1 Company Overview February 23, 2022

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 1 Special Note Regarding Forward-Looking Information & Use of Non-GAAP Information Statements in this presentation regarding our business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward- looking terminology, such as “remain,” “believe,” “outlook,” “expect,” “assume,” “proforma,” and similar terminology. These risks and uncertainties include factors such as (i) any ongoing impact of the COVID-19 pandemic due to new variants or efficacy and rate of vaccinations, as well as related measures taken by governmental or regulatory authorities to combat the pandemic, including the impact of federal vaccine mandates on our workforce and whether additional government stimulus payments or supplemental unemployment benefits will be approved, and the nature, amount and timing of any such payments or benefits, (ii) the possibility that the operational, strategic and shareholder value creation opportunities expected from the separation and spin-off of the Aaron’s Business into what is now The Aaron’s Company, Inc. may not be achieved in a timely manner, or at all; (iii) the failure of that separation to qualify for the expected tax treatment; (iv) changes in the enforcement and interpretation of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business; (v) legal and regulatory proceedings and investigations, including those related to consumer protection laws and regulations, customer privacy, third party and employee fraud and information security; (vi) the risks associated with our strategy and strategic priorities not being successful, including our e-commerce and real estate repositioning and optimization initiatives or being more costly than anticipated; (vii) risks associated with the challenges faced by our business, including the commoditization of consumer electronics and our high fixed-cost operating model; (viii) increased competition from traditional and virtual lease-to-own competitors, as well as from traditional and online retailers and other competitors; (ix) financial challenges faced by our franchisees; (x) increases in lease merchandise write-offs, and the potential limited duration and impact of stimulus and other government payments made by Federal and State governments to counteract the economic impact of the pandemic; (xi) the availability and prices of supply chain resources, including products and transportation; and (xii) the other risks and uncertainties discussed under “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Statements in this press release that are “forward-looking” include without limitation statements about: (i) the execution of our key strategic priorities; (ii) the growth and other benefits we expect from executing those priorities; (iii) our 2022 financial performance outlook; and (iv) the impact on our 2022 financial performance of any additional rounds of government stimulus payments. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this press release. This presentation contains certain financial information in a format not in accordance with generally accepted accounting principles in the United States (“GAAP”). Please see the appendix to this presentation for a definition of certain key performance indicators, such as same store revenues, and non-GAAP financial measures, such as EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP net earnings, non-GAAP net earnings per share and free cash flow, shown in this presentation. Management believes that presentation of these non-GAAP and other financial measures are useful because it gives investors supplemental information to evaluate and compare the underlying operating performance from period to period. Non-GAAP financial measures, however, should not be used as a substitute for, or be considered superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of each non-GAAP financial measure to the nearest comparable GAAP financial measure is included in the appendix to this presentation.

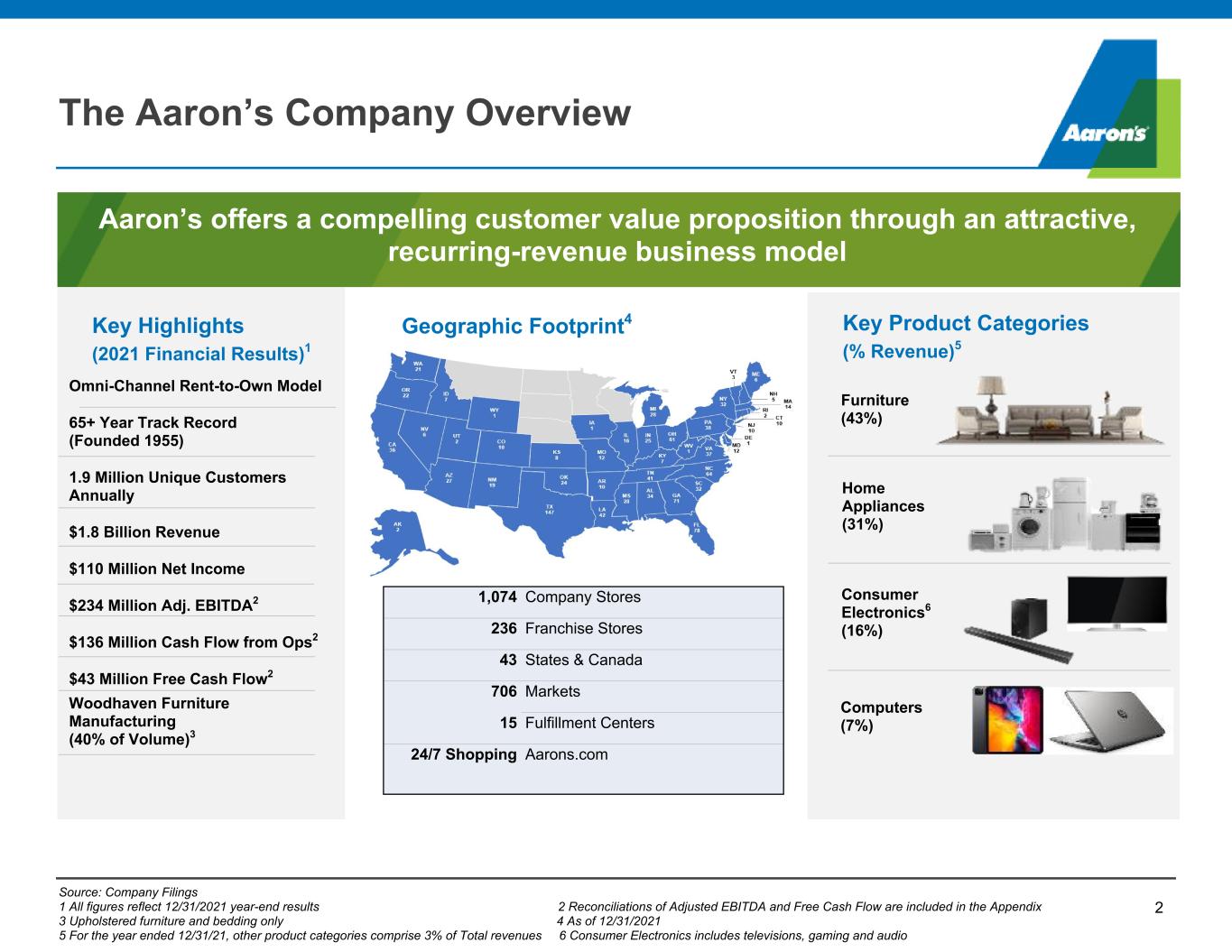

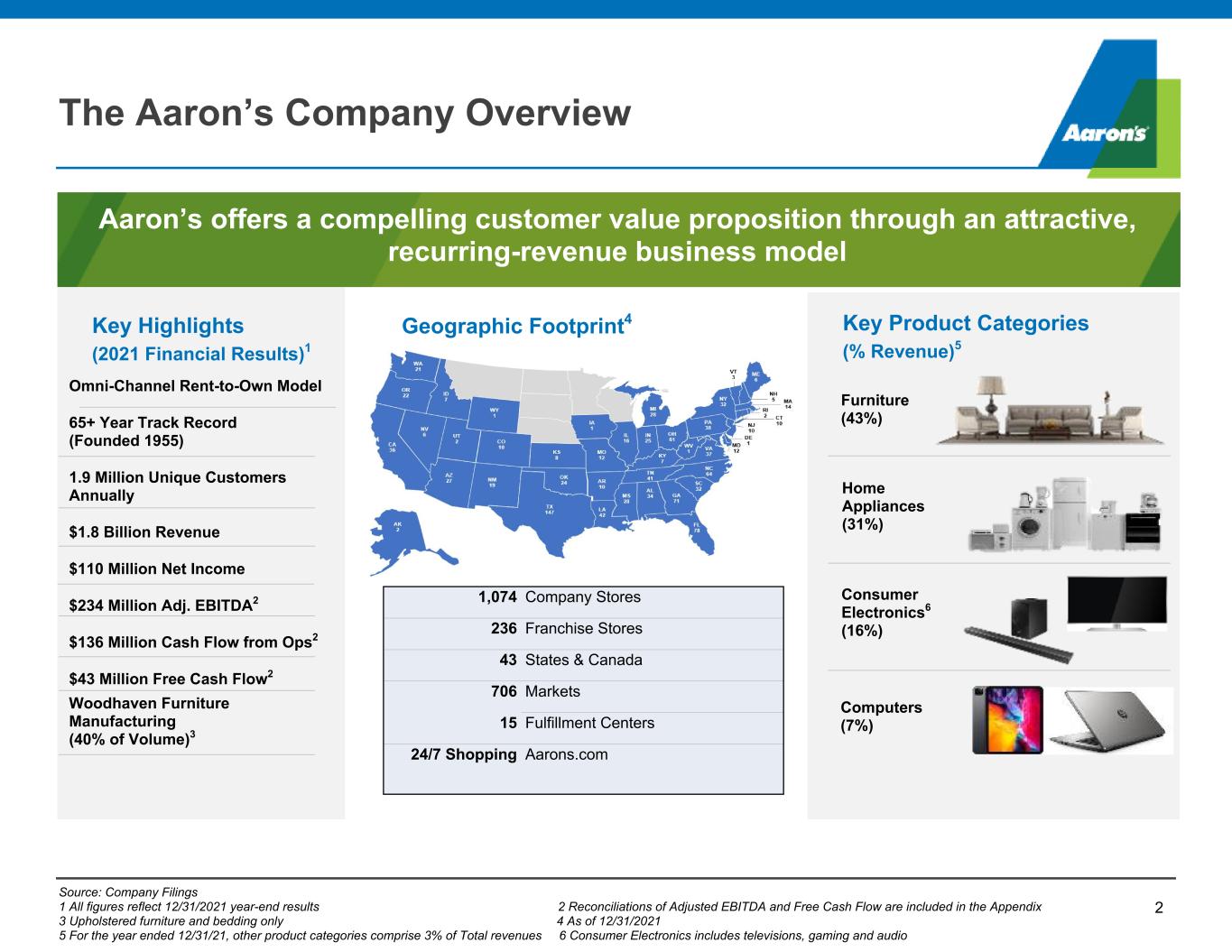

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . The Aaron’s Company Overview 2 Geographic Footprint4 Key Product Categories (% Revenue)5 Consumer Electronics6 (16%) Furniture (43%) Computers (7%) Home Appliances (31%) 1,074 Company Stores 236 Franchise Stores 43 States & Canada 706 Markets 15 Fulfillment Centers 24/7 Shopping Aarons.com Aaron’s offers a compelling customer value proposition through an attractive, recurring-revenue business model Source: Company Filings 1 All figures reflect 12/31/2021 year-end results 2 Reconciliations of Adjusted EBITDA and Free Cash Flow are included in the Appendix 3 Upholstered furniture and bedding only 4 As of 12/31/2021 5 For the year ended 12/31/21, other product categories comprise 3% of Total revenues 6 Consumer Electronics includes televisions, gaming and audio Omni-Channel Rent-to-Own Model 65+ Year Track Record (Founded 1955) 1.9 Million Unique Customers Annually $1.8 Billion Revenue $110 Million Net Income $234 Million Adj. EBITDA2 $136 Million Cash Flow from Ops2 $43 Million Free Cash Flow2 Woodhaven Furniture Manufacturing (40% of Volume)3 Key Highlights (2021 Financial Results)1

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Key Investment Highlights 3 Large, resilient customer base representing ~30% of the U.S. population Compelling customer value proposition driven by competitive pricing, high approval rates, and best-in-class customer service Digitally-enabled, omni-channel strategy that provides an integrated online and in-store experience Expect to grow earnings, expand margins, and generate strong free cash flow by optimizing store footprint and executing a digital-first strategy Capital structure with $13 million net cash and significant available liquidity providing flexibility for internal investment, strategic acquisitions or returns of capital to shareholders

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Enhance people’s lives by providing easy access to high-quality products through affordable lease and purchase options Mission Simplify and Digitize the Customer Experience Align Store Footprint to Customer Opportunity 4 Strategic Priorities Aaron’s Mission Guides Our Strategic Priorities Promote the Aaron’s Value Proposition

