Filed by TOTVS S.A. pursuant to Rule 425 under the Securities Act of 1933

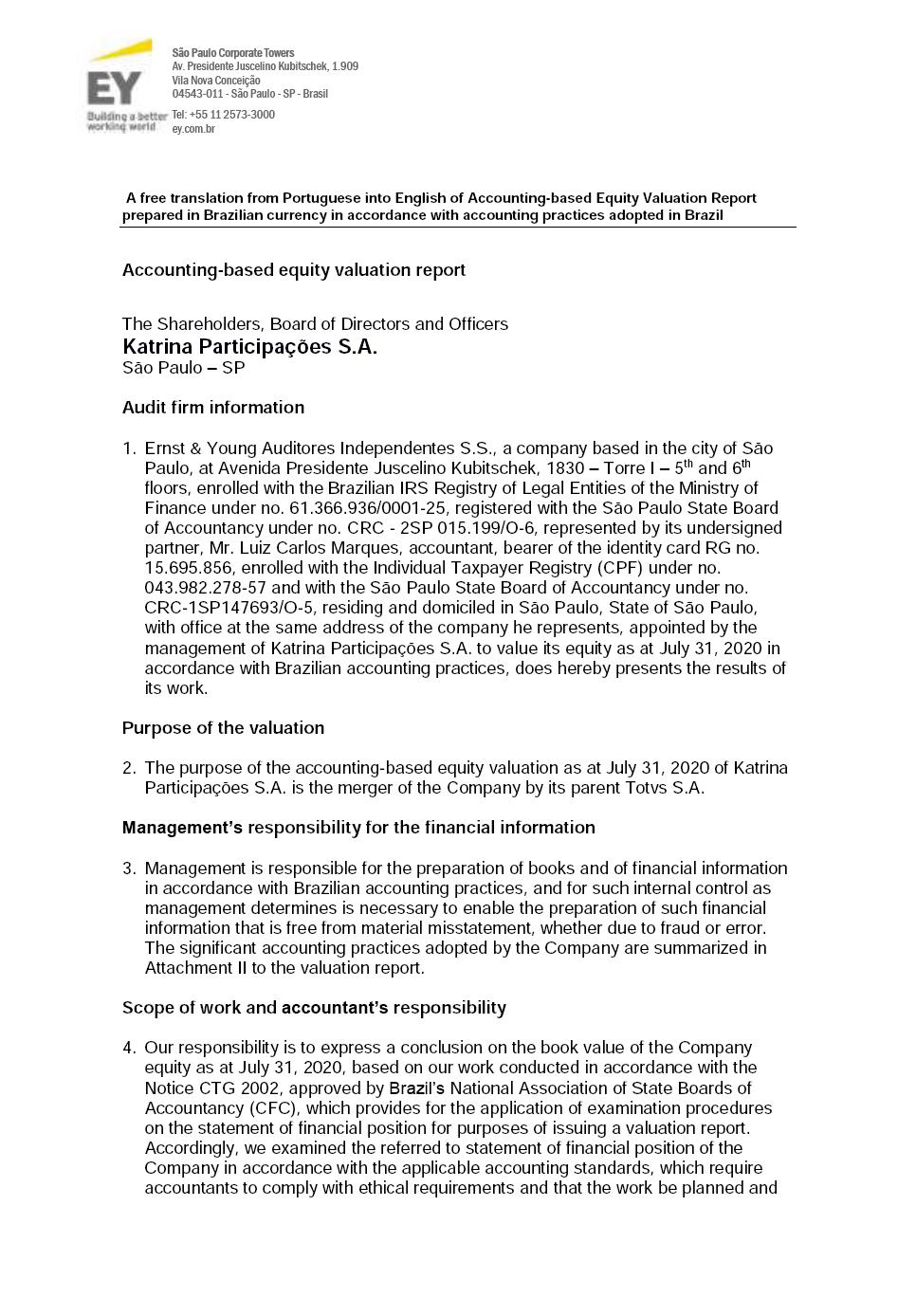

Subject Company: Linx S.A.

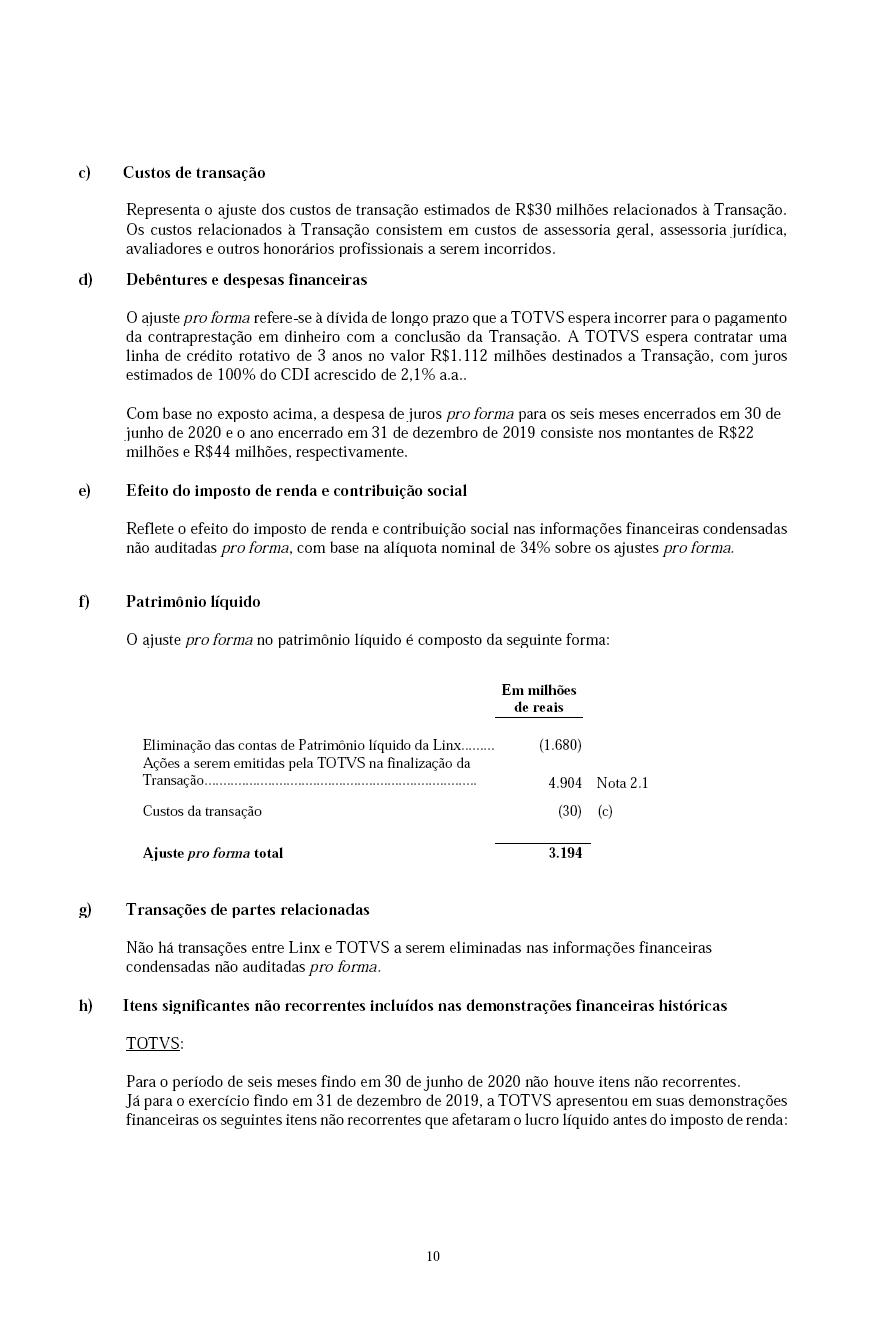

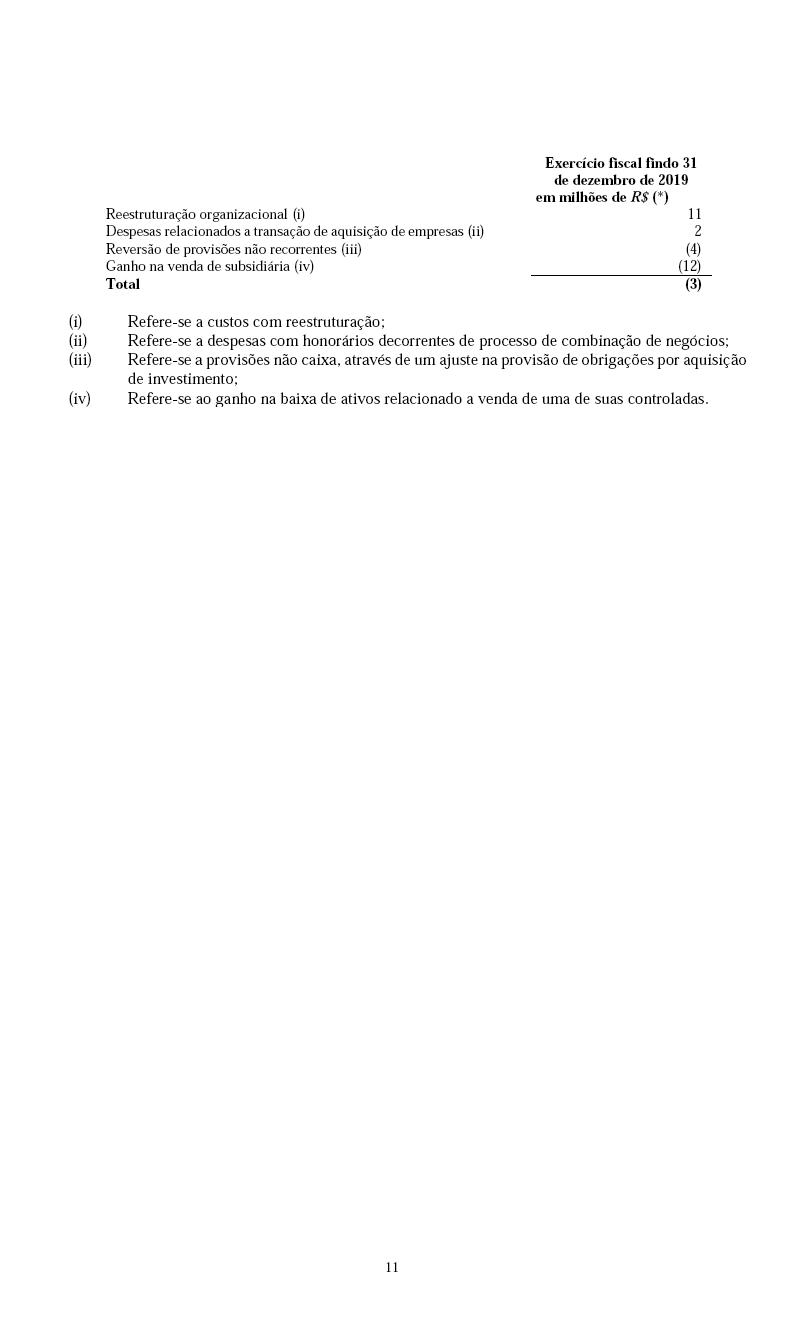

Filer’s Commission File Number: [●]

Subject Company’s Commission File Number: 001-38954

Date: October 28, 2020

Announcement Regarding the Merger

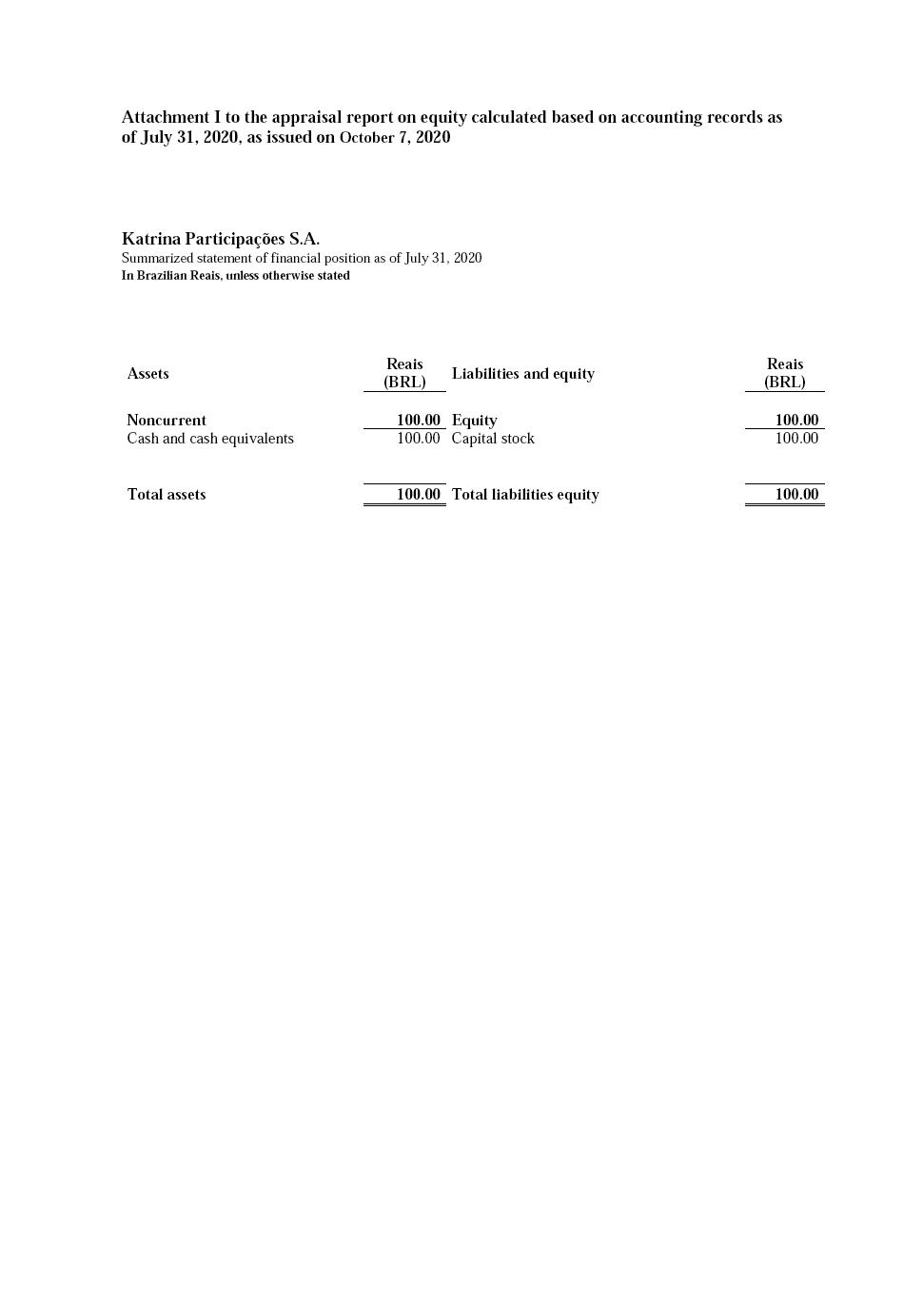

On October 27, 2020, TOTVS S.A., a Brazilian corporation (“TOTVS”), filed the following documents with the Brazilian Exchange Commission (“CVM”) in connection with the proposed business combination (“Transaction”) of TOTVS and Linx S.A. (“Linx”):

| | 1. | Material fact, regarding the call notice for the Extraordinary Shareholders Meeting of TOTVS to be held on November 27, 2020, at 10:00a.m. (“Shareholders Meeting”) (Exhibit 1); |

| | 2. | Call notice, inviting the shareholders of TOTVS to the Shareholders Meeting, at the headquarters of TOTVS, to consider and vote on the agenda described therein, in accordance with the management proposal of TOTVS (Exhibit 2); |

| | 3. | Management proposal and proxy statement of TOTVS with respect to the Shareholders Meeting, together with its appendices (Exhibit 3); |

| | 4. | Distance voting ballot for the Shareholders Meeting (Exhibit 4). |

| | | |

| | 5. | Protocol and Justification of Merger of Shares Issued by Linx S.A. into Katrina Participações S.A., followed by merger of Katrina Participações S.A. into TOTVS S.A. (Exhibit 5) |

| | | |

| | 6. | TOTVS’s Audit Committee opinion issued on October 23, 2020 (Exhibit 6) |

| | | |

| | 7. | Minutes of TOTVS’s Board of Directors meeting held on October 23, 2020 (Exhibit 7) |

Free translations into English of the above-mentioned documents are attached as Exhibits to this Form.

No Offer or Solicitation

This Notice is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to subscribe for or buy shares, nor is it a substitute for any offer materials that TOTVS will, if required, file with the U.S. Securities and Exchange Commission (“SEC”). No offer of securities will be made in the United States except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or pursuant to a waiver therefrom.

Additional Information and where it can be found

In connection with the proposed business combination, TOTVS will file with the U.S. SEC all relevant materials as required by the required by applicable laws and regulations. INVESTORS ARE URGED TO READ THE SCHEDULE TO, REGISTRATION STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION ABOUT THE PROPOSED BUSINESS COMBINATION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TOTVS, LINX AND THE PROPOSED BUSINESS COMBINATION AND RELATED MATTERS. All documents filed with the SEC that are related to the proposed transaction will be available when filed, free of charge, on the SEC website - www.sec.gov - and also on the TOTVS investor relations website - http://ri.totvs.com/.

Forward-looking Statements

This Notice may contain forward-looking statements. Such statements are not historical facts, and are based on TOTVS’ management’s current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the company or the proposed business combination, are intended to identify forward-looking statements. Statements connected to the statement or payment of dividends, the implementation of the key operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends that could affect the Company’s financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of the Management and are subject to a number of risks and uncertainties. There is no guarantee that such expected events, trends or results will actually take place. Such statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

EXHIBIT 1

TOTVS S.A.

