Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended.

PRELIMINARY AND SUBJECT TO COMPLETION, DATED NOVEMBER 24, 2020

INFORMATION STATEMENT

AIMCO OP L.P.

Common Limited Partnership Units

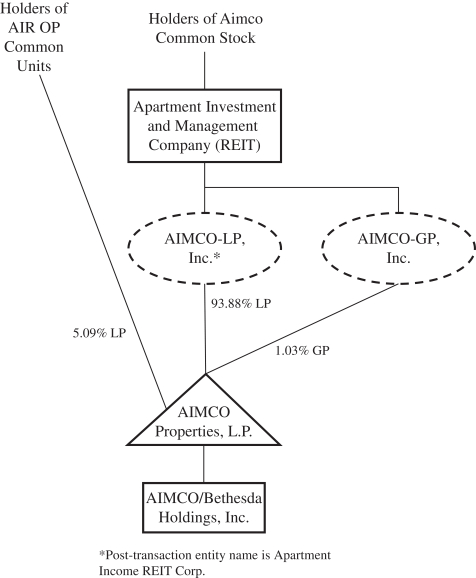

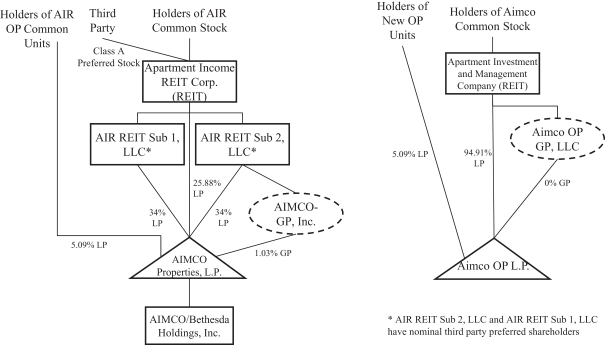

This information statement is being furnished in connection with (i) the pro rata distribution (the “New OP Separation”) by AIMCO Properties, L.P. (which is expected to be renamed Apartment Income, L.P. after a customary transitional period, “AIR OP”), the operating partnership of Apartment Investment and Management Company (“Aimco”), to the holders of AIR OP common limited partnership units (including Apartment Income REIT Corp., a Maryland corporation wholly owned by Aimco (formerly named Aimco-LP, Inc., “AIR”)), and the holders of AIR OP Class I High Performance partnership units (“AIR OP HP Units” and, collectively with the common limited partnership units, “AIR OP Common Units”), of all of the common limited partnership units of Aimco OP L.P. (“New OP Units”), a new Delaware limited partnership owned by AIR OP and formed to hold the businesses and portfolio of assets described below (formerly named Durango OP, LP, “New OP”), and (ii) the pro rata distribution (the “AIR Separation” and collectively with the New OP Separation and the related transactions, the “Separation”) by Aimco to its stockholders of all of the outstanding shares of Class A common stock of AIR (“AIR Common Stock”).

If you hold AIR OP Common Units as of the close of business on the record date, upon completion of the Separation, you will hold AIR OP Common Units and New OP Units. In addition, current AIR OP equityholders will own the same properties before and after the Separation, only in two simpler, more focused, and less levered entities.

The separation of assets representing approximately 10% of the total estimated value (“gross asset value” or “GAV”), as of March 31, 2020, of Aimco, will result in two, focused and independent companies: (I) “New” Aimco, which will own New OP, with assets approximating 10% of Aimco’s GAV, as of March 31, 2020, which is expected to continue the business of redeveloping and developing apartment communities, while also pursuing other accretive transactions; and (II) AIR, which will own AIR OP, with assets approximating 90% (prior to giving effect to certain transactions, which proceeds are intended to reduce leverage) of Aimco’s GAV, as of March 31, 2020, which is expected to provide a simple and transparent way to invest in the multifamily sector, combining (i) a narrow focus on allocating capital only to stabilized apartment communities; (ii) a high-quality and diversified portfolio of stabilized multifamily properties, (iii) best-in-class property operations, (iv) low financial leverage, (v) limited execution risk, (vi) low overhead costs as a percentage of GAV, and (vii) public market liquidity for its shares. The Aimco board of directors believes that the two businesses, each with a clear focus, strong, independent boards of directors, dedicated management teams, and strengthened balance sheets, will create greater equityholder value as two companies than as one. The separation will provide each equityholder the opportunity to make an individual allocation of capital to one or both of the two differentiated businesses, each with a distinct investment risk/return profile: ownership of stabilized apartment communities through an investment in AIR and AIR OP; or redevelopment, development, and transactions through an investment in Aimco and New OP.

Aimco and New OP will own the redevelopment and development business and a portfolio of assets that is expected to consist of 11 stabilized multifamily properties, primarily located in the Boston and San Diego areas, as well as: (i) Aimco’s loan to, and equity option in, the partnership owning Parkmerced Apartments located in southwest San Francisco, California (the “Parkmerced Loan”); (ii) Hamilton on the Bay, a multifamily property located on the waterfront in Miami, Florida, with 271 apartment homes as well as the land and zoning to construct 389 additional apartment homes; and (iii) the assemblage of 1001 Brickell Bay Drive, a 350,000 square foot office building located in Miami Beach, Florida, and the Yacht Club multifamily property adjacent to 1001 Brickell Bay Drive. Aimco will be well-capitalized with an estimated GAV of $1.3 billion, and an estimated Net Asset Value, or “NAV” (as defined below) of $1.2 billion, each as of March 31, 2020 (in each case, without giving effect to the value of the Initial Leased Properties or the Separate Portfolio Assets (each as defined below)). Aimco and New OP are also expected to own a separate portfolio of 16 assets (the “Separate Portfolio Assets”) with an estimated GAV of $0.9 billion, securing property debt of approximately $0.7 billion, including purchase money notes payable to AIR of approximately $0.5 billion.