized and subject to tax. The U.S. federal income tax consequences of the Merger are complex. You should read the section entitled “Material Tax Considerations—Material U.S. Federal Income Tax Considerations” for more information on the U.S. federal income tax consequences of the Merger, and you should consult your own tax advisors regarding the tax consequences of the Merger in your particular circumstances. |

| Q: | What are the Brazilian income tax consequences of the Merger? |

| A: | Brazilian Law No. 10,833/03 provides that gains on the disposition of assets located in Brazil by a Non-Brazilian Holder (as defined in the section entitled “Material Tax Considerations—Material Brazilian Tax Considerations”), regardless of whether the sale or the disposition is carried out in Brazil or abroad and/or whether it is carried out with an individual or entity resident or domiciled in Brazil, are not subject to withholding income tax on capital gains in Brazil. Linx Shares are expected to be treated as assets located in Brazil for purposes of the law, and, as a result, gains on the disposition of Linx Shares as a result of the Merger are expected to be subject to Brazilian income tax at rates of up to 25% (see the section entitled “Material Tax Considerations—Material Brazilian Tax Considerations”). |

There is no clear rule regarding how a disposition of ADSs as a result of the Merger will be treated under Brazilian tax law, including under Brazilian Law No. 10,833/03. Although arguments exist to support the view that ADSs should not fall within the definition of assets located in Brazil for the purposes of Law No. 10,833, in which case the disposition of Linx ADSs would not be subject to Brazilian taxation, considering the general and unclear scope thereof and the lack of any definitive judicial court ruling in respect thereof, we are unable to provide any assurances that courts will agree that Linx ADSs are not assets located in Brazil for purposes of Law No. 10,833. If ADSs are considered assets located in Brazil, gains on disposition of Linx ADSs by a Non-Brazilian Holder may be subject to income tax in Brazil according to the tax rules applicable to Linx Shares, as explained above.

| Q: | What will be the accounting treatment of the Merger? |

| A: | In accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), TOTVS will account for the Merger as a business combination applying the acquisition method of accounting with TOTVS as the acquiror. |

| Q: | When and where is the Linx Special Meeting? |

| A: | The Linx Special Meeting will be held on , 2020 at the headquarters of Linx. Linx’s headquarters are located at the following address: Avenida Doutora Ruth Cardoso, 7221, 7th floor, São Paulo, State of São Paulo, Brazil, 05425-902. |

| Q: | Who is entitled to vote at the Linx Special Meeting? |

| A: | Under Brazilian law, persons who were holders of record of Linx Shares as of the date of the Linx Special Meeting have the right to vote for or against the Merger at the Linx Special Meeting. Holders of Linx ADSs will be able to give voting instructions in accordance with the voting procedures of the Linx Deposit Agreement but are not entitled to vote directly or attend the Linx Special Meeting. For more information on the voting procedures for holders of Linx ADSs, see “The Linx Special Meeting—Manner of Voting—Holders of Linx ADSs”. |

| Q: | Have the Linx Board of Directors, the Linx Independent Directors or the TOTVS Board of Directors taken any position relating to the Merger? |

| A: | The full Linx Board of Directors has not taken a position relating to the Merger in view of possible conflict of interests from three of its members arising from their participation in the transaction agreements of a proposed business combination between Linx and StoneCo Ltd. (“StoneCo” and the “Stone Transaction”). Therefore, Linx determined that negotiations, assessment and decisions related to the Merger Proposal should be conducted by Linx Independent Directors. |

TOTVS Board of Directors unanimously approved the Merger Proposal on August 13, 2020 and the Merger Protocol was signed by Linx Independent Directors and TOTVS Directors on .

