AIR Reports Second Quarter 2021 Results – Full Year FFO Guidance Increased by 5%; Quarterly Dividend Raised by 2%

Denver, Colorado, July 29, 2021 – Apartment Income REIT Corp. (“AIR”) (NYSE: AIRC) announced today second quarter results for 2021 and an increase to full year Same Store Revenue, NOI and FFO guidance.

Chief Executive Officer Terry Considine comments: “Business is good! Strong consumer demand is driving higher occupancy and higher rents. The efficiency of the AIR business model is confirmed with peer-best operating margins, low corporate G&A, driving a 5% increase in full year FFO guidance.”

“Asking rents have now surpassed the pre-COVID peak and are at or above their long-term trend. Improving consumer demand and strong execution led to signed new rates up 2.7% in the second quarter… and up 9.5% month-to-date in July.”

"We are on track to meet leverage goals. In April, we issued $342 million of equity and used the proceeds to reduce debt. We expect similar proceeds from 3Q activity to sell our New York and Chicago properties, and a like amount from 4Q activities to sell properties outright or to joint ventures, with all proceeds applied to debt reduction.”

“We upgraded our portfolio with the $223 million purchase of City Center on 7th, a 700-apartment home community located in Pembroke Pines, Florida. We will increase 4Q property sales so that this purchase is funded on a leverage neutral basis.”

"We are well positioned for an excellent second half of 2021 and an even better 2022; our current loss to lease of 10% suggests double-digit revenue growth."

Chief Financial Officer Paul Beldin adds: “Second quarter FFO per share of $0.52 was $0.02 above the high-end of our guidance range due to better than anticipated property operations and lower than anticipated offsite costs.”

“With 80% of 2021 anticipated leasing activity completed, we now expect full year Same Store NOI growth between (0.50%) and 1.00%, with Same Store property operations contributing an incremental $0.08 to FFO per share at the midpoint. Our full year FFO expectations, at the mid-point, are now 7% above our beginning of year expectations.”

Financial Results: Second Quarter Pro Forma FFO Per Share

| | | | | | | | | | | | | |

| | 2021 |

(all items per common share - diluted) | | SECOND QUARTER | | | FIRST QUARTER | | | YEAR-TO-DATE | | |

Net income (loss) | | $ | (0.12 | ) | | $ | 0.56 | | | $ | 0.43 | | |

NAREIT Funds From Operations (FFO) | | $ | 0.28 | | | $ | 0.48 | | | $ | 0.75 | | |

Pro forma adjustments | | $ | 0.24 | | | $ | 0.02 | | | $ | 0.27 | | |

Pro forma Funds From Operations (Pro forma FFO) | | $ | 0.52 | | | $ | 0.50 | | | $ | 1.02 | | |

2

AIR Operating Results: Second Quarter Same Store Revenue Up 0.8% Sequentially

The table below includes the operating results of the 92 properties of AIR that meet our Same Store definition. These properties comprise approximately 99% of AIR’s GAAP revenue.

| | | | | | | | |

| SECOND QUARTER | YEAR-TO-DATE |

| Year-over-Year | Sequential | Year-over-Year |

($ in millions) | 2021 | 2020 | Variance | 1st Qtr. | Variance | 2021 | 2020 | Variance |

Revenue, before utility reimbursements | $154.2 | $157.1 | (1.9%) | $153.0 | 0.8% | $307.1 | $320.0 | (4.0%) |

Expenses, net of utility reimbursements | 45.1 | 43.0 | 5.0% | 44.0 | 2.7% | 89.1 | 85.7 | 4.0% |

Net operating income (NOI) | $109.0 | $114.1 | (4.5%) | $109.0 | —% | $218.0 | $234.3 | (6.9%) |

Components of Same Store Revenue Growth – Second quarter year-over-year Same Store revenue growth was impacted by lower residential rental rates and increased bad debt expense, offset partially by higher average daily occupancy, increased late fees, and a recovery in commercial rents. The table below summarizes the change in the components of our Same Store revenue growth.

| | | | | | | | | | | | | |

| | SECOND QUARTER | YEAR-TO-DATE |

Same Store Revenue Components | | Year-over-Year | Sequential | Year-over-Year |

Residential Rents | | | (2.3 | %) | | | 0.2 | % | | | (2.1 | %) | |

Average Daily Occupancy | | | 0.3 | % | | | (0.1 | %) | | | (0.6 | %) | |

Residential Net Rental Income | | | (2.0 | %) | | | 0.1 | % | | | (2.7 | %) | |

Bad Debt | | | (0.6 | %) | | | (0.1 | %) | | | (1.1 | %) | |

Late Fees and Other | | | 0.5 | % | | | 0.4 | % | | | — | % | |

Residential Revenue | | | (2.1 | %) | | | 0.4 | % | | | (3.8 | %) | |

Commercial Revenue | | | 0.2 | % | | | 0.4 | % | | | (0.2 | %) | |

Same Store Revenue Growth | | | (1.9 | %) | | | 0.8 | % | | | (4.0 | %) | |

Same Store Rental Rates – We measure changes in rental rates by comparing, on a lease-by-lease basis, the effective rate on a newly executed lease to the effective rate on the expiring lease for that same apartment. A newly executed lease is classified either as a new lease, where a vacant apartment is leased to a new customer, or as a renewal.

The table below details changes in lease rates, as well as the weighted-average (blended) lease rates for leases executed in the respective period. Transacted leases are those that became effective during a reporting period and are therefore the best measure of immediate effect on current revenues. Signed leases are those executed during a reporting period and are therefore the best measure of current activity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SECOND QUARTER | | YEAR-TO-DATE | | 2021 | |

| 2021 | | 2020 | | Variance | | 2021 | | 2020 | | Variance | | April | | May | | June | | July* | |

Transacted Leases | | | | | | | | | | | | | | | | | | | | |

Renewal rent changes | | 3.2 | % | | 5.0 | % | | (1.8 | %) | | 2.8 | % | | 5.2 | % | | (2.4 | %) | | 2.0 | % | | 3.0 | % | | 3.9 | % | | 5.7 | % |

New lease rent changes | | (0.9 | %) | | (2.8 | %) | | 1.9 | % | | (3.5 | %) | | (1.0 | %) | | (2.5 | %) | | (3.6 | %) | | (2.3 | %) | | 1.7 | % | | 5.9 | % |

Weighted-average rent changes | | 1.1 | % | | 1.5 | % | | (0.4 | %) | | (0.7 | %) | | 2.3 | % | | (3.0 | %) | | (0.8 | %) | | 0.1 | % | | 2.8 | % | | 5.8 | % |

| | | | | | | | | | | | | | | | | | | | |

Signed Leases | | | | | | | | | | | | | | | | | | | | |

Renewal rent changes | | 4.6 | % | | 3.8 | % | | 0.8 | % | | 4.1 | % | | 4.6 | % | | (0.5 | %) | | 3.9 | % | | 4.5 | % | | 5.2 | % | | 5.9 | % |

New lease rent changes | | 2.7 | % | | (4.0 | %) | | 6.7 | % | | (0.3 | %) | | (1.6 | %) | | 1.3 | % | | (0.2 | %) | | 1.6 | % | | 5.9 | % | | 9.5 | % |

Weighted-average rent changes | | 3.8 | % | | 0.5 | % | | 3.3 | % | | 2.2 | % | | 2.2 | % | | — | % | | 2.1 | % | | 3.1 | % | | 5.5 | % | | 7.5 | % |

| | | | | | | | | | | | | | | | | | | | |

Average Daily Occupancy | | 95.4 | % | | 95.1 | % | | 0.3 | % | | 95.5 | % | | 96.1 | % | | (0.6 | %) | | 95.4 | % | | 95.3 | % | | 95.5 | % | | 95.8 | % |

*July leasing results are preliminary and as of July 27, 2021.

3

Same Store Markets – Market conditions and leasing results in the second quarter exceeded our expectations at the beginning of the year. We continue to emphasize margin and long-tern NOI growth over short-term revenue growth. This approach contributed to sequential revenue growth of 80 basis points from the first to second quarter, and more importantly positioned the business for continued acceleration through the second half of the year and into 2022.

Weighted-average signed lease changes have now trended upwards for 10 consecutive months with July new lease rates up 9.5% through July 27, 2021.

Year-to-date, we have transacted 11,700 leases with a weighted-average rate increase of 70 basis points compared to the prior lease. We have signed an additional 4,000 leases with average rate increases of 8.6%. These 15,700 leases represent approximately 80% of our anticipated full year leasing activity and have weighted-average rent increases of 2.7%. We anticipate another 3,700 leases to be signed with blended rent changes in the range of 6%-8%, and a full year blended rate increase of approximately 3%.

The following chart details changes in Same Store asking rents from December 2018 and what we expect through December 2022. Today, asking rents are 6% above our pre-COVID peak:

In addition to accelerating market rents as shown above, leasing pace has also exceeded expectations, with second quarter leasing volume 65% ahead of 2020 and 10% above our previous high in the second quarter of 2019. Average Daily Occupancy remained stable in the second quarter despite significant increases in frictional vacancy due to the number of lease expirations in peak season. While occupancy remained stable, our leased percent, which is the percent of total apartment homes currently leased, improved from 90.7% to 93.1% during the second quarter. As of July 27, 2021, our leased percentage is now 95%; 800 basis points ahead of the same day last year and 400 basis points ahead of 2019.

4

Rent Collection Update

We measure residential rent collection as the amount of payments received as a percentage of all residential amounts owed. In the second quarter, we recognized 97.9% of all residential revenue owed during the quarter, treating the balance of 2.1% as bad debt. Of the 97.9% of residential revenue recognized, as of quarter-end, we collected in cash all but 120 basis points, with 96.7% of the residential rents collected. Year-to-date we have recognized 97.9% of all residential revenue and collected 97.6% of billed rents.

As of June 30, 2021, our proportionate share of gross residential accounts receivable was $12.7 million. After consideration of tenant security deposits and reserves for uncollectible amounts, our net exposure is $1.1 million. Most of this balance is expected to be collected during the third quarter of 2021. Of our uncollected accounts receivable, 73% relate to California residents.

The state of California has recently expanded the SB-91 rent relief program, to allow for 100% of past due rents to be paid by state funding (vs. 80% previously). As of June 30, 2021, we had received $0.7 million in payments under these programs. We remain cautiously optimistic that this program will allow us to recover rent that was uncollected in 2020 or 2021. We expect bad debt expense to decline as emergency ordinances are lifted that suspended legal action to collect past due rents.

Commercial rental income comprised 2.7% of second quarter revenue. In the second half of 2021, we expect an increased contribution from commercial tenants as their businesses re-open and rent payments resume.

Portfolio Management

Our portfolio of apartment communities is diversified across “A,” “B,” and “C+” price points, averaging “B/B+” in quality, and is also diversified across several of the largest markets in the United States. The table below relates to the AIR portfolio, excludes the properties retained by Aimco in the separation from AIR, and excludes the properties leased to Aimco for development or redevelopment.

| | | |

| SECOND QUARTER |

| 2021 | 2020 | Variance |

Apartment Communities | 96 | 99 | (3) |

Apartment Homes | 26,422 | 26,592 | (170) |

Average Revenue per Apartment Home | $2,215 | $2,294 | (3%) |

Percentage A (2Q 2021 Average Revenue per Apartment Home $2,832) | 44% | 43% | 1% |

Percentage B (2Q 2021 Average Revenue per Apartment Home $1,982) | 34% | 36% | (2%) |

Percentage C+ (2Q 2021 Average Revenue per Apartment Home $1,760) | 22% | 21% | 1% |

NOI Margin | 70% | 71% | (1%) |

Free Cash Flow Margin | 66% | 66% | —% |

Acquisitions and Dispositions – In the second quarter, we acquired City Center on 7th, a 700-apartment home community located in Pembroke Pines, Florida for $223 million. The acquisition was temporarily funded through borrowings on our revolving credit facility pending the completion of paired trade transactions later in 2021.

