1 Array Technologies 2Q 2022 Earnings Call August 9, 2022 Exhibit 99.2

2 Disclaimer Forward-Looking Statements and Other Information This presentation contains forward-looking statements, as the term is used within federal securities laws. All statements other than those of historical fact which appear in this presentation, including (without limitation) statements regarding our future results, financial positions, operations, business strategies, plans, objectives, expectations, intentions, and predictions, are forward-looking statements. Additional indicators that a statement is forward-looking may include the use of descriptors or qualifiers, such as: “anticipate,” “believe,” “could,” “seek,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Important factors that could cause actual results to differ materially from our expectations include: (i) if demand for solar energy projects does not continue to grow or grows at a slower rate than we anticipate, our business will suffer; (ii) the viability and demand for solar energy are impacted by many factors outside of our control, which makes it difficult to predict our future prospects; (iii) a loss of one or more of our significant customers, their inability to perform under their contracts, or their default in payment, could harm our business and negatively impact revenue, results of operations and cash flow; (iv) a drop in the price of electricity derived from the utility grid or from alternative energy sources may harm our business, financial condition, results of operations and prospects; (v) defects or performance problems in our products could result in loss of customers, reputational damage and decreased revenue, and we may face warranty, indemnity and product liability claims arising from defective products; (vi) an increase in interest rates, or a reduction in the availability of tax equity or project debt capital in the global financial markets could make it difficult for customers to finance the cost of a solar energy system and could reduce the demand for our products; (vii) existing electric utility industry policies and regulations, and any subsequent changes, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems, which may significantly reduce demand for our products or harm our ability to compete; (viii) the interruption of the flow of materials from international vendors could disrupt our supply chain, including as a result of the imposition of additional duties, tariffs and other charges on imports and exports; (ix) changes in the U.S. trade environment, including the imposition of import tariffs, could adversely affect the amount or timing of our revenues, results of operations or cash flows; (x) the reduction, elimination or expiration of government incentives for, or regulations mandating the use of, renewable energy and solar energy specifically could reduce demand for solar energy systems and harm our business; (xi) if we fail to, or incur significant costs in order to, obtain, maintain, protect, defend or enforce, our intellectual property and other proprietary rights, our business and results of operations could be materially harmed; (xii) we may need to defend ourselves against third-party claims that we are infringing, misappropriating or otherwise violating others’ intellectual property rights, which could divert management’s attention, cause us to incur significant costs and prevent us from selling or using the technology to which such rights relate; (xiii) significant changes in the cost of raw materials could adversely affect our financial performance; (xiv) we are dependent on transportation and logistics providers to deliver our products in a cost efficient manner, and disruptions to transportation and logistics, including increases in shipping costs, could adversely impact our financial condition and results of operations; (xv) the requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members and officers; (xv) we face risks related to actual or threatened health epidemics, such as the COVID-19 pandemic, and other outbreaks, which could significantly disrupt our manufacturing and operations; (xvii) provisions in our certificate of incorporation and our bylaws may delay or prevent a change of control; (xviii) our integration of STI Norland; (xix) the ongoing conflict in Ukraine These forward-looking statements are only predictions. They relate to future events, performance, and variables, and involve risks and uncertainties both known and unknown. It is possible that levels of activity, performance or achievements will materially differ from what is implied by the forward-looking statements contained within this presentation and associated materials and explication. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward- looking statements as guarantees of future events, or implications of certainty. The forward-looking statements in this presentation represent our expectations as of the date the presentation was created. We anticipate that subsequent events and developments will cause our expectations to change. We undertake no obligation to update any forward-looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this presentation. Non-GAAP Financial Information This presentation includes certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Adjusted EBITDA, Adjusted Net Income and Adjusted Net Income per share. We define Adjusted EBITDA as net income (loss) plus (i) interest expense, (ii) other (income) expense, (iii) income tax expense (benefit), (iv) depreciation expense, (v) amortization of intangibles, (vi) equity-based compensation, (vii) remeasurement of the fair value of contingent consideration, (viii) certain acquisition related costs, (ix) certain legal expense, and (x) other costs. We define Adjusted Net Income as net income (loss) less preferred dividends and accretion plus (i) amortization of intangibles, (ii) amortization of debt discount and issuance costs (iii) preferred dividend accretion, (iv) equity-based compensation, (v) remeasurement of the fair value of contingent consideration, (vi) certain legal expense, (viii) certain acquisition related costs, (ix) other costs, and (x) income tax (expense) benefit of adjustments. A detailed reconciliation between GAAP results and results excluding special items (“non-GAAP”) is included within this presentation. We calculate net income (loss) per share as net income (loss) to common shareholders divided by the basic and diluted weighted average number of shares outstanding for the applicable period and we define Adjusted Net Income (as detailed above) per share as Adjusted Net Income divided by the basic and diluted weighted average number of shares outstanding for the applicable period. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix for the reconciliations of certain non-GAAP financial measures to the comparable GAAP measures. Market and Industry Data This presentation also contains information regarding our market and our industry that is derived from third-party research and publications. That information may rely upon a number of assumptions and limitations, and we have not independently verified its accuracy or completeness.

