0 Array Technologies 2Q 2024 Earnings Call August 8, 2024

1 Disclaimer Forward-Looking Statements and Other Information This presentation contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include information concerning our projected future results of operations, sales volume, project timing, and industry and regulatory environment. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” "seek," “should,” “will,” “would” or similar expressions and the negatives of those terms. Array’s actual results and the timing of events could materially differ from those anticipated in such forward-looking statements as a result of certain risks, uncertainties and other factors, including without limitation: changes in growth or rate of growth in demand for solar energy projects; competitive pressures within our industry; a loss of one or more of our significant customers, their inability to perform under their contracts, or their default in payment; a drop in the price of electricity derived from the utility grid or from alternative energy sources; a failure to maintain effective internal controls over financial reporting; a further increase in interest rates, or a reduction in the availability of tax equity or project debt capital in the global financial markets, which could make it difficult for customers to finance the cost of a solar energy system; electric utility industry policies and regulations, and any subsequent changes, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems, which may significantly reduce demand for our products or harm our ability to compete; the interruption of the flow of materials from international vendors, which could disrupt our supply chain, including as a result of the imposition of additional duties, tariffs and other charges or restrictions on imports and exports; geopolitical, macroeconomic and other market conditions unrelated to our operating performance including the military conflict in Ukraine and Russia, the Israel-Hamas war, attacks on shipping in the Red Sea and rising inflation and interest rates; changes in the global trade environment, including the imposition of import tariffs or other import restrictions; our ability to convert our orders in backlog into revenue; fluctuations in our results of operations across fiscal periods, which could make our future performance difficult to predict and could cause our results of operations for a particular period to fall below expectations; the reduction, elimination or expiration, or our failure to optimize the benefits of government incentives for, or regulations mandating the use of, renewable energy and solar energy, particularly in relation to our competitors; failure to, or incurrence of significant costs in order to, obtain, maintain, protect, defend or enforce, our intellectual property and other proprietary right; significant changes in the cost of raw materials; defects or performance problems in our products, which could result in loss of customers, reputational damage and decreased revenue; delays, disruptions or quality control problems in our product development operations; our ability to obtain key personnel or failure to attract additional qualified personnel; additional business, financial, regulatory and competitive risks due to our continued planned expansion into new markets; cybersecurity or other data incidents, including unauthorized disclosure of personal or sensitive data or theft of confidential information; failure to implement and maintain effective internal controls over financial reporting; risks related to actual or threatened public health epidemics, pandemics, outbreaks or crises, such as the COVID-19 pandemic, which could have a material and adverse effect on our business, results of operations and financial condition; changes to tax laws and regulations that are applied adversely to us or our customers, which could materially adversely affect our business, financial condition, results of operations and prospects, including our ability to optimize those changes brought about by the passage of the Inflation Reduction Act; and the other risks and uncertainties described in more detail in the Company’s most recent Annual Report on Form 10-K and other documents on file with the SEC, each of which can be found on our website www.arraytechinc.com. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Non-GAAP Financial Information This presentation includes certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per share, and Free Cash Flow. We define Adjusted Gross Profit as Gross Profit plus (i) developed technology amortization and (ii) other costs if applicable. We define Adjusted EBITDA as net income (loss) to common shareholders plus (i) other (income) expense, (ii) foreign currency transaction (gain) loss, (iii) preferred dividends and accretion, (iv) interest expense, (v) income tax (benefit) expense, (vi) depreciation expense, (vii) amortization of intangibles, (viii) amortization of developed technology, (ix) equity-based compensation, (x) change in fair value of contingent consideration, (xi) certain legal expenses, (xii) certain acquisition related costs if applicable, and (xiii) other costs. We define Adjusted Net Income as net income to common shareholders plus (i) amortization of intangibles, (ii) amortization of developed technology, (iii) amortization of debt discount and issuance costs (iv) preferred accretion, (v) equity-based compensation, (vi) change in fair value of contingent consideration, (vii) certain legal expenses, (viii) certain acquisition related costs if applicable, (ix) other costs, and (x) income tax (benefit) expense of adjustments. We define Free Cash Flow as Cash provided by (used in) operating activities less purchase of property, plant and equipment. A detailed reconciliation between GAAP results and results excluding special items (“non-GAAP”) is included within this presentation. We calculate net income (loss) per share as net income (loss) to common shareholders divided by the basic and diluted weighted average number of shares outstanding for the applicable period and we define Adjusted Net Income per share as Adjusted Net Income (as detailed above) divided by the basic and diluted weighted average number of shares outstanding for the applicable period. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix for the reconciliations of certain non-GAAP financial measures to the comparable GAAP measures. Market and Industry Data This presentation also contains information regarding our market and our industry that is derived from third-party research and publications. That information may rely upon a number of assumptions and limitations, and we have not independently verified its accuracy or completeness.