We expect an NOI cap rate of 4.2% during our first year of ownership. An additional 160 basis points of growth is expected as we invest approximately $10 million in capital enhancements and implement fully our best-in-class operating platform. Since acquisition 45 days ago, we've signed 27 new leases with rate increases averaging 21.5%, while increasing occupancy by 70 basis points to 97.1%.

Dispositions – We had no dispositions in the second quarter.

5

Balance Sheet

We seek to increase financial returns by using leverage with appropriate caution. We limit risk through our balance sheet structure, employing low leverage, primarily long-dated debt; and we build financial flexibility by maintaining ample unused and available credit; holding properties with substantial value unencumbered by property debt; maintaining an investment grade rating; and using partners’ capital when it enhances financial returns or reduces investment risk.

Components of Leverage

Our leverage includes our share of long-term, non-recourse property debt encumbering our apartment communities, together with outstanding borrowings under our revolving credit facility, our term loans, and our preferred equity.

| | | | | | | | | | | | |

| | AS OF JUNE 30, 2021 | |

($ in millions) | | Amount | | | % of Total | | | Weighted-Avg.

Maturity (Yrs.) | |

AIR share of long-term, non-recourse property debt | | $ | 2,601 | | | | 68 | % | | | 8.9 | |

Term loans | | | 800 | | | | 21 | % | | | 4.5 | |

Outstanding borrowings on revolving credit facility | | | 347 | | | | 9 | % | | | 4.8 | |

Preferred equity* | | | 81 | | | | 2 | % | | | 9.9 | |

Total Leverage | | $ | 3,830 | | | | 100 | % | | | 7.6 | |

Cash and restricted cash | | | (67 | ) | | | | | | |

Notes receivable from Aimco** | | | (534 | ) | | | | | | |

Net Leverage | | $ | 3,229 | | | | | | | |

* AIR’s Preferred equity is perpetual in nature; however, for illustrative purposes, we have computed the weighted-average maturity of our preferred OP Units assuming a 10-year maturity and preferred stock assuming it is called at the expiration of the no-call period.

** We have notes receivable from Aimco with an aggregate principal amount of $534 million. The notes will mature on January 31, 2024, and are secured by a pool of properties owned by Aimco. We consider the notes a reduction of leverage as we expect proceeds to be used to repay current amounts outstanding.

We entered 2021 with approximately $3.2 billion of net leverage. We anticipate ending 2021 with net leverage of approximately $2.5 billion. The April equity offering and 2021 property sales are expected to reduce leverage by $920 million. This decline is somewhat offset by borrowing to fund capital projects and the City Center acquisition at a loan to value of approximately 25%.

Equity Issuance & Financing Activity

As previously announced in April, we sold 7.825 million shares of our Class A Common Stock in a private placement to a large global real estate-focused investment firm for a cash purchase price of $342 million. Proceeds raised were used to repay $318.4 million of property debt with a weighted-average interest rate of 4.6%, which resulted in a ~0.9x reduction in Net Leverage to Adjusted EBITDAre. Prepayment penalties incurred in connection with the debt repayment totaled $33.8 million. The economic cost of these prepayment penalties is expected to be substantially recovered through lower future interest expense.

On July 15, 2021, we closed on a new $350 million term loan. The loan matures on January 14, 2023, inclusive of a six month extension option, and bears interest at a LIBOR spread of 95 basis points. We used the proceeds to repay borrowings on our revolving credit facility, whose $600 million capacity is fully available.

6

Leverage Reduction – On Track

We target Net Leverage to Adjusted EBITDAre below 6.0x, with a current target of 5.5x by year-end.

At June 30, 2021, Net Leverage to Adjusted EBITDAre was 7.3x, a 0.5x reduction from March 31, 2021.

Liquidity

We use our revolving credit facility for working capital and other short-term purposes and to secure letters of credit. At June 30, 2021, our share of cash and restricted cash was $67 million and we had the capacity to borrow up to $249 million, under our revolving credit facility, bringing total liquidity to $316 million. Pro-forma for the closing of the July term loan, our liquidity increased to $666 million.

We manage our financial flexibility by maintaining an investment grade rating and holding communities that are unencumbered by property debt. AIR has been rated BBB by Standard & Poor’s. As of June 30, 2021, we held unencumbered communities with property debt with an estimated fair market value of approximately $4.2 billion; an increase of 50% from December 31, 2020. We anticipate seeking an investment grade credit rating from Moody’s. In assigning ratings, Moody’s places significant emphasis on the amount of non-recourse property debt as percentage of the undepreciated book value of a company’s assets. To achieve Moody’s required thresholds, we estimate that a Moody’s investment grade rating will require property debt to approximate $1.8 billion. At June 30, 2021 our share of property debt is $2.6 billion.

Dividend

On July 27, 2021, our Board of Directors increased our quarterly cash dividend from $0.43 to $0.44 per share of AIR Common Stock. This amount is payable on August 27, 2021, to stockholders of record on August 13, 2021.

7

2021 Outlook

At the midpoint, we expect FFO per share to be $2.12, up $0.11 from our previous expectations due primarily to increased Same Store NOI.

Our guidance ranges are based on the following components:

| | | | | | |

| | YEAR-TO-DATE JUNE 30, 2021 | | FULL YEAR 2021 | | PREVIOUS

FULL YEAR 2021 |

($ Amounts represent AIR Share) | | | | | | |

Net Income (loss) per share (1) | | $0.43 | | $(0.13) to $0.00 | | $0.01 to $0.14 |

Pro forma FFO per share | | $1.02 | | $2.09 to $2.15 | | $1.96 to $2.06 |

Pro forma FFO per share at the mid-point | | $1.02 | | $2.12 | | $2.01 |

| | | | | | |

Same Store Operating Components of NAREIT FFO | | | | | | |

Revenue change compared to prior year | | (4.0%) | | 0.50% to 1.50% | | (1.50%) to 0.50% |

Expense change compared to prior year | | 4.0% | | 3.00% to 2.50% | | 3.20% to 2.80% |

NOI change compared to prior year | | (6.9%) | | (0.50%) to 1.00% | | (3.40%) to (0.40%) |

| | | | | | |

Offsite Costs | | | | | | |

Property management expenses | | $12M | | ~$23M | | ~$24M |

General and administrative expenses, net of asset management income (2) | | $8M | | ~$15M | | ~$16M |

| | | | | | |

Other Earnings | | | | | | |

Lease income (3) | | $13M | | ~$27M | | ~$27M |

Tax expense (3) | | ($0.8M) | | ~($1M) | | ~($1M) |

Proceeds from dispositions of real estate, net | | — | | ~$800M | | ~$580M |

| | | | | | |

AIR Share of Capital Investments | | | | | | |

Capital Enhancements | | $35M | | $65M to $75M | | $45M to $55M |

(1)Does not include any gain from future property sales.

(2)In 2021, AIR G&A is expected to be reduced by a $5.8 million payment from Aimco.

(3)Presented net of FFO and Pro forma FFO adjustments.

In the third quarter, AIR anticipates Pro forma FFO between $0.51 and $0.55 per share.