3 Business Update Kevin Hostetler

4 Executive Summary Highlights Select Financials ► Total revenue growth of 116%, Organic revenue growth of 79% ► $1.9 billion in executed contracts and awarded, a 110% increase from June 30, 2021 ► Gross Margin of 11.1%, up 70 bps from Q2 2021 and 230 bps from Q1 2022 ► Adjusted EBITDA increased to $25.9 million, up from $0.7 million in Q1 2022 ► No covenant waivers or additional liquidity required $9.9 $25.9 Q2 Adjusted EBITDA(1) 2021 2022 $196.5 $424.9 Q2 Revenue 2021 2022 (1) See Appendix for reconciliation of non-GAAP measures to the closest GAAP measure

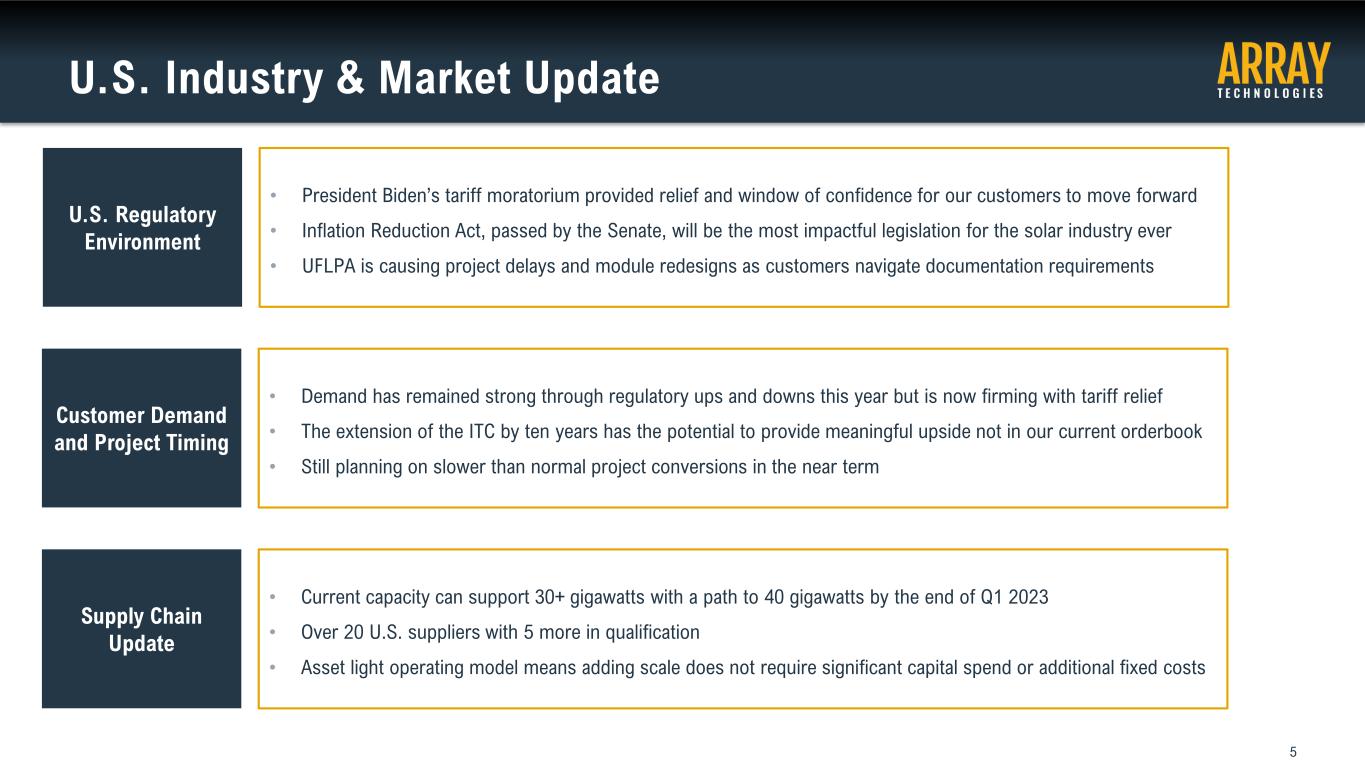

5 U.S. Industry & Market Update U.S. Regulatory Environment • President Biden’s tariff moratorium provided relief and window of confidence for our customers to move forward • Inflation Reduction Act, passed by the Senate, will be the most impactful legislation for the solar industry ever • UFLPA is causing project delays and module redesigns as customers navigate documentation requirements Customer Demand and Project Timing • Demand has remained strong through regulatory ups and downs this year but is now firming with tariff relief • The extension of the ITC by ten years has the potential to provide meaningful upside not in our current orderbook • Still planning on slower than normal project conversions in the near term Supply Chain Update • Current capacity can support 30+ gigawatts with a path to 40 gigawatts by the end of Q1 2023 • Over 20 U.S. suppliers with 5 more in qualification • Asset light operating model means adding scale does not require significant capital spend or additional fixed costs