A publicly-held Corporation

Corporate Taxpayer Id. (CNPJ/ME) No. 53.113.791/0001-22

Company Registry (NIRE) 35.300.153.171

MATERIAL FACT

TOTVS S.A. (B3: TOTS3) (hereinafter referred to as “TOTVS”) hereby informs that, on this date, an extraordinary general meeting of its shareholders was called to resolve on the proposal to perform a corporate restructuring involving TOTVS, its subsidiary Katrina Participações S.A. (“Katrina”) and Linx S.A. (“Linx” and, jointly with TOTVS and Katrina, referred to as the “Companies”) that was the subject of a Protocol and Justification (“Protocol and Justification”) which, once approved by the shareholders of TOTVS and Katrina, will be submitted to Linx's shareholders, and will result (a) in TOTVS holding all the shares issued by Linx; and (b) in Linx's1 shareholders receiving (i) one common share issued by TOTVS, adjusted as provided in such Protocol and Justification, for each share issued by Linx that they own on the date the Transaction is consummated, and (ii) R$ 6.20 (six Reais and twenty cents), adjusted pro rata by the variation of the CDI rate, from the sixth month counted from August 14, 2020, considering that on the date the Transaction is consummated the total capital stock of Linx is represented by 179,428,737 (one hundred and seventy-nine million, four hundred and twenty-eight thousand, seven hundred and thirty-seven) common shares, ex-treasury. These amounts are also subject to the adjustments provided for in section 2 of such Protocol and Justification, being proposed that TOTVS's management is to proceed with such adjustments within the limits set forth in the Protocol and Justification, without the need for a new shareholders’ meeting approval.

The call of the shareholders’ meeting of TOTVS, as another important step towards the consummation of the Transaction, among other objectives, meets the expectations of the independent directors of Linx who, in interactions with the management of TOTVS and in public interviews, expressed (an unjustified) fear about the firmness of TOTVS’ proposal and the approval of the Transaction by TOTVS’ shareholders. Therefore, TOTVS’ management, having consulted a number of its main shareholders and in view of the positive opinions received, decided to promptly call the company’s shareholders to express their opinion on the Transaction first, before even submitting the matter to Linx’s shareholders, as TOTVS’ management firmly believes in the benefits that the Transaction will bring to both companies, their shareholders and other stakeholders.

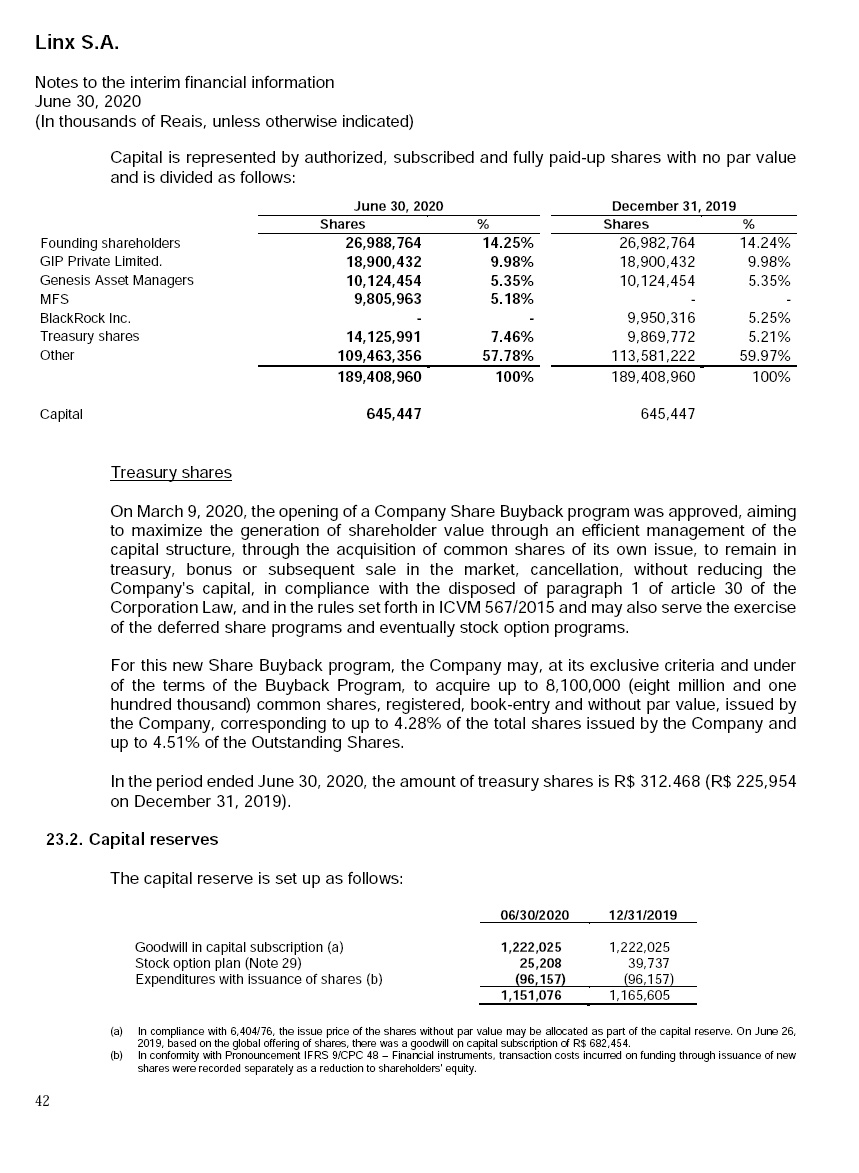

1This estimate considered that, on the date of consummation of the Transaction, there will be 179,428,737 shares of Linx (considering a total of 189,408,960 shares, excluding 14,125,991 shares in treasury and including 4,145,768 shares resulting from the early vesting of stock option plans and deferred shares). The number of outstanding shares of Linx may vary until the date of consummation of the Transaction.

This new step towards the conclusion of the process of the proposed business combination between TOTVS and Linx is another formal demonstration of the commitment of TOTVS’ management in making progress towards the success of this advantageous business combination.

Accordingly, TOTVS’ management provides a firm response once again and expects to receive a confirmation of this response from its own shareholders in regard to the expectations and comments made by Linx’s independent directors. TOTVS’ management firmly believes that, as publicly expressed by these directors, TOTVS’ proposal will continue to be examined in view of their legal duties and key fiduciary obligations as members of management of a publicly-held company, acting in benefit of all Linx’s shareholders, in a consistent and equanimous manner, and, to this end, promoting a procedure that will allow Linx’s shareholders to vote and choose the best proposal, without the undue coercion already established as illegitimate by the self-regulatory agency, and without the granting of asymmetric benefits to certain shareholders (whose necessary abstention, also established by the Brazilian Securities Commission (Comissão de Valores Mobiliários), does not make them less illegitimate and harmful to all Linx’s shareholders, whose interests TOTVS will always respect and protect, under the Transaction, as TOTVS has always done with its own shareholders).

Once the Transaction is approved by TOTVS’ shareholders, its effectiveness will still be subject to the approval of Linx’s shareholders and Brazilian antitrust authorities, in addition to other conditions listed in the Protocol and Justification (Protocolo e Justificação).

| 1. | Companies Involved in the Transaction and Activities thereof |

1.1. TOTVS.

(a) Identification. TOTVS S.A., a publicly-held corporation incorporated under the laws of Brazil, headquartered in the city of Sao Paulo, State of Sao Paulo (Brazil) at Avenida Braz Leme, 1000, Zip code 02511-000, with Tax Id. (CNPJ/MF) No. 53.113.791/0001-22.

(b) Activities. TOTVS's purpose has been to engage, as it will continue to do so after the Transaction, in the development and implementation of management and productivity platforms specialized in the various segments in which the company operates, maintaining its registration as a publicly-held company.

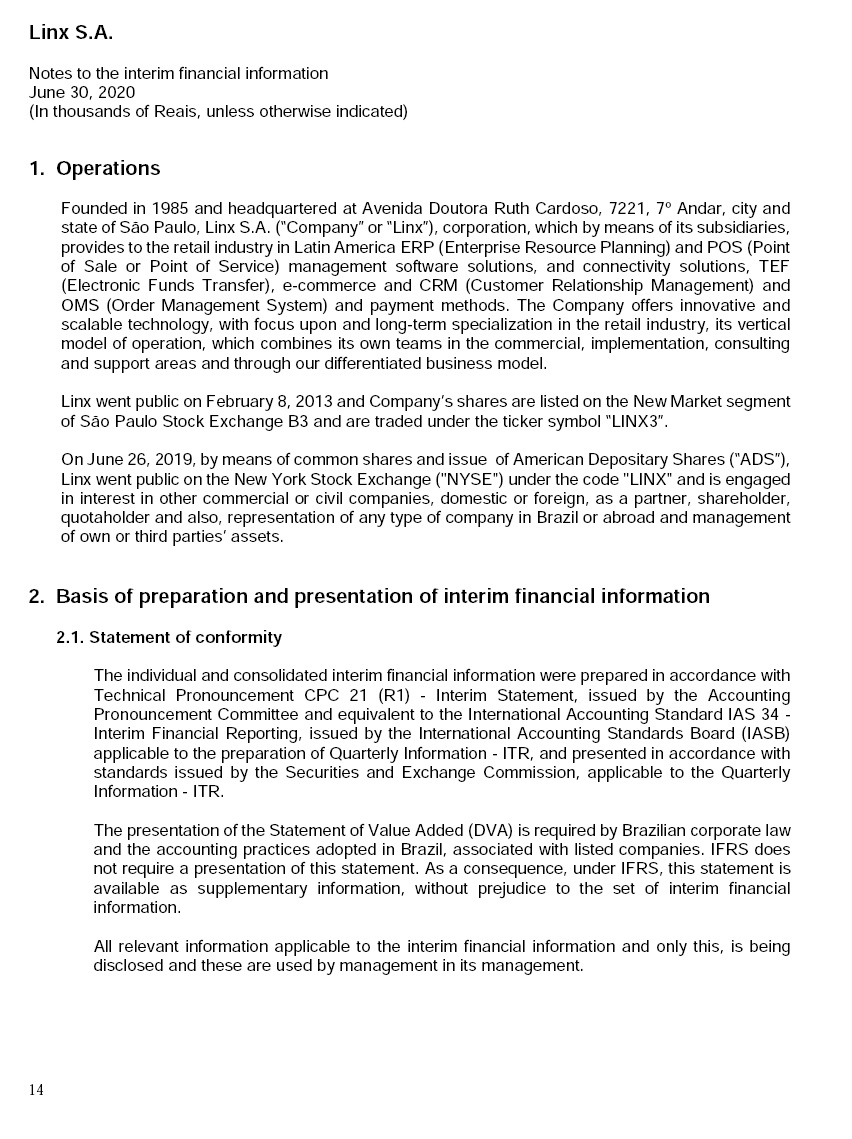

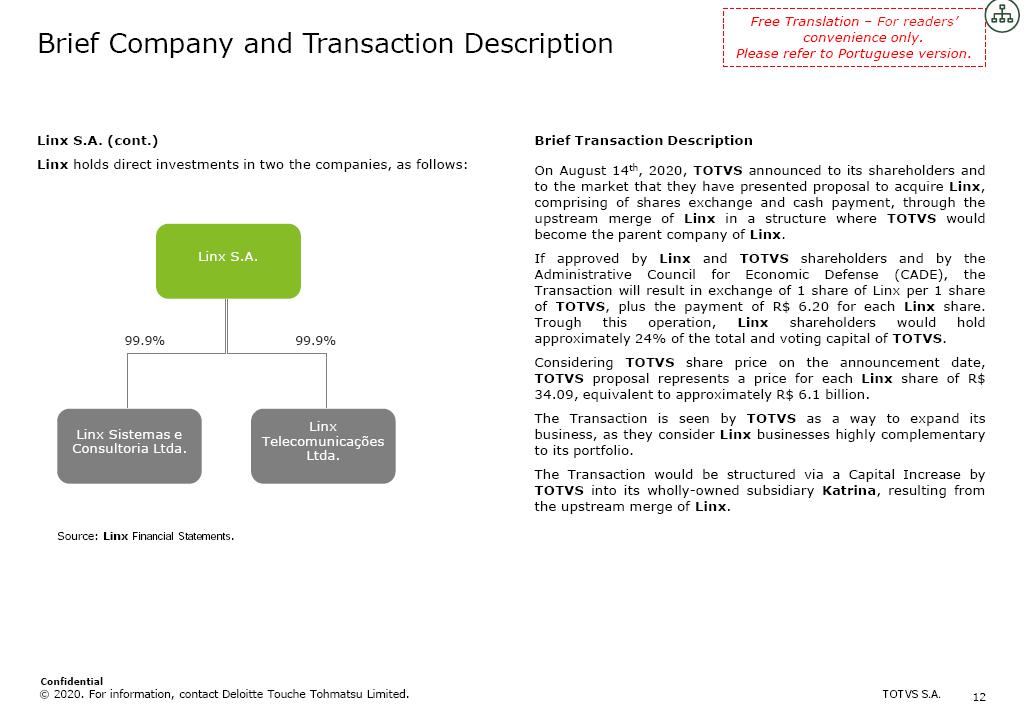

1.2. Linx.

(a) Identification. Linx S.A., a publicly-held corporation incorporated under the laws of Brazil, headquartered in the city of Sao Paulo, State of Sao Paulo (Brazil), at Avenida Doutora Ruth Cardoso, nº 7221, Cj. 701, Bl. A, room 1, Birmann 21 Building, Zip code 05425-902, registered with Corporate Taxpayer Id. (CNPJ/ME) No. 06.948.969/0001-75.

(b) Activities. Linx's main activities are the provision of infrastructure and hardware services; management, monitoring and storage of data in a cloud environment (i.e., cloud computing); advice and development of computerized systems (software); and the provision of such

systems for the management and automation of business organizations, especially in the retail industry.