8

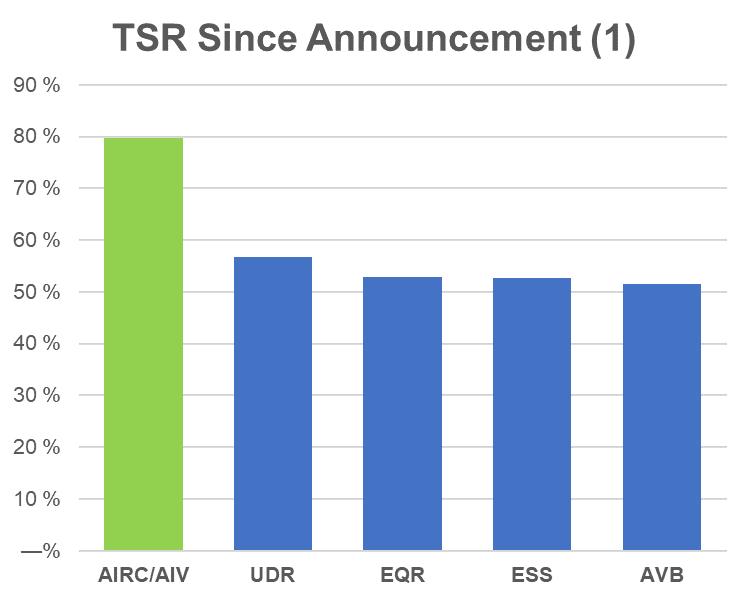

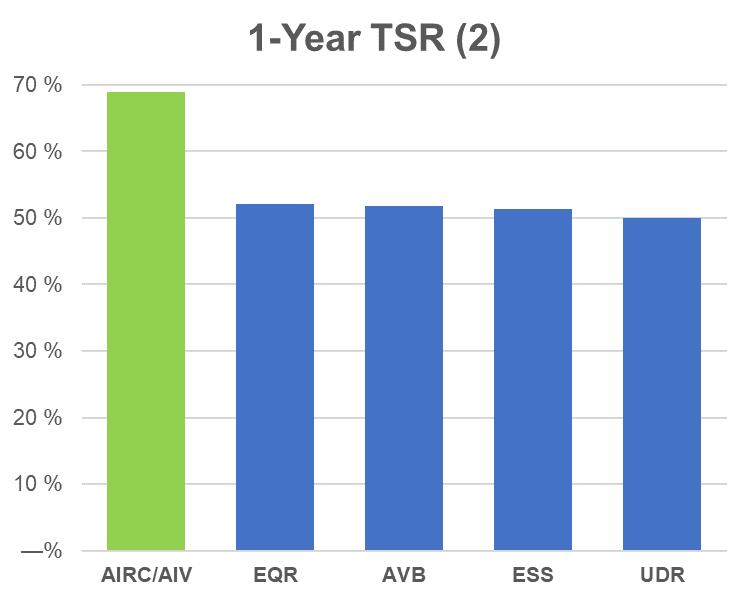

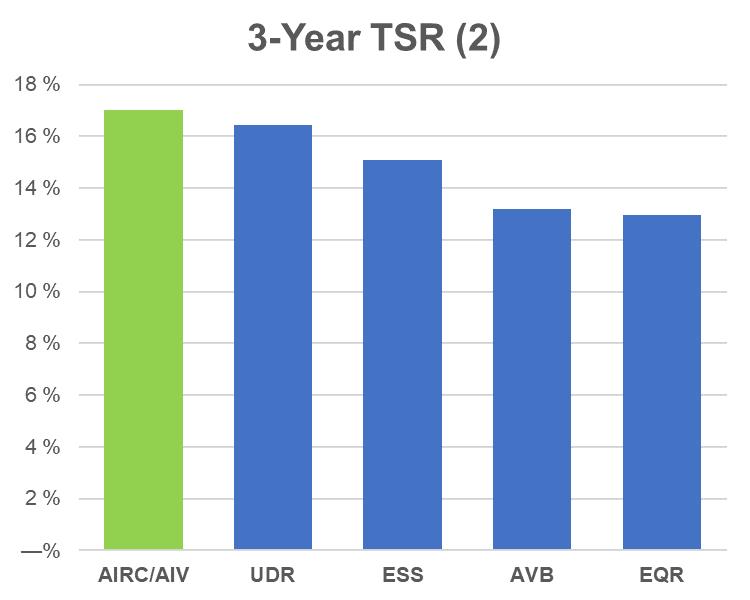

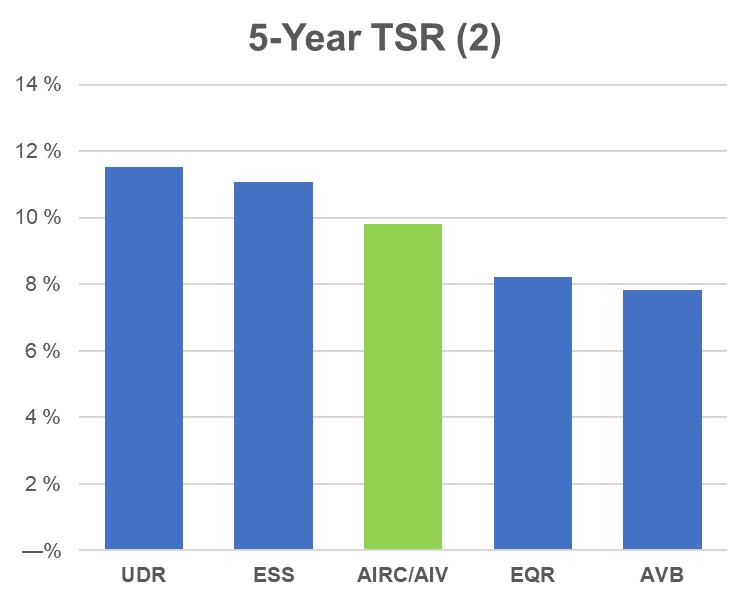

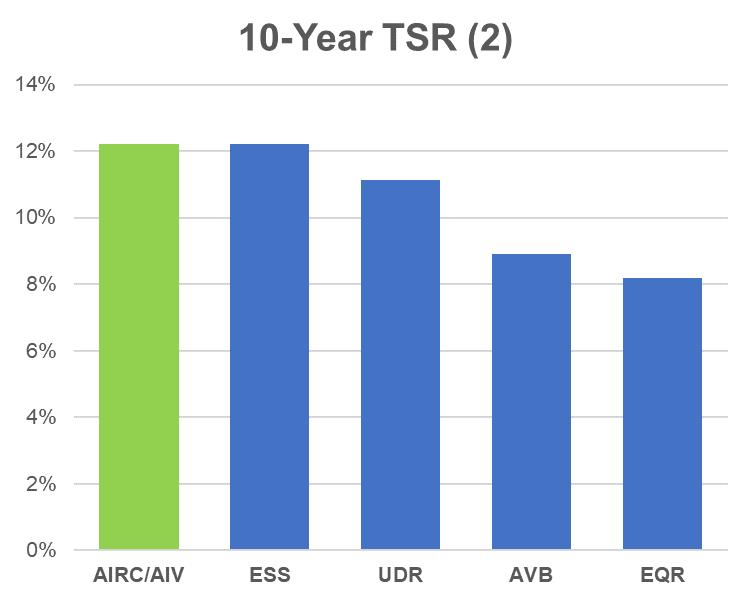

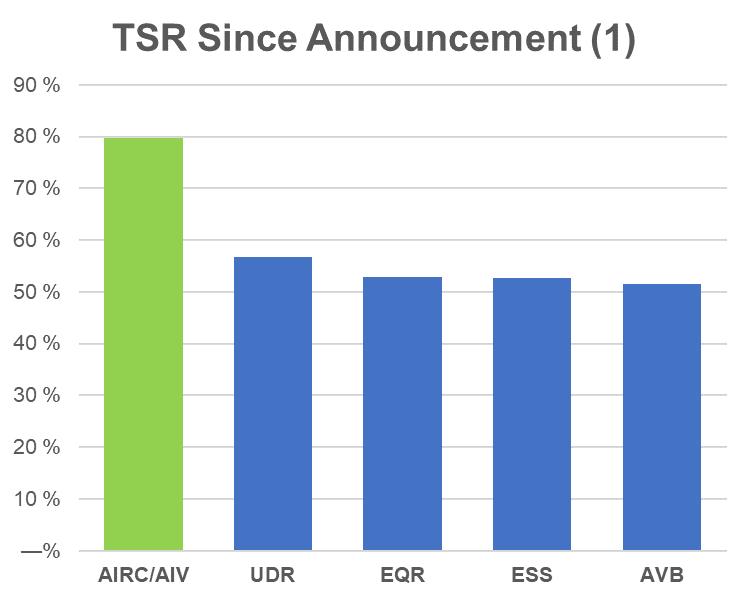

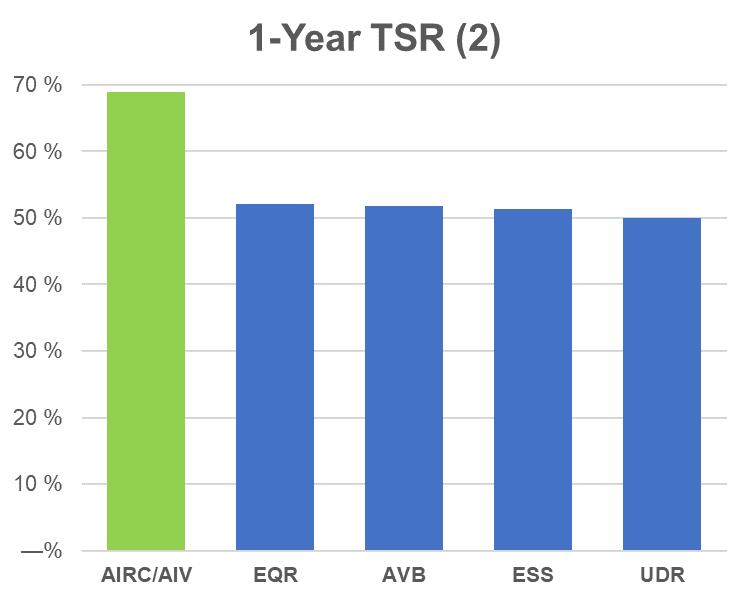

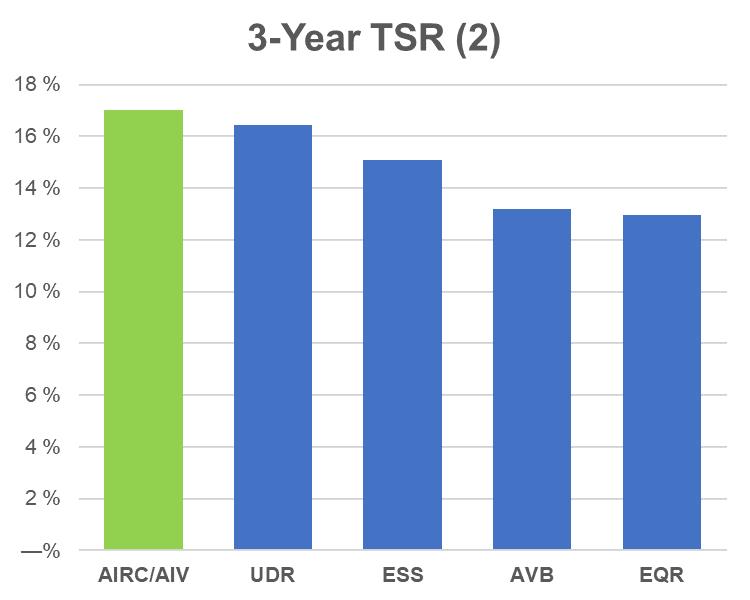

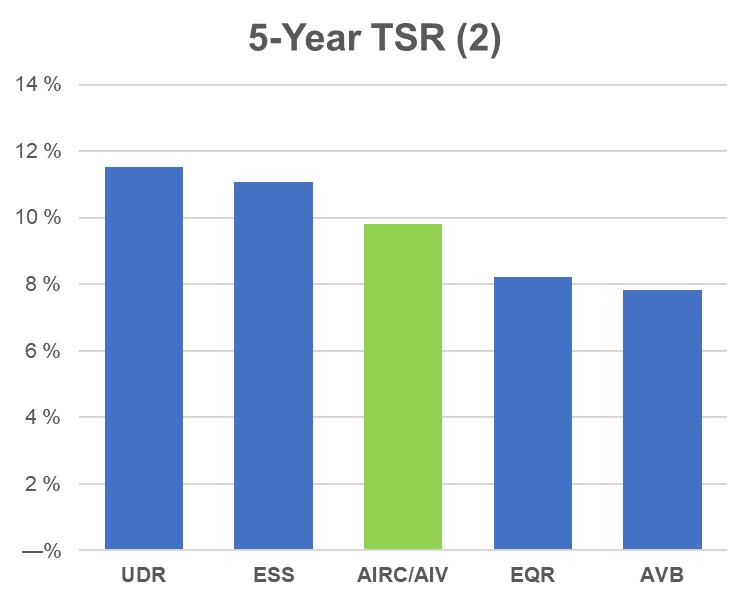

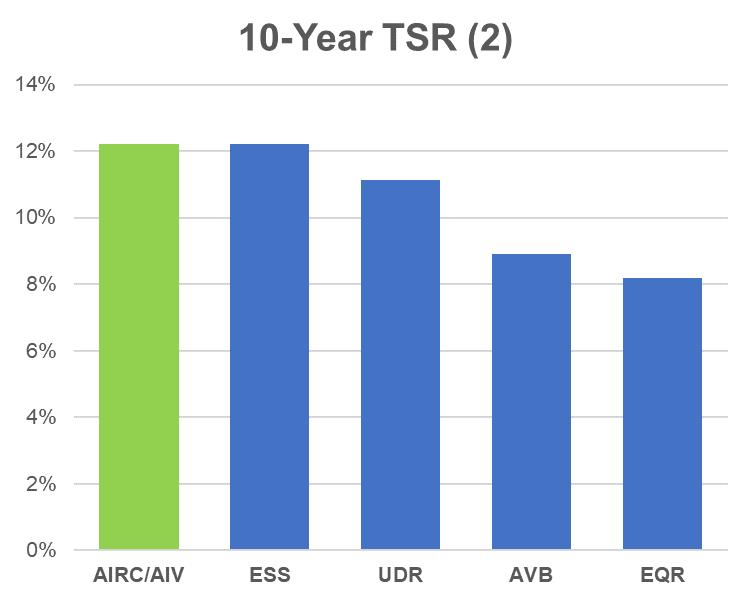

Total Shareholder Return

The separation of AIR from Aimco created significant value for shareholders. The combined outperformance since the announcement of the separation translates to ~$1.3 billion of incremental shareholder value creation, or approximately $8.00 per share.

This accretive capital allocation decision, builds on a long-track record of delivering strong returns to shareholders:

(1)Represents the combined TSR of AIR and Aimco since September 11, 2020, the last trading date prior to the September 14, 2020, announcement of the separation, through June 30, 2021.