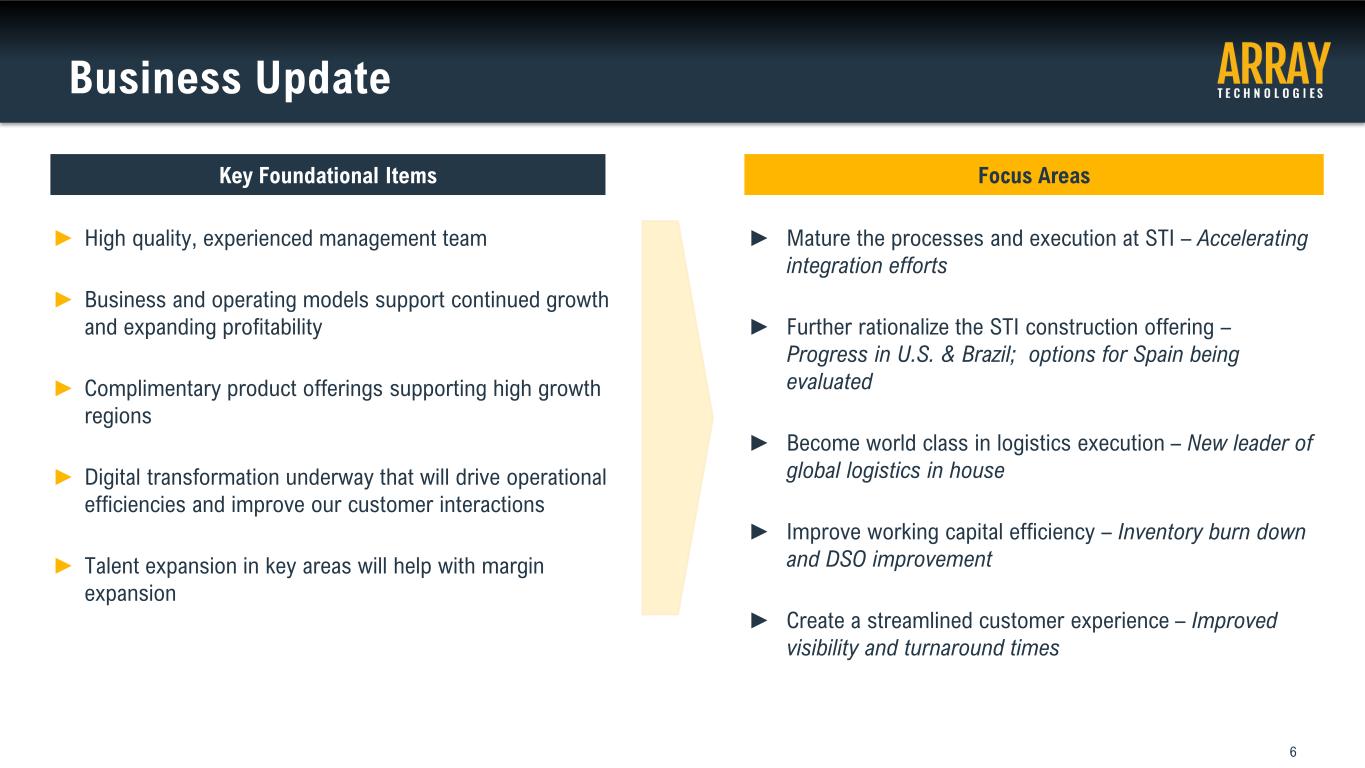

6 Business Update Key Foundational Items Focus Areas ► High quality, experienced management team ► Business and operating models support continued growth and expanding profitability ► Complimentary product offerings supporting high growth regions ► Digital transformation underway that will drive operational efficiencies and improve our customer interactions ► Talent expansion in key areas will help with margin expansion ► Mature the processes and execution at STI – Accelerating integration efforts ► Further rationalize the STI construction offering – Progress in U.S. & Brazil; options for Spain being evaluated ► Become world class in logistics execution – New leader of global logistics in house ► Improve working capital efficiency – Inventory burn down and DSO improvement ► Create a streamlined customer experience – Improved visibility and turnaround times

7 Financial Update Nipul Patel

8 2Q 2022 Financial Results Three Months Ended June 30, ($ in millions, except EPS Data) 2022 2021 Y/Y Revenue $424.9 $196.5 +$228.4 Gross margin 11.1% 10.4% + 70 bps Net loss to Common Shareholders ($15.0) ($5.5) ($9.5) Diluted EPS ($0.10) ($0.04) ($0.06) Adjusted EBITDA(1) $25.9 $9.9 +$16.0 Adjusted net income(1) $14.2 $3.0 +$11.2 Adjusted EPS(1) $0.09 $0.02 +$0.07 Free Cash Flow(2) ($12.2) ($92.6) +$80.4 (1) See Appendix for reconciliation of non-GAAP measures to the closest GAAP measure (2) Free Cash Flow calculated as cash from (used in) operating activities less CAPEX 2Q Snapshot Y/Y Comparison ► Revenue up 116% from addition of STI Norland business, increase in total MWs shipped and an increase in ASP ► Gross margin increased to 11.1% from 10.4% driven by higher pricing to our customers to offset the increase in input costs ► Adjusted EBITDA increased to $25.9 million, compared to $9.9 million for the prior-year period ► Free cash flow of ($12.2) million an $80.4 million improvement from prior year on better working capital efficiency and improved profitability