2 Business Update Kevin Hostetler, CEO Neil Manning, President & COO

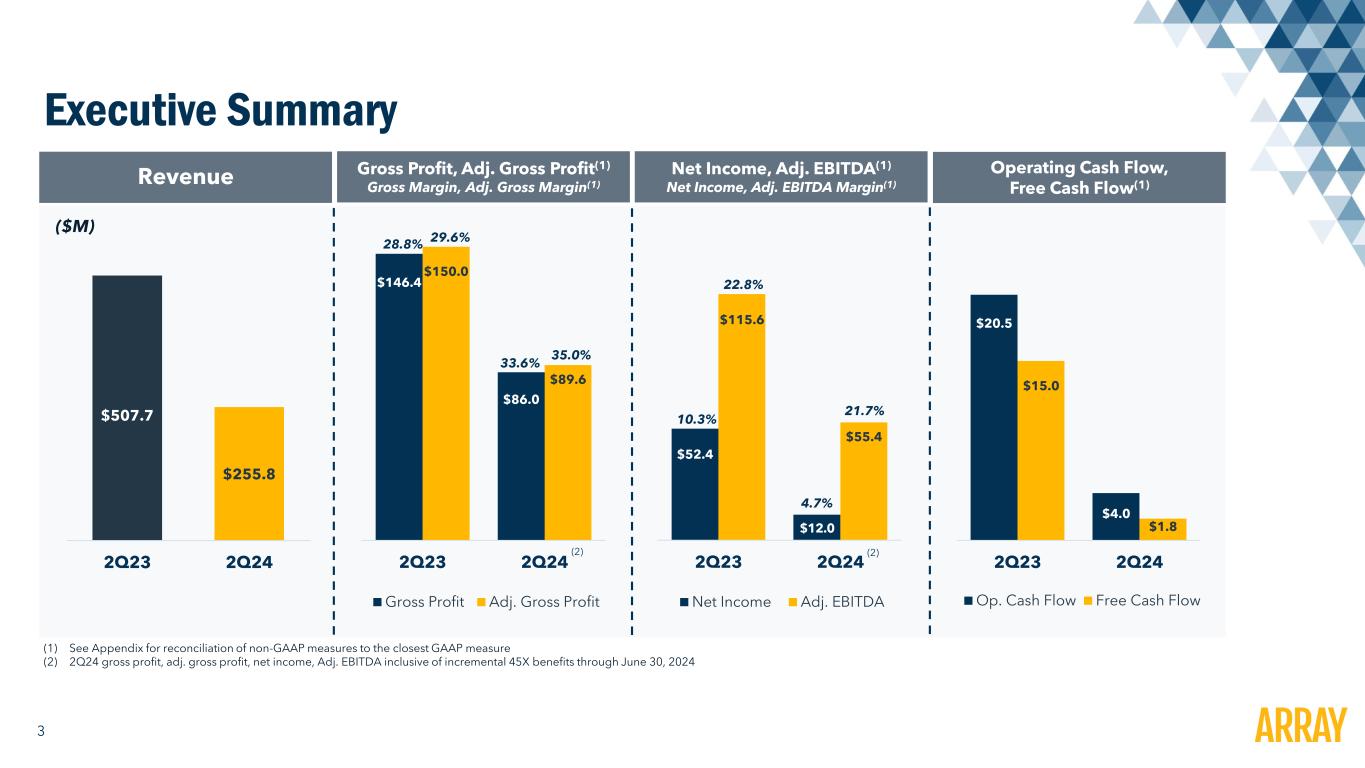

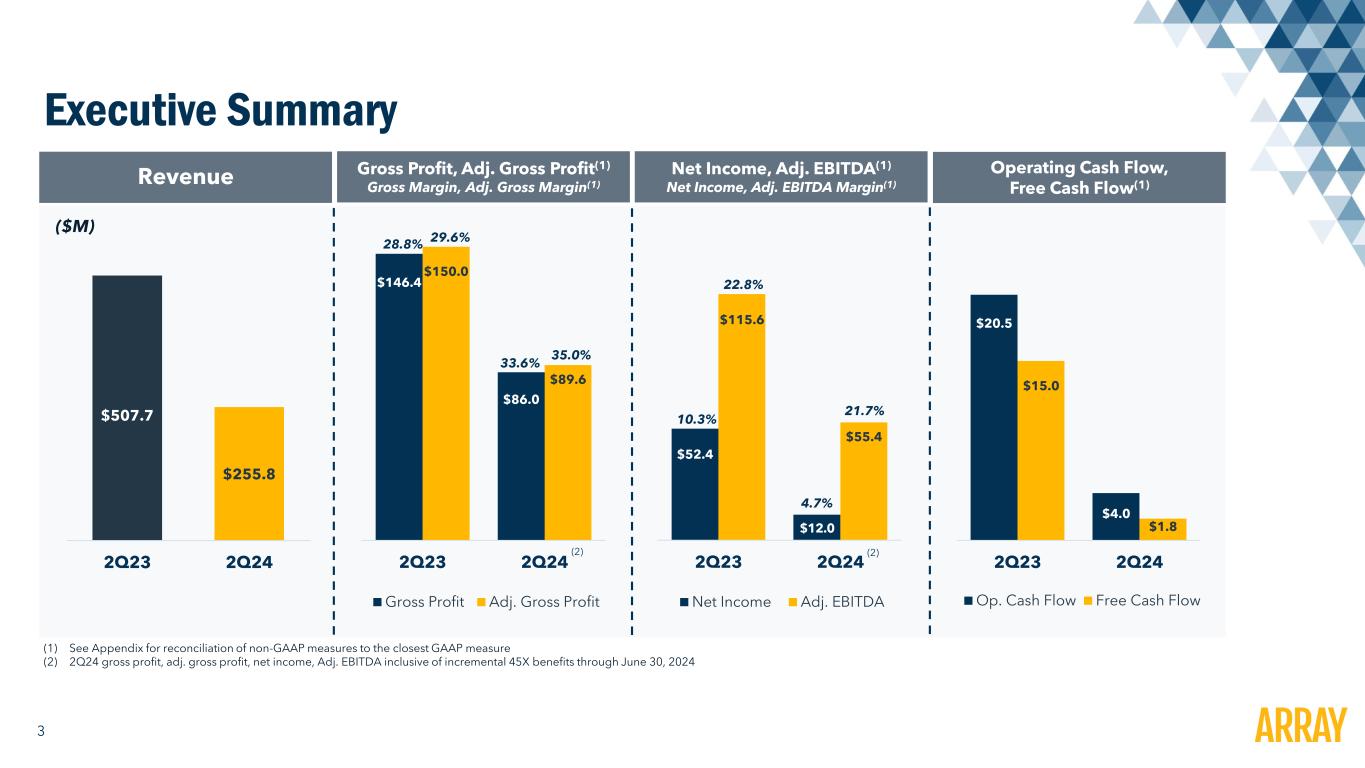

3 Executive Summary (1) See Appendix for reconciliation of non-GAAP measures to the closest GAAP measure (2) 2Q24 gross profit, adj. gross profit, net income, Adj. EBITDA inclusive of incremental 45X benefits through June 30, 2024 $507.7 $255.8 2Q23 2Q24 ($M) Revenue $146.4 $86.0 $150.0 $89.6 2Q23 2Q24 Gross Profit Adj. Gross Profit 35.0% 33.6% 29.6% 28.8% $52.4 $12.0 $115.6 $55.4 2Q23 2Q24 Net Income Adj. EBITDA $20.5 $4.0 $15.0 $1.8 2Q23 2Q24 Op. Cash Flow Free Cash Flow 22.8% 21.7% 10.3% 4.7% Gross Profit, Adj. Gross Profit(1) Gross Margin, Adj. Gross Margin(1) Net Income, Adj. EBITDA(1) Net Income, Adj. EBITDA Margin(1) Operating Cash Flow, Free Cash Flow(1) (2) (2)

4 Utility-Scale Solar Industry Environment Industry and Market Dynamics 2024 Market Dynamics ► Strong new bookings performance and orderbook remains over $2B ► Some customers continue to elongate timeline from awards to expected project starts; still face volatility from a variety of existing factors impacting near-term project timing ► Uncertainty around AD/CVD petitions and new domestic content guidance assessment causing new delays in project timing as customers navigate potential implications ► Rapid devaluation of Brazilian Real leading to extended project timelines as project developers work to renegotiate PPA pricing ► Solar continues to dominate new U.S. electric capacity additions1 ► AI datacenter growth likely a positive tailwind in coming years ► IRA expected to facilitate nearly 3X the current U.S. solar capacity by 20282 ► New domestic content elective safe harbor table creates easier pathway for customers seeking additional 10% bonus (1) Based on Federal Energy Regulatory Commission Energy Infrastructure Update with data through April 2024 (2) Wood Mackenzie “US solar market registers best first quarter in industry history as supply chains stabilize and Inflation Reduction Act takes hold”

5 SkyLink System Launch Wireless All-Weather String Powered DC Control System ► Extreme Weather Response: The PV power control system enables tracker movement regardless of grid status. Ensures trackers always stow with snow accumulation as detected by SmarTrackTM Automated Hail Alert Response. ► Enhanced Production: SkyLink’s eight-row architecture ensures minimal rows span over a hill yielding a higher degree of power