(2)Represents the combined TSR of AIR and Aimco for the indicated time period ending June 30, 2021.

9

AIR Strategic Objectives

We created AIR to be an efficient way to invest in U.S. multi-family real estate, due to its simplified business model and diversified portfolio of stabilized apartment communities. Upon AIR’s separation from Aimco, we identified 10 strategic objectives. The following table outlines our progress against these objectives.

| | |

| Objective | Progress |

| Simple business model without complex investments or development/lease-up risk | Done |

| | |

| High quality and diversified portfolio of stabilized multi-family properties | Done |

| | |

| Best-in-class property operations | Done |

| | |

| Efficient cost structure with the lowest G&A as a % of total assets | Done |

| | |

| Predictable and diversified cash flow to support dividend payout ratio | Done |

| | |

| Refreshed tax basis reduces tax friction on transactions driving more efficient capital allocation | Done |

| | |

| Committed focus on ESG | Done |

| | |

| Strong growth from economic expansion, portfolio management, and accretive acquisitions of properties with upside from AIR operations | Done |

| | |

| Strong, flexible balance sheet with low cost of leverage | Done |

| | |

| Reduce net leverage to EBITDA to 5.5:1 | Ahead of Plan |

| | |

10

Earnings Conference Call Information

| |

Live Conference Call: | Conference Call Replay: |

Friday, July 30, 2021 at 12:00 p.m. ET | Replay available until October 30, 2021 |

Domestic Dial-In Number: 1-888-317-6003 | Domestic Dial-In Number: 1-877-344-7529 |

International Dial-In Number: 1-412-317-6061 | International Dial-In Number: 1-412-317-0088 |

Passcode: 9955051 | Passcode: 10158457 |

Live webcast and replay: | |

investors.aircommunities.com |

Supplemental Information

The full text of this Earnings Release and the Supplemental Information referenced in this release is available on AIR’s website at investors.aircommunities.com.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release and the Supplemental Information include certain financial measures used by AIR management that are measures not defined under accounting principles generally accepted in the United States (“GAAP”). Certain AIR terms and Non-GAAP measures are defined in the Glossary in the Supplemental Information and Non-GAAP measures reconciled to the most comparable GAAP measures.

About AIR

AIR is a real estate investment trust focused on the ownership and management of quality apartment communities located in the largest markets in the United States. AIR is one of the country’s largest owners and operators of apartments, with 96 communities in 12 states and the District of Columbia. AIR common shares are traded on the New York Stock Exchange under the ticker symbol AIRC, and are included in the S&P 400. For more information about AIR, please visit our website at www.aircommunities.com.

Contact

Beth Hagan

(303) 757-8101

investors@aircommunities.com

11

Forward-looking Statements

This Earnings Release and Supplemental Information contain forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically forecasts of 2021 results, including but not limited to: NAREIT FFO, Pro forma FFO and selected components thereof; expectations regarding consumer demand, growth in revenue and strength of other performance metrics and models; expectations regarding sales of AIR apartment communities and the use of proceeds thereof; and AIR liquidity and leverage metrics. We caution investors not to place undue reliance on any such forward-looking statements.

These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: the effects of the coronavirus pandemic on AIR’s business and on the global and U.S. economies generally, and the ongoing, dynamic and uncertain nature and duration of the pandemic, all of which heightens the impact of the other risks and factors described herein, and the impact on entities in which AIR holds a partial interest, and the impact of governmental lockdowns on AIR’s residents, commercial tenants, and operations; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which we operate and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions and dispositions; changes in operating costs, including energy costs; negative economic conditions in our geographies of operation; loss of key personnel; AIR’s ability to maintain current or meet projected occupancy, rental rate and property operating results; expectations regarding sales of apartment communities and the use of proceeds thereof; insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by AIR; Aimco’s and AIR’s relationship with each other after the business separation; the ability and willingness of Aimco and AIR and their subsidiaries to meet and/or perform their obligations under any contractual arrangements that were entered into among the parties in connection with the business separation and any of their obligations to indemnify, defend and hold the other party harmless from and against various claims, litigation and liabilities; and the ability to achieve some or all the benefits that we expect to achieve from the business separation; and such other risks and uncertainties described from time to time in filings by AIR with the Securities and Exchange Commission (“SEC”).

In addition, AIR’s current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code, as amended (the “Code”), and depends on AIR’s ability to meet the various requirements imposed by the Code, through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review AIRs financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of AIR’s Annual Report on Form 10-K for the year ended December 31, 2020, and subsequent documents AIR files from time to time with the SEC. Readers should also carefully review the “Risk Factors” section of the registration statements relating to the business separation, that have been filed with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and AIR assumes no obligation to revise or update them to reflect future events or circumstances. This earnings release does not constitute an offer of securities for sale.

12

Consolidated Statements of Operations (Page 1 of 2)

(in thousands, except per share data) (unaudited)

The separation resulted in Aimco being presented as the predecessor for AIR’s financial statements. This presentation is in accordance with GAAP and is due primarily to the relative significance of AIR’s business as compared to Aimco before the separation. The financial results prior to the separation on December 15, 2020, include the financial results of AIR’s predecessor, and the financial results attributable to the apartment communities retained by Aimco in the separation are presented as discontinued operations.

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Six Months Ended | |

| | June 30, | | | June 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

REVENUES | | | | | | | | | | | | |

Rental and other property revenues (1) | | $ | 176,721 | | | $ | 181,643 | | | $ | 351,451 | | | $ | 367,686 | |

Other revenues | | | 1,612 | | | | — | | | | 3,295 | | | | — | |

Total revenues | | | 178,333 | | | | 181,643 | | | | 354,746 | | | | 367,686 | |

| | | | | | | | | | | | |

OPERATING EXPENSES | | | | | | | | | | | | |

Property operating expenses (1) | | | 64,758 | | | | 63,959 | | | | 129,375 | | | | 129,921 | |

Depreciation and amortization | | | 75,791 | | | | 78,949 | | | | 151,071 | | | | 160,395 | |

General and administrative expenses (2) | | | 5,221 | | | | 7,566 | | | | 9,635 | | | | 15,055 | |

Other expenses, net | | | 2,515 | | | | 4,156 | | | | 5,391 | | | | 5,647 | |

Total operating expenses | | | 148,285 | | | | 154,630 | | | | 295,472 | | | | 311,018 | |

Interest income (3) | | | 15,684 | | | | 2,303 | | | | 31,656 | | | | 6,292 | |

Interest expense, including prepayment penalties (4) | | | (70,807 | ) | | | (44,239 | ) | | | (107,842 | ) | | | (81,045 | ) |

Gain on derecognition of leased properties and dispositions

of real estate | | | 3,353 | | | | 47,282 | | | | 87,385 | | | | 47,295 | |

Mezzanine investment income, net (5) | | | — | | | | 6,936 | | | | — | | | | 13,683 | |

Income (loss) from continuing operations before income tax (expense)

benefit and discontinued operations | | | (21,722 | ) | | | 39,295 | | | | 70,473 | | | | 42,893 | |

Income tax (expense) benefit | | | 2,035 | | | | 783 | | | | (1,045 | ) | | | 2,097 | |

Income (loss) from continuing operations | | | (19,687 | ) | | | 40,078 | | | | 69,428 | | | | 44,990 | |

Income (loss) from discontinued operations, net of tax | | | — | | | | 3,126 | | | | — | | | | 7,191 | |

Net income (loss) | | | (19,687 | ) | | | 43,204 | | | | 69,428 | | | | 52,181 | |

Noncontrolling interests: | | | | | | | | | | | | |

Net (income) loss attributable to noncontrolling interests in consolidated real estate partnerships | | | 2,397 | | | | 17 | | | | 2,632 | | | | (1 | ) |

Net income attributable to preferred noncontrolling interests in AIR OP | | | (1,603 | ) | | | (1,859 | ) | | | (3,207 | ) | | | (3,728 | ) |

Net (income) loss attributable to common noncontrolling interests in AIR OP | | | 945 | | | | (2,107 | ) | | | (3,491 | ) | | | (2,475 | ) |

Net (income) loss attributable to noncontrolling interests | | | 1,739 | | | | (3,949 | ) | | | (4,066 | ) | | | (6,204 | ) |

Net income (loss) attributable to AIR | | | (17,948 | ) | | | 39,255 | | | | 65,362 | | | | 45,977 | |

Net income attributable to AIR preferred stockholders | | | (43 | ) | | | — | | | | (93 | ) | | | — | |

Net income attributable to participating securities | | | (39 | ) | | | (43 | ) | | | (103 | ) | | | (86 | ) |

Net income (loss) attributable to AIR common stockholders | | $ | (18,030 | ) | | $ | 39,212 | | | $ | 65,166 | | | $ | 45,891 | |

| | | | | | | | | | | | |

Earnings (loss) per common share – basic and diluted: | | | | | | | | | | | | |

Income (loss) from continuing operations attributable to AIR per common share | | $ | (0.12 | ) | | $ | 0.30 | | | $ | 0.43 | | | $ | 0.32 | |

Income from discontinued operations attributable to AIR per common share | | | — | | | | 0.03 | | | | — | | | | 0.06 | |

Net income (loss) attributable to AIR common stockholders per share – basic and diluted | | $ | (0.12 | ) | | $ | 0.33 | | | $ | 0.43 | | | $ | 0.38 | |

| | | | | | | | | | | | |

Weighted-average common shares outstanding – basic (6) | | | 154,608 | | | | 119,959 | | | | 151,609 | | | | 119,953 | |

Weighted-average common shares outstanding – diluted (6) | | | 154,608 | | | | 119,974 | | | | 152,083 | | | | 120,068 | |

Please see the following page for footnote descriptions.

13

Consolidated Statements of Operations (continued) (Page 2 of 2)

(1)Prior to the separation, Aimco sold two apartment communities in 2020. Rental and other property revenues for the three and six months ended June 30, 2020, is inclusive of $2.7 million and $6.1 million, respectively, of revenues related to Aimco’s sold properties. Property operating expenses for the three and six months ended June 30, 2020, is inclusive of $0.9 million and $1.9 million, respectively, of expenses related to Aimco’s sold properties.

(2)In setting our G&A benchmark of 15 bps of total assets, we consider platform fees earned on our California joint venture as a reduction of general and administrative expenses. In accordance with GAAP, general and administrative expenses are shown gross of these platform fees and they are instead included in the determination of net income (loss) attributable to noncontrolling interests in consolidated real estate partnerships.

(3)Interest income for the three and six months ended June 30, 2021, includes $6.9 million and $13.9 million, respectively, of income associated with our notes receivable from Aimco, and $6.5 million and $12.8 million, respectively, of interest income associated with the four properties leased to Aimco commencing on January 1, 2021.

(4)Interest expense for the three and six months ended June 30, 2021, includes $37.2 million and $38.2 million, respectively, of costs related to prepayment penalties from the repayment of property debt and the write-off of deferred financing costs associated with our previous credit facility.

(5)In connection with the Separation, Aimco was allocated economic ownership of the mezzanine loan investment and option to acquire a 30% equity interest in the partnership. Subsequent to the Separation, all risks and rewards of ownership are Aimco’s, but legal transfer is not complete. During the three and six months ended June 30, 2020, we recognized $6.9 million and $13.7 million of income, respectively, in connection with the mezzanine loan. For the three and six months ended June 30, 2021, the mezzanine investment income was entirely offset by an expense to recognize the requirement that this income be contributed to Aimco.