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Aaron’s Offers a Compelling Customer Value Proposition ■ Wholesale inventory costs ■ Lease ownership plan flexibility ■ Re-lease returned merchandise 5 Low Monthly Payments Competitive Total Cost of Ownership ■ Low customer acquisition costs ■ Product return capabilities ■ Advanced decisioning High Approval Rates ■ Advanced proprietary decisioning algorithms ■ Large repository of customer performance data ■ Relationship- based local account servicing Fast Delivery ■ Last mile capabilities ■ Integrated supply chain ■ Locally available inventory ■ Express delivery options Customer Lifecycle Management ■ Focus on customers achieving ownership ■ High repeat business ■ Advanced technology platforms Compelling value proposition supported by advanced omni-channel capabilities and existing infrastructure

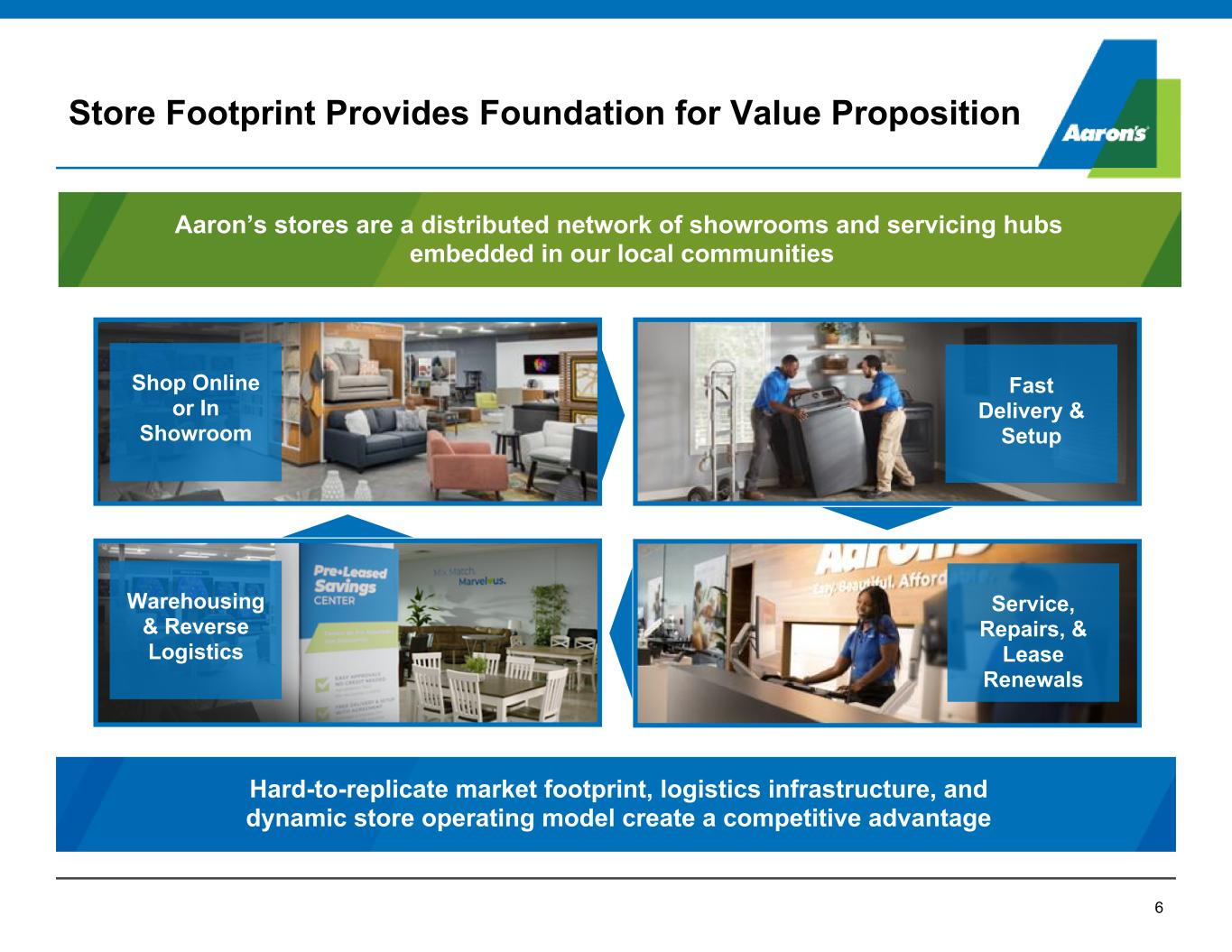

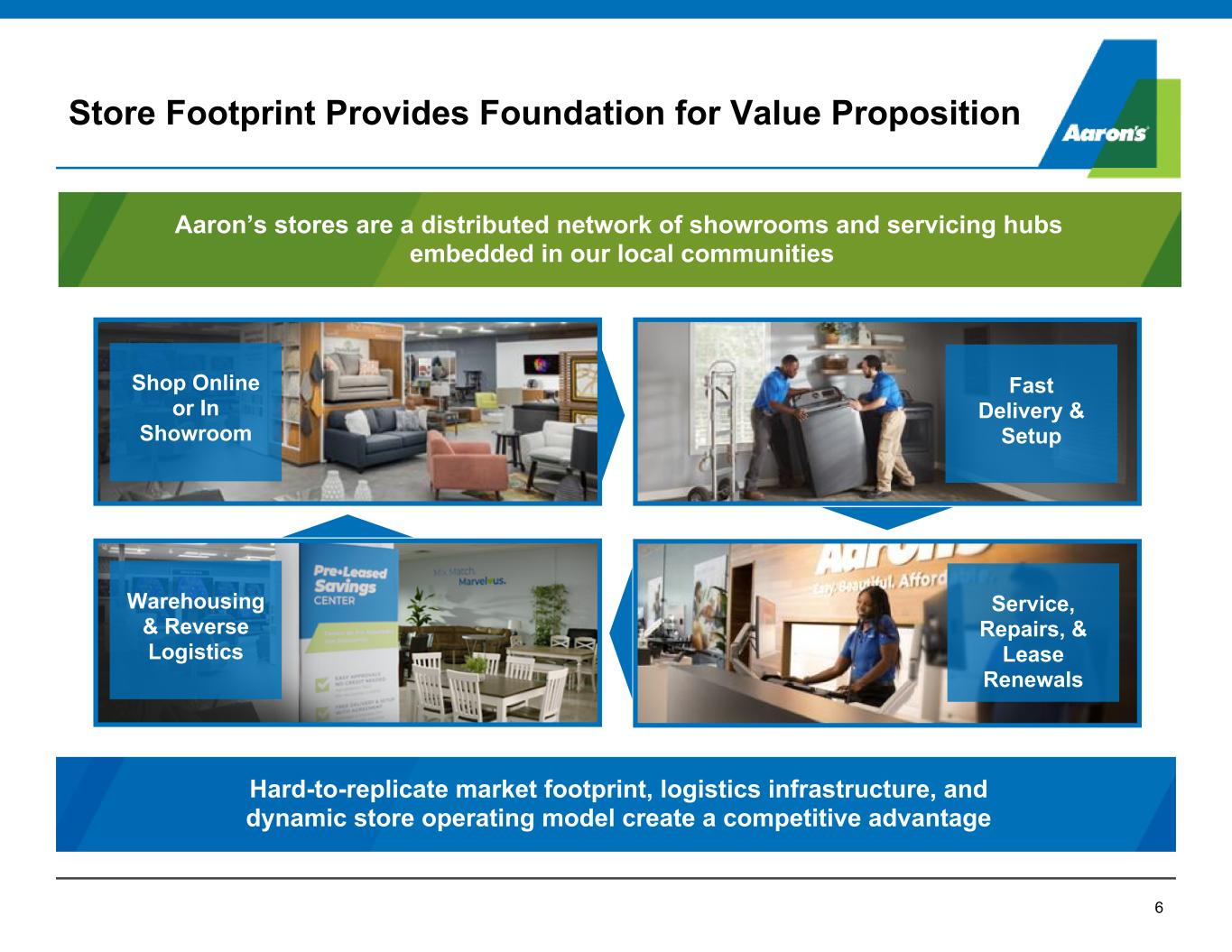

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 6 Service, Repairs, & Lease Renewals Warehousing & Reverse Logistics Hard-to-replicate market footprint, logistics infrastructure, and dynamic store operating model create a competitive advantage Fast Delivery & Setup Shop Online or In Showroom Aaron’s stores are a distributed network of showrooms and servicing hubs embedded in our local communities Store Footprint Provides Foundation for Value Proposition

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 7 Leverage digital technology to streamline all key touchpoints in the customer journey Digitize the Journey Put the Customer in Control Accelerate Omni-channel Provide the customer with increased flexibility and choice in all aspects of their experience Add capabilities that provide a seamless shopping and servicing experience across all channels Proprietary technology platforms position us to reduce customer friction, lower cost-to-serve, and expand our competitive advantage Digital-First Strategy Enhances the Customer Experience

