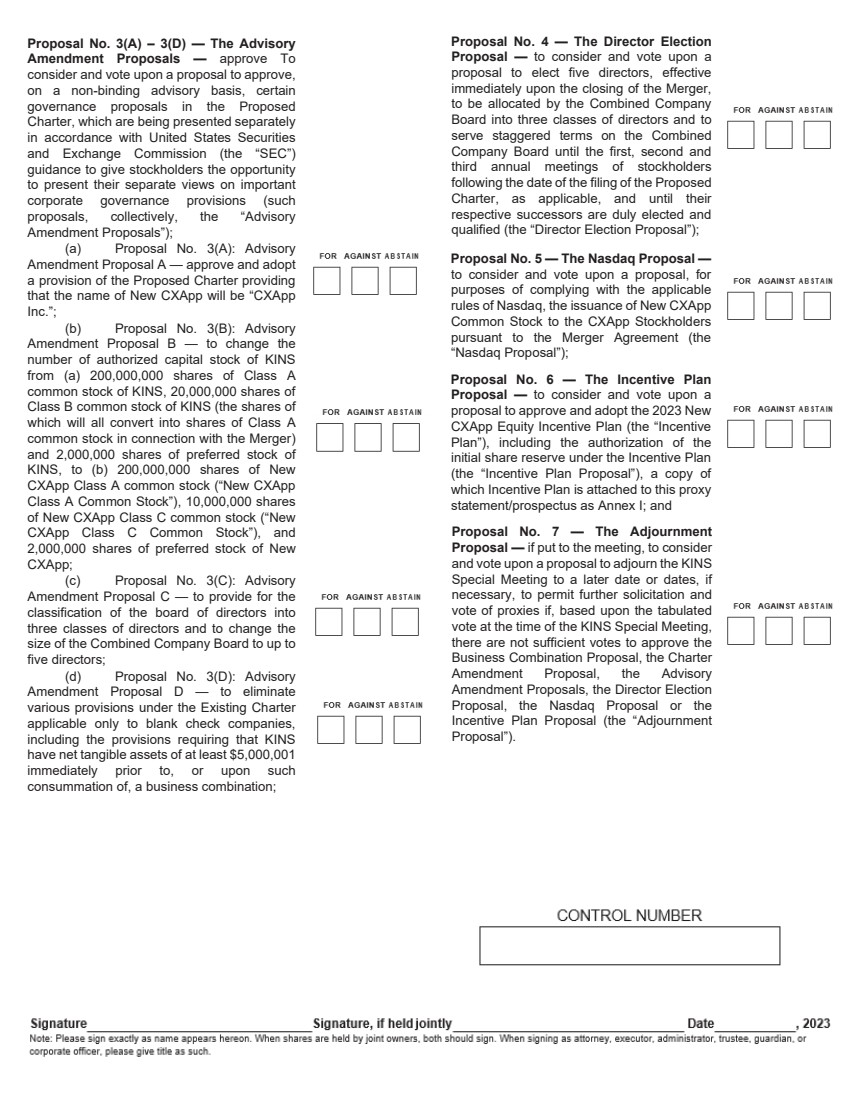

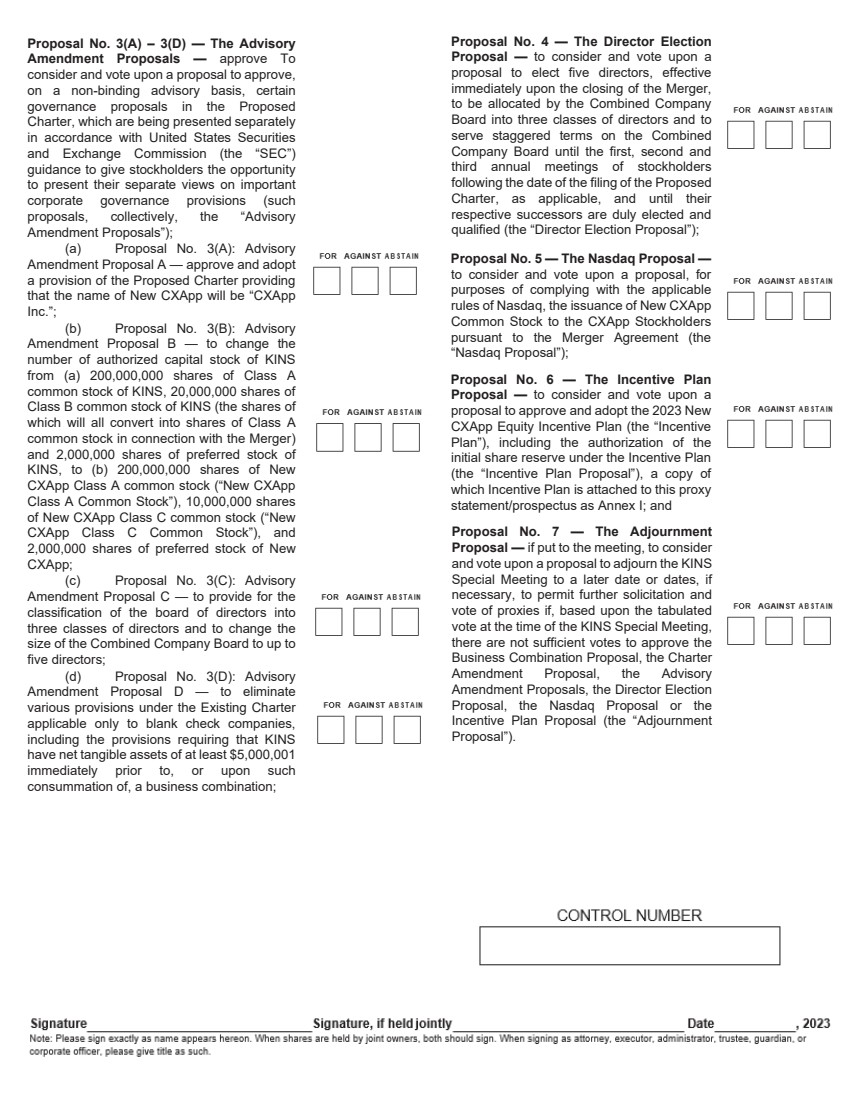

| Proposal No. 3(A) – 3(D) — The Advisory Amendment Proposal s — approve To consider and vote upon a proposal to approve, on a non -binding advisory basis, certain governance proposals in the Proposed Charter, which are being presented separately in accordance with United States Securities and Exchange Commission (the “SEC”) guidance to give stockholders the opportunity to present their separate views on important corporate governance provisions (such proposals, collectively, the “Advisory Amendment Proposals”); (a) Proposal No. 3(A): Advisory Amendment Proposal A — approve and adopt a provision of the Proposed Charter providing that the name of New CXApp will be “CXApp Inc.”; (b) Proposal No. 3(B): Advisory Amendment Proposal B — to change the number of authorized capital stock of KINS from (a) 200,000,000 shares of Class A common stock of KINS, 20,000,000 shares of Class B common stock of KINS (the shares of which will all convert into shares of Class A common stock in connection with the Merger) and 2,000,000 shares of preferred stock of KINS, to (b) 200,000,000 shares of New CXApp Class A common stock (“New CXApp Class A Common Stock”), 10,000,000 shares of New CXApp Class C common stock (“New CXApp Class C Common Stock”), and 2,000,000 shares of preferred stock of New CXApp; (c) Proposal No. 3(C): Advisory Amendment Proposal C — to provide for the classification of the board of directors into three classes of directors and to change the size of the Combined Company Board to up to five directors; (d) Proposal No. 3(D): Advisory Amendment Proposal D — to eliminate various provisions under the Existing Charter applicable only to blank check companies, including the provisions