(6)During the fourth quarter of 2020, Aimco completed a reverse stock split and a special dividend paid primarily in stock. For stock splits, GAAP requires the restatement of weighted-average shares as if the reverse stock split occurred at the beginning of the period presented, while shares issued in the special dividend are included in weighted-average shares outstanding from the date issued. Basic and diluted weighted-average common shares outstanding were 148,535 and 148,553, respectively, as previously reported for the three months ended June 30, 2020. Basic and diluted weighted-average common shares outstanding were 148,527 and 148,670, respectively, as previously reported for the six months ended June 30, 2020.

14

Consolidated Balance Sheets

(in thousands) (unaudited)

| | | | | | | | |

| | June 30, | | | December 31, | |

| | 2021 | | | 2020 | |

Assets | | | | | | |

Real estate | | $ | 7,258,778 | | | $ | 7,468,864 | |

Accumulated depreciation | | | (2,510,690 | ) | | | (2,455,505 | ) |

Net real estate | | | 4,748,088 | | | | 5,013,359 | |

Cash and cash equivalents | | | 59,401 | | | | 44,214 | |

Restricted cash | | | 21,300 | | | | 29,266 | |

Notes receivable from Aimco | | | 534,127 | | | | 534,127 | |

Leased real estate assets | | | 479,441 | | | | — | |

Goodwill | | | 32,286 | | | | 32,286 | |

Other assets (1) | | | 555,189 | | | | 576,026 | |

Total Assets | | $ | 6,429,832 | | | $ | 6,229,278 | |

| | | | | | |

Liabilities and Equity | | | | | | |

Non-recourse property debt | | $ | 3,079,576 | | | $ | 3,646,093 | |

Debt issue costs | | | (14,773 | ) | | | (17,857 | ) |

Non-recourse property debt, net | | | 3,064,803 | | | | 3,628,236 | |

Term loans, net | | | 796,658 | | | | 349,164 | |

Revolving credit facility borrowings | | | 347,200 | | | | 265,600 | |

Accrued liabilities and other (1) | | | 570,040 | | | | 598,736 | |

Total Liabilities | | | 4,778,701 | | | | 4,841,736 | |

| | | | | | |

Preferred noncontrolling interests in AIR OP | | | 79,375 | | | | 79,449 | |

| | | | | | |

Equity: | | | | | | |

Perpetual preferred stock | | | 2,000 | | | | 2,000 | |

Class A Common Stock | | | 1,569 | | | | 1,489 | |

Additional paid-in capital | | | 3,773,173 | | | | 3,432,121 | |

Accumulated other comprehensive income | | | — | | | | 3,039 | |

Distributions in excess of earnings | | | (2,197,843 | ) | | | (2,131,798 | ) |

Total AIR equity | | | 1,578,899 | | | | 1,306,851 | |

Noncontrolling interests in consolidated real estate partnerships | | | (67,531 | ) | | | (61,943 | ) |

Common noncontrolling interests in AIR OP | | | 60,388 | | | | 63,185 | |

Total Equity | | | 1,571,756 | | | | 1,308,093 | |

Total Liabilities and Equity | | $ | 6,429,832 | | | $ | 6,229,278 | |

(1)Other assets includes the Parkmerced mezzanine investment and the fair value of our interest rate swap option, and accrued liabilities and other includes the offsetting liabilities. The benefits and risks of ownership of both the Parkmerced mezzanine investment and the interest rate swap option have been transferred to Aimco, but legal transfer is not complete.

15

Supplemental Schedule 1

| |

Funds From Operations Reconciliation | |

Three and Six Months Ended June 30, 2021

(in thousands, except per share data) (unaudited)

| | | | | | | | |

| | Three Months Ended

June 30, | | | Six Months Ended

June 30, | |

| | 2021 | | | 2021 | |

Net income (loss) attributable to AIR common stockholders | | $ | (18,030 | ) | | $ | 65,166 | |

Adjustments: | | | | | | |

Real estate depreciation and amortization, net of noncontrolling partners’ interest | | | 69,588 | | | | 139,083 | |

Gain on dispositions and derecognition of leased properties (1) | | | (3,353 | ) | | | (87,385 | ) |

Income tax adjustments related to gain on dispositions and other

tax-related items | | | (1,528 | ) | | | 272 | |

Common noncontrolling interests in AIR OP’s share of above adjustments | | | (3,217 | ) | | | (2,573 | ) |

Amounts allocable to participating securities | | | (7 | ) | | | — | |

NAREIT FFO attributable to AIR common stockholders | | $ | 43,453 | | | $ | 114,563 | |

Adjustments, all net of common noncontrolling interests in AIR OP and participating securities: | | | | | | |

Separation costs (2) | | | 285 | | | | 2,342 | |

Prepayment penalties (3) | | | 36,047 | | | | 36,990 | |

Non-cash straight-line rent (4) | | | 635 | | | | 1,270 | |

Incremental cash received from leased properties (1) | | | 140 | | | | 294 | |

Pro Forma FFO | | $ | 80,560 | | | $ | 155,459 | |

| | | | | | |

Weighted-average common shares outstanding – basic | | | 154,608 | | | | 151,609 | |

Dilutive common share equivalents | | | 504 | | | | 474 | |

Total shares and dilutive share equivalents | | | 155,112 | | | | 152,083 | |

| | | | | | |

Net income (loss) attributable to AIR per common share – basic and diluted | | $ | (0.12 | ) | | $ | 0.43 | |

NAREIT FFO per share – diluted | | $ | 0.28 | | | $ | 0.75 | |

Pro forma FFO per share – diluted | | $ | 0.52 | | | $ | 1.02 | |

(1)Commencing on January 1 2021 and June 1, 2021, we leased four properties and one land parcel, respectively, to Aimco for redevelopment and development, which resulted in derecognizing the net book value of these properties and recording of leased real estate assets on the respective lease commencement date. During the three and six months ended June 30, 2021, we recognized $3.4 million and $87.1 million of gain, respectively, associated with these transactions. Due to the terms of these leases, during 2021 cash received exceeds GAAP income. We include the cash lease income in Pro forma FFO.

(2)During 2021, we incurred tax, legal and other costs in connection with the separation. We excluded these costs from Pro forma FFO because we believe they are not representative of ongoing operating performance.

(3)As a result of refinancing activities in 2021, we incurred debt extinguishment costs and wrote-off capitalized deferred financing costs related to our previous credit facility and the prepayment of debt during the quarter. We excluded such costs from Pro forma FFO because we believe these costs are not representative of ongoing operating performance.

(4)In 2018, we assumed a 99-year ground lease with scheduled rent increases. Due to the terms of the lease, GAAP rent expense will exceed cash rent payments until 2076. We include the cash rent payments for this ground lease in Pro forma FFO but exclude the incremental straight-line non-cash rent expense. The rent expense for this lease is included in other expenses, net, on our consolidated statements of operations.

16

Supplemental Schedule 2(a)

| |

Funds From Operations Information | |

Three and Six Months Ended June 30, 2021

(consolidated amounts, in thousands) (unaudited)

| | | | | | | | |

| | Three Months Ended June 30, 2021 | | | Six Months Ended June 30, 2021 | |

Revenues, before utility reimbursements | | | | | | |

Same Store | | $ | 167,287 | | | $ | 333,404 | |

Other Real Estate (1) | | | 2,395 | | | | 4,106 | |

Total revenues, before utility reimbursements | | | 169,682 | | | | 337,510 | |

Expenses, net of utility reimbursements | | | | | | |

Same Store | | | 48,916 | | | | 96,526 | |

Other Real Estate (1) | | | 1,355 | | | | 2,570 | |

Total expenses, net of utility reimbursements | | | 50,271 | | | | 99,096 | |

Net operating income | | | 119,411 | | | | 238,414 | |

Lease income | | | 6,457 | | | | 12,898 | |

Property management expenses, net | | | (5,250 | ) | | | (11,588 | ) |

Property income | | | 120,618 | | | | 239,724 | |

| | | | | | |

General and administrative expenses (2) | | | (3,142 | ) | | | (7,556 | ) |

| | | | | | |

Interest expense, including prepayment penalties | | | (70,807 | ) | | | (107,842 | ) |

Preferred dividends | | | (1,646 | ) | | | (3,300 | ) |

Interest income from note receivable from Aimco | | | 6,944 | | | | 13,889 | |

Interest income | | | 2,283 | | | | 4,869 | |

Total cost of capital | | | (63,226 | ) | | | (92,384 | ) |

| | | | | | |

Casualties | | | (585 | ) | | | (1,457 | ) |

Depreciation and amortization related to non-real estate assets | | | (869 | ) | | | (1,385 | ) |

Land leases | | | (1,321 | ) | | | (2,634 | ) |

Other expenses, net | | | (1,194 | ) | | | (2,757 | ) |

Tax (expense) benefit, net | | | 505 | | | | (770 | ) |

Total other | | | (3,464 | ) | | | (9,003 | ) |

| | | | | | |

Common noncontrolling interests in AIR OP | | | (2,318 | ) | | | (6,167 | ) |

Proportionate adjustments | | | (5,015 | ) | | | (10,051 | ) |

| | | | | | |

NAREIT FFO attributable to AIR common stockholders | | $ | 43,453 | | | $ | 114,563 | |

Total pro forma adjustments, net of common noncontrolling interests in

AIR OP and participating securities | | | 37,107 | | | | 40,896 | |

Pro forma FFO attributable to AIR common stockholders | | $ | 80,560 | | | $ | 155,459 | |

(1)Other Real Estate consists of communities that do not meet the criteria to be classified as Same Store.

(2)In setting our G&A benchmark of 15 bps of total assets, we consider platform fees earned on our California joint venture as a reduction of general and administrative expenses. In accordance with GAAP, these platform fees are included in the determination of net income (loss) attributable to noncontrolling interests in consolidated real estate partnerships in our consolidated statements of operations.

17

Supplemental Schedule 2(b)

Partially Owned Entities

Three and Six Months Ended June 30, 2021 Compared to Three and Six Months Ended June 30, 2020

(proportionate amounts, in thousands) (unaudited)

| | | | | | | | | | | | | | | | |

| | Noncontrolling Interests (1) | |

| | Three Months Ended

June 30 | | | Six Months Ended

June 30 | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Revenues, before utility reimbursements | | $ | 13,133 | | | $ | 650 | | | $ | 26,253 | | | $ | 1,328 | |

Expenses, net of utility reimbursements | | | 3,783 | | | | 178 | | | | 7,444 | | | | 359 | |

Net operating income | | | 9,350 | | | | 472 | | | | 18,809 | | | | 969 | |

| | | | | | | | | | | | |

Property management expenses, net | | | (409 | ) | | | (29 | ) | | | (817 | ) | | | (60 | ) |

Casualties | | | (13 | ) | | | — | | | | (70 | ) | | | (2 | ) |

Other expense, net | | | (23 | ) | | | (2 | ) | | | (29 | ) | | | (5 | ) |

Interest expense on non-recourse property debt | | | (3,828 | ) | | | (146 | ) | | | (7,711 | ) | | | (292 | ) |

Contribution from real estate operations | | | 5,077 | | | | 295 | | | | 10,182 | | | | 610 | |

| | | | | | | | | | | | |

Other non-property expenses, net | | | (62 | ) | | | (17 | ) | | | (131 | ) | | | (31 | ) |

FFO from real estate operations | | $ | 5,015 | | | $ | 278 | | | $ | 10,051 | | | $ | 579 | |

| | | | | | | | | | | | |

Total apartment communities | | | 16 | | | | 4 | | | | | | | |

Total apartment homes | | | 5,369 | | | | 2,016 | | | | | | | |

Noncontrolling interests’ share of consolidated apartment homes | | | 1,721 | | | | 142 | | | | | | | |

(1)Amounts represent the noncontrolling interests’ proportionate share of consolidated amounts, including the amounts related to the California joint venture transaction that closed on September 8, 2020.