production. ► Increased Project Savings: DC powered wireless communications requires minimal wire management and no trenching. Coupled with zero specialized tools, SkyLink can improve installation timelines and costs. ► Flexible Design: SkyLink’s eight row motor architecture allows for greater flexibility within a site layout, and with our trackers it increases PV capacity and cost savings for fragmented sites with irregular boundaries. ► Cyber Security: Zigbee wireless communications follows a “Defense-in- Depth” approach recommended by US Department of Homeland Security guidelines. This adds multiple layers of protection against security breaches. Key Benefits

6 Customer & Industry Engagement Updates ► Insurance Forum July 10-11 in Chandler, AZ ➢ Around 35 attendees from insurers, brokers and banks • Impressed at Array’s resilient design for trackers • Noted Array stowing capabilities are top-tier with fewer failure points • Remarked “passive stow is a game changer” regarding energy savings versus active wind stow ► Customer Forum July 30-31 in Chandler, AZ ➢ Over 40 EPC and developer attendees • Focused on extreme weather capabilities as a differentiator including Hail Stow and Passive Wind Stow • Customers interested in Array engagement with Insurers • VOC sessions helped gather needed and constructive feedback to improve end-to-end customer experience • Customers pleased with increased engagement and transparency into processes

7 ► Capacity: 50+ GW Globally; 30+ GW in the U.S. • Geographic diversity enhances security of supply ► Domestic Maturity: Long-standing U.S. focused presence • 31 domestic factories including our Albuquerque, NM facility • Majority supplying Array 3+ years • Strong quality and leading on-time delivery performance • Demonstrated year-over-year improvements across key measures including inventory, commodity and cost-out programs ► Domestic Content: 100% U.S. domestic content by 1H 2025 ! ► Renewable Electricity Usage: Increased renewably sourced electricity in operations to 29%, up from 25% the previous year ► Employee Safety: Achieved a 27% reduction in total recordable incident rate (TRIR) from the previous year through enhanced employee safety training and policies ► Emission Reductions: Continued to drive down direct emissions intensity through renewable energy sourcing and operational efficiency ESG & Sustainability - Array Technologies Supply Chain & ESG Updates 2023 ESG Disclosures Array's Supply Chain Profile