| Q: | What happens if I transfer or sell my Linx Shares or my Linx ADSs before the Linx Special Meeting or before completion of the Merger? |

| A: | You must hold Linx Shares immediately prior to the Linx Special Meeting in order to be entitled to vote at the meeting. If you hold Linx ADSs, you will be subject to a record date in accordance with the Linx Deposit Agreement, which will be earlier than the date of the Linx Special Meeting. If you transfer or sell your Linx Shares or Linx ADSs after the Linx Special Meeting but prior to the completion of the Merger, you will have transferred the right to receive the Merger Consideration in the Merger to such transferee and you will lose your right to receive the Merger Consideration. In order to receive the Merger Consideration, you must hold your Linx Shares or Linx ADSs through the record date selected by TOTVS in accordance with the Merger Protocol. If you hold Linx ADSs, you may need to comply with additional procedures and be subject to different record dates in accordance with the Linx Deposit Agreement. |

| Q: | What happens if I do not vote? |

| A: | If you are a holder of Linx Shares and you do not vote, and if you do not act to exercise your withdrawal rights as a shareholder of Linx within 30 days of the publication by Linx of the minutes of the extraordinary general shareholders meeting at which the Merger is approved, you will automatically receive the Merger Consideration applicable to the number of Linx Shares or Linx ADSs, as applicable, that you own, provided that you hold such Linx Shares or Linx ADSs through the record date selected by TOTVS in accordance with the Merger Protocol. |

If you are a holder of Linx ADSs and you do not give timely voting instructions in respect of your Linx ADSs to the Linx Depositary, the Linx Depositary will deem that you have instructed the Linx Depositary to give a discretionary proxy to a person designated by Linx to vote the underlying Linx Shares.

| Q: | What if I own TOTVS Shares in addition to Linx Shares? |

| A: | Please note that this document is not a proxy or solicitation of votes for the TOTVS Special Meeting that will be held in connection with the Merger. If you are a holder of TOTVS Shares in addition to Linx Shares, you will receive information from TOTVS separately regarding the TOTVS Special Meeting, including details on what matters will be voted on and instructions on how to vote at the TOTVS Special Meeting. |

| Q: | What should I do now, as a holder of Linx Shares or Linx ADSs? |

| A: | You should review the materials provided in this prospectus and the documents incorporated by reference, and you should prepare to vote on the date of the Linx Special Meeting or give voting instructions in accordance with the Linx Deposit Agreement, as applicable. Note that, if you are a holder of Linx Shares and you vote in favor of the Merger Proposal, you will not be able to exercise your withdrawal rights under Brazilian law. Holders of Linx ADSs will not be able to exercise any withdrawal rights. |

| Q: | Who can help answer my questions? |

| A: | If you have any questions about the proposed merger, you should contact TOTVS at the following address: |

TOTVS S.A.

Avenida Braz Leme, 1000

São Paulo, State of São Paulo, 02511-000

Brazil

Tel: +55 11 2099-7773

Attention: Investor Relations Team

http://ir.TOTVS.com.br

| Q: | Where can I find more information about TOTVS and Linx? |

| A: | You can find out more information about TOTVS and Linx from the various sources described in the section entitled “Where You Can Find More Information”. |

SUMMARY

The following is a summary that highlights information contained in this prospectus. This summary may not contain all the information that is important to you. For a more complete description of the Merger, the Merger Protocol and the transactions contemplated thereby, we encourage you to read carefully this entire prospectus, including the exhibits to the registration statement of which this prospectus is a part. In addition, we encourage you to read the information incorporated by reference into this prospectus, which includes important business and financial information about Linx and TOTVS that has been filed with the SEC. You may obtain the information incorporated by reference into this prospectus without charge by following the instructions in the section entitled “Where You Can Find More Information”.