18

Supplemental Schedule 3

Property Net Operating Income

Trailing Five Quarters

(consolidated amounts, in thousands) (unaudited)

The table below presents the operating results of AIR’s 96 property portfolio in consolidated amounts not adjusted for noncontrolling interest.

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | June 30, 2021 | | | March 31, 2021 | | | December 31, 2020 | | | September 30, 2020 | | | June 30, 2020 | |

Revenues, before utility reimbursements | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Same Store | | $ | 167,287 | | | $ | 166,117 | | | $ | 163,585 | | | $ | 166,822 | | | $ | 171,042 | |

| | | | | | | | | | | | | | | |

Other Real Estate (1) | | | 2,395 | | | | 1,711 | | | | 2,710 | | | | 2,012 | | | | 1,638 | |

| | | | | | | | | | | | | | | |

Total revenues, before utility reimbursements | | | 169,682 | | | | 167,828 | | | | 166,295 | | | | 168,834 | | | | 172,680 | |

| | | | | | | | | | | | | | | |

Expenses, net of utility reimbursements | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Same Store | | | 48,916 | | | | 47,610 | | | | 48,160 | | | | 48,836 | | | | 46,577 | |

| | | | | | | | | | | | | | | |

Other Real Estate (1) | | | 1,355 | | | | 1,215 | | | | 2,161 | | | | 1,985 | | | | 1,853 | |

| | | | | | | | | | | | | | | |

Total expenses, net of utility reimbursements | | | 50,271 | | | | 48,825 | | | | 50,321 | | | | 50,821 | | | | 48,430 | |

| | | | | | | | | | | | | | | |

Property Net Operating Income | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Same Store | | | 118,371 | | | | 118,507 | | | | 115,425 | | | | 117,986 | | | | 124,465 | |

| | | | | | | | | | | | | | | |

Other Real Estate (1) | | | 1,040 | | | | 496 | | | | 549 | | | | 27 | | | | (215 | ) |

| | | | | | | | | | | | | | | |

Total Property Net Operating Income | | $ | 119,411 | | | $ | 119,003 | | | $ | 115,974 | | | $ | 118,013 | | | $ | 124,250 | |

(1)Other Real Estate consists of communities that do not meet the criteria to be classified as Same Store.

19

Supplemental Schedule 4

Apartment Home Summary

As of June 30, 2021

(unaudited)

| | | | | | | | | | | | |

| | Number of Apartment Communities | | | Number of Apartment Homes | | | AIR Share of Apartment Homes | |

| | | | | | | | | |

Same Store | | | 92 | | | | 25,427 | | | | 23,706 | |

Other Real Estate | | | 4 | | | | 995 | | | | 995 | |

Total Portfolio | | | 96 | | | | 26,422 | | | | 24,701 | |

| | | | | | | | | |

Properties Currently Leased to Aimco (1) | | | 4 | | | | 865 | | | | 865 | |

(1)As of June 30,2021, we leased four properties to Aimco for development and redevelopment with an initial value of $467.0 million and quarterly cash lease income of $6.6 million. AIR has the option to purchase the improved assets at a discount to their fair value, when property operations are stabilized, currently expected between January 1, 2024 and January 1, 2025. Additionally, during the quarter we leased one vacant land parcel to Aimco, which has an initial value of $12.8 million, quarterly cash lease income of approximately $0.1 million, and expected stabilization in 2025.

20

Supplemental Schedule 5(a)

Capitalization and Financial Metrics

As of June 30, 2021

(dollars in thousands) (unaudited)

Leverage Balances and Characteristics

| | | | | | | | | | | | | | | | | | | | |

Debt | | Consolidated | | | Noncontrolling

Interests | | | Total

AIR

Share | | | Weighted-

Average

Maturity

(Years) | | | Weighted-

Average

Stated

Interest Rate | |

Fixed rate loans payable | | $ | 3,065,071 | | | $ | (478,231 | ) | | $ | 2,586,840 | | | | 8.9 | | | | 3.5 | % |

Floating rate tax-exempt bonds | | | 14,505 | | | | (1 | ) | | | 14,504 | | | | 12.0 | | | | 1.0 | % |

Total non-recourse property debt | | $ | 3,079,576 | | | $ | (478,232 | ) | | $ | 2,601,344 | | | | 8.9 | | | | 3.5 | % |

| | | | | | | | | | | | | | | |

Term Loans | | | 800,000 | | | | — | | | | 800,000 | | | | 4.5 | | (1) | | 1.6 | % |

Revolving credit facility borrowings | | | 347,200 | | | | — | | | | 347,200 | | | | 4.8 | | (1) | | 1.1 | % |

Preferred equity | | | 81,375 | | | | — | | | | 81,375 | | | | 9.9 | | (2) | | 8.1 | % |

Total leverage | | $ | 4,308,151 | | | $ | (478,232 | ) | | $ | 3,829,919 | | | | 7.6 | | | | 2.9 | % |

| | | | | | | | | | | | | | | |

Cash and restricted cash (3) | | | (70,878 | ) | | | 4,305 | | | | (66,573 | ) | | | | | n/a | |

Notes receivable from Aimco (4) | | | (534,127 | ) | | | — | | | | (534,127 | ) | | | | | | 5.2 | % |

Net leverage | | $ | 3,703,146 | | | $ | (473,927 | ) | | $ | 3,229,219 | | | | | | | 2.6 | % |

Leverage Ratios Second Quarter 2021 (5)

| | |

| | Annualized Current Quarter |

Proportionate Debt to Adjusted EBITDAre | | 7.1x |

Net Leverage to Adjusted EBITDAre | | 7.3x |

| | | | |

| | | | |

Unsecured Credit Facility Covenants | | June 30, 2021 | | Covenant |

Fixed Charge Coverage Ratio | | 2.00x | | 1.50x |

Leverage Ratio | | 46.2% | | ≤ 60.0% |

Secured Indebtedness Ratio (6) | | 31.8% | | ≤ 45.0% |

Unsecured Leverage Ratio | | 40.1% | | ≤ 60.0% |

(1)Assumes exercise of extension options.

(2)Our preferred OP Units are redeemable at the holder’s option and our preferred stock is redeemable by AIR on or after December 15, 2025. We have computed the weighted-average maturity of our preferred OP Units assuming a 10-year maturity and preferred stock assuming it is called at the expiration of the no-call period.

(3)Restricted cash on the balance sheet includes tenant security deposits, which are excluded for purposes of calculating our net leverage.

(4)Reflects AIR’s receipt of notes receivable from Aimco as part of the separation. The notes mature on January 31, 2024.

(5)We calculate Adjusted EBITDAre used in our leverage ratios based on annualized current quarter amounts. Our Adjusted EBITDAre has been calculated on a pro forma basis as further described in the Glossary.

(6)Covenant requirement becomes ≤ 40.0% after March 31, 2023.

21

Supplemental Schedule 5(b)

Capitalization and Financial Metrics

As of June 30, 2021

(dollar amounts in thousands) (unaudited)

AIR Share of Non-Recourse Property Debt and Term Loans

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amortization | | | Maturities | | | Sub-Total Non-Recourse Property Debt | | | Term Loans | | | Total | | | Maturities as a

Percent of Total | | | Average Rate on

Maturing Debt | |

2021 Q3 | | $ | 11,511 | | | $ | — | | | $ | 11,511 | | | $ | — | | | $ | 11,511 | | | | — | % | | | — | % |

2021 Q4 | | | 12,136 | | | | — | | | | 12,136 | | | | — | | | | 12,136 | | | | — | % | | | — | % |

Total 2021 | | | 23,647 | | | | — | | | | 23,647 | | | | — | | | | 23,647 | | | | — | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | | |

2022 Q1 | | | 12,252 | | | | — | | | | 12,252 | | | | — | | | | 12,252 | | | | — | % | | | — | % |

2022 Q2 | | | 12,337 | | | | — | | | | 12,337 | | | | — | | | | 12,337 | | | | — | % | | | — | % |

2022 Q3 | | | 12,445 | | | | — | | | | 12,445 | | | | — | | | | 12,445 | | | | — | % | | | — | % |

2022 Q4 | | | 12,290 | | | | 110,434 | | | | 122,724 | | | | — | | | | 122,724 | | | | 3.25 | % | | | 4.4 | % |

Total 2022 | | | 49,324 | | | | 110,434 | | | | 159,758 | | | | — | | | | 159,758 | | | | 3.25 | % | | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | | |

2023 | | | 47,865 | | | | 49,860 | | | | 97,725 | | | | — | | | | 97,725 | | | | 1.47 | % | | | 3.9 | % |

2024 | | | 48,898 | | | | — | | | | 48,898 | | | | — | | | | 48,898 | | | | — | % | | | — | % |

2025 | | | 48,827 | | | | 269,411 | | | | 318,238 | | | | 600,000 | | (1) | | 918,238 | | | | 25.56 | % | | | 2.1 | % |

2026 | | | 42,478 | | | | 198,205 | | | | 240,683 | | | | 200,000 | | | | 440,683 | | | | 11.71 | % | | | 2.6 | % |

2027 | | | 35,425 | | | | 225,249 | | | | 260,674 | | | | — | | | | 260,674 | | | | 6.62 | % | | | 3.5 | % |

2028 | | | 32,312 | | | | 210,778 | | | | 243,090 | | | | — | | | | 243,090 | | | | 6.20 | % | | | 3.8 | % |

2029 | | | 22,897 | | | | 236,239 | | | | 259,136 | | | | — | | | | 259,136 | | | | 6.95 | % | | | 4.3 | % |

2030 | | | 20,338 | | | | 328,920 | | | | 349,258 | | | | — | | | | 349,258 | | | | 9.67 | % | | | 3.1 | % |

Thereafter | | | 149,913 | | | | 450,324 | | | | 600,237 | | | | — | | | | 600,237 | | | | 13.24 | % | | | 3.1 | % |

Total | | $ | 521,924 | | | $ | 2,079,420 | | | $ | 2,601,344 | | | $ | 800,000 | | | $ | 3,401,344 | | | | 84.66 | % | | | 3.0 | % |

(1) Amount shown is assuming exercise of extension options.

