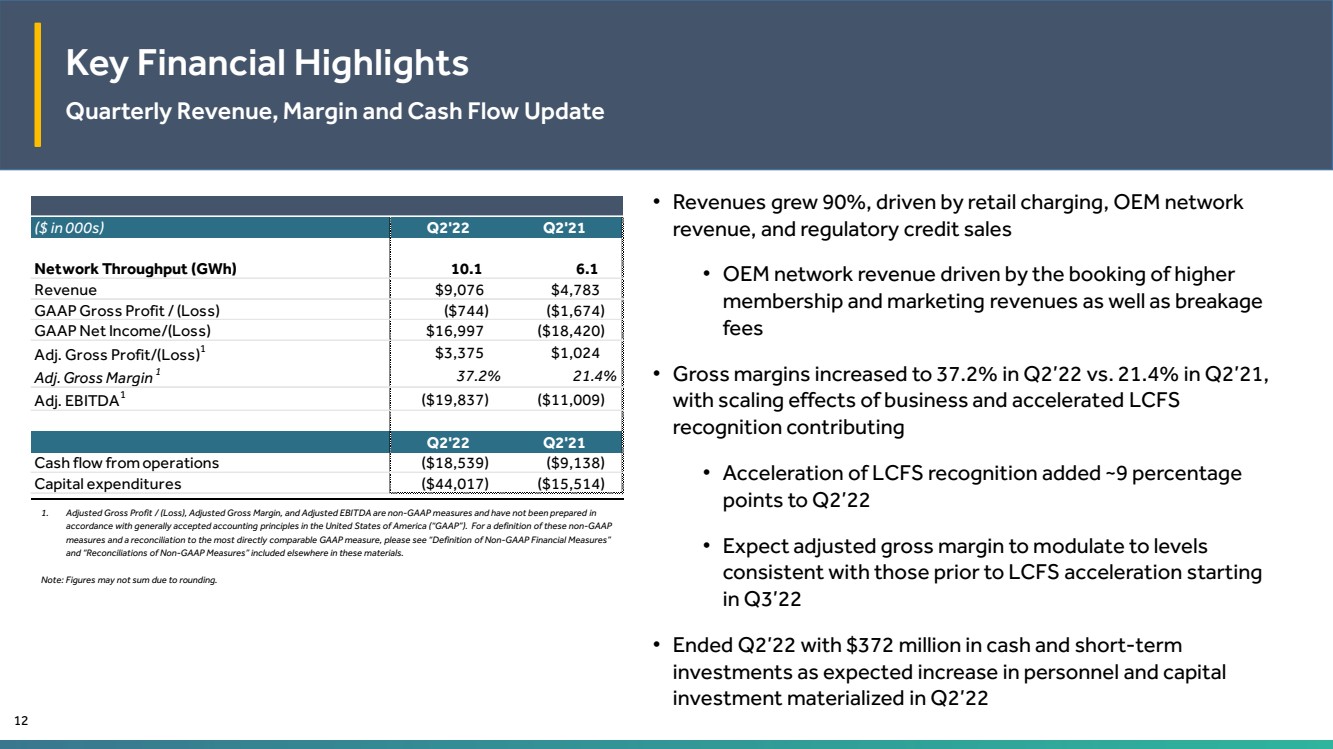

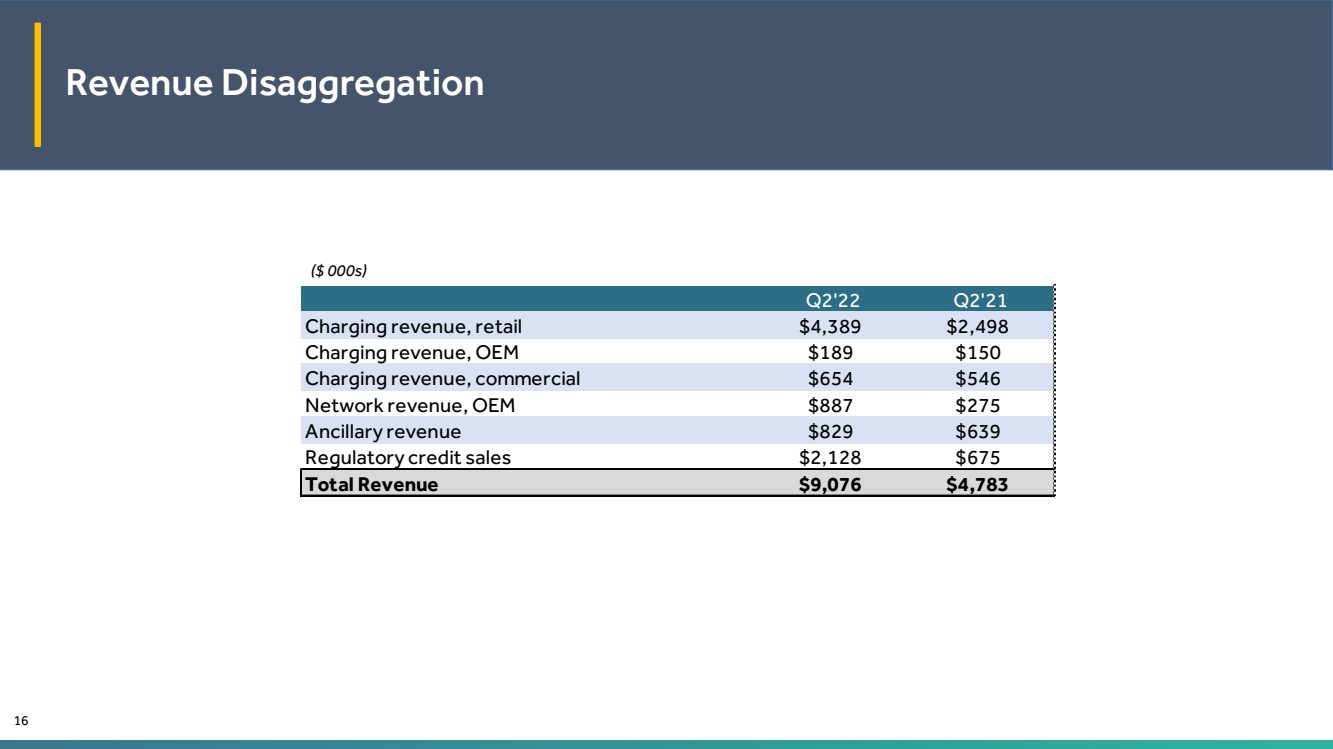

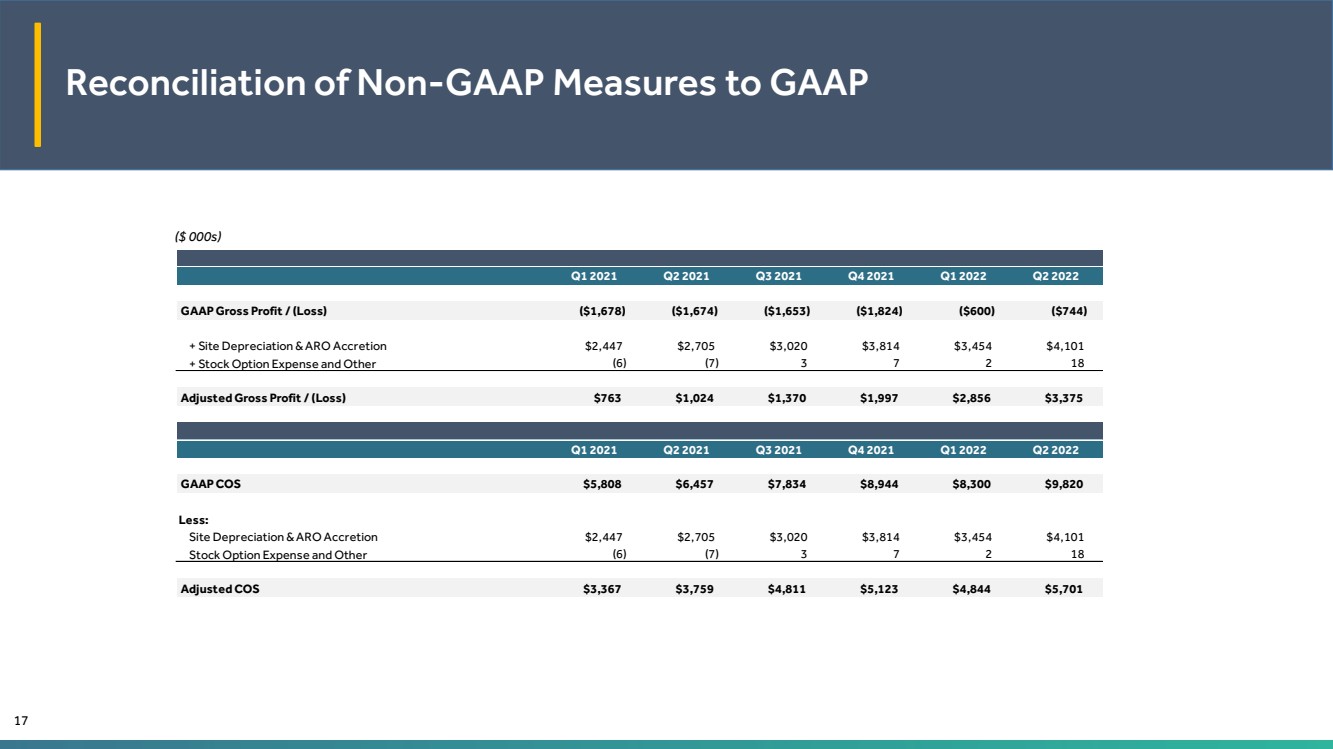

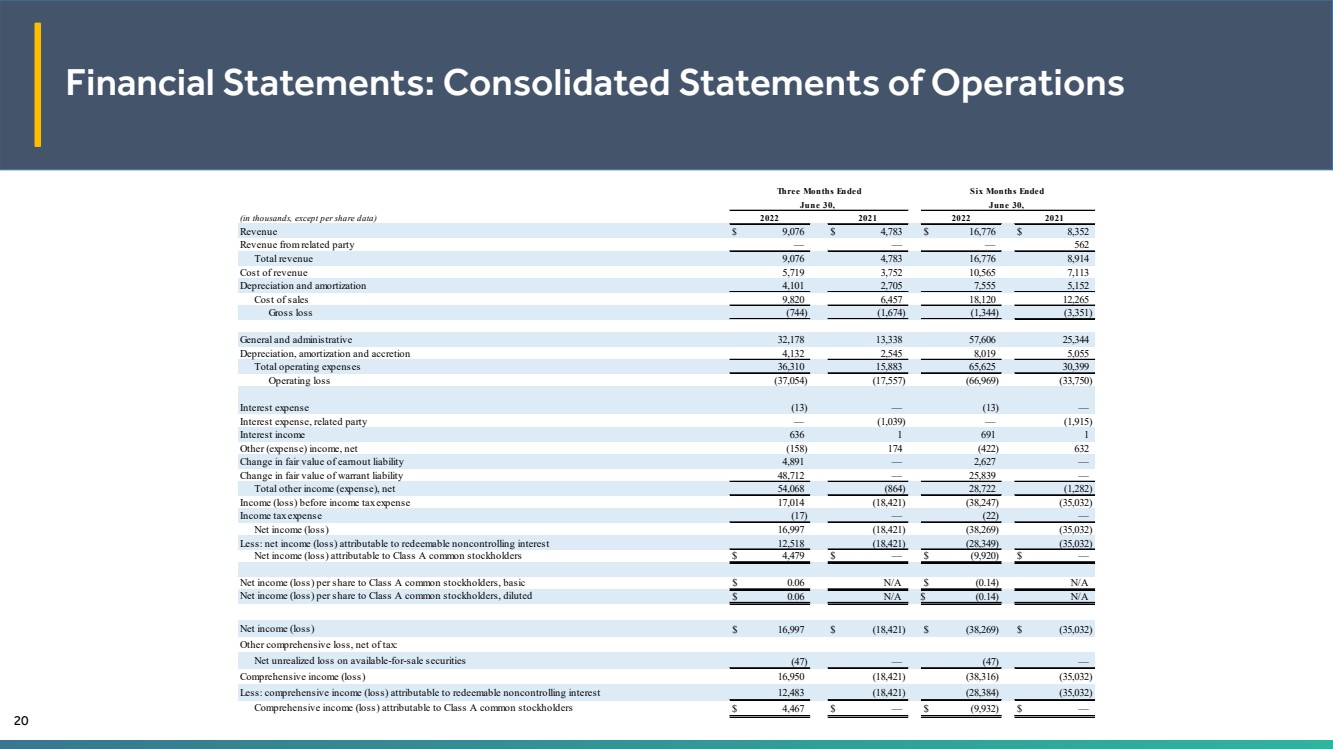

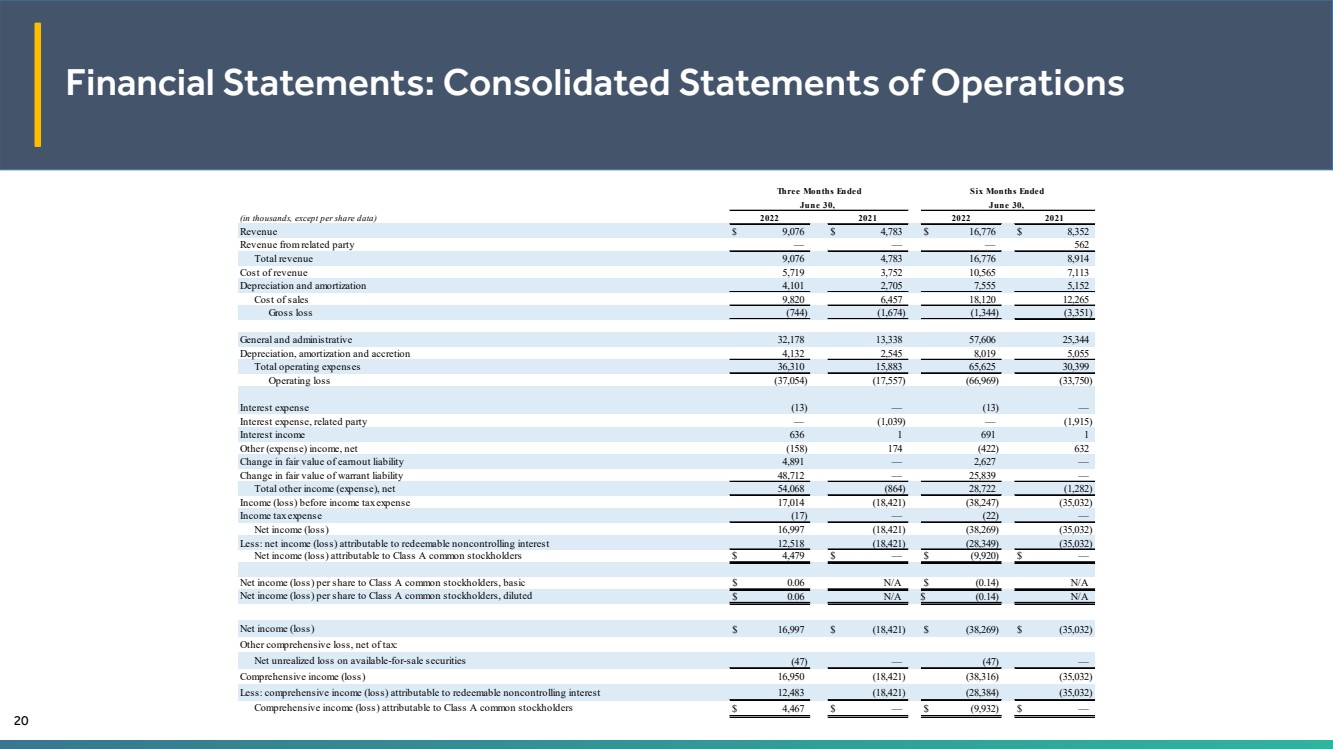

| Financial Statements: Consolidated Statements of Operations20 (in thousands, except per share data) Revenue $9,076 $4,783 $16,776 $8,352 Revenue from related party— — — 562 Total revenue9,076 4,783 16,776 8,914 Cost of revenue5,719 3,752 10,565 7,113 Depreciation and amortization4,101 2,705 7,555 5,152 Cost of sales9,820 6,457 