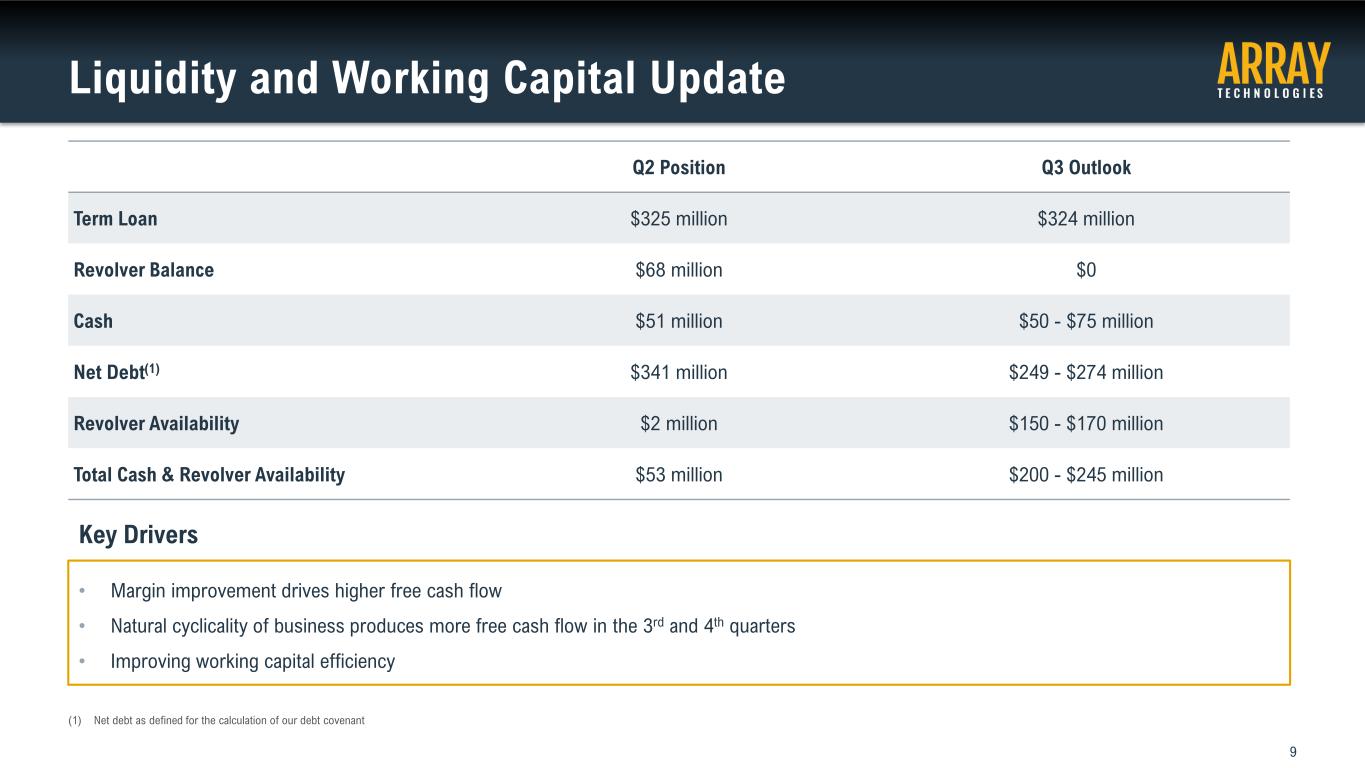

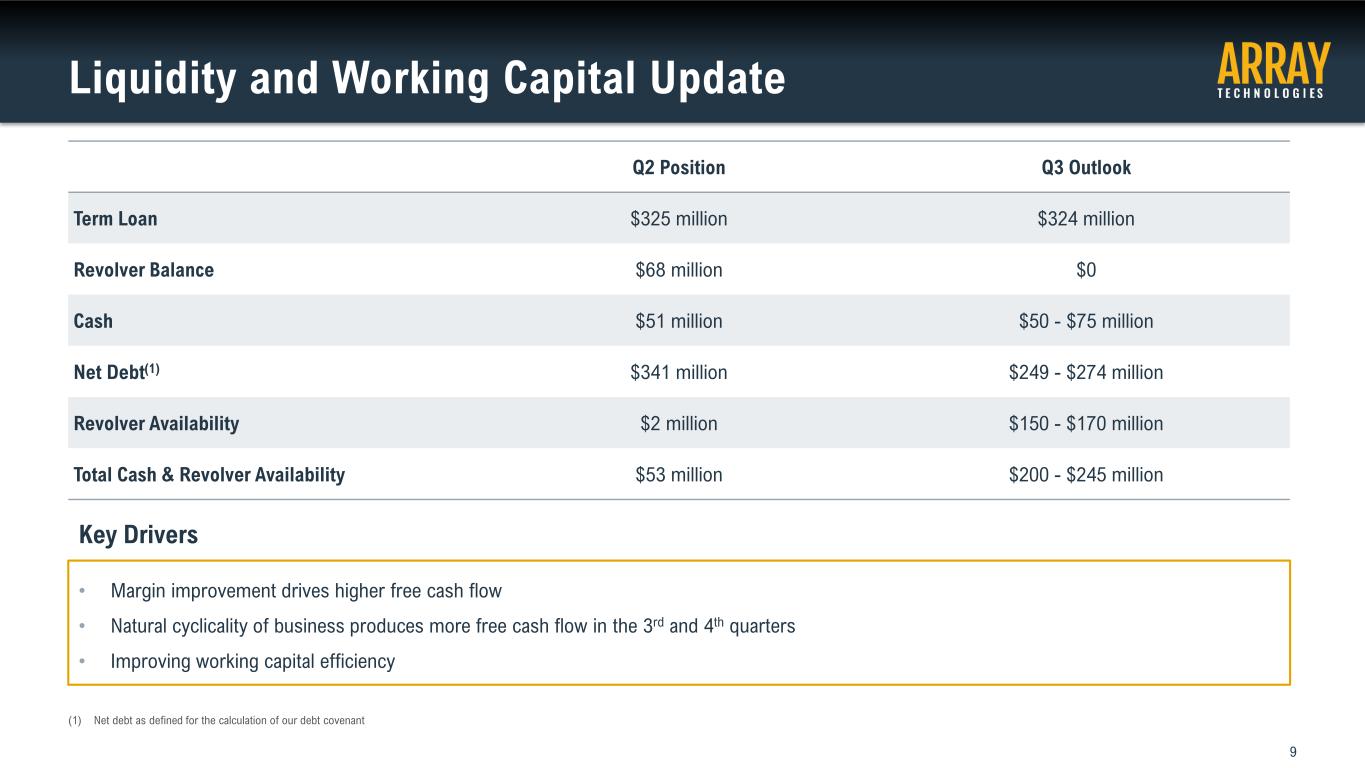

9 Liquidity and Working Capital Update Q2 Position Q3 Outlook Term Loan $325 million $324 million Revolver Balance $68 million $0 Cash $51 million $50 - $75 million Net Debt(1) $341 million $249 - $274 million Revolver Availability $2 million $150 - $170 million Total Cash & Revolver Availability $53 million $200 - $245 million • Margin improvement drives higher free cash flow • Natural cyclicality of business produces more free cash flow in the 3rd and 4th quarters • Improving working capital efficiency (1) Net debt as defined for the calculation of our debt covenant Key Drivers

10 FY2022 Guidance Reaffirmed (1) A reconciliation of projected adjusted EBITDA and adjusted net income per share, which are forward-looking measures that are not prepared in accordance with GAAP, to the most directly comparable GAAP financial measures, is not provided because we are unable to provide such reconciliation without unreasonable effort. The inability to provide a quantitative reconciliation is due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the components of the applicable GAAP measures and non-GAAP adjustments may be recognized. The GAAP measures may include the impact of such items as non-cash share-based compensation, revaluation of the fair-value of our contingent consideration, amortization of intangible assets and the tax effect of such items, in addition to other items we have historically excluded from adjusted EBITDA and adjusted net income per share. We expect to continue to exclude these items in future disclosures of these non-GAAP measures and may also exclude other similar items that may arise in the future (collectively, “non-GAAP adjustments”). The decisions and events that typically lead to the recognition of non-GAAP adjustments are inherently unpredictable as to if or when they may occur. As such, for our 2022 outlook, we have not included estimates for these items and are unable to address the probable significance of the unavailable information, which could be material to future results. Revenue $1.30 billion to $1.50 billion Adjusted EBITDA(1) $120 million to $140 million Adjusted net income per common share(1) $0.25 to $0.35 Full Year Ending December 31, 2022 ► AD/CVD relief providing minimal upside to 2022 ► Adjusted SG&A between $25 million to $28 million per quarter ► Effective Tax Rate: 26% ► Fx Rates: Euro to USD 1.05 | Euro to BRL 5.25 ► Diluted Shares Outstanding at December 31, 2022: 151 million Planning Assumptions Company Specifics Legacy Array STI Norland Revenue $0.95 billion to $1.05 billion $350 million to $450 million Gross Margin Mid Teens Mid Teens