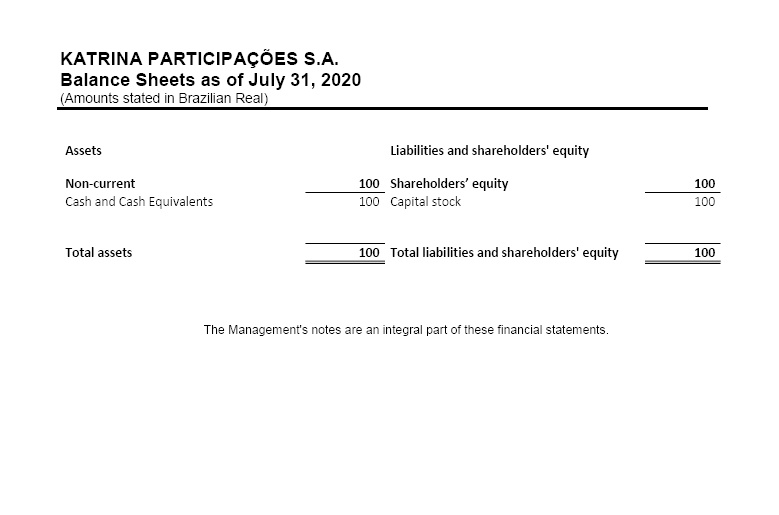

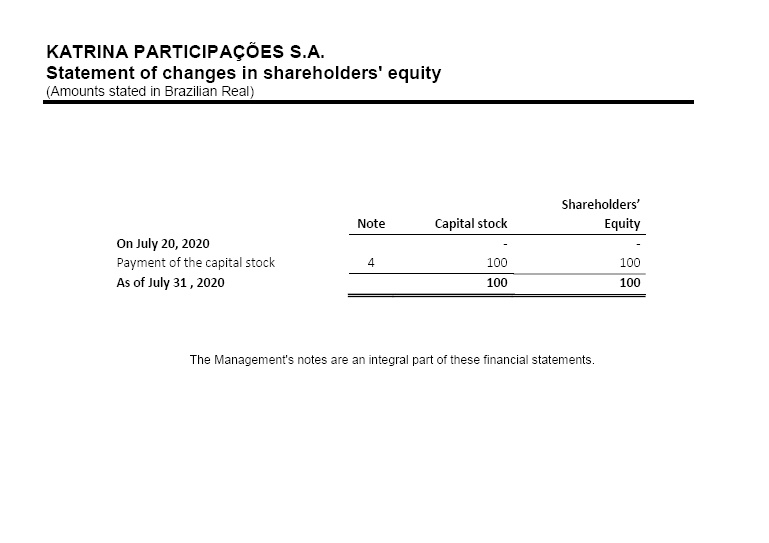

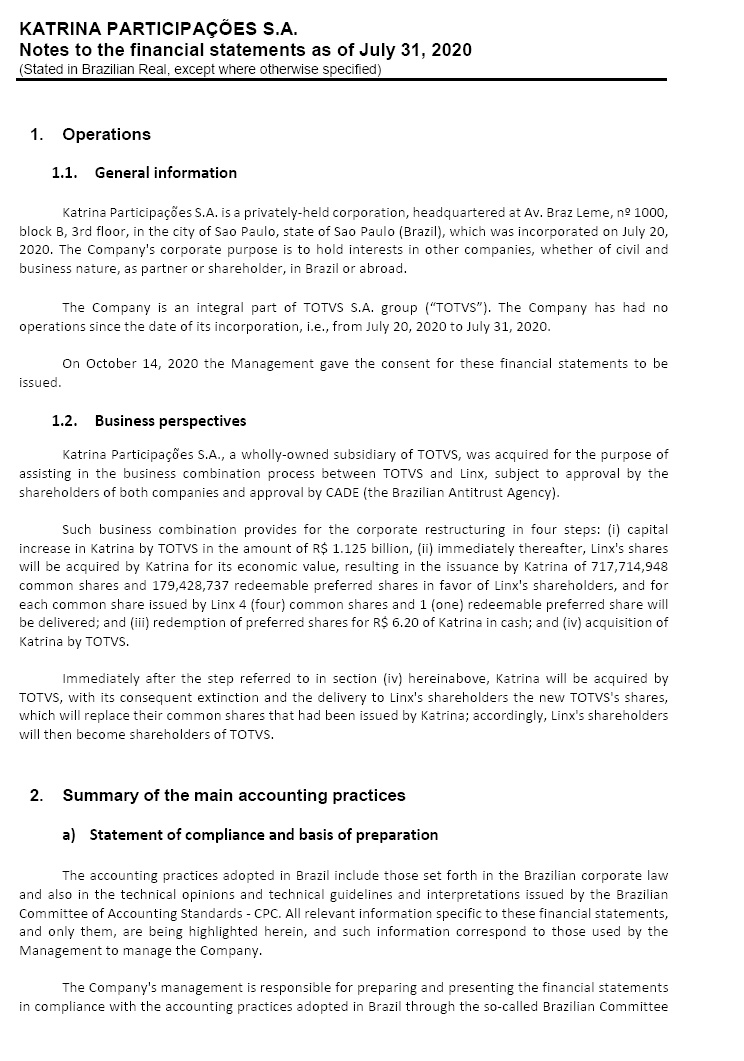

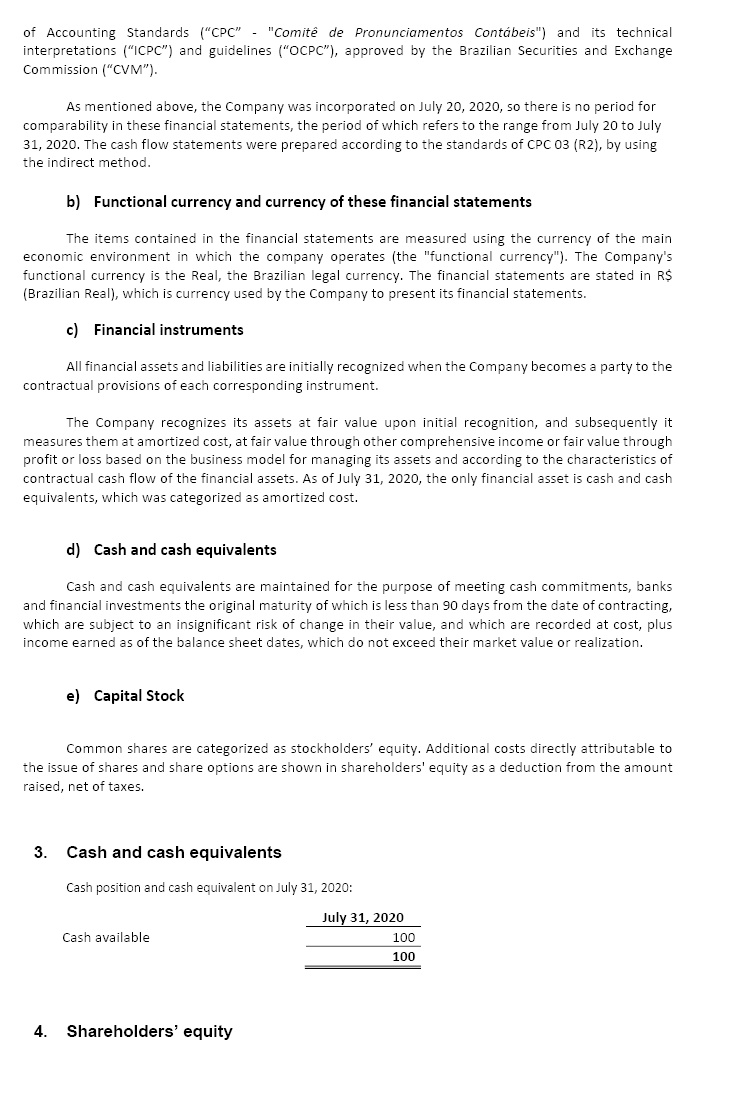

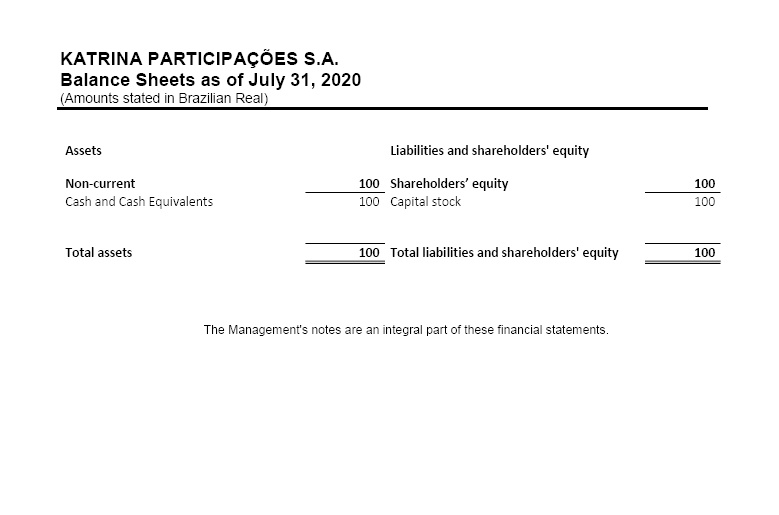

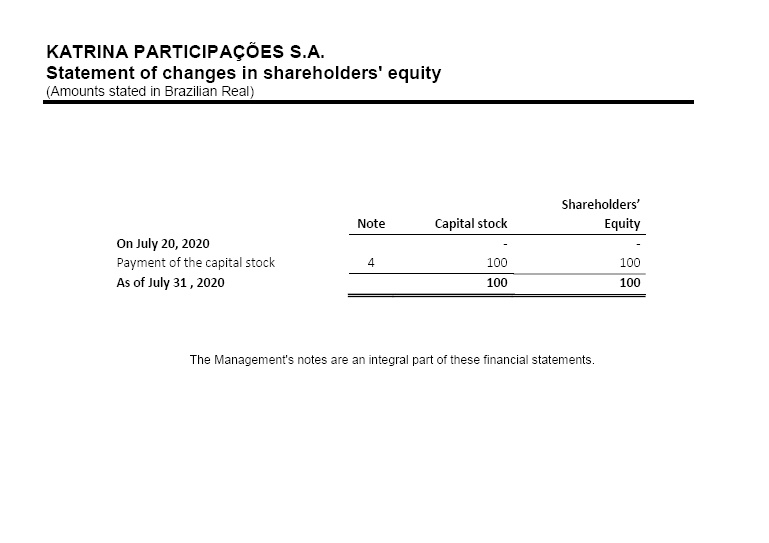

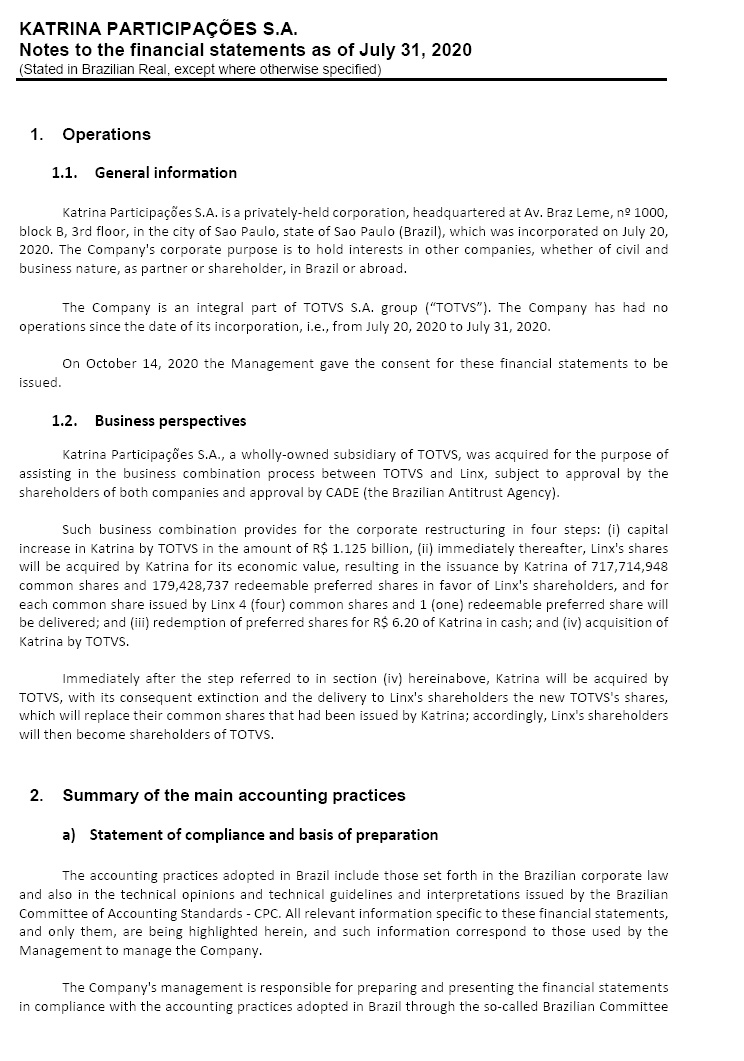

1.3. Katrina.

(a) Identification. Katrina Participações S.A., a Brazilian corporation headquartered in the city of Sao Paulo, State of Sao Paulo (Brazil), at Avenida Braz Leme nº 1,000, Block B, 3rd floor, Casa Verde district, Zip code 02511-000, with Corporate Taxpayer Id. (CNPJ/ME) No. 37.896.148/0001-66.

(b) Activities. Katrina is a non-operating company, the purpose of which is to hold interests in other companies or enterprises, and the shares of which are, on this date, fully owned by TOTVS, and which will be extinguished as a result of said Transaction.

| 2. | Description and purpose of the Transaction |

2.1. Description. The Transaction will comprise the following steps:

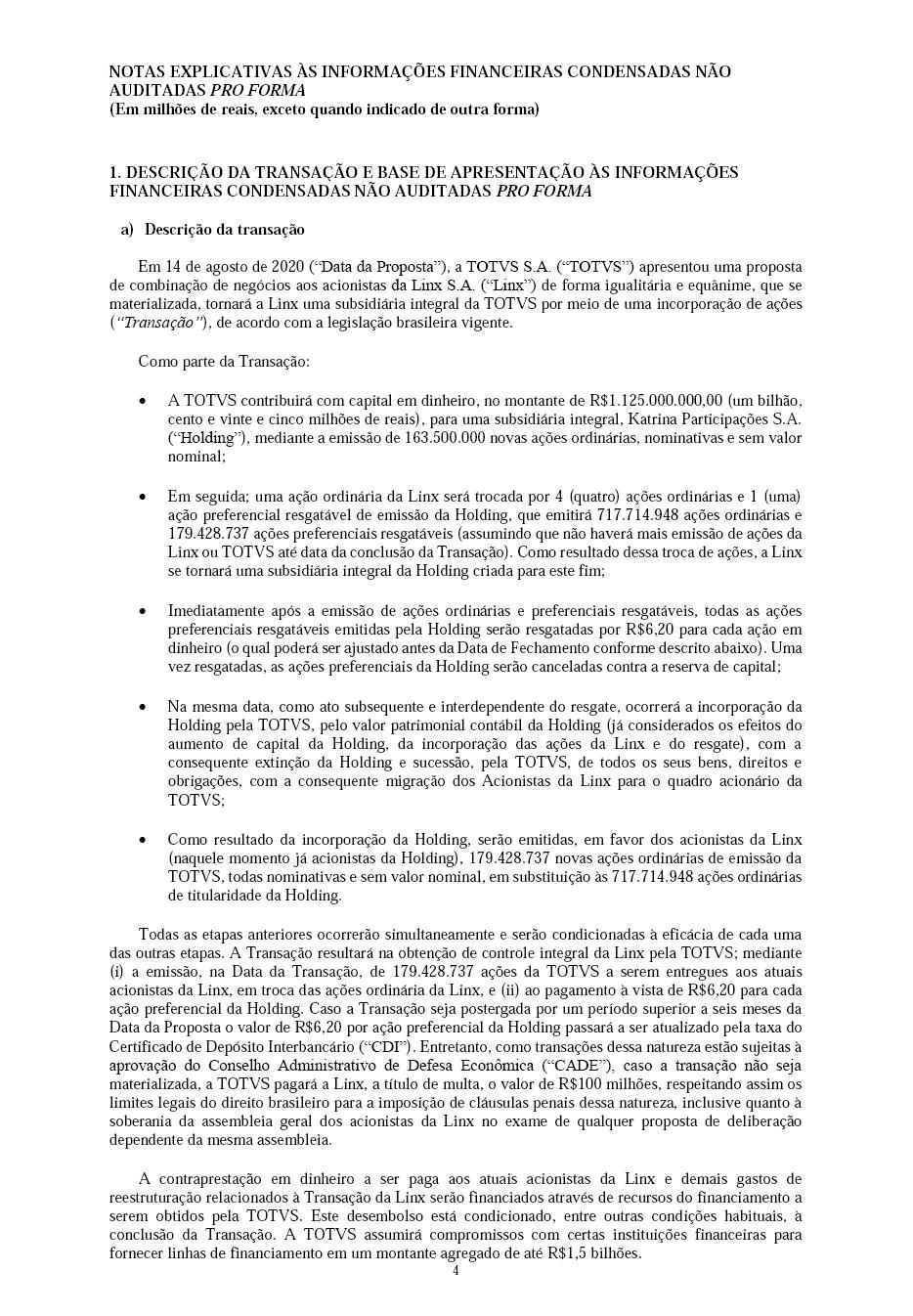

The transaction ("Transaction") will comprise the following steps:

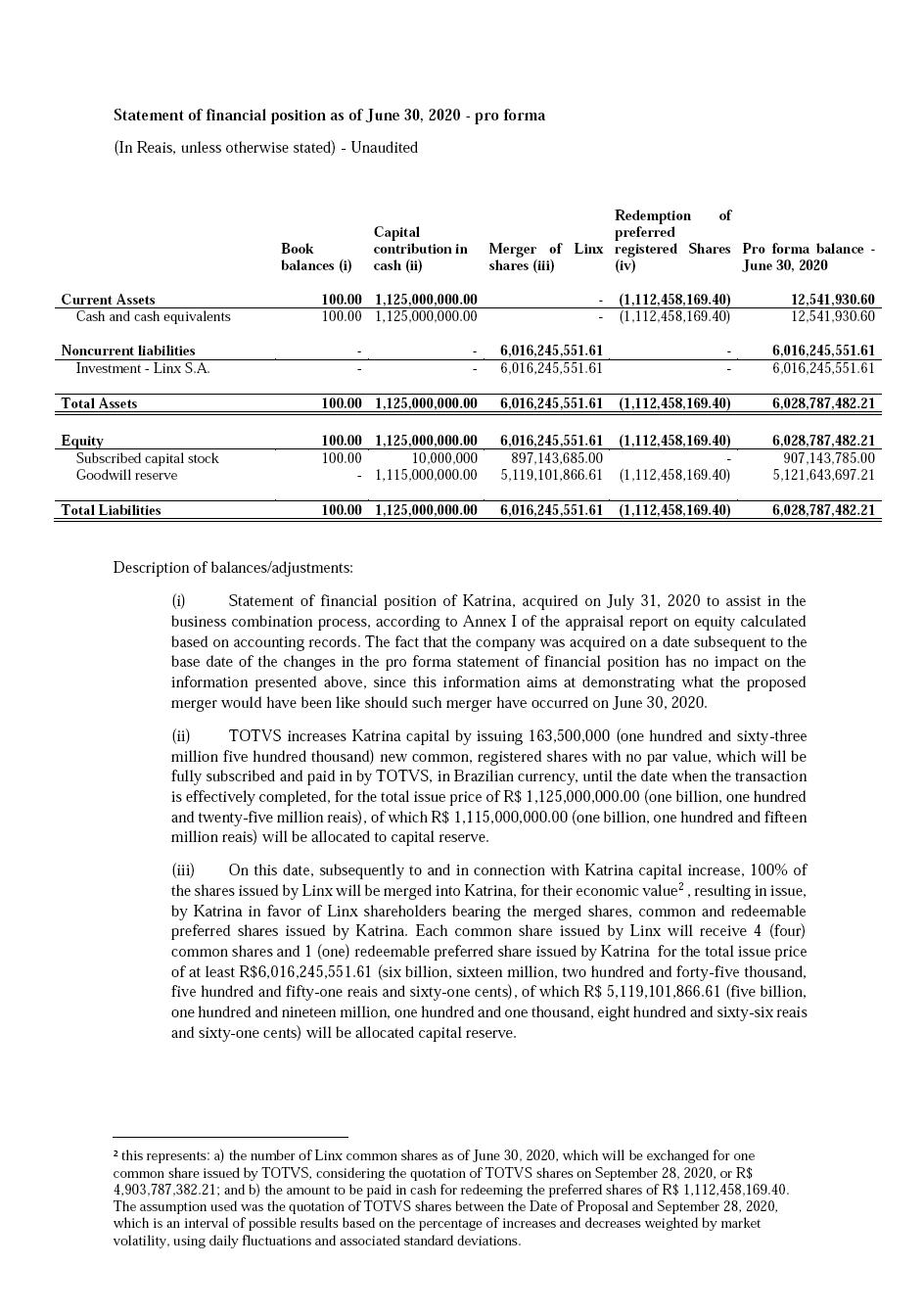

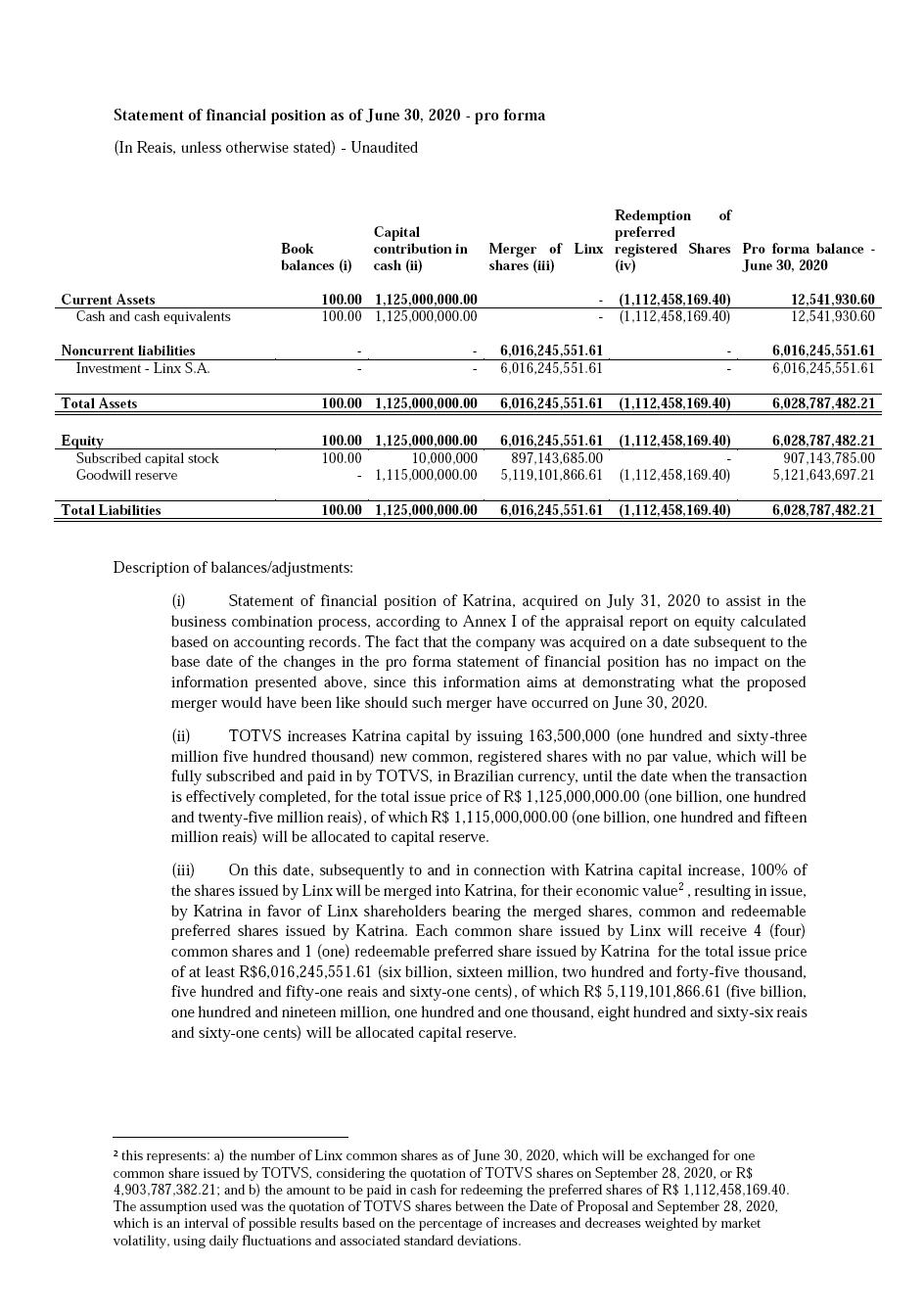

| (a) | Katrina’s capital increase upon issuance of at least one hundred sixty-three million five hundred thousand (163,500,000) new common shares without par value, which shall be fully subscribed and paid-up by TOTVS, in Reais, until the date of consummation of the Transaction (the “Closing Date”), for the total issue price of at least one billion one hundred twenty-five million Reais (R$1,125,000,000.00), of which at least one billion one hundred fifteen million Reais (R$1,115,000,000.00) shall be allocated for the creation of a capital reserve (“Katrina Capital Increase”) |

| (b) | on the same date, as a subsequent and interdependent act of Katrina’s Capital Increase, a merger of all the shares issued by Linx into Katrina, by their book value, resulting in the issuance by Katrina, to the shareholders of Linx who owned the merged shares (“Linx’s Shareholders”), of common shares and redeemable preferred shares issued by Katrina, provided that for each common share issued by Linx four common shares and one redeemable preferred share issued by Katrina shall be delivered, as set forth in the Protocol and Justification (“Merger of Linx Shares”) for the total issue price of at least six billion sixteen million two hundred forty-five thousand five hundred fifty-one Reais and sixty-one cents (R$6,016,245,551.61), of which at least five billion one hundred nineteen million one hundred one thousand eight hundred sixty-six Reais and sixty-one cents (R$5,119,101,866.61) shall be allocated for the creation of a capital reserve. These amounts are subject to the adjustments provided for in section 2 of the Protocol and Justification, with TOTVS’ management being authorized to make such adjustments within the limits set forth in the Protocol and Justification, without the need for a new shareholders’ meeting approval. |

| (c) | as a subsequent and interdependent act of the Merger of Linx Shares, there will be a redemption of all the preferred shares issued by Katrina, upon payment, for each preferred share being redeemed, of the Redemption Value, as defined in the Protocol |

and Justification (the “Redemption”). Upon Redemption, Katrina’s preferred shares will be cancelled against the capital reserve; and

| (d) | on the same date, as a subsequent and interdependent act of the Redemption, which is proposed to be approved in advance with effectiveness subject to the completion of the previous steps, the merger of Katrina into TOTVS for Katrina’s equity book value (already taking into consideration the effects of Katrina’s Capital Increase, the Merger of Linx Shares and the Redemption), with the consequential winding-up of Katrina and succession, by TOTVS, of all Katrina’s properties, rights and obligations, with the consequent migration of Linx’s Shareholders to become TOTVS’s shareholders (“Merger of Katrina”). After the Transaction is consummated, Linx will preserve its own existence as a legal entity, keeping also its shareholders' equity, and no legal succession will take place. |

The completion of the Merger of Linx's Shares, the Redemption and the Merger of Katrina will depend on the following acts ("Corporate Approvals"), which, to the exception of the extraordinary general meeting of TOTVS, already called, should tentatively take place on the same date:

| (a) | extraordinary general shareholders meeting of Linx to, in the following order, (i) confirm that the provisions of Article 43 of Linx's Bylaws will not be applicable to the Transaction, in the sense that it will not be required to perform the mandatory tender offer to acquire Linx's shares as provided for therein; (ii) approve the Protocol and Justification; (iii) approve the Transaction; and (iv) authorize the subscription, by its managers, of the new shares to be issued by Katrina; |

| (b) | extraordinary general shareholders meeting of Katrina to, in the following order, (i) approve Katrina's Capital Increase; (ii) approve the Protocol and Justification; (iii) ratify the appointment of auditors Deloitte Touche Tohmatsu Consultores Ltda. (“DTT”) to perform the appraisal and determine the market value of the shares issued by Linx to be merged into Katrina, already considering the effects of the Katrina's Capital Increase (“Linx Shares Appraisal Report”); (iv) approve the Linx Shares Appraisal Report of Linx's Shares; (v) approve the creation of a new class of preferred shares; (vi) approve the Merger of Linx's Shares; (vii) approve the capital increase to be subscribed and paid in by Linx's managers, with the consequent amendment to its bylaws; (viii) approve the Redemption, with the consequent amendment to its bylaws; (ix) approve the Merger of Katrina into TOTVS; and (x) authorize the subscription, by its managers, of the new shares issued by TOTVS; and |

| (c) | extraordinary general shareholders meeting of TOTVS, called on this date, to, in the following order, (i) examine, discuss and approve the Protocol and Justification, as proposed by TOTVS management to be subsequently submitted to Linx's shareholders; (ii) ratify the appointment of the specialized auditing company Ernst & Young Auditores Independentes S.S. (“EY”), as responsible for preparing the appraisal report of Katrina shareholders' equity to be considered for the Merger of Katrina into TOTVS, as an act subsequent to the merger of Linx's shares into Katrina and the Redemption referred to in the Protocol and Justification (the “Katrina Appraisal Report”); (iii) approve Katrina Appraisal Report; (iv) approve the |

proposed Transaction under the terms of the Protocol and Justification, the consummation of which will be subject to its subsequent approval by Linx's shareholders and by the Brazilian antitrust authorities, and to the other conditions as provided for in section 3.1 of the Protocol and Justification; (v) approve, once the merger of Katrina is completed, the increase of TOTVS's capital stock by issuing 179,428,737 (one hundred and seventy nine million, four hundred and twenty eight thousand and seven hundred and thirt seven) new common shares for the total issue price of R$4,910,209,947.18 (four billion, nine hundred and ten million, two hundred and nine thousand, nine hundred and forty-seven reais and eighteen cents)2, of which R$738,832,883.03 is allocated to the capital stock and the amount of R$4,171,377,064.16 was destined to the formation of a capital reserve, pursuant to the provisions of Article 182, Paragraph 1, 'a' of Law 6,404/76, all to be subscribed and paid in by Katrina's managers, for the benefit of its shareholders, with the consequent amendment to Article 5 of the TOTVS’ bylaws; and (vi) approve the investment by TOTVS in Katrina, in an amount sufficient to pay the Redemption Value (as defined in the Protocol and Justification) in the amount of at least R$1,125,000,000 (one billion, one hundred and twenty-five million Reais), adjusted as provided for in section 2 of the Protocol and Justification, upon the subscription of new shares, with the TOTVS’ management being authorized to make such adjustments within the limits set for therein, and for that purpose a new authorization by a meeting will not be required.

After all such corporate approvals, the Transaction will be consummated, and the shares issued by Linx will no longer be traded, within a maximum period of 10 business days from the implementation of the following conditions: (i) approval of the Transaction by CADE (the Brazilian Antitrust Agency); (ii) effectiveness of TOTVS’s registration statement on form 4 with the SEC (“Form F-4”) for the purpose of calling, performing, and approving the Transaction by the corresponding General Shareholders' Meeting of Linx; (iii) confirmation by Linx or by TOTVS, as the case may be, of the obligations to maintain the normal course of business, and other obligations, and the absence of a Material Adverse Change, as provided for in the Protocol and Justification; (iv) confirmation, by Linx or by TOTVS, as the case may be, of the veracity and accuracy in all its relevant aspects of the representations and warranties provided in the Protocol and Justification, being the sole responsibility of the other party, at its sole discretion, to expressly waive the confirmation of one or another representation; (v) (i) Linx shall have obtained the third-party consents for agreements which the early maturity would result in an amount equal to or higher than fifty million Reais (R$50,000,000.00), individually or in the aggregate; (ii) nonexistence of obligations that excee fifty million Reais (R$50,000,000.00), individually or in the aggregate, which may have their early maturity or other applicable penalties declared as a result of the Transaction (“Obligations Subject to Early Maturity”); (iii) settlement, by Linx, of all Obligations Subject to Early Maturity, in full and without any future obligations for Linx as a result of such settlement; or (iv) availability of cash at Linx, in an amount corresponding to at least 100% of the amount required to settle all Obligations Subject to Early Maturity (including any applicable penalties); (vi) absence of any law or order issued or enacted by a competent

2 Katrina's equity value corresponding to the interest of Linx's shareholders after the Merger of Linx's Shares into Katrina and the Redemption.

governmental authority, court, judicial authority or arbitration panel that could prevent the Transaction to be consummated; and (vii) compliance by the parties of the corresponding relevant obligations under the Protocol and Justification.

2.1.1. The Companies will disclose a new "Material Fact" on the date the Transaction is consummated.

2.2. Purpose of the Transaction. The purpose of the Transaction is to merge Linx into TOTVS with Linx becoming a wholly-owned subsidiary of TOTVS, and as a result thereof Linx's Shareholders will receive, for each share issued by Linx that they own on the date the Transaction is consummated, (i) one common share issued by TOTVS, adjusted as provided for in the Protocol and Justification, in addition to (ii) R$ 6.20 (six Reais and twenty cents), adjusted pro rata by the CDI rate variation starting from the sixth month counted from August 14, 2020 and adjusted as provided for in the Protocol and Justification.

| 3. | Key benefits, costs and risks of the Transaction |

3.1. Key Benefits. The operation aims to create a reference company in the software and technology market, with extensive capillarity and extensive experience in several business verticals, capable of extracting value from the operating and financial synergies resulting from such combination. In the view of TOTVS, the following strategic attributes make the Transaction meritorious for the shareholders of both Companies:

- The combination of said Companies would create the largest software and technology company in Latin America with shares listed on the stock exchange, supported by a solid financial and cash generation performance. Its competitive position, as well as its scale of business, would turn the combined company into the fittest candidate to lead the growing market for cloud-based SaaS solutions in Brazil.

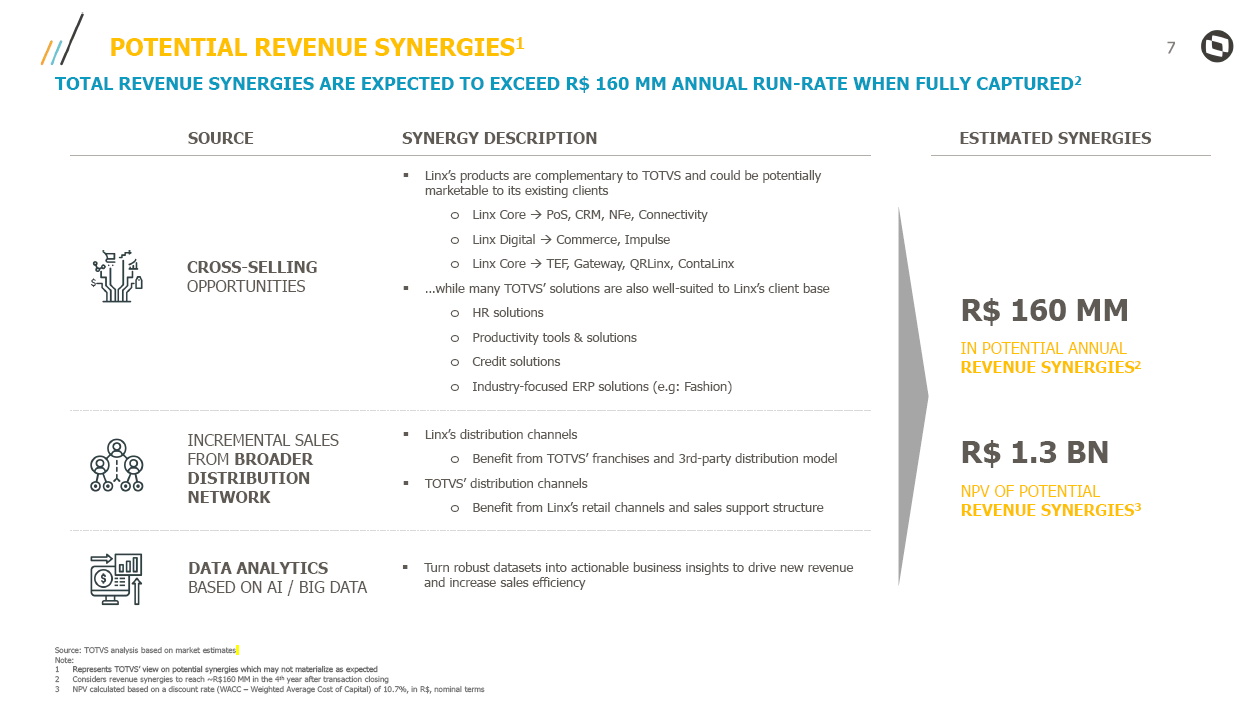

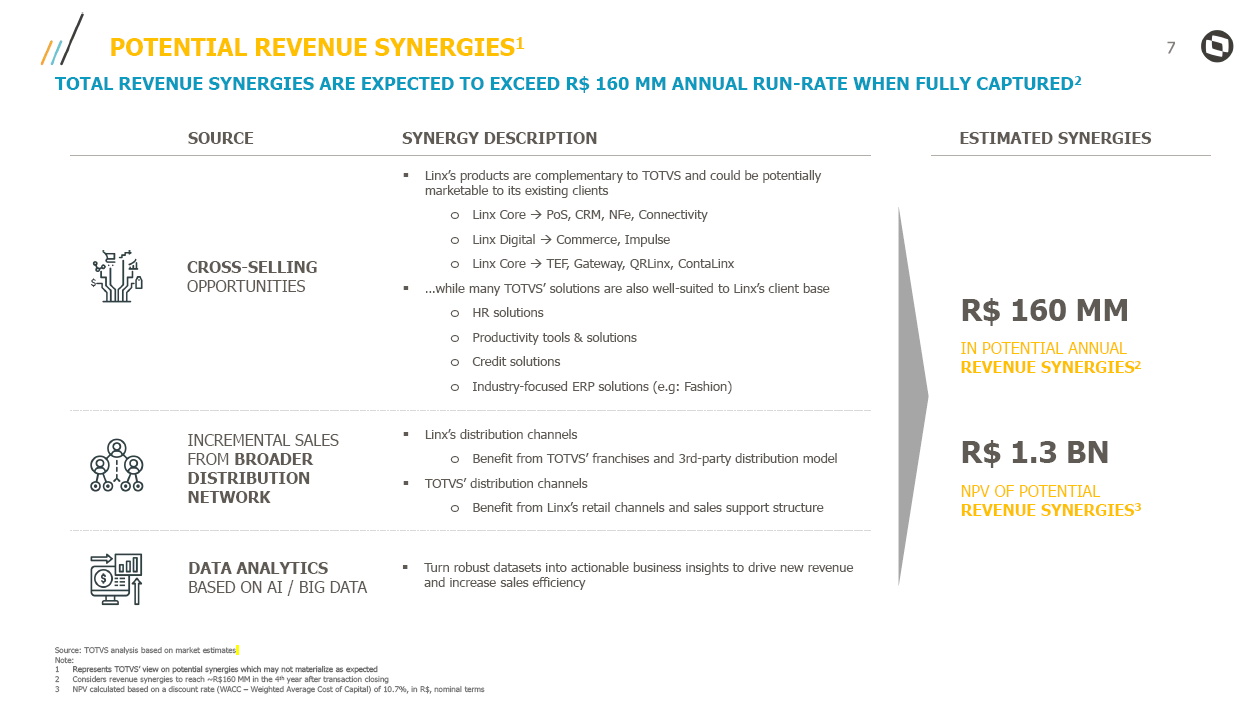

- Such combination of Companies would result in a complete software platform with complementary capabilities, able of generating revenue synergies in the following dimensions:

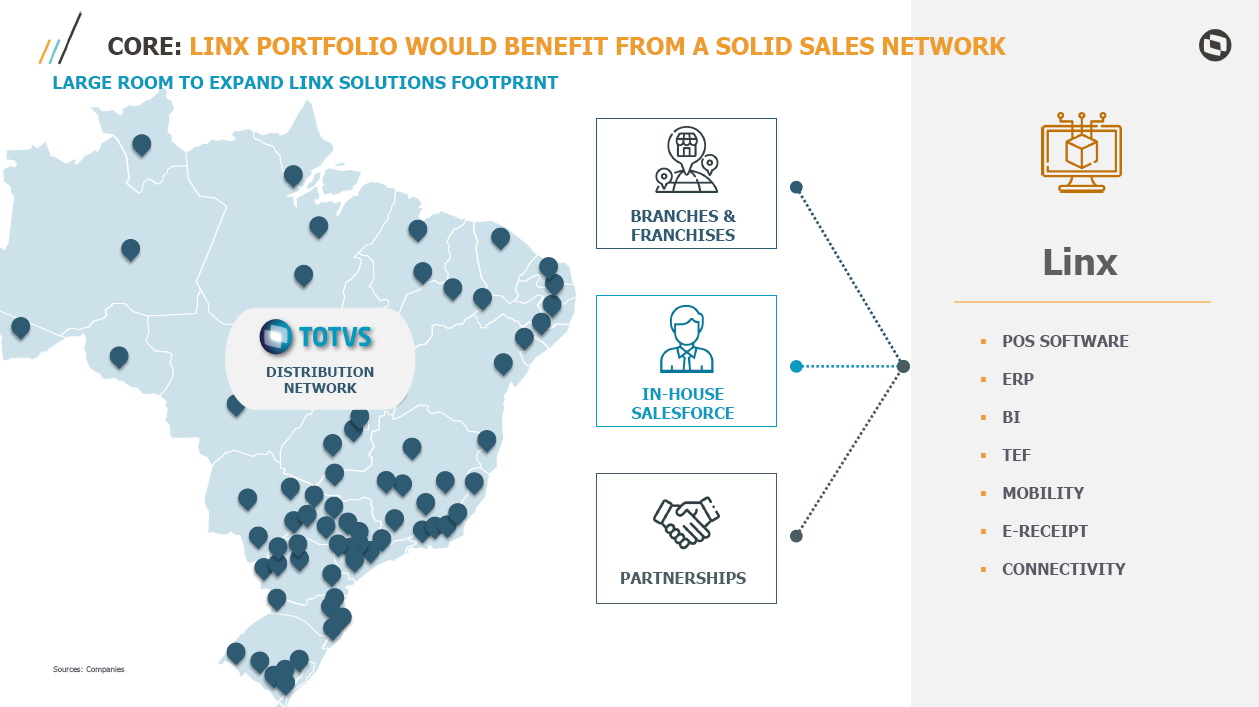

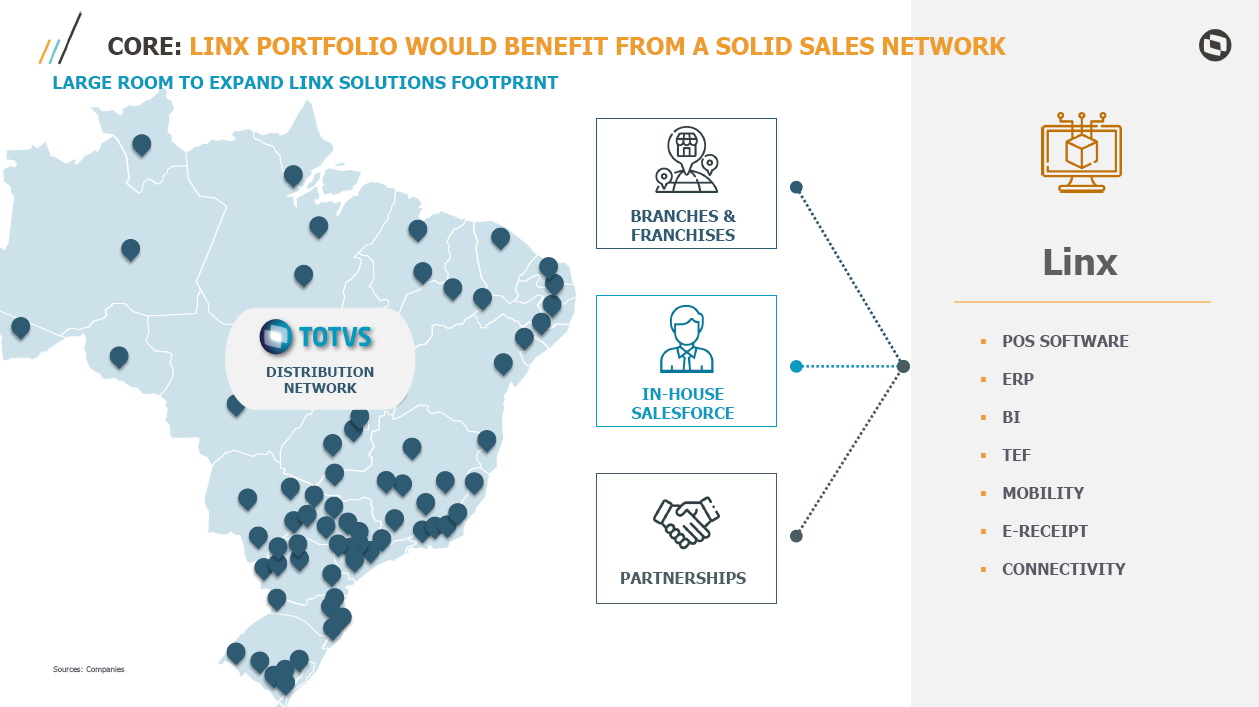

- Management - Linx would gain access to TOTVS's wide distribution network and expand its presence in management systems, benefiting from the distribution model based on regional branches, franchises and partnerships. In addition to gaining more ability to attract new clients and customers, the products of the Linx Core family, such as PoS, CRM, NFe and connectivity solutions also have business and technological appeal to a large part of TOTVS's current client base, indicating a high potential for synergies revenue. On the other hand, Linx's relevant presence in the retail channels would be complementary to TOTVS's portfolio, creating a potential to generate incremental sales, especially in products such as HR solutions, productivity tools, management systems (ERP) and credit solutions.

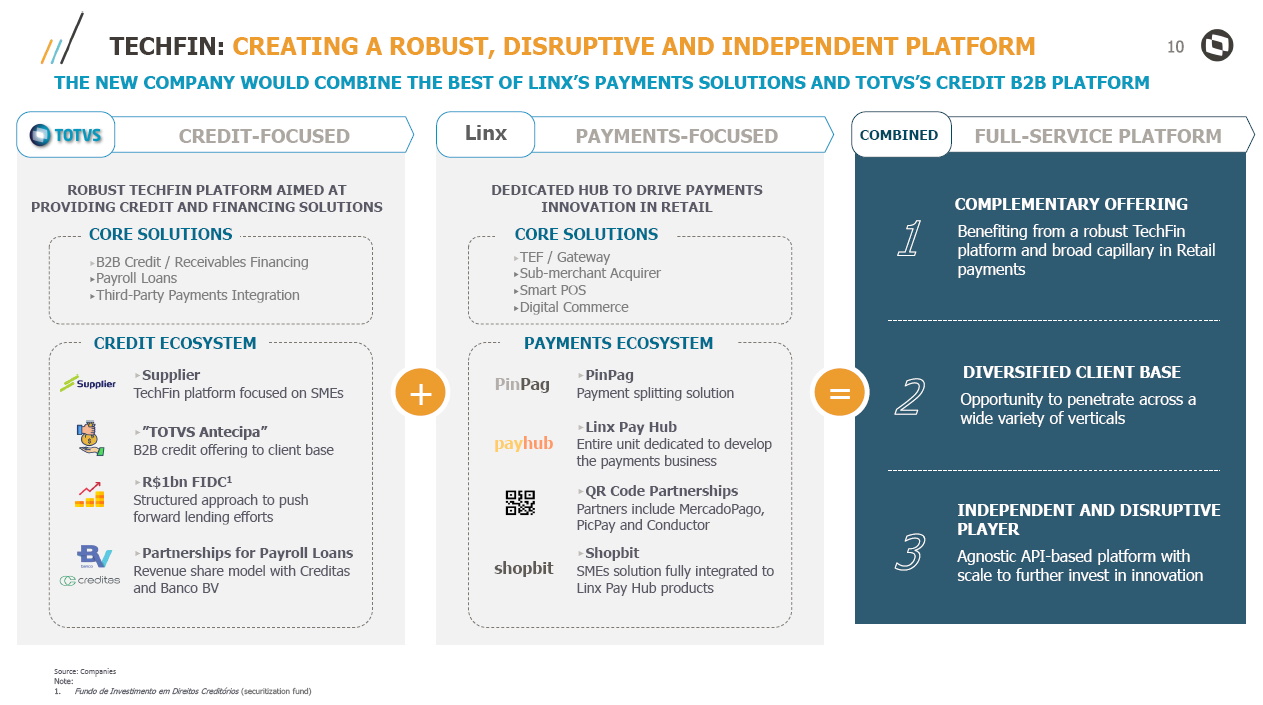

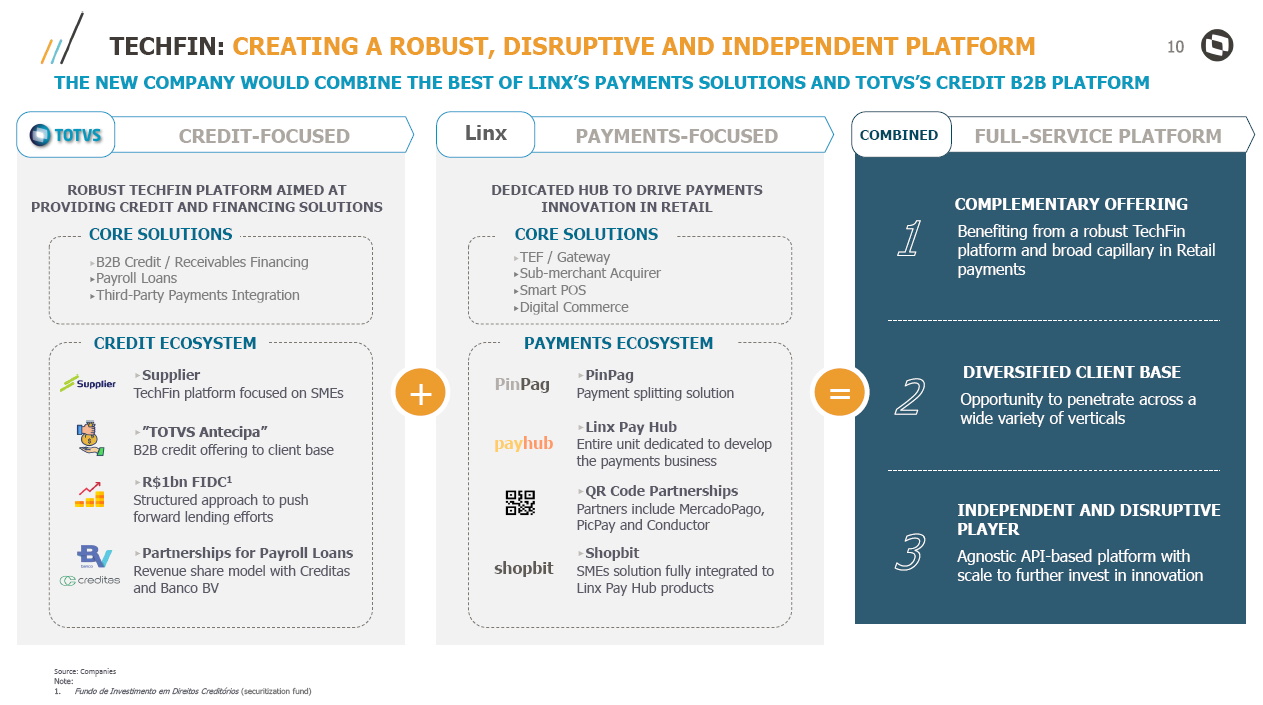

- Techfin - The combination of products belonging to the Linx Pay Hub and TOTVS's B2B credit platform would result in a complete Techfin ecosystem,

- capable of penetrating a wide range of sectors and clients/customers. The combined portfolio would include, among others, B2B credit, payroll loans, EFT, virtual gateway and digital payment systems.

- Business Performance - Acceleration of TOTVS's digital products strategy, adding Linx's extensive portfolio of digitalization solutions. The combination of such Companies would create a one-stop-shop platform to serve clients and customers of different sizes in their omnichannel transformation journeys and implementation of integrated e-commerce systems. By expanding their digital capabilities, the resulting combined company would achieve greater relevance to its client/customer base and expand its possibilities for future growth.

- Big Data - The combination of such two companies would create one of the most sophisticated data lakes among Brazilian companies, able of accelerating the achievement of synergies and particularly developing digital products in the Business Performance and Techfin segments. In the view of TOTVS, when implementing monetization strategies, such combined company could convert their solid databases into actionable insights for the business, with a potential positive impact on new revenues and sales efficiency.

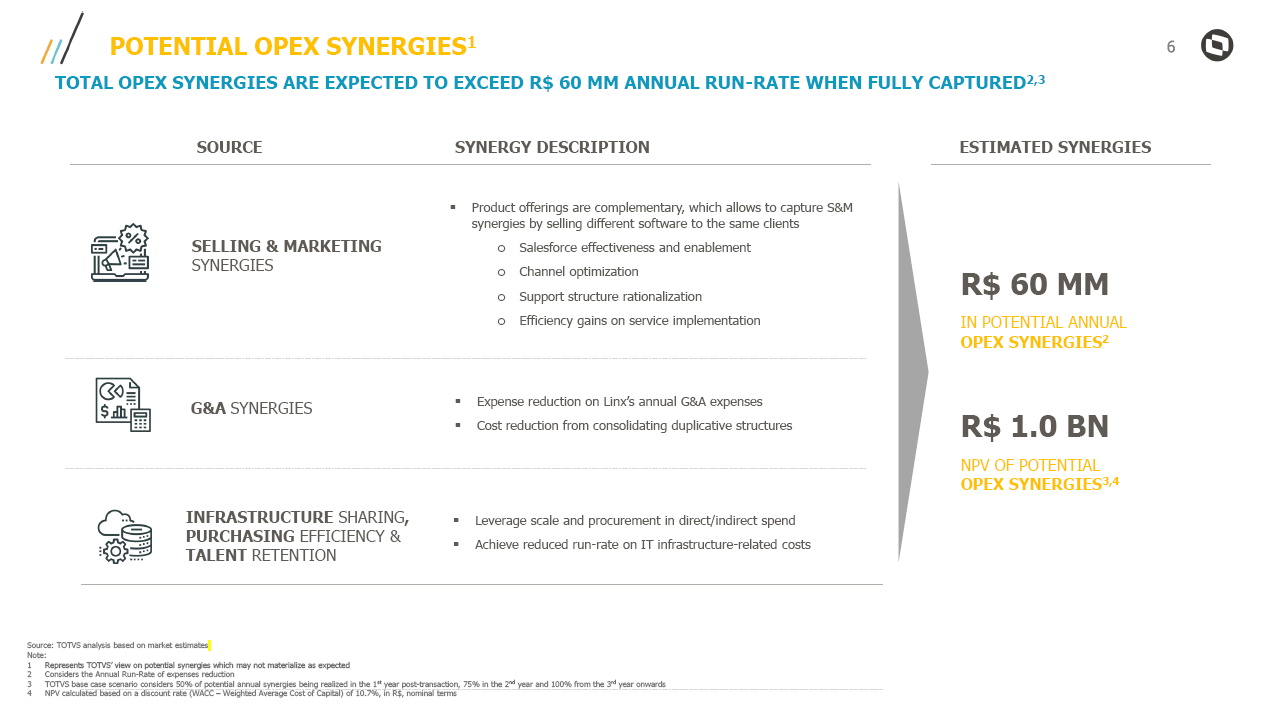

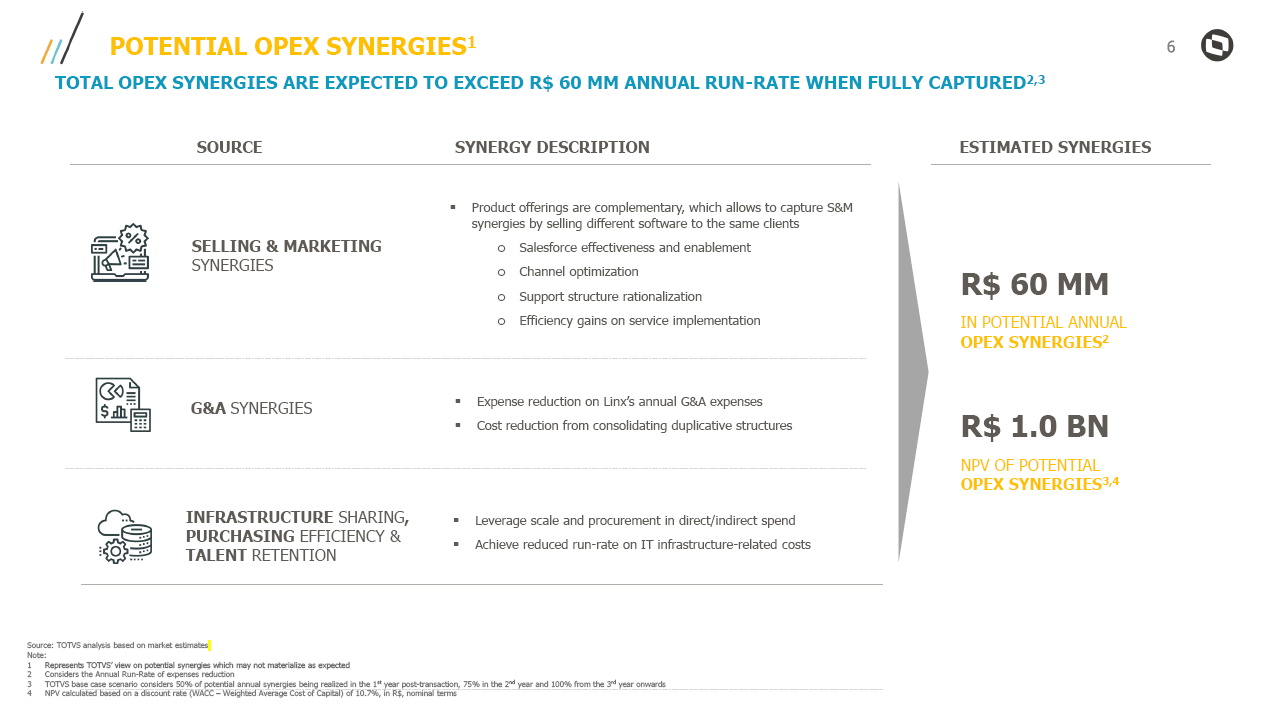

- In addition to potential revenue synergies, TOTVS believes that it will achieve significant synergies in costs and expenses from the integration of both Companies' operations. The resulting company, taking advantage of the scalability of its business, would be able to leverage economies of scale and explore efficiency gains in the following dimensions:

- General & Administrative Expenses - In TOTVS's view, there is ample room for efficiency gains through the rationalization of shared services, especially by eliminating duplicate structures. In addition, the resulting company would have greater potential to explore more favorable contracts for purchases and services, with an impact on its direct and indirect costs.