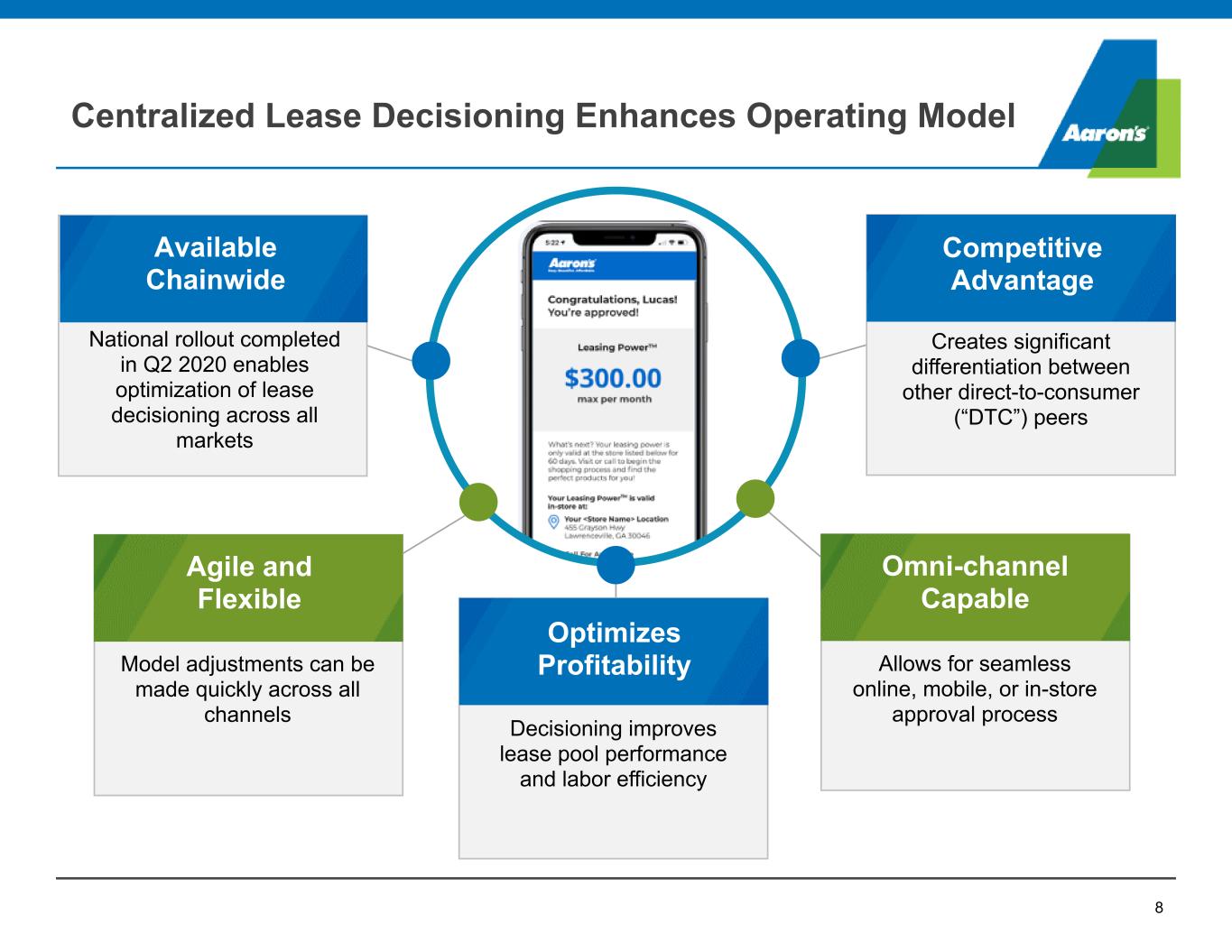

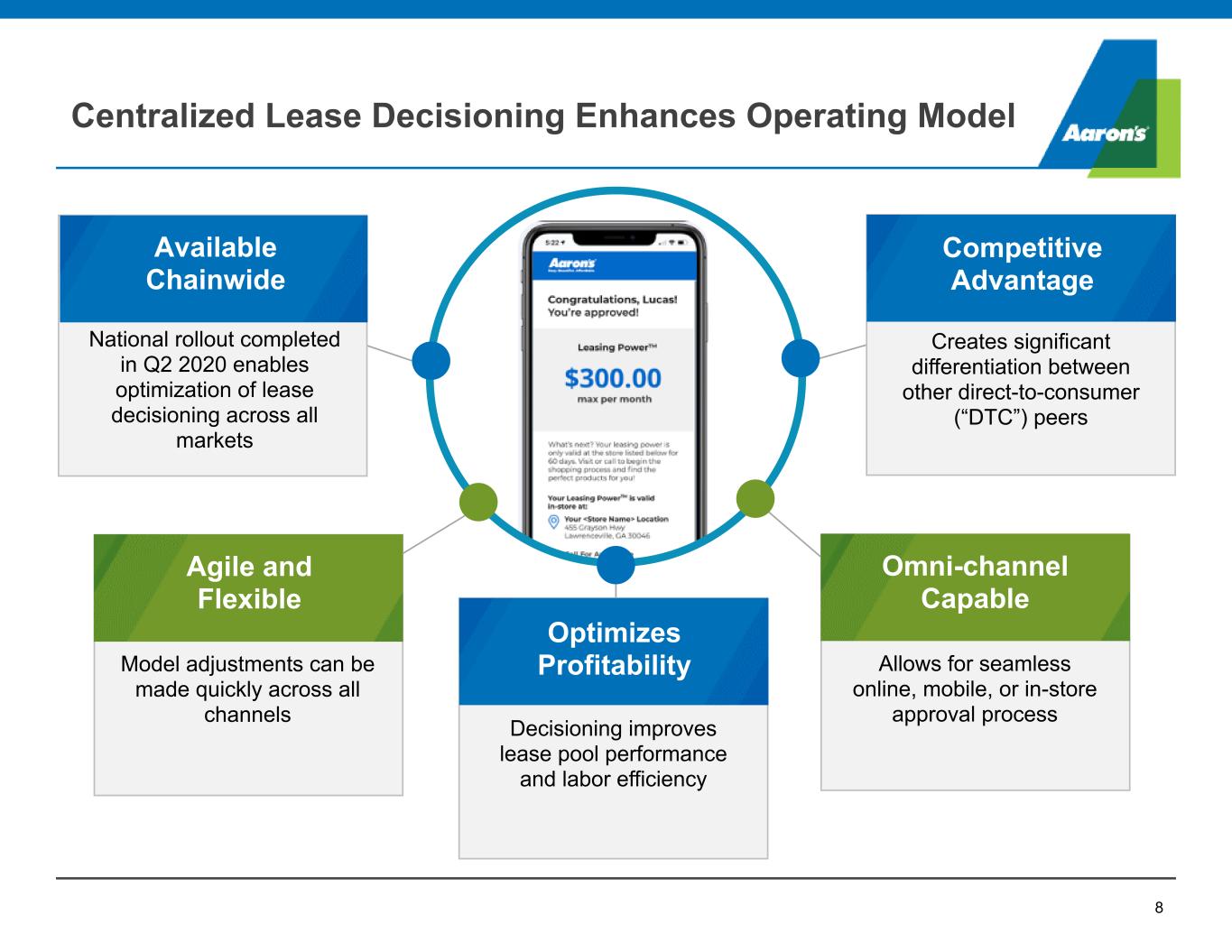

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Agile and Flexible 8 Decisioning improves lease pool performance and labor efficiency Model adjustments can be made quickly across all channels National rollout completed in Q2 2020 enables optimization of lease decisioning across all markets Creates significant differentiation between other direct-to-consumer (“DTC”) peers Available Chainwide Optimizes Profitability Competitive Advantage Allows for seamless online, mobile, or in-store approval process Omni-channel Capable Centralized Lease Decisioning Enhances Operating Model

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Aarons.com is an Industry Leading E-Commerce Platform 9 Aarons.com customers are 5 years younger than in-store New, Younger Customers… 48% of Aarons.com customers have never shopped at Aaron’s before Seamless Customer Experience End-to-end technology platform allows the customer to shop, get approved, start a lease, and schedule delivery Access to in-store and in-warehouse merchandise, as well as additional offerings direct from well-known national suppliers Online capabilities work seamlessly across smartphones, tablets, and computers Fully Transactional Broad Selection Mobile First

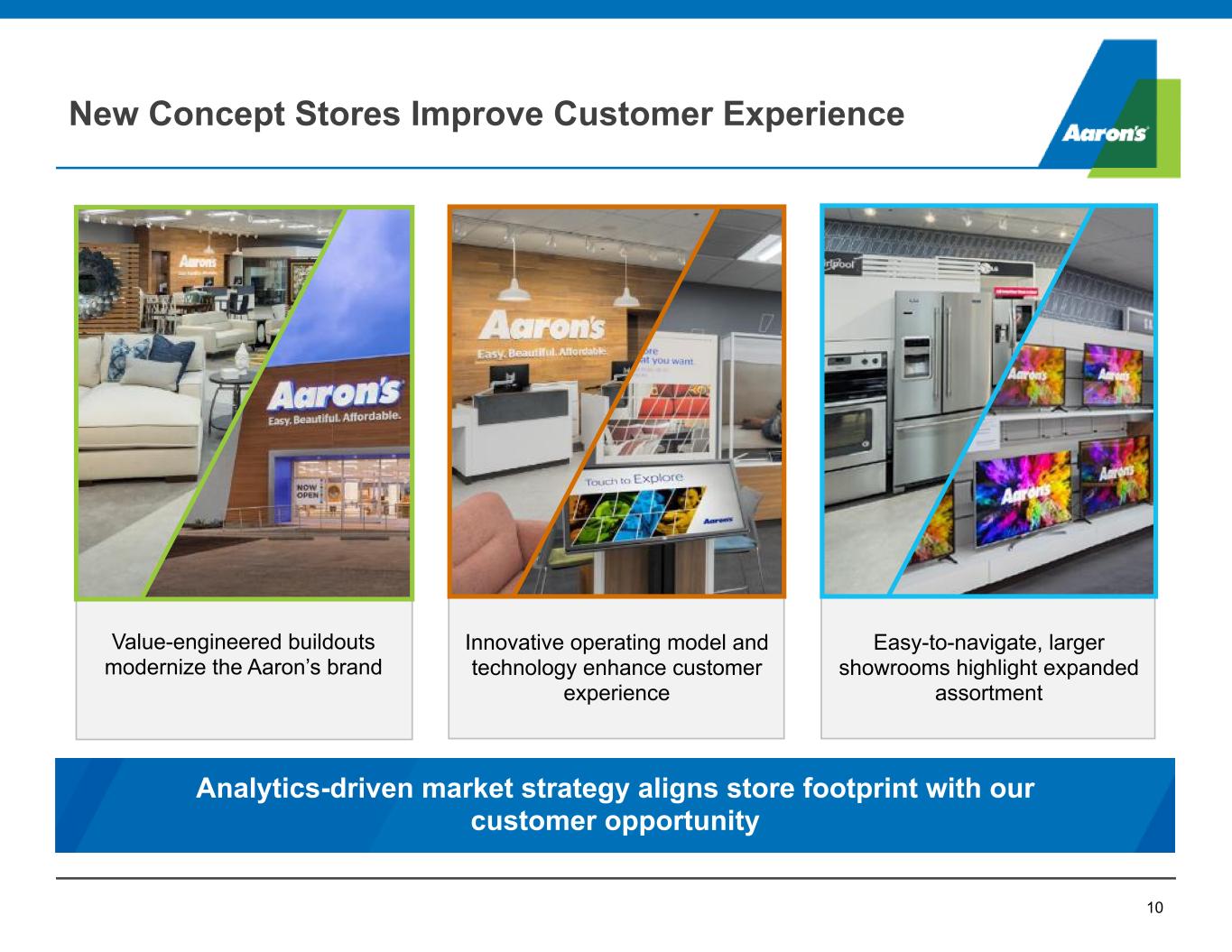

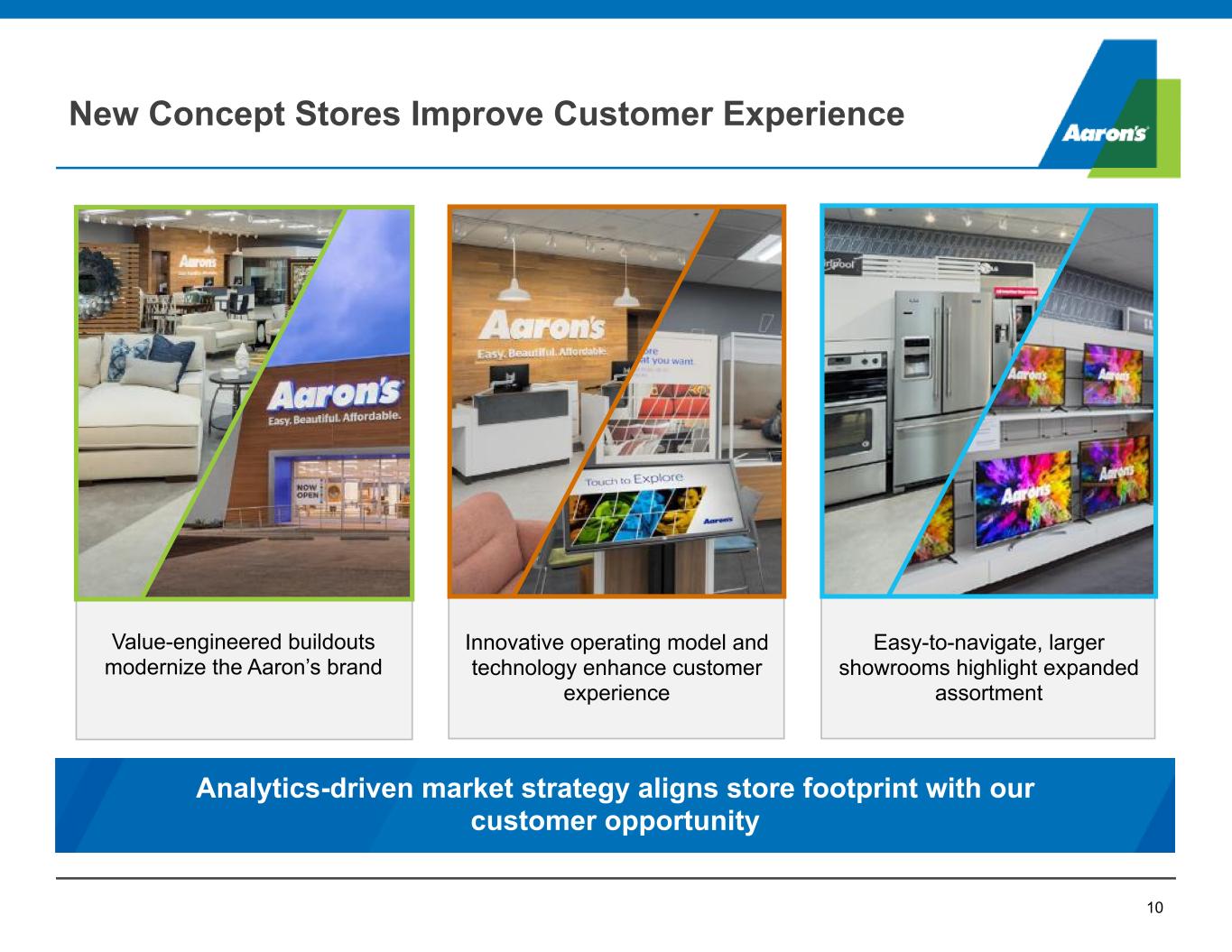

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 10 New Concept Stores Improve Customer Experience Easy-to-navigate, larger showrooms highlight expanded assortment Innovative operating model and technology enhance customer experience Value-engineered buildouts modernize the Aaron’s brand Analytics-driven market strategy aligns store footprint with our customer opportunity