11 Appendix

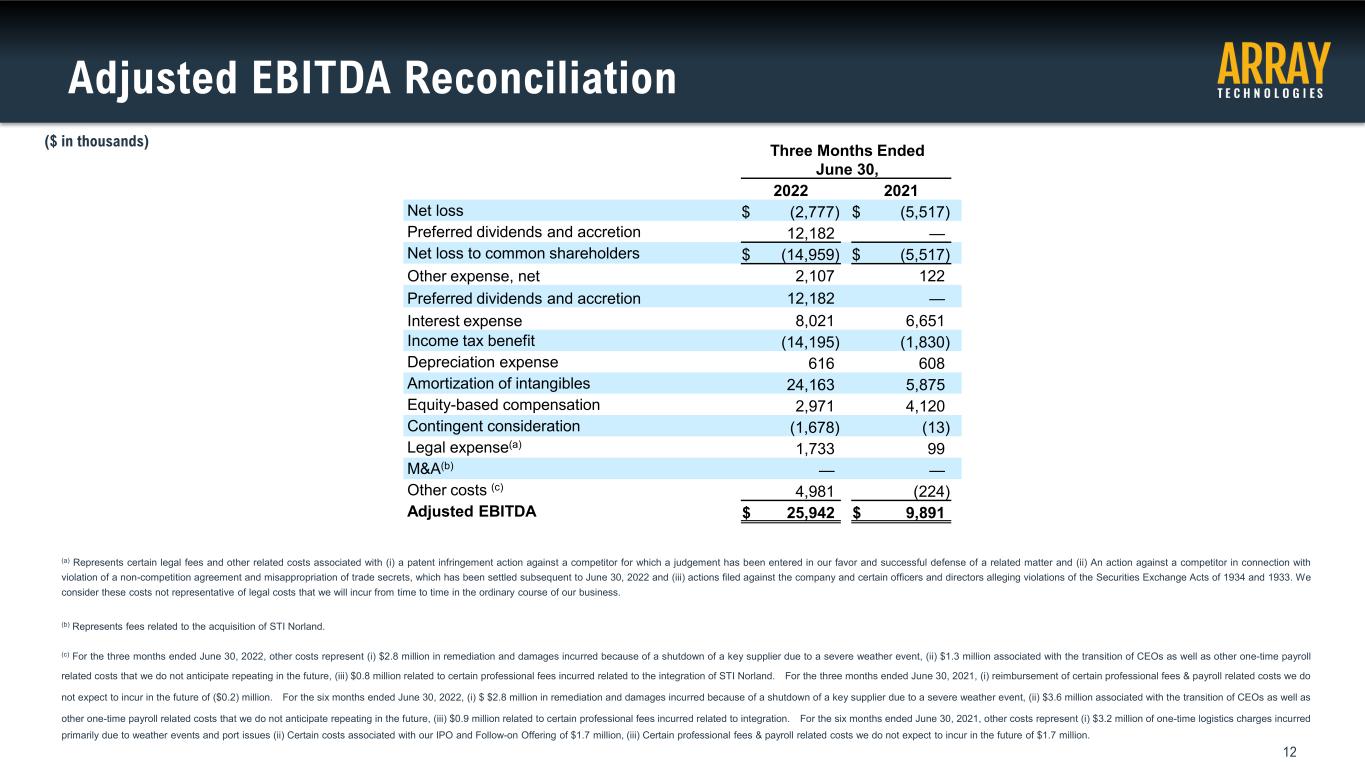

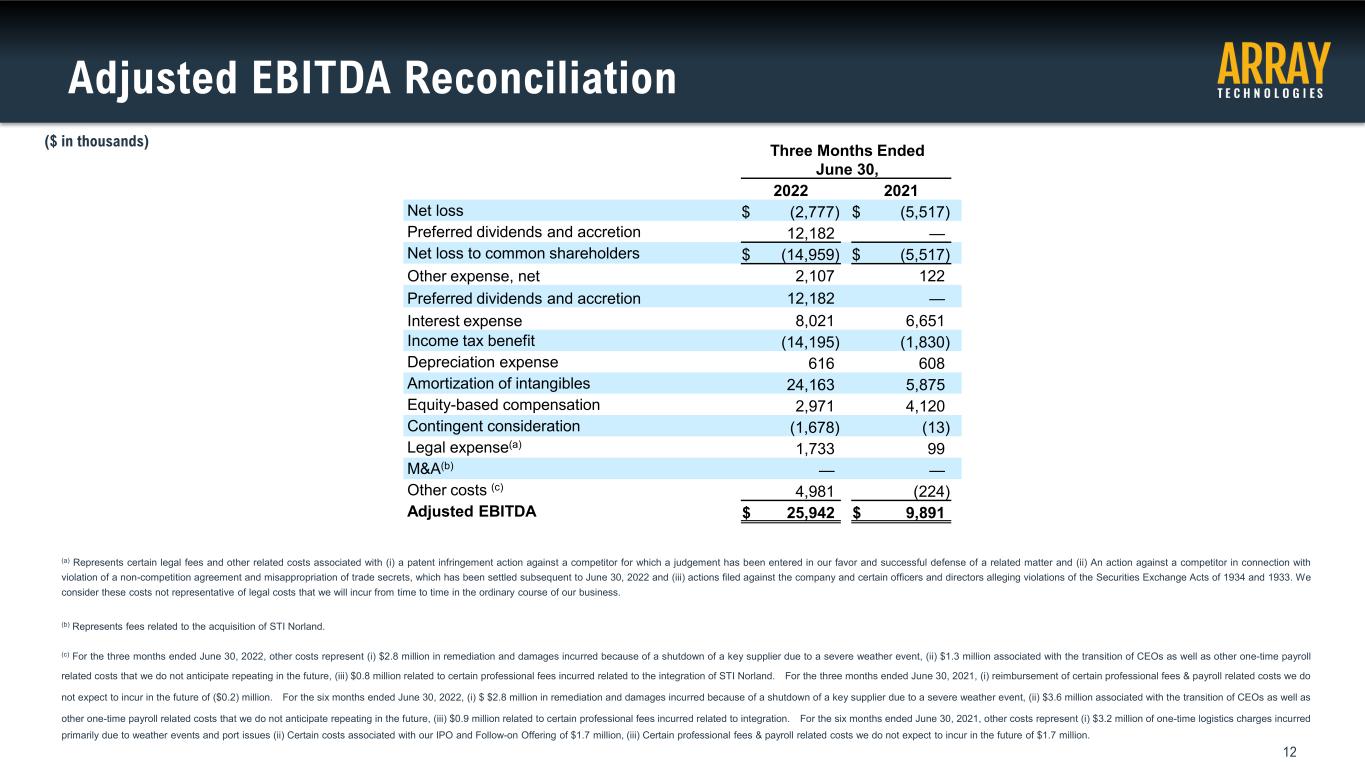

12 Adjusted EBITDA Reconciliation ($ in thousands) Three Months Ended June 30, 2022 2021 Net loss $ (2,777) $ (5,517) Preferred dividends and accretion 12,182 — Net loss to common shareholders $ (14,959) $ (5,517) Other expense, net 2,107 122 Preferred dividends and accretion 12,182 — Interest expense 8,021 6,651 Income tax benefit (14,195) (1,830) Depreciation expense 616 608 Amortization of intangibles 24,163 5,875 Equity-based compensation 2,971 4,120 Contingent consideration (1,678) (13) Legal expense(a) 1,733 99 M&A(b) — — Other costs (c) 4,981 (224) Adjusted EBITDA $ 25,942 $ 9,891 (a) Represents certain legal fees and other related costs associated with (i) a patent infringement action against a competitor for which a judgement has been entered in our favor and successful defense of a related matter and (ii) An action against a competitor in connection with violation of a non-competition agreement and misappropriation of trade secrets, which has been settled subsequent to June 30, 2022 and (iii) actions filed against the company and certain officers and directors alleging violations of the Securities Exchange Acts of 1934 and 1933. We consider these costs not representative of legal costs that we will incur from time to time in the ordinary course of our business. (b) Represents fees related to the acquisition of STI Norland. (c) For the three months ended June 30, 2022, other costs represent (i) $2.8 million in remediation and damages incurred because of a shutdown of a key supplier due to a severe weather event, (ii) $1.3 million associated with the transition of CEOs as well as other one-time payroll related costs that we do not anticipate repeating in the future, (iii) $0.8 million related to certain professional fees incurred related to the integration of STI Norland. For the three months ended June 30, 2021, (i) reimbursement of certain professional fees & payroll related costs we do not expect to incur in the future of ($0.2) million. For the six months ended June 30, 2022, (i) $ $2.8 million in remediation and damages incurred because of a shutdown of a key supplier due to a severe weather event, (ii) $3.6 million associated with the transition of CEOs as well as other one-time payroll related costs that we do not anticipate repeating in the future, (iii) $0.9 million related to certain professional fees incurred related to integration. For the six months ended June 30, 2021, other costs represent (i) $3.2 million of one-time logistics charges incurred primarily due to weather events and port issues (ii) Certain costs associated with our IPO and Follow-on Offering of $1.7 million, (iii) Certain professional fees & payroll related costs we do not expect to incur in the future of $1.7 million.