18,120 12,265 Gross loss(744) (1,674) (1,344) (3,351) General and administrative32,178 13,338 57,606 25,344 Depreciation, amortization and accretion4,132 2,545 8,019 5,055 Total operating expenses36,310 15,883 65,625 30,399 Operating loss(37,054) (17,557) (66,969) (33,750) Interest expense(13) — (13) — Interest expense, related party— (1,039) — (1,915) Interest income636 1 691 1 Other (expense) income, net(158) 174 (422) 632 Change in fair value of earnout liability4,891 — 2,627 — Change in fair value of warrant liability48,712 — 25,839 — Total other income (expense), net54,068 (864) 28,722 (1,282) Income (loss) before income tax expense17,014 (18,421) (38,247) (35,032) Income tax expense(17) — (22) — Net income (loss)16,997 (18,421) (38,269) (35,032) Less: net income (loss) attributable to redeemable noncontrolling interest12,518 (18,421) (28,349) (35,032) Net income (loss) attributable to Class A common stockholders$4,479 $— $(9,920) $— Net income (loss) per share to Class A common stockholders, basic$0.06 N/A$(0.14) N/A Net income (loss) per share to Class A common stockholders, diluted$0.06 N/A$(0.14) N/A Net income (loss)$16,997 $(18,421) $(38,269) $(35,032) Other comprehensive loss, net of tax: Net unrealized loss on available-for-sale securities(47) — (47) — Comprehensive income (loss)16,950 (18,421) (38,316) (35,032) Less: comprehensive income (loss) attributable to redeemable noncontrolling interest12,483 (18,421) (28,384) (35,032) Comprehensive income (loss) attributable to Class A common stockholders$4,467 $— $(9,932) $— Three Months Ended Six Months Ended June 30, June 30, 2022 2021 2022 2021 |