- Sales & Marketing - Due to the nature of their product portfolios, the combination between said Companies will allow greater efficiency in sales by distributing highly complementary software solutions to the same client/customer base. The restructuring of Linx's sales channels, integrating them into TOTVS's distribution network, represents an opportunity to capture potential synergies in expenses and reduce the combined costs.

- Research & Development - TOTVS expects to achieve reduced costs in aspects such as information technology, systems maintenance and expenses connected to technology infrastructure. In TOTVS’ view, it is possible to reorganize the technology areas to achieve significant savings by consolidating duplicate systems, combining software development structures and eliminating redundant tools, among other measures.

- Service Implementation - Currently, a substantial portion of TOTVS' distribution and support activities are carried out through franchisees and outsourced partners. On the other hand, Linx's sales operations are still mainly based on its own teams to implement and distribute its solutions. Such asymmetry is potentially addressable through the integration of Linx's channels into TOTVS's structure, creating a cost-efficient business and service network with broader reach.

- The Transaction, in addition to revenue and cost synergies, has the potential to generate amortized goodwill from the acquisition of Linx's assets by TOTVS in the course of its business plans. This factor contributes to the consolidation of a more efficient corporate structure.

- TOTVS has extensive experience in creating value from acquisitions of software companies, a key aspect to reduce integration risks and capture potential upsides of the Transaction. TOTVS's integration model consists of four main value levers: increasing cross-selling, agile integration of the product portfolio, exploring cost synergies and reducing the churn rate to a minimum.

- Favorable History of Acquisitions - Over the past few decades, TOTVS has accredited itself as one of the most successful Brazilian companies to perform an inorganic growth strategy through acquisitions. The model adopted has been able of delivering remarkable results to TOTVS’ shareholders in terms of creating value and synergies. TOTVS's executive officers were personally involved in some of the most iconic transactions in the Brazilian software market, including the acquisitions of Supplier, Datasul, RM Sistemas and Logocenter.

| o | Reduced Integration Risks - TOTVS and Linx share similar growth stories, with similar business strategies, based on the creation of complete ecosystems based on their products and services. In TOTVS's view, such factors considerably reduce integration risks, transition costs and other potential friction points. Both companies have built up a significant share of their software portfolios through intense M&A activity, integrating new talents and expanding their ecosystems. Moreover, in TOTVS's view the fact that the two Companies are listed on the Novo Mercado brings advantages in a potential combination of corporate structures, opening space for a more fluid integration process. |

Taking into account the factors shown above, the Business Combination Transaction with Linx is consistent with TOTVS's strategy to create value for its shareholders, strengthening a sustainable competitive position in our markets.

3.2. Costs of the Transaction. The managements of both Companies estimate that the costs of carrying out the Transaction will be of approximately R$ 30.5 million, including expenses with publications, auditors, appraisers, lawyers and other professionals hired to assist in the transaction.

3.3. Risks of the Transaction. With this Transaction TOTVS seeks to integrate its own businesses with Linx's businesses and take advantage of the synergies achieved with such integration. Such integration process can result in difficulties of an operational, business, financial, contractual and technological nature, which could mean that the expected synergies would not be achieved, that losses might occur, or TOTVS may incur unforeseen expenses. In addition, measures aimed at integrating both companies may divert the management's attention from existing businesses. For this reason, TOTVS may not be able to successfully implement the integration of Linx, or to achieve the expected returns on investments connected to the Transaction, which may adversely affect TOTVS.

Part of the consolidated revenue and the result of TOTVS will come from Linx. Any future negative financial result of Linx may affect TOTVS's financial result.

The market value of TOTVS's Shares at the time the Transaction is consummated may vary significantly as regards the price of shares existing on the date the Transaction was proposed by TOTVS's management to Linx's management. The change in stock prices can occur as a result of a variety of factors that are beyond the control of Companies including changes in their business, operations and projections, schedule and regulatory issues, general market and economic conditions as well as those connected to the industry.

There are also risks regarding the implementation of the Transaction itself, as it is still subject to approval by Linx shareholders and the verification of certain suspensive conditions that, ultimately, are beyond the control of Companies, such as, for example, approval by the Brazilian antitrust authorities.

| 4. | Share exchange ratio and criteria to determine it |

4.1. In the Merger of Linx's Shares: Linx's shareholders will receive four common shares and one redeemable preferred share issued by Katrina for each of Linx's common share that they own on the date the Transaction is consummated, resulting in the total issue by Katrina of 897,143,685 shares, all of them being registered shares with no par value, of which 717,714,948 will be common shares and 179,428,737 will be redeemable preferred shares.

4.2. In the Merger of Katrina: Linx's Shareholders will receive one common share of TOTVS for each set of four common shares of Katrina owned by them on the date on which the Transaction is consummated, resulting in the total issue, by TOTVS, of 179,428,737 common shares, all of them being registered shares with no par value.

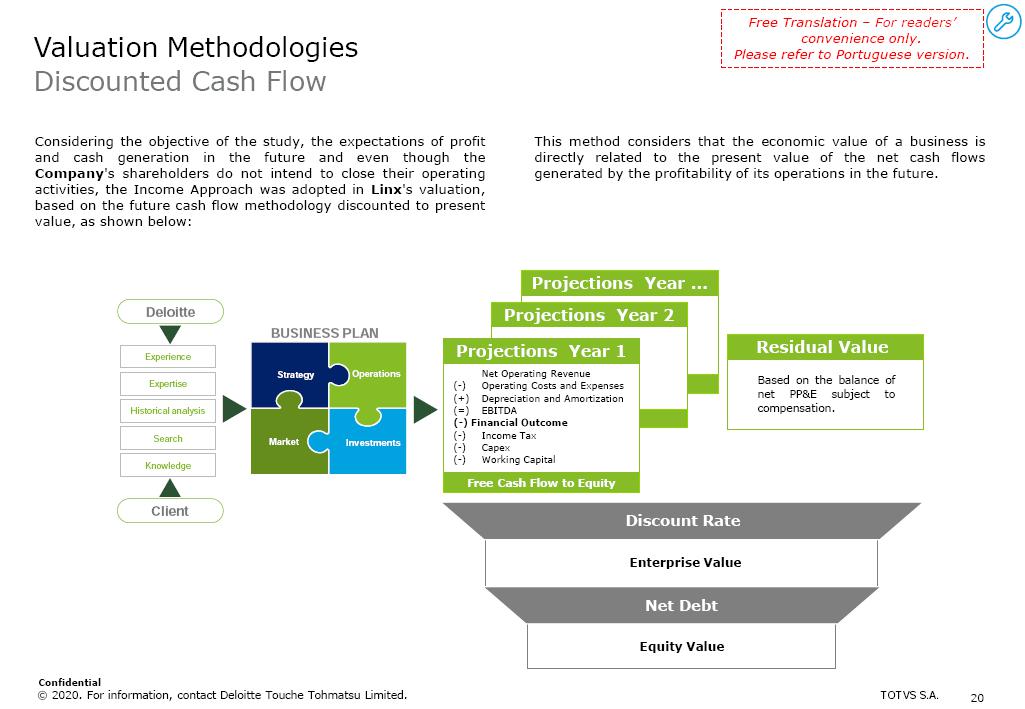

4.3. Criteria. The exchange ratio was proposed by the management of TOTVS based on several aspects, including the respective market values of the Companies; the historically exchange ratio between the Companies; the potential synergies from a business combination; the valuation of the Companies using the Enterprise Value divided by EBITDA; a discounted cash flow analysis, among other methodologies. A fairness opinion was issued to the Board of Directors of TOTVS confirming that such exchange ratio is fair.

The redemption value of Katrina's preferred shares and the number of TOTVS shares to be transferred to Linx shareholders after the Transaction were determined in a way that Linx’s

shareholders will receive, for each 1 share issued by Linx, 1 share issued by TOTVS plus R$6.20 in cash.

This payment structure allows Linx's shareholder, at its discretion, the opportunity to remain a shareholder and participate in the benefits of potential synergies resulting from the business combination with TOTVS. As described in the Material Fact published on October 8, 2020, the business combination may generate operating synergies currently estimated at a net present value of approximately R$ 3.2 billion.

| 5. | Transaction to be Submitted to Brazilian and Foreign Authorities |

5.1. The consummation of the Transaction will be subject to approval by CADE in Brazil, in addition to the effectiveness of the registration statement (“Form F-4”) filed by TOTVS with the SEC for purposes of calling, holding and approving the Transaction at the Linx’s general shareholders’ meeting. Aiming to keep the market and its shareholders informed, the Companies will disclose “Notices to the Market” when the main steps required for the Transaction to be approved by CADE and registered with the SEC occur.

| 6. | Right of Withdrawal and Amount of Reimbursement |

6.1. Right of Withdrawal in the Acquisition of Linx's Shares. Shareholders who dissent from the resolution that may approve the Acquisition of Linx's Shares and who express their intention to withdraw from Linx within 30 days counted from the date of publication of the minutes of Linx's extraordinary general meeting that approves the Acquisition of Linx's Shares, under the provisions set forth in article 230 of Brazilian Law No. 6,404/76, will be entitled to be reimbursed for Linx's shares that they own, due to the proven and uninterrupted ownership of Linx's shares, from the date of the first publication of the call notice for the meeting, or on the date the corresponding material fact is released on such resolution, if released prior to the meeting. The amount to be paid as a refund will correspond to the amount of the shareholders' equity of Linx's share, calculated based on the last approved balance sheets of Linx (on such date, and also on those prepared on December 31, 2019 and approved at the annual general shareholders' meeting held on April 30, 2020), which corresponds to R$9,45 per share, without prejudice to the right of preparing a special balance sheet.

6.2. When Linx's general shareholders' meeting is called to resolve on the Transaction, the companies will present, in addition to the documentation that is being submitted to TOTVS's general shareholders' meeting called for November 27, 2020, Appendix 20 to the CVM Instruction 481/09, which will detail and update the information regarding the reimbursement to be eventually paid to Linx's dissenting shareholders.

6.3. Right of Withdrawal in the Acquisition of Katrina. As TOTVS will be the sole shareholder of Katrina on the date of Katrina's extraordinary general meeting that decides on its merger into TOTVS, there is no need to talk about dissenting shareholders or the right of withdrawal as a result of this stage of the Transaction.

| 7. | Share exchange ratio pursuant to Article 264 of the Brazilian Corporations Act |

7.1. As TOTVS and Linx are independent parties, there is no need to talk about applying the provisions of Article 264 of Brazilian Law No. 6,404/76 (the Brazilian Corporations Act).

| 8. | Additional relevant information |

8.1. In the event that the Panel of CADE may (i) impose restrictions as a condition precedent for approving the Transaction and, after making their best efforts, TOTVS and Linx are unable to meet the requirements of such restrictions, or (ii) may disapprove the Transaction, Linx may consider the Transaction as terminated and will be entitled to receive from TOTVS, as liquidated damages for losses and damages, the amount of R$100,000,000 (one hundred million Reais), payable in the local currency of Brazil in a single cash installment, within 30 days from Linx's notice sent to TOTVS accordingly, and Linx may not require any additional amount due to the non-consummation of the Transaction, as provided for in the sole paragraph of article 416 of the Brazilian Civil Code.

8.2. Except for the provisions of section 8.1 above, if the Transaction is not consummated within 18 months counted from the date of its execution, once the Transaction is approved by the shareholders of both TOTVS and Linx, and such delay is due to fault or intent of either TOTVS or Katrina on the one hand, or Linx on the other hand, or even due to fault or intent of their corresponding managements, in which case the other company that is not responsible for such delay may, at its sole discretion, (i) extend the 18-month period hereby agreed to allow the Transaction to be consummated; or (ii) consider the Transaction as terminated, becoming entitled to receive, as liquidated damages for losses and damages, the amount of R$ 150,000,000, payable in the Brazilian local currency in cash and in a single installment, within 30 days from the notice sent for that purpose, and the other Party will not be entitled to require any additional amount due to the non-consummation of the Transaction, as provided for in the sole paragraph of Article 416 of the Brazilian Civil Code.

8.3. Either party may remedy or cause non-compliance with any of the obligations under the Protocol and Justification to be remedied within up to 30 days from the date on which a notice is sent by the other party to do so.

8.4. Also, for clarification purposes, the payment by Linx of the penalty referred to in section 7.1 of the Protocol and Justification will result in the option by of TOTVS and its managers to, in its sole discretion, not proceeding with the Transaction, even if, after the Transaction is approved by the shareholders of TOTVS at a general meeting, if TOTVS exercises such right, the Protocol and Justification and the corresponding approval thereto will cease to take effect, without any indemnity or payment of losses being payable by each party to each other.

8.5. If, as of this date, Linx makes any distribution of dividends or interests on equity, the amount to be paid to Linx's Shareholders as a result of the Redemption will be reduced proportionately considering such distributions.

8.6. It will be responsibility of TOTVS's managers to perform all actions necessary to effectively implement the merger of Katrina into TOTVS, including the cancellation of Katrina's registration with the competent federal, state and municipal authorities of Brazil, as well as the maintenance of Katrina's accounting books for the term required by law.

8.7. The Protocol and Justification and the appraisal reports will remain available to the shareholders of the Companies at their corresponding head offices as of this date, on the TOTVS Investor Relations website (http://ri.totvs.com.br), as well as on the websites of the Brazilian Securities and Exchange Commission (http://www.cvm.gov.br) and B3 - Brasil, Bolsa, Balcão (http://www.b3.com.br).

8.8. For further clarification, please contact TOTVS's Investor Relations Department.

Sao Paulo (SP, Brazil), October 27, 2020.

Gilsomar Maia Sebastião

Chief Financial and

Investor Relations Officer

Investor Relations

Phone: (+55 11) 2099-7773/7097/7089/7105

ri@totvs.com.br | http://ri.totvs.com/en

Absence of Offer or Request

This Notice of Material Fact is for informational purposes only and does not constitute an offer to sell or a request to subscribe or purchase shares, nor does it replace any offer material that TOTVS will, if necessary, file with the SEC. No offer of securities will be made in the United States, except by means of a prospectus that meets the requirements of Section 10 of the US Securities Act of 1933, or based on the waiver provided for therein.

Additional Information and where it can be found

With respect to the proposed transaction, TOTVS will file with the SEC all relevant documents as required by the corresponding applicable laws and regulations. INVESTORS ARE RECOMMENDED TO READ CAREFULLY AND FULLY THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TOTVS, LINX, THE PROPOSED TRANSACTION AND RELATED MATTERS. All documents filed with the SEC connected to the proposed transaction will be available when filed, free of charge, on the SEC website - www.sec.gov - and on TOTVS's investor relations website - http://ri.totvs.com/.

Forward-looking Statements

This Notice of Material Fact may contain forward-looking statements. Such statements are not historical facts and are based on the management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipate", "believe", "esteem", "expect", "plan" and similar expressions, with respect to the company or the Transaction, are intended to identify forward-looking statements. Statements connected to the declaration or payment of dividends, the implementation of the key operating and financial strategies and capital expenditure plans, the direction of future operations and the factors or trends that affect the financial condition, liquidity or results of operations, are examples of forward-looking statements. Such statements reflect the management's current views and are subject to a number of risks and uncertainties. There is no guarantee that the events, trends or expected results will actually happen. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ substantially from current expectations.