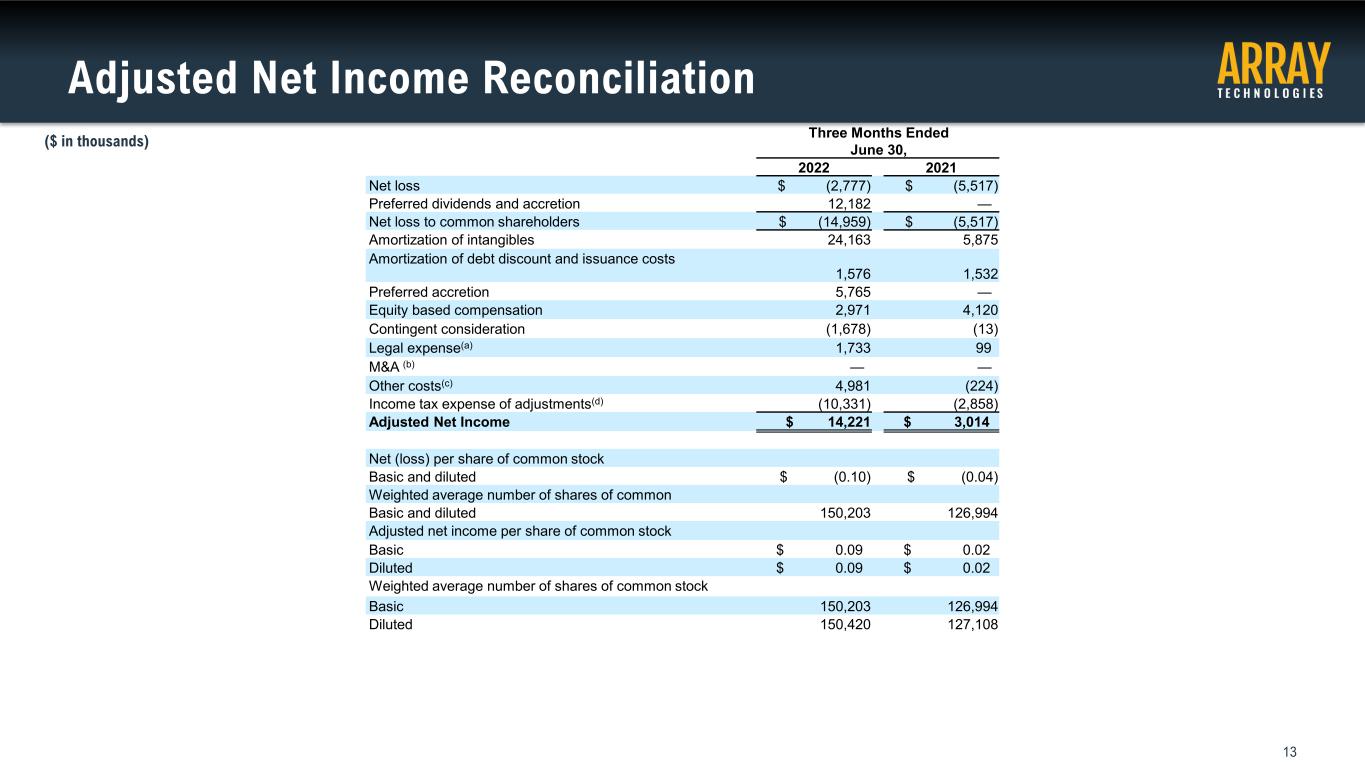

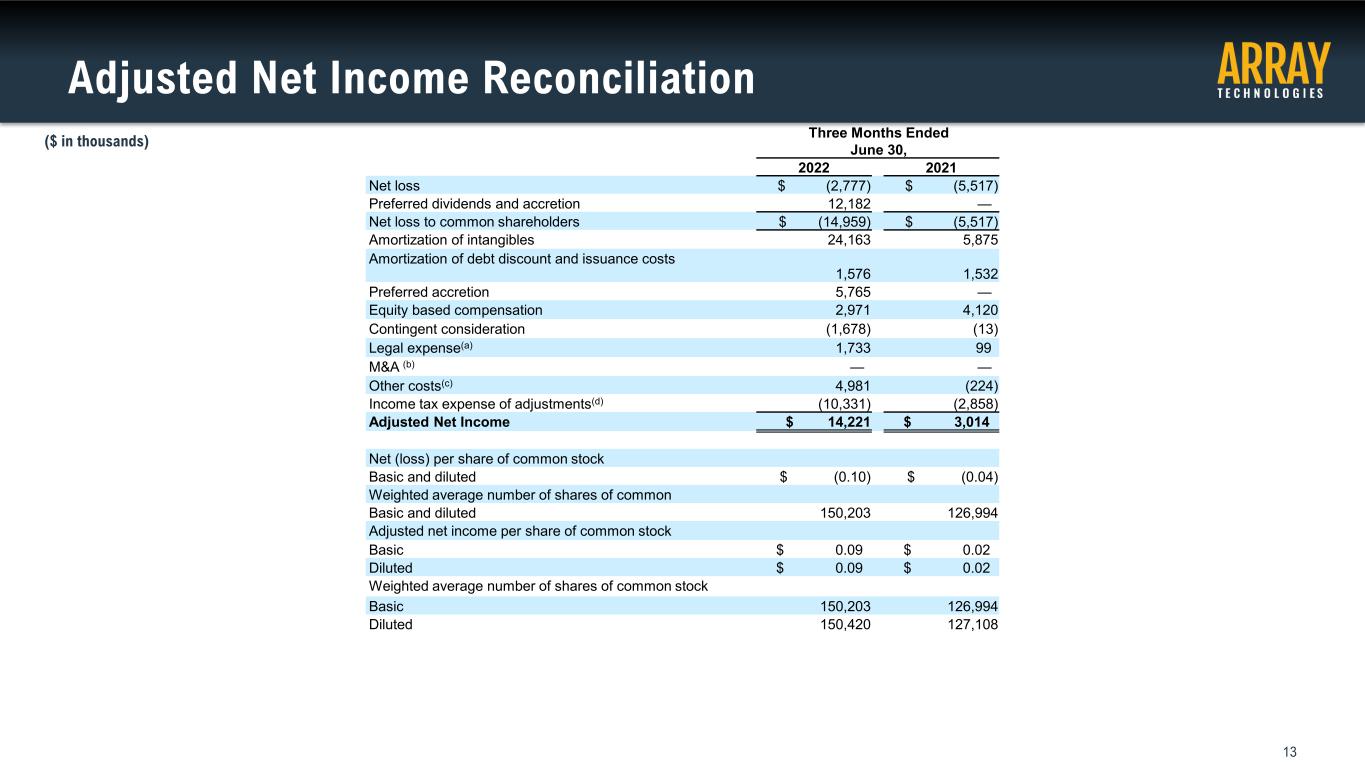

13 Adjusted Net Income Reconciliation ($ in thousands) Three Months Ended June 30, 2022 2021 Net loss $ (2,777) $ (5,517) Preferred dividends and accretion 12,182 — Net loss to common shareholders $ (14,959) $ (5,517) Amortization of intangibles 24,163 5,875 Amortization of debt discount and issuance costs 1,576 1,532 Preferred accretion 5,765 — Equity based compensation 2,971 4,120 Contingent consideration (1,678) (13) Legal expense(a) 1,733 99 M&A (b) — — Other costs(c) 4,981 (224) Income tax expense of adjustments(d) (10,331) (2,858) Adjusted Net Income $ 14,221 $ 3,014 Net (loss) per share of common stock Basic and diluted $ (0.10) $ (0.04) Weighted average number of shares of common Basic and diluted 150,203 126,994 Adjusted net income per share of common stock Basic $ 0.09 $ 0.02 Diluted $ 0.09 $ 0.02 Weighted average number of shares of common stock Basic 150,203 126,994 Diluted 150,420 127,108

14 Adjusted Net Income Reconciliation, Continued (a) Represents certain legal fees and other related costs associated with (i) a patent infringement action against a competitor for which a judgement has been entered in our favor and successful defense of a related matter and (ii) An action against a competitor in connection with violation of a non-competition agreement and misappropriation of trade secrets which has been settled subsequent to June 30, 2022, and (iii) actions filed against the company and certain officers and directors alleging violations of the Securities Exchange Acts of 1934 and 1933. We consider these costs not representative of legal costs that we will incur from