8 Financial Update Kevin Hostetler, CEO

9 Three Months Ended June 30, ($ in millions, except EPS Data) 2024 2023 Y/Y Revenue $255.8 $507.7 ($251.9) Gross margin(1) 33.6% 28.8% + 480 bps Net income (loss) to Common Shareholders(1) $12.0 $52.4 ($40.4) Diluted EPS(1) $0.08 $0.34 ($0.26) Adjusted gross margin(1)(2) 35.0% 29.6% +540 bps Adjusted EBITDA(1)(2) $55.4 $115.6 ($60.2) Adjusted net income(1)(2) $30.6 $74.3 ($43.7) Adjusted, diluted EPS(1)(2) $0.20 $0.49 ($0.29) Free Cash Flow(2) $1.8 $15.0 ($13.2) 2Q 2024 Financial Results 2Q Snapshot Y/Y Comparison (1) All 2Q24 profitability metrics inclusive of incremental 45X benefits through June 30, 2024 (2) See Appendix for reconciliation of non-GAAP measures to the closest GAAP measure ► Revenue down 50% primarily from lower volumes and ASP decline on lower input costs ► Adjusted gross margin increased to 35.0% from 29.6% driven by strong core margin performance coupled with the recognition of 45X benefits for torque tube and structural fasteners ► Adjusted EBITDA of $55.4M, compared to $115.6M in the prior year period driven by lower revenue base year-over- year, partly offset by improved gross margin performance