requiring that KINS have net tangible assets of at least $5,000,001 immediately prior to, or upon such consummation of, a business combination; Proposal No. 4 — The Director Election Proposal — t o consider and vote upon a proposal to elect five directors, effective immediately upon the closing of the Merger, to be allocated by the Combined Company Board into three classes of directors and to serve staggered terms on the Combined Company Board until the first, second and third annual meetings of stockholders following the date of the filing of the Proposed Charter, as applicable, and until their respective successors are duly elected and qualified (the “Director Election Proposal”); Proposal No. 5 — The Nasdaq Proposal — t o consider and vote upon a proposal, for purposes of complying with the applicable rules of Nasdaq, the issuance of New CXApp Common Stock to the CXApp Stockholders pursuant to the Merger Agreement (the “Nasdaq Proposal”); Proposal No. 6 — The Incentive Plan Proposal — t o consider and vote upon a proposal to approve and adopt the 2023 New CXApp Equity Incentive Plan (the “Incentive Plan”), including the authorization of the initial share reserve under the Incentive Plan (the “Incentive Plan Proposal”), a copy of which Incentive Plan is attached to this proxy statement/prospectus as Annex I; and Proposal No. 7 — The Adjournment Proposal — if put to the meeting, to consider and vote upon a proposal to adjourn the KINS Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the KINS Special Meeting, there are not sufficient votes to approve the Business Combination Proposal, the Charter Amendment Proposal, the Advisory Amendment Proposals, the Director Election Proposal, the Nasdaq Proposal or the Incentive Plan Proposal (the “Adjournment Proposal”). |