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Site selection is driven by data analytics and insights into where customers live, work, and shop Recurring revenue model produces compelling real estate consolidation opportunities 11 A A A A A A A A 1 2 3 4 Illustrative Case Study Proposed SiteExisting Stores 10 Miles 5 Miles 4 3 Real Estate Strategy Leads to Fewer, More Profitable Stores Plan to reduce our store count over the next 5 years Expect increased capital efficiency, improved unit economics, and strong free cash flow A Company Store Count 1 Represents the midpoint of our expected 20% - 30% reduction Full Year 1167 1092 1074 825 2019 2020 2021 2025E 1

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . • We have three different types of GenNext store projects: • Every project is unique, and we develop multi-year operational targets for each store • Early results: Achieving expected internal financial targets • Early Results: Recurring revenue written growth for GenNext stores open less than one year exceeded the average legacy Aaron’s stores by more than 20 percentage points Project Type Concept Proforma Expectation Multi-Store Consolidation Close two or three existing stores and relocate to a new location that is better positioned to serve the market • Revenue – Decline due to closures • Profit – Improve due to cost consolidation • Highest IRR and shortest payback Single Store Repositioning Close one existing store and relocate to a new location that is better positioned to serve the market • Revenue – Improve • Profit – Improve Single Store Renovation Renovate an existing store with GenNext design and operating model • Revenue – Improve • Profit – Improve GenNext Store Repositioning & Renovation Overview 12

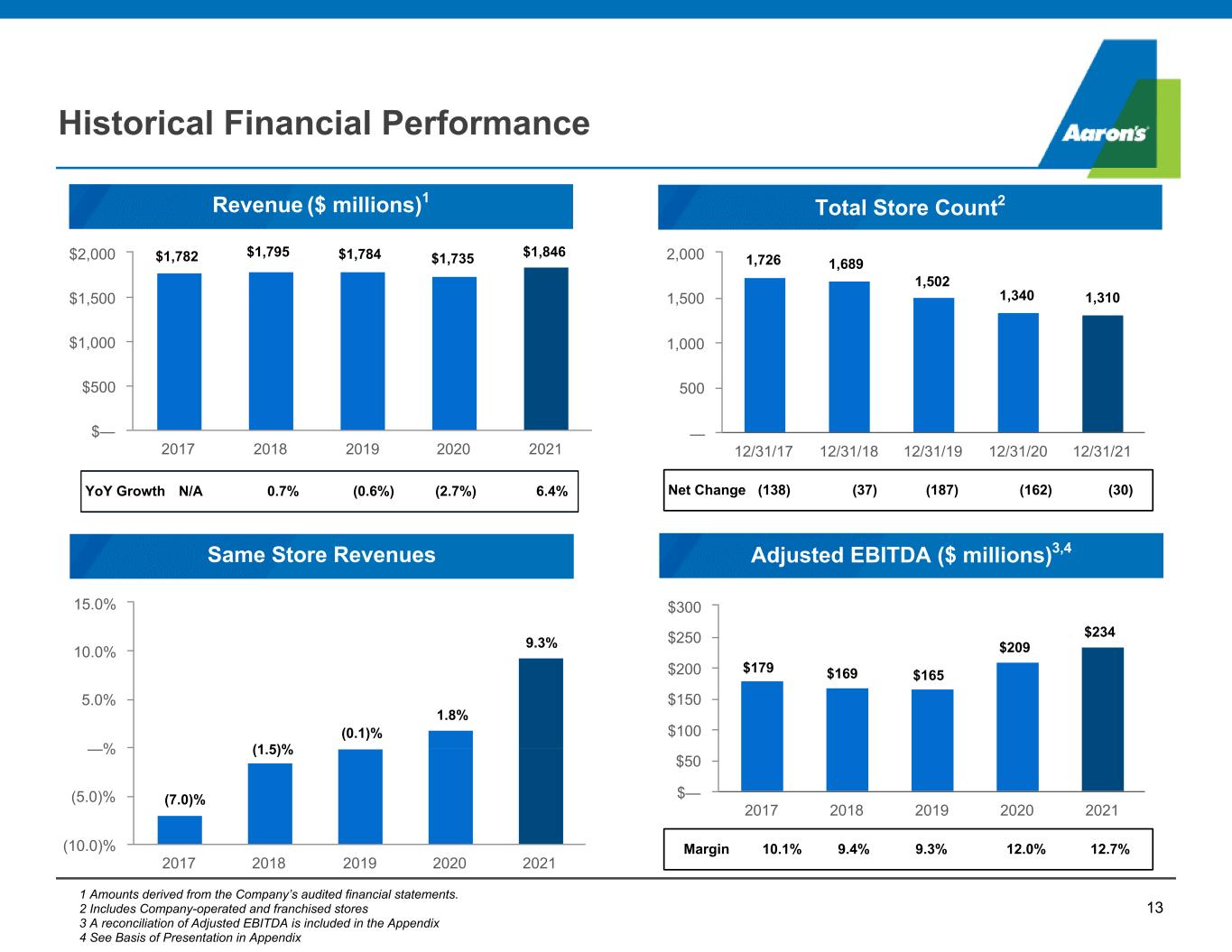

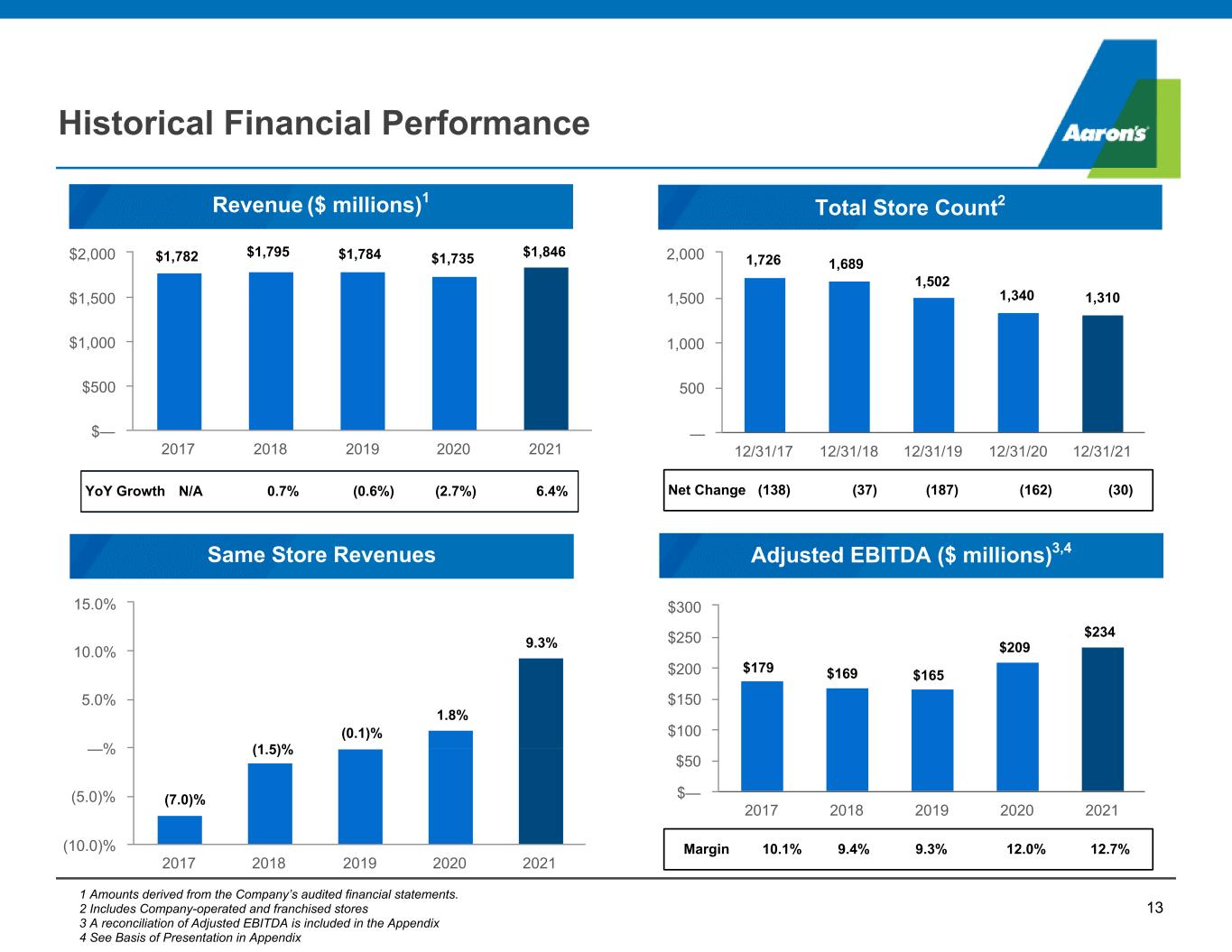

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . YoY Growth N/A 0.7% (0.6%) (2.7%) 6.4% 13 Historical Financial Performance 1 Amounts derived from the Company’s audited financial statements. 2 Includes Company-operated and franchised stores 3 A reconciliation of Adjusted EBITDA is included in the Appendix 4 See Basis of Presentation in Appendix Total Store Count2 Same Store Revenues Net Change (138) (37) (187) (162) (30) Adjusted EBITDA ($ millions)3,4 Revenue ($ millions)1 Margin 10.1% 9.4% 9.3% 12.0% 12.7% 2017 2018 2019 2020 2021 $— $500 $1,000 $1,500 $2,000 $1,846$1,735$1,784$1,795$1,782 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 — 500 1,000 1,500 2,000 1,726 1,689 1,502 1,340 1,310 2017 2018 2019 2020 2021 (10.0)% (5.0)% —% 5.0% 10.0% 15.0% 2017 2018 2019 2020 2021 $— $50 $100 $150 $200 $250 $300 $234 $209 $165$169$179 1.8% (0.1)% (1.5)% (7.0)% 9.3%