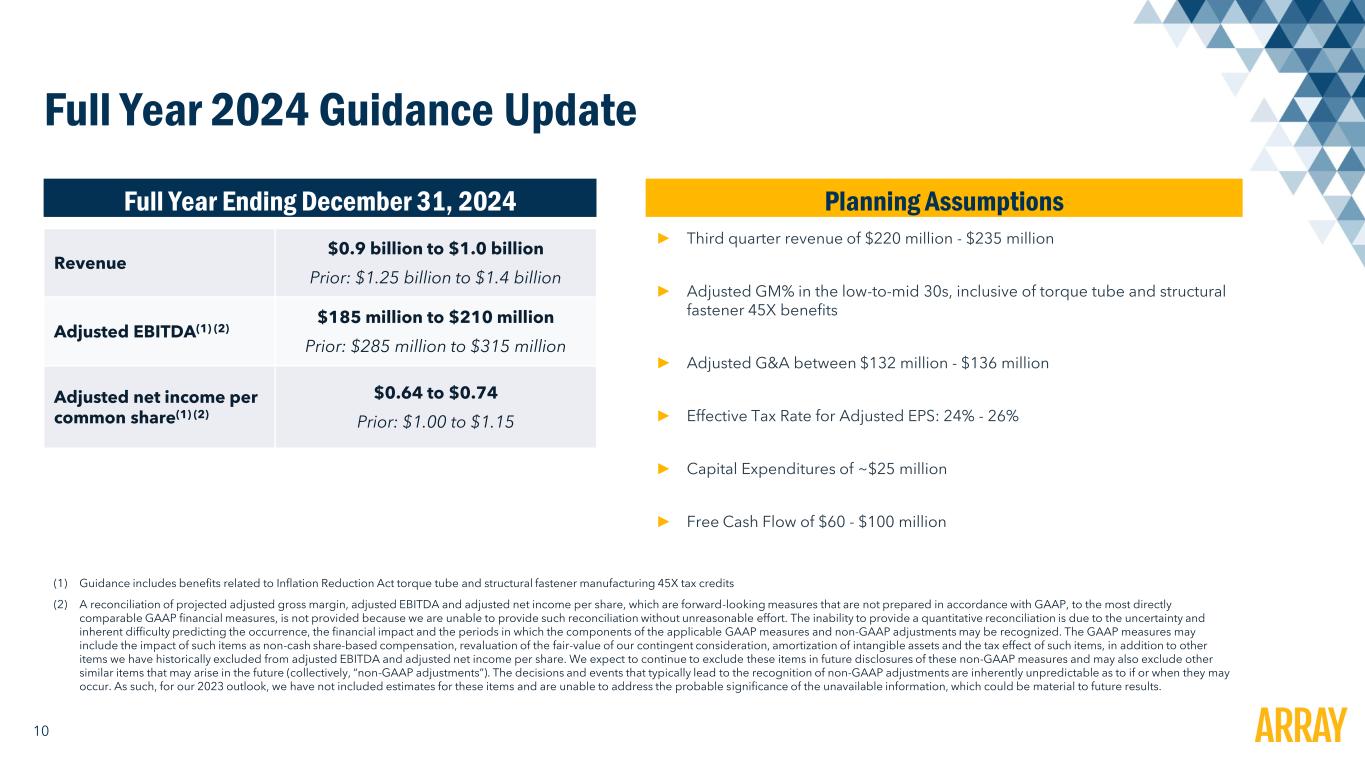

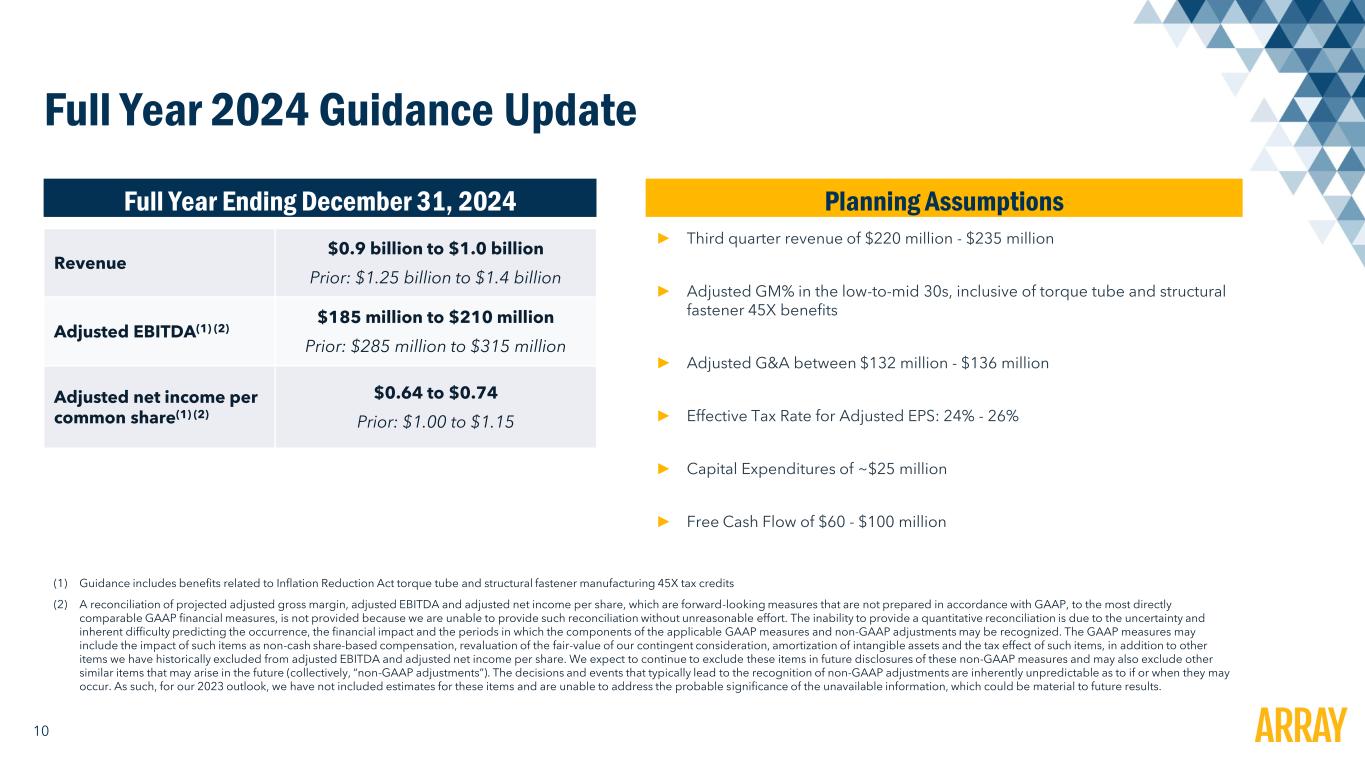

10 Full Year 2024 Guidance Update Full Year Ending December 31, 2024 Revenue $0.9 billion to $1.0 billion Prior: $1.25 billion to $1.4 billion Adjusted EBITDA(1) (2) $185 million to $210 million Prior: $285 million to $315 million Adjusted net income per common share(1) (2) $0.64 to $0.74 Prior: $1.00 to $1.15 (1) Guidance includes benefits related to Inflation Reduction Act torque tube and structural fastener manufacturing 45X tax credits (2) A reconciliation of projected adjusted gross margin, adjusted EBITDA and adjusted net income per share, which are forward-looking measures that are not prepared in accordance with GAAP, to the most directly comparable GAAP financial measures, is not provided because we are unable to provide such reconciliation without unreasonable effort. The inability to provide a quantitative reconciliation is due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the components of the applicable GAAP measures and non-GAAP adjustments may be recognized. The GAAP measures may include the impact of such items as non-cash share-based compensation, revaluation of the fair-value of our contingent consideration, amortization of intangible assets and the tax effect of such items, in addition to other items we have historically excluded from adjusted EBITDA and adjusted net income per share. We expect to continue to exclude these items in future disclosures of these non-GAAP measures and may also exclude other similar items that may arise in the future (collectively, “non-GAAP adjustments”). The decisions and events that typically lead to the recognition of non-GAAP adjustments are inherently unpredictable as to if or when they may occur. As such, for our 2023 outlook, we have not included estimates for these items and are unable to address the probable significance of the unavailable information, which could be material to future results. Planning Assumptions ► Third quarter revenue of $220 million - $235 million ► Adjusted GM% in the low-to-mid 30s, inclusive of torque tube and structural fastener 45X benefits ► Adjusted G&A between $132 million - $136 million ► Effective Tax Rate for Adjusted EPS: 24% - 26% ► Capital Expenditures of ~$25 million ► Free Cash Flow of $60 - $100 million