Preferred Equity

| | | | | | | | | | | | | | |

| | Amount Outstanding

as of June 30, 2021 | | | Date First Available for Redemption by AIR | | Coupon | | | Amount | |

Class A Perpetual Preferred Stock | | | 20 | | | December 2025 | | | 8.50 | % | | $ | 2,000 | |

Preferred Partnership Units | | | 2,935,920 | | | n/a | | | 8.08 | % | | | 79,375 | |

Total Preferred Equity | | | | | | | | 8.09 | % | | $ | 81,375 | |

Common Stock, Partnership Units and Equivalents (shares and units in thousands)

| | | | |

| | June 30,

2021 | |

Class A Common Stock outstanding | | | 156,534 | |

Participating unvested restricted stock | | | 115 | |

Dilutive options, share equivalents and non-participating unvested restricted stock | | | 602 | |

Total shares and dilutive share equivalents | | | 157,251 | |

Common Partnership Units and equivalents outstanding | | | 8,065 | |

Total shares, units, and dilutive share equivalents | | | 165,316 | |

22

Supplemental Schedule 6(a)

Same Store Operating Results

Three Months Ended June 30, 2021 Compared to Three Months Ended June 30, 2020

(proportionate amounts, in thousands, except community, home, and per home data) (unaudited)

The table below presents AIR’s Same Store portfolio as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Revenues, Before Utility

Reimbursements (1) | | | Expenses, Net of Utility

Reimbursements | | | Net Operating Income | | | | Net Operating

Income

Margin | | Average Daily

Occupancy

During Period | | Average

Revenue per

AIR Apartment

Home | |

| Apartment

Communities | | Apartment

Homes | | AIR Share

of Apartment

Homes | | | 2Q

2021 | | 2Q

2020 | | Growth | | | 2Q

2021 | | 2Q

2020 | | Growth | | | 2Q

2021 | | 2Q

2020 | | Growth | | | | 2Q

2021 | | 2Q

2021 | 2Q

2020 | | 2Q

2021 | | 2Q

2020 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bay Area | | 9 | | | 2,212 | | | 1,657 | | | $ | 13,883 | | $ | 15,115 | | | (8.2 | %) | | $ | 3,744 | | $ | 3,511 | | | 6.6 | % | | $ | 10,139 | | $ | 11,604 | | | (12.6 | %) | | | 73.0% | | 94.6% | 95.7% | | $ | 2,952 | | $ | 3,176 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston | | 11 | | | 2,462 | | | 2,462 | | | | 16,745 | | | 17,146 | | | (2.3 | %) | | | 5,132 | | | 5,063 | | | 1.4 | % | | | 11,613 | | | 12,083 | | | (3.9 | %) | | | 69.4% | | 95.7% | 95.5% | | | 2,369 | | | 2,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Denver | | 7 | | | 2,026 | | | 1,987 | | | | 10,445 | | | 9,500 | | | 9.9 | % | | | 3,056 | | | 2,583 | | | 18.3 | % | | | 7,389 | | | 6,917 | | | 6.8 | % | | | 70.7% | | 95.4% | 90.7% | | | 1,837 | | | 1,756 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Greater Washington, DC | | 11 | | | 5,238 | | | 5,215 | | | | 24,919 | | | 25,099 | | | (0.7 | %) | | | 7,037 | | | 6,773 | | | 3.9 | % | | | 17,882 | | | 18,326 | | | (2.4 | %) | | | 71.8% | | 95.7% | 96.6% | | | 1,664 | | | 1,661 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | 13 | | | 4,347 | | | 3,498 | | | | 28,293 | | | 30,409 | | | (7.0 | %) | | | 7,096 | | | 6,712 | | | 5.7 | % | | | 21,197 | | | 23,697 | | | (10.5 | %) | | | 74.9% | | 96.5% | 94.7% | | | 2,794 | | | 3,060 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Miami | | 5 | | | 1,725 | | | 1,725 | | | | 11,585 | | | 10,646 | | | 8.8 | % | | | 4,002 | | | 3,906 | | | 2.5 | % | | | 7,583 | | | 6,740 | | | 12.5 | % | | | 65.5% | | 97.5% | 94.4% | | | 2,297 | | | 2,180 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Philadelphia | | 9 | | | 2,748 | | | 2,669 | | | | 19,251 | | | 20,436 | | | (5.8 | %) | | | 6,082 | | | 5,611 | | | 8.4 | % | | | 13,169 | | | 14,825 | | | (11.2 | %) | | | 68.4% | | 91.3% | 95.3% | | | 2,633 | | | 2,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

San Diego | | 9 | | | 3,051 | | | 2,875 | | | | 18,132 | | | 17,545 | | | 3.3 | % | | | 4,012 | | | 3,974 | | | 1.0 | % | | | 14,120 | | | 13,571 | | | 4.0 | % | | | 77.9% | | 97.2% | 96.0% | | | 2,163 | | | 2,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Markets | | 18 | | | 1,618 | | | 1,618 | | | | 10,901 | | | 11,236 | | | (3.0 | %) | | | 4,982 | | | 4,864 | | | 2.4 | % | | | 5,919 | | | 6,372 | | | (7.1 | %) | | | 54.3% | | 93.6% | 94.6% | | | 2,400 | | | 2,446 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 92 | | | 25,427 | | | 23,706 | | | $ | 154,154 | | $ | 157,132 | | | (1.9 | %) | | $ | 45,143 | | $ | 42,997 | | | 5.0 | % | | $ | 109,011 | | $ | 114,135 | | | (4.5 | %) | | | 70.7% | | 95.4% | 95.1% | | $ | 2,272 | | $ | 2,322 | |

(1)Approximately 60 basis points of the second quarter 2021 year-over-year decline in revenue growth is attributable to elevated bad debt expense.

23

Supplemental Schedule 6(b)

Same Store Operating Results

Three Months Ended June 30, 2021 Compared to Three Months Ended March 31, 2021

(proportionate amounts, in thousands, except community, home, and per home data) (unaudited)

The table below presents AIR’s Same Store portfolio as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Revenues, Before Utility

Reimbursements | | | Expenses, Net of Utility

Reimbursements | | | Net Operating Income | | | | Net Operating

Income

Margin | | Average Daily

Occupancy

During Period | | Average

Revenue per

AIR Apartment

Home | |

| Apartment

Communities | | Apartment

Homes | | AIR Share

of Apartment

Homes | | | 2Q

2021 | | 1Q

2021 | | Growth | | | 2Q

2021 | | 1Q

2021 | | Growth | | | 2Q

2021 | | 1Q

2021 | | Growth | | | | 2Q

2021 | | 2Q

2021 | 1Q

2021 | | 2Q

2021 | | 1Q

2021 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bay Area | | 9 | | | 2,212 | | | 1,657 | | | $ | 13,883 | | $ | 13,929 | | | (0.3 | %) | | $ | 3,744 | | $ | 3,680 | | | 1.7 | % | | $ | 10,139 | | $ | 10,249 | | | (1.1 | %) | | | 73.0% | | 94.6% | 92.4% | | $ | 2,952 | | $ | 3,033 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston | | 11 | | | 2,462 | | | 2,462 | | | | 16,745 | | | 16,697 | | | 0.3 | % | | | 5,132 | | | 5,340 | | | (3.9 | %) | | | 11,613 | | | 11,357 | | | 2.3 | % | | | 69.4% | | 95.7% | 96.6% | | | 2,369 | | | 2,339 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Denver | | 7 | | | 2,026 | | | 1,987 | | | | 10,445 | | | 10,206 | | | 2.3 | % | | | 3,056 | | | 2,708 | | | 12.9 | % | | | 7,389 | | | 7,498 | | | (1.5 | %) | | | 70.7% | | 95.4% | 96.0% | | | 1,837 | | | 1,784 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Greater Washington, DC | | 11 | | | 5,238 | | | 5,215 | | | | 24,919 | | | 24,954 | | | (0.1 | %) | | | 7,037 | | | 6,676 | | | 5.4 | % | | | 17,882 | | | 18,278 | | | (2.2 | %) | | | 71.8% | | 95.7% | 96.6% | | | 1,664 | | | 1,651 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | 13 | | | 4,347 | | | 3,498 | | | | 28,293 | | | 28,445 | | | (0.5 | %) | | | 7,096 | | | 6,911 | | | 2.7 | % | | | 21,197 | | | 21,534 | | | (1.6 | %) | | | 74.9% | | 96.5% | 96.7% | | | 2,794 | | | 2,803 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Miami | | 5 | | | 1,725 | | | 1,725 | | | | 11,585 | | | 11,206 | | | 3.4 | % | | | 4,002 | | | 3,806 | | | 5.1 | % | | | 7,583 | | | 7,400 | | | 2.5 | % | | | 65.5% | | 97.5% | 97.9% | | | 2,297 | | | 2,212 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Philadelphia | | 9 | | | 2,748 | | | 2,669 | | | | 19,251 | | | 19,133 | | | 0.6 | % | | | 6,082 | | | 5,819 | | | 4.5 | % | | | 13,169 | | | 13,314 | | | (1.1 | %) | | | 68.4% | | 91.3% | 90.4% | | | 2,633 | | | 2,644 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

San Diego | | 9 | | | 3,051 | | | 2,875 | | | | 18,132 | | | 17,815 | | | 1.8 | % | | | 4,012 | | | 3,994 | | | 0.5 | % | | | 14,120 | | | 13,821 | | | 2.2 | % | | | 77.9% | | 97.2% | 98.1% | | | 2,163 | | | 2,107 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Markets | | 18 | | | 1,618 | | | 1,618 | | | | 10,901 | | | 10,608 | | | 2.8 | % | | | 4,982 | | | 5,026 | | | (0.9 | %) | | | 5,919 | | | 5,582 | | | 6.0 | % | | | 54.3% | | 93.6% | 92.0% | | | 2,400 | | | 2,376 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 92 | | | 25,427 | | | 23,706 | | | $ | 154,154 | | $ | 152,993 | | | 0.8 | % | | $ | 45,143 | | $ | 43,960 | | | 2.7 | % | | $ | 109,011 | | $ | 109,033 | | | — | % | | | 70.7% | | 95.4% | 95.5% | | $ | 2,272 | | $ | 2,252 | |

24

Supplemental Schedule 6(c)

Same Store Operating Results

Six Months Ended June 30, 2021 Compared to Six Months Ended June 30, 2020

(proportionate amounts, in thousands, except community, home, and per home data) (unaudited)

The table below presents AIR’s Same Store portfolio as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Revenues, Before Utility