time to time in the ordinary course of our business. (b) Represents fees related to the acquisition of STI Norland. (c) For the three months ended June 30, 2022, other costs represent (i) $2.8 million in remediation and damages incurred because of a shutdown of a key supplier due to a severe weather event, (ii) $1.3 million associated with the transition of CEOs as well as other one-time payroll related costs that we do not anticipate repeating in the future, (iii) $0.8 million related to certain professional fees incurred related to the integration of STI Norland. For the three months ended June 30, 2021, (i) reimbursement of certain professional fees & payroll related costs we do not expect to incur in the future of ($0.2) million. For the six months ended June 30, 2022, (i) $2.8 million in remediation and damages incurred because of a shutdown of a key supplier due to a severe weather event, (ii) $3.6 million associated with the transition of CEOs as well as other one-time payroll related costs that we do not anticipate repeating in the future, (iii) $0.9 million related to certain professional fees incurred related to the integration of STI Norland. For the six months ended June 30, 2021, other costs represent (i) $3.2 million of one-time logistics charges incurred primarily due to weather events and port issues (ii) Certain costs associated with our IPO and Follow-on Offering of $1.7 million, (iii) Certain professional fees & payroll related costs we do not expect to incur in the future of $1.7 million. (d) Represents the estimated tax impact of all Adjusted Net Income add-backs, excluding those which represent permanent differences between book versus tax.