11 Appendix

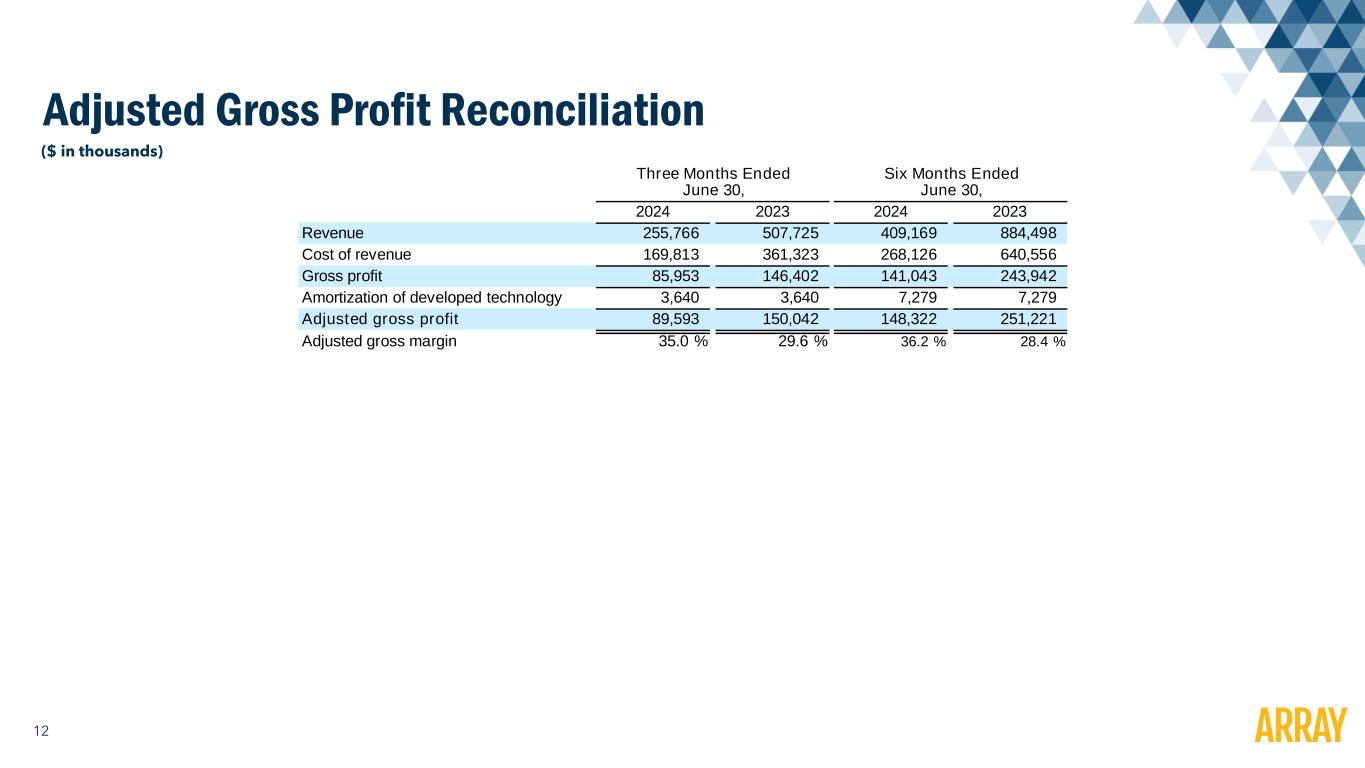

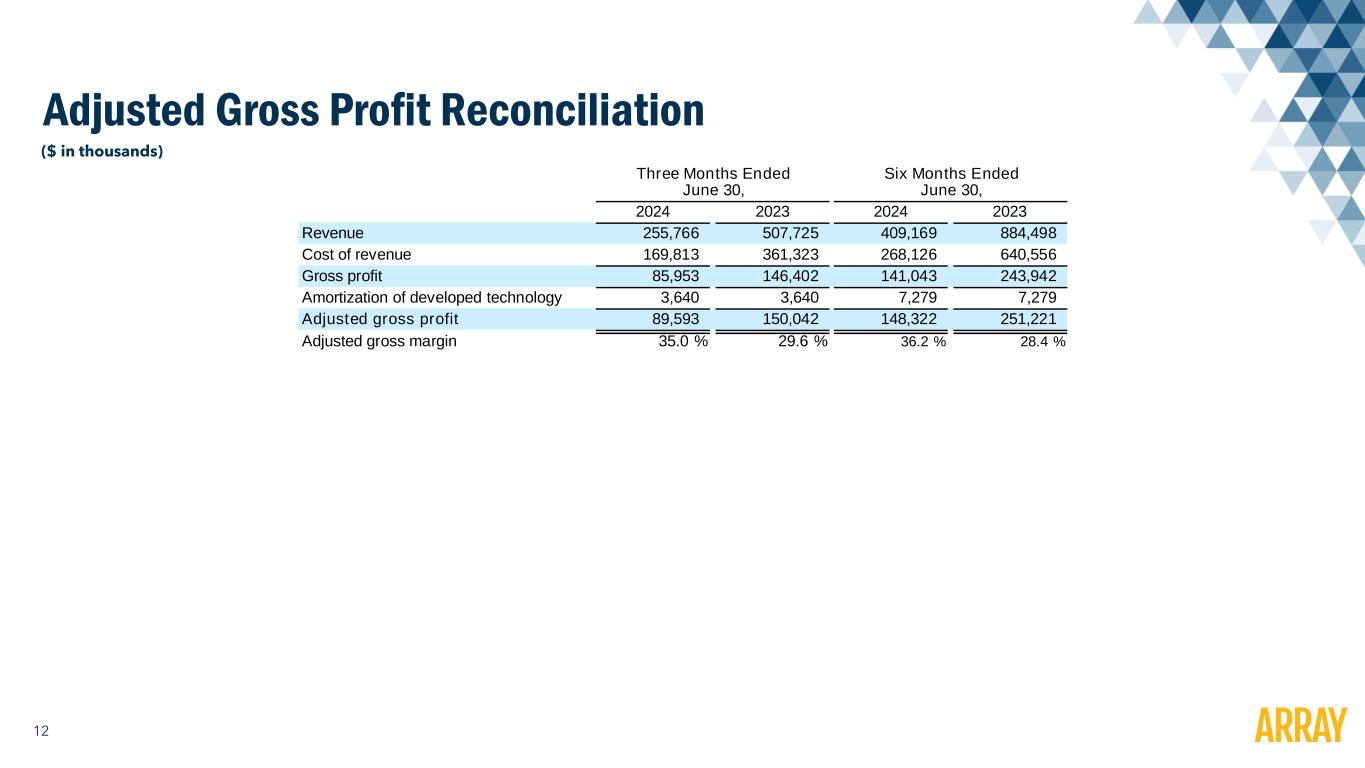

12 Adjusted Gross Profit Reconciliation ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue 255,766 507,725 409,169 884,498 Cost of revenue 169,813 361,323 268,126 640,556 Gross profit 85,953 146,402 141,043 243,942 Amortization of developed technology 3,640 3,640 7,279 7,279 Adjusted gross profit 89,593 150,042 148,322 251,221 Adjusted gross margin 35.0 % 29.6 % 36.2 % 28.4 %