Reimbursements (1) | | | Expenses, Net of Utility

Reimbursements | | | Net Operating Income | | | | Net Operating

Income

Margin | | Average Daily

Occupancy

During Period | | Average

Revenue per

AIR Apartment

Home | |

| Apartment

Communities | | Apartment

Homes | | AIR Share

of Apartment

Homes | | | YTD

2Q 2021 | | YTD

2Q

2020 | | Growth | | | YTD

2Q 2021 | | YTD

2Q

2020 | | Growth | | | YTD

2Q 2021 | | YTD

2Q

2020 | | Growth | | | | YTD

2Q 2021 | | YTD

2Q 2021 | YTD

2Q

2020 | | YTD

2Q 2021 | | YTD

2Q

2020 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bay Area | | 9 | | | 2,212 | | | 1,657 | | | $ | 27,812 | | $ | 30,450 | | | (8.7 | %) | | $ | 7,424 | | $ | 6,921 | | | 7.3 | % | | $ | 20,388 | | $ | 23,529 | | | (13.3 | %) | | | 73.3% | | 93.5% | 96.4% | | $ | 2,992 | | $ | 3,177 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston | | 11 | | | 2,462 | | | 2,462 | | | | 33,442 | | | 35,093 | | | (4.7 | %) | | | 10,472 | | | 10,161 | | | 3.1 | % | | | 22,970 | | | 24,932 | | | (7.9 | %) | | | 68.7% | | 96.2% | 96.9% | | $ | 2,354 | | $ | 2,452 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Denver | | 7 | | | 2,026 | | | 1,987 | | | | 20,651 | | | 19,143 | | | 7.9 | % | | | 5,764 | | | 5,084 | | | 13.4 | % | | | 14,887 | | | 14,059 | | | 5.9 | % | | | 72.1% | | 95.7% | 91.2% | | $ | 1,810 | | $ | 1,759 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Greater Washington, DC | | 11 | | | 5,238 | | | 5,215 | | | | 49,873 | | | 50,536 | | | (1.3 | %) | | | 13,713 | | | 13,467 | | | 1.8 | % | | | 36,160 | | | 37,069 | | | (2.5 | %) | | | 72.5% | | 96.2% | 97.4% | | $ | 1,658 | | $ | 1,658 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | 13 | | | 4,347 | | | 3,498 | | | | 56,738 | | | 62,212 | | | (8.8 | %) | | | 14,007 | | | 13,367 | | | 4.8 | % | | | 42,731 | | | 48,845 | | | (12.5 | %) | | | 75.3% | | 96.6% | 96.0% | | $ | 2,799 | | $ | 3,088 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Miami | | 5 | | | 1,725 | | | 1,725 | | | | 22,791 | | | 21,929 | | | 3.9 | % | | | 7,808 | | | 7,724 | | | 1.1 | % | | | 14,983 | | | 14,205 | | | 5.5 | % | | | 65.7% | | 97.7% | 95.4% | | $ | 2,254 | | $ | 2,221 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Philadelphia | | 9 | | | 2,748 | | | 2,669 | | | | 38,384 | | | 41,445 | | | (7.4 | %) | | | 11,901 | | | 11,087 | | | 7.3 | % | | | 26,483 | | | 30,358 | | | (12.8 | %) | | | 69.0% | | 90.8% | 96.7% | | $ | 2,639 | | $ | 2,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

San Diego | | 9 | | | 3,051 | | | 2,875 | | | | 35,947 | | | 35,385 | | | 1.6 | % | | | 8,006 | | | 7,824 | | | 2.3 | % | | | 27,941 | | | 27,561 | | | 1.4 | % | | | 77.7% | | 97.6% | 96.8% | | $ | 2,135 | | $ | 2,120 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Markets | | 18 | | | 1,618 | | | 1,618 | | | | 21,509 | | | 23,824 | | | (9.7 | %) | | | 10,008 | | | 10,055 | | | (0.5 | %) | | | 11,501 | | | 13,769 | | | (16.5 | %) | | | 53.5% | | 92.8% | 95.9% | | $ | 2,388 | | $ | 2,558 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 92 | | | 25,427 | | | 23,706 | | | $ | 307,147 | | $ | 320,017 | | | (4.0 | %) | | $ | 89,103 | | $ | 85,690 | | | 4.0 | % | | $ | 218,044 | | $ | 234,327 | | | (6.9 | %) | | | 71.0% | | 95.5% | 96.1% | | $ | 2,262 | | $ | 2,340 | |

(1)Approximately 110 basis points of the year-to-date 2021 year-over-year decline in revenue growth is attributable to elevated bad debt expense.

25

Supplemental Schedule 6(d)

Same Store Operating Expense Detail

(proportionate amounts, in thousands) (unaudited)

Quarterly Comparison

| | | | | | | | | | | | | | | | | | | | |

| | 2Q 2021 | | | % of Total | | | 2Q 2020 | | | $ Change | | | % Change | |

Operating expenses (1) | | $ | 21,952 | | | | 48.6 | % | | $ | 21,348 | | | $ | 604 | | | | 2.8 | % |

Utility expense, net of reimbursement | | | 2,436 | | | | 5.4 | % | | | 2,318 | | | | 118 | | | | 5.1 | % |

Real estate taxes | | | 18,121 | | | | 40.1 | % | | | 17,305 | | | | 816 | | | | 4.7 | % |

Insurance | | | 2,634 | | | | 5.9 | % | | | 2,026 | | | | 608 | | | | 30.0 | % |

Total | | $ | 45,143 | | | | 100.0 | % | | $ | 42,997 | | | $ | 2,146 | | | | 5.0 | % |

Sequential Comparison

| | | | | | | | | | | | | | | | | | | | |

| | 2Q 2021 | | | % of Total | | | 1Q 2021 | | | $ Change | | | % Change | |

Operating expenses (1) | | $ | 21,952 | | | | 48.6 | % | | $ | 20,295 | | | $ | 1,657 | | | | 8.2 | % |

Utility expense, net of reimbursement | | | 2,436 | | | | 5.4 | % | | | 2,830 | | | | (394 | ) | | | (13.9 | %) |

Real estate taxes | | | 18,121 | | | | 40.1 | % | | | 18,435 | | | | (314 | ) | | | (1.7 | %) |

Insurance | | | 2,634 | | | | 5.9 | % | | | 2,400 | | | | 234 | | | | 9.8 | % |

Total | | $ | 45,143 | | | | 100.0 | % | | $ | 43,960 | | | $ | 1,183 | | | | 2.7 | % |

Year-To-Date Comparison

| | | | | | | | | | | | | | | | | | | | |

| | YTD 2Q 2021 | | | % of Total | | | YTD 2Q 2020 | | | $ Change | | | % Change | |

Operating expenses (1) | | $ | 42,247 | | | | 47.4 | % | | $ | 41,520 | | | $ | 727 | | | | 1.8 | % |

Utility expense, net of reimbursement | | | 5,266 | | | | 5.9 | % | | | 5,202 | | | | 64 | | | | 1.2 | % |

Real estate taxes | | | 36,556 | | | | 41.0 | % | | | 34,878 | | | | 1,678 | | | | 4.8 | % |

Insurance | | | 5,034 | | | | 5.7 | % | | | 4,090 | | | | 944 | | | | 23.1 | % |

Total | | $ | 89,103 | | | | 100.0 | % | | $ | 85,690 | | | $ | 3,413 | | | | 4.0 | % |

(1)Includes onsite payroll, repairs and maintenance, software and technology expenses, marketing, expensed turnover costs, and other property related operating expenses. Year-over-year operating expenses are elevated due to a significant reduction in spend during the second quarter of 2020.

26

Supplemental Schedule 7

Portfolio Data by Market

Second Quarter 2021 Compared to Second Quarter 2020

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended June 30, 2021 | | | Quarter Ended June 30, 2020 | |

| | Apartment

Communities | | | Apartment

Homes | | | AIR Share of

Apartment Homes | | | % AIR

NOI | | | Average

Revenue

per AIR

Apartment Home | | | Apartment

Communities | | | Apartment

Homes | | | AIR Share of

Apartment Homes | | | % AIR

NOI | | | Average

Revenue

per AIR

Apartment

Home | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bay Area | | | 9 | | | | 2,212 | | | | 1,657 | | | | 9.3 | % | | $ | 2,952 | | | | 10 | | | | 2,322 | | | | 2,322 | | | | 12.6 | % | | $ | 3,212 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston | | | 11 | | | | 2,462 | | | | 2,462 | | | | 10.6 | % | | | 2,369 | | | | 12 | | | | 2,598 | | | | 2,462 | | | | 9.9 | % | | | 2,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Denver | | | 7 | | | | 2,026 | | | | 1,987 | | | | 6.7 | % | | | 1,837 | | | | 8 | | | | 2,279 | | | | 2,240 | | | | 5.5 | % | | | 1,757 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Greater Washington, DC | | | 11 | | | | 5,238 | | | | 5,215 | | | | 16.4 | % | | | 1,664 | | | | 11 | | | | 5,238 | | | | 5,215 | | | | 15.0 | % | | | 1,661 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | | 13 | | | | 4,347 | | | | 3,498 | | | | 19.5 | % | | | 2,794 | | | | 13 | | | | 4,347 | | | | 4,347 | | | | 22.9 | % | | | 2,958 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Miami | | | 6 | | | | 2,425 | | | | 2,425 | | | | 7.5 | % | | | 1,897 | | | | 6 | | | | 2,091 | | | | 2,091 | | | | 5.6 | % | | | 1,796 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Philadelphia | | | 9 | | | | 2,748 | | | | 2,669 | | | | 11.1 | % | | | 2,462 | | | | 9 | | | | 2,748 | | | | 2,669 | | | | 11.2 | % | | | 2,511 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

San Diego | | | 9 | | | | 3,051 | | | | 2,875 | | | | 12.9 | % | | | 2,163 | | | | 9 | | | | 3,051 | | | | 3,051 | | | | 11.7 | % | | | 2,105 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Markets | | | 21 | | | | 1,913 | | | | 1,913 | | | | 6.0 | % | | | 2,388 | | | | 21 | | | | 1,918 | | | | 1,918 | | | | 5.6 | % | | | 2,380 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 96 | | | | 26,422 | | | | 24,701 | | | | 100.0 | % | | $ | 2,215 | | | | 99 | | | | 26,592 | | | | 26,315 | | | | 100.0 | % | | $ | 2,294 | |

27

Supplemental Schedule 8

Apartment Community Disposition and Acquisition Activity

(dollars in millions, except average revenue per home) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Disposition and Acquisition Activity | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

We did not dispose of any apartment communities during 2021.

| | | | | | | | | | | | | | | | |

Full Year 2021 Acquisitions | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Apartment Community Name | | Location | | Month

Acquired | | Apartment

Homes | | Purchase

Price | | | Average Rent per Apartment Home (1) | |

| | | | | | | | | | | | | | |

City Center on 7th | | | | Pembroke Pines, FL | | June | | 700 | | $ | 222.7 | | | $ | 1,892 | |

(1)Represents average rent per apartment home for leases in place at the time of acquisition.

28

Supplemental Schedule 9

Apartment Community Capital Additions Information

Three and Six Months Ended June 30, 2021

(consolidated amounts in thousands, except per apartment home data) (unaudited)

We classify capital additions as Capital Replacements (“CR”), Capital Improvements (“CI”), Capital Enhancements (“CE”), or Other Capital Expenditures. Recurring capital additions are apportioned between CR and CI based on the useful life of the item under consideration and the period over which we have owned the item. Under this method of classification, CR represents the portion of the item consumed during our ownership of the item, while CI represents the portion of the item consumed prior to our period of ownership.

The table below includes our capital spend in consolidated amounts, not adjusted for noncontrolling interest, excluding activities related to properties leased to Aimco.

| | | | | | | | |

| | Three Months Ended June 30, 2021 | | | Six Months Ended June 30, 2021 | |

Capital Additions (1) | | | | | | |

Capital Replacements | | | | | | |

Buildings and grounds | | $ | 5,056 | | | $ | 13,277 | |

Turnover capital additions | | | 896 | | | | 896 | |

Capitalized site payroll and indirect costs | | | 1,472 | | | | 1,472 | |

Capital Replacements | | | 7,424 | | | | 15,645 | |

Capital Improvements | | | 2,336 | | | | 3,904 | |

Capital Enhancements | | | 27,707 | | | | 37,641 | |

Other Capital Expenditures | | | 2,631 | | | | 4,457 | |

Total | | $ | 40,098 | | | $ | 61,647 | |

| | | | | | |

Total apartment homes | | | 26,422 | | | | 26,422 | |

| | | | | | |

Capital Replacements per apartment home | | $ | 281 | | | $ | 592 | |

(1)For the three and six months ended June 30, 2021, capital additions for our apartment communities included $0.4 million and $1.1 million, respectively, of capitalized interest costs.

29

GLOSSARY AND RECONCILIATIONS OF NON-GAAP FINANCIAL AND OPERATING MEASURES