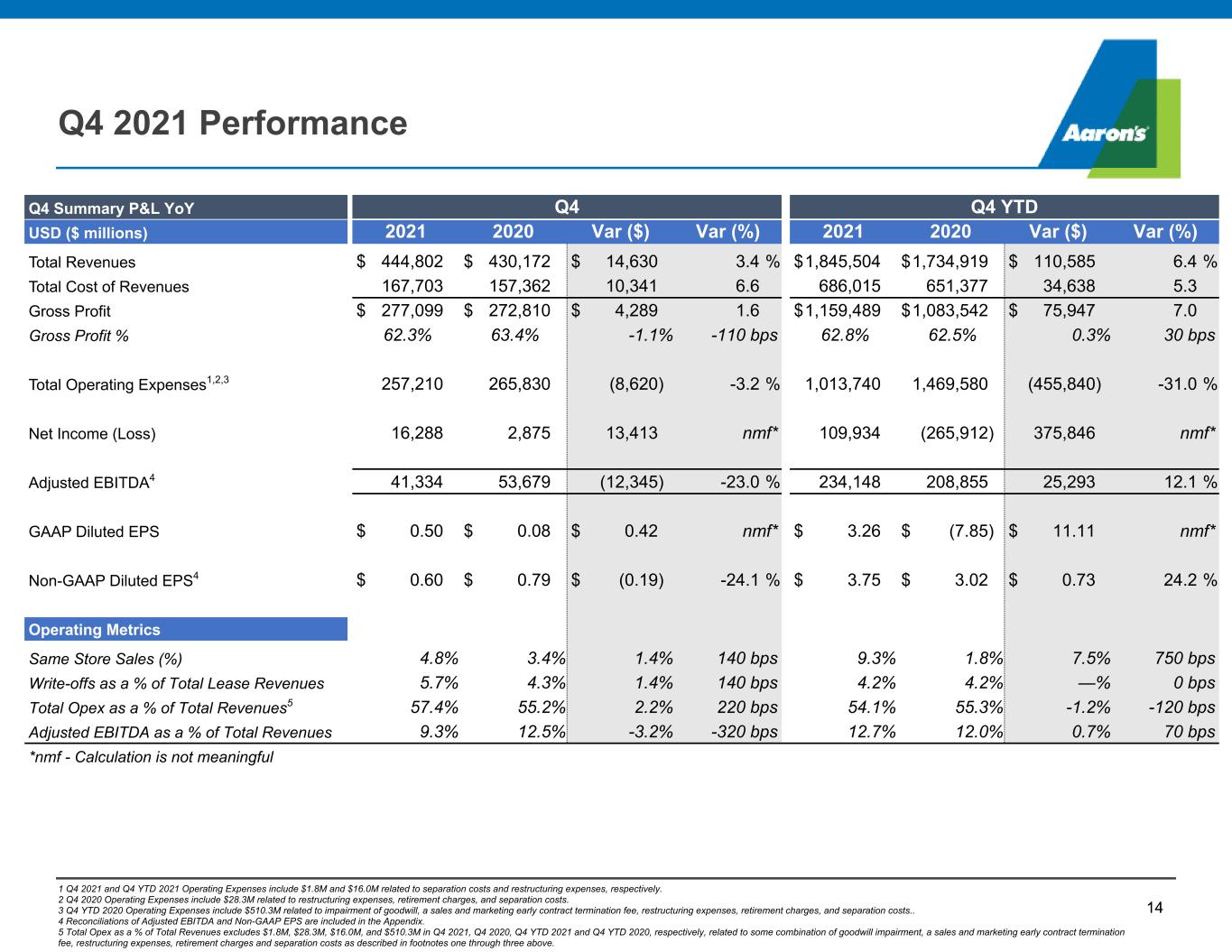

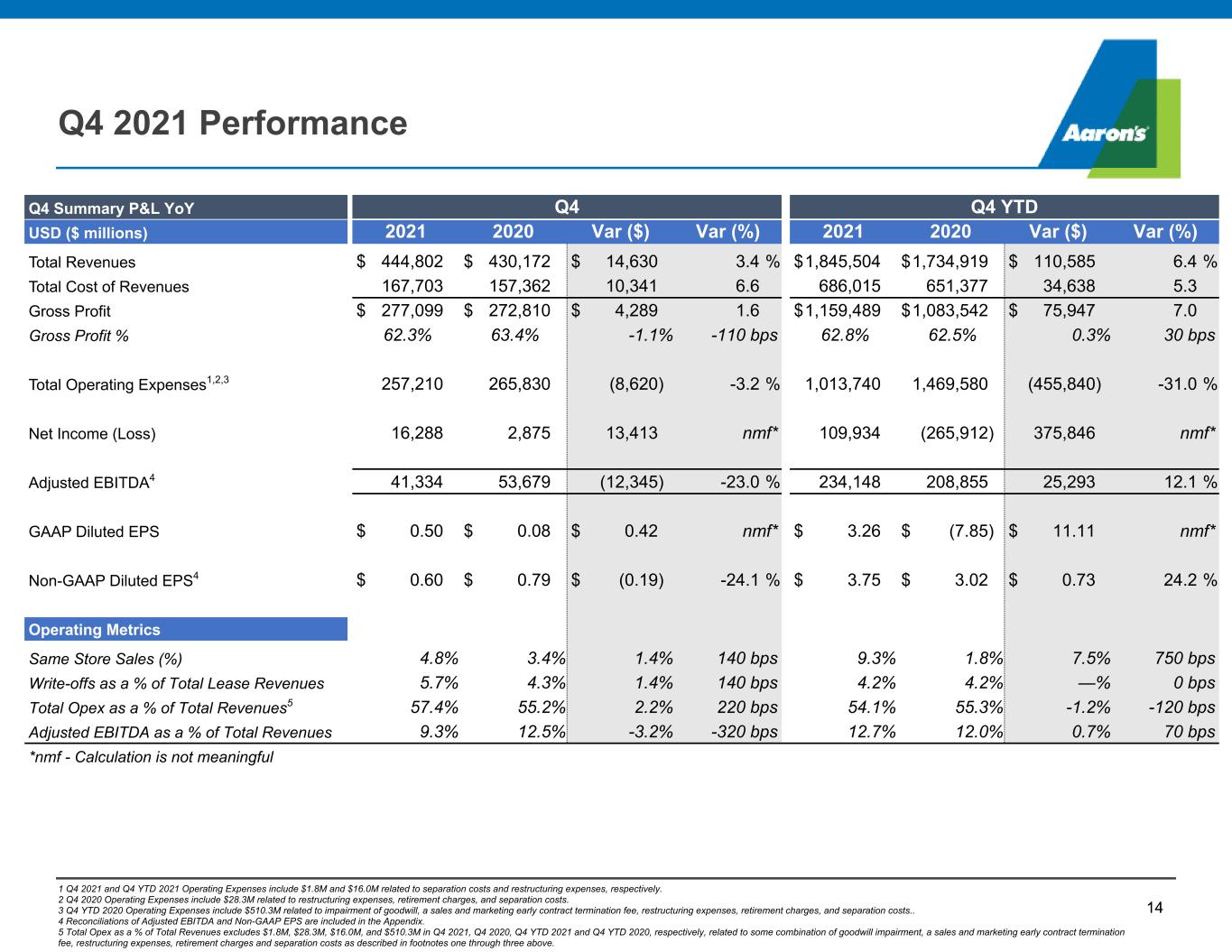

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 14 Q4 2021 Performance 1 Q4 2021 and Q4 YTD 2021 Operating Expenses include $1.8M and $16.0M related to separation costs and restructuring expenses, respectively. 2 Q4 2020 Operating Expenses include $28.3M related to restructuring expenses, retirement charges, and separation costs. 3 Q4 YTD 2020 Operating Expenses include $510.3M related to impairment of goodwill, a sales and marketing early contract termination fee, restructuring expenses, retirement charges, and separation costs.. 4 Reconciliations of Adjusted EBITDA and Non-GAAP EPS are included in the Appendix. 5 Total Opex as a % of Total Revenues excludes $1.8M, $28.3M, $16.0M, and $510.3M in Q4 2021, Q4 2020, Q4 YTD 2021 and Q4 YTD 2020, respectively, related to some combination of goodwill impairment, a sales and marketing early contract termination fee, restructuring expenses, retirement charges and separation costs as described in footnotes one through three above. Q4 Summary P&L YoY Q4 Q4 YTD USD ($ millions) 2021 2020 Var ($) Var (%) 2021 2020 Var ($) Var (%) Total Revenues $ 444,802 $ 430,172 $ 14,630 3.4 % $ 1,845,504 $ 1,734,919 $ 110,585 6.4 % Total Cost of Revenues 167,703 157,362 10,341 6.6 686,015 651,377 34,638 5.3 Gross Profit $ 277,099 $ 272,810 $ 4,289 1.6 $ 1,159,489 $ 1,083,542 $ 75,947 7.0 Gross Profit % 62.3% 63.4% -1.1 % -110 bps 62.8% 62.5% 0.3 % 30 bps Total Operating Expenses1,2,3 257,210 265,830 (8,620) -3.2 % 1,013,740 1,469,580 (455,840) -31.0 % Net Income (Loss) 16,288 2,875 13,413 nmf* 109,934 (265,912) 375,846 nmf* Adjusted EBITDA4 41,334 53,679 (12,345) -23.0 % 234,148 208,855 25,293 12.1 % GAAP Diluted EPS $ 0.50 $ 0.08 $ 0.42 nmf* $ 3.26 $ (7.85) $ 11.11 nmf* Non-GAAP Diluted EPS4 $ 0.60 $ 0.79 $ (0.19) -24.1 % $ 3.75 $ 3.02 $ 0.73 24.2 % Operating Metrics Same Store Sales (%) 4.8 % 3.4 % 1.4 % 140 bps 9.3 % 1.8 % 7.5 % 750 bps Write-offs as a % of Total Lease Revenues 5.7 % 4.3 % 1.4 % 140 bps 4.2 % 4.2 % — % 0 bps Total Opex as a % of Total Revenues5 57.4 % 55.2 % 2.2 % 220 bps 54.1 % 55.3 % -1.2 % -120 bps Adjusted EBITDA as a % of Total Revenues 9.3 % 12.5 % -3.2 % -320 bps 12.7 % 12.0 % 0.7 % 70 bps *nmf - Calculation is not meaningful