13 Adjusted EBITDA Reconciliation (a) Represents certain legal fees and other related costs associated with (i) Actions filed against the Company and certain officers and directors alleging violations of the Securities Exchange Acts of 1934 and 1933, which litigation was dismissed with prejudice by the court on May 19, 2023 and subsequently appealed. The appeal has been fully briefed, argued, and the Company is awaiting a decision, and (ii) other litigation. We consider these costs not representative of legal costs that we will incur from time to time in the ordinary course of our business. (b) For the six months ended June 30, 2024, other costs represent costs related to Capped-Call accounting treatment evaluation. ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net income $ 25,699 $ 65,165 $ 27,863 $ 94,800 Preferred dividends and accretion 13,749 12,784 27,251 25,268 Net income to common shareholders $ 11,950 $ 52,381 $ 612 $ 69,532 Other expense, net (2,989) (1,593) (7,482) (3,018) Foreign currency loss (gain), net 468 (260) 967 (66) Preferred dividends and accretion 13,749 12,784 27,251 25,268 Interest expense 8,614 11,577 17,554 22,308 Income tax expense 7,810 21,352 9,114 29,675 Depreciation expense 1,155 576 2,038 1,188 Amortization of intangibles 8,141 8,942 17,395 19,224 Amortization of developed technology 3,640 3,640 7,279 7,279 Equity-based compensation 808 5,240 4,828 8,580 Change in fair value of contingent consideration 503 705 (232) 2,043 Certain legal expenses (a) 1,533 248 2,263 552 Other costs (b) — — 42 — Adjusted EBITDA $ 55,382 $ 115,592 $ 81,629 $ 182,565

14 Adjusted Net Income Reconciliation (a) Represents certain legal fees and other related costs associated with (i) Actions filed against the Company and certain officers and directors alleging violations of the Securities Exchange Acts of 1934 and 1933, which litigation was dismissed with prejudice by the court on May 19, 2023 and subsequently appealed. The appeal has been fully briefed, argued, and the Company is awaiting a decision, and (ii) other litigation. We consider these costs not representative of legal costs that we will incur from time to time in the ordinary course of our business. (b) For the six months ended June 30, 2024, other costs represent costs related to Capped-Call accounting treatment evaluation. (c) Represents the estimated tax impact of all Adjusted Net Income add-backs, excluding those which represent permanent differences between book versus tax. ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net income $ 25,699 $ 65,165 $ 27,864 $ 94,800 Preferred dividends and accretion 13,749 12,784 27,251 25,268 Net income to common shareholders $ 11,950 $ 52,381 $ 613 $ 69,532 Amortization of intangibles 8,141 8,942 17,395 19,224 Amortization of developed technology 3,640 3,640 7,279 7,279 Amortization of debt discount and issuance costs 1,549 2,172 3,101 4,998 Preferred accretion 6,805 6,263 13,470 12,398 Equity based compensation 808 5,240 4,828 8,580 Change in fair value of contingent consideration 503 705 (232) 2,043 Certain legal expenses (a) 1,533 248 2,263 552 Other costs(b) — — 42 — Income tax expense of adjustments(c) (4,285) (5,301) (9,137) (10,752) Adjusted net income $ 30,644 $ 74,290 $ 39,622 $ 113,854

15 Adjusted EPS Reconciliation ($ in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Income per common share Basic $ 0.08 $ 0.34 $ — $ 0.47 Diluted $ 0.08 $ 0.34 $ — $ 0.46 Weighted average number of common shares outstanding Basic 151,797 150,919 151,574 150,763 Diluted 152,207 152,129 152,170 151,970 Adjusted net income per common share Basic $ 0.20 $ 0.49 $ 0.26 $ 0.76 Diluted $ 0.20 $ 0.49 $ 0.26 $ 0.75 Weighted average number of common shares outstanding Basic 151,797 150,919 151,574 150,763 Diluted 152,207 152,129 152,170 151,970