EXHIBIT 2

TOTVS SA

A publicly-held Corporation

Corporate Taxpayer Id. (CNPJ) No. 53.113.791/0001-22

Meeting Notice

Extraordinary General Meeting

The shareholders are hereby invited to meet at the Extraordinary General Meeting (“EGM”) of TOTVS S.A. (the "Company"), which will be held on November 27, 2020, at 10:00 a.m., at the Company's headquarters located at Avenida Braz Leme, 1000, Block A, 1st floor, Espaço Arena, offices 7 and 8, Casa Verde district, city of São Paulo, State of São Paulo, Brazil, Zip code 02511-000, with the following agenda:

| | (a) | examining, discussing, and approving the Protocol and Justification for the Acquisition of the shares of Linx S.A. (“Linx”) by Katrina Participações S.A. (“Katrina”), a corporation whose shares are, on this date, wholly owned by the Company, followed by the acquisition of Katrina by the Company, as proposed by the Company's management which will then be submitted to Linx's shareholders/partners (“Protocol and Justification”) (“Transaction”); |

| | (b) | ratifying the appointment of the specialized auditing company Ernst & Young Auditores Independentes S.S. to prepare the Appraisal Report of Katrina’s Shareholders’ Equity to be considered for the acquisition of Katrina by the Company, as an act subsequent to the acquisition of Linx's shares by Katrina and to the Redemption referred to in the Protocol and Justification (the “Appraisal Report”); |

| | (c) | approving the Appraisal Report; |

| | (d) | approving the proposed Transaction under the terms of the Protocol and Justification, the consummation of which will be subject to its subsequent approval by Linx's shareholders and by the Brazilian antitrust authorities, also complying with the other conditions provided for in section 3.1 of the Protocol and Justification; |

| | (e) | approving, once the acquisition of Katrina is consummated, the increase in the Company's capital stock through the issuance of new common shares, to be subscribed and paid in by Katrina's management, to the benefit of its shareholders at the time, with the consequent amendment to the caption of Article 5 of the Company's Bylaws, as detailed by the Management’s proposal. |

| | (f) | approving the investment by the Company in Katrina, in an amount sufficient to pay the Redemption Amount (as defined in the Protocol and Justification), with the adjustments provided for in section 2 of the Protocol and Justification, upon the subscription of new shares, and the Company's management are hereby authorized to make the referred revisions within the limitations set forth therein, and for that purpose a new authorization by a meeting will not be required; |

| | (g) | increasing the authorization limit for capital increase regardless of any amendment to the Bylaws to R$4,500,000,000.00 (four billions and five hundred million Reais), with the consequent amendment to the caption of Article 6 of the Company's Bylaws. |

| | (h) | giving the due consent to the Company's managers to perform all actions required to complete the Transaction. |

The events described in paragraphs (a) a to (f) of this meeting notice are reciprocally interdependent legal transactions, such that an action will not be effective if the remaining actions are not effective. Accordingly, if the EGM approves one of the topics contained in paragraphs (a) to (f), but rejects another topic contained in one of such items, the items approved will not take effect.

Pursuant to article 10, paragraph 5 of the Company's Bylaws, Shareholders are requested to submit, at least 48 (forty-eight) hours in advance of the scheduled Meeting date, in addition to the identification document and/or relevant corporate actions that prove legal representation, as the case may be: (i) proof issued by the bookkeeping entity, no later than five days before the scheduled Meeting date; (ii) the instrument of power of attorney; and/or (iii) as regards those Shareholders taking part in the fungible custody of registered shares, a statement showing the corresponding shareholding, issued by the competent body. A shareholder that wishes to do so may choose to exercise his/her/its voting right by the remote voting system, pursuant to CVM Instruction No. 481/09, by sending the corresponding distance voting ballot through their corresponding custodians or directly to the Company, according to the guidelines contained in section 12.2 of the Company's Reference Form (except for the signature notarization, as explained in the paragraph hereinbelow) and the Management Proposal for the corresponding Meeting.

Considering the current guidelines of the Brazilian Ministry of Health and the Government of the State of Sao Paulo (Brazil) to prevent and control infections by the new Coronavirus (COVID-19), the Company suggests to its shareholders that, if possible, preference is given to the use of the Distance Voting Ballot to take part in the Extraordinary General Meeting hereby called. The Company hereby also informs that it will accept, exceptionally for this General Meeting, as a way to facilitate the participation of its remote shareholders, instruments of powers of attorney and distance voting ballots without any certified signature, notarization or consularization being required. Copies of the documents to be discussed at the Company's Meeting convened hereby, including those required by CVM Instruction 481/09, are available to the Shareholders whether at the Company's headquarters, on its Investor Relations website (http://ri.totvs.com), as well as on the corresponding websites of the CVM (Brazilian Securities and Exchange Committee) and B3 stock exchange.

São Paulo, October 27, 2020.

LAÉRCIO JOSÉ DE LUCENA COSENTINO

Chairman of the Board of Directors

EXHIBIT 3

APPENDIX I

INFORMATION ON THE TRANSACTION

(Appendix 20-A of ICVM Standard 481)

EXHIBIT I - INFORMATION ON THE MERGER

(according to Exhibit 20-A of CVM Instruction No. 481/09)

1. Protocol and Justification of the transaction, pursuant to articles 224 and 225 of Brazilian Law No. 6,404 of 1976.

The Protocol and Justification (“Protocol and Justification”) for the Merger of the shares of Linx S.A. (“Linx”) by Katrina Participações S.A. (“Katrina”), followed by the acquisition of Katrina by TOTVS S.A. (“TOTVS” or “Company”), proposed by the management of TOTVS and to be submitted to the shareholders/partners of the companies involved is found in Exhibit I.1 to this Proposal.

2. Other agreements, contracts and precontracts governing the exercise of the right to vote or the transfer of shares of existing companies or companies resulting from the transaction, filed with the Company's headquarters or to which the controlling shareholder of the company is a party.

None.

3. Description of the transaction, including:

a. Terms and conditions

The transaction ("Transaction") will comprise the following steps:

| | (a) | increase of the capital stock of Katrina by issuing at least 163,500,000 new common, registered shares with no par value, which will be fully subscribed and paid up by TOTVS, in the Brazilian legal currency until the date of consummation of the Transaction, for the total issue price of R$1,125,000,000, of which R$1,115,000,000 will be allocated to create the capital reserve ("Katrina's Capital Increase"); |

| | (b) | on the same date, as a subsequent and interdependent act of Katrina's Capital Increase, all shares issued by Linx will be acquired by Katrina, for their economic value, resulting in the issuance, by Katrina, in favor of Linx's shareholders who own the acquired shares (“Linx's Shareholders”), of redeemable common and preferred shares issued by Katrina, and for each common share issued by Linx, four common shares and one redeemable preferred share issued by Katrina will be delivered, as provided for in the Protocol and Justification ("Acquisition of Linx's Shares") for the total issue price of at least R$6,016,245,551.61, of which at least R$ 5,119,101,866.61 will be allocated to create a capital reserve. These amounts are subject to the adjustments provided for in section 2 of the Protocol and Justification, with the TOTVS’ management being authorized to make the said adjustments within the limits set forth in the Protocol and Justification, without the need for a new consent to be given in a meeting; |

| | (c) | on the same date, as a subsequent and interdependent act of the Merger of Linx's Shares, all preferred shares issued by Katrina will be redeemed, with the payment of the Redemption Amount for each one redeemed preferred share issued by Katrina, |

also subject to the adjustments provided for in section 2 of the Protocol and Justification, with the TOTVS’ managers being authorized to make the said adjustments within the limits set forth in the Protocol and Justification, without the need for a new consent to be given in a meeting (the “Redemption”). Once they are so redeemed, Katrina's preferred shares will be canceled against the capital reserve; and

| | (d) | as a subsequent and interdependent act of the Redemption, which is proposed to be approved now, with effectiveness subject to the completion of the previous steps, the acquisition of Katrina by TOTVS of Katrina's shareholders' equity (already considering the effects of the Katrina Capital Increase, the Acquisition of Linx's Shares, and the Redemption), with the consequent extinction of Katrina and succession, by TOTVS, of all its assets, rights and obligations, and Linx's Shareholders will then become shareholders of TOTVS (“Merger of Katrina”).After the Transaction is consummated, Linx will preserve its own existence as a legal entity, keeping also its shareholders' equity, and no legal succession will take place. |

The completion of the Acquisition of Linx's Shares, the Redemption and the Acquisition of Katrina will depend on the following acts ("Corporate Approvals"), which, to the exception of the extraordinary general meeting of TOTVS already called, should tentatively take place on the same date:

| | (a) | extraordinary general meeting of Linx to, in the following order, (i) confirm that the provisions of Article 43 of Linx's Bylaws will not be applicable to the Transaction, in the sense that it will not be required to perform the public offer to acquire Linx's shares as provided for therein; (ii) approve the Protocol and Justification; (iii) approve the Transaction; and (iv) authorize the subscription, by its administrators, of the new shares to be issued by Katrina; |

| | (b) | extraordinary general meeting of Katrina to, in the following order, (i) approve Katrina's Capital Increase; (ii) approve the Protocol and Justification; (iii) ratify the appointment of auditors Deloitte Touche Tohmatsu Consultores Ltda. (“DTT”) to perform the appraisal and determine the market value of the shares issued by Linx to be acquired by Katrina, already considering the effects of the Katrina's Capital Increase (“Linx's Shares Appraisal Report”); (iv) approve the Appraisal Report of Linx's Shares; (v) approve the creation of a new class of preferred shares; (vi) approve the Acquisition of Linx's Shares; (vii) approve the capital increase to be subscribed and paid in by Linx's managers, with the consequent amendment to its bylaws; (viii) approve the Redemption, with the consequent amendment to its bylaws; (ix) approve the Acquisition of Katrina by TOTVS; and (x) authorize the subscription, by its managers, of the new shares issued by TOTVS; and |

| | (c) | TOTVS extraordinary general meeting called on this date, to, in the following order, (i) examine, discuss and approve the Protocol and Justification as proposed by the TOTVS’ management to be subsequently submitted to Linx's shareholder; (ii) ratify the appointment of the specialized audit company Ernst & Young Auditores Independentes S.S. (“EY”) to prepare the appraisal report of Katrina's shareholders' equity to be considered for the Acquisition of Katrina by TOTVS as an act subsequent to the Acquisition of shares Linx by Katrina and the Redemption referred to in the Protocol and Justification (“Katrina’s Appraisal Report”); (iii) approve the Katrina’s |

Appraisal Report; (iv) approve the proposed Transaction under the terms of said Protocol and Justification, the consummation of which will be subject to its subsequent approval by Linx's shareholders and by the Brazilian antitrust authorities, and to the other conditions provided for in section 3.1 of the Protocol and Justification; (v) to approve, once the Acquisition of Katrina is completed, the increase of TOTVS’ capital stock by issuing 179,428,737 (one hundred and seventy nine million, four hundred and twenty eight thousand and seven hundred and thirt seven) new common shares for the total issue price of R$4,910,209,947.18 (four billion, nine hundred and ten million, two hundred and nine thousand, nine hundred and forty-seven Reais and eighteen cents)1, of which R$738,832,883.03 was allocated to capital and the amount of R$4,171,377,064.16, to be subscribed and paid in by Katrina's management, to the benefit of its shareholders, with the consequent amendment of Article 5 of the TOTVS’ Bylaws; and (vi) approve the investment by TOTVS in Katrina, in an amount sufficient to pay the Redemption Amount (as defined in the Protocol and Justification the Protocol and Justification, upon the subscription of new shares, with TOTVS’ management being authorized to make such adjustments within the limits set for therein, and for that purpose a new authorization by a meeting will not be required.

After all such corporate approvals, the Transaction will be consummated, and the shares issued by Linx will no longer be traded, within a maximum period of 10 business days from the implementation of the following conditions: (i) approval of the Transaction by CADE (the Brazilian Antitrust Agency); (ii) the corresponding registration statement is issued by SEC as it was filed by TOTVS (“Form F-4”) with the SEC for the purpose of calling, performing, and approving the Transaction by the corresponding General Shareholders' Meetings of Linx, Katrina, and TOTVS; (iii) checking the compliance by Linx or by TOTVS, as the case may be, of the obligations to maintain the normal course of business, and other obligations, and the absence of a Material Adverse Change, as provided for in the Protocol and Justification; (iv) confirmation, by Linx or by TOTVS, as the case may be, of the veracity and accuracy in all its relevant aspects of the statements provided in the Protocol and Justification, being the sole responsibility of the other party, at its sole discretion, to expressly waive the confirmation of one or another statement; (v) (i) obtention, by Linx, of the third parties' consents provided for in its contracts currently in force, whose early maturity resulting from the Transaction ends up in an amount equal to or greater than R$ 50,000,000 (fifty million Reais), whether individually or in the aggregate, (ii) absence of obligations in an amount higher than R$ 50,000,000 (fifty million Reais), whether individually or in the aggregate, which may have their early maturity declared (or other incident penalties) as a result of the Transaction (hereinafter referred to as “Obligations Subject to Early Maturity”); or (iii) settlement, by Linx, of all Obligations Subject to Early Maturity, in their entirety and without any future obligations to Linx as a result of such settlement; or (iv) existence of cash, at Linx, in an amount corresponding to at least 100% of the amount necessary to settle all Obligations Subject to Early Maturity (including any penalties); (vi) absence of any kind of law or order issued or enacted by a competent governmental authority, court, judicial authority or arbitration panel that could prevent the Transaction to be consummated; and

1 Katrina's equity value corresponding to the interest of Linx's shareholders after the Merger of Linx's Shares into Katrina and the Redemption.

(vii) compliance by the parties of the corresponding relevant obligations under the Protocol and Justification.

b. Potential obligations to compensate: (i) managers of any of the companies involved; (ii) if the transaction does not materialize.

There is no obligation to indemnify the managers of any of the companies involved.

In the event that the Panel of CADE may (i) impose restrictions as a condition precedent for approving the Transaction and, after making their best efforts, TOTVS and Linx are unable to meet the requirements of such restrictions, or (ii) may disapprove the Transaction, Linx may consider the Transaction as terminated and will be entitled to receive from TOTVS, as liquidated damages for losses and damages, the amount of R$ 100,000,000 (one hundred million Reais), payable in a cash lump sum in the local currency, within 30 days from Linx's notice to TOTVS accordingly, in which case Linx may not require any additional amount due to the non-consummation of the Transaction, as provided for in the sole paragraph of article 416 of the Brazilian Civil Code.

Except for the provisions of the paragraph above, if the Transaction is not consummated within 18 months counted from the date of its execution, once the Transaction is approved by the shareholders of both TOTVS and Linx, and such delay is due to fault or intent of either TOTVS or Katrina on the one hand, or Linx on the other hand, or even due to fault or intent of their corresponding managements, in which case the other company that is not responsible for such delay may, at its sole discretion, (i) extend the 18-month period hereby agreed to allow for the completion of the Transaction; or (ii) consider the Transaction as terminated, becoming entitled to receive, as liquidated damages for losses and damages, the amount of one hundred fifty million Reais (R$ 150,000,000), payable in a cash lump sum in the local currency within 30 days from the notice sent for that purpose, and the other Party will not be entitled to require any additional amount due to the non-consummation of the Transaction, as provided for in the sole paragraph of Article 416 of the Brazilian Civil Code. Either party may remedy or cause non-compliance with any of the obligations under the Protocol and Justification to be remedied within up to 30 days from the date on which a notice is sent by the other party to do so. Also, for clarification purposes, the payment by Linx of the penalty referred to in section 7.1 of the Protocol and Justification will result in the option by of TOTVS and its managers to, in its sole discretion, not proceeding with the Transaction, even if, after the Transaction is approved by the shareholders of TOTVS at a general meeting, if TOTVS exercises such right, the Protocol and Justification and the corresponding approval thereto will cease to take effect, without any indemnity or payment of losses being payable by each party to each other.

c. Comparative table of the rights, benefits and restrictions of the shares of the companies involved or arising from the transaction, before and after the transaction

Please see below the rights, benefits and restrictions attributed to the shares of TOTVS and Linx, before and after the intended restructuring, which will preserve the same rights and advantages in force today, namely:

TOTVS:

| Right to dividends: | The shares guarantee their holders the right to the mandatory dividend, in each fiscal year, equivalent to 25% of the adjusted net profit, pursuant to article 202 of the Brazilian Corporation Act. In addition, according with the Bylaws and the Brazilian Corporations Act, holders of common shares are entitled to receive dividends or other distributions made in relation to common shares, in proportion to their interest in the capital stock. |

| Voting rights: | Full |

| Description of the restricted vote: | Not applicable |

| Exchangeability: | No |

| Exchangeability condition and effects on the capital stock: | Not applicable |

| Right to reimbursement of capital: | Yes |

| Description of the characteristics of the capital reimbursement: | Characteristics described in section 18.12 of the reference form |

| Restriction to circulation: | No |

| Details of restrictions: | Not applicable |

| Conditions for changing the rights guaranteed by such securities: | Characteristics described in section 18.12 of the reference form |

| Other relevant characteristics: | TOTVS is listed on “Novo Mercado”, the most advanced level of corporate governance of companies listed on the BM&FBOVESPA, and adopts practices that exceed the requirements of the legislation with reference to corporate governance and the rights of shareholders, according to the rules of the Novo Mercado Listing Regulation. |

Linx:

| Right to dividends: | The mandatory dividend (dividends and/or interest on equity), as provided for in article 202 of the Brazilian Corporation Law, corresponds to a portion of the net profit that Linx cannot fail to distribute to its shareholders, as it is a minimum distribution commitment by Linx. Pursuant to article 36 of Linx's Bylaws, shareholders will be entitled to receive, each year, as dividends and / or interest on equity, shareholders will be entitled to receive, each year, as dividends and/or interest on equity, a mandatory minimum of 25% of the net income for the year, with the increases and decreases set forth in paragraphs (a) and (b) of article 36 of the Bylaws. Therefore, Linx must not distribute dividends and/or interest on equity less than that, subject to legal exceptions. |

| Voting rights: | Full |

| Description of the restricted vote: | Not applicable |

| Exchangeability: | No |

| Exchangeability condition and effects on the capital stock | Not applicable |

| Right to reimbursement of capital: | Yes |

| Description of the characteristics of the capital reimbursement: | In case Linx is liquidated, after payment of all its obligations, its shareholders will receive payments related to the reimbursement of the invested capital in proportion to their corresponding interest held in the capital stock. Any shareholder dissenting from certain resolutions passed at the Shareholders’ Meeting may withdraw from Linx’s shareholding structure, by reimbursement of the value of the shares, based on the book value, under the terms of article 45 of the Brazilian Corporation Law, as long as any of the events expressly provided for in items I to VI and IX of article 136 in the Brazilian Corporation Law takes place. The withdrawal right must be exercised within 30 days counted from the publication of the minutes of the Shareholders’ Meeting that approved the act that gave rise to the withdrawal, pursuant to article 137, IV of the Brazilian Corporations Act. |

| Restriction to circulation: | No |

| Details of restrictions: | Not applicable |

| Conditions for changing the rights guaranteed by such securities: | Pursuant to the Brazilian Corporations Act, neither Linx's Bylaws nor the resolutions taken at the General Meeting may deprive the Linx’s shareholders of their rights to (i) profit sharing; (ii) participate, in proportion to their interest in the capital, in the distribution of any remaining assets, in the event of Linx’s liquidation; (iii) supervise the management of the company’s affairs, subject to the conditions set forth in the Brazilian Corporations Act; (iv) preference for the subscription of shares, debentures convertible into shares and subscription warrants, except in certain circumstances provided for in the Brazilian Corporation Law; (v) withdraw from the shareholding structure in the cases provided for in the Brazilian Corporation Law and (vi) the right to vote at shareholders’ meetings. |

| Other relevant characteristics: | Not applicable. |

The shares issued by Katrina will be canceled upon the completion of the Transaction, provided that (i) the preferred shares will be canceled through the Redemption; and (ii) the common shares will be canceled through the Acquisition of Katrina by TOTVS.

d. Any need for approval by debenture holders or other creditors

Obtaining the prior consent of Linx's creditors in the Obligations Subject to Early Maturity (as defined above) is one of the options to be adopted for the implementation of a suspensive condition for completing the Transaction, under penalty of the contracted debts having their early maturity. Not applicable in relation to TOTVS.

e. Items of assets and liabilities that will compose each portion of shareholders' equity in the event of a split-up

Not applicable.

f. Intention of the resulting companies to be registered as an issuer of securities

Upon the completion of the Transaction, the shares issued by Linx will no longer be traded in the Novo Mercado segment of B3 S.A. - Brazil. Bolsa, Balcão (“B3”), Linx's registration as a publicly-held corporation will be canceled, and Linx's American Depositary Shares (“ADS”) will no longer be traded on the New York Stock Exchange (“NYSE”).