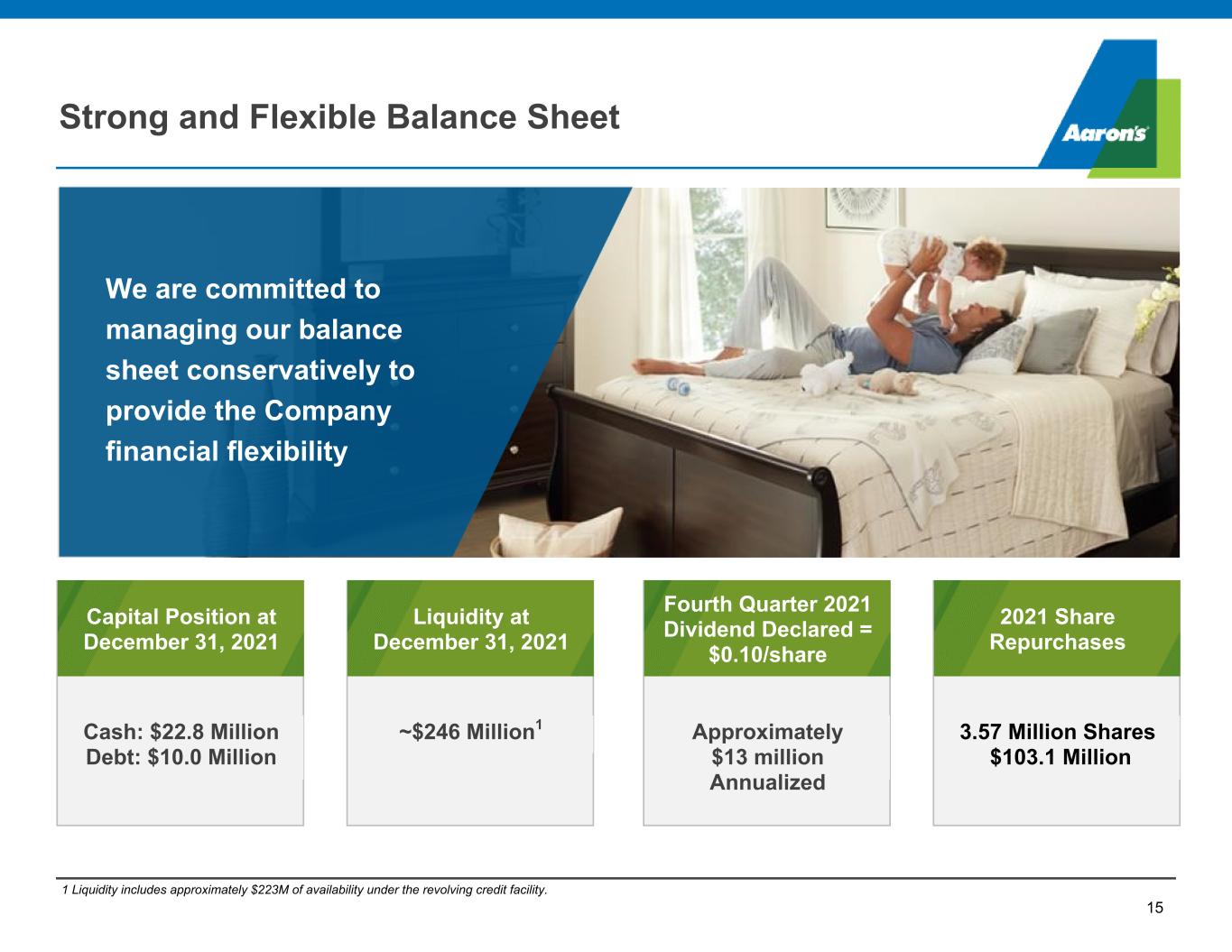

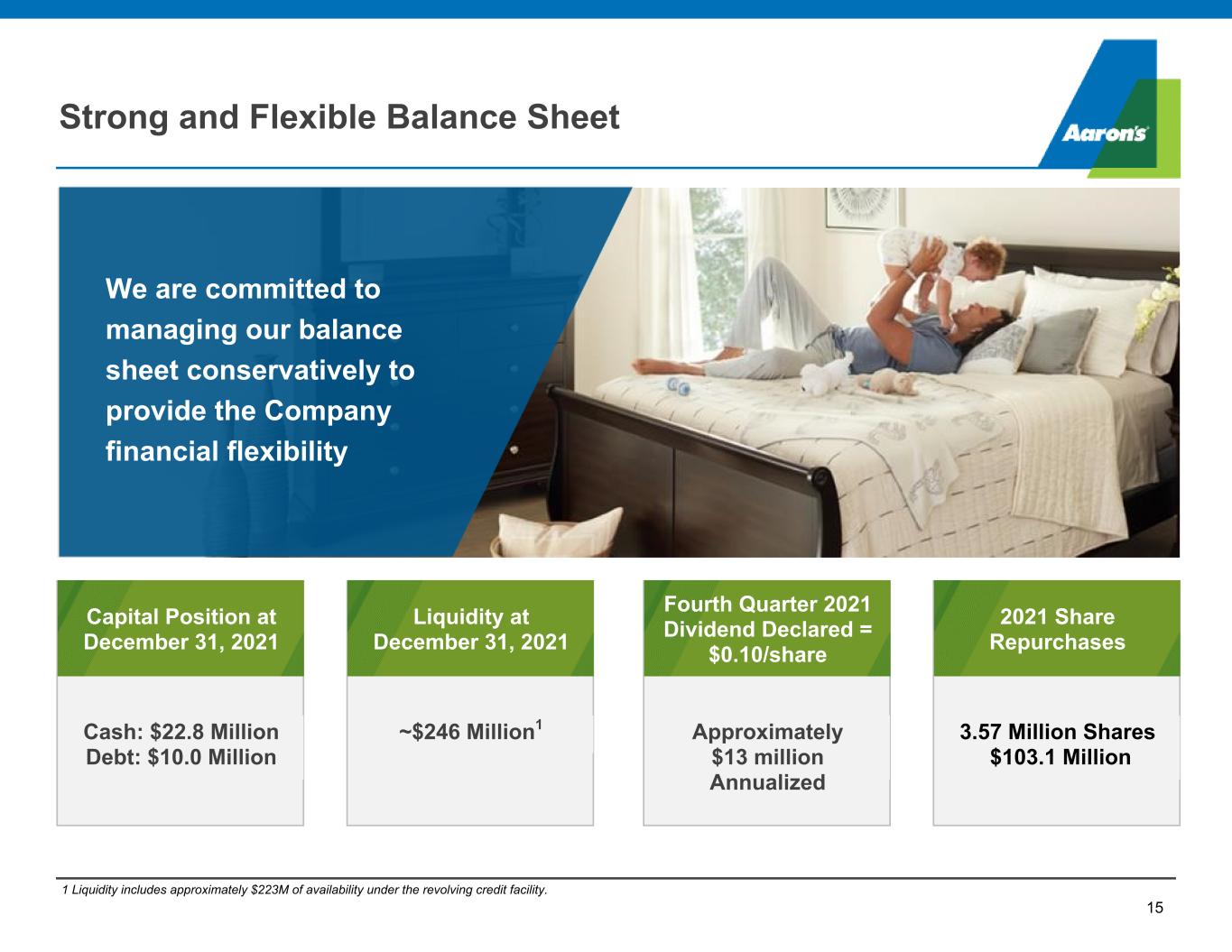

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Strong and Flexible Balance Sheet Capital Position at December 31, 2021 Cash: $22.8 Million Debt: $10.0 Million 1 Liquidity includes approximately $223M of availability under the revolving credit facility. 15 Third Quarter 2021 Dividend Declared = $0.10/share We are committed to managing our balance sheet conservatively to provide the Company financial flexibility Liquidity at December 31, 2021 ~$246 Million1 Fourth Quarter 2021 Dividend Declared = $0.10/share Approximately $13 million Annualized 2021 Share Repurchases 3.57 Million Shares $103.1 Million

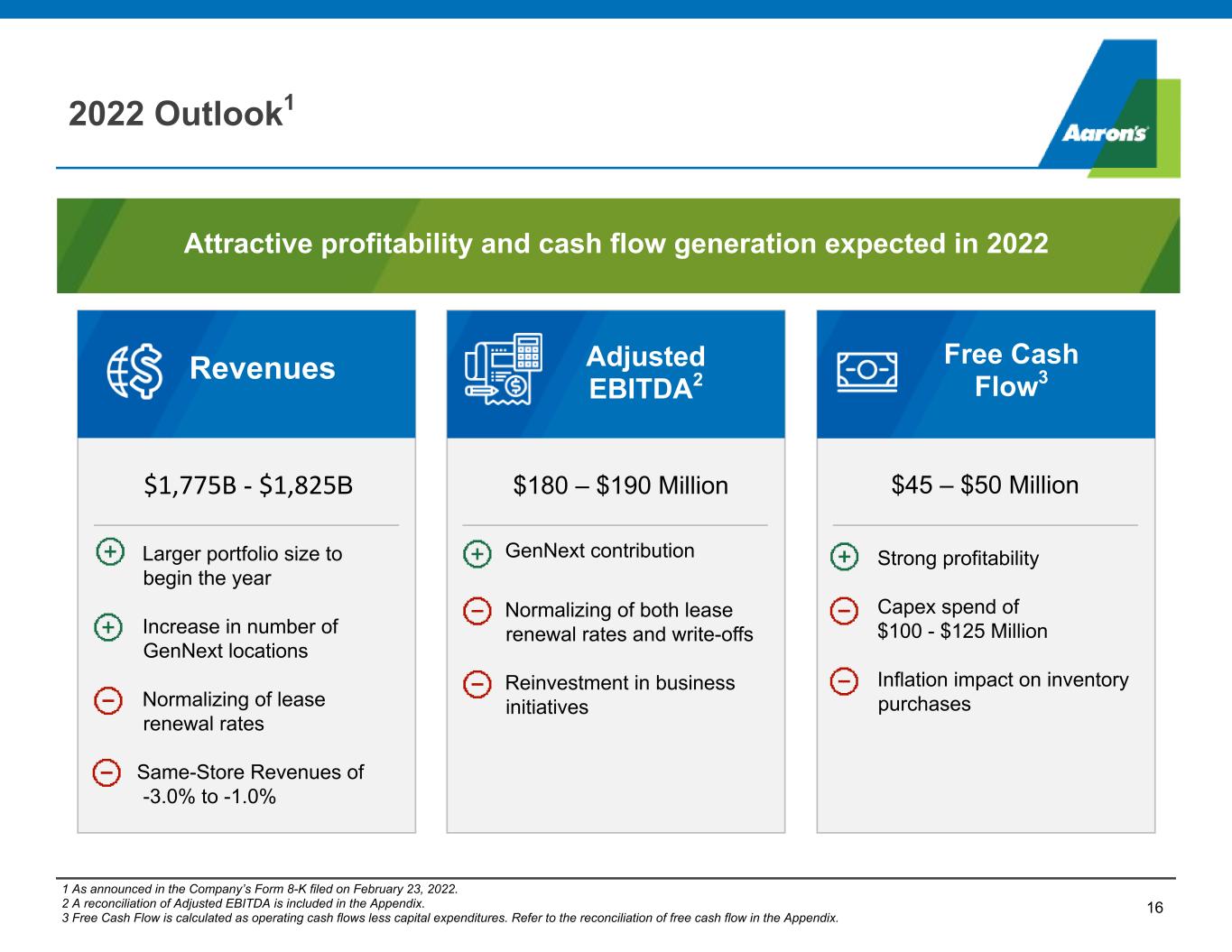

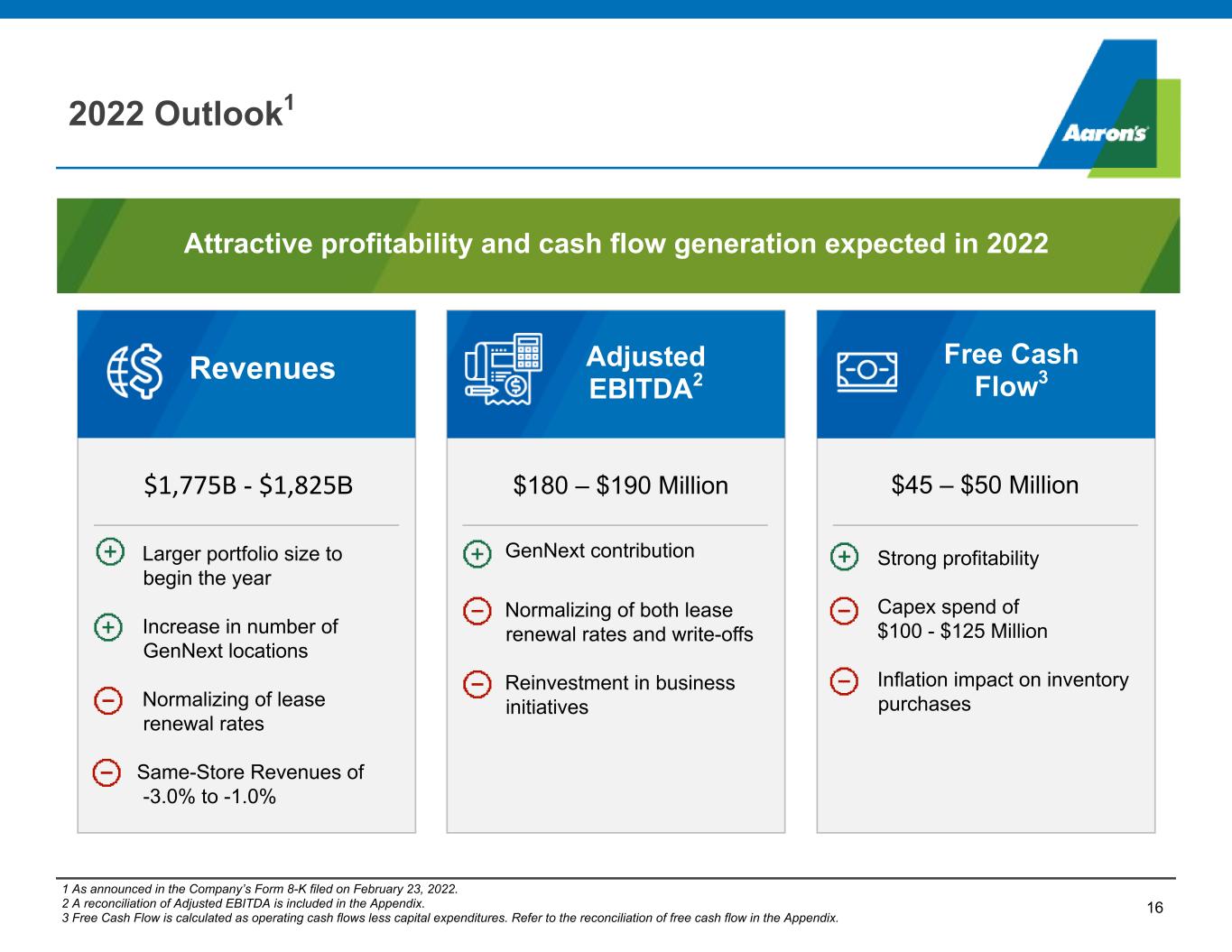

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Larger portfolio size to begin the year Increase in number of GenNext locations Normalizing of lease renewal rates Same-Store Revenues of -3.0% to -1.0% GenNext contribution Normalizing of both lease renewal rates and write-offs Reinvestment in business initiatives Strong profitability Capex spend of $100 - $125 Million Inflation impact on inventory purchases Adjusted EBITDA2 Free Cash Flow3 16 Revenues Attractive profitability and cash flow generation expected in 2022 2022 Outlook1 1 As announced in the Company’s Form 8-K filed on February 23, 2022. 2 A reconciliation of Adjusted EBITDA is included in the Appendix. 3 Free Cash Flow is calculated as operating cash flows less capital expenditures. Refer to the reconciliation of free cash flow in the Appendix. $1,775B - $1,825B $180 – $190 Million $45 – $50 Million