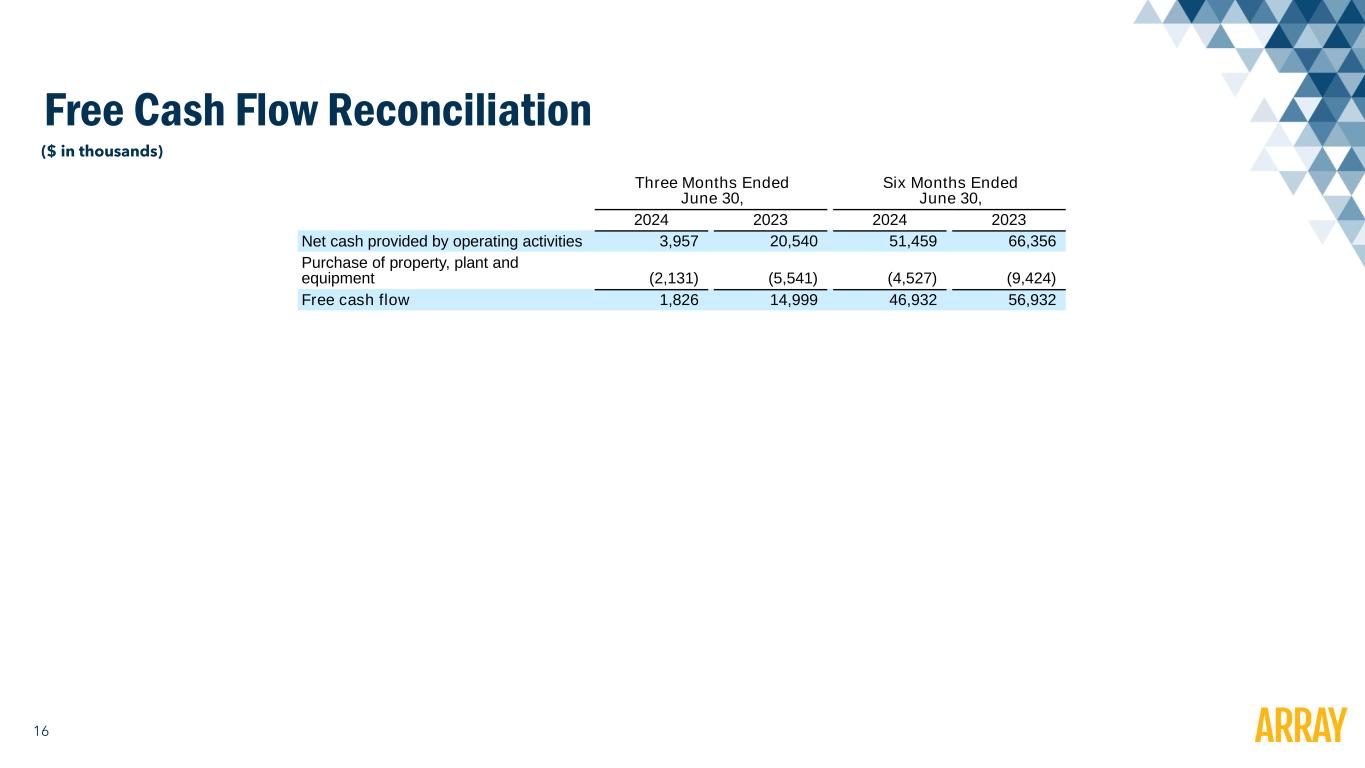

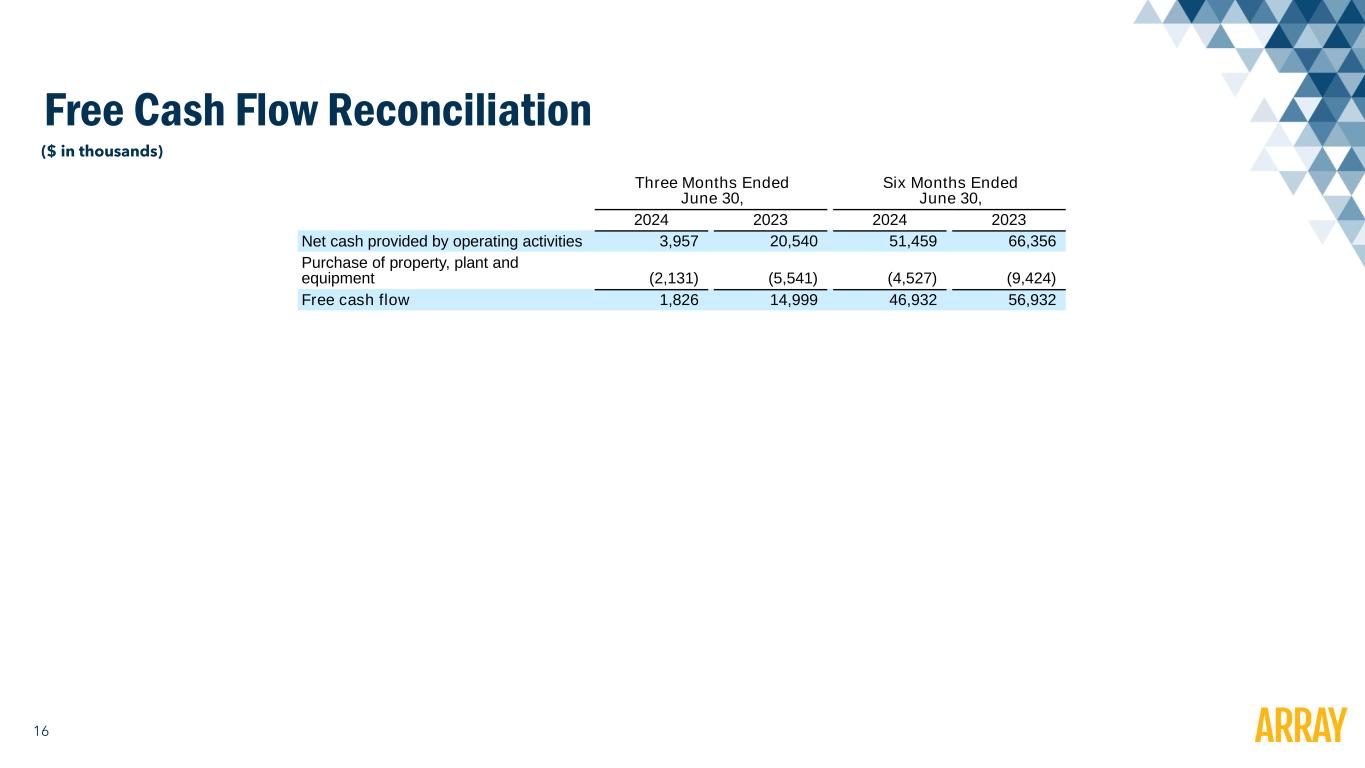

16 Free Cash Flow Reconciliation ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net cash provided by operating activities 3,957 20,540 51,459 66,356 Purchase of property, plant and equipment (2,131) (5,541) (4,527) (9,424) Free cash flow 1,826 14,999 46,932 56,932