Information about the Companies

TOTVS

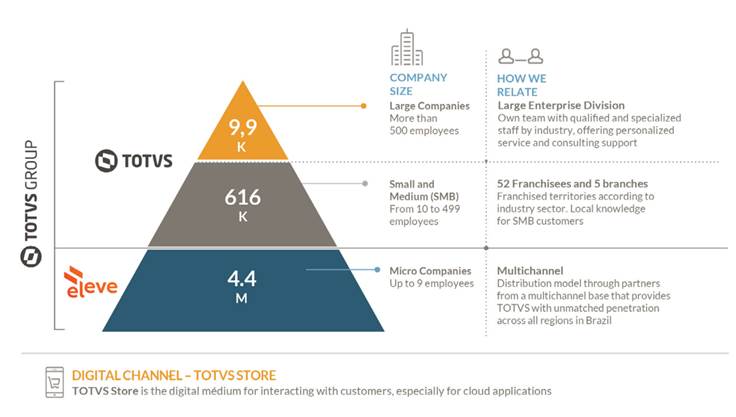

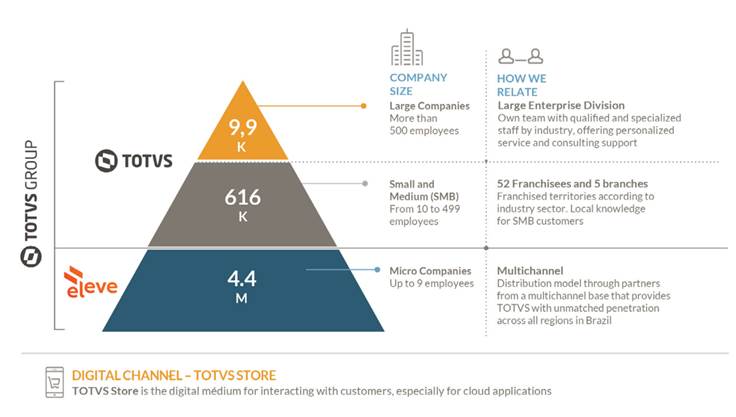

TOTVS is one of the leading companies in integrated enterprise resource planning, or ERP software, in Brazil, according to the Enterprise Application Software Worldwide study issued by Gartner in 2020. According to the same study, we have 30% of the ERP software market share in Latin America and are an important player in the region. We have been operating for more than 36 years providing companies of all sizes with business solutions, management software, technological platforms and consulting services.

Our principal place of business is located at Avenida Braz Leme, 1000, São Paulo, State of São Paulo. Brazil, 02511-000, telephone: +55 11 2099-7773. TOTVS’s website address is: http://ri.totvs.com.br.

Linx

Linx is one of the leading cloud-based technology companies in Latin America and a relevant player in Brazil in terms of revenue. Linx is focused on developing and providing affordable, easy-to-use, reliable and seamlessly integrated software solutions to retailers in Latin America, through its software-as-a-service, or SaaS, business model. With a comprehensive offering of solutions, Linx is an end-to-end service provider that offers business management tools, payment solutions, e-commerce and omni-channel applications through an integrated and ever-evolving platform to retailers of all sizes and capabilities.

As of the date of this prospectus, Linx’s corporate headquarters are located at Avenida Doutora Ruth Cardoso, 7221, 7th floor, São Paulo, SP, 05425-902. Its telephone number at this address is +55-11-2103-1575 and its website is www.linx.com.br.

Merger Vehicle

Merger Vehicle is a closely held corporation that is a wholly owned subsidiary of TOTVS. Merger Vehicle has no assets or operations as of the date hereof. Upon the closing of the Merger, Merger Vehicle will merge into TOTVS and no longer exist.

Risk Factors

The Merger involves risks, some of which are related to the Merger itself and others of which are related to TOTVS’s and Linx’s respective businesses and to investing in and ownership of TOTVS Shares and TOTVS ADSs following the Merger, assuming the Merger is completed. In considering the Merger, you should carefully consider the information about these risks set forth under the section entitled “Risk Factors”, together with the other information included in or incorporated by reference into this prospectus.

The Merger and the Merger Protocol

The proposed Merger involves a business combination between Linx and TOTVS pursuant to which, upon closing, Linx will become a wholly owned subsidiary of TOTVS and Linx Shareholders will become