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 Thank You

Appendix

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . We report our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). We supplement the reporting of our financial information determined under GAAP with certain non-GAAP financial information. These non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as our GAAP basis results. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP Adjusted EBITDA, Adjusted EBITDA Margin, same store revenues, and free cash flow may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. We encourage investors to review our financial statements and other information filed with the SEC in conjunction with the information included in this presentation. A reconciliation of the non-GAAP measures to the corresponding amounts prepared in accordance with GAAP appears in the tables of the Appendix of this presentation. The reconciliations provide additional information as to the items and amounts that have been excluded from the adjusted non-GAAP measures. Non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA and Adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with GAAP. Non-GAAP net earnings and non-GAAP diluted earnings per share for 2021 exclude certain charges including amortization expense resulting from franchisee acquisitions, restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company, and transaction costs associated with the announced acquisition of BrandsMart. Non- GAAP net earnings and non-GAAP diluted earnings per share for 2020 exclude certain charges including separation and retirement costs, amortization expense resulting from franchisee acquisitions, early termination charges incurred to terminate a sales and marketing agreement, goodwill impairment charges, restructuring charges, loss on extinguishment of debt, and an income tax benefit resulting from the revaluation of a net operating loss carryback. The amounts for these pre-tax non-GAAP adjustments, which are tax-effected using estimated tax rates which are commensurate with non-GAAP pre-tax earnings, can be found in the Reconciliation of Net Earnings (Loss) and Earnings Per Share Assuming Dilution to non-GAAP Net Earnings (Loss) and Earnings Per Share Assuming Dilution table in this presentation. The EBITDA and Adjusted EBITDA figures presented in this press release are calculated as the Company’s earnings (loss) before interest expense, depreciation on property, plant and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA also excludes the other adjustments described in the calculation of non-GAAP net earnings above. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of total revenues. The amounts for these pre-tax non-GAAP adjustments can be found in the Quarterly EBITDA tables in this presentation. 19 Use and Definitions of Non-GAAP and Other Financial Measures (1 of 2)

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA and Adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance. Non-GAAP net earnings and non-GAAP diluted earnings per share provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arose from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations or transactions that have variability and volatility of the amount. This measure may be useful to an investor in evaluating the underlying operating performance of our business. EBITDA and adjusted EBITDA also provide management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance and liquidity because the measures: • Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. • Are a financial measurement that is used by rating agencies, lenders and other parties to evaluate our creditworthiness. • Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting. The Free Cash Flow figures presented in this presentation are calculated as the Company's cash flows provided by operating activities less capital expenditures. Management believes that Free Cash Flow is an important measure of liquidity provides relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing liquidity. Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share, the Company’s GAAP revenues and earnings before income taxes and GAAP cash from operating activities, which are also presented in the presentation. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA, adjusted EBITDA and Free Cash Flow may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. When we provide forward looking expectations of Adjusted EBITDA, Adjusted EBITDA margin, and free cash flow, a reconciliation of differences between the non-GAAP expectations and the corresponding GAAP measures generally are not available without unreasonable effort due to high variability, complexity, and limited visibility as to items that would be excluded from the GAAP measure in the relevant future period such as restructuring charges related to our business transformation initiatives, including real estate repositioning, and other operational costs we may incur in connection with, and after, becoming a separate, publicly traded company, including, for example, additional personnel costs that we may not have fully anticipated. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. 20 Use and Definitions of Non-GAAP and Other Financial Measures (2 of 2)

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . The financial statements and related results discussed herein for periods prior to and through the date of the separation and distribution, November 30, 2020, were prepared on a combined standalone basis and were derived from the consolidated financial statements and accounting records of PROG Holdings, Inc. The financial statements for the periods subsequent to December 1, 2020 and through December 31, 2021 are consolidated financial statements of the Company and its subsidiaries, each of which is wholly-owned, and is based on the financial position and results of operations of the Company as a standalone company. The combined financial statements prepared through November 30, 2020 include all revenues and costs directly attributable to the Company and an allocation of expenses from PROG Holdings, Inc. related to certain corporate functions and actions. These costs include executive management, finance, treasury, tax, audit, legal, information technology, human resources and risk management functions and the related benefit cost associated with such functions, including stock-based compensation. These expenses have been allocated to the Company based on direct usage or benefit where specifically identifiable, with the remaining expenses allocated primarily on a pro rata basis using an applicable measure of revenues, headcount or other relevant measures. 21 Basis of Presentation

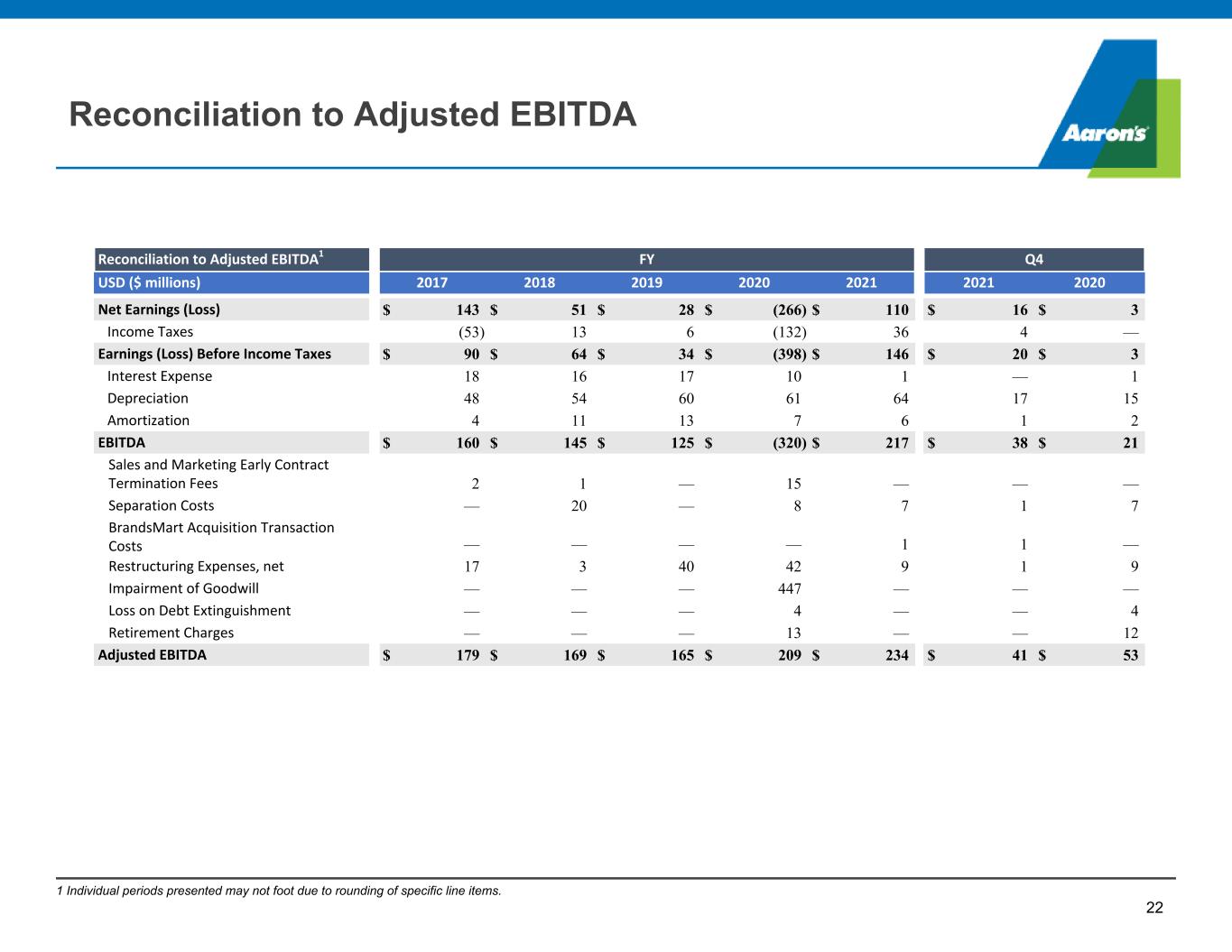

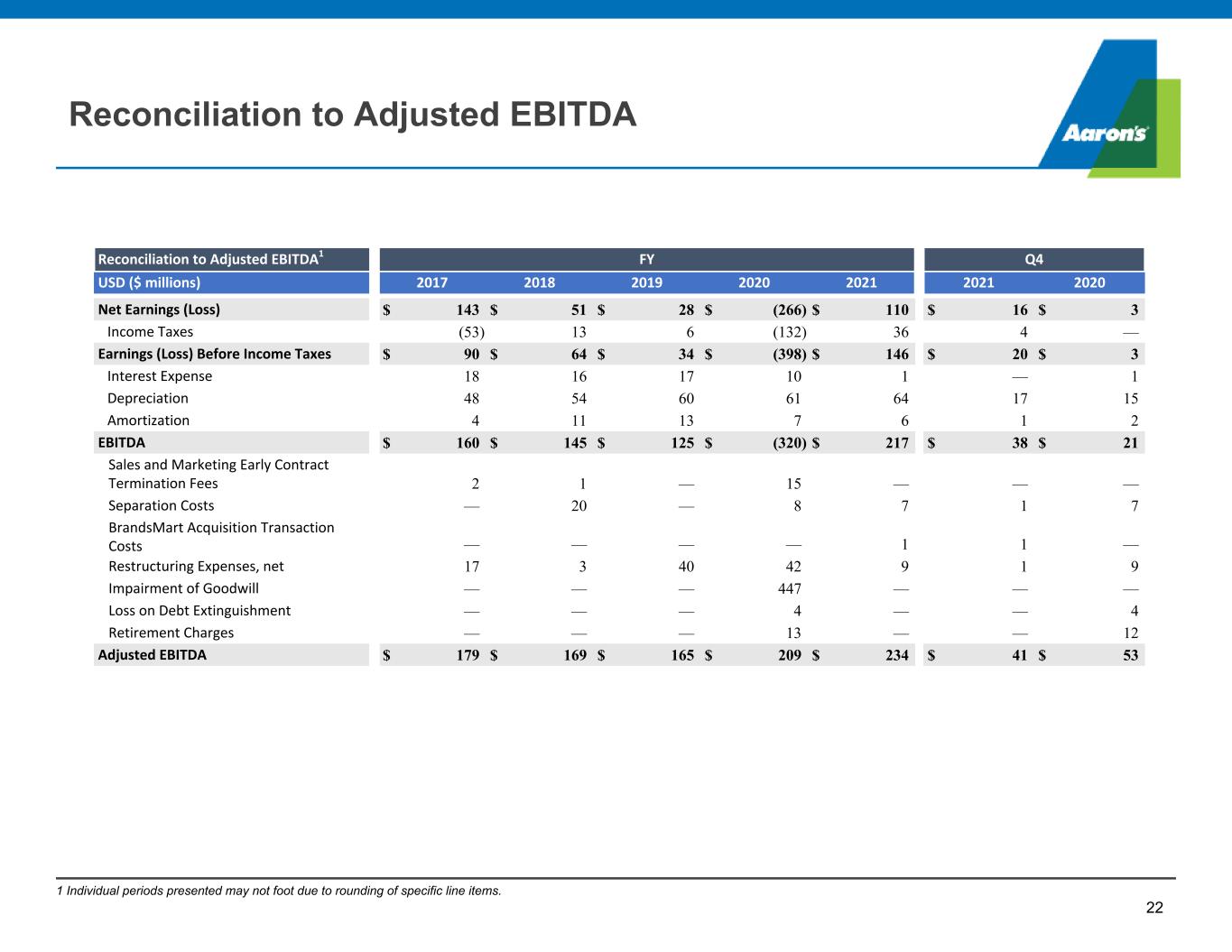

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Reconciliation to Adjusted EBITDA 22 1 Individual periods presented may not foot due to rounding of specific line items. Reconciliation to Adjusted EBITDA1 FY Q4 USD ($ millions) 2017 2018 2019 2020 2021 2021 2020 Net Earnings (Loss) $ 143 $ 51 $ 28 $ (266) $ 110 $ 16 $ 3 Income Taxes (53) 13 6 (132) 36 4 — Earnings (Loss) Before Income Taxes $ 90 $ 64 $ 34 $ (398) $ 146 $ 20 $ 3 Interest Expense 18 16 17 10 1 — 1 Depreciation 48 54 60 61 64 17 15 Amortization 4 11 13 7 6 1 2 EBITDA $ 160 $ 145 $ 125 $ (320) $ 217 $ 38 $ 21 Sales and Marketing Early Contract Termination Fees 2 1 — 15 — — — Separation Costs — 20 — 8 7 1 7 BrandsMart Acquisition Transaction Costs — — — — 1 1 — Restructuring Expenses, net 17 3 40 42 9 1 9 Impairment of Goodwill — — — 447 — — — Loss on Debt Extinguishment — — — 4 — — 4 Retirement Charges — — — 13 — — 12 Adjusted EBITDA $ 179 $ 169 $ 165 $ 209 $ 234 $ 41 $ 53

