During the year ended December 31, 2018, compared to 2017, controllable operating expenses increased by $1.0 million, or 1.5%.

Redevelopment and Development proportionate property net operating income increased by $18.8 million, or 18.2%, for the year ended December 31, 2018, compared to 2017 due to leasing activities at communities, offset partially by decreases due to apartment homes taken out of service for redevelopment.

Acquisition proportionate property net operating income increased by $24.0 million, or 230.1%, for the year ended December 31, 2018, compared to 2017 due to the 2018 acquisitions of Bent Tree Apartments, Avery Row, and four apartment communities in Philadelphia.

Non-Segment Real Estate Operations

Operating income amounts not attributed to our segments include offsite costs associated with property management, casualty losses, and the results of apartment communities sold or held for sale, reported in consolidated amounts, which we do not allocate to our segments for purposes of evaluating segment performance.

For the years ended December 31, 2019, 2018, and 2017, casualty losses totaled $9.0 million, $4.0 million, and $8.2 million, respectively. Casualty losses during the year ended December 31, 2019, included one major claim due to storm-related flooding at our One Canal apartment community and several other claims due to fire damage. Casualty losses for the year ended December 31, 2018, included several claims due primarily to storm and fire damage, offset partially by recovery from insurance carriers for insured losses in excess of policy limits. Casualty losses were elevated during the year ended December 31, 2017, due primarily to hurricane damage.

For the years ended December 31, 2019, 2018, and 2017, apartment communities that were sold or classified as held for sale generated net operating income of $16.6 million, $54.6 million, and $91.1 million, respectively.

Asset Management Results

For the year ended December 31, 2019, there was no net operating income attributable to the Asset Management business, which we sold in July 2018.

For the years ended December 31, 2018 and 2017, net operating income attributable to the Asset Management business was $28.9 million and $51.8 million, respectively.

Depreciation and Amortization

For the year ended December 31, 2019, compared to 2018 and the year ended December 31, 2018, compared to 2017, depreciation and amortization expense increased by $2.4 million and $11.6 million, respectively, due primarily to apartment communities acquired in 2019 and 2018 and renovated apartment homes placed in service after their completion. This increase was offset partially by decreases in depreciation associated with apartment communities sold and with communities owned by partnerships served by our Asset Management business, which we sold in 2018.

General and Administrative Expenses

General and administrative expenses for the year ended December 31, 2019, were relatively flat compared to the year ended December 31, 2018.

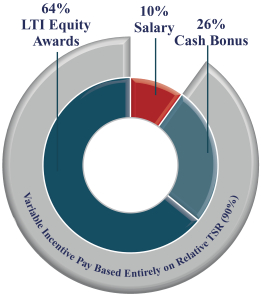

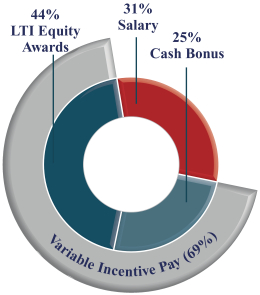

For the year ended December 31, 2018, compared to 2017, general and administrative expenses increased $2.6 million, due primarily to higher variable incentive compensation cost.

116