4. Plans to conduct corporate businesses, particularly as regards specific corporate events that might be promoted

After the Transaction is consummated, TOTVS and Linx will continue to dedicate themselves to their activities, maintaining the registration of TOTVS as a publicly-held corporation and the trading of their shares in B3's Novo Mercado segment, and in view of the period necessary to promote the integration of businesses that TOTVS' experience has shown to be essential, making Linx a wholly-owned subsidiary of TOTVS. Moreover, as mentioned in the

previous section, upon the consummation of the Transaction the shares issued by Linx will no longer be traded in the B3's Novo Mercado segment, Linx's registration as a public company will be canceled, and the Linx ADSs will no longer be traded on the NYSE.

5. Analysis of the following aspects of the transaction:

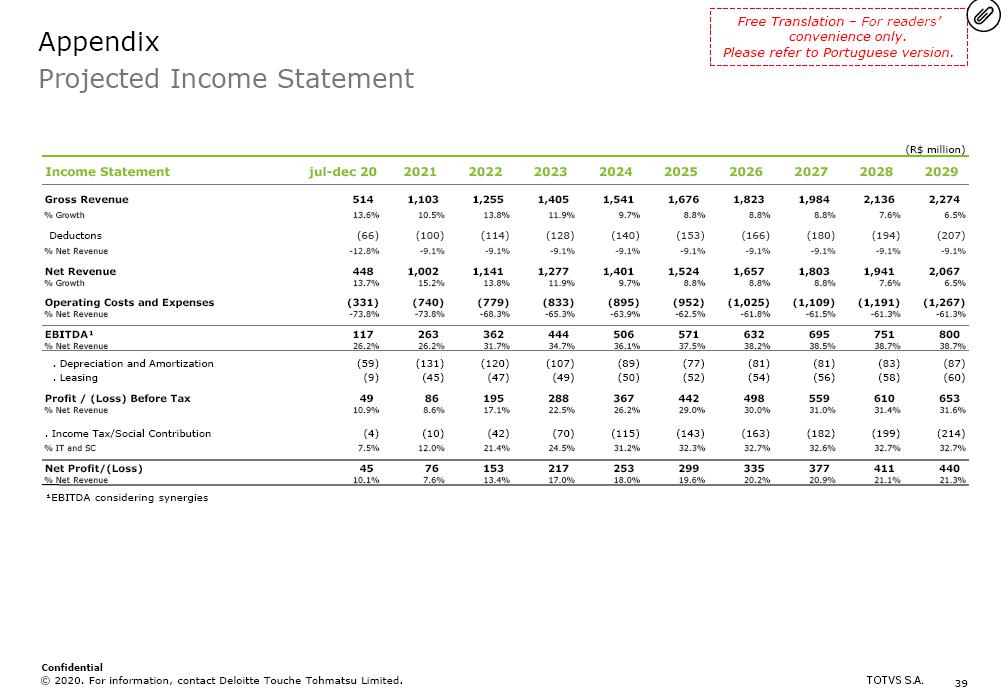

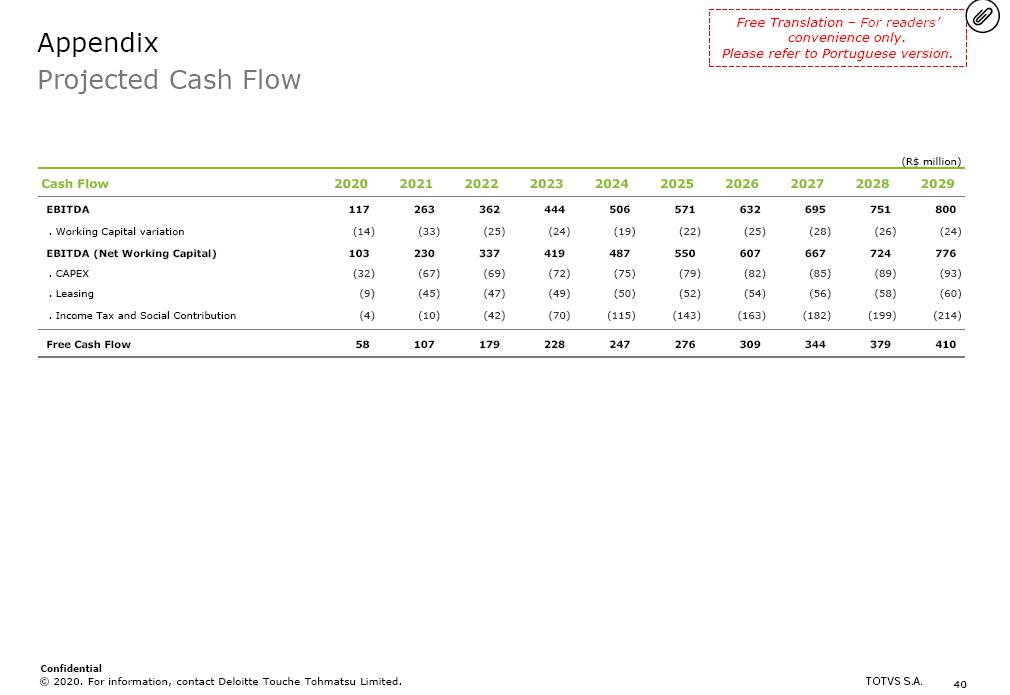

a. Description of the key benefits expected, including synergies, tax benefits and strategic advantages:

The Transaction aims to create a reference company in the software and technology market, with extensive capillarity and extensive experience in several business verticals, capable of extracting value from the operational and financial synergies resulting from such business combination. In the view of TOTVS, the following strategic attributes make the Transaction meritorious for the shareholders of both Companies:

| | · | The combination of said Companies would create the largest software and technology company in Latin America with shares listed on the stock exchange, supported by a solid financial and cash generation performance. Its competitive position, as well as its scale of business, would turn the combined company into the fittest candidate to lead the growing market for cloud-based SaaS solutions in Brazil. |

| | · | Such combination of Companies would result in a complete software platform with complementary capabilities, able of generating revenue synergies in the following dimensions: |

| | o | Management - Linx would gain access to TOTVS's wide distribution network and expand its presence in management systems, benefiting from the distribution model based on regional branches, franchises and partnerships. In addition to gaining more ability to attract new clients and customers, the products of the Linx Core family, such as PoS, CRM, NFe and connectivity solutions also have business and technological appeal to a large part of TOTVS's current client base, indicating a high potential for synergies revenue. On the other hand, Linx's relevant presence in the retail channels would be complementary to TOTVS's portfolio, creating a potential to generate incremental sales, especially in products such as HR solutions, productivity tools, management systems (ERP) and credit solutions. |

| | o | Techfin - The combination of products belonging to the Linx Pay Hub and TOTVS's B2B credit platform would result in a complete Techfin ecosystem, capable of penetrating a wide range of sectors and clients/customers. The combined portfolio would include, among others, B2B credit, payroll loans, EFT, virtual gateway and digital payment systems. |

| | o | Business Performance - Acceleration of TOTVS's digital products strategy, adding Linx's extensive portfolio of digitalization solutions. The combination of such Companies would create a one-stop-shop platform to serve clients and customers of different sizes in their omnichannel transformation journeys and implementation of integrated e-commerce systems. By expanding their digital capabilities, the resulting combined company would achieve greater relevance to its client/customer base and expand its possibilities for future growth. |

| | o | Big Data - The combination of such two companies would create one of the most sophisticated data lakes among Brazilian companies, able of accelerating the achievement of synergies and particularly developing digital products in the Business Performance and Techfin segments. In the view of TOTVS, when implementing monetization strategies, such combined company could convert their solid databases into actionable insights for the business, with a potential positive impact on new revenues and sales efficiency. |

| | · | In addition to potential revenue synergies, TOTVS believes that it will achieve significant synergies in costs and expenses from the integration of both Companies' operations. The resulting company, taking advantage of the scalability of its business, would be able to leverage economies of scale and explore efficiency gains in the following dimensions: |

| | o | General & Administrative Expenses - In TOTVS's view, there is ample room for efficiency gains through the rationalization of shared services, especially by eliminating duplicate structures. In addition, the resulting company would have greater potential to explore more favorable contracts for purchases and services, with an impact on its direct and indirect costs. |

| | o | Sales & Marketing - Due to the nature of their product portfolios, the combination between said Companies will allow greater efficiency in sales by distributing highly complementary software solutions to the same client/customer base. The restructuring of Linx's sales channels, integrating them into TOTVS's distribution network, represents an opportunity to capture potential synergies in expenses and reduce the combined costs. |

| | o | Research & Development - TOTVS expects to achieve reduced costs in aspects such as information technology, systems maintenance and expenses connected to technology infrastructure. In TOTVS’ view, it is possible to reorganize the technology areas to achieve significant savings by consolidating duplicate systems, combining software development structures and eliminating redundant tools, among other measures. |

| | o | Service Implementation - Currently, a substantial portion of TOTVS' distribution and support activities are carried out through franchisees and outsourced partners. On the other hand, Linx's sales operations is still mainly based on its own teams to implement and distribute its solutions. Such asymmetry is potentially addressable through the integration of Linx's channels into TOTVS's structure, creating a cost-efficient business and service network with broader reach. |

| | · | The Transaction, in addition to revenue and cost synergies, has the potential to generate amortized goodwill from the acquisition of Linx's assets by TOTVS in the course of its business plans. This factor contributes to the consolidation of a more efficient corporate structure. |

| | · | TOTVS has extensive experience in creating value from acquisitions of software companies, a key aspect to reduce integration risks and capture potential upsides of the Transaction. TOTVS's integration model consists of four main value levers: increasing cross-selling, agile integration of the product portfolio, exploring cost synergies and reducing the churn rate to a minimum. |

| | o | Favorable History of Acquisitions - Over the past few decades, TOTVS has accredited itself as one of the most successful Brazilian companies to perform an inorganic growth strategy through acquisitions. The model adopted has been able of delivering remarkable results to TOTVS’ shareholders in terms of creating value and synergies. TOTVS's executive officers were personally involved in some of the most iconic transactions in the Brazilian software market, including the acquisitions of Supplier, Datasul, RM Sistemas and Logocenter. |

| | o | Reduced Integration Risks - TOTVS and Linx share similar growth stories, with similar business strategies, based on the creation of complete ecosystems based on their products and services. In TOTVS's view, such factors considerably reduce integration risks, transition costs and other potential friction points. Both companies have built up a significant share of their software portfolios through intense M&A activity, integrating new talents and expanding their ecosystems. Moreover, in TOTVS's view the fact that the two Companies are listed on the Novo Mercado brings advantages in a potential combination of corporate structures, opening space for a more fluid integration process. |

Taking into account the factors shown above, the Business Combination Transaction with Linx is consistent with TOTVS's strategy to create value for its shareholders, strengthening a sustainable competitive position in our markets.

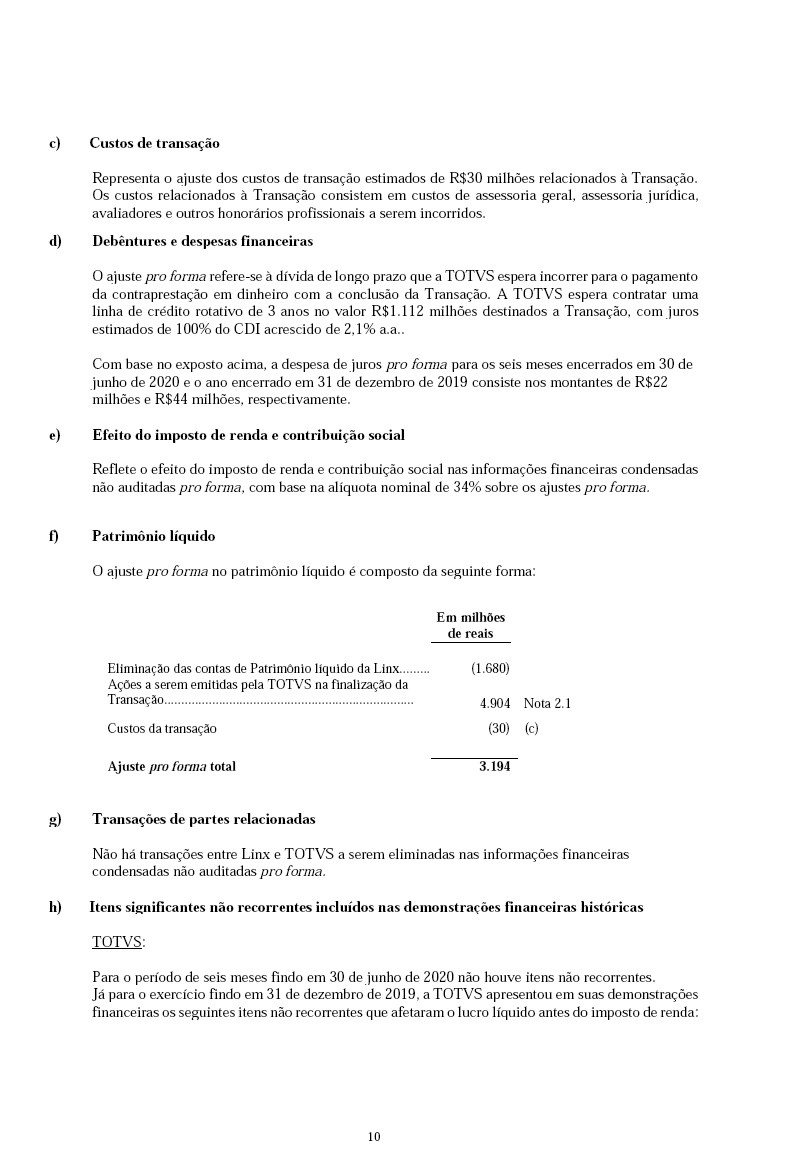

b. Costs

The managements of both Companies estimate that the costs of carrying out the Transaction will be of approximately R$30.5 million, including expenses with publications, auditors, appraisers, lawyers and other professionals hired to assist in the transaction.

c. Risk Factors

With this Transaction TOTVS seeks to integrate its own businesses with Linx's businesses and take advantage of the synergies achieved with such integration. Such integration process can result in difficulties of an operational, business, financial, contractual and technological nature, which could mean that the expected synergies would not be achieved, that losses might occur, or the Company may incur unforeseen expenses. In addition, measures aimed at integrating both companies may divert the management's attention from existing businesses. For this reason, TOTVS may not be able to successfully implement the integration of Linx, or to achieve the expected returns on investments connected to the Transaction, which may adversely affect TOTVS.

Part of the consolidated revenue and the result of TOTVS will come from Linx. Any future negative financial result of Linx may affect TOTVS's financial result.

The market value of TOTVS's Shares at the time the Transaction is consummated may vary significantly as regards the price of shares existing on the date the Transaction was proposed by TOTVS's management to Linx's management. The change in stock prices can occur as a result of a variety of factors that are beyond the control of companies including changes in their business, operations and projections, schedule and regulatory issues, general market and economic conditions as well as those connected to the industry.

There are also risks regarding the implementation of the Transaction itself, as it is still subject to approval by Linx shareholders and the verification of certain suspensive conditions that, ultimately, are beyond the control of companies, such as, for example, approval by the Brazilian antitrust authorities.

d. In the case of a transaction with a related party, please point out any alternatives that could have been used to achieve the same targets, indicating the reasons why those options were rejected

Not applicable, considering that the transaction involves independent parties.

e. Exchange ratio.

In the Merger of Linx Shares: Linx's shareholders will receive 4 (four) common shares and 1 (one) redeemable preferred share issued by Katrina for each common share of Linx that they own on the date the Transaction is consummated, resulting in Katrina's total issuance of 897,143,685 shares, all of them being registered shares with no par value, of which 717,714,948 will be common shares and 179,428,737 will be redeemable preferred shares.