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Reconciliation of 2022 Current Outlook 23 1 Projected Other Adjustments include non-GAAP charges related to restructuring charges and separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company Reconciliation of 2022 Current Outlook to Adjusted EBITDA Fiscal Year 2022 Ranges USD ($ millions) Consolidated Total Estimated Net Earnings $81,000 - $84,000 Income Taxes 28,000 - 30,000 Projected Earnings Before Income Taxes 109,000 - 114,000 Interest Expense 1,000 Depreciation and Amortization 70,000 - 75,000 Projected Adjusted EBITDA $180,000 - $190,000 Reconciliation of 2022 Current Outlook to Free Cash Flow Fiscal Year 2022 Ranges USD ($ millions) Consolidated Total Cash Provided by Operating Activities $145,000 - $175,000 Capital Expenditures 100,000 - 125,000 Free Cash Flow $45,000 - $50,000

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . Reconciliation of 2021 Free Cash Flow 24 Reconciliation of 2021 Free Cash Flow FY 2021 USD ($ millions) Consolidated Total Cash Provided by Operating Activities $ 136 Capital Expenditures (93) Free Cash Flow $ 43

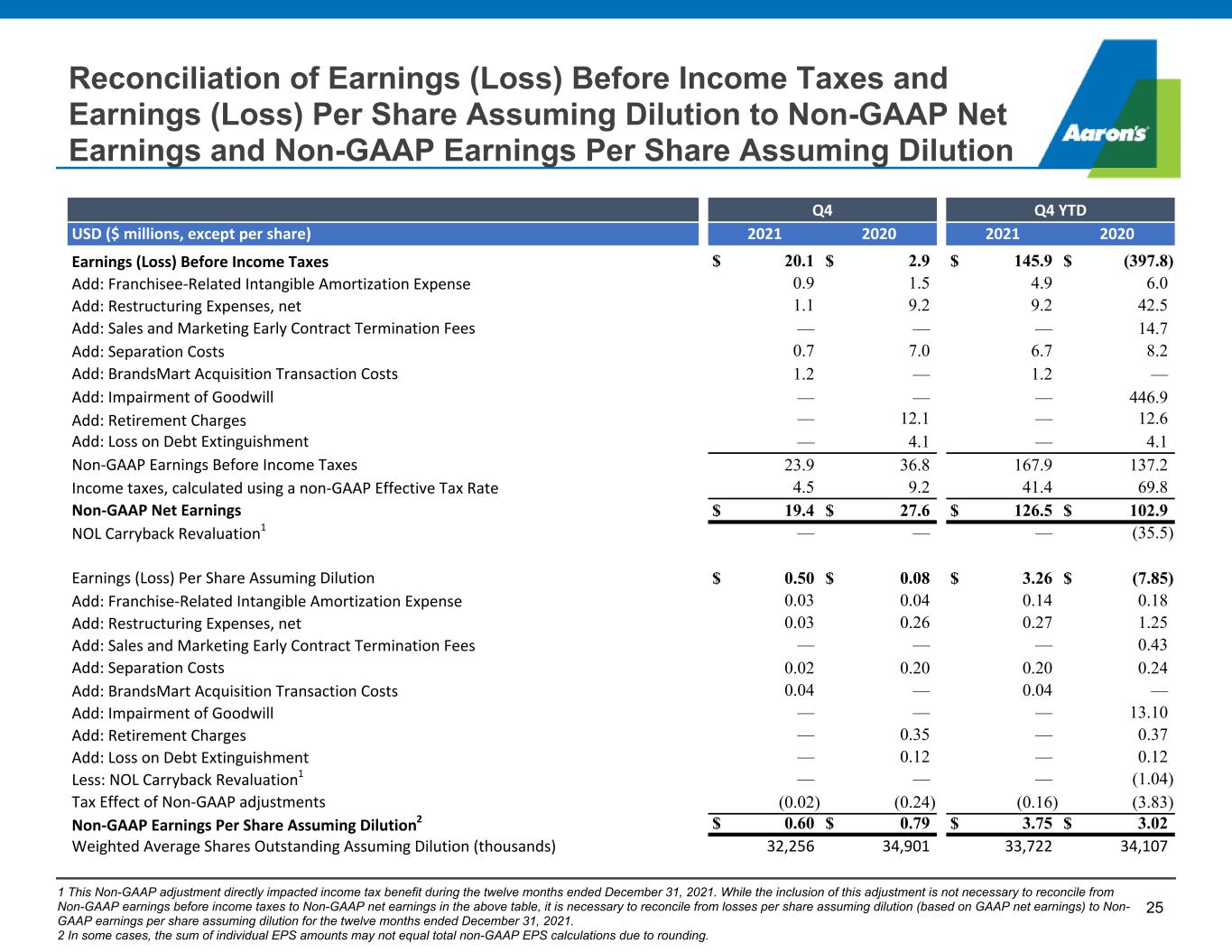

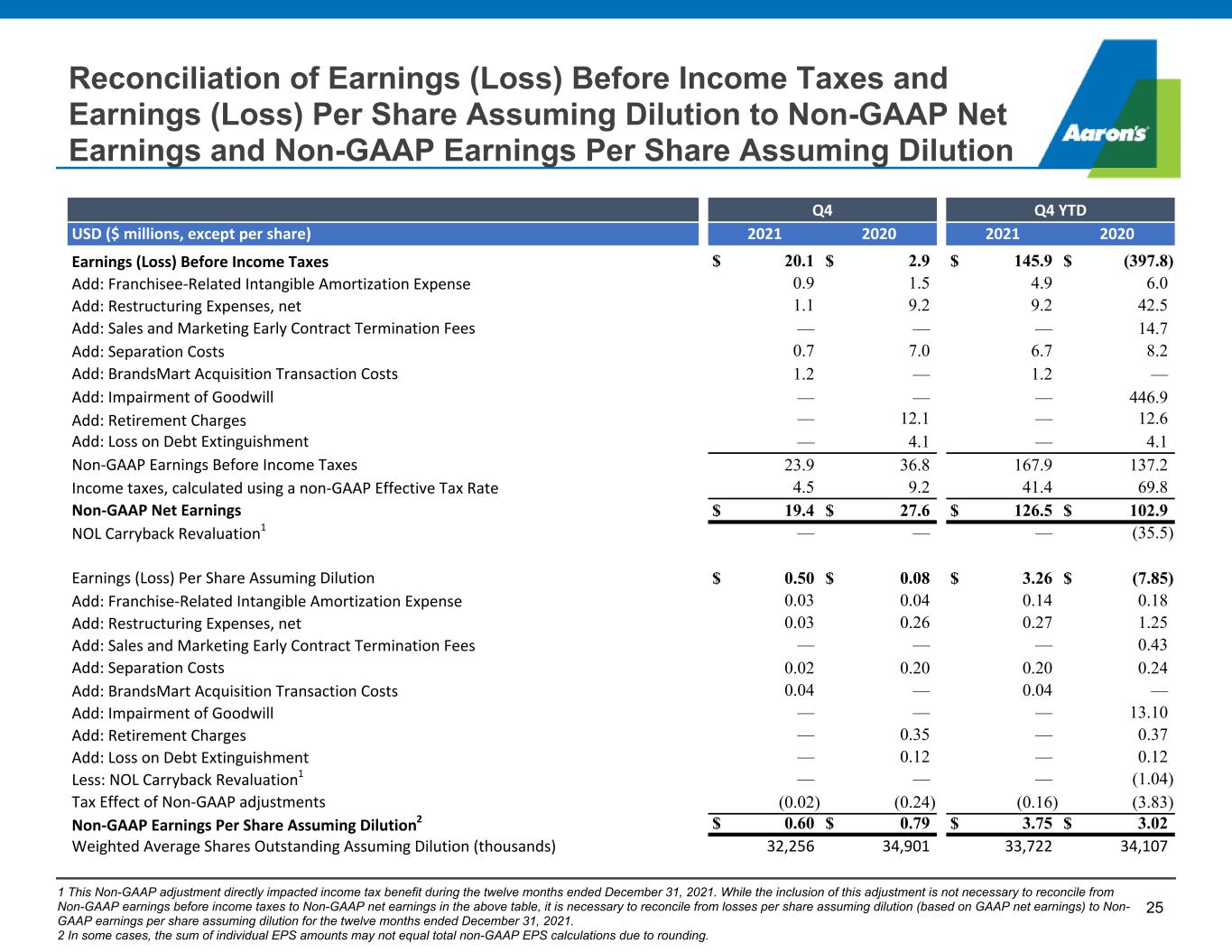

0 113 185 23 109 68 151 201 60 250 210 46 210 109 1 181 7 0 20 190 241 64 64 64 . 25 Reconciliation of Earnings (Loss) Before Income Taxes and Earnings (Loss) Per Share Assuming Dilution to Non-GAAP Net Earnings and Non-GAAP Earnings Per Share Assuming Dilution 1 This Non-GAAP adjustment directly impacted income tax benefit during the twelve months ended December 31, 2021. While the inclusion of this adjustment is not necessary to reconcile from Non-GAAP earnings before income taxes to Non-GAAP net earnings in the above table, it is necessary to reconcile from losses per share assuming dilution (based on GAAP net earnings) to Non- GAAP earnings per share assuming dilution for the twelve months ended December 31, 2021. 2 In some cases, the sum of individual EPS amounts may not equal total non-GAAP EPS calculations due to rounding. Q4 Q4 YTD USD ($ millions, except per share) 2021 2020 2021 2020 Earnings (Loss) Before Income Taxes $ 20.1 $ 2.9 $ 145.9 $ (397.8) Add: Franchisee-Related Intangible Amortization Expense 0.9 1.5 4.9 6.0 Add: Restructuring Expenses, net 1.1 9.2 9.2 42.5 Add: Sales and Marketing Early Contract Termination Fees — — — 14.7 Add: Separation Costs 0.7 7.0 6.7 8.2 Add: BrandsMart Acquisition Transaction Costs 1.2 — 1.2 — Add: Impairment of Goodwill — — — 446.9 Add: Retirement Charges — 12.1 — 12.6 Add: Loss on Debt Extinguishment — 4.1 — 4.1 Non-GAAP Earnings Before Income Taxes 23.9 36.8 167.9 137.2 Income taxes, calculated using a non-GAAP Effective Tax Rate 4.5 9.2 41.4 69.8 Non-GAAP Net Earnings $ 19.4 $ 27.6 $ 126.5 $ 102.9 NOL Carryback Revaluation1 — — — (35.5) Earnings (Loss) Per Share Assuming Dilution $ 0.50 $ 0.08 $ 3.26 $ (7.85) Add: Franchise-Related Intangible Amortization Expense 0.03 0.04 0.14 0.18 Add: Restructuring Expenses, net 0.03 0.26 0.27 1.25 Add: Sales and Marketing Early Contract Termination Fees — — — 0.43 Add: Separation Costs 0.02 0.20 0.20 0.24 Add: BrandsMart Acquisition Transaction Costs 0.04 — 0.04 — Add: Impairment of Goodwill — — — 13.10 Add: Retirement Charges — 0.35 — 0.37 Add: Loss on Debt Extinguishment — 0.12 — 0.12 Less: NOL Carryback Revaluation1 — — — (1.04) Tax Effect of Non-GAAP adjustments (0.02) (0.24) (0.16) (3.83) Non-GAAP Earnings Per Share Assuming Dilution2 $ 0.60 $ 0.79 $ 3.75 $ 3.02 Weighted Average Shares Outstanding Assuming Dilution (thousands) 32,256 34,901 33,722 34,107